Crypto World

Bitcoin Entering Phase 2 Bear Market, Analyst Warns

Analyst warns Bitcoin nearing Phase 2 bear market as volatility and liquidity trends point to further downside risk across crypto markets.

Veteran on-chain analyst Willy Woo has warned that the Bitcoin (BTC) market is strengthening its bear trend and approaching the second phase of a multi-stage downturn.

The forecast challenges persistent bullish narratives, suggesting the worst may be ahead for the world’s largest cryptocurrency.

Phase 1 Nears Its End as Volatility Spells Trouble

In a series of posts on X on February 18, Woo outlined a three-phase bear market framework, positioning Bitcoin at a crucial juncture. According to him, the first stage of the current bear market started in the third quarter of 2025 when liquidity first broke down, and the price started to follow.

He explained that the key signal comes from volatility metrics used by quantitative analysts, with Bitcoin entering a prolonged decline when volatility spiked upward. That volatility is still climbing, indicating the bear trend is gaining ground.

“In this phase, perma bulls will blindly say it’s a correction inside a broader bull market but will not give you any hard evidence of capital flowing in,” Woo wrote.

The analyst added that his internal liquidity models, released weekly to investors, currently match the volatility signals. In his opinion, the second part of the bear market will kick in when global equities begin to weaken.

He argued that the largest cryptocurrency often reacts faster than equities when capital exits markets because of its smaller size and higher sensitivity to liquidity shifts.

“Under this bear market framework, BTC is presently in Phase 1 and close to Phase 2,” stated Woo.

He characterized the final episode as “the light at the end of the tunnel,” predicting a turnaround in liquidity, with capital outflows hitting a high point before stabilizing. However, he warned that there could be one more price capitulation just before or immediately after the peak outflows.

You may also like:

Cycle Indicators Show Mixed Signals for Long-Term Outlook

Not all analysts are interpreting the data as outright bearish. In a recent post, Axel Adler Jr. wrote that Bitcoin’s Entity-Adjusted Liveliness metric peaked in December 2025 and has started declining, a pattern seen in past accumulation periods lasting between 1.1 and 2.5 years. The indicator tracks BTC movement relative to holding time and tends to fall after distribution periods end.

Another perspective from GugaOnChain focused on valuation. Using the MVRV Z-Score developed by Murad Mahmudov and David Puell, the analyst said the current reading near 0.48 places Bitcoin close to historical accumulation zones rather than overheated territory. That suggests some investors may see current prices as discounted compared with average acquisition costs.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

16.6 Million PIPPIN Bought Since ATH Price Now Sits At 40% Loss

PIPPIN has entered a volatile phase after failing to sustain its recent breakout. The altcoin rallied sharply but has since retraced, placing many recent buyers at a loss.

Price action now threatens to invalidate a projected 221% breakout from a broadening descending wedge pattern.

Sponsored

Sponsored

PIPPIN Holders Run To Buy

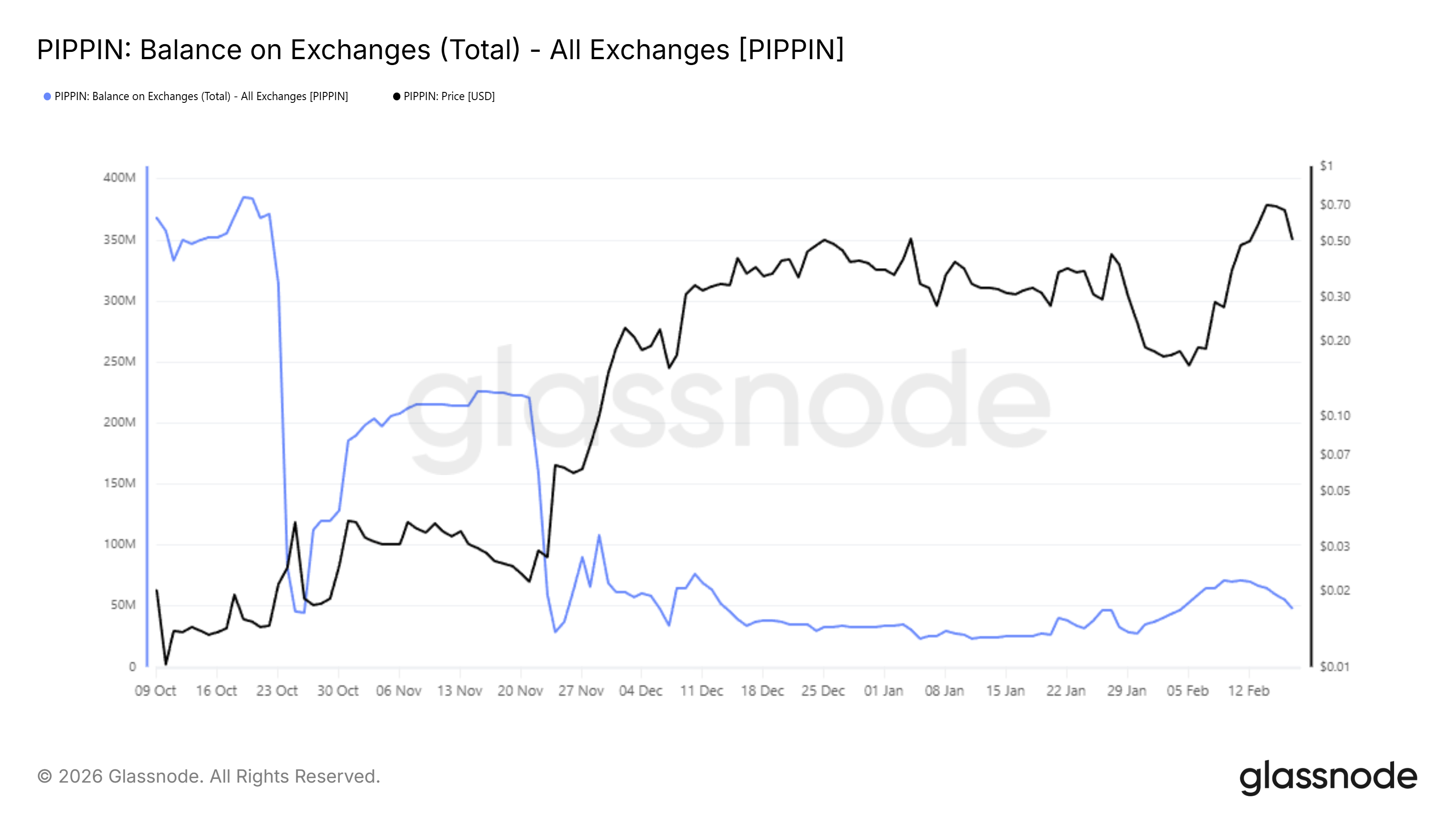

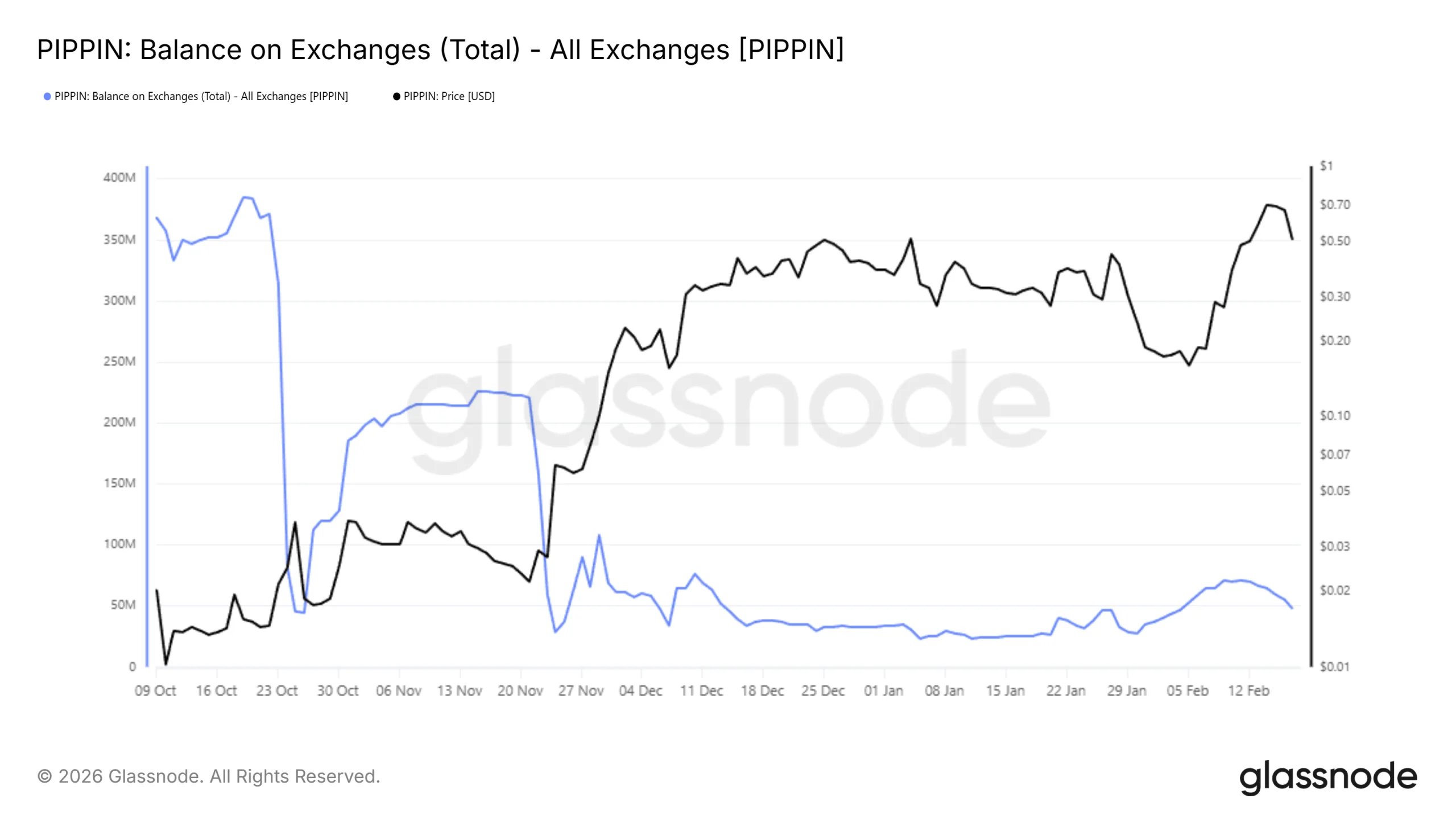

Exchange balance data reveals notable accumulation following the recent all-time high. Since the peak three days ago, investors have purchased approximately 16.6 million PIPPIN. At current valuations, this represents roughly $7.7 million in buying activity.

This accumulation pattern is not new. Historical data shows that PIPPIN holders often buy aggressively near peaks. As prices decline, panic selling frequently follows. Similar behavior appeared during the late January surge and again during the October 2025 spike.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

These cycles tend to delay sustained recovery. Early buyers accumulate at elevated levels, then exit during pullbacks. If the price weakens further, selling pressure may intensify again. This pattern raises the probability of renewed volatility in the near term.

Momentum indicators signal caution. The Money Flow Index currently sits above 80.0, placing PIPPIN in overbought territory. Elevated readings often precede cooling phases as capital inflows slow.

Broader market indecision compounds the risk. Without strong directional cues from major cryptocurrencies, speculative altcoins often struggle to sustain rallies. Unless holders begin aggressive distribution, however, a full reversal may remain delayed rather than immediate.

Sponsored

Sponsored

Will LTHs Prove To Be Pippin’s Saviour?

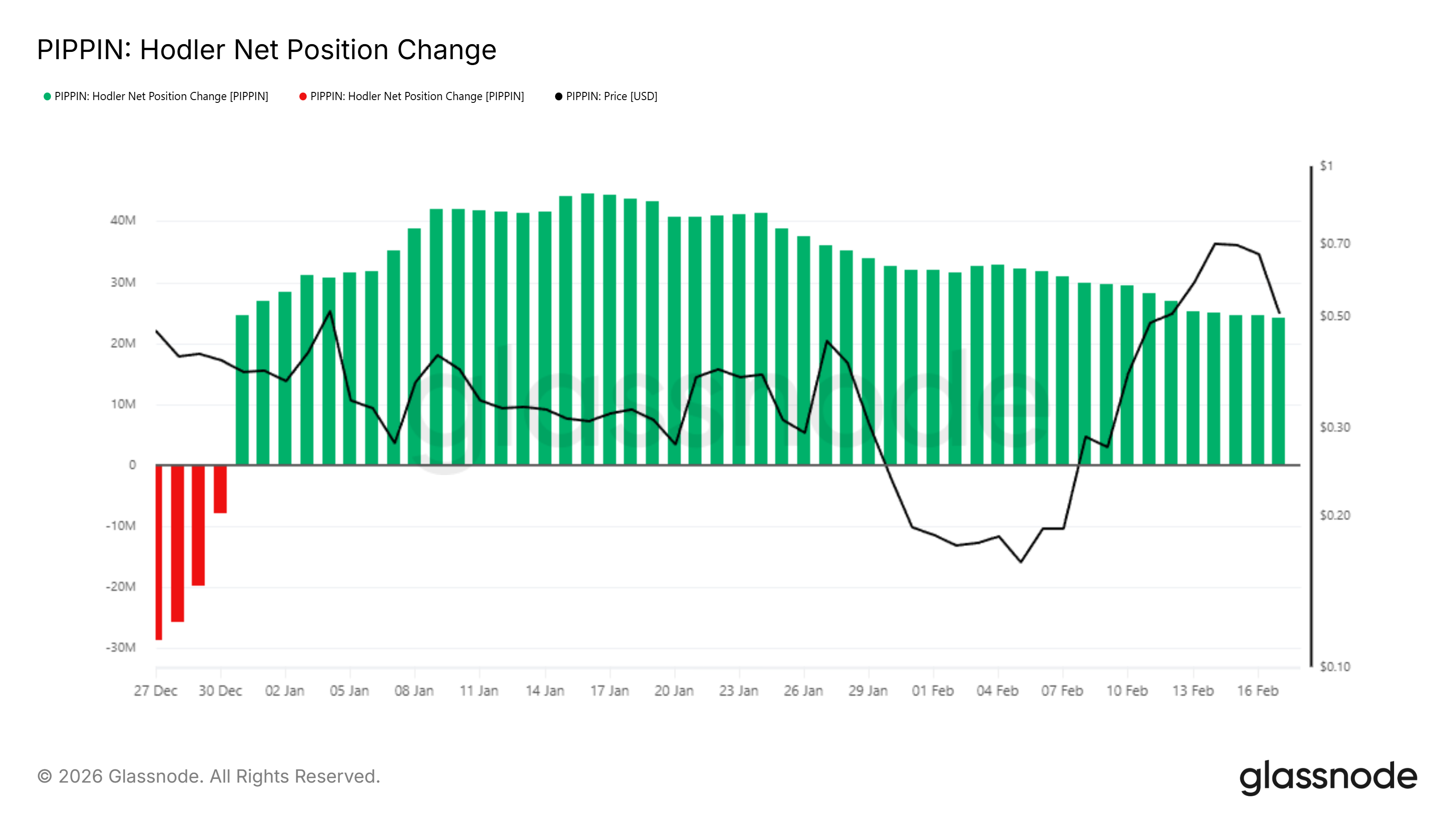

The HODLer Net Position Change metric provides a mixed outlook. Long-term holders continue to accumulate, as indicated by persistent green bars. Although the slope has weakened, net buying remains intact.

This ongoing support is critical. If long-term PIPPIN holders shift to distribution, downside risk would escalate quickly. A transition from accumulation to selling could accelerate losses and confirm bearish control over the trend.

PIPPIN Price Faces a Crash

PIPPIN previously broke out of a broadening descending wedge pattern. That formation projected a potential 221% upside move. However, current price action suggests the breakout is at risk of invalidation if support levels fail.

If long-term holder support stabilizes the token, PIPPIN could rebound from the $0.449 support zone. A sustained bounce may drive the price toward $0.600. Strong follow-through could retest the $0.772 all-time high, recovering recent losses.

Conversely, downside risk remains substantial. Many investors who bought at the all-time high are currently facing losses of about 40%. If panic selling resumes, PIPPIN could break below $0.449. A drop toward $0.372 would invalidate the bullish pattern and confirm the breakdown scenario.

Crypto World

Bitwise wants to list prediction markets ETFs for U.S. elections in 2026 and 2028

Bitwise Asset Management wants to offer a prediction markets for the next U.S. presidential election through exchange-traded funds (ETFs).

Under “Prediction Shares” branding, the San Francisco-based crypto asset manager filed to list two ETFs tracking prediction markets betting on the outcome of the 2028 election — one for a Democratic winner, one for Republican — with the Securities and Exchange Commission (SEC) on Tuesday.

Bitwise also listed four equivalent products for 2026 mid-terms, predicting Democratic and Republican wins in the House of Representatives and the Senate.

Each ETFs will invest their assets in prediction markets bets supporting the applicable outcome denoted by that fund.

The same way that a bitcoin ETF allows investors to invest in BTC without purchasing the underlying cryptocurrency, these ETFs will allow users to bet on the outcome of U.S. elections without using a prediction platform like Polymarket.

Prediction markets came to prominence during the last U.S. election and now process trading volumes of around $10 billion monthly.

With ETFs also having opened the door to crypto investment for a wider array of prospective investors including institutions, Bitwise appears to trying to replicate this model for prediction markets, with the 2026 mid-terms as its testbed.

Crypto World

Crypto Long & Short: Crypto’s liquidity mirage

Welcome to our institutional newsletter, Crypto Long & Short. This week:

- Leo Mindyuk on how executable liquidity at scale is more fragmented and fragile than most institutions assume

- Top headlines institutions should pay attention to by Francisco Rodrigues

- Helium’s deflationary flip in Chart of the Week

Expert Insights

Crypto’s liquidity mirage: why headline volume doesn’t equal tradable depth

– By Leo Mindyuk, co-founder and CEO, ML Tech

Crypto looks liquid, until you try to trade large volumes. Especially during periods of market stress and even more so if you want to execute on coins outside of the top 10-20.

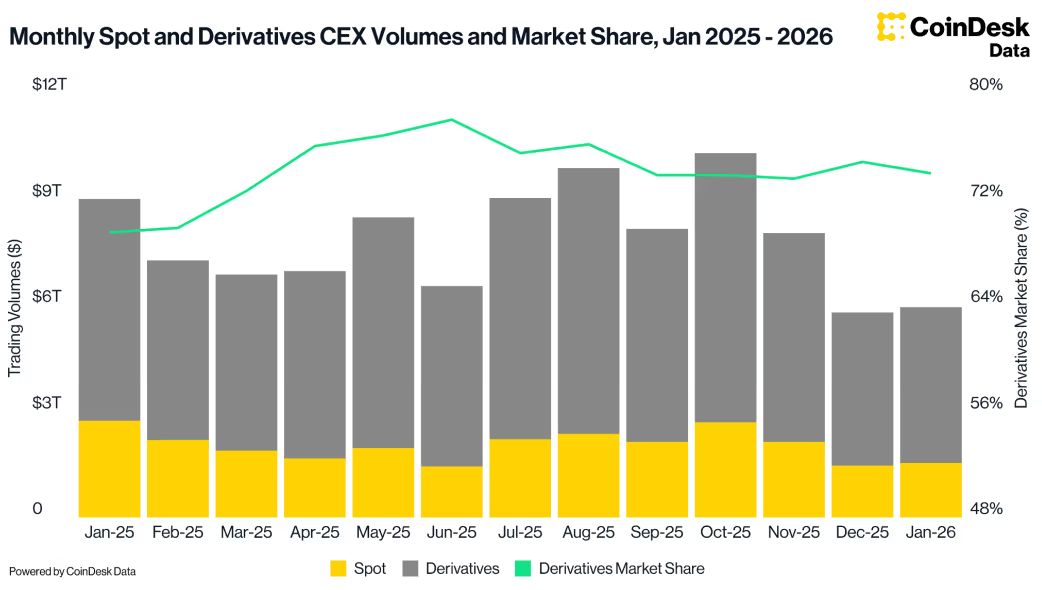

On paper, the numbers are impressive. Billions traded in daily volume and trillions traded in monthly volume. Tight spreads on bitcoin and ether (ETH). Dozens of exchanges competing for flow. It resembles a mature, highly efficient market. The beginning of the year saw around $9 trillion of monthly spot and derivatives volumes, then October 2025 saw around $10 trillion in monthly volume (including a lot of activity around the October 10th market bloodbath). Then in November, derivatives trading volumes decreased 26% to $5.61 trillion, recording the lowest monthly activity since June, followed by even larger declines in December and January, according to CoinDesk Data. Those are still some very impressive numbers, but let’s zoom in further.

At first glance there are a lot of crypto exchanges competing for flow, but in reality just a small group of exchanges dominate (see the graph below). If those have liquidity thinning out or connectivity issues preventing the execution of volume, the whole crypto market is impacted.

It’s not just that the volumes are concentrated on a few exchanges, they are also highly concentrated in BTC, ETH and a couple of other top coins.

The liquidity seems quite solid with a number of institutional market makers active in the space. However, the visible liquidity is not the same as executable liquidity. According to Amberdata (see the graph below), markets that showed $103.64 million in visible liquidity suddenly had just $0.17 million available, a 98%+ collapse. The bid-ask imbalance flipped from +0.0566 (bid-heavy, buyers waiting) to -0.2196 (ask-heavy, sellers overwhelming the market at a 78:22 ratio).

For institutions deploying meaningful capital, the distinction becomes obvious very quickly. The top of the book might show tight spreads and reasonable depth. Go a few levels down, and liquidity thins out fast. Market impact doesn’t increase gradually, it accelerates. What looks like a manageable order can move price far more than expected once it interacts with real depth.

The structural reason is simple. Crypto liquidity is fragmented. There is no single consolidated market. Depth is distributed across venues, each with different participants, latency profiles, API systems (that can break or have disruptions) and risk models (that can come under stress). Reported volume aggregates activity, but it does not aggregate liquidity in a way that makes it easily accessible for large execution. This is specifically apparent for smaller coins.

That fragmentation creates a false sense of comfort. In calm markets, spreads compress and books look stable. During volatility, liquidity providers reprice or pull entirely. They get unfavorable inventory and are unable to de-risk and pull out their quotes. Depth disappears faster than most models assume. The difference between quoted liquidity and durable liquidity becomes clear when conditions change.

What matters is not how the book looks at 10:00 a.m. on a quiet day. What matters is how it behaves during stress. Experienced quants know that but most of the market participants do not, as they struggle to close open positions gradually and then get liquidated during the stress events. We saw this in October, and a couple of times since.

In execution analysis, slippage does not scale linearly with order size; it compounds. Once an order crosses a certain depth threshold, impact increases disproportionately. In volatile conditions, that threshold shrinks. Suddenly, even modest trades can move prices more than historical norms would suggest.

For institutional allocators, this is not a technical nuance. It is a risk management issue. Liquidity risk is not only about entering a position, it is about exiting when liquidity is scarce and correlations rise. Want to execute a couple of millions of some smaller coins? Good luck! Want to exit losing positions in less liquid coins when the market is busy like during the October crash? It can become catastrophic!

As digital asset markets continue to mature, the conversation needs to move beyond headline volume metrics and top level liquidity snapshots during the calm markets. The real measure of market quality is resilience and how consistently liquidity holds up under pressure.

In crypto, liquidity isn’t defined by what’s visible during normal stable conditions. It’s defined by what’s left when the market gets tested. That’s when capacity assumptions break and risk management takes center stage.

Headlines of the Week

Wall Street giants have kept moving deeper into the cryptocurrency space over the past week, while new data has shed light on just how large the space is in Russia and how big it could become in Asia. Major market participants Binance and Strategy have meanwhile doubled down on their massive BTC reserves.

- Wall Street giants enter DeFi market with token investments: BlackRock has made its tokenized U.S. Treasury fund BUIDL tradable on decentralized exchange Uniswap, as part of a deal that saw it invest an undisclosed amount in UNI. Similarly, Apollo Global Management (APO) struck a cooperation agreement with Morpho.

- Russia’s daily crypto turnover exceeds $650 million, the Ministry of Finance says: The country’s government and central bank are pushing for legislation to regulate cryptocurrency activities, while the Moscow Exchange is looking to deepen its presence in the market.

- Binance converts its $1 billion safety net into 15,000 BTC: Leading cryptocurrency exchange Binance has finished converting the Secure Asset Fund for Users (SAFU) into bitcoin, turning about $1 billion into 15,000 BTC.

- BlackRock exec says 1% crypto allocation in Asia could unlock $2 trillion in new flows: BlackRock’s head of APAC iShares, Nicholas Peach, has said that even a modest portfolio allocation to crypto in Asia could unlock $2 trillion in new flows.

- Strategy says it can survive even if bitcoin drops to $8,000 and will ‘equitize’ debt: Strategy, the largest bitcoin treasury firm with 714,644 bitcoin on its balance sheet, said it can withstand a bitcoin price drop to $8,000 and still cover its roughly $6 billion in debt.

Chart of the Week

Helium’s deflationary flip

Helium has surged 37.5% month-to-date, decoupling from the broader market as its fundamentals shift toward a deflationary model. Since the start of 2026, the protocol’s net emissions have turned negative, effectively neutralizing long-standing sell pressure. This transition is fueled by a jump in network demand, with daily Data Credit burns climbing from $30,000 to over $50,000 since the beginning of the year, signaling that utility-driven token destruction is now outpacing new issuance.

Listen. Read. Watch. Engage.

Looking for more? Receive the latest crypto news from coindesk.com and explore our robust Data & Indices offerings by visiting coindesk.com/institutions.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc., CoinDesk Indices or its owners and affiliates.

Crypto World

Bitcoin price at risk of hitting $50k, Coinbase premium sinks

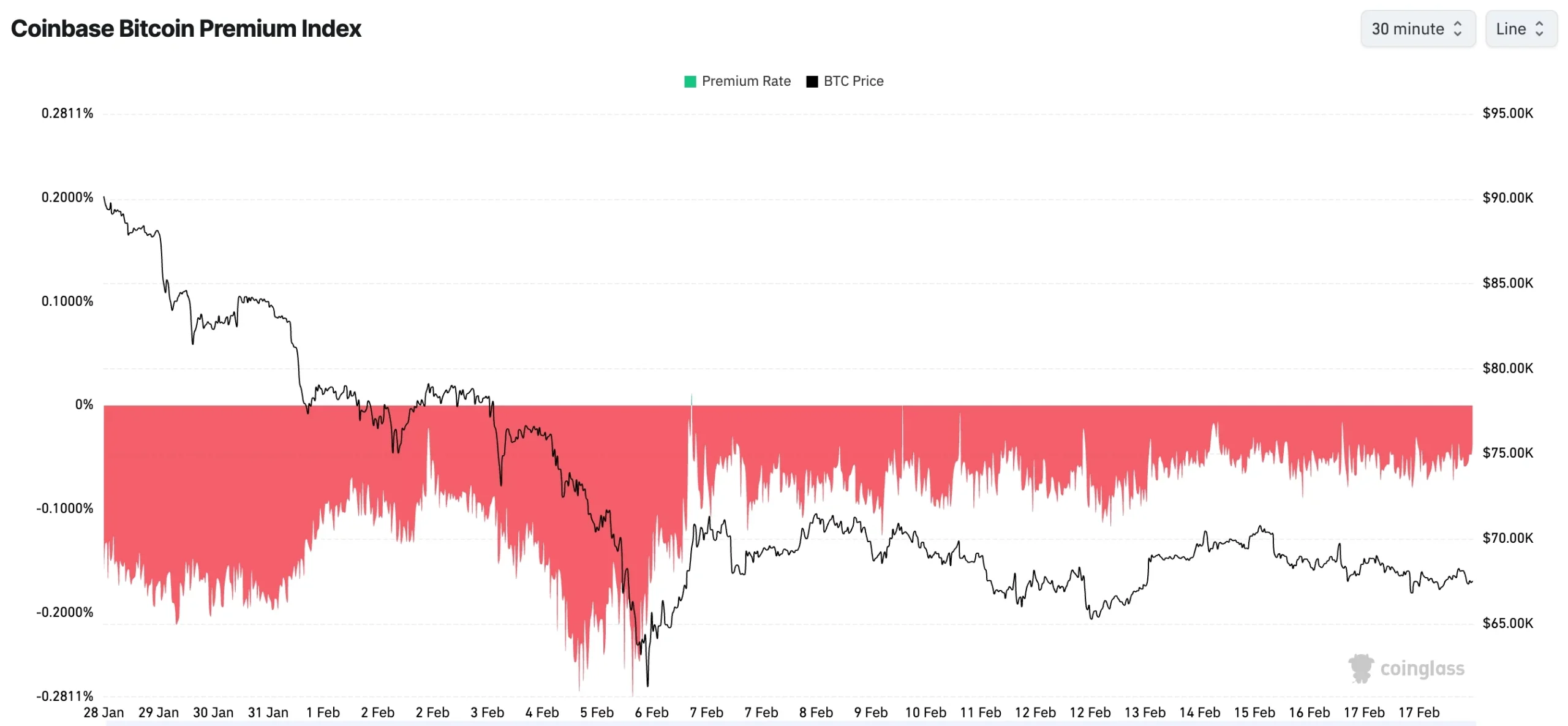

Bitcoin price remained in a tight range this week, and the waning Coinbase Premium Index points to more downside as institutional demand wanes.

Summary

- Bitcoin price has formed a bearish pennant pattern on the daily chart.

- The Coinbase Premium Index has remained in the red, a sign of weak demand from the US.

- Futures open interest has continued falling this month.

Bitcoin (BTC) was trading at $67,420 on Wednesday, down modestly from last weekend’s high of over $70,000. It has slumped by double digits from its all-time high of $126,300.

One major risk facing Bitcoin is that institutional demand has largely waned in the United States, which explains why the Coinbase Premium Index has remained in the red throughout this year. Coinbase is the most preferred platform for Bitcoin investing by American investors.

Additionally, only a handful of Bitcoin treasury companies are accumulating Bitcoin as they did last year. Strategy continued buying Bitcoin last week, bringing its total holdings to over 717,000. American Bitcoin and Strive have also bought Bitcoin this year.

Meanwhile, SoSoValue’s data shows that spot Bitcoin ETF outflows have jumped in the past few months. All these funds have shed over $8 billion in assets since October last year, and the trend is continuing.

According to Bloomberg, institutions have largely given up on Bitcoin because it has not fulfilled its role as a hedge against inflation and equity market stress. It has also not served its perceived role as a hedge against currency debasement.

Bitcoin’s futures open interest has continued falling in the past few months and now sits at $44 billion, down sharply from last year’s high of over $95 billion. Also, demand for borrowed exposure on CME has remained muted into the past few months.

Bitcoin price technical analysis suggests a crash

The daily timeframe chart shows that Bitcoin price is flashing red alerts. For example, the coin is slowly forming a large bearish pennant pattern. It has already completed forming the vertical line and is now in the process of forming the triangle section.

The Supertrend indicator has remained red since January 19 this year. It has also remained below the 50-day and 100-day Exponential Moving Averages.

Therefore, the coin will likely continue falling, with the initial target being the year-to-date low of $60,000. A drop below that level will signal further downside, potentially to the psychological $50,000 level, as Standard Chartered analysts predicted last week.

Crypto World

Hyper Foundation Backs New DC Lobby with 1M HYPE for Clearer DeFi Rules

With Jake Chervinsky at the helm, the Hyperliquid Policy Center gives the perp DEX a formal policy foothold in Washington.

Hyperliquid, the largest on-chain perpetual futures exchange by trading volumes, said it is backing a new Washington-based policy organization with 1 million HYPE tokens (around $29 million at current prices), as crypto firms try to influence U.S. rules for decentralized finance.

According to a press release published today, Feb. 18, the so-called “Hyperliquid Policy Center” — or just HPC — received the tokens from the Hyper Foundation and plans to use them to produce research and lobby for practical regulations on decentralized markets. The foundation is an independent organization that supports the development of the Hyperliquid ecosystem, per the release.

“We will publish technical research, comment on proposed rules and legislation, and serve as a resource for policymakers who want to understand how DeFi really works,” the new organization said in an X post today.

Jake Chervinsky, a long-standing crypto policy lawyer and former chief policy officer at the Blockchain Association, will lead the organization as founder and CEO.

“HPC exists to ensure that American entrepreneurs, consumers, and institutions have the regulatory clarity they need to build and benefit from the future of finance,” Chervinsky said in the release.

The Hyperliquid Policy Center also said it will “introduce lawmakers and regulators to Hyperliquid” and push for clear rules on DeFi.

Despite the news, HYPE is trading down 1% on the day at around $29.10, per CoinGecko data.

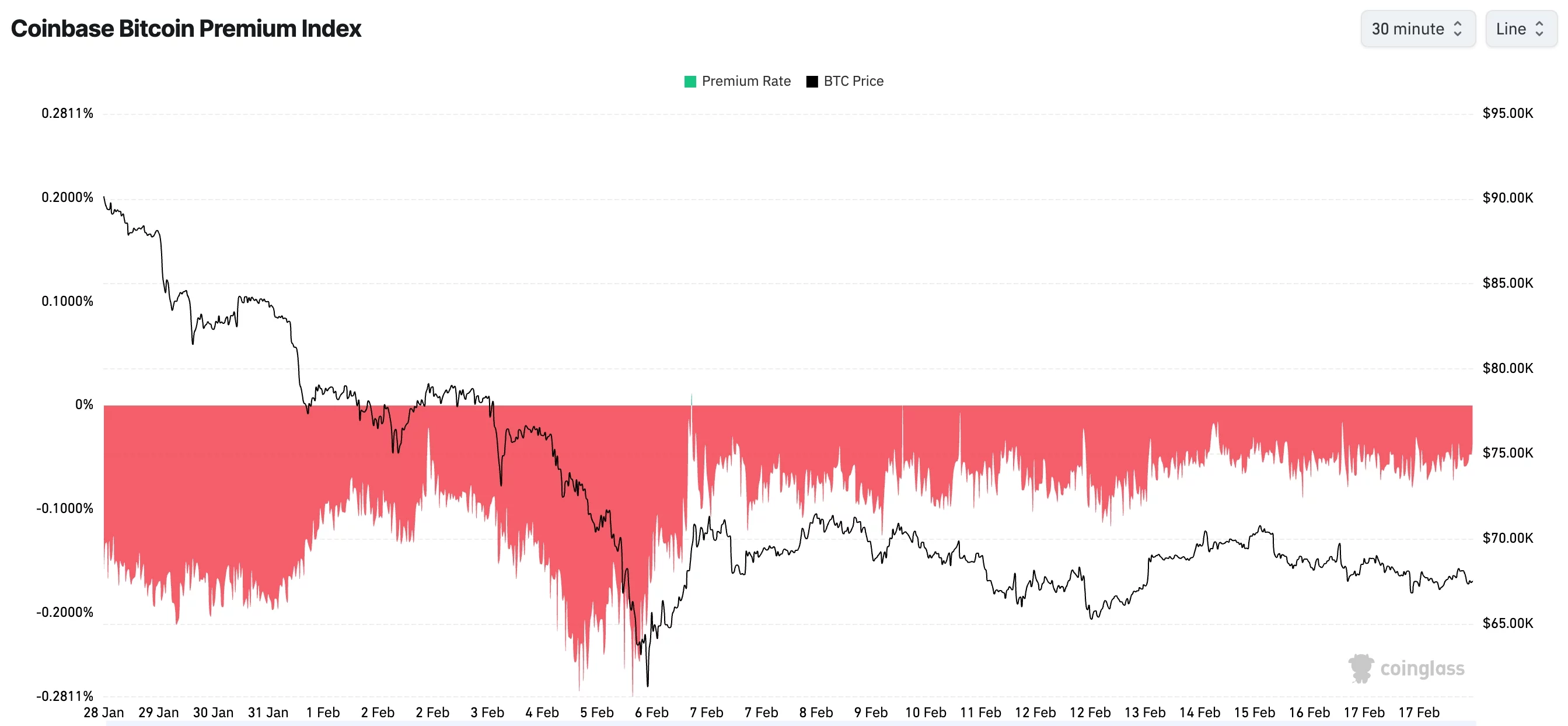

In the past 24 hours, Hyperliquid processed nearly $5.4 billion in trades, and open interest on the platform currently stands at over $5 billion, per data from DefiLlama. Perps trading on Hyperliquid surged in 2025, with monthly volumes reaching an all-time high of nearly $400 billion in July.

While the perp DEX mania that took off last year was mostly dominated by Hyperliquid, competitors like Aster and Lighter also saw rapid growth.

Crypto World

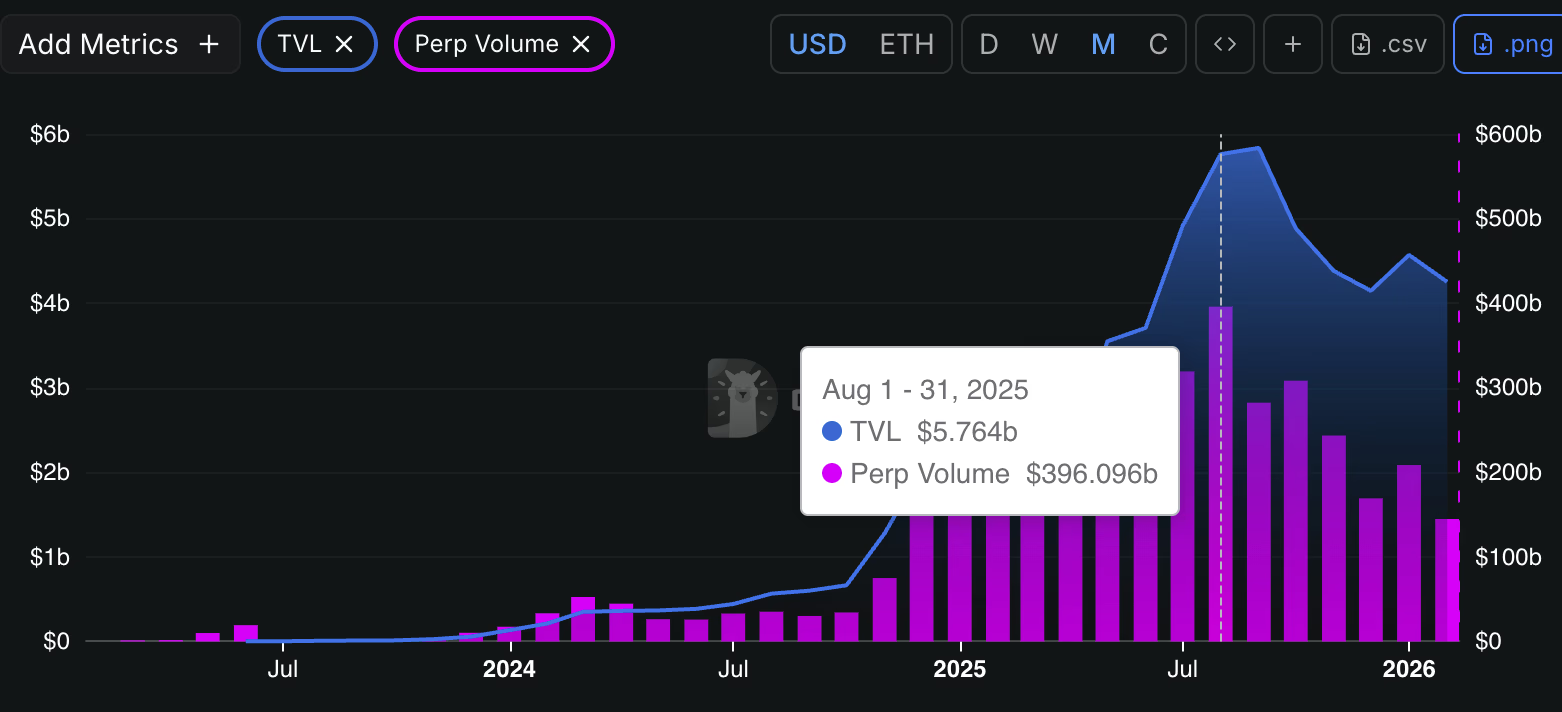

HYLQ Strategy Invests in Hyperliquid Quantum Solutions Pioneer qLABS, Buys 18,333,334 qONE Tokens

HYLQ Strategy Corp has completed a strategic digital asset investment in qLABS, acquiring qONE tokens in an over-the-counter transaction with the Quantum Labs Foundation.

The qONE token trades on the booming Hyperliquid platform and is the native token of the qLABS ecosystem. HYLQ Strategy is the second public company to invest in quantum-safe tokens. qLABS partner 01 Quantum, as a founding member, is also a holder of qONE tokens.

According to the terms of the agreement shared in a company press release, HYLQ purchased 18,333,334 qONE tokens for an aggregate purchase price of $0.006 in an investment totalling $100,000, inclusive of bonus tokens.

The transaction was executed directly with the Quantum Labs Foundation and settled in USDC. This strategic investment represents HYLQ’s commitment to supporting quantum-resistant infrastructure within the Hyperliquid ecosystem, making this the first institutional investment in quantum-safe cryptographic solutions built natively on Hyperliquid.

qLABS is the world’s first quantum-native crypto foundation, developing blockchain solutions resistant to quantum computing threats.

qLABS Launching Quantum-Safe Protection for Digital Assets

The foundation will launch the Quantum-Sig smart contract wallet to provide quantum-safe protection for digital assets at the user and asset level.

A separate L1 Migration Toolkit is in the works. Its design will help Layer-1 blockchains transition their core infrastructure to quantum-resistant cryptography ahead of Q-Day. Q-Day is the anticipated moment when quantum computers become powerful enough to break current cryptographic systems.

The qONE token, launched on Hyperliquid on 6 February 2026, serves as the ecosystem utility token, granting access to quantum-resilient wallet functions, protocol governance, and the broader quantum-safe infrastructure developed by qLABS.

qLABS leverages IronCAP by 01 Quantum Inc. (TSXV: ONE), a NIST-approved post-quantum cryptography system.

by 01 Quantum Inc. (TSXV: ONE), a NIST-approved post-quantum cryptography system.

HYLQ Strategy CEO Matt Zahab, commenting on the company’s investment in qLABS’ Quantum Labs Foundation, said:

“As quantum computing advances toward Q-Day, protecting crypto assets from quantum threats is becoming increasingly critical.”

He added: “qLABS is building essential quantum-resistant infrastructure natively on Hyperliquid, addressing a systemic risk that threatens the entire blockchain industry. This investment aligns perfectly with HYLQ’s mandate to support innovative companies within the Hyperliquid ecosystem that are building foundational infrastructure for the future of decentralized finance.”

HYLQ Stock Price is up 28.5% YTD

Year-to-date, HYLQ Strategy (HYLQ:CNSX CA) stock is up 28.5% at CAD0.90. In addition to its primary Canadian listing, the stock also trades over-the-counter in the US (HYLQF: OTCMKTS US). HYLQ is not to be confused with the competing digital asset treasury company, Hyperliquid Strategies (PURR), which trades on the Nasdaq.

How qONE’s staking plans could provide an income stream for HYLQ shareholders

According to Ada Jonuse, Executive Director at qLABS, qONE owners will be able to stake their tokens to earn yield and acquire protocol governance rights.

This means that HYLQ – at some point in the future – may be able to generate yield for its shareholders as a direct result of its $100,000 investment in qONE. An exact date for staking going live is yet to be revealed.

“Staking and governance participation are features to be enabled further down the roadmap when our core products are live and implemented in a full operational environment,” Jonuse explains.

“Because our 100% focus lies on security, in the early stage of the ecosystem, key decisions will be taken by the core team with gradual decentralization envisioned over the years.”

The centralization risk is acknowledged and mitigated through staking-based governance participation, time-weighted and activity-weighted voting, and progressive decentralization as emissions and unlocks occur.

Governance is expected to decentralize meaningfully as protocol usage grows.

Staking rewards will be set dynamically, which means yield is determined by the size of the staking pool, protocol usage, and fee generation, as well as the staker’s proportional contribution.

Jonuse says this approach “aligns incentives with real economic activity rather than fixed inflation.”

The price of the qONE token has been on a bullish run since launch, but the discounted token price offered to HYLQ triggered a sharp pullback, followed by an equally sharp bounceback. qONE was trading at $$0.01569 in the European morning session.

Why launching qONE on Hyperliquid was probably a smart move

Since last year’s 10 October record liquidation event, which wiped out $19 billion in value and marked the start of the current bear market, Hyperliquid and its native HYPE token have decoupled from other crypto assets.

While Bitcoin and Ethereum struggle with institutional outflows, retail investor apathy, and stagnant price action, HYPE surged to new highs, recently trading around $30.05.

YTD Performance Comparison (1 Jan – 17 Feb 2026)

Launching on Hyperliquid is looking increasingly like a very smart move by the qLABS team. As Jonuse points out, “Hyperliquid is a top player in DeFi and soon a venue for trading pretty much all assets on-chain.

“While Quantum-Sig wallet technology will protect any EVM or Solana assets, and our core innovation can be used to upgrade any smart contract-based chain, we are launching on Hyperliquid to highlight the importance of this chain.

“Launching $qONE on Hyperliquid positions us at the intersection of cutting-edge security infrastructure and an actively expanding ecosystem, allowing $qONE to benefit not only from technical alignment but also from narrative-driven adoption and visibility.”

The post HYLQ Strategy Invests in Hyperliquid Quantum Solutions Pioneer qLABS, Buys 18,333,334 qONE Tokens appeared first on Cryptonews.

Crypto World

Grayscale Sui Staking ETF launches on NYSE Arca with staking

Editor’s note: In today’s rapidly evolving digital asset landscape, Grayscale’s new GSUI ETF adds a familiar avenue for investors to access SUI and participate in its staking dynamic. The move signals growing mainstream interest in scalable, real-world blockchain applications and the potential for staking-driven returns within an ETF wrapper. This note provides context on the implications for investors, regulators, and the broader ecosystem.

Key points

- Grayscale Sui Staking ETF (GSUI) begins trading on NYSE Arca.

- Investors gain exposure to SUI and staking rewards through an ETF.

- GSUI is not registered under the Investment Company Act of 1940 and carries higher risk; not suitable for all investors.

- Sui aims to enable real-world, scalable applications with parallel transaction processing.

Why this matters

As blockchain networks mature and institutional interest grows, products like GSUI offer a familiar market-access mechanism for exposure to a high-potential ecosystem. By combining SUI token exposure with staking mechanics inside an ETF wrapper, Grayscale signals continued momentum for real-world digital assets and their use cases in finance, gaming, and beyond.

What to watch next

- Trading liquidity and price performance of GSUI on NYSE Arca.

- Actual staking rewards realized by the fund and their impact on NAV.

- Adoption of the Sui ecosystem and related applications across industries.

- Regulatory and market developments affecting non-40 Act ETFs.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Grayscale® Sui Staking ETF (Ticker: GSUI) Launches on NYSE Arca with Staking

GSUI Delivers Targeted Exposure to Sui, the Next-Generation Smart Contract Platform

STAMFORD, Conn., February 18, 2026 – Grayscale, the world’s largest digital asset- focused investment platform*, today announced Grayscale® Sui Staking ETF (Ticker: GSUI), has begun trading on NYSE Arca, offering investors exposure to SUI while seeking to capture staking rewards generated through participation in the Sui network. Grayscale Sui Staking ETF (“GSUI” or the “Fund”), an exchange traded product, is not registered under the Investment Company Act of 1940, as amended (“40 Act”), and therefore is not subject to the same regulations and protections as 40 Act registered ETFs and mutual funds. GSUI is subject to significant risk and heightened volatility. GSUI is not suitable for an investor who cannot afford the loss of the entire investment. An investment in GSUI is not a direct investment in SUI.

Built by an industry-renowned team previously responsible for Facebook’s Diem project**, Sui is a fast, low-cost blockchain built to deliver the seamless digital experiences people expect from modern apps, on a network designed for real-world use. By processing multiple transactions in parallel, Sui is intended to offer blockchain applications at internet-level speed. It also has distinct features that allow for ease of use, like simple wallet logins through Gmail and continued functionality even when users are offline***.

Since its launch, Sui has rapidly expanded as a technology stack, rebuilding core infrastructure to allow developers to create sophisticated and highly valued applications.

In addition to providing investors exposure to SUI, GSUI is designed to participate in network staking, a core mechanism that supports the security and operation of the Sui blockchain. Staking rewards, net of applicable fees and expenses, may be reflected in the ETP’s net asset value, offering investors a potential additional source of return beyond price appreciation.

“GSUI’s launch on NYSE Arca marks an important milestone in expanding the range of exchange-traded products tied to the Sui ecosystem, including exposure to potential staking rewards,” said Krista Lynch, Senior Vice President, ETF Capital Markets, at Grayscale. “GSUI is structured to provide investors with exposure to SUI and its staking activity through an ETP, offering a convenient way to gain exposure to a network designed for scalable, real-world applications, and the next generation of digital experiences.”

As adoption expands across finance, gaming, AI, and consumer apps, Grayscale expects Sui to continue positioning itself to power a broad range of real-world digital experiences.

“This milestone further cements Sui’s growing role in the institutional adoption of digital assets, as Sui is backed with both the infrastructure required to support real-world applications at scale and the trust of leading financial partners,” said Adeniyi Abiodun, Chief Product Officer and Co-Founder at Mysten Labs, the original contributors to Sui.

“GSUI provides traditional investors with a streamlined way to access the SUI token and participate in its network activity through a familiar exchange-traded structure.”

Grayscale® Sui Trust ETF first launched as a private placement to eligible accredited investors in August 2024 and received its public quotation in November 2025. For more information about GSUI, please visit: https://etfs.grayscale.com/gsui

About Grayscale

Grayscale is the world’s largest digital asset-focused investment platform* with a mission to make digital asset investing simpler and open to all investors. Founded in 2013, Grayscale has been at the forefront of bringing digital assets into the mainstream. The firm has a long history of firsts, including launching the first Bitcoin and Ethereum exchange traded products in the United States. Grayscale continues to pioneer the asset class by providing investors, advisors, and institutional allocators with exposure to more than 45 digital assets through a suite of over 40 investment products, spanning ETFs, private funds, and diversified strategies. For more information, please follow @Grayscale or visit grayscale.com.

*Largest digital asset-focused investment platform based on asset under management (“AUM”) as of September 30, 2025. For other companies in this category, AUM is considered as of most recent public disclosure.

**Young Platform. (n.d.). Sui: What it is and how it works. Young Platform Academy.

***CoinGecko. (n.d.). What is Sui blockchain?. CoinGecko Learn.

Please read the prospectus carefully before investing in Grayscale Sui Staking ETF

(“GSUI” or the “Fund”). Foreside Fund Services, LLC is the marketing agent for the Fund and Grayscale Investments Sponsors, LLC is the sponsor.

As a non-diversified and single industry fund, the value of the shares may fluctuate more than shares invested in a broader range of securities. There is no guarantee that a market for the shares will be available, which will adversely impact the liquidity of the Fund.

Sui is a delegated proof-of-stake (DPoS) blockchain that relies on a distributed network of validators to confirm transactions and secure the network. Validators’ voting power (and participation in the active set) is determined by the amount of SUI staked to them by token holders through delegation.

Staking Risk. When the Fund stakes SUI, SUI is subject to the risks attendant to staking generally. Staking requires that the Fund lock up SUI for the period of time required by the staking protocol, meaning that the Fund cannot sell or transfer the staked SUI , thereby making it illiquid for the period it is being staked. Staked SUI is also subject to security breaches, network downtime or attacks, smart contract vulnerabilities, and validator or custodian failure or compromise, which can result in a complete loss of the staked SUI or a loss of any rewards. Potential staking rewards are earned by the Fund and not issued directly to investors.

SUI may have concentrated ownership and large sales or distributions by holders of SUI could have an adverse effect on the market price of such digital assets. The value of the Fund relates directly to the value of SUI, the value of which may be highly volatile and subject to fluctuations due to a number of factors. Because the value of the Fund is correlated with the value of SUI, it is important to understand the investment attributes of, and the market for, SUI. Please consult with a financial professional.

Media Contact

press@grayscale.com

Client Contact

866-775-0313

info@grayscale.com

Crypto World

Ethereum price prints bearish pennant as breakdown risk grows

Ethereum price is compressing into a tight bearish pennant, with declining volatility and converging structure signaling that a decisive move is approaching as downside risks continue to build.

Summary

- Bearish pennant structure suggests continuation risk, not reversal

- Volume expansion is required to confirm a valid breakdown

- $1,740 swing low is the key downside target, if support fails

Ethereum (ETH) price action is approaching a critical inflection point as the market compresses into a well-defined pennant structure. Periods of tightening range and declining volatility often precede strong directional moves, and in Ethereum’s case, the broader technical context leans bearish. The prevailing trend remains to the downside, with the market printing consecutive lower highs and lower lows before entering consolidation.

This consolidation phase is not random. Instead, it reflects a pause in momentum as buyers and sellers temporarily reach equilibrium before the next expansion. Given the bearish trend preceding this structure, the current pennant formation increases the likelihood of downside continuation rather than a reversal.

Ethereum price key technical points

- Bearish pennant structure is clearly defined, with converging support and resistance

- Prevailing trend remains bearish, favoring downside resolution

- $1,740 swing low is the key downside target, if breakdown is confirmed

Ethereum’s current structure fits the classic definition of a pennant formation. Support and resistance are converging, forcing price into a tightening range that is approaching an apex. This compression phase reflects declining volatility, which is often visible on both price action and the volume profile.

Historically, pennants tend to resolve in the direction of the prior trend. In Ethereum’s case, the move leading into this consolidation was clearly bearish, marked by sustained selling pressure and weak follow-through on relief rallies. As a result, the probability favors a continuation lower once the structure resolves.

The closer price trades toward the apex, the more likely it is that volatility will return abruptly. Pennant breakouts are often sharp, leaving little room for reaction once the move begins.

Volume behavior is the key confirmation signal

One of the most important factors to monitor during pennant formations is volume. Ethereum’s consolidation has been accompanied by declining volume, which is typical during compression phases. This contraction in volume reflects reduced participation as traders wait for confirmation of direction.

For a bearish breakdown to be considered valid, it must be accompanied by increasing bearish volume. A strong expansion in sell-side volume would confirm that sellers are regaining control and that the breakout is not a false move. Without this confirmation, any break risks being short-lived or reversing back into the range.

Volume, therefore, will be the deciding factor in determining whether Ethereum’s next move develops into a sustained trend or a temporary spike.

$1,740 swing low comes into focus

If Ethereum breaks down from the bearish pennant with volume confirmation, the next major downside target sits at the $1,740 swing low. This level represents the most recent structural low and a natural magnet for price if downside momentum accelerates.

Markets often revisit prior swing lows during corrective or continuation phases to test demand and clear remaining liquidity. A move toward $1,740 would align with the broader bearish structure and reflect a continuation of the prevailing trend.

How price reacts at that level will be critical. A sharp rejection could lead to a short-term bounce, while acceptance below it would expose Ethereum to deeper downside risk.

Market structure remains bearish

From a market structure perspective, Ethereum has not yet shown signs of reversal. Lower highs remain intact, and no meaningful reclaim of resistance has occurred. Until price breaks above the upper boundary of the pennant and holds with volume, rallies should be treated as corrective rather than trend-changing.

This reinforces the idea that the current pennant is more likely a continuation pattern than a base for reversal. Structural confirmation will only come after the market resolves decisively out of compression.

What to expect in the coming price action

From a technical, price action, and market structure perspective, Ethereum is approaching a moment of expansion. The bearish pennant suggests that the market is storing energy for a directional move, with downside continuation favored due to the prevailing trend.

In the near term, traders should expect increased volatility as price reaches the apex of the structure. A breakdown backed by strong bearish volume would legitimize a move toward the $1,740 swing low. Conversely, a lack of volume or a failed breakdown would signal continued consolidation.

Until proven otherwise, Ethereum remains vulnerable to downside continuation, and the next breakout from this pennant is likely to define short-term market direction.

Crypto World

Hyperliquid starts DeFi lobbying group in U.S. with $29 million HYPE token backing

Hyperliquid (HYPE), a blockchain-based exchange that processed more than $250 billion in perpetual futures trading last month, has launched a U.S. lobbying and research arm aimed at shaping how lawmakers regulate decentralized finance (DeFi).

The Hyperliquid Policy Center, a Washington, D.C.-based nonprofit, will focus on regulatory frameworks for decentralized exchanges, perpetual futures and blockchain-based market infrastructure, according to a Wednesday press release.

Jake Chervinsky, a prominent crypto lawyer and former policy head at the Blockchain Association, will serve as founder and CEO.

The launch comes as Congress and federal agencies debate how to oversee crypto trading platforms and derivatives markets. Perpetual futures, which allow traders to hold leveraged positions without an expiration date, are widely used on offshore venues but remain a gray area under U.S. law.

The arrival of a new group also represents just the latest entrant into a Washington crypto-policy scene that’s jammed with similar organizations, including the DeFi Education Fund and Solana Policy Institute, in addition to the broader groups such as the Digital Chamber, Blockchain Association and Crypto Council for Innovation. And the new organization lands as negotiation is well underway on Senate legislation that may set U.S. DeFi policy.

Hyperliquid operates a decentralized exchange that lets users trade perpetual futures directly on blockchain rails without a central intermediary. Instead of routing trades through a traditional broker or clearinghouse, transactions settle onchain.

The platform has emerged as one of the fastest-growing venues in crypto derivatives. It handled more than $250 billion in perpetual trading volume and $6.6 billion spot volume over the past month, DefiLlama data shows.

“Financial markets are migrating onto public blockchains because they offer efficiency, transparency and resilience that legacy systems cannot match,” Chervinsky said in a statement.

“Now the United States must choose: We can either adopt new rules that allow this innovation to flourish here at home, or we can wait and watch as other nations seize the opportunity,” he added.

The new policy group plans to brief lawmakers, publish technical research and advocate for rules tailored to decentralized systems, the press release said.

The Hyper Foundation, which supports the Hyperliquid ecosystem, is contributing 1 million HYPE tokens, worth roughly $29 million, to fund the launch. While that’s less than was committed to the launch last year of the Ripple-backed National Cryptocurrency Association, it’s much more than the $5.6 million the Digital Chamber spent in 2024 or the $8.3 million spent by the Blockchain Association, according to public filings.

Crypto World

BTC will make new records as Fed responds to AI-related credit collapse

BitMEX co-founder Arthur Hayes says bitcoin’s recent 52% crash from its October all-time high is flashing a critical warning signal — but the crypto could ultimately soar to new records once the Federal Reserve responds to an AI-driven banking crisis he believes is imminent.

In his latest essay, “This Is Fine,” Hayes argued that bitcoin’s divergence from traditional tech stocks reveals its role as the “global fiat liquidity fire alarm.” While the Nasdaq has remained relatively flat, bitcoin has plunged from $126,000 to its current $67,000, pricing in what Hayes describes as a massive credit destruction event that equity markets have yet to acknowledge.

“Bitcoin is the most responsive freely traded asset to the fiat credit supply,” Hayes wrote. “The divergence recently between bitcoin and the Nasdaq sounds the alarm that a massive credit destruction event is nigh.”

Hayes models a scenario where artificial intelligence displaces just 20% of America’s 72.1 million knowledge workers, triggering approximately $557 billion in consumer credit and mortgage defaults — about half the severity of the 2008 financial crisis. This AI-driven shock would devastate regional banks and force the Federal Reserve into “the biggest money printing in history,” he predicts.

“Deflation is bad, but ultimately good for fiat credit-sensitive assets like Bitcoin,” said Hayes. “First, the market prices the impact … Then … the monetary mandarins panic and press that Brrrr button harder than I shred pow the morning after a one-meter dump.”

Hayes noted gold’s recent gains, particularly against bitcoin, as another red flag, stating that “a surging gold versus a slumping Bitcoin clearly tells us that a deflationary risk-off credit event within Pax Americana is brewing.”

Hayes said that once the Fed intervenes with emergency liquidity measures — similar to the March 2023 response to regional bank failures — bitcoin will “pump decisively off its lows” and the expectation of sustained money printing will drive it to new all-time highs.

That doesn’t mean there won’t be more pain ahead for the foreseeable future, said Hayes. He warned bitcoin could fall further before the Fed acts, potentially breaking below $60,000 as political dysfunction delays the central bank’s response. Crypto investors, he advised, should stay liquid, avoid leverage, and “wait for the all-clear from the Fed that it’s time to dump filthy fiat and ape into risky assets with wanton abandon.”

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World1 day ago

Crypto World1 day agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Business16 hours ago

Business16 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video1 day ago

Video1 day agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment3 hours ago

Entertainment3 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech7 hours ago

Tech7 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video7 days ago

Video7 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business9 hours ago

Business9 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal