Crypto World

Coinbase posts $670M Q4 loss as it expands beyond trading

Coinbase reported a quarterly loss as it expanded into derivatives, stablecoins, and new markets to reduce reliance on spot crypto trading.

Summary

- Coinbase diversified its business through futures, global expansion, and new financial products.

- Market volatility and lower trading activity weighed on short-term performance.

- Management remains focused on long-term stability and revenue balance.

Coinbase Global, Inc. reported a net loss of $670 million in the fourth quarter of 2025, despite posting record operational metrics for the full year, according to its earnings report released on Feb. 12.

The company said its Q4 results were in line with internal expectations, even as weaker crypto market conditions in late 2025 weighed on transaction revenue and profitability.

Strong growth, weaker bottom line

In its shareholder letter, Coinbase highlighted major gains in trading activity and product adoption throughout 2025. While its crypto market share doubled to 6.4%, the total trading volume reached $5.2 trillion, up 156% year-over-year.

Revenue from subscriptions and services also reached a record $2.8 billion, indicating rising demand for non-trading products such as stablecoins, staking, and custody services. Paid Coinbase One subscribers climbed to nearly one million, tripling over the past three years.

“We drove all-time highs across our products,” said chief executive officer Brian Armstrong. “The Everything Exchange is working, and we’re well-positioned for 2026.”

Chief financial officer Alesia Haas added that the company met or exceeded its revenue and expense targets throughout the year, extending what she described as a multi-year track record of operational discipline.

However, softer market conditions in the final months of 2025 reduced trading activity and lowered asset prices, putting pressure on Coinbase’s core transaction business. According to GAAP accounting standards, these elements played a part in the quarterly net loss.

Expanding beyond spot trading

As part of its “Everything Exchange” strategy, which aims to bring various asset classes onto a single platform, Coinbase continued to grow beyond spot trading in 2025.

The company introduced 24/7 U.S. perpetual-style futures, expanded its global reach by acquiring Deribit, and launched new products like stock trading and prediction markets. At the same time, stablecoin and institutional services were further developed.

These efforts are meant to reduce dependence on traditional crypto trading and make revenue less sensitive to price swings. As a result, average USD Coin (USDC) balances on the platform climbed to $17.8 billion, while customer-held assets tripled over three years. In 2025, more than 12% of the world’s crypto was stored on Coinbase.

After the earnings report was released, Coinbase shares fell about 8% as the wider digital asset market weakened. Analysts pointed to ongoing volatility and uncertain trading volumes as major short-term risks.

Even so, the company ended 2025 with a solid financial position, holding $11.3 billion in cash and equivalents. It also bought back $1.7 billion worth of shares during the year. Early 2026 has shown signs of recovery, with about $420 million in transaction revenue recorded by early February.

Crypto World

How Will Markets React to $3B Crypto Options Expiring Today?

The end of another week has arrived, which means another batch of crypto options contracts is expiring while spot markets continue to decline.

Around 38,000 Bitcoin options contracts will expire on Friday, Feb. 13, with a notional value of roughly $2.5 billion. This event is a little larger than last week’s expiry.

Crypto markets remain in bear market territory, losing around $125 billion since the start of the week, as sentiment plunges and the retail and institutional exodus continues.

Bitcoin Options Expiry

This week’s batch of Bitcoin options contracts has a put/call ratio of 0.76, meaning that there are more expiring calls (longs) than puts (shorts). Max pain is around $75,000, according to Coinglass, which is above current spot prices, so many will be out of the money on expiry.

Open interest (OI), or the value or number of Bitcoin options contracts yet to expire, remains highest at $60,000 and is now mounting up at $50,000, which has over $1 billion at these strike prices on Deribit as bearish bets increase. Total BTC options OI across all exchanges has been climbing this month and is at $36.6 billion.

Derivatives analyst ‘Laevitas’ said there was a “bear put spread” on Deribit, which involves buying a higher strike put and selling a lower strike put with the same expiry.

“With BTC stabilizing and volume cooling from panic levels, the key question is whether expiry acts as a magnet toward $75K or clears the way for the next directional move,” stated Deribit.

🚨 Options Expiry Alert 🚨

At 08:00 UTC tomorrow, over $2.9B in crypto options expire on Deribit.$BTC: $2.53B notional | Put/Call: 0.76 | Max Pain: $75K$ETH: $406M notional | Put/Call: 0.89 | Max Pain: $2,150

After last week’s break below $70K triggered liquidations and… pic.twitter.com/ZH2dgNglrC

— Deribit (@DeribitOfficial) February 12, 2026

“Put options continue to dominate the market, with over $1 billion in BTC put options traded today, accounting for 37% of the total volume,” commented Greeks Live this week, which added that the majority of these are “out-of-the-money options priced between $60,000 and $65,000.”

You may also like:

“This indicates that institutions hold a negative outlook on the medium-to-long-term market trajectory, with a strong expectation of a bearish trend within the next one to two months.”

In addition to today’s batch of Bitcoin options, around 217,000 Ethereum contracts are also expiring, with a notional value of $406 million, max pain at $2,150, and a put/call ratio of 0.89. Total ETH options OI across all exchanges is around $7 billion. This brings the total notional value of crypto options expiries to around $2.9 billion.

Spot Market Outlook

Total market capitalization is down another 1.5% on the day at $2.34 trillion as the sell-off continues. Bitcoin is weakening again, falling to just above $65,000 in late trading on Thursday and trading just above $66,000 during Friday morning’s Asian session.

Analysts are mostly bearish, with many predicting a bottom near or below its realized price of $55,000. Ether remains weak below $2,000, hitting $1,900 in an intraday low. Continued weakness for BTC will drag ETH even further down over the coming weeks.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Did a Whale Trigger Bitcoin’s Recent Price Slide?

Bitcoin (BTC) has extended its downward trajectory. Over the past 24 hours, the asset has declined 1.39%, pushing its total losses for the month beyond 30%.

While the broader bear market environment remains the primary driver of weakness, emerging on-chain signals suggest that concentrated whale activity could reportedly be amplifying BTC’s downside.

Sponsored

Whale Activity Raises Concerns Over Short-Term Bitcoin Volatility

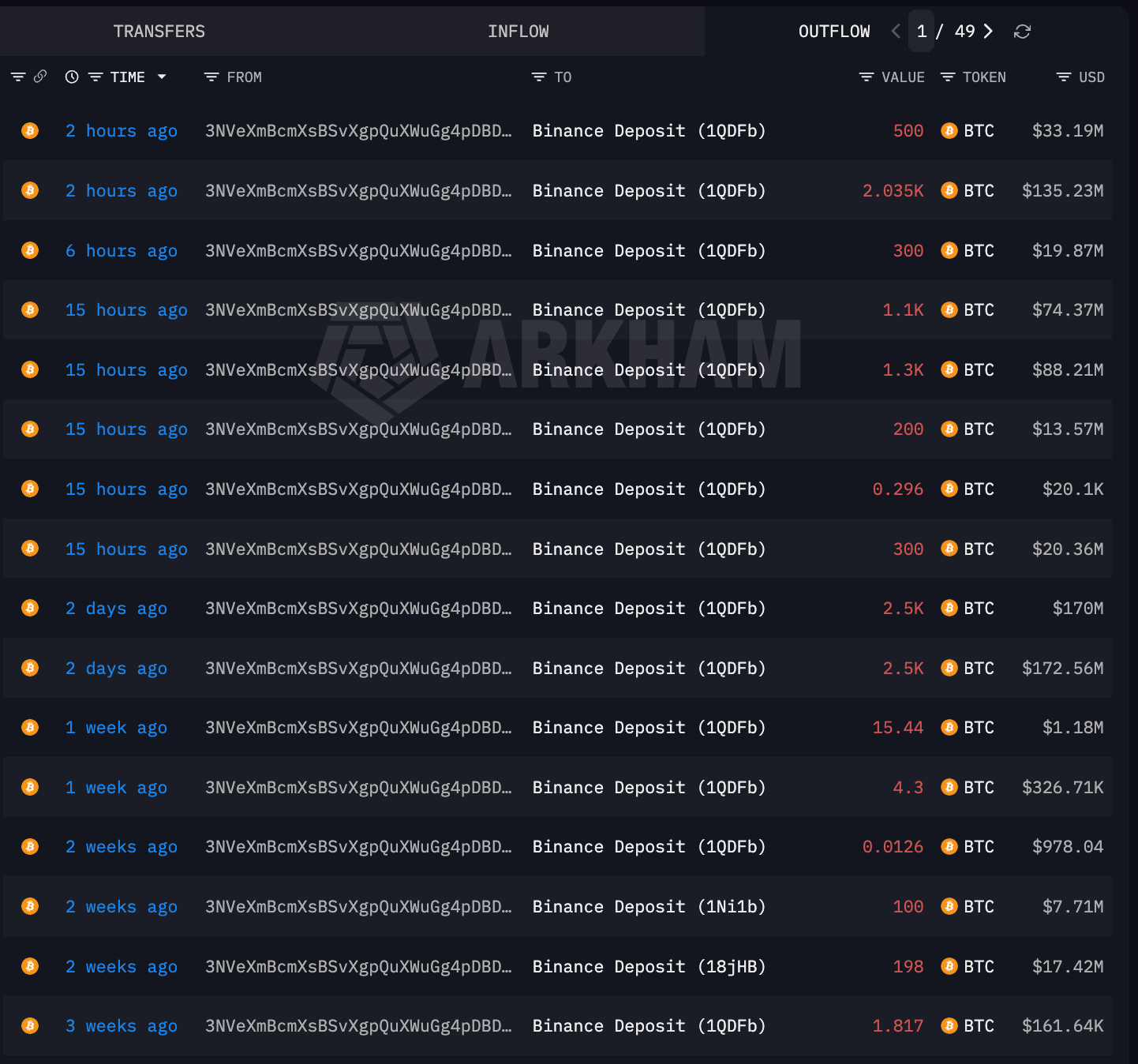

In a post on X (formerly Twitter), blockchain analytics firm Lookonchain reported that a whale’s (3NVeXm) deposits have coincided with Bitcoin’s price drops. Data from Arkham showed that the whale started depositing Bitcoin to Binance three weeks ago, starting out with modest amounts.

However, activity accelerated this week. On February 11, the whale transferred 5,000 BTC into the exchange. The string of transfers has continued with the wallet sending another 2,800 coins just today.

Lookonchain suggested that the timing of these deposits may have influenced short-term price action.

“Every time he deposits BTC, the price drops. Yesterday, I warned when he made a deposit — and soon after, BTC dropped over 3%,” the post read.

Sponsored

As of the latest available data, the address still holds 166.5 BTC, valued at over $11 million at current market prices. Large exchange inflows are often interpreted as a precursor to selling, as investors typically move assets to trading platforms to liquidate or hedge positions.

While correlation does not necessarily imply causation, the scale and timing of these transfers could have increased immediate sell-side pressure in an already fragile market structure. In periods of heightened sensitivity, even the perception of whale-driven selling can amplify downside moves as traders react to on-chain signals and adjust positions accordingly.

Capitulation Signals Point to Market Stress

The transfers come at a time of pronounced weakness across the Bitcoin market. An analyst noted that Bitcoin’s realized losses surged to $2.3 billion.

Sponsored

“This puts us in the top 3-5 loss events ever recorded. Only a handful of moments in Bitcoin’s history have seen this level of capitulation,” the analysis read.

The analyst added that short-term holders, defined as those holding coins for less than 155 days, appear to be driving much of the current capitulation. Investors who accumulated BTC at $80,000-$110,000 are now locking in significant losses, suggesting that overleveraged retail participants and weaker hands are exiting their positions.

In contrast, long-term holders do not appear to be the primary source of this latest wave of selling. Historically, this cohort tends to hold through drawdowns.

Sponsored

“In the past, extreme loss spikes like this triggered rebounds. We’re seeing it now: BTC bounced from $60K to $71K after the capitulation. But this could still be the beginning of a deep and slow bleed-out. Relief rallies happen even in prolonged bear markets,” the analyst stated.

Meanwhile, BeInCrypto previously highlighted several signals suggesting that BTC may still be in the early stages of a broader bear cycle, leaving room for further downside risk. CryptoQuant analysts have pointed to the $55,000 level as Bitcoin’s realized price, a level historically associated with bear market bottoms.

In previous cycles, BTC traded 24% to 30% below its realized price before stabilizing. Currently, Bitcoin remains above that level.

When BTC approaches its realized price zone, it has historically entered a period of sideways consolidation before staging a recovery. Some analysts argue that a deeper correction toward the sub-$40,000 range could mark a more definitive bottom formation.

Crypto World

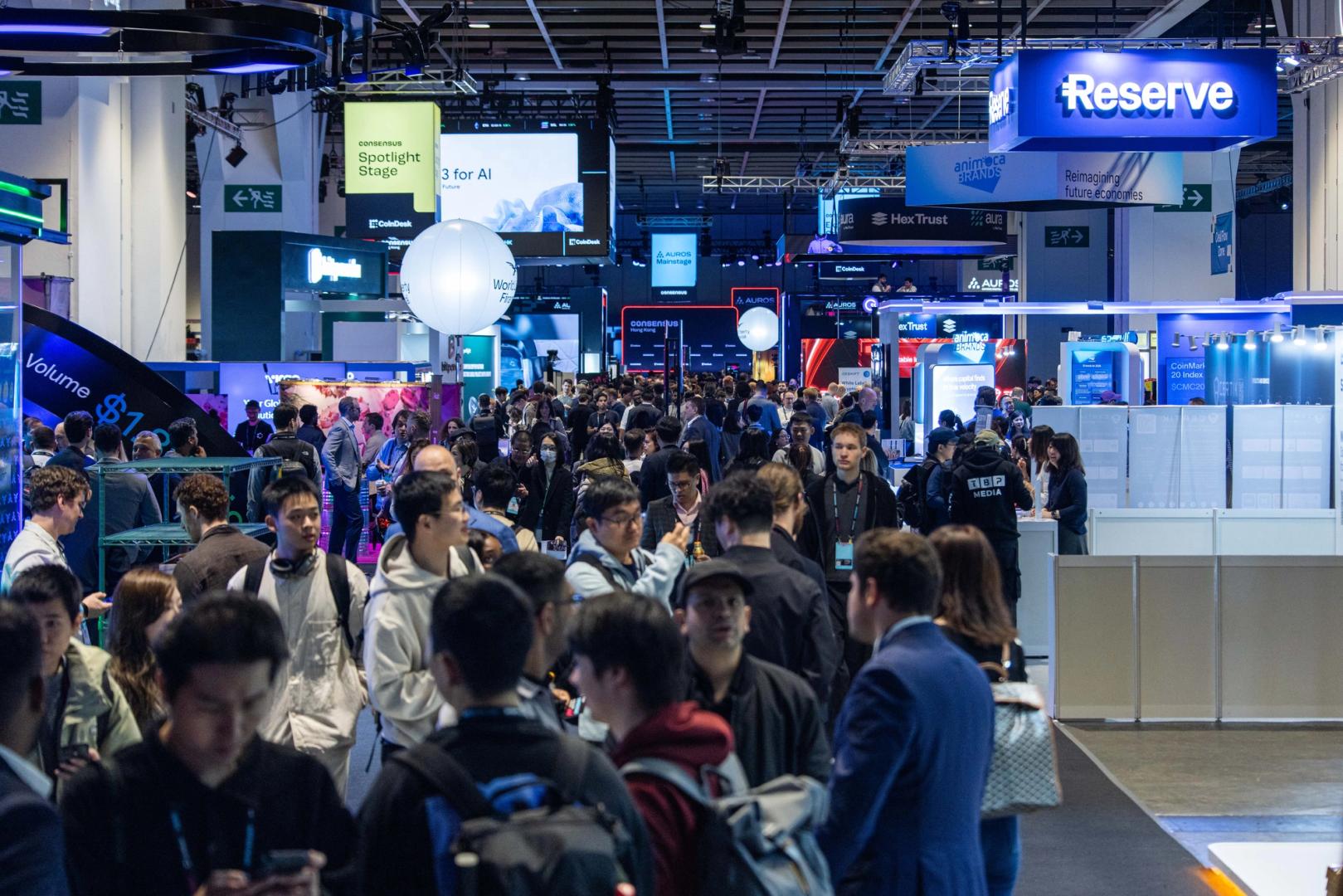

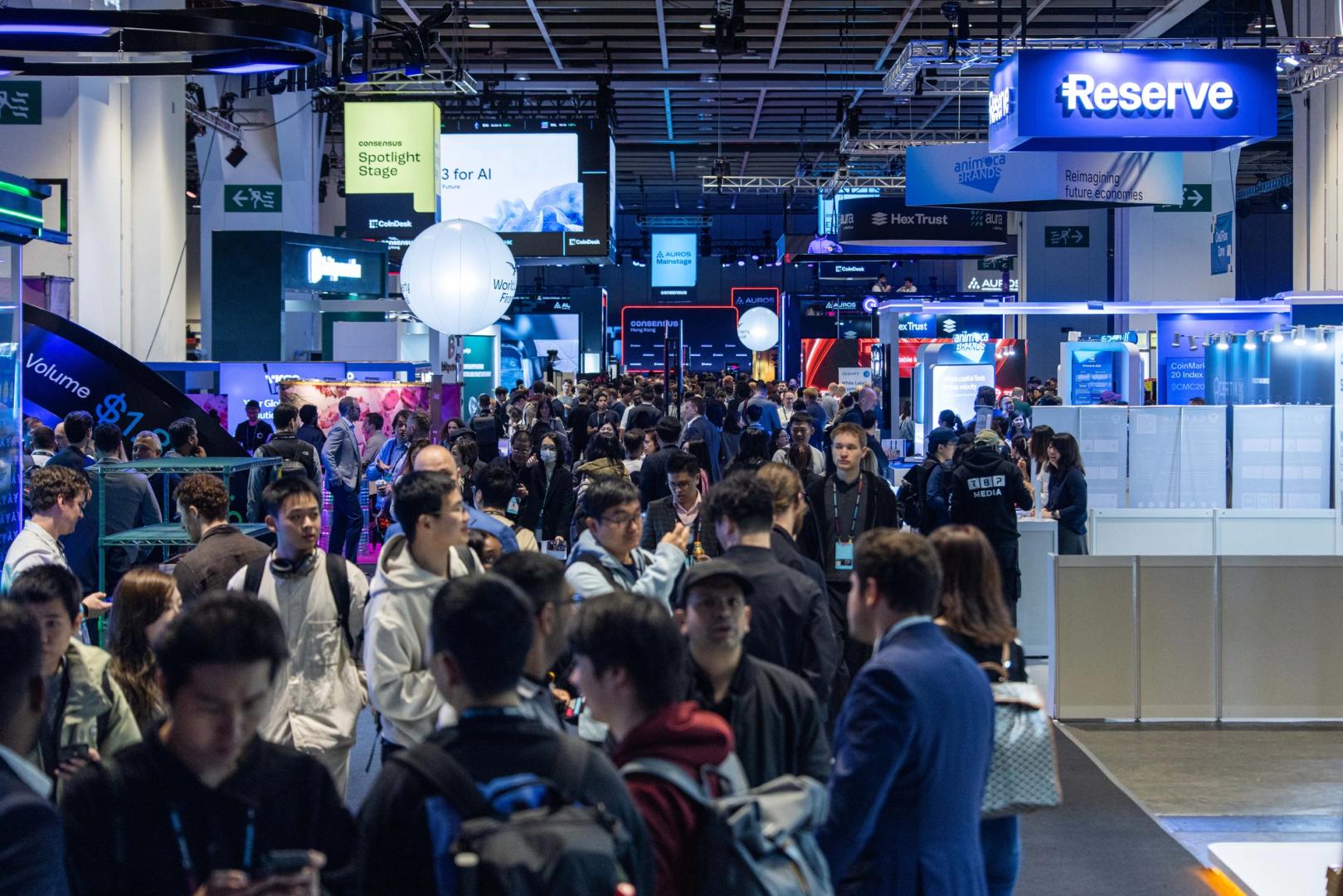

Recapping Consensus Hong Kong 2026

HONG KONG — Crypto finding a new niche as the payments tool of choice for machines, bitcoin not yet at rock bottom, U.S. regulatory changes and the role of prediction markets were some of the topics discussed at CoinDesk’s Consensus Hong Kong conference this week.

“As AI agents become capable of making and executing decisions independently, we may begin to see the early forms of what some call the machine economy, where AI agents can hold and transfer digital assets, pay for services and transact with one another onchain,” said Hong Kong Financial Secretary Paul Chan Mo-po.

These tools may be used to automatically book hotels and flights or make other purchases, Binance CEO Richard Teng said during a fireside chat on Thursday.

“If you think about the agentic AI, so the booking of hotels, flights, whatever purchases that you would make, how you think that those purchases will be made — it’ll be via crypto and stablecoins,” he said. “So, crypto is the currency for AI, if you think about it, and that’s how it’s going to pan out.”

Other participants discussed market volatility. Bitcoin has already fallen nearly $30,000 in a month, and some industry viewers fear it may drop further before hitting a bottom. Market participants are looking at $50,000 as one level to watch, several individuals told CoinDesk.

Similarly, the sentiment around betting markets is starting to turn negative. Traders said they were concerned the platforms might suck out liquidity from “productive sectors,” and in turn cause a “negative wealth effect.”

On the regulatory front, though Hong Kong’s policymakers’ announcements took center stage, industry participants told CoinDesk they were closely watching U.S. lawmakers and the negotiations around crypto market structure legislation.

One person said the U.S. market is large enough that it has outsize influence on other locales, and so some regulators are waiting to see how the U.S. lands before taking on policymaking in crypto.

Hong Kong does not appear to be one of these jurisdictions. The Securities and Futures Commission is moving ahead with various proposals to bring crypto companies further into the regulatory sphere.

Crypto World

CEO sentenced to 20 years for $200M Bitcoin Ponzi scheme

A U.S. federal court has sentenced the chief executive of a crypto trading and multi-level marketing firm to 20 years in prison for orchestrating a massive Bitcoin-based Ponzi scheme that defrauded tens of thousands of investors worldwide.

Summary

- Ramil Ventura Palafox, CEO of Praetorian Group International, was sentenced to 20 years in prison for running a $200 million Bitcoin Ponzi scheme.

- Prosecutors said the scheme defrauded more than 90,000 investors worldwide, promising daily returns of up to 3% through supposed crypto trading.

- The U.S. Department of Justice said investor funds were misused for personal expenses, with no legitimate trading activity backing the returns.

Bitcoin Ponzi scheme CEO sentenced to 20 years

Ramil Ventura Palafox, 61, former CEO and Chairman of Praetorian Group International (PGI), received the sentence Thursday after being convicted on multiple federal charges, including wire fraud and money laundering.

According to court documents, Palafox used PGI to lure more than 90,000 investors into a purported Bitcoin (BTC) trading program that promised daily returns of 0.5% to 3%.

Prosecutors said the program never engaged in genuine trading, instead, returns were paid with funds from new investors, a classic Bitcoin Ponzi scheme.

Victims from around the world collectively invested more than $200 million, with documented losses exceeding tens of millions for many individuals.

Government filings show Palafox made lavish personal purchases with investor money, which reportedly included luxury cars, high-end designer goods and real estate. Earlier reports in the case revealed that millions flowed into personal expenses rather than investment activity, exacerbating investors’ losses.

“He spent approximately $3 million on 20 luxury vehicles, including automobiles by Porsche, Lamborghini, McClaren, Ferrari, BMW, Bentley, and others. Palafox spent approximately $329,000 on penthouse suites at a luxury hotel chain and purchased four homes in Las Vegas and Los Angeles worth more than $6 million. Palafox spent another $3 million of investors’ money to buy clothing, watches, jewelry, and home furnishings at luxury retailers, including Louboutin, Neiman Marcus, Gucci, Versace, Ferragamo, Valentino, Cartier, Rolex, and Hermes, among others,” the DoJ statement said.

Palafox initially pleaded guilty in September 2025 to fraud and money laundering charges, acknowledging his role in the Bitcoin Ponzi scheme that operated between December 2019 and October 2021.

The FBI’s Washington Field Office and IRS Criminal Investigation Division assisted in the case, and some victims have already been granted restitution orders. Efforts continue to track down remaining assets to repay those defrauded.

Crypto World

Thailand SEC Approves Bitcoin and Crypto Assets for Regulated Futures and Options Trading

TLDR:

- Thailand SEC authorizes Bitcoin and digital assets as underlyings for futures and options trading

- New rules follow cabinet approval of amendments to the country’s long-standing Derivatives Act

- Trading will occur only through licensed operators on the Thailand Futures Exchange platform

- Spot crypto trading stays regulated, while payments using digital assets remain restricted

Thailand’s Securities and Exchange Commission has approved the use of Bitcoin and other digital assets in regulated derivatives markets.

Futures and options tied to crypto will trade on the Thailand Futures Exchange under licensed supervision. The move expands investor access while keeping activity inside formal rules. Spot trading remains limited to approved exchanges, and payment restrictions stay in place.

Crypto Assets Enter Thailand’s Derivatives Market

Under the revised Derivatives Act, digital assets may serve as underlying assets for futures, options, and related contracts. Bitcoin was listed among eligible instruments, alongside carbon credits and other approved assets. Trading will occur on the Thailand Futures Exchange.

The SEC stated that derivatives tied to crypto will follow the same oversight standards as traditional contracts. Operators must obtain licenses and meet reporting and compliance requirements. These controls aim to keep trading orderly and transparent.

Thailand has regulated crypto markets since 2018. Spot trading remains allowed only through licensed exchanges. At the same time, authorities continue to prohibit the use of cryptocurrencies as everyday payment tools.

SEC Secretary-General Pornanong Budsaratragoon said the update expands investment choices and supports risk diversification. Investors can now access digital asset exposure through familiar financial products rather than direct holdings.

Framework Expands While Supervision Continues

The development gained attention on social media after Vivek Sen posted on X that Thailand was easing crypto trading rules. His post drew market interest and reflected the broader response from the crypto community.

Regulators clarified that the new structure builds on existing laws, not a full policy shift. The focus remains on controlled growth within regulated venues. Derivatives allow participation while exchanges maintain custody and compliance standards.

The SEC also plans additional rules for operator licensing and supervision updates. Future steps may include crypto exchange-traded funds and tokenization initiatives. No timelines were provided for those measures.

Trading and settlement will follow established exchange procedures. Digital assets will function as approved underlyings rather than separate markets. Authorities said implementation will occur gradually to ensure stability.

Through these measures, Thailand expands access to crypto-based products while maintaining strict regulatory control.

Crypto World

This Bitcoin Indicator Just Flashed Red After 3 Years

The Bitcoin network’s structural growth has entered a contraction phase.

Bitcoin stabilized above $66,000 on Friday, though the asset has fallen about 30% over the past month. According to analysis by Alphractal, Bitcoin’s Realized Cap Impulse (Long-Term) has turned negative for the first time in three years.

When this signal turned negative in past cycles, the crypto asset entered extended downturns as long-term capital inflows weakened.

Bitcoin’s Capital Structure

Bitcoin’s long-term Realized Cap Impulse tracks changes in realized capitalization over extended periods and is used to assess whether new capital is entering the network or whether inflows are slowing or reversing.

A negative reading indicates that new capital inflows have weakened or stalled, demand is no longer absorbing supply at the same pace, and the network’s structural growth has moved into a contraction phase. Alphractal explained that in previous market cycles, every instance in which the Realized Cap Impulse (Long-Term) turned negative was followed by significant price corrections or prolonged bear markets.

The firm linked this pattern to Bitcoin’s supply-demand dynamics and said that when supply remains available while new capital inflows decline, downward pressure on price typically emerges. Unlike traditional market capitalization, realized capitalization values BTC at the price it last moved on-chain, which allows the metric to reflect actual capital committed to the network rather than price-driven fluctuations.

By filtering out short-term market noise, the indicator focuses on long-term capital behavior over months and years. With the signal now negative again after three years, Alphractal said the current cycle is potentially entering a phase of structural weakening in capital inflows.

Meanwhile, Alphractal founder Joao Wedson also said that “even with ETFs accumulating and large institutions like Strategy increasing their positions, it is still not enough to offset the period when supply exceeds demand.”

You may also like:

Global Uncertainty

The latest on-chain capital trends appear to be unfolding against a macro backdrop of unusually high uncertainty. As per CryptoQuant, the Global Uncertainty Index has reached an all-time high, after exceeding levels seen during the 9/11 attacks, the Iraq War, the 2008 financial crisis, the Eurozone debt crisis, as well as the Covid-19 pandemic.

CryptoQuant stated that the current reading demonstrates an environment where markets are struggling to find direction, capital is moving with greater caution, and risk is being priced more aggressively. The data also indicates that geopolitical, economic, and political pressures are all active at the same time. This environment has created conditions in which high volatility may become a feature rather than a temporary disruption.

Periods of extreme uncertainty have coincided with significant changes in market positioning, as participants reassess exposure amid unstable conditions. While uncertainty often triggers defensive behavior, the firm added that such phases have also seen periods of large-scale repositioning.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Aave Labs Proposes “Aave Will Win” Framework to Route All Revenue to DAO Treasury

TLDR:

- Aave Labs plans to send 100% product revenue directly to the DAO treasury

- Proposal seeks $25M stablecoins and 75K AAVE tokens for V4 development

- V4 will add fixed-rate lending and real-world asset support

- Community reaction shows strong support for better token value alignment

Aave Labs introduced the “Aave Will Win” framework to align product revenues with DAO value. Under the proposal, all revenue from Aave-branded products will flow to the DAO treasury.

In return, Aave Labs seeks funding to develop V4 with new features like fixed-rate lending and real-world assets. The move aims to strengthen the $AAVE token utility and long-term ecosystem growth.

Aave Introduces Token-Centric Revenue Framework

Aave shared the proposal through its official X account, presenting the “Aave Will Win” framework. The model directs 100% of gross revenue from Aave-branded tools to the DAO treasury. These tools include aave.com swaps, the mobile app, and Aave Card.

The proposal builds on existing protocol fees from Aave V3, which generate around $100 million per year. Product revenue is expected to add about $10 million annually. The plan follows earlier community debates about revenue sharing and intellectual property ownership.

Aave founder Stani Kulechov described the framework as a step toward routing all value to the AAVE token. Early community responses on X showed support for stronger alignment between products and token value.

The proposal requests $25 million in stablecoins and 75,000 AAVE tokens for Aave Labs. It also seeks growth grants to expand the ecosystem and develop new features.

Funding Request and Aave V4 Development Plans

The funding request focuses on building Aave V4, which aims to add fixed-rate lending and real-world asset support. The proposal outlines plans for broader product expansion while maintaining DAO ownership of revenue streams.

Aave Labs stated that the framework would allow the DAO to capture value from all Aave-branded products. The team would continue to build tools while contributing revenue directly to the treasury.

Community members had raised concerns in December 2025 about how product revenue should be shared. The new model addresses those concerns by aligning product monetization with DAO governance.

The proposal is now subject to community review and governance processes. Further steps depend on DAO voting and final agreement on funding terms and product development milestones.

Crypto World

ETHZilla Unveils Jet Engine Leases-Backed Token in Tokenization Pivot

ETHZilla, a crypto treasury firm that began life as a biotech venture, is pressing further into tokenized real-world assets. In January it pivoted to build a portfolio around on-chain representations of non-digital assets, and this week it unveiled Eurus Aero Token I, a tradable stake secured by two jet engines leased to a major U.S. airline. The tokenization initiative is being launched under ETHZilla Aerospace, the company’s new subsidiary. Each token is priced at $100 with a minimum purchase of 10 tokens, and the issuer targets an 11% return over the life of the leases, which extend into 2028. Ether (CRYPTO: ETH) has been a central part of its treasury strategy in recent years.

Key takeaways

- ETHZilla launches Eurus Aero Token I via ETHZilla Aerospace, with the asset backing provided by two commercial jet engines leased to a leading U.S. carrier.

- The offering sets a $100 price per token and requires a minimum purchase of 10 tokens, aiming for an 11% return through the end of the current engine leases in 2028.

- The move marks a formal shift from a pure crypto treasury model toward tokenizing real-world assets that generate contractual cash flows.

- ETHZilla acquired the two jet engines for a combined $12.2 million in January, following the sale of part of its Ether treasury the prior year.

- Executives say the program broadens access to fractional ownership and demonstrates how blockchain can convert traditional asset classes into on-chain, tradable securities.

Tickers mentioned: $ETH

Market context: On-chain tokenization of real-world assets (RWAs) has been gaining traction as crypto firms seek yield opportunities beyond token prices and volatility. The ETHZilla initiative arrives as RWAs continue to attract institutional interest and as the broader market observes how regulated, cash-flow–backed tokens perform relative to traditional securities and crypto-native instruments.

Why it matters

The ETHZilla pivot illustrates a broader industry trend: crypto treasury firms expanding beyond pure digital assets toward structured products that deliver visible, contractually backed revenue. By tying ownership of physical engines to a blockchain-based token, ETHZilla is testing whether on-chain instruments can offer predictable cash flows while preserving liquidity and transparency for investors. For a subset of crypto enthusiasts and accredited investors, this approach promises a familiar risk/return profile—income from lease payments—wrapped in a tokenized wrapper that can be traded or held alongside other digital assets.

Observers note that tokenized aviation assets combine visible, contractual cash flows with the efficiency and programmability of blockchain. The two jet engines underpin a stream of lease income that, in theory, may appeal to investors seeking exposure to high-value industrial assets without owning the aircraft outright. ETHZilla chairman and CEO McAndrew Rudisill framed the offering as a way to “expand investment access and modernize fractional asset ownership in markets that have historically been available only to institutional credit and private equity.” In his view, the use of a token backed by engines leased to a major airline serves as a compelling proof point for applying blockchain infrastructure to asset classes with global demand and predictable revenue streams.

The enterprise has a history that underscores its strategy: ETHZilla began life as a biotech venture before pivoting to Ether accumulation and tokenized assets. The company disclosed a substantial Ether stake in a Securities and Exchange Commission filing, reporting hundreds of millions of dollars in value at the time, and then redirected capital toward physical assets and on-chain structures. This history highlights both the volatility of crypto treasuries and the growing experimentation across the sector to convert traditional assets into liquid, traceable, on-chain instruments.

At the same time, the broader market environment remains a mixed backdrop for RWAs. Industry observers point to a rising footprint of tokenized assets on blockchain networks, alongside ongoing regulatory scrutiny and evolving frameworks that could shape who can issue such tokens and under what conditions. The RWA market, including tokenized debt, receivables, and asset-backed securities, has seen a surge of interest as institutions seek yield opportunities outside equity and crypto price movements. Data aggregators show that hundreds of thousands of holders participate in on-chain RWAs, with billions of dollars reportedly on-chain, underscoring the potential reach of asset-backed tokens beyond traditional finance.

ETHZilla’s execution also highlights the practical dynamics of tokenized asset bring-to-market: the engines were acquired for $12.2 million in January as part of the company’s broader shift away from a pure ETH-hold approach toward asset-backed, on-chain offerings. The venture has signaled that future token offerings could include other asset classes, such as home and car loans, suggesting a pipeline that blends tangible collateral with transparent, blockchain-native distribution mechanisms. Industry commentary has suggested that tokenized RWAs could gain momentum in 2026 as emerging markets adopt formalized structures for capital formation and foreign investment, though execution risks—valuation sensitivity, lease covenants, custody, and regulatory constraints—remain salient considerations for investors.

As the project unfolds, ETHZilla’s own treasury position provides context for the risk/reward calculus of tokenized assets. The company’s strategic reserve data and public disclosures show a balancing act between on-chain liquidity and the need to preserve exposure to Ether as a potential long-term stabilizer or growth asset. The tension between holding Ether and deploying capital into tokenized assets reflects a broader question in crypto governance: how to optimize treasury strategy when tokenized opportunities promise both diversification and yield, but hinge on real-world performance and contractual enforcement.

What to watch next

- Progress reports on Eurus Aero Token I performance, including lease cash flows and any collateralization updates.

- Additional asset classes targeted for tokenization by ETHZilla, particularly home and car loans, and the regulatory steps required for those offerings.

- Updates on ETHZilla Aerospace’s corporate structure, future engine acquisitions, and potential partnerships with other airlines or service providers.

- Regulatory developments affecting tokenized RWAs, including disclosures, custody standards, and compliance requirements for on-chain asset-backed instruments.

Sources & verification

- ETHZilla announces first-ever tradable tokenized aviation assets on Ethereum network secured by jet engines on lease with a leading US air carrier — PR Newswire (link in original text).

- ETHZilla disclosed its Ether holdings in an SEC filing, including the size and average acquisition price of its ETH stash.

- ETHZilla’s jet engine acquisition: two engines purchased for a combined $12.2 million in January, per the article corpus.

- Tokenization push and broader RWAs context: RWA.xyz data indicating billions on-chain and hundreds of thousands of holders.

- Related coverage and background on ETHZilla’s pivot and industry expectations for 2026–2028, including on-chain RWA trends and associated market commentary.

Market reaction and key details

The Eurus Aero Token I offering marks a notable step in the gradual convergence of aviation assets and blockchain technology. By attaching a direct business asset—two jet engines—to a tradable on-chain instrument, ETHZilla is testing whether the promise of liquidity, fractional ownership, and transparent revenue streams can coexist with the complexities of lease contracts, depreciation, maintenance reserves, and counterparties. If the structure proves resilient, it could pave the way for a broader ecosystem of asset-backed tokens tied to physical capital across sectors with robust cash flows and global demand.

Key figures and next steps

ETHZilla’s strategy hinges on converting contractual cash flows into liquid, on-chain instruments that investors can access with relative ease. The initial offering, priced at $100 per token and requiring a minimum purchase of 10 tokens, presents an explicit yield target of 11% over the lease horizon through 2028. The engines’ lease arrangement, the counterparty credit quality, and the ongoing maintenance and insurance terms will be critical inputs to the project’s actual performance and the token’s market acceptance. As the industry watches, ETHZilla’s next moves—whether it expands into additional asset classes or scales the aviation example—will be a bellwether for the broader viability of tokenized RWAs in a diversified crypto treasury framework.

What to verify

Readers can corroborate details in ETHZilla’s official disclosures and the referenced press materials, including the terms of the Eurus Aero Token I offering, the January engine purchase, and the SEC filing documenting the company’s Ether holdings. Market data from RWA.xyz and CoinGecko provides a snapshot of on-chain asset trends and the scale of the RWAs ecosystem. Additionally, primary sources such as the PR Newswire release and ETHZilla’s public statements offer direct insights into strategy and execution milestones.

Crypto World

ETH, XRP, ADA, BNB, and HYPE

This Friday, we examine Ethereum, Ripple, Cardano, Binance Coin, and Hyperliquid in greater detail.

Ethereum (ETH)

Ethereum closed the week up 2%, but the trend remains bearish, with $1,800 acting as a key support level for this downtrend.

If buyers hope for a reversal in the future, then ETH needs to bounce and hold above that level. Any weakness there would basically erase all the progress made since early 2025.

Looking ahead, this cryptocurrency has strong resistance around $2,400, and that price point will be decisive if tested later. A rejection there could lead to lower lows, while a breakout can sustain a rally towards $3,000.

Ripple (XRP)

XRP bounced after a sharp drop and closed this week with a 6% gain. However, this bounce will likely be short-lived, as the downtrend remains intact and new lows are likely.

The most important support levels are found at $1.4, which is currently being contested, and $1, where XRP may eventually fall if the overall market remains bearish in the coming months.

Looking ahead, this correction has accelerated in 2026, with the price accelerating as it declines. This is quite bearish, but it may also help identify a bottom more quickly. Hopefully, buyers will stop the downtrend around $1.

Cardano (ADA)

ADA has been struggling in the past 30 days and has booked a 38% loss. Nevertheless, it closed this week in the green with a modest 4% gain. The price also bounced on the 24-cent support.

Ideally, Cardano will begin forming a bottom around these price levels, as it has in the past. The alternative would be new lows not seen since 2020. Reclaiming a price above 30 cents is critical if bulls want to regain control.

Looking ahead, the outlook is grim for this cryptocurrency, especially if Bitcoin and Ethereum continue to underperform. That will likely pull it even lower. A price under 20 cents would make this one of the worst bear markets for ADA.

Binance Coin (BNB)

Unsurprisingly, BNB finally touched the support at $580. This level has long been a key target for sellers, and it has now been reached. The question is whether it will hold.

Ideally, the market should bounce after months of bearish price action. This also applies to Binance Coin, which has been in a downtrend since October 2025. If $580 fails to hold, conditions become more challenging, as the next key support levels are at $500 and $380.

Looking ahead, this cryptocurrency has lost nearly 60% of its valuation since its all-time high of approximately $1,375. If the past is to serve as a guide, this bear market may take BNB to -70% before a bottom is found.

Hype (HYPE)

HYPE closed the week in red with a 11% loss. That’s because buyers were unable to break above $36 and turn it into a key support level. For this reason, the current price action could be interpreted as a lower high. That is bearish.

Nevertheless, at the time of this post, buyers appear to be defending the support at $30 quite well. As long as this holds, buyers have another shot at making new highs.

Looking ahead, the rally that started at $20 appears to have reached its peak this week when buyers were unable to book new highs. For this reason, a bearish reversal is likely if $30 is lost again.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Crypto-linked human trafficking payments surged 85% in 2025, Chainalysis report finds

Cryptocurrency use for transactions involving human trafficking surged 85% in 2025.

Summary

- Cryptocurrency use in human trafficking transactions surged in 2025 through cryptocurrencies like Bitcoin, XMR and stablecoins.

- Telegram-based escort networks and CSAM vendors accounted for a large share of tracked crypto flows.

- Payments were primarily routed through stablecoins, laundering networks, and escrow platforms based in Southeast Asia.

According to a Feb. 13 Chainalysis report, which tracked cryptocurrency-facilitated human trafficking payments tied to escort services, labor recruiters connected to Southeast Asian scam compounds, and child sexual abuse material, among other categories, the networks comprised cryptocurrency transactions valued at “hundreds of millions of dollars across identified services.”

Chainalysis said that the various payment methods involved ranged from Bitcoin and alternative Layer 1 tokens to stablecoins. Meanwhile, platforms involved with facilitating these transactions included Chinese-language money laundering networks and various Telegram-based services that operated guarantee and escrow mechanisms to coordinate and confirm payments.

Large transactions were primarily centered around Telegram-based international escort networks, with 48.8% of each transaction exceeding $10,000. These platforms were mostly reliant on stablecoin payments, per the report.

Transactions in connection with CSAM were smaller in size, with an average value under $100. However, one platform tracked by Chainalysis had reportedly used over 5,800 cryptocurrency addresses and accumulated over $530,000 since July 2022. These platforms, which previously operated primarily using Bitcoin (BTC), were found to be using privacy-focused Monero (XMR) to launder the proceeds.

“Instant exchangers, which provide rapid and anonymous cryptocurrency swapping without KYC requirements, play a crucial role in this process,” Chainalysis said.

Meanwhile, Scam compounds use a combination of Telegram-based recruitment channels, guarantee platforms like Tudou and Xinbi, and stablecoin payment rails to coordinate and process payments.

As previously reported by crypto.news, these organizations lure in victims through fake job offers before forcing them to operate various crypto-linked scams under inhumane conditions.

Chainalysis was able to trace the flow of funds from several different countries like the United States, United Kingdom, Brazil, Spain, and Australia, to Chinese-language services that processed large-scale stablecoin transactions and facilitated laundering through Southeast Asian trafficking networks.

“While traditional trafficking routes and patterns persist, these Southeast Asian services exemplify how cryptocurrency technology enables trafficking operations to facilitate payments and obscure money flows across borders more efficiently than ever before,” Chanalysis said.

Cryptocurrency technology has long been criticized for supporting criminal activity by helping bad actors circumvent traditional financial controls and oversight. Recently, there has been renewed scrutiny over its role in ransom demands and alleged links to early crypto investments associated with Jeffrey Epstein.

However, Chainalysis notes that the underlying blockchain technology can be leveraged to detect and disrupt trafficking operations, as it offers visibility that is not possible with cash transactions.

It urged compliance teams and law enforcement to adopt proactive monitoring strategies and track key risk indicators.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 day ago

Sports1 day agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Sports7 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat7 days ago

NewsBeat7 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World1 day ago

Crypto World1 day agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video1 day ago

Video1 day agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month