Crypto World

BTC, SOL, UNI, PUMP slide

Crypto prices today are in the red as forced liquidations and weak demand pushed major tokens lower.

Summary

- Extreme fear dominated sentiment, with the Fear & Greed Index at 12.

- Analysts see $70,000 as the next key level for Bitcoin.

- Short-term recovery possible if BTC holds $72,000–$74,000 and spot inflows resume.

At press time, total crypto market capitalization was down 4.4% to $2.35 trillion. Bitcoin fell 5.5% in the past 24 hours to $73,103. Almost all top 100 altcoins were in the red.

Solana briefly slipped below $90, a level last seen in 2024, and was trading at $91, down 7.6%. Uniswap declined 3% to $3.78, while Pump.fun dropped 6% to $0.002271.

Alternative’s Fear and Greed Index fell two points to 12, remaining in the extreme fear range. The average relative strength index across the market was at 40, showing weak short-term momentum.

In addition, total open interest fell 4% to $106 billion, indicating continued deleveraging.

Liquidations put pressure on crypto prices

Much of the selling pressure came from forced liquidations in leveraged futures and perpetual contracts. Traders holding highly leveraged long positions faced margin calls, leading exchanges to automatically close those positions. This added to the selling and contributed to cascading losses.

According to CoinGlass data, long positions accounted for $520 million of the $650 million in total liquidations, which rose by 22% over the previous day. Since late January 2026, cumulative liquidations have now reached about $7 billion, contributing to a market capitalization drop of roughly $500 billion in the same period.

Open interest is now at multi-month lows in several markets, indicating that over-leveraged positions are being cleared.

Other pressures are coming from risk-averse behavior across financial markets. Crypto has moved alongside declines in technology stocks, mostly AI-related shares. Hawkish signals from the Federal Reserve, including expectations for higher interest rates for longer, have reduced liquidity and made speculative assets less attractive.

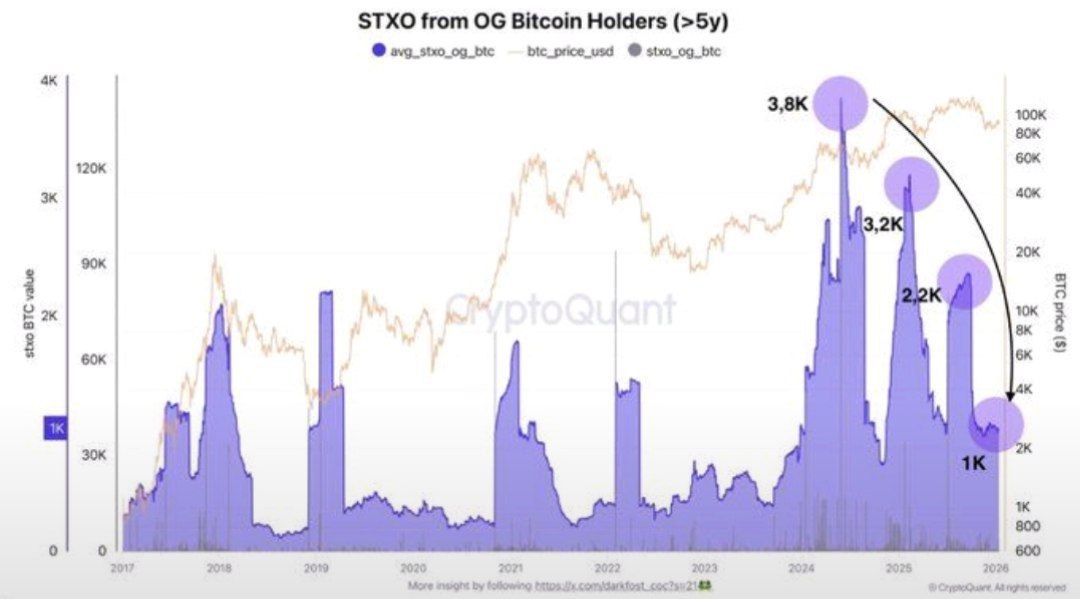

Institutional flows have weakened as well. Spot Bitcoin exchange-traded funds have seen outflows in recent weeks, while a negative Coinbase premiums and selling by large holders has added steady pressure.

Short-term outlook and analyst views

The short-term outlook for crypto is cautious. Bitcoin has broken support in the $75,000–$78,000 range, and many analysts are watching $70,000 as the next test level. If the price falls below that, it could move toward $65,000–$68,000 if selling intensifies.

On the upside, a hold above $72,000–$74,000 could allow a relief rally toward $82,000–$88,000 by late February. Liquidity is thin, and market swings could be sharp if macroeconomic news or Fed updates influence sentiment.

Polymarket odds now show an 82% probability of Bitcoin falling below $70,000. Analysts at Citi noted that slowing spot ETF inflows and regulatory uncertainty could push Bitcoin toward that level. In a February 4 report, Citi highlighted that the average entry price for spot ETF investors is $81,600.

Compared with gold, which has gained amid geopolitical concerns, Bitcoin is more sensitive to liquidity and risk appetite. According to Citi, delays in the U.S. CLARITY crypto bill and shrinking liquidity from the Federal Reserve are also adding pressure.

As of now, traders are watching closely to see whether oversold conditions and historical February trends will create opportunities for short-term relief.

Crypto World

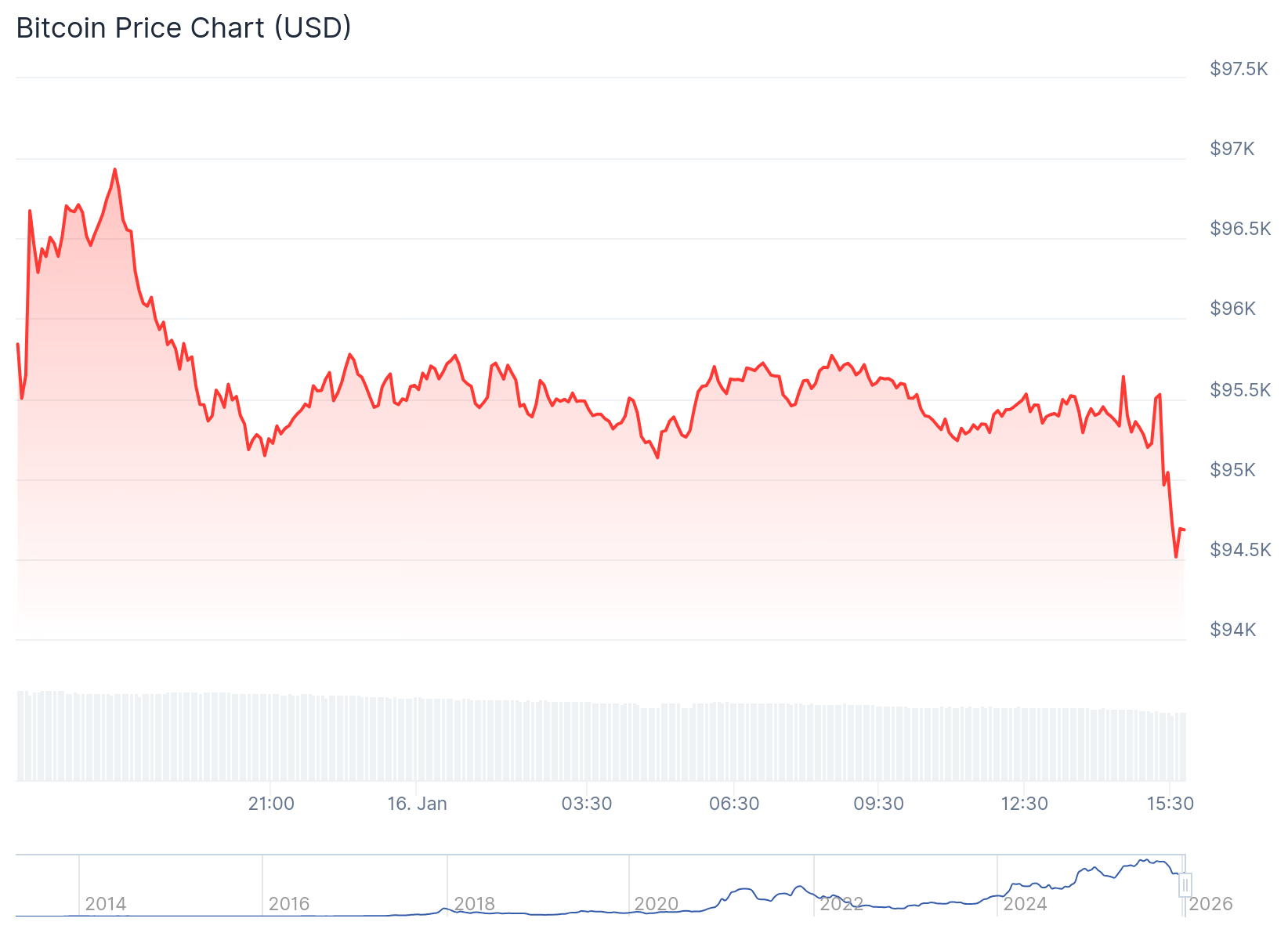

Bitcoin Slips Below $95K as Analysts Flag Make-Or-Break Zone

Crypto markets are mostly lower today as momentum fades and analysts flag a key range for Bitcoin.

Crypto markets pulled back slightly on Friday morning, Jan. 16, giving up some recent gains after a short-lived rally earlier this week.

As of press time, Bitcoin (BTC) was trading around $94,700, down about 1.2% on the day, after reaching over $96,900 in the past 24 hours. Despite the downturn, BTC is still up over 4% on the week, rising out of the holiday doldrums.

Total crypto market capitalization fell to roughly $3.3 trillion, slipping 1.7% on the day.

All of the top-10 cryptocurrencies by market capitalization were slightly lower on the day, with Dogecoin (DOGE) losing the most in 24 hours, down 4%.

Ethereum (ETH) is down 1.8% today, but still posting weekly gains of 5.5%, trading above $3,365 at press time.

BTC at Key Inflection Point

In a post on X today, glassnode analyst Chris Beamish said Bitcoin is nearing a “key inflexion point,” adding that the BTC price reclaiming the short-term holder cost basis “would signal that recent buyers are back in profit, typically a prerequisite for momentum to re-accelerate. “

At the same time, in another X post glassnode analysts pointed to growing activity on Ethereum, saying a sharp rise in month-over-month retention among new users is signaling a “wave of first-time wallets interacting with the network rather than activity driven only by existing participants.”

Mike Marshall, head of research at blockchain analytics firm Amberdata, said several signals still look constructive beneath the surface.

“Bitcoin’s price movement appears driven by a convergence of on-chain and market-structure signals,” Marshall said in commentary shared with The Defiant.

Marshall also pointed to recent stablecoin minting, signs that ETF outflows are slowing, and derivatives markets showing accumulation, while warning that “portfolio rotations and broader macro uncertainty could introduce volatility” later in Q1.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, privacy-focused cryptocurrency DASH led gains again, rising about 15% today, following its recent 50% rally. The next biggest gainer today is SKY, which is up roughly 4.8% on the day, according to CoinGecko.

On the downside, POL (ex-MATIC) dropped around 8% after its recent rally, making today’s biggest loser among the top-100 crypto assets.

Liquidations remained relatively muted over the past 24 hours with total crypto liquidations reaching roughly $239 million, per Coinglass data. Long positions made up $181 million, compared with $58 million in short ones.

Bitcoin liquidations totaled about $62.5 million, followed by Ethereum at roughly $38 million, with another $31 million across altcoins.

ETFs and Macro Conditions

On Thursday, Jan. 15, spot Bitcoin ETFs recorded net inflows of $100.2 million, bringing cumulative inflows to $58.2 billion, per data from SoSoValue.

Meanwhile, spot Ethereum ETFs continued to see stronger demand, posting $164.4 million in net inflows on the day, while total net assets across spot Ethereum ETFs climbed to about $20.4 billion.

On the macro side, U.S. Treasury yields were mixed, with the 10-year around 4.18% and the 30-year near 4.8%, as markets stayed on edge over geopolitical concerns, including U.S. President Donald Trump’s renewed push to take control of Greenland, per CNBC.

According to the U.S. Labor Department’s Bureau of Labor Statistics, import prices rose 0.4% between September and November, even as imported fuel prices fell 2.5% over the same period.

In terms of geopolitical moves, traders were also eyeing Canada’s deepening ties with China. Prime Minister Mark Carney said today that Canada is moving toward a “new strategic partnership” with Beijing, signaling a break from the U.S. on tariffs amid what he described as a shifting global order, Bloomberg reports.

“I’m extremely pleased that we are moving ahead with our new strategic partnership,” Carney said during meetings with China President Xi Jinping, framing the move as preparation for what he called a “new world order.”

Crypto World

OpenSea Rewards Its NFT Users With Pudgy Penguins SBTs

Join Our Telegram channel to stay up to date on breaking news coverage

OpenSea, the world’s largest non-fungible token market platform by trading sales volume, has partnered with Igloo Inc., the parent company behind the globally acknowledged non-fungible token series Pudgy Penguins, to reward its top marketplace users with Soulbound tokens (SBTs). In response to this integration, the Pudgy Penguins NFT collection has seen its floor price rise by 2% over the past 24 hours.

OpenSea x Pudgy Penguins Integration

In a January 16 blog post, the OpenSea NFT team confirmed that it has launched its fourth wave of rewards to its marketplace users. Launched in December 2017, OpenSea is the world’s largest decentralized marketplace for buying, selling, and trading NFTs and crypto collectibles. It functions like an eBay for unique digital assets, such as art, virtual land, and game items, all verified on blockchains like Ethereum and Polygon. It allows users to create (mint), list, and trade these unique digital items through smart contracts, giving creators a platform and collectors a way to own verifiable digital property.

Some people opening Chests are noticing that their Rewards includes a special item – the chance to mint a @PudgyPenguins SBT.

Anyone with a Tier 5 Treasure or above earned in Wave 4 is eligible to mint. Head to your Rewards tab on OpenSea or or go to the link below to mint.👇 pic.twitter.com/8xfOu6OSc3

— OpenSea (@opensea) January 16, 2026

The OpenSea NFT marketplace launched its pre-token generation reward program, including the “Treasure Chests” and XP system, starting in phases around mid-September 2025, leading up to the expected $SEA token launch in early 2026. This initiative, which funnels 50% of NFT platform fees into user rewards and boosts activity for future token allocation, marked a major shift toward a broader on-chain trading hub, with new features and an AI-powered mobile app.

From January 16, 2026, some people opening Chests are noticing that their Rewards include a special item giving them a chance to mint a Pudgy Penguins SBT. Anyone with a Tier 5 Treasure or above earned in Wave 4 is eligible to mint. OpenSea chest is a feature in OpenSea’s rewards program, where users level up a virtual chest by completing activities like buying and selling NFTs and tokens, earning XP, and completing “Voyages” (quests) to unlock rewards like NFTs and crypto at the end of each reward wave.

OpenSea x Pudgy Penguins SBT Overview

In its fourth-round wave of rewards, the OpenSea team has integrated with Pudgy Penguins team to launch soulbound tokens (SBTs.) These SBTs commemorate all individuals who used the NFT marketplace OpenSea to purchase Pudgy Penguins or Lil Pudgy NFTs. The OpenSea SBT honors Pudgy Penguin or Lil Pudgy NFT buyers on the OpenSea who have never sold their NFT collections.

Related NFT News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Ripple Integrates Hyperliquid, Bridging DeFi with Traditional Finance

Ripple has announced the inclusion of Hyperliquid on its multi-asset prime brokerage platform, marking the first integration of decentralized finance (DeFi) into its services. This move enables institutional clients to tap into on-chain derivatives liquidity while managing their DeFi exposures alongside traditional assets. By integrating DeFi into its platform, Ripple aims to bridge the gap between traditional finance and decentralized markets.

Ripple Prime now supports Hyperliquid as its first DeFi venue, offering access to advanced trading infrastructure. With this integration, clients will be able to cross-margin their DeFi exposures with all other asset classes supported by the platform. The service promises to offer institutions centralized risk management, a single counterparty relationship, and consolidated margin across portfolios.

This strategic move positions Ripple to strengthen its offerings for institutional clients by enhancing access to decentralized markets. The inclusion of Hyperliquid allows Ripple Prime’s clients to benefit from faster on-chain liquidity and greater trading efficiency. According to Ripple Prime CEO Michael Higgins, the integration helps address the growing demand for decentralized finance, providing clients with scalable access while maintaining capital efficiency.

Ripple’s Mission to Integrate DeFi and Traditional Finance

Ripple’s expansion into DeFi is part of its broader mission to merge traditional finance (TradFi) with decentralized finance. The firm aims to offer institutions a unified framework that combines both asset classes into a single, efficient platform. Through this integration, Ripple Prime hopes to enhance liquidity access and foster further innovation in institutional crypto trading.

In the release, Ripple highlighted that the inclusion of Hyperliquid will support institutions as they scale their DeFi operations. The crypto firm noted that clients will benefit from improved capital efficiency and a robust risk management system, while enjoying access to on-chain liquidity. This development could pave the way for more institutional players to enter the DeFi space, signaling the growing influence of decentralized markets in mainstream finance.

Ripple’s initiative is seen as a significant step forward in the institutional adoption of DeFi. By offering clients integrated access to both traditional and decentralized markets, Ripple is positioning itself as a key player in the evolving crypto trading landscape. The move is expected to attract greater institutional participation and further blur the lines between traditional finance and decentralized finance.

Impact on XRP and Hyperliquid (HYPE)

Ripple’s move is set to have significant implications for both XRP and the Hyperliquid (HYPE) token. With the integration, XRP is expected to gain more institutional interest, particularly in the form of perpetual trading and spot pairs. This increased liquidity could drive up demand for XRP and create additional trading opportunities for Ripple’s institutional clients.

The Hyperliquid platform, now linked with Ripple Prime, stands to benefit from increased exposure and trading volume. As more institutions engage with the platform, trading fees will likely rise, providing more liquidity to Hyperliquid. This increase in activity may result in more buybacks of the HYPE token, further supporting its value.

By expanding its offerings and securing greater access to DeFi markets, Ripple is positioning itself to become a significant player in the crypto institutional space. The integration of Hyperliquid into Ripple Prime is seen as a win for both the Ripple ecosystem and the broader DeFi market.

Crypto World

Treasury Draws Firm Line as Bitcoin Reserve Debate Roils Capitol Hill

The U.S. Treasury faced sharp questions Tuesday over Bitcoin policy during a tense Capitol Hill hearing. Lawmakers focused on whether the government should purchase Bitcoin or allow federal assets to back crypto. Treasury Secretary Scott Bessent firmly stated that taxpayer funds would not be used to buy or support digital currencies.

Treasury Blocks Bitcoin Intervention Despite Pressure

During a House Financial Services Committee hearing, Rep. Brad Sherman pressed Bessent about potential Bitcoin-related bailouts. Sherman suggested the Treasury could direct banks to hold Bitcoin or tweak reserve policies to support crypto. However, Bessent responded that the law gives him no such authority, and he cannot compel banks to make crypto purchases.

Bessent further clarified that taxpayer funds cannot be invested in digital currencies or in any tokens, including Solana-based meme assets. He emphasized that his role under current regulations does not permit using federal funds for Bitcoin exposure. Sherman countered by raising concerns over private banking funds, but Bessent maintained that those are not public monies.

The exchange intensified when Sherman questioned if the government would ever use tax revenue to accumulate Bitcoin reserves. Bessent reiterated that only seized Bitcoin is held by the U.S. government under existing forfeiture processes. He cited prior seizures totaling $1 billion, with $500 million retained and now worth over $15 billion.

TRUMP Coin Draws Fire During Crypto Oversight Talks

Rep. Sherman also referenced the “TRUMP” meme coin issued on the Solana blockchain, linking it to speculation and volatility. He asked if such coins could ever qualify for government-backed purchases or policy inclusion. Bessent replied that neither the Treasury nor the FSOC has the authority to act on speculative meme coins.

While Bessent stayed neutral on the TRUMP coin, Sherman emphasized its unregulated nature and alleged political branding. He warned that using public resources for these assets could set a dangerous precedent. The discussion signaled growing discomfort among lawmakers about crypto products perceived to be linked to public figures.

Bessent declined to provide specific commentary on TRUMP coin but reinforced that the Treasury does not engage in speculative crypto activities. He stood by the department’s position that taxpayer dollars should not enter volatile or unregulated digital markets. This stance continues to define Treasury policy amid rising political attention on meme coins.

World Liberty Financial Raises Scrutiny Over Security Risks

Rep. Gregory Meeks shifted focus to World Liberty Financial, citing concerns about foreign ties and investor transparency. He referenced statements from founder Eric Trump, who claimed he had undisclosed yet “meaningful” investors. Meeks argued that such ambiguity could pose national security risks, especially if linked to foreign capital.

The lawmaker also pointed out that the WLFI token had lost over 50% of its value, adding to concerns of instability. He said discussion forums revealed unease about governance, suggesting that the Trump family controlled key decisions. Meeks argued this ownership structure could allow selective profit-taking from token sales.

Senator Elizabeth Warren had previously called for an investigation into a deal involving a UAE royal entity and World Liberty Financial. Meeks followed up by urging tighter oversight of any bank license applications tied to the firm. However, Bessent refused to intervene, stating that the Office of the Comptroller of the Currency operates independently.

Crypto World

Stifel predicts bitcoin (BTC) price crash to $38,000. Yes, you read it right.

The race is on among analysts to forecast how far bitcoin could drop, with target prices dropping further every day. The latest to jump in is Stifel, a premier, full-service financial services firm headquartered in St. Louis, Missouri.

Analysts at the 136-year-old firm predict the bitcoin price could crash to as low as $38,000.

“Already down -41% from the high, bitcoin super-bears have followed a linear trend suggesting a potential low of~$38K,” the team led by Barry B. Bannister said in a note to clients on Wednesday.

They’re looking at straight line drawn across the low points of every major bitcoin crash since 2010. Bitcoin slumped 93% in 2011, 84% in 2015, 83% in 2018 and 76% in 2022. A line connecting those market bottoms slopes upward and points to $38,000 as the potential nadir for the current slide.

Bitcoin peaked over $126,000 in October and has since crashed to nearly $70,000 revisiting levels last seen in November 2024.

The curios case of Benjamin Bitcoin

The Stifel analysts explained the bearish case with an analogy tied to the movie “The Curious Case of Benjamin Button.”

In the movie and the F. Scott Fiztgerald story on which it is based, Button gets younger as everyone else ages. Bitcoin is like that: A fixed supply cap of 21 million BTC made it stronger — younger in the analysts’ terms — as the dollar weakened from regular money printing.

Now it’s fraying, like the kid version of Button, who looks 10 but acts 80, stuck playing piano for retirees.

Bitcoin used to rise with more global cash and weaker dollars, but since 2025, the relationship has reversed. It now falls with the dollar. The Dollar Index has dropped nearly 1% this year, extending last year’s near 10% slide.

“Prior to 2025, Bitcoin rose when the dollar fell and Global M2 money supply (converted to dollars) rose, thus “aging backward” versus fiat, but since 2025 the relationship has reversed,” the analysts said.

The behavior is compounded by bitcoin closely following Wall Street’s tech heavy Nasdaq 100 index and growth stocks, surging on dovish pivots by the Federal Reserve and slumping on hawkish ones. Though the Fed cut interest rates in the final three meetings of 2025, those largely carried a hawkish tone, downplaying faster cuts in future.

That tone is ominous, the analysts said, especially as technology companies are borrowing more heavily, which has raised their borrowing costs. This could lead to financial tightening, hitting stock valuations and adding to the pain in the bitcoin market.

Crypto World

White House May Drop Support for Crypto Bill

Join Our Telegram channel to stay up to date on breaking news coverage

The White House is thinking about pulling its support for a major crypto regulation bill after Coinbase suddenly withdrew its backing.

A source close to the Trump administration said officials were caught off guard by Coinbase’s decision. The administration is reportedly angry, calling Coinbase’s move a “rug pull” that hurt not just the White House but the wider crypto industry.

Officials claim Coinbase did not warn them before going public with its opposition. Because of this, the White House may fully walk away from the Digital Asset Market Clarity Act. However, the administration could stay involved if Coinbase returns to talks and agrees to a compromise.

🚨SCOOP: The White House is considering pulling its support for the crypto market structure bill entirely if @coinbase does not come back to the table with a yield agreement that satisfies the banks and gets everyone to a deal, a source close to the Trump administration tells me.…

— Eleanor Terrett (@EleanorTerrett) January 17, 2026

The biggest sticking point is stablecoins, especially rules around yield-bearing stablecoins. Banks are worried that allowing stablecoins to offer around 5% returns could pull money out of traditional savings accounts. The source emphasized that this is “President Trump’s bill,” not one controlled by Coinbase or its CEO, Brian Armstrong.

Why Coinbase Opposes the Crypto Market Structure Bill

Coinbase says it pulled support because the bill, in its current form, could harm the crypto industry. Armstrong said it is better to have no bill than a bad one. He raised concerns that the proposal could effectively ban tokenized stocks, place heavy restrictions on decentralized finance (DeFi), and give the government broader access to users’ financial data, which could hurt privacy.

Armstrong also warned that the bill weakens the Commodity Futures Trading Commission while giving more power to the Securities and Exchange Commission. The SEC has faced strong criticism from the crypto industry for relying heavily on enforcement actions instead of clear rules.

Reactions within the crypto community are mixed. Some support Coinbase, saying lawmakers are protecting banks at the expense of innovation. Others argue that Coinbase is just one exchange and should not have the power to block legislation that affects the entire crypto industry.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

BlackRock Moves Millions in BTC and ETH to Coinbase Amid Market Decline

BlackRock has moved millions of dollars in Bitcoin (BTC) and Ethereum (ETH) to Coinbase Prime, sparking speculation about its intentions. The transfer of approximately $170 million comes at a time when BTC is on a downward trend in the market. With the price of Bitcoin falling, questions have emerged regarding whether BlackRock is preparing to sell its assets or purchase more.

The transfer follows a series of similar moves in the past, adding to the ongoing market uncertainty. In January, BlackRock transferred $600 million in BTC and ETH to Coinbase, which later saw an outflow of $142 million. This has raised concerns about potential sell-offs, with some fearing BlackRock may be offloading assets in response to the market downturn. However, it remains unclear whether the funds are being moved for selling or for reinvestment purposes.

Bitcoin Price Continues to Struggle as ETF Outflows Persist

The price of Bitcoin has continued its decline, with the BTC price falling below $100,000 for the first time since April 2025. This comes as Bitcoin ETFs experience significant outflows, with total assets under management (AUM) for Bitcoin ETFs now standing at approximately $97 billion. The drop in the AUM is the lowest it has been in nearly two years.

BTC ETF funds, such as the ones managed by BlackRock, have seen daily outflows. Experts point out that these outflows coincide with the price of Bitcoin being well below the cost of creation for the ETFs. The cost of creating the ETFs stands at around $84,000 per Bitcoin. Given this disparity, there are concerns that the situation could lead to further declines in ETF investments.

While these ongoing outflows have raised concerns, it is important to note that the market is experiencing a wider trend of consolidation and realignment. Despite the challenges faced by Bitcoin ETFs, BlackRock is looking to expand its offerings. The firm has filed for a Bitcoin Premium Income ETF, signaling its continued interest in the cryptocurrency space.

Other Institutions Follow BlackRock’s Lead with Large Transfers

BlackRock is not the only institution to have moved large amounts of cryptocurrency to Coinbase. GameStop Holdings recently transferred all of its Bitcoin holdings, valued at around $450 million, to Coinbase. The transfer, however, was not without its challenges. The value of GameStop’s Bitcoin holdings has decreased by approximately $70 million from their initial purchase price.

GameStop’s move aligns with statements from its CEO, Ryan Cohen, who hinted that the company is looking to diversify its investment strategy. This decision reflects the broader trend of traditional financial institutions and corporations adjusting their positions in the crypto market. BlackRock’s latest move, paired with GameStop’s, could signal a shift in how these firms approach their digital asset portfolios.

This shift in strategy could have wider implications for the market as more institutions look to rebalance or shift their cryptocurrency holdings. While the future of Bitcoin and Ethereum remains uncertain, these movements show how large institutions are responding to ongoing market fluctuations.

Crypto World

Google’s Gemini AI Predicts the Price of XRP, Ethereum and Solana By the End of 2026

Google’s Gemini AI leverages big data for its analyses, and when using a carefully structured prompt, the LLM generates eye-catching 2026 price projections for XRP, Ethereum, and Solana.

According to Gemini’s analysis, an extended crypto bull market combined with clearer and more constructive regulation in the United States could propel leading digital assets to fresh all-time highs faster than many market participants anticipate.

Below is Gemini’s projected outlook for the three biggest altcoins over the next eleven months.

XRP ($XRP): Gemini AI Predicts a Run Toward $8 by 2027

Ripple’s XRP ($XRP) began 2026 with strong upward momentum, gaining roughly 19% in the first week of the year. With the token currently trading around $1.55, Gemini estimates that a sustained bullish trend could push XRP as high as $8 by the end of 2026. That would represent gains of roughly 420%, more than quadrupling.

XRP was one of the top-performing cryptocurrencies last year. In July, it reached its first new all-time high (ATH) in seven years, surging to $3.65 after Ripple secured a decisive legal victory over the U.S. Securities and Exchange Commission.

That ruling removed a significant regulatory cloud hanging over XRP and helped calm broader concerns about altcoins getting treated as unlicensed securities

From a technical standpoint, XRP’s Relative Strength Index (RSI) currently sits near 26, placing it in oversold territory. This suggests the recent selloff may be nearing exhaustion, with buyers likely to step in over the weekend to accumulate at lower price levels.

Meanwhile, support and resistance lines throughout January form an unresolved bullish flag pattern. As XRP re-converges with its 30-day moving average, positive developments could ignite a gold rush in the coming weeks or months.

When combined with ETF inflows and expectations surrounding the U.S. CLARITY bill, a proposed comprehensive framework for crypto regulation, these factors suggest that Gemini’s target is largely conceivable.

Ethereum ($ETH): Gemini Sees an Easy 4x for Current HODLers

Ethereum ($ETH), the leading platform for smart contracts, decentralized applications, and decentralized finance, remains the foundational layer for much of the Web3 economy.

With a market capitalization of around $263 billion and over $59 billion in total value locked (TVL) across DeFi protocols, Ethereum serves as the primary hub of on-chain economic activity.

Its strong security history, dependable settlement layer, and early leadership in stablecoins and real-world asset tokenization position Ethereum favorably for deeper institutional adoption.

This trend could accelerate if U.S. lawmakers pass the CLARITY bill, providing the regulatory certainty institutions need to deploy capital using Ethereum-based infrastructure.

ETH is currently trading just below $2,172, with significant resistance expected near the $5,000 level after reaching an all-time high of $4,946.05 in August.

If Gemini’s bullish scenario materializes, a clear break above $5,000 could set the stage for multiple new highs this year, with potential upside targets ranging far beyond $8,000 in a bull run.

Solana (SOL): Gemini AI Suggests SOL Has 440% Upside by 2027

The Solana ($SOL) ecosystem now supports more than $7.2 billion in TVL and carries a market capitalization of around $53 billion, underpinned by consistent growth in both developer engagement and user adoption.

Investor interest in SOL has intensified following the introduction of Solana-based ETFs by major asset managers such as Bitwise and Grayscale.

After experiencing a sharp pullback in late 2025, SOL has spent recent months in the $130 to $145 support range until Greenland and Iran scares plunged the price down to the $90 to $100 support range. At $93, Solana appears to be in hot water, but its oversold RSI of 25 indicates a sharp bounce could begin before the weekend.

Under Gemini’s most bullish assumptions, Solana could climb to $500 by 2027. That scenario would imply approximately 440% upside from current prices and would place SOL well above its previous all-time high of $293, recorded last January.

Institutional adoption continues to reinforce Solana’s long-term outlook. The network is increasingly being used for real-world asset tokenization, with firms such as Franklin Templeton and BlackRock pointing to Solana’s expanding role within traditional financial infrastructure.

Maxi Doge (MAXI): Move Over Dogecoin! Memesville Has a New Alpha

While not included in Gemini’s core forecasts, Maxi Doge ($MAXI) has quickly become one of the most discussed meme coin presales of 2026, raising approximately $4.6 million ahead of its public debut.

The project features an over-the-top, high-energy parody mascot loosely inspired by Dogecoin (a distant relative, according to the lore), Maxi Doge combines gym-bro aesthetics with unapologetic degen humor.

Loud, exaggerated, and intentionally chaotic, Maxi Doge leans fully into the speculative spirit that originally fueled the meme coin boom.

MAXI is an ERC-20 token running on Ethereum’s proof-of-stake network, giving it a significantly smaller environmental footprint compared with Dogecoin’s proof-of-work model.

During the presale, buyers can stake MAXI tokens for yields of up to 68% APY, with rewards gradually decreasing as more tokens enter the staking pool.

The token is currently selling at $0.0002802 in the latest presale phase, with automatic price increases at each funding milestone. Purchase via MetaMask and Best Wallet.

Say goodbye to Dogecoin. Maxi Doge is the new alpha in Memesville!

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here

The post Google’s Gemini AI Predicts the Price of XRP, Ethereum and Solana By the End of 2026 appeared first on Cryptonews.

Crypto World

Bitcoin Price Rises as Spot Bitcoin ETFs Attract $1.42B in Inflows

Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price has jumped by a fraction of a percentage in the last 24 hours to trade at $95,324, as spot Bitcoin ETFs saw a strong return recording $1.42 billion in net inflows over the past week.

ETF activity was heavily concentrated in the middle of the week. Data shows that Wednesday delivered the largest single-day inflow of approximately $844 million, followed closely by $754 million on Tuesday. Although momentum cooled toward the end of the week, including a notable $395 million outflow on Friday, the strong midweek buying was enough to push total weekly inflows to their highest level since early October. At that time, spot Bitcoin ETFs attracted around $2.7 billion, highlighting the scale of the renewed interest.

The latest inflow trend suggests that institutional investors are gradually returning to Bitcoin through regulated investment products after a period of caution. Vincent Liu, chief investment officer at Kronos Research, said that ETF inflows indicate long-only allocators re-entering the market. He added that ETF buying, combined with reduced selling from large Bitcoin holders, or whales, is helping tighten effective supply.

On-chain data shows whale selling pressure has eased compared to late December, reducing a key source of distribution and downside risk. Ethereum ETFs also posted positive inflows, though at more modest levels compared to Bitcoin. The strongest inflow day occurred on Tuesday, with approximately $290 million, followed by $215 million on Wednesday. However, late-week selling weighed on performance, with Friday seeing roughly $180 million in outflows, trimming total weekly inflows to around $479 million.

Despite the improved flow data, analysts remain cautious. Market observers note that short-lived spikes in ETF inflows have historically led to brief price rebounds rather than sustained rallies. Analysts argue that Bitcoin will likely need several consecutive weeks of strong and consistent ETF demand to support a durable uptrend. Without sustained inflows, price gains may continue to face resistance and fade during periods of weaker demand.

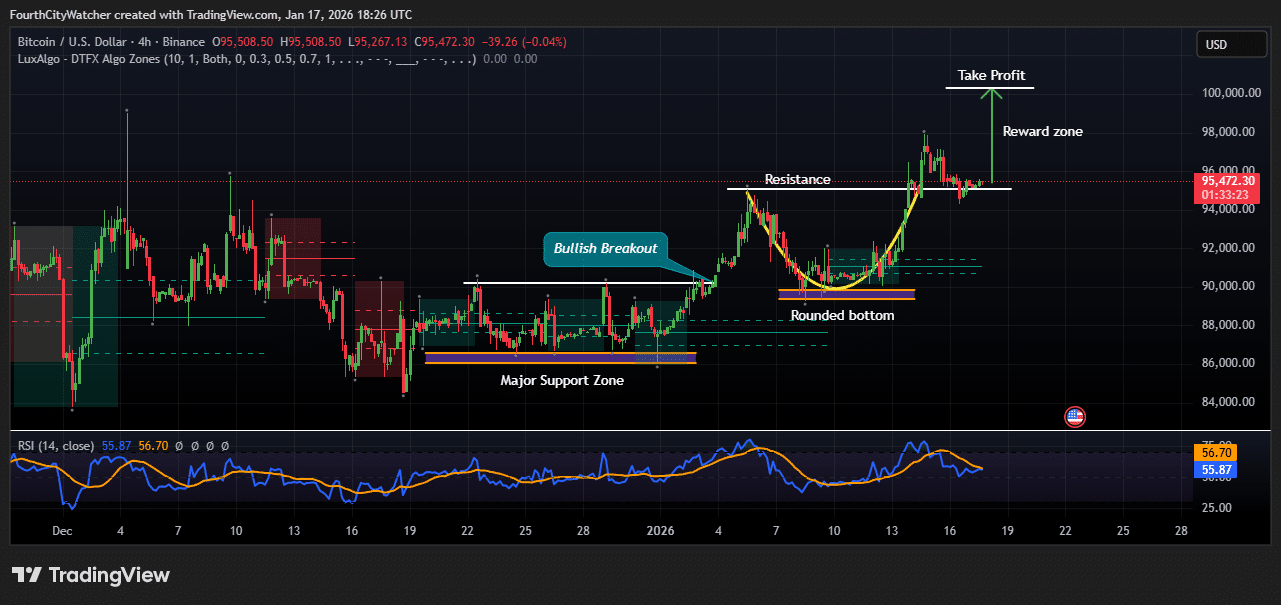

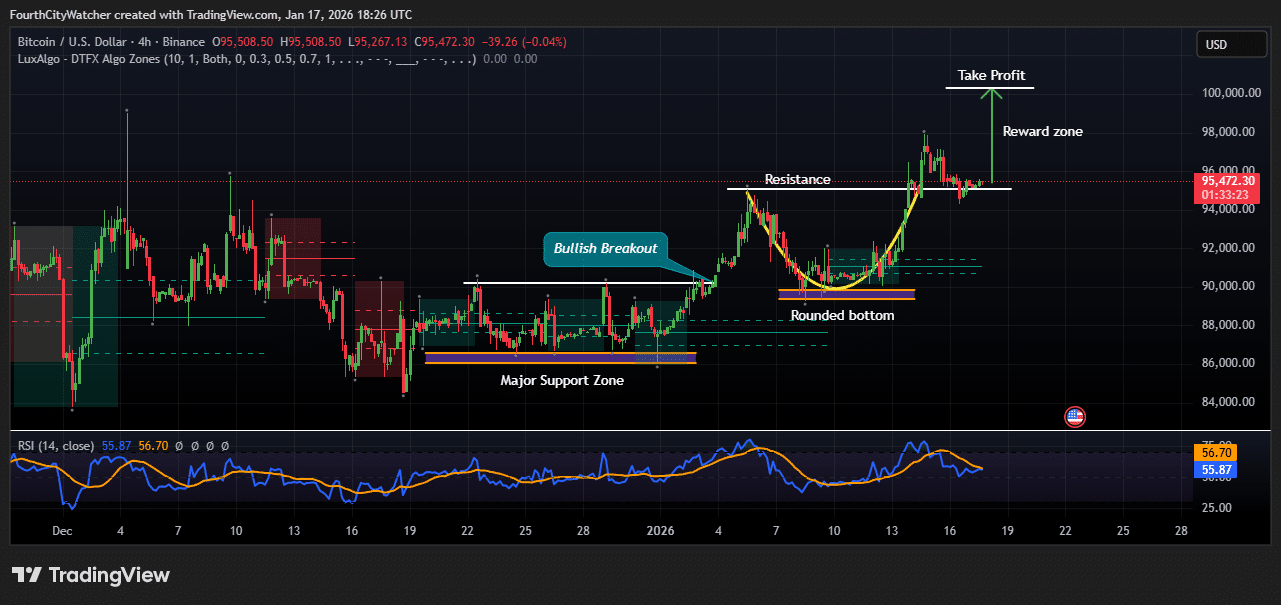

Bitcoin Price Consolidates Above Key Support After Bullish Breakout

Bitcoin (BTC) shows steady consolidation after a strong bullish breakout, according to the latest 4-hour chart, as price trades at $95,470 at the time of writing. The chart highlights a major support zone near the $86,000–$88,000 range, where Bitcoin previously formed a solid base.

This area acted as a demand zone, absorbing selling pressure and setting the stage for a rebound. From this level, BTC began forming a rounded bottom pattern, a classic bullish structure that often signals a gradual shift from bearish to bullish momentum. The bullish bias was confirmed after the price broke above a key resistance zone around $91,000–$92,000, labeled as a bullish breakout on the chart. Following the breakout, Bitcoin rallied sharply toward the $97,000–$98,000 area, where sellers temporarily stepped in. This level now acts as short-term resistance.

Currently, BTC is moving sideways just below resistance, suggesting healthy consolidation rather than weakness. Price is holding above the former resistance zone, which has now flipped into support around $94,500–$95,000. This behavior often indicates that buyers are defending higher levels while preparing for a possible continuation move.

BTCUSD Chart Analysis Source: Tradingview

The chart also marks a reward zone targeting the $100,000 psychological level, aligning with the projected take-profit area. A clean break and close above the $96,000–$97,000 resistance could open the door for a retest of six-figure prices in the near term.

Momentum indicators support this outlook, with the Relative Strength Index (RSI) is hovering around the mid-50s, indicating a neutral-to-bullish momentum. Notably, RSI is neither overbought nor oversold, leaving room for further upside if buying pressure increases.

The technical structure remains constructively bullish, as long as Bitcoin holds above the $94,000 support zone. A drop below this level could invite short-term pullbacks toward $92,000, but unless BTC loses the major support near $88,000, the broader trend continues to favor the bulls.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Pi Network Price Predictions for this Week

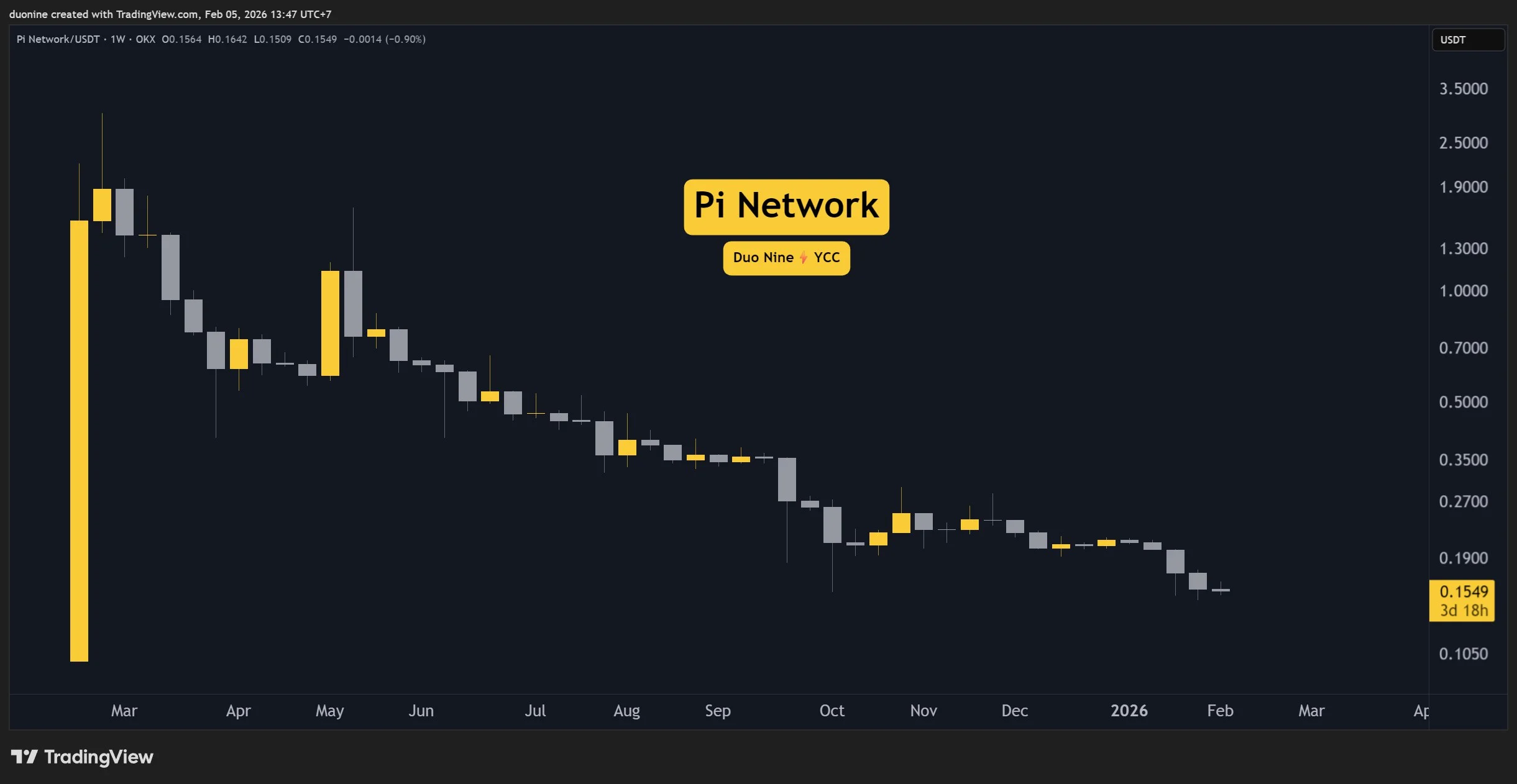

Let’s have a look at some important PI price targets as the cryptocurrency continues to fall toward new all-time lows.

PI reached a new all-time low at 14.6 cents. Is this the bottom?

PI Network (PI) Price Predictions: Analysis

Key support levels: $0.15

Key resistance levels: $0.2

PI Downtrend Accelerates

PI closed January with a new all-time low after briefly touching $0.146. Since then, buyers have pushed the price above 15 cents, but this is unlikely to hold if the downtrend continues.

Worst, there is no sign of a possible bottom yet, especially when major market leaders such as BTC and ETH continue to fall.

Aggressive Selloff since the start of 2026

As soon as the new year started, PI bears intensified their presence on the orderbook with massive sell orders. This led to a sharp 25% crash in mid-January. This pressure appears to continue in February, as can be seen on the chart.

Daily RSI Extremely Oversold

The daily RSI has been in the oversold region (below 30) since the start of the year, and it has not moved out of it. This is an extremely bearish signal, but it does hint at a possible bounce in the future, since prices rarely remain in extremes for long.

You may also like:

Should a bounce materialize later, watch the resistance at 20 cents, which could stop any relief rally.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World1 day ago

Crypto World1 day agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards