Crypto World

Bitcoin Mining’s Biggest Shock Since the 2021 China’s Ban

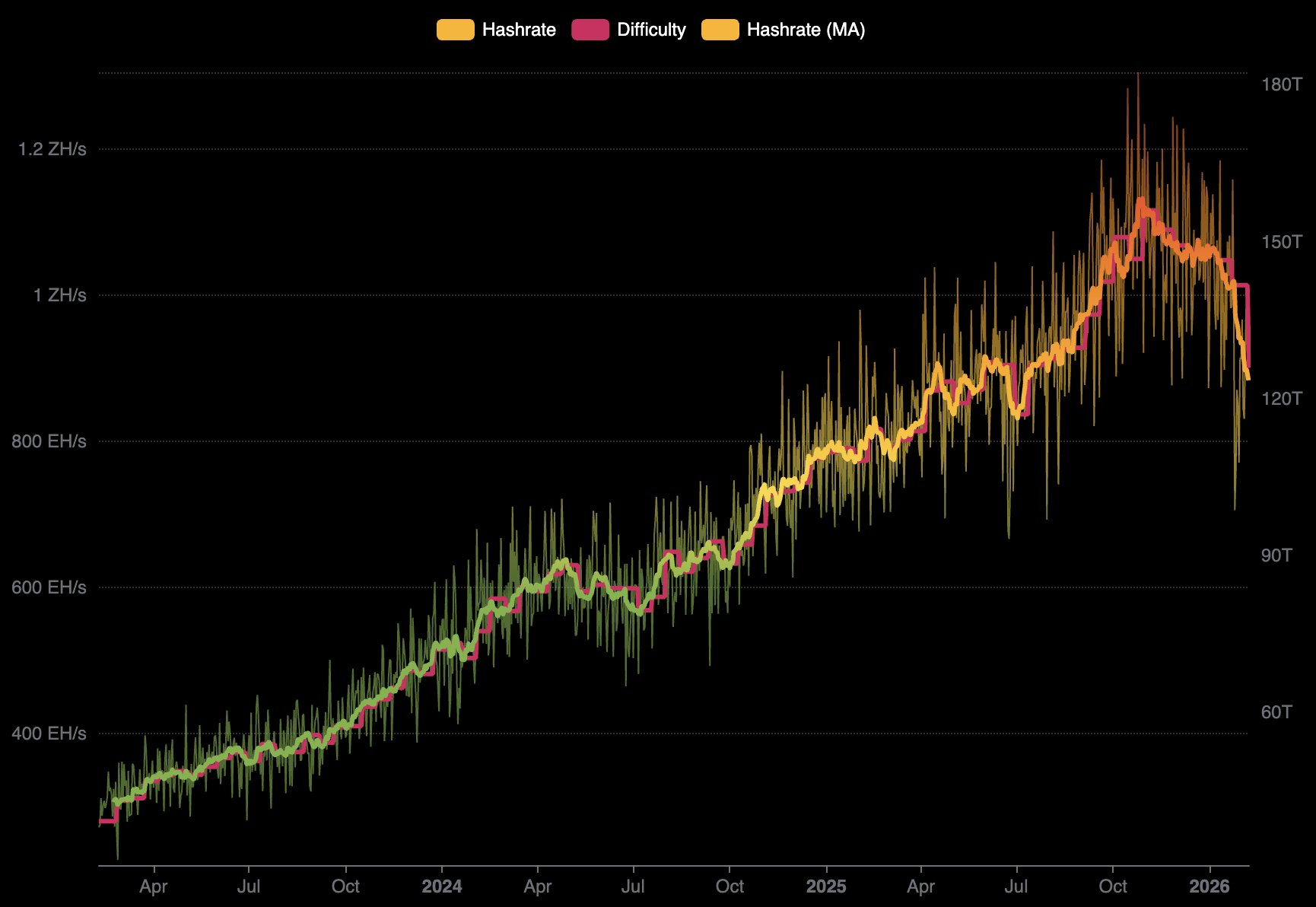

Bitcoin’s mining difficulty has registered its steepest decline in nearly five years.

The historic drop signals a dual crisis of extreme weather constraints and deepening economic pressure on network operators.

Sponsored

Sponsored

Bitcoin Mining Economics Crack Amid Falling Prices

According to Mempool developer Mononaut, the network’s difficulty adjusted downward by 11.16% to 125.86 trillion (T) this week.

Notably, this adjustment marks the largest capitulation in mining power since July 2021. At the time, a state-mandated ban in China forced a massive exodus of hashing power.

The difficulty adjustment mechanism is designed to keep Bitcoin block production at steady 10-minute intervals.

When miners go offline, block times slow, prompting the protocol to lower the difficulty to make mining easier for the remaining participants.

Unlike the geopolitical shocks of 2021, the current decline is driven by a collision of meteorological instability and thinning profit margins.

Sponsored

Sponsored

The sharp contraction follows severe winter storms across North America in late January, which disrupted energy grids serving major mining clusters.

In jurisdictions such as Texas, miners participate in “demand response” programs. These operators voluntarily reduce their power consumption during peak load periods to help stabilize the grid in exchange for energy credits.

However, the magnitude of this 11% drop suggests more than just temporary curtailment. It points to economic capitulation.

The severe weather stressed the electrical infrastructure, spiking spot power prices.

For operators running older, less efficient hardware, the surge in operating expenses likely pushed profitability into negative territory. This financial strain led to a permanent or semi-permanent shutdown of rigs.

Notably, available data suggest that major industry players were already operating with exceptionally thin margins before the storms hit.

Ki Young Ju, CEO of the analytics firm CryptoQuant, estimated that Bitcoin miner Marathon Digital spent approximately $67,704 to mine a single BTC in the third quarter of 2025.

With BTC trading below $70,000, several miners are operating at a loss before accounting for other general expenses.

Crypto World

Arthur Hayes Reportedly Dumps These DeFi Tokens: Full Details

The former BitMEX CEO has moved millions of dollars worth of certain DeFi tokens, here’s which ones.

Arthur Hayes, perhaps best known for his leadership at BitMEX years ago, has made several high-value transfers for numerous altcoins, mostly from the DeFi space, which caught the attention of monitoring resources such as Lookonchain.

Given his history of offloading similar tokens in times of market uncertainty, the analysts speculated that he had likely made the transfers to sell $1.06 million worth of ENA, $954,000 worth of ETHFI, and $1.14 million worth of PENDLE.

Arthur Hayes(@CryptoHayes) is selling DeFi tokens.

In the past 15 minutes, he moved out 8.57M $ENA($1.06), 2.04M $ETHFI($954K), and 950K $PENDLE($1.14M) — likely to sell.https://t.co/loeYKUb9rN pic.twitter.com/ZOJnUHCTdr

— Lookonchain (@lookonchain) February 8, 2026

Hayes made several big sell-offs in August last year, claiming that the crypto market was due for a large correction. However, the market went the other direction, and some of the assets he sold, such as ETH, skyrocketed in the following weeks.

Just days later, he regretted his decision with a post on X. Hayes explained that he had to buy it all back at higher prices, asked for forgiveness from the Ethereum community, and promised not to take ETH profits again.

In November, though, further on-chain data from Lookonchain showed that he disposed of 520 ETH for $1.66 million, alongside ENA and ETHFI.

Another report from late December 2025 indicated that he had sold additional ETH and purchased PENDLE, LDO, ENA, and ETHFI again. If he indeed offloaded the DeFi tokens now, it would result in a substantial loss given the latest market correction.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Crypto is Europe’s answer to Revolut’s fintech dominance

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Revolut’s fintech expansion across Europe and globally is severely constraining the playing field for European fintech founders. Attempting to build a European-scale fintech — which means competing directly with Revolut — has become extremely challenging, both from a product and marketing perspective.

Summary

- Revolut closed the fintech door — crypto opens a new one: Competing head-on with a 65M-user super-app is a losing game, but Revolut’s relative neglect of crypto creates a rare, defensible opening.

- MiCA turned crypto from a risk into a credential: Regulatory clarity doesn’t just unlock Europe — it boosts global trust, capital access, and turns licenses into real balance-sheet value.

- Europe is perfectly priced for crypto scale: Cheaper talent, growing stablecoin demand, and returning VC capital make crypto-finance Europe’s best shot at building the next pan-regional champion.

By September 2025, Revolut reached 65 million customers worldwide, with 12 million in the UK alone. The company has also announced a firm timeline for serving 100 million customers, aiming to hit this milestone by mid-2027. As a result, the window of opportunity for European fintech development is rapidly narrowing. Entrepreneurs are left with only two viable options: either build a super-niche project, both in terms of product and geography — think local payment services — or exploit Revolut’s main blind spot. In their pursuit of banking licenses and regulatory relationships, they haven’t been developing crypto services with sufficient intensity.

The latter model offers several compelling advantages. Due to certain characteristics of the European startup scene, a crypto-finance project has excellent chances for global expansion, or at a minimum, pan-European growth.

Regulation

The rollout of Markets in Crypto-Assets Regulation has given crypto projects a major boost — not because it specifically permitted or prohibited anything, but simply because it established clear, understandable frameworks for what a project must comply with to stay compliant in Europe.

There’s an unusual side effect to this regulation: MiCA enhances trust in crypto projects beyond Europe’s borders. For example, in Latin American markets, it creates an extremely positive attitude from regulators toward projects, so it becomes a notable green flag.

The workforce and economy

Compared to the US, hiring employees in Europe is significantly cheaper. Hiring one engineer in the US is equivalent to hiring two or three in Europe. It’s worth noting that in Europe, you can recruit the same developers or product managers from Revolut itself, which definitely makes sense in the context of expansion.

Cryptocurrency turnover is actively growing in Europe. Even our own statistics confirm that users are interested in receiving stablecoins to their accounts and using them as a means of payment.

Funding

While fintech attracted less and less money in recent years, the situation is now changing.

“If 2024 was defined by scarcity, 2025 was defined by bifurcation. The recovery in fundraising has been robust, with year-to-date figures reaching approximately €6.3 billion by September, surpassing 70% of 2024’s total.”

Part of this money is flowing into crypto, as the sector becomes institutionalized through MiCA. A license significantly capitalizes a company, transforming it in investors’ eyes from an unproven concept into a clearly understood fintech company.

“With MiCA fully live, we expect 2026 to be the year of Stablecoin Rails. Major European banks are already piloting Euro-denominated stablecoins. The ‘wild west’ of crypto is over; the institutionalization of digital assets is here, and it will likely become the standard for cross-border B2B payments.”

What could be improved?

Despite being a major benefit, MiCa still hasn’t fully solved compliance. Current legislation and regulators still stumble over crypto-specific issues when it comes to how businesses earn and spend money in crypto form. Moreover, since we’re dealing with an extremely young fintech instrument, tax incentives could facilitate its development and growth.

So if you’re feeling the pressure from Revolut on your European fintech business, we strongly advise taking a serious look at the crypto-finance market. Europe provides numerous benefits to fintech businesses that they can leverage for global expansion.

Crypto World

Ethereum price confirms inverted H&S as staking queue soars

Ethereum price could be preparing a strong rebound after forming a giant hammer candle and confirming the inverted head-and-shoulders chart pattern as the staking queue jumps to a record high.

Summary

- Ethereum price dropped for three consecutive weeks.

- The staking queue has jumped to a record high.

- ETH has formed an inverted head-and-shoulders pattern.

Ethereum (ETH) token was trading at $2,080, up sharply from last week’s low of $1,738. This price is much lower than the all-time high of nearly $5,000.

The ongoing Ethereum crash is notable as it is happening when the token has some of the best fundamentals ever. For example, more investors are delegating their coins to staking. Data shows that 4 million ETH coins are waiting in line to stake.

The entry queue has jumped to a record high of 4.06 million coins, while only 31,915 coins are waiting to get out. These numbers mean that the wait time to stake has jumped to 70 days. These numbers mean that there is still demand for Ethereum and that most holders are not panic-selling.

Ethereum’s network statistics are booming, a sign that the Fusaka upgrade was successful. Nansen data shows that Ethereum’s active addresses jumped by 38% in the last 30 days to over 15 million. Its transactions soared by 37% to over 70 million, while its fees soared to nearly $20 million.

Ethereum is benefiting because of its commanding market share in some of the most important industries in the crypto industry. For example, it is the biggest chain in the real-world asset tokenization industry, with a market share of over 70%.

Ethereum price technical analysis

The weekly timeframe chart shows that the ETH price has been in a freefall in the past few months. It has dropped in the last three consecutive weeks, with the Relative Strength Index moving to the oversold level of 30.

The coin has been slowly forming the inverted head-and-shoulders pattern, a common bullish reversal sign. There are signs that the coin has completed the formation of the right shoulder.

It has also formed a hammer candle, which is made up of a long lower shadow and a small body. A hammer is another common bullish reversal sign in technical analysis.

Therefore, the coin will likely bounce back in the coming weeks, potentially to the psychological point at $2,500. A move below the lower side of the hammer will invalidate the bullish outlook.

Crypto World

HBAR Price Signals Potential Rally, But Bitcoin Risk Looms

Hedera has come under renewed pressure after a broader market downturn dragged HBAR lower. The recent price drop reflects bearish cues driven by macro uncertainty and weakness in Bitcoin.

While the long-term outlook for Hedera remains constructive, near-term recovery attempts may struggle as market headwinds continue to weigh on sentiment.

Sponsored

HBAR Has A Different Target

Price action remains macro bullish, with HBAR trading inside a well-defined descending channel. The rejection from the channel’s upper boundary near $0.1290 confirmed seller dominance.

The recent drop toward $0.0893 shows weak demand, signaling continuation risk as momentum and structure remain tilted to the downside.

Immediate support sits at $0.0786, which previously triggered a short-lived bounce. As the pattern projects a bullish outcome, the breakout from it can trigger a 31% rise. This would send HBAR rallying towards $0.1252, marking a short bounce which in turn could lead to further recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Sponsored

HBAR Traders Are Preparing For New Lows

Derivatives data, however, paints a more nuanced picture of trader expectations. HBAR’s futures funding rate has stayed in negative territory for the past 48 hours, even as the price attempted to stabilize. Negative funding indicates short positions are paying longs, reflecting a bias toward further downside.

This positioning suggests traders expect additional weakness and are attempting to profit from it. Short contracts currently dominate longs, signaling skepticism around any immediate recovery.

While excessive short exposure can fuel sharp squeezes, it also highlights prevailing caution across speculative participants.

Sponsored

HBAR’s high correlation with Bitcoin adds another layer of risk. The correlation coefficient between HBAR and BTC currently sits near 0.96. Such a strong relationship typically benefits altcoins during Bitcoin rallies, as capital flows across the market in unison.

In the current environment, however, this correlation acts as a constraint. Bitcoin has struggled to regain momentum, and continued weakness in BTC could delay HBAR’s recovery. Until Bitcoin stabilizes or reverses higher, HBAR is likely to mirror broader market pressure rather than decouple meaningfully.

Sponsored

HBAR Price Support Levels Next

HBAR is trading near $0.0895 at the time of writing, sitting just below the $0.0907 resistance. This level has capped recent upside attempts. A successful flip of $0.0907 into support would be the first signal of improving structure, opening a path toward the $0.1029 target.

Given prevailing conditions, a failed breakout appears more likely in the near term. If HBAR cannot reclaim $0.0907, the price may consolidate above the $0.0832 support. A breakdown below that level would expose HBAR to a deeper decline toward $0.0710, extending the downtrend.

A more constructive outcome depends on reclaiming $0.1029. Securing that level would allow HBAR to recover a meaningful portion of recent losses. Such a move would invalidate the bearish thesis and signal that buyers are regaining control, provided broader market conditions, led by Bitcoin, also improve.

Crypto World

Is This the Best Crypto Coin to Buy While Prices Are Still Low?

With the crypto market still trading below previous highs, many investors are asking a familiar question: where is the best opportunity before the next major move begins? Historically, periods of muted prices have rewarded those who focus on early-stage projects showing real progress rather than short-term hype. One name increasingly coming up in these discussions is Mutuum Finance (MUTM), a new DeFi project that is still in presale while actively delivering on development.

Why MUTM Is Still Considered Undervalued

Mutuum Finance is currently in Phase 7 of its presale, with the MUTM token priced at $0.04, compared to a confirmed $0.06 launch price. Since the presale began at $0.01, the token price has increased in structured steps tied to development milestones rather than speculation. At today’s level, MUTM is already up 300% from its starting price, yet it remains 50% below its launch valuation.

The presale has raised over $20.43 million, drawing participation from a growing number of holders and signaling sustained demand. Analysts often point out that this combination—strong fundraising, disciplined price progression, and a clear launch price—creates a window where tokens are still considered discounted relative to their initial market entry.

Analyst Price Outlook and Upside Potential

Some analysts are projecting that MUTM could reach $0.35 shortly after launch, driven by a mix of early adoption, development delivery, and potential exchange exposure. From the current presale price of $0.04, a move to $0.35 would represent an increase of approximately 775%.

These projections are largely based on execution rather than narrative alone. Mutuum Finance has already launched its V1 lending and borrowing protocol on the Sepolia testnet, allowing users to test core functionality ahead of mainnet. In addition, the project has completed security audits and continues to roll out updates, which analysts see as key factors in reducing execution risk.

Some market observers also suggest there is a high possibility of listings on major exchanges after launch, as platforms often prioritize projects that demonstrate live infrastructure, audited contracts, and sustained investor demand. Exchange exposure, if it materializes, has historically been a catalyst for increased liquidity and price discovery in the early post-launch phase.

To put the potential upside into perspective, a $2,000 investment at the current $0.04 price would secure 50,000 MUTM tokens. When the token were to reach the $0.35 level discussed by analysts, that position would be valued at $17,500, representing a gain of $15,500 before fees and market considerations.

How Mutuum Finance Works

At its core, Mutuum Finance is designed to generate real utility through decentralized lending and borrowing. Users who supply assets receive mtTokens, which represent their deposit positions and automatically accrue yield over time. These mtTokens can be staked, making holders eligible for dividends paid in MUTM tokens through a buy-and-distribute mechanism funded by protocol revenue.

Borrowers, meanwhile, can unlock liquidity by providing overcollateralized positions rather than selling their assets. This structure allows users to access capital while maintaining exposure to their holdings, a model widely used across DeFi but refined in Mutuum Finance through automated risk controls and transparent on-chain tracking.

Expansion and Ecosystem Growth

Beyond launch, Mutuum Finance’s roadmap includes several developments aimed at expanding the ecosystem. Plans include multi-chain expansion, allowing the protocol to operate across multiple blockchain networks, and the future introduction of a native overcollateralized stablecoin designed to enhance liquidity and platform utility.

The project is also running a $100,000 giveaway, aimed at rewarding early participants during the presale phase. Entry requirements and tasks are outlined on the project’s website, adding an additional incentive for community engagement while development continues.

For investors searching for the best crypto coin to buy while prices are still low, Mutuum Finance is increasingly part of the conversation. With a token price of $0.04, a confirmed $0.06 launch price, active protocol development, and analyst projections pointing toward higher post-launch valuations, MUTM remains in a phase that many view as an early opportunity.

As always, market conditions can change, but with the presale still open and development milestones already delivered, Mutuum Finance continues to stand out as a project worth watching while prices remain at early-stage levels.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Jack Dorsey’s Block May Slash Up To 10% of Staff: Report

Jack Dorsey’s payments company Block Inc. has begun informing hundreds of employees that their roles could be eliminated during annual performance reviews, as the firm undertakes a wider restructuring effort.

As much as 10% of Block’s workforce may be affected, Bloomberg reported on Sunday, citing people familiar with the matter. The company employed just under 11,000 people as of late November, an executive reportedly said at the time.

The potential layoffs come as Block reshapes its operations following a reorganization launched in 2024 aimed at improving efficiency and aligning its product lines. The company is working to more closely link its peer-to-peer payments platform Cash App with its merchant services arm Square.

At the same time, Block is expanding newer initiatives, including its Bitcoin (BTC) mining division Proto and an artificial intelligence project known as Goose.

Related: Cash App plans to unlock stablecoin transactions ’soon’

Block expected to post $403 million Q4 profit

Block is scheduled to release quarterly earnings on Feb. 26, according to Bloomberg. Analysts expect adjusted profit of about $403 million, or 68 cents per share, on revenue of roughly $6.25 billion for the fourth quarter, per the report.

The company last reported third-quarter net income of $461.5 million on $6.11 billion in revenue. Gross profit rose 18% year over year, driven by 24% growth in Cash App and 9% growth in Square, though the stock fell after the release as some performance metrics missed Wall Street expectations.

For the third quarter, Bitcoin generated about $1.97 billion in revenue, down from $2.4 billion a year earlier but still the company’s second-largest revenue stream. Block held 8,780 BTC worth over $1 billion by the end of September, recording a $59 million quarterly valuation loss.

Related: Jack Dorsey urges tax-free status for ‘everyday’ Bitcoin payments

Square launches Bitcoin payments for merchants

In November last year, Square, the payments platform owned by Block, rolled out a Bitcoin payment option, allowing merchants to accept BTC directly at checkout through its point-of-sale terminals. Sellers can process transactions in multiple ways, including Bitcoin-to-Bitcoin and automatic conversion between Bitcoin and fiat currency.

The launch added on earlier tools that let merchants convert a portion of daily card sales into Bitcoin as part of Square’s broader payment and wallet ecosystem. More than four million sellers across eight countries use Square.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Bitso Deploys Ripple Payments and RLUSD to Speed Up Latin American Transfers

TLDR:

- Bitso reduces cross-border transfer times from multiple days to near-instant using blockchain technology

- RLUSD provides regulated dollar-denominated stability for volatile Latin American payment corridors

- Platform positions as U.S.-LATAM payout partner as demand for compliant stablecoin solutions expands

- Ripple Payments eliminates multi-hop banking processes, reducing costs and increasing transparency

Bitso accelerates cross-border payments through its deployment of Ripple Payments, XRP and RLUSD across Latin American markets.

The digital asset platform reduces international transfer times from days to near-instant settlement for business clients.

Traditional banking systems previously required multiple intermediaries and extended processing periods. Bitso now delivers faster money movement by leveraging blockchain rails and regulated stablecoin infrastructure for regional payment corridors.

Speed Improvements Replace Multi-Day Settlement Processes

Bitso has transformed its platform to prioritize transaction velocity for cross-border transfers. The company shifted from crypto exchange operations to B2B payment infrastructure.

Legacy payment systems in Latin America typically process international transfers through several correspondent banks. Each intermediary adds processing time and reduces transparency throughout the settlement chain.

Ripple Payments enables Bitso to bypass traditional multi-hop routing entirely. Blockchain technology settles transactions in minutes rather than the standard two-to-five business days.

XRP serves as a bridge currency to accelerate conversions between different fiat denominations. RLUSD provides dollar-denominated stability without requiring traditional banking infrastructure.

The acceleration benefits both remittance flows and commercial payment operations. Businesses previously waited days to receive international payments from partners or customers.

Bitso now completes these same transfers within minutes using distributed ledger technology. Recipients access funds almost immediately after transaction initiation.

Gabriele Zuliani, Head of Growth at Bitso, spoke about the transformation this technology brings. “RLUSD and Ripple Payments let us reinvent how money moves globally: faster, at lower cost, and with far greater transparency,” Zuliani said.

He added that as demand grows in the U.S., Bitso stands ready to serve that demand. The platform aims to become the rail and payout partner for LATAM.

Rapid Blockchain Settlement Powers Regional Payment Distribution

The acceleration strategy addresses specific pain points within Latin American financial markets. Local currency volatility creates urgency around fast, stable settlement options.

Businesses cannot afford to wait days while exchange rates fluctuate during transfer processing. RLUSD enables rapid conversion to dollar-denominated value.

Bitso positions itself as a payout partner capable of distributing funds throughout the region quickly. The platform maintains local market presence across multiple Latin American countries.

This regional footprint combines with blockchain speed to deliver comprehensive payment solutions. Companies can now send payments that reach recipients the same day.

Regulated stablecoin infrastructure supports the acceleration without sacrificing compliance requirements. RLUSD operates within established financial oversight frameworks while maintaining transaction speed.

Traditional compliance processes often slow down international transfers through extended verification periods. Bitso balances regulatory adherence with operational efficiency.

Growing demand from U.S. businesses requires scalable, rapid payment infrastructure for Latin American operations.

Bitso’s blockchain-based approach handles increasing transaction volumes without proportional slowdowns. As cross-border payment needs expand, the platform scales its acceleration capabilities accordingly.

The combination of Ripple Payments, XRP and RLUSD creates infrastructure for next-generation regional money movement.

Crypto World

Ethereum Faces 200-Day EMA Rejection Amid $7B Liquidation Cascade

TLDR:

- ETH failed three times at the 200-day EMA, confirming weakening momentum and sustained selling pressure.

- Over $1.3B in long liquidations shows derivatives activity dominated price action, not spot demand.

- The $2.7K level flipped from support to resistance, redefining near-term market structure.

- Focus now shifts to $2.3K and $1.8K as the next zones of potential buyer interest.

ETH 200-day EMA rejection shows repeated failures near resistance aligned with a wave of forced liquidations. Price action now reflects leverage-driven volatility instead of organic trend recovery.

Distribution Behavior Emerges at Key Technical Resistance

ETH price moved higher, yet the advance lacked sustained demand. Instead, it appeared driven by short covering into a known supply zone.

Momentum weakened with every approach to the moving average. Candle bodies narrowed, and upper wicks became more frequent. At the same time, volume failed to expand.

Furthermore, the repeated rejection pattern reinforced technical exhaustion. Three attempts at the same resistance level produced lower follow-through each time. This suggested that sellers maintained control despite temporary upside pressure.

On social media, several analysts shared charts showing price stalling exactly at the 200-day EMA. Therefore, upside strength functioned mainly as liquidity for larger participants.

Soon after, ETH slipped back below $2.7K. That level had served as short-term support during the rebound phase. Once breached, it transitioned into resistance, and market bias tilted downward.

This pivot divided two narratives. Above $2.7K, traders could argue for base formation. Below it, the structure favored continued probing lower. As a result, each rally into that zone now attracts selling interest.

Moreover, price behavior showed hesitation rather than conviction. Buyers failed to defend higher levels with sustained closes. Sellers, in contrast, reacted quickly at technical boundaries.

Thus, the pattern reflected strategic positioning rather than emotional panic. Distribution unfolded gradually, supported by visible rejection zones and fading momentum. The chart no longer communicated recovery. Instead, it communicated controlled exits into strength.

Liquidation Cascades Replace Organic Market Flow

ETH 200-day EMA rejection coincided with violent intraday swings driven by derivatives activity. Price repeatedly moved from $80 to $100 within minutes. Such behavior is not typical of spot-led markets.

Approximately $1.3 billion in long liquidations occurred during the session. These events represented forced closures of leveraged positions, not discretionary selling. Therefore, the tape reflected margin mechanics rather than investor sentiment.

As the price crossed clustered liquidation levels, automated orders accelerated the decline. Each wave triggered the next. Consequently, volatility expanded in both directions.

Total liquidations surpassed $7 billion across the broader market. This scale revealed how one-sided positioning had become before the breakdown. When exposure concentrates, even small price shifts can ignite chain reactions.

Meanwhile, ETH failed to stabilize above reclaimed levels. The $2.7K zone remained overhead resistance. This reinforced the idea that rebounds were corrective, not impulsive.

Attention has now shifted to the $2.3K region. That area previously hosted strong demand. If the price reaches it, buyers may attempt to stabilize conditions. However, failure there would expose the $1.8K support band.

Traders continue to frame current rallies as liquidity events. Strength is treated cautiously, while resistance zones receive priority.

Crypto World

ARK Invest Sells $22M Coinbase Shares, Buys Bullish Across ETFs

error code: 524

This article was originally published as ARK Invest Sells $22M Coinbase Shares, Buys Bullish Across ETFs on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

Crypto World

Gemini and ChatGPT Predict Shocking Lows for Cardano’s ADA

Has ADA finally bottomed after dumping below $0.23 or is there more pain ahead?

Cardano’s native token is once again under heavy pressure, alongside most of the market. However, while BTC and most other alts crashed to their lowest levels since the US presidential elections in late 2024, ADA went even further, dropping to $0.222 (on Bitstamp and other exchanges) for the first time since June 2023.

Despite recovering slightly to $0.27, the token is still 34% down monthly. Moreover, it has plunged by 80% since its cycle top at $1.33 marked in late 2024. Consequently, we asked ChatGPT and Gemini whether the worst is behind ADA or if there is more pain around the corner.

ChatGPT Says…

ChatGPT began with some harsh words for Cardano investors, suggesting that the decline to the $0.22 area is “not just another routine dip.” Instead, it believes it represents a “structural breakdown of long-term support, confirming that sellers remain firmly in control.” This was proven after the asset plunged below key support levels at $0.40, $0.30, and even $0.25 (which was later reclaimed, though).

What could spell further trouble for ADA looking ahead is that these consecutive price drops suggest that “the buy-the-dip demand has steadily weakened” lately. As such, all eyes have now turned to the $0.20 support, which has become the “line in the sand.”

If ADA is to fall below that psychological level, the most realistic target during the ongoing bear phase would be a dip to $0.15-$0.16. However, ChatGPT outlined a more extreme capitulation scenario, in which the token plummets to $0.10-$0.12.

“While this may sound shocking, large-cap altcoins have historically lost 80-90% from cycle highs during severe downturns. ADA is not immune to that pattern,” it concluded.

Gemini’s Take

Dumping below $0.30 meant that ADA’s daily chart has turned into a “falling knife,” said Gemini. This breakdown below the multi-year support was the “final nail in the coffin for many long-term holders.” On its way down, the asset dumped below its 200-day MA (at around $0.45), and it obliterated millions in leveraged longs. Gemini’s “nightmare” scenario envisions a drop to even below $0.10 if certain factors align in an adverse manner:

“If Bitcoin capitulates to $55K in the coming weeks, ADA risks losing its status as a “major” altcoin. A breakdown below $0.15 opens a liquidity vacuum all the way down to $0.09. While this sounds impossible, remember that “impossible” things happen regularly in crypto winters,” it warned.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech4 days ago

Tech4 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics6 days ago

Politics6 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports1 day ago

Sports1 day agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports23 hours ago

Former Viking Enters Hall of Fame

-

Crypto World6 days ago

Crypto World6 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports2 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat5 days ago

NewsBeat5 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business3 days ago

Business3 days agoQuiz enters administration for third time

-

Sports6 days ago

Sports6 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat6 days ago

NewsBeat6 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat1 day ago

NewsBeat1 day agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World5 days ago

Crypto World5 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat5 days ago

NewsBeat5 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World3 days ago

Crypto World3 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World3 days ago

Crypto World3 days agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

Business2 hours ago

Business2 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation