Crypto World

BTC, ETH, BNB, DOGE Build Liquidation Pressure After $60K BTC Test

TLDR:

- Aggregated liquidation data shows rising long and short exposure across major crypto assets.

- Bitcoin’s move to $60K triggered a new phase of positioning in derivatives markets.

- Traders expect consolidation for up to 30 days before a clear trend emerges.

- Expanding liquidation clusters increase the chance of a sharp price swing.

Recent liquidation data across major cryptocurrencies shows mounting pressure in derivatives markets. Aggregated levels for Bitcoin, Ether, BNB, and Dogecoin point to growing long and short exposure. Market participants now watch for a decisive move after Bitcoin’s return to $60,000.

Liquidation Levels Expand Across Major Crypto Assets

Crypto analyst Joao Wedson shared aggregated liquidation levels for Bitcoin, Ethereum, BNB, and Dogecoin over the past seven days. The data shows consistent growth in both long and short positions across these assets.

According to Wedson’s tweet, traders continue building exposure on both sides of the market. As leverage accumulates, liquidation clusters expand above and below current price levels. This structure often sets the stage for sharp price swings once liquidity is triggered.

He noted that the current setup increases the probability of a strong move in the coming days. When long and short positions rise together, the market often seeks liquidity in one direction. As a result, volatility tends to increase after periods of compression.

However, the data does not confirm the direction of the next breakout. Instead, it shows a market preparing for expansion. Traders remain positioned for both downside continuation and recovery.

30-Day Consolidation Expected Before Clear Direction

Wedson also stated that the market may require around 30 days of consolidation after Bitcoin reached $60,000. This cooling period could allow excessive leverage to reset. Until then, price action may remain range-bound.

Many traders continue to expect further capitulation. Others anticipate a steady recovery from recent lows. Even so, Wedson suggested that neither scenario is likely to fully develop without extended consolidation.

The return of Bitcoin to the $60,000 level marked a psychological shift. Yet sustained direction often follows structural balance. Therefore, time may be required before momentum builds decisively.

As positions accumulate, liquidation levels act as reference zones for traders. A breakout above or below these clusters could trigger cascading liquidations. That sequence may define the next major move.

For now, derivatives data reflects tension rather than clarity. Both bullish and bearish participants remain active. Consequently, the market appears positioned for volatility, though timing remains uncertain.

Crypto World

Roundhill’s US Election Event Contract ETFs ‘Potentially Groundbreaking’

US-based ETF issuer Roundhill Investments has filed with the US securities regulator to launch six exchange-traded funds (ETFs) tied to event contracts on the outcome of the 2028 US presidential election.

ETF analyst Eric Balchunas said in an X post on Saturday that, if approved, the ETF products would be “potentially groundbreaking.”

“Opens up huge door to all kinds of stuff,” Balchunas said, adding that prediction market applications are easy to sign up to, but ETFs are “just that much easier.”

Roundhill Investments filed with the US Securities and Exchange Commission on Friday to launch six ETF products that allow investors to speculate on the outcome of the 2028 US presidential election.

“In seeking to achieve its investment objective, the Fund invests in, or seeks exposure to, a unique type of derivative instrument known as an event contract,“ the filing said.

The ETFs include the Roundhill Democratic President ETF, the Roundhill Republican President ETF, the Roundhill Democratic Senate ETF, the Roundhill Republican Senate ETF, the Roundhill Democratic House ETF, and the Roundhill Republican House ETF.

Roundhill Investments warns investors of the risks

The filing said the objective of the ETF tied to the winning election outcome is to deliver “capital appreciation,” but warned the other five ETFs could lose almost all their value.

“This convergence will result in a sudden and substantial increase or decrease in the value of the Fund’s NAV, which is highly unique among other investment products,” the filing said.

The filing also warned investors that US regulations on event contracts are “evolving,” and any change in how event contracts are classified or “restricted” may affect the fund.

“Political outcome event contracts have been the subject of heightened regulatory scrutiny and debate, and regulators may conclude that some or all of such contracts should be limited, suspended, modified, or prohibited,” the filing said, adding that investors uncomfortable with regulatory uncertainty should avoid purchasing shares.

CFTC leans towards a favorable stance on prediction markets

On Feb. 5, Cointelegraph reported that the US Commodity Futures Trading Commission had withdrawn a Biden administration-era proposal to ban sports and political prediction markets, which are among the most popular event contracts today.

Related: Trump Media files for two new crypto ETFs tied to Bitcoin, Ether, Cronos

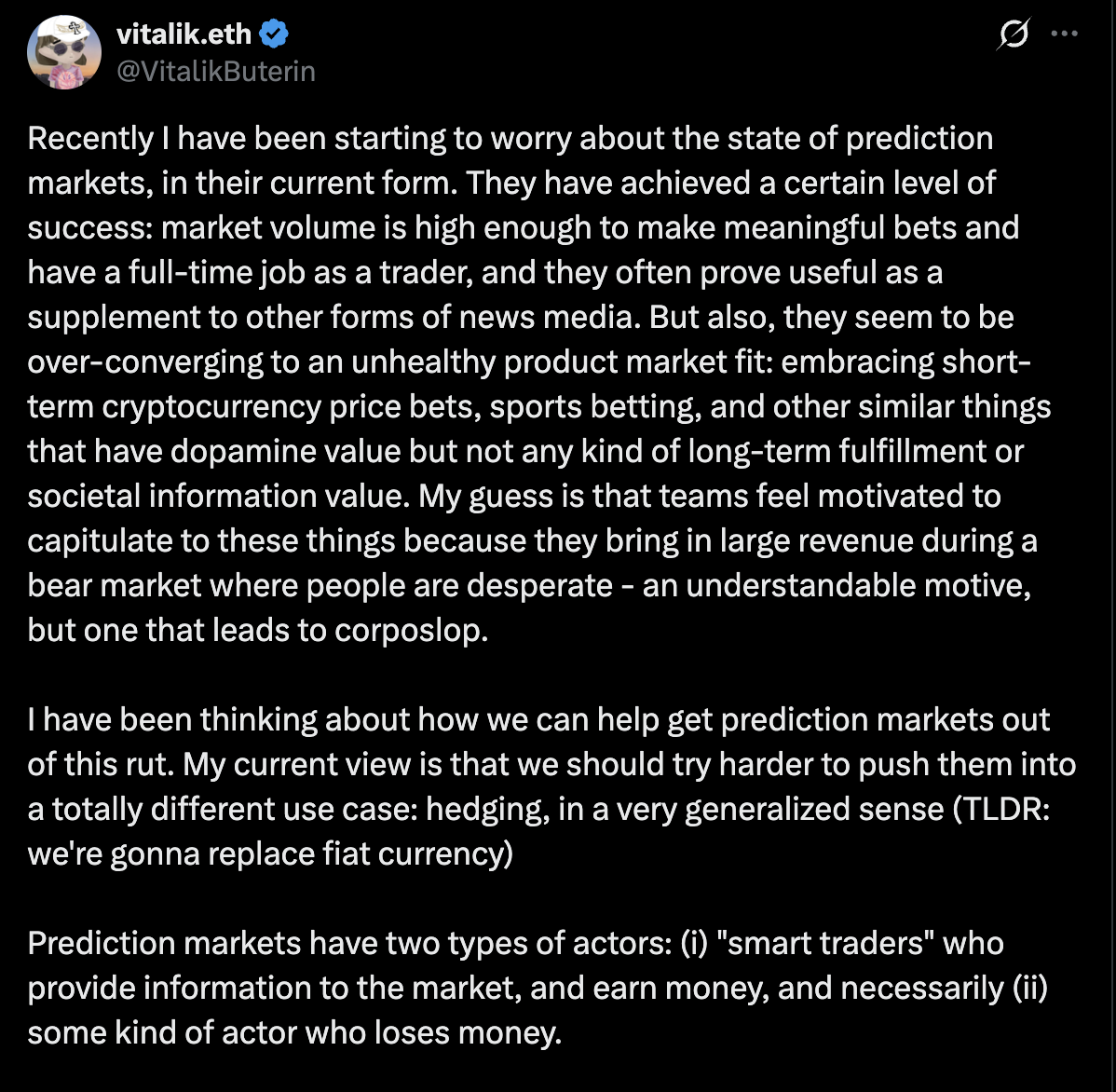

Meanwhile, Ethereum co-founder Vitalik Buterin said he is starting to “worry” about the direction of prediction markets and suggested they shift to marketplaces that hedge against price-exposure risk for consumers.

Prediction markets are “over-converging” to “unhealthy” products that are focused on short-term price betting and speculative behavior as opposed to long-term building, Buterin said in an X post.

Magazine: Brandt says Bitcoin yet to bottom, Polymarket sees hope: Trade Secrets

Crypto World

BlackRock Joins DeFi as Institutional Crypto Push Accelerates

BlackRock has taken a formal step into decentralized finance by listing its tokenized U.S. Treasury fund on Uniswap, signaling a measured pivot toward on-chain trading of real-world assets. The USD Institutional Digital Liquidity Fund (BUIDL) is being tokenized with the help of Securitize and will be tradable on a public decentralized exchange, a first for the asset manager in DeFi. This collaboration sits within a broader backdrop of continued institutional exploration of crypto rails even as traditional markets wrestle with ETF flows and shifting sentiment. In parallel, Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH) posted modest weekly gains of about 2.5% but failed to clear key psychological levels, pressured by a pattern of ETF inflows and subsequent outflows that underscored the fragility of near-term upside in a risk-off environment.

Bitcoin ETFs started the week with some inflows but quickly surrendered ground, registering net outflows of $276 million on Wednesday and $410 million on Thursday, according to data from market trackers. Ether ETFs displayed a similar pattern, with two light days of inflows followed by $129 million and $113 million of outflows on the same two days. The net effect was a market that, while buoyed by a perceived liquidity boost from tokenized assets, remained sensitive to shifting flows and investor appetite for risk-sensitive exposure. The weekly price action did not decisively break above crucial levels, leaving traders weighing the significance of macro liquidity versus on-chain adoption momentum.

Against this backdrop, BlackRock’s move into DeFi stands out as a milestone for institutional participation. The BUIDL fund is described as a tokenized version of a money-market approach to Treasuries, issued across multiple blockchains, including Ethereum, Solana, BNB Chain, Aptos and Avalanche. The asset manager’s public-facing rationale centers on providing transparent, on-chain access to highly liquid, U.S. Treasury–backed instruments for institutions that favor self-custody and programmable settlement. The collaboration is being driven by Securitize, a tokenization platform that previously partnered with BlackRock on the BUIDL launch, and the Uniswap deployment aligns with the exchange’s mission to expand institutional liquidity into DeFi.

Initial trading is described as selective, with eligibility limited to certain institutional investors and market makers before broader access is opened. The official rollout underscores a broader trend: institutions are increasingly testing the on-chain infrastructure that underpins tokenized real-world assets as counterparties seek improved settlement speed, on-chain custody options, and transparent governance. In the wake of this development, industry observers noted that BlackRock’s involvement could set a precedent for other asset managers exploring tokenized securities and on-chain liquidity solutions.

The BUIDL fund is reported to hold more than $2.18 billion in total assets, according to RWA.xyz, and its cross-chain issuance has brought it to multiple networks, including Ethereum, Solana, BNB Chain, Aptos and Avalanche. That breadth matters because it signals an on-ramp for real-world assets to traverse different ecosystems—potentially expanding liquidity across layers and enabling more nuanced risk and yield profiles for institutional participants. In December, BUIDL reached a milestone of surpassing $100 million in cumulative distributions from its Treasury holdings, reflecting the ongoing interest in tokenized treasury income streams and the potential for on-chain yield to complement traditional fixed-income exposure.

Beyond the specific instrument, the broader DeFi landscape remains mired in a tension between innovation and regulatory scrutiny. In a separate development this week, a New York federal court dismissed a Bancor-affiliated patent suit against Uniswap, ruling that the asserted patents described abstract ideas related to calculating on-chain exchange rates and did not meet the standards for patent eligibility. While the dismissal was without prejudice, the ruling represented a procedural win for Uniswap and illustrated the ongoing IP and legal risk environment that surrounds major DeFi protocols. The court’s decision does not end the dispute, but it does provide a window for Uniswap to continue operating while the case can be refined in future filings.

On the crypto market’s more tactical front, Binance completed the conversion of $1 billion in Bitcoin into its SAFU emergency fund, adding another tranche of BTC to its reserve. The exchange disclosed that the SAFU wallet now holds 15,000 Bitcoin, valued at just over $1 billion, acquired at an average cost basis of about $67,000 per coin. Binance had announced the move earlier in the month, stating it would rebalance the fund if volatility pushed its value below a defined threshold. The decision to anchor the SAFU reserve in Bitcoin reinforces the ongoing narrative of BTC as a long-term store of value within the ecosystem’s risk-management framework.

Meanwhile, voices within the blockchain community continued to draw lines around what constitutes “real” DeFi. Ethereum co-founder Vitalik Buterin argued that DeFi’s true value lies in rethinking risk allocation and governance, rather than chasing yield on centralized assets. He cautioned that yield-centric strategies tied to fiat-backed stablecoins can obscure issuer risk and counterparty exposure, a reminder that the sector’s risk dynamics remain a central theme as institutions seek scalable, on-chain alternatives to traditional finance.

The broader DeFi market activity remained resilient in its own right, with data from Cointelegraph Markets Pro and TradingView showing a majority of the top 100 cryptocurrencies finishing the week in the green. Among standout performers, the Pippin (CRYPTO: PIPPIN) token surged as the week’s top gainer in the broader ranks, followed by the Humanity Protocol (CRYPTO: H), which posted notable gains. The week’s digest also highlighted continuing interest around tokenized assets and on-chain credit vehicles, even as volatility persisted and risk sentiment remained tepid.

In short, a week marked by a landmark institutional move into DeFi coexisted with ongoing market frictions—ETF outflows, macro caution and a series of regulatory and IP questions that continue to shape the pace and scope of blockchain-enabled finance. The juxtaposition underscores a sector attempting to bridge the gap between traditional liquidity channels and the new, programmable infrastructure driving tokenized real-world assets across multiple chains.

Hayden Adams

https://platform.twitter.com/widgets.js

Why it matters

The listing of BlackRock’s BUIDL on Uniswap marks a watershed for institutional access to tokenized real-world assets. It demonstrates a willingness among large asset managers to experiment with DeFi infrastructure not merely as a speculative overlay but as a potential avenue for compliant, on-chain trading of regulated securities. If the model proves scalable and cost-efficient, more traditional asset managers could follow, accelerating the normalization of tokenized fixed income within institutional portfolios and potentially expanding liquidity pools for tokenized securities on public exchanges.

From a market dynamics perspective, the week’s ETF flow patterns reaffirm that short-term price action remains highly sensitive to inflows and outflows. While BTC and ETH posted modest gains, the absence of a sustained breakout suggests that the macro backdrop—comprising liquidity conditions, risk appetite, and regulatory signals—continues to constrain upside despite positive structural developments in DeFi adoption. The Bancor-Uniswap ruling also underscores that the legal framework governing DeFi protocols remains unsettled, with patent arguments still in flux and ongoing debates about what constitutes innovation versus abstract idea protection.

For on-chain participants and developers, the Binances SAFU move reinforces the idea that reserve designs are evolving under pressure to balance security, liquidity, and risk management. The repeated emphasis on Bitcoin as a reserve asset signals confidence in BTC as a durable anchor for risk-averse users and institutions seeking transparent, auditable reserves in a rapidly changing landscape. In parallel, Vitalik Buterin’s call for a clearer definition of DeFi’s core value proposition keeps attention on risk-sharing mechanisms and the governance of on-chain ecosystems, moving the debate beyond yield optimization toward sustainable, systemic risk management.

What to watch next

- Broader rollout of BUIDL to additional institutional clients and potential cross-chain expansions in the coming weeks.

- Further tokenization of real-world assets and the adoption trajectory of Securitize’s platform across more issuers.

- Resolution or further filings in remaining IP and patent matters related to DeFi protocols, shaping protocol-level risk profiles.

- Continued monitoring of ETF and on-chain liquidity flows to gauge whether institutional demand for tokenized assets translates into sustained price action.

- Regulatory signals and macro liquidity shifts that could either reinforce or dampen the case for tokenized fixed income and DeFi-enabled settlement rails.

Sources & verification

- Uniswap-Labs and Securitize collaboration to unlock liquidity options for BlackRock’s BUIDL — Business Wire

- BlackRock’s BUIDL tokenization milestone and Uniswap collaboration — Fortune

- Bitcoin ETF and Ether ETF flow data — Farside Investors

- BUIDL asset data and cross-chain issuance — RWA.xyz

- Bear-market inflection point discussion and Kaiko Research notes

Crypto World

Stocks Are Mounting a Comeback

Stocks Are Mounting a Comeback

Crypto World

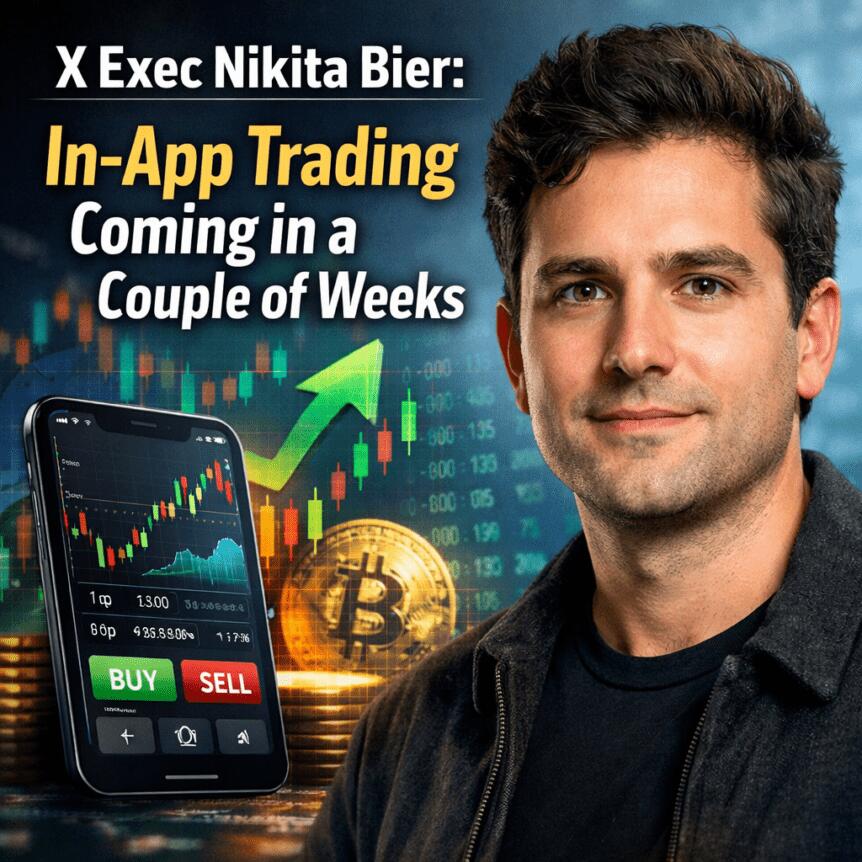

In-App Trading Coming in a Couple of Weeks

X is moving toward integrating financial services more deeply into its social platform with a feature known as Smart Cashtags. Nikita Bier, the platform’s head of product, signaled in a weekend post that users will soon be able to trade stocks and crypto directly from their timeline, marking a significant step in bringing traditional markets and digital assets closer to social interaction. The timeline for rollout, Bier indicated, includes a sequence of features launching in the next few weeks, suggesting a staged approach rather than a single, sweeping update. The idea builds on X’s previous experiments with Cashtags and reflects broader ambitions to weave commerce and finance into everyday activity on the app, potentially altering how millions interact with markets while they scroll.

The concept isn’t entirely new for X. In 2022 the platform introduced a basic Cashtag system designed to track the prices of major stocks and cryptocurrencies and to present visual financial data for assets such as Bitcoin (CRYPTO: BTC) and Ether (CRYPTO: ETH). That pilot was later discontinued, but the renewed emphasis on in-app trading signals a more ambitious plan to keep price data, discussion, and execution under one roof. The current push appears to be part of a broader strategy to reclaim a central role for financial functionality within the app, rather than relegating it to standalone apps or separate tabs. The public focus on Smart Cashtags and in-timeline trading follows a January teaser that hinted at in-app trading, though the company did not formally confirm the rollout at that time.

Cointelegraph reached out to X for comment about the Smart Cashtags feature and the timing of its launch, but the company did not respond by publication. The moves come as X, under the leadership of Elon Musk, has repeatedly emphasized a vision of the platform evolving into an “everything app”—a space where social interaction, payments, and transactions are seamlessly integrated. Musk has framed this ambition in terms of replacing multiple standalone apps with a single, feature-rich experience, drawing comparisons to WeChat, the Chinese messaging and payments ecosystem that blends social, financial, and commerce functions in one place.

While attention centers on Smart Cashtags, X is advancing another major line of development: X Money. Musk touched on the payments initiative during a recent All Hands presentation hosted by his AI venture, xAI. He outlined that X Money is still in a limited beta phase for roughly two months before any worldwide rollout. The aim, he said, is for X Money to become “the place where all money is” and a primary hub for monetary transactions on the platform. Musk’s comments underscore a strategic push to embed payments so deeply into daily use that the app becomes a de facto financial operating system for its hundreds of millions of users. In his remarks, Musk also emphasized the platform’s substantial reach, noting that X serves roughly 600 million average monthly users and articulating a vision in which a user could conceivably conduct most, if not all, daily digital activities within the app.

The broader context for these developments is the evolving landscape of social platforms that fuse content with financial services. If successful, Smart Cashtags could provide a frictionless entry point for casual users to engage with markets, while more seasoned traders may appreciate the convenience of real-time price feeds, charts, and trading execution within a single interface. The rollout also signals X’s continued experimentation with monetizable features that extend beyond advertising or content curation, shifting the platform toward a more transactional, payments-enabled model. The integration of trading and payments may also influence how brands, creators, and communities monetize engagement as users gain easier access to financial tooling alongside social interaction.

X inches into payments as it attempts to become an “everything app”

Elon Musk provided an update on the launch timeline for X Money, the platform’s payments feature that would enable users to send money to one another, in another high-profile public forum. Speaking at a recent All Hands event run by xAI, Musk indicated that X Money remains in limited beta testing for the next two months, after which a global rollout would follow. The goal is not merely to add another payments tool; it is to establish X Money as the central backbone for all monetary activity on the platform, a foundational capability that could influence how users view and rely on the app for everyday financial tasks. Musk’s framing of X Money as a unifying payment layer reinforces the broader strategy to turn X into an integrated ecosystem where social activity and financial transactions coexist seamlessly.

With roughly 600 million average monthly users, Musk suggested that the potential for such an integration is vast. The assertion underscores the strategic importance of any feature that can convert passive engagement into routine financial interactions. The concept of “everything in one place” has long animated the ambitions of tech leaders who seek to reduce the friction between social media and commerce. If the beta phase demonstrates reliability and security at scale, a worldwide rollout could significantly accelerate how users conduct payments and financial exchanges within the app, potentially affecting user behavior, merchant adoption, and the overall demand for linked financial services on social platforms.

Why it matters

The Smart Cashtags initiative, if realized, could redefine the user journey from curiosity to action on social media. Rather than leaving the app to check prices, follow tickers, or execute trades on separate platforms, users might access real-time information and make transactions in a single, familiar environment. This could lower the perceived barriers to entry for crypto investors and stock traders who are comfortable with the social context, potentially boosting liquidity and engagement around a wider range of assets. The integration would also place pressure on competing social networks and fintechs to offer similar in-app capabilities, raising the bar for how social apps monetize and retain users through integrated financial services.

From a regulatory and risk-management standpoint, the move to in-app trading and payments raises important considerations. In-app trading raises questions about suitability, know-your-customer (KYC) standards, and consumer protection within social platforms. The beta and phased rollout approach may help X observe user behavior, test security controls, and refine compliance workflows before reaching a broad audience. While the exact list of supported assets remains to be clarified, the emphasis on Bitcoin (CRYPTO: BTC) and Ether (CRYPTO: ETH)—the two largest crypto assets by market capitalization—signals that the feature aims to cover both traditional and digital assets in parallel.

What to watch next

- Official confirmation and timing for the Smart Cashtags rollout, including which assets will be tradable at launch.

- Details on the X Money beta scope, duration, and security enhancements prior to a global rollout.

- Regulatory updates or disclosures from X regarding compliance, user protections, and suitability testing for in-app trading.

- Any public statements from X or xAI about partnerships, supported brokers or custody arrangements, and asset coverage beyond BTC and ETH.

Sources & verification

- Nikita Bier’s public post on X regarding Smart Cashtags and a timeline for the rollout.

- The January teaser image signaling a potential in-app trading rollout for Smart Cashtags.

- Cointelegraph reporting on X’s Smart Cashtags development and the 2022 Cashtag system, including reference to BTC and ETH data.

- Elon Musk’s All Hands presentation at xAI discussing X Money and its beta status and rollout plans.

- Official statements and posts from X and xAI related to payments and financial features in development.

Smart Cashtags and in-app trading: what the plan could change for X users

X’s renewed focus on in-app trading via Smart Cashtags represents a meaningful pivot from a primarily social platform to a hybrid financial product. The first wave of changes centers on enabling trades directly from the timeline, a move designed to reduce friction for users who want to act on information they encounter in their feed. The initiative aligns with a broader push to consolidate services within a single app, an approach Musk has long described as a path toward creating an “everything app.” The potential impact on user habits could be substantial: a user who previously opened a separate brokerage or crypto exchange app might instead transition to executing trades while scrolling through posts, creating new kinds of engagement loops and monetizable moments for the platform.

From a user experience perspective, Smart Cashtags would need to balance speed with security and clarity. Real-time price data, simple execution flows, reliable order types, and clear disclosures about risk are essential for adoption. The 2022 Cashtag experiment established a framework for asset price visualization but did not culminate in a full trading experience. The new approach would require robust risk controls, transparent fee structures (if any), and intuitive interfaces that resonate with both casual observers and more active traders. The public discourse around in-app trading on social platforms has grown louder in recent years, and X’s iteration could influence how other apps approach embedding financial functionalities in social feeds.

The broader context also includes X Money, a payments feature Musk described as aiming to centralize monetary transactions within the app. The beta approach—limited for two months before a worldwide rollout—suggests a cautious, iterative path toward the final product. If successful, X Money could reduce the need for switching between apps when sending money, splitting bills, or conducting peer-to-peer transfers. This seamless integration of payments and trading could change demand patterns for both fiat-based and crypto-based transactions, potentially increasing on-platform liquidity and widening the audience for financial services embedded in social experiences. The lines between social engagement, information gathering, and financial activity could blur further as features like Smart Cashtags and X Money mature.

In the longer run, the vision of an “everything app” rests on user trust, reliability, and a coherent experience. The path will likely involve ongoing refinement of the user interface, more granular control over asset types, and stronger safeguards to protect users from mispricing, scams, or missteps in fast-moving markets. As X navigates these challenges, observers will be watching closely for how the platform handles compliance, data privacy, and cross-border considerations—issues that have become central to the broader dialogue around fintech on social platforms. Whether the Smart Cashtags initiative becomes a core daily utility or remains a niche feature will depend on how convincingly the platform demonstrates value, safety, and ease of use to a global audience.

Crypto World

China’s U.S. Treasury Holdings Fall to Lowest Share Since 2001 Amid Gold Accumulation

TLDR:

- China’s U.S. Treasury holdings fell to $682.6B, down from a $1.3T peak in 2013.

- China’s share of foreign Treasury holdings dropped to 7.3%, the lowest since 2001.

- Gold reserves reached 2,308 tonnes after 15 straight months of central bank buying.

- Total foreign U.S. Treasury holdings hit a record $9.36T despite China’s reduction.

China’s holdings of U.S. Treasuries declined to their lowest share in foreign reserves since 2001. As of November 2025, Beijing held $682.6 billion in U.S. government debt, while its gold reserves climbed to record levels.

Treasury Holdings Decline to Multi-Decade Low Share

Data shows China’s Treasury holdings dropped to $682.6 billion in November 2025. This marks a sharp fall from its 2013 peak of over $1.3 trillion.

China now accounts for 7.3% of total foreign-held U.S. Treasuries. That share is the lowest recorded since 2001. Despite the decline, overall foreign holdings reached a record $9.36 trillion. Japan and the United Kingdom remain the largest foreign holders.

The reduction has drawn attention across financial markets. However, bond markets have remained stable during the adjustment period. The figures indicate a gradual rebalancing rather than an abrupt market disruption.

On X, user Wimar X claimed that China “dumped $638 billion” in U.S. Treasuries. The post also stated that current holdings are the lowest since 2008. The tweet further suggested China is “exiting the system.”

Official data confirms the decline in holdings. However, total foreign demand for Treasuries remains strong, led by other major economies.

Gold Reserves Rise for 15 Consecutive Months

At the same time, the People’s Bank of China continued adding gold to its reserves. January 2026 marked the fifteenth straight month of gold purchases.

China’s gold holdings reached 2,308 tonnes, valued at about $370 billion. Gold now represents roughly 5% of the country’s $3.3 trillion in total reserves. This is the highest recorded level for China’s gold stockpile.

Some market observers view the shift as a move toward hard assets. Others describe it as standard reserve diversification. The increase in gold has occurred alongside the steady reduction in Treasury exposure.

Even so, China remains one of the largest holders of U.S. government debt globally. The adjustment appears gradual rather than sudden.

The combination of lower Treasury holdings and higher gold reserves reflects changing reserve allocations. Meanwhile, global Treasury markets continue to operate without major volatility.

Crypto World

Prediction Markets Must Evolve Into Hedging Platforms

Ethereum co-founder Vitalik Buterin has grown wary of how prediction markets are evolving, warning they risk becoming short-term price betting engines rather than tools that support long-term infrastructure. In a post on X, he argued that the current trajectory shows “over-converging” focus on immediate price moves and speculative behavior. He called for a shift toward onchain prediction markets that serve as hedges against price exposure for consumers, rather than betting mechanisms that amplify fiat-driven volatility. The thrust of his critique centers on moving from pure price bets to broader markets that can stabilize expenditures over time. He suggested a framework that blends prediction markets with AI-driven tools to counter inflationary pressures faced by households and businesses alike. In essence, his stance positions prediction markets as potential risk-management primitives if redesigned with real-world spending in mind.

Key takeaways

- Buterin argues prediction markets are tilting toward short-horizon price betting, which he views as unhealthy for long-term building in crypto and beyond.

- He envisions a model where onchain prediction markets are paired with AI large-language models to hedge consumer price exposure across goods and services.

- The proposed system would create price indices by major spending categories and regional differences, with prediction markets for each category.

- Each user could have a local LLM that maps their expenses and generates a personalized basket of prediction-market shares representing several days of future outlays.

- Supporters say such markets can offer valuable market intelligence and hedging capabilities, potentially improving price stability in a fiat-dominated environment.

- Existing prediction-market platforms like Polymarket and Kalshi are cited as part of the broader ecosystem that could be reoriented toward hedging and risk management rather than speculative bets.

Tickers mentioned: $ETH

Sentiment: Neutral

Market context: The discussion sits at the intersection of onchain finance, risk management, and regulatory scrutiny, as investors and developers weigh how to apply AI tools to price hedging while navigating evolving policy debates around prediction markets.

Why it matters

The idea of coupling onchain prediction markets with AI-assisted personal finance tools signals a broader attempt to retrofit crypto-native mechanisms for real-world stability. If successful, the approach could reframe how individuals and businesses manage price risk—shifting from a speculative posture to a practical hedging framework that protects purchasing power in an inflationary fiat environment. Buterin’s proposal emphasizes a user-centric model in which private data about expenses informs a custom set of market instruments. That alignment between individual spending patterns and market-based hedges could, in theory, yield more predictable budgeting for everyday goods and services.

Critics of prediction markets often point to concerns about manipulation, liquidity distribution, and regulatory risk. But proponents argue that when linked to digital, onchain ledgers and AI-driven personalization, these markets can deliver more resilient price signals and a public-good function by aggregating diverse information. The debate touches broader questions about how decentralized finance should interact with traditional market dynamics and consumer protection standards. In this framing, the role of prediction markets extends beyond forecasting political events or commodity prices to becoming a probabilistic toolkit for household and business planning.

As the ecosystem evolves, the boundary between information services and financial instruments remains a focal point for policymakers and practitioners alike. The discussion around onchain prediction markets is part of a wider push to explore how AI can augment human decision-making in finance, risk assessment, and purchasing power. The outcome will hinge on how convincingly the model demonstrates real-world utility, addresses liquidity and governance challenges, and remains compliant with applicable rules in various jurisdictions.

What to watch next

- The publication of any whitepapers or technical notes detailing the proposed onchain prediction-market architecture and the role of local LLMs in personal expense modeling.

- Emerging experiments or pilot programs that test category-based price indices and category-specific prediction markets in real-world settings.

- Regulatory responses or clarifications around prediction markets and onchain hedging tools, particularly in jurisdictions weighing consumer protection and market integrity.

- Public discussions and research from academics and practitioners about the feasibility and governance of personalized prediction-market portfolios.

- Follow-up statements or interviews from Vitalik Buterin or affiliated teams that expand or refine the proposed framework.

Sources & verification

- Vitalik Buterin’s X post outlining concerns about prediction markets and the proposed shift to hedging mechanisms. Link: https://x.com/VitalikButerin/status/2022669570788487542

- Cointelegraph op-ed discussing onchain prediction markets and the integration of AI LLMs. Link: https://cointelegraph.com/opinion/blockchain-prediction-markets

- Cointelegraph coverage on prediction markets and information markets, including perspectives on market intelligence. Link: https://cointelegraph.com/news/prediction-markets-information-finance

- Cointelegraph coverage of academic perspectives on prediction markets, including comments from Harry Crane of Rutgers University. Link: https://cointelegraph.com/news/prediction-markets-polymarket-polls

- CFTC-related developments regarding proposals on prediction markets, cited in Cointelegraph coverage. Link: https://cointelegraph.com/news/cftc-withdraws-proposal-ban-sports-political-prediction-markets

Rethinking prediction markets as hedging tools with AI

Ethereum co-founder Vitalik Buterin has grown wary of how prediction markets are developing, warning they risk becoming short-term price betting engines rather than tools that support long-term infrastructure. In a post on X, he argued that the current trajectory shows “over-converging” focus on immediate price moves and speculative behavior. He called for a shift toward onchain prediction markets that serve as hedges against price exposure for consumers, rather than betting mechanisms that amplify fiat-driven volatility. The thrust of his critique centers on moving from pure price bets to broader markets that can stabilize expenditures over time. He suggested a framework that blends prediction markets with AI-driven tools to counter inflationary pressures faced by households and businesses alike. In essence, his stance positions prediction markets as potential risk-management primitives if redesigned with real-world spending in mind. He proposed a system in which price indices are constructed across major spending categories, with regional variations treated as distinct categories, and a dedicated prediction market for each.

Buterin elaborates a mechanism where each user—whether an individual or a business—operates a local AI model that understands that user’s expenses. This AI would curate a personalized basket of market shares, effectively representing “N” days of predicted future outlays. The intent is to offer a dynamic hedge against rising costs, allowing participants to hold a mix of assets to grow wealth while maintaining a safety net against inflation via tailored prediction-market positions.

Supporters of prediction markets argue they provide valuable information about global events and financial trajectories, potentially serving as a hedge against a variety of risks. They point to platforms such as Polymarket and Kalshi as examples of how publicly sourced probabilities can supplement traditional data sources. Academic voices, including Rutgers professor Harry Crane, contend that well-structured prediction markets can outpace conventional polls in forecasting accuracy and should be treated as a public good in principle, assuming robust governance and safeguards. Critics, however, worry about misuse, regulatory constraints, and the potential for manipulation if markets are driven by centralized or biased actors. The debate straddles both the philosophy of information markets and the practical design challenges of turning them into reliable hedges for everyday life.

Ultimately, the question is whether a hybrid system—combining onchain markets with AI personalization—can deliver tangible price stability without sacrificing liquidity or inviting abuse. If such a model proves viable, it could redefine how crypto-native financial instruments interact with the real economy, offering tools that help households and firms weather price fluctuations while contributing to a broader ecosystem that values data-driven risk management.

Crypto World

Lightning Labs Unveils Open-Source Toolkit Enabling AI Agents to Transact with Bitcoin

TLDR:

- Lightning Labs released open-source toolkit enabling AI agents to transact with bitcoin independently.

- The L402 protocol allows AI systems to pay for services without requiring accounts or authentication.

- Remote signer architecture separates private keys from agent operations to prevent security breaches.

- Agents can now purchase data feeds and sell services autonomously using bitcoin through micropayments.

Lightning Labs has released an open-source toolkit that enables artificial intelligence agents to send and receive bitcoin payments independently through the Lightning Network.

The technology eliminates the need for human intervention, traditional accounts, or API authentication systems. This development represents a major advance toward autonomous machine commerce, where AI systems can directly purchase data, services, and computational resources without human oversight.

Automated Payment Infrastructure for AI Systems

The new toolkit addresses a critical limitation in current AI agent capabilities. While modern AI systems can write code, analyze information, and execute complex tasks, they cannot easily conduct financial transactions.

Traditional payment methods require human identity verification through credit cards, bank accounts, and regulated payment platforms.

These systems depend on personal documentation and manual approval processes that AI agents cannot navigate.

Lightning Labs explained that agents face a fundamental barrier despite their technical sophistication. The company stated that AI systems still struggle with payments despite being able to read documentation and call APIs effectively.

This gap exists because agents need to transact instantly and programmatically at massive scale, requirements incompatible with conventional financial infrastructure.

The solution centers on L402, a protocol built upon the HTTP 402 “Payment Required” status code. When an AI agent attempts to access paid content or services, the server responds with a Lightning invoice.

The agent pays this invoice and receives cryptographic proof of payment. This proof functions as an access credential, allowing the agent to retrieve the requested resource.

Lightning Labs introduced “lnget,” a command-line tool that automates the entire payment process. When an agent encounters paid content, lnget handles invoice payment in the background without requiring manual steps.

The tool supports multiple Lightning backend configurations, including direct connections to local nodes and encrypted tunnel access through Lightning Node Connect.

Michael Levin, head of product development at Lightning Labs, emphasized the toolkit allows agents to use bitcoin payments without mandatory identification or registration requirements.

Security Architecture and Commercial Applications

Security measures form a core component of the toolkit’s design. The recommended configuration uses a remote signer architecture that separates private key storage from payment operations.

The signing machine holds private keys offline while the agent machine executes transactions. This separation ensures that compromised agent systems cannot expose private keys.

The macaroon-based credential system enables fine-grained permission control. Developers can create credentials limited to specific functions such as payment-only or read-only access.

These bearer tokens can be further restricted without issuing new credentials. The system supports five preset security roles tailored to different agent functions.

On the server side, Aperture enables developers to convert standard APIs into pay-per-use services. This reverse proxy handles L402 protocol negotiation and supports dynamic pricing based on resource consumption.

Backend systems require no Lightning-specific modifications. The combination creates a complete commerce loop where one agent can host paid services while another consumes them.

The toolkit enables direct agent-to-agent transactions at scale. AI systems can now purchase premium data feeds, acquire computational resources, and sell services for bitcoin.

This infrastructure supports micropayments that would be economically unfeasible with traditional payment rails. Lightning Labs positions the technology as foundational infrastructure for an emerging machine economy where autonomous agents conduct billions of programmatic transactions.

Crypto World

Prediction Markets Should Become Hedges for Consumers

Ethereum co-founder Vitalik Buterin said he is starting to “worry” about the direction of prediction markets and suggested that they shift to become marketplaces to hedge against price exposure risk for consumers.

Prediction markets are “over-converging” to “unhealthy” products that are focused on short-term price betting and speculative behavior as opposed to long-term building, Buterin said in an X post.

Instead, onchain prediction markets coupled with AI large-language models (LLMs) should become general hedging mechanisms to provide consumers with price stability for goods and services, Buterin said. He explained how this system would work:

“You have price indices on all major categories of goods and services that people buy, treating physical goods and services in different regions as different categories, and prediction markets on each category.

Each user, individual or business, has a local LLM that understands that user’s expenses and offers the user a personalized basket of prediction market shares, representing ‘N’ days of that user’s expected future expenses,” he continued.

Individuals and businesses can hold a combination of assets to grow wealth and “personalized prediction market shares” to offset the rising cost of living created by fiat currency inflation, Buterin concluded.

Related: CFTC pulls Biden-era proposal to ban sports, political prediction markets

Prediction markets are useful market intelligence tools, supporters say

Prediction markets are crowdsourced intelligence platforms that can provide insight into global events and financial markets, while allowing individuals and businesses to hedge against a wide variety of risks, proponents of prediction markets say.

Prediction markets are more accurate than polls and should be treated as a public good, according to Harry Crane, a statistics professor at Rutgers University.

Crane told Cointelegraph that opponents of prediction markets in the US government want to restrict these platforms because they offer insights that cannot be easily ignored or manipulated by centralized entities.

Prediction markets like Polymarket or Kalshi provide an alternative to information presented in official sources or media reports that can be controlled or manipulated to feed certain narratives by distorting public opinion, Crane said.

Magazine: Brandt says Bitcoin yet to bottom, Polymarket sees hope: Trade Secrets

Crypto World

BlackRock Says Bitcoin ETF Holders Stayed Calm Amid Volatility

TLDR:

- Only 0.2% of IBIT assets were redeemed during recent Bitcoin volatility

- BlackRock says ETF investors are long-term and buy-and-hold focused

- Major liquidations occurred on leveraged perpetual platforms

- IBIT has grown to nearly $100B despite short-term market swings

Bitcoin exchange-traded fund investors remained steady during last week’s market turbulence, according to BlackRock.

The asset manager reported minimal redemptions from its iShares Bitcoin Trust, even as leveraged traders faced sharp liquidations across perpetual futures platforms.

BlackRock Reports Limited IBIT Redemptions

A recent post by CryptosRus on X cited comments from BlackRock executive Robert Mitchnick. He stated that only about 0.2% of the $IBIT was redeemed during the recent Bitcoin volatility.

The iShares Bitcoin Trust, known as iShares Bitcoin Trust, has grown to roughly $100 billion in assets in record time. Despite the rapid growth, redemptions during the market swing remained nearly flat.

Mitchnick explained that if hedge funds had aggressively reduced ETF exposure, billions in outflows would have appeared. However, that scenario did not occur. Instead, the bulk of liquidations took place on leveraged perpetual trading platforms.

These remarks came from BlackRock, the world’s largest asset manager with over $14 trillion in assets under management. The firm described its Bitcoin ETF investor base as largely long-term and buy-and-hold oriented.

That characterization suggests the presence of institutional capital rather than short-term trading desks. As a result, ETF flows remained stable even while Bitcoin prices moved sharply.

Leverage Drives Volatility as ETF Base Holds Firm

The contrast between ETF stability and leveraged liquidations stands out. According to the statements referenced in the tweet, leverage created most of the volatility seen during the period.

Perpetual futures platforms often amplify price swings when traders use high leverage. When markets move against those positions, forced liquidations can accelerate declines or rallies.

In this case, the turbulence occurred largely within those leveraged venues. Meanwhile, spot ETF investors did not rush to exit positions. That dynamic marks a shift from earlier crypto cycles dominated by retail speculation.

The steady ETF base points to deeper capital participation in the Bitcoin market. With a growing pool of long-term holders, market shocks may be absorbed differently compared to prior periods.

Moreover, the presence of large asset managers changes the structure of Bitcoin ownership. Institutional allocation through regulated vehicles offers a different capital profile than margin-based trading.

As noted in the tweet, the takeaway centers on the source of volatility. Leverage drove price action, while ETF holders remained composed. For market observers, this separation between trading platforms and fund flows offers a clearer view of where pressure originated.

Crypto World

Paxful Fined $4M After Admitting It Profited From Criminal Activity on Its Crypto Platform

Despite pleading guilty to serious AML violations, Paxful received a reduced $4 million penalty instead of the $112.5 million figure agreed by the parties.

Peer-to-peer virtual asset trading platform Paxful has been sentenced to pay a $4 million criminal penalty after pleading guilty to multiple federal offenses, according to an official press release from the US Department of Justice.

The sentence follows Paxful’s admission that it conspired to promote illegal prostitution, violated the Bank Secrecy Act, and knowingly transmitted funds derived from criminal activity.

Illicit Crypto Flows

The penalty was determined based on the company’s ability to pay. Federal authorities said Paxful profited from facilitating transactions for criminals while promoting its lack of anti-money laundering (AML) controls and failing to comply with applicable money laundering laws, despite knowing that users on its platform were engaged in crimes including fraud, extortion, prostitution, commercial sex trafficking, romance scams, and human trafficking.

Court documents revealed that Paxful operated an online virtual currency platform and money transmitting business where users traded cryptocurrency for cash, prepaid cards, gift cards, and other items. From January 1, 2017, to September 2, 2019, Paxful facilitated more than 26.7 million trades worth nearly $3 billion in total value and generated more than $29.7 million in revenue.

Authorities said Paxful knew that a portion of these transactions involved funds derived from criminal offenses, including fraud schemes and illegal prostitution. The company also deliberately transferred virtual currency on behalf of Backpage, an online advertising platform that later admitted in criminal proceedings that it advertised and profited from illegal prostitution, including content involving minors.

According to the Justice Department, Paxful’s founders referred internally to the “Backpage Effect,” which they credited with helping the platform grow. Between December 2015 and December 2022, Paxful’s dealings with Backpage and a similar website resulted in nearly $17 million worth of Bitcoin being transferred from Paxful wallets to those sites. From this, Paxful earned at least $2.7 million in profits.

The plea agreement states that from July 2015 to June 2019, Paxful marketed itself as a platform that did not require know-your-customer (KYC) information. It not only allowed users to trade without collecting sufficient KYC data but also provided third parties with AML policies that were not implemented or enforced, and failed to file suspicious activity reports despite clear indicators of criminal conduct.

You may also like:

DOJ Cuts Penalty

Paxful pleaded guilty to conspiring to violate the Travel Act by promoting illegal prostitution through interstate commerce, conspiring to operate an unlicensed money transmitting business, and conspiring to violate the Bank Secrecy Act’s AML requirements.

Although the parties agreed that the appropriate criminal penalty was $112.5 million, the department concluded Paxful could only pay $4 million as part of the resolution.

Paxful’s guilty plea was part of a coordinated resolution with the Financial Crimes Enforcement Network (FinCEN), and in July 2024, the company’s co-founder and former CTO, Artur Schaback, also pleaded guilty to related AML violations.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Politics6 days ago

Politics6 days agoWhy Israel is blocking foreign journalists from entering

-

Business6 days ago

Business6 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat5 days ago

NewsBeat5 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech4 days ago

Tech4 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports6 days ago

Sports6 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video2 days ago

Video2 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business7 days ago

Business7 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business6 days ago

Business6 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

NewsBeat6 days ago

NewsBeat6 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World1 day ago

Crypto World1 day agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video3 days ago

Video3 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Tech1 hour ago

Tech1 hour agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

![Biggest Crypto News Happening Now!! [BlackRock + Joe Rogan + Ethereum]](https://wordupnews.com/wp-content/uploads/2026/02/1771127665_maxresdefault-80x80.jpg)