Crypto World

Bitcoin Slumps in February, Yet HODLers and Miners Signal Support

Bitcoin slides in February, but strong miner and long-term holder accumulation hints at possible price support.

The opening weeks of February have delivered a stark diagnosis for Bitcoin’s health, with nearly 43% of its circulating supply in a state of loss and quarterly price performance standing at just under -26%, according to analyst GugaOnChain.

According to them, there is little prospect for recovery before April.

On-Chain Metrics Show Widespread Capitulation

In their latest assessment of the Bitcoin market, CryptoQuant contributor GugaOnChain painted a grim picture for holders of the OG cryptocurrency. Per the analyst, 42.85% of Bitcoin’s circulating supply is now underwater, while the Net Unrealized Profit/Loss (NUPL) indicator has slumped to 21.30%, which is firmly in fear territory.

GugaOnChain’s analysis was backed by experts at XWIN Research, who noted that the recent reading of 8 on the Fear and Greed Index was one that has rarely been seen, only appearing in previous stress events, including the 2018 bear market bottom, the March 2020 COVID crash, and the FTX collapse in November 2022.

The analysts pointed out that from a behavioral finance perspective, this reflects loss aversion and herd behavior, with investors reducing risk exposure after significant losses.

Looking at the quarterly price performance, it stands at -25.8%, with GugaOnChain seeing little prospect for recovery before Q2 2026. Additionally, spot Bitcoin ETF flows tell a similar story of institutional exhaustion. Since the start of the month, the products have seen net outflows of $2.17 billion, with the exodus accelerating as prices tumbled toward $60,000 on February 6.

Price Action Reflects Volatility

Other recent research provides context for the conditions described above. For instance, analytics firm Santiment reported that funding rates across exchanges had turned deeply negative, meaning traders were heavily positioned for price drops.

You may also like:

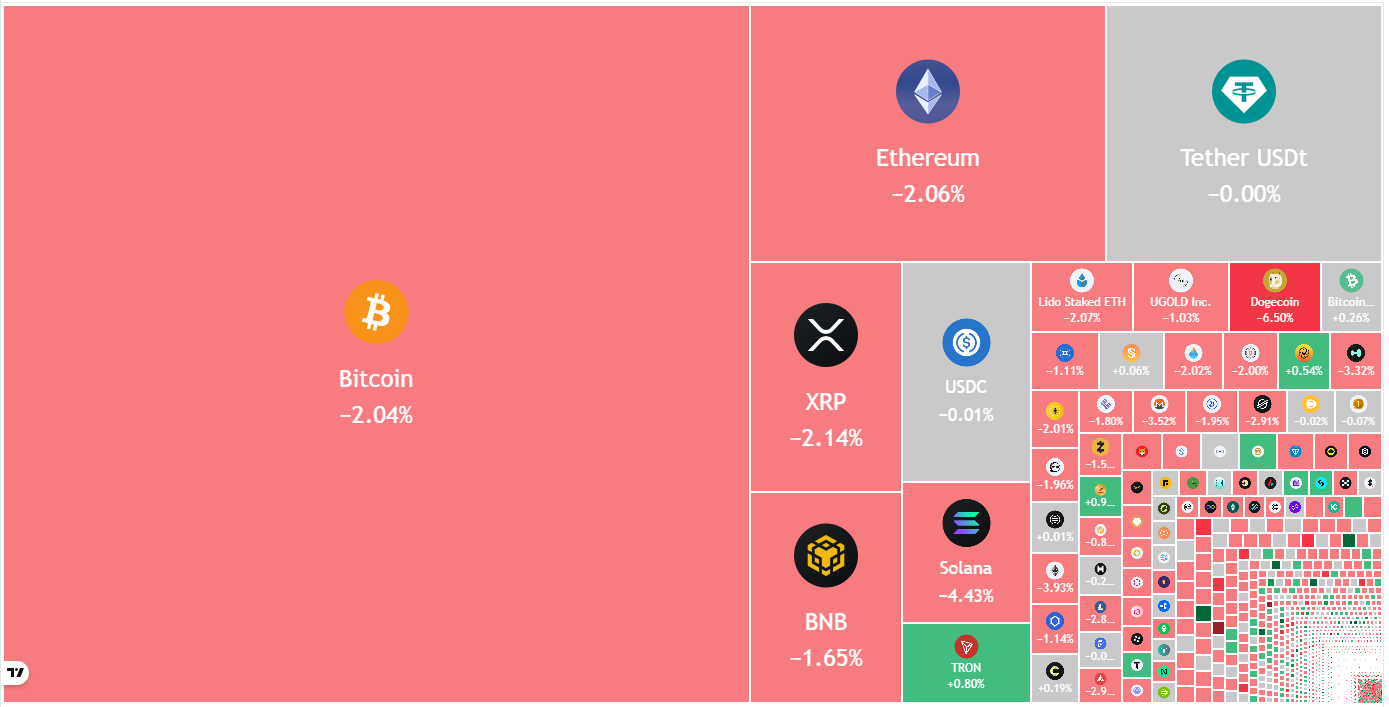

BTC’s price movement is reflecting the tension, with data from CoinGecko showing the asset had fallen about 3% in the last seven days, 10% over two weeks, and 28% across the past month, while trading roughly 46% below its October 2025 all-time high when it went past $126,000.

The growth contraction extends beyond Bitcoin itself, with GugaOnChain’s analysis showing the broader crypto economy shrinking, as mid-cap and small-cap altcoins contracted by 18.3% while the growth rate of the top 20 assets folded by -12.48%.

However, even with prices collapsing, demand from accumulator addresses has stayed strong at 380,104 BTC over the last 30 days. Furthermore, miners appear to be holding their BTC rather than selling, with their operations supported in part by AI revenue streams.

Taken all together, the conditions described in GugaOnChain’s assessment frame the current phase as one defined by fear, defensive positioning, and selective accumulation with little broad market confidence. According to them, “the turn toward recovery now depends on investor resilience.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Mike McGlone Forecasts Bitcoin Price Could Fall to $10,000 Amid Economic Concerns

TLDR

- Mike McGlone warns that Bitcoin could drop to $10,000 due to rising recession risks in the U.S.

- The long-standing “buy the dip” mentality may no longer support risk assets, including cryptocurrencies.

- McGlone highlights Bitcoin’s volatility and predicts a potential reversion to $56,000 before a possible $10,000 decline.

- Broader market instability, including low volatility in major stock indices, contributes to the ongoing crypto price decline.

- Jason Fernandes disagrees with McGlone’s forecast, suggesting a $40,000 to $50,000 price range instead of a collapse to $10,000.

Bloomberg Intelligence’s Mike McGlone has raised concerns about the future of Bitcoin. In a recent analysis, he suggested that the ongoing decline in cryptocurrency prices could signal broader financial stress. McGlone also warned that Bitcoin could revert to as low as $10,000, especially if a U.S. recession becomes more likely.

The analyst observed that the market’s traditional “buy the dip” mentality, which has supported risk assets since 2008, may be losing its strength. McGlone pointed out that the worsening situation in the cryptocurrency market is contributing to broader market volatility. He highlighted several macro indicators suggesting heightened risk conditions in global financial markets.

Bitcoin Price Faces Potential Decline to $10,000

McGlone’s analysis specifically mentions Bitcoin’s vulnerability in the current financial environment. He noted that Bitcoin, which recently fluctuated around $68,800, could continue to struggle. According to McGlone, the cryptocurrency’s decline reflects a broader market breakdown, suggesting that the “buy the dip” mindset may no longer be effective.

He further explained that Bitcoin could fall back toward $10,000 if stock markets continue to weaken. McGlone’s chart comparing Bitcoin to the S&P 500 highlighted how both assets were underperforming. He pointed out that Bitcoin’s volatile nature means it is unlikely to remain above current levels if equity markets experience further instability.

In his analysis, McGlone identified a potential reversion level of $56,000 for Bitcoin. This value corresponds to the 5,600 mark for the S&P 500, adjusted for Bitcoin’s volatility. Beyond this, McGlone predicts that the cryptocurrency could fall further, potentially reaching the $10,000 threshold.

Broader Market Volatility Contributes to Crypto Price Decline

McGlone attributes the ongoing volatility in the cryptocurrency market to broader financial instability. The U.S. stock market’s capitalization relative to GDP is at a century-high, signaling potential bubbles. He noted that the low volatility observed in major stock indices like the S&P 500 and Nasdaq 100 could be masking underlying risks.

Furthermore, McGlone emphasized the “imploding” crypto bubble and the role of factors like “Trump euphoria” in amplifying market stress. While gold and silver are seeing a resurgence, McGlone believes their rise could eventually spill over into equities. He noted that rising market volatility might further challenge asset prices across the board, including cryptocurrencies.

Contrasting Views on Bitcoin’s Future

While McGlone’s thesis on Bitcoin’s potential fall to $10,000 has drawn attention, it has also faced criticism. Jason Fernandes, co-founder of AdLunam, disagreed with McGlone’s view. Fernandes argued that market excesses can resolve through mechanisms like time, rotation, or inflation erosion, rather than necessarily collapsing.

According to Fernandes, Bitcoin’s price could instead stabilize between $40,000 and $50,000 in response to a macro slowdown. He pointed out that a crash to $10,000 would require more severe conditions, including liquidity contraction and financial stress. Fernandes believes that a true recession, marked by global liquidity drainage, would be needed for such a dramatic decline.

However, McGlone’s analysis continues to gain attention, as it reflects rising concerns over both the cryptocurrency and broader market conditions. His forecast suggests that Bitcoin, along with other risk assets, remains highly susceptible to a changing macroeconomic environment.

Crypto World

Binance Founder CZ Urges Faster Evolution of Privacy Features in Crypto

TLDR

- Changpeng Zhao, founder of Binance, emphasizes that privacy is the most significant unresolved issue in the cryptocurrency industry.

- Zhao argues that Bitcoin and most cryptocurrencies lack adequate privacy features, leaving users vulnerable to tracking.

- CZ highlights that blockchain transactions are traceable, especially with KYC practices on centralized exchanges.

- The Binance founder calls for the development of better privacy infrastructure to enable secure crypto payments while complying with regulations.

- Binance’s history with privacy coins, such as the delisting of Monero, raises concerns about the exchange’s stance on privacy.

Changpeng Zhao, the founder of Binance, has stressed the importance of privacy in the cryptocurrency sector. He pointed out that most digital assets lack sufficient privacy protections, making users vulnerable in ways traditional currency does not. Speaking on the All-In Podcast, CZ emphasized the need for faster advancements in crypto privacy.

Privacy Concerns for Cryptocurrency Payments

CZ argued that privacy plays a fundamental role in society but is currently inadequate in most cryptocurrencies, including Bitcoin. “Bitcoin was designed to be pseudo-anonymous,” he explained. “But in reality, every transaction on the blockchain can be traced, especially with KYC on centralized exchanges.” This, he noted, exposes users to risks like unwanted tracking, especially in scenarios such as hotel bookings where third parties might gain access to personal information.

He further elaborated on how payment privacy is a significant hurdle as the cryptocurrency industry moves toward mainstream adoption. With major players like AI agents and institutional investors getting involved, the open ledger design of blockchains like Bitcoin remains a challenge. CZ believes that to achieve widespread use, privacy features must evolve to meet the needs of both businesses and consumers.

Binance and Privacy Coins

Despite CZ’s calls for better privacy features, Binance’s own history with privacy coins has been controversial. In February 2024, Binance delisted Monero (XMR), which at the time was the largest privacy coin. This decision came shortly after CZ stepped down as CEO of Binance, and it led to a 17% drop in Monero’s price. Binance has often cited factors such as trading volume and liquidity in delisting assets, claiming it takes action when a coin no longer meets its standards.

CZ’s comments also raised questions about Binance’s stance on privacy coins like Zcash (ZEC). Last year, Binance included Zcash in a community vote on potential delistings. Zcash’s founder, Zooko Wilcox, raised concerns directly with Binance, highlighting the importance of privacy features in cryptocurrency transactions.

The Need for Widespread Privacy Infrastructure

While privacy coins like Monero and Zcash exist, CZ and industry experts suggest that they are not a complete solution. Nic Puckrin, a digital asset analyst, believes the focus should be on developing broader privacy-preserving infrastructure. Puckrin stressed that the issue isn’t to make payments untraceable but to ensure privacy while staying compliant with regulations. He argued that businesses must adopt these privacy features to enable secure crypto payments.

In the face of these challenges, CZ acknowledged that privacy features are a crucial aspect for crypto’s future. Although law enforcement may seek transparency for security reasons, CZ is confident that privacy can be enhanced without undermining efforts to track bad actors.

Crypto World

Paradigm Challenges Bitcoin Mining Narrative Amid AI Data Center Boom

The rapid buildout of AI data centers has revived a long-running debate over energy consumption, with critics arguing that large computing operations, including Bitcoin mining, strain power grids and drive up electricity prices.

As Cointelegraph previously reported, the surge in AI data center construction has fueled local resistance in several US regions, with residents and lawmakers raising concerns about power demand and rising electricity costs. Bitcoin (BTC) mining has increasingly been linked to the broader debate over high-density computing infrastructure.

In a recent research note, crypto investment firm Paradigm pushed back on that narrative, arguing that Bitcoin mining is frequently misunderstood and often mischaracterized in public energy debates. Rather than treating mining as a static energy drain, Paradigm frames it as a participant in electricity markets, one that responds to price signals and grid conditions.

Paradigm’s Justin Slaughter and co-author Veronica Irwin also challenge several common assumptions used in energy modeling. For example, they note that some analyses measure Bitcoin’s energy use on a per-transaction basis, even though mining energy consumption is tied to network security and competition among miners, not transaction volume.

Other models assume energy production is effectively limitless or that miners will continue operating regardless of profitability, assumptions Paradigm argues are unrealistic in competitive power markets.

According to Paradigm, Bitcoin mining currently accounts for about 0.23% of global energy consumption and about 0.08% of global carbon emissions. Because the network’s issuance schedule is fixed and mining rewards decline about every four years, Paradigm argues that long-term energy growth is constrained by economic incentives.

Related: Bitcoin miner production data reveals scale of US winter storm disruption

Bitcoin mining as flexible grid demand

A central pillar of Paradigm’s argument is demand flexibility.

Bitcoin miners typically seek out the lowest-cost electricity, often sourced from surplus or off-peak generation.

Mining operations can scale consumption based on grid conditions, reducing usage during periods of stress and increasing it when supply exceeds demand. In that sense, Paradigm describes mining as a flexible load, similar to energy-intensive industries that respond to real-time pricing signals.

The debate has taken on new urgency as AI data center expansion accelerates. As Cointelegraph recently reported, some crypto-era infrastructure is now being repurposed to support artificial intelligence workloads, with companies shifting from Bitcoin mining to AI data processing to pursue higher margins. Several traditional Bitcoin miners, including Hut 8, HIVE Digital, MARA Holdings, TeraWulf and IREN, have begun making partial transitions.

By framing mining as responsive demand rather than constant consumption, Paradigm’s report shifts the debate from environmental alarmism to grid economics. The implication for policymakers is that Bitcoin mining should be evaluated within the broader electricity market rather than through simplified energy comparisons.

Related: The real ‘supercycle’ isn’t crypto, it’s AI infrastructure: Analyst

Crypto World

South Korea Uses AI to Detect Crypto Market Manipulation

South Korea is accelerating its crypto market supervision by shifting from manual investigations to AI-powered surveillance. The Financial Supervisory Service (FSS) is upgrading its Virtual Assets Intelligence System for Trading Analysis (VISTA) to automate the initial detection of suspicious activity, a move aimed at coping with the speed and scale of modern digital-asset trading. The upgrade, supported by funding through 2026, enables sliding-window analysis across overlapping time frames to flag abnormal patterns such as sudden volume spikes or atypical price movements. In tandem, regulators are planning to extend AI capabilities to identify networks of coordinated trading accounts and trace the sources of funds used in manipulation. Officials also explore proactive interventions, including potential temporary suspensions of transactions or payments, to curb illicit gains before they can be withdrawn.

Key takeaways

- The Financial Supervisory Service’s upgraded VISTA now performs the initial detection of suspicious trading using automated algorithms rather than relying solely on human investigators.

- A sliding-window grid search method segments trading data into overlapping time frames to identify abnormal patterns, such as unusual volume surges or abrupt price moves.

- Through 2026, the FSS plans to add AI tools capable of detecting networks of coordinated trading accounts and tracing the funding sources behind manipulation schemes.

- Regulators are weighing proactive interventions, including temporary suspensions of transactions or payments, to block illicit gains before withdrawal or laundering.

- The move signals a broader shift toward continuous, AI-assisted oversight in digital-asset markets to align crypto supervision with evolving market dynamics.

Market context: Link the story to broader crypto conditions (liquidity, risk sentiment, regulation, ETF flows, macro, or sector trends) WITHOUT inventing facts.

Why it matters

The shift to automated surveillance reflects regulators’ need to keep pace with the sheer volume and velocity of crypto trading. In markets where a single exchange can process thousands of trades in minutes, manual review struggles to keep up, creating gaps that manipulators may exploit. By automating the detection of irregular activity, authorities can flag suspect intervals with far greater speed and consistency, reducing the window during which illicit actors can operate unchecked. Yet, automation also raises questions about the balance between vigilance and overreach. As algorithms flag patterns that resemble manipulation, there is a risk of false positives that could disrupt legitimate trading activity if not carefully managed.

For market participants, the move toward AI-driven oversight could raise the bar for compliance. Exchanges and custodians will need to ensure data quality and interoperability so that automated systems can access comprehensive, timely information. Regulators’ increased reliance on machine learning models may also spur new governance practices around model validation, transparency, and accountability. The net effect could be a more resilient market environment where manipulative tactics are detected earlier, but with continued diligence to avoid unintended penalties on innocent actors.

Beyond crypto-specific implications, the initiative signals regulators’ intent to harmonize digital-asset oversight with traditional financial markets. Korea’s exploration of proactive intervention intersects with broader debates on supervisory tools, due-process safeguards, and the threshold for action in fast-moving markets. If Korea proves effective, other jurisdictions may adopt similar AI-enabled approaches, extending the reach of automated risk detection across asset classes and trading venues.

What to watch next

- Milestones in the AI upgrade rollout through 2026, including when specific detection modules for coordinated accounts and funding tracing become operation-ready.

- Details of the proposed proactive intervention mechanism, such as criteria, governance, and safeguards for temporary transaction suspensions.

- Results from internal tests demonstrating the accuracy and coverage of automated detection, including any externally verified validation.

- Regulatory guidance on cross-venue data sharing and the integration of AI surveillance with existing market surveillance frameworks.

- Any expansion of AI-based monitoring to other asset classes or to cross-border coordinated trading investigations.

Sources & verification

- Official statements or documentation from the Financial Supervisory Service detailing the VISTA upgrade and its automated detection capabilities.

- Technical briefings or regulator notes describing the sliding-window grid search approach used to scan trading data.

- Public announcements about funding or timelines for AI enhancements through 2026.

- Regulatory notices or policy discussions about a potential payment-suspension mechanism to curb illicit gains.

- Industry coverage on pump-and-dump groups and spoofing in crypto markets for context on monitoring challenges.

South Korea deploys AI-powered surveillance to tighten crypto market oversight

The Financial Supervisory Service’s upgrade to VISTA represents a deliberate shift from reactionary, case-by-case probes to proactive, continuous monitoring of digital-asset markets. The upgraded system can autonomously identify likely manipulation windows across the entire data set, a capability regulators say was not feasible with earlier, manually driven methods. In internal testing, the AI detected all known manipulation periods from completed investigations and also highlighted additional intervals that human analysts had previously missed. This progress is framed as a necessary response to the extraordinary pace and complexity of today’s crypto markets, where millions of transactions occur across dozens of tokens every hour.

Central to the upgrade is a sliding-window grid search, a methodological choice that allows the model to examine overlapping time segments of varying durations. Rather than requiring investigators to guess where misconduct might lie, the algorithm evaluates every potential sub-period for telltale signs—such as sudden price spikes followed by rapid reversals or unusual bursts in trading volume. By prioritizing high-risk windows, the system helps analysts focus on the most suspicious intervals, enabling faster, more targeted inquiries. One striking insight from industry observers is that in crypto markets, some manipulation can unfold in under five minutes, a time frame that challenges human monitoring but is well within the reach of automated systems.

The upgrade is more than a technical upgrade; it signals regulators’ intent to extend AI capabilities beyond detection to prevention and enforcement. Through 2026, the FSS plans to implement tools that map networks of trading accounts that operate in coordination—an important step in dismantling capital flows that underpin manipulation schemes. The regulator also aims to perform large-scale analyses of trading-related text across thousands of crypto assets, seeking to correlate promotional narratives with price movements and to understand how attention shocks translate into market risk. And by tracing the origin of funds used in manipulation, authorities hope to build stronger enforcement cases and curb the ability of bad actors to launder proceeds.

As with any AI-driven regime, the initiative faces practical and philosophical challenges. Regulators acknowledge that automated surveillance must be complemented by human oversight to address issues such as cross-venue manipulation and off-platform coordination, which may elude any single venue’s view. Regular evaluation is required to mitigate bias or drift in models and to avoid flagging legitimate activity. The plan explicitly states that AI tools are intended to support, not replace, investigators, reinforcing the role of experienced analysts in interpreting and acting on automated signals.

Beyond the Korean context, the effort echoes a broader transition in financial markets toward real-time surveillance that blends traditional risk controls with modern data science. The Korea Financial Services Commission has even discussed a broader governance framework for algorithmic trading that would apply across asset classes, coupling market surveillance with behavioral signals and automated risk scoring. The overarching objective is a more resilient system capable of identifying irregularities promptly, while maintaining due-process protections and avoiding overreach that could disrupt legitimate market activity.

As policymakers weigh the regulatory levers, observers will look for concrete demonstrations of how these AI tools perform in live markets. The integration of automated detection with proactive interventions—such as potential temporary suspensions of transactions tied to suspected manipulation—could reshape how traders approach liquidity, risk, and compliance. The evolving framework may also influence how other jurisdictions craft AI-enhanced surveillance, potentially accelerating a global shift toward more transparent and accountable crypto markets.

For readers seeking deeper context, related analyses on pump-and-dump groups and the use of spoofing in crypto trading are available here: pump-and-dump groups: are they legal? and how scammers use fake transaction simulation sites to steal crypto.

Crypto World

$321 Million in Crypto Tokens Unlock This Week: What to Watch

The crypto market will welcome tokens worth more than $321 million in the third week of February 2025. Major projects, including LayerZero (ZRO), YZY (YZY), and KAITO (KAITO), will release significant new token supplies.

These unlocks could introduce market volatility and influence short-term price movements. So, here’s a breakdown of what to watch.

Sponsored

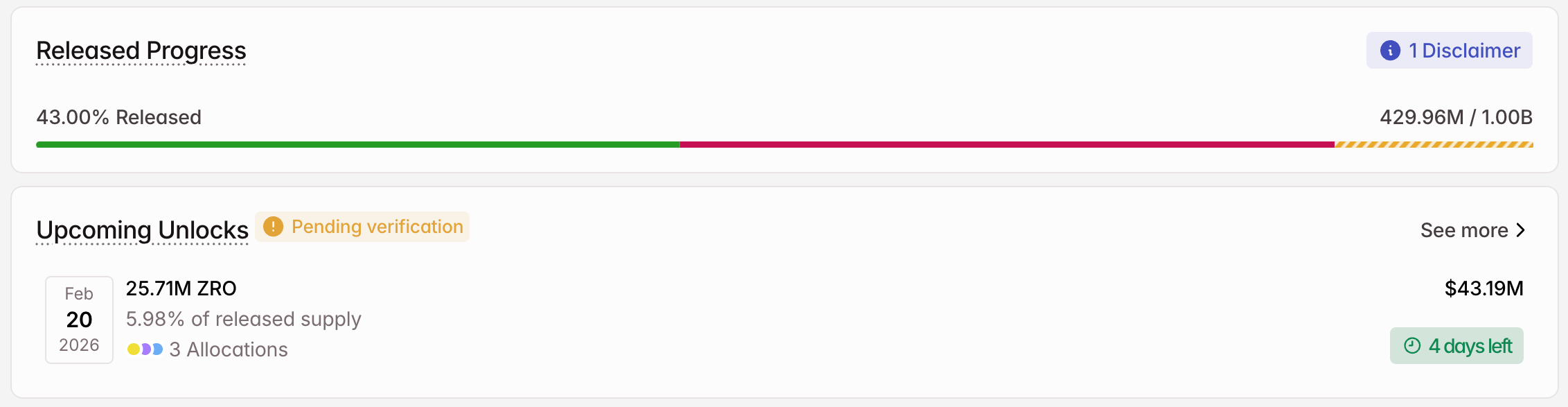

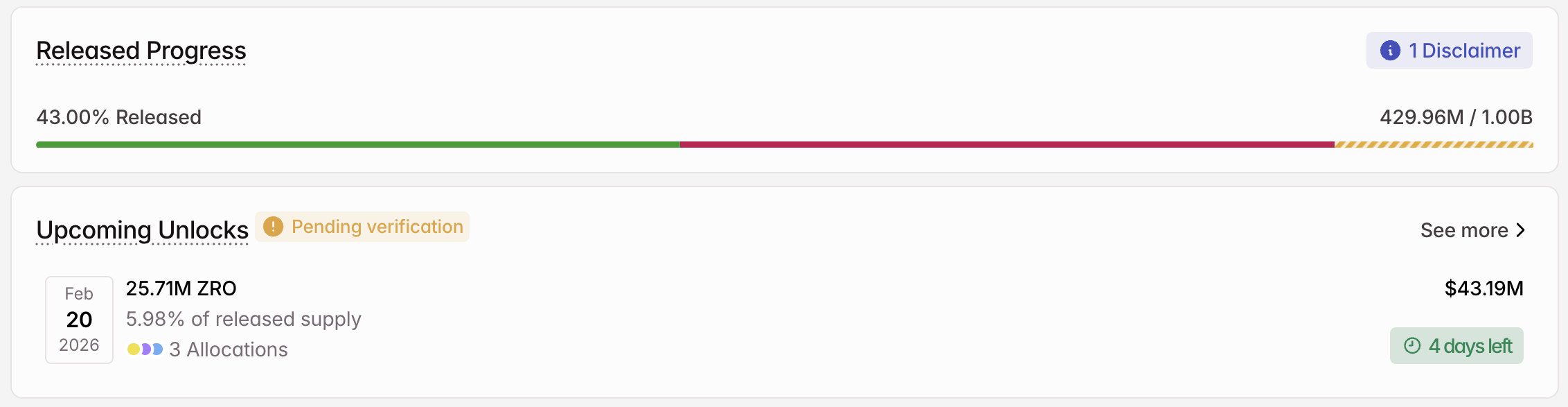

1. LayerZero (ZRO)

- Unlock Date: February 20

- Number of Tokens to be Unlocked: 25.71 million ZRO

- Released Supply: 429.96 million ZRO

- Total Supply: 1 billion ZRO

LayerZero is an interoperability protocol that connects different blockchains. Its primary goal is to facilitate seamless cross-chain communication. Thus, it enables decentralized applications (dApps) to interact across multiple blockchains without relying on traditional bridging models.

The team will unlock 25.71 million tokens on February 20, representing 5.98% of the released supply. Moreover, the supply is worth approximately $43.19 million.

LayerZero will award 13.42 million altcoins to strategic partners. Core contributors will get 10.63 million ZRO. Lastly, 1.67 million ZRO are for tokens repurchased by the team.

Sponsored

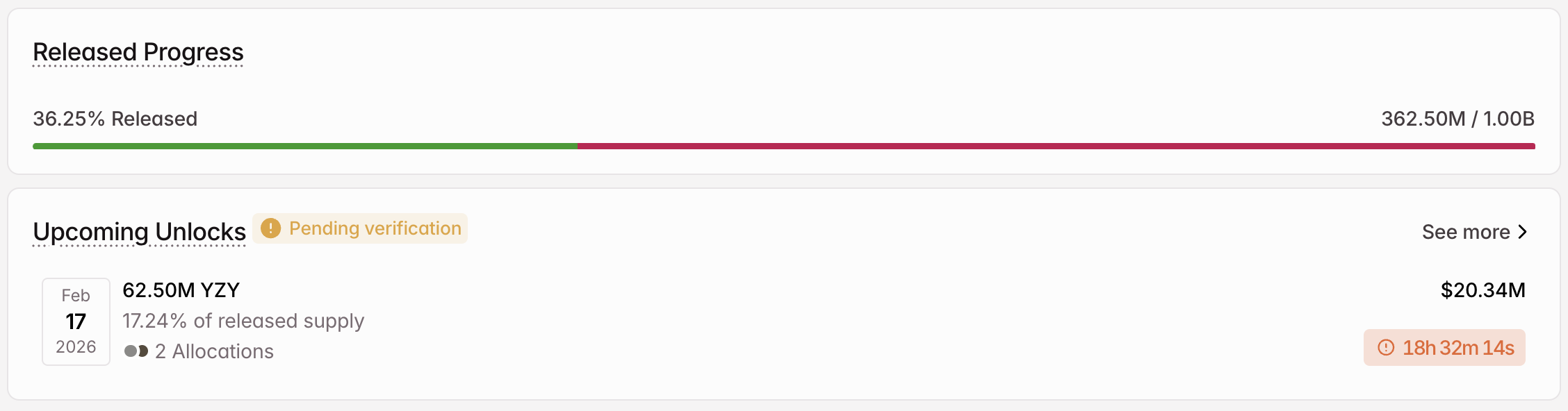

2. YZY (YZY)

- Unlock Date: February 17

- Number of Tokens to be Unlocked: 62.5 million YZY

- Released Supply: 362.5 million YZY

- Total supply: 1 billion YZY

YZY is a cryptocurrency token associated with the rapper Ye (formerly known as Kanye West). It is positioned as part of the broader “YZY MONEY” ecosystem, which includes the YZY token, a payment platform called Ye Pay, and a physical YZY Card.

On February 17, YZY will unlock 62.5 million tokens worth around $20.34 million. The tokens represent 17.24% of the released supply.

Sponsored

The team will allocate 50 million altcoins to Yeezy Investments LLC, Vesting 2. Moreover, it will direct 12.5 million tokens to Yeezy Investments LLC, Vesting 1.

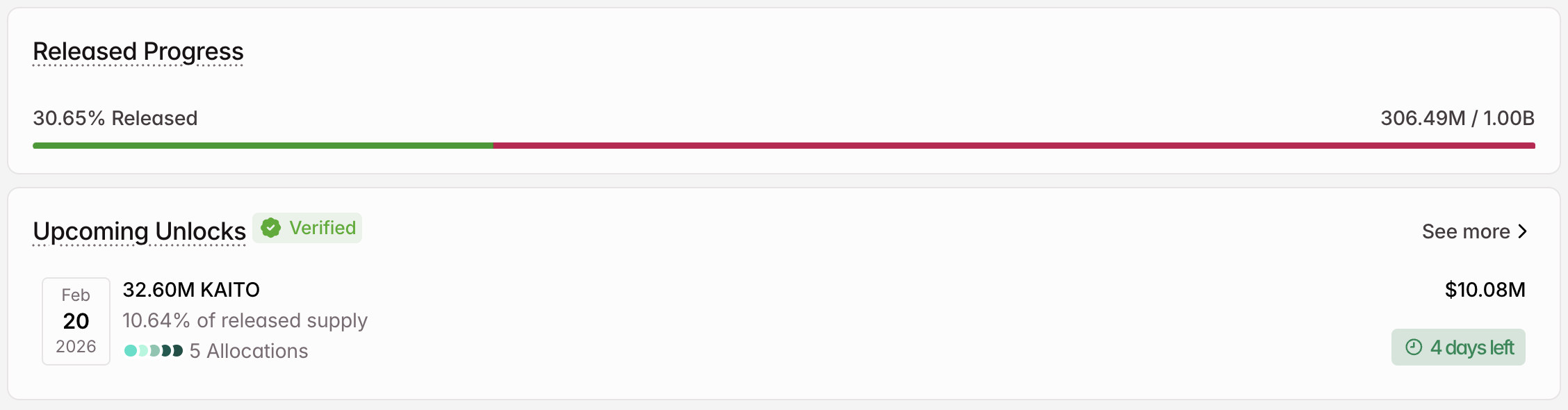

3. Kaito (KAITO)

- Unlock Date: February 20

- Number of Tokens to be Unlocked: 32.6 million KAITO

- Released Supply: 306.49 million KAITO

- Total Supply: 1 billion KAITO

Kaito is an artificial intelligence (AI)-powered Web3 information platform that aggregates and analyzes cryptocurrency market data from diverse sources like social media, governance forums, news, and more. The KAITO token serves as a medium of exchange, governance tool, and incentive mechanism within the platform.

Sponsored

On February 20, the team will unlock 32.6 million tokens, representing 10.64% of the current released supply. The supply is worth approximately $10.08 million.

The team will split the unlocked tokens five ways. The foundation will receive 1.19 million tokens. Core contributions will get 6.94 million tokens. Furthermore, early backers will receive 2.31 million KAITO.

Finally, the team will direct 7.16 million KAITO for ecosystem and network growth and 15 million tokens for long-term creator incentives.

In addition to these, other prominent unlocks that investors can look out for in the third week of February include ZKsync (ZK), Solv Protocol (SOLV), ApeCoin (APE), and more, contributing to the overall market-wide releases.

Crypto World

Bitcoin Holds Key Level, Altcoins Aim To Follow: Will Bears Relent?

Key points:

-

Bitcoin remains under pressure as bears are selling on rallies near the $74,508 resistance

-

The bears are mounting a solid defense in several major altcoins at higher levels, indicating a negative sentiment.

Bitcoin (BTC) has started the new week on a cautious note as bulls attempt to maintain the price above $67,500. Investors are not rushing in to buy the dip, as seen from the $133.3 million in outflows from BTC exchange-traded products last week. The total outflows from crypto investment products have risen to $3.8 billion over the past four weeks, according to a CoinShares update on Monday.

If BTC ends the month below $79,500, it will record its first-ever consecutive negative monthly closing in January and February. With more than 22% loss, BTC is staring at its worst first-quarter performance since the 49.7% loss in 2018, per CoinGlass data.

Despite BTC’s weak performance and uncertain near-term direction, Strategy co-founder Michael Saylor indicated in a post on X that the company is buying more BTC. That will be Strategy’s 99th BTC transaction, showing their long-term bullish view remains intact.

Could BTC and the major altcoins defend the support levels and start a strong relief rally? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

S&P 500 Index price prediction

The S&P 500 Index (SPX) is witnessing a tough battle between the bulls and the bears at the support line of the ascending channel pattern.

The moving averages are on the verge of a bearish crossover, and the relative strength index (RSI) is in the negative territory, indicating that the bears are making a comeback. The index may start a deeper correction to 6,720 and then to solid support at 6,550 if the price breaks below the 6,780 level.

Buyers will have to propel the price above the 7,002 level to retain control. If they manage to do that, the index may resume its uptrend and surge toward the 7,290 level.

US Dollar Index price prediction

The US Dollar Index (DXY) has been trading below the moving averages, but the bears have failed to challenge the 96.21 to 95.55 support zone.

The bulls will try to strengthen their position by pushing the price above the moving averages. If they can pull it off, the index may rally to 99.49 and then to the overhead resistance at 100.54.

Contrarily, if the price turns down sharply from the moving averages, it suggests that the bears continue to sell on rallies. The index may the next leg of the downtrend on a close below the 95.55 support.

Bitcoin price prediction

Sellers are attempting to halt BTC’s recovery near $71,000, indicating that the bears remain sellers on rallies.

The sellers will have to pull the price below the $65,000 level to remain in command. The BTC/USDT pair may then retest the critical $60,000 level. If the $60,000 support cracks, the next stop is likely to be $52,500.

Buyers will have to drive the Bitcoin price above the breakdown level of $74,508 to signal that the bearish momentum is weakening. The pair may then surge toward the 50-day SMA ($83,910), where the bears are expected to mount a strong defense.

Ether price prediction

Ether (ETH) once again turned down from the $2,111 level on Sunday, indicating that the bears are fiercely defending the level.

Sellers will attempt to pull the price below the immediate support at $1,897. If they do that, the ETH/USDT pair may drop to the $1,750 level. Buyers are expected to defend the $1,750 level with all their might, as a close below it may sink the pair to $1,537.

Instead, if the Ether price turns up and breaks above the 20-day EMA ($2,221), it signals that the selling pressure is reducing. The pair may then rally to the 50-day SMA ($2,744).

BNB price prediction

BNB’s (BNB) relief rally fizzled out at $642 on Sunday, indicating that the bears are selling on every minor rise.

The bears will attempt to increase their hold by pulling the BNB price below the $570 level. If they manage to do that, the BNB/USDT pair may extend its decline to psychological support at $500.

The bulls will have to drive the price above the 20-day EMA ($686) to suggest that the bears are losing their grip. The pair may then climb to $730 and subsequently to the 50-day SMA ($817).

XRP price prediction

XRP (XRP) turned up from the support line of the descending channel pattern on Friday and pierced the 20-day EMA ($1.53) on Sunday.

However, the bears successfully defended the breakdown level of $1.61 and pulled the XRP price back below the 20-day EMA. The bulls are unlikely to give up easily and will make another attempt to clear the $1.61 level.

If they succeed, the XRP/USDT pair may rise to the 50-day SMA ($1.81). Such a move suggests that the pair may remain inside the channel for some more time.

Sellers will have to tug the price below the support line to gain the upper hand. The pair may then retest the Feb. 6 low of $1.11.

Solana price prediction

Buyers are attempting to push Solana (SOL) back above the breakdown level of $95, but the bears have held their ground.

The Solana price may trade inside the $76 to $95 range for some time. Such a move increases the likelihood of an upside breakout. The SOL/USDT pair may then rally toward $117.

This positive view will be negated in the near term if the price turns down and breaks below the $76 support. The pair may then retest the Feb. 6 low of $67, where the buyers are expected to step in.

Related: $75K or bearish ‘regime shift?’ Five things to know in Bitcoin this week

Dogecoin price prediction

Dogecoin (DOGE) turned down from the breakdown level of $0.12 on Sunday, indicating that the bears are defending the level.

The 20-day EMA ($0.10) is flattening out, and the RSI is just below the midpoint, signaling a possible range-bound action in the near term. The DOGE/USDT pair may swing between $0.08 and $0.12 for a few days.

Buyers will gain the upper hand on a close above the $0.12 resistance. That opens the doors for a rally to $0.16. Alternatively, the advantage will tilt in favor of the bears on a close below $0.08. The Dogecoin price may then slump to $0.06.

Cardano price prediction

Cardano’s (ADA) relief rally reached the 20-day EMA ($0.29) on Saturday, which is expected to act as a stiff hurdle.

If the bulls do not give up much ground to the bears, the possibility of a break above the 20-day EMA increases. That suggests the ADA/USDT pair may remain inside the descending channel for some more time. A break and close above the downtrend line signals a potential short-term trend change.

Sellers will have to pull the Cardano price below the support line to extend the downward move toward the next support at $0.20.

Bitcoin Cash price prediction

Bitcoin Cash (BCH) surged above the 20-day EMA ($544) on Friday, indicating that the bears are losing their grip.

The recovery is facing resistance at the 50-day SMA ($578), but a positive sign is that the bulls have not allowed the Bitcoin Cash price to slip back below the 20-day EMA. That increases the likelihood of the continuation of the relief rally. If buyers pierce the 50-day SMA, the BCH/USDT pair may reach $600.

Sellers will have to swiftly yank the price below the 20-day EMA to apply pressure on the bulls. The pair may then skid to the $500 support.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Bitcoin Weekly RSI Echoes Mid-2022 Bear Market as BTC Plays Liquidity

Bitcoin (CRYPTO: BTC) briefly surged toward the $70,000 level on a U.S. bank holiday before retreating, underscoring how thin liquidity can amplify price moves in markets with limited participants. The session featured swift reversals as major venues saw shallow order books, allowing large players to push the price in sharp, short-lived bursts and then pull back just as quickly. Traders described a day of both dramatic squeezes and measured pauses, with liquidity gaps creating a backdrop where price action could swing without a clear directional trend. While the move rekindled talk of potential bottoming signals, observers cautioned that a single holiday-driven spike is not a proof point for a durable trend, particularly given the broader context of a market accustomed to volatile cross-currents.

Key takeaways

- Holiday-thinned liquidity on a U.S. trading day amplified both upside and downside moves, with BTC briefly touching $70,000 before a pullback.

- Price action occurred in a tight range, described by analysts as a pattern of “breakouts and shakeouts” that failed to establish a decisive breakout.

- CoinGlass tracked roughly $120 million in crypto liquidations across four hours, highlighting the reflexive nature of order-book dynamics during low-volume sessions.

- Weekly RSI readings dipped to 27.8, the lowest since June 2022, fueling discussions about potential cycle lows and macro bottoming patterns.

- Market commentary emphasized ongoing liquidity-driven reversals, with notable divergence in activity on different exchanges and persistent bullish-bias signals outside of a handful of venues.

- A sequence of social posts from traders highlighted mixed sentiment, with some noting net buying pressure overall while exceptions persisted on certain platforms such as OKX.

Tickers mentioned: $BTC

Price impact: Neutral. The episode demonstrated how thin liquidity can drive rapid intraday reversals without signaling a sustained directional shift.

Trading idea (Not Financial Advice): Hold. Given the absence of a clear breakout and the sensitivity to depth on holiday sessions, traders may prefer to wait for a more decisive move backed by stronger liquidity and higher-volume participation.

Market context: The latest price activity reflects a broader pattern in crypto markets where liquidity constraints during holidays or low-volume sessions can magnify swings. It also sits amid ongoing debates about macro risk sentiment, ETF-related flows, and the persistence of risk-on versus risk-off dynamics that shape digital-asset price formation.

Why it matters

The episode matters because it exercises a fundamental risk for traders: price discovery in environments where liquidity is not consistently deep. Thin order books can magnify both hopeful breakouts and fear-driven reversals, making risk management and position sizing more critical than in normal trading conditions. For market participants, the contrast between a swift move to the multi-year high vicinity and a rapid retracement underscores how much of Bitcoin’s price action still depends on the availability of buyers and sellers at key price levels rather than on a sustained flow of capital. The event also provides a practical test bed for risk controls, as exchanges and liquidity providers calibrate their resilience to sudden, liquidity-driven shocks.

From a technical perspective, weekly RSI readings toward oversold territory suggest potential patience is warranted before drawing conclusions about a longer-term bottom. Yet the narrative is not binary: the same chart readings were cited in past cycles as precursors to stalled consolidations or gradual basing patterns rather than immediate recoveries. Analysts emphasized that while the current RSI dip resembles patterns seen in previous bear markets, it does not guarantee a repeat of those outcomes. The broader takeaway is a need to monitor how price, momentum, and volume evolve together in the weeks ahead, particularly as markets digest macro inputs and any incremental developments in crypto regulation or product approvals that could influence risk appetite.

On-chain and on-exchange observations further enrich the story. Market participants noted blocks of liquidity getting reconfigured as bids and offers were removed and re-placed at new levels, reinforcing the sense that order-book dynamics played a leading role in the day’s action. The interplay between short-term liquidations, bid-ask wall reformation, and whale activity suggested a tug-of-war between buyers aiming for a breakout and sellers defending certain price zones. In this context, a minority of observers highlighted a pattern that echoes the bear-market conditions of 2022, while others warned that a single holiday-driven session is not the best proxy for broader market health or a definitive trend reversal.

Social signals added texture to the narrative. One prominent trader noted that net buying pressure remained robust across most venues, with OKX standing out as an exception where the balance shifted toward selling pressure. The dialogue around the differing dynamics across exchanges highlighted how venue-specific liquidity can shape price trajectories in real time, contributing to a landscape where market participants must weigh cross-exchange liquidity, funding conditions, and cross-venue order flow as part of a single, evolving story.

Beyond Bitcoin itself, observers highlighted ongoing patterns in price response to liquidity shocks across the crypto market. The day’s action fed into a broader conversation about how investors seasonally recalibrate risk, particularly during holiday windows when traditional liquidity pools are thinner and risk sentiment can swing on a coin flip. While the event did not trigger any explicit new catalysts, its implications for short-term trading strategies—particularly those relying on liquidity-driven breakouts—remain a focal point for traders who seek to understand how much of BTC’s price movement is driven by depth versus fundamental shifts in demand.

What’s different about $BTC from yesterday is that net buying is maintained except for OKX. pic.twitter.com/x3Y1OegrsI

— CW (@CW8900) February 16, 2026

What to watch next

- Follow BTC price action in the next several sessions to determine if a sustained move beyond the current range emerges on higher liquidity.

- Monitor the weekly RSI to see whether momentum stabilizes above oversold territory or slides deeper, which could influence near-term bias.

- Track liquidation flows and changes in order-book depth across major venues to assess whether the market is rebalancing its risk tolerance.

- Observe cross-exchange buy/sell pressure differences, particularly after the holiday period, to gauge whether a broader consolidation or a fresh breakout is forming.

- Keep an eye on macro catalysts and regulatory developments that could shift appetite for risk assets in the coming weeks.

Sources & verification

- TradingView BTCUSD price action within the holiday session showing moves toward and away from $70,000 (BTCUSD chart).

- CoinGlass liquidity and liquidation data indicating roughly $120 million in liquidations over four hours.

- Material Indicators’ analysis of BTC/USDT liquidity and whale activity on major exchanges.

- Social posts from Daan Crypto Trades and Keith Alan discussing RSI patterns and bear-market similarities.

- Public social post from CW highlighting net buying dynamics and exchange-specific commentary.

Rewritten Article Body: Liquidity squeezes and RSI signals shape BTC price action on a holiday

Bitcoin, trading as Bitcoin (CRYPTO: BTC), confronted a unique set of conditions on a U.S. bank holiday: liquidity was thin, and that scarcity amplified even modest market forces into notable intraday moves. The price briefly tested the $70,000 mark before retreating, a pattern consistent with the kind of rapid, liquidity-driven reversals that have become familiar in low-volume sessions. Rather than a clean breakout, the action unfolded in a narrow corridor, with bids and asks repeatedly clearing and reforming at new levels as traders recalibrated risk exposure in the absence of the usual institutional floor.

Market observers described a day of “breakouts and shakeouts”—moments when prices appeared ready to run but were quickly checked by the lack of robust order-book depth. The dynamic is a reminder that, on days when major markets are closed, a handful of large participants can move prices meaningfully without the broader market’s participation. The net effect was a series of swift moves that left many participants unsure of the prevailing directional bias, reinforcing a common refrain: liquidity is the prime mover in such environments, more so than fresh macro catalysts or new fundamental data.

Data from CoinGlass illustrated the scale of activity during the session: approximately $120 million in liquidations occurred across a four-hour window. This is a hallmark of a market where thin liquidity can produce outsized volatility, as participants face sudden sifts in supply and demand balance. In practical terms, those who believed the momentum favored a sustained tilt toward the upside found themselves facing rapid opposition as new walls formed above and below the current price to absorb incoming bids or offers. The absence of deep liquidity magnifies the impact of individual large trades, making every order a potential flash point for the next move.

On the technical front, a closer look at momentum indicators painted a nuanced picture. Weekly RSI readings dipped toward oversold territory, with the metric landing at 27.8 on one trading day—its lowest reading since June 2022. Some analysts pointed to this as a potential bottoming signal, drawing parallels to prior bear-market cycles where oversold conditions laid the groundwork for a period of consolidation and eventual macro recovery. Others cautioned that history does not guarantee a repeat outcome and that the present pattern could diverge from 2022 depending on subsequent liquidity and macro dynamics. The discussion underscored how traders weigh technical signals in conjunction with the underlying liquidity environment, rather than relying on any single indicator in isolation.

Beyond the numbers, the day’s narrative included qualitative observations about exchange-specific activity. Traders noted that buying pressure remained more robust than on the previous session, with the exception of OKX, where selling pressure appeared to dominate. This divergence highlighted how different venues can diverge in real time, driven by liquidity distributions, funding conditions, and the behavior of large players who shuttle capital across platforms. A prominent market participant summarized the sentiment on social media, noting that net buying was generally positive across most venues, but the OKX discrepancy reminded the market that liquidity fragmentation persists and can influence short-term outcomes in unpredictable ways.

In a broader context, the episode fed into ongoing discussions about how crypto markets navigate cycles of risk appetite and liquidity stress. While the price action did not deliver a definitive directional signal, it reinforced a familiar pattern: during periods of limited depth, price discovery is a two-way process propelled by cautious, incremental moves rather than a single decisive breakout. The presence of “breakouts and shakeouts” as a recurring motif highlights how traders are adapting to a market structure where depth can evaporate quickly, forcing participants to reprice their expectations with each new order that clears the book.

Looking forward, the market will likely want to see a more explicit signal of conviction—whether it be a sustained move above a key level with robust volume or a decisive breakdown that confirms a shift in risk sentiment. For now, the data suggests that the landscape remains dominated by short-term liquidity dynamics rather than a clear, long-term directional thesis. The ongoing debate about potential bottoming signals versus continued consolidation is a reminder that, in crypto markets, the path of least resistance is often determined by how much liquidity remains available to absorb the next wave of orders.

//platform.twitter.com/widgets.js

Crypto World

MicroStrategy Stock Price at 10% Risk as Bitcoin Link Tightens

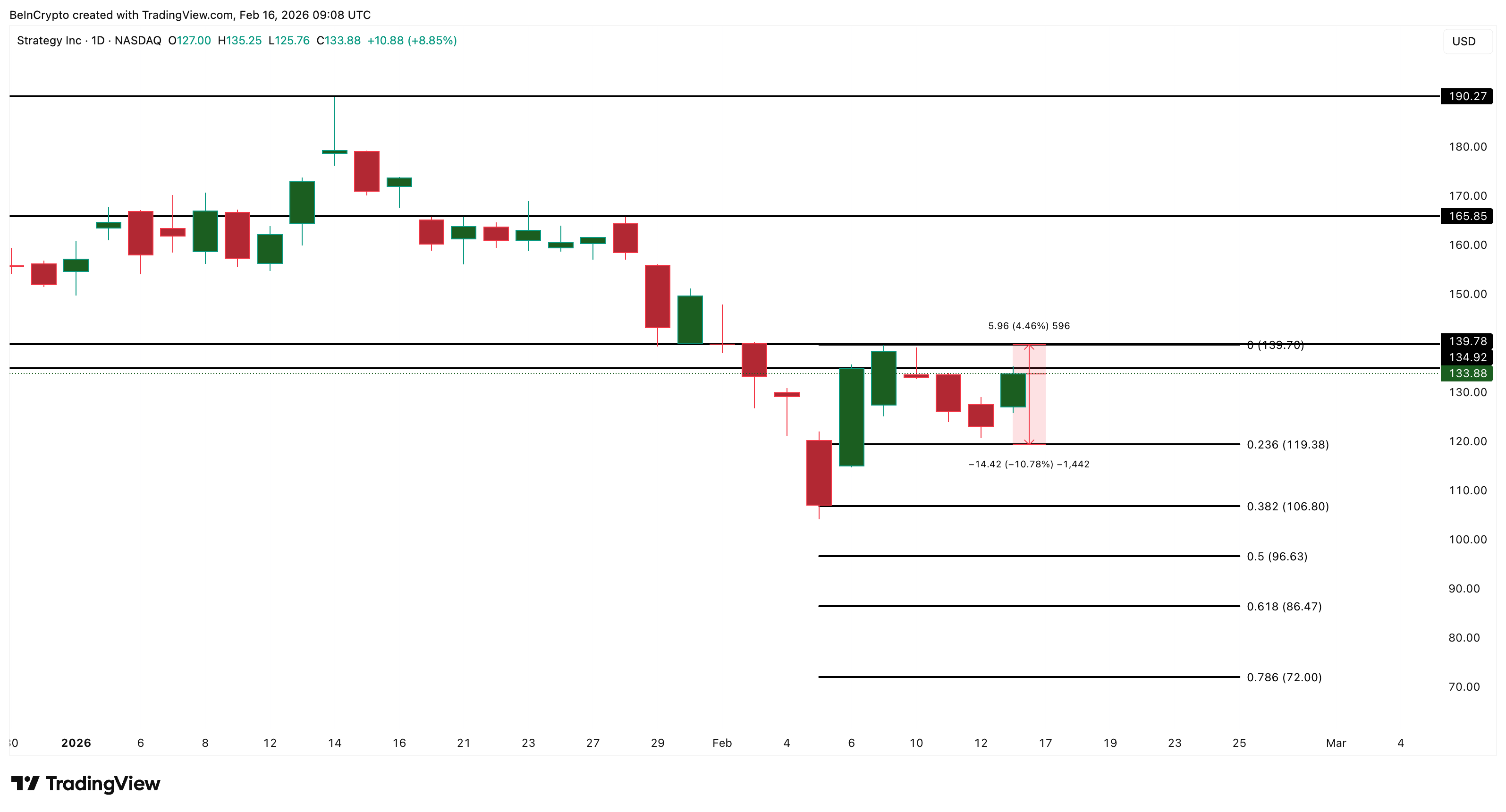

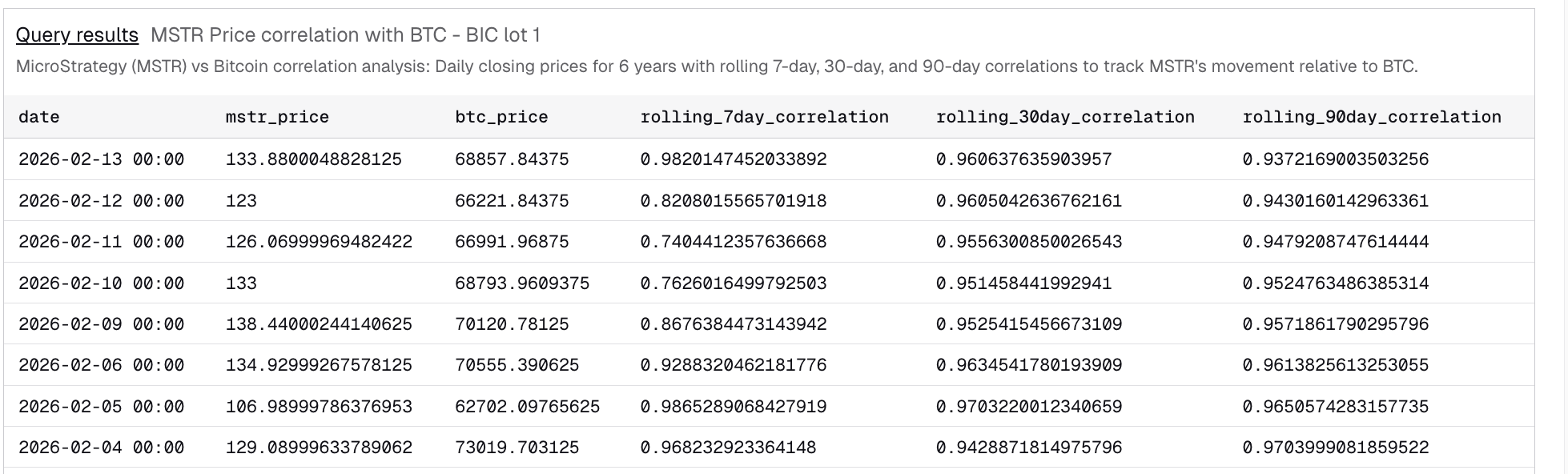

The MicroStrategy stock price closed around $133 on February 13, rising 8.85% in one day. The weekly gain reached nearly 5%, showing strength despite broader uncertainty. But this rally comes at a strange time. Bitcoin fell about 2.2% over the same period, creating a gap between the two assets that rarely lasts long.

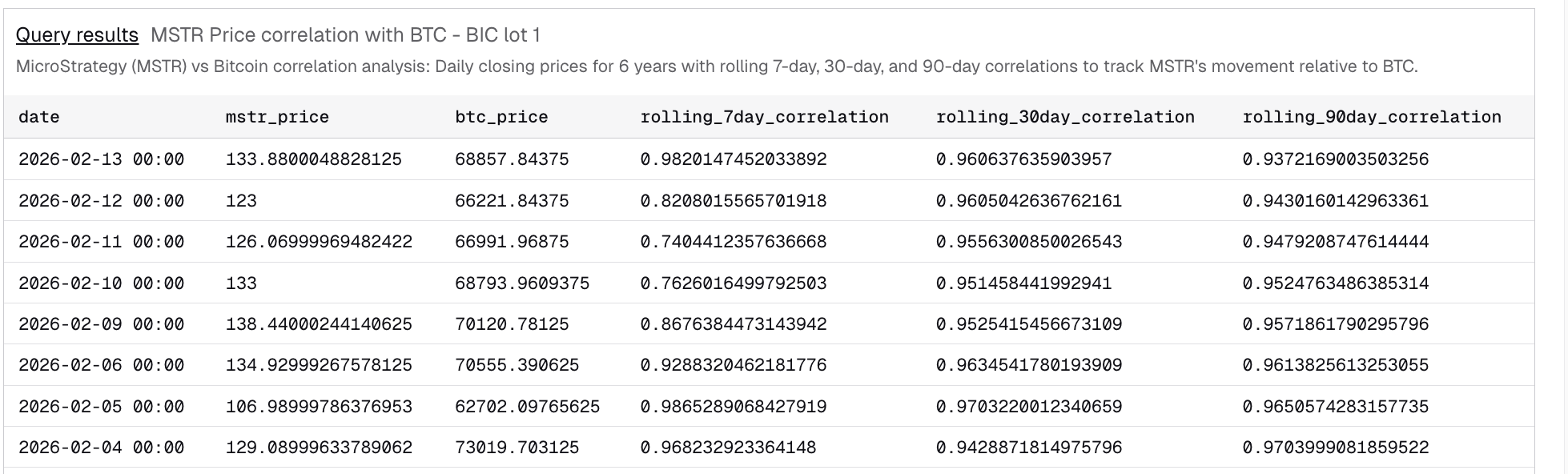

New data shows that MicroStrategy and Bitcoin are moving almost identically again. The 7-day rolling correlation has surged to 0.98, near perfect alignment. This tight link means the MicroStrategy price prediction going forward in 2026 may depend heavily on Bitcoin’s next move. At the same time, momentum indicators and volume signals show early warning signs that the recent MSTR price bounce may face pressure.

Sponsored

Sponsored

MicroStrategy’s Bitcoin Correlation and RSI Signal Correction Risk

Rolling correlation measures how closely two assets move together over a set period. The current 7-day correlation of 0.98 means MicroStrategy and Bitcoin are moving in nearly the same direction. This is the highest level since early February. When correlation reaches this level, price moves in one asset often carry over to the other.

This creates a risk because Bitcoin has weakened recently while MicroStrategy stock moved higher. Such gaps often close when markets reopen, causing delayed corrections.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

At the same time, the Relative Strength Index (RSI) is showing a hidden bearish divergence. RSI measures buying and selling momentum by comparing recent gains and losses. Between December 9 and February 13, the MicroStrategy price seems to be forming a lower high.

However, during the same period, the Relative Strength Index (RSI), a momentum indicator, has already flashed a higher high. This pattern is called hidden bearish divergence. It shows that even though momentum appears stronger, the underlying price structure remains weak. Sellers may still be in control.

Sponsored

Sponsored

A similar divergence formed earlier between December and February. After that signal, MicroStrategy stock dropped nearly 14%. The same setup is now appearing again.

The key level to watch is $133 ($133.88 to be exact). If the next MicroStrategy (Strategy) stock price candle stays below this level, the correction risk remains active. A move above it would weaken this bearish signal (the hidden divergence) for now and could further the bounce. But that would also mean that Bitcoin’s influence would weaken temporarily.

Institutional Buying Supports Price, While Retail Selling Weakens Conviction

Despite the bearish momentum signal, institutional investors are showing a different behavior. The Chaikin Money Flow (CMF) indicator tracks large money flows into and out of an asset. Since November 21, the MSTR price has trended lower overall. But CMF has steadily moved higher and is now above zero.

This means that large investors have continued to buy even as the price has struggled. Institutional accumulation can reduce downside risk and stabilize prices during corrections.

Sponsored

Sponsored

However, retail investors are showing the opposite trend.

The On-Balance Volume (OBV) indicator tracks cumulative buying and selling volume. Unlike CMF, OBV has been trending lower since November, aligning with the price. This shows that smaller investors have been selling during recent months.

This creates a conflict. Institutional buyers are supporting the price, but retail investors are possibly reducing exposure. The key OBV level now sits near 972 million. If OBV fails to break above this level, it would confirm continued retail weakness. This would increase correction risk and support the forming bearish divergence signal.

This conflict between institutional and retail investors leaves MicroStrategy’s price prediction uncertain in the short term.

Sponsored

Sponsored

MicroStrategy Price Prediction Depends on $139 Breakout or $119 Breakdown

The MSTR price levels now provide the clearest guide to the next move. On the downside, the first key support level sits at $119. This level aligns with the 0.236 Fibonacci retracement and represents a potential 10% decline from current levels. This target also matches the size of previous divergence-driven corrections.

If MicroStrategy stock falls below $119, the next support sits near $106. This would represent a deeper correction and confirm seller control.

On the upside, the most important recovery level is $133, as mentioned earlier, followed by $139. This resistance has capped recent rallies. A confirmed breakout above $139 would signal renewed strength.

If this breakout happens, MicroStrategy stock could move toward $165. A stronger rally could extend toward $190 if Bitcoin also recovers. However, if Bitcoin weakness continues, MicroStrategy could follow lower due to the strong correlation.

For now, MicroStrategy stock remains at a critical point. The extremely high correlation with Bitcoin means its next move may depend on Bitcoin’s direction. If Bitcoin weakness continues, the MicroStrategy stock price could face a delayed correction. But if institutional buying continues and resistance breaks, the bullish trend could still resume for MSTR.

Crypto World

Nexo Partners with Bakkt for US Crypto Exchange and Yield Programs

TLDR

- Nexo is relaunching its crypto services in the United States after more than three years of absence.

- The platform will offer yield programs, a spot exchange, and crypto-backed credit lines to US users.

- Nexo has partnered with Bakkt to provide the trading infrastructure for its US operations.

- The company’s return is driven by improved regulatory clarity for digital assets in the US.

- Nexo’s new US operations will be based in Florida and run by an announced management team.

Crypto platform Nexo is set to return to the United States after more than three years. The company paused its operations in 2022 due to regulatory concerns. Now, with clearer guidelines in place, Nexo aims to offer crypto services including yield programs, a spot exchange, and more.

Nexo Partners with Bakkt for Trading Infrastructure

Nexo’s trading infrastructure will be powered by Bakkt, a US-based digital asset platform. Bakkt primarily serves institutional clients but will help Nexo build its new US offering. Eleonor Genova, Nexo’s head of communications, confirmed that the platform will provide both flexible and fixed-term yield programs.

The platform will also feature crypto-backed credit lines and a loyalty program for US customers. Nexo’s management team will operate the new venture from Florida, with plans to announce the team soon. Genova emphasized that all services will be offered through partnerships with licensed US providers.

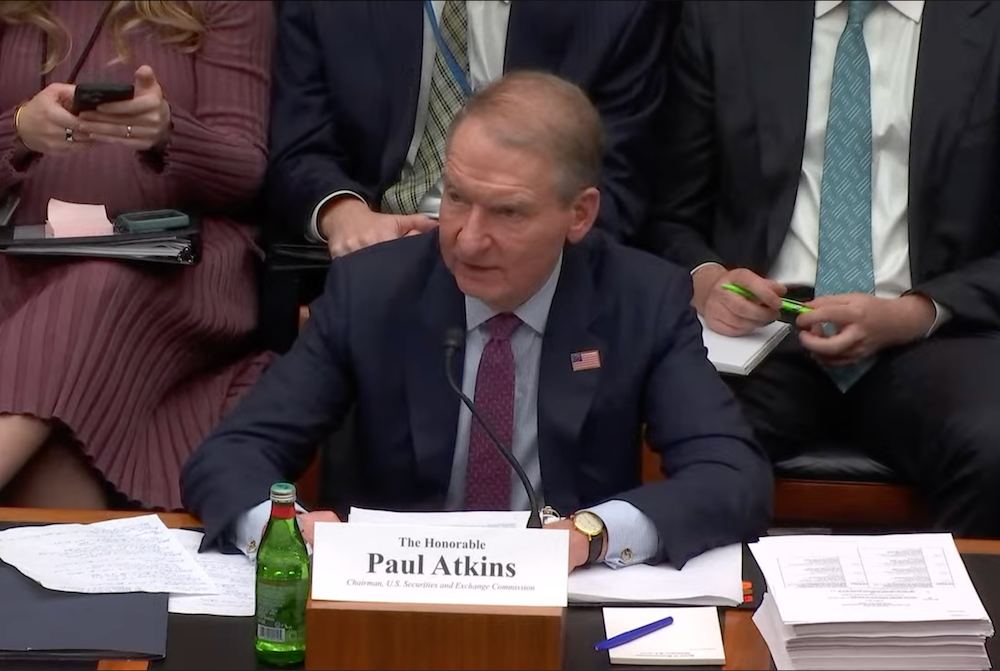

After leaving the US market in late 2022, Nexo now sees improved regulatory clarity for digital assets in the country. The company originally withdrew due to what it called an unfriendly regulatory environment under former SEC chair Gary Gensler. Nexo’s “Crypto Earn” program, which lets users earn interest on their crypto holdings, was a key issue in the company’s exit.

Nexo settled with the SEC in 2023, agreeing to pay $45 million for failing to register its interest-bearing program. The company later shut down the program for US users, marking the end of its earlier US operations. Despite these setbacks, Nexo now believes the regulatory landscape is more favorable for blockchain businesses.

Nexo’s Relaunch and US Crypto Regulatory Landscape

Nexo’s return comes as the US continues to work on crypto regulations. The House recently passed the CLARITY Act, but the Senate has yet to move it forward. Patrick Witt, a White House crypto advisor, called for compromises to pass crypto-related legislation before the 2024 elections.

This renewed effort to regulate crypto coincides with Nexo’s own regulatory framework. Genova stated that the new US operations are compliant with US securities laws. The company hopes to provide a stable platform for crypto users amid ongoing regulatory discussions.

Nexo’s rebooted platform will rely on third-party advisory services registered with the SEC. This ensures that the services offered are in line with applicable securities laws. The crypto exchange aims to establish itself as a trusted platform for US users after its previous exit.

Crypto World

Nexo Relaunches Crypto Platform in the United States

Nexo is set to relaunch its digital asset services and crypto exchange platform in the US on Monday, more than three years after it left the market following battles with federal and state regulators.

Now, citing improved regulatory clarity for digital assets in the US, the rebooted Nexo platform will offer flexible and fixed-term yield programs, a spot cryptocurrency exchange, crypto-backed credit lines and a loyalty program for US users, Nexo head of communications Eleonor Genova told Cointelegraph.

The platform’s trading infrastructure will be provided by Bakkt, a US-based digital asset platform focused on serving institutional clients. Genova said:

“Nexo’s US offering is structured through partnerships with appropriately licensed US service providers. Certain services are made available via a third-party Securities and Exchange Commission-registered (SEC) investment adviser, which provides advisory services under applicable US securities laws.”

The new US operations will be based in Florida and run by a management team to be announced soon, according to the company.

Nexo first announced plans to re-enter the US during an exclusive event in April 2025, which featured Donald Trump Jr., the son of US President Donald Trump, as a keynote speaker. At the event, Trump Jr. described crypto as the future of finance.

Related: Nexo to pay $500K fine to California regulator over ‘risky loans’

2022 exit cited regulatory uncertainty under Gensler regime

Nexo left the US market in December 2022 during the depths of the crypto bear market, citing the hostile regulatory posture toward the crypto industry under the leadership of former SEC chair Gary Gensler.

The company said it had decided to exit the US out of necessity after engaging in “good faith” conversations with US state and federal regulators over 18 months that did not move the needle.

“It is now unfortunately clear to us that despite rhetoric to the contrary, the US refuses to provide a path forward for enabling blockchain businesses,” the company said at the time.

Nexo’s “Crypto Earn” program, which allowed users to earn compounding interest on select cryptocurrencies loaned to the platform, was a major point of contention between the SEC and the company.

In January 2023, Nexo agreed to a $45 million settlement with the SEC over failing to register its interest-bearing crypto rewards program with the regulator. The company also settled a $22.5 million multi-state securities settlement related to the earn interest program.

The company shuttered its Crypto Earn program for US users one month later.

Washington mulls crypto “clarity”

Nexo’s market reentry comes amid efforts in Washington to pass a bill defining how US market regulators will police crypto. The House passed a similar bill, the CLARITY Act, in July, but the effort has stalled as the Senate Banking Committee has yet to gather enough bipartisan support to advance it.

White House crypto adviser Patrick Witt said on Friday that both sides must compromise on the issue and push for passage before November’s midterm elections. Contributing to the stalemate are concerns voiced by crypto industry executives, which US Treasury Secretary Scott Bessent believes have negatively impacted the industry, he told CNBC on Friday.

A White House-brokered meeting last week between crypto and banking industry representatives to reach an agreement on stablecoin provisions in the market structure bill was described as “productive,” but remains unresolved.

Magazine: Astrology could make you a better crypto trader: It has been foretold

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World7 days ago

Crypto World7 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video5 hours ago

Video5 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World7 days ago

Crypto World7 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat1 day ago

NewsBeat1 day agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat1 day ago

NewsBeat1 day agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat2 days ago

NewsBeat2 days agoUK construction company enters administration, records show

-

Sports6 days ago

Sports6 days agoWinter Olympics 2026: Australian snowboarder Cam Bolton breaks neck in Winter Olympics training crash