Crypto World

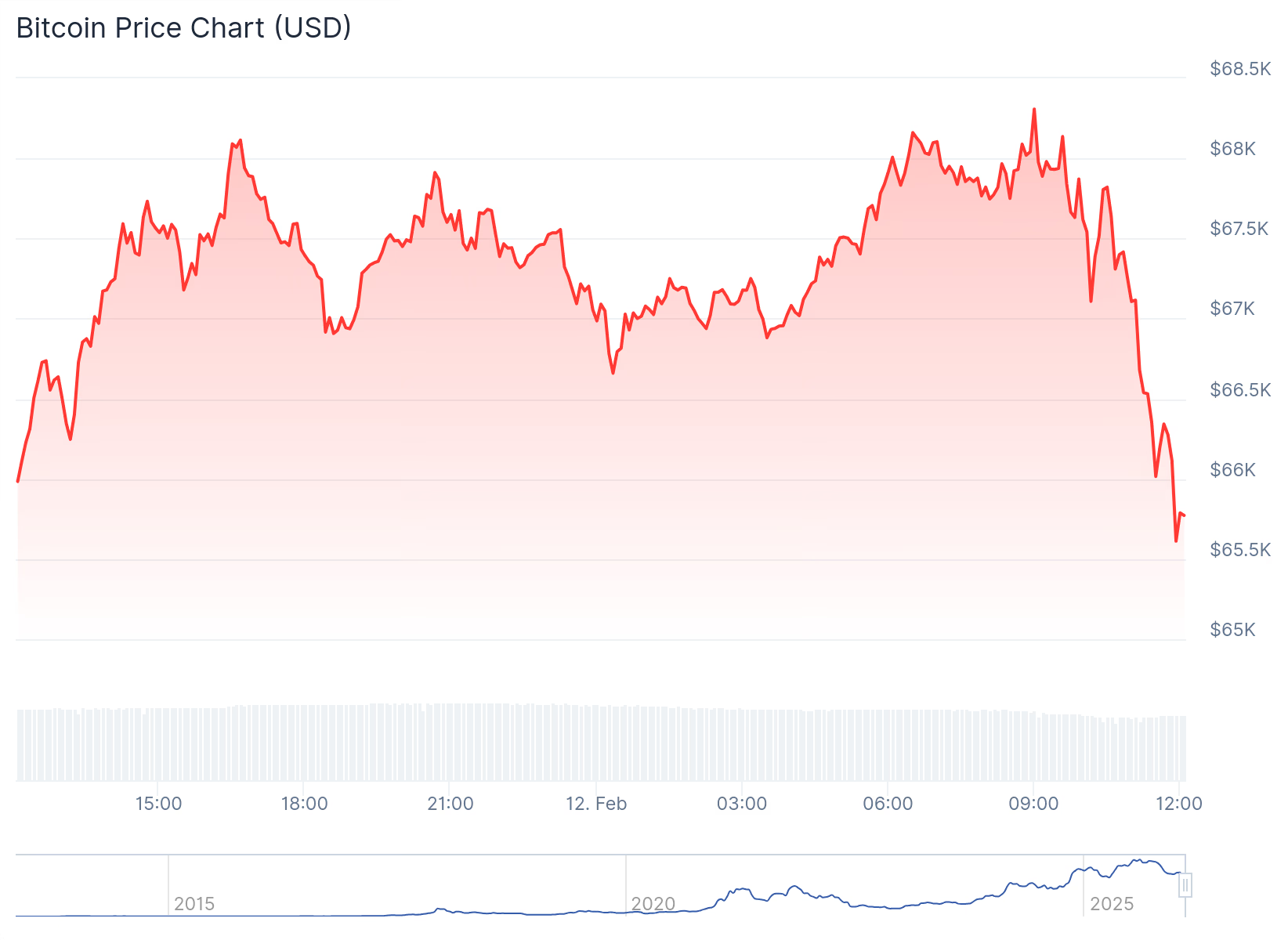

Bitcoin Plunges Under $66,000 as Crypto Sentiment Index Hits Historic Low

Total market cap is holding steady today, even as sentiment sinks to the weakest level on record.

Crypto markets took a tumble Thursday morning, Feb. 12, pushing Bitcoin below $66,000 and Ethereum below $2,000, as investor sentiment deteriorated to unprecedented lows.

Total crypto market capitalization is flat over the past 24 hours around $2.33 trillion, while large-cap assets are mixed today. At press time, Bitcoin (BTC) is trading at $65,747 at press time, down marginally on the day and bringing 7-day losses to about 5%.

Ethereum (ETH) fell to $1,910 this morning, little changed over the past 24 hours and down 4% on the week.

While BNB gained nearly 2% on the day, it’s still down almost 10% over the past week. Solana (SOL) slipped 0.6% in the past 24 hours, and is down 8% on the week.

Among the top-10 crypto assets, XRP and Figure Heloc (FIGR_HELOC) stood out on the weekly timeframe, both up about 4%.

Unprecedented Extreme Fear

Market sentiment, however, continues to lag price action. The Crypto Fear & Greed Index fell today to a reading of 5, its lowest level on record, pushing sentiment deeper into “extreme fear” territory than during any previous bear market.

Glassnode analysts said in an X post today that the disconnect between prices and sentiment reflects a market under sustained stress rather than a clear capitulation event.

The analysts pointed out that the 30-day simple moving average of net flows for both BTC and ETH spot ETFs has remained negative for most of the past 90 days, showing “no sign of renewed demand.”

They added in a separate research report that liquidity remains thin, with traders maintaining defensive positioning. Without renewed spot demand or improvement in risk appetite, glassnode warned that price action is likely to remain driven by short-term positioning.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, earlier today, Aster (ASTER) climbed more than 7% after the decentralized exchange confirmed that the mainnet launch of Aster Chain is scheduled for March. Hyperliquid’s HYPE token also rose about 7%, extending its recent rebound.

On the downside, Uniswap (UNI) led losses among large-caps, down 11.6%, erasing all of its gains from Wednesday’s rally that followed news of a strategic investment by BlackRock.

According to CoinGlass data, over 120,000 traders were liquidated over the past 24 hours, with total liquidations reaching $285 million. Bitcoin accounted for roughly $118 million of that total, followed by Ethereum at about $65 million.

ETFs and Macro Conditions

On Wednesday, Feb. 11, spot Bitcoin ETFs reversed their inflow streak, posting over $276 million in net outflows on the day. Spot Ethereum ETFs also recorded net outflows of more than $129 million, according to data from SoSoValue.

In macro markets, U.S. Treasury yields moved lower today as investors assessed fresh labor data and looked ahead to Friday’s consumer price index report. The 10-year yield slipped to 4.158%, while the 30-year fell to 4.782%, CNBC reported.

Per a report published today from the U.S. Labor Department, initial jobless claims came in at 227,000 for the week ended Feb. 7, slightly above expectations but lower than the prior week, the report notes, adding that investors continue to digest January’s nonfarm payrolls report, which showed a decline in the unemployment rate to 4.3%.

Crypto World

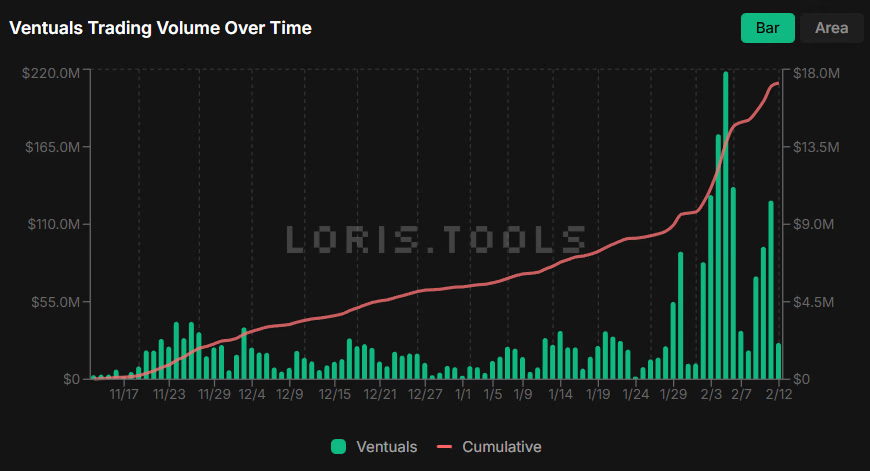

Hyperliquid-Based Ventuals’ Trading Volume Surges 100% in 17 Days

Cumulative trading volume on the tokenized private equity platform reached $200 million about four months after the protocol’s launch.

Ventuals, a protocol that lets users trade tokenized exposure to private and pre-IPO companies, has crossed $200 million in cumulative trading volume less than three months after launch, according to a Feb. 11 X post from the platform’s co-founder, Alvin Hsia.

The milestone was reached just 17 days after cumulative volume first hit $100 million, on Jan. 24, a level that took the platform 73 days to achieve, Hsia noted.

On-chain data from LorisTools, which tracks activity across Hyperliquid’s HIP-3 products, shows cumulative volume on Ventuals has climbed past $215 million by press time. The platform has recorded 5,342 unique traders and generated over $70,000 in fees since going live in October 2025.

Built on the Hyperliquid blockchain, Ventuals allows traders to take synthetic, leveraged positions tied to the valuations of private companies, including firms such as Anthropic and OpenAI.

The most actively traded product so far is MAG7 — a contract tracking the so-called “Magnificent Seven” U.S. tech companies, which includes Amazon, Apple and Microsoft — which has seen over $4 million in trading volume today, Feb. 12, the data shows.

Alongside the surge in activity, Ventuals’ liquid staking token vHYPE, which represents a claim on the underlying HYPE, Hyperliquid’s native token, rose about 20% to $30, according to CoinGecko data.

Crypto World

Bitcoin price could crash further, Standard Chartered slashes target

The Bitcoin price has already crashed by nearly 50% from its all-time high, and a top long-term bull believes there is more downside to come in the near term.

Summary

- Bitcoin price has slumped from the all-time high to $66,000.

- Standard Chartered warned that the coin may drop to $50k.

- Technical analysis suggests that the coin may fall before rebounding.

Bitcoin (BTC) retreated to $66,000 on Thursday, a few points above the year-to-date low of $60,000. This decline has persisted as its divergence from American stocks has widened, with leading indices such as the Dow Jones and the Nasdaq 100 hovering near their record highs.

Bitcoin’s price may have further downside in the near term, according to Standard Chartered, which warned that the coin may crash to $50,000.

The bank then lowered its Bitcoin price target for the year to $100,000, down from its previous estimate of $150,000. It was the second major downgrade as the bank had previously set the target price to $300,000.

Geoffrey Kendrick, the bank’s head of digital assets, predicts there will be more capitulation in the coming months. At the same time, he pointed to the ongoing Bitcoin ETF outflows, plunging futures open interest, and lack of a clear narrative.

“I think we are going to see more pain and a final capitulation period for digital asset prices in the next few months. The macro backdrop is unlikely to provide support until we near [Kevin] Warsh taking over at the Fed,” Kendrick told The Block. “On the downside I think this will see BTC to $50,000 or just below, ETH to $1,400.”

SoSoValue data shows that spot Bitcoin ETFs have shed over $282 million in assets this month. They have lost close to $6 billion in the last four months, a sign that investors are capitulating, with some moving their cash to the booming stock market.

Meanwhile, the futures open interest has tumbled to $44 billion from last year’s high of $96 billion. Falling open interest is a sign that investors are reducing their exposure to Bitcoin.

Bitcoin price technical analysis

The weekly chart shows that the BTC price has declined over the past few months and is now hovering near its lowest point of the year. It has already dropped below the 50-week and 100-week Exponential Moving Averages. Also, the Average Directional Index has jumped to 30, a sign that the downtrend is strengthening.

Therefore, the most likely outlook is bearish, with the initial target being at $60,000. A drop below that level will signal further downside to $50,000, as Standard Chartered predicts.

Crypto World

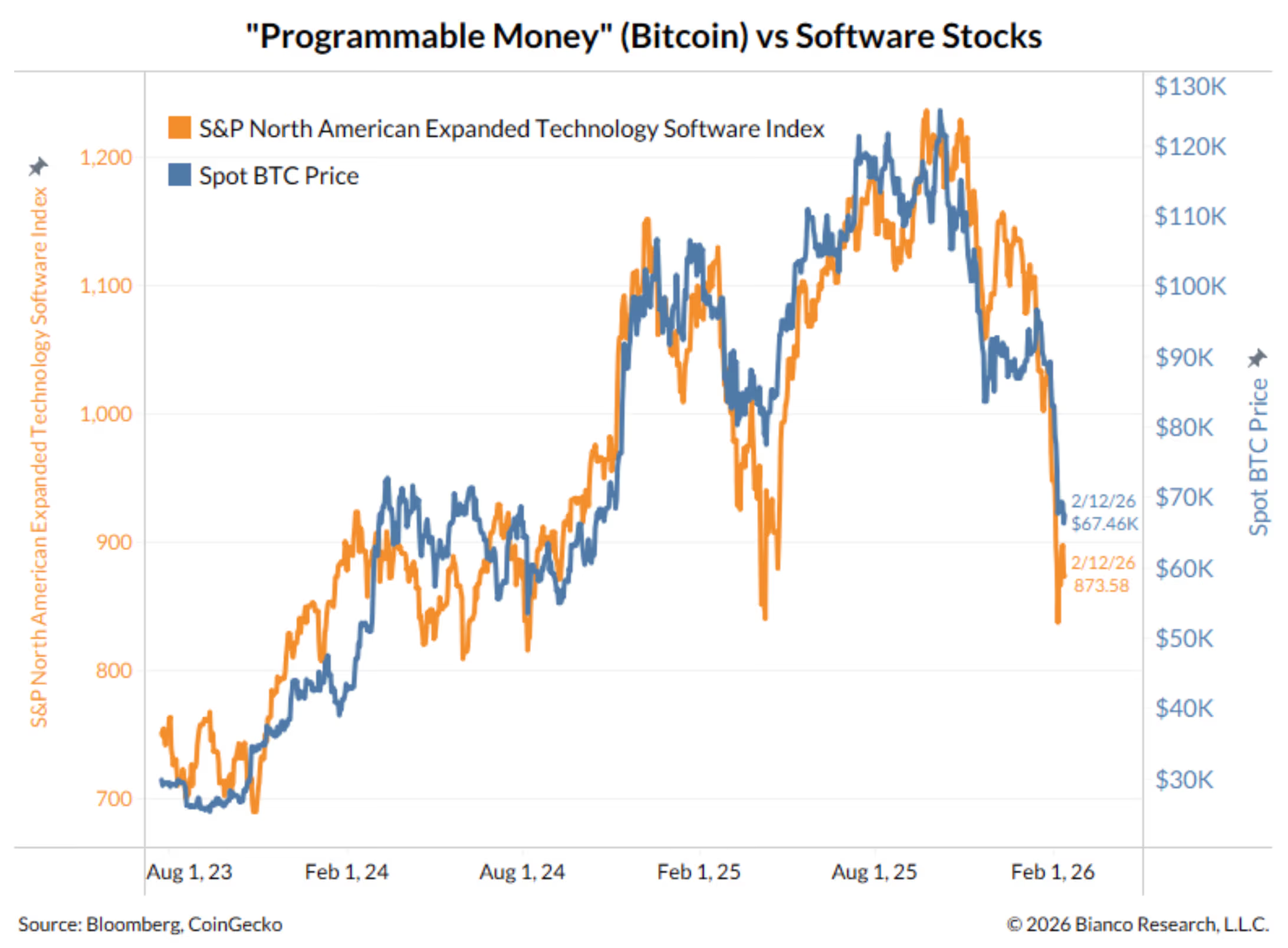

BTC falls back to $65,000 as software sector slides 3%

Bitcoin fell back toward last week’s lows, giving up nearly all of its recent gains above $70,000 and resuming its slide alongside weakness in the broader tech sector, as the crypto now trades back around $65,000.

Bitcoin was down 2% over the past 24 hours, with losses in ether and solana roughly tracking.

The decline mirrored broad price action in the Nasdaq, which fell 2% on Wednesday and more particularly in the software sector, where the iShares Expanded Tech-Software Sector ETF (IGV) tumbled 3%. The IGV is now down 21% year to date as investors question the sector’s pricey multiples in a world where the coding abilities of artificial intelligence agents appear to be rising exponentially.

“Software stocks are struggling again today,” wrote macro strategist Jim Bianco. “IGV is essentially back to last week’s panic lows.”

“Don’t forget there’s another type of software, ‘programmable money,’ crypto,” Bianco added. “They are the same thing.”

Precious metals not immune

Cruising along with modest gains through most of the day, gold and silver suffered quick, steep plunges in the mid-afternoon. Late in the session, silver was lower by 10.3% to $75.08 per ounce and gold was down 3.1% to $4,938.

Crypto World

Binance October 10 Backlash Hijacks Consensus Hong Kong

Binance Co-CEO Richard Teng has defended the exchange against claims that it was responsible for the October 10, 2025, “10/10” crypto crash, which saw roughly $19 billion in liquidations.

Speaking at CoinDesk’s Consensus Hong Kong conference on February 12, 2026, Teng argued the sell-off was driven by other factors besides any Binance-specific failures.

Sponsored

Sponsored

Richard Teng Gives Binance’s Side of the Story on October 10 Crash

The Binance co-CEO cited macroeconomic and geopolitical shocks between the US and China. Specifically, he cited:

- Fresh US tariff threats, including potential 100% duties on Chinese imports, and

- China’s imposition of rare-earth export controls.

The combination, he said, flipped global risk sentiment, triggering mass liquidations across all exchanges, centralized and decentralized alike.

“The US equity market plunged $1.5 trillion in value that day,” Teng said. “The US equity market alone saw $150 billion of liquidation. The crypto market is much smaller. It was about $19 billion. And the liquidation on crypto happened across all the exchanges.”

The majority of liquidations (roughly 75%) occurred around 9:00 p.m. ET, coinciding with the release of macro news.

Teng acknowledged minor platform issues during the event, including a stablecoin depegging (USDe) and temporary slowness in asset transfers.

However, he stressed these were unrelated to the broader market collapse. He also emphasized that Binance supported affected users, including by compensating some of them.

Sponsored

Sponsored

“…trading data showed no evidence of a mass withdrawal from the platform,” he added.

Last year, Binance reportedly facilitated $34 trillion in trading volume and served over 300 million users.

It is worth noting that the October 10 crash has been a persistent cause of Binance FUD over the past several months. The exchange has faced criticism from far and wide, with the heaviest attacks coming from rival exchange OKX and its CEO, Star Xu.

Traders Reject Teng’s Macro Shock Explanation Amid $19 Billion 10/10 Liquidation

Despite Teng’s detailed defense, traders on social media have responded swiftly and critically. On X (Twitter), users accused Binance of locking APIs and engineering conditions that forced liquidations, only to deflect responsibility with the “macro shock” explanation.

Sponsored

Sponsored

“Blaming macro shocks is the new ‘it was a glitch.’ $19B liquidated and somehow nobody at Binance is responsible lol,” one user challenged.

Naysayers go further, with some users likening Teng’s claims to colloquial phrases in harsh criticism.

“‘It wasn’t us, it was the macro’ is the crypto exchange version of the dog ate my homework. $19B in liquidations and every platform just points at the guy next to them,” another said.

However, the majority of responses revolved around alleged fake API responses and questioned internal coordination at Binance. The general sentiment is that users feel the exchange is not fully transparent.

The backlash illustrates the ongoing tension between centralized exchanges and leveraged traders during high-volatility events.

While retail demand has cooled compared to previous years, Teng highlighted that institutional and corporate participation in crypto remains strong.

Sponsored

Sponsored

“Institutions are still entering the sector,” he said. “Meaning the smart money is deploying.”

Teng also framed the 10/10 event as part of a broader cyclical pattern in crypto markets. He argued that despite short-term turbulence, the sector’s underlying development continues, with institutional capital driving long-term confidence.

Still, the exchange faces a twofold challenge:

- It must defend its role during unprecedented market stress

- Binance must also restore trust with a skeptical trading community.

While the $19 billion liquidation wiped out positions across the market, the debate over who or what should be held accountable continues to simmer online. This is expected, given the fragility of confidence in high-leverage crypto trading.

Crypto World

Bitcoin risk-reward has shifted after recent selloff

Bitcoin’s recent price decline has prompted market analysts to assess whether a price floor is forming, with one prominent on-chain researcher stating the risk-reward profile has shifted following the selloff.

Summary

- “Checkmate” Check suggests Bitcoin has entered “deep value” territory.

- Recent selloff capitulation losses resemble those seen at 2022 cycle lows, indicating a potential market bottom forming with a 60% probability.

- Bitcoin’s price may be forming a bottom, but further declines are possible as market sentiment shifts.

James “Checkmate” Check, a former lead researcher at Glassnode and author of Check On Chain, told What Bitcoin Did host Danny Knowles that Bitcoin entered “deep value” territory across multiple mean-reversion frameworks when it dropped into recent price zones, according to statements made on the podcast. Check noted that capitulation-style losses spiked to levels last seen at the 2022 cycle lows.

Check stated that if Bitcoin is not trending toward zero, the statistical setup appears increasingly asymmetric after the selloff. The analyst said the current environment represents a time for market participants to pay attention rather than lose focus.

The researcher said he was focused on market structure rather than identifying a single forced seller behind the price movement.

Check offered a probabilistic assessment, stating that the odds of a bottom forming have increased significantly. He said the probability that the market has already set a meaningful low stands at more than 50%, likely around 60%, according to his analysis. The analyst assigned low odds to Bitcoin reaching a new all-time high within the year without a major macroeconomic shift or significant market event.

Regarding exchange-traded funds, Check cited billions in outflows during the drawdown, but characterized the situation as positioning unwinds rather than structural failure. He noted that at an earlier peak, approximately 62% of cumulative inflows were underwater, while ETF assets under management declined only in the mid-single digits. Check suggested earlier outflows aligned with CME open interest, consistent with basis-trade adjustments.

The analyst criticized reliance on the four-year halving cycle as a timing tool, calling it an “unnecessary bias.” Check said his approach prioritizes observing investor behavior over calendar-based predictions.

Even if the low has been established, Check said he expects the market to revisit it. He argued that bottoms typically form through multiple “capitulation wicks” followed by extended periods of reduced activity, where sustained uncertainty erodes confidence among late-cycle buyers. Check stated that formulating a bear case at current levels would be premature, framing the current zone as late-stage rather than early-stage in the move, while acknowledging prices could decline further.

The analyst described two failed all-time-high attempts in October followed by a sharp decline that likely resulted in significant losses for market participants. He referenced what he termed a “hodler’s wall” of invested wealth positioned above key levels, including a threshold he called the “bull’s last stand.” Check argued that once price broke below those levels, downside probability increased.

A key reference level cited by Check was the True Market Mean, described as a long-term center-of-gravity price that also overlapped with the ETF cost basis. He said that once that level broke, the psychological regime shifted to an acceptance phase where market participants began to believe a bear market had begun.

Check argued the market was subsequently pulled toward a prior high-volume consolidation zone where a significant portion of this cycle’s trading volume had occurred. He said the selloff likely involved leverage liquidations but framed that as secondary to a broader shift in market sentiment, where participants sell rallies during perceived downtrends.

The most significant bottoming signal emphasized by Check was the scale of realized losses during the recent decline. He said capitulation losses occurred at a very large daily rate, comparable to the 2022 bottom, with sellers concentrated among recent buyers from the late cycle and those who purchased during an earlier consolidation period. Check also noted that SOPR (Spent Output Profit Ratio) printed around minus one standard deviation, a reading that has historically appeared in only two contexts: as an early warning signal and near bottoming phases.

Check reiterated that bottoms form through a process involving multiple capitulation events followed by extended periods of reduced speculative interest, rather than a single definitive price point.

Crypto World

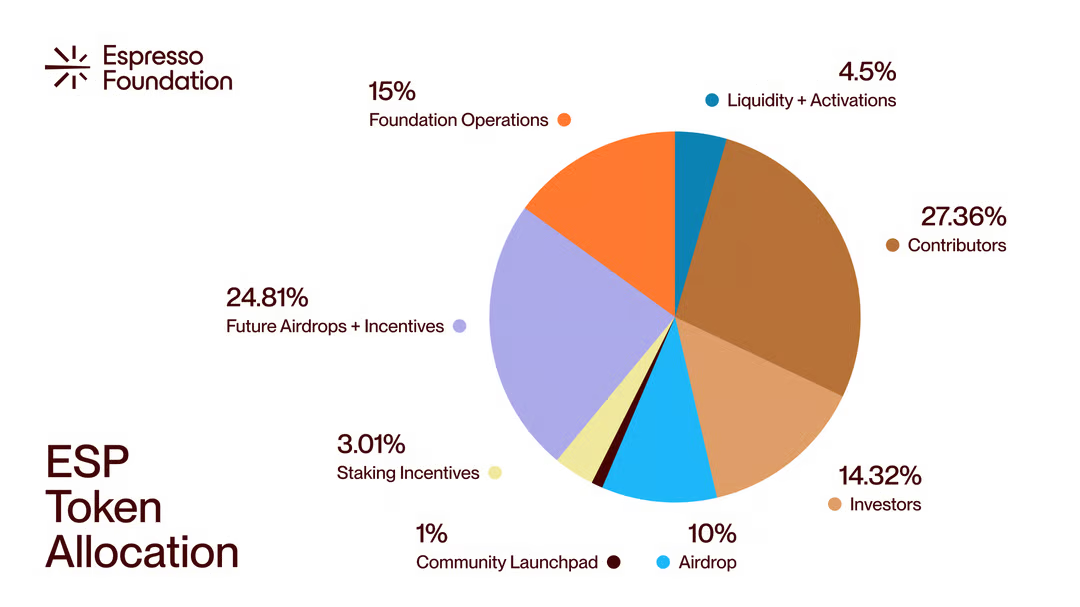

Espresso Token Launches at $275 Million Valuation

Launchpad buyers are down 30% with a 2-year vesting period ahead of them.

Espresso, a decentralized rollup base layer, launched its native ESP token this morning at a valuation of roughly $275 million following its token airdrop and distribution.

The token debuted at $0.072 before jumping up to $0.083 shortly after its launch and has reported $115 million in trading volume over its first 7 hours across CoinGecko-tracked platforms.

The protocol is designed to support rollups and appchains with everything they need from a base layer to ensure high performance, including finality, data availability, and real-time interoperability.

Today’s ESP token launch enables the network to transition to proof-of-stake, and the protocol has distributed 10% of the token supply in an airdrop to more than one million eligible addresses.

There was also a Kaito Launchpad sale in July 2025, which sold 1% of the supply at a $400 million valuation, leaving launchpad investors with a 31% loss at current prices.

The ESP token is the latest in a line of ICOs and token sales that are opening underwater, with Infinex and Aztec being two other recent examples.

Crypto World

Coinbase misses Q4 estimates as transaction revenue falls below $1 billion

Coinbase (COIN) missed fourth-quarter earnings forecasts on Thursday, thanks to weaker trading activity and lower crypto asset prices.

The U.S.-based crypto exchange posted total revenue of $1.78 billion against estimates for $1.83 billion. Adjusted EPS of $0.66 was well lower than the consensus $0.86.

Total transaction revenue of $983 million was below forecasts for $1.02 billion and down from $1.046 billion in the third quarter and $1.556 billion in the fourth quarter one year ago.

Subscription revenue of $727.4 million was down from $746.7 million the previous quarter and up from $641.1 million a year earlier.

Through Feb. 10 of the first quarter, the company saw transaction revenue of about $420 million. It guided to full-quarter subscription revenue of $550-$630 million.

“We continue to be optimistic about the long-term trajectory of the crypto industry,” Coinbase said. “Crypto is cyclical, and experience tells us it’s never as good, or as bad as it seems. While asset prices can be volatile, under the surface an undercurrent of technological change and crypto product adoption continues.”

Shares are modestly higher in after-hours trading, but fell 7.9% during the regular session, extending year-to-date declines to 40%.

Crypto World

Vitalik Buterin Advocates for Decentralized Reform in Russia’s Governance

TLDR

- Vitalik Buterin condemned Russia’s invasion of Ukraine, calling it criminal aggression and not a situation of equal fault.

- He argued that lasting peace in Ukraine and Europe can only be achieved through internal change within Russia.

- Buterin proposed that decentralized governance could be the key to reforming Russia’s political system.

- He highlighted tools like quadratic voting and zero-knowledge systems as potential solutions for improving decision-making.

- Buterin emphasized the importance of involving more people in governance through platforms like pol.is to find societal compromises.

Vitalik Buterin, co-founder of Ethereum, shared his views on Russia’s future in a post published on February 12. In the post, originally written in Russian, Buterin called Russia’s invasion of Ukraine “criminal aggression.” He emphasized the need for structural reform within Russia to achieve long-term peace and security, advocating for a decentralized governance model.

Buterin Criticizes Russia’s War and Calls for Internal Change

In his recent post, Vitalik Buterin condemned Russia’s invasion of Ukraine, labeling it as “criminal aggression.” He strongly rejected the idea that both sides are equally at fault, which some have argued. Buterin clarified that peace in Europe and Ukraine could not be achieved through a simple ceasefire alone.

He suggested that the best path to stability in the region involves internal change within Russia itself. For Russia to secure lasting peace, Buterin proposed significant structural reforms. These reforms, according to him, should focus on decentralizing governance, moving away from centralized power.

Vitalik Buterin Advocates for Decentralized Governance

Vitalik Buterin emphasized the potential of decentralized governance to transform Russia. He mentioned specific tools that could help in building a new system, such as quadratic voting and zero-knowledge (ZK) systems. These tools, Buterin argued, could allow large groups of people to find common ground without relying on a small elite.

The Ethereum co-founder believes that decentralized governance could be key to building a more transparent and fair system. In his post, he also referenced platforms like pol.is, which allow for broader participation in decision-making. These digital tools, Buterin suggested, could provide a way for citizens to directly engage with governance.

New Leadership and Ideas for Russia’s Future

Buterin also discussed the importance of new leadership in Russia, highlighting the need for fresh ideas. He stressed that the Russian opposition should focus on involving more people in decision-making. This approach would help avoid the concentration of power in the hands of a few.

He pointed out that using platforms for online voting and discussions could allow people to reach societal compromises. These compromises could then be turned into official policies without the need for intermediaries. According to Buterin, achieving consensus in this manner is crucial for Russia’s long-term stability.

Crypto World

ETHZilla Launches Tokenized Jet Engine Leases Amid Ethereum Decline

TLDR

- ETHZilla has launched a tokenized investment opportunity in leased jet engines through its subsidiary ETHZilla Aerospace.

- The company acquired two CFM56 commercial jet engines worth $12.2 million and is offering equity in these assets via the Eurus Aero Token I.

- The tokens, available to accredited investors, are priced at $100 each, with a minimum investment of 10 tokens.

- ETHZilla aims to provide a targeted return of 11% for token holders if they hold through the lease term, ending in 2028.

- Cash flows from the leased engines will be distributed monthly to token holders via blockchain technology.

ETHZilla has expanded its operations into the tokenization sector, launching a new project focused on jet engine leases. The company, through its new subsidiary ETHZilla Aerospace, is offering tokenized equity in jet engines it recently acquired. This move comes as ETHZilla seeks to diversify its investments amid Ethereum prices continuing to decline.

ETHZilla Introduces Tokenized Engine Leases on Arbitrum

ETHZilla’s new venture centers around tokenizing a $12.2 million investment in two leased CFM56 commercial jet engines. These engines are leased to a major U.S. airline, though the company has not disclosed the airline’s identity due to confidentiality concerns. By launching the Eurus Aero Token I on the Arbitrum layer-2 network, ETHZilla offers tokenized equity in the engines, allowing investors to participate in this emerging market.

ETHZilla CEO McAndrew Rudisill commented on the project, stating, “Offering a token backed by engines leased to one of the largest and most profitable U.S. airlines serves as a strong use case in applying blockchain infrastructure to aviation assets with contracted cash flows.” The company believes that this move will help modernize fractional ownership of aviation assets, a market traditionally dominated by institutional investors and private equity firms.

Token Sale Details and Project Goals

The Eurus Aero Token I, available to accredited investors, will be sold through Liquidity.io’s token marketplace. Each token is priced at $100, with a minimum investment of $1,000, or 10 tokens. The project aims to offer a return of approximately 11% if token holders hold until the lease agreements conclude in 2028. However, a disclaimer notes that actual returns could differ based on various factors.

Cash flows from the leased engines will be distributed monthly to token holders through the blockchain. ETHZilla has structured the tokens with collateral consisting of the engines, related lease receivables, insurance proceeds, and other reserves. The company’s tokenization model ensures transparency and on-chain distribution, making it accessible to a broader group of investors.

ETHZilla’s expansion into tokenized aviation assets is part of a broader effort to pivot from its Ethereum holdings. The firm recently revealed a $250 million share buyback program, following a drop in the company’s market cap. ETHZilla’s share price has seen fluctuations, including a significant drop in recent months.

Crypto World

BitGo Expands Custody, Staking Partnership With 21Shares

BitGo Holdings and 21Shares said Thursday they have expanded their existing partnership to include custody and staking services supporting 21Shares’ crypto exchange-traded products (ETPs) for investors in the United States and Europe.

Under the agreement, BitGo will deliver qualified custody, trading and execution services and integrated staking infrastructure for 21Shares’ US exchange-traded funds and global ETPs. The arrangement also provides 21Shares with access to liquidity across electronic and over-the-counter markets, according to the announcement.

BitGo said the services will be delivered through its regulated entities in the US and Europe, including its federally chartered trust bank approved by the Office of the Comptroller of the Currency (OCC) and its MiCA-licensed operations authorized by Germany’s Federal Financial Supervisory Authority.

21Shares, a subsidiary of FalconX, is one of the largest crypto ETF issuers globally, with 59 exchange-traded products listed across 13 exchanges and more than $5.4 billion in assets under management as of Feb. 11, according to its website.

The move comes less than a month after BitGo, a digital asset infrastructure company based in Palo Alto, California, began trading on the New York Stock Exchange under the ticker BTGO.

Related: BitGo’s IPO pop turns volatile as shares slip below offer price

Staking moves deeper into regulated products

In recent months, institutional custody platforms have increasingly embedded staking services into their core offerings as investor demand grows for yield-generating crypto infrastructure.

In October, Coinbase expanded its integration with staking infrastructure provider Figment, allowing Coinbase Prime and Coinbase Custody clients to stake Avalanche (AVAX), Aptos (APT), Sui (SUI) and Solana (SOL) directly from Coinbase custody.

About a month later, Anchorage Digital partnered with Figment to add staking for Hyperliquid (HYPE), offering the service through Anchorage Digital Bank and its Singapore entity, with access also available via its Porto self-custody wallet.

On Feb. 9, Ripple said it expanded its institutional custody platform through integrations with Securosys and Figment, adding hardware security module support that allows banks and custodians to offer crypto custody and staking services without running their own validator or key management infrastructure.

There has also been growing institutional interest in liquid staking, which allows investors to earn proof-of-stake rewards while receiving a tradable token that keeps their underlying assets liquid.

On Tuesday, Hong Kong-based custodian Hex Trust announced it has partnered with the Jito Foundation to integrate JitoSOL, a liquid staking token on the Solana blockchain, enabling clients to earn staking and MEV rewards while keeping their SOL liquid and eligible for use as collateral in borrowing and lending through its markets platform.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports22 hours ago

Sports22 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World23 hours ago

Crypto World23 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video18 hours ago

Video18 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’