Crypto World

Building Digital Economies with Metaverse Blockchain Games

For years, metaverse games were treated as experimental digital spaces, immersive, creative, but largely positioned as merely entertainment projects. However, that perception is changing rapidly.

Enterprises and forward-looking studios are no longer investing in metaverse blockchain games just to create virtual worlds. The focus is on building persistent digital economies where users socialize, trade, own assets, and generate value.

The shift is subtle but powerful. Metaverse game development is evolving from experiences into economic ecosystems. Businesses that understand this transition are positioning themselves at the forefront of the next digital economy wave. It is because the next generation of digital platforms will not simply be social networks or apps; they will be immersive environments where commerce, community, and ownership converge.

From Virtual Spaces to Economic Systems

A traditional virtual world offers exploration and interaction. On the other hand, a metaverse blockchain game introduces something far more powerful that is economic permanence. When assets exist on-chain & transactions are verifiable, the environment becomes more than just a playground, it becomes a marketplace and a functioning economy.

These ecosystems are built on several pillars:

- Digital Ownership

True digital ownership changes user psychology. When players genuinely own assets like characters, land, skins, or tools, they tend to treat them as investments rather than consumables. For enterprises, this increases willingness to spend and builds long-term emotional attachment. - Asset Scarcity

Scarcity drives perceived value. Limited or time-bound assets create collectability and stimulate secondary markets. When managed strategically, scarcity supports demand cycles and stabilizes ecosystem value. - Tokenized Economies

Tokens are not just rewards, they are economic instruments. At the time when structured properly, they guide participation, governance, and ecosystem sustainability. Enterprises can use tokenomics to align user incentives with platform growth. - Interoperable Assets

Assets usable across environments hold higher value. Interoperability reduces user risk and encourages deeper investment. It also enables cross-platform partnerships and larger ecosystem reach. - Transparent Transactions

Blockchain-backed transparency builds trust. Every trade and transfer is verifiable, thereby reducing disputes & reinforcing fairness both of which are critical for long-term economic health.

Players stop being mere participants. They become stakeholders. For enterprises, this transforms games into economic platforms.

Why Businesses Are Paying Attention

Decision-makers increasingly view metaverse blockchain games as strategic digital infrastructure rather than creative experiments.

- Brand Engagement at Depth

Unlike short campaigns, immersive worlds host users for hours. This builds emotional connection and stronger brand recall. - Digital Commerce Opportunities

Virtual goods, land, access passes, and collectibles open recurring revenue streams. These are not one-off purchases but parts of ongoing economies. - Loyalty & Membership Ecosystems

Ownership-based loyalty outperforms point systems. NFT or token memberships carry tradable value and exclusivity, driving retention. - Community-Led Growth

Users who own assets become advocates. When ecosystem success benefits participants, organic growth follows. - First-Mover Positioning

Early adopters gain insights, data, and ecosystem maturity before competitors enter. This builds defensible advantages.

It is exactly the reason why metaverse initiatives are now discussed in boardrooms, not just marketing teams.

Want to Build a Full-Scale Digital Gaming Economy?

The Role of Blockchain in Making Economies Work

Without blockchain, virtual economies rely on centralized control, which weakens trust and portability. The introduction of blockchain brings in:

- Verifiable Ownership

Ownership recorded on-chain gives users real control, not platform-dependent licenses. - Trustless Transactions

Peer-to-peer transactions reduce reliance on intermediaries, lowering costs and friction. - Smart Contract Automation

Rules execute automatically. Royalties, revenue splits, and governance can function without manual oversight. - Transparency

Open ledgers help reduce fraud and simplify the audit process. - Interoperability Potential

Shared standards allow assets to travel across platforms, increasing lifespan and utility.

When users trust the system, they invest more time and capital. That trust fuels sustainable economies.

Where Many Projects Go Wrong

Not every metaverse blockchain game succeeds. A number of them fail due to economic misdesign rather than technical flaws.

- Speculation-Driven Models

Short-term hype collapses without utility. - Inflationary Reward Systems

Over-issuance devalues tokens and drives users away. - Weak Governance

Without rules, economies tend to destabilize. - Poor Onboarding

Complex wallet flows deter mainstream users. - Infrastructure Gaps

Systems must be built to scale over time. Performance failures damage credibility.

What Sustainable Metaverse Economies Require

Persistent economies demand disciplined planning.

- Economic Modeling

Balanced supply-demand and token sinks maintain value. - Scalable Infrastructure

Cloud and blockchain must work together for real-time experiences. - Security Frameworks

Audited contracts and secure wallets protect ecosystems. - Governance Systems

Clear rules build confidence. - Live Economy Management

Economies need monitoring and tuning. - Content Pipelines

Fresh content sustains demand and engagement.

The Strategic Value for Businesses

Enterprises that invest thoughtfully gain:

- Recurring monetization channels

- High-value digital communities

- Long-term retention

- Behavioral data insights

- Brand differentiation

- Platform-level control over engagement

Instead of chasing users, they build environments users return to.

The Competitive Reality

The metaverse space is no longer empty. Major brands, gaming studios, and tech firms are actively experimenting and investing. As more players enter, the cost of late adoption rises.

Businesses that wait will have to face:

- Higher user acquisition costs

- Saturated virtual spaces

- Reduced novelty advantage

- Fewer partnership opportunities

Early movers, however, shape standards and user expectations. They build ecosystems before markets mature. This is not about rushing blindly; it’s about strategic timing. Businesses that plan now can enter with clarity rather than urgency later.

Why Development Expertise Matters

Metaverse blockchain games sit at the intersection of:

- Game design

- Blockchain engineering

- Economic architecture

- Security infrastructure

- Community mechanics

Poor execution doesn’t just create bugs; it destabilizes economies. A capable game development company understands how these layers interact to build sustainable ecosystems.

Final Thoughts

Metaverse blockchain games are no longer novelty projects. They are evolving into persistent digital economies where ownership, engagement, and value intersect. Enterprises recognizing this shift are not building games; they are building digital nations.

Antier, as a reliable metaverse game development partner, works with enterprises & studios to develop blockchain games designed for scalability, sustainability, and long-term economic participation. It is because the future of digital economies won’t just be visited, they’ll be lived in.

Frequently Asked Questions

01. What is the main shift in the perception of metaverse games?

The perception is shifting from viewing metaverse games as mere entertainment projects to recognizing them as platforms for building persistent digital economies where users can socialize, trade, own assets, and generate value.

02. How does digital ownership impact user behavior in metaverse games?

True digital ownership changes user psychology, leading players to treat their assets as investments rather than consumables, which increases their willingness to spend and fosters long-term emotional attachment.

03. What are the key pillars that support metaverse economic ecosystems?

The key pillars include digital ownership, asset scarcity, tokenized economies, interoperable assets, and transparent transactions, all of which contribute to a functioning economy within the metaverse.

Crypto World

Rebuilding Global Payments with Stablecoins | Circle & USDC with Nikhil Chandhok

Stablecoins have quietly become the most successful use case in crypto.

Crypto World

Remittix Presale Holders Set To See A 5x This Week As Mega 300% Bonus Event Goes Live

Remittix (RTX) holders are positioning for gains this week as a mega 300% bonus event has gone live and early data shows strong participation momentum. Investors in the crypto market are analysing potential returns as Remittix’s recent adoption signals accelerate with downloads and wallet engagement.

The activated bonus means new buyers receive 300% extra tokens via email activation, which is driving demand and giving holders reasons to expect a 5x move in the short term.

With over 703 million tokens sold and the platform launch scheduled for 9th February 2026, Remittix is standing out as a top crypto under $1 project that blends incentives with early product engagement.

Remittix Sales And Bonus Event Fuel Short-Term Upside

Remittix has sold more than 703 million tokens from its total 750 million allocation, with tokens priced at $0.123 and funds raised exceeding $29 million, moving quickly toward the $30 million milestone.

This strong uptake shows that demand remains high, driven in part by the newly activated 300% bonus available via email signup. The bonus gives every new buyer a larger token allocation for the same contribution, which in turn boosts market activity.

Downloads of the Remittix wallet have increased as users prepare to engage with upcoming features. The wallet is currently live on the Apple App Store with a Google Play release underway, allowing holders to store, send and manage assets ahead of the full platform launch on 9 February 2026.

This product engagement supports the thesis that Remittix is gaining real user participation rather than passive speculation.

Market observers also note that incentives, when paired with growing usage, often correlate with increased interest and volume. The activated bonus, combined with a limited remaining supply, is creating conditions where holders see the potential for strong upside this week.

Why Remittix’s Fundamentals Support Continued Growth

Remittix’s appeal goes beyond short-term incentives. The project is positioned at the intersection of crypto, payments and global remittance, a market worth $19 trillion. The goal is to make Remittix the go-to crypto-to-fiat payment hub for merchants, users, and businesses worldwide.

This Remittix DeFi project roadmap includes a wallet, web app, fiat rails and API integrations for developers and payment providers, practical tools that give the token real utility.

Security and credibility are strong points for Remittix. The team is fully verified by CertiK, the gold standard in blockchain security and Remittix is ranked #1 on CertiK Skynet with an 80.09 Grade A score from over 24,000 community ratings. These metrics help build investor trust and reinforce confidence among holders and new entrants alike.

Remittix also offers a 15% USDT referral program, boosting participation beyond basic buying incentives. The project has already secured two CEX listings on BitMart and LBANK, with preparations in motion for a third major exchange listing once the $30 million raise is reached.

The upcoming full platform release on the 9th February 2026 marks a transition from early engagement to real utility as PayFi infrastructure begins rolling out. This scheduled launch, combined with the mega bonus event and rising wallet activity, gives holders multiple reasons to believe that strong moves could unfold this week and beyond.

Reasons Why Remittix Is Drawing Attention:

- Solving a real-world $19 trillion cross-border payments problem

- Utility first token model built around real transaction volume

- Deflationary tokenomics with growth potential

- Global payout rails are expanding with a focus on key remittance corridors

- Built for adoption rather than short-term speculation

Why This Week Could Mark A Turning Point For Remittix

Remittix’s activated 300% bonus, strong sales data, expanding product footprint and scheduled platform launch align in a way that supports both short-term interest and longer-term utility adoption. Early participants now see a potential path to meaningful gains, while the project’s growth signals continue to attract attention in the broader crypto market.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Griffin AI announces partnership with OpenAI and receives usage milestone trophy recognizing 20+ billion tokens processed

- Griffin AI received a second OpenAI milestone trophy after surpassing 20 billion tokens processed.

- Growth reflects rising reliance on AI agents for crypto research, workflows, and decision support.

- Company aims to convert high usage into durable, utility-driven value across Web3 ecosystems.

User engagement with GriffinAI agents accelerates with 57% month-over-month growth in prompt-driven activity, reinforcing Griffin AI’s position among the most active OpenAI model users in the crypto sector.

6 February 2026— Griffin AI, the AI agent builder for DeFi, today announced its partnership with OpenAI and confirmed it has received a milestone trophy from OpenAI recognizing Griffin AI’s continued high-volume usage of OpenAI models.

Founder Oliver Feldmeier shared the milestone publicly during a recent AMA on X, noting that Griffin AI first received recognition after surpassing 10 billion tokens consumed via OpenAI’s platform, and has now received a second trophy after passing another 10 billion tokens—a sign of accelerating adoption and platform engagement.

Oliver Feldmeier, Founder of Griffin AI said:

In times like these, during the extreme market turmoil in the bear market phase, what counts is that users keep using our agents — and premium usage is paid in our native GAIN token. That organic demand, driven by real utility of our agents, is what matters beyond short-term market movements. This isn’t just a vanity metric. It’s evidence that real users are actively engaging with our agents—triggering prompts, running workflows, and using the platform at meaningful scale.

Customer growth and engagement momentum

Griffin AI has seen steady growth in user adoption and a material increase in usage intensity on the platform.

In recent months, prompt-driven activity triggering Griffin AI agents grew by 57% month-over-month, reflecting a sharp rise in engagement as users increasingly rely on AI agents to support crypto research, decision support, and workflow automation.

While much of today’s activity occurs within the platform—prior to being fully observable on-chain—Griffin AI views these engagement metrics as an early indicator of product-market fit for agent-led experiences in crypto.

Why this matters

This recognition from OpenAI reinforces Griffin AI’s focus on scaling reliable, production-grade AI agent experiences for crypto users.

The token milestone trophies serve as external validation that Griffin AI is operating at top-tier usage levels—positioning the company among the most active OpenAI model consumers in the crypto space.

Key milestones highlighted:

- 20+ billion OpenAI model tokens processed across two recognized usage thresholds

- Second OpenAI milestone trophy received, signaling accelerating platform demand

- 57% month-over-month growth in prompt-generated agent activity in recent months

What’s next: converting demand into durable utility

Griffin AI’s next phase is centred on converting rising usage into measurable end-user value—through commercial-grade agents that can operate across the web, social platforms, and crypto workflows, with a roadmap that ties platform usage to broader ecosystem utility.

Griffin AI also continues to operate a multi-model stack—leveraging OpenAI alongside additional leading models and self-hosted deployments—ensuring performance, resilience, and flexibility as the product scales.

About Griffin AI

#1 AI Agent Builder for Web3

IGriffin AI is the leading AI agent builder for decentralized finance, enabling anyone to create, deploy, and scale autonomous crypto-native agents. Its flagship agents “Transaction Execution Agent” executes swaps, yields, and cross-chain operations through natural language, while multiple research agents help investors find Alpha.

PR Contact:

[email protected]

Note: “Tokens” refer to AI model tokens processed through OpenAI model usage (not blockchain tokens). Forward-looking statements in this release are subject to risks and uncertainties.

Crypto World

Bitcoin Plunges in One of Its Fastest Crashes Ever

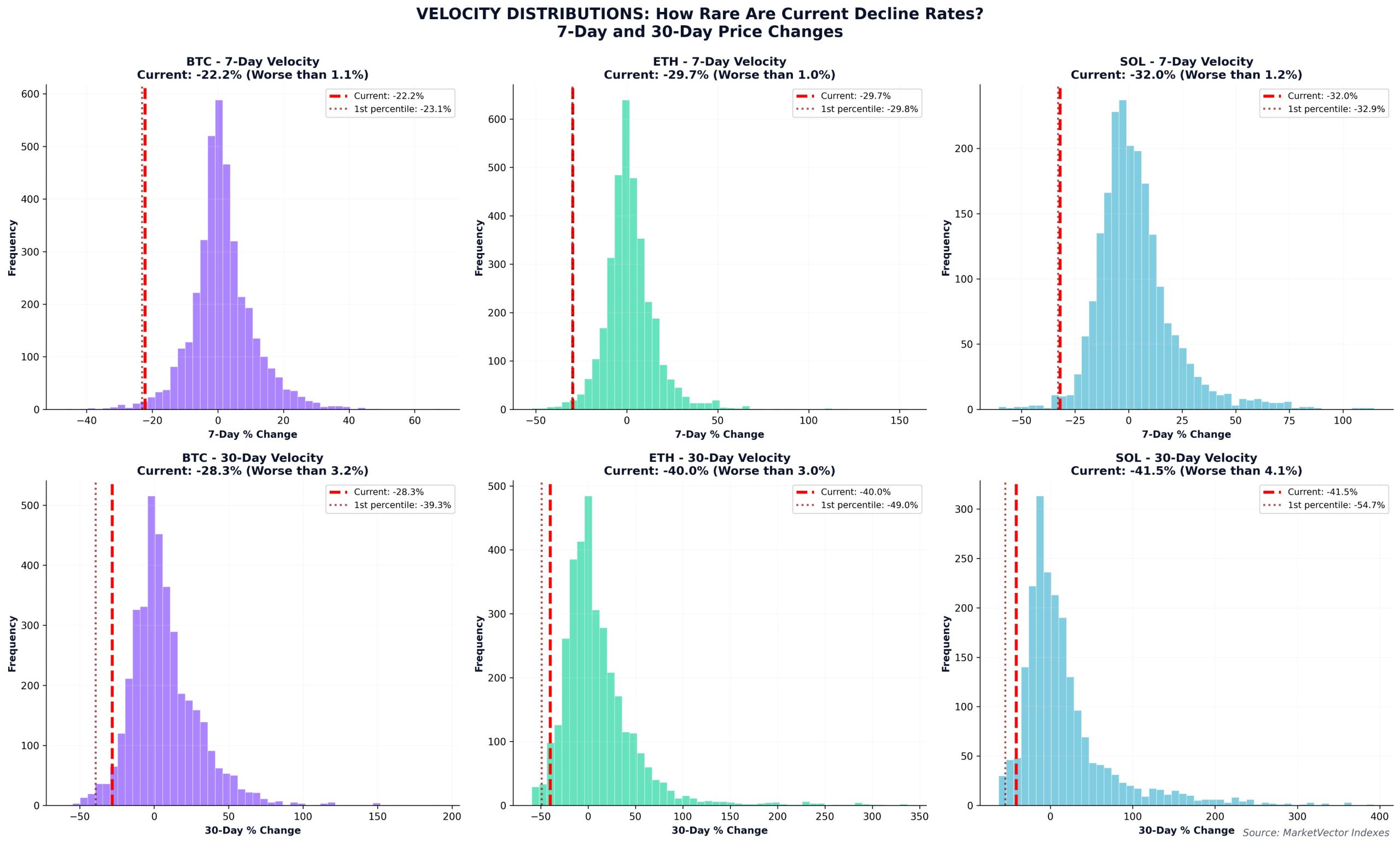

Bitcoin (CRYPTO: BTC) trading action suggests a rebound is becoming increasingly likely, even as the asset tests downside extremes. Data show BTC is about 2.88 standard deviations below its 200-day moving average—the kind of deviation that has not occurred in a decade of data, according to Martin Leinweber of MarketVector Indexes. A dip below $60,000 intensified the narrative that this is macro-driven rather than a breakdown of the technology or the network’s fundamentals, with analysts framing the move as a potential prelude to mean reversion. While official bottoms remain uncertain, the long-term thesis for Bitcoin’s role in diversified portfolios remains intact, keeping attention on what happens next as liquidity and risk sentiment evolve.

Key takeaways

- Bitcoin (BTC) sits about 2.88σ below its 200-day moving average, an extreme not seen in roughly ten years of data.

- BTC plunged more than 22% in a single week, placing the move among the fastest drawn‑down episodes in its history.

- Analysts describe the current bear market as macro-driven rather than a tech failure, with the long‑term thesis for BTC still intact.

- Ethereum (ETH) and Solana (SOL) have underperformed BTC during this episode, underscoring broad risk-off conditions across major crypto assets.

- Despite the drawdown, some observers see signs of mean reversion ahead, though a definitive bottom remains elusive.

Tickers mentioned: $BTC, $ETH, $SOL

Sentiment: Bearish

Price impact: Negative. A steep weekly loss reinforces risk-off sentiment and pressures near-term liquidity dynamics.

Market context: The move aligns with broader risk-off environments where macro factors drive volatility in crypto markets, shaping trading ranges and participant behavior rather than signaling a systemic breakdown of the asset class.

Why it matters

Bitcoin’s recent performance has spotlighted the fragility and resilience of crypto markets at the intersection of macro stress and digital asset hedging. On one hand, the unprecedented distance from the 200-day SMA underscores how stretched sentiment and liquidity can become during risk-off phases. On the other hand, the fact that the long-term investment narrative remains intact—often cited by researchers and institutions—suggests that the drawdown may eventually be absorbed as traders reprice risk rather than reallocate away from the asset class entirely.

Analysts point to the speed and magnitude of the move as a catalyst for renewed interest among long-term holders and “cash-heavy” buyers prepared to accumulate during volatility. In the near term, the market is watching whether the price reverts toward trend lines and whether any technical floor emerges around historically meaningful levels. The divergence between BTC and altcoins like Ethereum (CRYPTO: ETH) and Solana (CRYPTO: SOL) during this period also matters: a widening dispersion could indicate selective risk appetite among institutional players or hedged traders recalibrating exposure across chains.

Macro factors continue to loom large. When bear markets crest on macro-driven dynamics, the consensus often shifts between “this is a pause before a recovery” and “this is the start of a longer review of risk premia across digital assets.” The sentiment readings have been grim at moments, such as the episode’s rapid liquidation cycles and the perception of liquidity shortages in stressed markets. Yet within this volatility, the potential for mean reversion persists because the observed distances from trend lines are statistically extreme. In the view of Leinweber and others, the dataset suggests that outsized deviations can produce sharp, corrective rebounds when liquidity and risk tolerance normalize.

Historical context remains a persistent theme. The drawdown scenario recalls prior stress events but stokes caution against assuming a bottom has formed. While the macro narrative dominates near-term moves, participants continue to scrutinize on-chain signals, exchange flows, and the behavior of large holders to gauge whether capacity is forming for a technical bounce or if further declines could unfold before any stabilization.

What to watch next

- Monitor Bitcoin’s proximity to the 200-day SMA and any early signs of mean reversion, including turnover in liquidity metrics and order-book dynamics.

- Track hedging and accumulation patterns among large traders and institutions, particularly any shifts in funding rates and open interest on BTC-denominated derivatives.

- Assess sentiment indicators, such as the Crypto Fear & Greed Index, for any uptick from extreme readings as prices stabilize or bounce.

- Compare performance across BTC, ETH, and SOL to determine whether the macro backdrop is driving broad risk-off or if assets begin to decouple in a stabilization phase.

Sources & verification

- Martin Leinweber’s X thread detailing BTC’s distance from the 200-day SMA and the sub-$60,000 dip (via New analysis).

- BTC’s weekly drawdown exceeding 22% and its ranking among the fastest declines in history.

- Crypto Fear & Greed Index reading at 9/100, signaling extreme market pessimism (via Alternative.me).

- Reported dip-buying activity and commentary from traders discussing potential opportunities for cash-rich buyers (via buying the dip).

- On-chain and market observations cited in discussions around BTC’s move and altcoin relative performance (via linked analyses and price pages for ETH and SOL).

Market reaction and key details

Bitcoin (CRYPTO: BTC) has moved into a territory that market technicians label as extraordinarily rare: a sustained deviation from the 200-day moving average that has not appeared in roughly ten years of data. The data show BTC trading below the 200-day SMA by about 2.88 standard deviations, a statistic that Leinweber describes as a once-in-a-decade event. The price fragment below the $60,000 level has arrived amid a weekly slide of more than 22%, a pace that places the move among the most rapid drawdowns in the currency’s history. In practical terms, the slide has undertaken both the breadth of a market-wide risk-off mood and the depth associated with cascading liquidations across leveraged positions.

Despite the severity of the move, the analyst notes that Bitcoin’s long-term investment thesis remains intact. He stresses that the bear market at hand appears macro-driven rather than a sign of systemic weakness in the protocol or in its underlying economic model. In his perspective, the combined signals—distance from the 200-day SMA, an outsized daily drawdown, and the persistence of macro headwinds—point toward a high probability of mean reversion as liquidity conditions normalize and market participants recalibrate risk appetites. This framing resonates with the broader interpretation that the current episode is more about macro dynamics than a fundamental failure of Bitcoin’s supply-demand mechanics.

The broader market also reveals differentiated performance among major crypto assets. Ethereum (CRYPTO: ETH) and Solana (CRYPTO: SOL) have not kept pace with Bitcoin’s decline, reinforcing the narrative that capital follows risk-off trends with selective dispersions across chains. The distances from trend lines for these assets underscore how volatility has affected the sector as a whole, even as some observers argue that BTC’s unique status as a market anchor can drive sharper moves in its wake. The juxtaposition between BTC’s outsized deviation and altcoins’ responses provides a window into how market participants are weighing potential rebounds versus the risk of renewed downside momentum.

Market participants have also been watching the buy-and-dump cycles that have characterized recent weeks. Several commentators described how large‑volume liquidations have created pockets of opportunity for those with dry powder, especially among hedge funds and major exchange ecosystems. One trader emphasized that the “middle” of 2024’s range could offer attractive entry points for those prepared to accumulate while volatility remains elevated. Yet even as accumulation narratives gain traction, the scale of the current decline and the magnitude of the deviation suggest that any reprieve could be inherited with caution rather than enthusiasm, as investors assess where the next catalyst might come from and whether a longer-term stabilizing phase can emerge from the micro- and macro- forces at play.

As observers parse the data, the emphasis remains on risk management and disciplined positioning. While the macro backdrop remains unsettled—characterized by inflation dynamics, central bank policy expectations, and liquidity considerations—the consensus among several researchers is that Bitcoin’s core narrative persists. The asset’s scarcity, its history of resilience, and the belief that it still acts as a portfolio hedge for some traders anchor a case for eventual recovery, even if the near term remains volatile and uncertain. In short, the market is braced for a potential rebound, but the path there will be shaped by evolving macro signals and the behavior of market participants navigating a complex risk environment.

https://platform.twitter.com/widgets.js

Crypto World

Bitcoin Just Saw One of Its Fastest Crashes in History

Bitcoin (BTC) rebounding is now “highly probable” as BTC price action sets another bearish record.

Key points:

-

Bitcoin has never traded so far below its 200-day moving average, data shows.

-

BTC price action is due “mean reversion” as a result.

-

Analysis describes a “macro-driven” Bitcoin bear market now in progress.

Bitcoin sees one of its fastest price drawdowns

New analysis from Martin Leinweber, director of digital asset research and strategy at European index provider MarketVector Indexes, says Bitcoin’s long-term investment thesis is “intact.”

BTC price action has never strayed so far from its 200-day simple moving average (SMA), and Leinweber said the dip below $60,000 was anything but “normal.”

“Bitcoin is -2.88σ below its 200-day moving average. In 10 years of data, this has literally NEVER happened before. Not during COVID. Not during FTX. Never,” he wrote in an X thread on Friday.

The analysis places this week’s crash among Bitcoin’s 15 fastest, with BTC/USD dropping by more than 22% in a single week, a worse rate than in 98.9% of its history.

“When you’re in the 99th percentile of bad outcomes, mean reversion becomes highly probable,” Leinweber continued.

2.88 standard deviations below the 200-day SMA, however, has never happened before, and sees Bitcoin beat the drawdowns for major altcoins Ether (ETH) and Solana (SOL).

“We’re not at generational lows yet. But we ARE at statistical extremes across multiple indicators,” the analysis said.

Despite that, Leinweber is not in a hurry to predict a long-term BTC price bottom, arguing that the current floor may only be a “local” one.

Zooming out, meanwhile, there remains reason to believe in the Bitcoin bull case.

“Bear market = macro driven, not tech failure. Long-term thesis intact,” the X thread concluded.

Bitcoin dip-buying needs “patience”

Earlier, Cointelegraph reported on the record-breaking nature of recent BTC price losses.

Related: BTC price heads back to 2021: Five things to know in Bitcoin this week

Thursday saw Bitcoin’s first-ever $10,000 red daily candle, with liquidations beating significant bearish events in the past, including the COVID-19 crash and implosion of exchange FTX.

Sentiment dropped to extreme lows, as measured via the Crypto Fear & Greed Index’s 9/100 score.

At the same time, signs that large-volume investors were buying the dip quickly emerged, with the focus on hedge funds and Binance.

Analyzing the wave of liquidations in recent weeks, trader Daan Crypto Trades was among those eyeing a potentially lucrative buying opportunity.

“$BTC Bouncing from the middle of the 2024 range. Price sold off -38% in just a few weeks and a lot of large leveraged positions have been wiped out,” he told X followers.

“Great time if you are more cash heavy and have the patience to accumulate or profit from the volatility.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Is $1,500 Next for ETH After the ‘Aggressive Deleveraging’?

Ethereum has entered an aggressive deleveraging phase, breaking decisively lower after weeks of distribution near the upper boundary of its medium-term range. A key macro driver behind this move appears to be the recent escalation of geopolitical tensions in the Middle East, which has pushed broader risk assets into de-risking mode and amplified existing technical fragilities in the ETH market.

The combination of macro uncertainty, elevated leverage, and vulnerable chart structure has produced a sharp unwind rather than a controlled pullback.

Ethereum Price Analysis: The Daily Chart

On the daily chart, ETH has broken down from the prior ascending structure that extended from the late-2025 lows and has failed to break above the 100-day and 200-day moving averages, which are now both located above the $3,000 mark. This price behavior has confirmed a transition from corrective sideways action into a clear downside trend.

The price has also broken below the first major demand band around the $2,200-$2,000 area, which coincides with a prior consolidation base and the origin of the last strong impulsive advance. Daily RSI has also fallen into deeply oversold territory in the low 20s, indicating stretched short-term conditions.

However, as long as the market remains capped below the broken moving averages and former support around $2,200, the broader structure continues to point toward a bear-market rally at best rather than a confirmed reversal.

ETH/USDT 4-Hour Chart

The 4-hour chart highlights the velocity of the current sell-off, with ETH cascading lower from the previously defended $2,800–$2,900 support and barely pausing on intermediate levels. The market is now trying to stabilize around the $1,850–$1,900 range, and a mild bullish divergence is emerging on the 4-hour RSI, where momentum has begun to print higher lows despite marginally lower price lows.

This configuration often signals that forced selling pressure is easing and that a short-term relief bounce or sideways consolidation may follow.

Immediate resistance now sits in the $2,100–$2,200 area, with a stronger supply zone at $2,800. Any rebound that stalls below these bands would keep the intraday trend firmly bearish, while a clean breakdown below the recent $1,800 low would pave the way toward the deeper demand zone at $1,500.

Sentiment Analysis

On the derivatives side, open interest across Ethereum futures has collapsed from elevated levels above 30 billion USD to nearly a third that size, tracking the price decline and signaling a large-scale liquidation cascade rather than an orderly reduction in positioning. This sharp contraction in open interest indicates that a significant portion of leveraged longs has been forced out of the market, with margin calls and auto-deleveraging accelerating the downside once key support levels failed.

While such events are painful in the short term, they also tend to cleanse excess leverage from the system, leaving a lighter positioning backdrop where spot flows and fresh capital, rather than crowded derivatives exposure, can play a larger role in setting the next directional move.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Eurozone to Discuss Stablecoins in Bid to Strengthen Euro’s Role

Eurozone finance ministers will convene on Feb. 16 to deliberate on integrating euro-denominated stablecoins as part of efforts to bolster the euro’s global influence.

Eurozone finance ministers are set to meet on Feb. 16 to explore the integration of euro-denominated stablecoins and central bank digital currencies (CBDCs) to enhance the euro’s global standing, Reuters has learned.

The European Commission is preparing a set of proposals aimed at strengthening the euro’s role in the international monetary system. These proposals are expected to include the issuance of euro-denominated stablecoins, tokenized deposits, and CBDCs.

Currently, the euro accounts for approximately 20% of global currency reserves, compared to about 60% for the U.S. dollar, the report reads.

Despite this significant presence, euro-denominated instruments make up less than 1% of the stablecoin market, which is predominantly dominated by U.S. dollar-pegged assets.

Economic security is a central theme of this meeting. The commission has highlighted the need for the EU to act decisively in strengthening its economic and financial security. This includes proposals for joint EU debt issuance to finance common projects, potentially increasing the euro’s appeal in global financial markets.

As The Defiant reported earlier, analysts at credit rating agency S&P Global anticipate that the growth of euro stablecoins will likely be driven by real-world asset (RWA) tokenization rather than payments.

This article was generated with the assistance of AI workflows.

Crypto World

Bitcoin Erases Post-Trump Election Gains, Altcoins Crash by Double-Digits: Your Weekly Crypto Recap

It was a catastrophic week in terms of price movements, but HYPE has defied the trend and stands out as a top performer.

The past few weeks have been anything but dull in the cryptocurrency markets. Unfortunately for the bulls, it’s not in their favor.

It all began last Saturday. Bitcoin had finally recovered some ground following the previous crash to $81,000 and stood around $83,000-$84,000, which was rather unusual as the two largest precious metals – assets known for their stability – crashed on Friday by double digits.

This heightened volatility reached BTC on Saturday when it dumped from $84,000 to under $76,000. The bulls tried to intervene, but all they could do was help BTC recover slightly to $79,000. The asset was quickly rejected there and dipped below $74,000 on Monday. The same failed rebound scenario repeated, and the bears took complete control of the market in the following days.

The culmination, at least for now, transpired yesterday. Another brutal sell-off drove the largest digital asset down to $60,000. As such, BTC not only erased all gains charted after Trump’s reelection victory in late 2024, but it actually dumped to under the levels from back then. Strategy’s bitcoin positions went deep in the red as the cryptocurrency dropped by $30,000 in just over a week.

The reasons behind this calamity may vary and are still debated by analysts. From rising geopolitical tensions to the new Fed Chair to excessive leverage in the markets. The fact is, though, the overall crash on Thursday alone wiped out more than $2.6 billion in leveraged positions.

Despite rebounding to $67,000 as of press time, BTC is still nearly 20% down weekly. Many altcoins have produced even more significant declines, such as ETH (-28%), BNB (-23%), LINK (-21%), XMR (-26%), and others. HYPE, on the other hand, continues to defy the overall trend and has soared by 19% within the same timeframe.

Market Data

Market Cap: $2.38T | 24H Vol: $360B | BTC Dominance: 56.6%

You may also like:

BTC: $67,200 (-18.4%) | ETH: $1,950 (-28.3%) | XRP: $1.43 (-20%)

This Week’s Crypto Headlines You Can’t Miss

Institutional Exit? US Investors Are Dumping ETH at a Record Rate. Even before Ethereum’s most significant decline to under $1,800, reports claimed that US-based investors had intensified the selling pressure, which was evident from the declining ETH Coinbase Premium Index.

Roubini Predicts a ‘Crypto Apocalypse’ Amidst Bitcoin’s Plunge Under Trump-Era Policies. These times of pure uncertainty and price calamity are the perfect opportunity for industry haters, such as Nouriel Roubini, to lash out again. Recently, the economist predicted a “crypto apocalypse,” explaining that the evolution of money and payments will be a gradual process, instead of the quick revolution promised by crypto advocates.

Michael Burry Warns Bitcoin Treasury Firms Face Existential Risk as BTC Slide Deepens. Michael Burry also spoke out after years of silence, warning that Bitcoin Treasury Companies could soon face liquidation threats if the cryptocurrency’s price declines continue.

Crypto Winter Has Been Here Since January 2025, But Recovery May Be Closer Than You Think. Despite the multiple new all-time highs registered by BTC last year before October, Bitwise’s CIO, Matt Hougan, recently asserted that the asset has been in a bear market since January 2025. More optimistically, though, he noted that the end may be closer than you expect.

Tom Lee Shrugs Off ETH Sell-Off, Says Fundamentals Don’t Match Falling Prices. Tom Lee, who has perhaps the largest exposure to ETH through Bitmine, dismissed the recent asset decline. Although Bitmine’s position is deep in the red, Lee said ETH’s crashing price doesn’t reflect the strong fundamentals behind the token and the network.

Bitcoin Trading at 41% Discount, Power-Law Model Shows $122K Fair Value. Basing their analysis using the power-law valuation model, market commentator David put BTC’s fair value at just under $123,000. If true, this would mean that the cryptocurrency currently trades with a massive discount of roughly 50%.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ethereum weakens after Bitcoin plunge, downside risks build

- Ethereum price is trading inside a huge channel on the monthly chart.

- Bitcoin’s crash to $60,000 dragged ETH to its intraday lows.

- After falling to lows of $1,748, ETH risks another leg down.

Ethereum’s price hovers above $1,960 as of writing on February 6, 2026.

This follows a sharp downturn in the past 24 hours, with the top altcoin crashing to lows of $1,700 amid broader market turbulence.

Bitcoin’s crash to $60,000, before rebounding to $67,000, dragged ETH to its intraday lows.

All the top altcoins, including Solana, BNB and XRP, fell sharply amid the bloodbath.

Ethereum price recap

Ethereum fell below $1,800 on Thursday, marking its weakest level since mid-2025 as heavy selling pressure intensified.

The decline followed a sharp drop in Bitcoin to around $60,000, which sent shockwaves through the broader crypto market.

Although prices have since recovered above $1,900, continued ETF outflows and a prevailing risk-off environment suggest bullish momentum remains fragile.

Ethereum is down more than 29% over the past week and about 40% over the past month, underscoring the depth of the recent sell-off.

ETH price prediction: could bears target $1,000 next?

Although bulls are targeting a move back above $2,000, the monthly chart points to a fragile price structure.

The chart paints a massive range with $4,900 forming the top established during the past bear cycle.

At the lower end, the parallel channel suggests potential downside toward the $1,000–$1,200 zone.

At present, the $1,800–$1,900 area aligns with support levels seen in April and May 2025, which were tested after ETH retraced from highs of around $4,100 in December 2024.

This overlap reinforces the zone’s importance in determining near-term price direction.

Analysts see this as a critical support zone, but if sellers breach it, it could give way to a downturn to levels untested since Ethereum’s 2022 bear market bottom.

As such, bulls must eye a notable bounce above $2,000. If this happens, the next targets lie in the $2,250-$2,700 range.

However, a breakdown below $1,800 risks testing $1,700 again.

This week’s breakdown aligns with a similar breakdown in March-April 2025, which put prices beneath a key uptrend line formed since the bullish flip in April 2020 after the COVID crash.

With bears having touched the mark already amid current bearish conditions, the picture isn’t in favour of bulls.

A revisit could open up a path to the multi-year demand reload zone around $1,250-$1,000. This area represents untapped liquidity from the 2022 lows.

Crypto World

Cardano price prediction ahead of CME ADA futures launch

Cardano price continued its strong downward trend, reaching its lowest level since February 2021, as the crypto market crash accelerated.

Summary

- Cardano price dropped to a crucial support level as the crypto market crash continued.

- CME will launch its ADA futures on Monday next week.

- ADA’s price action will depend on the performance of the broad crypto market.

Cardano (ADA) token was trading at $0.2650, down by 80% from its highest point in December 2024. It has also retreated by 91% from its all-time high of $3.

A potential catalyst for ADA’s price will be the upcoming CME Group futures listing on February 9 this year. This is a major listing that will make it available to institutional and retail traders.

Historically, such important launches normally lead to higher prices. For example, tokens such as Solana (SOL) and Ripple (XRP) jumped after their futures launched.

However, in Cardano’s case, there is a possibility that the rebound will not happen after the futures launch. First, the launch will occur during a crypto market crash. As such, the broader sentiment in the industry may outweigh the importance of the futures listing.

Second, Cardano may remain under pressure since the ADA futures launch has been priced in by market participants. Additionally, Cardano has lost favor with investors in the past few years because it has been left behind by similar chains like Solana, BNB Chain, and Ethereum.

Cardano has failed to attract major oracle networks like Chainlink. Its total value locked in the DeFi industry is less than $300 million, which is much lower than the billions in assets in the industry. Also, it has a small market share in the stablecoin industry, with just $30 million in assets.

Charles Hoskinson and the team are working to address these issues through a 70 million ADA fund launched last year. The fund’s goal is to attract more oracles, tier-1 stablecoins, and analytics tools. Also, Cardano is preparing for the Midnight mainnet launch either this month or in March.

Cardano price technical analysis

The weekly chart shows that the ADA token has been in a strong downtrend in the past few months. It retreated from a high of $1.3296 in December 2024 to a low of $0.2360. Its lowest level this week was notable as it has failed to move below it several times since December 2022.

ADA price has moved below the 50-week and 100-week Exponential Moving Averages, which have made a bearish crossover. The Relative Strength Index has moved into the oversold zone at 30.

Therefore, the most likely Cardano price prediction is neutral. On the positive side, it has always bounced back whenever it reached this support level. This means that it may rebound again in the coming weeks.

On the other hand, losing this support will lead to more downside, potentially to the key level at $0.100.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports7 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat3 hours ago

NewsBeat3 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business23 hours ago

Business23 hours agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World24 hours ago

Crypto World24 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World22 hours ago

Crypto World22 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation