Crypto World

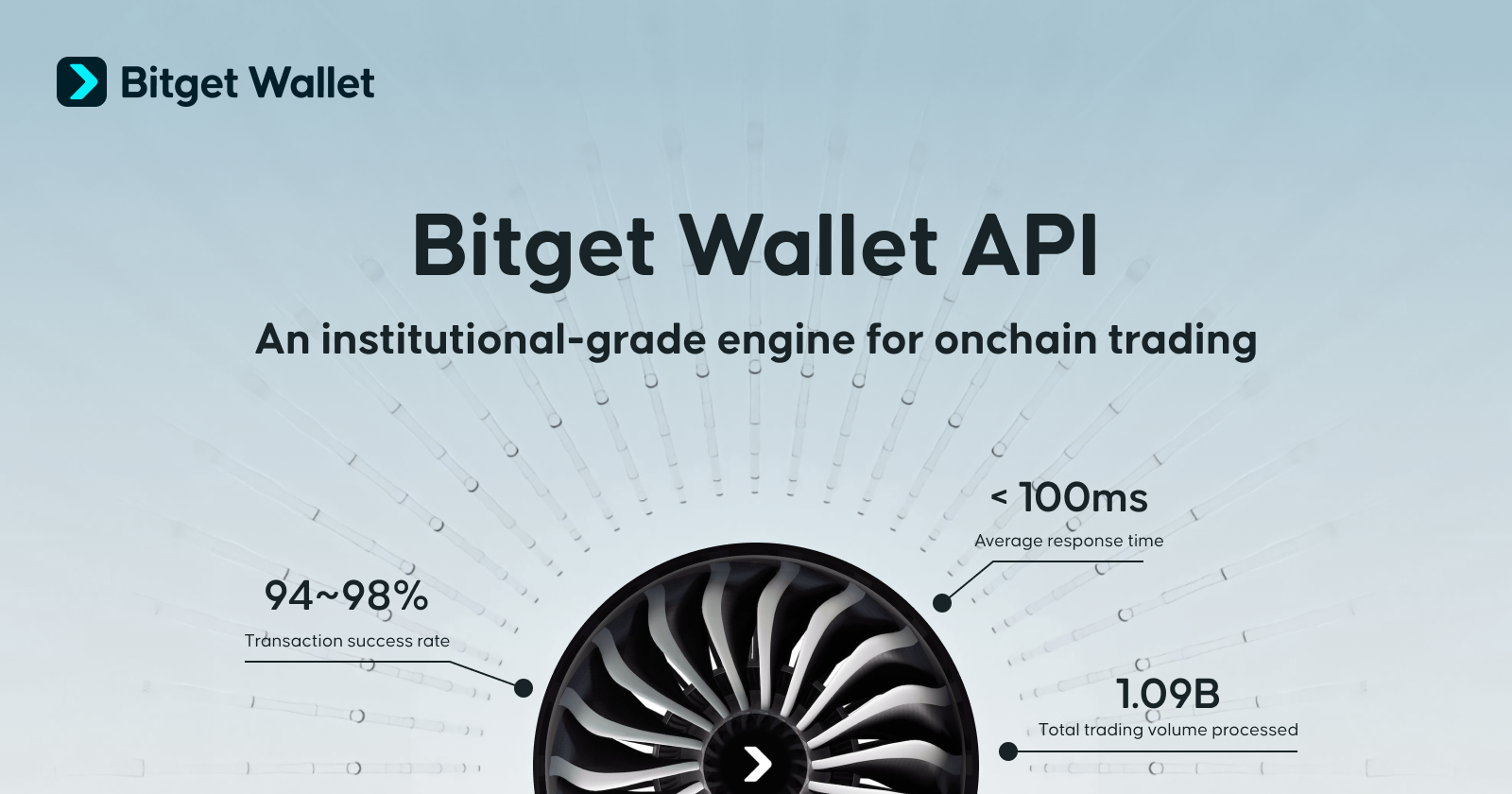

Bitget Wallet Expands Into B2B With Trading Infrastructure API

Launch signals strategic move to provide trading execution and market data services to fintech platforms.

San Salvador, El Salvador, February 5, 2026 – Bitget Wallet, the everyday finance app, has launched Bitget Wallet API, marking a strategic expansion into business-to-business infrastructure as more fintech firms and digital asset platforms look to offer onchain trading services at scale. The API allows partners to access trading execution, market data, and cross-chain asset transfers through a single integration, reducing the need for companies to build and maintain complex backend systems internally.

The move reflects a broader shift toward fintech platforms relying on specialized infrastructure rather than building full technology stacks in-house. BCG estimates B2B fintech services will grow at a 32% annual rate to reach $285 billion in revenues by 2026, alongside rapid growth in Wallet-as-a-Service and embedded finance. At the same time, decentralized exchange trading hit a five-year high in January 2026, with more than $400 billion traded, highlighting DEXs’ growing role as a core source of market liquidity.

“Onchain trading is reaching a wider audience, but the underlying infrastructure is still fragmented and difficult to operate at scale,” said Alvin Kan, COO of Bitget Wallet. “By making the same systems that run our consumer wallet available to partners, we’re supporting companies that want to build professional trading products without taking on unnecessary operational complexity. This makes a step beyond being solely a user-facing wallet toward supporting the broader financial ecosystem.”

At the core of the API is Bitget Wallet’s proprietary DEX-based trade execution engine, which currently handles about 80% of all trades executed within Bitget Wallet. The Trading API aggregates liquidity from 80 decentralized trading protocols and supports trading across Ethereum, Solana, Base, Polygon, Arbitrum, Morph and BNB Chain. By using intelligent routing to compare quotes across venues and select execution paths, the system is designed to improve pricing consistency and reduce failed trades. Bitget Wallet said recent transaction success rates across major networks have remained in the mid-to-high 90% range, with the service operating under a 99.9% availability target.

To support reliable execution, the API includes Sentinel, an automated monitoring system that continuously reviews liquidity sources and removes unstable or abnormal pools before trades are placed. Transactions are also routed through MEV-protected nodes, which are designed to limit interference such as front-running during periods of market volatility. These measures are intended to address common operational challenges faced by trading platforms as transaction volumes increase.

In addition to execution, the Market API provides real-time pricing and activity data across 33 blockchains, covering millions of cryptocurrencies as well as more than 200 widely traded stocks through tokenized market data. The service includes address-level insights, such as activity linked to experienced market participants, alongside automated risk indicators that help flag unusual assets or trading patterns. The API suite also includes a Cross-chain API, which allows assets to be converted and transferred between blockchains in a single process, with built-in tracking that gives users and platforms visibility into transaction progress from start to finish.

Users can visit the Bitget Wallet website for more information.

About Bitget Wallet

Bitget Wallet is an everyday finance app designed to make crypto simple, secure, and usable in daily life. Serving more than 90 million users worldwide, it offers an all-in-one platform to send, spend, earn, and trade crypto and stablecoins through blockchain-based infrastructure. With global on- and off-ramps, the app enables faster and borderless onchain finance, supported by advanced security and a $700 million user protection fund. Bitget Wallet operates as a fully self-custodial wallet and does not hold or control user funds, private keys, or user data. Transactions are signed by users and executed on public blockchains.

For more information, visit: X | LinkedIn | Telegram | YouTube | TikTok | Discord | Facebook

Crypto World

Aptos Holders Pass Proposal to Hard Cap APT Supply at 2.1 Billion Tokens

Participating token holders voted nearly unanimously to pass the Aptos Foundation’s proposal to shift toward deflationary tokenomics, which is now awaiting execution.

The Aptos community passed a proposal to introduced deflationary tokenomics in a vote that ended on March 1. The now approved change sets a hard cap on the total supply of APT tokens at 2.1 billion, aligning with a broader shift towards performance-driven tokenomics, as The Defiant previously reported.

The proposal aims to enhance the deflationary nature of the APT token and received substantial backing, with 335.2 million APT voting in favor and only 1,500 APT opposing it, according to the Aptos Governance page for the proposal. However, only 39% of voting power participated, just above the 35% that the community requires for the vote to proceed. The proposal is now awaiting execution, per the blockchain’s governance website.

This initiative reflects a strategic pivot by the Aptos Foundation, which focuses on developing the Aptos blockchain, a Layer 1 network optimized for both scalability and security. Prior to this vote, the maximum APT token supply was infinite, but the change seeks to limit future inflation and reward long-term stakeholders by reducing staking rewards and increasing gas fees.

This proposal also includes using transaction fees for token buybacks, evidently also in an attempt to increase value for token holders.

The Aptos Foundation’s decision comes at a time when the APT token has been hitting new lows, most recently on Feb. 23, when it reached $0.79, per CoinGecko data. The token is down over 85% on the year, though it got some relief in recent weeks, up 17% over the past seven days. APT is trading around $0.96 at press time, up about 3.5% in the past 24 hours as the broader crypto market rallies.

This article was generated with the assistance of AI workflows.

Crypto World

Iran’s $7.8B Crypto Shadow Economy Just Got a Lot More Interesting

While the world watches missiles fly over Iran, there’s a parallel war happening on-chain.

And it’s been running quietly for years.

Iran legalized Bitcoin mining back in 2019. The deal? Licensed operators get subsidized electricity, and mined BTC goes straight to the central bank. The government then uses it to pay for imports, machinery, fuel, consumer goods, without touching a single U.S.-controlled bank.

Clean. Borderless. Almost invisible.

The numbers are staggering. Chainalysis clocked Iran’s crypto ecosystem at $7.78 billion in 2025, bigger than the GDP of the Maldives, and growing faster than the year before.

This isn’t a fringe workaround. It’s infrastructure.

The IRGC doesn’t just participate, It dominates

IRGC-linked addresses accounted for more than 50% of total Iranian crypto inflows in Q4 2025, with over $3 billion received last year. And those are only the wallets we know about — the ones already flagged on sanctions lists. The real number is almost certainly bigger.

The U.S. Treasury has since sanctioned two UK-registered crypto exchanges — Zedcex and Zedxion — for facilitating IRGC transactions. One of them processed over $94 billion in transactions since 2022. Let that sink in.

Stablecoins are the other half of the equation

Iran’s central bank accumulated at least $507M in USDT, purchased systematically through a network of around 50 crypto wallets — while the rial hit a historic low of 1.47 million per dollar and inflation hit 42.5%. The stablecoin play wasn’t saving the rial. It was replacing it.

Meanwhile, Iran’s defense export center Mindex now openly accepts crypto for weapons exports. Missiles. Aircraft. Tanks. Ships. The website lists “the cryptocurrency agreed upon in the contract” as an accepted payment method.

This is no longer just sanctions evasion. It’s a parallel economy with its own rails.

Then things got messy

In June 2025, Nobitex — Iran’s largest crypto exchange with over 11 million users — was hit by a $90M cyberattack attributed to Israel-linked group Predatory Sparrow. The attackers didn’t cash out. They moved the funds to vanity wallet addresses referencing the IRGC, ensuring the money stayed permanently frozen. This was financial warfare, not theft.

The fallout was immediate. Inbound transactions to Nobitex dropped 70% year-on-year. June saw a 50% contraction in crypto flows compared to the previous year. July slumped 76%.

Then Tether piled on. In July 2025, Tether executed its largest-ever freeze of Iranian-linked funds, blocking 42 crypto addresses, over half of which were heavily tied to Nobitex.

Iran’s response? The central bank imposed overnight trading restrictions, limiting exchange operating hours to between 10AM and 8PM. When the financial system cracks, the first instinct is control.

But here’s what makes this story bigger than sanctions

Iran’s IRGC-linked mining operations have been drawing colossal amounts of power at heavily subsidized rates — effectively stealing electricity from the national grid. The cost of power outages to Iran’s economy is estimated at over $25 billion annually. Ordinary Iranians sit in the dark while the regime mines Bitcoin.

And yet — those same Iranians also use crypto to survive. For most people in Iran, crypto is primarily about access. Hedging against 40%+ inflation. Moving savings before the rial loses another 20%. Getting money out during internet blackouts.

Around 22% of the Iranian population now uses cryptocurrencies. Not for speculation. For survival.

So what happens now?

Fresh U.S. and Israeli strikes are targeting the infrastructure that keeps all of this running. Power grids. Mining operations. Financial nodes. The same system the regime uses to fund weapons exports is the same system ordinary Iranians use to protect their savings.

That dual reality, state weapon AND civilian lifeline, is what makes this situation unlike anywhere else in the world.

The conflict isn’t just military. It’s financial. And it’s playing out on a public blockchain, for anyone paying attention.

Crypto World

US Authorities Seek to Recover $327K USDt from Romance Fraud Scheme

A February report claimed that Tether had frozen about $4.2 billion worth of its USDt stablecoin allegedly connected to illicit activities since 2023.

The US Justice Department is seeking to recover about $327,829 worth of stablecoins allegedly connected to a money laundering scheme part of an online romance scam.

In a Monday notice, the US Attorney’s Office for Massachusetts said it had filed a civil forfeiture action to recover more than 327,829 of Tether’s USDt (USDT). According to authorities, the funds were tied to an alleged online romance fraud scheme perpetrated by an individual named “Linda Brown” which targeted a Massachusetts resident starting in 2024.

“Some of the victim’s funds were traced to multiple unhosted cryptocurrency wallets, which were seized in August 2025,” said the Justice Department. “The complaint alleges that all cryptocurrency associated with those wallets was property involved in money laundering.”

The notice of the romance scam came about three weeks after people in many countries celebrated Valentine’s Day. The US Attorney’s Office for the Northern District of Ohio issued a warning before the holiday about romance scams, informing people not to “send money, gift cards, or cryptocurrency to someone you have not met in person.”

Related: February crypto losses hit lowest level since March 2025, says PeckShield

Cointelegraph reached out to Tether for comment, but had not received a response at the time of publication.

Tether froze $4.2 billion tied to illicit activity in previous three years

On Friday, a spokesperson for the stablecoin issuer reportedly told Reuters that Tether had frozen about $4.2 billion worth of USDt connected to suspected criminal activity since 2023.

The company has the ability to freeze its stablecoin by blacklisting certain wallet addresses. For example, Tether reported in February that it had frozen about $544 million allegedly tied to unlawful betting platforms and money laundering at the request of Turkish authorities.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

Bitcoin futures demand sinks to 2024 lows: Are institutions exiting?

Bitcoin (CRYPTO: BTC) staged a cautious recovery, rising roughly 10% from a Saturday retest near $63,000 as traditional markets moved in a contrasting direction amid geopolitical tensions in the Middle East. The uptick offered a measure of relief for bulls, yet a closer inspection of the derivatives landscape revealed a more tepid appetite for risk among large players. Futures demand deteriorated to levels not seen since 2024, even as other channels indicated ongoing institutional exposure. Across major exchanges, open interest hovered around $32 billion on Sunday, a 20% retreat from a month earlier, signaling that leverage had begun to unwind even as traders remained engaged in the market.

The immediate price action has not resolved the longer-term tug-of-war between bulls and bears. While spot markets showed resilience, the futures market has shown signs of cooling off. The combination of a price rebound and waning futures interest paints a nuanced picture: institutions appear to be staying put, but with less aggressive positioning than in prior cycles. This divergence underscores a broader theme in crypto markets—steadfast core demand from long-term holders and institutions coexists with episodic volatility that tests short-term trading appetite.

The narrative around where institutional capital stands is further complicated by evidence from the options and futures segments. The average activity in Bitcoin futures remains robust in some respects, with notable players continuing to demonstrate an ongoing, if selective, appetite for exposure. Data from market analytics providers illustrate how the market is balancing risk and reward: while price momentum has faded from peak levels, the structural support from large holders and listed companies remains intact. In particular, the presence of significant on-chain holdings by publicly listed companies and steady ETF inflows suggests that institutions continue to anchor demand for Bitcoin even when leverage cools.

Market reaction and key details

The futures landscape shows a divergence between price action and leverage. The Bitcoin futures aggregate open interest on major exchanges declined to $32 billion on Sunday, marking a 20% decrease from the prior month. Even after adjusting for price moves, the measure signals cooling demand for long exposure in the near term. This cooling is not necessarily a retreat by institutions; rather, it may reflect a interim reassessment as market participants wait for clearer catalysts. In parallel, the annualized premium on Bitcoin monthly futures slipped to 2%, the lowest in roughly a year, underscoring a shift away from the exuberant bullish tilt that characterized earlier phases of the cycle.

The premium, or basis rate, for monthly futures has historically tended to run higher than the spot price as a compensation for the longer settlement horizon. A typical neutral range would be roughly 5% to 10%. The fact that the basis has lingered around the 2% level for an extended period—spanning a year that included a 50% rally between April and May 2025—speaks to a market that has not consistently priced in outsized bullish momentum in the near term. This pattern aligns with a broader sentiment shift as investors weigh macro uncertainty and regulatory signals against the asset’s fixed-supply characteristics.

Despite these indicators, Bitcoin’s performance relative to traditional risk-on assets remains mixed. Bitcoin has underperformed Gold and equity indices in certain periods, prompting a recalibration of expectations among risk assets. However, there is still substantial evidence of ongoing institutional involvement. Bitcoin ETFs, for instance, trade in excess of $3 billion daily on average, a metric that highlights persistent demand from some of the world’s largest mutual and pension fund managers. This ETF activity provides a floor of demand that buffers the market against abrupt, full-on selling pressure.

On the on-chain front, publicly listed companies continue to accumulate Bitcoin, reinforcing a structural bid from corporate treasuries. Notable holders include Strategy (MSTR US), MARA Holdings (MARA US), XXI (XXI US), and Metaplanet (MPLTF US). In total, more than $79 billion in Bitcoin sit on-chain with these entities, a level that argues against a wholesale retreat by institutions even if leverage is temporarily resting. Countries such as Bhutan, El Salvador, and the United Arab Emirates have also pursued exposure to Bitcoin, signaling a broader, albeit selective, alignment of public sector and corporate actors with the asset class.

Looking at derivatives more granularly, odds and hedges within the options market portray a resilient backdrop. The put-to-call premium for Bitcoin options has remained relatively tepid, hovering near 0.7, indicating a tilt toward upside bets rather than extensive bearish plays. This dynamic persisted even after a brief uptick in demand for bearish strategies on a single trading day, suggesting that the market did not sustain distress or systemic risk fears despite the recent volatility. The overarching message from the derivatives data is one of guarded resilience: hedging activity remains present, but there is no clear signal of a structural, multi-month downturn.

The breadth of activity in the CME space further strengthens the sense that institutions have not exited the market. Open interest in Bitcoin futures on CME remains a meaningful indicator of institutional engagement, with around $7.5 billion still outstanding—a figure that underscores ongoing activity even as other indicators show cautious positioning. The balance between sell-side pressure and corresponding buy-side commitments continues to hold, implying that the market remains in a state of negotiated risk rather than a wholesale capitulation.

Taken together, the data points paint a picture of a market that is maneuvering through a transitional phase. Prices can still move higher as buyers re-enter on dips, but the persistent ceiling around prior all-time highs and the current fragility of some bullish signals suggest that any advance will likely require new catalysts—be it macro developments, regulatory clarity, or significant ETF inflows—to sustain momentum over the medium term. In this environment, Bitcoin remains a compelling case study in how a fixed-supply asset interacts with diversified institutional demand, market maturity, and evolving governance around digital assets.

Market context: The current stretch sits at the intersection of evolving macro dynamics, ETF flows, and a still-developing institutional landscape for digital assets. While price action has improved, the rhythm of hedges, open interest, and basis rates points to a market that is absorbing shocks more gracefully than in earlier cycles, aided by steady on-chain and ETF-backed demand and a continued, selective institutional footprint.

Why it matters

The ongoing interplay between price performance and derivatives signals matters for traders, investors, and builders in the crypto space. A sustained price rally absent corresponding growth in futures open interest would risk overheating risk controls; conversely, a sustained level of open interest alongside a steady price path would indicate durable institutional interest. The presence of large corporate holders and persistent ETF inflows punctuates the story: institutions are not pulling out, even if they are not aggressively leveraging, and this could influence how market participants price risk, allocate capital, and plan for liquidity in stressed conditions.

From a systemic perspective, the divergence between spot strength and derivatives caution underscores a nuanced market maturity. As crypto markets evolve, the willingness of major funds and companies to allocate crypto exposure—through direct balance-sheet purchases, public equity-linked holdings, or ETF participation—shapes a pathway toward broader, steadier adoption. The data also suggest that while the friction points—volatility, basis rates, and short-term momentum—may persist, the underlying demand from institutional layers remains a critical anchor for liquidity and price discovery in a market that still holds a relatively small share of global financial allocations.

What to watch next

- Monitor CME open interest and overall futures activity for the next 2–4 weeks to gauge whether institutions maintain exposure or begin to recalibrate risk after recent volatility.

- Watch Bitcoin’s price action around key support levels (e.g., $60k) to see if the current bounce sustains or falters.

- Track ETF inflows and new listings to assess whether institutional demand seeds a renewed price floor or accelerates upside momentum.

- Observe on-chain accumulation trends by publicly listed companies and major corporate holders for signs of renewed balance-sheet strategy shifts.

- Follow regulatory developments and macro catalysts that could reframe risk sentiment for digital assets and related products.

Sources & verification

- Bitcoin futures aggregate open interest data from CoinGlass showing $32 billion, down 20% from a month prior.

- Bitcoin monthly futures annualized premium data from Laevitas.ch indicating a 2% level—the lowest in a year.

- Information on Bitcoin ETFs trading over $3 billion per day on average and the involvement of large mutual/pension fund managers.

- On-chain and corporate holdings context, including public-company BTC ownership (Strategy/MSTR, MARA, XXI, MPLTF).

- Derivatives signals, including put-to-call premiums near 0.7 on Deribit (source: Laevitas.ch and Deribit data).

Crypto World

Peter Schiff Mocks Michael Saylor After Strategy Adds 3,015 New BTC

TLDR

- Peter Schiff reacted to Michael Saylor’s latest Bitcoin purchase with a sarcastic congratulatory message.

- Michael Saylor announced that Strategy acquired 3,015 Bitcoin for about $204.1 million.

- Strategy’s total Bitcoin holdings reached 720,737 Bitcoin after the new acquisition.

- Peter Schiff argued that Saylor continued to average down a losing trade during market volatility.

- Schiff claimed that gold continued to outperform Bitcoin and traded above $5,400.

The market saw a new debate today as Michael Saylor expanded his Bitcoin holdings with another large purchase, and the move quickly drew a sharp reaction from Peter Schiff, and both sides repeated their long-held views as community discussions grew. The announcement detailed a fresh acquisition of 3,015 BTC, and the news pushed new conversations across trading circles. Reactions surfaced fast as both supporters and critics responded with firm and clear messages.

Peter Schiff Challenges Saylor After New BTC Move

Peter Schiff issued a short message that referenced Saylor’s latest move, and he framed it with clear sarcasm. He wrote that Saylor “brought Strategy’s average price back under $76,000,” and the statement spread fast.

He argued that Saylor continued “averaging down a losing trade,” and he claimed the firm faced growing unrealized losses. He added that gold kept trading higher when compared with Bitcoin and kept pushing his point.

He repeated that gold traded above $5,400 and suggested Saylor could have directed the purchase toward gold instead. He stated his view plainly and kept his long-running position unchanged.

The crypto community responded with strong comments, and users defended Saylor’s strategy with confidence. They pointed to recent activity and said the purchase reinforced trust among smaller buyers.

Strategy Expands Bitcoin Holdings With New Purchase

Saylor confirmed that Strategy acquired 3,015 BTC for about $204.1 million, and he released the update online. He reported an average purchase price of about $67,700 per coin.

The firm now holds 720,737 BTC worth about $54.77 billion, and Saylor repeated his focus on long-term value. He said Strategy continued to follow its chosen plan.

Community members highlighted the new average cost of $75,985 per coin and shared charts showing the updated levels. Traders echoed Saylor’s stance and compared the numbers with current price action.

Saylor also repeated his outlook and said Bitcoin could move above $200,000 soon. He pushed this view as part of his ongoing public comments.

Market Reactions Grow After Latest BTC Announcement

Users linked Saylor’s repeated purchases with increased confidence across smaller trading groups. They argued the move added fresh energy to ongoing discussions.

Commentators responded with mixed views and tracked charts that compared Bitcoin with gold prices. They used new metrics and pointed to changing ratios.

Analysts said the timing of the new purchase placed more attention on Bitcoin’s short-term movement. They examined updated values and watched price behavior closely.

Saylor continued to promote his forecast as he shared data on long-term adoption. He kept pointing to the expanding global interest.

New figures from the purchase circulated through crypto channels and formed the core of ongoing conversations. Updates included fresh calculations tied to the Strategy’s holdings.

Crypto World

Solana Mobile Stack Goes Global as OEM Push Begins at MWC 2026

TLDR:

- Solana Mobile shipped 200,000+ devices across Saga and Seeker, generating over $5B in onchain volume.

- The SMS stack integrates with Visa, Stripe, PayPal, and Western Union on Solana’s live financial rails.

- Stablecoin volume on blockchains hit $27.6T in 2024, surpassing combined Visa and Mastercard totals.

- Over 75,000 users claimed SKR at launch; 46% staked immediately, signaling strong early retention.

Solana Mobile unveiled its Solana Mobile Stack for Android device manufacturers at MWC 2026 in Barcelona. The modular toolkit connects handsets to Solana’s blockchain infrastructure at the hardware level.

It follows the shipment of over 200,000 devices and $5 billion in onchain transaction volume. The company now targets OEMs seeking recurring revenue beyond device sales.

Solana Mobile Stack Brings Hardware Crypto Wallets to Android Manufacturers

According to a press release, the stack bundles three core components: Seed Vault, Seeker Wallet, and the SKR token.

Seed Vault integrates with a device’s existing secure element and trusted execution environment. Users authenticate via biometrics, similar to tap-to-pay. No seed phrases or third-party custodians are involved.

Seeker Wallet sits on top, giving users the ability to send, receive, buy, and sell digital assets. Peer-to-peer transfers and cross-border payments run at near-zero cost.

Payment networks including Visa, Stripe, Western Union, and PayPal already operate on Solana. That means users connect to live financial rails from day one.

The stack is modular and opt-in. According to the official press release from Barcelona, it does not interfere with Google Mobile Services, payments certification, or Android security approvals. OEMs can deploy it by region, SKU, or product line. No platform fragmentation risk applies.

MediaTek, the leading smartphone chip vendor by global shipment volume, has opened its development platform to Solana Mobile.

The stack runs production-ready on MediaTek Dimensity chipsets. Qualcomm chipset support is also included. Trustonic’s Kinibi TEE architecture is integrated for GlobalPlatform-compliant security.

SMS Production Data and OEM Revenue Model Detailed at MWC 2026

Solana Mobile has six-plus months of real-world data from its Seeker device. The network reports 85,000-plus weekly active wallets and over $5 billion in onchain volume.

More than 500 apps are published on the Solana dApp Store. Around 4,000 active developers are building across the ecosystem.

Devices have shipped to 50 countries. The US, Hong Kong, Japan, and South Korea lead sales. Solana reports 50 to 150 million monthly active addresses on its blockchain, per the press release.

Revenue sharing is built into the model. OEMs earn on transaction fees, staking commissions, and ecosystem activity as their installed base grows. The SKR token launched with over 75,000 claimants. Of those, 46% staked their tokens immediately.

Stablecoin transaction volume on blockchains reached $27.6 trillion in 2024, according to GSMA data cited in the announcement.

That figure exceeded the combined volumes of Visa and Mastercard. Mobile money transactions in emerging markets alone totalled $1.68 trillion that same year.

Regional deployment strategies differ. Emerging markets like India, Brazil, and Mexico focus on stablecoins and yield.

Developed Asia emphasizes self-custody and portfolio tools. Europe targets stablecoin yield and bank connectivity.

Crypto World

Japanese payments firm PayPay, partial owner of Binance Japan, seeks $1.1 billion IPO

PayPay, a SoftBank Corp-backed payments company that owns a 40% stake in Binance Japan, is seeking to raise as much as $1.1 billion in a U.S. initial public offering, Reuters reported Monday.

The Tokyo-based company and a selling shareholder plan to offer 55 million American depositary shares priced between $17 and $20 each, according to the report. At the top end of that range, the offering would value PayPay at more than $10 billion.

PayPay is Japan’s largest cashless payments provider, with more than 70 million registered users. The company’s app allows consumers to make mobile payments at stores, transfer money and manage digital balances, as Japan steadily shifts away from cash.

The shares are expected to trade on the Nasdaq under the symbol “PAYP.” The listing was initially slated to launch before markets opened on Monday but was postponed after global markets were rattled by this weekend’s attack on Iran, Reuters reported earlier.

The IPO comes as fintech firms test investor appetite for new listings amid volatile equity markets and rising geopolitical risk. A successful debut would mark one of the larger Japanese listings in the U.S. in recent years and provide SoftBank with another publicly traded asset tied to its broader digital finance strategy.

PayPay moved deeper into crypto through a capital and business alliance with Binance Japan in October. The partnership aimed to link digital payments with crypto, letting Binance Japan users fund purchases and withdraw proceeds through PayPay Money. A representative for Binance did not respond to a request for comment in time for publication.

Crypto World

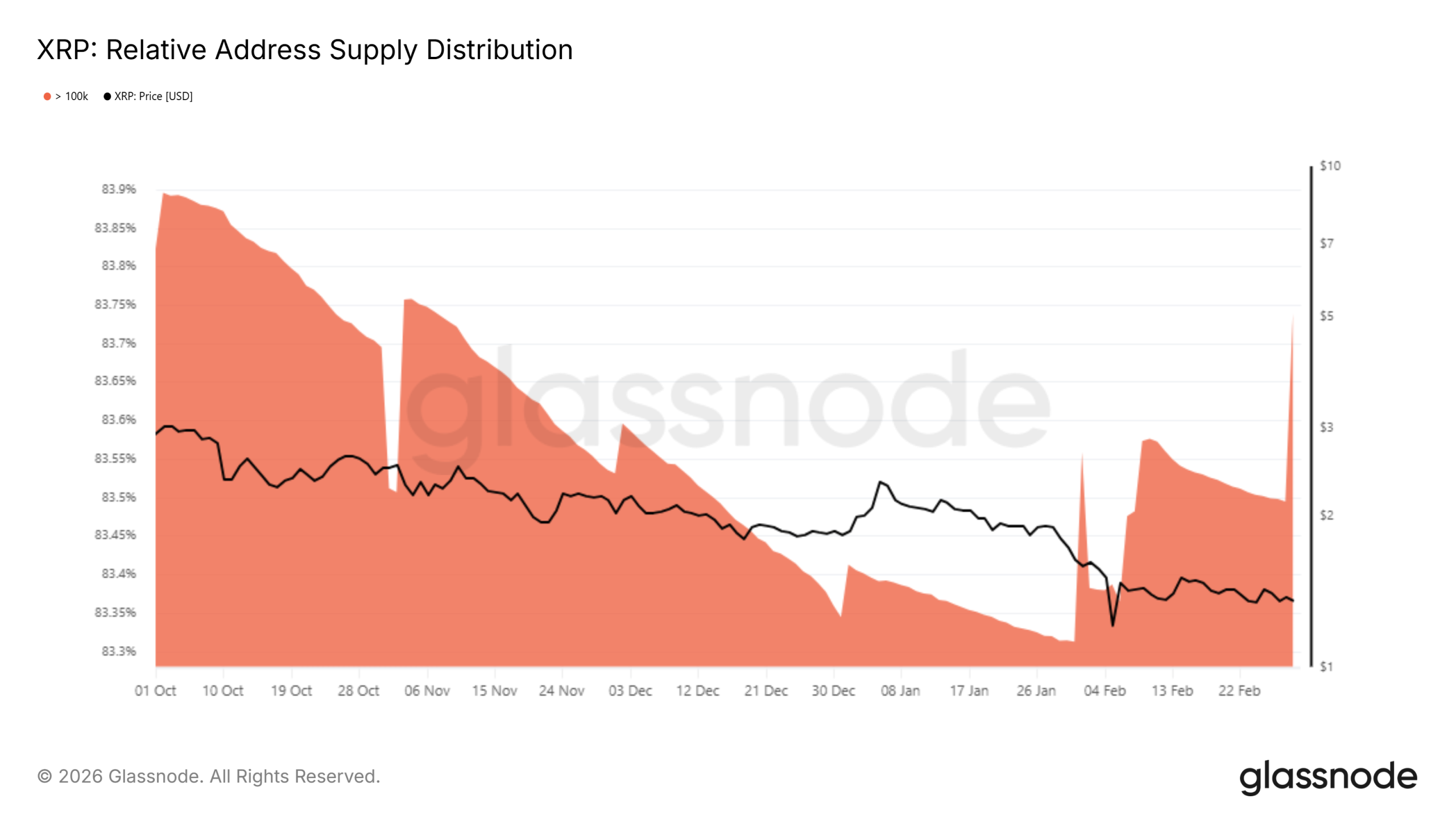

Is XRP Price at Risk as Profit Taking Hits Monthly High?

XRP price continues to trade under a prolonged downtrend that has limited sustained upside for months. The altcoin has repeatedly failed to reclaim key resistance levels. While short-term sentiment shows mild improvement, the broader macro structure remains tilted toward caution.

Recent on-chain developments introduce a complex dynamic. Whale accumulation suggests confidence in a rebound. At the same time, profit-taking activity and weakening network growth highlight structural risks that could cap recovery attempts.

XRP Whales Are Buying

Large XRP holders appear committed to accumulation despite challenging market conditions. Throughout February, addresses holding more than 100,000 XRP increased their collective ownership. These wallets now control 83.7% of the total XRP supply.

This concentration indicates strong conviction among high-capital participants. Whales often accumulate during consolidation phases to position for future upside. Their buying suggests expectations of price recovery rather than imminent distribution. Sustained accumulation can reduce circulating supply and stabilize volatility.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bearish Signals Appear

However, early signs of profit-taking are emerging on-chain. The network realized a profit and loss metric surged to $207 million over the past 24 hours. This marks the first significant wave of profit booking in nearly a month.

While moderate profit realization is healthy for market structure, accelerated selling could undermine bullish setups. If short-term gains motivate broader distribution, XRP’s recovery may stall. Monitoring realized profit trends will be critical for assessing sustained upside potential.

New address momentum paints a more cautious macro picture. This indicator compares monthly (red) new address growth against yearly (blue) trends. When monthly growth falls below yearly averages, it signals contraction in network activity.

Since early December 2025, XRP’s monthly new address growth has remained below yearly levels. This divergence reflects declining on-chain engagement and reduced network utilization. Weak onboarding often correlates with slower capital inflows.

Persistent contraction limits organic demand. Without consistent expansion in active addresses, price recovery becomes dependent on existing holders rather than new participants. Historical data show that prolonged divergence can suppress rallies until growth normalizes.

Reversal of this trend would signal improving fundamentals. A rise in monthly new addresses above yearly averages would indicate renewed adoption. Until that shift occurs, macro fundamentals remain fragile despite whale optimism.

XRP Price Downtrend Persists

XRP is trading at $1.34 at the time of writing, hovering directly above critical support at the same level. The altcoin remains capped below $1.47 resistance. A descending trendline active since early 2026 continues to restrict upward movement.

If bearish momentum strengthens, XRP could lose the $1.34 support. Combined with increasing profit-taking, such a breakdown may push the price toward $1.28. Further weakness could extend losses to $1.21, reinforcing the prevailing downtrend structure.

Conversely, stabilization in realized profits would support consolidation above $1.34. Holding this level may weaken the descending resistance line. A decisive breakout above $1.47 would invalidate the bearish thesis. Sustained momentum could then propel XRP toward $1.58, marking a structural shift in market sentiment.

Crypto World

Court Dismisses Class Action Lawsuit Against Uniswap

The decision marks a legal milestone for DeFi by reaffirming the immunity of decentralized platforms from liability for third-party misuse.

A New York court has dismissed a class action lawsuit against Uniswap Labs, underscoring the decentralized nature of the protocol and the challenges of holding developers accountable for third-party misuse.

The ruling, delivered by Judge Katherine Polk Failla, emphasizes that Uniswap Labs cannot be held liable for fraudulent activities conducted by third parties on their platform, drawing parallels to Venmo or Zelle regarding user misuse.

The court’s decision involved dismissing federal claims with prejudice and state-law claims without prejudice, further reinforcing the legal standing of smart contract developers. This ruling follows the affirmation by the Second Circuit Court of Appeals, highlighting that creators of smart contracts are not liable for third-party misconduct.

Founded by Hayden Adams in 2018, Uniswap decentralized exchange on Ethereum that pioneered the Automated Market Maker (AMM) model. The platform has been at the forefront of the DeFi movement, providing a marketplace for buyers and sellers without intermediaries.

This legal victory not only secures Uniswap’s operational model but also sets a precedent for other decentralized platforms facing similar legal challenges.

This article was generated with the assistance of AI workflows.

Crypto World

Core Scientific turns lower after Q4 results disappoint

Core Scientific (CORZ), a bitcoin mining and digital infrastructure company, reported fourth-quarter revenue of $79.8 million for the period ended Dec. 31, compared with $94.93 million a year earlier. Consensus forecasts were for revenue of $122.08 million, according to LSEG data.

The company posted a loss of $0.42 per share, versus expectations for a loss of $0.08 per share.

The weaker results come as bitcoin miners continue to adjust to the April 2024 halving, which cut block rewards in half and squeezed margins across the industry. A higher network hash rate and rising energy and infrastructure costs have pressured profitability, particularly for operators still scaling new capacity.

Core has been repositioning itself beyond pure self-mining and toward hosting and colocation services for high-performance computing clients, including AI workloads. CEO Adam Sullivan said the company is leaning into that strategy.

“We’re now past the halfway point on our existing builds and scaling our colocation platform into a 1.5 gigawatt pipeline of leasable capacity,” Core Scientific CEO Adam Sullivan, said in a statement. “With a multi-geography footprint and proven execution, we’re accelerating RFS timelines across multiple sites to position the company for durable growth.”

As part of this plan, the company announced that it is expanding into Texas, adding about 430 mega watts of gross power capacity. It also increased capacity across other regions by about 300 mega watts.

CORZ shares were lower by 4.5% in after hours trading.

Meanwhile, Riot Platforms (RIOT), a bitcoin mining and data center development company, reported fourth-quarter revenue of $647.4 million, up from $376.7 million a year earlier. Analysts had expected revenue of $157.4 million, including $136 million from bitcoin mining and $21.3 million from engineering.

RIOT shares were flat after hours.

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Iris Top

-

Politics4 days ago

Politics4 days agoITV enters Gaza with IDF amid ongoing genocide

-

Business6 days ago

Business6 days agoTrue Citrus debuts functional drink mix collection

-

Tech2 days ago

Tech2 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports3 days ago

The Vikings Need a Duck

-

Crypto World7 days ago

Crypto World7 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

NewsBeat2 days ago

NewsBeat2 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Tech6 days ago

Tech6 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat2 days ago

NewsBeat2 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat1 day ago

NewsBeat1 day ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat2 days ago

NewsBeat2 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoPolice latest as search for missing woman enters day nine

-

Entertainment15 hours ago

Entertainment15 hours agoBaby Gear Guide: Strollers, Car Seats

-

Business5 days ago

Business5 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business4 days ago

Business4 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech4 days ago

Tech4 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Crypto World6 days ago

Crypto World6 days agoEntering new markets without increasing payment costs

-

Politics2 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers