Crypto World

Bitcoin price prediction as Arkham data reveals who controls BTC supply

Bitcoin price is stabilizing after a sharp correction, but on-chain data suggests the real story may lie beneath the surface.

Summary

- Bitcoin consolidates near $68,000 after falling from the mid-$90,000s to $60,000, with the 50-day SMA around $83,000 acting as key resistance.

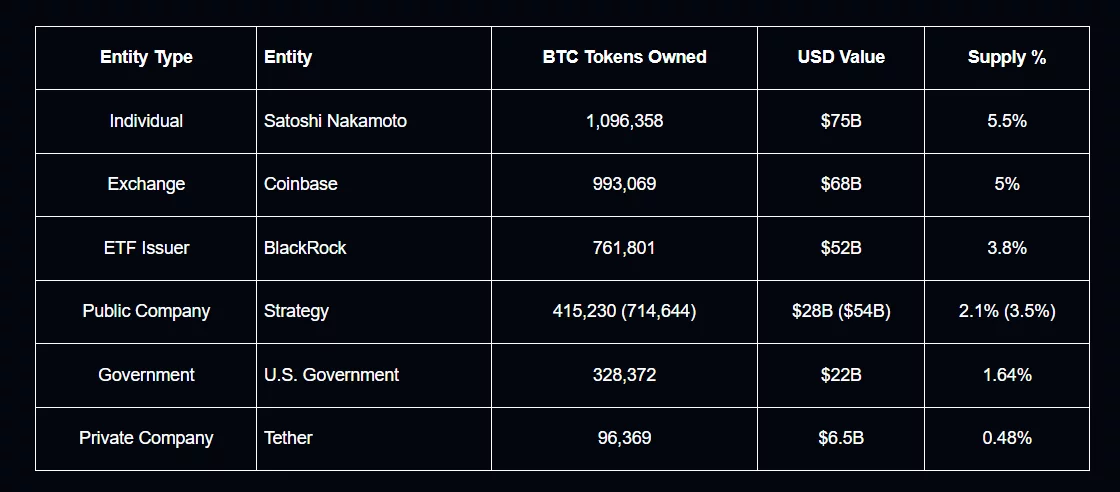

- Arkham data shows heavy supply concentration, with Satoshi, major exchanges, BlackRock’s ETF, Strategy, and the U.S. government controlling a significant share of total BTC.

- Whale inactivity and potential exchange outflows could tighten supply, meaning renewed institutional demand may trigger a sharper upside move.

As Bitcoin (BTC) consolidates near the $68,000 level, Arkham Intelligence’s latest ownership data reveals who controls a large share of supply and that concentration could shape the next breakout or breakdown.

Bitcoin price recently fell from the mid-$90,000 region earlier this year to a local low near $60,000 before rebounding. At press time, price action shows consolidation below the 50-day simple moving average, which sits around $83,000. That level now acts as dynamic resistance.

Until bulls reclaim it, upside momentum remains capped.

The daily chart shows heavy selling through late January and early February. A sharp capitulation candle drove price toward $60,000, followed by a reflex bounce.

However, the Chaikin Money Flow indicator remains slightly negative at around -0.03. This suggests capital inflows are still weak. Momentum has improved, but conviction is not yet strong.

While short-term momentum remains fragile, ownership structure tells a longer-term story.

Bitcoin whale concentration and supply control

Arkham’s 2026 data shows Bitcoin ownership remains highly concentrated. Satoshi Nakamoto’s wallets still hold roughly 1.096 million BTC, representing over 5% of total supply.

Coinbase controls close to 1 million BTC, while Binance holds more than 600,000 BTC. BlackRock’s spot ETF alone holds over 760,000 BTC. Strategy, formerly MicroStrategy, controls more than 400,000 BTC. The U.S. government also holds over 300,000 BTC.

This concentration matters. Large holders reduce effective circulating supply when coins remain dormant. Satoshi’s coins have never moved. Corporate and ETF holdings also tend to be long-term allocations rather than short-term trading inventory. That structurally tightens supply during periods of demand expansion.

However, exchange balances are a different story. When large exchanges hold significant BTC reserves, liquidity remains accessible. If exchange-held Bitcoin begins declining while ETFs continue accumulating, the float could tighten quickly. In that scenario, even modest demand could trigger an outsized upside move.

What it means for Bitcoin price’s next move

Technically, Bitcoin must reclaim the 50-day SMA near $83,000 to confirm a bullish reversal. A break above that level could open a move back toward $90,000. Failure to hold $65,000 may expose $60,000 again.

Structurally, whale dominance suggests long-term supply remains constrained. If institutional demand returns while major holders stay inactive, price pressure could build quickly.

The next decisive move will likely depend on whether capital inflows return and whether the biggest holders continue to sit tight.

Crypto World

WLFI Price Eyes Another Rally? 3 Distribution Risks Loom

World Liberty Financial price, or the WLFI price, surged nearly 20% over the past 24 hours, triggering optimism across holders. But three separate metrics now reveal hidden risks beneath the surface strength.

Distribution happening across whale cohorts and mid-term holders preparing exits create consolidation pressure that could derail the pattern entirely. Or, is the WLFI price action planning a plot twist here?

Cup Pattern Needs Controlled Consolidation Above $0.105

The 8-hour chart shows a rounded bottom structure resembling a cup. The cup itself has already completed, given the recent price recovery. Now WLFI needs to form the handle through controlled consolidation before attempting the next breakout.

Sponsored

Sponsored

The key detail is the upsloping neckline connecting the rim of the cup on both sides. The left rim formed at an earlier high while the right rim sits at a higher level. This upward slope indicates that buyers are willing to pay higher prices over time, creating structural strength. The neckline must be broken upward to complete the pattern and trigger the measured 17% move.

Between February 4 and February 18, a hidden bearish divergence formed on the 8-hour timeframe. WLFI price made a lower high after peaking at $0.119. During that same period, the Relative Strength Index made a higher high. RSI measures momentum strength by comparing the magnitude of recent gains to recent losses.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

When price makes lower highs, but RSI makes higher highs, it signals that a pullback could be coming.

The divergence could actually be constructive for the pattern. Cup formations require a handle to complete properly. The handle forms through sideways or slight downward price movement that shakes out weak hands before the next explosive move.

The critical level is $0.105. As long as WLFI consolidates without breaking below this support, the pattern and breakout possibility remain intact. A measured move from the cup’s low to the neckline projects a breakout target of $0.142, representing approximately 17% additional upside from the possible breakout point.

Sponsored

Sponsored

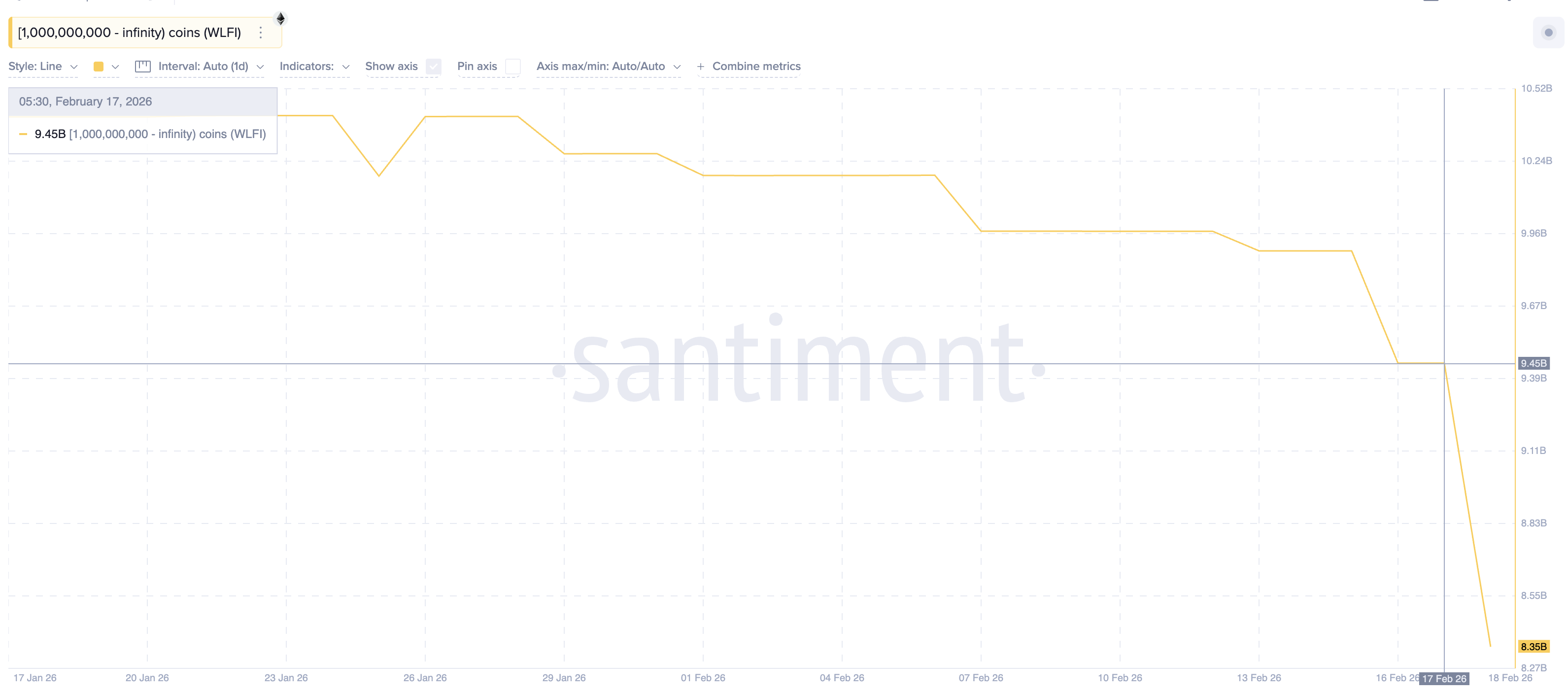

Mega-Whales Sold 1.1 Billion Tokens as Long Positions Diverged

While new whale cohorts accumulated approximately 25 million WLFI tokens during the past 24 hours, the largest holders moved in the opposite direction.

Mega-whale addresses holding more than 1 billion tokens have been steadily reducing their positions since February 6. On February 17, during the price rally, they dropped holdings dramatically from 9.45 billion to 8.35 billion WLFI. That represents 1.1 billion tokens sold directly into the strength.

The price did not crash because smaller whales and leveraged long positions absorbed the selling.

But the distribution creates overhead pressure.

Data from Hyperliquid derivatives exchange shows diverging behavior across different WLFI trader cohorts over the past 24 hours. General whale addresses increased their long positions by 68%, showing continued optimism.

Sponsored

Sponsored

But the top 100 addresses (mega whales) by trading volume reduced long positions significantly.

Smart Money, which tracks positioning by experienced traders, shows a net short position over the past 24 hours, hinting at caution.

This creates a dangerous setup where smaller participants are buying and adding leverage while the largest and most sophisticated players distribute and position defensively.

The rally relied on smaller whale buying and leverage rather than conviction from mega-whales. If consolidation turns into a long squeeze where leveraged longs get forced to sell, the pullback could accelerate beyond the healthy handle formation needed for pattern completion.

Sponsored

Sponsored

Mid-Term Holders Activate 500 Million Tokens for Exit, Could This Impact the WLFI Price?

The third warning comes from on-chain activity metrics. Spent Coins Age Band tracks coin movement from specific holder cohorts based on how long they held the tokens. The 90-day to 180-day age band represents mid-term holders who acquired WLFI between three and six months ago.

Before February 17, this cohort showed activity of approximately 949,000 tokens moving. Between February 17 and 18, that number exploded to over 500 million tokens.

This represents a 500-times increase in coin activity from mid-term WLFI holders. When holders who sat through months of price action suddenly activate coins en masse, it typically means preparation for exit. They see the 20% rally as their opportunity to take profits after months of waiting. The 500 million tokens moving creates significant potential selling pressure on top of the 1.1 billion already sold by mega-whales and the cautious positioning by Smart Money.

All three risks point toward consolidation. The 8-hour chart RSI divergence predicts it. Mega-whales selling 1.1 billion confirms it. Mid-term holders activating 500 million validates it. The consolidation is healthy and necessary for handle formation if it stays controlled above $0.105 and respects the upsloping neckline. But the market remains weak broadly.

Fibonacci extension to the downside projects $0.090 or lower if the pattern breaks, invalidating the entire setup.

On the upside, breaking above $0.119 reactivates bullish momentum with first resistance at $0.132 before the main pattern target of $0.142. The $0.105 level decides everything. Controlled consolidation above it allows the cup to complete its handle. Breakdown below it turns the distribution into a cascade.

Crypto World

Altcoin spot sell pressure hits 5-year high at -$209b

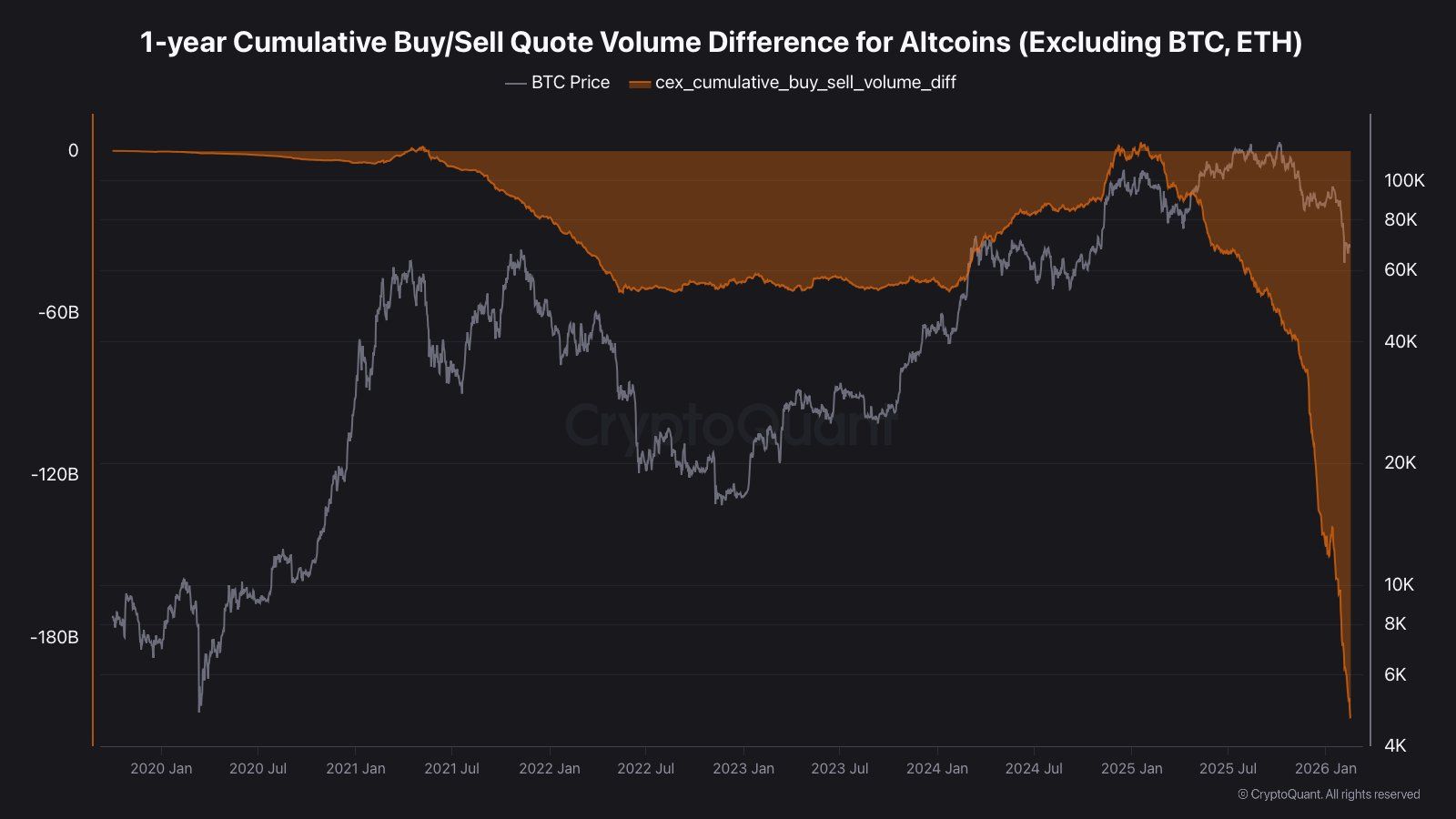

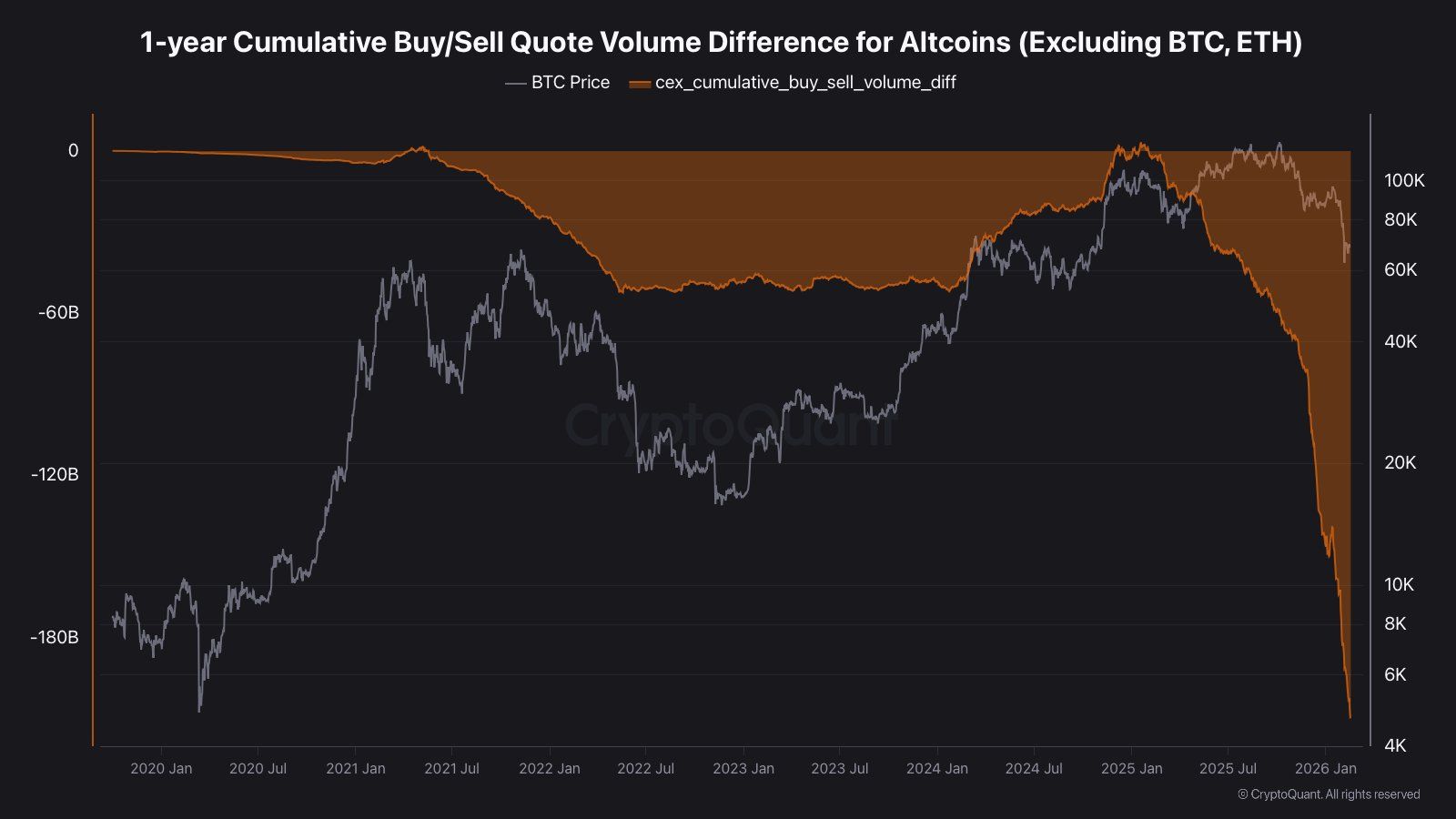

Cumulative spot selling pressure across altcoins, excluding Bitcoin and Ethereum, has reached a five-year extreme, according to data released by CryptoQuant, marking one of the most persistent distribution phases in recent market cycles.

Summary

- Cumulative altcoin buy-sell difference excluding BTC, ETH widened to about -$209b over 13 straight months, the most sell-dominant phase in 5 years.

- Indicator was near $0 in Jan 2025 before prolonged selling, signaling structural outflows, fading retail demand, and little visible institutional accumulation in altcoins.

- BTC trades well below its Oct 2025 ATH, while altcoin spot markets remain under pressure, with past cycle reversals only emerging after sustained net buying replaces directional sellin

The cumulative buy-sell difference for altcoins now stands at negative 209 billion, reflecting 13 consecutive months of net selling on centralized exchanges, the data showed.

In January 2025, cumulative buy and sell pressure across altcoins was roughly balanced, marking the last point where demand matched supply, according to the analysis. Since then, altcoins have recorded a cumulative negative 209 billion in net sell pressure over the following 13 months, with limited evidence of sustained buying activity.

Bitcoin currently trades well below its October 2025 all-time high. While Bitcoin has retraced from peak levels, altcoins have experienced stronger structural pressure, the data indicated. The absence of net positive inflows suggests retail participation has declined, with capital rotation toward major cryptocurrencies occurring earlier in the cycle, according to market observers. Institutional accumulation in altcoins remains limited, the data showed.

Bitcoin trading as alt-coin difference expands

A cumulative negative 209 billion reading signals that supply has consistently exceeded demand, though it does not automatically indicate a market bottom, analysts noted. Extended net selling phases can persist until liquidity conditions improve or new capital enters the market, according to historical patterns.

Durable market reversals have historically occurred only after sustained buying activity replaces directional selling, market data shows. Altcoin spot markets remain under pressure and demand recovery has not yet materialized, according to the CryptoQuant analysis.

Crypto World

The DAO’s second act focuses on security with $150M endowment

In the summer of 2016, the Decentralized Autonomous Organization, known as the DAO, became the defining crisis of Ethereum’s early years. A smart contract exploit siphoned millions of dollars’ worth of ether (ETH) from that initial project, and the community’s response — a contentious hard fork to recover those funds, splintered the original chain from the current one, leaving the old chain behind, known as Ethereum Classic.

The DAO was once the largest crowdfunding effort in crypto’s history, but faded into a cautionary tale of governance, security, and the limits of “code is law.”

Now, nearly a decade later, that story has taken an unexpected turn. What was lost, or rather, left untouched, is being repurposed as a ~$150 million (at today’s prices) security endowment for the Ethereum ecosystem.

The endowment, known now as the DAO Security Fund, will stake some of the 75,000 dormant ether (ETH) and deploy the yield through community-driven funding rounds to support Ethereum security research, tooling and rapid-response efforts, while keeping claims open for any remaining eligible token holders.

At the center of this story is Griff Green, one of the original DAO curators and a veteran of Ethereum decentralized governance.

“When the DAO hack happened [in 2016], obviously, I jumped into action and basically led everything but the hard fork,” Green said of assembling the white hat group that rescued funds on the original Ethereum chain. “We hacked all these hackers. It was straight up DAO wars”.

That effort, alongside others, helped salvage funds that might otherwise have been lost forever.

At the time, the hard fork restored roughly 97% of the DAO’s funds to token holders, but left a small fraction, roughly 3%, in limbo. These “edge case” funds came from quirks of the original smart contracts: people who paid more than expected, those who burned tokens to form sub-DAOs, and other anomalies that didn’t cleanly map back.

Over time, that leftover balance, once only worth a few million, ballooned into something far more significant due to ether’s [ETH] appreciation. “The value of the funds we control has grown dramatically… well over 75,000 ETH,” a blog post for the new DAO fund states.

Green and his fellow curators have spent the last decade quietly helping people recover funds and managing these residual balances. But as he tells it, the landscape has shifted. “Six volunteers were securing $300 million with decade keys. It didn’t make sense,” he told CoinDesk in an interview. “With all these AI hacks and stuff, we just got kind of scared.” Their old security model simply is no longer fit to guard nine-figure sums, Green shared.

Rather than let these funds sit idle in perpetuity, the team has decided to stake the ETH and use the yield to fund Ethereum security initiatives, honor claims indefinitely, and professionalize governance and key management. “We can stake these funds, keep claims open forever, and use the staking rewards to fund Ethereum security projects,” Green explained.

The fund will distribute capital through decentralized mechanisms such as quadratic funding, retroactive public goods funding, and ranked-choice voting for proposals.

‘Financial backbone of the world’

For Green, the revival is also personal.

The DAO hack was Ethereum’s first existential test, exposing how experimental the ecosystem still was. Nearly a decade later, he argues, the industry remains vulnerable in different ways.

“MetaMask, hot wallet keys, just any kind of private keys on your daily driver computer is probably the main fuel for a whole cyber crime industry,” Green said. “The fact that we have hot keys with billions of dollars sitting on like 10,000 laptops spread out throughout the world has an industry of cybercrime.”

The persistence of hacks, phishing schemes and smart contract exploits frustrates him. “Not only amazes me, it disappoints me and frustrates me,” he said, describing the state of Ethereum security today.

That urgency is shaping how the new fund will operate. Unlike the Ethereum Foundation’s more top-down grantmaking process, the DAO Security Fund is designed as a bottom-up experiment, allowing participants in the DAO to decide how to distribute funds. Round operators will apply to distribute funds, security experts will help set eligibility standards, and staking rewards will provide a renewable pool of capital.

If Ethereum is to become what many believe it is, the core infrastructure for global finance, Green says security must come first.

“Ethereum is at the cusp of being the financial backbone of the world, if it fixes security,” he said.

The DAO Security Fund, in Green’s view, is therefore both a continuation of unfinished work and a forward-looking vehicle for safeguarding Ethereum as it scales.

Read more: Ethereum OGs revive the DAO with $220 million security fund, Unchained reports

Crypto World

Base TVL Drops $1.4 Billion Amid Strategic Rift at Coinbase

Base, the Ethereum Layer-2 network incubated by Coinbase, has seen its total value locked (TVL) fall by $1.4 billion in the past few weeks.

The decline comes as public debate over the chain’s strategy and product direction intensifies.

Base TVL Slides as Builders, Critics, & Coinbase Leadership Clash Over the Chain’s Direction

Base TVL has dropped from about $5.3 billion in January to roughly $3.9 billion as of this writing.

Sponsored

Sponsored

The drop matters because TVL remains one of the most closely watched indicators of capital activity and developer confidence in blockchain ecosystems.

However, TVL fluctuations are common across L2 networks, particularly during broader market rotations or liquidity shifts.

As liquidity tightens, Base is also facing unusually open criticism (and responses) from founders, investors, and Coinbase leadership.

Base creator Jesse Pollak framed the moment as part of a typical growth cycle for fast-scaling ecosystems.

“Base went from not existing to one of the most important chains in the world in two years, which happened because of the builders. And as with all fast growth, along the way, some left, some pivoted, some gave up. The builders who remain are the ones who define the next era,” Pollak wrote.

His comments reflect a view held by many infrastructure teams: that early surges often attract speculative capital and short-term projects, followed by periods of consolidation before the next phase of development.

Sponsored

Sponsored

Critics Argue Base Lost Focus

Some founders and investors say Base’s recent challenges are strategic rather than cyclical. A builder and Coinbase shareholder known as Hish on X publicly criticized the rollout of the Base App, arguing it was marketed as a “super app” but delivered features users did not request.

Investor Mike Dudas echoed similar concerns, saying Coinbase Wallet had previously been positioned as a broad on-chain hub, only to have its priorities shifted by strategic pivots.

Coinbase Leadership Acknowledges Missteps

Coinbase CEO Brian Armstrong responded directly to criticism and accepted responsibility for earlier decisions.

“I’ll take ownership of that if you want to fire someone,” Armstrong wrote, adding that the Base App is now focused on being “the self-custodial version of Coinbase, and trading focused.”

Sponsored

Sponsored

He emphasized that self-custody is becoming increasingly important as more financial activity moves on-chain. However, the Coinbase executive also articulated that most company resources remain directed toward the main retail platform.

In separate remarks about Coinbase’s broader strategy, Armstrong also noted rising institutional engagement with crypto and highlighted growth in:

- Trading volumes

- Assets on the platform, and

- Product revenue streams,

According to Armstrong, the company remains well-positioned as the financial system grows.

Debate Expands to Ecosystem Design

The discussion has extended beyond immediate product changes to larger questions about how crypto ecosystems grow.

Sponsored

Sponsored

Uniswap founder Hayden Adams suggested that combining managed accounts and self-custody into a unified interface could improve usability. His remarks reflect ongoing industry efforts to simplify onboarding without sacrificing decentralization.

At the same time, some community commentators argue that Base must strengthen incentives and culture to retain developers and users.

Meanwhile, others counter that long-term adoption depends more on infrastructure, compliance, and institutional partnerships.

If Base can translate its infrastructure advantages and Coinbase distribution into sustained user growth, the current pullback may prove temporary.

If not, competition among Layer-2 ecosystems is likely to intensify as liquidity and developer attention remain highly mobile.

Crypto World

Bitcoin stuck in tight range; WLFI rallies ahead of crypto forum

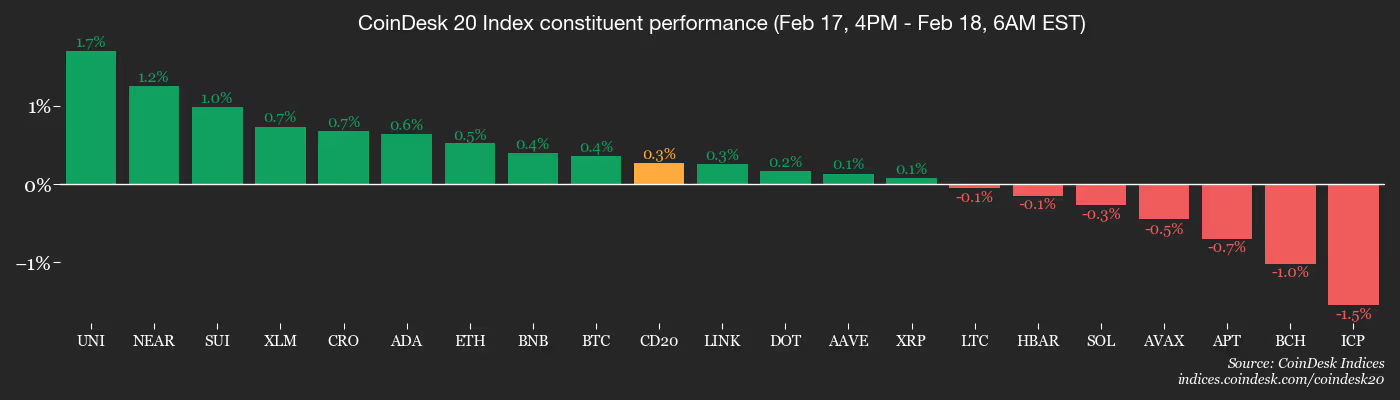

The crypto market continues to trade within a tight range on Wednesday, with bitcoin rising by 0.9% to around $68,000 since midnight UTC.

The largest cryptocurrency has held between $65,100 and $72,000 since Feb. 6 as market volatility has reduced following a Feb. 5 selloff that took BTC to its lowest point since October 2024.

The altcoin market is running its own race. Monero (XMR) and are posting gains of 3% and 1.7%, respectively, since midnight, while zcash (ZEC) and hyperliquid (HYPE) lost 3.5% and 1.1% over the same period.

The muted performance across the crypto market comes as U.S. equities begin to claw their way out of trouble — S&P 500 and Nasdaq 100 index futures are up 0.57% and 0.66% since midnight UTC as investors await hints on monetary policy when the Fed releases its meeting minutes later on Wednesday.

Derivatives

- Market dynamics have shifted toward stabilization as open interest holds firm at $15.5 billion, marking a transition from leverage cleanup to a steady floor.

- While retail sentiment has cooled with funding rates turning flat to slightly negative (Binance at -0.11%), institutional conviction remains anchored, the three-month annualized basis persists at 3%.

- The BTC options market has reached a state of relative equilibrium, with 24-hour volume split 49/51 between calls and puts.

- While the one-week 25-delta skew has eased further to 11%, the implied volatility (IV) term structure remains in short-term backwardation, as evidenced by the sharp front-end spike in the IV curve before leveling off near 49% for longer dated tenors.

- Coinglass data shows $193 million in 24-hour liquidations, with a 62-38 split between longs and shorts. BTC ($72 million), ETH ($52 million) and others ($12 million) were the leaders in terms of notional liquidations.

- The Binance liquidation heatmap indicates $68,800 as a core liquidation level to monitor in case of a price rise.

Token talk

- The “altcoin season” indicator has risen to 34/100, up from lows of 22/100 on Feb. 8, indicating relative strength across the altcoin market despite relatively low levels of volatility.

- The top performing asset on Wednesday has been , the Trump family-backed DeFi token, which is up 8.8% since midnight and 18.52% over the past 24 hours.

- Investors are betting on WLFI ahead of the projects’s crypto forum at Mar-a-Lago on Wednesday, which will be attended by executives from Goldman Sachs, Nasdaq and Franklin Templeton, among others.

- It should be noted that rallies leading up to real-world events or announcements often result in a “sell the news” scenario as those “buying the rumor” race to secure profits.

- Lending platform Morpho’s native MORPHO token has also been on a bullish run of late, rising by 36% in the past week and 7% in the past 24 hours as traders attempt to capitalize on an otherwise unmoving market.

Crypto World

While some big investors cash out, others double down: Crypto Daybook Americas

By Jacob Joseph (All times ET unless indicated otherwise)

Bitcoin remains within the tight $66,000-$70,000 range we’ve seen in the past few days. At the time of writing, the BTC price was about 1.04% higher over 24 hours. Ether was changing hands at $2,020, up 1.43% on the day.

Institutional positioning remains a central theme.

Digital asset treasury companies and public institutions were among the strongest sources of demand in mid-2025, helping propel prices to record highs. But with bitcoin down more than 50% from its October peak, the landscape has shifted. Many treasury-focused firms are now feeling the strain. Metaplanet reported a $619 million net loss earlier this week, while Harvard Management Company trimmed its exposure to bitcoin ETFs.

Ether treasury firms are also recalibrating. ETHZilla disclosed last evening that tech billionaire Peter Thiel and affiliated Founders Fund entities have exited their entire 7.5% stake in the company. The firm also reduced its ether holdings through multiple sales since October.

Still, not everyone is pulling back.

Michael Saylor’s Strategy continued to build its bitcoin position, adding 2,486 BTC earlier this week and bringing total holdings to 717,131 BTC. Meanwhile, two Abu Dhabi-based funds — Mubadala Investment Company and Al Warda Investments — disclosed yesterday that they collectively held more than $1 billion in BlackRock’s Bitcoin ETF at the end of last year.

BitMine Immersion Technologies announced yesterday that it continues to lean in, adding 45,759 ETH over the past week and bringing its total holdings to 4.4 million ETH. About 3 million of that is currently staked, generating additional yield on top of its core position.

Meanwhile, in a separate development disclosed yesterday, BlackRock advanced its plans for a U.S.-listed yield-generating ether product. An amended S-1 filing signaled further progress toward the iShares Staked Ethereum Trust ETF, with a BlackRock affiliate purchasing 4,000 seed shares at $25 each, providing $100,000 in initial capital for the trust.

While these developments provide constructive long-term signals, it may be premature to call an end to the recent drawdown even with bitcoin and ether trading roughly 50% and 60% below their all-time highs, respectively.

At the same time, TradFi indexes are beginning to show signs of fatigue, as rising AI-related capital expenditures outpace earlier estimates and place increasing pressure on corporate cash flows. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Feb. 18, 1 p.m.: Hedera to undergo a mainnet upgrade expected to take about 40 minutes to complete.

- Macro

- Feb. 18, 8:30 a.m.: U.S. durable goods orders MoM for December (Prev. 5.3%)

- Feb. 18, 9:15 a.m.: U.S. industrial production MoM for January est. 0.3% (Prev. 0.4%)

- Feb. 18, 2:00 p.m.: U.S. FOMC Minutes

- Earnings (Estimates based on FactSet data)

- Feb. 18: Figma (FIG), post-market, $0.45

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Unlocks

- Token Launches

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is up 0.86% from 4 p.m. ET Tuesday at $68,227.58 (24hrs: -0.09%)

- ETH is up 1.03% at $2,019.54 (+2.24%)

- CoinDesk 20 is up 0.55% at 1,994.39 (+0.54%)

- Ether CESR Composite Staking Rate is down 3 bps at 2.81%

- BTC funding rate is at 0.0018% (1.9425% annualized) on Binance

- DXY is up 0.13% at 97.28

- Gold futures are up 0.58% at $4,934.20

- Silver futures are up 2.92% at $75.68

- Nikkei 225 closed up 1.02% at 57,143.84

- Hang Seng closed up 0.52% at 26,705.94

- FTSE is up 1.03% at 10,664.40

- Euro Stoxx 50 is up 0.93% at 6,077.76

- DJIA closed on Tuesday unchanged at 49,533.19

- S&P 500 closed up 0.1% at 6,843.22

- Nasdaq Composite closed up 0.14% at 22,578.38

- S&P/TSX Composite closed down 0.54% at 32,896.55

- S&P 40 Latin America closed down 0.62% at 3,694.06

- U.S. 10-Year Treasury rate is up 1.9 bps at 4.073%

- E-mini S&P 500 futures are up 0.52% at 6,896.50

- E-mini Nasdaq-100 futures are up 0.59% at 24,914.00

- E-mini Dow Jones Industrial Average Index futures are up 0.47% at 49,844.00

Bitcoin Stats

- BTC Dominance: 58.56% (-0.01%)

- Ether-bitcoin ratio: 0.02947 (-0.11%)

- Hashrate (seven-day moving average): 1,062 EH/s

- Hashprice (spot): $34.12

- Total fees: 2.29 BTC / $155,681

- CME Futures Open Interest: 116,675 BTC

- BTC priced in gold: 13.7 oz.

- BTC vs gold market cap: 4.5%

Technical Analysis

- The chart shows bitcoin’s price against the dollar in one-week candles.

- The latest reading shows the price remains below the 200-week exponential moving average (EMA).

- Historically, breaks below the EMA have established a “bottom” in a bear market. Whether that’s the case now remains to be seen.

- The lack of divergences in the RSI suggests we are unlikely to see a sustained rebound in the short term.

Crypto Equities

- Coinbase Global (COIN): closed on Tuesday at $166.02 (+1.03%), +1.37% at $168.29 in pre-market

- Circle Internet (CRCL): closed at $61.62 (+2.63%), +2.21% at $62.98

- Galaxy Digital (GLXY): closed at $21.30 (-1.66%), +0.80% at $21.47

- Bullish (BLSH): closed at $32.00 (+0.85%), unchanged in pre-market

- MARA Holdings (MARA): closed at $7.51 (-5.18%), +1.33% at $7.61

- Riot Platforms (RIOT): closed at $14.65 (-3.75%), +1.43% at $14.86

- Core Scientific (CORZ): closed at $17.23 (-3.42%)

- CleanSpark (CLSK): closed at $9.28 (-5.79%), +0.86% at $9.36

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $40.00 (-3.24%)

- Exodus Movement (EXOD): closed at $10.09 (-10.47%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $128.67 (-3.89%), +1.27% at $130.30

- Strive (ASST): closed at $8.18 (-1.80%), +0.86% at $8.25

- SharpLink Gaming (SBET): closed at $6.66 (-2.77%), +0.30% at $6.68

- Upexi (UPXI): closed at $0.72 (-6.37%)

- Lite Strategy (LITS): closed at $1.10 (-1.79%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$104.9 million

- Cumulative net flows: $54.21 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: $48.6 million

- Cumulative net flows: $11.73 billion

- Total ETH holdings ~5.73 million

Source: Farside Investors

While You Were Sleeping

Crypto World

Crypto mortgage lender Milo surpasses $100 million in home loans

Milo, a U.S. cryptocurrency lending business that specializes in crypto-backed mortgages, has originated over $100 million in home loans, including the company’s largest single transaction to date, a $12 million crypto mortgage.

The firm, which holds mortgage provider licenses in ten U.S. states with more to follow, has a perfect track record of zero margin calls across its mortgage portfolio, despite enduring consistently choppy periods of volatility for bitcoin and other cryptos, Milo said in a press release on Wednesday.

The firm allows crypto holders to pledge their bitcoin or ether as collateral for loan amounts up to $25 million without having to sell their digital assets, eliminating the need for cash down payments and avoiding costly taxable events.

Stepping back, Milo founder Josip Rupena said people who were perhaps advised by a friend to buy some Bitcoin 10 years ago say, and had the courage to hold on to it through recurring cycles of volatility, may find that today maybe 95% of their net worth is in crypto.

Such people will typically be aged between 30 and 55, have a job, and perhaps a retirement account, but they don’t have enough income to buy the home they would like to, Rupena said.

“Our typical transaction is a million and a half dollar home,” Rupena said in an interview. “A customer might make $100k a year and their crypto net worth might be anywhere from three to seven million. If you were to replace Bitcoin with Apple stock, a product like ours would probably not need to exist. But because the consumer owns an asset that is not widely accepted, plus its concerns around the volatility, means that products like ours do need to exist to help them buy a home.”

Milo asks for 100% of the value of the property in crypto collateral, which can be held with qualified custodians like Coinbase or BitGo, or there is a self-custodial option for those who want to keep complete control of their assets. The loans, which start at 8.25%, can also be used for things like acquiring land, funding home improvements, and business investments.

Unlike regular crypto loans which can have margin calls at 25% drops, Milo designed the product to be more conservative and accommodate 65% drawdowns.

Even in turbulent times like the past few months, if a drawdown situation were to cross the necessary threshold, Milo would reduce the value of the loan, Rupena said, so that the customer could continue to have the mortgage.

“We would just essentially derisk the 100% and bring it down to a 65% or 70%, like a regular mortgage, and then they could continue to make payments. We designed it in a way that as long as a person can continue to make payments, they’re going to be able to continue to have this home. They’re not going to lose their home, because Bitcoin goes down,” he said.

So far Milo has done several transactions in the property hotspot of Miami and more in other parts of Florida, as well as Texas, California, Colorado, Connecticut and Arizona. The $12 million transaction mentioned in the press release was in Tennessee, Rupena said.

The product has been given the blessing of bitcoin pioneer and CEO of Blockstream, Adam Back.

“Milo’s product is a game changer in bitcoin lending and unlocks real world use cases for so many bitcoiners,” said Back in a statement. “While bitcoin continues to appreciate, buyers are able to build equity in real estate and don’t have to sell their long term conviction, bitcoin.”

Crypto World

Pump.fun launches Cashback Coins Rewards Feature

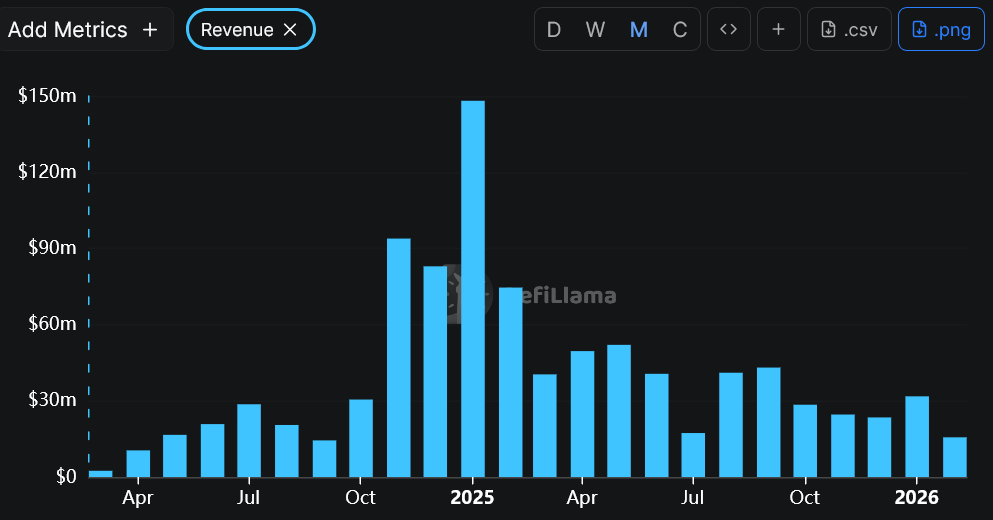

Solana-based memecoin launchpad Pump.fun has rolled out a new feature that shifts rewards toward memecoin traders rather than its deployers — a tweak to its fee model that once generated over $15 million in a single day at its peak.

In a post to X on Tuesday, Pump.fun said the platform’s memecoin creators can now decide whether a token “truly deserves” Creator Fees, or whether it’s best to redirect rewards to traders engaging with the token through “Cashback Coins.”

Pump.fun’s original model features Creator Fees, giving token creators 0.3% of all fees generated by the tokens they launch.

However, Pump.fun said not all tokens deserve Creator Fees because many tokens achieve success without a team or project lead, thereby disproportionately rewarding token deployers.

Creator Fees need change. Not every token deserves Creator Fees.

Now, users have the ability to decide whether a token truly deserves Creator Fees, or whether it makes more sense to reward the traders engaging with the token.

Cashback Coins are now live. Learn more 👇 pic.twitter.com/UbYoAbQ1Ya

— Pump.fun (@Pumpfun) February 17, 2026

“Now, traders can choose to engage with tokens they feel the most aligned with, ultimately letting the market decide who gets rewarded and where the bar is set.”

Pump.fun said coin creators must choose between the Creator Fees or Trader Cashback model before launching. Once chosen, the decision is irreversible.

Terminal, a crypto trading platform built into Pump.fun, said Cashback Coins are generated on every trade made and are only accessible through Terminal.

It comes as analysts from onchain analytics firm Santiment said on Friday that memecoins are showing signs of a potential bottom.

“This collective acceptance of the ‘end of the meme era’ is a classic capitulation signal,” Santiment said, explaining that when a sector of the market is completely written off, it is often the “contrarian time” to start paying attention.

Pump.fun fees have fallen over the last year

Pump.fun’s new rewards feature comes as it recorded $31.8 million worth of fees in January, marking a 75.6% fall from the $148.1 million posted in January 2025 — the platform’s best-performing month to date.

Pump.fun has brought in $15.6 million so far in February, putting it on track to fall short of its January total.

The change to the rewards model also follows months of criticism that only a small number of traders were profiting on Pump.fun, while the vast majority of retail traders were incurring losses.

Data from Dune Analytics shows that of the 58.7 million crypto wallets that have interacted with Pump.fun, only 4.76 million have profited between $1,000 and $10,000, while 969,780 wallets have posted winnings between $10,000 and $100,000.

Less than 13,700 Pump.fun wallets have reached millionaire status on the platform.

The new feature was received well by many in the Pump.fun community, while others, such as X user Coos, pondered whether the rewards model could reduce incentives for developers to launch new coins:

“So devs have less reasons to push coins longer, as the most lucrative time is when coins are still on pf, and have just graduated where there is the most volume.”

Coinbase’s Base shut down its Creator Rewards offering

While Pump.fun has changed its rewards model, others have shut down their rewards programs entirely.

On Feb. 10, Coinbase’s Base App sunset its Creator Rewards program as part of a strategic shift to focus entirely on tradable assets.

Related: Zora debuts attention markets on Solana, betting on social trends

The Creator Rewards program launched in July and was intended to make Base, Coinbase’s Ethereum layer-2, a more social ecosystem, where activity translated into earnings.

The Base App X account said it had paid around $450,000 to 17,000 creators over seven months, with data suggesting that creators earned an average of $26.

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

Why Altcoin Season Is Unlikely in Early 2026, Data Shows

Altcoin market capitalization (TOTAL2) remained below $1 trillion in February, while market sentiment fell to its most extreme level in years. Many investors expect altcoins to form a bottom soon after five consecutive months of decline.

The first quarter of 2026 may still offer opportunities. However, investors need objective signals to evaluate the broader picture.

Sponsored

Sponsored

Persistent Selling Pressure and Fragmented Liquidity Weigh on Altcoins

A report from CryptoQuant states that selling pressure on altcoins (excluding BTC and ETH) has reached its most extreme level in five years.

Cumulative buy/sell delta data has reached -$209 billion over the past 13 months. In January 2025, this delta was nearly zero, which reflected balanced supply and demand. Since then, it has continued to decline without any reversal.

This extreme condition differs completely from the 2022 bear market. During 2022–2023, selling pressure slowed, allowing the market to enter a sideways phase before recovering. That slowdown has not occurred in the current cycle.

“This is not a dip. It’s 13 months of continuous net selling on CEX spot. -209B doesn’t mean bottom. It means buyers are gone,” analyst IT Tech stated.

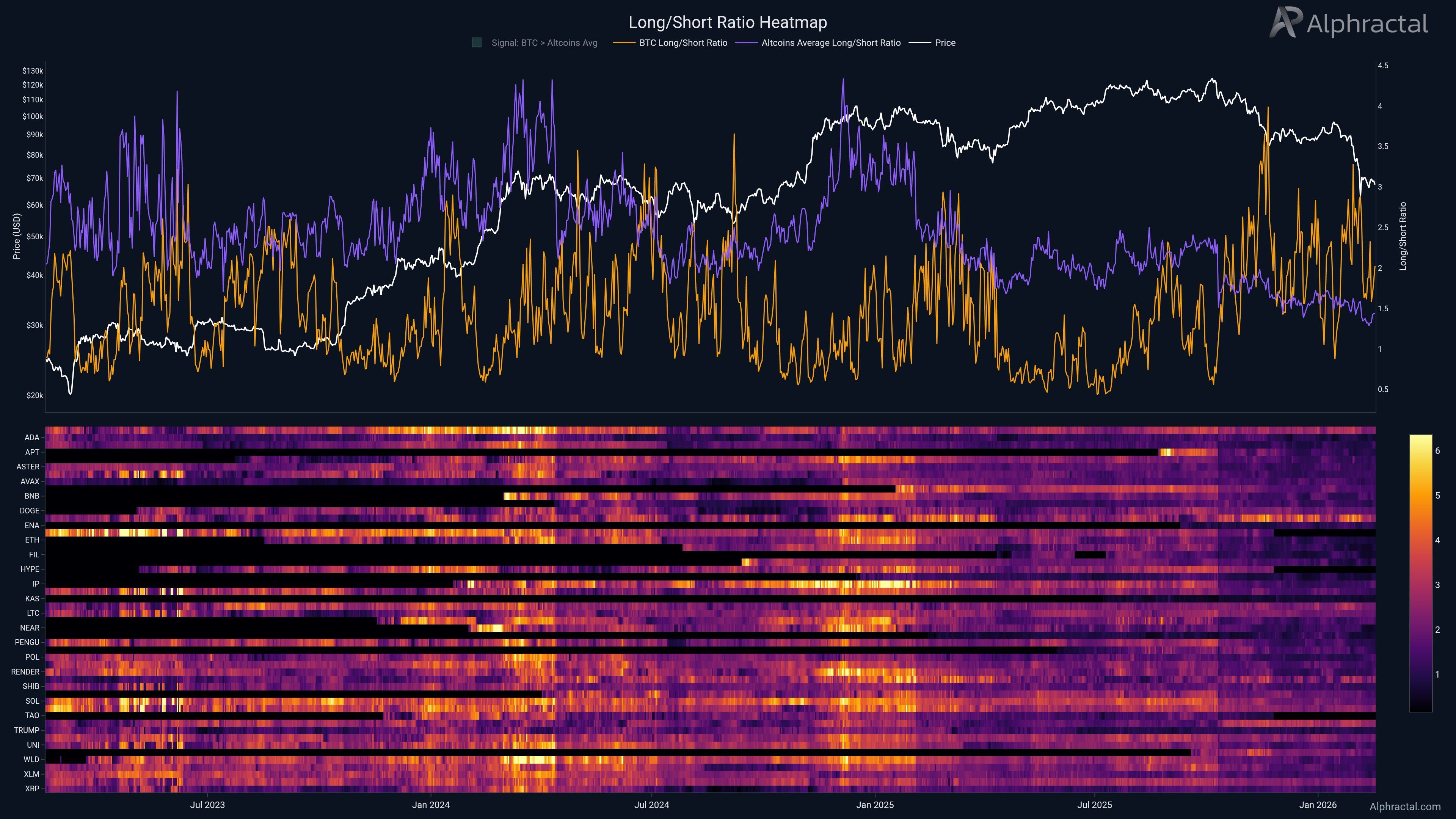

Additionally, derivatives data can provide additional short-term insights. Traders are currently holding significantly more long positions in Bitcoin than in altcoins, as reflected in Alphractal’s Long/Short Ratio data.

Sponsored

Sponsored

The chart shows that this is the first time in history that Bitcoin’s long ratio has remained above the altcoin average for four consecutive months. This indicates that short-term traders have reduced their exposure to altcoins and that expectations for altcoin volatility have weakened.

In addition, the total altcoin market capitalization has dropped back to levels five years ago, below $1 trillion. The altcoin analytics account OverDose pointed out that the biggest difference lies in the number of tokens. Five years ago, only about 430,000 coins were listed. Currently, that figure has surged to 31.8 million, an increase of roughly 70 times.

Too many tokens are competing for a market “pie” that has not grown larger. This dynamic makes recovery more fragile and threatens the survival of low-cap tokens.

Excluding the top 10, the remaining market capitalization stands at less than $200 billion. The technical structure shows a head-and-shoulders pattern, and this capitalization is moving toward its neckline support. Analyst Pentoshi commented that even if altcoins rebound, the gains will likely not be substantial.

“Even if alts bounce here, it likely won’t be substantial. I think eventually they make new lows… Imo it’s going to take some time to work through,” analyst Pentoshi predicted.

According to CoinGecko research, 53.2% of all cryptocurrencies listed on GeckoTerminal had failed by the end of 2025. In 2025 alone, 11.6 million tokens collapsed.

The current bear market may permanently reshape how investors allocate capital within the altcoin sector. Market participants may become more selective, prioritize liquidity and fundamentals, and reduce exposure to speculative low-cap assets.

Crypto World

Enso partners with Chainlink for live production deployments of cross-chain minting

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Enso announced live production deployments of cross-chain minting and execution flows powered by Chainlink, enabling assets to move across chains.

Enso today announced live production deployments of cross-chain minting and execution flows powered by Chainlink Cross-Chain Interoperability Protocol (CCIP). With this integration, issuers and asset strategy platforms can move capital across chains and deploy it into live strategies, atomically and pre-simulated, in a single transaction.

The integration is live in production with launch partners including Reservoir, World Liberty Financial (WLFI), Maple, Avant, Liquity, and Dolomite. Enso and Chainlink now enable assets to arrive on destination chains already deployed according to predefined logic.

Stablecoins and yield-bearing assets bridged via CCIP can be automatically routed through swaps, deposits, zaps, and protocol interactions, all executed in a single bundled transaction. This removes operational overhead, removes execution risk, and eliminates the need for manual post-bridge deployment.

At the center of the integration is Enso’s CCIP Receiver, a destination-side smart contract that combines Chainlink’s secure cross-chain messaging with Enso’s deterministic execution engine. Issuers define outcome-driven workflows, such as minting or distributing assets on one chain and programmatically deploying them into yield, liquidity, or treasury strategies on another, without building custom integrations for each network.

This integration also supports capital-efficient hub-and-spoke models for cross-chain asset expansion. Asset issuers such as USD1 by World Liberty Financial and BOLD by Liquity can mint on a primary chain while distributing and deploying across multiple ecosystems without pre-funding fragmented liquidity pools.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World1 day ago

Crypto World1 day agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Business13 hours ago

Business13 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video1 day ago

Video1 day agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech4 hours ago

Tech4 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business6 hours ago

Business6 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show