Crypto World

Could BTC slip to $60K?

The Bitcoin price is struggling amid persistent selling pressure in the crypto market. Key support and resistance levels are under scrutiny as traders weigh the next move.

This Bitcoin price prediction assesses the market’s current structure, potential upward moves, and downside risks.

Summary

- The Bitcoin price is under pressure, trading near $69,055 and range-bound between $68,000 and $70,000, reflecting market consolidation.

- BTC faces mixed sentiment, with retail traders bearish while large holders continue accumulating, making this period notable for a price prediction.

- Upside potential requires a decisive break above $74,500 to confirm bullish momentum and ease short-term market pressure.

- Downside risks include support at $66,000 and $60,000, which could trigger short-term selling but may also present strategic buying opportunities for long-term investors.

Current market scenario

As of February 9, Bitcoin (BTC) is trading near $68,388.46, down about 2.73% over the past 24 hours. Price remains range-bound between $68,000 and $70,000, signaling consolidation after the volatility earlier this year. Strong buying near $60,000 has highlighted the market’s resilience despite the recent pullback.

The current correction followed a rejection near $97,900 in January, marking a local high and cooling short-term momentum. While traders have become more cautious, the broader bullish structure on higher timeframes remains intact.

Sentiment is mixed. Retail traders are largely bearish, while large holders continue to accumulate according to on-chain data. Historically, extreme negative sentiment has often been a contrarian signal, making this period especially relevant for a BTC price prediction.

Upside potential

Bitcoin must break above $74,500 to signal that the bulls are in charge. Achieving this would improve the short-term setup and reduce market pressure.

Until that happens, rallies are likely to be met with selling, keeping the price range-bound for now.

Downside risks

If Bitcoin doesn’t maintain above $69,000, lower support levels are in focus. $66,000 comes first, with $60,000 as the next major line if selling intensifies.

While falling below these levels could trigger short-term panic selling, long-term investors have historically treated these dips as strategic buying opportunities near important price points.

Bitcoin price prediction based on current levels

To wrap it up, this Bitcoin price prediction is about waiting for confirmation rather than guessing the next move. Bitcoin is still consolidating in a key range, which means there’s room for both upside and further downside. Short-term technicals are fragile, but whale accumulation and extreme bearish sentiment suggest selling pressure may be easing.

Crypto World

Bitcoin’s Latest Drop May Be Proof the 4-Year Cycle Still Holds

Bitcoin’s (BTC) latest price correction is reinforcing, rather than undermining, the long-standing 4-year halving cycle that has historically shaped the asset’s market behavior, according to a new report from Kaiko Research.

The debate carries significant implications for traders and investors navigating Bitcoin’s volatility in early 2026.

Sponsored

Sponsored

Bitcoin Is Following Its 4-Year Cycle Amid Sharp Correction

Bitcoin fell from its cycle peak near $126,000 to the $60,000–$70,000 range in early February. This marked a drawdown of roughly 52%.

While the move rattled market sentiment, Kaiko argues the decline is fully consistent with previous post-halving bear markets and does not signal a structural break from historical patterns.

“Bitcoin’s decline from $126,000 to $60,000 confirms rather than contradicts the four-year halving cycle, which has consistently delivered 50-80% drawdowns following cycle peaks,” Kaiko’s data debrief read.

The report notes that the 2024 halving took place in April. Bitcoin topped out roughly 12–18 months later, aligning closely with prior cycles. In past instances, such peaks have typically been followed by extended bear markets lasting around a year before the next accumulation phase begins.

Kaiko says the current price action suggests Bitcoin has transitioned out of the euphoric post-halving phase and into that expected corrective period.

It is worth noting that many experts have previously challenged Bitcoin’s 4-year cycle. They argue that it no longer holds in today’s market. In October, Arthur Hayes said the 4-year Bitcoin cycle was over. He pointed instead to global liquidity as the dominant driver of price movements.

Sponsored

Sponsored

Others have argued that Bitcoin now follows a 5-year cycle rather than a 4-year one. They cite the growing influence of global liquidity conditions, institutional participation, and broader macroeconomic policy shifts.

Kaiko acknowledged that structural changes, including spot Bitcoin exchange-traded fund (ETF) adoption, greater regulatory clarity, and a more mature DeFi ecosystem, have distinguished 2024-2025 from previous cycles. Nonetheless, it said these developments have not prevented the expected post-peak retracement.

Instead, they have changed how volatility manifests. Spot Bitcoin ETFs recorded more than $2.1 billion in outflows during the recent sell-off.

This amplified downside pressure and demonstrated that institutional access increases liquidity in both directions, not just on the way up. According to Kaiko,

“While DeFi infrastructure has shown relative resilience compared to 2022, TVL declines and slowing staking flows indicate no sector is immune to bear market dynamics. Regulatory clarity has proven insufficient to decouple crypto from broader macro risk factors, with Fed uncertainty and risk-asset weakness dominating market direction.”

Kaiko also raised the key question now dominating market discussions: where is the bottom? The report explained that Bitcoin’s intraday rebound from $60,000 to $70,000 suggests initial support may be forming.

However, historical precedent shows that bear markets typically take six to 12 months and involve multiple failed rallies before a sustainable bottom is established.

Kaiko noted that stablecoin dominance stands at 10.3%, while funding rates have fallen close to zero and futures open interest has dropped by about 55%, signaling significant deleveraging across the market. Still, the firm cautioned that it remains unclear whether current conditions represent early, mid, or late-stage capitulation.

“The four-year cycle framework predicts we should be at the 30% mark. Bitcoin is doing exactly what it has done in every previous cycle, but it seems many market participants convinced themselves this time would be different,” Kaiko wrote.

As February 2026 progresses, market participants must weigh both sides of this argument. Bitcoin’s next moves will reveal whether history continues to repeat or a new market regime is taking shape.

Crypto World

Vitalik Buterin Unveils Four-Pillar Framework for Ethereum AI Integration

TLDR:

- Buterin proposes local LLM tooling and zero-knowledge payments to enable private AI interactions on-chain.

- Ethereum could serve as economic infrastructure for autonomous AI agents to coordinate and transact.

- AI models can revitalize prediction markets and quadratic voting by overcoming human attention limits.

- The framework enables cypherpunk vision where local AI verifies transactions without third-party trust.

Ethereum co-founder Vitalik Buterin has presented an updated perspective on integrating blockchain technology with artificial intelligence. The framework moves beyond abstract concepts toward practical implementations in the near term. Buterin’s approach centers on preserving human freedom while building decentralized systems that leverage AI capabilities. His vision encompasses four distinct areas where Ethereum can facilitate meaningful AI interactions without compromising security or privacy.

Privacy-Focused Infrastructure for AI Interactions

Buterin criticizes undifferentiated approaches to AI development, comparing vague directives to “work on AGI” with describing Ethereum as “working in finance” or “working on computing.” He argues such framing lacks the specificity needed for meaningful progress. Instead, his framework emphasizes choosing positive directions rather than embracing acceleration without purpose. The technical vision prioritizes human empowerment and avoiding scenarios where humans lose agency.

The proposal includes developing local large language model tooling that allows users to maintain control over their data. Zero-knowledge payment systems for API calls would prevent identity linking across different transactions. This approach addresses growing concerns about data privacy in AI applications. Additionally, ongoing cryptographic research aims to enhance AI privacy protections.

Client-side verification methods such as cryptographic proofs and trusted execution environment attestations form another component. These mechanisms mirror previous work on Ethereum privacy improvements but apply specifically to LLM interactions. The goal is creating infrastructure comparable to existing non-LLM compute privacy solutions. Buterin referenced his earlier work on Ethereum privacy roadmaps from 2024.

That foundation now extends to protecting AI-related computational processes. The technical approach maintains consistency with established blockchain privacy principles while adapting to AI-specific requirements. This continuity ensures compatibility with existing Ethereum infrastructure. The emphasis on local processing and cryptographic verification reflects broader cypherpunk values.

Economic Coordination and Enhanced Governance Systems

Ethereum can function as an economic layer facilitating AI-to-AI interactions, according to Buterin’s framework. This includes API payments, autonomous agents hiring other agents, and security deposit mechanisms. The economic infrastructure enables decentralized AI architectures rather than centralized organizational control. Smart contracts could eventually handle complex dispute resolution between AI entities.

The proposal mentions ERC-8004 and AI reputation systems as potential standards. These tools would create accountability frameworks for autonomous agents operating on-chain. Economic coordination becomes essential for scaling decentralized authority across AI systems. Without such mechanisms, AI collaboration would remain confined within single organizations.

Buterin’s vision includes revitalizing market and governance concepts previously limited by human constraints. Prediction markets, quadratic voting, combinatorial auctions, and decentralized governance structures gain new viability. Large language models can overcome the attention and decision-making bottlenecks that hampered these systems. AI assistance effectively scales human judgment across complex coordination problems.

The framework also addresses what Buterin describes as the cypherpunk “mountain man” vision of “don’t trust; verify everything.” Local AI models could propose and verify blockchain transactions without third-party interfaces. Smart contract auditing and formal verification interpretation become accessible through AI assistance. This enables the verify-everything approach that was previously impractical for individual users.

Crypto World

Vitalik Buterin Slams ‘Fake’ DeFi, Backs ETH-Based Algo Stablecoins

Buterin criticized modern DeFi as centralized in disguise, arguing USDC yield farming misses core principles.

Ethereum co-founder Vitalik Buterin has questioned the legitimacy of popular USDC yield strategies, arguing they don’t follow the principles of true decentralized finance (DeFi).

His critique was in response to crypto analyst C-node, who said that most modern DeFi focuses on speculative gains instead of building genuinely decentralized infrastructure.

Critique of Modern DeFi

C-node challenged the crypto industry on social media, saying there is little reason to use DeFi unless users hold long cryptocurrency positions and need financial services while keeping self-custody.

Buterin supported this perspective, arguing that depositing stablecoins such as USDC into lending protocols like Aave does not count as true DeFi. He dismissed such strategies, stating, “inb4 ‘muh USDC yield,’ that’s not DeFi.”

In his view, the underlying asset remains controlled by Circle, meaning the arrangement is fundamentally centralized even if the protocol itself is decentralized.

The Ethereum developer suggested two frameworks for evaluating what should qualify as real DeFi. The first, which he described as the “easy mode,” centers on ETH-backed algorithmic stablecoins. In this model, users can shift counterparty risk to market makers through collateralized debt positions (CDPs), where assets are locked to mint stablecoins.

He explained that even if 99% of the liquidity is backed by CDP holders who hold negative algorithmic dollars while holding positive ones elsewhere, the ability to offload counterparty risk to a market maker remains an important feature.

You may also like:

The second, or “hard mode,” framework allows for real-world asset (RWA) backing, but only under strict conditions. Buterin said an algorithmic stablecoin backed by RWAs could still qualify as DeFi if it is sufficiently overcollateralized and diversified to survive the failure of any single backing asset.

Under this structure, the overcollateralization ratio must be more than the maximum share of any individual asset, ensuring the system remains solvent even if one part collapses. This means that it would act as a buffer that distributes risk instead of concentrating it within centralized entities.

“I feel like that sort of thing is what we should be aiming more towards,” Buterin said, adding that the long-term goal should be moving away from the dollar as the unit of account toward a more diversified index.

Crypto Community Response

The remarks were widely supported within the X crypto community, with one user calling it a “great take” and noting that ETH-backed algorithmic stablecoins offer real risk reduction, while RWA diversification spreads it instead of eliminating it. Another commented that “True DeFi needs real risk innovation, not just USDC parking.”

However, there were also some concerns. For instance, X user Kyle DH pointed out that algorithmic stablecoins have not updated their designs to address known issues, which makes them similar to money market funds that have the same “breaking the buck” risks seen before with TerraUSD and LUNA. They added that RWA backing requires careful diversification, warning that highly correlated assets or black swan events could still cause a stablecoin to fail.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

How Hyperliquid Is Challenging Crypto Exchange Hierarchy

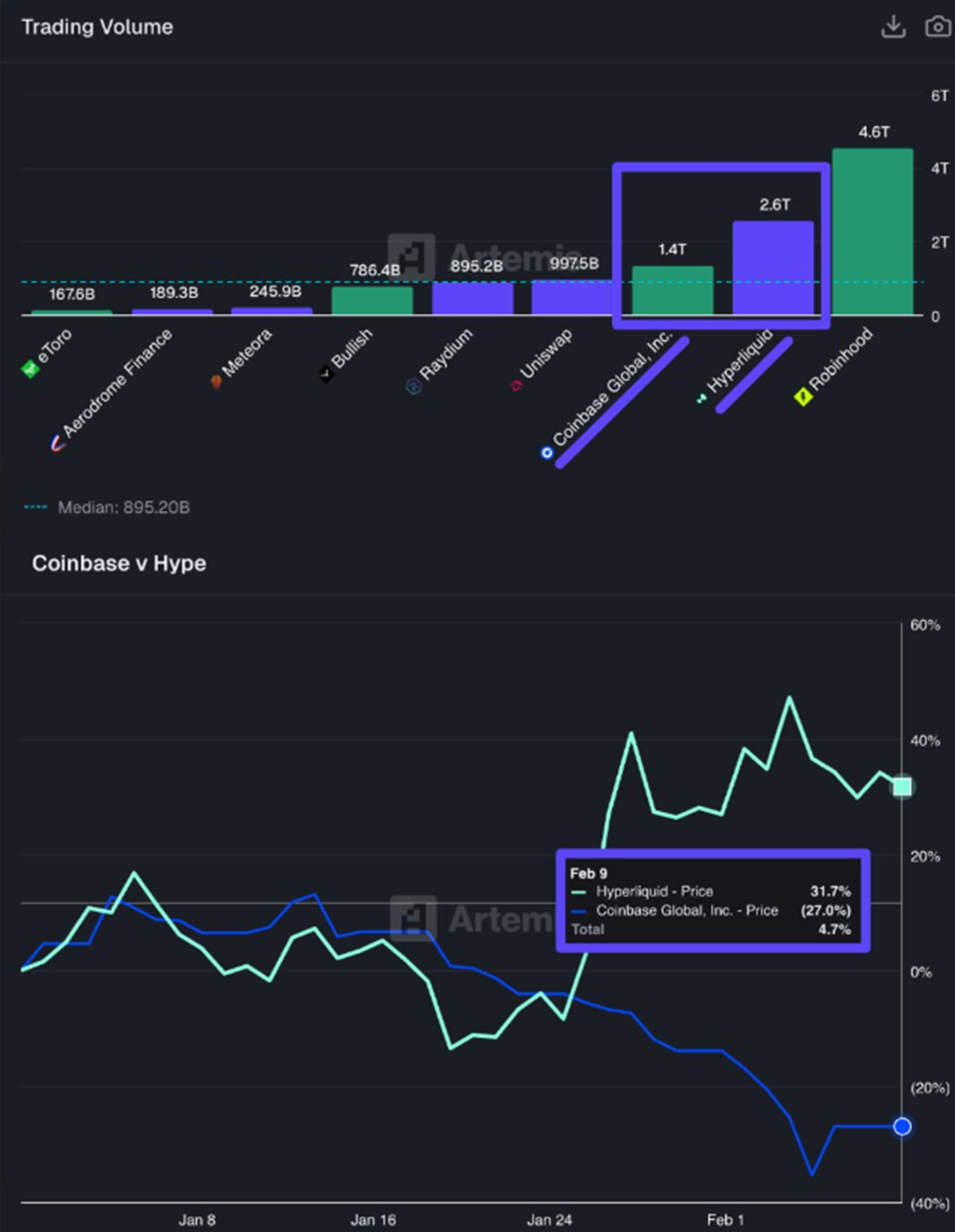

New data from Artemis shows that Hyperliquid, an on-chain derivatives platform, has overtaken Coinbase in notional trading volume. Notably, Coinbase is revered as the largest US-based exchange by trading volume.

Hyperliquid’s ascent is forcing the crypto industry to reassess long-held assumptions about where serious trading activity takes place.

Hyperliquid Surpasses Coinbase in Trading Volume

According to Artemis, Hyperliquid recorded roughly $2.6 trillion in notional trading volume, compared with $1.4 trillion for Coinbase, meaning nearly double the activity.

Sponsored

Sponsored

The figures mark one of the clearest signals yet that high-performance on-chain platforms are capturing a growing share of global derivatives flows.

This milestone fuels debate over whether decentralized trading venues are beginning to rival centralized exchanges in scale and influence.

“Hyperliquid is quietly outgrowing Coinbase. Trading Volume (Notional): Coinbase: $1.4T Hyperliquid: $2.6T That’s nearly 2x Coinbase’s volume… from an on-chain exchange. And the market is noticing,” Artemis stated.

The gap is not limited to trading volumes. Year-to-date performance data shows a striking divergence between the two companies.

Hyperliquid is up 31.7%, while Coinbase is down 27.0%, creating a 58.7% performance gap in just a matter of weeks.

For analysts, this divergence reflects deeper structural shifts rather than short-term volatility. Anthony, a data analyst at Artemis, emphasized that underlying metrics are increasingly driving market sentiment.

The comment highlights a growing belief among market observers that liquidity, execution quality, and user activity are beginning to shape valuations and investor narratives. This is as opposed to brand recognition alone.

Sponsored

Sponsored

One question raised by the data is why Binance, the world’s largest crypto derivatives exchange, was not included in the comparison.

The reason lies in what the figures are measuring and the narrative surrounding them. The Artemis analysis focused on Hyperliquid overtaking Coinbase, a major centralized exchange whose business is heavily weighted toward spot trading and regulated markets.

The milestone, therefore, highlights a shift in market structure rather than a direct challenge to the largest derivatives venue.

Binance remains the dominant player in perpetual futures trading by a wide margin. Coingecko data shows the exchange processing over $53 billion in daily derivatives volume. This exceeds Hyperliquid’s $6.4 billion.

Hyperliquid’s Surge Sparks a New Fight Over Who Controls Crypto Trading

The data has sparked strong reactions across the crypto community, highlighting long-standing tensions between centralized and decentralized trading models.

Sponsored

Sponsored

To some, Hyperliquid’s rise is a validation of on-chain markets, while others used the moment to criticize centralized exchanges.

Such criticism reflects a broader sentiment among some traders who argue that transparent, on-chain systems reduce counterparty risk and improve market fairness.

However, defenders of centralized exchanges note that they still dominate in fiat on-ramps, regulatory integration, and retail accessibility.

Perhaps the most significant implication of Hyperliquid’s growth is how it is changing the competitive sector. Rather than being compared primarily with other perpetual DEXs, the platform is increasingly being measured against major centralized derivatives venues.

Hyperliquid Hub, a community account tracking the ecosystem, argued that the platform has already pulled ahead of most decentralized rivals.

“Hyperliquid is now absolutely dominating the on-chain derivatives sector. At this point, people are only comparing Hyperliquid with major centralized exchanges like Binance, OKX, and Bybit. Other perp DEXs have already been left far behind by Hyperliquid in terms of technology, liquidity depth, and overall performance,” they wrote.

Sponsored

Sponsored

If this perception continues to gain traction, it could mark a turning point in how traders evaluate execution venues. It is less about whether they are centralized or decentralized and more about liquidity, speed, and reliability.

While the Coinbase exchange remains one of the largest and most regulated crypto platforms globally, Hyperliquid’s momentum highlights how quickly market structure can shift in the digital asset space.

Still, challenges exist, after Coinglass data showed major gaps between volume, open interest, and liquidations across perp DEXs.

As BeInCrypto reported, there remains disagreement about the lack of standards for defining “real” activity in decentralized derivatives markets.

Additionally, industry executives like Kyle Samani also bear reservations about the integrity of Hyperliquid, saying the DEX is in most respects, everything wrong with crypto.

Crypto World

Analysts Warn of Extended Downturn as Bitcoin Struggles at $68K

Crypto market analysts have become increasingly bearish, with technical signals favoring further downside before any meaningful recovery.

More and more peak bear market signals are flashing up on the Bitcoin charts, leading analysts to believe that the pain is not over yet, but we may be nearing the bottom.

Bitcoin has now closed for a third week below the 100-week moving average and has been under this long-term trendline for 13 days, observed Coin Bureau CEO Nic Puckrin on Monday.

Historically, BTC has remained below this for an average of 267 days, with the shortest period at 34 days during the Covid flash crash in March 2020, he added, before predicting it could stay below this for longer.

“Therefore, historically, we are more likely to remain below for a longer period of time. A quick bounce back is still possible, but the longer we remain below, the less likely.”

Further Losses Make Accumulation Opportunities

Meanwhile, MN Fund founder Michaël van de Poppe said the “holder’s supply in profit/loss is rising,” which means more people aren’t profiting from Bitcoin, and the loss is growing significantly.

“This is something we’ve only been seeing during peak bear markets in 2015, 2018, and 2022,” he said, before adding that it should provide accumulation opportunities.

CryptoQuant founder Ki Young Ju was also bearish, stating, “Bitcoin is not pumpable right now.”

Selling pressure is too heavy for any multiplier effect, he said before adding that digital asset treasuries “won’t work until it becomes pumpable again.”

You may also like:

Bitcoin is not pumpable right now.

In 2024, $10B in cash could create $26B in BTC book value. In 2025, $308B flowed in, yet the market cap fell $98B. Selling pressure is too heavy for any multiplier effect.

MSTR and DATs won’t work until it becomes pumpable again. pic.twitter.com/T8NZHio4H9

— Ki Young Ju (@ki_young_ju) February 9, 2026

Glasnode reported on Monday that the unrealized market loss of $70,000 is approximately 16% of the market cap.

“Current market pain echoes a similar structure seen in early May 2022.”

“Bitcoin volume is telling,” observed analyst ‘Sykodelic’. “On the nuke to $60k we hit the fourth largest volume period since the 2022 bottom,” he said.

However, the analyst also said that each period since then that has recorded volume to this degree “has marked a key pivot in price direction,” questioning whether $60,000 was the bottom.

Bitcoin Loses $70K Level Again

The bearish sentiment is for good reason. Bitcoin fell below $70,000 twice on Monday and traded around $69,000 on Tuesday morning in Asia.

The asset has been consolidating around this level since recovering from its crash to $60,000 on Friday. It remains down 44% from its peak and is in bear-market territory, with the path of least resistance downward.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

XRP Price Analysis Reveals Why the 30% Bounce Failed

The XRP price rebounded more than 30% after bouncing from its early February low near $1.12. The move revived hopes of a recovery and briefly pushed the token toward the $1.50 zone. On the surface, the rally looked constructive. Momentum indicators improved. A breakout pattern began to form. Traders started discussing a possible trend reversal.

But blockchain data tells a different story. Instead of showing strong accumulation, on-chain metrics suggest that many holders used the rebound to exit losing positions. Selling at a loss remains dominant. Several groups are still reducing exposure. This raises a key question: was the bounce genuine demand, or simply exit liquidity for trapped sellers?

Technical Setup Shows Bounce Potential, But It Needs Confirmation

On the 12-hour chart, XRP is trading inside a falling wedge pattern, with a 56% breakout potential above the upper trendline.

Sponsored

Sponsored

For this pattern to activate, XRP needs to first reclaim its short-term moving average, the 20-period exponential moving average (EMA), which gives more weight to recent prices. This level acts as dynamic resistance in downtrends. In early January, a clean break above this EMA triggered a rally of nearly 30%.

Momentum is also showing early improvement.

Between January 31 and February 9, XRP printed a lower low in price. At the same time, the Relative Strength Index (RSI), a momentum indicator that measures buying and selling pressure, formed a higher low. This bullish divergence suggests that sellers are losing strength.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On its own, this setup points to a possible bounce.

But technical patterns only work when holders are willing to stay invested. To understand whether this bounce has real support, we need to look at how investors are behaving on-chain.

SOPR Shows Holders Are Still Selling at Losses Despite the Bounce

One of the clearest warning signals comes from the Spent Output Profit Ratio, or SOPR. SOPR measures whether coins being moved on-chain are sold in profit or at a loss. When it stays above 1, it shows profit-taking. When it remains below 1, it shows loss-selling.

Since late January, XRP’s SOPR has remained below 1 for more than ten consecutive days.

Sponsored

Sponsored

This is unusual. After a 30%+ rebound, short-term traders are normally sitting in profit. That usually pushes SOPR higher. But in XRP’s case, profitability never returned. Loss selling continued even as the price recovered. This means many holders are still exiting underwater positions.

In simple terms, the market is not seeing confident profit-taking. It is seeing stress-driven exits. To understand who is responsible, we need to look at holder cohorts.

Holder Data Confirms the XRP Bounce Is Being Used to Exit, Not Accumulate

HODL Waves group XRP wallets based on how long they have held their coins. This helps identify which investor groups are buying or selling.

The most striking shift appeared in the 24-hour holder cohort.

On February 6, this group controlled about 1% of XRP’s circulating supply. Within days, that share collapsed to roughly 0.09%. That represents a decline of more than 90%.

Sponsored

Sponsored

These were highly reactive traders who entered during volatility and rushed to exit during the rebound.

Selling was not limited to this group.

The 1-month to 3-month cohort, which accumulated heavily in January when XRP traded near $2.07, has also been reducing exposure. Their share of supply fell from around 14.48% in mid-January to about 9.48% recently. That is a decline of roughly 35%.

These holders remain underwater. Instead of waiting for a full recovery, they are using rallies to minimize losses. Together, these two cohorts explain why SOPR has remained depressed for a long time now.

Short-term traders are exiting failed trades. Medium-term holders are cutting losing positions.

This behavior is typical of distribution phases, not early bull markets. And it directly impacts price structure.

Sponsored

Sponsored

Cost Basis Data Shows Why $1.44–$1.54 Is a Wall for the XRP Price

Cost basis heat maps show where large groups of investors bought their coins. These zones often become resistance when the price returns to them.

For XRP, the strongest near-term cluster sits between $1.42 and $1.44. More than 660 million XRP were accumulated in this range. This creates a powerful sell zone.

When the price approaches this area, many holders reach break-even. After weeks of losses, they chose to exit.

Above this cluster lies the $1.54 level, which aligns with EMA resistance. Together, these zones form a barrier that XRP has repeatedly failed to clear. Each time the XRP price rallies into this region, selling intensifies. This is consistent with the distribution seen in SOPR and HODL Waves.

If XRP fails again near $1.44, downside risk increases. A rejection could send the price back toward $1.23 and possibly $1.12, the recent low. That would represent a decline of more than 20% from current levels.

Only a sustained break above $1.54, supported by improving profitability and reduced selling, would change this XRP price structure.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

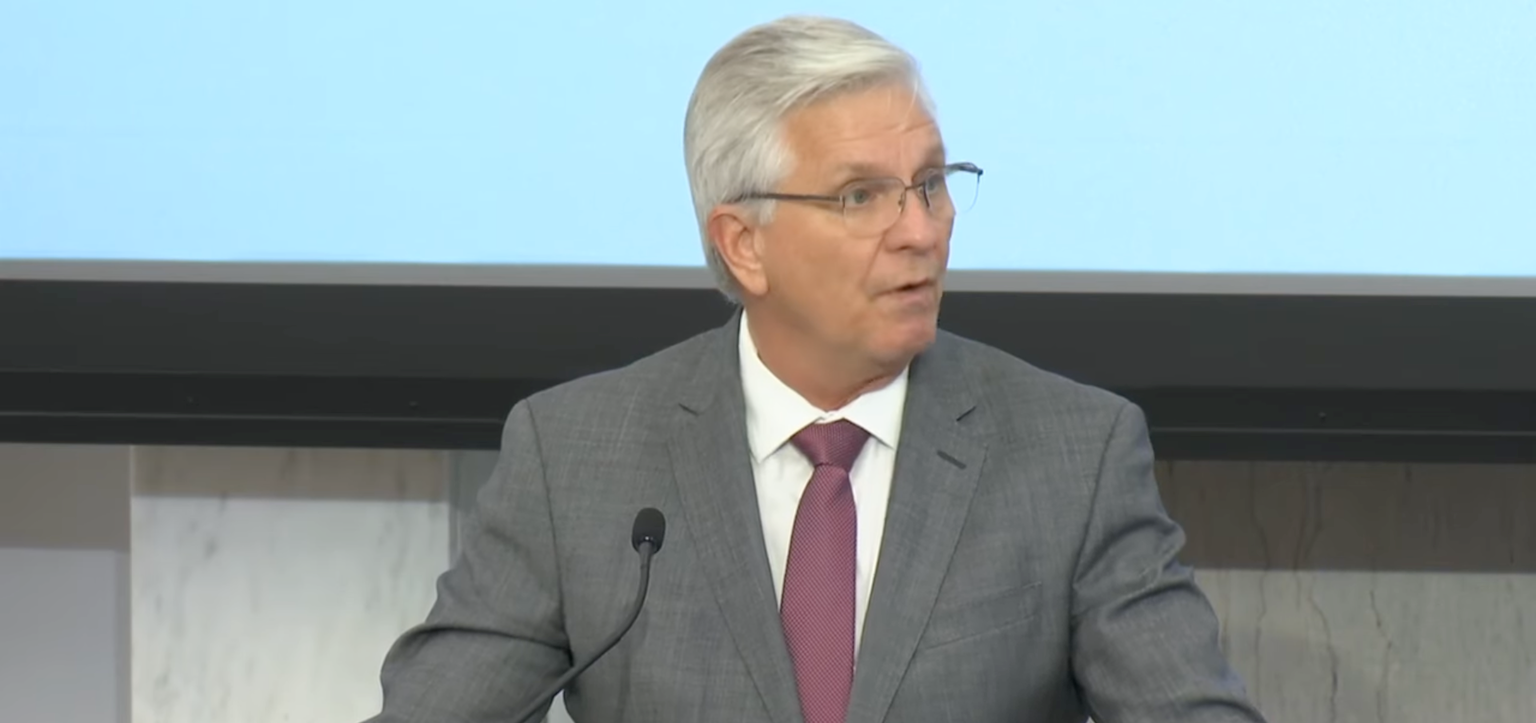

Federal Reserve Governor Chris Waller says the crypto hype that came with US President Donald Trump’s election victory has begun to wane as the market has become more entangled with traditional finance.

“I think some of the euphoria that came into the crypto world with the current administration, some of that’s kind of fading,” Waller said at a conference on Monday.

“A lot of it has been brought into the mainstream finance,” Waller said. “Then, you know, things have to happen there, so I think there was a lot of sell-off just because firms that got into it from mainstream finance had to adjust their risk positions.”

More traditional finance players have started to increase their exposure to crypto under the Trump administration, which has helped to elevate the market, but Waller argued that Congress’ failure to quickly pass the crypto market structure bill had also “put people off” as it leaves much uncertainty about how the products are regulated.

He also brushed off the recent market drop as “part of the game” with crypto. “You get in, you make some money, you might lose some money — that’s the nature of the beast.”

“Look, prices go up, prices go down — it’s just the nature of the business,” Waller said. “If you don’t like it, don’t get in it, that’s my advice to everybody.”

Bitcoin (BTC) has fallen 45% from its peak of $125,000 in October and is currently trading around $69,500 after a brief crash to under $60,000 on Friday.

Fed “skinny master accounts” to come this year: Waller

Waller said that the Fed would roll out its proposed “payment accounts” this year, which aims to give fintech and crypto firms limited access to the central banking system.

The Fed fielded feedback on the accounts, dubbed “skinny master accounts,” up until Friday, with crypto companies backing the plan while banking associations urged caution over the proposal.

Related: Bessent suggests Warsh nomination hearings alongside Powell probe

“We got a ton of stuff, and we’ll have to kind of work through that,” Waller said. “If we can get that done reasonably well, I’d like to try to have this done by the end of the year, if possible.”

The Fed’s proposal would see payment accounts given fewer privileges compared to master accounts commonly owned by major banks, such as removing the ability to earn interest and imposing balance limits.

Waller has previously said that payment accounts would “support innovation while keeping the payments system safe” and are necessary due to “rapid developments” in payments technology.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Vitalik Buterin’s Vision for Privacy, Economic Layer, and Governance

TLDR

- Vitalik Buterin proposes Ethereum as a key tool for privacy-preserving AI interactions and trust-minimized AI systems.

- He advocates for local AI models and cryptographic tools to protect users’ identities in AI interactions.

- Ethereum can serve as an economic layer for AI-to-AI interactions, supporting decentralized coordination and an AI reputation mechanism.

- Buterin envisions AI scaling human judgment to improve prediction markets and decentralized governance.

- Ethereum’s involvement in AI could decentralize power and shift control from corporations to more distributed systems.

Vitalik Buterin, the co-founder of Ethereum, shared his updated vision on the intersection of Ethereum and Artificial Intelligence (AI). In his statement, Buterin emphasized avoiding “accelerationist AGI” and instead focusing on human empowerment, privacy, and safety. He proposed that Ethereum could play a key role in building trust-minimized tools for secure AI interactions and integrating these technologies with crypto.

Building Privacy-Preserving AI Tools

Buterin advocates for the development of tools that prioritize privacy and trust in AI systems. He highlighted the importance of creating local AI models (LLMs) that allow users to interact without revealing their identities.

“ZK-payment for API calls” was also mentioned as a way to prevent linking users’ identities during transactions with remote models. Moreover, Buterin stressed the significance of cryptographic advancements that could improve AI privacy.

These technologies could include client-side verification of cryptographic proofs and trusted execution environments (TEEs). By implementing these tools, Ethereum could help ensure the safe interaction between AI systems and their users.

Ethereum as an Economic Layer for AI Interactions

Buterin envisions Ethereum becoming the backbone for economic transactions in AI ecosystems. He sees Ethereum facilitating AI-to-AI interactions, such as bots hiring bots and securing deposits for AI services.

By incorporating mechanisms like ERC-8004 for AI reputation, Ethereum can support decentralized coordination between AI systems. This setup would reduce the dependency on centralized organizations controlling AI models.

Ethereum could allow these systems to function economically, empowering more decentralized architectures. By doing so, Ethereum would help shift the power dynamic in AI from large corporations to a more distributed and transparent framework.

Decentralizing Governance and Expanding Human Judgment

In his vision, Buterin believes that AI could help overcome the limits of human decision-making. He emphasized how large language models (LLMs) can scale human judgment, making prediction markets and decentralized governance more efficient.

LLMs could help in areas like quadratic voting, combinatorial auctions, and universal barter economies. Buterin’s focus is on using AI to create better markets and governance structures that were previously limited by human attention.

With AI support, these systems could function more effectively, enabling more accurate decision-making at scale. Ethereum’s role in facilitating these interactions would strengthen the foundation of decentralized cooperation and improve future defense mechanisms.

Crypto World

Crypto exchange Backpack nears unicorn status as CEO lays out token strategy

Backpack Exchange, the crypto trading platform founded by former FTX and Alameda leaders, is reportedly in talks to raise around $50 million in new financing at a pre-money valuation above $1 billion.

Summary

- Backpack Exchange is reportedly in discussions to raise around $50 million at a valuation exceeding $1 billion, potentially elevating it to unicorn status.

- CEO Armani Ferrante outlined a tokenomics structure aimed at preventing early insider sell-offs and aligning incentives with long-term product growth.

- The company has also revealed plans for a 1 billion token supply, with 25% allocated at the token generation event, including community rewards.

If completed, the round would cement Backpack’s position in the crypto sector and potentially elevate it into unicorn status, a milestone for a firm still emerging from the post-FTX landscape.

The discussions come amid increased investor interest in fintech and crypto startups, and Backpack could parlay the fresh capital into expanding its exchange, wallet, and regulatory footprint globally.

The $50 million figure is a baseline, and reports suggest the eventual round size could grow larger.

Backpack CEO outlines tokenomics strategy

Meanwhile, Backpack CEO Armani Ferrante took to X to flesh out the company’s tokenomics framework ahead of a future token generation event.

Ferrante emphasized that the structure is designed to prevent early insiders from “dumping” tokens on retail investors, with no founders, executives, or venture backers receiving unlockable tokens until the product reaches significant traction, a concept he described as product “escape velocity.”

He also highlighted Backpack’s long-term goal of eventually going public in the U.S., signaling ambition beyond private fundraising and into regulated capital markets.

According to Ferrante, aligning token incentives with users, not short-term speculation, lays a foundation for sustainable growth and broader global adoption.

In a related post on the official Backpack account, the team confirmed elements of its upcoming token issuance plans. This includes a 1 billion token supply at launch and the allocation of 25 % of tokens at the Token Generation Event (TGE), with a portion earmarked for active community participants and points holders.

Crypto World

Bitmine ETH holdings hit 4.3M as firm buys $83M Ethereum in a day

Bitmine Immersion Technologies has pushed its Ethereum treasury to new highs, with total ETH holdings now standing at 4.326 million tokens, as the firm continued aggressive accumulation despite ongoing volatility in the crypto market.

Summary

- Bitmine Immersion Technologies’ Ethereum holdings have reached 4.326 million ETH, representing about 3.6% of ETH’s circulating supply.

- On-chain data shows the firm bought 40,000 ETH worth roughly $83.4 million in a single day, including a $42.3 million purchase from BitGo.

- Nearly 2.9 million ETH are staked, underscoring Bitmine’s long-term strategy despite ongoing market volatility.

The Tom Lee–chaired company disclosed in a recent press release that its Ethereum stash now represents around 3.6% of ETH’s total circulating supply, cementing Bitmine’s position as the largest known corporate holder of the asset.

Combined with Bitcoin and cash reserves, Bitmine’s total crypto and cash holdings are valued at approximately $10 billion.

Fresh $83M ETH buy signals continued accumulation

On-chain data flagged by Lookonchain shows that Bitmine added significantly to its position on Monday.

According to the analytics account, the firm purchased 20,000 ETH worth about $42.3 million from BitGo, following an earlier buy of the same size.

“Bitmine has been steadily buying Ethereum, as we view this pullback as attractive, given the strengthening fundamentals. In our view, the price of ETH is not reflective of the high utility of ETH and its role as the future of finance,” said Tom Lee, Executive Chairman of Bitmine.

Staking strategy anchors long-term bet on Ethereum

Bitmine said nearly 2.9 million ETH of its total holdings are currently staked, generating yield through its expanding Ethereum infrastructure operations. The company added that its ETH-focused strategy is aimed at long-term value creation rather than short-term price movements.

Chairman Tom Lee described recent price weakness as an opportunity, citing Ethereum’s history of sharp recoveries following deep drawdowns and pointing to staking yields as an additional source of return.

Ethereum has struggled to regain upside momentum amid broader risk-off sentiment across crypto markets. Still, Bitmine’s continued buying underscores growing interest among institutional players in Ethereum as a treasury asset, even as near-term price action remains uncertain.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat11 hours ago

NewsBeat11 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

NewsBeat22 hours ago

NewsBeat22 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports10 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report