Crypto World

BlackRock’s head of digital assets warns leverage-driven volatility risks undermine b itcoin’s institutional narrative

NEW YORK — While BlackRock’s iShares Bitcoin ETF (IBIT) is among the most successful product launches in Wall Street history, the crypto market’s growing reliance on leverage could be doing long-term damage to bitcoin’s institutional appeal, according to Robert Mitchnick, head of digital assets at BlackRock.

During a conversation with Anthony Pompliano and investor Dan Tapiero at the Bitcoin Investor Week conference in New York on Thursday, Mitchnick said that while bitcoin’s fundamentals remain strong, excessive speculation — particularly on leveraged derivatives platforms — is introducing instability that threatens the asset’s positioning as a serious portfolio hedge.

“These days where you have a tiny little thing that shouldn’t have any price impact really at all — and if it does, should be small — like, for example, October 10th, some tariff-related thing, and next thing you know, [bitcoin] is down 20%,” Mitchnick said. “That’s because you get cascading liquidations and auto-deleveraging.”

While bitcoin’s long-term value proposition as a “global, scarce, decentralized monetary asset” remains intact, Mitchnick warned that the asset’s short-term trading behavior is starting to look dangerously similar to “levered NASDAQ” — a perception that may deter conservative allocators from entering the space.

“The facts are more on the side of how I characterized it,” he said, referring to bitcoin’s fundamental attributes. “But now the trading data, at least lately, looks very different, and the bar to adoption if it trades like levered NASDAQ is much, much, much higher.”

Mitchnick also pushed back on the idea that exchange-traded funds (ETFs) like IBIT are contributing to volatility, pointing instead to perpetual futures platforms as the source of instability.

“There’s a misperception out there that it’s a bunch of hedge funds in ETFs that are creating volatility and selling; that’s not what we’re seeing,” he said. “On a week that was tumultuous, obviously, in the bitcoin market, we had 0.2% of the fund redeem. If there actually were hedge funds massively unwinding trades… you would have seen billions. We saw many billions liquidated on these levered platforms.”

Despite short-term turbulence, Mitchnick emphasized that BlackRock remains committed to digital assets as part of a broader financial transformation.

“We see ourselves as having the role of a bridge… between traditional finance and the digital asset world,” he said. “Over time, there’s certainly going to continue to be a greater role for digital assets and this technology theme in general for many of our clients.”

Read More: Bitcoin May Evolve Into Low-Beta Equity Play Reflexively, BlackRock’s Mitchnik Says

Crypto World

Hong Kong is trying to build up its crypto regulations: State of Crypto

Consensus Hong Kong wrapped up with a bang as policymakers announced new initiatives to grow the digital assets sector.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

The narrative

Policymakers at Consensus Hong Kong announced a slew of initiatives aimed at strengthening the local digital asset ecosystem.

Why it matters

Philosophically speaking, the question of why we still care about this industry remains top of mind. Consensus showed that despite the sometimes ridiculous projects and unachievable hype cycles, companies still have a genuine use for the technology.

Breaking it down

Hong Kong’s regulators are trying to encourage growth in the local digital asset ecosystem, unveiling a framework for perpetual contracts and saying that stablecoin licenses will be announced in the coming month.

“That certainty of direction gives a lot of companies confidence to invest in Hong Kong and to build further,” said Jason Atkins, the chief commercial officer of crypto trading firm Auros.

While the Special Administrative Region of China is not yet close to approving all applicants and activities, the fact that regulators like the Securities & Futures Commission and the Hong Kong Monetary Authority are willing to engage and adapt their approaches to digital assets is still significant, he told CoinDesk. They’re asking companies what they need to do to encourage investment, he said.

“We’ve gone into the SFC a few times, spoken with the HKMA on think tanks and panels and groups where they literally are just trying to understand how our businesses operate and what we need to invest even more into the city, which is really positive,” he said.

The regulators have been positively engaged, trying to discern what companies need from them to operate in the region. This includes asking whether certain regulations need to be adjusted to address market needs, he said.

“So they think about ways they can loosen those or lighten them up for certain types of investor classes,” he said.

This fits with a broader trend of more traditional institutions wanting to get into crypto — or at least blockchain.

Multiple panelists, representing companies like Franklin Templeton and Swift, said they were using or exploring blockchain technology to streamline their operations. It’s reminiscent of the 2018 “blockchain, not Bitcoin” era, but these entities are actually executing, rather than just announcing pilots.

That an increasing number of traditional entities are moving into blockchain may be the story of 2026, said Edge & Node CEO Rodrigo Coelho.

Companies are “rushing to figure this out,” he told CoinDesk. “Companies are seeking out consulting and expertise.”

Shawn Chan, of Singapore Gulf Bank, described these types of rails as being superior for transferring value.

While international regulatory hurdles need to be worked out, he estimated that companies will increasingly adopt blockchain tooling within the next decade.

This week

- Congress and federal regulators are not holding any hearings tied to crypto this week.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Bluesky @nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See ya’ll next week!

Crypto World

Bitcoin’s $78K Realized Price Emerges as Make-or-Break Level for Market Recovery

TLDR:

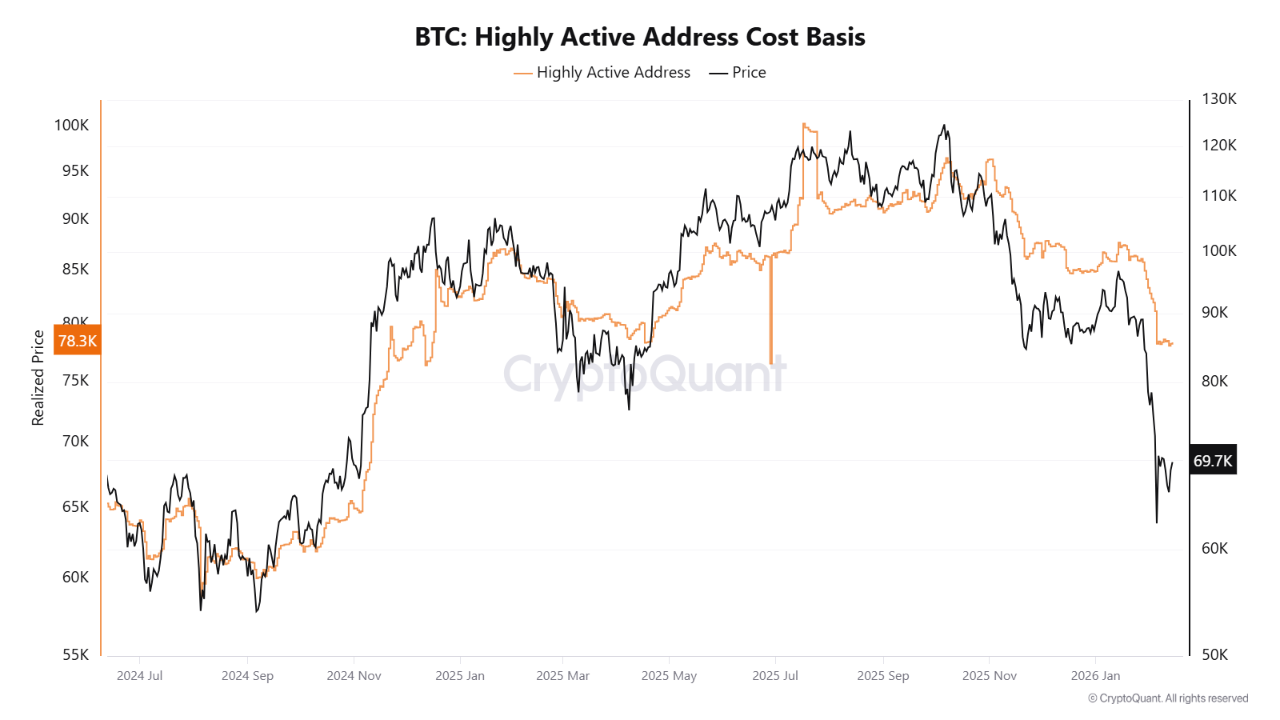

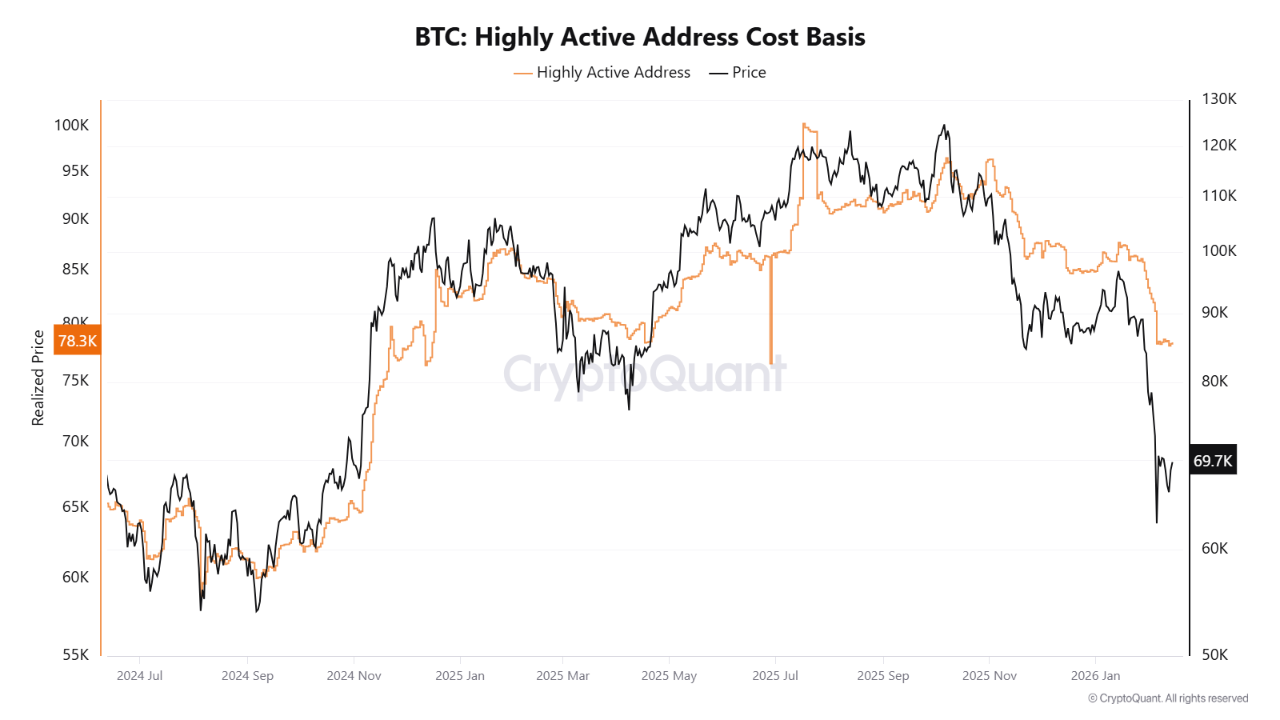

- Bitcoin currently trades below $78K, the realized price representing active addresses’ cost basis.

- Holding below this level places frequent traders underwater, shifting behavior from buying to selling.

- Sustained reclaim above $78K would return active participants to profit and reduce supply pressure.

- Failure to break resistance increases the probability of decline toward $50K long-term holder support zone.

Bitcoin trades below a structural threshold that could determine the market’s near-term direction. The cryptocurrency currently sits beneath $78,000, which represents the realized price of highly active addresses.

This level serves as a critical cost basis for participants who transact most frequently. Market observers note that price behavior around this zone will likely shape recovery prospects or signal further downside pressure.

The $78K Threshold as Market Divider

Bitcoin’s realized price for highly active addresses stands near $78,000 at present. This metric reflects the aggregate cost basis of market participants who respond quickly to changing conditions.

Unlike static technical levels, this threshold represents actual positioning and sentiment among active traders. The realized price functions as a behavioral marker rather than a simple chart reference.

Spot price currently trades below this realized level across major exchanges. This positioning places highly active addresses in unrealized losses on average.

Market structure shifts when participants hold underwater positions relative to their entry points. The change alters trading behavior from accumulation toward distribution as holders seek exits.

Trading below the $78K realized price historically increases overhead supply during rally attempts. Active addresses shift from absorbing sell pressure to contributing to it.

Source: Cryptoquant

Each move higher faces resistance from participants looking to reduce exposure near breakeven. The dynamic transforms what might otherwise serve as support into a supply zone.

The transition from support to resistance carries weight for short-term price action. Recovery attempts meet sellers who entered at higher levels and now seek liquidity.

This pattern reinforces the $78K zone as a divider between market phases. Acceptance below this level suggests continued pressure until equilibrium shifts.

Path Forward and Downside Risk

Market recovery requires the price to reclaim and hold above the $78K realized price. A successful breakout would return highly active addresses to profitability on average.

This shift reduces the incentive to distribute on strength and allows demand to stabilize. Sustained acceptance above this threshold validates the bullish case for continuation.

Reclaiming $78K would materially alter the market structure by removing a layer of supply. Profitable positions among active traders typically reduce selling pressure during subsequent advances.

The change allows price to build on higher ground without constant resistance. Recovery from above this level tends to show better follow-through than rallies from beneath it.

Repeated failures to break above $78K carry asymmetric downside risk for current holders. Each unsuccessful attempt reinforces the zone as distribution territory and weakens buyer conviction.

The pattern increases the probability that the price will seek the next major realized anchor. Technical structure deteriorates when key levels repel multiple breakout attempts.

The next dominant realized price sits near $50,000, corresponding to the long-term holder cost basis. This lower threshold represents participants with stronger conviction and lower propensity to sell.

Price typically finds more durable support at long-term holder levels due to reduced panic selling. A move toward $50K would mark deeper mean reversion before sustainable bottoming patterns can emerge.

Crypto World

Cardano is Launching a New Stablecoin This Month

The Cardano blockchain ecosystem will integrate USDCx, a variant of Circle’s USDC stablecoin, by the end of February.

On February 15, Philip DiSaro, CEO of the smart contract development firm Anastasia Labs, confirmed that “USDCx” will go live on the network before the end of the month.

Sponsored

Sponsored

Cardano Targets Stablecoin Deficit With Upcoming USDCx Debut

USDCx is a dollar-denominated stablecoin backed 1:1 by USDC held through Circle’s xReserve infrastructure. Circle is the issuer of USDC, the second-largest stablecoin by market capitalization.

According to DiSaro, USDCx will function identically to native USDC for retail users, allowing for seamless transactions across decentralized applications.

However, he noted that the asset differs slightly in its redemption mechanics compared to USDC.

“USDCx is functionally identical to native USDC for retail users. The literal only difference in functionality is that USDC can be redeemed directly for USD in a bank account through Circle EXCLUSIVELY by institutional partners of Circle. That means this is not possible and doesn’t matter to retail users, or even DeFi power users because they are not able to do this with USDC either,” DiSaro stated.

Still, DiSaro emphasized that the new stablecoin retains full USDC utility for the broader Cardano ecosystem.

“USDCx is not scuffed USDC; it has all of the functionality that USDC has for retail. You can bridge USDCx to any CCTP enabled chain in a single transaction, which would be the same amount of transactions if we had native USDC. Anything that you can pay for with USDC in a transaction, you can pay for with USDCx in a transaction,” DiSaro explained.

Nonetheless, market observers have noted that the launch represents a critical infrastructure upgrade for Cardano.

Sponsored

Sponsored

Notably, the Charles Hoskinson-led blockchain has historically struggled to attract the deep, stablecoin liquidity seen on rival chains such as Ethereum and Solana.

Data from DeFiLlama shows it hosts less than $40 million in stablecoin supply, compared with the billions held on rivals such as Ethereum.

Previous attempts to bootstrap stablecoin liquidity on Cardano have largely failed to gain traction, leaving the network at a competitive disadvantage in the decentralized finance sector.

So, this move is designed to address the network’s long-standing liquidity fragmentation and bolster its decentralized finance capabilities.

Meanwhile, the initiative arrives as Cardano attempts to shed its reputation for isolation through an integration with LayerZero. This interoperability protocol facilitates communication between separate blockchains.

By leveraging LayerZero, Cardano applications can theoretically interact trustlessly with more than 50 other networks, including Ethereum and Solana.

However, investors have yet to react positively to these structural changes.

BeInCrypto’s data shows that the network’s native ADA token has declined more than 25% over the past month to a 2-year low of $0.24. It has recovered to $0.28 as of press time.

This price performance reflects the broader crypto market downtrend and skepticism about the chain’s ability to capture market share in an increasingly crowded crypto economy.

Crypto World

Most Undervalued Since March 2023 at $20K, BTC Price Metric

Bitcoin (CRYPTO: BTC) is approaching what on-chain researchers describe as an undervalued zone for the first time in more than three years, according to CryptoQuant’s latest data. The market-value-to-realized-value (MVRV) ratio, a classic gauge of whether Bitcoin is fairly valued relative to the price at which the supply last moved, has moved toward a breakeven point after a months-long downtrend that followed an October 2025 all-time high. Last week’s price action saw BTC dip below $60,000, a level that has framed the market’s sentiment and testing of support in recent cycles. With the MVRV metric hovering near 1.1, analysts say the asset is edging into territory that historically accompanies accumulation and potential reversal, though they caution that no single indicator guarantees a bottom.

Key takeaways

- The MVRV ratio is approaching its key breakeven threshold for the first time in more than three years, signaling a potential move toward undervaluation.

- CryptoQuant data show the MVRV reading around 1.1, the lowest since March 2023 when Bitcoin was trading near $20,000.

- Analysts emphasize that when MVRV dips below 1, Bitcoin tends to be undervalued; the current reading sits above that level but within a range historically tied to bottoms or near-bottom conditions.

- The two-year rolling Z-score of the MVRV ratio has recently reached historic lows, a pattern some traders compare to prior bear-market bottoms, suggesting accumulation dynamics may be forming.

- Past commentary notes that the Downdraft since the October 2025 peak has not featured a rapid ascent into an overvalued zone, a nuance that could differentiate this cycle’s bottom formation from earlier ones.

Tickers mentioned: $BTC

Market context: On-chain signals come as Bitcoin experiences a multi-quarter consolidation after a new all-time high, with traders watching MVRV and Z-score metrics alongside price levels around $60,000. The combination of shifting on-chain signals and macro risk sentiment will likely influence whether the current downtrend resumes or a broader accumulation phase takes hold.

Why it matters

On-chain metrics like MVRV provide a lens into the psychological and behavioral underpinnings of Bitcoin’s price action. When the market value to realized value ratio approaches breakeven, commentators interpret it as a potential signal that the supply-weighted cost basis is, on average, becoming cheaper relative to current market prices. CryptoQuant contributors have highlighted that Bitcoin’s MVRV ratio hovered around 1.13 after Bitcoin’s dip below the $60,000 level last week—the lowest print since March 2023, when BTC traded near $20,000. That backdrop matters because it frames a broader narrative: the asset may be transitioning from a drawdown phase into a period where long-term holders could be stepping in at historically favorable levels.

“Generally, when the MVRV ratio falls below 1, Bitcoin is regarded as undervalued. At present, the indicator stands at around 1.1, suggesting that price levels are nearing the undervaluation range.”

CryptoQuant’s analysis emphasizes that the current reading should be interpreted in the context of a four-month downtrend that followed Bitcoin’s October 2025 peak. The team notes that the market did not experience a sharp move into an obviously overvalued zone during the most recent bull cycle, a nuance that could influence how traders interpret the “bottom formation” narrative this time around. The research argues that such a structural difference could mean the eventual bottom may form gradually rather than through a sudden capitulation event—a scenario that has implications for long-term investors and risk teams evaluating exposure.

“The current Z-Score of $BTC is lower than during the bear market bottom in 2015, 2018, COVID crash 2020 and 2022,”

commented Michaël van de Poppe, a well-known trader and analyst, underscoring how the present configuration differs from prior cycles. In another update, CryptoQuant contributor GugaOnChain used a separate Z-score iteration to characterize BTC/USD as being in a “capitulation zone,” a reading that some interpret as an early stage of accumulation pressure forming behind the scenes. The analyst framed the takeaway as an invitation to consider the bottom could be forged in the current environment rather than simply waiting for a textbook capitulation event to materialize.

“The indicator suggests that we are approaching the historical accumulation phase,”

GugaOnChain wrote, adding that the statistical deviation captured by the Z-score points to opportunity rather than imminent disaster. While the language is nuanced, the consensus in these on-chain circles is that Bitcoin’s downside risk may be increasingly limited as long-term holders show willingness to accumulate near these levels.

What to watch next

- Track the MVRV ratio for a breakeven shift toward or below 1.0, which historically signals stronger undervaluation periods or a local bottom formation.

- Monitor the two-year rolling Z-score trajectory for a sustained move away from capitulation readings toward accumulation-style behavior.

- Observe Bitcoin price action around key support zones, particularly a continued hold above $60,000 and any subsequent retests that could validate the on-chain narrative.

- Look for corroborating on-chain signals, such as realized-cap data and transaction-flow metrics, that would reinforce a shift from distribution to accumulation.

Sources & verification

- CryptoQuant analysis on Bitcoin’s MVRV ratio and the “undervalued” zone hypothesis.

- CryptoQuant commentary on Z-score readings and capitulation-zone signals for BTC/USD.

- Cointelegraph coverage of Bitcoin’s price action, including the recent dip below $60,000 and prior bear-market analyses referenced in related on-chain pieces.

- Historical context from on-chain reporting on prior cycle bottoms (2015, 2018, 2020, 2022) and the 2023 regime when MVRV prints below 1.

Bitcoin’s on-chain signals point toward undervaluation and potential bottom formation

Bitcoin’s current on-chain narrative centers on a delicate balance between valuation signals and price action. The MVRV ratio, long used to gauge whether market prices are aligned with realized on-chain cost bases, has begun to test a breakeven threshold after a prolonged downtrend. The latest reads show MVRV around 1.1, a level that CryptoQuant contributors describe as edging into an undervaluation zone. This is especially notable given that the most recent weekly close saw BTC slip under the $60,000 mark, a psychological line that has acted as both a magnet and a ceiling in various market regimes. The juxtaposition of a price discipline around key levels with an MVRV metric that says, metaphorically, “value is being accumulated near the current prices,” fuels a nuanced debate on whether a lasting bottom is imminent or whether further consolidation is necessary before a durable uptrend can resume. (CRYPTO: BTC)

CryptoQuant researchers emphasize that when MVRV falls below 1, the signal is a cleaner undervaluation flag. While the current approximation sits around 1.1 rather than 1.0, the interpretation remains constructive: price levels could reflect a rising probability of longer-term value attraction. The last time MVRV explicitly dipped below 1 was at the start of 2023, when BTC traded around $20,000. The comparison underscores that the present cycle has delivered a different flavor of bottoming dynamics, one that may unfold more gradually than in prior cycles. The source notes that the peak-to-trough structure of the current drawdown did not send the market into a textbook overvalued regime, which broadens the set of possible scenarios around the eventual bottom and subsequent recovery.

“Generally, when the MVRV ratio falls below 1, Bitcoin is regarded as undervalued. At present, the indicator stands at around 1.1, suggesting that price levels are nearing the undervaluation range.”

Beyond the MVRV signal, the market is attuned to the behavior of another metric set—the Z-scores that measure how far current values diverge from historical patterns. In two-year windows, the MVRV Z-score has dipped to an all-time low in several instances, a pattern analysts say mirrors the kinds of bottoming behavior seen in previous cycles. Michaël van de Poppe has highlighted that the current Z-score is lower than what was observed at major bear-market bottoms in 2015, 2018, 2020, and 2022, though no single metric guarantees an outcome. A different analyst, GugaOnChain, has used an alternate Z-score variant to characterize BTC/USD as being in a capitulation zone—an environment that often precedes accumulation-driven rebounds. The underlying message is that the bottom formation, if it is underway, could be a more drawn-out process than in some historical episodes, with on-chain dynamics providing nuance that price charts alone might miss.

These signals come at a time when the broader market is listening closely to on-chain data instead of relying solely on momentum-driven narratives. The combination of a price dip to sub-60k levels and a valuation framework that points toward undervaluation is generating renewed interest among long-term holders who recall similar cycles in which the real value of Bitcoin begins to assert itself well before a definitive price breakout appears on traditional charts. In this light, the discussion shifts from whether a bottom exists to how convincingly the current readings could translate into a sustainable reversal once the cycle completes its consolidation phase. The narrative remains contingent on a confluence of factors, including future price action, on-chain flows, and macro risks that continue to shape risk appetite across the crypto ecosystem.

The analysis, while nuanced, reinforces a cautious yet curious stance among observers: the market may be near a critical juncture where valuation signals begin to align with price stability and eventual demand. As ever, the caution remains that on-chain indicators offer probabilities, not certainties, and that a range of outcomes remains plausible depending on how external forces evolve in the weeks ahead.

Crypto World

Morgan Stanley Hiring Blockchain Engineers to Integrate Ethereum, Polygon, Canton, and Hyperledger

TLDR:

- The blockchain engineer role integrates Ethereum, Polygon, Hyperledger, and Canton.

- Multi-chain strategy balances public liquidity with enterprise-grade compliance.

- Role focuses on interoperability, secure APIs, and internal orchestration layers.

- Compensation reaches $150,000, reflecting strategic blockchain talent investment.

Morgan Stanley is building a multi-chain blockchain infrastructure integrating Ethereum, Polygon, Hyperledger, and Canton, with engineers earning up to $150,000.

Globally, top banks like ICBC ($6.7T assets) and JPMorgan Chase ($4T) are driving trading and investment growth. This highlights institutional focus on secure, real-time financial data and advanced blockchain solutions.

Role Overview and Multi-Chain Focus

In their post, Morgan Stanley noted that the blockchain engineer will lead projects integrating at least four blockchains. Ethereum offers a public ecosystem with deep liquidity and extensive developer tools.

Polygon complements Ethereum by providing lower fees and faster transactions while maintaining compatibility with Ethereum standards.

Hyperledger supports permissioned networks, channel-level privacy, and customizable consensus, making it suitable for internal banking workflows and consortium-based settlement systems.

Canton emphasizes privacy-preserving synchronization across networks, designed for regulated financial markets.

The combination indicates Morgan Stanley is targeting a hybrid approach. Public networks may handle secondary market activity and broader liquidity access.

Permissioned networks focus on issuance, compliance, and confidential processing. Engineers in this role will manage the integration across these systems to ensure consistent performance and interoperability.

This structure allows different layers of the platform to operate according to business needs. Developers will need to design abstraction layers, secure API gateways, and key management frameworks.

This ensures governance, observability, and DevOps controls remain uniform across networks.

Strategic Purpose and Talent Investment

Morgan Stanley’s posting highlights the institution’s intent to build multi-chain capabilities while reducing reliance on any single blockchain.

Ethereum and Polygon provide market access, while Hyperledger and Canton satisfy privacy and regulatory requirements.

By combining public and permissioned systems, the bank maintains flexibility for evolving regulatory landscapes. Banks are increasingly adopting hybrid systems to balance compliance with liquidity opportunities.

The posting lists compensation up to $150,000 per year, reflecting the strategic value of this role. The position signals that Morgan Stanley is not experimenting but actively investing in blockchain infrastructure.

Candidates are expected to deliver integration solutions that connect public networks with enterprise-grade permissioned systems.

Internal orchestration and platform-agnostic engineering will allow Morgan Stanley to select networks based on product requirements. Engineers will ensure secure transaction processing, consistent governance, and operational transparency.

This aligns the bank with global trends toward tokenized assets and programmable financial infrastructure.

Crypto World

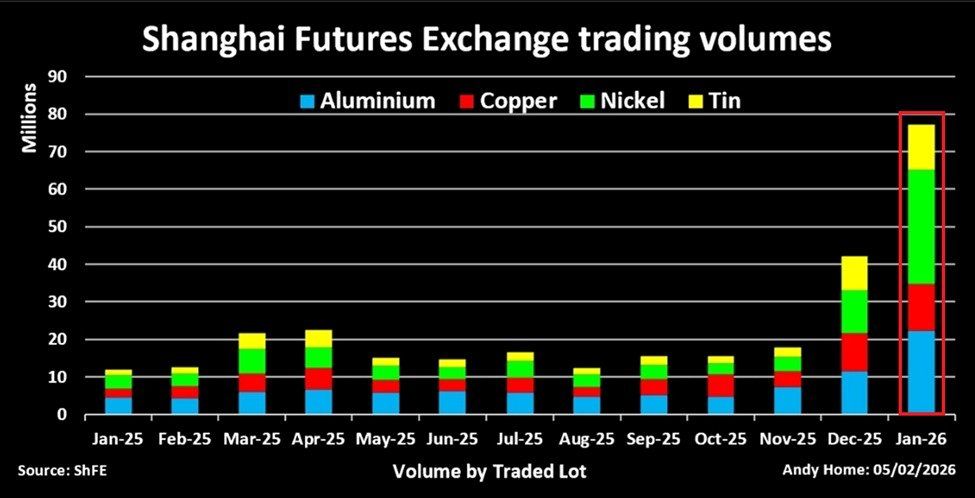

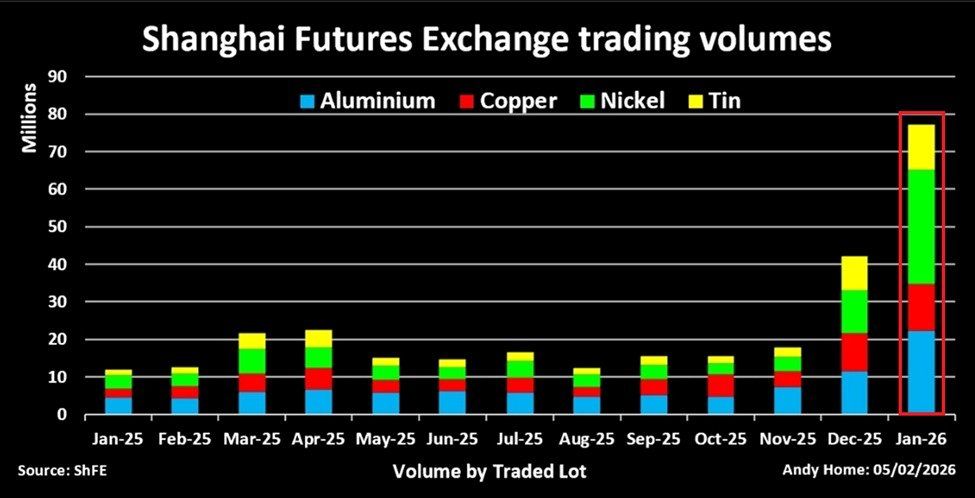

China Metals Futures Jump 86%, Retail Frenzy Triggers 38 Rule Changes

Industrial metals have suddenly become one of the most crowded trades in China, with futures volumes in aluminum, copper, nickel, and tin surging as retail traders pile into the market.

The spike in activity has pushed exchanges and regulators to intervene repeatedly, raising concerns that a wave of speculation—rather than fundamentals—is driving prices and volatility.

Recent market data shows trading activity in key base metals accelerating at an exceptional pace. Combined futures volumes in aluminium, copper, nickel, and tin on the Shanghai Futures Exchange surged sharply month-over-month, reaching levels far above the recent average.

Sponsored

Sponsored

Nickel contracts led the rally, with trading volumes jumping several-fold in a single month. Tin markets also saw extraordinary activity, with daily trading volumes at times exceeding levels that dwarf typical physical consumption benchmarks.

The turnout points to derivatives speculation, not industrial demand, dominating flows, with retail participation being a key catalyst.

Metals trading has become a trending topic across Chinese social media platforms and WeChat trading groups.

“…short-term momentum strategies and leverage are increasingly popular among individual investors,” the Kobeissi Letter indicated.

This pattern mirrors earlier speculative episodes seen in equities, crypto, and commodities, where retail enthusiasm quickly amplified price swings.

The rally’s speed has forced exchanges to step in. Both Shanghai and regional futures markets have repeatedly raised margin requirements and tightened trading rules in recent weeks.

Sponsored

Sponsored

“As a result, the Shanghai and Guangzhou Futures Exchanges have raised margins and tightened trading rules 38 times over the last 2 months to try to contain the speculation. The metals rush is far from over,” Markets Today reported.

This unusual but frequent set of interventions may signal mounting concern about excessive leverage. Historically, such measures have been used to slow speculative inflows and stabilize markets when price movements become detached from underlying supply-and-demand fundamentals.

However, repeated tightening also shows:

- How quickly trading volumes have expanded

- How difficult it may be to contain momentum once retail participation reaches critical mass.

Periods of rapid speculative growth often precede sharp corrections, particularly in highly leveraged derivatives markets.

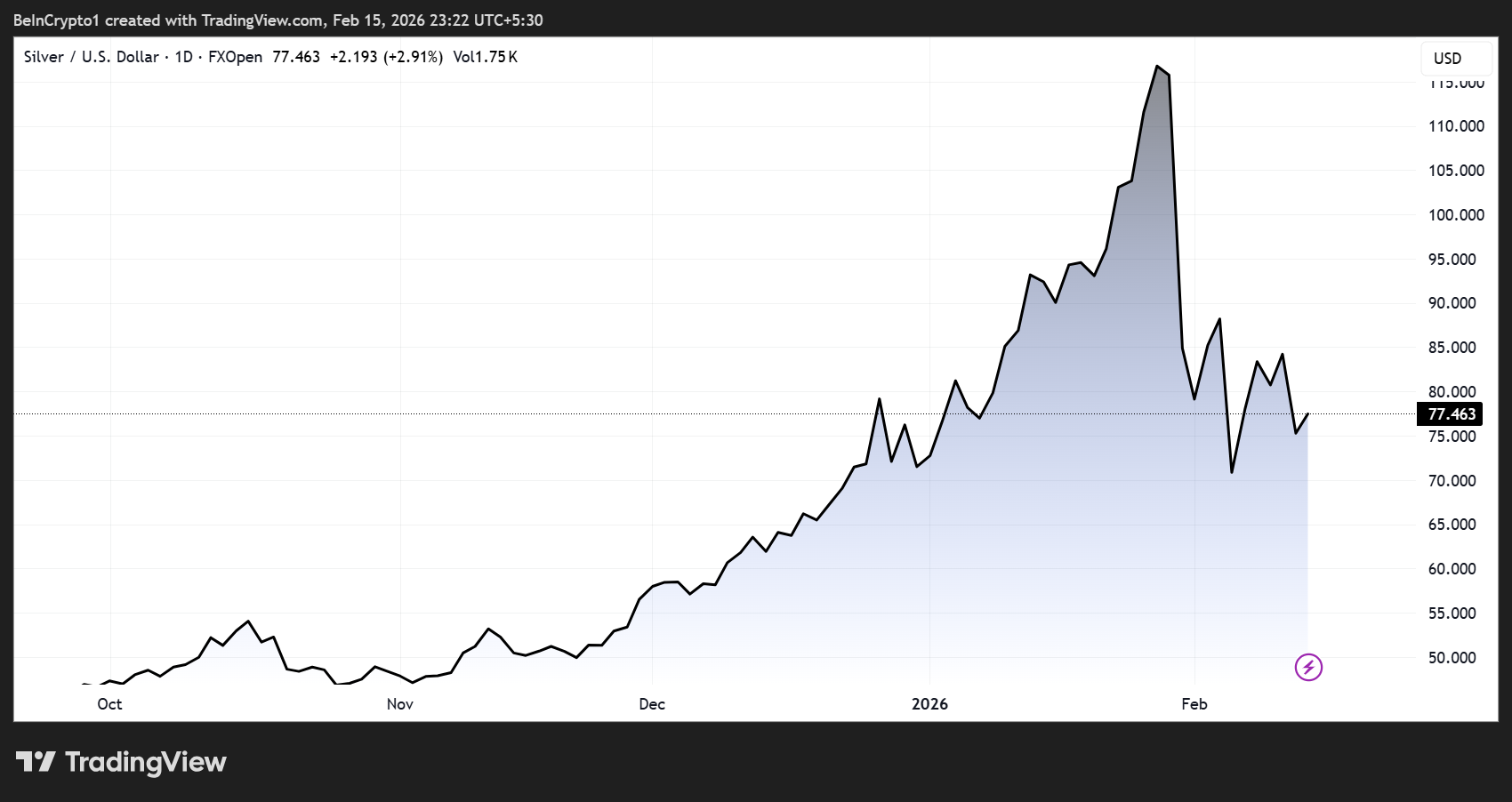

At the same time, the broader metals complex is sending mixed signals. Silver, in particular, has experienced one of the strongest rallies in its history, climbing sharply over the past year before entering a more volatile consolidation phase.

Sponsored

Sponsored

Against this backdrop, some strategists argue that silver and other metals have become stretched relative to broader commodity indices. In previous cycles, such conditions sometimes preceded cooling price action.

Others counter that structural supply constraints and strong industrial demand, especially from energy transition technologies, could continue to support elevated prices over the longer term.

The divergence in views reflects a market struggling to distinguish between structural trends and speculative excess.

Sponsored

Sponsored

Macro Forces Lurking Behind the Rally

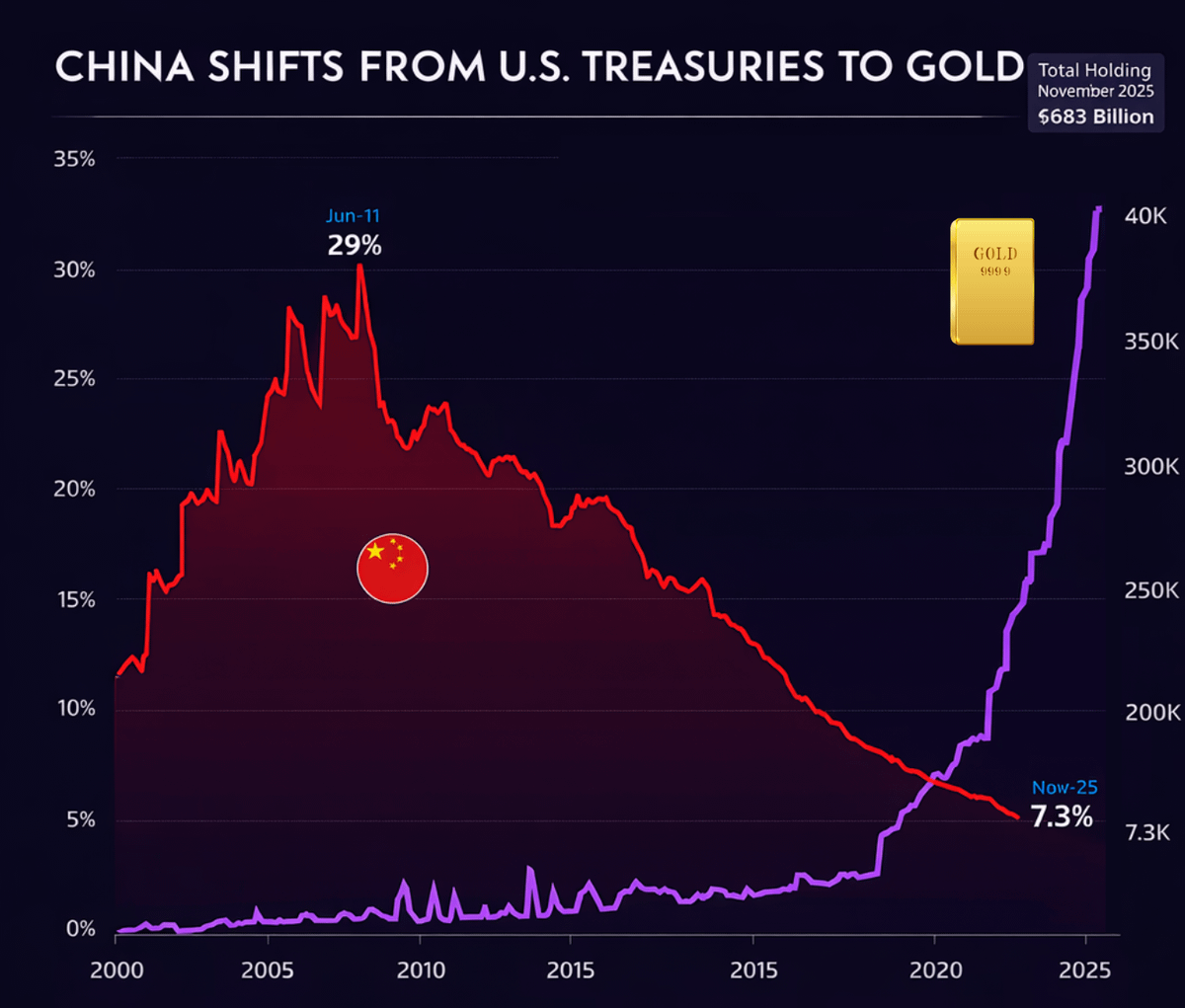

Beyond retail speculation, the metals surge comes amid broader macroeconomic shifts. China has been steadily reducing its holdings of US Treasuries while increasing gold reserves.

This reinforces the perception that global capital is increasingly seeking diversification away from TradFi assets.

The People’s Bank of China has reported consecutive months of gold accumulation, a trend mirrored by several other central banks in recent years.

While these macro trends do not directly explain the retail-driven surge in industrial metals trading, they contribute to a wider narrative that investors at multiple levels—from individuals to sovereign institutions—are reassessing risk, liquidity, and the role of hard assets in portfolios.

The combination of retail speculation, tightening exchange controls, and mixed macro signals suggests volatility is likely to remain elevated in the months ahead.

Crypto World

Founders admit blockchain transparency is the only defense

Prediction markets are increasingly being framed not as gambling platforms but as vehicles for monetizing information, though founders acknowledged the line can blur depending on user intent at Consensus Hong Kong 2026.

Ding X, founder of Predict.fun, argued that prediction markets more closely resemble insurance underwriting or poker than roulette. “It’s more information trading and trying to hedge risk, rather than gambling,” he said, distinguishing skill-based forecasting from games where long-term odds guarantee losses.

Farokh Sarmad, co-founder of DASTAN, agreed that speculation exists but described the sector as “a multi-trillion dollar asset class in the making.” In his view, prediction markets are simply “financializing information,” allowing participants to monetize insight rather than leaving value solely with media companies or bookmakers.

Jared Dillinger, CEO of New Prontera Group and a former professional athlete, said the classification depends largely on how platforms are built and used. “It just depends on the eyes of the beholder,” he said, adding that prediction markets function as “an information asset class,” even if some users approach them like bets.

The more pressing challenge is insider trading. High-profile examples—from leaked entertainment setlists to geopolitical developments—have underscored the risk of information asymmetry.

“Insider information is not okay,” Sarmad said, noting that blockchain transparency can make suspicious wallets visible. Still, Dillinger acknowledged enforcement limits. “There’s always going to be some loopholes that people will find.”

As trading volumes rise and regulators take notice, founders agreed that surveillance tools, clearer disclosure norms and stronger platform governance will determine whether prediction markets mature into a recognized financial category—or remain viewed as speculative betting.

Crypto World

XRP ETFs Weekly Review: Has the Demand Disappeared?

Here’s what happened to the Ripple ETFs in the past week.

It was three months ago when the wait was finally over for the XRP Army as the first spot exchange-traded fund tracking the performance of their favorite asset in the US launched.

The initial trading days were more than impressive, and a few more funds joined the Ripple fleet. However, the past week showed a rather worrying trend reversal.

XRP ETFs’ Demand Slows

Canary Capital’s XRPC set a debut-day trading volume record in 2025 on its November 13 launch and remains the market leader despite the launch of four additional funds. It now holds more than $410 million in cumulative net inflows, followed by Bitwise’s XRP ($360 million) and Franklin Templeton’s XRPZ ($328 million).

The products went for over a month without a single red day in terms of net flows, and quickly surpassed the $1 billion mark. However, the green streak broke on January 7, and there were a few more painful days since then, including January 20, and the worst – January 29.

Nevertheless, most full trading weeks ended in the green, with total net inflows stabilizing above $1.20 billion. The past week, though, showed little interest despite three days being in the green. The net inflows were $6.31 million on Monday, $3.26 million on Tuesday, and $4.5 million on Friday, shows data from SoSoValue.

Thursday was a red day, with a net withdrawal of $6.42 million, while Wednesday’s trading volume was absent, with $0.00 in flows. Although the week ended slightly in the green ($7.65 million), the total number and individual daily performance clearly show a declining demand.

But XRP Price Rockets

Despite the lack of interest in the ETFs, the underlying asset’s price went through some intense volatility, especially during the weekend. The token recovered from last week’s plunge to $1.11 but was rejected at $1.55 and spent most of the past several days sitting around $1.40.

You may also like:

The bulls went on the offensive in the past 48 hours, pushing the cryptocurrency to a multi-week peak of just over $1.65 earlier today. Nevertheless, XRP was rejected once again there and now sits around $1.55 once more.

Despite the retracement, XRP’s market cap remains well above $90 billion, placing it north of BNB for the battle for the fourth place in terms of that metric.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

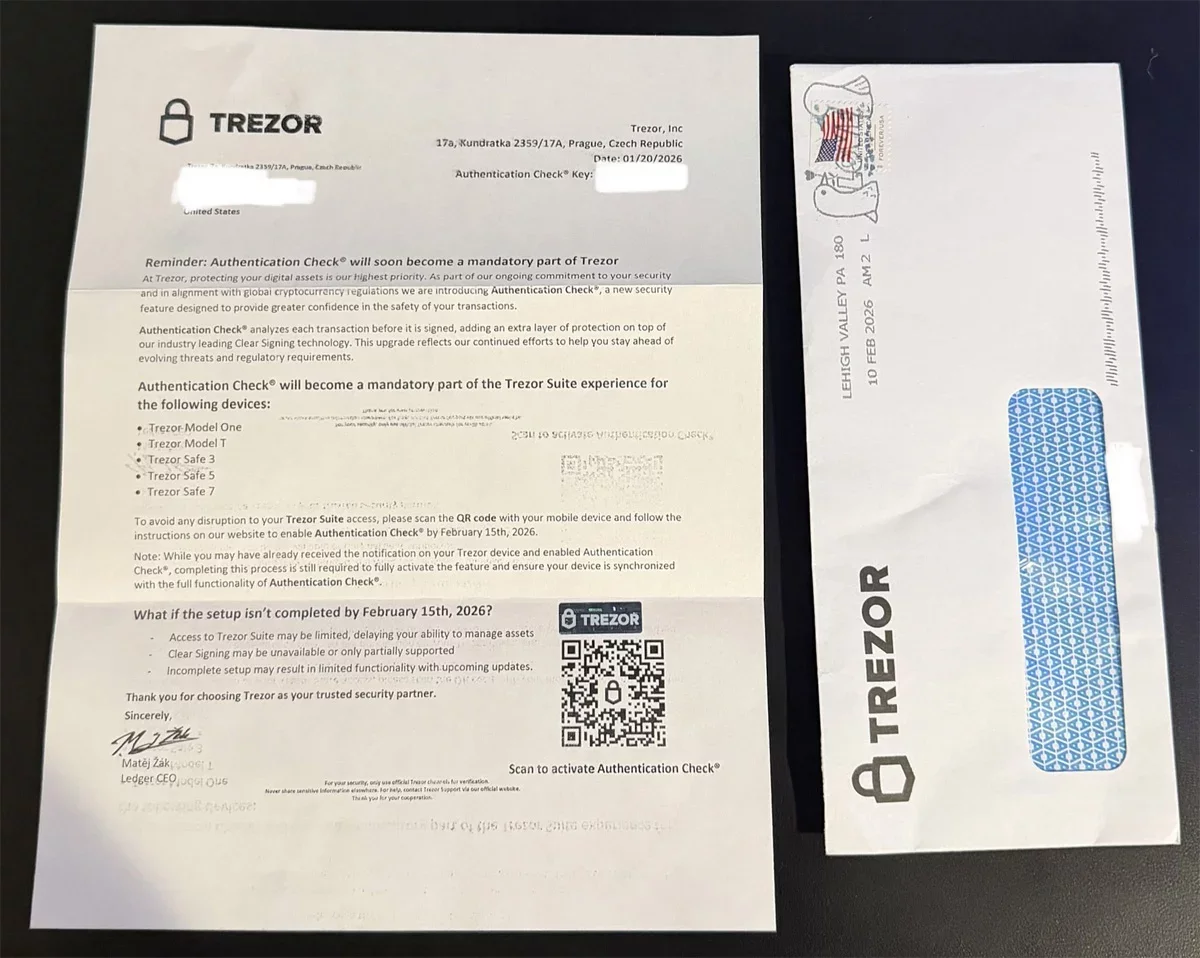

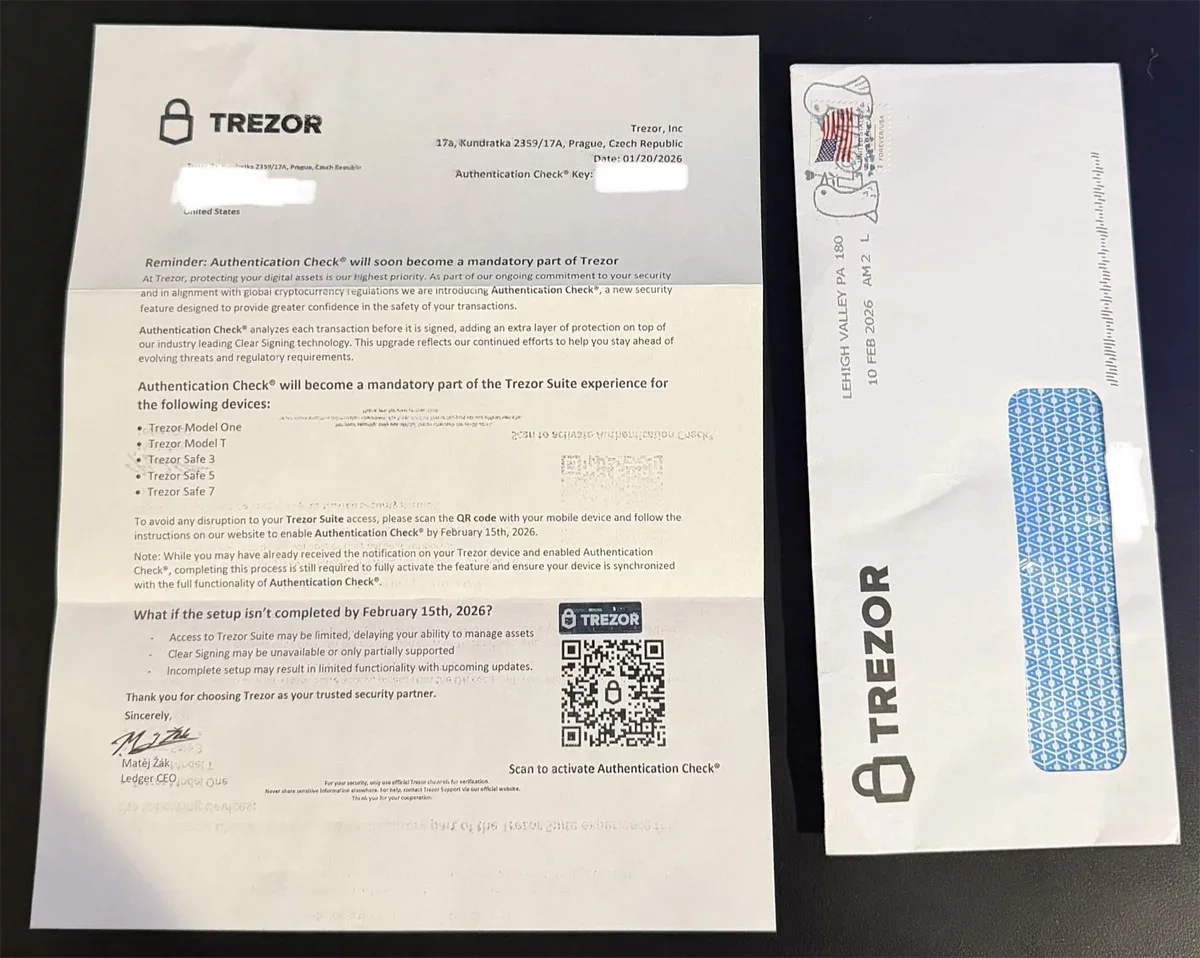

Fake Trezor, Ledger letters target crypto wallet recovery phrases

Crypto hackers are sending physical letters impersonating Trezor and Ledger to steal cryptocurrency wallet recovery phrases.

Summary

- Hackers mail fake Trezor and Ledger letters with phishing QR codes.

- Sites request recovery phrases and grant attackers full wallet control.

- Hardware wallet firms never ask users to share seed phrases.

The phishing campaign claims recipients must complete mandatory “Authentication Check” or “Transaction Check” procedures.

The hackers are also creating urgency through deadlines of February 15, 2026 for Trezor. Letters printed on official-looking letterhead direct users to scan QR codes leading to malicious websites.

The phishing sites request 24-, 20-, or 12-word recovery phrases under the pretense of verifying device ownership.

Once entered, recovery phrases transmit to threat actors through backend API endpoints, granting attackers full control over victims’ wallets and funds.

Both hardware wallet companies suffered data breaches in recent years that exposed customer contact information.

Phishing sites create urgency through functionality warnings

Cybersecurity expert Dmitry Smilyanets received a fake Trezor letter warning that failure to complete authentication would result in lost device functionality.

“To avoid any disruption to your Trezor Suite access, please scan the QR code with your mobile device and follow the instructions on our website,” the letter stated.

The Trezor phishing site displays warnings about limited access, transaction signing errors, and disruption with future updates.

A similar Ledger-themed letter circulated on X, claiming Transaction Check would become mandatory.

The phishing pages allow users to enter recovery phrases in multiple formats, falsely claiming the information verifies device ownership and enables authentication features.

Once victims enter recovery phrases, data transmits to the phishing site. Attackers import the wallet onto their own devices and drain funds.

The letters create false urgency by claiming devices purchased after November 30, 2025 come pre-configured, pressuring earlier buyers to act.

Crypto hardware wallet companies never request recovery phrases

Physical mail phishing campaigns targeting hardware wallet users remain relatively rare. Crypto hackers mailed modified Ledger devices in 2021 designed to steal recovery phrases during setup. A similar postal campaign targeting Ledger users was reported in April.

Anyone possessing a wallet’s recovery phrase gains full control over the wallet and all funds. Trezor and Ledger never ask users to enter, scan, upload, or share recovery phrases through any channel.

Recovery phrases should only be entered directly on hardware wallet devices when restoring wallets, never on computers, mobile devices, or websites.

The targeting criteria for the physical letters remains unclear. However, both companies’ past data breaches exposed customer mailing addresses and contact information to potential attackers.

Crypto World

prediction markets must shift from betting

Ethereum co-founder Vitalik Buterin warned that prediction markets are sliding toward “unhealthy product market fit” by focusing on short-term cryptocurrency price bets and sports betting.

Summary

- Vitalik warns prediction markets are becoming short-term gambling tools.

- He urges a pivot toward hedging and real-world risk management uses.

- Proposes personalized prediction baskets replacing fiat stability.

Writing on X, Buterin called the trend “corposlop” and argued platforms feel pressured to embrace dopamine-driven content that lacks long-term societal value.

Buterin proposed redirecting prediction markets toward hedging use cases, including a system where personalized prediction market baskets replace fiat currency entirely.

“We do not need fiat currency at all! People can hold stocks, ETH, or whatever else to grow wealth, and personalized prediction market shares when they want stability,” he wrote.

Current model relies on traders with “dumb opinions”

Buterin identified three types of actors willing to lose money in prediction markets: naive traders with incorrect opinions, info buyers running automated market makers to learn information, and hedgers using markets as insurance to reduce risk.

The industry currently depends on naive traders and creates what Buterin called a “fundamentally cursed” dynamic.

“It gives the platform the incentive to seek out traders with dumb opinions, and create a public brand and community that encourages dumb opinions to get more people to come in. This is the slide to corposlop,” he wrote.

Personalized prediction baskets could replace stablecoins

Buterin questioned whether an “ideal stablecoin” based on decentralized global price indices is the right solution. “What if the real solution is to go a step further, and get rid of the concept of currency altogether?” he asked.

The proposed system creates price indices for all major categories of goods and services, treating physical items in different regions as separate categories.

Each user maintains a local large language model understanding their expenses, offering personalized baskets of prediction market shares representing future spending needs.

Users could hold stocks, ETH, or other assets for wealth growth while holding personalized prediction market shares for stability. The system removes fiat currency dependence while allowing customization for individual expense patterns.

Implementation needs prediction markets denominated in assets people want to hold: interest-bearing fiat, wrapped stocks, or ETH. Non-interest-bearing fiat carries opportunity costs that overwhelm hedging value.

“Both sides of the equation are likely to be long-term happy with the product that they are buying, and very large volumes of sophisticated capital will be willing to participate,” Buterin concluded.

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Business7 days ago

Business7 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

NewsBeat7 days ago

NewsBeat7 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports7 days ago

Sports7 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Tech16 hours ago

Tech16 hours agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video2 days ago

Video2 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business6 days ago

Business6 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

NewsBeat6 days ago

NewsBeat6 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World5 days ago

Crypto World5 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World5 days ago

Crypto World5 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat2 hours ago

NewsBeat2 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business3 days ago

Business3 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market