Crypto World

BTC Must Reclaim These Key Levels to End the Downtrend

Bitcoin’s broader structure continues to reflect a dominant bearish trend, yet the recent price action shows a short-term recovery attempt from the major demand zone around $60K–$62K. At this stage, the market is positioned between a higher-timeframe bearish structure and a developing lower-timeframe corrective rebound.

Bitcoin Price Analysis: The Daily Chart

On the daily timeframe, the asset is still trading within a well-defined descending channel, with both the upper and lower boundaries clearly guiding the macro structure. After losing the $79K level and breaking decisively below the $75K range, Bitcoin accelerated toward the major blue demand zone around $60K, where a strong reaction occurred.

The recent bounce from this region has pushed the price back toward the mid-$60Ks to high-$60Ks area, but the overall structure remains corrective. The price is still trading below the channel’s midline and beneath the 100- and 200-day moving averages, both of which are sloping downward.

As long as Bitcoin remains below the broken $75.3K support and under the $78.9K–$81.4K Fibonacci cluster, the broader bias on the daily timeframe stays bearish. The current recovery appears to be a pullback within a dominant downtrend rather than the start of a confirmed reversal.

BTC/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, the corrective nature of the rebound becomes more evident. After the sharp capitulation wick into the $60K region, the price formed a local base and initiated a rebound toward the $70K area. However, this recovery is unfolding beneath a descending trendline and below the prior breakdown structure.

The $73K–$76K supply zone, which previously acted as support, now stands as a strong resistance area. Until the asset reclaims this region and invalidates the sequence of lower highs, the short-term structure remains vulnerable to another leg down.

The recent consolidation around the high-$60Ks reflects a temporary equilibrium between buyers defending the higher low and sellers protecting overhead resistance. A decisive break above the descending trendline could open the door toward the mid-$70Ks, while failure to sustain momentum increases the probability of a renewed test of the $60K demand zone.

Onchain Analysis

On-chain data from the Long-Term Holder SOPR (LTH-SOPR) suggests that sustained downside pressure is beginning to affect even Bitcoin’s most resilient cohort, marking a subtle but important shift in market dynamics.

Although the annual average LTH-SOPR remains elevated at 1.87, the metric has recently dropped below the critical 1.0 threshold, reaching 0.88—a configuration not seen since the late stages of the 2023 bear market. Historically, such breakdowns tend to occur during more advanced corrective phases, when even strong hands begin reducing exposure under sustained pressure.

That said, broader timeframe data paints a more nuanced picture. The monthly average SOPR still stands at 1.09, implying that, on aggregate, long-term holders are still realizing profits. Full-scale capitulation has typically coincided with much deeper compressions, with prior bear market bottoms marked by monthly SOPR levels approaching 0.5.

In this context, the current move does not yet confirm structural capitulation. Rather, it signals early stress among long-term participants—an inflection point that could either stabilize if market conditions improve or evolve into deeper distribution should selling pressure intensify.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

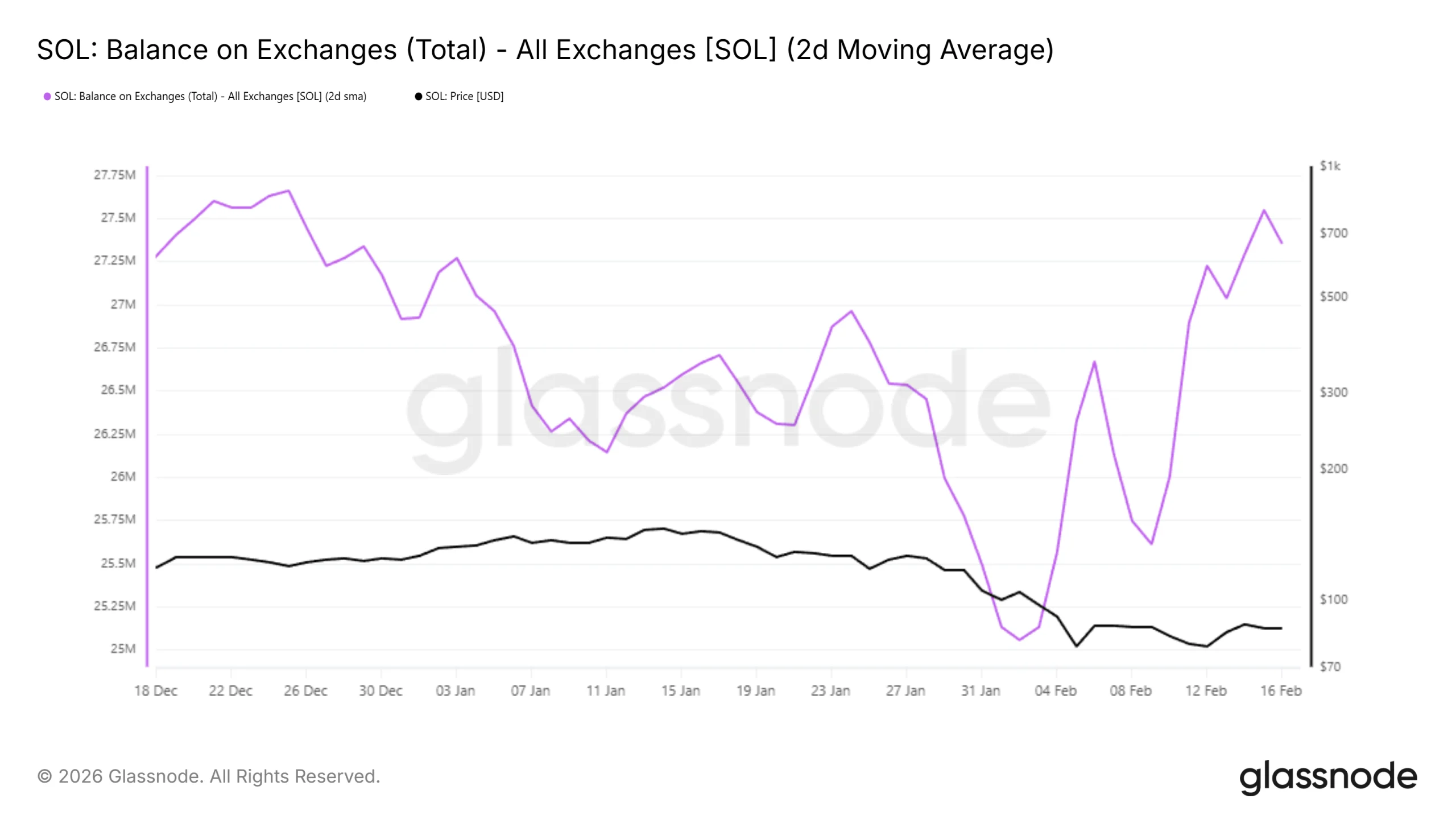

$202 Million Solana Selling Sparks First Capitulation Since 2022

Solana remains under sustained pressure as broader market conditions deteriorate. SOL has extended its downtrend for several weeks, reflecting reduced investor confidence.

Recent on-chain data reveals a surge in exchange-directed supply. Roughly $202 million worth of SOL has moved to trading platforms since the beginning of the month. This wave of selling has intensified bearish momentum and revived capitulation signals not observed since 2022.

Sponsored

Sponsored

Solana Holders Are Selling

Active deposits on the Solana network have started declining after a sharp rise earlier this month. This metric tracks tokens transferred to exchanges, often signaling intent to sell.

Despite moderating deposit flows, exchange balances continue to reflect elevated supply. Over the past 17 days, exchange wallets have added 2.35 million SOL. At current prices, this increase equates to approximately $202 million in additional sell-side liquidity.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Rising exchange reserves generally amplify downward pressure. Larger balances make it easier for traders to execute sell orders. However, this influx has also triggered a historical capitulation signal. Similar spikes in exchange supply previously aligned with late-stage bear market conditions.

Sponsored

Sponsored

The MVRV Pricing Bands provide critical valuation context. Solana’s price is currently trading below the Extreme Lows deviation band. For this classification, the Market Value to Realized Value ratio must stay below 0.8 for roughly 5% of trading days.

SOL has remained beneath that threshold for 26% of recent sessions. This confirms a prolonged undervaluation phase. The only comparable event occurred in May 2022. Following that period, Solana remained depressed for 17 months before staging a meaningful recovery.

SOL Price Downtrend Continues

Solana is trading at $86 at the time of writing. The token remains capped below the $90 resistance while holding above the $81 support zone. A move above $90 would intersect the prevailing downtrend line, signaling potential technical improvement.

However, current data suggests downside risk persists. Continued exchange inflows and weak macro momentum could pressure SOL further. A decisive break below $81 may expose the next support near $67, extending the drawdown.

Alternatively, reclaiming $90 would shift short-term sentiment. A breakout above the descending trendline could attract renewed capital inflows. If momentum strengthens, SOL may rally toward $105 and potentially higher, invalidating the prevailing bearish thesis.

Crypto World

Kraken Integrates OTC Desk with ICE Chat for Institutions

US-based crypto exchange Kraken has integrated its over-the-counter desk with Intercontinental Exchange’s ICE Chat, enabling institutional traders to access Kraken’s crypto liquidity directly through a messaging platform widely used across global financial markets.

ICE Chat connects more than 120,000 market participants, including banks, brokers and trading desks that use the system for real-time deal negotiation and execution. The integration allows those clients to communicate directly with Kraken’s OTC desk within their existing trading workflows.

Kraken said it is the first cryptocurrency platform approved to connect to ICE Chat, placing its crypto liquidity alongside traditional asset classes within established institutional communications infrastructure.

The companies added that they expect to expand the integration over time, reflecting broader efforts to embed digital asset trading into traditional financial market systems.

Kraken’s OTC desk facilitates large block trades in crypto spot and options markets. Intercontinental Exchange, which operates ICE Chat and owns the New York Stock Exchange, provides data, clearing and technology services to global financial markets.

The news follows Kraken’s pledge on Monday to support US President Donald Trump’s proposed “Trump Accounts,” a savings program for Americans under 18.

Related: Kraken parent Payward revenues jump 33% as crypto traders pile in

ICE expands deeper into crypto and tokenized markets

Intercontinental Exchange has stepped up its involvement in digital asset markets over the past year, expanding beyond traditional exchange infrastructure into blockchain data, prediction markets and crypto payments.

In August, ICE partnered with blockchain oracle provider Chainlink to bring foreign exchange and precious metals data onchain. The collaboration integrates ICE’s Consolidated Feed, which aggregates pricing data from more than 300 global exchanges and marketplaces, into Chainlink’s Data Streams.

In October, ICE invested $2 billion in crypto-based prediction market Polymarket, valuing the company at a reported $9 billion post-money. In December, ICE entered discussions to back crypto payments company MoonPay in its latest funding round, which is reportedly seeking a $5 billion valuation, though the size of ICE’s potential investment was not disclosed.

Both Nasdaq and the NYSE have also been making moves in crypto recently, particularly the tokenization of equities.

In September, Nasdaq filed a request with the US Securities and Exchange Commission seeking approval to list tokenized stocks through a proposed rule change.

In January, the NYSE announced plans to develop a 24/7 trading platform for tokenized stocks and ETFs, combining the exchange’s Pillar matching engine with blockchain-based post-trade settlement systems, subject to regulatory approval.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Gemini Space Station Shares Slide 14% Amid Executive Shake-Up

The shares dropped after the company reported large losses and announced leadership changes.

Shares of GEMI fell about 14% to around $6.50 on Tuesday after Gemini Space Station, a U.S.-based cryptocurrency exchange, said three top executives were leaving.

The company revealed in a new 8-K filing that Chief Operating Officer Marshall Beard, Chief Financial Officer Dan Chen and Chief Legal Officer Tyler Meade all stepped down effective immediately. Beard also resigned from the board, though his resignation “was not the result of any disagreement,” the filing reads.

Gemini currently ranks 19th among centralized exchanges (CEXs), with about $31.9 million in 24-hour trading volume, according to CoinGecko.

There are currently no plans to name a new COO as of now, and co-founder Cameron Winklevoss is expected to take on many of Beard’s duties alongside his current role. Meanwhile, Chief Accounting Officer Danijela Stojanovic will take over as interim CFO.

The leadership shake-up underscores how unexpected leadership changes can unsettle investors and sink stock prices. The filing also showed the company expects a net loss of roughly $587 million to $602 million for 2025, likely adding to investor concerns. Although, as of Dec. 31, 2025, the company recorded 600,000 monthly transacting users, up 17% from a year earlier.

Moreover, the leadership shake-ups come as the broader crypto markets remain weak, with Bitcoin trading at $67,000, down 25% over the past three months, per CoinGecko.

The changes follow Gemini’s announcement two weeks ago that it would cut up to 25% of its staff, as the Wall Street Journal reported.

The company, which went public in September 2025, has recorded a sharp downturn in recent months. Its total assets have also declined, falling to about $5.2 billion from $10.8 billion in October, according to DeFiLlama.

Gemini went public amid a broader rush of crypto firms seeking to IPO, driven by strong investor demand for industry stocks in 2025. The Defiant has reached out to Gemini for comment, but has not heard back at the time of publishing.

Crypto World

Pi Coin Price Completes Breakout, Now Eyes Another 60% Move?

Pi Coin price has gone through a sharp roller-coaster-like move over the past month. Between Jan. 14 and Feb. 11, Pi Coin fell nearly 38% as sentiment collapsed and sellers dominated. But the trend reversed quickly. Since Feb. 11, Pi Coin surged as much as 58% before correcting again.

Now, sentiment is improving once more for the Pi Network’s native token, and charts show this correction may not be a reversal. Instead, it could be preparation for the next breakout. Momentum, money flow, and price structure now explain why a much larger 60% move may still be possible.

Sponsored

Sponsored

Sentiment Collapse and Recovery Explain Pi Coin’s Roller-Coaster Move

Investor sentiment played a key role in Pi Coin’s recent volatility. Positive sentiment, which measures how optimistic investors feel based on social and market data, dropped sharply between December and early February. The sentiment score fell from 9.06 in early December to nearly zero by Feb. 4.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This collapse aligned with Pi Coin’s earlier range-bound move and the 38% price decline post Jan.14.

However, sentiment began improving again after Feb. 4. By Feb. 17, the score recovered to 3.82, aligning with the sharp price surge between Feb. 11 and Feb. 15 (over 58%). While still below earlier highs, this sentiment rebound, both before and after the rally, shows confidence is slowly returning.

This shift helps explain why Pi Coin quickly reversed its downtrend and began recovering. But the recovery itself was not random. It followed a precise technical breakout.

Sponsored

Sponsored

Breakout Pattern Completed, But Dip Buyers Still Active?

Pi Coin formed an inverse head-and-shoulders pattern, a bullish structure that signals a trend reversal after a decline. This pattern completed on Feb. 14 and pushed Pi Coin up roughly 26% toward its $0.206 level.

This level acted as the breakout target, and once reached, many traders took profits. This explains the large upper wick and the sharp pullback that followed. However, the Money Flow Index (MFI) tells a deeper story. The MFI measures buying and selling pressure by combining price and volume. When MFI forms higher lows, it possibly indicates that buyers continue to enter on dips.

Despite the correction, PI’s MFI stayed elevated, close enough to its recent local peak. This confirms dip buyers remained active and present even during the pullback.

This behavior often appears when investors position for another move higher. That raises the next question. Why are buyers still accumulating after the breakout target already completed? The answer appears in Pi Coin’s current price structure.

Sponsored

Sponsored

Bull Flag and EMA Crossover Show Next Breakout Structure Forming

After completing its first breakout, Pi Coin entered consolidation, a 19% dip from $0.206. This consolidation is forming a bull flag pattern. A bull flag is a continuation pattern where price pauses briefly before starting another rally.

At the same time, Pi Coin’s Exponential Moving Averages (EMAs) are signaling growing strength. The 20-period EMA is now approaching a crossover above the 50-period EMA, a potential bullish crossover. The EMA measures the average price over time, and when shorter-term averages cross above longer-term averages, it signals strengthening momentum.

This alignment explains why dip buyers continue entering.

Sponsored

Sponsored

However, timing is critical. If consolidation continues too long, the pattern could weaken. Bull flags require relatively quick breakouts to remain valid. This urgency also explains why buying pressure has remained steady. All of this now brings attention to Pi Coin’s key breakout levels.

Pi Coin Price Targets 60% Move if Key Breakout Level Clears

The immediate resistance level sits at $0.184. Pi Coin has tested this level multiple times but has not yet confirmed a breakout.

If Pi Coin closes above $0.184, the next targets are $0.204 and $0.242. The full bull flag projection points toward $0.290, representing a potential 60% rally from the breakout level. However, downside risk remains.

If Pi Coin falls below $0.158, the bull flag pattern would be invalidated. Extended sideways movement could also weaken the setup if consolidation becomes too large relative to the original breakout move. For now, the structure remains intact.

Pi Coin has already completed one breakout. Sentiment is improving. Money flow shows that dip buyers remain active, and the price structure is preparing for another potential breakout. The next confirmed move above resistance will determine whether Pi Coin can complete its larger 60% rally setup.

Crypto World

Gamma Prime’s Tokenized Capital Summit

On February 9 in Hong Kong, Gamma Prime held the Tokenized Capital Summit 2026, bringing together over 2,000 attendees from across the global investment landscape. The audience included family offices, institutional investors, and representatives of leading investment firms, reflecting the growing convergence between traditional capital and tokenized markets.

The stage welcomed prominent industry figures such as Yat Siu, Nenter Chow, Andrew Robinson, Head of Institutional Coverage at Coinbase, Adrian Tan, Head of Binance VIP & Institutional, and Akshat Vaidya, Co-Founder of Maelstrom, among other respected speakers. Together, they represented more than $20 billion in assets under management, reinforcing the summit’s status as one of the year’s most significant gatherings at the intersection of institutional finance and Web3.

Gamma Prime’s Product

Gamma Prime operates a compliant and secure marketplace for private investments, built to provide access to opportunities that are typically difficult to reach. The platform focuses on non-correlated yield, offering investors a practical way to diversify their portfolios beyond public markets.

By adhering to regulatory requirements across multiple jurisdictions, Gamma Prime is developing into a global marketplace for hedge funds, venture capital, private equity, and other illiquid private assets. This approach enables funds to reach new institutional partners, family offices, and accredited investors worldwide, while expanding the range of investment opportunities available on the platform.

The company’s leadership team includes DeFi builders, professionals from traditional finance, and Stanford PhDs, combining strong experience in blockchain innovation with institutional-grade governance and operational discipline.

Connecting Traditional Finance and Tokenization

The Tokenized Capital Summit represents an important step for the institutional Web3 sector. It brings together participants from traditional finance and companies active in tokenization, creating a platform for practical discussions on market developments and institutional adoption.

By organizing the summit, Gamma Prime advances its objective of expanding global access to private investments that have historically been fragmented and difficult to access. The event in Hong Kong demonstrates the growing cooperation between institutional investors, family offices, and Web3 companies, reflecting broader structural shifts within the financial industry.

About Gamma Prime

Gamma Prime is a tokenized marketplace of curated private investments specializing in hard-to-find uncorrelated returns – hedge funds, private credit, and other alternatives across both digital and real world asset classes. Fully regulatory compliant and built with institutional security standards, Gamma Prime is positioned to become the leading global platform for hedge funds, venture capital, private equity, and other illiquid private investment opportunities. The company was founded by a team of DeFi pioneers, traditional finance professionals, and Stanford PhDs.

Crypto World

Larry Lepard ragequits after Bloomberg analyst forecasts $10k BTC

A recent conversation between Bloomberg’s Mike McGlone and bitcoin (BTC) advocate Lawrence Lepard on Scott Melker’s show devolved into expletives and a ragequit. On one side, a BTC price forecast of $10k. On the other side, a BTC forecast of $140k to over $1 million.

The shouting match is a case study in how polarized beliefs about the value of BTC have become.

On one side of the argument, McGlone forecasted a BTC drop to $10,000 and laughed at Lepard’s buy-and-hold investment strategy. “You’re dollar cost averaging in an asset that has an unlimited supply, that’s done, that’s over,” McGlone stated.

That forecast earned immediate backlash. “Whoa, whoa, whoa. Unlimited supply? What the f*** are you talking about?” Lepard countered.

McGlone recast his claim about unlimited supply to the asset class of altcoins, even though he made the initial claim about bitcoin specifically.

“OK, maybe you should let me speak before you interrupt,” McGlone continued. “You’re at the start of a classic bear market. You’re denying it, you’re trying to buy every dip. You’ll sell out. You’ll stop out when – and I’ll say it now – it reads as a pretty low plateau around $10,000. That’s usually how markets work.”

Read more: CHART: BTC underperforms in Trump’s first year in office

McGlone called 2024 “as good as it gets” for crypto amid that initial euphoria about Donald Trump’s presidential election. Indeed, on November 18, 2024, the Fear & Greed rocketed to 83 on a scale from 0 to 100, its highest reading in 3.5 years.

McGlone concluded that the crypto industry is “done” and recommended everyone to immediately “get out.” “From the future, we will look back at the crypto mania as very comparable to tulips.”

Lawrence Lepard responds to a BTC $10k forecast

After McGlone’s rant, Lepard said he would clip that video of McGlone as the “dumbest fucking comments.” Within six minutes, Lepard ragequit the interview entirely.

After a brief moment of ambiguity over whether McGlone had said the acronym ETF or ETS, and after McGlone reiterated his view that inflows into ETFs as a bullish catalyst for BTC had failed to sustain prior rallies, Lepard claimed that McGlone was not letting him finish his bullish comments about BTC.

“Fuck you, I mean fuck you, seriously,” Lepard concluded. “Bye guys.”

Lepard is a professional money manager and a BTC permabull. McGlone is a senior commodity strategist at Bloomberg Intelligence.

After Lepard ended the exchange abruptly, his supporters celebrated. Soon, McGlone apologized on X for cutting-in. “I have apologized to Larry for interrupting him on Macro Mondays.”

Lepard has incorrectly predicted the price of BTC before, including a failed forecast for BTC to hit $140,000 last year.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Next Best Crypto 2026: Hong Kong SFC Licenses Victory Fintech, but DeepSnitch AI Is Likely the Next Best Crypto to Define Your Portfolio

Hong Kong’s Securities and Futures Commission (SFC) has formally added Victory Fintech Company Limited to its list of licensed cryptocurrency trading platforms. This marks the first approval since June 2025, showing the rigorous standards now required to operate in one of the world’s strictest financial hubs.

While legacy assets like Render ($RNDR) and Cosmos ($ATOM) struggle with bearish sentiment and stagnant price action, a new contender is rising. DeepSnitch AI ($DSNT) aligns perfectly with the market’s demand for transparency and security as the next best crypto.

With its presale already raising over $1.63 million, the chance for a 100x rally is high.

Hong Kong’s exclusive club

The addition of Victory Fintech to the SFC’s licensed list is a signal of survival of the fittest. The SFC now lists only 12 entities authorized to operate, a stark contrast to the hundreds of exchanges that once flooded the market.

Since June 2024, operating an unlicensed platform has been a criminal offense, forcing major players like OKX and Bybit to withdraw their applications and exit the region.

This creates a safer environment for institutional capital but raises the bar for retail traders. As Hong Kong sets the standard for compliance, DeepSnitch AI provides the global infrastructure for verification. Its SnitchScan tool allows users to audit smart contracts and track wallet associations, ensuring that they are not interacting with blacklisted entities.

Finding the next best crypto

DeepSnitch AI ($DSNT): Likely the next best crypto

The project has surged past $1.63 million in its presale, with the token price holding at $0.03985. This capital influx is a vote of confidence in the platform’s ability to solve the industry’s trust deficit.

DeepSnitch AI is likely the next best crypto because it offers an intelligence access that no other project can match. The team has created a closed ecosystem where presale buyers get exclusive access to live AI tools. This allows early investors to spot risks and opportunities before the broader market, effectively giving them insider status.

This utility drives demand, evidenced by the 36 million+ tokens already staked. The setup for DeepSnitch AI mirrors the early days of top utility tokens. A $15,000 investment at the current price secures roughly 369,094 DSNT tokens. As a top choice for the next best crypto, DeepSnitch AI has the potential to increase by 100x and turn this investment into $1.5 million.

Render market performance

Render ($RNDR) is facing a tough reality check. The token is currently underperforming, with technical analysis showing a bad outlook for the short-term. Based on data from mid-February, 21 technical indicators signal bearish signals, compared to only 9 bullish ones.

The sentiment is firmly bearish, and volatility remains very high. While the long-term forecast suggests Render could hit $1.65 by the end of 2026, this growth is average compared to the risks involved.

Render is trading below its 200-day SMA ($2.53), indicating a long-term downtrend. For investors seeking high-growth crypto picks, a 13% gain over a year is insufficient compensation for the volatility.

Cosmos price prediction

Cosmos ($ATOM) is struggling to find its footing in the current cycle. The Fear & Greed Index is at a terrifying 12 as of February 16th, which indicates Extreme Fear, and the sentiment remains neutral to bearish.

More alarmingly, long-term models predict that Cosmos could actually lose value by 2030, dropping to $1.06, a 53% decline from current levels. Despite a slight projected gain of 5% by the end of 2026, Cosmos is failing to offer massive profit potential. Hence, smart money is rotating out of these declining legacy chains and into emerging blockchain projects like DeepSnitch AI.

Final thoughts

Hong Kong is cleaning up the exchange market, and DeepSnitch AI is cleaning up the data market. One is a regulatory necessity, while the other is a profitable opportunity. DeepSnitch AI is likely the investment that will define your 2026 performance and could be the next best crypto to buy now. Use the DSNTVIP50 code to get an extra 50% bonus when you join the presale.

Visit the official DeepSnitch AI website, join Telegram, and follow on X for more updates.

FAQs

What is the next best crypto to buy now?

DeepSnitch AI ($DSNT) is likely the next best crypto to buy now due to its fast presale funding and high utility in a regulated market.

How does the Hong Kong SFC license affect the market?

The SFC licensing of Victory Fintech signals a maturing, stricter market. This benefits the next top cryptocurrency contenders like DeepSnitch AI, which provide the verification and compliance tools necessary for this new environment.

What are the best high-growth crypto picks for 2026?

While legacy coins struggle, DeepSnitch AI tops the list of high-growth crypto picks for 2026, offering potential exponential returns through its presale structure and AI utility.

Is Cosmos ($ATOM) a good long-term hold?

Cosmos is a risky long-term hold, with forecasts predicting a 53% price drop by 2030. Investors are shifting focus to emerging blockchain projects with better growth trajectories.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

XRP Price Target $1.90 as Grayscale Names It the ‘Second Most Talked-About Asset’

XRP price is hanging on by a thread. After sliding nearly 29% in the past month, it is now battling to stay above key support while bears line up targets near $1.45. The chart does not look comfortable.

But here is the strange part.

While price has been bleeding, attention has exploded. A new Grayscale report shows XRP is now the second most talked about crypto asset in the market.

That kind of divergence does not usually last forever.

What Grayscale’s Sentiment Report Signals

The chart looks heavy, but the hype is loud. Grayscale’s research team says advisors keep getting questions about XRP, calling it the second most talked about asset after Bitcoin.

That kind of attention hints at demand building beneath the surface, even if price has not responded yet.

Still, hype has limits. The level that matters is $1.60 That is the wall active traders are watching.

Right now, XRP is trying to lead the post crash rotation. But without reclaiming key resistance, talk alone will not turn into a real breakout.

What Happens Next for XRP Price?

Traders should brace for heightened crypto volatility in the coming sessions. If XRP price can establish a base above $1.45 and avoid a weekly close below $1.40, a relief bounce toward $1.90 is plausible.

This aligns with data showing whale wallets accumulating quietly during this dip.

Conversly, a confirmed break below $1.30 invalidates the bullish divergence and exposes the $1.11 zone. Smart money is watching the $1.50 daily close as the first sign of strength, but patience remains the primary edge in this market.

The post XRP Price Target $1.90 as Grayscale Names It the ‘Second Most Talked-About Asset’ appeared first on Cryptonews.

Crypto World

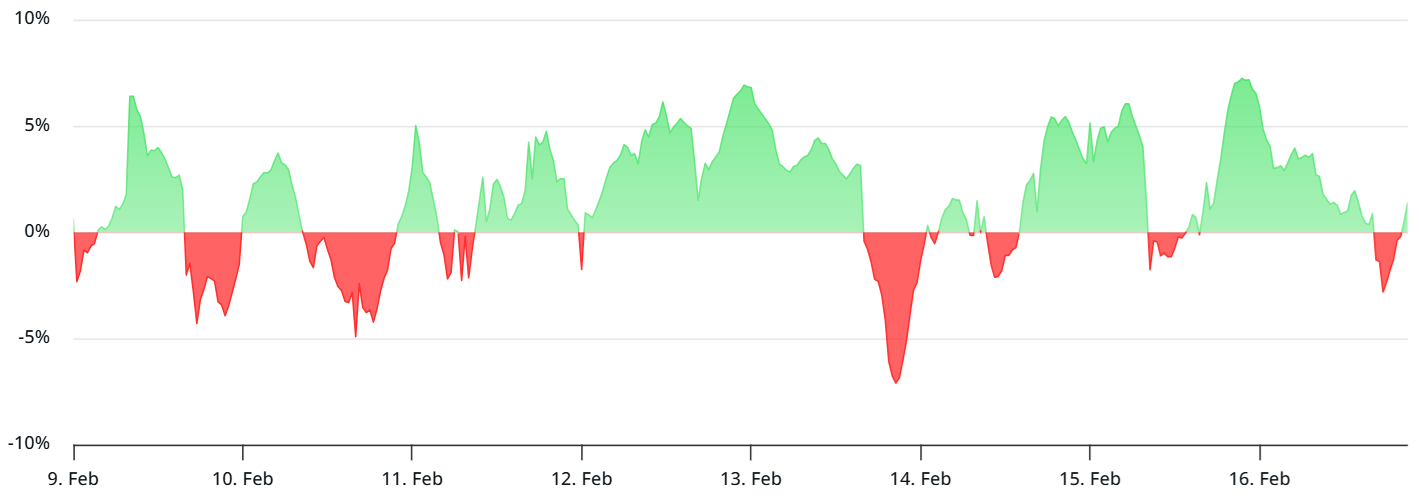

Bitcoin Bears Cap BTC At $70K Despite Negative Funding

Key takeaways:

-

Bitcoin’s futures funding rates briefly turned negative, signaling that bullish traders currently lack the conviction to use leverage.

-

Uncertainty regarding the long-term profitability of artificial intelligence has pushed investors toward gold and US government bonds.

Bitcoin (BTC) failed to reclaim the $70,000 level on Tuesday following a retraction in the S&P 500 futures. Traders are concerned that investments in the artificial intelligence sector could take longer to mature, which pressured shares of Nvidia (NVDA US), Apple (AAPL US), and Google (GOOGL US) on Friday. Bearishness in Bitcoin futures became apparent, leading traders to fear further downside.

The annualized BTC futures funding rate briefly flipped negative on Monday, indicating a lack of demand for leveraged long positions. Under neutral conditions, this indicator typically ranges between 6% and 12%; consequently, a lack of conviction from bulls has been the norm for the past week. The recent dominance of precious metals has also contributed to the disappointment of Bitcoin investors.

Silver and gold emerged as clear winners over the past two months while the stock market entered a consolidation period. Gains in the tech sector have come to a standstill as some analysts argue that valuations have become excessive, while others claim efficiency gains from AI are finally paying off. Regardless of the outcome, investors sought protection in government bonds.

Yields on the 10-year US Treasury declined to their lowest levels since November 2025, signaling that demand for these bonds has increased. This trend does not necessarily reflect higher confidence in the Federal Reserve’s strategy to avoid a recession without fueling inflation. In fact, the US dollar has weakened against a basket of foreign currencies, as reflected in the DXY index.

Dario Amodei, co-founder and CEO of Anthropic, reportedly stated on Friday that revenues from AI investments are unlikely to pay off in the next couple of years. According to Fortune, he warned that spending massive amounts to build data centers quickly could be “ruinous.”

Amodei also noted that delivering $10 trillion of compute by mid-2027 is impossible due to capacity constraints. This uncertainty in the tech sector has pushed investors toward more risk-averse behavior.

Bitcoin options market stabilizes as macroeconomic uncertainty lingers

Demand for neutral-to-bearish strategies using BTC options has stagnated over the past week. The panic following the unexpected crash to $60,200 on Feb. 6 has largely subsided, yet traders are still far from flipping bullish.

Related: Bitcoin accumulation wave puts $80K back in play–Analyst

The BTC options put-to-call ratio at Deribit stood at 0.8x on Monday, indicating balanced demand between put (sell) and call (buy) instruments. This data contrasts sharply with the 1.5x ratio seen last Wednesday, a level typically deemed bearish. While it will likely take a couple of weeks for bulls to regain full confidence, Bitcoin derivatives metrics currently show no signs of panic among market participants.

Traders may have opted to act more cautiously, choosing to take profits after Bitcoin flirted with the $70,000 mark. This caution was amplified as both the US and Chinese markets were closed for holidays on Monday. There is no clear indication that Bitcoin is bound for further downside based solely on the negative BTC futures funding rate. However, establishing sustainable bullish momentum will likely depend on a reduction in macroeconomic uncertainty.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Why This Could be Good News for Bitcoin (BTC)?

“When gold cools, profits rotate. That’s when capital flows from gold into BTC,” one X user argued.

The prices of many precious metals, including gold, have declined recently, with some analysts viewing this trend as bullish for Bitcoin (BTC).

Other factors, such as recent whale accumulation, reinforce the theory that the primary cryptocurrency could be ready to take off soon.

Gold Leads, BTC Follows

The yellow metal experienced a major pump at the start of the year, reaching a new historical peak of around $5,600 in late January. Since then, though, it has declined by roughly 11%, and today (February 17) the price dipped once again below the psychological level of $5,000.

According to some industry participants, there is an interesting correlation between the performance of gold and that of BTC. Earlier this month, X user Merlijn The Trader noted that in recent years, pullbacks in the precious metal have often been followed by an upswing in the cryptocurrency.

“Gold always leads. Bitcoin follows. When gold cools, profits rotate. That’s when capital flows from gold into BTC,” he argued.

Ash Crypto spotted the same parallel. The X user revisited mid-2020, a period when gold went through a sharp correction, and shortly after, the leading digital asset kicked off a bull run.

Other market observers who believe that liquidity rotates into BTC after the precious metal loses momentum include Crypto Fergani and Gargoyle.

The latter presented a pattern in which the cryptocurrency tends to mirror gold’s movements, albeit with its own timing. In their view, both assets pass through three stages: base building, accumulation, and pump. According to the chart, gold has completed these phases, whereas BTC has yet to enter the last one.

You may also like:

More Bullish Factors

Recent actions by large investors, known as whales, support an optimistic outlook for BTC, whose price has declined by almost 30% over the past month. As CryptoPotato recently reported, these market participants remain unfazed by the asset’s negative performance and continue to increase their exposure.

Whales are known as experienced players who may have insider information about forthcoming events. For that reason, some believe that their selling or buying efforts are neither random nor irrational.

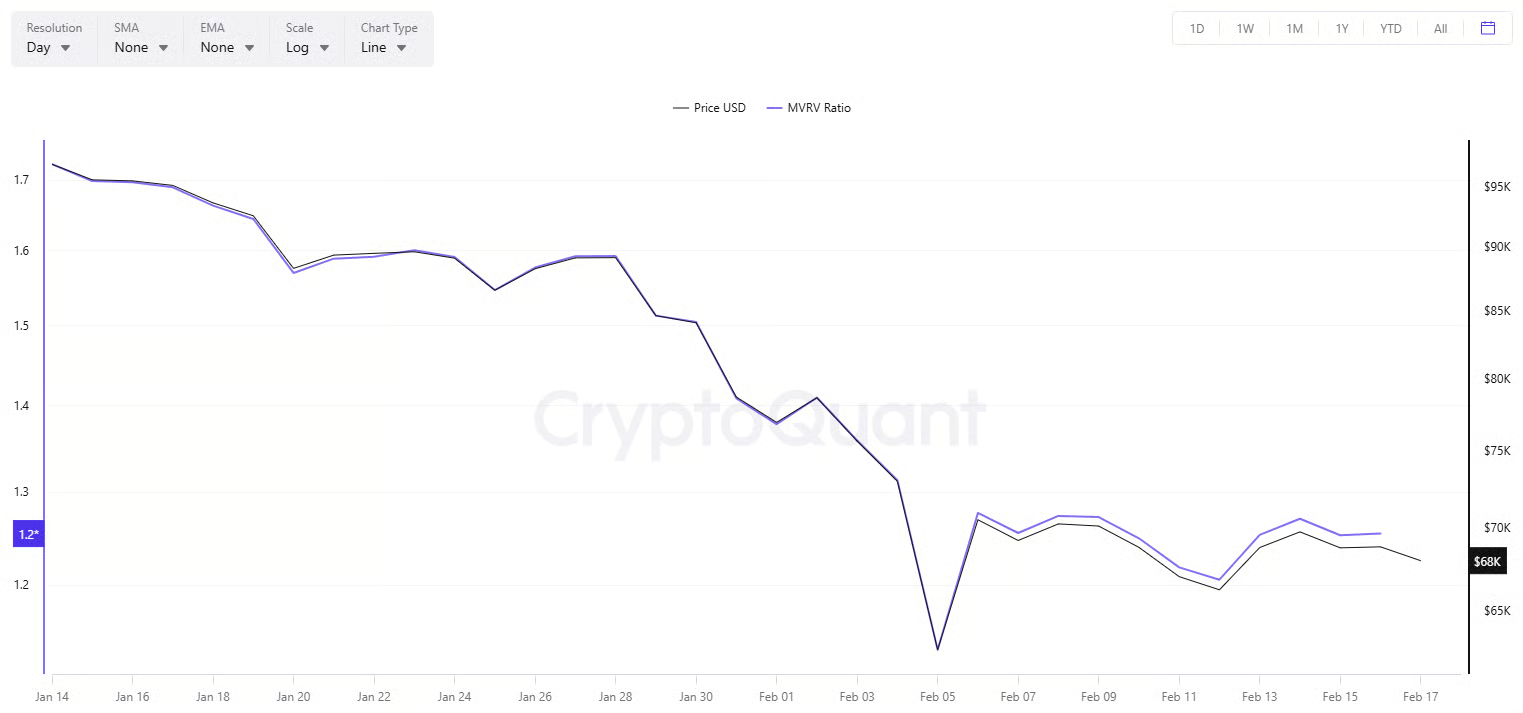

Certain indicators and price formations are also worth observing. Bitcoin’s Market Value to Realized Value (MVRV), for instance, has been steadily declining recently and currently stands at approximately 1.25. It compares the current value of all BTC to the price at which people originally paid to acquire their holdings. According to CryptoQuant, ratios below 1 indicate bottoms, while anything above 3.7 signals that the top is in.

Meanwhile, the popular analyst Ali Martinez claimed that the asset might have formed an “Adan & Eve” pattern on its price chart, in which a break above $71,500 could fuel a jump to as high as $79,000.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech7 days ago

Tech7 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video1 day ago

Video1 day agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech15 hours ago

Tech15 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Video10 hours ago

Video10 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World9 hours ago

Crypto World9 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports16 hours ago

Sports16 hours agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Politics7 days ago

Politics7 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery