Crypto World

CryptoQuant Founder Proposes Freezing Old Bitcoin Addresses to Prevent Quantum Attacks

Bitcoin may need drastic fix against quantum threats as CryptoQuant founder urges freezing inactive wallets holding billions in BTC.

Ki Young Ju, founder of CryptoQuant, has proposed that a future Bitcoin (BTC) quantum upgrade may require freezing old addresses to protect against potential theft by quantum computers.

He also believes that addressing the risk would be challenging because the crypto community has historically struggled to agree on protocol changes.

Solution to Quantum Risk

In a social media post, Ju explained that anyone holding BTC in old address types faces the same risk. This is because the digital assets could either be frozen by design or stolen if quantum machines evolve enough to break BTC’s cryptography. He added that even securely stored private keys could become useless if owners fail to adopt protocol upgrades in time.

“In simple terms, coins that appear perfectly safe today could become spendable by an attacker tomorrow,” warned Ju.

In response to the threat, the CryptoQuant founder has suggested freezing old addresses, including the one containing Satoshi’s 1 million BTC, to prevent them from being stolen or compromised.

“Would you support freezing dormant coins, including Satoshi’s, to save BTC from quantum attacks?” he asked.

Bitcoin’s security relies on cryptography that is effectively unbreakable by classical computers. However, quantum computers change this assumption. Under certain conditions, a sufficiently powerful machine of this kind could get a private key from an exposed public key.

Once a public key is revealed on-chain, the risk is permanent. Ju estimates that roughly 6.89 million BTC are currently exposed to such attacks. Data shows that about 3.4 million BTC have been dormant for over a decade, including Satoshi’s stash, representing hundreds of billions of dollars in potential value. He explained that with so much value at risk, hackers could be very motivated if the technology becomes cheaper and easier to use.

Social Consensus Challenges

Even if freezing dormant BTC is technically possible, achieving community agreement is still a major challenge. This is because such solutions move quickly, while social consensus happens slowly.

You may also like:

The Bitcoin ecosystem has historically struggled with agreeing on protocol changes. This can be seen in the block size debate, which lasted more than three years and led to hard forks. Another example is the failed SegWit2x upgrade, demonstrating how difficult coming to an agreement can be.

Freezing coins, even to prevent quantum attacks, would likely face similar resistance because it conflicts with the OG cryptocurrency’s core philosophy of decentralization and user control.

Ju cautioned that the lack of full agreement could potentially lead to rival BTC forks as quantum technology progresses. According to him, the real question is not whether the threat will arrive in five or ten years, but whether the crypto community will be united on how to handle it before then.

Elsewhere, Bankless co-founder David Hoffman believes that in the event of a quantum attack, ETH would continue functioning normally even if BTC were to fail because it has been long prepared for these challenges.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

$887 Million Inflows Raise Red Flags

Ethereum has extended its recent decline, slipping toward the $2,000 level. At first glance, the pullback appears to be stabilizing. However, on-chain data suggests the weakness may not be over.

While ETH is hovering near a key level, underlying metrics reveal persistent stress; there is a chance that this cycle mirrors prior downturn patterns.

Sponsored

Sponsored

Ethereum Can Repeat History

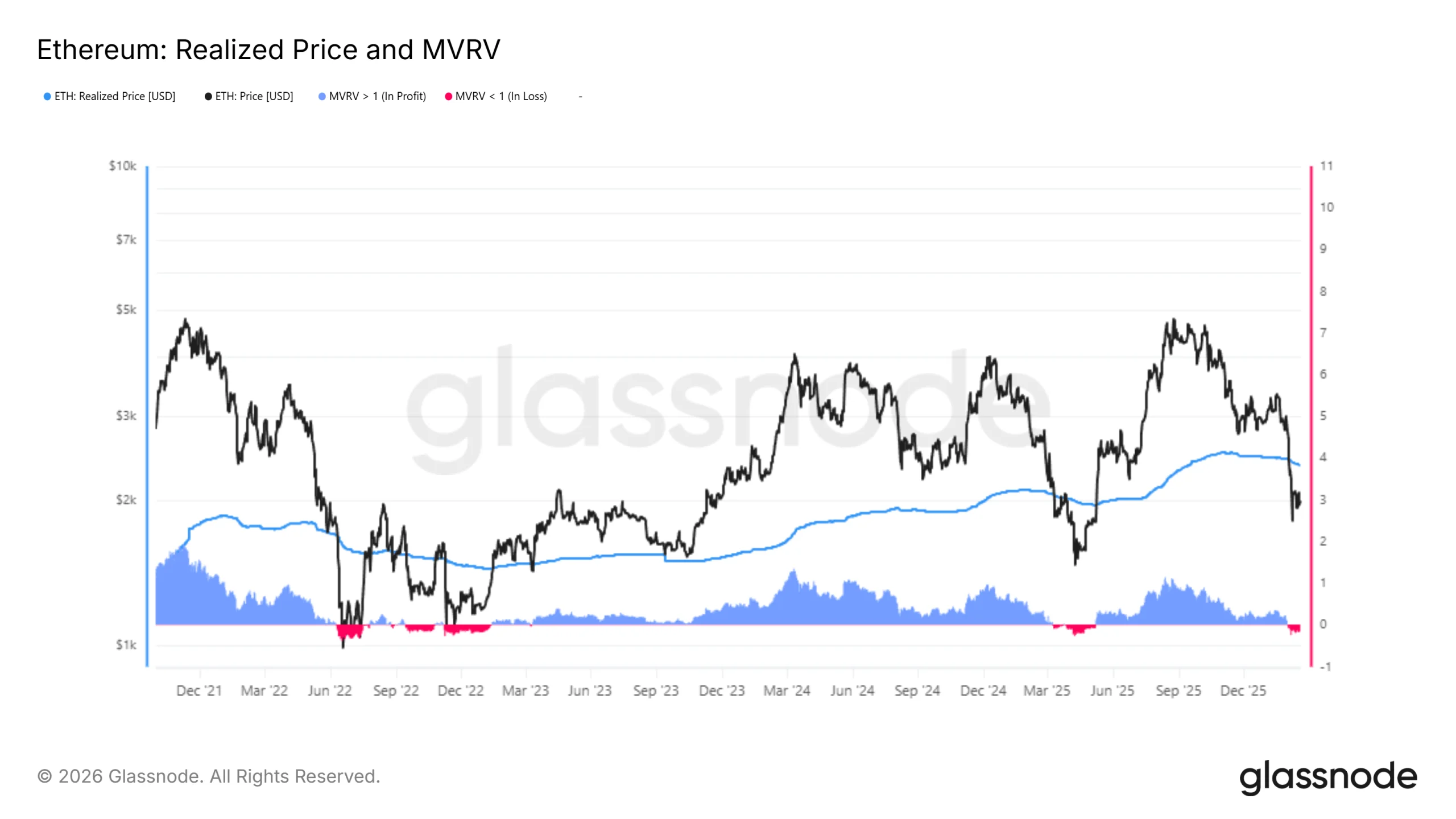

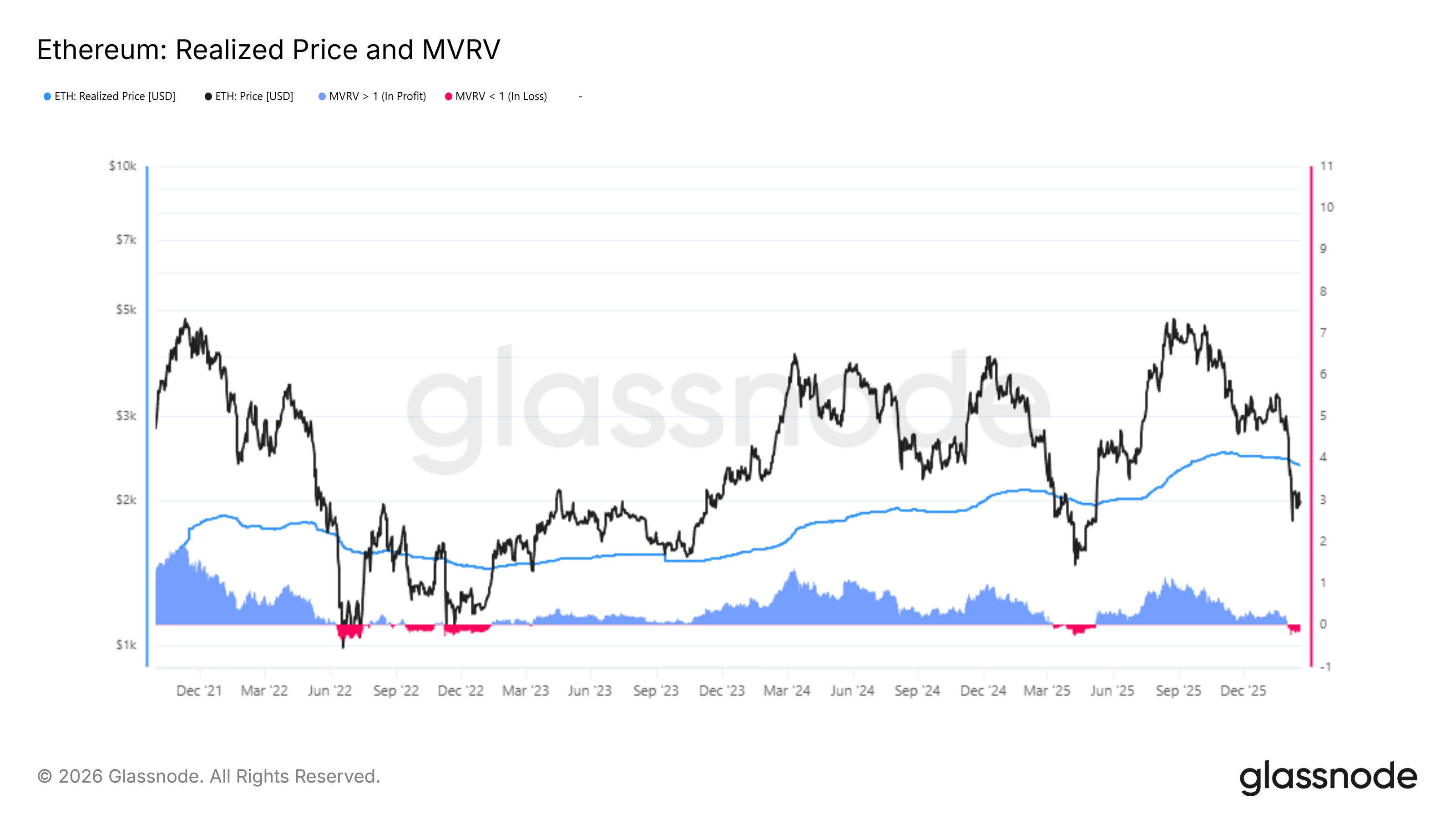

Ethereum fell below its Realized Price toward the end of January. Since then, ETH has remained trapped under this crucial on-chain benchmark. The Realized Price reflects the average acquisition cost of all coins in circulation. Trading below it often signals widespread unrealized losses.

The Market Value to Realized Value, or MVRV, ratio confirms this pressure. ETH’s MVRV has remained below 1.0, indicating that the average holder is at a loss. Extended periods in this zone historically coincide with deep market corrections.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Past cycles show that recovery eventually follows prolonged sub-Realized Price trading. However, such recoveries often occur after capitulation phases. In prior bear markets, ETH experienced additional downside before forming durable bottoms. Current conditions suggest that further decline could precede stabilization.

ETH Selling Is Active

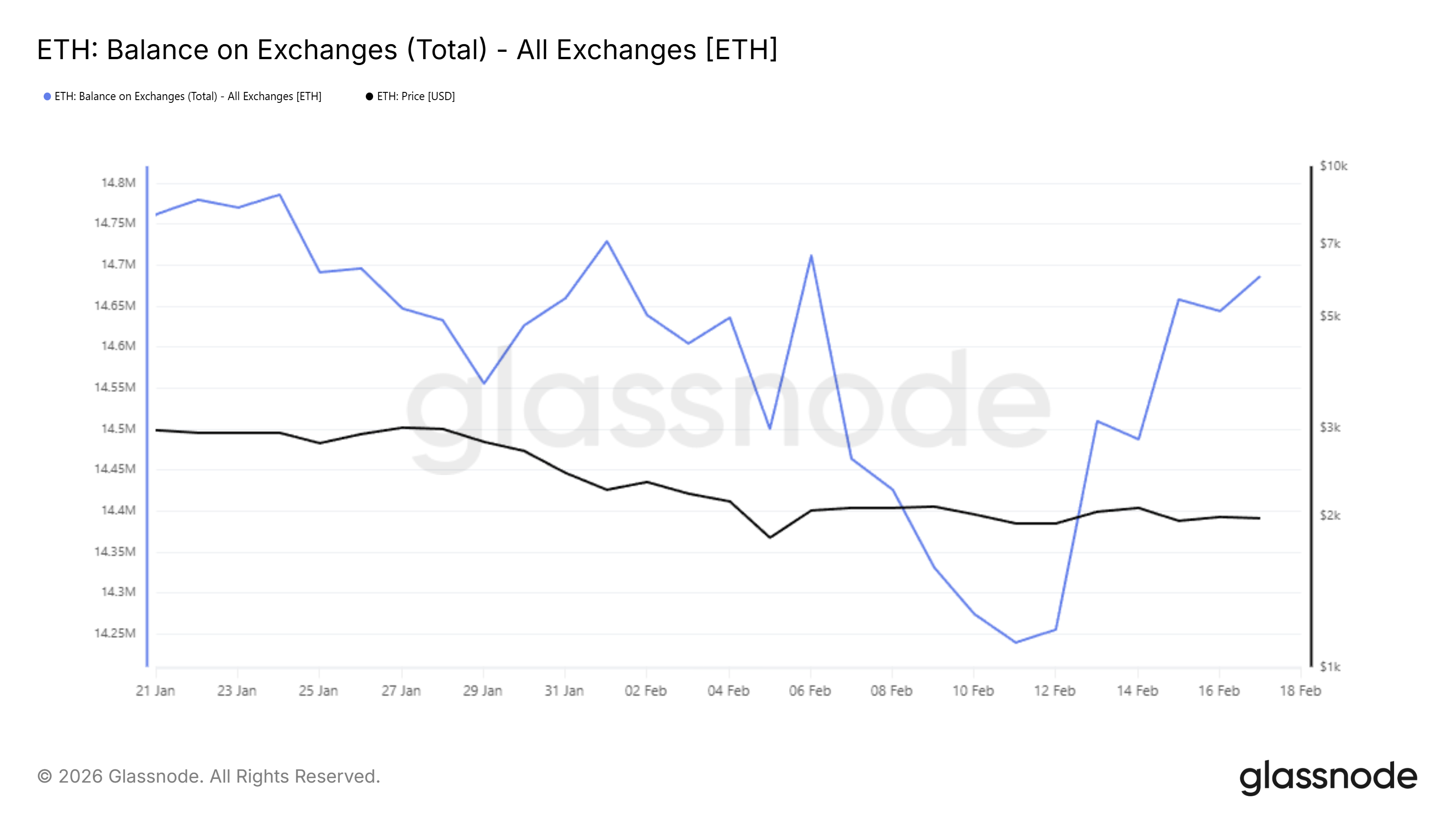

Exchange On-Balance data reveals an increasing supply moving onto trading platforms. Over the past week, approximately 445,000 ETH entered exchanges. At current prices, this represents more than $887 million in potential sell pressure.

Sponsored

Sponsored

Rising exchange balances typically indicate distribution. ETH Investors often transfer assets to exchanges with the intention of selling. The scale of recent inflows suggests heightened caution among holders.

If the price fails to rebound quickly, panic selling could intensify. Similar spikes in exchange deposits have historically preceded sharp drawdowns. The combination of unrealized losses and rising supply increases downside vulnerability.

ETH Price May Witness Further Decline

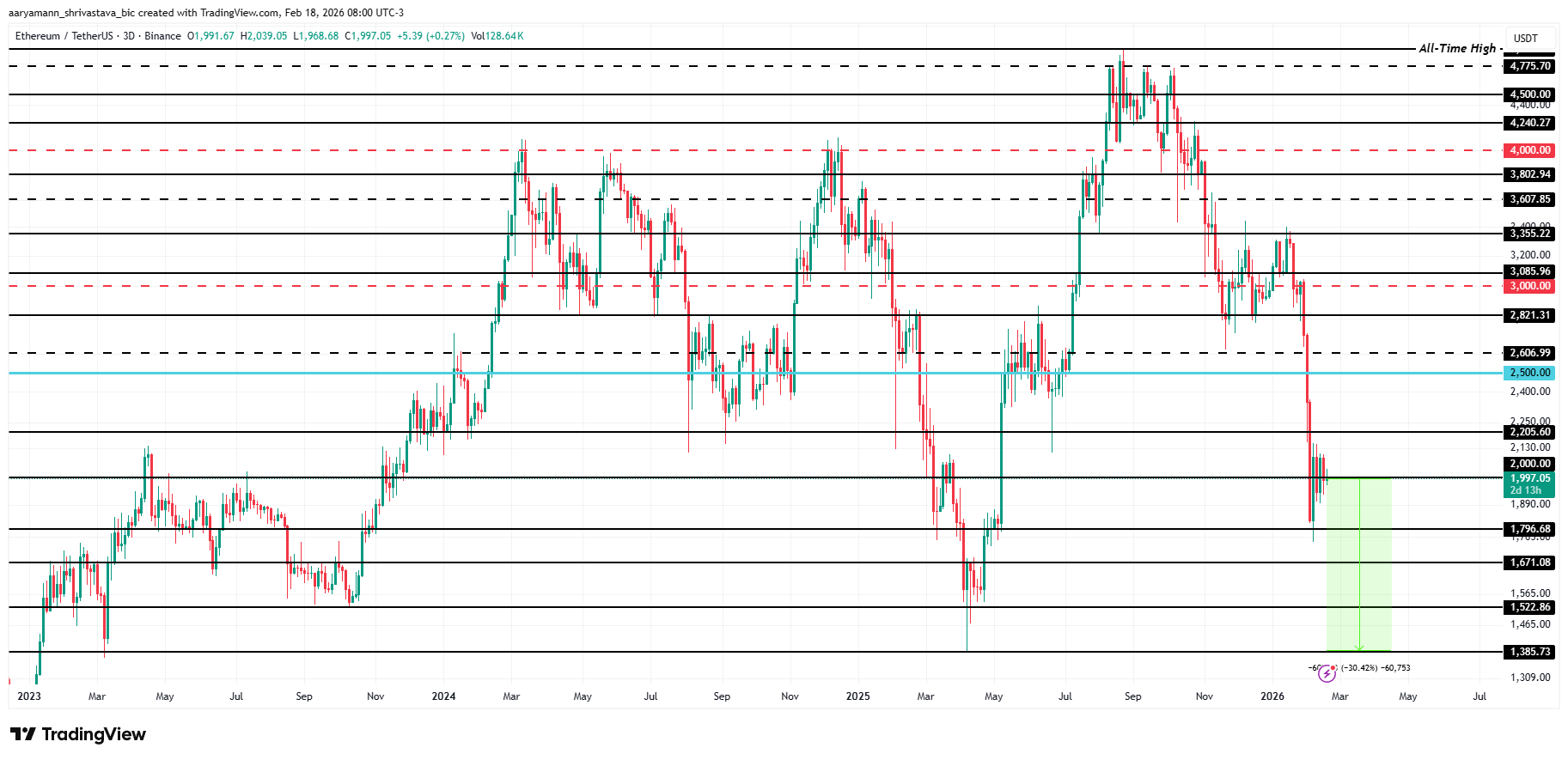

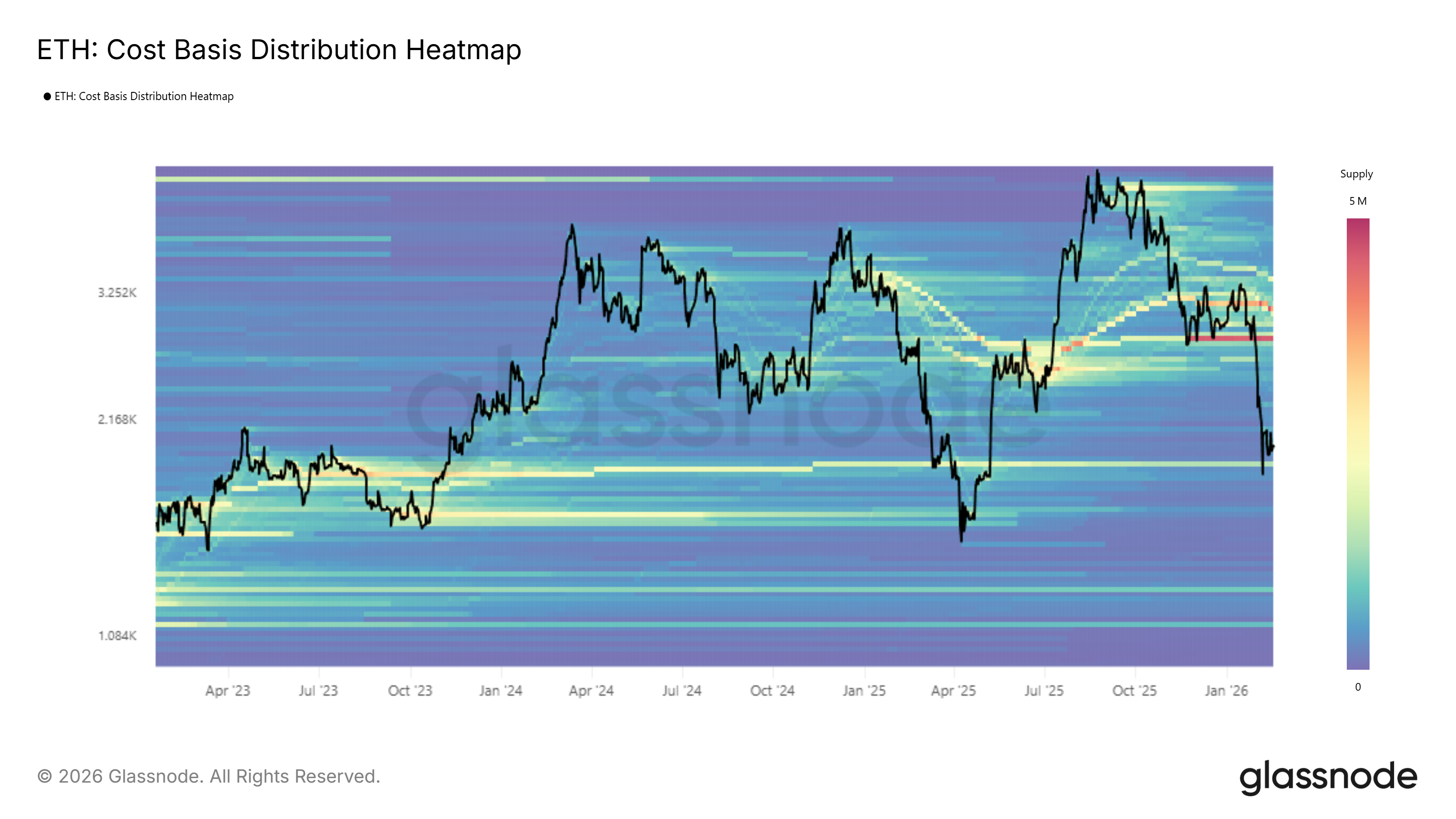

Ethereum is trading at $1,997 at the time of writing. The $2,000 level represents a critical psychological threshold. While this zone may attract short-term buying, persistent selling pressure reduces the probability of a sustained bounce. The $1,866 level represents the next notable support based on the CBD Heatmap.

This zone reflects prior accumulation activity. If ETH loses $1,866, downside risk expands toward $1,385. This level has served as a structural bottom during previous cycles. A drop to $1,385 would represent roughly a 30% decline from current levels. The next major support beyond that sits near $1,231.

Conversely, a change in investor behavior could alter the trajectory. If holders reduce exchange deposits and accumulation resumes, ETH could stabilize above $2,000. A rebound may target $2,205 in the short term. Sustained buying pressure could extend gains toward $2,500, invalidating the current bearish outlook.

Crypto World

Relative-Value Strategies Beat Directional Bets as Crypto Volatility Bites

Crypto funds shifted to market-neutral trades as volatility punished directional bets and triggered a fourth straight month of losses.

Crypto funds opened 2026 with losses and defensive positioning, according to a February 18 survey by Presto Research and Otos Data.

The report shows investors shifting toward relative-value and market-neutral trades as macro uncertainty and price swings weigh on directional bets.

Market-Neutral Funds Outperform as Directional Strategies Sink

According to Presto’s survey, all liquid crypto hedge funds dipped by an average of 1.49% last month. The losses extended a difficult stretch for active managers, marking the fourth consecutive month of negative equally weighted performance across both fundamental and quantitative categories, a sequence not seen since late 2018 and early 2019.

The dispersion within the numbers tells a clearer story, with fundamental funds dropping 3.01% in January, while quantitative funds fell 3.51%. On the other hand, Presto revealed that market-neutral funds, which aim to profit from price differences rather than market direction, gained about 1.6%. Over six months, those same neutral strategies are up nearly 5% while fundamental funds are down more than 24%.

During that same period, Bitcoin (BTC) has fallen approximately 31%, Ethereum (ETH) 23%, and Solana (SOL) 47%.

Analysis by other market watchers supports the fragile tone, with data from Alphractal showing that Bitcoin was trading in a stress zone where weaker holders tend to sell while long-term investors accumulate. The firm’s founder, Joao Wedson, said long-term holder profit levels are still positive, a sign the market may not yet be at a final turning point.

Positioning Data Points to Defensive Posture, Not Panic

The Presto survey’s flow analysis shows a clear behavioral arc through January. The month opened with constructive positioning and call buying, but as rallies failed, traders rotated into tactical fade structures. By the third week, downside hedging became dominant, as ETF flows fluctuated, with periods of inflow offset by miner distribution and whale selling. Meanwhile, corporate accumulation remained present but insufficient to offset broader risk reduction.

You may also like:

Importantly, the report noted that positioning into the month-end was not outright capitulative. The analysts stated that while protection was in place, the leverage looked more orderly compared to the chaotic reset event in October 2025.

The absence of broad panic suggests that stress is building in pockets rather than being expressed as systemic liquidation. This distinction matters as the market assesses whether January represents continuation or exhaustion.

The researchers advised that until policy clarity improves or a structural crypto-specific catalyst emerges, rallies are likely to fade, volatility will stay reactive to headline risk, and adaptability rather than conviction will determine survival in the first quarter of 2026.

Whether January marked a continuation of the bear trend or the exhaustion phase of selling pressure remains an open question. However, at present, the data indicate that strategies that prioritize relative value over directional conviction are successfully navigating the current challenges.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ethereum Protocol Restructures Into Three Tracks to Drive Scaling and Security Goals in 2026

TLDR:

- Ethereum shipped Pectra and Fusaka in 2025, doubling blob throughput and enabling validator data sampling via PeerDAS.

- The new Scale track merges L1 and blob scaling efforts, targeting gas limits beyond 100M under unified leadership.

- The Improve UX track advances native account abstraction and cross-L2 interoperability as top priorities for 2026.

- The new Harden the L1 track addresses post-quantum security, censorship resistance, and network testing infrastructure.

Ethereum Protocol has announced a major structural shift heading into 2026. The Ethereum Foundation’s Protocol team has reorganized its work into three core tracks: Scale, Improve UX, and Harden the L1.

This follows a productive 2025 that saw two major network upgrades shipped. The restructuring reflects a more mature approach to developing Ethereum’s infrastructure. It also sets a clear roadmap for the year ahead, covering scaling, usability, and network security.

Ethereum Protocol Reflects on a Productive 2025

Ethereum Protocol shipped two major upgrades in 2025: Pectra in May and Fusaka in December. Pectra introduced EIP-7702, allowing externally owned accounts to temporarily execute smart contract code.

This enabled transaction batching, gas sponsorship, and social recovery for users. Pectra also doubled blob throughput and raised the max effective validator balance to 2,048 ETH.

Fusaka brought PeerDAS to mainnet, changing how validators handle blob data. Instead of downloading full blob data, validators now sample it, cutting bandwidth requirements.

This change enabled an 8x increase in theoretical blob capacity. Two additional Blob Parameter Only forks shipped alongside Fusaka to begin ramping up blobs per block.

Beyond the two forks, the mainnet gas limit rose from 30M to 60M during 2025. This marked the first meaningful gas limit increase since 2021.

History expiry also removed pre-Merge data from full nodes, saving hundreds of gigabytes of disk space. On the UX side, the Open Intents Framework reached production and cross-chain address standards moved forward.

These milestones made 2025 one of the most active years at the Ethereum protocol level. With those deliverables behind it, the team saw an opportunity to restructure.

The new track model moves away from milestone-driven initiatives. It instead organizes work around longer-term goals.

Three Tracks Now Guide Ethereum Protocol’s Direction

The Scale track merges what were previously two separate efforts: Scale L1 and Scale Blobs. Led by Ansgar Dietrichs, Marius van der Wijden, and Raúl Kripalani, it targets gas limits beyond 100M.

The track also covers ePBS, zkEVM attester client development, and statelessness research. Blob scaling and execution scaling are treated as one connected effort.

The Improve UX track, led by Barnabé Monnot and Matt Garnett, focuses on account abstraction and interoperability. EIP-7701 and EIP-8141 are pushing smart account logic directly into the protocol.

Work here also connects to post-quantum readiness, since native account abstraction offers a natural path away from ECDSA. Cross-L2 interactions and faster confirmations remain central priorities.

The Harden the L1 track is entirely new and is led by Fredrik Svantes, Parithosh Jayanthi, and Thomas Thiery. Fredrik leads the Trillion Dollar Security Initiative, covering post-quantum hardening and trustless RPCs.

Thomas focuses on censorship resistance research, including FOCIL (EIP-7805) and measurable resistance metrics. Parithosh oversees devnets, testnets, and client interoperability testing infrastructure.

Glamsterdam is the next planned network upgrade, targeting the first half of 2026. Hegotá is expected to follow later in the year.

Crypto World

Why Pi Network Coin is pumping as crypto prices remain muted

Pi Network Coin’s price is surging this month, even as the broader crypto market remains muted, with Bitcoin stuck at $67,000.

Summary

- Pi Network Coin price has rebounded by nearly 50% from its lowest level this month.

- The network will celebrate the first year anniversary of the mainnet launch on Friday.

- There are rising odds that it will be listed by Kraken, a top US exchange.

Pi Coin (PI) token jumped to a high of $0.20 on Wednesday, February 18, up by nearly 50% from its lowest level this month. This rally has brought its market capitalization to over $1.68 billion.

Pi Network is soaring as several important factors converge. First, the network will celebrate the first anniversary of its mainnet launch this Friday. As such, there is a likelihood the developers will make a major announcement to mark this occasion.

Second, there is a likelihood that Kraken, an American crypto exchange valued at over $20 billion, will list it later this year. Kraken added it to the chain section of the listing roadmap page.

A Kraken listing would be a big deal, as it would expose it to American investors, since it is now listed on exchanges like OKX, MEXC, and Gate, which have a negligible market share in the country. It would also raise the possibility of being listed by other companies, such as Binance and Coinbase.

Pi Coin’s price is soaring ahead of the first validator rewards distribution, which will occur in March this year. The risk, however, is that many of these validators may decide to sell their rewards.

Pi is also rising after developers began implementing a major network upgrade, as it transitions from Protocol 19 of the Stellar Network Consensus to Protocol 23. The first stage of the upgrade started on Sunday, and the process may continue in the coming weeks.

Meanwhile, data compiled by PiScan shows that the pace of token unlocks will continue to fall over the next few months. 109 million tokens will be unlocked in the remainder of February, followed by 104 million in March, 86 million in April, and 78 million in May.

Pi Network Coin price technical analysis

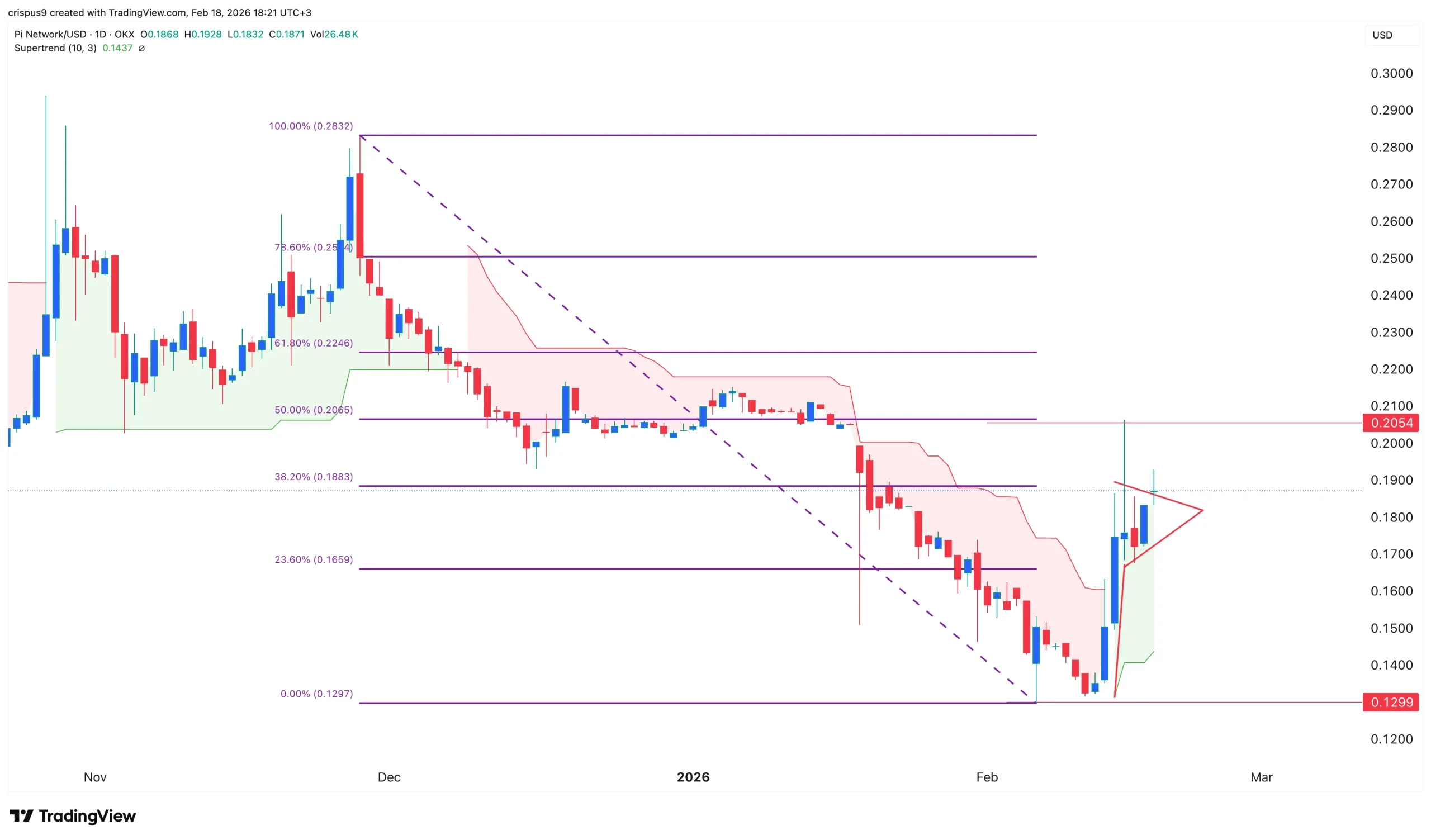

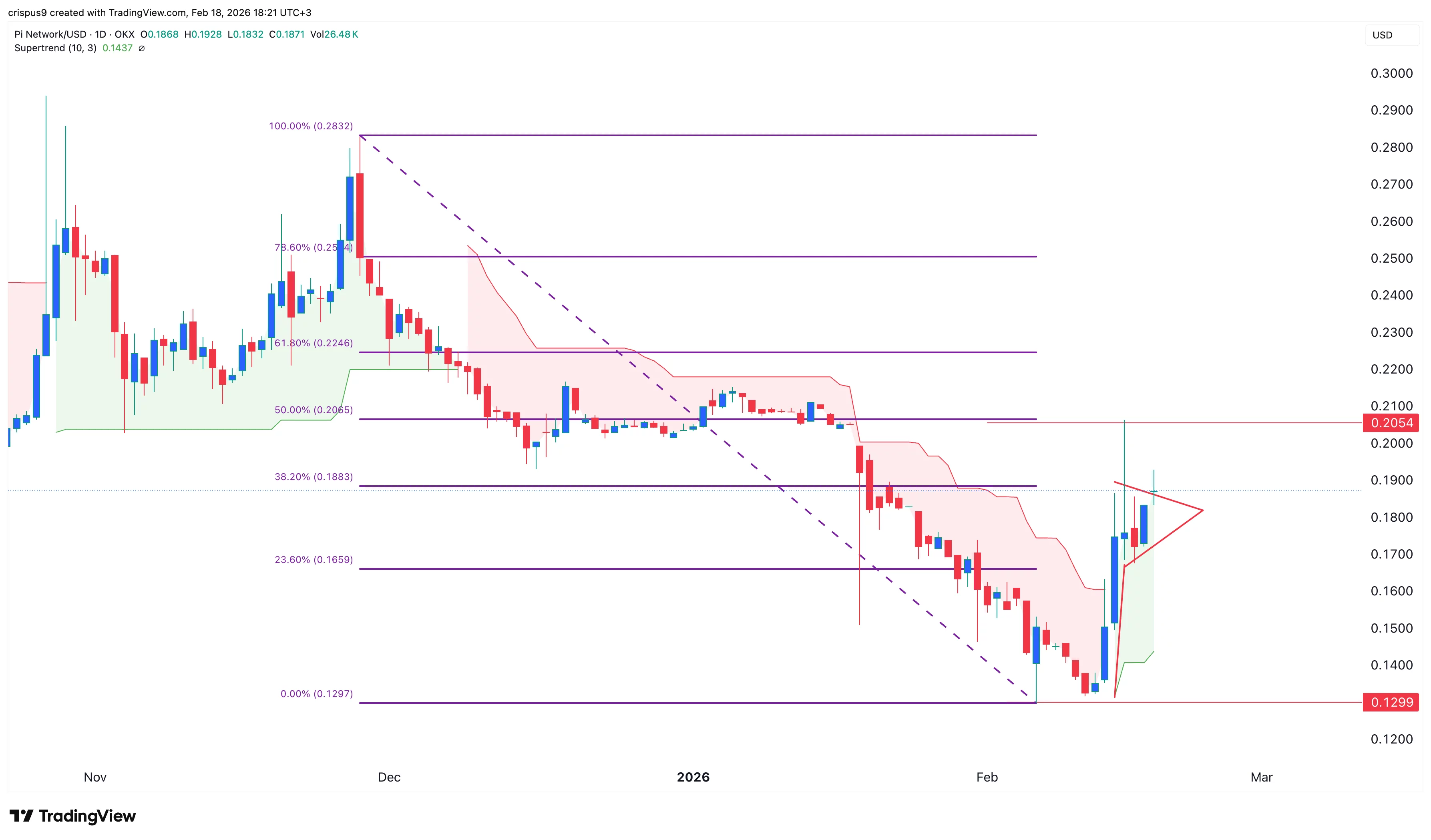

The 12-hour chart shows that the Pi Network Coin price has rebounded in the past few weeks, moving from a low of $0.1300 to the current $0.1870. It has flipped the Supertrend indicator from red to green for the first time since October last year.

The coin has also jumped above the 50-period and 100-period moving averages, and is slowly forming a bullish pennant pattern. It is also hovering at the 38.2% Fibonacci Retracement level.

Therefore, the coin may continue rising as bulls target the next key resistance level at $0.2055, its lowest level this month. This target aligns with the 50% Fibonacci Retracement level.

Crypto World

Crypto Lobby Forms Working Group to Push for Prediction Market Regulatory Clarity

The Digital Chamber has officially announced the Prediction Markets Working Group, a strategic unit designed to secure federal oversight for the booming wagering sector.

With individual state regulators cracking down on prediction market platforms, the group is pushing for the Commodity Futures Trading Commission (CFTC) to take exclusive control to end the fragmentation of the market.

Key Takeaways

- New Defense Unit: The Digital Chamber forms a specialized group to defend prediction markets against state-level bans.

- Primary Goal: Advocating for CFTC supremacy over fragmented state gaming commission enforcement.

- First Move: Strategic letter sent to CFTC Chair Mike Selig urging tailored federal rulemaking over litigation.

What’s Happening to U.S. Prediction Markets Now?

The regulatory turf war has reached a boiling point. While volumes on decentralized platforms explode, state regulators are effectively trying to shut the sector down.

Just recently, the Nevada Gaming Control Board hit Kalshi with a civil enforcement action, seeking an injunction against what they term “unlicensed wagering.”

This creates a hostile environment for traders. Platforms are caught between federal compliance efforts and aggressive state gaming commissions claiming jurisdiction.

The Digital Chamber’s move is a direct response to this chaos, aiming to consolidate oversight under federal law rather than state gambling statutes.

The Mechanics of the Push

The group’s immediate strategy involves aggressive advocacy and litigation support. In the announcement released Tuesday, the Digital Chamber outlined plans to file “friend-of-the-court” briefs to educate judges on the CFTC’s historic regulatory exclusivity.

Their first official action was sending a letter to CFTC Chairman Mike Selig. The group praised Selig’s stance on maintaining federal jurisdiction but demanded an end to regulation by enforcement.

“For too long, operators in this space have navigated a maze of regulatory ambiguity, including unclear overlaps between federal and state regulators,” the group stated.

This initiative parallels broader legislative efforts. While Trump wants a market structure bill soon, this working group seeks to define prediction markets strictly as financial derivatives, not gambling products.

Discover: The hottest meme coins on Solana right now.

What Happens Next for Traders?

If the working group succeeds in establishing federal oversight, it opens the floodgates for institutional capital.

A clear mandate from the CFTC would remove the “gambling” stigma and allow US-based traders deeper access to liquid markets without fear of sudden platform geo-blocking.

However, the legal battles will likely drag on. While international jurisdictions move quickly, evident as Germany and the EU solidify frameworks like MiCA, the US remains stuck in litigation.

The next thing to look out for will be the CFTC’s response to the Digital Chamber’s letter.

Any signal of formal rulemaking could be a bullish catalyst for governance tokens associated with prediction platforms.

Discover: The next crypto to explode.

The post Crypto Lobby Forms Working Group to Push for Prediction Market Regulatory Clarity appeared first on Cryptonews.

Crypto World

Fed minutes January 2026:

Divided Federal Reserve officials at their January meeting indicated that further interest rate cuts should be paused for now and could resume later in the year only if inflation cooperates.

While the decision to hold the central bank’s benchmark rate steady mostly was met with approval, the path ahead appeared less certain, with members conflicted between fighting inflation and supporting the labor market, according to minutes released Wednesday from the Jan. 27-28 Federal Open Market Committee meeting.

“In considering the outlook for monetary policy, several participants commented that further downward adjustments to the target range for the federal funds rate would likely be appropriate if inflation were to decline in line with their expectations,” the meeting summary said.

However, meeting participants disagreed on where policy should head, with officials debating over whether the focus should be more on fighting inflation or supporting the labor market.

“Some participants commented that it would likely be appropriate to hold the policy rate steady for some time as the Committee carefully assesses incoming data, and a number of these participants judged that additional policy easing may not be warranted until there was clear indication that the progress of disinflation was firmly back on track,” the minutes said.

Moreover, some even entertained the notion that rate hikes could be on the table and wanted the post-meeting statement to more closely reflect “a two-sided description of the Committee’s future interest rate decisions.”

Such a description would have reflected “the possibility that upward adjustments to the target range for the federal funds rate could be appropriate if inflation remains at above-target levels.”

The Fed reduced its benchmark borrowing rate by three-quarters of a percentage point in consecutive cuts in September, October and December. Those moves put the key rate in a range between 3.5%-3.75%.

The meeting was the first for a new voting cast of regional presidents, at least two of whom, Lorie Logan of Dallas and Beth Hammack of Cleveland, have publicly said they think they Fed should be on hold indefinitely. Both have said they see inflation as a continuing threat and should be the focus of policy now. All 19 governors and regional presidents participate at the meeting, but only 12 vote.

With the Fed already split along ideological lines, the fissure could grow deeper if former Governor Kevin Warsh is confirmed as the next central bank chair. Warsh has spoken in favor of lower rates, a position also supported by current Governors Stephen Miran and Christopher Waller. Both Waller and Miran voted against the January decision, preferring instead another quarter-point cut. Current Chair Jerome Powell‘s term ends in May.

The meeting minutes do not identify individual participants and featured an array of characterizations to describe positions, rotating between “some,” “a few,” “many” and even featured two rare references to “a vast majority.”

Participants generally expected inflation to come down through the year, “though the pace and timing of this decline remained uncertain.” They noted the impact tariffs were having on prices and said they expected the impact to wane as the year goes by.

“Most participants, however, cautioned that progress toward the Committee’s 2 percent objective might be slower and more uneven than generally expected and judged that the risk of inflation running persistently above the Committee’s objective was meaningful,” the document said.

At the meeting, the rate-setting FOMC adjusted some of the language in its post-meeting statement. The changes noted that the risks to inflation and the labor market had come more closely into balance, softening prior worries over the employment picture.

Since the meeting, labor data has been a mixed bag, with indications that private sector job creation is slowing further and that the meager growth is coming almost entirely from the health-care sector. However, the unemployment rate dipped to 4.3% in January and nonfarm payroll growth was stronger than expected.

On inflation, the Fed’s key personal consumption expenditures prices metric has been mired around 3%. However, a report last week showed that the consumer price index when excluding food and energy prices was at its lowest in nearly five years.

Futures traders are placing the best bet for the next cut to come in June, with another in September or October, according to the CME Group’s FedWatch gauge.

Crypto World

XRP gains momentum as Arizona moves to add it to state crypto reserve

- XRP has held strong near $1.40 despite mixed market signals.

- Key resistance levels to watch are $1.50, $1.54, and $1.91.

- Arizona has proposed to include XRP in a state-managed crypto reserve fund.

XRP cryptocurrency has held steady above $1.40, showing resilience despite a broadly cautious market.

Recent developments in US policy have added a fresh layer of optimism for XRP enthusiasts.

Arizona advances bill to include XRP in state reserve

Arizona lawmakers are moving forward with legislation that could formally include XRP in a state-managed digital assets fund.

The proposal seeks to create a strategic reserve for digital currencies obtained through seizures or confiscations.

XRP, alongside Bitcoin (BTC), is explicitly listed as an eligible asset.

🚨BREAKING: ARIZONA ADVANCES BILL TO ADD XRP TO OFFICIAL STATE DIGITAL ASSET RESERVE 🇺🇸🔥

Arizona’s Digital Assets Strategic Reserve Fund bill (SB1649) just CLEARED the Senate Finance Committee in a 4–2 vote — and it explicitly includes $XRP in the RESERVE. 👀

The bill now… pic.twitter.com/2x8uVH6LXD

— Diana (@InvestWithD) February 17, 2026

The bill recently passed a key Senate committee in a 4-2 vote, marking a significant step forward.

If enacted, the fund would be managed by the state treasurer with strict custodial oversight.

This move would make Arizona one of the first US states to formally reference XRP in a government financial framework.

For XRP holders, this development is largely symbolic.

The state would not be directly purchasing XRP with taxpayer money, but inclusion in the reserve adds credibility.

It reinforces XRP’s reputation as a functional and settlement-oriented digital asset rather than just a speculative token.

Market activity signals caution

XRP’s short-term price action has been mixed.

The coin is supported around $1.40 to $1.44, creating a key floor that traders are watching closely.

Exchange outflows suggest accumulation by larger holders, while smaller whales have added to their balances, hinting at potential upward pressure.

Technical indicators show both bullish and bearish signals.

Momentum oscillators suggest limited buying activity in the short term, but longer-term smart money metrics point to possible gains.

Patterns on the charts indicate that a break below $1.42 could trigger a short-term pullback toward $1.12.

At the same time, if support holds, traders could see upside targets near $1.91 and $2.13.

XRP has been rangebound for the past month, but the combination of policy developments and structural market accumulation could push it higher.

XRP price prediction

Policy developments in Arizona, combined with accumulation patterns and technical support, may give XRP the momentum it needs to challenge its next resistance levels.

Traders should watch the $1.40–$1.44 support zone closely.

A strong hold here could set the stage for a breakout.

The resistance levels to monitor are $1.50 and $1.54 in the near term.

Beyond that, the next targets are $1.67 and $1.91.

These levels align with smart money accumulation and historical trading ranges.

A sustained move above $2.00 could signal a return of broader bullish sentiment.

Overall, XRP’s price is poised in a delicate balance.

Short-term caution is warranted, but medium-term prospects look promising.

Crypto World

Riot Platform‘s AI/HPC Push could Net up to $21B, Says Stockholder

An activist Riot Platform shareholder is pressing the crypto mining company to accelerate its pivot to high-performance computing (HPC) and artificial intelligence.

In a Wednesday letter to executives, Starboard Value, which holds about 12.7 million shares of Riot, said that the company could generate between $9 billion to $21 billion in equity value contribution from AI/HPC data centers in Texas. The shareholder said that “time is of the essence,” stressing urgency in getting “more material deals completed” as it moves deeper into AI and HPC.

“With 1.4 [gigawatts] of gross capacity remaining to be monetized, Riot is in an enviable position – but it must execute with excellence and urgency,” said Starboard. “We believe Riot should be able to attract high-quality tenants for tier-3 data centers with terms similar to or better than the peer transactions announced towards the end of 2025.”

Starboard referred to Riot’s primary sites in Corsicana and Rockdale, Texas, where other crypto miners also operate due to low energy costs and friendly regulations.

At Wednesday’s Nasdaq market open, Riot’s share price surged and were up by almost 6%, at the time of publication. Industry tracker CoinShares Bitcoin Mining ETF was down less than 1%, by comparison.

Related: Moonwell hit by $1.78M exploit as AI vibe coding debate reaches DeFi

“The recently announced transaction with Advanced Micro Devices […] is a positive signal and confirms our views regarding the intrinsic value of Riot’s key sites, but it is a small proof of concept deal, and we, like you, expect significantly more,” said Starboard, referring to a data center lease and services agreement announced in January.

Many mining companies pivoting away from crypto

Riot Platforms is not the only crypto company shifting some of its operations into AI and HPC amid increasing mining difficulty and other costs. CleanSpark, MARA Holdings, Core Scientific, Hut 8, and TeraWulf repurposed some of their infrastructure or announced similar plans in a move toward AI.

Cango, another Bitcoin miner, sold $305 million worth of its BTC holdings last week in part to fund its planned expansion into AI and HPC.

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

Oracle Error Leaves DeFi Lender Moonwell With $1.8 Million in Bad Debt

A critical oracle pricing glitch has left decentralized lending platform Moonwell grappling with nearly $1.8 million in bad debt.

A misconfigured oracle briefly valued Coinbase Wrapped ETH (cbETH) at just $1 Sunday morning, triggering a sudden cascade of liquidations, in a sobering reminder of the fragility lurking in DeFi infrastructure.

Key Takeaways

- Oracle Failure: A configuration error in Chainlink OEV wrapper contracts caused the system to price $2,200 cbETH at a 99.9% discount.

- Bad Debt Event: Liquidators seized collateral by repaying mere pennies on the dollar, wiping out 1,096 cbETH and leaving the protocol with $1.78 million in bad debt.

- Risk Signal: The incident highlights systemic liquidity risks, mirroring concerns seen as BlockFills freezes withdrawals due to counterparty exposure.

What Caused the Oracle Failure on Moonwell?

According to the postmortem on Moonwell’s Discord, the trouble started Sunday at 6:01 PM UTC following the execution of governance proposal MIP-X43. This upgrade enabled Chainlink OEV wrapper contracts on Base and Optimism, but one feed contained a fatal flaw.

According to risk management firm Anthias Labs, the system failed to multiply the cbETH/ETH exchange rate by the ETH/USD price. Instead, it used the raw exchange rate directly.

This resulted in the oracle reporting a price of roughly $1.12 for an asset trading near $2,200.

Reports indicate the flawed code layout may have been generated by AI tools, specifically Claude Opus 4.6, raising serious questions about audit verification standards for generated code.

Breaking Down the $1.8M Bad Debt

Trading bots immediately pounced on the discrepancy. With the system believing cbETH was worth barely a dollar, liquidators repaid roughly $1 of debt to seize massive amounts of collateral.

In total, 1,096 cbETH was wiped out. That effectively erased the collateral for many borrowers while leaving the protocol holding the bag for the unpaid loan value.

Moonwell’s risk manager, Anthias Labs, moved fast to contain the bleeding. They reduced supply and borrow caps to 0.01 to prevent new users from entering the broken market.

This type of sudden liquidation cascade shows why Ethereum faces crash risks whenever on-chain leverage is mispriced.

Discover: The best new crypto on the market

What This Means for DeFi Lenders

While Moonwell operates across multiple chains with over $90 million in TVL, this incident shakes confidence in automated governance execution. Users must now wait for a governance vote to fix the configuration.

This is not an isolated event. It follows a trend of oracle-related exploits, reinforcing why decentralized protocol security is just as critical as centralized solvency.

The crypto market structure is currently fragile, evidenced by data showing Binance controls 65% of CEX stablecoin reserves.

When liquidity is concentrated and validation fails, the fallout is instant. For yield farmers, this is a signal to check whether your protocol’s code was written by a human or a chatbot before depositing.

Discover: The best meme coins in the world.

The post Oracle Error Leaves DeFi Lender Moonwell With $1.8 Million in Bad Debt appeared first on Cryptonews.

Crypto World

BTC ETH XRP BNB SOL DOGE BCH ADA HYPE XMR

Bitcoin (CRYPTO: BTC) continues to face selling pressure as it tries to defend a key zone around $67,000, with bears pressing at every incline. The $65,118 support remains a focal point for downside risk, while the upside faces hurdles near $72,000 and $74,508. The longer-term picture is complicated by a pair of moving averages that traders watch closely: the 200-week simple moving average sits near $58,371, while the 200-week exponential moving average hovers around $68,065. The current positioning near the 200-week EMA has prompted some analysts to suggest that BTC may be near a bottom, even as near-term momentum remains fragile.

Analysts have pointed to long-run price action to argue that a bottom could be forming. On X, analyst Jelle observed that almost all of BTC’s significant bottoms formed within the range defined by the 200-week SMA and the 200-week EMA, and he noted that trading near the 200-week EMA might indicate that the bottoming process has begun. That view is echoed by others who study short- and mid-term cycles, suggesting that a durable bottom could be emerging even if volatility remains elevated in the near term. In tandem with this assessment, market watchers highlighted that BTC’s path remains sensitive to macro shocks and micro-structure signals as traders try to discern a durable foundation for a broader recovery.

Matrixport offered a similar read, arguing that BTC may be approaching a durable bottom as sentiment indicators flip from negative to positive. The firm noted that when its daily sentiment indicator’s 21-day moving average dips below zero and then turns upward, selling pressure tends to ease, increasing the odds of a meaningful upside attempt. While such readings do not guarantee an immediate rally, they create a frame of reference for risk-takers who seek to gauge whether sellers are drying up and buyers are growing more aggressive. The bottom line from this view is that BTC could be approaching an inflection point even if the near term still looks susceptible to downside noise.

An additional tailwind cited by a Wells Fargo analyst, Ohsung Kwon, was a potential increase in demand driven by tax refunds. In a note seen by CNBC, Kwon suggested that refunds—especially among higher-income households—could flow into equities and BTC, rekindling the so-called “YOLO” trade. The interplay between consumer liquidity and risk assets remains a critical driver of price action, and the idea that tax-related inflows could buttress a market that has struggled to sustain momentum is shaping expectations for a potential rebound.

The question on many traders’ lips is whether BTC and its leading altcoins can surmount overhead resistance and reestablish a constructive trend. The immediate challenge remains a confluence of resistance around the 20-day moving average and notable round numbers, with a potential pivot to a stronger ascent if buyers can push beyond those barriers. For BTC specifically, there is a clear roadmap: a successful push above the 20-day EMA around $72,282 and the $74,508 threshold could usher in a renewed upside, potentially opening a path to the 50-day simple moving average near $83,129. Conversely, a failure to hold above the critical $65,118 support could invite a rapid test of the next major line near $60,000, with a risk of accelerating declines if selling intensifies.

Ether (CRYPTO: ETH) has managed to keep a constructive posture above the immediate support at $1,897, suggesting that buyers are still defending the downside. The next test is the overhead zone around the 20-day EMA at $2,183. If bulls can clear that area, a more pronounced recovery could unfold toward the 50-day moving average near $2,707. A failure to hold the $1,897 floor would likely invite a renewed pullback toward the $1,750 level, with a deeper break potentially exposing the $1,537 area as a critical line in the sand for bulls to defend.

XRP (CRYPTO: XRP) has been trading just below the 20-day EMA around $1.52, signaling ongoing pressure from sellers but also a willingness among bulls to defend the line. A decisive move above the 20-day EMA and the $1.61 breakdown level could set XRP on a path toward the 50-day SMA near $1.80, keeping the pair within its current channel for now. A sustained move below the channel’s support could intensify selling and push XRP toward lower supports, testing the stability of the current range.

BNB (CRYPTO: BNB) has traded in a narrow range, reflecting indecision between buyers and sellers. A breakdown below the $570 support could signal a resumption of the downtrend, potentially dragging the pair toward the $500 psyche level. If buyers manage to push above the 20-day EMA around $676, the path could open to a rally toward $730 and then toward $790, where bears are expected to reassert control.

Solana (CRYPTO: SOL) continues to face resistance near the $95 mark, a level that has previously capped upside. A slip below $76 would be a warning sign that bears are reasserting themselves and could turn the $95 threshold into a new ceiling. Should buyers manage to push through the $95 level, the next target would likely be the 50-day SMA around $116, a level where selling pressure historically intensifies as traders reassess risk.

Dogecoin (CRYPTO: DOGE) has hovered just under the 20-day EMA at roughly $0.10, a pattern that suggests a potential breakout to the upside if selling pressure remains light. A sustained push above the $0.12 resistance could set DOGE on a course toward the 50-day SMA near $0.12 and beyond, potentially reaching the $0.16 level if buyers grow more aggressive. If price action fails to clear the $0.12 resistance, a consolidation range between roughly $0.08 and $0.12 could prevail for several sessions.

Bitcoin Cash (CRYPTO: BCH) has traded between its moving averages, signaling indecision about the next directional move. The 20-day EMA around $547 and the RSI’s intermediate position imply a possible upside breakout if demand strengthens, potentially pushing BCH toward $600 and then toward $630. A break below the 20-day EMA could invite a correction toward $500 as bears gain ground.

Hyperliquid (CRYPTO: HYPE) closed below the 20-day EMA recently, underscoring selling pressure at higher levels. The path of least resistance would depend on whether buyers can sustain a move above the 50-day SMA around $27.74; failing that, a slide toward the $20.82 support area could unfold. A breakout above the $32.50 barrier would be a bullish signal, potentially leading to a rally into the $38.42–$35.50 zone as momentum compresses in the near term.

Cardano (CRYPTO: ADA) has held near the 20-day EMA of about $0.29, suggesting that bulls are keeping the pressure on the downside. A sustained move above the 20-day EMA could carry ADA toward the downtrend line, which has historically acted as a strong resistance. If buyers manage to pierce the downtrend, the price could advance toward $0.44 and then to $0.50. Conversely, a break below the current support could push ADA down toward the $0.15 region, underscoring the risk of a renewed downleg if buyers fail to defend critical levels.

Monero (CRYPTO: XMR) has not breached the key $360 breakdown threshold, with bulls maintaining the immediate support near $309. A sustained push above the 20-day EMA around $366 could open a path toward the 50-day SMA near $449, where bears are expected to reassert themselves. A break below $309 would suggest that bears are regaining control and could test the crucial $276 support, potentially leading to a contained range if buyers respond with resilience at that level.

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World1 day ago

Crypto World1 day agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business21 hours ago

Business21 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video1 day ago

Video1 day agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment7 hours ago

Entertainment7 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech12 hours ago

Tech12 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Video7 days ago

Video7 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business13 hours ago

Business13 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

Claude Opus 4.6 wrote vulnerable code, leading to a smart contract exploit with $1.78M loss

Claude Opus 4.6 wrote vulnerable code, leading to a smart contract exploit with $1.78M loss