Crypto World

Bitcoin Teeters Between CME Gaps and New Macro Lows: Analysis

Bitcoin failed to sustain a move above $69,000 as markets opened the weekend with caution, mirroring a broader hesitancy among traders about chasing new highs amid an uncertain macro backdrop. Fresh downside risk was baked into price action as BTC slipped more than $4,000 from the daily open, signaling that the rebound into the weekend may have been a relief rally rather than a durable trend reversal. Analysts point to resistance just below or at the old 2021 all-time high, around $69,000, which is seen as a formidable barrier. Meanwhile, two CME futures gaps loom on the horizon, offering potential magnets for price if demand accelerates again.

Key points:

-

Bitcoin faces a lack of acceptance above $69,000, while traders see new lows to come.

-

Analysis says that the rebound into the weekend was nothing more than a “relief rally.”

-

Two CME futures gaps provide potential targets for BTC price upside.

BTC price bottom “not in,” analysis warns

Data from TradingView showed BTC price action dropping more than $4,000 versus the daily open. With the old 2021 all-time high increasingly turning to resistance, cautious traders rejected the notion of a quick revival. The immediate takeaway among several market observers was that the weekend rally looked more like a relief bounce than a sustainable bottom formation.

“TLDR: The bottom for BTC is not in. My priority right now is capital preservation,” said Keith Alan, cofounder of trading resource Material Indicators, in a post on X the day before the latest price action. His warning captured a broader mood among traders who view the market as exposed to further downside risk before any durable upward momentum could reassert itself. A separate blockquote captured his sentiment: “If you’re thinking, ‘We’re so back,’ we’re not. There is literally no evidence of that yet.”

Alan also highlighted the significance of the 2021 peak around $69,000, describing it as an “important” level within what he characterized as an ongoing relief rally. He added that the recent move was “a gift yesterday,” but warned that lower prices may come before a renewed bull-market cycle could take hold.

Zooming out, market analyst Rekt Capital also argued that the most pronounced downside pressure may still be ahead. In a post on X, he likened BTC/USD’s behavior to the late-2022 bear market, suggesting that a recurring historical pattern—where a fourth consecutive cycle echoes a familiar base formation—points to further weakness before a potential bottom is established. “This is the 4th consecutive cycle that this historical tendency has continued. And history suggests there’s more downside to come,” he wrote, underscoring the stubborn risk that BTC could test lower support before a broader recovery materializes.

Bitcoin bulls bet on CME gap fills

Saturday’s retracement, meanwhile, left a new potential “gap” in CME Group’s Bitcoin futures market. This development has kept a subset of traders focused on classic short-term price magnets, with the market watching two CME gaps that could act as catalysts if prices rally in the near term.

Related: Bitcoin beats FTX, COVID-19 crash with record dive below 200-day trend line

A short-term magnet narrative has re-emerged, centered on a gap near $84,000 and a separate level that could pull prices higher if demand re-emerges. Traders argued that such gaps often attract price action as liquidity cycles through the market, even if the longer-term trend remains uncertain. The chatter around CME gaps aligns with a broader view that a relief rally could redraw price trajectories in the near term, though it is not a guarantee of a lasting bounce.

Will we see this #Bitcoin CME Gap filled next week?

$84,215 🎯 pic.twitter.com/ZHaKynuR3F

— Elja (@Eljaboom) February 7, 2026

In parallel, traders like Michaël van de Poppe, a veteran analyst and founder of various crypto ventures, voiced a more constructive near-term view. He forecast a continuation pattern where a correction gives way to a move toward the CME gap and beyond, suggesting that the next week could carry BTC toward the $75,000-and-higher zone if momentum reasserts. “Today: correction day. Tomorrow: back up again towards the CME gap. Next week: continuation to $75k+,” he wrote in a post on X, signaling that the possibility of a rebound is not dismissed by some observers.

Notably, Samson Mow, CEO of Bitcoin-adoption firm JAN3, framed the event as a test of whether large-scale corporate buyers will step in to buy BTC at the new price levels. He described the higher CME gap as one of two questions every financial analyst should be asking: whether institutional demand can absorb the selling pressure given the 15-month low in BTC prices, and whether corporate treasury activity will pick up as prices drift lower. “I believe the answers are not for long and very soon,” he concluded in a post on X, signaling that the near term could reveal significant shifts in demand just as price action wobbles around key levels.

//platform.twitter.com/widgets.js

Why it matters

The present price action matters because it tests the resilience of BTC’s uptrend hypothesis at a time when macro uncertainties linger. A failure to sustain moves beyond critical resistance around $69,000 reinforces the notion that the market is wrestling with a structural pivot rather than a short-lived surge. The CME gaps add a practical, price-target dimension to the debate: if price finds buyers near those gaps, it could spur a corrective rally that lasts into the following week; if not, the risk-off mood may extend and push BTC toward the lower end of recent ranges.

Moreover, the discourse around corporate treasury demand—an ongoing theme in crypto markets—could shape the supply/demand balance in the months ahead. If large buyers re-enter at these levels, they could provide a floor that mitigates downside risk and sets the stage for a broader recovery. Conversely, persistent macro weak spots or a fresh risk-off impulse could keep BTC mired in a corrective phase, testing support levels that traders have watched since late 2025.

Taken together, the footage from trading desks shows a market that remains finely poised between a cautious, risk-averse stance and a renewed appetite for risk-taking when specific technical benchmarks align with liquidity drivers. The result is a price story that is less about a single breakout and more about the tug of war between macro-impacted liquidity and market structure signals like CME gaps and key resistance levels.

What to watch next

- Watch how BTC trades around the CME gap near $84,000 in the coming days and whether price action tests that area again.

- Monitor whether buyers reappear near the mid-to-upper $70k region, potentially signaling a shift in the short-term trend.

- Look for any signs of renewed institutional or corporate BTC treasury activity as prices approach critical levels.

- Assess macro cues and liquidity conditions, since they likely will continue shaping volatility and the pace of any potential relief rallies.

Sources & verification

- TradingView BTCUSD price data referenced in the price action discussion.

- Comments from Keith Alan (Material Indicators) on BTC’s bottom and capital preservation, shared on X.

- Analysis from Rekt Capital regarding cycle patterns and potential downside in BTC/USD.

- Forecasts from Michaël van de Poppe on CME gaps and near-term targets.

- Remarks from Samson Mow on corporate BTC treasury activity and near-term demand dynamics.

What the market is watching next

The coming days will be telling for BTC’s near-term orientation. If the price can reclaim and sustain a move above the $75,000–$80,000 range and, more broadly, approach the CME gap around $84,000, bulls may gain a foothold that could catalyze a more substantive rebound. Conversely, if selling pressure intensifies and price breaks back toward the mid-$60,000s, the market could extend the current corrective phase while traders reassess whether a longer bear-market cycle has run its course. As always, liquidity, macro risk sentiment, and institutional participation will remain the key variables shaping outcomes in the weeks ahead.

Crypto World

MicroStrategy Bankruptcy Claims Debunked: Financial Analysis Reveals Strong Position

TLDR:

- MicroStrategy holds $49.4B in Bitcoin against only $8.2B debt, maintaining a six-to-one coverage ratio

- Company maintains $2.25B cash reserves covering 2.5 years of dividend payments without Bitcoin sales

- Earliest debt maturity arrives in September 2028, allowing time for potential Bitcoin cycle recovery

- Company held through 16-month downturn in 2022 when Bitcoin fell 50% below average purchase price

MicroStrategy bankruptcy concerns have dominated crypto discussions as Bitcoin prices fluctuate. However, recent analysis of the company’s financial structure reveals a different picture than the prevailing narrative suggests.

The business intelligence firm holds Bitcoin reserves worth approximately $49.4 billion against total debt of $8.2 billion. This substantial asset-to-liability ratio contradicts widespread predictions of imminent financial collapse.

Meanwhile, cash reserves and extended debt maturity timelines provide additional protection against short-term market volatility.

Financial Structure Provides Multiple Layers of Protection

The asset coverage ratio stands at roughly six-to-one, with Bitcoin holdings far exceeding debt obligations. Crypto analyst Crypto Rover addressed the bankruptcy narrative directly, stating “the reality is most people spreading this FUD do not understand how MicroStrategy’s balance sheet is structured.”

The analysis breaks down multiple protective layers within the company’s financial position. “At current levels, MicroStrategy’s Bitcoin holdings are worth roughly $49.4B, while total company debt is about $8.2B,” Crypto Rover noted. This means their Bitcoin reserve is almost six times larger than their debt obligations.

Beyond the Bitcoin reserve itself, MicroStrategy maintains USD cash reserves totaling around $2.25 billion. Regarding dividend concerns, Crypto Rover explained “the company has built a USD cash reserve of around $2.25B. That alone can cover dividend payments for 2.5 years without selling a single BTC.” Annual dividend obligations total approximately $890 million.

Debt maturity schedules further reduce near-term pressure on the company. “Strategy’s debt is not due immediately. The earliest maturity comes in September 2028,” according to the analysis.

Additional maturities follow in December 2029 and June 2032. This timeline aligns favorably with Bitcoin’s historical four-year market cycles, potentially allowing prices to recover before major debt obligations arrive.

Historical Performance Demonstrates Resilience Under Stress

MicroStrategy already survived a severe market test during 2022 and early 2023. Bitcoin prices fell nearly 50 percent below the company’s average purchase price of $30,000. The cryptocurrency remained at those depressed levels for approximately 16 months.

Crypto Rover highlighted the company’s response during that period: “Even then: They did not panic sell, They did not liquidate holdings, They held through the drawdown.” Only 200 Bitcoin were sold for tax loss harvesting purposes, and those coins were subsequently reacquired.

This real-world stress test validates the company’s commitment to its long-term strategy. “There is already a real historical stress test, and they held through it,” the analysis emphasized. The precedent demonstrates management’s willingness to weather extended market downturns.

Recent claims about exchange transfers have largely proven unfounded or misinterpreted. “There have been viral screenshots claiming MicroStrategy is moving BTC to exchanges. Most of these are either misinterpreted or fake,” Crypto Rover stated. No verified evidence supports accusations of distressed selling behavior.

The current fear narrative follows familiar patterns from previous market cycles. “Every cycle has a dominant fear narrative,” the analyst observed, comparing current concerns to past Tether collapse predictions that never materialized.

When examining actual financial data rather than speculation, the bankruptcy thesis lacks supporting evidence.

Crypto World

23% of Investors Forecast Rate Cut at March FOMC Meeting

The number of traders expecting a rate cut at the March Federal Open Market Committee meeting rose following fears of a hawkish Fed nominee.

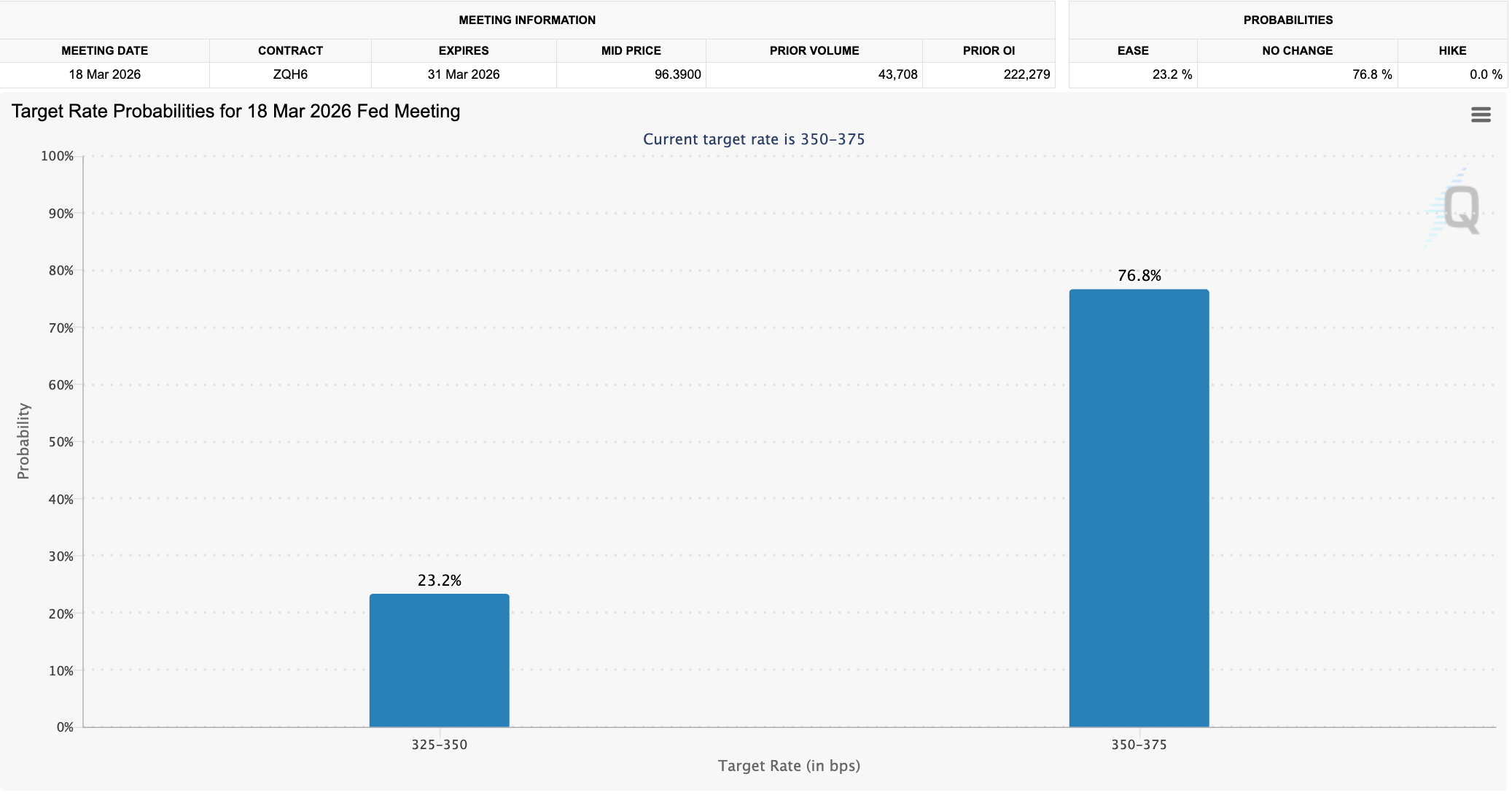

The number of traders expecting an interest rate cut at the March Federal Open Market Committee (FOMC) meeting has risen to 23%, following investor fears of a hawkish stance from Kevin Warsh, US President Donald Trump’s Federal Reserve chair nominee.

Investors and traders forecasting a rate cut surged by nearly 5% from Friday, when only 18.4% signaled they were expecting an interest rate cut, according to data from the Chicago Mercantile Exchange (CME) Group.

Those anticipating a rate cut in March forecast a 25 basis point (BPS) cut, with no investors expecting a rate cut of 50 BPS or more.

President Trump nominated Warsh in January as a replacement for Federal Reserve Chairman Jerome Powell, whose term is over in May.

Interest rate policy can influence crypto asset prices, with easing liquidity conditions seen as a positive price catalyst, and tightening liquidity conditions through higher rates impacting asset prices negatively, as access to financing dries up.

Related: Bitcoin’s next bull market may not come from more ‘accommodative policies’

Markets and investors spooked by Warsh’s nomination

“The nomination of Kevin Warsh as the next Fed Chair has shaken markets to the core,” crypto market analyst Nic Puckrin said in a message shared with Cointelegraph.

Puckrin attributed the sharp decline in precious metals toward the end of January and early days of February to investor perceptions of Warsh, who is viewed as more hawkish, meaning he is in favor of keeping interest rates higher for longer. He said:

“Markets are digesting Warsh’s views on future Fed policy, most notably the central bank’s balance sheet, which he says is ‘trillions larger than it needs to be’. If he does adopt policies to shrink the balance sheet, markets will have to reckon with a lower-liquidity environment.”

Thomas Perfumo, a global economist at cryptocurrency exchange Kraken, told Cointelegraph that Warsh’s nomination sends a ‘mixed’ macroeconomic signal to investors.

The nomination of Warsh may signal that liquidity and credit will stabilize in the US, rather than expand, as crypto investors had anticipated, Perfumo said.

Magazine: If the crypto bull run is ending… it’s time to buy a Ferrari: Crypto Kid

Crypto World

62% of Crypto Press Releases Come From High-Risk or Scam Projects: Chainstory

High-risk and scam-adjacent projects have been found to dominate press release volume.

A majority of press releases published across crypto news sites originate from high-risk or outright fraudulent projects.

In a new report, crypto communications firm Chainstory analyzed 2,893 crypto press releases published between June 16 and November 1, 2025, and found that roughly 62% were issued by projects classified as either High Risk or confirmed Scams, based on indicators such as anonymous teams, unrealistic return claims, and cross-referencing with legal and consumer scam databases.

Low-Impact Updates

Crypto-specific press release “wires” operate on a pay-to-play model that allows projects to buy guaranteed placement across partner media sites, and, in the process, bypass traditional editorial judgment. Unlike legacy wire services that distribute releases for journalists to evaluate, many crypto wires sell direct publication to audiences with minimal compliance checks. This effectively turns article placement into a paid commodity.

Chainstory said that any crypto project with sufficient budget can secure visibility on recognizable news domains regardless of credibility.

The analysis revealed that most wire content consists of low-impact announcements that would typically be ignored by newsroom editors. Nearly half of all releases, or 49%, focused on routine product or feature updates, while another 24% covered exchange listings and trading promotions. Token launches and tokenomics changes accounted for 14% of releases.

On the other hand, only 58 releases, approximately 2% of the dataset, related to traditionally newsworthy events such as venture funding rounds, mergers and acquisitions, or major corporate finance activity.

Promotional Hype Dominates Crypto Wire

Chainstory also examined tone and language, finding that promotional framing dominates crypto press releases. Only around 10% were written in a neutral, factual style, while approximately 54% were categorized as “overstated” and another 19% as overtly promotional. The report observed that superlative-heavy language common in marketing copy remains unchallenged in paid releases, even when similar claims would be edited or questioned in reported journalism.

You may also like:

Risk profiling of issuers revealed a heavy skew toward questionable projects. High-risk issuers accounted for 35.6% of all releases, while confirmed scams made up 26.9%. Low-risk, established projects were responsible for only about 27% of press releases, which indicates that more credible firms rely less on paid distribution and are more likely to receive organic coverage. In sectors such as cloud mining, almost 90% of press releases came from projects flagged as high risk or scams.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Sberbank Launches Crypto-Backed Loans for Russian Corporations Amid Growing Digital Asset Demand

TLDR:

- Sberbank completed its first crypto-backed loan to mining company Intelion Data in late 2025 as a pilot program.

- Russia’s central bank permits cryptocurrency trading but prohibits domestic payments, creating specific use cases.

- Western sanctions have accelerated cryptocurrency adoption in Russian foreign trade and corporate transactions.

- The central bank plans to finalize comprehensive crypto asset legislation by July 1, 2026, for the sector.

Sberbank, Russia’s largest lender, is preparing to expand crypto-backed lending services to corporate clients following strong market interest.

The bank completed a pilot transaction with mining company Intelion Data in late 2025. This development positions Sberbank alongside domestic competitor Sovkombank in offering cryptocurrency collateral financing.

The move reflects broader adoption of digital assets in Russia’s corporate sector amid ongoing economic pressures.

Pilot Program Marks Entry Into Digital Asset Lending

The state-controlled bank issued its first crypto-backed loan to Intelion Data, accepting mined cryptocurrency as collateral. Sberbank declined to reveal the transaction value but confirmed the pilot’s success.

The bank’s spokesperson told Reuters on Thursday that corporate demand has driven the expansion plans, citing “strong interest from corporate clients.” The institution now seeks cooperation with Russia’s central bank to develop proper regulatory frameworks.

Sovkombank previously pioneered this lending category among Russian financial institutions. However, Sberbank’s entry carries greater weight given its dominant market position.

The bank serves millions of corporate and retail customers across Russia. Its participation validates cryptocurrency’s growing role in mainstream Russian finance.

Sberbank aims to extend services beyond cryptocurrency miners to any corporation holding digital assets. This broader approach could unlock significant lending opportunities.

Many Russian companies have accumulated crypto holdings through various business operations. The bank’s willingness to accept these holdings as collateral provides new liquidity options.

Regulatory Environment Shapes Market Development

Russia’s central bank classifies cryptocurrencies as foreign exchange assets under current regulations. The regulator “permits their purchase and sale but prohibits domestic payments” using digital currencies.

This framework creates specific use cases while limiting others. The distinction allows Russians to hold crypto while preventing it from replacing the ruble.

The regulator plans to complete comprehensive crypto asset legislation by July 1, 2026. Sberbank expressed readiness to collaborate on developing these rules.

Proper regulation could accelerate institutional adoption across Russia’s banking sector. The July deadline suggests authorities recognize cryptocurrency’s economic importance.

Western sanctions have accelerated cryptocurrency adoption in Russian foreign trade and domestic business. Traditional global currency transactions face restrictions following military actions in Ukraine.

Digital assets offer alternative settlement mechanisms outside conventional banking channels. This practical necessity has transformed cryptocurrencies from speculative instruments to functional business tools.

International banks are exploring similar services despite different regulatory environments. JPMorgan is examining crypto-backed loan products for institutional clients.

Wells Fargo already offers such financing options. These parallel developments indicate global banking’s gradual embrace of cryptocurrency collateral. Sberbank’s initiative aligns Russia’s financial sector with international trends while addressing specific domestic needs.

Crypto World

Solana Surges 25% From Lows: Has SOL Found Its Bottom or Is This Just a Dead-Cat Bounce?

TLDR:

- Solana rebounded 25% from $67.69 to $85, finding support at a critical January 2024 demand zone amid extreme fear.

- Record $6.371 billion USDT exchange inflow on February 6th provides liquidity fuel for potential sustained recovery.

- Volume indicators show cooling patterns suggesting oversold exhaustion, but sustainability depends on holding $85 resistance.

- Traditional markets crossing Dow 50,000 created risk-on sentiment, though SOL must prove this isn’t a temporary bounce.

<

Solana has posted a dramatic 25% recovery in 24 hours, rebounding from $67.69 to approximately $85 amid intense debate over the sustainability of this move.

The rally coincides with Bitcoin’s climb back toward $70,000 and record inflows of stablecoins into exchanges. However, traders remain divided on whether SOL has established a genuine bottom or merely staged a temporary relief rally destined to fail.

Dead-Cat Bounce or Genuine Reversal?

The cryptocurrency community faces a critical question as Solana tests resistance levels following its sharp decline.

SOL found support at a demand zone established in January 2024, a technical level that has proven significant in past price action. Yet the velocity of the bounce has raised concerns about its durability.

Market structure suggests both scenarios remain possible at this juncture. The extreme fear reading on sentiment indicators typically accompanies major bottoms, as capitulation creates buying opportunities.

Conversely, such rapid recoveries often fail when underlying demand proves insufficient to absorb overhead supply.

Volume analysis reveals increased activity during the recovery, but questions persist about buyer commitment. Dead-cat bounces characteristically feature sharp moves on moderate volume before rolling over. The current price action bears some hallmarks of this pattern, though definitive confirmation remains elusive.

Traditional markets provided a tailwind as the Dow Jones crossed 50,000 for the first time. This risk-on environment has lifted technology assets broadly, including cryptocurrencies. The challenge lies in determining whether this support will persist or prove fleeting.

Critical Tests Ahead for Solana’s Recovery

Solana’s spot and futures volume indicators show cooling trends, suggesting the recent selloff reached exhaustion.

This data point supports the bottom formation thesis, as oversold conditions often precede sustainable reversals. However, cooling alone does not guarantee upside continuation.

The $6.371 billion USDT inflow on February 6th represents the largest liquidity injection of Q1 2026. This capital could fuel additional gains if deployed strategically into quality assets.

Alternatively, these funds may remain on the sidelines if investors lack conviction about the recovery’s legitimacy.

Technical resistance now emerges as the decisive factor in determining SOL’s trajectory. The $85 level represents a key battleground where sellers may reassert control.

A failure to break convincingly above this zone would strengthen the dead-cat bounce argument considerably.

The January 2024 demand area must hold on to any retest to validate the bottom formation. If SOL returns to the $67 range and breaks lower, the recent rally will be dismissed as a false start. Bulls need to defend this support zone while pushing the price above overhead resistance.

Market participants are scrutinizing order flow for evidence of institutional accumulation versus retail speculation. Large wallet movements and exchange withdrawal patterns will provide clues about smart money positioning. These metrics will help distinguish between a temporary squeeze and a genuine demand resurgence.

The answer to whether Solana has bottomed or merely bounced will unfold over the coming sessions. Price action around current levels holds the key to resolving this debate decisively.

Crypto World

BTC is seeing accumulation across all cohorts, according to Glassnode

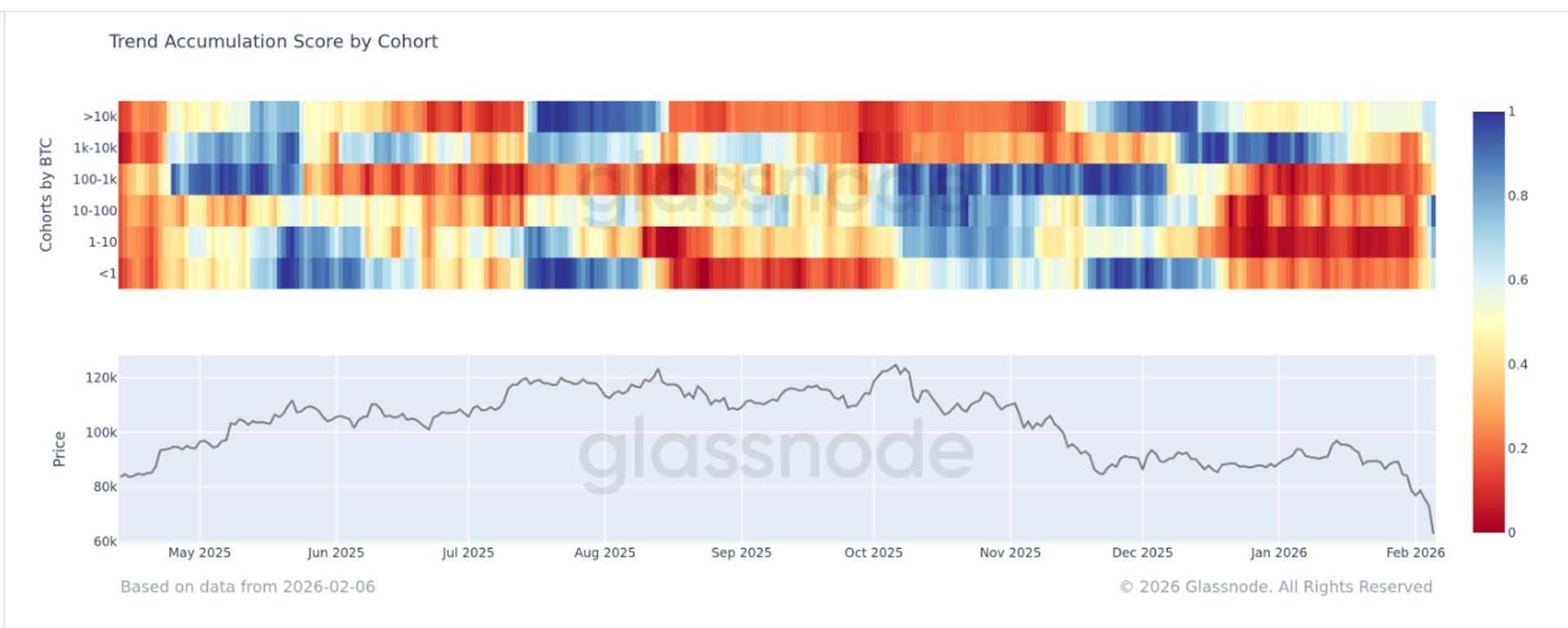

As February began, bitcoin was trading around $80,000, with whales dipping their toes in while retail investors were running for the exits. Just one week later, bitcoin plunged to $60,000 on Feb. 5, and the market is now showing a broad shift toward accumulation across nearly all cohorts as investors start to see value.

This change follows one of the most severe capitulation events in bitcoin’s history. Which now appears to be evolving into a more synchronized accumulation phase.

Glassnode’s Accumulation Trend Score by cohort highlights this shift in behavior. The metric measures the relative strength of accumulation across different wallet sizes by factoring in both entity size and the amount of BTC accumulated over the past 15 days. A score closer to 1 signals accumulation, while a score closer to 0 indicates distribution.

On an aggregate basis, the Accumulation Trend Score by cohort has now climbed above 0.5, reaching 0.68. This marks the first time since late November that broad-based accumulation has been observed, a period that previously coincided with bitcoin forming a local bottom near $80,000.

The cohort showing the most aggressive dip buying has been wallets holding between 10 and 100 BTC, particularly as prices fell toward $60,000

While it remains uncertain whether the ultimate bottom is in, it is evident that investors are once again finding value in bitcoin after a drawdown of more than 50% from its October all-time high.

Crypto World

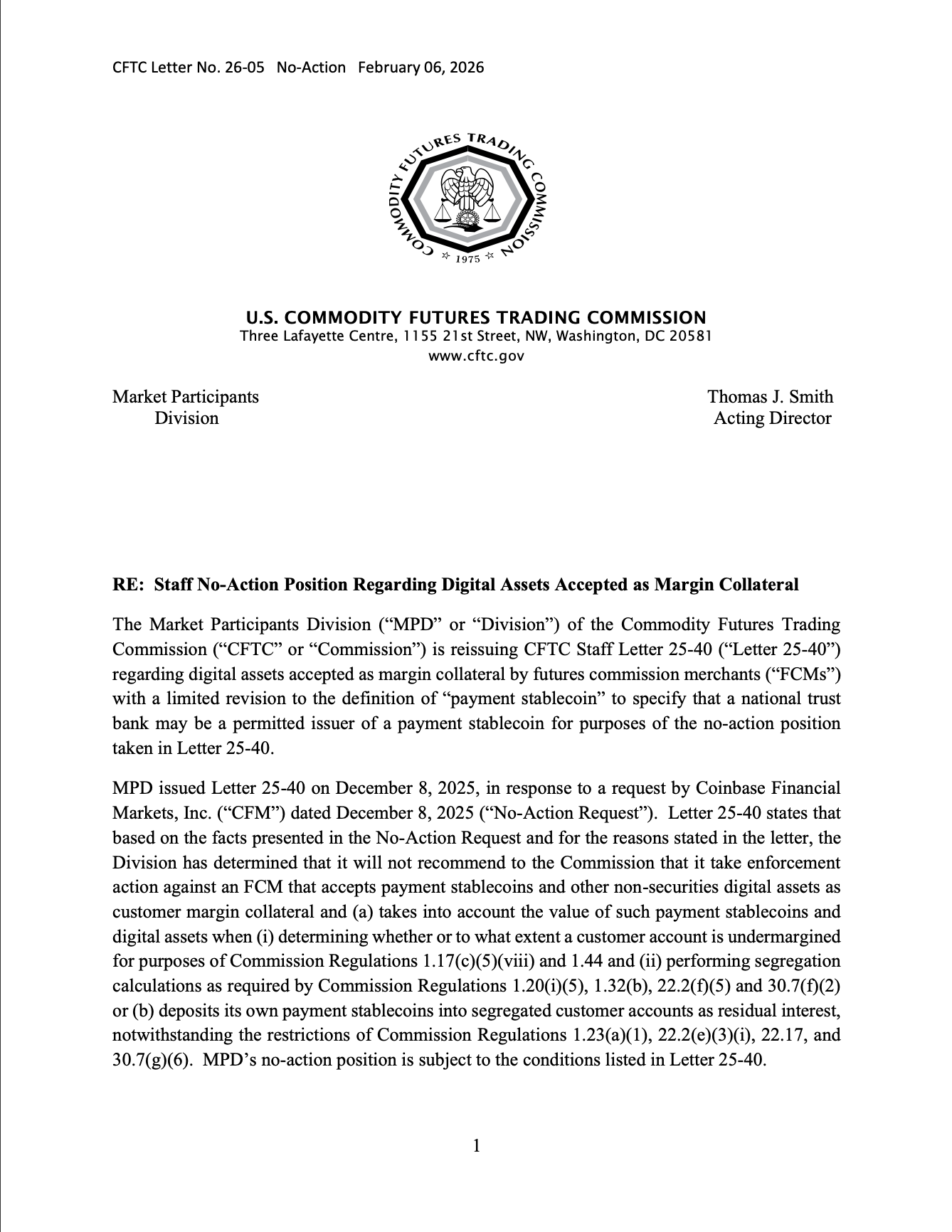

National Trust Banks Now Stablecoin Issuers

The Commodity Futures Trading Commission (CFTC) has broadened the universe of entities eligible to issue payment stablecoins, expanding the scope beyond traditional banks to include national trust banks. In a reissued staff communication, the agency clarified that national trust banks — institutions that typically provide custodial services, act as executors, and manage assets on behalf of clients rather than engaging in retail lending — can issue fiat-pegged tokens under its framework. The update, formally an amended Letter 25-40 dated December 8, 2025, signals a regulatory opening for non-retail institutions to participate in the stablecoin issuance landscape while staying within the agency’s risk controls and disclosure requirements. This move sits within a broader push to bring more clarity and supervision to U.S. dollar stablecoins as lawmakers push for a comprehensive framework.

The CFTC’s updated stance came alongside a wider regulatory environment shaped by the GENIUS Act, a flagship effort signed into law in July 2025 to establish a comprehensive regime for dollar-backed stablecoins. In parallel, the Federal Deposit Insurance Corporation (FDIC) has put forward a proposal that would allow commercial banks to issue stablecoins through a subsidiary, subject to FDIC oversight and alignment with GENIUS Act requirements. Taken together, the developments reflect a concerted push by U.S. regulators to delineate who can issue stablecoins, how reserves are managed, and what governance standards apply to ensure stability and consumer protection.

“The [Market Participants] Division did not intend to exclude national trust banks as issuers of payment stablecoins for purposes of Letter 25-40. Therefore, the division is reissuing the content of Letter 25-40, with an expanded definition of payment stablecoin.”

The evolution of guidance and policy in this space underscores the Biden-era regulatory stance on digital assets, even as political dynamics shift. A key inflection point cited by supporters and critics alike is the GENIUS Act, which aims to codify how dollar-pegged tokens are issued, backed, and redeemed in the U.S. financial system. The act envisions a framework in which stablecoins are tethered to high-quality assets—principally fiat currency deposits or short-term government securities—and prioritizes robust reserve backing over more speculative, algorithmic approaches. The law’s emphasis on 1:1 backing is central to the U.S. regulatory thesis that stablecoins should function as trusted payment rails rather than speculative instruments.

The interest in national trust banks as issuers reflects a broader attempt to harness existing financial infrastructure for stablecoin issuance while ensuring strong oversight. Custodial banks and asset managers are well-positioned to manage reserve assets and redemption mechanics, provided they meet the GENIUS Act’s criteria and the CFTC’s risk-management expectations. Yet the legal architecture remains complex: the GENIUS Act excludes algorithmic and synthetic-stablecoin models from its defined regulatory regime, signaling a deliberate preference for on-chain dollars that are backed by explicit, liquid reserves. This delineation matters for developers, exchanges, and institutions weighing whether to launch or scale stablecoin products within the U.S. market.

From a policy perspective, the FDIC’s December 2025 framework signals a parallel track for banks that want to participate in the stablecoin economy. The FDIC proposal contemplates a governance and oversight regime where a parent bank may issue stablecoins through a subsidiary, with the parent and subsidiary jointly evaluated for GENIUS Act compliance. In practical terms, banks would need clear redemption policies, transparent reserve management, and robust risk controls to withstand liquidity stress scenarios. The proposal’s emphasis on cash deposits and allocations in short-term government securities as backing underlines a risk-conscious approach to reserve management, designed to protect consumers and maintain trust in the stability mechanism.

Taken together, the CFTC, GENIUS Act, and FDIC proposals illustrate a coordinated effort to formalize who can issue stablecoins and under what safeguards. While this regulatory contour aims to reduce systemic risk and increase transparency, it also raises questions about competition, innovation, and the pace at which institutions adapt to new requirements. For market participants, the implications are twofold: potential increases in the number of credible issuers and more stringent standards for reserves and governance. The exact shape of implementation will hinge on subsequent rulemaking, agency guidance, and how firms align their compliance programs with the evolving framework.

Why it matters

First, the expansion to national trust banks widens the potential issuer base for U.S. dollar stablecoins, potentially increasing liquidity and providing new on-ramps for institutions that already manage large asset pools and custodial services. By enabling custody-focused banks to issue stablecoins, regulators acknowledge that core trust and settlement functions can be integrated with digital tokens in a controlled, audited environment. This could accelerate the adoption of digital-dollar payments for settlement, payroll, and cross-border transactions, provided these tokens remain backed by transparent reserves and subject to robust supervisory oversight.

Second, the GENIUS Act’s emphasis on 1:1 backing and the exclusion of algorithmic models create a delineated path for stablecoins to be treated as genuine state-of-the-art payment instruments rather than speculative vehicles. The act’s framework aims to minimize counterparty risk and maintain trust among users, merchants, and financial institutions. For issuers, this means that any new product entering the U.S. market will need to demonstrate verifiable reserves and clear redemption policies, which could influence how liquidity is sourced, how collateral is allocated, and how risk is modeled. Investors and traders will scrutinize reserve disclosures and governance structures more closely, knowing that regulatory compliance is a central prerequisite for broader market access.

Third, the FDIC’s proposed model for bank-issued stablecoins introduces a layered supervisory process that ties parent institutions to a dedicated subsidiary. While this structure could isolate risk and enhance accountability, it also adds a layer of administrative complexity for banks seeking to participate in the stablecoin economy. For the broader crypto ecosystem, the development signals a maturing regulatory environment in which stablecoins can function as reliable payment rails if they meet explicit, enforceable standards. This clarity could encourage more mainstream financial players to engage with digital currencies, provided the business models remain aligned with prudential risk controls.

What to watch next

- December 8, 2025 — CFTC confirms amended Letter 25-40 and expands the scope to national trust banks.

- FDIC December 2025 proposal — Banks may issue stablecoins through a subsidiary under FDIC oversight; track the Federal Register notice and subsequent rulemaking.

- GENIUS Act implementation timeline — Monitor any updates on how the regime will be phased in and how enforcement expectations will be communicated.

- Regulatory alignment — Any further CFTC or FDIC guidance clarifying reserve composition, redemption windows, and reporting obligations for issuers.

Sources & verification

- CFTC press release 9180-26 announcing the amended Letter 25-40 and inclusion of national trust banks as potential issuers of payment stablecoins.

- Federal Register notice or FDIC filing outlining the proposed framework for banks issuing stablecoins via a subsidiary and GENIUS Act alignment.

- Donald Trump stablecoin law signed in July 2025 — coverage detailing GENIUS Act context and regulatory aims.

- GENIUS Act overview — cointelegraph Learn article explaining how the act could reshape U.S. stablecoin regulation.

Regulatory expansion widens who can issue payment stablecoins

The CFTC’s decision to explicitly include national trust banks as potential issuers of payment stablecoins marks a notable shift in the agency’s interpretive posture. By reissuing Letter 25-40 with an expanded definition of “payment stablecoin,” the commission provides a clearer pathway for custodial institutions to participate in the stablecoin economy without stepping outside the boundaries of current risk management expectations. The language adopted by the Market Participants Division signals a deliberate attempt to harmonize regulatory definitions with evolving market realisms, where large custody providers and asset managers already perform core settlement and custody functions that could be extended to tokenized dollars.

At the core of the GENIUS Act is a drive to formalize stablecoins as trusted payment instruments. The act aims to curb regulatory ambiguity by outlining precise reserve requirements and governance standards, ensuring that dollars backing stablecoins are protected by transparent, high-quality assets. The law’s emphasis on 1:1 backing—whether through fiat deposits or highly liquid government securities—reflects a preference for stability over novelty. By excluding algorithmic or synthetic stablecoins from the GENIUS framework, policymakers intend to minimize complexity and counterparty risk, reducing the likelihood of sudden depegging or reserve shocks.

The FDIC’s forthcoming framework—allowing banks to issue stablecoins through a subsidiary under its oversight—complements the CFTC’s redefinition. It signals a practical progression toward integrating traditional banking structures with digital-asset processes, provided banks meet the GENIUS Act’s criteria. The proposed safeguards emphasize redemption policies, reserve adequacy, and ongoing financial health assessments, underscoring the regulators’ focus on resilience and public trust. In broad terms, the convergence of these initiatives points to a gradual, monitored expansion of the stablecoin ecosystem rather than a rapid, unbounded growth of new issuers.

Market participants should watch not only the formal issuers that emerge but also the evolving standards for disclosures, stress testing, and governance. As more entities participate in this space, the demand for clear, consistent regulatory expectations will intensify, prompting issuers to adopt rigorous compliance programs and robust risk controls. The balance regulators seek is clear: widen access to stablecoins as practical payment tools while maintaining sufficient guardrails to protect consumers, financial stability, and the integrity of settlement systems.

Crypto World

CFTC Amends Guidance, Includes National Trust Banks As Stablecoin Issuers

The Commodity Futures Trading Commission (CFTC), a US financial regulator, reissued a staff letter on Friday to expand the criteria for payment stablecoins to include national trust banks, recognizing their eligibility to issue the fiat-pegged tokens.

The CFTC amended Staff Letter 25-40, which was issued on December 8, 2025, to include national trust banks, financial institutions allowed to function in all 50 US states.

National Trust Banks typically do not provide retail banking services like lending or checking accounts. Instead, they offer custodial services, act as executors on behalf of clients and provide asset management services. The CFTC letter said:

“The [Market Participants] Division did not intend to exclude national trust banks as issuers of payment stablecoins for purposes of Letter 25-40. Therefore, the division is reissuing the content of Letter 25-40, with an expanded definition of payment stablecoin.”

The letter reflects the regulatory climate in the US toward stablecoins after US President Donald Trump signed the GENIUS stablecoin bill into law in July 2025.

The Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act is a comprehensive regulatory framework for US dollar stablecoins, blockchain tokens pegged to the dollar.

Related: CFTC pulls Biden-era proposal to ban sports, political prediction markets

The Federal Deposit Insurance Corporation outlines a plan for banks to issue stablecoins

In December 2025, the Federal Deposit Insurance Corporation (FDIC), a US banking regulator, proposed a framework under which commercial banks could issue stablecoins.

The proposal allows banks to issue the tokens through a subsidiary subject to oversight by the FDIC, which will gauge whether both the parent company and subsidiary are compliant with GENIUS Act requirements for issuing stablecoins.

These requirements include redemption policies, sufficient backing collateral for the stablecoin in the form of cash deposits and short-term government securities, as well as assessments of the bank and subsidiary’s overall financial health.

Under the GENIUS Act, only overcollateralized stablecoins, which are backed 1:1 with fiat currency deposits or short-term government securities, like US Treasury Bills, are recognized.

Algorithmic stablecoins and synthetic dollars, which rely on software to maintain their dollar pegs or complex market trading strategies, were excluded from the regulatory framework.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Erebor Secures First New US Bank Charter in Trump’s Second Term

The United States has granted a nationwide banking charter to a crypto-friendly startup for the first time during President Trump’s second term, signaling a rare regulatory opening for niche lenders that straddle technology and finance. The Office of the Comptroller of the Currency confirmed Erebor Bank’s charter, allowing the lender to operate across the country and serve a market long underserved after the 2023 Silicon Valley Bank collapse, according to people familiar with the matter cited by the Wall Street Journal. Erebor begins life with about $635 million in capital and a mandate to back startups, venture-backed firms, and high-net-worth clients while pursuing a differentiated set of services tailored to cutting-edge tech sectors.

The approval comes as part of a broader movement to redefine how traditional banks engage with crypto-friendly business lines, fintech models, and complex asset classes. Erebor’s launch is anchored by a roster of prominent technology investors, including Andreessen Horowitz, Founders Fund, Lux Capital, 8VC and investor Elad Gil. Palmer Luckey, Oculus co-creator and Erebor’s founder, will sit on the bank’s board but will not manage day-to-day operations, a structure described to sources close to the matter. The bank’s regulatory path has already included a deposit insurance clearance from the Federal Deposit Insurance Corporation (FDIC), underscoring a careful balance between innovation and consumer protections.

Industry observers note that Erebor is positioning itself to address a unique demand: lending to tech-forward firms whose assets, including crypto holdings or private securities, may require non-traditional collateral frameworks. The bank’s blueprint also envisions a future where blockchain-based payment rails enable rolling settlements—a feature that diverges from the conventional, business-hours timetable of many U.S. banking rails. The project’s backers have framed Erebor as a “farmers’ bank for tech,” a nod to the expertise needed to evaluate startups whose assets aren’t always easy to quantify by traditional metrics.

In late 2024, Erebor’s capital raise and strategic milestones were mirrored in the broader tech-finance press, with coverage highlighting the bank’s ambitious scope and its founders’ willingness to explore uncharted territory in U.S. banking. The Bank’s trajectory has been tied to a broader push by high-profile investors to reshape crypto banking in the United States, with conversations around regulatory alignment and product suitability for crypto-related activities continuing to unfold across the ecosystem. The project’s narrative also intersects with broader industry discussions about how banks can adapt to support frontier technologies while maintaining prudent risk controls.

As Erebor evolves, it plans to offer lending backed by crypto holdings or private securities, and to finance acquisitions of high-performance AI hardware—an area where demand has grown as generative models and specialized chips have become central to competitive advantage. The bank’s leadership argues that technical sophistication matters when assessing borrowers whose value is tied to innovation, rather than conventional asset bases. This approach could help fill a vacuum left by traditional banks that pulled back from specialized tech lending after the SVB disruptions.

Coverage over the following months tied Erebor’s story to a broader wave of crypto-native banking efforts and regulatory discussions. In related reporting, industry observers noted the ongoing conversation around how new charters might coexist with crypto custody, on-chain settlement, and risk-management frameworks designed to protect consumers and institutions alike.

Key takeaways

- The OCC granted Erebor Bank a nationwide charter, enabling operations across the United States and formalizing a crypto-friendly banking approach for a niche client base.

- The lender starts with approximately $635 million in capital and aims to serve startups, venture-backed firms, and high-net-worth clients underserved after the 2023 SVB collapse.

- Erebor’s backers include Andreessen Horowitz, Founders Fund, Lux Capital, 8VC and Elad Gil; Palmer Luckey sits on the board but will not manage daily operations.

- FDIC deposit insurance was approved, adding a layer of consumer protection to the bank’s regulatory standing.

- The bank intends to explore blockchain-based payment rails for continuous settlement and to offer credit lines backed by crypto holdings or private securities, plus financing for AI hardware purchases.

Tickers mentioned:

Market context: The Erebor charter comes amid a broader regulatory dialogue around crypto-friendly banking and fintech partnerships in the United States, reflecting ongoing efforts to reconcile innovation with safety standards and consumer protections. Regulatory attention remains focused on how specialized banks can support frontier technologies while maintaining robust risk controls in an evolving landscape.

Why it matters

For startups navigating a capital-intensive growth phase, Erebor represents a potential new channel that blends traditional banking with a deep understanding of technology-driven business models. By anchoring lending strategies to assets such as crypto holdings and private securities, the bank could provide credit facilities that are more attuned to the capital structures of venture-backed companies and cutting-edge manufacturers. This approach could help alleviate liquidity strains that some tech teams faced during the SVB downturn, offering a more diversified banking relationship beyond the conventional routes that often rely on standard collateral.

Investors and builders may view Erebor’s platform as a test case for how specialized financial services can evolve to accommodate emerging industries—defense tech, robotics, AI-driven manufacturing, and other sectors where conventional metrics do not easily capture value. The combination of a robust capital base, notable backers, and a charter that enables nationwide operations could set the stage for more banks to calibrate their risk models toward the needs of frontier tech ecosystems. Yet the model also invites scrutiny around governance, liquidity risk, and the management of crypto-related exposures, especially as ongoing debates about stablecoins, custody, and on-chain settlement unfold in regulatory circles.

In a landscape where crypto and traditional finance increasingly intersect, Erebor’s trajectory could influence competitor strategies and policy discussions about how banking products should adapt to serve technology-forward clients without compromising safety. The bank’s willingness to pursue blockchain rails and crypto-backed credit arrangements signals a broader shift in which regulated institutions experiment with novel settlement mechanisms and capital structures to support rapid innovation.

What to watch next

- The pace and scale of Erebor’s onboarding of startups and venture-backed clients as it transitions from charter approval to full-scale nationwide operations.

- Regulatory updates on risk management practices, asset collateralization standards, and any changes to how blockchain-based settlement features integrate with conventional banking rails.

- Further disclosures on the composition of loan portfolios, particularly those backed by crypto holdings or private securities, and how these exposures are hedged or liquidated if market conditions tighten.

- Details on governance and operational oversight as Luckey participates on the board, including any updates to management structure or external audits.

Sources & verification

- Wall Street Journal report on the OCC charter approval for Erebor Bank. https://www.wsj.com/finance/banking/hobbit-inspired-startup-becomes-first-new-bank-greenlighted-by-trump-2-0-0d6075ef

- FDIC press release confirming deposit insurance approval for Erebor Bank NA. https://www.fdic.gov/news/press-releases/2025/fdic-approves-deposit-insurance-application-erebor-bank-na-columbus-ohio

- Preliminary conditional approval of Erebor by the OCC. https://cointelegraph.com/news/peter-thiel-erebor-silicon-valley-bank-rival-approval

- Valuation context following a Lux Capital-led round that propelled Erebor to a multi-billion-dollar valuation. https://cointelegraph.com/news/palmer-luckey-erebor-valuation-occ-fdic-crypto-bank

Regulatory milestones redefine crypto-friendly banking in the US

Erebor’s charter marks a notable inflection point in the regulatory landscape for crypto-adjacent banking endeavors. The OCC’s decision to charter a bank expressly positioned to engage with technology-driven clients signals a pathway for growth that balances innovation with the protections expected of federally chartered lenders. The FDIC’s deposit insurance approval further certifies a structural commitment to consumer protection, a critical factor for institutions considering crypto-backed financing models or on-chain settlement capabilities.

As Erebor moves toward full-scale operations, the industry will watch how its governance and risk frameworks evolve, how the bank manages collateral volatility tied to crypto markets, and how its product suite—ranging from crypto-backed lending to blockchain settlement rails—is received by regulators, customers, and rival banks. The broader banking ecosystem is contending with questions about capital adequacy, liquidity management, and the compatibility of new tech-driven products with established supervision regimes. Erebor’s progress could influence the speed at which others pursue niche charters and crypto-friendly banking partnerships in a climate where innovation and caution must be carefully balanced.

Crypto World

BlockDag presale finally ends while Remittix sees thousands of holders join its new 300% bonus offer

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

BlockDag closes $453m presale ahead of Feb 16 listing as Remittix surges with 300% bonus and growing investor demand.

Summary

- Remittix raises $28.9m and launches its crypto-to-fiat platform Feb. 9, drawing strong investor attention in 2026.

- CertiK-audited Remittix gains traction with live wallet access, real-world utility, and a limited 300% bonus offer.

- Over 703m tokens sold as Remittix positions itself as a leading PayFi project bridging crypto and fiat payments.

The crypto market is buzzing, especially with the recent conclusion of BlockDag’s presale. The project has raised a massive $453 million, and now, with its official exchange listing set for February 16th, it’s on the verge of disrupting the blockchain world. However, one project is quickly gaining more traction, offering tremendous potential for early investors: Remittix.

As BlockDag’s presale wraps up, Remittix, with its 300% bonus offer, is drawing in thousands of new investors, catching the eye of those looking for the next big crypto opportunity. With its wallet already live and a crypto-to-fiat platform launching soon, investors are racing to buy RTX tokens before the presale ends, and the next XRP-like opportunity slips away.

BlockDag’s rise amid a transforming crypto landscape

BlockDag’s presale has certainly caught the attention of the crypto community. With over 312,000 participants and a price launch target of $0.05, this project is poised to make waves in the industry. The tech behind BlockDag promises to support 15,000 transactions per second, with predictions pointing to price highs of $0.30 by February 26, $0.20 for March, and even $0.45 by April.

However, the window for massive returns in BlockDag is likely narrowing. With the presale completed, the project is now shifting to the exchange phase, where exponential growth may be limited compared to the early entry points. While it’s expected to perform well post-listing, the real opportunity has passed for presale investors. This gives rise to the perfect question: What’s next for those seeking higher returns in the ever-shifting world of crypto?

Remittix: The next major opportunity in crypto

While BlockDag has its potential, Remittix is quickly becoming the top crypto to buy now in 2026, offering something different to its community. With over $28.9 million raised through the sale of 703.7 million tokens, currently priced at $0.123 each, Remittix stands out as a project with real-world utility that’s already beginning to change the crypto landscape.

The crypto-to-fiat platform launching on February 9, 2026, is a game-changer, giving users the ability to convert crypto into fiat seamlessly. As the Remittix wallet is already available on the Apple App Store with Google Play coming soon, it is evident that Remittix is taking all the right steps to provide lasting value.

Remittix has not only raised significant funds but has also passed a rigorous CertiK security audit, further cementing its position as a safe and trustworthy investment. The 300% bonus offer, which has caught the attention of many new crypto buyers, is yet another reason why this project is attracting so much attention.

Paired with Remittix’s secure and transparent development, this incentive has already led thousands of holders to join the Remittix community. With so much value locked in the token, the 300% bonus gives buyers the chance to maximize their returns before Remittix becomes a household name in the crypto world.

Remittix is poised to become one of the top crypto assets in the world, offering the following strengths:

- Over 93% of the total token supply has already been sold, creating scarcity that could drive up the value of $RTX in the near future.

- The upcoming launch of the crypto-to-fiat platform on February 9th promises to solve one of the biggest problems in the crypto world: bridging digital assets and real-world finance.

- With its CertiK verification, transparent development process, and early-stage community support, Remittix is one of the most promising new altcoins to consider for long-term growth.

- The 300% bonus offer, exclusively available to email subscribers, creates a sense of urgency for investors to act before the opportunity is gone.

- The wallet’s already live, and Android users can expect it soon, positioning Remittix as a leader in the growing PayFi sector.

Why now is the time to act

With only a few tokens remaining, there’s no time to wait. Over 93% of the supply has already been sold, and as more listings are set to be announced, the window for securing tokens at this price is closing fast. For those searching for the best crypto to buy now in 2026, Remittix offers a rare opportunity for exponential growth.

The crypto market is volatile, but Remittix provides a clear use case and a roadmap that gives it staying power. With its upcoming crypto-to-fiat platform and PayFi ecosystem, this is a project built to thrive in the real world, not just on speculative hype. The combination of security, real-world utility, and community engagement positions Remittix as one of the best investments you can make today.

For more information, visit the official website or socials.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

-

Video5 days ago

Video5 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech4 days ago

Tech4 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics6 days ago

Politics6 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Tech1 day ago

Tech1 day agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports18 hours ago

Sports18 hours agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Sports8 hours ago

Former Viking Enters Hall of Fame

-

Crypto World6 days ago

Crypto World6 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports1 day ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat1 day ago

NewsBeat1 day agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

NewsBeat5 days ago

NewsBeat5 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business2 days ago

Business2 days agoQuiz enters administration for third time

-

Sports6 days ago

Sports6 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat19 hours ago

NewsBeat19 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World4 days ago

Crypto World4 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat5 days ago

NewsBeat5 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World2 days ago

Crypto World2 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World2 days ago

Crypto World2 days agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

Crypto World2 days ago

Crypto World2 days agoHeads Up! Bitcoin Enters Capitulation Mode, Trades In a ‘Phase That Rewards Discipline Over Prediction’