Crypto World

Bitcoin Could Drop to $45K by Late 2026, Analyst Warns Using Historical Halving Cycle Data

TLDR:

- Bitcoin historical halving cycles show 363-406 day pattern from ATH to bottom across 2012, 2016, and 2020

- October-November 2026 identified as highest probability window for cycle bottom based on time analysis

- Ultimate price target ranges between $45,000-$50,000 with current accumulation starting at $60,000 zone

- NUPL on-chain indicator has not yet reached capitulation levels seen in previous 2018 and 2022 bottoms

A cryptocurrency analyst has shared a detailed thesis suggesting Bitcoin could continue declining throughout 2026.

The prediction relies on historical halving cycle data spanning over a decade. Analyst, Wimar. X tracks both temporal and price-based metrics.

This approach differs from the conventional price-only analysis that many traders employ. The forecast anticipates a cycle bottom occurring between October and November 2026.

Time-Based Analysis Points to Late 2026 Bottom

The analyst’s methodology centers on measuring days from all-time highs to cycle lows following Bitcoin halvings. Historical data shows the 2012 cycle took 406 days to reach bottom.

The 2016 cycle required 363 days for the same journey. Meanwhile, the 2020 cycle saw 376 days pass before hitting its lowest point. These numbers cluster within a narrow range, creating a predictable pattern.

Building on this consistency, the current cycle projects a similar timeline. The analyst calculates October through November 2026 as the highest probability window for the next major bottom.

This time-focused strategy removes emotional decision-making from the equation. According to the post, buying during this window will occur regardless of price levels.

The analyst emphasizes that most market participants miss optimal entry points. They focus exclusively on price action while ignoring temporal patterns.

This narrow view leads to missed opportunities when historical windows align. The time-based approach aims to prevent getting “front run” by market movements.

Wimar.X stated that execution of daily purchases worth $500,000 begins when either time or price conditions trigger.

The commitment to this strategy remains firm despite market volatility. Past predictions have already materialized, including the recent drop into the $60,000 range.

Price Targets and On-Chain Indicators Signal Further Downside

The price component of the analysis sets $60,000 as an initial accumulation zone. The analyst began purchasing Bitcoin after prices entered this territory.

However, waiting for perfect price levels can result in missing entire market moves. This pragmatic approach balances patience with opportunistic buying.

A lower price target sits between $45,000 and $50,000 by year-end 2026. This range represents the analyst’s “ultimate bottom target” for aggressive accumulation.

The prediction acknowledges the current risk of lower lows materializing. Market conditions remain uncertain, but historical precedent guides the strategy.

Net Unrealized Profit/Loss serves as the third analytical pillar. This on-chain metric successfully identified cycle bottoms in 2018, during the COVID crash, and in 2022.

Current readings show the market has not yet reached the capitulation zone. The NUPL indicator historically appears in a specific blue zone during major bottoms.

The analyst’s experience dates back to 2016, providing perspective through multiple market cycles. Prior predictions, including calls made when Bitcoin traded near $114,000, have proven accurate.

The framework combines quantitative analysis with disciplined execution across both time and price dimensions.

Crypto World

The Insiders Know Something: 200 Consecutive Sales as Markets Crumble

TLDR:

- All 200 top insider transactions were sales, marking unusual broad risk reduction among insiders.

- Bitcoin ETFs saw significant outflows as the price dipped below key technical support levels.

- ETF flows have fluctuated widely, signaling shifting institutional sentiment toward crypto exposure.

- Concurrent declines in BTC, ETH, and ETFs indicate heightened market correlation and risk aversion.

The Insider Selling Storm 2026 narrative emerges amid real market stress and mixed institutional flows. Bitcoin recently traded near $63,000–$74,000 after a multi‑month selloff that erased much of 2025’s gains.

Major Bitcoin ETFs like iShares Bitcoin Trust (IBIT) and Fidelity’s FBTC saw outflows and deep losses as prices fell below support levels.

Despite near‑term weakness, Bitcoin ETF flows have swung between record inflows and heavy redemptions in recent months. This points to a volatile institutional interest as macro risks rise.

Insider Activity Signals Market Caution

High-volume insider trades last week show that all 200 meaningful transactions were sales. No significant purchases occurred, highlighting informed caution across sectors.

Public messaging remains optimistic, but insider behavior diverges sharply. Confidence is high in narratives, yet top-level actors systematically reduce exposure.

Market participants respond to risk rather than headline sentiment. Structured risk management drives uniform selling patterns.

Insiders offload overvalued and liquid assets while preserving scarce, durable holdings. Their actions align with simultaneous declines across multiple markets globally.

Trading volume provides further clarity. While prices stabilized temporarily, reduced liquidity suggests relief rallies are absorption events.

Participants are used strategically as exit points rather than accumulation opportunities. This behavior demonstrates that the market is in a late-cycle phase.

Distribution occurs quietly as informed sellers convert exposure into liquidity, leaving fewer active buyers for high-risk assets.

Synchronized Declines and Defensive Positioning

Bitcoin fell to $60,000 while silver dipped to $64, and major tech stocks weakened sharply during the same period. Housing shows early signs of reduced activity.

Short-term price recovery is evident but weak. Lower trading volumes indicate the bounce is temporary and driven by selective buyers.

Stablecoins, including USDT and USDC, exhibit steady inflows, signaling defensive capital allocation. Long-duration assets such as Bitcoin, metals, and select real estate remain largely held.

These assets retain value when financial markets rely on confidence rather than scarcity, emphasizing durability and risk protection.

Relief rallies are distribution phases. Informed participants sell methodically while weaker buyers absorb inventory.

Market breadth remains thin, and recovery depends on volume expansion, not temporary price movements.

Capital allocation is increasingly selective. Participants seek optionality through liquid assets and avoid overvalued securities.

Market structure shows calm superficially, but underlying depth reflects cautious positioning and preparation for volatility.

Crypto World

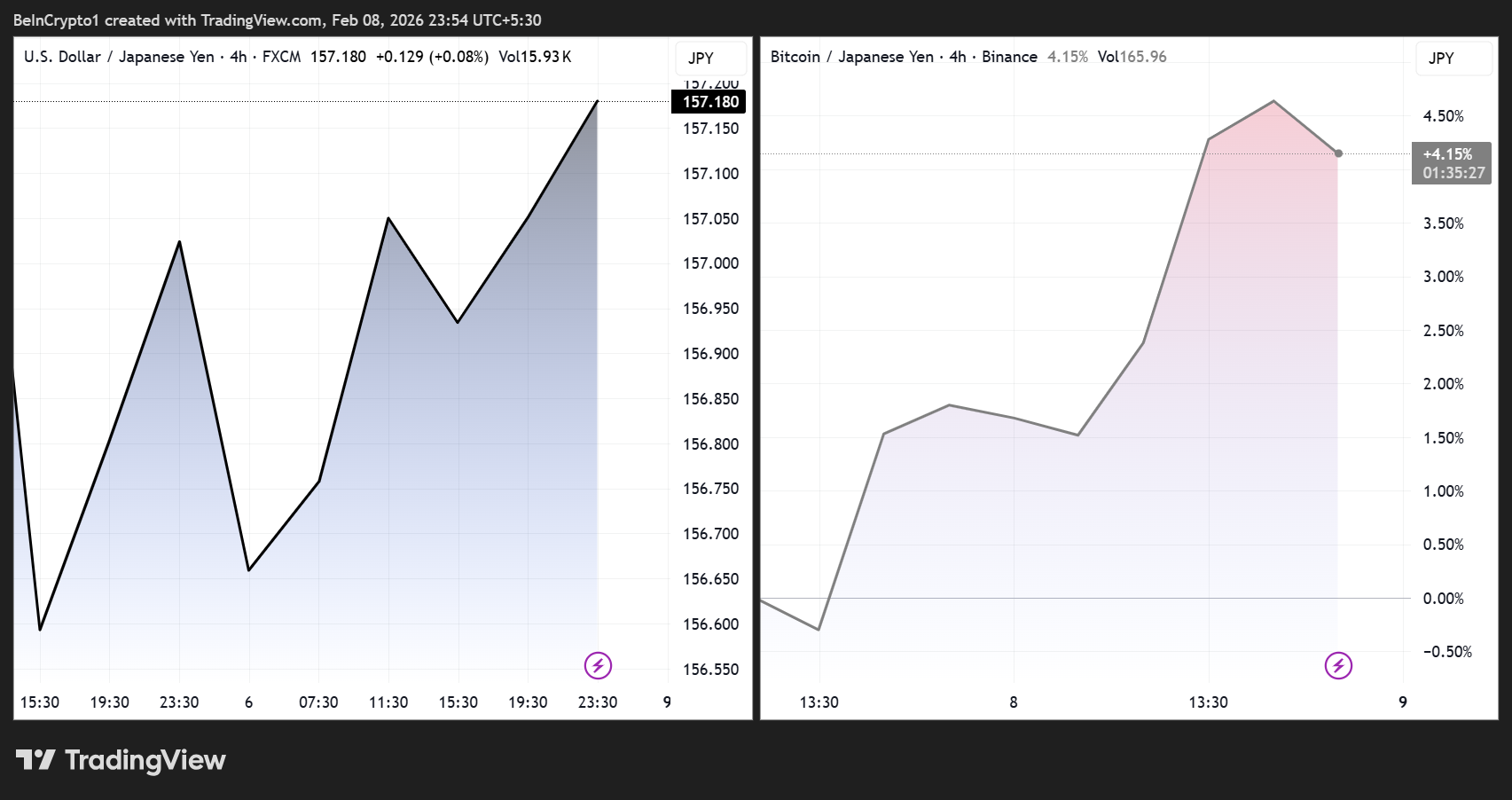

BTC/JPY Surges After Japan’s “Iron Lady” Sanae Takaichi Wins

Japan’s Prime Minister Sanae Takaichi, often dubbed the country’s “Iron Lady,” has secured a historic landslide victory in the February 8, 2026, snap parliamentary elections. Her Liberal Democratic Party (LDP) is projected to win between 274 and 326 of the 465 seats in the lower house, marking the largest post-war electoral margin for any Japanese party.

The decisive result consolidates Takaichi’s authority and positions her to pursue ambitious economic and regulatory reforms.

Sponsored

Sponsored

Japan’s Sanae Takaichi Secures Landslide Win, Sets Stage for Crypto Tax Reform

Markets reacted swiftly to the outcome. The dollar/yen climbed 0.2% to 157, while the BTC/JPY trading pair rose almost 5%, signaling investor confidence in Takaichi’s pro-growth agenda.

This so-called “Takaichi trade” draws momentum from expectations of fiscal stimulus, loose monetary policy, and increased liquidity.

It has already lifted Japanese equities to record highs, while government bonds and the yen have faced pressure.

US officials quickly weighed in on the result, with Treasury Secretary Scott Bessent calling the victory “historic” and emphasizing the strength of US-Japan relations under Takaichi’s leadership.

Days before, President Donald Trump also offered a full endorsement, highlighting her leadership qualities and recent trade and security successes.

Sponsored

Sponsored

In turn, Takaichi expressed gratitude, reaffirming plans to visit the White House in spring 2026 and describing the US-Japan alliance as having “unlimited potential” built on deep trust and cooperation.

Takaichi’s Mandate Signals Potential Crypto Tax Overhaul and Blockchain-Friendly Policies

Takaichi’s electoral mandate is widely seen as a green light to accelerate Japan’s crypto reforms. The country currently taxes crypto gains as miscellaneous income at rates up to 55%.

This framework has driven some investors abroad despite Japan’s leading position in blockchain adoption.

Sponsored

Sponsored

Under discussion for fiscal year 2026 are reforms that could:

- Reduce gains tax to around 20%

- Allow loss carryforwards for three years, and

Reclassify certain digital assets as financial products.

The general sentiment is that her pro-growth policies and willingness to collaborate with crypto-friendly opposition parties, such as the Japan Innovation Party and the Democratic Party for the People, could finally push these long-awaited measures through by 2028.

Earlier in her tenure, Takaichi endorsed policies supporting technology, innovation, and economic security, aligning with broader blockchain and Web3 development.

While she has not made crypto a central campaign issue, her aggressive fiscal stance, modeled after her mentor Shinzo Abe’s “Abenomics,” could create an economic environment that favors risk assets, including Bitcoin, Ethereum, and Japan-related digital projects.

“Takaichi has pledged aggressive fiscal policy funded largely through bond issuance…will her electoral momentum fuel even larger stimulus, or give her the political cover to proceed more cautiously, as investors remain uneasy over Japan’s massive debt load and recent spikes across the JGB yield curve,” posed Rob Wallace.

Sponsored

Sponsored

Indeed, uncertainties remain. Japan’s national debt exceeds 250% of GDP after topping out at 232.35% in 2025. Meanwhile, recent spikes in government bond yields have raised investor concerns about fiscal sustainability.

Key cabinet appointments and regulatory priorities will be critical in shaping the pace and scope of crypto reform. Finance Minister Katsunobu Kato’s continued role could maintain policy continuity, though his limited engagement on crypto issues may temper ambitious changes.

Digital Minister Masaki Taira has yet to articulate specific positions on crypto or Web3.

Nevertheless, the Financial Services Agency’s ongoing proposals, combined with Takaichi’s strong political mandate, suggest a turning point for Japan’s digital asset sector.

If successful, reforms could provide clearer regulatory frameworks, tax relief, and legal recognition for crypto, laying the groundwork for a more innovation-friendly ecosystem.

Crypto World

South Korea Jails Crypto CEO in First-Ever Case Under New Virtual Asset Law

The Seoul court handed crypto asset manager prison sentence in the first case under the new Virtual Asset User Protection Act.

A South Korean court has sentenced Jong-hwan Lee, CEO of a local crypto asset management firm, to three years in prison for manipulating cryptocurrency prices to secure illicit profits.

The Seoul Southern District Court ruled on Wednesday that Lee violated the Virtual Asset User Protection Act, earning approximately 7.1 billion Korean won (which is worth around $4.88 million) through price manipulation.

Court Findings

In addition to the prison term, the court imposed a fine of 500 million won, nearly $344,000, and ordered the forfeiture of around 846 million won, or $581,900 in criminal proceeds. However, Lee was not taken into custody during the court proceedings, as the judges cited his good behavior throughout the trial.

The court found that between July 22 and October 25, 2024, Lee employed an automated trading program to inflate trading volumes and repeatedly place wash trades in the ACE cryptocurrency. Investigators reported that the daily trading volume of ACE jumped from roughly 160,000 units to 2.45 million units overnight, and Lee was responsible for 89% of the activity.

Min-cheol Kang, a former employee of the firm also indicted in the case, received a two-year prison sentence with three years of probation. While the court confirmed the defendants’ involvement in manipulating ACE for unfair profits, it partially acquitted them regarding the exact 7.1 billion won figure due to insufficient evidence.

Interestingly, this case is the first enforcement under South Korea’s Virtual Asset User Protection Act, which came into effect in July 2024.

South Korea Crypto Mishap

As courts move to punish crypto market abuse, other branches of the legal system are grappling with the risks tied to handling digital assets. In January, South Korean prosecutors were investigating the disappearance of a large amount of Bitcoin that had been seized and stored as part of a criminal case.

You may also like:

The issue was discovered during a routine internal inspection at the Gwangju District Prosecutors’ Office, where officials check access details for confiscated assets, including credentials stored on removable devices like USB drives. While authorities have not confirmed the exact amount lost, local media estimates the missing Bitcoin could be worth around 70 billion won, or roughly $47.7 million.

According to officials cited in local reports, the loss may have occurred after an agency worker accessed a fraudulent website, which raised suspicion of a phishing attack rather than a direct breach of government systems. It is believed that wallet passwords or access credentials may have been exposed, allowing attackers to drain the seized funds.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

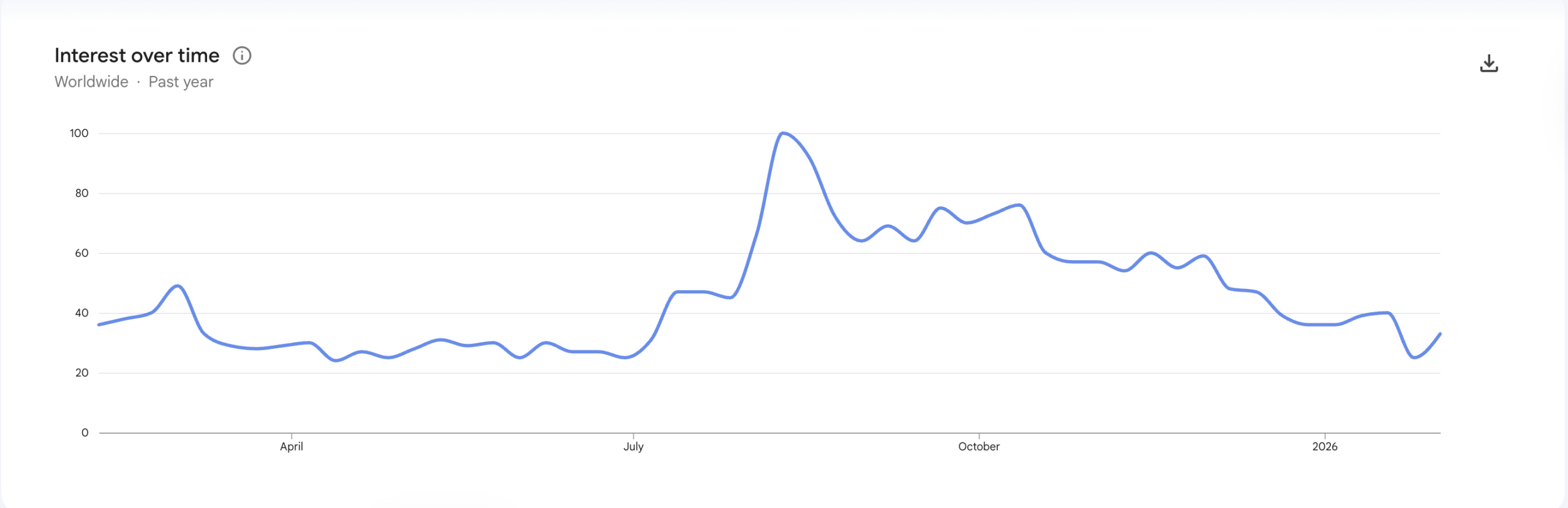

Crypto Google Searches Plummet to 1-Year Lows Amid Market Crash

Google worldwide search volume for “crypto” is hovering near a one-year low as investor sentiment cools amid a broad market downturn that has trimmed the crypto market’s total capitalization from a peak above $4.2 trillion to roughly $2.4 trillion. The global Google Trends reading for crypto sits at 30 out of 100, with the 12-month high of 100 last reached in August 2025 when market fervor and valuations were at their peak. In the United States, the pattern mirrors the wider trend but with its own rhythm: after a July high of 100, US search interest dipped below 37 in January and then rebounded to 56 in the first week of February. Taken together, these metrics paint a cautious mood among retail and institutional participants alike.

Google search data has long been used by market observers as a proxy for investor interest and potential turning points, aligning with sentiment gauges such as the Crypto Fear & Greed Index. As liquidity has cooled and volatility has persisted, traders and long-term holders have faced a challenging environment where on-chain activity and capital flows tighten alongside waning enthusiasm for risk-on bets in the crypto space. The juxtaposition of dwindling searches with continuing headlines about market stress underscores a market that remains sensitive to macro headlines, policy signals, and evolving risk appetites.

Google search data is often used as a gauge of investor sentiment and corroborates other indicators that track crowd psychology across the crypto market. As the broader market contends with macro headwinds, retail chatter and social signals continue to reflect a cautious stance, even as some pockets of volatility persist.

Investor sentiment craters as Fear & Greed Index hits record lows

The Crypto Fear & Greed Index plunged to a record low of 5 on Thursday, before ticking up to 8 by Sunday, according to CoinMarketCap. Both readings sit in the “extreme fear” territory, signaling widespread risk aversion among market participants. The latest readings echo sentiment conditions observed during past downturns, including periods that followed the Terra ecosystem collapse and the associated de-pegging event in 2022. CoinMarketCap notes that extreme fear can coexist with abrupt bursts of selling pressure, creating environments where short squeezes and liquidity gaps become more pronounced.

In broader terms, sentiment has moved in lockstep with price action and liquidity constraints. The market’s mood now resembles the climate seen after the Terra collapse, when contagion fears and leverage-induced liquidations amplified downside pressure. The Terra incident, which destabilized the Terra ecosystem and its dollar-pegged stablecoin, remains a reference point for how quickly confidence can erode in a highly correlated sector. The event set in motion cascading liquidations that helped accelerate a protracted bear phase in 2022, a period that many participants say still informs risk management and portfolio construction today.

The dialogue around sentiment is also fed by data-driven signals from analysts tracking social conversations and on-chain indicators. Santiment has highlighted a sharp decline in positive versus negative commentary, with crowd sentiment skewing heavily negative as traders search for a bottom to time their entries. While some investors seek capitulation points as an opportunity to accumulate, others remain wary of premature bets in an environment where liquidity can tighten quickly and price swings remain pronounced.

The broader mood is reinforced by market structure data: daily aggregate crypto trading volume has fallen markedly from a high near $153 billion on Jan. 14 to around $87.5 billion most recently, underscoring the retreat in participation and the challenge of sustaining momentum in a risk-off regime. These shifts in activity, combined with sentiment indicators, paint a picture of a market that remains fragile and sensitive to macro catalysts and policy developments. Investors are paying closer attention to how institutions and retail players reposition their risk budgets in the face of ongoing volatility and mixed fundamentals.

Why it matters

At a fundamental level, the convergence of weak search interest, suppressed trading volumes, and extreme fear in sentiment indices matters for participants across the crypto ecosystem. For traders, the current environment reinforces the importance of risk controls, liquidity considerations, and disciplined position sizing, given the potential for rapid shifts if macro catalysts improve or if liquidity flows reaccelerate. For builders and developers, the mood underscores the need for clarity around use cases, real-world utility, and user acquisition strategies that can drive sustained engagement even when markets are challenged.

From a retail vantage point, the data suggest that casual interest is not being replaced by immediate price upside; rather, attention remains episodic, with bursts around major headlines and then a reversion to the mean. This dynamic can affect onboarding curves for new users and the cadence of education and tooling that platforms rely on to convert curiosity into participation. Meanwhile, for institutions, the subdued atmosphere might translate into more selective allocations, tighter diligence, and a wait-and-see posture as they gauge how the regulatory and macro landscapes unfold in the coming quarters.

The Terra episode remains a salient reminder of how quickly sentiment can flip when confidence erodes and liquidity drains. In such environments, risk models that emphasize stress-testing, collateral management, and scenario planning can be more valuable than outright exposure bets. Investors should remain mindful of the connections between search behavior, sentiment, and price action, recognizing that public interest can act as a leading indicator of potential market inflection—but not a reliable predictor on its own.

What to watch next

- Continuing Google Trends updates on crypto search interest (worldwide and US) to spot any turning points in public curiosity.

- Monitoring the Crypto Fear & Greed Index and related sentiment metrics on CoinMarketCap and comparable aggregators.

- Observing developments around Terra’s ecosystem and the future trajectory of LUNA, as well as any regulatory or governance signals affecting stablecoins and cross-chain liquidity.

- Watching liquidity dynamics and macro flows, including ETF-related product activity and institutional risk appetites, to gauge potential shifts in market participation.

Sources & verification

- Google Trends data for Crypto worldwide and US searches (Google Trends links in the article).

- CoinMarketCap Fear & Greed Index page for sentiment data.

- CoinMarketCap charts page for market volume trends.

- Terra ecosystem collapse coverage and its impact on market psychology and liquidity (2022 references cited in the article).

- Santiment research and weekly summaries on crowd sentiment and social signals.

Market reaction and key details

What the data collectively suggest is a crypto market that remains highly sensitive to macro dynamics, liquidity conditions, and high-profile narrative events. The decline from a peak market cap above $4.2 trillion to roughly $2.4 trillion reflects not only price moves but also a broad retrenchment in risk appetite and a retreat by weaker hands who fueled the late-2021 to mid-2025 hype cycle. The rebound in US search interest in early February indicates that public attention can snap back, but whether that translates into durable capital inflows remains uncertain. As one anchor of the ecosystem, Bitcoin (CRYPTO: BTC) continues to lead price discovery, even as broader market participation ebbs and flows in response to evolving fundamentals and sentiment.

Terra’s collapse and the subsequent liquidity shock provided a stark reminder of how correlated risk exposures can be, particularly when leverage is high and confidence deteriorates. The reverberations from that event still inform risk controls, governance discussions, and the pace at which new products attempt to attract capital in a cautious environment. In the near term, the market will likely hinge on macro signals, regulatory clarity, and the interplay between sentiment indicators and actual on-chain activity.

Why it matters (expanded)

For users and investors, the current climate underscores the importance of diversification, prudent risk management, and clear investment objectives. It also highlights the value of staying informed through reliable data sources and avoiding overreliance on short-term sentiment alone. For builders in the space, the message is to emphasize tangible use cases, security, and user-friendly tooling that can withstand periods of market stress. For the market as a whole, the ongoing scrutiny around liquidity, regulatory development, and institutional participation will shape the trajectory of adoption and the resilience of the sector to shocks.

Ultimately, the story is one of a maturing market that continues to wrestle with volatility, narrative risk, and the pace of innovation. As investors weigh risk-adjusted returns in a downbeat environment, the data offer a sober reminder: interest can surface quickly, but sustained participation requires credibility, resilience, and real-world utility that transcends cycles.

What to watch next

- Weekly updates on Google Trends for crypto and related terms to identify shifts in public interest.

- Monitoring the Fear & Greed Index for potential signals that market psychology is shifting toward a more constructive phase.

- Tracking Terra-related developments and the performance of its associated assets, including governance updates and liquidity restoration efforts.

Sources & verification

Crypto World

Bitmine Buys 20,000 ETH During Market Panic, Defies Bearish Sentiment

TLDR:

- Bitmine added 42,000 ETH in one week, reflecting sustained accumulation during heightened market volatility

- The latest 20,000 ETH purchase occurred near market lows, signaling strategic timing rather than reactive buying

- Staking remains central to Bitmine’s model, with projected annual rewards tied to validator expansion plans

- Bitmine equity trades below NAV despite rising ETH holdings and improving Ethereum network activity.

Bitmine Ethereum accumulation has gained attention as the firm increased exposure during a broader crypto market downturn.

The move reflects a disciplined strategy centered on long-term fundamentals, staking income, and balance sheet growth rather than short-term price action.

Bitmine Ethereum Accumulation Confirms Sustained Buying and Strategic Timing

Bitmine Ethereum accumulation accelerated during a period of sharp selling across digital asset markets. On-chain data showed the firm acquired 20,000 ETH from a Kraken hot wallet during heightened volatility.

The purchase, valued at approximately $41.98 million, occurred without public statements or coordinated messaging. Market participants identified the transfer after wallet activity was shared on X.

According to Lookonchain data cited in those posts, the transaction took place within hours of the broader market downturn. The timing suggested planned accumulation rather than reactive buying.

Over the same week, Bitmine added roughly 42,000 ETH in total. Holdings now approach 4.17 million ETH, reflecting consistent balance sheet expansion.

Charts shared across social platforms showed steady increases in ETH balances. There were no visible distribution patterns or abrupt reductions in holdings.

Liquidity during the period remained thin, with forced sellers present across major venues. Such conditions often allow long-term participants to accumulate supplies efficiently.

Bitmine’s approach aligned with historical institutional behavior during prior market drawdowns. Accumulation occurred quietly while sentiment remained cautious.

The absence of hedging activity reinforced the view that ETH was treated as a strategic reserve asset. Price volatility appeared secondary to position sizing.

Staking Strategy and Valuation Context Shape Bitmine Positioning

Bitmine Ethereum accumulation is closely linked to its staking-focused operating model. The firm emphasizes yield generation to reduce idle asset risk during price weakness.

Chairman Tom Lee stated that stakeholder income could reach $374 million annually. This projection depends on full deployment of the Made in America Validator Network in 2026.

Staked ETH provides recurring revenue regardless of short-term price movement. Validator participation also supports Ethereum network security and decentralization.

Ethereum network metrics continue to show resilience. Daily transactions recently reached 2.5 million, while active addresses climbed to one million.

Lee referred to the recent pullback as an attractive entry point during remarks shared on X. He cited growing validator participation and steady network usage.

Bitmine’s equity valuation presents an additional layer. Shares recently traded near $20.44, below the reported NAV per share of $21.25.

This places the stock at approximately 0.96 times MNAV. The discount suggests the market values Bitmine’s ETH holdings below spot value.

ETH rebounded to around $2,123, gaining nearly three percent intraday. However, Bitmine’s equity closed slightly lower, reflecting ongoing caution.

As volatility stabilizes, balance sheet growth, stakeholder income, and network fundamentals remain central to Bitmine’s positioning.

Crypto World

Previewing policy at Consensus Hong Kong 2026: State of Crypto

CoinDesk is hosting its second annual Consensus Hong Kong conference, and as always, we’ll have a number of policy-focused sessions. Are you in town? Find me on stage or around the show floor and say hi!

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

The narrative

CoinDesk’s annual Consensus Hong Kong conference will kick off this Wednesday with a speech from Hong Kong Chief Executive John KC Lee.

Why it matters

Hong Kong is playing an interesting role in the intersection of financial services between the global East and West. CoinDesk will be exploring that role at Consensus,

Breaking it down

We’ll be hearing from Financial Secretary Paul Chan and Securities and Futures Commission Chief Executive Julia Leung on day one of Consensus, and having conversations around the growth of real-world asset tokenization, stablecoins and evolving payment systems and how exchange-traded funds (ETFs).

Our speakers will include regulators and politicians from around the world, with panels looking at how both regulators and industry participants alike approach the sector — a conversation we’ve had every year at Consensus, but one that continues to evolve.

Privacy, artificial intelligence, decentralized finance and trading behaviors will also take one of the many stages throughout the conference.

It’ll be part of a busy week ahead: SEC Chair Paul Atkins will be testifying before the House Financial Services and Senate Banking Committees. Though the hearings are focused on SEC oversight generally, expect crypto and Atkins’ efforts to develop rulemakings around the sector to come up.

The White House is also convening yet another meeting between crypto and banking industry representatives. Not a lot of detail is available yet.

Tuesday

- The White House is convening a second meeting between representatives of the crypto and banking industries to discuss stablecoin yield concerns.

Wednesday

- 01:30 UTC (9:30 a.m. HKT) Day 1 of Consensus Hong Kong kicks off.

- 15:00 UTC (10:00 a.m. ET) The House Financial Services Committee is holding an oversight hearing with Securities and Exchange Commission Chair Paul Atkins.

Thursday

- 02:00 UTC (10:00 a.m. HKT) Day 2 of Consensus Hong Kong kicks off.

- 15:00 UTC (10:00 a.m. ET) The Senate Banking Committee is holding an oversight hearing with Securities and Exchange Commission Chair Paul Atkins.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Bluesky @nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See ya’ll next week!

Crypto World

Google Search Interest in ‘Crypto’ Near 1-Year Lows Amid Market Crash

Google worldwide search volume for “crypto” is hovering near one-year lows, reflecting weak investor sentiment amid a broad market downturn that reduced the total market capitalization of crypto from an all-time high of more than $4.2 trillion to about $2.4 trillion.

Worldwide search volume for “crypto” is 30 out of 100 at the time of this writing, with a reading of 100 indicating the highest level of search interest, which was last reached in August 2025 in parallel with the market capitalization high. The 12-month low is 24, according to Google Trends data.

Search volume in the US featured a similar pattern, with volume peaking at 100 in July and dropping to below 37 in January. However, US search figures diverged from worldwide volume data by surging back up to 56 in the first week of February.

The yearly low for the US is 32, which was recorded during the April 2025 market crash fueled by US President Donald Trump’s tariff policies.

Crypto market volume is down sharply, with total market volume dropping from a high of more than $153 billion on Jan. 14 to about $87.5 billion on Sunday, according to CoinMarketCap.

Google search volume data is often used as a gauge of investor sentiment and corroborates other sentiment indicators like the Crypto Fear & Greed Index, a market indicator used to measure crowd sentiment.

Related: Google search volume for ‘Bitcoin’ skyrockets amid BTC price swings

Investor sentiment craters as Fear & Greed Index hits record lows

The Crypto Fear & Greed Index hit a record low of 5 on Thursday, but inched up to 8 by Sunday, according to CoinMarketCap. Still, both levels signal “extreme fear” in the markets.

Crypto investor sentiment is now at the same levels it was following the collapse of the Terra ecosystem and its dollar-pegged stablecoin in 2022.

The collapse of Terra sent shockwaves through the crypto world, triggering a wave of cascading liquidations that accelerated the 2022 bear market.

Investors are currently searching for social signals that the crypto market has bottomed to time their entries, according to market sentiment analysis platform Santiment.

“Crowd sentiment is fiercely bearish. The ratio of positive to negative commentary has collapsed, with negative comments hitting their highest point since December 1st,” Santiment said in a report published Friday.

Magazine: If the crypto bull run is ending… It’s time to buy a Ferrari: Crypto Kid

Crypto World

BTC Tests $70K Resistance: Could Bulls Rally to $75K or Drop Toward $65K?

TLDR:

- Bitcoin struggles at $70K, revealing weak buyer power amid high trading activity.

- BTC trades at $71,098 with $44.95B in 24-hour volume, showing strong market participation.

- Reclaiming $70K could trigger 8–10% rally toward $75K–$77K resistance zones.

- Failing $70K increases risk of testing mid-$60K support in the short term.

The price of Bitcoin (BTC) is $71,098.81 today, gaining 2.65% over the past 24 hours. However, BTC has fallen 9.04% in the last seven days, reflecting short-term volatility and resistance near the $70K level.

Trading activity remains high, with a 24-hour volume of $44.95 billion, signaling strong market engagement. Bitcoin is balancing upward momentum against broader weekly losses while determining the next potential market direction.

$70K: Key Resistance and Market Response

Bitcoin recently attempted to reclaim $70K, but the price faced rejection and could not sustain above this critical level. This shows that buyers were insufficient to absorb the supply concentrated in this zone.

Historically, decisive upward moves require serious, aggressive attempts. Weak responses often lead to temporary consolidation or minor pullbacks in the short term.

Below $70K, Bitcoin is trading in a low-liquidity area, where support remains limited until mid-$60K levels. Markets often retest recently broken levels after sharp impulse moves downward.

The failure to reclaim $70K increases the likelihood of revisiting this zone before any sustained upward attempt. Traders and analysts monitor these zones closely for structural signals rather than relying on emotional reactions.

If Bitcoin reclaims $70K with real acceptance, meaning sustained closes above the level, momentum continuation becomes clearer. Technical projections suggest an 8–10% move, targeting $75K–$77K.

This potential upward path would likely involve short covering and new buyers entering positions. Observing acceptance above $70K, rather than temporary wicks, is crucial for short-term direction.

Monthly Chart Structure and Conditional Paths

Monthly charts show Bitcoin losing key support after a parabolic advance. Historical cycles indicate hesitation below critical levels before accelerated downward moves.

Such pauses trap long-term investors and erode confidence gradually among market participants.

From 2021 to 2022, Bitcoin followed a similar pattern: strong uptrend, loss of key support, brief consolidation, then accelerated decline into demand zones.

Current action mirrors this structure, with low-$80K support broken and a potential downside expansion zone forming near historical demand areas.

Bitcoin’s short-term path depends on interaction with $70K. A decisive reclaim could trigger bullish continuation, while sustained rejection increases the likelihood of testing mid-$60K support.

Minor retracements allow accumulation for the next leg higher. Traders are advised to respect high-timeframe levels and focus on market structure rather than reacting to short-term volatility.

Crypto World

Crypto Phishing Attacks Hit New Record in January 2026

Crypto investors faced a sharp increase in sophisticated “signature phishing” attacks in January, with losses jumping more than 200%.

According to data from blockchain security firm Scam Sniffer, signature phishing drained approximately $6.3 million from user wallets in the first month of the year. While the raw count of victims fell by 11%, the total value stolen surged 207% from December levels.

Signature Phishing and Address Poisoning Wreak Havoc in January

This divergence highlights a tactical shift among cybercriminals toward “whale hunting.” The strategy involves targeting a smaller number of high-net-worth individuals rather than casting a wide net for smaller retail accounts.

Sponsored

Sponsored

Scam Sniffer reported that just two victims accounted for nearly 65% of all signature phishing losses in January. In the largest single incident, a user lost $3.02 million after signing a malicious “permit” or “increaseAllowance” function.

These mechanisms grant a third party indefinite access to move tokens from a wallet. This allows attackers to drain funds without requiring the user to approve a specific transaction.

While signature scams rely on confusing permissions, a separate and equally damaging threat known as “address poisoning” is also plaguing the sector.

In a stark example of this technique, a single investor lost $12.25 million in January after sending funds to a fraudulent address.

Address poisoning exploits user habits by generating “vanity” or “lookalike” addresses. These fraudulent strings mimic the first and last few characters of a legitimate wallet found in a user’s transaction history

The attacker hopes the user will copy and paste the compromised address from their history rather than verifying the full string.

The rise in these incidents prompted Safe Labs, the developer behind the popular multisig wallet formerly known as Gnosis Safe, to issue a security warning. The firm identified a coordinated social engineering campaign targeting its user base, using approximately 5,000 malicious addresses.

“We’ve identified a coordinated effort by malicious actor(s) to create thousands of lookalike Safe addresses designed to trick users into sending funds to the wrong destination. This is social engineering combined with address poisoning,” the firm stated.

Consequently, the firm warned users to always verify the full alphanumeric string of any recipient address before executing high-value transfers.

Crypto World

BTC surely closer to bottom than top as bears celebrate

With crypto’s multi-month downturn accelerating into a freefall last week, bulls were frantically grasping for technical signals, or maybe yarns about the blowup of some leveraged hedge fund, that might signal a final bottom for this bear market.

Perhaps the ultimate sign of a bottom, though, might be the cheers arising from those who have been faithfully bearish on bitcoin as its price rose from $0 to more than $100,000 over its 16-year lifespan.

Over the years, the Financial Times has surely stood above all traditional publications in its steadfast opposition to bitcoin and crypto. The London paper’s team of truly talented writers has seemingly never wavered from a firm no-coiner stance, and this week was their moment.

“Bitcoin is still about $69,000 too high,” was the headline of a Sunday essay by the FT’s Jemima Kelly that wonderfully summed up Kelly’s and the FT’s general stance over the last decade-plus. [The FT subsequently changed the headline to “$70,000 too high” after bitcoin rose overnight].

“Ever since its creation, bitcoin has been on a journey that will end, splattered on the ground,” Kelly wrote. “This week has shown us that the supply of ‘greater fools’ that bitcoin relies on is drying up,” she continued. “The fairy tales that have been keeping crypto afloat are turning out to be just that. People are beginning to wake up to the fact that there is no floor in the value of something based on nothing more than thin air.”

Earlier in the week, with the price of bitcoin declining below the $76,000 average cost basis of BTC treasury giant Strategy (MSTR), the FT’s Craig Coben published, “Strategy’s long road to nowhere.”

With the stock already down about 80% from its record high of late 2024, Coben in February 2026 declared, “Management has no safe choices — only different paths to destroying shareholder value … it is hard to see the case for buying into a vehicle that has merely broken even on its investments over five years.”

“Like a gigantic mastodon stuck in La Brea tar pits,” Coben concluded. “Strategy is flailing for a way out.”

Peter Schiff joins in

With gold — despite a good deal of recent volatility — continuing in a major bull cycle, longtime goldbug and bitcoin critic Peter Schiff was feeling his oats as well.

“According to Michael Saylor, bitcoin is the best-performing asset in the world,” he wrote on Tuesday. “Yet Strategy invested over $54 billion in bitcoin over the past five years, and as of now the company is down about 3% on that investment. I’m sure the losses over the next five years will be much greater!”

“Bitcoin below $76,000, it’s now worth 15 ounces of gold, down 59% from its Nov. 2021 high,” Schiff continued. “Bitcoin is in a long-term bear market priced in gold.”

Other signs

“I refuse to pick bottoms,” once said former hedge fund manager Hugh Hendry. “Monkeys spend all their time picking bottoms.”

As Hendry noted, it’s probably a good idea not to get too cute timing one’s buys to headlines like those seen in the FT this week. It’s probably fairly safe to say, though, that some sort of bottoming process is underway.

In other news this week that would never appear near tops, it appears that investor interest in Tether is evaporating. With the crypto market still perky late last year, it was reported that the stablecoin issuing giant was in talks to raise $15-$20 billion at as much as a $500 billion valuation.

According to a report in the FT on Tuesday, however, investors appear to be pushing back against that valuation, and capital-raising efforts may only be on the order of about $5 billion.

For its part, Tether CEO Paolo Ardoino told the FT that the original reports of a $15-$20 billion capital raise were a “misconception,” and that Tether had received plenty of interest at that $500 billion valuation.

Nevertheless, according to the report, investors have privately raised concerns about that lofty valuation. Things are fluid, the report continued, and a crypto rally could quickly change sentiment.

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech4 days ago

Tech4 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics7 days ago

Politics7 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Politics2 hours ago

Politics2 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat5 days ago

NewsBeat5 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Politics4 hours ago

Politics4 hours agoThe Health Dangers Of Browning Your Food

-

Sports1 day ago

Former Viking Enters Hall of Fame

-

Crypto World6 days ago

Crypto World6 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports2 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business9 hours ago

Business9 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat2 days ago

NewsBeat2 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business3 days ago

Business3 days agoQuiz enters administration for third time

-

Sports6 days ago

Sports6 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat6 days ago

NewsBeat6 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World5 days ago

Crypto World5 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat6 days ago

NewsBeat6 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know