Crypto World

Blockchain Identity Management Solutions for Risk-Free Operations

Identity today sits at the center of nearly every digital interaction, including onboarding customers, approving transactions, accessing services, and ensuring compliance. Yet most identity systems enterprises rely on were designed for a different era.

They are centralized, fragmented, and vulnerable. With the digital ecosystems expanding, their weaknesses are becoming harder to ignore. Data breaches, identity fraud, duplicate identities, and verification delays are no longer occasional problems; they are recurring business risks.

It is exactly the reason why enterprises are actively exploring blockchain identity management solutions as a structural upgrade, not a technological experiment. The reason behind this is that identity is no longer just an IT concern. It is a business-critical asset.

What’s Broken in Traditional Identity Systems

Many organizations still operate with legacy identity frameworks built on siloed databases and third-party verifiers. These models introduce several vulnerabilities.

Centralized Data Silos

Traditional identity systems store sensitive user data in centralized repositories. These become prime targets for cyberattacks. One breach can expose millions of identities, damaging trust and triggering regulatory consequences. For enterprises, this means financial loss, reputational damage, and compliance scrutiny.

Repetitive Verification Processes

Users often verify their identity multiple times across services. This creates:

- Poor user experience

- Higher onboarding costs

- Longer verification cycles

Enterprises lose conversions when onboarding feels slow or intrusive.

Limited User Control

In most traditional systems, organizations control identity data, not users. This, in turn, increases privacy concerns and reduces transparency. Modern consumers increasingly expect control over how their data is used.

Fraud & Identity Theft

Centralized databases make identity manipulation easier. Synthetic identity fraud and credential theft continue to rise globally. For enterprises, this directly impacts fraud management costs and regulatory risk.

Compliance Complexity

Regulations such as KYC, AML, GDPR, and data localization laws require strict identity handling. Managing compliance across jurisdictions becomes complex and costly.

Identity as a Revenue Enabler, Not Just a Security Layer

Traditionally, identity systems were viewed as compliance & security necessities and cost centers rather than value drivers. However, blockchain identity management solutions change that perspective. With verifiable, user-controlled identity frameworks, organizations can unlock:

- Faster customer onboarding

- Reduced KYC friction

- Cross-platform identity reuse

- Lower fraud-related losses

- Personalized digital services

This, in turn, plays a significant role in transforming identity from a back-end obligation into a front-end business enabler.

For instance, fintech platforms can onboard users in minutes instead of days. Healthcare systems can share verified credentials without repeated paperwork. Marketplaces can reduce fake accounts and chargebacks.

In other words, strong identity infrastructure improves revenue efficiency, not just security. Forward-looking enterprises now treat digital identity as part of their growth stack, not just their compliance stack.

Want to Fix Loopholes in Traditional Identity Systems with Blockchain?

How Blockchain Identity Management Changes the Model

Blockchain introduces a decentralized and tamper-resistant identity framework. Instead of relying on a single authority, identity verification becomes distributed, secure, and verifiable.

Decentralized Identity Storage

Data is not stored in one central database. Instead, blockchain enables distributed identity references with cryptographic security. This plays a significant role in reducing breach risk. Even if one node is compromised, the system remains secure.

Self-Sovereign Identity (SSI)

Users have complete control over their identity credentials. They decide what to share and with whom. Enterprises verify credentials without storing excessive personal data, which readily improves privacy compliance and builds user trust.

Tamper-Proof Records

Blockchain records cannot be altered retroactively. Verification history remains fully transparent and reliable, thereby reducing the chances of fraud and simplifying the overall audit process.

Faster Verification

Reusable credentials allow verified identities to be shared across platforms. This helps accelerate the onboarding process while lowering operational costs.

Smart Compliance

Blockchain can embed compliance logic into identity flows. KYC or AML checks can be verified instantly through trusted credentials, reducing repetitive checks.

Real Business Value for Enterprises

Blockchain identity management solutions are not just about security upgrades. They drive measurable business benefits.

Reduced Fraud Losses

Tamper-resistant identity systems lower fraud risk and prevent duplicate identities.

Faster Customer Onboarding

Streamlined verification reduces drop-offs and improves conversion rates.

Lower Compliance Costs

Automated verification reduces manual review and regulatory complexity.

Stronger User Trust

Privacy-centric identity models resonate with modern consumers.

Trust translates to retention.

Interoperable Identity Ecosystems

Identity credentials can work across partners, platforms, and regions, enabling collaboration.

Where Do Enterprises Need to Be Careful?

Adopting blockchain identity requires strategic planning. Here are a few of the most common mistakes committed by enterprises:

- Over-engineering early stages

- Ignoring regulatory nuance

- Poor integration with legacy systems

- Focusing on tech instead of user experience

Identity management transformation should be phased and goal-driven, which is exactly where enterprises need to be cautious.

Why Choosing the Right Digital Identity Solutions Provider Matters

A full-scale blockchain identity management solution touches:

- Security architecture

- Compliance frameworks

- User experience design

- Infrastructure scalability

- Integration layers

Enterprises should understand that it is not a plug-and-play deployment. A capable digital identity solutions provider understands regulatory environments, enterprise infrastructure, and decentralized identity frameworks. Moreover, it is essential to note that poorly designed identity systems create friction rather than trust.

Final Thoughts

Traditional identity systems are showing structural cracks in a digital-first world. On the other hand, blockchain identity management solutions offer a path toward secure, user-centric, and scalable identity ecosystems.

Enterprises adopting it are not just fixing loopholes; they are future-proofing their digital interactions. Antier, as a trusted digital identity solutions provider, works with organizations to design and implement blockchain-based identity systems that align with security, compliance, & user expectations. It is because in the digital economy, trust begins with identity.

Crypto World

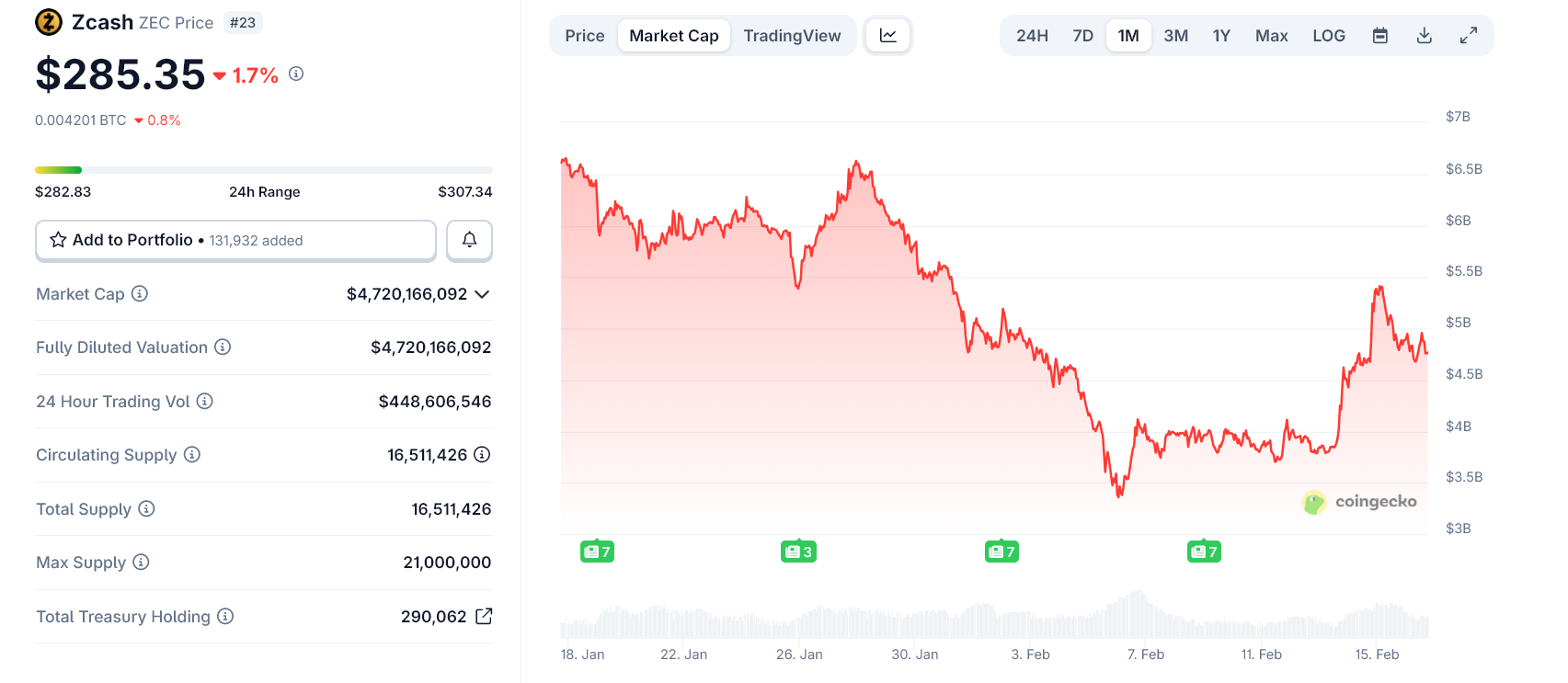

Zcash Creators Officially Split Like OpenAI and Anthropic

Zcash’s original creators have formally broken away from the Electric Coin Company (ECC) and launched a new independent development entity, marking the clearest structural split in the privacy coin’s history.

The team announced today that the Zashi wallet will be rebranded as “Zodl,” confirming that Zcash’s flagship wallet and its original engineers now operate outside ECC’s control.

Sponsored

Sponsored

Original Builders Continue Zcash Development Outside ECC

The announcement formalizes a break that began in January, when the entire ECC staff resigned following a governance dispute with Bootstrap, the nonprofit that owns ECC.

That conflict centered on control, autonomy, and the future direction of Zcash development.

The newly formed ZODL now includes the same engineers and product team that built Zcash’s core privacy technology and developed its flagship wallet.

The organization said it will continue building tools to expand shielded ZEC adoption, independently of ECC and the Zcash Development Fund.

Critically, this means Zcash’s original creators did not leave the ecosystem.

Instead, they regrouped under a new entity and retained operational continuity through the wallet infrastructure. The Zodl wallet remains fully compatible with the Zcash blockchain.

Sponsored

Sponsored

Meanwhile, ECC still exists as a legal entity under Bootstrap ownership. However, it no longer employs the original team that designed and maintained much of Zcash’s modern infrastructure.

As a result, Zcash now has two separate organizational centers tied to its future development.

Split Mirrors OpenAI and Anthropic’s Structural Break

The split closely resembles the OpenAI–Anthropic divide, where former OpenAI leaders left to form a new independent AI company after disagreements over governance and strategic direction. In both cases, the founding engineers and technical leadership exited the original organization and launched a parallel development effort aligned with their original mission.

Importantly, the Zcash blockchain itself has not forked. Blocks continue to process normally, and the ZEC asset remains unchanged.

However, development leadership and technical direction now exist outside the original corporate structure.

This distinction highlights a growing pattern in decentralized ecosystems, where developer continuity can matter more than institutional ownership.

In practice, the engineers who build and maintain protocol infrastructure often shape its long-term trajectory.

Crypto World

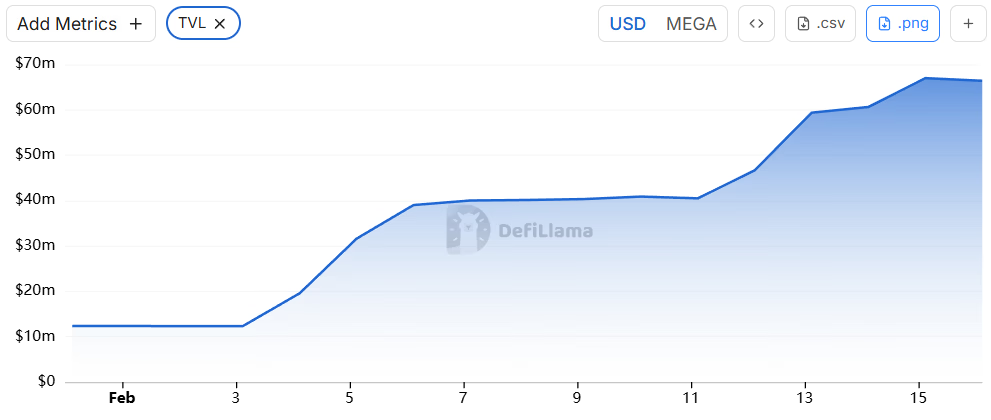

MegaETH TVL Rises 65% in a Week, but TGE Conditions Remain Unmet

A week after the much-anticipated L2’s mainnet launch, the network is showing early liquidity gains, but traction is still below its KPIs for the MEGA token launch.

Ethereum Layer 2 MegaETH’s mainnet, which launched on Feb. 9 following a high‑profile stress test ahead of its debut, has seen total value locked climb to roughly $66.48 million as of today, Feb. 16. The total value on MegaETH represents a roughly 65% increase compared with TVL at the immediate post‑launch period, where it was around $40.3 million, data from DefiLlama shows.

Stablecoins account for the bulk of on‑chain balances, with the chain’s $99.2 million stablecoin market cap up 56% over the past week, while bridged asset TVL are about $122 million.

Decentralized crypto exchange Kumbaya is the largest app on MegaETH by value locked by a wide margin, with roughly $51 million in TVL, dwarfing other early entrants as users have parked capital in its liquidity pools since launch.

Behind Kumbaya, yield‑oriented vault Avon MegaVault, unified DEX World Markets and multi-chain lending protocol Aave collectively hold about $19 million in TVL as of press time.

Token Launch KPIs Lag

As The Defiant previously reported, MegaETH told supporters that its token generation (TGE) event for MEGA is explicitly tied to the network achieving one of three on‑chain key performance indicators after mainnet launch:

- A $500 million circulating supply of the network’s stablecoin, MegaUSD (USDM)

- At least ten “Mega Mafia” apps — the network’s first live and verified dApps — meeting usage thresholds of more than 100,000 transactions across at least 25,000 wallets

- At least three dApps generating $50,000 in daily fees for a month.

As of press time, none of the above conditions have been met, according to MegaETH’s own dashboard that tracks the network’s progress toward TGE. The “Live Mafia Apps” counter shows 5 of the required 10 apps have deployed and are live with verified contracts.

Meanwhile, USDM’s stablecoin circulation metric also sits at just about 10% of the $500 million target, with roughly 13% of that circulating supply deposited into verified smart contracts.

On the revenue front, none of the deployed dApps have hit the critical $50,000 daily fee threshold. According to the dashboard, both Kumbaya is generating $19,000 in daily fees, Cap has $13,000 in daily fees, and Avon hasn’t registered meaningful fee volume.

So, while L2’s infrastructure shows early traction with capital flows and app deployment, the core adoption milestones tied to TGE remain out of reach, at least for now.

MegaETH’s public token sale took place on Sonar in late October and was 20x oversubscribed, seeing over $1 billion in deposits competing for an allocation of the future MEGA token.

Crypto World

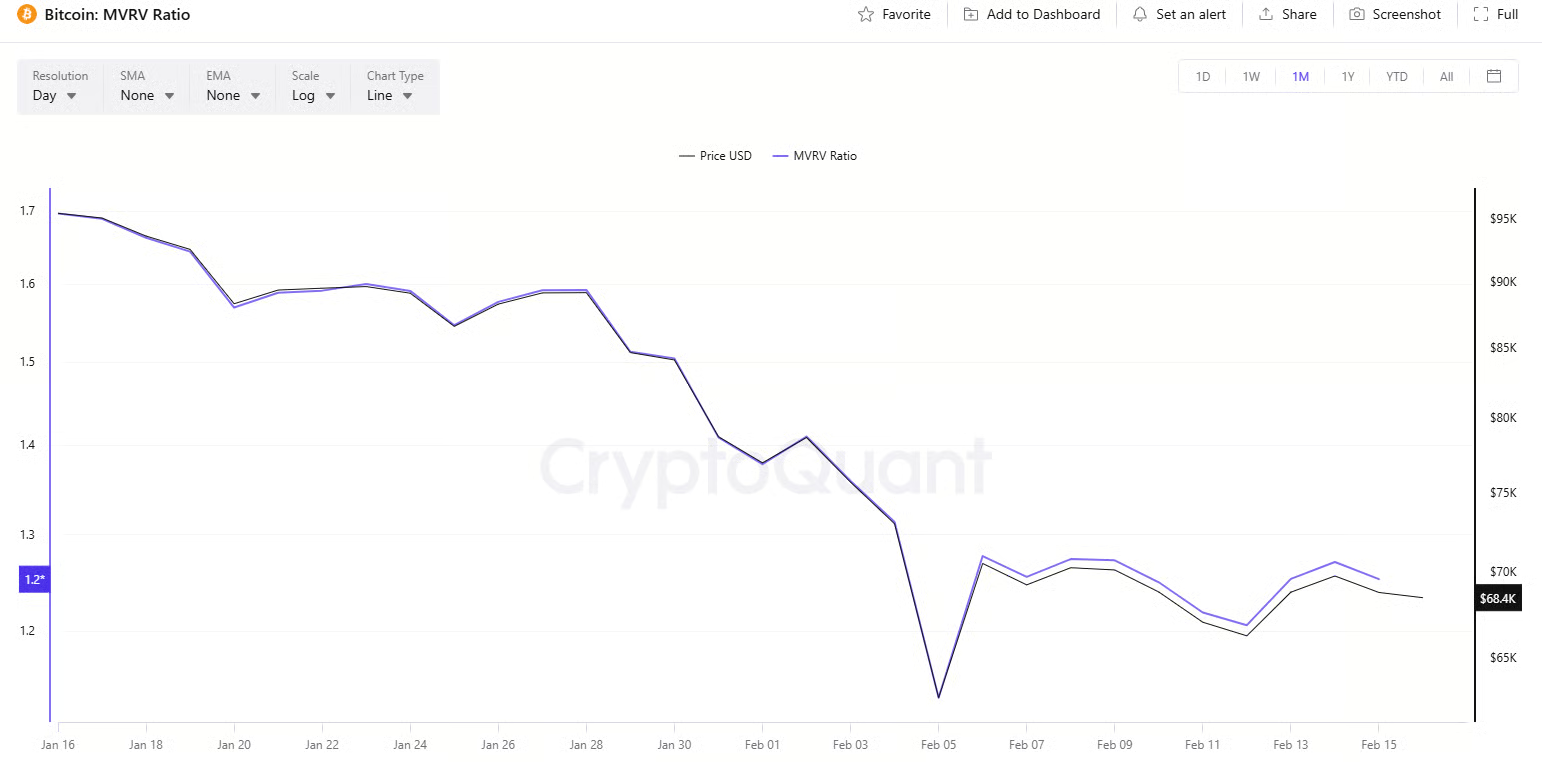

Bitcoin Whales Accumulate as BTC Price Revisits 2024 Entry Zone

Bitcoin has revisited its 2024 whale entry zone as large holders keep buying even as prices keep on falling.

Bitcoin (BTC) has slipped back to price levels last seen in October 2024, the exact moment when whales began their most recent accumulation phase.

On-chain data now shows these large holders are continuing to buy, not exit, suggesting the current downturn may be viewed as a re-entry opportunity rather than a reason to flee.

Whales Accumulate as Retail Fears Grow

According to pseudonymous market watcher CW8900, there has been a steady accumulation among large BTC and Ethereum (ETH) holders. They wrote that Bitcoin’s current price matches the zone where whales started buying in October 2024, and they claim accumulation has increased rather than slowed.

“Despite the decline in $BTC, accumulation continues. In fact, it’s increasing,” CW8900 said.

In a separate post, the analyst noted that Ethereum whales now hold positions at losses comparable to earlier cycle lows, which they described as a pattern seen near bottoms.

The expert wrote regarding the giant ETH holders,

“Their target is the upcoming rally. They are still accumulating massive amounts in preparation for a bull market.”

Market data supports the context behind those claims, with numbers from CoinGecko showing BTC changing hands near $69,000 after moving between $68,000 and $71,000 in the past day. The asset is down about 2% this week, 10% over two weeks, and nearly 28% in a month.

On its part, ETH is showing deeper losses. At the time of writing, the token was trading at just under $2,000 after falling about 40% in a month and 13% in two weeks.

You may also like:

Despite the prevailing conditions, Fundstrat’s Tom Lee believes ETH will rebound fully. He pointed to eight separate drawdowns exceeding 50% that the world’s second-largest cryptocurrency has faced since 2018, including a 64% drop earlier last year. In every case, the asset formed a V-shaped bottom and recovered completely.

However, not all large positions have survived. Trend Research, once Asia’s largest ETH long, closed its final position last week after accumulating $2.1 billion in leveraged longs. According to Arkham, the exit resulted in an $869 million realized loss and came even after founder Jack Yi had predicted ETH would reach $10,000 just days before.

Diverging Signals

Not all indicators are leaning bullish, as revealed by analyst Wise Crypto, who said Bitcoin’s recent 9% rebound between February 12 and February 15 may be a trap. The market technician pointed to hidden bearish divergence on 12-hour charts and a 90% surge in NUPL, which indicated a higher sell risk, with key support levels sitting at $65,000 to $66,000, and $60,000 as the major psychological floor.

To add context to that caution, a recent poll run by chartist Ali Martinez found that only 22.7% of respondents believed $60,000 was the cycle low, while the largest share expected prices to fall toward $38,000.

Interestingly, market intelligence provider Santiment has noted that BTC typically moves opposite crowd expectations, suggesting a potential rally if fear continues to dominate sentiment.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Walmart Stock Surges 20% in 2026: Should Investors Buy Ahead of Earnings?

TLDR

- Walmart stock has gained 20.18% in 2026, outperforming the S&P 500 and Dow Jones indices.

- Walmart became the first retailer to reach a $1 trillion market capitalization.

- Analysts have a ‘Strong Buy’ rating for Walmart stock, but price targets suggest limited growth.

- Walmart stock is expected to retrace slightly, with a 12-month target price of $133.04.

- The company has exceeded earnings per share forecasts in three of the last four quarters.

Walmart (NYSE: WMT), one of the top-performing blue-chip stocks of 2026, is set to release its next quarterly earnings report on February 19. Investors are closely monitoring whether Walmart stock remains a solid buy ahead of the event. The retail giant has recently achieved impressive growth, making it a standout in a challenging market.

Walmart Stock Recent Performance

Walmart stock has surged 20.18% in 2026, outpacing both the S&P 500 and Dow Jones indices. In contrast, the broader market has struggled, with the S&P 500 declining by 0.33% and the Dow Jones rising by just 2.31%. This strong performance is raising questions about whether the stock can continue to climb or if a pullback is imminent.

The retailer’s market capitalization recently crossed $1 trillion, making it the first retailer to reach this milestone. Despite its success, there are concerns about the stock’s high valuation, especially ahead of its upcoming earnings report. A slight miss in earnings could trigger a correction, similar to what occurred with Microsoft’s stock after its latest report.

Wall Street remains largely positive on Walmart stock, with an average rating of ‘Strong Buy.’ However, analysts’ 12-month price targets suggest that the stock may see only modest growth. Walmart stock is expected to retrace 0.63%, with a target price of $133.04 in the next year.

Several analysts have raised concerns about potential pullbacks despite the positive outlook. Bernstein’s Zhihan Ma recently maintained a ‘Buy’ rating but forecasted a drop to $129. Similarly, Citi’s most bullish forecast of $147 suggests just a 9.79% increase from current levels. These predictions indicate that even optimistic estimates expect limited upside for the stock in the near term.

The Outlook for Walmart’s Earnings Report

Ahead of its earnings report, Walmart’s strong performance in recent quarters offers some reassurance. The company has exceeded earnings per share (EPS) forecasts in three of the last four quarters, increasing the likelihood of another beat. Walmart’s diversified business model, which includes e-commerce and technology, positions it well in both favorable and unfavorable economic conditions.

Even if the economy faces a downturn, Walmart’s reputation for offering ‘great value’ prices could drive continued consumer demand. This defensive nature of Walmart’s business model has contributed to its strong performance, making it a relatively safe investment in uncertain times.

Crypto World

OKX Secures Malta License to Launch Regulated Stablecoin Payments Across Europe

Key insights

- MiCA + PSD2 licensing lets OKX legally offer EU-wide stablecoin payments and merchant settlement services.

- Mastercard partnership enables self-custody spending, auto conversion at checkout, and fiat payouts to merchants.

- Investment in tokenized RWA stablecoins signals shift from trading platform to full financial infrastructure provider.

Can Stablecoins Finally Be Used Like Everyday Money

Cryptocurrency exchange OKX has received a Payment Institution (PI) license in Malta, clearing the way to offer regulated stablecoin payment services across the European Economic Area (EEA). The approval aligns the company with both the Markets in Crypto-Assets (MiCA) regulation and the Second Payment Services Directive (PSD2), which take full effect in March 2026.

🇪🇺 OKX EXPANDS CRYPTO PAYMENTS IN EUROPE

OKX just secured a European payments license to expand stablecoin payments and its crypto card business. pic.twitter.com/yZnQSkKWyh

— Coin Bureau (@coinbureau) February 16, 2026

Payment systems handling payments in stablecoins (treated as electronic money tokens) under PSD2 require either a payment institution or electronic money authorization. With the new license, OKX can legally process stablecoin payments while operating under a recognized European regulatory framework.

The exchange says the authorization strengthens its compliance structure and allows its payment products to function across multiple EU countries through passporting rights.

How Does the OKX Card Actually Work at Checkout?

The license supports the rollout of OKX Pay and the OKX Card, launched in partnership with Mastercard. The card enables users to use the stablecoins at merchants all over the world that accept Mastercard.

Funds remain in self-custody until the moment of purchase. At checkout, the stablecoins automatically convert to euros with a 0.4% market spread. Merchants get paid with fiat, whereas users will pay off their crypto account balances without manual conversion.

The card also supports Apple Pay and Google Pay and has up to 20% promotional rewards in crypto on eligible purchases. Transactions operate through a licensed European payments partner and follow strict AML and KYC requirements.

OKX Building More Than a Payment Card

The licensing move coincides with OKX’s broader investment in stablecoin infrastructure. Its venture arm recently backed STBL, a project developing a real-world-asset-backed stablecoin on the company’s X Layer blockchain. The initiative involves Hamilton Lane and Securitize and will provide tokenized exposure to a private credit fund.

By combining its earlier MiCA CASP authorization with the new PI license, OKX now operates a fully regulated crypto payments framework in Europe. The plan is to bridge traditional finance and blockchain settlement systems-enabling crypto to be not only tradable, but spendable in life.

With this move, OKX positions itself as a compliant, payment-ready crypto platform built for Europe’s next regulatory era.

Crypto World

Solana price confirms bull trap as local structure shifts bearish

Solana’s price invalidated its recent breakout attempt after failing to hold above key resistance, confirming a bull trap and shifting the short-term market structure back to bearish.

Summary

- Failed breakout above $88 confirms bull trap, trapping late buyers

- Rejection at the point of control signals bearish control, favoring downside rotation

- $78 support is the key level to watch, with potential reaction or swing-failure setup

Solana (SOL) price has entered a critical corrective phase after recent price action failed to sustain acceptance above major resistance levels. What initially appeared to be a bullish continuation has now revealed itself as a classic bull trap, catching late buyers before the price reversed sharply lower.

This type of failed breakout often marks an important inflection point, especially when it occurs at high-timeframe resistance and value extremes.

As price rotates back into its prior trading range, technical signals suggest that downside continuation is now the higher-probability scenario in the immediate short term.

Market participants are closely watching how Solana behaves as it approaches key support levels, where either further breakdown or a reactive bounce may emerge.

Solana price key technical points

- Bull trap confirmed above $88 resistance, invalidating the bullish breakout

- Rejection at the point of control signals weakness, favoring range rotation lower

- $78 high-timeframe support comes into focus, with Fibonacci confluence below

Solana’s recent rally pushed price above the value area high and into high-timeframe resistance near the $88 region. However, this move lacked sustained acceptance. Instead of consolidating above the resistance, the price quickly stalled and reversed, signaling that buyers were unable to maintain control at higher levels.

This behavior is characteristic of a bull trap, where price briefly trades above resistance to attract breakout buyers before reversing back into the prior range. Once acceptance above resistance fails, the resulting move lower is often sharp as trapped longs are forced to exit positions.

The inability to hold above the value area high was the first warning sign. This level typically defines the upper boundary of fair value within a range, and rejection here often leads to rotations back toward lower value.

Rejection at point of control confirms bearish shift

Following the failure above resistance, Solana rotated back into the trading range and attempted to stabilize near the point of control (POC). The POC represents the price level at which the highest trading volume has occurred and often serves as a balance point during consolidation phases.

However, Solana was unable to reclaim or hold above this level. The rejection at the POC confirms that sellers remain dominant and that the market has transitioned from balance into renewed imbalance. When a price is rejected at the POC after a failed breakout, it significantly increases the probability of a full-range rotation.

This rejection marks a clear shift in short-term market structure, turning the local bias bearish and opening the path toward lower support levels.

$78 support becomes the immediate downside target

With local structure now bearish, attention turns to the next major downside level. High-timeframe support near $78 stands out as the primary target. This region aligns with the value area low and represents the lower boundary of the broader trading range.

Importantly, the 0.618 Fibonacci retracement rests just below this level, adding further technical confluence. Fibonacci retracement zones often act as magnets for price during corrective phases, particularly after failed breakouts.

A move into this region would complete a full range rotation and likely coincide with increased volatility as liquidity is tested. Whether Solana stabilizes or continues to decline will depend heavily on the reaction at this support zone.

Swing failure pattern could signal reversal

While the immediate bias favors downside continuation, the $78 region is not just a bearish target — it is also a potential inflection zone. If price sweeps below this support, tests the 0.618 Fibonacci level, and then quickly reclaims the level, it could form a swing failure pattern (SFP).

Such behavior would indicate a liquidity grab rather than a true breakdown and could mark the beginning of a corrective bounce or even a larger reversal, depending on volume and follow-through. For this reason, price action around $78 should be monitored closely rather than treated as an automatic breakdown.

What to expect in the coming price action

From a technical, price action, and market structure perspective, Solana’s recent rejection confirms a bull trap and shifts short-term momentum firmly bearish. As long as the price remains below the value area high and the point of control, downside continuation toward the $78 support zone remains the higher-probability outcome.

Until bullish acceptance returns above key value levels, rallies should be treated with caution. The market is now in a corrective rotation phase, and how Solana reacts around $78 will likely define the next major move.

Crypto World

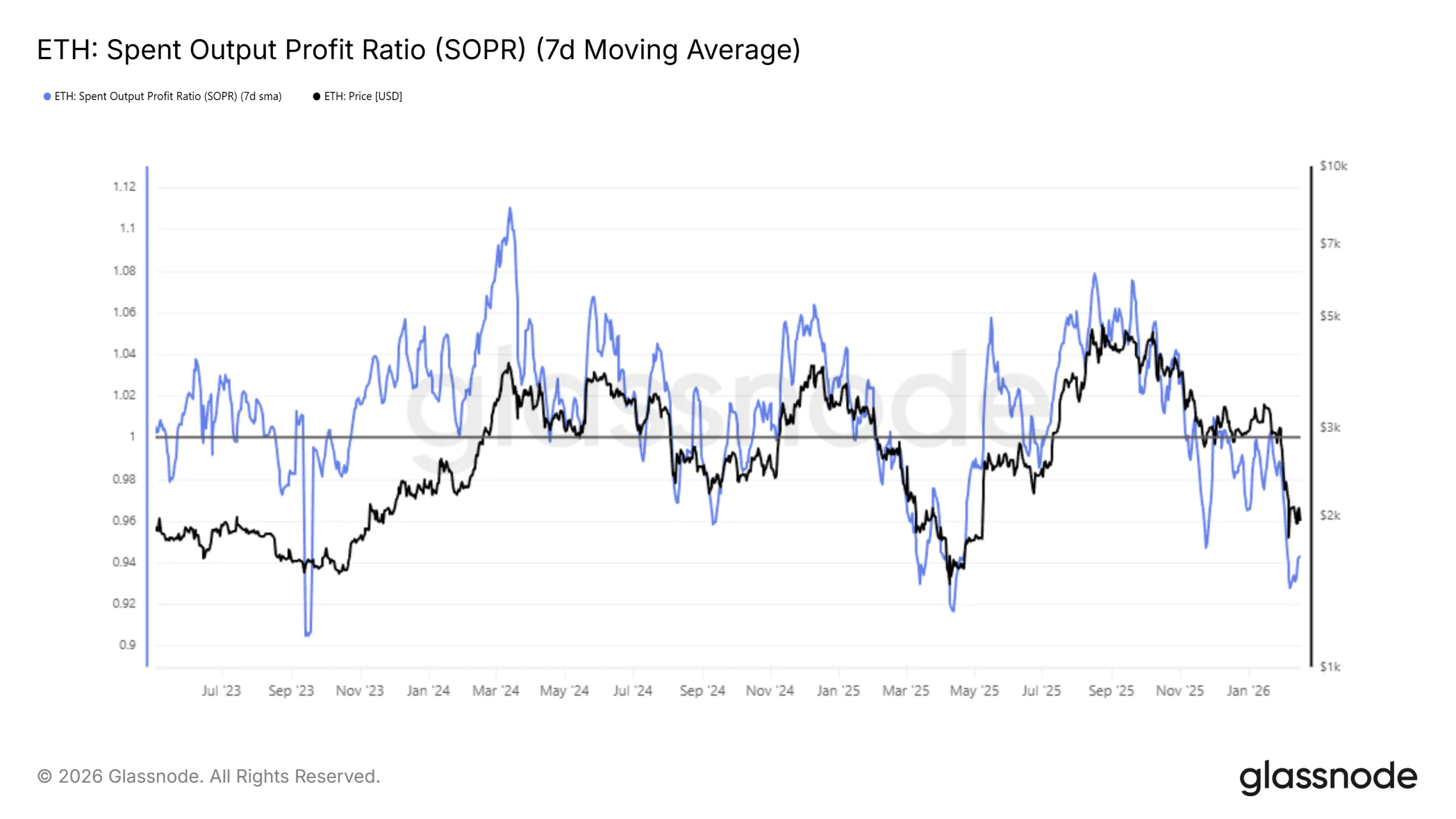

Ethereum Loss Saturates, but Holder Exodus Caps Price Recovery

Ethereum continues to trade in a narrow range near $2,000. ETH has struggled to generate sustained upside momentum in recent weeks.

While on-chain data suggests selling pressure may be nearing exhaustion, another concern is emerging. A decline in new network participation could restrict fresh capital inflows.

Ethereum Holders Are Realizing Losses

Ethereum’s Spent Output Profit Ratio, or SOPR, recently slid to 0.92. This marks the deepest level since April 2025. A reading below 1 indicates that investors are selling at a loss. Such behavior often reflects panic and fear during prolonged consolidation phases.

Sponsored

Sponsored

Historically, extreme lows in SOPR have preceded reversals. Selling at a loss tends to saturate at these levels. As panic fades, investors often shift to holding rather than exiting positions. Many choose to accumulate at discounted prices. Similar behavior could support ETH stabilization if confidence gradually returns.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Despite potential loss exhaustion, broader network metrics raise caution. The number of new Ethereum addresses recently fell to an eight-week low. New participants typically inject fresh liquidity and support recovery phases.

Over the past 48 hours, new addresses declined by 34%. The figure dropped from 336,000 to 221,000. This sharp contraction suggests waning retail interest. Reduced onboarding can limit capital inflows, which may constrain short-term Ethereum price appreciation despite improving sentiment among existing holders.

ETH Price Is Stuck At $2,000

Ethereum is trading at $1,970 at the time of writing. The asset remains above the $1,902 support level. However, it continues to struggle below the $2,051 resistance, which aligns with the 23.6% Fibonacci retracement level. Failure to reclaim this zone keeps upside limited.

Current indicators suggest continued consolidation between $1,902 and $2,241. ETH may face repeated rejection near $2,051 until stronger demand emerges. Without confirmation of this level as support, recovery attempts are likely to remain capped, reinforcing range-bound price action.

However, a decisive breakout could shift sentiment quickly. If Ethereum secures $2,051 as support and breaches the $2,241 resistance, bullish momentum may strengthen. Such a move could propel ETH toward $2,395 and higher, invalidating the prevailing bearish outlook and signaling renewed market confidence.

Crypto World

Revival to $80K or Brutal Crash Below $30K?

“Are you actually prepared for the longest bear market in history,” one analyst asked.

Bitcoin bears have been in control lately, with the asset trading well below last year’s peak levels.

The question now is whether BTC can stage a decisive comeback or if a new painful pullback is on the way.

The Bullish Scenario

The primary cryptocurrency started the month on the wrong foot, with the correction intensifying on February 6 when it plummeted to around $60K, the lowest point since October 2024. In the following days, it reclaimed some lost ground and currently trades at approximately $68,200 (per CoinGecko’s data).

One person touching upon the most recent price dynamics of BTC is the popular analyst Ali Martinez. He assumed that the asset appears to have formed an “Adam & Eve” pattern, in which a break above $71,500 could trigger an additional pump to $79,000.

The bullish setup consists of two bottoms: a sharp drop (Adam) followed by a rounder one (Eve). Some traders see it as a sign that selling pressure is fading and that the price may post a substantial short-term revival.

Bitcoin’s Market Value to Realized Value (MVRV) supports the bullish outlook. The index compares the current value of all BTC to the price people initially paid to acquire their holdings. High ratios mean that investors are sitting on big profits and could increase selling pressure, whereas low readings might be interpreted as the end of the bear market.

Over the past few weeks, the MVRV has been steadily declining and now sits near 1.25. According to CryptoQuant, ratios above 3.7 indicate a price top, while values under 1 hint that the bottom could have been reached.

You may also like:

Bitcoin’s Relative Strength Index (RSI) is also worth observing. The technical analysis tool measures the speed and magnitude of recent price changes and provides traders with indications of potential reversal points. It ranges from 0 to 100, with values below 30 seen as buying opportunities and suggesting that BTC may be oversold. On the contrary, ratios above 70 are generally considered a warning of a possible pullback. The RSI has fallen to 28 on a weekly scale.

The Bear Phase Is Just Starting?

Other analysts, including Chiefy, believe another painful decline is the more likely option for BTC in the short term. The X user argued that the asset might be on the verge of a major dump to $29,000 as early as this week and added:

“The final Bull Trap of 2026 is over, and according to this chart, the next crash has already started. Are you actually prepared for the longest bear market in history?”

Meanwhile, BTC balances on centralized exchanges have been climbing in recent weeks. Although this development doesn’t guarantee further downside, it could be interpreted as a bearish sign because it means the number of coins that can be offloaded at any time is increasing.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Tokenized RWAs Rise 13% as Crypto Market Loses $1T

Demand for tokenized real-world assets (RWAs) continued to grow over the past month, even as broader cryptocurrency markets faced heavy selling pressure, underscoring the sector’s resilience and growing institutional footprint.

The total value of onchain RWAs increased 13.5% over the past 30 days, according to data from RWA.xyz. The increase reflects both higher asset issuance, meaning more tokenized securities brought onto public blockchains, and growth in the number of unique wallet addresses holding these assets, signaling expanding participation.

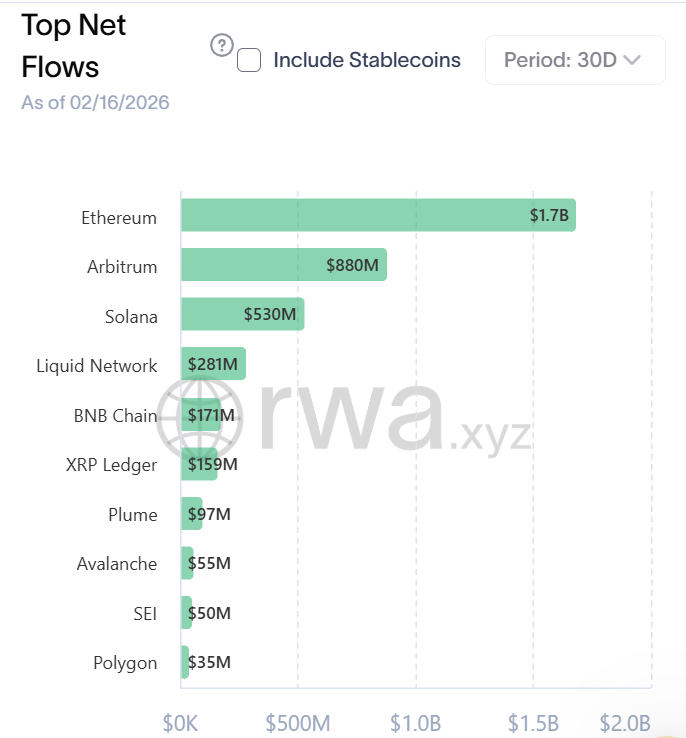

As of Feb. 16, all major blockchain networks tracked by RWA.xyz recorded increases in tokenized asset value, led by Ethereum, with roughly $1.7 billion in net growth, followed by Arbitrum at $880 million and Solana at $530 million. The figures refer to the increase in total onchain value of tokenized assets issued or circulating on those networks.

Tokenized US Treasurys and government debt remain the largest RWA category, with more than $10 billion in outstanding onchain products. Flows into these instruments continued during the period, while tokenized stocks and exchange-traded products also posted gains.

Related: Tokenized gold accounts for 25% of RWA net growth in 2025 after 177% market-cap rise

A sharp contrast with the broader crypto market

Steady demand for tokenized RWAs points to deeper institutional participation, as asset managers increasingly use public blockchains to issue and settle tokenized versions of traditional financial products.

Tokenized money market funds, for example, are evolving beyond simple yield vehicles and are beginning to serve as collateral in certain trading and lending markets. Major institutions, including BlackRock, JPMorgan and Goldman Sachs, have become active participants in the space.

BlackRock last week made its first formal move into decentralized finance, bringing its USD Institutional Digital Liquidity Fund (BUIDL) tokenized US Treasury fund to Uniswap.

The growth also stands in contrast to the broader cryptocurrency market, which has shed roughly $1 trillion in market value over the past month, highlighting the relative stability of yield-bearing tokenized assets.

Derivatives markets have been a key source of stress, with a large-scale deleveraging event in October triggering broader weakness across digital assets. Conditions have yet to fully recover, and sentiment remains fragile even as equities continue trading near record highs.

Related: TradFi giant Fiserv builds real-time dollar rails for crypto companies

Crypto World

2026 is crypto’s integration year, Silicon Valley Bank says

Last year restored crypto’s institutional footing. This year, according to Silicon Valley Bank (SVB), is when it becomes more integrated into the financial system.

Regulatory clarity improved in 2025, institutional engagement accelerated and capital markets reopened. Now the focus is shifting from price cycles to infrastructure as digital assets become more deeply embedded into payments, custody, treasury management and capital markets.

“Regardless of how tangible or visible, all the forces shaping crypto today share a common thread: Crypto is moving from expectations to production. Pilot programs are scaling and capital is consolidating,” Anthony Vassallo, senior vice president of crypto at SVB, told CoinDesk in an interview.

The bank, which maintains more than 500 relationships with crypto companies and venture firms investing in the sector, says institutional capital, consolidation, stablecoins, tokenization and AI are converging to reshape how money moves.

After its 2023 collapse, SVB was bought by North Carolina–based First Citizens Bank and now operates within a top-20 U.S. bank with $230 billion in assets. In 2025, it added 2,100 clients and ended the year with $108 billion in total client funds and $44 billion in loans.

Fewer experiments, more conviction

“The suits and ties have arrived,” according to the bank’s 2026 outlook report.

Venture funding in U.S. crypto companies rose 44% last year to $7.9 billion, according to PitchBook data cited by SVB. While the deal count fell, median check sizes climbed to $5 million as investors concentrated capital into stronger teams. Seed valuations jumped 70% from 2023 levels.

The bank warns that demand for institutional-grade crypto companies could outstrip the number of investable firms.

“In 2026, conditions are ripe for continued growth in VC investment in crypto. As institutional adoption accelerates, driving larger venture capital checks, we expect continued capital concentration in fewer companies with investors prioritizing higher-quality projects and follow-ons into proven teams,” Vassallo said.

“For end users, the result will be a more seamless experience across everyday financial interactions, from sending cross-border payments to managing an investment portfolio.”

Corporate balance sheets are reinforcing the shift. At least 172 public companies held bitcoin in the third quarter of 2025, up 40% from the second, collectively controlling roughly 5% of circulating supply, according to data referenced by SVB.

A new class of digital asset treasury companies, firms that treat crypto accumulation as a core strategy, has emerged. The bank expects consolidation as standards tighten and volatility tests business models.

Meanwhile, traditional banks are moving deeper into the sector. JPMorgan, the largest U.S. bank by assets, plans to accept bitcoin and ether as collateral, Bloomberg reported last year. SoFi Technologies offers direct digital asset trading. U.S. Bank provides custody through NYDIG. SVB expects more institutions to roll out lending, custody and settlement products as compliance guardrails solidify.

M&A and the race to full-stack crypto

Why build when you can buy?

More than 140 venture capital-backed crypto companies were acquired in the four quarters ending in September, a 59% year-over-year jump, according to the bank’s analysis of PitchBook data. Coinbase’s $2.9 billion acquisition of Deribit and Kraken’s $1.5 billion purchase of NinjaTrader underscored the scale.

The trend extends to banking charters. In 2025, 18 companies applied for charters from the Office of the Comptroller of the Currency (OCC), most of them blockchain-enabled firms. The OCC granted conditional approval to digital-asset-focused trust banks including custody provider BitGo (BTGO), Circle Internet (CRCL), the company behind the second-largest stablecoin, trading platform Fidelity Digital Assets, stablecoin issuer Paxos and payments network Ripple.

For SVB, that marks a turning point: stablecoin and custody infrastructure moving inside the federal banking perimeter. The bank expects traditional financial institutions to accelerate dealmaking rather than risk being disrupted by vertically integrated crypto-native rivals.

“We expect M&A to set a record again in 2026. As digital asset capabilities

become table stakes for financial services, companies will focus on acquisition strategies instead of building products from scratch,” Vassallo says.

“To meet market demands ranging from stablecoin capabilities to full-stack crypto banks, exchanges, custodians, infrastructure providers and brokerages will consolidate into multiproduct companies,” he said.

Stablecoins become the ‘internet’s dollar’

Stablecoins, SVB said, are evolving from trading tools into digital cash.

With near-instant settlement and lower transaction costs than interbank transfer system ACH or card networks, dollar-backed tokens are attractive for treasury operations, cross-border payments and business-to-business settlement.

Regulatory clarity is accelerating adoption. The U.S. GENIUS Act, passed in July, established federal standards for stablecoin issuance, including 1:1 reserve backing and monthly disclosures. Similar frameworks are in place in the EU, U.K., Singapore and the UAE.

Beginning in 2027, only permitted entities such as banks or approved nonbanks will be allowed to issue compliant stablecoins in the U.S. SVB expects issuers to spend 2026 aligning products with federal oversight.

Banks are already experimenting. Société Générale introduced a euro stablecoin. JPMorgan expanded JPM Coin to public blockchains. A group including PNC, Citi and Wells Fargo is exploring a joint token initiative.

Venture dollars are following. Investment in stablecoin-focused companies surged to more than $1.5 billion in 2025, up from less than $50 million in 2019, according to SVB.

In 2026, the bank expects tokenized dollars to move into core enterprise systems, embedded in treasury workflows, collateral management and programmable payments.

Tokenization and AI

Real-world asset tokenization is scaling. Onchain representations of cash, Treasuries and money-market instruments exceeded $36 billion in 2025, according to data cited by the bank.

Funds from BlackRock (BLK) and Franklin Templeton have amassed hundreds of millions in assets, settling flows directly onchain. ETF issuers and asset managers are testing blockchain-based wrappers to reduce transfer costs and enable intraday settlement. Robinhood (HOOD) now has tokenized stock exposure for European users and plans U.S. expansion.

SVB sees private and public markets converging on shared settlement rails, with tokenization expanding beyond Treasuries into private markets and consumer-facing applications.

Then there’s the convergence with AI. In 2025, 40 cents of every venture dollar invested in crypto went to companies also building AI products, up from 18 cents the year prior, according to SVB’s analysis. Startups are building agent-to-agent commerce protocols, and major blockchains are integrating AI into wallets.

Autonomous agents capable of transacting in stablecoins could enable machines to negotiate and settle payments without human intervention. Blockchain-based provenance and verification tools are being developed to address AI’s trust deficit.

The consumer impact may be subtle. SVB predicts that next year’s breakout apps won’t brand themselves as crypto. They will look like fintech products, with stablecoin settlement, tokenized assets and AI agents operating quietly in the background.

From expectation to infrastructure

Silicon Valley Bank’s overarching message is to treat crypto as infrastructure.

Pilot programs are scaling. Capital is concentrating. Banks are entering. Regulators are defining the perimeter. Blockchain technology is poised to underpin treasury operations, collateral flows, cross-border payments and parts of capital markets.

Volatility will remain, and headlines will continue to move prices. But the deeper narrative, the bank argues, is about the plumbing.

“In 2025, momentum in onchain representations of cash, treasuries and money market instruments carried real-world assets into the financial mainstream,” Vassallo said. “This year, cryptocurrency will be treated as infrastructure.”

Read more: R3 bets on Solana to bring institutional yield onchain

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat7 days ago

NewsBeat7 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video3 hours ago

Video3 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports7 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat1 day ago

NewsBeat1 day agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat1 day ago

NewsBeat1 day agoMan dies after entering floodwater during police pursuit

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery