Crypto World

Bitget Targets 40% of Tokenized Stock Trading by 2030

Bitget, the world’s largest Universal Exchange (UEX), today announced a major mobile app upgrade that puts crypto and traditional financial markets side by side on the homepage, reflecting how traders are increasingly moving between asset classes in one trading session. The release follows Bitget’s January rollout of TradFi trading, which expanded access to stock-linked products, FX, indices, commodities, and precious metals such as gold and silver, all settled in USDT.

Bitget’s tokenized TradFi thesis is that crypto is changing from its speculative traits to a rising global financial infrastructure. While annual stock trading is estimated at $100 – $130 trillion currently, it could reach $160 –$200 trillion by 2030, with a significant share of stocks, credit, funds, and commodities shifting onchain as Bitcoin strengthens its role in macro hedge portfolios.

As tokenized stocks increasingly route through crypto-market platforms, exchanges could facilitate roughly 20–40% of that flow; Bitget’s UEX strategy is to be a primary liquidity and distribution hub by expanding into tokenized stocks, FX, gold, and more with an internal base case of handling 40% of the tokenized stock activity roughly $15–$30 trillion in tokenized-stock trading volume by 2030.

Under the new layout, all crypto products including futures, spot, margin, onchain, and earn are consolidated under a unified “Trade” tab, reducing friction for active traders who move frequently between crypto assets. Simultaneously, a new, dedicated TradFi tab provides one-tap access to global markets such as gold, FX, indices, and stock perps and real-world asset tokens, eliminating the need to navigate multiple menus or workflows.

“Bitget is building for the trillion dollar migration. As regulation matures and institutions bring products like treasuries onchain, the direction is clear: crypto is turning into the settlement layer for everyday finance. Sooner than most people think, stablecoins and native assets won’t feel crypto at all, just backend infra working behind when people move value worldwide,” said Gracy Chen, CEO at Bitget.

That’s also why the product experience has been rebuilt around it, on Bitget TradFi is accessible within a click and a UI/UX flow cuts the total steps by around 30% versus typical industry journeys,” she added.

Bitget has successfully pivoted from a crypto-native exchange to the global liquidity hub for this migration. The platform has established itself as the dominant venue for tokenized equities. Bitget currently captures 89.1% of the global market share for Ondo’s tokenized stock tokens, reaching record daily volumes of $6 Billion in January 2026.

The upgraded app experience is now live globally.

For more information, please click here.

About Bitget

Bitget is the world’s largest Universal Exchange (UEX), serving over 125 million users and offering access to over 2M crypto tokens, 100+ tokenized stocks, ETFs, commodities, FX, and precious metals such as gold. The ecosystem is committed to helping users trade smarter with its AI agent, which co-pilots trade execution. Bitget is driving crypto adoption through strategic partnerships with LALIGA and MotoGP™. Aligned with its global impact strategy, Bitget has joined hands with UNICEF to support blockchain education for 1.1 million people by 2027. Bitget currently leads in the tokenized TradFi market, providing the industry’s lowest fees and highest liquidity across 150 regions worldwide.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

Crypto World

What is Zero Knowledge Proof (ZKP)? A $100M Self-Funded Layer-1 Powering Private AI and Driving Massive Growth

In recent years, millions of traders and crypto users have experienced what it feels like when personal data gets exposed. Exchange leaks, identity verification breaches, wallet tracking, and analytics tools have made privacy a growing concern in digital finance. Many blockchain networks record everything publicly, making transactions transparent but not always private. For users who value security, that model no longer feels enough.

This is where Zero Knowledge Proof (ZKP) enters the conversation. ZKP is a Layer-1 blockchain built around one clear principle: prove computation is correct without revealing the underlying data. Instead of exposing sensitive information, it validates results while protecting privacy. In a market where trust is often tested, Zero Knowledge Proof (ZKP) is gaining attention as the top crypto to buy today for those seeking a more secure blockchain foundation.

What is Zero Knowledge Proof (ZKP)?

Zero Knowledge Proof (ZKP) is a Layer-1 blockchain built to validate computation without revealing the underlying data. In simple terms, the network allows a result to be proven correct while keeping sensitive inputs private. This approach is central to zero-knowledge cryptography and is the foundation of the entire ZKP ecosystem.

The project was developed with a strong commitment to readiness. Before launching its presale, the team invested $100 million of self-funded capital into building the blockchain architecture, proof systems, and supporting infrastructure. This build-first model reduces risk and signals long-term focus.

Core features include:

- A privacy-focused Layer-1 blockchain

- Zero-knowledge validation of computation

- Architecture designed for secure AI workloads

- Integration with real hardware through Proof Pods

For newcomers exploring options in today’s market, ZKP stands apart because it already operates with infrastructure in place. This foundation strengthens its case as the top crypto buy today, especially for those looking beyond early hype and into practical execution.

Live Presale Auction: Stage 2 Momentum Builds

Zero Knowledge Proof (ZKP) is currently in a structured crypto presale auction that distributes coins in progressive stages. The presale has already raised $1.85 million, showing early traction. At present, Stage 2 is closing in 6 days, marking a critical point in the auction cycle.

Market observers and analysts have noted the pace of participation. Some experts project that if momentum continues, the ZKP presale auction could reach $1.7 billion, highlighting expectations around the project’s scale.

Below is the current auction snapshot:

| Category | Details |

| Current Stage | STAGE 2 : ROUND 4 |

| Total Raised | $1.85M |

| Yesterday’s Closing Price | $0.00007 USD |

| Auction Day | 77 / 450 |

The auction model allows price discovery across stages rather than through a fixed-price sale. This structured progression creates measurable entry points and encourages sustained participation. For those searching for the top crypto buy today, the combination of raised capital, staged structure, and projected growth gives ZKP a strong position within the current presale market.

Proof Pods: A Working Product Backed by $17M

Proof Pods represent the tangible layer of the Zero Knowledge Proof (ZKP) ecosystem. These physical devices are designed to generate verifiable computation for the network. Instead of relying solely on digital staking models, ZKP connects blockchain incentives to measurable hardware performance.

The project allocated $17 million specifically for Proof Pods creation, covering development, production, and logistics. This investment demonstrates that Proof Pods are not conceptual but operational components of the network’s design.

Key benefits of Proof Pods include:

- Real hardware participation in blockchain validation

- Generation of cryptographic proofs

- Decentralized distribution of computing power

- Accessibility for non-technical users

Proof Pods strengthen decentralization while tying network rewards to real activity. For presale participants, this working product provides tangible backing to the blockchain’s function.

When evaluating the top crypto buy today, projects with operational hardware and capital commitment often stand out. ZKP’s integration of Proof Pods shows that it is building a functioning ecosystem rather than relying purely on token demand.

Final Say

Zero Knowledge Proof (ZKP) combines three critical elements rarely seen together in early-stage blockchain projects: a fully developed Layer-1 architecture, a structured live presale auction, and a working hardware product in Proof Pods. With a $100 million self-funded development, $17 million allocated to hardware, and a presale that has already raised $1.85 million, ZKP demonstrates preparation and execution before scaling further.

As Stage 2 closes in 6 days and experts project the presale could reach $1.7 billion, the project continues to build measurable momentum. The staged auction structure provides transparency, while Proof Pods anchor the network in real-world computation.

For newcomers seeking the top crypto buy today, Zero Knowledge Proof (ZKP) presents a strong combination of privacy technology, financial commitment, and live participation mechanics. Rather than promising future development, ZKP enters the market with infrastructure already built and an ecosystem actively expanding.

Explore ZKP:

Website: https://zkp.com/

Buy: https://buy.zkp.com

Telegram: https://t.me/ZKPofficial

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

The Market Is Terrified, Institutions Aren’t. Analyzing the ‘Extreme Fear’ Floor

Retail traders are dumping Bitcoin in panic mode right now. Fear is everywhere. The Fear and Greed Index is stuck at 12. That is extreme.

However, perpetual futures volume is actually spiking. That kind of divergence does not show up for no reason.

The market has wiped out nearly $800 billion in a month. Brutal. But the real question is this. Is smart money quietly positioning before the next major move.

Because when fear is loud and volume rises at the same time, something is about to break.

Key Takeaways

- JPMorgan maintains a bullish 2026 outlook despite the total market cap falling from $3.1T to $2.3T.

- The Crypto Fear & Greed Index is pinned at 12 (“Extreme Fear”), levels historically associated with bottom formation.

- Bitcoin is trading at $67,610, significantly below its estimated production cost of $77,000.

- Whale activity in perpetual markets suggests complex institutional hedging is dominant over spot selling.

Is This Institutional Hedging or Strategic Accumulation?

So let’s pause for a second.

Who is buying when the market feels this terrified? Bitcoin price is around $67,610 and Ether near $1,950, both down heavily this month.

Spot charts look rough and retail is clearly panicking. Yet, Perpetual futures volume is climbing fast, which usually signals sophisticated players stepping in with structured positions, not emotional longs.

This isn’t what speculative euphoria looks like. When retail piles in, funding spikes positive. Instead, BTC funding is nearly flat and ETH funding is negative.

There are only two real explanations here: institutional hedging… or strategic positioning ahead of a larger move.

Will Bitcoin Price $50K Floor Hold?

The charts look terrible right now, no doubt about it. However, fundamentals wise it might leaning bullish good long term.

JPMorgan estimates Bitcoin’s production cost sits around $77,000. BTC is trading well below that.

Historically, when price drops under production cost, it does not stay there long. Miners either shut off machines or pressure builds for a rebound.

Still, the downside risk is not gone. Chief equity strategist John Blank warned Bitcoin could slide to $40,000 within 6 to 8 months.

That would be a full blown capitulation scenario. All Traders are now locked on $60,000 as the key support to watchout for.

The post The Market Is Terrified, Institutions Aren’t. Analyzing the ‘Extreme Fear’ Floor appeared first on Cryptonews.

Crypto World

Stacks price retests $0.28: can STX go higher?

- Stacks price surged by 5% to test resistance near $0.28.

- Gains follow Bitcoin’s uptick to $67,500.

- STX could still dip to recent lows if the Bitcoin price falls to new lows.

Stacks’ STX token edged higher on the day as Bitcoin held above the $67,500 level following a roughly 2% intraday move.

Despite the modest gain, the Bitcoin layer-2 network’s native token continues to trade in volatile conditions, reflecting uncertainty across the broader cryptocurrency market.

A sustained pickup in momentum could lift STX toward levels last seen in May 2025.

However, ongoing market turbulence and expectations of further downside risk for Bitcoin suggest Stacks may remain under pressure.

Analysts point to $0.24 as a key support level that bulls will need to defend to prevent a deeper pullback.

Stacks price today

STX posted modest daily gains on February 12, 2026, trading around $0.27 at the time of writing with a 5% uptick.

But buyers are hovering at these levels after hitting resistance around $.028, a level reached after STX recovered from Feb.5, 2026, lows of $0.22.

Despite weekly losses having moderated to 2%, Stacks remains more than 32% down in the monthly time frame.

Meanwhile, gains on the day have also come amid reduced buyer interest, with daily trading volume down 6% to $13.2 million.

Notably, prices remain within the range that offers support at $0.24, with bulls revisiting the level on three occasions year-to-date.

Stacks price prediction

Stacks is among the top Bitcoin DeFi protocols looking to leverage a layer-2 network to enable smart contracts and yield opportunities directly on Bitcoin’s security.

The project has gained traction as the digital asset investment space broadens.

One of its landmark moves is the recent integration with Fireblocks, which could potentially expose over 2,400 institutional clients to STX for native Bitcoin DeFi participation.

“Bitcoiners want to earn yield without sacrificing security. They want their yield to be denominated in Bitcoin and ideally, with as few additional trust assumptions as possible,” the firms stated in their announcement.

Clients will be able to tap into Bitcoin-denominated rewards, BTC-yielding vaults, and BTC-backed loans.

This institutional gateway could significantly boost STX adoption, especially if Bitcoin prices spike.

Bulls could eye the $0.56-$0.60 range or higher, with the altcoin having reached highs of $1.05 in May 2025.

The technical picture supports this short-term outlook and targets.

On the daily chart, the Relative Strength Index (RSI) hovers at 34, but signals bullish divergence.

Charts also show the Moving Average Convergence Divergence (MACD) indicator pointing to a bullish crossover.

If Bitcoin faces intensified selling pressure, Stacks’ upside potential could suffer.

In this case, STX may find support in the $0.23-$0.20 area.

Crypto World

Optimism Taps Succinct to Enable Instant Withdrawals

The zero-knowledge validity proofs will become canonical across the OP stack.

Ethereum Layer 2 Optimism is partnering with Succinct as its first zero-knowledge (ZK) proving provider, in order to provide instant and real-time withdrawals from the L2, according to an announcement shared exclusively with The Defiant.

The move makes Succinct Optimism’s first official ZK partner, and by leveraging Succinct’s proof system, users can off-ramp capital from Optimism to any other chain in a timely fashion, as opposed to the bridge’s traditional, multi-day wait time.

By accelerating the bridge time from Optimism, large on-chain operators such as market makers or treasuries, can move capital quickly without having to rely on a third party bridging solution.

In addition to its withdrawal time upgrade, Optimism is also working towards a larger ZK proof infrastructure launch on the chain, which will allow teams building across the OP Stack to upgrade to ZK validity proofs “seamlessly” per a release shared with The Defiant.

Karl Floersch, the co-founder of Optimism commented on the news:

“Succinct offers one of the most trusted proof systems in the industry, securing billions of dollars in TVL. We’re excited to bring validity proofs to the Superchain as we focus on fast, cost-effective scaling for Optimism and our partners in 2026 and beyond.”

“We’re honored to partner with Optimism to bring ZK to the Superchain, starting with OP Mainnet. As rollups consolidate around ZK, Succinct is building the proving infrastructure the ecosystem can rely on,” said Uma Roy, CEO and co-founder of Succinct.

The news comes shortly after Optimism unveiled OP Enterprise — a new chain deployment suite for enterprise clients who are looking to build their own native blockchains.

Crypto World

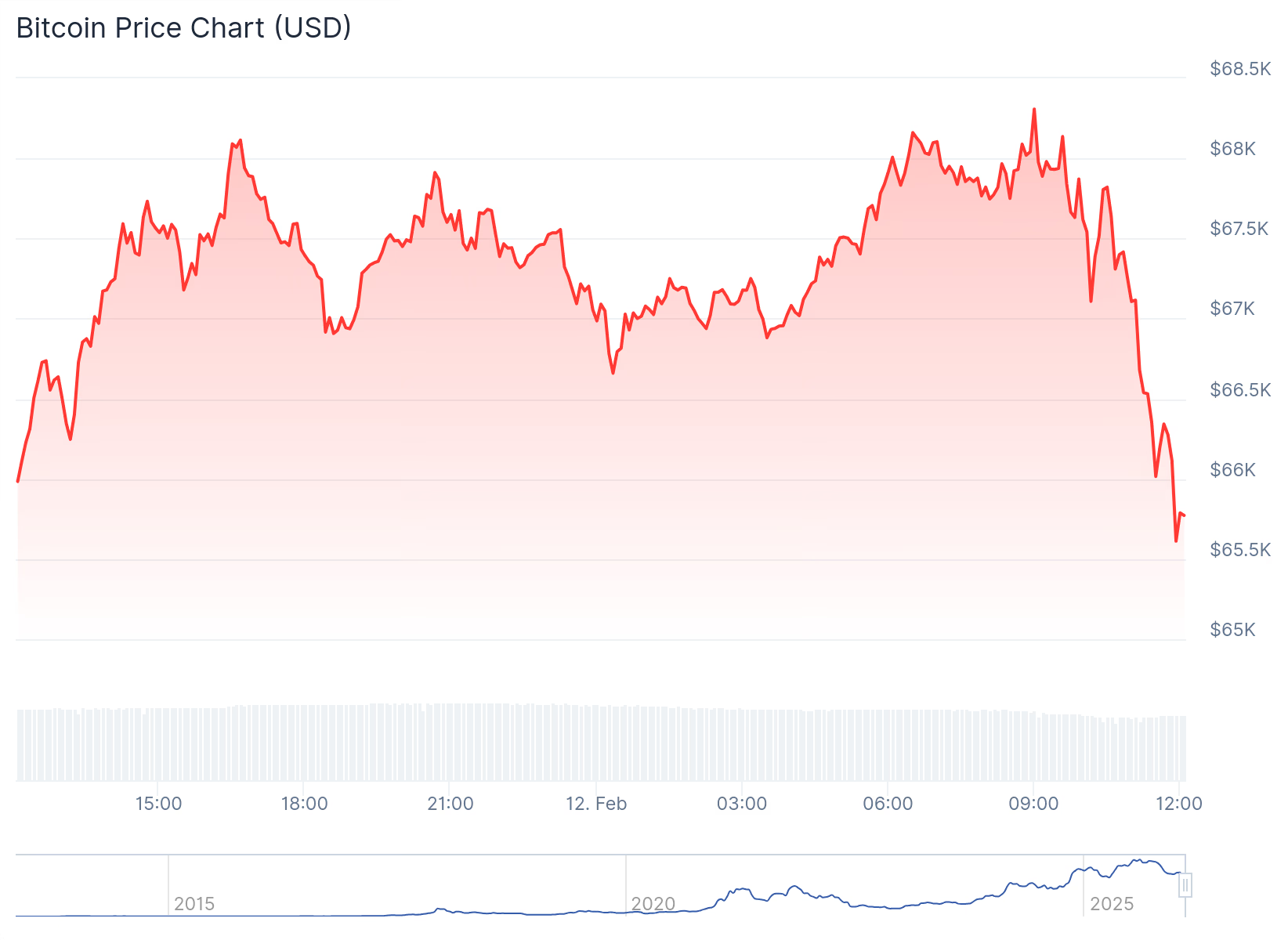

Bitcoin Plunges Under $66,000 as Crypto Sentiment Index Hits Historic Low

Total market cap is holding steady today, even as sentiment sinks to the weakest level on record.

Crypto markets took a tumble Thursday morning, Feb. 12, pushing Bitcoin below $66,000 and Ethereum below $2,000, as investor sentiment deteriorated to unprecedented lows.

Total crypto market capitalization is flat over the past 24 hours around $2.33 trillion, while large-cap assets are mixed today. At press time, Bitcoin (BTC) is trading at $65,747 at press time, down marginally on the day and bringing 7-day losses to about 5%.

Ethereum (ETH) fell to $1,910 this morning, little changed over the past 24 hours and down 4% on the week.

While BNB gained nearly 2% on the day, it’s still down almost 10% over the past week. Solana (SOL) slipped 0.6% in the past 24 hours, and is down 8% on the week.

Among the top-10 crypto assets, XRP and Figure Heloc (FIGR_HELOC) stood out on the weekly timeframe, both up about 4%.

Unprecedented Extreme Fear

Market sentiment, however, continues to lag price action. The Crypto Fear & Greed Index fell today to a reading of 5, its lowest level on record, pushing sentiment deeper into “extreme fear” territory than during any previous bear market.

Glassnode analysts said in an X post today that the disconnect between prices and sentiment reflects a market under sustained stress rather than a clear capitulation event.

The analysts pointed out that the 30-day simple moving average of net flows for both BTC and ETH spot ETFs has remained negative for most of the past 90 days, showing “no sign of renewed demand.”

They added in a separate research report that liquidity remains thin, with traders maintaining defensive positioning. Without renewed spot demand or improvement in risk appetite, glassnode warned that price action is likely to remain driven by short-term positioning.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, earlier today, Aster (ASTER) climbed more than 7% after the decentralized exchange confirmed that the mainnet launch of Aster Chain is scheduled for March. Hyperliquid’s HYPE token also rose about 7%, extending its recent rebound.

On the downside, Uniswap (UNI) led losses among large-caps, down 11.6%, erasing all of its gains from Wednesday’s rally that followed news of a strategic investment by BlackRock.

According to CoinGlass data, over 120,000 traders were liquidated over the past 24 hours, with total liquidations reaching $285 million. Bitcoin accounted for roughly $118 million of that total, followed by Ethereum at about $65 million.

ETFs and Macro Conditions

On Wednesday, Feb. 11, spot Bitcoin ETFs reversed their inflow streak, posting over $276 million in net outflows on the day. Spot Ethereum ETFs also recorded net outflows of more than $129 million, according to data from SoSoValue.

In macro markets, U.S. Treasury yields moved lower today as investors assessed fresh labor data and looked ahead to Friday’s consumer price index report. The 10-year yield slipped to 4.158%, while the 30-year fell to 4.782%, CNBC reported.

Per a report published today from the U.S. Labor Department, initial jobless claims came in at 227,000 for the week ended Feb. 7, slightly above expectations but lower than the prior week, the report notes, adding that investors continue to digest January’s nonfarm payrolls report, which showed a decline in the unemployment rate to 4.3%.

Crypto World

XRP price shows bottoming signs as RLUSD hits key milestone

XRP’s price has retreated for six consecutive weeks, in line with the broader market’s performance.

Summary

- XRP price has retreated and moved into a bear market in the past few months.

- Ripple USD’s stablecoin supply has jumped to over $1.5 billion for the first time ever.

- The coin has become oversold and formed a falling wedge chart pattern.

Ripple (XRP) token was trading at $1.3915 on Thursday, down by 62% from its all-time high of $3.6590. Technical indicators suggest the coin may be about to rebound as demand for the Ripple USD (RLUSD) stablecoin rises.

Ripple USD supply is rising

There are signs that demand for the RLUSD stablecoin is growing, a trend that may accelerate after Binance completes its integration on the XRP Ledger. The integration enabled users to deposit and withdraw the token on the largest crypto exchange in the industry.

Data compiled by Artemis shows that the supply of RLUSD in circulation jumped to over $1.5 billion for the first time ever. $1.1 billion of these tokens are in Ethereum, while the rest is in the XRP Ledger.

In a statement on Thursday, Jack McDonald, the Senior Vice President at Ripple Labs, hinted that the stablecoin will overtake “traditional dollar, Venmo, PayPal, and others.” He pointed to the rising institutional demand for the coin, especially as the developers gears to launch the Permissioned DEX platform.

Artemis data show that RLUSD’s usage continues to grow. It handled over 480,000 transactions in the last 30 days, while the adjusted transaction volume soared to close to $4.9 billion. Most of the volume was in decentralized finance, followed by blockchains and centralized exchanges.

Meanwhile, XRP price may benefit from the ongoing ETF inflows. Data compiled by SoSoValue show that spot XRP ETFs have added over $48 million this month so far, more than Bitcoin and Ethereum, which have shed substantial assets in the past few months.

XRP price prediction: Technical analysis

The weekly timeframe chart shows that the XRP price has pulled back in the past few months as the crypto market crash accelerated.

The Relative Strength Index has moved to the oversold level of 30, its lowest level since August 2022. It is common for a coin to rebound after moving to the oversold level.

XRP has also formed a large falling wedge pattern, consisting of two descending, converging trendlines that are nearing the confluence point.

Therefore, the coin will likely rebound in the coming weeks, potentially reaching the key psychological level of $2.0, which is 45% above the current level.

Crypto World

BTC remains under pressure amid slumping stock market

Bitcoin has fallen back to the low end of its recent trading range during late-morning U.S. trading hours on Thursday as the tech-heavy Nasdaq tumbles 1.6%.

Trading at $65,700, bitcoin is now lower by 1.5% over the past 24 hours, while ether , just above $1,900, is down more than 2%.

The bitcoin price action — uncorrelated with the Nasdaq when that index is headed higher, but perfectly correlated when it heads lower — has become all too familiar for the crypto sector. And the failure to hold any sort of sustained bounce from last week’s panicky plunge has bulls seemingly in full capitulation mode.

Alternative’s well-followed Crypto Fear & Greed Index today fell to just 5, a level of “extreme fear” exceeding even what was seen during the multiple collapses of the 2022 crypto winter and the 2020 Covid crash.

Also raising eyebrows is longtime bull Geoff Kendrick from Standard Chartered, slashing his 2026 price targets for bitcoin, ether, solana, BNB and AVAX, while warning bitcoin could dip to as low as $50,000.

Crypto stocks lose ground

Coinbase (COIN) and Robinhood (HOOD) are among the largest losers on Thursday, each down more than 8%. Coinbase reports fourth-quarter results after the bell, but Robinhood’s fourth-quarter report earlier this week confirmed that the crypto bear market had taken a large bite out of trading revenues in the final three months of 2025 — and that was before the price action got really bad to begin 2026.

Other large decliners today include Strategy (MSTR), down 4.2%, Circle Financial (CRCL), down 4.3%, and Hut 8 (HUT), down 6.6%.

Crypto World

Juspay Strengthens Middle East Presence with DIFC Headquarters

Editor’s note: In today’s fintech landscape, global payment infrastructures are increasingly decisive in unlocking cross-border commerce. Juspay’s Dubai DIFC HQ marks a milestone in its expansion, signaling a focus on enterprise-grade payments in the Middle East. The move aligns with GCC digitization goals and regional fintech collaboration, and demonstrates how scalable payments platforms can drive growth across international markets. This release outlines Juspay’s strategy and what it means for merchants, banks, and developers navigating multi‑currency challenges.

Key points

- Juspay opens a regional headquarters in DIFC Dubai to expand its Middle East presence.

- The expansion aims to serve enterprise merchants, banks, and networks across GCC and MEASA.

- The DIFC hub enables closer engagement with partners to scale enterprise payments.

- Juspay powers 500+ enterprise merchants and banks globally with full‑stack payment orchestration and related services.

Why this matters

This expansion signals a long‑term commitment to open, interoperable payments across the MEA region, offering an institutional‑grade platform to handle multi‑currency and regulatory challenges. It also reinforces Dubai’s role as a fintech hub and positions Juspay to partner with regional banks, networks and merchants to scale payments across markets.

What to watch next

- Regional team growth and partnerships with banks and networks in DIFC and GCC.

- Adoption of Juspay’s payments orchestration platform by MEA enterprises.

- Regulatory and compliance readiness to support multi‑currency, cross‑border payments across GCC and MEASA.

- Expansion of services to additional markets in MEASA as demand scales.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Juspay Strengthens Middle East Presence with DIFC Headquarters

Dubai, February 10th, 2026 – Juspay, a global leader in payment infrastructure solutions for enterprises and banks, today announced its expansion into the Middle East with the opening of its regional headquarters in Dubai International Financial Centre (DIFC). This move marks an important step in Juspay’s international expansion, deepening its focus on serving enterprise merchants, banks, and financial institutions in the Middle East. The DIFC headquarters will support closer engagement with existing partners as enterprise payment demand continues to scale.

With digital commerce accelerating in the GCC region, rapidly scaling enterprises in sectors such as airlines, hospitality, e‑commerce, and financial services face increasing complexity driven by multiple regional currencies, evolving regulations, and diverse local payment methods.

To address this complexity, Juspay’s payments orchestration platform provides a unified & reliable payments stack, helping organizations optimize authorisation rates and costs, simplify compliance and scale seamlessly across GCC and global markets with institutional‑grade reliability.

Establishing operations in DIFC highlights Juspay’s long‑term commitment to the Middle East, with a focus on building , regulated, and enterprise‑grade payments infrastructure in the region. As a leading global financial hub, DIFC provides a strong regulatory environment, robust infrastructure, and access to high quality talent. Juspay plans to leverage this and work closely with regional banks, acquirers, networks, and ecosystem partners to deliver scalable and reliable payment solutions tailored for enterprises operating across global markets.

Commenting on the expansion, Sheetal Lalwani, Co‑founder & COO of Juspay, said: “Juspay has been building foundational payments infrastructure for large‑scale, mission‑critical commerce globally for over a decade. We are excited to bring these learnings to the Middle East and partner with merchants, banks, networks, and the broader ecosystem to build secure, scalable payments infrastructure that supports the region’s rapidly evolving digital economy.”

Salmaan Jaffery, Chief Business Development Officer at DIFC Authority said: “We are pleased to welcome Juspay to the Middle East, Africa and South Asia’s most significant fintech and financial services ecosystem. As a global leader in payment infrastructure, Juspay’s presence strengthens our growing digital economy, reinforces DIFC’s role as a catalyst for financial innovation and cements Dubai’s position as a top four global FinTech hub.”

With more than a decade of experience in scaling payment infrastructure, Juspay powers 500+ enterprise merchants and banks globally including Agoda, Amazon, Flipkart, Google, HSBC, IndiGo, Swiggy, Urban Company, Zepto & more. It offers a comprehensive suite of payment solutions that spans full‑stack payment orchestration, authentication, tokenisation, reconciliation, fraud solutions and more. The company also provides end‑to‑end, white‑label payment gateway and real‑time payments infrastructure tailored for banks. Together these capabilities enable merchants and banks to deliver seamless, reliable and scalable payment experiences to the end‑consumers.

Speaking about Juspay’s regional focus, Nakul Kothari, head of Middle East & APAC said, “By establishing our presence in the Middle East with DIFC, we continue our mission of building innovative payment solutions rooted in deep local market understanding. The region holds tremendous potential, and we are investing in long‑term partnerships with merchants and banks to help them build future‑ready payment stacks that can scale across markets.”

This expansion reflects Juspay’s long‑term vision of enabling open, interoperable, and accessible payments worldwide. With a team of over 1,500 payment experts solving payment complexities across Asia‑Pacific, Latin America, Europe, UK, and North America, Juspay is strategically positioned to reshape the Middle Eastern payments landscape. The company plans to grow its regional team, specifically targeting growth in business development, solution engineering, and partnerships.

About Juspay

Juspay is a leading multinational payments technology company, redefining payments for 500+ top global enterprises and banks. Founded in 2012, the company processes over 300 million daily transactions, exceeding an annualized total payment volume (TPV) of $1 trillion with 99.999% reliability. Headquartered in Bangalore, India, Juspay is powered by a global network of 1500+ payment experts operating across San Francisco, Dublin, São Paulo, Dubai, and Singapore.

Juspay offers a comprehensive product suite for merchants that includes open‑source payment orchestration, global payouts, seamless authentication, payment tokenization, fraud & risk management, end‑to‑end reconciliation, unified payment analytics & more. The company’s offerings also include end‑to‑end white label payment gateway solutions & real‑time payments infrastructure for banks. These products help businesses achieve superior conversion rates, reduce fraud, optimize costs, and deliver seamless customer experiences at scale.

To learn more about Juspay, visit: http://www.juspay.io

About Dubai International Financial Centre

Dubai International Financial Centre (DIFC) is one of the world’s most advanced financial centres, and the leading financial hub for the Middle East, Africa and South Asia (MEASA), which comprises 77 countries with an approximate population of 3.7bn and an estimated GDP of USD 10.5trn. With a 20‑year track record of facilitating trade and investment flows across the MEASA region, the Centre connects these fast‑growing markets with the economies of Asia, Europe, and the Americas through Dubai. DIFC is home to an internationally recognised, independent regulator and a proven judicial system with an English common law framework, as well as the region’s largest financial ecosystem of 46,000 professionals working across over 6,900 active registered companies – making up the largest and most diverse pool of industry talent in the region. Comprising a variety of world‑renowned retail and dining venues, a dynamic art and culture scene, residential apartments, hotels, and public spaces, DIFC continues to be one of Dubai’s most sought‑after business and lifestyle destinations. For further information, please visit our website: http://difc.ae, or follow us on LinkedIn and X @DIFC.

Crypto World

What Pioneers Need to Know

Here’s the latest hint from the Pi Network team that could affect millions within its community.

The Core Team behind the popular project has provided a comprehensive update on its Node infrastructure, revealing major progress on the promised decentralization while maintaining its phased rollout strategy.

They claimed that 16 million Pioneers have already migrated to the Mainnet, and Pi is trying to position its node system as the backbone of a large and identity-driven blockchain ecosystem. Additionally, they made some big claims about an upcoming “series of upgrades” that would require all Mainnet nodes to complete the first step by February 15.

Important reminder for Nodes: The Pi Mainnet blockchain protocol is currently undergoing a series of upgrades. The deadline for the first upgrade step is February 15. All Mainnet nodes must complete this step to remain connected to the network. More information is available here…

— Pi Network (@PiCoreTeam) February 11, 2026

Why Do Pi Nodes Matter

The post reiterated by the team explains that Pi Nodes represent the “fourth role” in Pi Network’s community, and they run on laptops and desktop computers, instead of mobile devices. Similar to nodes in other blockchain networks, they validate transactions and help maintain the distributed ledger.

However, since Pi Network does not use proof-of-work like Bitcoin, for example, as it relies on a consensus model based on the Stellar Consensus Protocol (SCP), they have different responsibilities. In this system:

- Nodes form trusted groups (quorum slices)

- Security circles from mobile miners create a global trust graph

- Consensus is achieved through trust relationships rather than mining competition

The team believes this makes the system designed to be more energy efficient and accessible.

Levels of Participation

The post also explained that the Pi Network ecosystem works with three levels of participation. Through the first one, the computer app, users can install the Pi App interface to check balances, chat, and access internal apps. Node participation enables them to verify blockchain validity, submit transactions, and run the blockchain component.

You may also like:

The third and most advanced option, called SuperNode, which is believed to be the “backbone of the blockchain,” allows Pioneers to participate in consensus, maintain ledger state, and synchronize network activity. They must operate 24/7 with stable connectivity and are selected by the Core Team upon KYC approval.

The Upcoming Upgrades

As mentioned above, the Core Team published on X that a series of upgrades is coming, which requires the first deadline step to be completed within the next few days. However, as it has happened during several of the team’s previous posts, the community was quick to lash out against some of the project’s controversial features.

Instead of commenting on the upcoming upgrades, many users questioned the lack of a clear strategy for the second migration and asked when their Pi tokens would be migrated to the Mainnet.

Others wanted more details on the upcoming upgrades and whether they would finally be able to shed light on the missing tokens.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Hyperliquid price confirms support at $28.40

Hyperliquid price is showing early signs of a bullish market structure shift after confirming strong demand at $28.40, setting the stage for a potential expansion toward higher levels.

Summary

- $28.40 reclaimed and defended, confirming demand after the breakout

- Bullish engulfing candles show strong momentum, supporting structure shift

- Holding support opens upside, with $48.02 as the next major resistance

Hyperliquid (HYPE) price action has entered a critical phase after reclaiming and successfully retesting a key high-timeframe support zone. Following a period of corrective consolidation, the market has responded with strong bullish impulses, suggesting that buyers are beginning to regain control. The $28.40 level, previously a major structural pivot, has now been confirmed as support, signaling a potential shift in the broader trend.

This development is significant, as market structure shifts often begin with decisive break-and-retest behavior at high-timeframe levels. With bullish momentum building and price holding above former resistance, Hyperliquid may be transitioning from a corrective phase into a new expansionary cycle.

Hyperliquid price key technical points

- $28.40 high-timeframe level has been reclaimed and retested, confirming strong demand

- Bullish engulfing candles signal impulsive buying pressure, supporting trend reversal

- Holding above support opens upside toward $48.02, the next major resistance

Hyperliquid’s recent price behavior has been characterized by impulsive bullish expansions, marked by strong bullish engulfing candles. These moves indicate aggressive buyer participation rather than slow accumulation, a key distinction when evaluating trend shifts.

After breaking above the $28.40 level, the price pulled back and reacted strongly from the value area high, confirming this region as newly established support. The first successful retest is often the most important, as it confirms whether former resistance has truly become demand. In this case, buyers stepped in decisively, reinforcing confidence in the bullish scenario.

This reaction suggests that market participants are willing to defend value above $28.40, shifting the balance of control away from sellers.

Liquidity sweep potential strengthens structure

One additional level to monitor closely is the 0.618 Fibonacci retracement positioned just below the current support zone. In many bullish structures, price briefly revisits this region to clear remaining sell-side liquidity before resuming its trend. A controlled retest of the 0.618 Fibonacci, followed by a strong bullish reaction, would further strengthen the case for a higher low.

Such behavior would confirm that the market has successfully absorbed supply and transitioned into accumulation above support. Importantly, this would solidify the shift in market structure from bearish or neutral to bullish.

Until that occurs, short-term volatility remains possible. However, as long as the price maintains acceptance above $28.40 on a closing basis, the broader bullish thesis remains intact.

Market structure shift opens upside expansion

From a market structure perspective, Hyperliquid appears to be transitioning into a higher-high and higher-low sequence. The impulsive nature of the recent move higher, combined with the successful support retest, suggests that the corrective phase may have concluded.

If price continues to hold above support and builds a higher low, the probability of a bullish expansion increases. In this scenario, the next major upside target sits near the high-timeframe resistance around $48.02. This level represents a prior rejection zone and is likely to act as the next area of supply.

A move toward this region would align with classic trend continuation behavior following a structural flip.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Hyperliquid is positioned favorably as long as the $28.40 support level continues to hold. Short-term pullbacks remain healthy within bullish trends, particularly if they result in higher lows above key support.

For now, the evidence suggests that Hyperliquid has successfully completed a bullish retest and is beginning to shift the market structure. If buyers remain active, the path toward higher resistance levels remains open, with $48.02 emerging as the primary upside objective in the coming phase.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports17 hours ago

Sports17 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World19 hours ago

Crypto World19 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video14 hours ago

Video14 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process