Crypto World

Bithumb Error Sends Bitcoin Crashing 10% After 2,000 BTC Airdrop

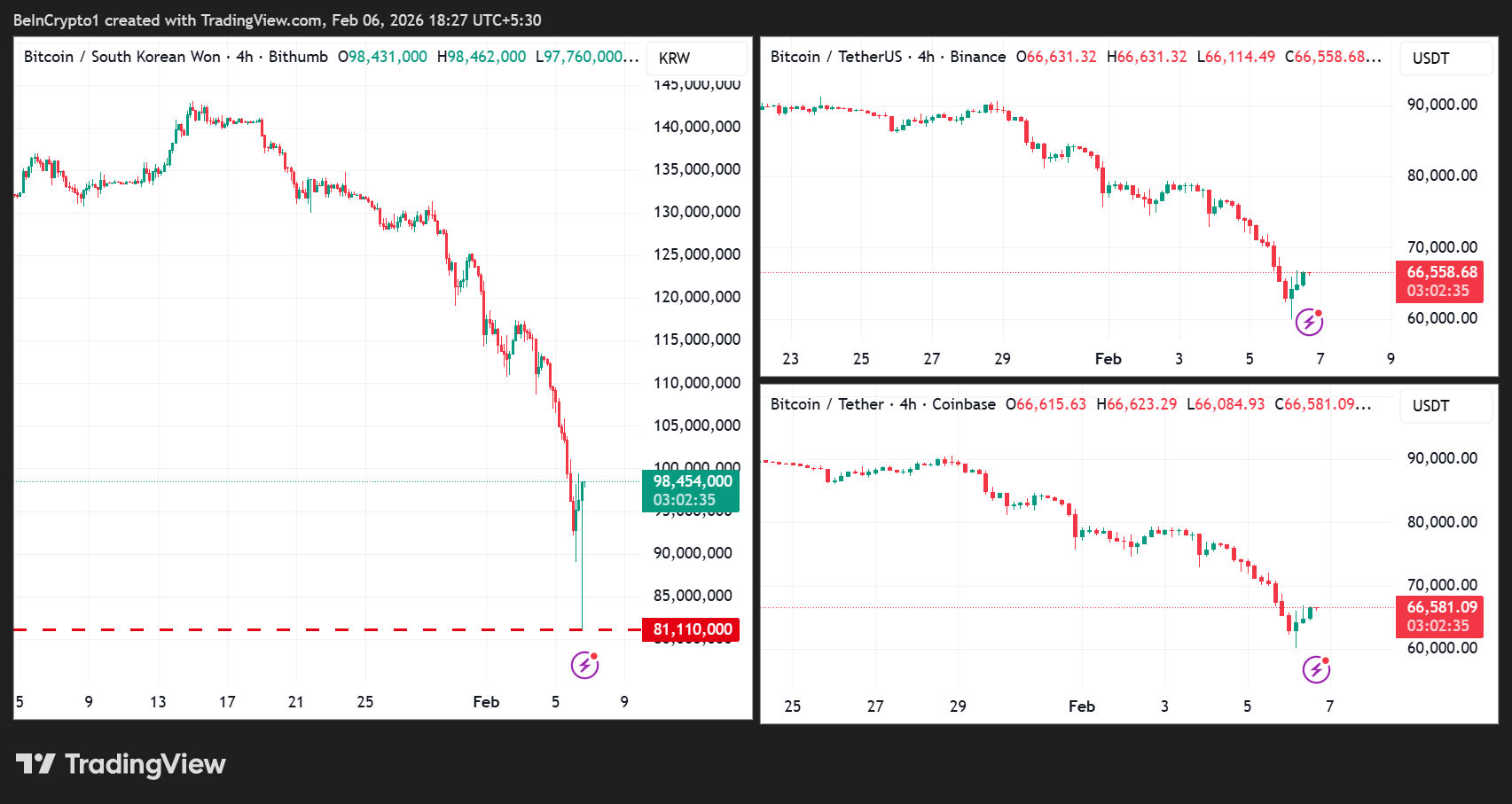

South Korea’s cryptocurrency exchange Bithumb faced a major operational mishap on February 6, 2026, which quickly sent the BTC/KRW trading pair down by double digits.

It brings to mind past controversies about the exchange, including incidents of partial liability in data leaks.

Sponsored

Sponsored

Bithumb’s Accidental 2,000 BTC Airdrop Sparks 10% Bitcoin Crash on Exchange

Reportedly, a staff member accidentally sent 2,000 Bitcoin (BTC) to hundreds of users instead of the intended 2,000 Korean Won (KRW) reward.

The error triggered an immediate wave of sell-offs, sending Bitcoin’s price on the exchange more than 10% below global market rates.

Dumpster DAO core member Definalist first reported the incident, citing a routine airdrop meant as a small incentive for platform users.

Amidst the chaos, some users reportedly benefited significantly from the mistake, selling their unexpected Bitcoin windfall at market prices.

The accidental BTC distribution has raised questions about internal controls and risk management at crypto exchanges, particularly those handling high-value digital assets.

Sponsored

Sponsored

“Crazy to think that exchanges can still do paper trading like this, even in 2026 lmao,” remarked Definalist.

Notably, however, the Bitcoin price crash was largely confined to Bithumb due to the exchange’s isolated order book. Users sold massive amounts of BTC directly on Bithumb, overwhelming its liquidity and causing a 10% local drop.

Other exchanges remained unaffected because the selling pressure didn’t enter their markets, and global arbitrage mechanisms hadn’t yet adjusted the discrepancy, keeping the impact largely contained.

Notwithstanding, the incident highlights the operational risks that can persist even in major exchanges, despite years of industry maturation. It also shows how a simple input error can cascade into substantial market disruption.

Sponsored

Sponsored

Bithumb did not immediately respond to BeInCrypto’s request for comment and has not yet released an official public statement on corrective measures.

Still, the event could influence market confidence in the short term, particularly on exchanges where operational errors have immediate price consequences.

Bithumb’s Operational History and Corporate Changes Highlight Ongoing Risks

Bithumb itself has a checkered history with security and operational issues. In 2017, a data breach exposed customer information, and in a 2020 ruling, local media reported that the exchange was found partially liable in one case in which a user lost $27,200.

The court ruled that, although Bithumb’s database had been accessed, the claimants should have recognized the scam attempts and awarded only $5,000 in damages.

Sponsored

Sponsored

Other claims were dismissed because the court found the private information could have been obtained elsewhere.

Bithumb has also undergone significant corporate changes in recent years. In 2018, the exchange sold a 50% stake to BK Global Consortium, a group led by startup investor Kim Byung-gun, who was already the company’s fifth-largest shareholder.

This acquisition came amid a broader contraction in the crypto sector investment. According to FinTech Global research, global crypto investments peaked at $7.62 billion in 2018 before falling to $3.11 billion in 2019. In the first half of 2020 alone, the sector raised just $578.2 million.

This latest mishap adds to Bithumb’s long history of operational challenges, reinforcing the view that while crypto adoption is growing, the sector remains vulnerable to human and technical errors, even in leading exchanges.

Crypto World

Price predictions 2/6: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

Bitcoin and altcoins saw strong double-digit price rebounds after this week’s brutal sell-off, but do technical charts forecast a longer-term recovery, or is today’s rally just a dead cat bounce?

Crypto World

2000 Bitcoin Airdrop? Bithumb Addresses Incident

South Korean cryptocurrency exchange Bithumb has officially confirmed that an operational error led to an abnormal Bitcoin payout during a promotional event.

The incident triggered a brief but sharp price dislocation on the platform before markets stabilized within minutes.

Sponsored

Sponsored

Bithumb Confirms Accidental Bitcoin Payout

In a statement, Bithumb apologized to users, acknowledging that “an abnormal amount of Bitcoin was paid to some customers” during the event, which caused temporary volatility as recipients sold the assets.

“The Bitcoin price temporarily fluctuated sharply as some accounts that received the Bitcoin sold it,” the exchange said.

According to Bithumb, its internal monitoring systems quickly detected the abnormal transactions. The platform responded by restricting trading activity on the affected accounts, which helped contain the disruption.

“As a result, the market price returned to normal levels within 5 minutes, and the domino liquidation prevention system functioned normally, preventing chain liquidations due to the abnormal Bitcoin price,” the company stated.

The clarification comes after Bitcoin briefly traded significantly below global market rates on Bithumb, fueling speculation about the cause of the sudden price drop.

Bithumb emphasized that the incident was not the result of a cyberattack or security breach.

Sponsored

Sponsored

“We want to make it clear that this incident is unrelated to any external hacking or security breach, and does not pose any issues with system security or customer asset management,” the exchange said.

Impact on Bithumb Customer Funds

The company also reassured users that customer funds remain safe and that core services are operating normally.

“Customer assets are being safely managed as before, and transactions and deposits/withdrawals are currently operating normally,” the statement added.

Importantly, Bithumb indicated that no customers suffered losses as a result of the incident, noting that it is continuing to review the situation and will disclose further details as necessary.

“It is understood that this incident did not result in any loss or damage to customer assets. We will share all follow-up actions transparently and take full responsibility to ensure that not a single customer is harmed,” the exchange said.

The episode highlights how operational errors, even when quickly resolved, can trigger sharp short-term price distortions in crypto markets, particularly on individual exchanges where liquidity conditions differ from global averages.

Bithumb concluded its statement with another apology, saying it would strengthen safeguards and continue working to provide a stable trading environment.

“Once again, we deeply apologize for any inconvenience caused. We will continue to do our best to provide a stable and trustworthy trading environment.”

Crypto World

Bitcoin’s brutal crash just became a nightmare for the plan to put crypto in Americans’ retirement

Bitcoin’s 50% plunge from its October peak has done more than just erase $2 trillion in market value — it has reignited a fierce debate over the fiduciary math of the American retirement system.

As investors scramble to parse the drivers of the latest crash, industry observers are asking if volatile digital assets have any business being in a $12.5 trillion 401(k) market designed for stability.

“If investors want to speculate on crypto, they are welcome to do so on their own. 401ks exist to help people save for a secure retirement, not gamble on speculative assets with no intrinsic value,” said Lee Reiners, a lecturing fellow at the Duke Financial Economics Center and a co-host of the Coffee & Crypto podcast.

U.S. President Donald Trump issued an executive order in August that allowed 401(k) and other defined-contribution retirement plans access to alternative assets, including digital assets. Even Securities and Exchange Commission (SEC) chair Paul Atkins said last week, just on the eve of the latest brutal crypto selloff, that “the time is right” to open up the retirement market to crypto.

But the recent rout in crypto might just turn retirement fund managers away from plans to add crypto to 401(k)s.

Reiners said that several large crypto companies, such as Coinbase (COIN), are already included in major equity indices, which means many 401(k) plans already have indirect exposure to crypto, and that should be enough.

“Unless Congress changes the law, plan sponsors are unlikely to include crypto, or ETFs, as plan options because they don’t want to be sued by their employees. For any employers that were considering it, I’m sure recent events have them reconsidering,” Reiners said.

The problem with putting people’s life savings into crypto is that the industry is relatively young and extremely volatile, and pension funds are for stable growth.

Buying and holding can work for assets like the S&P 500, which sees large volatility mostly during Black Swan events, such as the 2008 financial crisis or COVID-19 uncertainties. However, given the size of traditional markets, the government often steps in to stop the bleeding, and numerous regulatory frameworks exist to protect people’s investments.

But for crypto, much of its activity is just speculation, and that means prices can see extreme swings over a weekend or a week, which can quickly decimate billions in value with no regulatory oversight over market moves. This makes it even more nerve-wracking for investors to put their life savings into it.

Didn’t ‘get out quickly’

To put the uncertainty in perspective, many firms were likely blindsided by the sudden crash in bitcoin and crypto over the last few days.

In fact, the recent brutal selloff was so violent and sudden that BlockTrust IRA, an AI-powered retirement platform that has added $70 million in IRA funds in the past 12 months, was caught in the bloodbath.

“Sometimes we look at things that we say, ‘you know what, we should get out,’ and sometimes we don’t. And last week, we did not get out as quickly because a lot of the underlying fundamental data we’re looking at is still very strong,” Chief Technical Officer Maximilian Pace said in an interview with CoinDesk.

However, concerning the sudden selloff, Pace pointed to the firm’s “broad sense of analytics,” which operates effectively over longer timelines than short-term trading. That strategy helped it outperform in 2025, and the firm added that it is “not necessarily wavered by volatility.” The AI trading firm’s Animus Fund outperformed bitcoin throughout 2025 and was up 27% from January to December 2025, while the bitcoin buy-and-hold strategy was down 6% to 13% over the same period, the firm said in a press release.

In Pace’s view, zooming out and considering crypto investments over a five- to 10-year time horizon is the right way to think about 401(k) plans.

“You would be better thinking like a venture capitalist rather than like a day trader,” Pace said. “There are ways of de-risking the investment, either from a time perspective or from a strategy perspective, that make it more attractive or more acceptable for things like 401(k) programs. But like anything, there’s risk.”

The future of pensions

Perhaps there’s a need to zoom out further and think about the actual blockchain technology for retirement investment management than just putting money into tokens.

Robert Crossley, Franklin Templeton’s global head of industry and digital advisory services, is thinking exactly that. The retirement industry, which he says is siloed, slow-moving and over-regulated, could be revolutionized by onchain wallets that hold tokenized assets.

And by doing so, an individual’s digital wealth will be much more aligned with the rest of their lives, Crossley said.

“Whether you are a saver, an investor, a spender, you have all of these different financial activities which are currently serviced very differently by different providers in your life,” Crossley said in an interview.

If regulations come into play that don’t prohibit innovations, it is very likely that blockchain technology can eliminate such fragmentation of intermediaries. It’s possible that industry could see a supply of wallets that “unlock the possibility of programmable assets and securities and the ability to see all of your assets in one place and control them directly, rather than being intermediated,” he said.

“When something becomes tokenized, it becomes software. That software can be an asset, but it also could be a benefit, it also could be a liability. It could be a whole 401(k). It could be your whole DC [defined contribution] plan,” Crossley said.

Crypto World

Turn $100 Into $300 Now With Remittix – Project Rewards Presale Buyers With 300% Bonus

Investors searching for the best crypto to buy now are increasingly focusing on projects that provide real infrastructure alongside structured early participation incentives. Among these projects, Remittix is gaining popularity with its PayFi payment framework and its 300% allocation incentive that is limited.

As discussions regarding cryptocurrency with actual use continue to grow, Remittix is included in discussions regarding the use of blockchain technology for payments and actual use of cryptocurrency.

Market participants are not only evaluating future price movement potential but also looking at how early allocation incentives can influence entry positioning. With the Remittix ecosystem progressing through product launches and rollout milestones, attention is shifting toward participation timing as access windows narrow across the platform.

Allocation Windows Tighten As Bonus Multiplier Drives Demand

Remittix is valued at $0.123 per RTX token, making it a part of the search discussions on the top crypto under $1. Remittix has managed to raise over $29 million from private funding, which is a clear indication of the demand for the blockchain infrastructure focused on payments.

Over 703 million tokens out of the 750 million available have already been secured. This is a clear indication that over 93% of the total allocation is no longer available. Participation activity has accelerated as availability continues to shrink across the ecosystem.

A major factor behind this surge is the 300% bonus available via email, allowing participants to receive up to three times more RTX tokens compared to their initial allocation. This incentive is widely viewed as one of the strongest allocation multipliers currently available among early stage crypto investment opportunities.

Infrastructure Launch Timeline Strengthens Real Utility Narrative

Remittix is widely recognized as a Remittix DeFi project focused on solving cross-border payment inefficiencies. The ecosystem is entering a critical rollout phase, supported by the Remittix Wallet already live on Apple devices while Android deployment continues toward release.

The broader PayFi platform is scheduled to go live on the 9th February 2026, marking the first full release of the crypto-to-fiat infrastructure. The platform aims to allow users to send digital assets directly into traditional bank accounts, addressing one of blockchain’s largest real-world adoption challenges.

Users can track ecosystem progress and allocation access directly through the Remittix platform homepage, where dashboard tools allow allocation monitoring and reward tracking.

As the platform rollout approaches, participation timing is becoming a major focus. Investors tracking how to buy crypto early are positioning themselves before broader payment infrastructure deployment expands user access.

Security Verification And Exchange Expansion Build Market Confidence

Remittix recently achieved a major credibility milestone after receiving full verification from CertiK. The project is also ranked as the #1 pre-launch token on CertiK, strengthening investor confidence and highlighting platform transparency.

The full security verification details can be reviewed through CertiK’s Remittix audit listing, which confirms project security standards and infrastructure validation.

The project has also revealed upcoming centralized exchange partnerships with BitMart and LBank. These future listings are expected to expand liquidity, increase accessibility and improve global exposure for RTX holders once trading access opens.

Allocation tracking, bonus activation and participation tools remain available through the Remittix dashboard portal, where referral rewards and allocation monitoring are currently active.

Core Factors Supporting Remittix Ecosystem Growth:

- Crypto-to-bank transfers designed for global payment efficiency

- Wallet infrastructure already deployed and expanding

- CertiK verification reinforcing platform security

- Global PayFi rollout targeting cross-border finance

- Referral rewards offering 15% USDT returns for ecosystem growth

Referral Rewards Expand Community-Driven Adoption

Remittix recently introduced a referral program allowing participants to receive 15% of new allocations in USDT, claimable every 24 hours through the dashboard. The program is helping accelerate ecosystem expansion while rewarding early network contributors.

The referral structure is designed to increase liquidity growth and broaden global participation. Many community members are using referral participation as an additional allocation strategy while supporting project expansion across new regions.

Final Allocation Phase Before PayFi Infrastructure Goes Live

Remittix is entering one of the most time-sensitive phases of its rollout as the PayFi platform launch approaches. With security verification completed, exchange partnerships revealed and wallet infrastructure already deployed, the ecosystem is transitioning toward full payment network deployment.

With over 93% of token allocation already secured, remaining access is narrowing rapidly. The 300% email allocation multiplier continues to drive strong participation as investors race to secure remaining availability.

As infrastructure rollout accelerates, the final allocation phase is expected to close quickly, marking one of the last opportunities to secure expanded RTX participation before broader ecosystem activation begins.

Discover the future of PayFi with Remittix by checking out their project here:

Website: remittix.io

Socials: https://linktr.ee/remittix

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

XRP Sees Impressive Recovery Wick With Massive 37% Price Surge: Here’s Why

Ripple’s token has also surpassed BNB in terms of market cap after its sublime surge.

It was just hours ago, less than a day, when we wrote about XRP’s spectacular collapse as the asset plummeted to $1.11 for the first time since before the US presidential elections at the end of 2024.

This meant that it had shed over 50% of its value in a month as it peaked at $2.40 on January 6. Oh, how the landscape in crypto can change in hours sometimes, not even days or weeks.

What happened with XRP’s price since that local low has been nothing short of amazing. There were some signs about a potential rebound, such as the plummeting RSI metric, but even the most vocal XRP bulls were probably surprised by the extent of the rally.

After all, the cross-border token skyrocketed by 37% in about 18 hours – going from the aforementioned low to $1.54 before it faced some resistance and now trades around $1.50. This still represents a 34% surge in less than a day.

Santiment also weighed in on the token’s performance. The analysts acknowledged XRP’s rise in terms of market cap as well, as it now sits above BNB as the fourth-largest crypto asset.

They blamed the massive price pump in the past several hours on the overall network stability and growing activity on the XRP Ledger. Moreover, they showcased a chart indicating that Ripple whales went on an accumulation spree, with almost 1,400 separate $100K+ whale transactions (the highest in four months).

📈 Crypto markets are rebounding, but $XRP‘s price has been on a particularly huge tear. Since bottoming out below $1.15 just under 18 hours ago, the #4 market cap has now recovered to back above $1.50.

😱 Panic sellers should have stopped to notice the massive activity on the… pic.twitter.com/3y0eyGxpo2

— Santiment (@santimentfeed) February 6, 2026

You may also like:

The ETF behavior will also be interesting to compare, but we would need to verify the data at the end of the trading day in the US. Preliminary data on SoSoValue shows a minor net inflow even for yesterday, but there’s no official confirmation as of yet, which is rather surprising.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

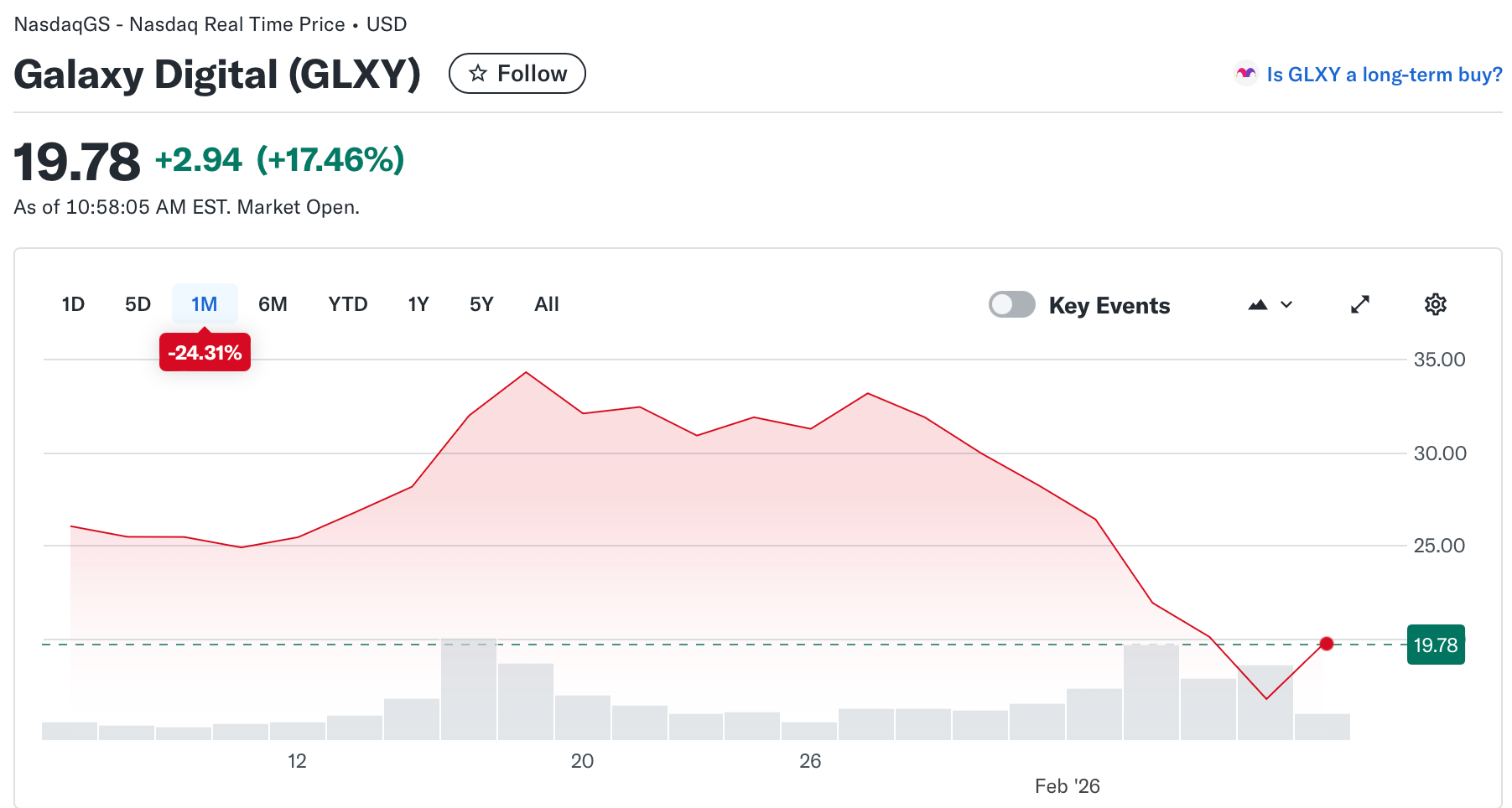

Galaxy Authorizes $200M Share Buyback Amid Crypto Market Downturn

Galaxy Digital Inc. (Nasdaq: GLXY) has authorized a share repurchase program of up to $200 million, allowing the company to buy back its Class A common stock over the next 12 months.

According to a company announcement, the repurchases may be conducted on the open market or through privately negotiated transactions, including under Rule 10b5-1 trading plans, and remain subject to applicable securities laws and exchange rules. The program does not obligate Galaxy to repurchase any shares and may be suspended or discontinued at any time.

The buyback program has a term of 12 months and, if conducted on the Toronto Stock Exchange, remains subject to regulatory approval under a normal course issuer bid. Purchases made on Nasdaq would be capped at 5% of Galaxy’s outstanding shares at the start of the program, according to the announcement.

Galaxy is listed on the Nasdaq and the Toronto Stock Exchange and operates across digital asset trading, asset management, staking, custody and data center infrastructure. The company did not disclose how much of the $200 million authorization it expects to use, or when repurchases might begin.

Mike Novogratz, founder and CEO of Galaxy, said the company is “entering 2026 from a position of strength,” adding that its balance sheet and ongoing investments give it flexibility to return capital when management believes the stock is undervalued.

The news comes three days after Galaxy reported a net loss of $482 million for the fourth quarter of 2025 and a $241 million loss for the full year, citing lower digital asset prices and about $160 million in one-time costs.

At the time of writing, shares of Galaxy were up about 17% over 24 hours, but remained down about 25% for the month, according to Yahoo Finance.

Related: Optimism passes buyback proposal to bolster OP token

Market downturn impacts crypto stocks

Galaxy’s recent share-price decline reflects a broader pullback across crypto-related equities, as Bitcoin has fallen over the past month from January highs above $97,000 to to a low of about $60,300 on Thursday.

Shares of Coinbase Global (COIN) were down about 36% over the past month, while Circle Internet Group (CRCL) fell about 34% over the same period and about 65% over six months.

Strategy (MSTR), the largest public holder of Bitcoin with 713,502 BTC on its balance sheet, has fallen about 20% over the past month and nearly 68% over six months. Cointelegraph reported Thursday that the company posted a $12.4 billion net loss in the fourth quarter of 2025.

Bitcoin mining stocks have also declined, with MARA Holdings (MARA) down about 27% over the past month and about 52% over the past six months, while IREN Limited (IREN) is down about 8% on the month.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

Samson Mow Breaks Down Bitcoin Market Crash

In a video interview, Samson Mow shares his views on Bitcoin’s latest bloodbath, quantum fears and the catalysts that could drive Bitcoin’s next recovery.

In an exclusive Cointelegraph interview, Bitcoin OG Samson Mow shares his perspective on Bitcoin’s latest massive crash, what’s driving the sell-offs and why a rebound could be closer than most expect.

We discuss gold and silver’s rally, forced liquidations, the “quantum threat” to crypto, and examine the long-term Bitcoin thesis: Is Bitcoin truly designed to rise in price due to fiat devaluation, or is that a flawed narrative?

After months of relentless selling pressure, sharp liquidations and growing bearish sentiment, many investors are asking the same question: Why does Bitcoin keep falling despite strong fundamentals, and when could it finally recover?

According to Mow, Bitcoin’s unique role as the most liquid asset in global markets, combined with its 24/7 tradability, makes it particularly sensitive to downside shocks that more traditional assets often avoid, at least in the short term.

The discussion also explores one of the most important dynamics in today’s market: the relationship between gold, silver and Bitcoin. After a powerful rally in precious metals, Mow lays out the case for why capital rotation from other hard assets may be setting the stage for Bitcoin’s next move.

If you’re trying to understand the nature of Bitcoin’s recent decline and what may come next, watch the full interview on our YouTube channel.

This interview has been edited and condensed for clarity.

Crypto World

Bitcoin’s Rollercoaster Ride Continues as BTC Price Recovers $10K in a Day

Bitcoin’s price jumped past $71,000 minutes ago, while XRP and other altcoins have produced massive double-digit daily gains.

What a ride it has been in the cryptocurrency space lately. The quick and sharp moves continue as of press time, as BTC has skyrocketed to over $71,000 just less than a day after it dipped to $60,000.

The altcoins are well in the green now on a daily scale, and the total crypto market cap has increased by roughly $200 billion since its low from earlier this morning.

Bitcoin’s price chart from above paints a very clear and volatile picture. It shows that the cryptocurrency plummeted by roughly $30,000 in the span of just over a week – from last Wednesday to Friday morning.

As reported earlier today, popular analysts blamed this latest crash, in which bitcoin dropped from $77,000 to $60,000 in about 24 hours, to emotional selling and structural change rather than broken fundamentals within BTC and the crypto market.

Since then, BTC has gone on a tear. It added over $10,000 since this morning’s multi-year low, and briefly surpassed $71,000 minutes ago before it was stopped and now trades inches below it.

The altcoins have produced even more impressive gains, with XRP leading the pack. Ripple’s cross-border token has soared by 19% daily to over $1.50 as of press time, while ETH has reclaimed the psychological $2,000 level.

The total value of wrecked positions daily is still over $2 billion, but most of it is from longs, which happened before today’s recovery. Nevertheless, over $350 million worth of shorts have been wrecked in the past 12 hours, with BTC responsible for the lion’s share ($261 million).

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin gets slashed in half. What’s behind the crypto’s existential crisis

Bitcoin tumbled toward $60,000 this week as investors reassessed its utility. And while there isn’t one clear catalyst driving the bloodbath, one thing is clear: the crypto market is in crisis.

“There’s nothing going on in the marketplace that should have necessitated this type of a crash,” Anthony Scaramucci, founder and managing partner of alternative investment firm SkyBridge, told CNBC. “And so I think that’s made people, frankly, more fearful. … You have to ask yourself, ‘is it over for bitcoin?’”

Bitcoin fell as low as $60,062 on Thursday, bringing it to its lowest level since Oct. 11, 2024. That’s more than 52% off from its record high of $126,000 hit in early October 2025.

The previous session marked one of bitcoin’s bloodiest ever, with the token shedding more than 15% on the day. Its daily relative strength index fell to 18, putting the asset in extremely oversold territory. As of Thursday, other digital assets like ether and solana were also down 24% and 26% for the week to date, respectively — a sign investors’ confidence in the entire crypto market is faltering.

Bitcoin bounces, but losses loom large

Bitcoin was rebounding on Friday, with the token last trading at $69,631.97, up more than 9% on the day.

But, its recent drawdown has prompted investors to re-evaluate its utility, including its role as a digital currency or as a store of value. Simultaneously, institutional appetite for the flagship crypto appears to be waning as spot bitcoin exchange-traded funds record outsized outflows, threatening to drive bitcoin deeper into the red.

“This time is markedly different from other bear markets, however, in that it’s not in response to a structural blowup,” Jasper De Maere, desk strategist at crypto market-making firm Wintermute, said in a statement shared with CNBC. “It’s a fundamentally macro-driven deleveraging tied to positioning, risk appetite and narratives rather than systemic failures within crypto itself.”

Bitcoin prices over the past year

Over the past few months, investors have grown increasingly skeptical of efforts to recast bitcoin as “digital gold,” or an alternative to traditional safe havens such as gold. Bitcoin is down 28% over the past 12 months, while gold is up 72% during the same period — a testament to the latter’s utility as a hedge against macro risks.

Conversely, bitcoin has often traded down alongside other risk-on assets such as equities amid periods of high macroeconomic and geopolitical uncertainty, raising doubts about its utility as a safe haven. Nearly a week after Trump’s “liberation day” tariff announcement on April 2, 2025, bitcoin had fallen about 10% to below $80,000, while the S&P 500 had declined roughly 4%.

Separately, investors are also reassessing the extent to which financial institutions, treasury firms and governments are willing to adopt bitcoin — a major catalyst for the token in recent years.

Large institutional outflows are mounting as investors brace for bitcoin to go lower, thinning liquidity for the token, according to a recent analyst note from Deutsche Bank.

Those outflows are also noticeable among spot bitcoin ETFs in recent months, according to the investment firm. The funds have seen outflows of more than $3 billion in January, in addition to roughly $2 billion last December and about $7 billion last November.

Additionally, a swath of Strategy copy-cats that emerged over the past year or so have slowed or paused their bitcoin purchases amid the digital asset’s correction.

Finally, traders have acknowledged that long-time efforts to market bitcoin as an alternative to fiat currencies have largely faded. While Steak ‘n Shake and Compass Coffee have rolled out support for bitcoin payments in recent years, initiatives to make the asset a form of payment have largely died, particularly as interest in dollar-pegged stablecoins grows, according to Bitwise’s Ryan Rasmussen.

“We’re seeing Wall Street adopt stablecoins because it is a fundamental transformation of the way payments work, and bitcoin is just a different asset. It’s not meant for that today,” Rasmussen said, arguing that the token’s purpose has evolved from that of a currency to a decentralized, non-governable store of value. “I’ve never paid for coffee or a sandwich with Bitcoin, and I never will.”

And beyond those more immediate concerns, investors are also increasingly worried that bitcoin’s underlying network could be hacked, driving the token to zero.

“It certainly is a risk that is seeing more attention from investors as they’re getting more worried about [it], and I think you’re seeing a little bit of that risk priced into bitcoin,” Rasmussen said.

He noted that Bitwise has allocated funds toward efforts to mitigate the threat from quantum computing.

Nevertheless, traders’ appetite for bitcoin has largely dwindled, denting its price. That’s true even as long-time believers are still proudly betting on bitcoin, despite of the charts and the naysayers.

“I believe that the story is intact,” said Scaramucci, adding that he bought bitcoin for his fund on Thursday. “But, I don’t have a crystal ball. … Who the hell knows.”

Crypto World

PBOC Officially Bans ‘Unapproved’ Yuan-Pegged Stablecoins

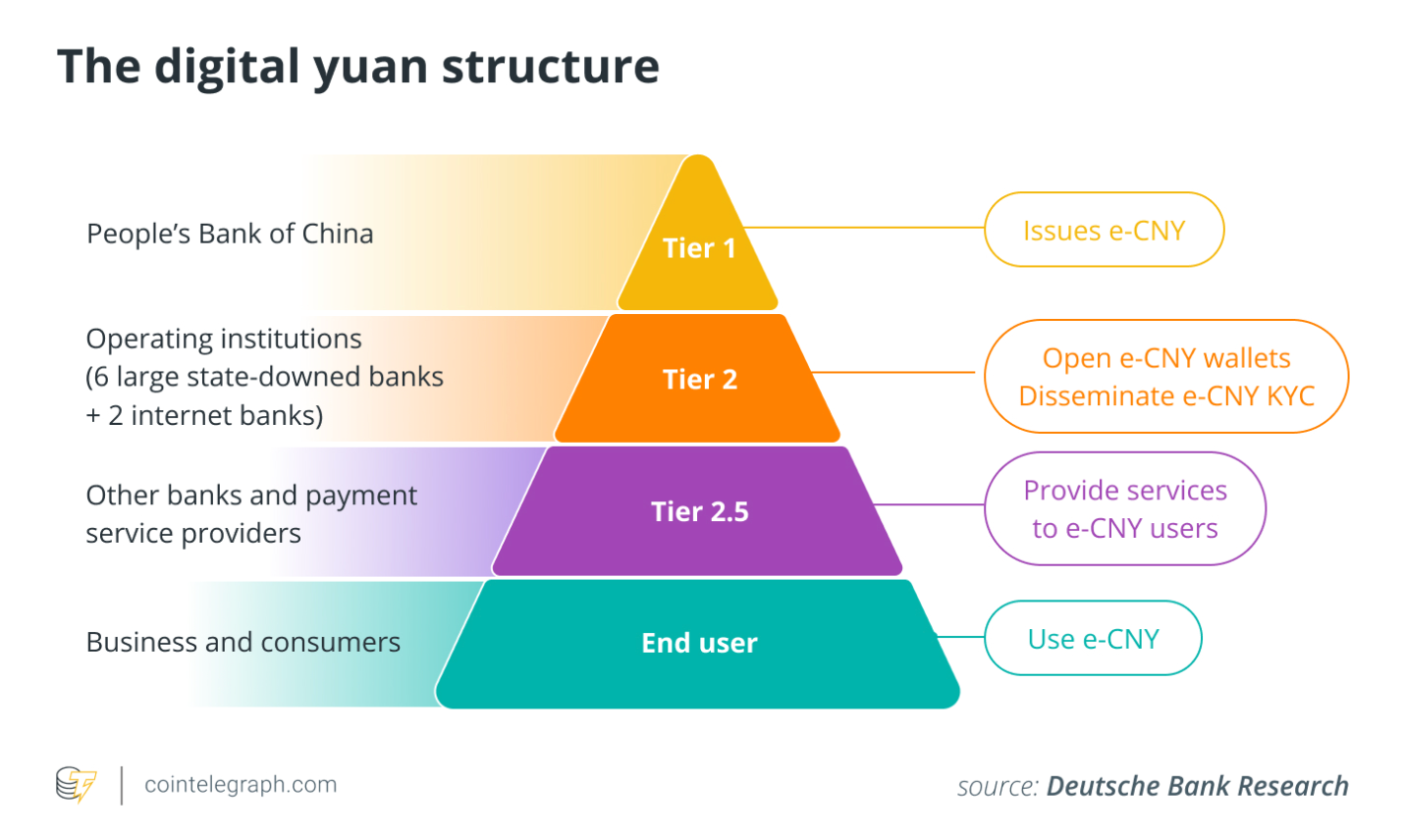

The People’s Bank of China (PBOC), the country’s central bank, and seven Chinese regulatory agencies published a joint statement on Friday banning the unapproved issuance of Renminbi-pegged stablecoins and tokenized real-world assets (RWAs).

The ban applies to both domestic and foreign stablecoin and tokenized RWA issuers, according to the statement, which was also signed by the Ministry of Industry and Information Technology and China’s Securities Regulatory Commission. A translation of the announcement said:

“Stablecoins pegged to fiat currencies perform some of the functions of fiat currencies in disguise during circulation and use. No unit or individual at home or abroad may issue RMB-linked stablecoins without the consent of relevant departments.”

Winston Ma, an adjunct professor at New York University (NYU) Law School and former Managing Director of CIC, China’s sovereign wealth fund, told Cointelegraph that the ban extends to the onshore and offshore versions of China’s Renminbi, also called the yuan.

“The Beijing crypto ban rule applies across all RMB-related markets, whether CNH or CNY,” he said. CNH is the offshore version of the Renminbi, designed to give the currency flexibility in foreign exchange markets, without sacrificing currency controls, Ma said.

“This is the latest step in a multi‑year project: Keep speculative crypto outside the formal financial system, while actively promoting the usage of e-CNY, the sovereign CBDC issued by China’s central bank,” he said.

The announcement follows the Chinese government approving commercial banks to share interest with clients holding the country’s digital yuan, a central bank digital currency (CBDC) managed by state authorities.

Related: China’s interest-bearing digital yuan piles pressure on US stablecoin rules

Chinese government briefly considered yuan-pegged stables, but focused on CBDC instead

In August 2025, reports began circulating that China’s government was considering allowing private companies to issue yuan-pegged stablecoins, a major reversal of long-standing policy.

However, the Chinese government restricted stablecoin and digital asset issuance in September of that same year, instructing stablecoin issuers to pause or halt their stablecoin trials until further notice.

In January 2026, the PBOC approved commercial banks paying interest to digital yuan wallets in a push to make the CBDC more attractive to investors.

Magazine: China officially hates stablecoins, DBS trades Bitcoin options: Asia Express

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports9 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat4 hours ago

NewsBeat4 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World1 day ago

Crypto World1 day agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation