Crypto World

Crypto Flows to Human Trafficking Services Jump 85% to Hundreds of Millions in 2025

As Epstein-linked revelations emerged, new data show crypto payments to suspected trafficking services surged 85% globally in 2025.

As global attention remains fixed on the continued release and scrutiny of emails and documents tied to sex trafficker Jeffrey Epstein, attention has turned to how exploitation networks operate and move money.

Against this backdrop, a new report from Chainalysis disclosed that cryptocurrency flows to suspected human trafficking-related services surged sharply in 2025. Transaction volumes reached hundreds of millions of dollars, up 85% year-over-year. While the figures quantify financial activity, the report stressed that the true cost of these crimes is borne by victims, not balance sheets.

Trafficking-Linked Crypto Activity

The increase in crypto-linked trafficking activity has occurred alongside the expansion of Southeast Asia–based scam compounds, online gambling operations, and Chinese-language money laundering and guarantee networks, many of which operate openly on Telegram and form a tightly connected illicit ecosystem with global reach.

Unlike cash-based systems, blockchain transparency helps investigators to trace these flows, thereby creating opportunities to identify and disrupt networks that would otherwise remain hidden. Blockchain analytics company Chainalysis tracked four primary categories of suspected cryptocurrency-facilitated trafficking: Telegram-based “international escort” services suspected of trafficking people; “labor placement” agents linked to kidnapping and forced labor in scam compounds; prostitution networks; and vendors of child sexual abuse material (CSAM).

Payment behavior differs across categories. “International escort” services and prostitution networks rely almost entirely on stablecoins as they prioritize price stability and ease of conversion, but CSAM vendors have historically favored Bitcoin. However, its dominance is declining as alternative Layer 1 networks and privacy tools emerge.

Escort services were found to be deeply integrated with Chinese-language money laundering networks that rapidly convert stablecoins into local currencies and reduce exposure to asset freezes by centralized issuers. Transaction-size analysis points to professionalized operations as nearly 49% of “international escort” service transfers surpass $10,000, which is consistent with organized enterprises operating at scale.

Meanwhile, prostitution networks cluster in the $1,000-$10,000 range. These networks often use structured pricing and customer-service models, advertising standardized rates across major East Asian cities, which in turn produce identifiable on-chain patterns useful for detection.

You may also like:

CSAM Crypto Economy

CSAM operations reveal a different structure. It was found that roughly half of transactions are under $100, and there is a shift toward subscription-based models that generate predictable revenue streams. In 2025, Chainalysis observed growing use of Monero and instant exchangers to launder CSAM proceeds, in addition to an emerging overlap between CSAM networks and sadistic online extremism communities, where abuse material is monetized through cryptocurrency payments.

One major CSAM site identified in July 2025 alone used more than 5,800 crypto addresses and generated over $530,000 since 2022. The report also stated that trafficking-linked services leverage US-based infrastructure for scale and legitimacy, while operators often remain overseas to limit personal exposure.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

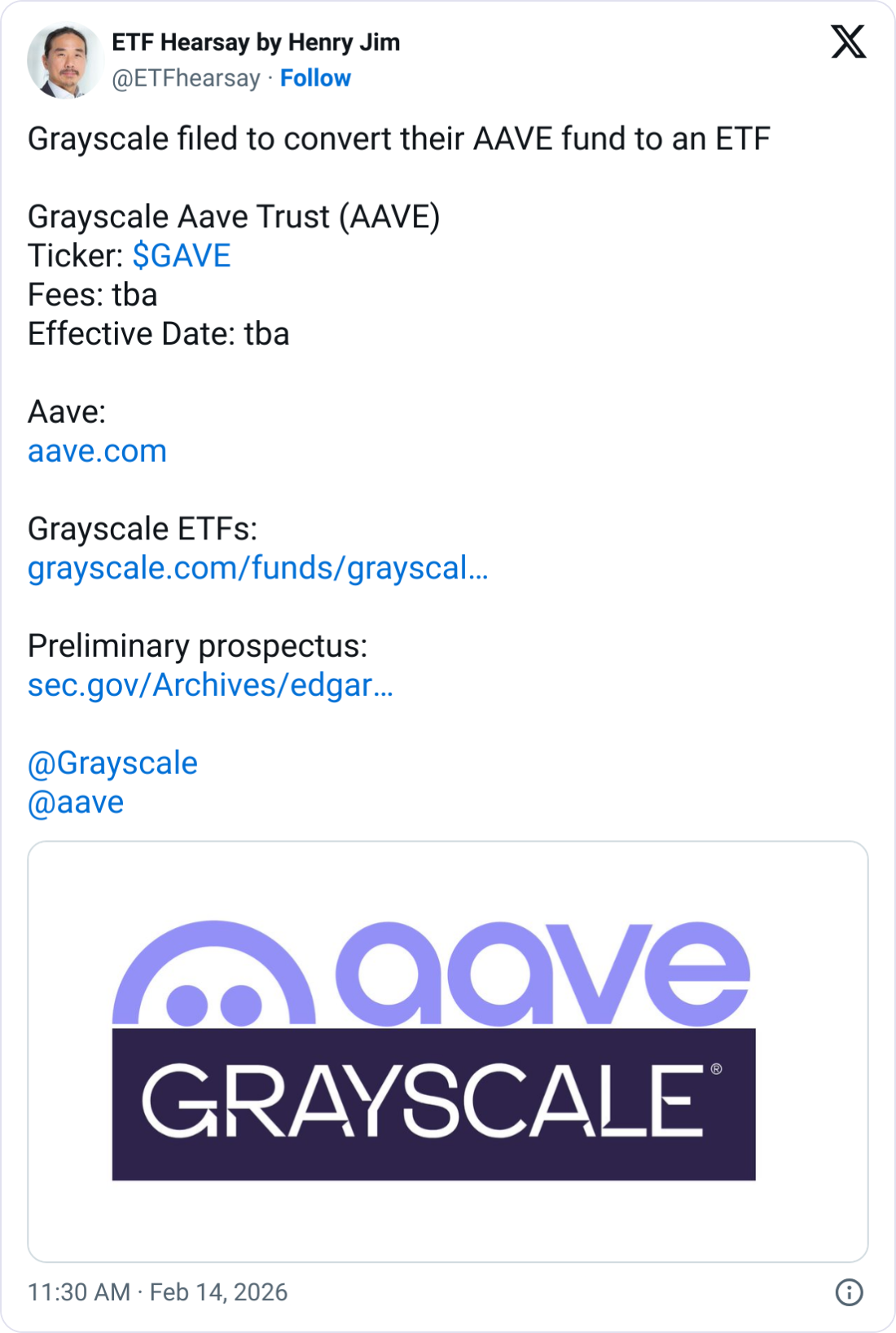

Grayscale Files With SEC to Convert Aave Trust Into ETF

Crypto asset manager Grayscale filed for regulatory approval to convert its trust tracking the token of the decentralized lending protocol Aave into an exchange-traded fund (ETF).

The company filed a Form S-1 registration statement with the Securities and Exchange Commission on Friday, saying it intends to convert the trust and rename it the Grayscale Aave Trust ETF.

Grayscale added that it plans to list the fund on NYSE Arca, one of the most popular exchanges for trading ETFs, under the ticker “GAVE.” It will charge a 2.5% fee, and Coinbase will serve as both its custodian and prime broker.

Grayscale’s filing is one of several ETFs seeking to track altcoins, suggesting that Wall Street still has an appetite for crypto exposure even amid a market downturn.

Aave is the largest decentralized finance protocol, with over $27 billion in total value locked, according to DefiLlama. The platform allows users to lend and borrow crypto across multiple blockchains, and the AAVE token can be staked to earn yield.

Grayscale joins Bitwise in Aave ETF race

With its filing, Grayscale is the second to seek US regulatory approval for an ETF tied to Aave (AAVE), currently joining only Bitwise in looking to launch a similar fund.

Bitwise filed with the SEC in December to launch the Bitwise AAVE Strategy ETF, among a slew of filings that sought to create ETFs tied to popular altcoins, including Uniswap (UNI) and Zcash (ZEC).

Bitwise’s ETF plans to hold up to 60% of its assets directly in AAVE tokens and at least 40% in securities, such as other ETFs that are exposed to AAVE, while Grayscale’s would hold AAVE tokens directly.

Related: Roundhill’s election prediction ETFs are ‘potentially groundbreaking’: Analyst

The two ETFs are set to be the first in the US to offer direct exposure to Aave, joining a short list of overseas products that have launched to track the token.

In Europe, 21Shares launched an Aave exchange-traded product on the Nasdaq Stockholm in November, several years after Global X launched a similar Aave product in Germany in early 2023.

The AAVE token has traded down 1.6% over the past day to $126 and is more than 80% off its all-time high of nearly $662, reached in May 2021 amid a bull market for altcoins, according to CoinGecko.

Magazine: Getting scammed for 100 Bitcoin led Sunny Lu to create VeChain

Crypto World

Grayscale to Turn AAVE Trust into ETF on NYSE Arca

Grayscale has filed with the U.S. Securities and Exchange Commission to convert its Aave-tracking trust into an exchange-traded fund, signaling a continuing push to bring decentralized-finance exposure to mainstream investors. The filing, disclosed via a Form S-1 on February 13, 2026, envisions renaming the vehicle the Grayscale Aave Trust ETF and listing on NYSE Arca under the ticker GAVE, with Coinbase serving as custodian and prime broker. If approved, the product would hold AAVE tokens directly, rather than using a mix of securities and assets. Aave, a cornerstone of DeFi, currently dominates borrowing and lending activity across multiple chains and has drawn sustained investor interest despite broader market softness.

Key takeaways

- Grayscale aims to convert its Aave Trust into an NYSE Arca-listed ETF (GAVE) with a 2.5% management fee, and Coinbase would act as custodian and prime broker.

- The filing makes Grayscale the second U.S. firm to seek regulatory approval for an ETF tied to AAVE, joining Bitwise in a growing field of altcoin ETFs.

- Grayscale would hold AAVE tokens directly in the fund, contrasting with Bitwise’s approach that blends a substantial token stake with traditional securities to track AAVE exposure.

- AAVE remains the largest DeFi protocol by total value locked, a lens through which the ETF product could unlock liquidity for users and risk-managed investors alike.

- EU-listed products, including 21Shares’ AAVE ETP in Nasdaq Stockholm, illustrate a global appetite for regulated crypto access even as the U.S. market weighs its own framework.

Tickers mentioned: $AAVE

Sentiment: Neutral

Market context: The push for crypto ETFs persists even as risk sentiment remains cautious in the broader markets. Regulators are scrutinizing novel structures that blend regulated investment vehicles with direct token holdings, a trend that continues to shape the way institutions access DeFi assets.

Why it matters

The Grayscale filing underscores a sustained appetite among traditional market participants to provide regulated access to key crypto rails, particularly in decentralized finance. By proposing to hold AAVE tokens directly, the Grayscale Aave Trust ETF would deliver a relatively simple, token-centric exposure that mirrors the underlying protocol’s on-chain activity. This structure could appeal to investors seeking a transparent, single-asset vehicle that tracks a well-established DeFi protocol without the complexities of a blended equity-and-token approach.

From a market-theory perspective, a direct-token ETF has the potential to increase liquidity and price discovery for AAVE, a token that sits at the core of a multi-chain lending and borrowing ecosystem. AAVE (CRYPTO: AAVE) powers collateralized lending across different networks, and its token economics include staking opportunities that reward participants for securing the platform’s stability. If the fund gains approval, it would provide a familiar, U.S.-listed conduit for macro investors to gain leverage to DeFi yields and protocol growth while mitigating some idiosyncratic risk through ETF mechanics. The decision could also influence how other altcoins are packaged into ETFs, potentially accelerating similar filings across the sector.

The competition landscape is notable. Grayscale is not entering a vacuum; Bitwise currently seeks regulatory clearance for the Bitwise AAVE Strategy ETF, a plan that would allocate up to a majority of assets to AAVE tokens and place a substantial portion in securities linked to the token’s performance. The contrast between Grayscale’s direct-token approach and Bitwise’s mixed-asset strategy highlights a broader debate about how best to structure crypto exposure for institutional portfolios. As the two filings advance, regulators will weigh issues such as custody, liquidity, and investor protection in the context of a market where on-chain activity can diverge from traditional equity markets.

Beyond the United States, the appetite for regulated Aave exposure is evident. In Europe, 21Shares launched an Aave exchange-traded product on Nasdaq Stockholm in November, joining earlier European efforts by Global X in Germany. These products reflect a broader trend of creating accessible, regulated pathways for investors to participate in the DeFi economy without directly managing private keys or navigating on-chain custody. The cross-border momentum matters because it signals that crypto-native products can find distribution channels outside the U.S., even as policymakers refine the domestic framework for crypto-asset ETFs.

From a price perspective, the market has not fully priced in the regulatory drama and potential upside from a US-listed AAVE ETF. The AAVE token has hovered around the mid-$100s, with price swings often reflecting broader crypto market sentiment as well as protocol-specific developments, such as staking mechanics and governance changes. Market data show that the token’s trajectory remains sensitive to both macro risk appetite and the evolving regulatory landscape for crypto funds and custodians.

As this story unfolds, the sector’s growth narrative continues to hinge on clarity from regulators, custody capabilities, and the ability of managers to deliver transparent, liquid products that align with investor expectations. The Grayscale filing does not guarantee approval or listing, but it does reinforce that, even in a downturn, there is continued demand among asset managers to bridge the gap between DeFi innovation and traditional market access.

What to watch next

- Regulatory decision on Grayscale’s Form S-1 for the Grayscale Aave Trust ETF, including potential timing for a decision.

- NYSE Arca listing logistics and the official launch timeline for GAVE, if approved.

- Regulatory progress on Bitwise’s AAVE Strategy ETF and any subsequent outcomes for U.S.-listed altcoin ETFs.

- Developments in European AAVE-linked ETFs/ETPs, including any new products or regime changes that affect cross-border distribution.

- Market reaction in AAVE pricing and liquidity as ETF chatter intensifies and custody arrangements mature.

Sources & verification

- Grayscale’s Form S-1 registration for the Grayscale Aave Trust ETF filed with the SEC (aave-20260213.htm).

- Bitwise’s SEC filing for the Bitwise AAVE Strategy ETF.

- DefiLlama data confirming Aave’s market position as a leading DeFi protocol with significant TVL.

- 21Shares’ Aave ETP on Nasdaq Stockholm as an example of Europe’s regulated exposure to the token.

- CoinGecko price data for the AAVE token and on-chain activity references used to illustrate the current market context.

Grayscale targets Aave ETF, expanding US access to DeFi exposure

AAVE (CRYPTO: AAVE) has become a focal point in a growing wave of regulated products designed to mirror the performance of decentralized finance assets. Grayscale’s filing with the SEC outlines a structure in which the Grayscale Aave Trust ETF could hold the token directly on its balance sheet. The move—should it clear regulatory hurdles—would place a U.S.-listed, token-backed vehicle alongside existing crypto ETFs and ETPs, potentially broadening the investor base for Aave and the DeFi ecosystem more broadly.

In the current filing framework, the Grayscale vehicle would be listed on NYSE Arca under the symbol GAVE, with a management fee of 2.5% and a custody arrangement described as handled by Coinbase. The direct-token approach contrasts with other ETF strategies that blend token holdings with traditional securities or derivatives to achieve exposure. The difference may matter to fund sponsors and investors alike, particularly around liquidity profiles, redemption mechanics, and custody risk management in a landscape where on-chain activity can precede off-chain valuations.

The regulatory backdrop for a token-backed ETF remains nuanced. While the SEC has shown openness to crypto investment products, it has also emphasized investor protection, disclosure, and custody standards. Grayscale’s S-1 indicates a careful alignment with those expectations, aiming to provide transparent access while maintaining robust safeguards around token custody and exchange mechanisms. The broader market context—where Bitwise is pursuing a similar filing and European issuers have already brought Aave-linked products to market—suggests a multi-regional competition to offer the most liquid and compliant versions of DeFi exposure.

From a product design standpoint, the choice between direct token ownership and a blended allocation represents more than a stylistic preference. Direct token holdings could simplify the fund’s tracking error relative to the underlying asset but require sophisticated custody and liquidity planning. In contrast, a partially token-weighted ETF can diversify risk by incorporating securities linked to the token’s performance, potentially smoothing volatility but introducing tracking complexities. As both Grayscale and Bitwise move through the regulatory process, the evaluation of these trade-offs will inform not just AAVE ETFs, but the future shape of DeFi-focused investment products in the United States.

The evolving narrative around Aave ETFs also intersects with activity on other fronts. Europe’s active ETP pipelines and ongoing discussions about crypto product approvals in the U.S. highlight a broader market interest in regulated crypto access. The Aave ecosystem—where users lend, borrow, and earn yield across multiple blockchains—remains a compelling case study for what “regulated DeFi exposure” could look like in practice. Investors watching the Grayscale filing should consider how direct token exposure compares to more traditional ETF constructs, and what this implies for the future of institutional participation in the DeFi economy.

What to watch next

- The SEC’s decision timeline for Grayscale’s Aave Trust ETF filing and any subsequent amendments to the Form S-1.

- Timing and logistics for an NYSE Arca listing if the ETF receives regulatory approval.

- Regulatory and market updates on Bitwise’s AAVE Strategy ETF and any related product developments.

- Regulatory developments in Europe and other regions, where Aave-linked ETPs have already gained traction.

- Market reactions to the potential launch, including AAVE price dynamics and liquidity indicators on major exchanges.

Crypto World

Apollo Partners With Morpho To Support Lending Infrastructure

Traditional finance giant Apollo Global Management Inc. has signed a partnership agreement with decentralized lending platform Morpho to take a significant stake in the project and help support its blockchain lending infrastructure.

The move was announced on Friday by the Morpho Association, the nonprofit organization behind the decentralized finance (DeFi) platform.

The partnership, or “cooperation agreement,” will see Apollo or its affiliates buy up to 90 million Morpho (MORPHO) governance tokens over the next four years, representing 9% of the total 1 billion-token supply of MORPHO.

“Under the Agreement, Apollo or its affiliates may acquire MORPHO tokens through a combination of open-market purchases, OTC transactions, and other contractual arrangements, subject to an overall ownership cap of 90 million MORPHO tokens over a 48-month period as well as transfer and trading restrictions,” the Morpho Association said.

The Morpho Association added that they will also be working together to “support onchain lending markets on Morpho’s protocol,” without providing further specifics.

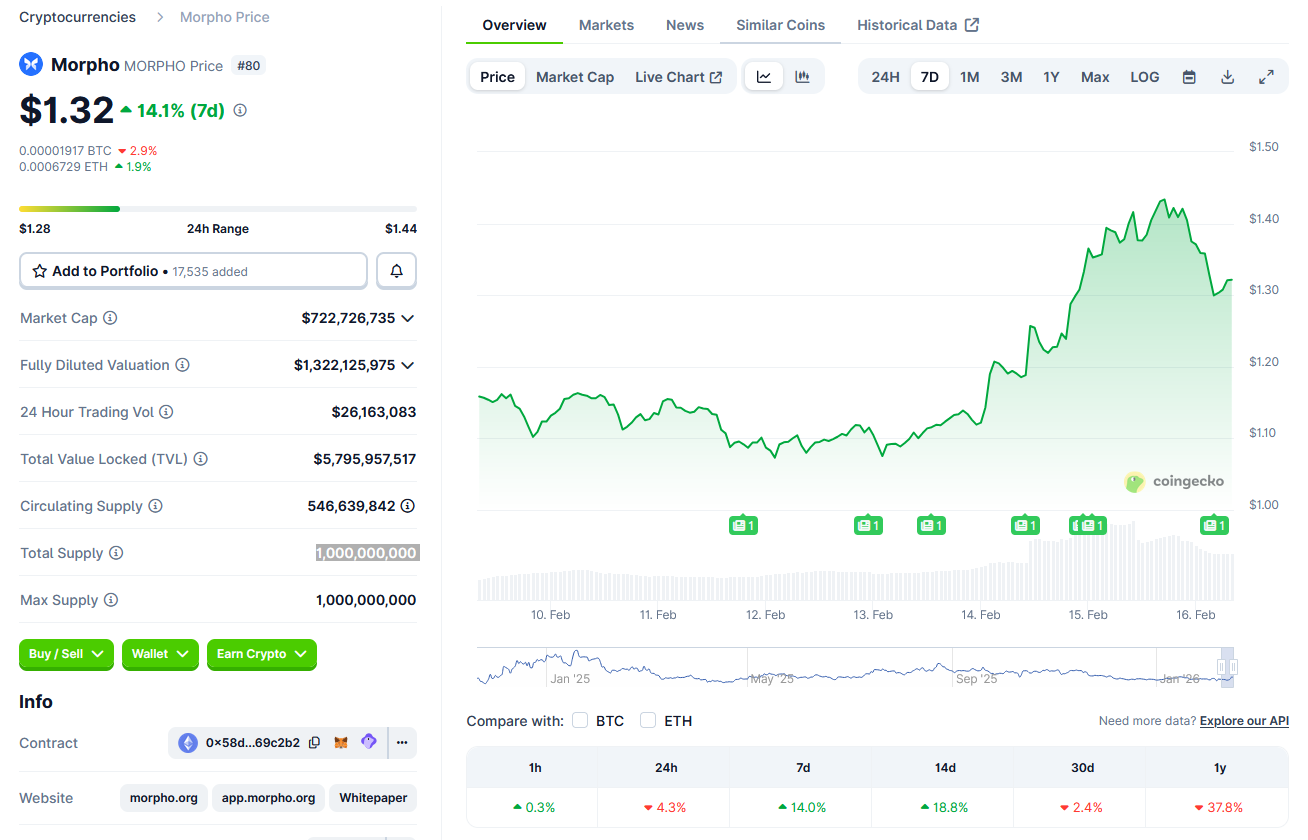

The move saw a 17.8% bump in the price of MORPHO over the weekend, rising from around $1.12 on Friday to $1.32 at the time of writing, according to CoinGecko data.

However, the asset is down 38% over the past 12 months amid a broader crypto market slump.

Morpho is the sixth-largest DeFi protocol on the market, with $5.8 billion worth of total value locked, according to DeFi Llama. The project primarily provides lending markets and curated investment vaults for investors to earn yield.

Related: BlackRock enters DeFi as institutional crypto push accelerates: Finance Redefined

The deal with Apollo, a multinational asset manager with nearly $940 billion worth of assets on its books, marks another significant partnership secured by Morpho in recent months.

In late January, Cointelegraph reported that digital asset manager Bitwise had jumped on board to provide curated vaults offering a 6% annual yield on Morpho. Last week, Bitcoin DeFi project Lombard also announced that Morpho had signed on as an initial liquidity partner as part of its launch of Bitcoin Smart Accounts.

Meanwhile, Apollo has been gradually upping its exposure to crypto and blockchain. Last year, the firm partnered with Coinbase to develop stablecoin credit strategies and made an undisclosed investment in Plume to support its real-world-asset tokenization infrastructure.

Magazine: Coinbase misses Q4 earnings, Ethereum eyes ‘V-shaped recovery’: Hodler’s Digest, Feb. 8 – 14

Crypto World

Adam Back Opposes BIP-110 Ordinals Fix

Blockstream CEO Adam Back has opposed a proposal aimed at reducing Ordinals-like “spam” on Bitcoin, warning that the fix could do more harm than good to the network’s credibility.

Bitcoin Improvement Proposal (BIP-110) was proposed by pseudonymous Bitcoin developer Dathon Ohm in December. Nearly 7.5% of Bitcoin nodes — all of which are Bitcoin Knots clients — have signaled readiness for BIP-110, according to data.

The proposal seeks to temporarily shrink how much data can be stored in Bitcoin transactions to reduce the amount of images, videos, audios and other “data abuse” flooding the network.

While Back agreed that Bitcoin should act as “sound money,” he said in a post to X on Sunday that it wasn’t worth a consensus-level change, adding that BIP-110 would be “an attack” on Bitcoin’s credibility as a store of value and secure monetary network.

“It’s a lynch mob attempt to push changes there is not consensus for,” he said, adding that spam is “just an annoyance” that poses no real security threat to the network.

BIP-110 is only a temporary fix to reduce arbitrary data, aimed at giving the Bitcoin community the ability to evaluate the impact for 12 months while developers work on a longer-term solution.

BIP-110 has gained more support from validators running Bitcoin Knots, which started taking market share from Bitcoin Core in the back half of 2025, when Bitcoin Core developers removed the 80-byte limit on the OP_RETURN function in late October, enabling more non-financial transactions to flood the Bitcoin network.

Bitcoin Core’s market share of Bitcoin nodes has fallen from about 98% to 77.2% since the controversial OP_RETURN function sparked debate in the Bitcoin community over what transactions should be allowed on the network, with Bitcoin Knots’ share rising to 22.7%.

Back is among many who opposed removing the 80-byte limit on the OP_RETURN function, stating in September that Ordinals-like spam has “no place in the timechain.”

However, he flagged that a solution like BIP-110 has the potential to freeze funds by rendering certain unspent transaction outputs (UTXOs) unspendable.

Ohm acknowledged that it is theoretically possible for funds to be frozen, but added: “This proposal goes to great pains to avoid affecting any known use cases.”

Related: Bitcoin holders are being tested as inflation eases: Pompliano

Those in favor of non-financial transactions, like Bitcoin Ordinals leader Leonidas, have noted that the Ordinals and Runes ecosystems have contributed over $500 million in transaction fees to strengthen Bitcoin’s security — something which has become an increasing concern as the mining block subsidy continues to halve every four or so years.

Bitcoin Ordinals activity has tanked

However, Dune Analytics data shows that Ordinals inscription fees were consistently netting less than $10,000 per day for Bitcoin miners by the end of 2025, making it difficult for them to rely on non-financial transactions for revenue.

Ordinal activity reached its peak more than two years ago, with Bitcoin miners collecting almost $10 million in fees on Dec. 16, 2023.

Since then, fees have trended downward except for a few short-lived spikes.

Magazine: Did a Hong Kong fund kill Bitcoin? Bithumb’s ‘phantom’ BTC: Asia Express

Crypto World

MYX Finance Crashed 70% This Week, But Why?

MYX Finance has posted one of the steepest weekly drawdowns in the digital asset market. The token plunged 72% over the past seven days, underperforming most comparable altcoins. The sell-off erased months of gains and pushed MYX to a three-month low.

At first glance, such a collapse often signals protocol failure or declining utility. However, on-chain data and derivatives metrics tell a different story.

Sponsored

MYX Finance Is Still Doing Well In The DeFi Space

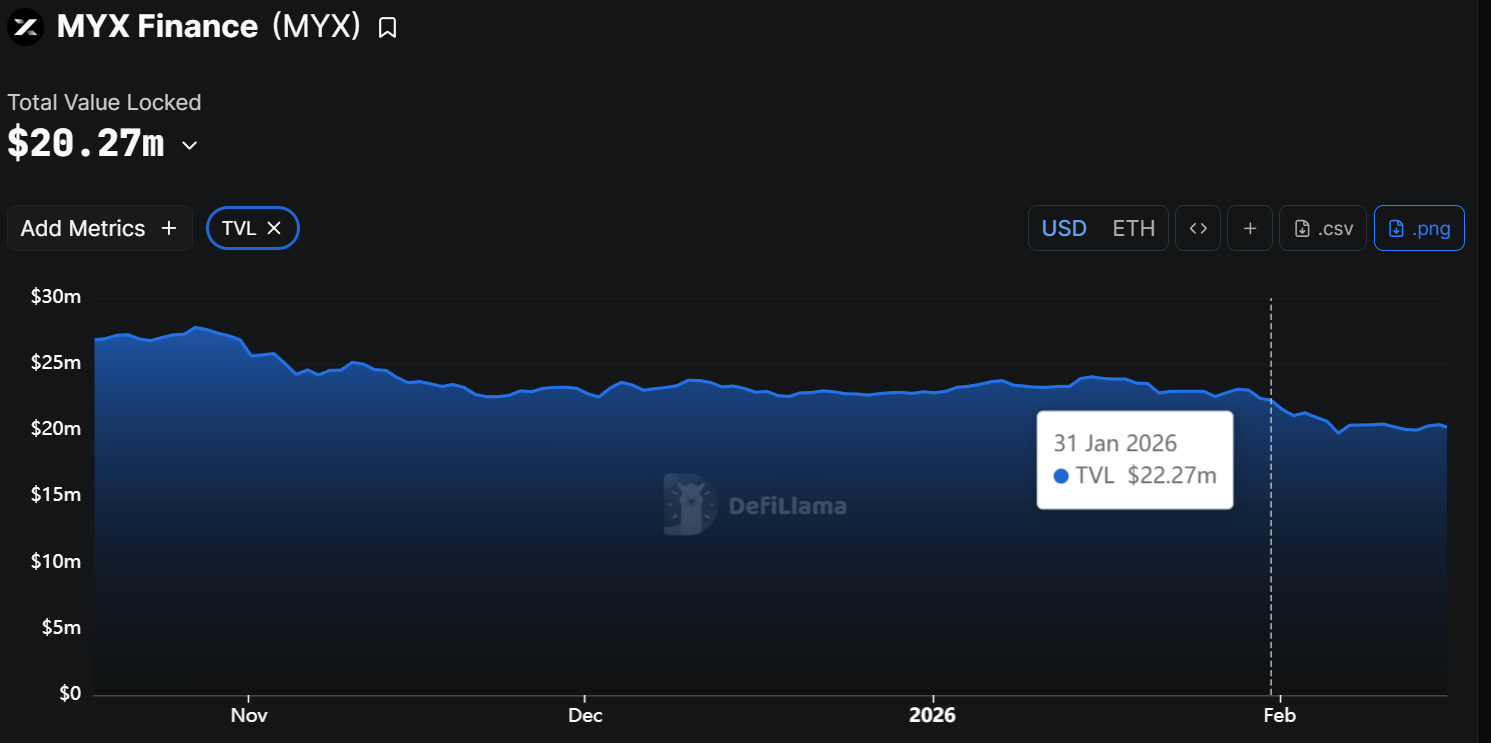

A sharp decline typically raises concerns about weakening demand or user migration. Investors often examine total value locked, or TVL, to assess platform health. In decentralized finance, TVL measures the amount of capital secured within a protocol’s smart contracts.

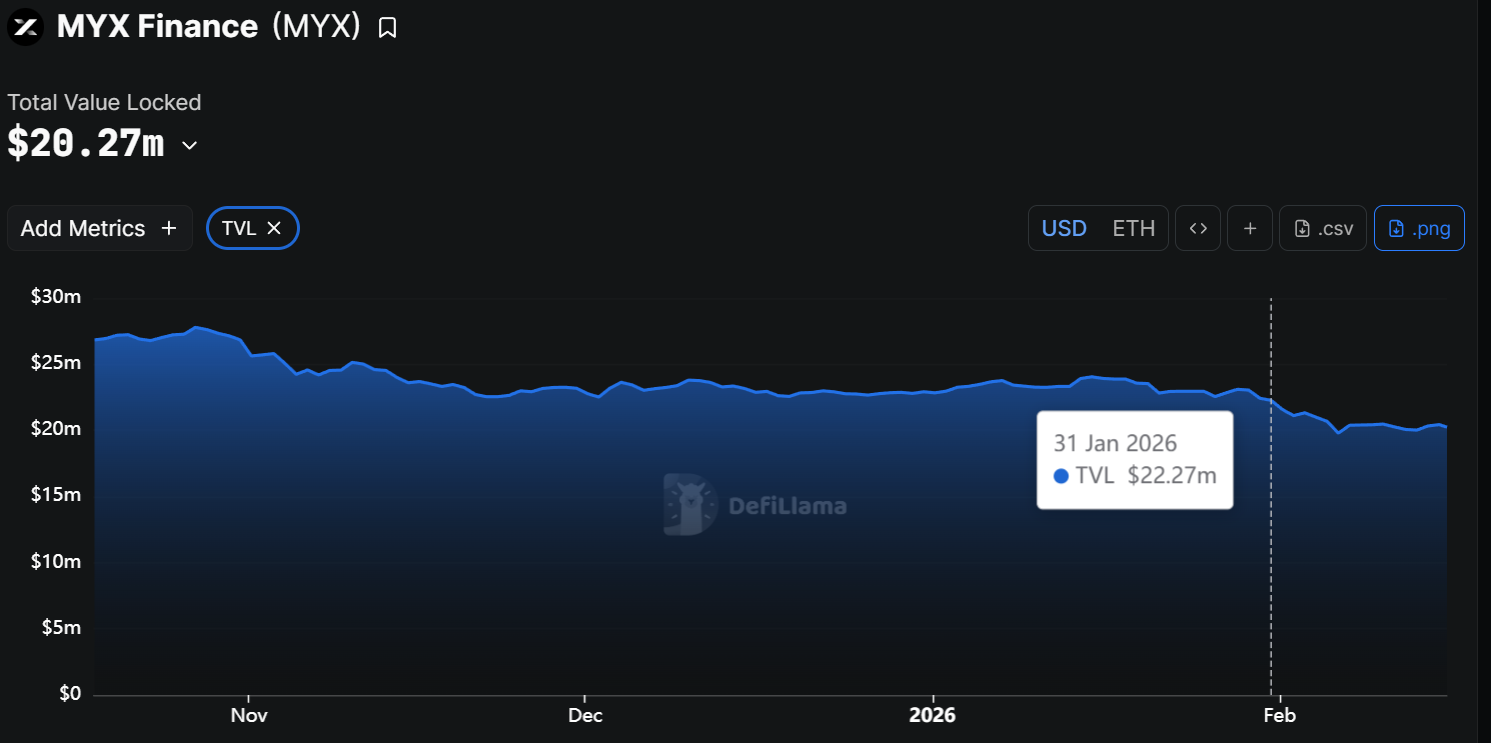

MYX Finance’s TVL declined by roughly $2 million since the start of the month. It fell from $22.27 million on January 31 to $20.27 million today. While the drop reflects some capital outflow, it does not indicate a systemic collapse. The reduction represents less than 10% of the total locked value.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This moderate contraction suggests that users have not exited en masse. Core utility appears intact. The data imply that the price crash was not driven by a dramatic fall in platform adoption.

Sponsored

Traders Are Pining For MYX Price Drop

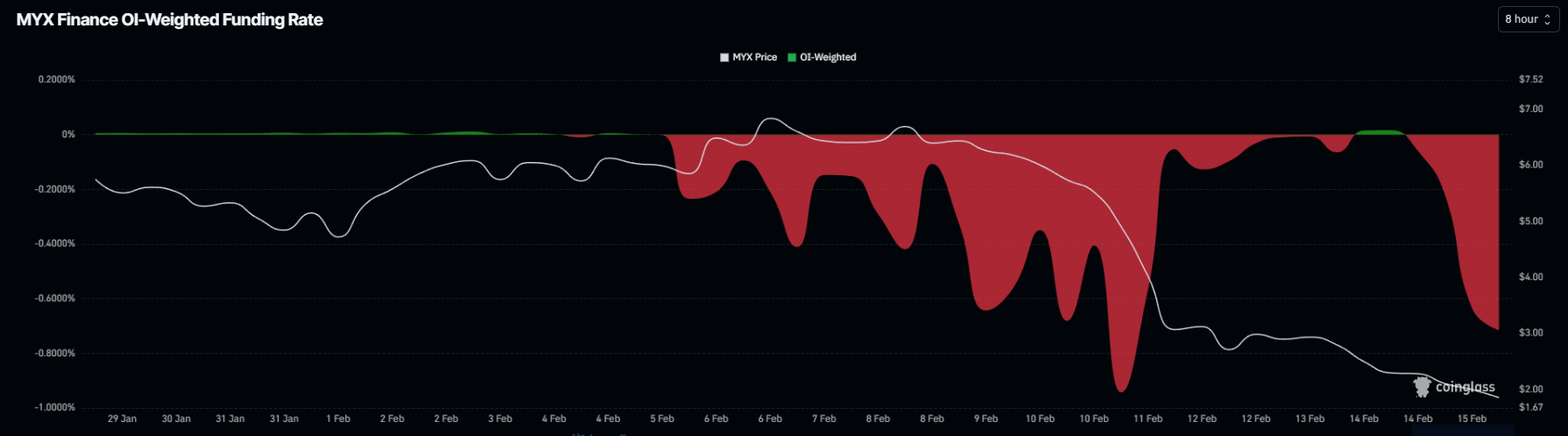

Derivatives data provides stronger insight into the recent volatility. Funding rates in perpetual futures markets reveal whether traders are leaning long or short. When funding turns deeply negative, short sellers dominate and pay fees to long holders.

MYX has experienced persistently negative funding rates, with spikes reflecting intense bearish pressure. This pattern shows traders have been aggressively opening short contracts. The imbalance suggests speculation on continued downside rather than a reaction to deteriorating fundamentals.

Such positioning can accelerate price movements. Heavy short exposure amplifies downward momentum during periods of fear. In MYX’s case, sustained negative funding indicates that sentiment, not utility loss, has driven much of the decline.

Sponsored

How Are MYX Holders Acting?

The Money Flow Index, or MFI, further supports this view. The MFI tracks capital inflows and outflows by combining price and volume. A move below the neutral 50 level signals strengthening selling pressure.

MYX’s MFI has fallen beneath that midpoint, confirming that MYX sellers currently control momentum. The shift reflects growing fear, uncertainty, and doubt among traders. As liquidity thins, price declines can intensify quickly.

Historical patterns offer additional context. The last time MYX’s MFI moved decisively from buying to selling pressure, the token dropped 50%. This time, the decline has already reached 72%. The trend may continue until the MFI approaches the oversold zone, where selling pressure typically begins to exhaust.

Sponsored

MYX Price Crashes

MYX is trading at $1.88 at the time of writing. The token broke below the psychological $2.00 level, marking its lowest price in three months. The 72% weekly decline reflects extreme short-term weakness and heightened volatility.

If MYX fails to hold the $1.68 support level, additional downside risk increases. A breakdown could push the token toward $1.43. Losing that support would expose the next critical level near $1.22, where buyers may attempt to stabilize price action.

Conversely, sentiment shifts can occur quickly in crypto markets. If investors view current levels as undervalued, accumulation could begin. A sustained move above $2.48 would signal improving strength. Reclaiming that level as support could invalidate the bearish outlook as MYX approaches the $3.00 mark.

Crypto World

Lack of On-Chain Privacy Holds Back Crypto Payments

The lack of privacy for on-chain transactions is a core obstacle to mainstream crypto payments. Binance co-founder Changpeng Zhao argues that privacy gaps deter businesses from using crypto to settle expenses, including payroll. He highlighted a scenario in which a company paying employees in crypto on-chain could have salary details exposed simply by inspecting sending addresses. The remark underscores a broader debate about whether public ledgers can sustain enterprise-level use without compromising sensitive information. In a separate exchange with Chamath Palihapitiya, host of the All-In Podcast, CZ connected these concerns to physical security, suggesting that transparency could heighten corporate risk even beyond financial data. The conversation comes as privacy-focused narratives—rooted in crypto’s cypherpunk origins—reassert themselves in a landscape where AI and data security add new layers to the discussion.

Key takeaways

- The privacy question sits at the center of enterprise crypto adoption, with executives arguing that transparent on-chain activity deters payrolls and other payments.

- A concrete example cited by CZ shows how salary information could be inferred from transfer histories, illustrating a tangible risk for corporate use cases.

- The revival of cypherpunk values in crypto debates signals a shift toward prioritizing user control over data and resistance to pervasive surveillance on public ledgers.

- Industry voices warn that as AI-powered tools become more capable, centralized servers and on-chain data could become more attractive targets for attackers, elevating the need for privacy-preserving technologies.

- Policy and product developments around on-chain privacy—alongside pragmatic privacy narratives in media and research—are likely to shape how institutions view crypto as a payments and settlement layer.

Tickers mentioned:

Sentiment: Neutral

Market context: The privacy debate in crypto intersects with ongoing discussions about regulatory expectations, enterprise data handling, and the evolving threat landscape. As institutions weigh the benefits of programmable money against the risks of exposure, privacy-preserving technologies are entering broader conversations, alongside calls for pragmatic privacy implementations in the industry. The issue sits within a wider trend of renewed Cypherpunk-inspired discourse and a cautious approach to on-chain transparency in corporate contexts.

Why it matters

Privacy is not a niche concern but a practical constraint on the practical use of blockchain technology for everyday business. The payroll example alone illustrates how a lack of on-chain privacy can undermine a core financial function, potentially stalling broader corporate adoption. For enterprises, the risk is twofold: accidental data leakage that reveals payroll structures, vendor relationships, or strategic alliances, and the more subtle threat of data aggregation by adversaries who can piece together a company’s financial health from transaction patterns.

Industry voices emphasize that corporate workflows—trade secrets, supplier networks, and internal budgets—rely on confidentiality even when the underlying infrastructure aims to be transparent. The Kaspa project’s privacy emphasis, echoed in conversations about enterprise adoption, highlights that a meaningful on-chain privacy layer can be a prerequisite for companies to feel safe transacting with crypto as a payment method. As AI systems grow more capable, the ability to infer sensitive information from on-chain activity could become easier, making robust privacy protections not just desirable but necessary for security of business data.

These threads align with a broader narrative about cypherpunk values resurfacing in crypto discourse: the principle that encryption and privacy are foundational to a decentralized, censorship-resistant financial system. The idea that privacy tools can coexist with auditability and compliance is increasingly a focal point for developers building privacy-enhanced protocols and for policymakers considering how to balance innovation with consumer protection. The conversation is not about anonymity at all costs but about ensuring that legitimate users—businesses and individuals—have the ability to shield sensitive data while preserving the integrity of financial ecosystems.

In parallel, industry commentators point to a future in which on-chain privacy becomes a standard part of enterprise-grade crypto infrastructure. This includes recognition that centralized data stores and surveillance risks will attract AI-assisted threats, making privacy technologies a strategic requirement for any organization looking to deploy blockchain-based financial solutions. The discussion is complemented by media and research highlighting pragmatic privacy innovations and the potential for privacy-centric architectures to coexist with regulated, auditable systems. These developments suggest a trajectory where privacy enhancements are not a tech niche but a core governance and risk-management consideration for the crypto economy.

As regulators scrutinize the balance between transparency and confidentiality, the industry is watching for concrete privacy implementations that can satisfy both corporate needs and compliance frameworks. The dialogue around privacy has also gained renewed attention from mainstream voices who emphasize that the absence of privacy could undermine trust and slow adoption, particularly in areas like cross-border payments, supply chain finance, and employee compensation. The culmination of these conversations points to a broader, more nuanced approach to privacy in crypto—one that enables legitimate use while guarding sensitive information from exposure and misuse.

Further reading on related privacy themes includes discussions on the cypherpunk ethos and the evolving privacy landscape in crypto, including analyses of pragmatic privacy strategies and infrastructural approaches to privacy-preserving transactions. For a broader view of where privacy discussions are headed and how they intersect with industry and policy, see discussions on cypherpunk values in crypto, the role of privacy in CBDCs, and analyses of AI’s impact on on-chain data security.

What to watch next

- Regulatory and industry acceptance of privacy-preserving on-chain transactions for enterprise use, including payroll and treasurer workflows.

- Advancements in privacy-focused protocols and projects, with attention to practical implementations that can meet corporate governance standards.

- Analysis of how AI-enabled data analytics could exploit on-chain transparency and what mitigations are being proposed.

- Public discourse around cypherpunk values and their influence on product design, governance, and interoperability in crypto networks.

- Emerging coverage and research on pragmatic privacy in crypto, highlighting specific case studies and measurable privacy gains.

Sources & verification

- Changpeng Zhao’s comments on on-chain privacy and payroll visibility, via his X post: https://x.com/cz_binance/status/2023016538677371079

- Cypherpunk values and their place in modern crypto debates: https://cointelegraph.com/news/cypherpunk-values-dying-but-not-dead-yet-show

- Ray Dalio on privacy concerns around CBDCs: https://cointelegraph.com/news/zero-privacy-highly-controlled-cbdcs-coming-soon-warns-ray-dalio

- Kaspa’s perspective on enterprise privacy and adoption drivers: https://cointelegraph.com/news/institutions-wont-embrace-web3-without-privacy-options-dop-exec

- On-chain privacy in the context of AI and security threats: https://cointelegraph.com/news/onchain-privacy-necessity-age-ai-shielded-ceo

Privacy as the missing link for on-chain adoption

The on-chain privacy dilemma is not a theoretical debate but a practical bottleneck that could shape how quickly crypto-based payments move from pilot projects to everyday business operations. CZ’s remarks place a spotlight on concrete use cases—like payroll—where public visibility of transactions may undermine trust and willingness to adopt crypto at scale. The ongoing discussion around cypherpunk principles, combined with rising concerns about data security and AI-enabled threats, suggests that the next phase of crypto development will hinge on privacy-by-default features that preserve confidentiality without sacrificing auditable and compliant frameworks.

Ultimately, the market will look for a balanced path: privacy tools that protect sensitive information, clear governance around data handling, and privacy-preserving infrastructure that supports legitimate business needs. As projects and policymakers continue to test and refine these approaches, the industry’s ability to reconcile transparency with confidentiality could determine whether crypto payments become a mainstream, trusted option for corporate finance and everyday transactions alike.

Further reading on privacy’s role in the crypto era includes explorations of pragmatic privacy implementations and the revival of cypherpunk philosophies in today’s landscape, offering a framework for how technology and policy might converge to empower users while mitigating risk. The conversation remains dynamic, with developments that could redefine what “privacy” means in a decentralized economy and how enterprises securely participate in the programmable money revolution.

Crypto World

CZ Finally Reveals Hidden Story Behind Binance Exit From FTX

The relationship between Binance and FTX has long been one of the most debated rivalries in crypto. Now, Changpeng Zhao (CZ) is offering one of his most detailed public accounts yet.

CZ describes how cooperation turned into competition well before FTX’s 2022 collapse.

Sponsored

Sponsored

CZ Lifts the Curtain on Binance’s Secretive Break With FTX

Speaking on the All-In Podcast, the former Binance CEO traced the relationship back to early 2019, when he first met Sam Bankman-Fried (SBF), then running Alameda Research.

“Uh, I think I first met him in January 2019 in one of the Singapore conferences Binance organized. I think FTX did not exist at the time… Sam… was running Alameda,” CZ said, recalling that Alameda was then a major trading client on Binance and relations were initially friendly.

According to CZ, Alameda and the future FTX team soon approached Binance with proposals to collaborate on a derivatives platform. Several offers were made over time, including a joint venture structure that would have favored Binance.

Eventually, in late 2019, Binance agreed to invest.

“Yeah… we invested in them only 20% as equity at some point, and then we exited a year… later… we didn’t stay there for very long,” CZ said.

The deal included a token swap involving BNB and FTT, and Binance became a minority shareholder. CZ emphasized that:

- He remained a passive investor throughout the relationship

- Chose not to request financial statements because both firms operated competing futures businesses.

“Because of the competitive nature in the businesses… I never really… ask them for financial statements… I’m a very passive investor. So when I invest, I don’t get involved in their business,” he said.

Sponsored

Sponsored

Binance-FTX Tensions Beneath the Surface

Despite the early cooperation, CZ said relations deteriorated quickly. Reportedly, he began hearing reports that SBF was criticizing Binance in policy and regulatory circles in Washington.

“And then almost as soon as we did that deal, I kept hearing from my friends… SBF badmouthing us in the Washington circles,” CZ said.

He also described frustration over hiring practices, alleging that FTX recruited Binance staff by offering dramatically higher salaries. Allegedly, FTX would then use those hires to approach Binance’s VIP clients with competing offers.

While CZ said he attempted to maintain a cooperative tone publicly and even agreed to appear jointly at industry events, he suggested the rivalry was already intensifying behind the scenes.

Sponsored

Sponsored

Why Binance Exited

By early 2021, FTX was raising capital at valuations reportedly reaching $32 billion. CZ said Binance had contractual veto rights over future funding rounds but chose not to exercise them.

“So… we said… why don’t we exit, actually?” CZ recalled, explaining that Binance preferred to compete freely rather than remain a shareholder in a fast-growing rival.

The exit was finalized in July 2021, roughly a year and a half before FTX collapsed in November 2022.

“This is like a full year and a half before they had issues… at the time we didn’t know,” he said, rejecting claims that Binance exited because of inside knowledge. “That’s categorically not true.”

FTX Collapse and Its Aftermath

FTX ultimately failed after revelations that customer funds had been misused to cover losses at Alameda Research, triggering a liquidity crisis and bankruptcy.

Sponsored

Sponsored

Binance’s decision in November 2022 to liquidate its FTT holdings accelerated a bank run. However, subsequent investigations and court proceedings concluded that the core cause of the collapse was internal fraud and mismanagement.

CZ declined to comment extensively on ongoing legal disputes, including efforts by the FTX bankruptcy estate to recover funds from the 2021 exit. However, he reiterated that Binance had no visibility into FTX’s internal finances while it was a shareholder.

Taken together, CZ’s account portrays the Binance–FTX relationship not as a sudden breakdown but as a gradual unraveling. If his remarks are any guide, the relationship was marked by early cooperation, growing rivalry, and a strategic exit long before the crisis that reshaped the crypto industry.

SBF did not immediately respond to BeInCrypto’s request for comment about CZ’s claims.

Crypto World

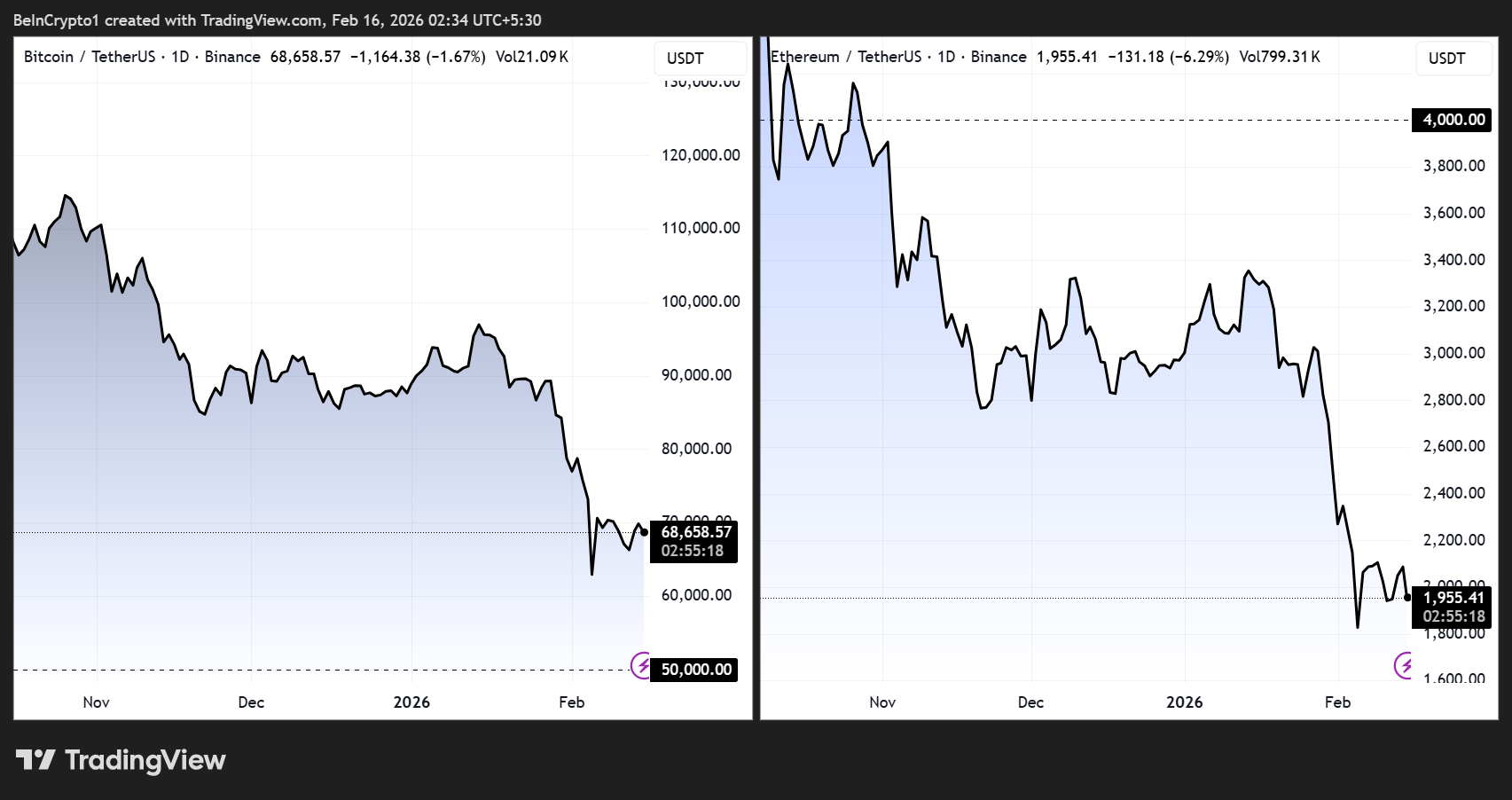

Why Coinbase CEO Is Not Shaken By 7% Ethereum Price Drop

Ethereum (ETH) has fallen 6.6% in the last 24 hours, trading around $1,947, as broader crypto markets continue to navigate volatility and macroeconomic headwinds.

Yet amidst the price turbulence, Coinbase CEO Brian Armstrong is pointing to a surprising source of optimism: retail investor resilience.

Sponsored

Retail “Diamond Hands” Hold Strong Despite Ethereum’s 7% Drop

Armstrong highlighted that, beyond weathering the market downturn, Coinbase’s retail users are actively buying the dip, resulting in net increases in BTC and ETH holdings.

“Retail users on Coinbase have been very resilient during these market conditions, according to our data,” Armstrong wrote. “They’ve been buying the dip.

According to the Coinbase executive, they have seen a native unit increase for retail users across BTC and ETH on the exchange.

Citing diamond hands, Armstrong says most of Coinbase’s customers had native unit balances in February equal to or greater than their balances in December.

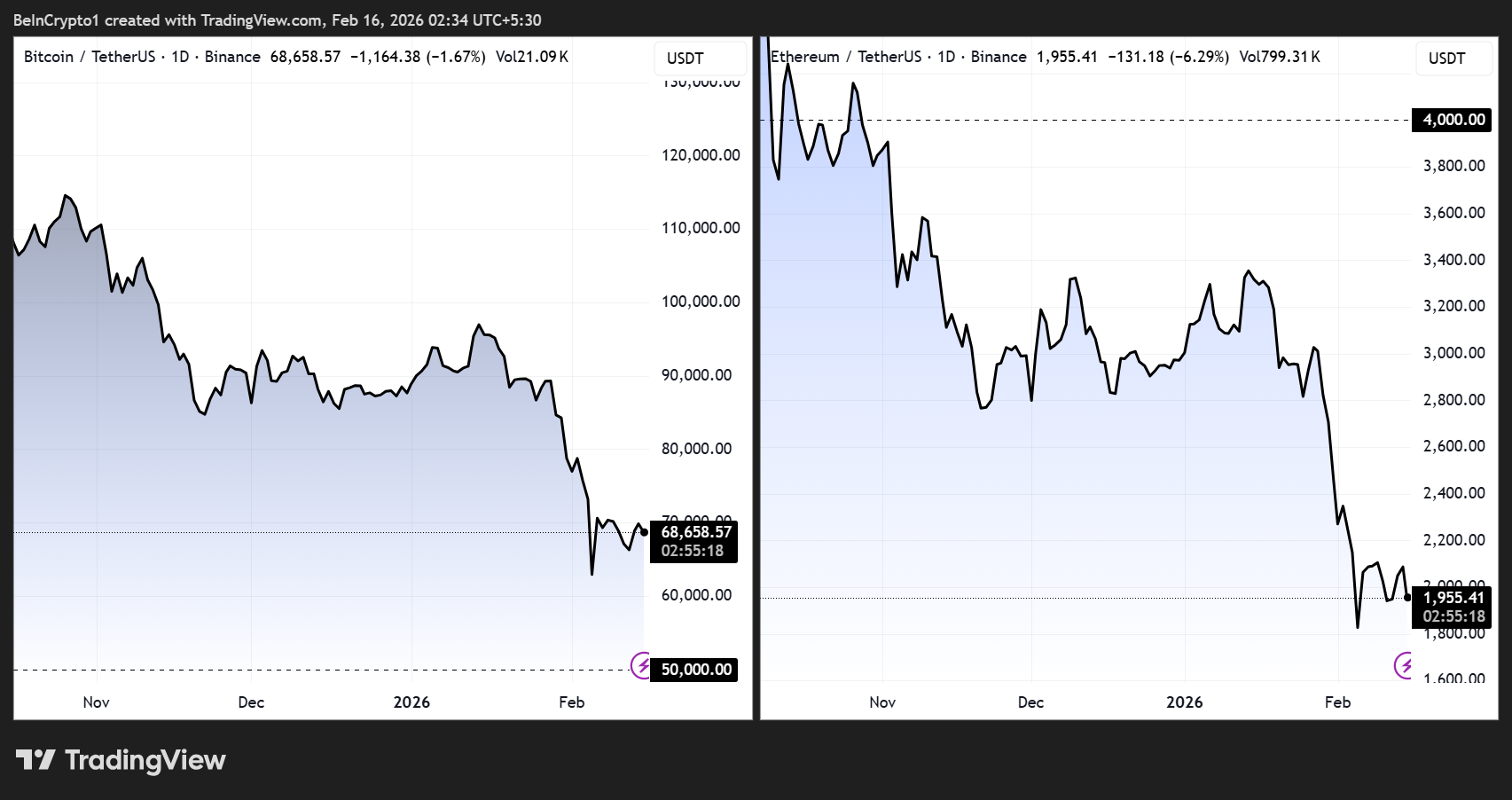

The Coinbase CEO framed this trend as a bullish counter-narrative to the current market gloom. While Bitcoin has pulled back toward the $68,000–$69,000 range and Ethereum has seen a 7% drop to levels below $2,000, retail investors are demonstrating conviction rather than panic.

Sponsored

The “diamond hands” phenomenon, where users maintain or increase their crypto holdings despite drawdowns, suggests a maturing retail base that may help stabilize prices and underpin long-term adoption.

Mixed Views Emerge as Retail Conviction Faces Market Risks

However, not everyone shares Armstrong’s optimism. Some critics argue that holding through sharp declines merely reflects significant drawdowns rather than true resilience.

Beyond holding behavior, community members are also voicing broader policy and market access concerns.

Sponsored

“Retail users deserve access to yield on stablecoins and the reversal of the accredited investor law,” commented Wendy O.

This suggests that expanded DeFi participation and yield opportunities could further strengthen retail confidence.

The context is important, coming days after Coinbase’s Q4 2025 earnings revealed declining trading volumes amid an 11% drop in broader crypto market capitalization.

Yet the exchange continued to see inflows of native units from retail users, hinting at a floor of accumulation that may cushion the market during bearish stretches.

Sponsored

Historical crypto cycles show that periods of sustained retail conviction often precede rebounds, as retail holders absorb volatility while institutional participants adopt more cautious postures.

Therefore, while Armstrong’s message reassures the crypto community and subtly defends Coinbase’s performance amid a turbulent quarter, it also shows that the retail market is changing from short-term speculation to longer-term accumulation.

While prices may remain choppy in the near term, these patterns suggest that retail investors are increasingly acting as stabilizing forces in the market, potentially serving as a catalyst for recovery when broader sentiment shifts.

Crypto World

XRP Rally Fails as Traders Take Early Profit: What’s Next?

XRP price surged sharply, nearly posting an 18.7% intraday gain before surrendering half of that advance. The token now trades near $1.53 after closing with a 9% rise.

Premature profit-taking by holders capped momentum and may influence XRP price direction in the coming sessions.

Sponsored

Sponsored

XRP Selling Continues

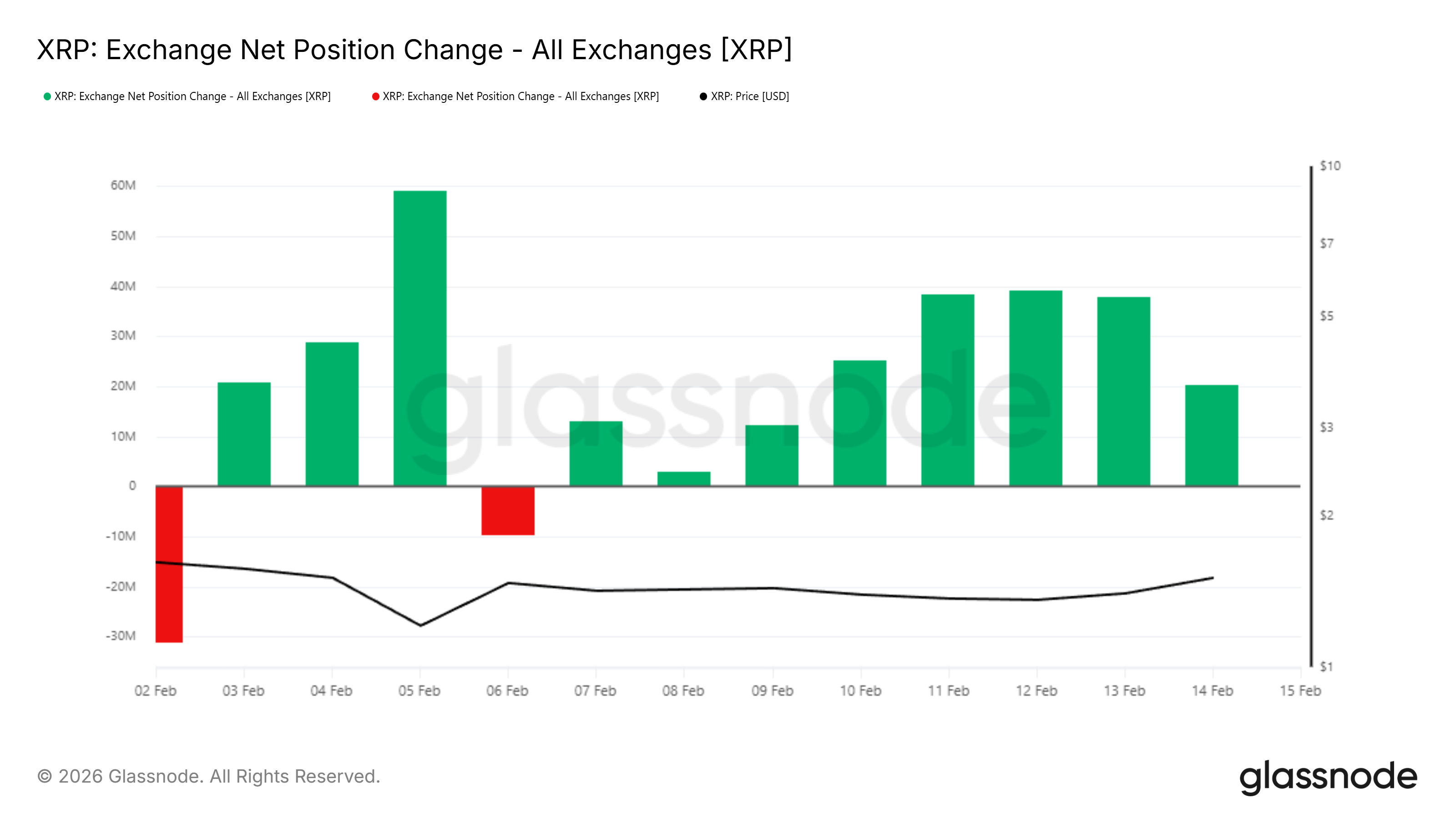

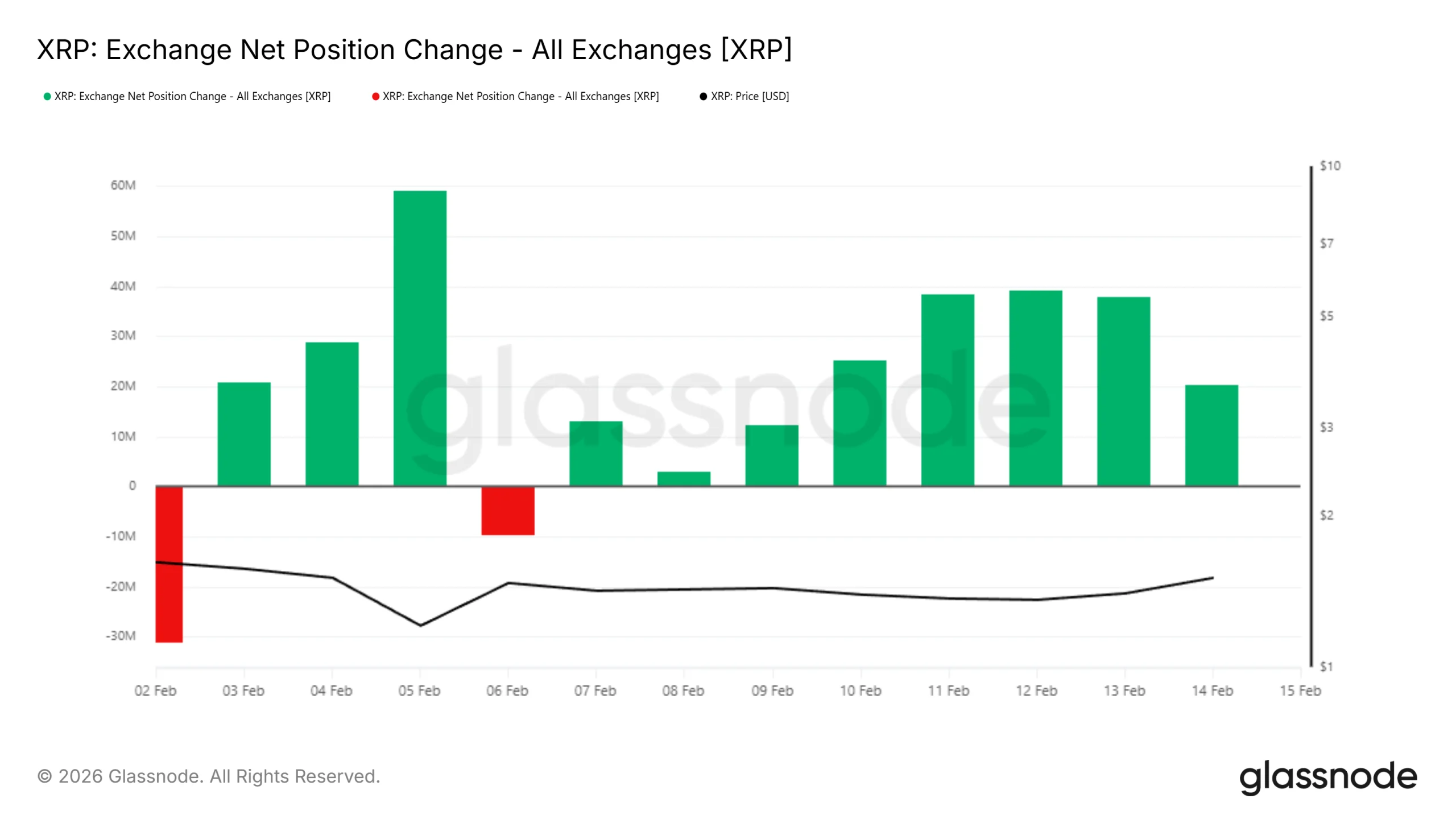

Exchange net position change data indicates that selling among XRP holders remains consistent. Green bars on the metric show continued inflows to exchanges, which typically signal intent to sell. This steady movement suggests holders are offloading XRP during price rallies.

Outflows continue to dominate net flows despite the recent surge. Investors appear eager to secure profits after weeks of volatility. Such behavior often suppresses sustained breakouts and reinforces consolidation near resistance levels.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

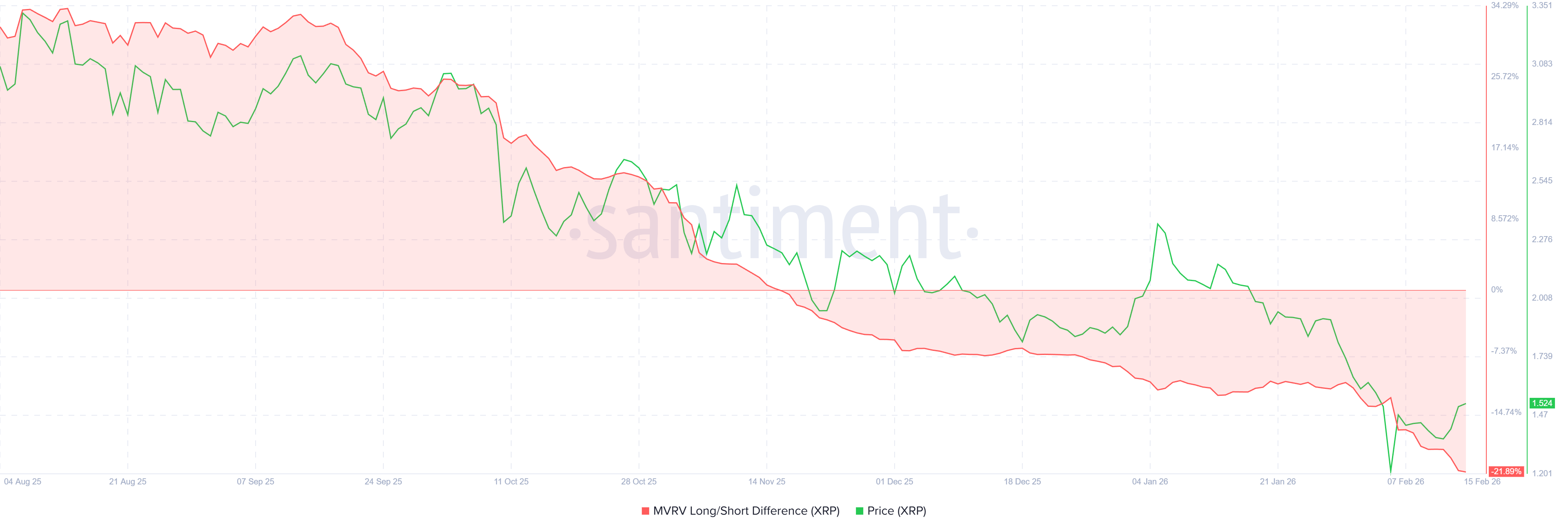

The MVRV Long/Short Difference highlights the dominance of XRP short-term holder profits. This metric measures the distribution of unrealized gains between long-term and short-term investors. Current low readings indicate that short-term holders hold a larger share of profits.

Short-term holders typically react quickly to price increases. Their tendency to sell at the first sign of gains likely contributed to the rally’s abrupt halt.

Sponsored

Sponsored

As long as STH profits dominate, upward momentum may encounter repeated resistance.

XRP Price May Face Some Resistance

XRP nearly recorded an 18.7% rise during the latest trading session before settling at a 9% gain. The long wick and rapid reduction in upside reflect early profit booking. Such behavior highlights fragile bullish conviction despite renewed interest.

The immediate objective is securing $1.51 as a support floor. XRP trades slightly above that level at $1.53.

Resistance near $1.62 may cap gains, and renewed selling from short-term holders could pull the price back toward $1.36.

If distribution slows and demand stabilizes, XRP could regain upward traction.

A decisive move above $1.62 would strengthen the technical structure. Sustained buying could drive the price toward $1.76, invalidating the bearish thesis and reinforcing recovery momentum.

Crypto World

Crypto Needs Privacy To Scale in Payments: Binance Co-Founder CZ

The lack of privacy for onchain transactions is one of the biggest hurdles to the mass adoption of cryptocurrencies for payments and a medium of exchange, according to Changpeng Zhao, co-founder of the Binance cryptocurrency exchange.

The executive commonly known as “CZ” said the lack of privacy prevents businesses and institutions from paying expenses in crypto. He gave this example:

“Lack of Privacy may be the missing link for crypto payments adoption. Imagine a company pays employees in crypto onchain. With the current state of crypto, you can pretty much see how much everyone in the company is paid by clicking the ‘from’ address.”

In a previous conversation with investor and host of the All-In Podcast Chamath Palihapitiya, CZ also cited physical security concerns as a reason why onchain transparency is a risk to users. The comments follow a revival of privacy and the cypherpunk ethos in crypto.

Cypherpunk ideology is central to the birth of cryptocurrencies, peer-to-peer digital money that can be transferred without centralized intermediaries, and the encryption of online communication to shield messages from surveillance.

Related: ‘No privacy’ CBDCs will come, warns billionaire Ray Dalio

Encrypt everything: the rise of onchain privacy

Businesses and institutions will not embrace crypto, Web3 platforms, or blockchain if they cannot shield their transactions, Avidan Abitbol, the former Business Development Specialist for the Kaspa cryptocurrency project, told Cointelegraph.

Transaction data contains critical information about corporate workflows, trade secrets, business relationships and can provide clues about a company’s overall financial health to competitors, he said.

These issues can lead to corporate theft, negatively impact corporations during business negotiations and increase the threat of an institution being targeted by scammers, Abitbol added.

The continued technological development of AI systems will exacerbate this issue, according to Eran Barak, the former CEO of privacy company Shielded Technologies.

Centralized servers containing critical or valuable information will become increasingly attractive for AI-assisted hackers, he told Cointelegraph.

This means that onchain privacy technologies will become necessary to protect valuable online information as AI becomes more powerful and can assemble heuristic clues about a potential target and statistically model probable outcomes, he said.

Magazine: 2026 is the year of pragmatic privacy in crypto: Canton, Zcash and more

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business7 days ago

Business7 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Sports7 days ago

Sports7 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Tech1 day ago

Tech1 day agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat7 days ago

NewsBeat7 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat10 hours ago

NewsBeat10 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World3 days ago

Crypto World3 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics5 days ago

Politics5 days agoWhy was a dog-humping paedo treated like a saint?