Crypto World

CryptoQuant Places Bitcoin Bear Market Bottom at $55,000 as Key Indicators Show Extended Correction Ahead

TLDR:

- Bitcoin trades 25% above its realized price of $55,000, which historically marks bear market bottoms

- February 5 sell-off triggered $5.4 billion in daily losses, the largest since March 2023’s $5.8 billion event

- Monthly realized losses at 0.3 million BTC remain far below 2022 bear market bottom of 1.1 million BTC

- Long-term holders selling near breakeven versus 30-40% losses typical at previous bear market cycle lows

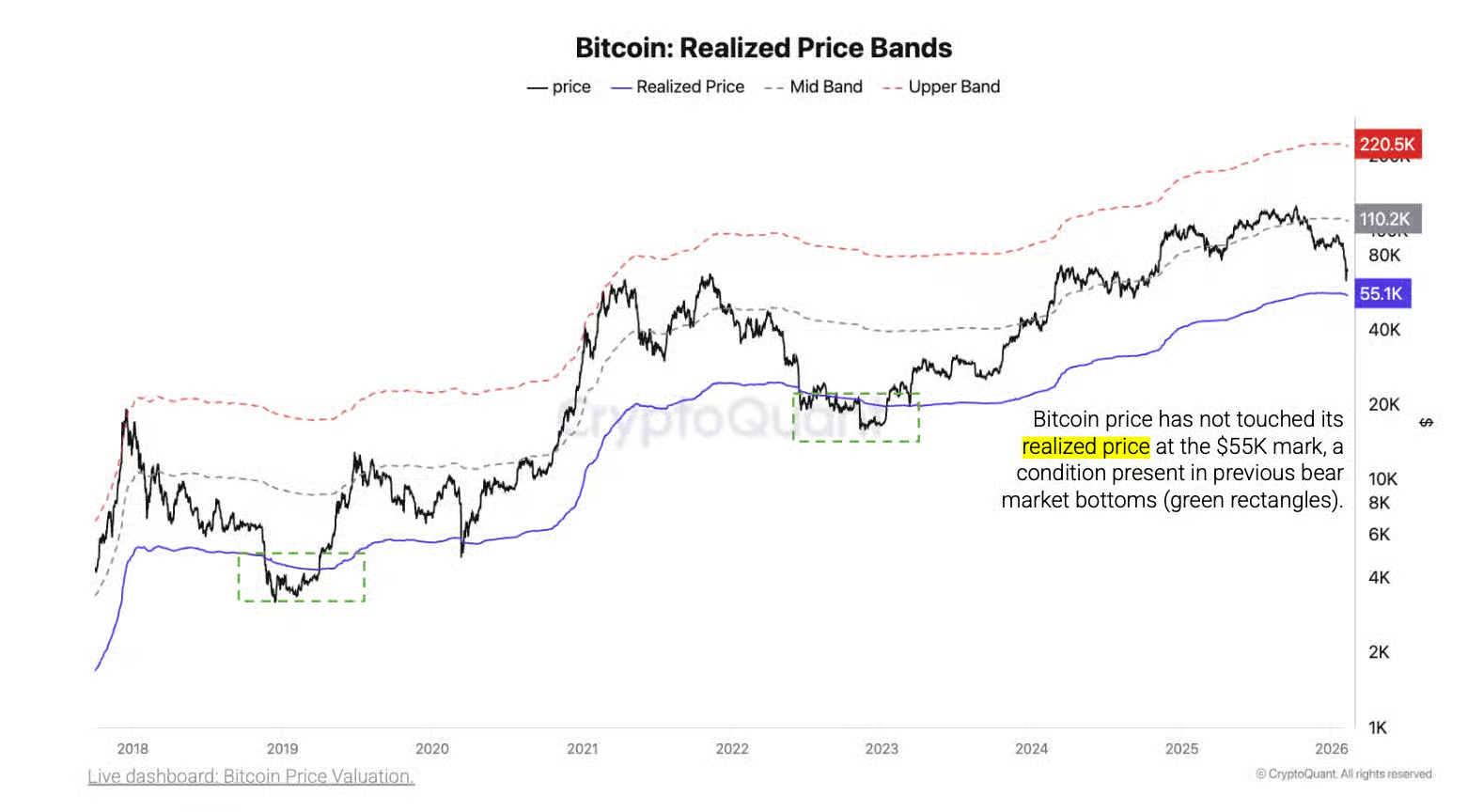

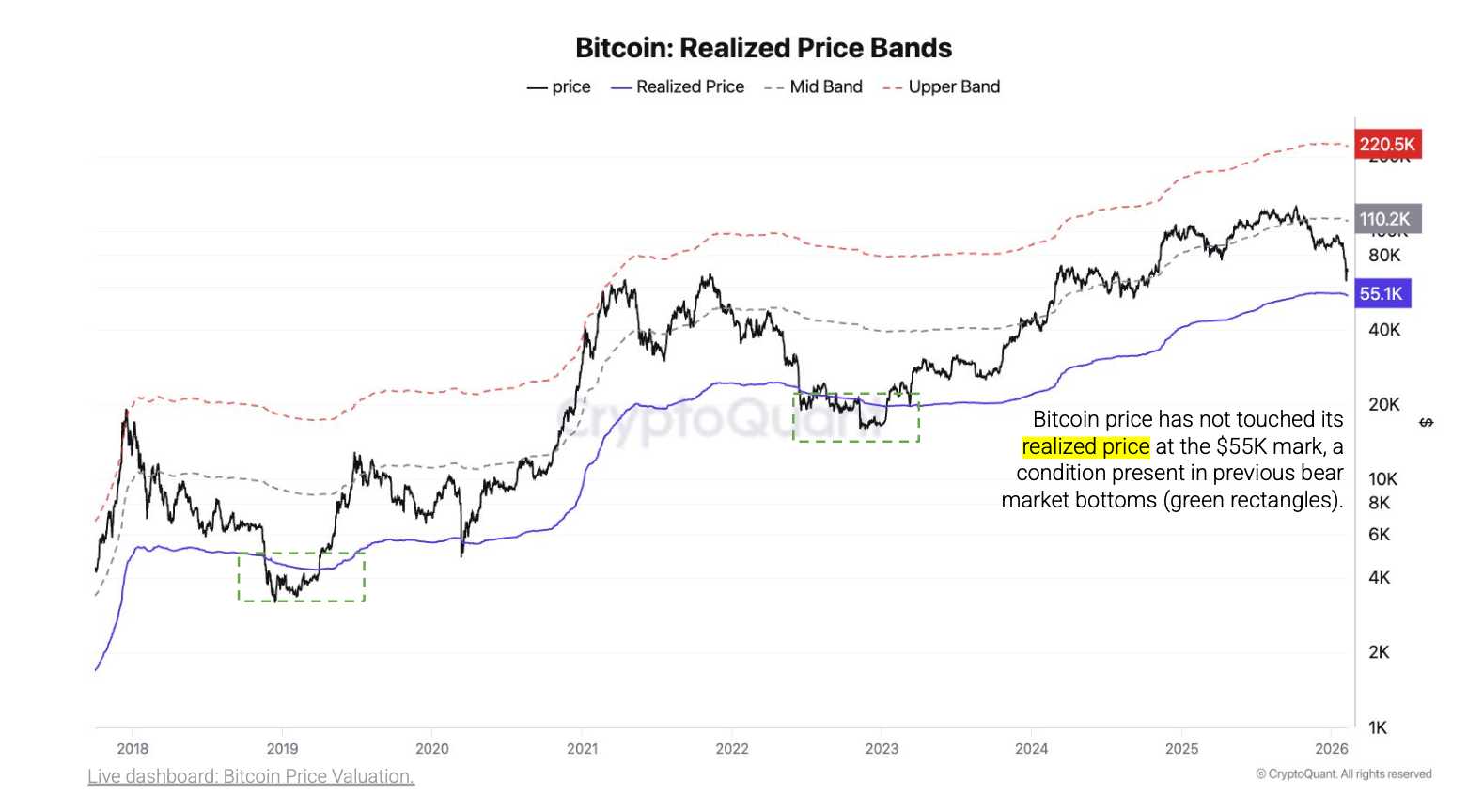

Bitcoin’s bear market floor sits around $55,000, according to blockchain analytics platform CryptoQuant. The firm’s latest assessment suggests the cryptocurrency remains more than 25% above this critical support level.

CryptoQuant analysts note that bear market bottoms require several months to establish rather than forming through sudden capitulation events.

This analysis comes as Bitcoin trades significantly higher than key historical support zones that marked previous cycle lows.

Realized Price Indicates Extended Bottoming Process

The realized price metric serves as CryptoQuant’s primary indicator for determining Bitcoin’s potential bottom. This measure calculates the average price at which all coins last moved on the blockchain.

Historical data shows this metric provided strong support during past bear markets. Current trading prices remain elevated compared to this threshold, suggesting additional downside potential exists.

Previous bear cycles demonstrated distinct patterns when Bitcoin approached these levels. During the 2018 downturn, prices dropped 30% below the realized price before stabilizing.

The FTX collapse in 2022 pushed Bitcoin 24% beneath this metric. After reaching these depths, the cryptocurrency spent between four and six months building a foundation before recovery began.

Recent market volatility has not yet pushed Bitcoin into the extreme zones that characterize true bottoms. On February 5, the asset experienced a 14% decline to $62,000, triggering $5.4 billion in realized losses.

This marked the largest single-day loss realization since March 2023, when holders crystallized $5.8 billion in losses. The figure also exceeded the $4.3 billion recorded shortly after the FTX exchange collapsed.

Despite these substantial losses, CryptoQuant maintains that a structural bottom has not materialized. Monthly cumulative realized losses currently stand at 0.3 million BTC, well below the 1.1 million BTC observed at the end of the 2022 bear market. This disparity suggests selling pressure has not reached the intensity associated with cycle lows.

Source: Cryptoquant

Multiple Indicators Show Market Remains Above Capitulation Levels

The MVRV ratio, which compares market value to realized value, has not entered extreme undervaluation territory. This metric historically signals bear market bottoms when reaching deeply depressed levels.

Current readings indicate Bitcoin trades above the ranges that marked previous cycle nadirs. Similarly, the Net Unrealized Profit and Loss metric has not declined to the 20% unrealized loss threshold observed at past bottoms.

Long-term holder behavior provides additional evidence that full capitulation has not occurred. These investors currently sell positions near breakeven prices.

During previous bear market conclusions, long-term holders typically absorbed losses between 30% and 40% before markets reversed. This behavioral difference suggests conviction remains higher than at historical turning points.

Approximately 55% of Bitcoin’s circulating supply remains profitable at current prices. This contrasts with the 45% to 50% range typically observed at cycle lows.

The elevated proportion of profitable holdings indicates many investors entered positions at lower prices and maintain paper gains. Bear market bottoms usually feature a higher percentage of underwater positions across the holder base.

CryptoQuant’s Bull-Bear Market Cycle Indicator remains in the Bear Phase rather than advancing to the Extreme Bear Phase. The latter designation historically marks the beginning of extended bottoming periods.

These extreme phases typically persist for several months, reinforcing the firm’s assessment that bear markets require time to resolve.

Standard Chartered recently adjusted its outlook, projecting Bitcoin could test $50,000 before recovering later this year.

Crypto World

Pompliano Says Cooling Inflation Tests Bitcoin Investors’ Conviction

Bitcoin holders may be entering a different phase of the market cycle as inflation eases, according to entrepreneur and investor Anthony Pompliano, who says the asset’s core thesis is now being challenged.

Key Takeaways:

- Pompliano says easing inflation is testing Bitcoin investors’ long-term conviction.

- Bitcoin’s scarcity thesis depends more on money supply expansion than short-term CPI moves.

- Weak sentiment and macro uncertainty may pressure prices before a potential recovery.

In an interview with Fox Business on Thursday, Pompliano argued that many investors first turned to Bitcoin during a period of rising prices and aggressive monetary expansion.

With inflation slowing, he said, the real question is whether participants still believe in Bitcoin’s long-term purpose.

Pompliano: Bitcoin’s Case Tested Without High Inflation

“I think the challenge for Bitcoin investors, can you hold an asset when there is not high inflation in your face on a day-to-day basis?” he said.

“Can you still believe in what Bitcoin’s value proposition is, which is that it’s a finite-supply asset. If they print money, Bitcoin is going higher.”

Government data shows inflation cooling modestly. The Consumer Price Index slowed to 2.4% in January from 2.7% a month earlier, according to the US Bureau of Labor Statistics.

Even so, Moody’s Analytics chief economist Mark Zandi recently told CNBC that the improvement appears stronger in statistics than in everyday costs faced by consumers.

Bitcoin has long been promoted as a hedge against currency debasement because its supply is capped at 21 million coins.

When central banks expand liquidity and weaken purchasing power, investors often move toward scarce assets, including Bitcoin and gold, both of which Pompliano described as durable long-term stores of value.

Market sentiment, however, has deteriorated. The Crypto Fear & Greed Index recently dropped to an “Extreme Fear” reading of 9, a level not seen since June 2022.

Bitcoin was trading near $68,850 at publication, down roughly 28% over the past month, according to CoinMarketCap.

Pompliano expects macroeconomic conditions to create turbulence before any sustained recovery.

He anticipates deflationary pressures in the short run, followed by policy responses such as rate cuts and renewed liquidity injections.

“We’re going get deflationary-type forces in the short term, people are going to ask to print money and to drop interest rates,” he said.

He described the dynamic as a “monetary slingshot,” where currency devaluation occurs while falling prices temporarily obscure its effects.

Over time, he argued, additional money creation would weaken the U.S. dollar and strengthen scarce assets.

Bitcoin Slides as US Jobs Revision Shakes Market Confidence

Bitcoin’s recent decline followed a sharp shift in economic expectations after US authorities revised last year’s employment data lower by nearly 900,000 jobs.

While January payrolls showed a modest gain of 130,000 positions, the large adjustment undermined confidence in earlier reports and unsettled financial markets.

Investors reacted less to the weak headline figure and more to the reliability of the data itself, as uncertainty tends to weigh heavily on risk assets.

The change quickly rippled across markets. US Treasury yields rose, with the 10-year moving from about 4.15% to 4.20%, while expectations for a March interest-rate cut dropped sharply from 22% to 9%.

Derivatives activity also intensified, with large traders increasing hedging positions against further downside.

Analysts noted that preliminary labor estimates, including statistical models used during economic transitions, may have overstated job creation in prior readings.

For Bitcoin, the bond market remains a key signal. Higher yields typically tighten liquidity conditions, making it harder for speculative assets to recover.

Although some traders believe prices could be nearing a bottom, current market behavior suggests hesitation.

The post Pompliano Says Cooling Inflation Tests Bitcoin Investors’ Conviction appeared first on Cryptonews.

Crypto World

ARK Invest Buys $15M Coinbase Shares After Recent Selling

ARK Invest has returned to buying shares of Coinbase Global after trimming its position, adding roughly $15 million worth of stock across several of its actively managed exchange-traded funds (ETFs) on Friday.

The Cathie Wood-led asset manager purchased 66,545 Coinbase shares through the ARK Innovation ETF (ARKK), 16,832 shares through Next Generation Internet ETF (ARKW) and 9,477 shares through Fintech Innovation ETF (ARKF), according to the firm’s daily trade disclosures.

The buying activity coincided with a sharp surge in Coinbase stock. Shares closed the trading session at $164.32, up about 16.4% on the day, before edging higher in after-hours trading, according to data from Google Finance. The surge put the firm’s total purchase at roughly $15.2 million.

Alongside Coinbase, ARK also increased its stake in Roblox Corporation, buying shares in ARKK, ARKW and ARKF. Roblox closed near $63.17 on the New York Stock Exchange on Friday.

Related: Coinbase unveils crypto wallets designed specifically for AI agents

ARK cuts Coinbase shares across ETFs

Last week, ARK Invest reduced its exposure to Coinbase, selling about $17.4 million in Coinbase stock on Feb. 5 for the first time this year and its first reduction since August 2025.

The exchange then sold another $22 million worth of Coinbase shares across several ETFs on Feb. 6, while increasing its position in digital-asset platform Bullish.

As Cointelegraph reported, Coinbase became the top detractor across several of Cathie Wood’s ARK Invest ETFs in the fourth quarter of 2025, as a broader crypto market pullback pressured performance. Shares of Coinbase fell more sharply than both Bitcoin (BTC) and Ether (ETH) during the quarter.

Related: Coinbase bets on Backstreet Boys nostalgia in return to Super Bowl

Coinbase posts $667 million Q4 loss

Coinbase reported a net loss of $667 million in the fourth quarter of 2025, ending an eight-quarter run of profitability. Earnings per share came in at 66 cents, missing analyst expectations of 92 cents, while net revenue fell 21.5% year-over-year to $1.78 billion. Transaction revenue dropped nearly 37% to $982.7 million, although subscription and services revenue rose more than 13% to $727.4 million.

The weaker results coincided with a downturn in crypto markets. Coinbase said it generated $420 million in transaction revenue early in Q1 but expects subscription and services revenue to decline.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Mint Incorporation Limited Partners with Rice Robotics to Launch Physical AI Joint Venture

TLDR:

- Mint signs MOU with Rice Robotics to establish a joint venture for physical AI solutions.

- Initial investment of HK$10M aims to accelerate robotics R&D in Hong Kong and Asia.

- MIMI shares surged nearly 97% in after-hours trading following the strategic announcement.

- Joint venture plans to expand from B2B services into consumer-focused robotics markets.

Mint Incorporation Limited (NASDAQ: MIMI) has signed a non-binding Memorandum of Understanding with Rice Robotics Holdings Limited on February 9, 2026.

The agreement sets the stage for a joint venture focused on physical AI solutions across Asia. Mint will provide an initial investment of approximately HK$10 million.

Following the announcement, MIMI shares surged nearly 97% in after-hours trading, reflecting investor interest in the company’s expansion into robotics and AI.

Joint Venture to Drive Physical AI Innovation

Mint Incorporation Limited’s subsidiary, Aspiration X Limited, will lead the collaboration with Rice Robotics Holdings Limited.

The joint venture aims to develop localized robotic technologies and expand research and development capabilities in Hong Kong.

Chairman and CEO Damian Chan said, “This partnership provides a compelling response to the question, ‘Why not Hong Kong?’ Many local firms act mainly as sales channels, but together with Rice Robotics, we are building core proprietary technology here.”

The comment reflects the company’s intention to establish Hong Kong as a hub for intelligent robotics development.

Mint brings experience in Southeast Asia, including smart office solutions in Singapore and security robot deployments in Thailand and Malaysia.

Rice Robotics adds expertise in delivery robotics and a robust client base in Japan, providing a strong operational foundation for the venture.

“The partnership significantly diversifies and strengthens our robotics portfolio, allowing us to move beyond B2B into the promising B2C space—developing robots for companionship, education, and daily life, powered by our robust AI,” added Chan.

This demonstrates the companies’ aim to combine AI and robotics across both enterprise and consumer markets.

Market Reaction and Strategic Vision

MIMI shares climbed nearly 97% in after-hours trading, more than doubling from the previous close. Investors reacted positively to the announcement, signaling confidence in Mint’s expansion into physical AI.

Victor Lee, Founder of Rice Robotics, commented, “Mint’s rapid expansion in AI and robotics across Southeast Asia makes it an ideal partner. Its dedicated commercial teams and AI platform will dramatically accelerate our joint R&D and market expansion.” His statement emphasizes the operational synergy between the two companies.

Lee also noted, “We share a bold vision to build the most anticipated robotics company in Hong Kong and drive meaningful diversification in the region’s tech ecosystem.” This highlights the joint venture’s ambition to strengthen Hong Kong’s robotics presence regionally.

The collaboration targets “Physical AI”—autonomous systems capable of reasoning, planning, and acting in real-world environments.

By integrating Mint’s AI platform with Rice Robotics’ proven hardware, the joint venture plans to deliver intuitive and practical robotic solutions. The MOU remains non-binding pending the execution of formal agreements.

Crypto World

Dreamcash Partners with Tether to Launch USDT0-Collateralized Perpetual Markets

TLDR:

- Tether invests in Dreamcash to expand USDT0-collateralized perpetual markets globally.

- Ten equity and commodity markets, including TSLA/USDT and GOLD/USDT, are now live.

- USDT0 allows seamless transfers from centralized exchanges to Dreamcash wallets.

- Dreamcash launches $200K weekly incentive program to encourage USDT trading adoption.

Dreamcash has received a strategic investment from Tether to expand USDT-quoted RWA perpetual markets on Hyperliquid.

Through its operating entity, Supreme Liquid Labs, Dreamcash launched the first USDT0-collateralized HIP-3 perpetual markets. Ten markets, including USA500/USDT, TSLA/USDT, and NVDA/USDT, are now live.

The initiative allows millions of retail traders to access equity and commodity perpetuals directly using USDT without changing their preferred trading setup.

Tether Invests to Enable USDT0 Markets

Dreamcash confirmed the investment via its official channel, noting Tether’s role in supporting broader retail access.

“This investment from Tether validates what we’ve been building; a trading experience that meets retail users where they are,” said Marco van den Heuvel, emphasizing the strategic importance for retail traders.

The first HIP-3 markets collateralized with USDT0 leverage LayerZero’s OFT standard. Since January 2025, USDT0 has processed over $50 billion in transfers across 15 networks, offering fast cross-chain liquidity.

USDT0 maintains a 1:1 peg with USDT through a lock-and-mint system. Traders can move funds seamlessly from centralized exchanges to non-custodial wallets in Dreamcash, preserving stablecoin exposure.

The investment underlines a shared goal of making on-chain trading accessible to retail users holding USDT.

Dreamcash noted that millions of traders who already use USDT for margin trading can now participate in Hyperliquid markets without converting their assets.

Equity and Commodity Perpetuals Live on Dreamcash

Dreamcash now offers equity and commodity perpetuals, including TSLA/USDT, NVDA/USDT, MSFT/USDT, GOOGL/USDT, AMZN/USDT, META/USDT, HOOD/USDT, INTC/USDT, GOLD/USDT, and SILVER/USDT.

Liquidity for these markets is provided by Selini Capital. According to the announcement, the collaboration ensures tight spreads, consistent fills, and reliable execution quality for retail traders.

To encourage adoption, Dreamcash will introduce a $200,000 weekly incentive program for CASH markets using USDT. Traders will earn rewards proportional to their share of total USDT trading volume during the initial launch period.

Marco van den Heuvel explained the practical benefits of the launch: “With USA500, TSLA, NVDA, and many others now live, traders can finally access equity perpetuals using the stablecoin they already hold, removing a barrier that has kept mainstream traders on centralized platforms.”

The USDT0-collateralized markets position Dreamcash as a bridge for millions of traders to enter Hyperliquid’s onchain ecosystem.

By combining a mobile-first interface with institutional-grade liquidity, Dreamcash delivers accessible and seamless trading for global retail participants.

Crypto World

Dutch Lawmakers Advance 36% Capital Gains Tax on Crypto

Lawmakers in the Netherlands have taken a major step toward reshaping how digital assets are taxed.

The country’s House of Representatives voted Thursday to advance legislation introducing a 36% capital gains tax on savings and most liquid investments, including cryptocurrencies.

Key Takeaways:

- Dutch lawmakers advanced a 36% tax on savings, equities and crypto, including unrealized gains.

- Critics warn the proposal could trigger investor relocation and capital outflows.

- The bill still requires Senate approval before a planned 2028 implementation.

The proposal cleared the chamber comfortably, receiving 93 votes, well above the 75 required to move forward, according to the official tally.

Netherlands Targets Unsold Crypto Profits in New Tax Proposal

If adopted, the measure would apply broadly. Bank savings, crypto holdings, most equities and returns generated from interest-bearing instruments would all fall under the levy.

Notably, the tax would be assessed regardless of whether investors actually sell their assets, meaning unrealized gains could still be taxed.

The Dutch Senate must still approve the bill before it can become law. Implementation is targeted for the 2028 tax year, but reaction from investors has already been swift.

Critics argue the policy risks pushing wealth out of the country. Some investors warn that higher-net-worth individuals could relocate to jurisdictions with lighter tax regimes, particularly within the European Union where cross-border movement is relatively straightforward.

Entrepreneur Denis Payre pointed to historical precedent, saying France experienced a wave of business departures after imposing similar policies in the late 1990s.

Crypto analyst Michaël van de Poppe was even more blunt, calling the plan deeply misguided and predicting significant relocation by investors.

Financial projections circulating among market participants illustrate the concern. According to data shared by Investing Visuals, an investor starting with €10,000 and contributing €1,000 monthly over 40 years could accumulate roughly €3.32 million without the tax.

Under the proposed 36% levy, the ending value would drop to about €1.885 million, a reduction of roughly €1.435 million.

The debate echoes similar disputes elsewhere. In the United States, technology leaders and crypto industry figures pushed back strongly against California’s proposed wealth tax on billionaires, with some entrepreneurs openly discussing relocation.

While supporters argue the Dutch plan modernizes taxation across financial assets, opponents say it could discourage long-term investment and weaken the country’s position as a destination for fintech and digital asset businesses.

The Senate’s decision will determine whether the proposal becomes one of Europe’s strictest crypto tax regimes.

Dutch Indirect Crypto Investments Hit €1.2B

As reported, Dutch exposure to cryptocurrency through financial securities has grown rapidly over the past five years, reaching about €1.2 billion by October 2025, according to De Nederlandsche Bank (DNB).

The increase largely reflects rising prices of major digital assets rather than a surge of new investor money.

Holdings stood at roughly €81 million at the end of 2020, showing how valuation gains have expanded crypto-linked investments across households, institutions and companies.

Despite the jump, direct ownership of cryptocurrencies remains relatively limited for many investors.

Even with the growth, crypto securities represent only about 0.03% of the Netherlands’ overall investment market, indicating traditional assets still dominate portfolios.

Last year, Dutch crypto firm Amdax raised €30 million ($35 million) to launch Amsterdam Bitcoin Treasury Strategy (AMBTS), a dedicated Bitcoin treasury company that plans to accumulate up to 1% of the total BTC supply, or roughly 210,000 Bitcoin.

The post Dutch Lawmakers Advance 36% Capital Gains Tax on Crypto appeared first on Cryptonews.

Crypto World

Injective (INJ) Crashes 90%: Market Cap Falls to $300M Amid Weak Fundamentals

TLDR:

- Injective INJ lost 90% as market cap fell from $4B to $300M due to weak fundamentals.

- Total value locked remained under $100M, failing to support previous market hype.

- Price failed to reclaim $10 breakout level, signaling structural trend weakness.

- Large protocol wallets reduced circulating liquidity, increasing volatility and pressure on INJ.

Injective (INJ) has experienced a steep decline, losing nearly 90% of its market value. The token’s market cap dropped from almost $4 billion in 2024 to around $300 million today.

Early hype around on-chain derivatives, fast execution, and new integrations fueled a vertical price surge. However, underlying fundamentals such as total value locked (TVL) and trading activity did not grow at the same pace, leading to structural weaknesses that became evident over time.

Rapid Valuation and Price Structure Shifts

During 2024, Injective’s market cap approached $4 billion while TVL remained under $100 million, according to a report by Our Crypto Talk.

The gap between valuation and actual capital suggested the market was pricing in significant future growth. Investor attention focused on derivatives and integration narratives rather than tangible ecosystem adoption.

The token’s price rallied sharply, creating a vertical move that often signals overextension. When market risk appetite slowed, the price faced pressure as participants questioned whether usage and capital were sufficient to support such a high valuation.

In late 2025, INJ attempted to reclaim its previous $10 breakout level. The attempt failed, showing that buyer conviction was weakening.

Technical indicators, including the RSI, did not regain strength, and the trend channel continued downward. The failed breakout signaled a structural shift, with previous support zones now acting as resistance.

Price behavior reflected not just a temporary dip but a broader market reassessment. When a token cannot hold key technical levels, it indicates that participants are hesitant to enter at higher prices, resulting in a sustained decline.

TVL Limitations and Supply Concentration

Injective’s TVL never matched its market hype. At a nearly $4 billion market capitalization, TVL remained under $100 million, highlighting limited capital adoption.

Competing chains offered deeper liquidity and lower fees, attracting more participants. Without a strong TVL foundation, price momentum was harder to maintain, making the market correction inevitable.

Supply concentration also added downward pressure. A wallet labeled “Peggy Bridge Proxy” holds roughly $248 million of INJ, representing a large portion of the total market cap.

Although the wallet is protocol-related, its presence reduces effective circulating liquidity, making the token more sensitive to market movements.

Thin tradable supply contributes to higher volatility and faster drawdowns. It also complicates recovery because fewer tokens are available for market participants to absorb buying or selling pressure.

At its current $300 million valuation, INJ’s recovery would require meaningful TVL growth, increased derivatives volume, and broader participation beyond structured wallets.

Reclaiming previous technical levels would further indicate a healthier market structure and renewed investor confidence.

This reset in expectations may provide a clearer foundation for future growth if underlying metrics improve.

Crypto World

Stablecoin Yield Debate: The Digital Chamber Outlines Principles to Preserve DeFi Liquidity

TLDR:

- TDC urges retaining Section 404 exemptions to maintain DeFi liquidity and LP pairs.

- Stablecoins should remain viable payment instruments without disrupting the ecosystem.

- Firms must disclose that DeFi yields are not equivalent to traditional bank interest.

- Deposit impact studies will assess how stablecoins interact with insured U.S. banks.

Stablecoin yield debate is now a central topic in U.S. digital finance policy as The Digital Chamber (TDC) released principles to guide lawmakers.

The organization emphasized the need to preserve stablecoins as payment instruments while protecting liquidity in decentralized finance (DeFi) markets.

TDC’s guidance aims to maintain the role of dollar-denominated stablecoins, support innovation, and provide a structured, data-driven framework for assessing their effect on deposits and banking activity.

TDC shared its guidance on X, stating, “Today, The Digital Chamber is releasing principles to help illuminate the path forward on the stablecoin yield debate so that the U.S. can move forward in advancing a durable market structure bill.”

The post also acknowledged ongoing collaboration with the White House and Senate Banking Committee staff.

Preserving Section 404 Exemptions to Support DeFi

TDC addressed Section 404 of the Senate Banking Committee’s draft market structure bill, which prohibits interest or rewards for merely holding payment stablecoins.

The organization stressed that exemptions (E) and (F) are essential to maintaining DeFi operations and liquidity provision.

“Without exemptions (E) and (F), legislation could significantly impair U.S. dollar denominated stablecoins currently deployed in DeFi protocols and as liquidity provider pairs,” the Chamber noted.

The principles explain that U.S. dollar stablecoins currently serve as critical components of LP pairs on decentralized exchanges.

Removing these exemptions could shift activity toward foreign jurisdictions and reduce U.S. oversight. “Eliminating these provisions would severely undermine dollar dominance in the digital asset ecosystem,” TDC warned.

TDC also highlighted the importance of compensating liquidity providers who facilitate trading. According to the statement, banning such rewards could increase user exposure to impermanent loss. Exemptions allow users to continue pairing assets with trusted dollar-denominated stablecoins safely.

The organization concluded that retaining Section 404 exemptions protects existing market participants while fostering innovation.

By maintaining these clauses, the U.S. can safeguard financial infrastructure and its position in digital asset markets.

Enforcement and Deposit Impact Considerations

Enforcement and disclosure are key components of TDC’s framework. The Chamber recognized concerns from financial institutions regarding community banking and main street lending.

“Assuming exemptions (b)(2)(E) and (b)(2)(F) are retained, we concur that no person shall circumvent a direct or indirect yield prohibition,” the statement read.

TDC emphasized the importance of clear disclosure. Firms offering rewards in DeFi must clarify that any yield earned is not comparable to traditional bank interest. This ensures transparency and regulatory compliance.

Section 404 also mandates a “deposit impact” study two years after enactment. “We support the requirement present in Section 404… that regulators submit a study examining the benefits of increased payment stablecoin activity and its impact on deposits at insured depository institutions,” TDC said.

The Chamber further expressed support for initiatives like the Main Street Capital Access Act, highlighting the synergy between blockchain technologies and community banking infrastructure.

These principles aim to guide lawmakers in advancing balanced stablecoin legislation while protecting innovation.

Crypto World

Trump Media Files for Two Crypto ETFs Tied to Bitcoin, Ether, Cronos

Trump Media & Technology Group, via its Truth Social Funds unit, has moved to offer crypto-focused exchange-traded vehicles registered with the U.S. Securities and Exchange Commission. The filings outline a plan to launch two crypto ETFs tied to major digital assets, along with a Cronos-based yield vehicle designed to capture staking income. The actions mark a notable step in a celebrity-backed enterprise expanding into asset management and crypto markets, with the SEC still reviewing the registrations. The funds are to be developed in partnership with Crypto.com, which would provide custody, liquidity, and staking services if regulators approve the products. Yorkville America Equities would act as investment adviser, and investors would access the funds through Foris Capital US LLC, bearing a 0.95% management fee.

Key takeaways

- The Truth Social Funds propose a Bitcoin (CRYPTO: BTC) and Ether (CRYPTO: ETH) ETF designed to mirror the combined performance of the two largest cryptos and include staking rewards for Ether.

- A third fund, the Truth Social Cronos Yield Maximizer ETF, targets Cronos (CRYPTO: CRO) and would incorporate staking income from the CRO token.

- The partnerships with Crypto.com and Yorkville America Equities place custody, liquidity, and advisory services at the center of the rollout, contingent on SEC approval.

- Investors would access the ETFs via Foris Capital US LLC, with a proposed 0.95% management fee on assets under management.

- Past disclosures show Truth Social’s broader crypto ambitions, including earlier deals to create “Made in America” ETFs and a treasury-pooling arrangement tied to CRO; these efforts set the backdrop for the current filings.

- The move comes as the crypto ETF landscape has faced mixed flows, with spot Bitcoin ETFs recently experiencing weeks of outflows amid ongoing regulatory scrutiny.

Tickers mentioned: $BTC, $ETH, $CRO

Sentiment: Neutral

Market context: The filings arrive as crypto ETF development continues to unfold against a backdrop of tightening regulation and selective appetite for crypto-linked vehicles. In recent weeks, spot Bitcoin ETFs have posted net outflows, underscoring cautious investor sentiment even as interest in regulated crypto exposure remains intact in other corners of the market.

Why it matters

The new proposals signal a cautious but strategic expansion of a media brand into asset management, seeking to monetize crypto exposure for investors who want regulated access to digital assets. By pairing Bitcoin and Ether with staking considerations, the funds aim to offer both price appreciation potential and income features, a combination that could appeal to investors seeking a balanced crypto allocation within traditional portfolios. The structure—employing Yorkville America as adviser and Crypto.com for custody and liquidity—highlights a model where traditional financial rails intersect with on-chain capabilities, potentially smoothing investor onboarding if approvals come through.

Historically, Trump Media’s crypto ambitions have traversed partnerships beyond simple trading products. Earlier moves included talks around “Made in America” ETFs and a treasury collaboration with Crypto.com to accumulate CRO, signaling a longer-term thesis on aligning the issuer with scalable crypto ecosystems. If the SEC approves the current filings, these products would not only broaden the firm’s product lineup but also test the appetite of mainstream investors for regulated crypto exposure linked to a recognizable brand. The CRO angle, in particular, ties the product suite to Crypto.com’s Cronos chain, a network that has sought broader adoption through staking and DeFi integrations.

Market context matters for framing the potential impact of these filings. While the crypto market has benefited from ongoing institutional attention, regulators remain a decisive gatekeeper. The sector has seen pockets of inflows and outflows depending on regulatory signals, macro risk sentiment, and the perceived robustness of custody solutions. The latest data show spot Bitcoin ETFs experiencing persistent outflows over several weeks, reinforcing the idea that even as regulated vehicles grow, investor caution can persist in periods of policy ambiguity. In this environment, a well-structured product with institutional partners could provide a bridge for investors seeking regulated crypto exposure with a familiar framework.

What to watch next

- SEC review and potential approval timeline for the Truth Social Funds’ registrations.

- Regulatory clarity on custody, staking, and ETF structure for crypto assets in the United States.

- Progress of the Crypto.com custody and liquidity arrangements if approvals are granted.

- Any updates on the Foris Capital US LLC platform accessibility and investor onboarding processes.

- Follow-up disclosures on the performance and governance of the two crypto ETFs and the CRO-focused Yield Maximizer ETF once launched.

Sources & verification

- Truth Social Funds files registration statement for two digital asset ETFs. PR Newswire, which announced the SEC filing.

- Trump Media inks deal with Crypto.com for Made in America ETFs (historical context). Cointelegraph.

- Trump Media Company Crypto.com treasury deal (historical context). Cointelegraph.

- Spot Bitcoin ETF fund flows and outflows data. SoSoValue.

Trump-affiliated funds seek crypto ETF exposure to BTC, ETH and CRO

Trump Media & Technology Group, via its Truth Social Funds arm, has filed with the U.S. Securities and Exchange Commission to launch two crypto-focused exchange-traded funds and a Cronos-based yield vehicle. The proposed Bitcoin (CRYPTO: BTC) and Ether (CRYPTO: ETH) ETF would aim to mirror the combined performance of the two largest cryptos by market capitalization while also capturing staking rewards generated by Ether. A Cronos (CRYPTO: CRO) Yield Maximizer ETF would pursue a similar approach for Crypto.com’s native token, including staking income. The filings are not yet effective and remain under SEC review.

The proposals outline a multi-asset strategy designed to provide investors with both capital appreciation and income opportunities within a regulated framework. Yorkville America Equities would serve as investment adviser for both funds, while Crypto.com is positioned to supply custody, liquidity, and staking services should regulators approve the products. Access to the ETFs would be provided through Foris Capital US LLC, and each product is expected to carry a 0.95% management fee.

In a broader sense, the filings reflect an ongoing push by Truth Social’s financial arm to expand beyond its social platform into crypto-market infrastructure. The company has, in the past, pursued partnerships that would blend digital assets with traditional securities, including a set of “Made in America” ETFs and a treasury collaboration with Crypto.com to accumulate CRO—an initial purchase of about 684.4 million CRO valued at roughly $105 million through a mix of stock and cash. The evolution from partnership announcements to formal ETF registrations suggests a disciplined step toward regulated crypto exposure, with the emphasis on custody and staking services designed to address investor risk concerns.

From a market perspective, the timing of these filings aligns with a phase where regulated crypto products remain aspirational for some investors but seem increasingly plausible for others. The sector has experienced churn in flows as liquidity, risk appetite, and regulatory signals shift. The latest spot-Bitcoin ETF data show a streak of net outflows, signaling continued investor caution even as institutions increasingly discuss and consider regulated routes to crypto exposure. As the SEC reviews the Truth Social Funds’ proposals, observers will be watching not only for approval decisions but also for how these products handle custody, staking, and distribution through existing broker-dealer channels.

Crypto World

Quant Joins Bank of England Synchronisation Lab for Multi-Bank Treasury Testing

TLDR:

- Quant is testing synchronised multi-bank treasury operations in the Bank of England RT2 Lab.

- Treasury actions like liquidity rebalancing will execute as single atomic settlement bundles.

- Quant Flow automates multi-bank cash movements using PayScript® for auditable workflows.

- Participation is experimental; it does not indicate endorsement or policy adoption by the Bank.

Quant selected to participate in the Bank of England’s Synchronisation Lab marks a new stage in the firm’s work on programmable settlement infrastructure.

The company will test synchronised payment techniques inside the Bank of England’s simulated RT2 environment. The programme forms part of the RTGS Future Roadmap after the renewed core ledger and settlement engine went live.

The initiative focuses on experimentation rather than policy direction or endorsement.

RT2 Synchronisation Lab and Atomic Multi-Bank Settlement

Quant selected to participate in the Bank of England’s Synchronisation Lab enables structured testing within a controlled RT2 simulation.

The Lab allows participants to assess synchronisation models for future payment and settlement workflows. It operates in a non-live environment following delivery of the renewed RTGS core.

A spokesperson for Quant said participation centres on a practical corporate treasury scenario. “The Synchronisation Lab provides a simulated RT2 environment in which participants can explore how synchronisation techniques could support future payment and settlement workflows,” the spokesperson stated.

Quant’s proposed use case focuses on synchronized multi-bank treasury rebalancing. Large corporates and upper-SMEs often manage liquidity across several domestic banks. Treasury teams currently execute independent CHAPS or high-value transfers to rebalance positions.

According to Quant, this sequential structure introduces operational constraints. “This sequential model introduces structural challenges, including partial settlement risk, intraday liquidity buffers, manual intervention, and complex reconciliation,” the company noted.

Quant Flow and Programmable Treasury Orchestration

Quant selected to participate in the Bank of England’s Synchronisation Lab builds on its enterprise platform, Quant Flow.

The platform orchestrates multi-bank cash movements using PayScript®, a domain-specific language for auditable financial workflows.

Within the simulation, Quant Flow packages treasury actions into a synchronised settlement bundle. “Each participating bank prepares and reserves funds before settlement, with all legs committed together or not at all,” the company explained.

Quant said the prepare-and-commit structure changes treasury execution mechanics. “This prepare and commit approach removes the failure modes inherent in sequential transfers and enables deterministic finality across multiple banks in a single treasury action,” the spokesperson added.

The company also clarified the scope of its participation. “Participation in the Synchronisation Lab involves experimentation and technical validation within a non-live environment,” Quant stated.

It added that involvement does not represent approval, endorsement, or adoption by the Bank of England, and future deployment remains independent of the Lab.

Crypto World

Treasury’s Bessent Says Crypto Clarity Act Could Calm Markets

The cryptocurrency market has swung sharply in recent weeks, with both Bitcoin and Ethereum trading well below the record levels they reached last year.

Key Takeaways:

- Bessent says the proposed Clarity Act could reduce uncertainty and stabilize crypto markets.

- He attributes part of Bitcoin’s recent drop to industry resistance to regulation.

- The bill faces political hurdles and opposition from some firms despite a 62% passage outlook.

However, US Treasury Secretary Scott Bessent believes a pending regulatory framework could help steady sentiment.

Speaking to CNBC on Friday, Bessent said passage of the proposed Clarity Act, a market structure bill aimed at defining oversight of digital assets, would ease uncertainty among investors.

Bessent Urges Swift Passage of Crypto Clarity Bill This Spring

“Some clarity on the Clarity bill would give great comfort to the market,” he said, adding that lawmakers should move quickly to place the legislation on the president’s desk this spring.

Bessent described part of the recent downturn as avoidable. Bitcoin has fallen more than 29% over the past month, a decline he characterized as partly driven by industry resistance to regulation.

“There is a group of Democrats who want to work with Republicans on getting a market structure bill,” he said.

“But there are a group of crypto firms who have been blocking it… that doesn’t seem to have been good for the overall crypto community.”

His latest comments were more measured than earlier criticisms directed at companies opposing the proposal.

In recent interviews, Bessent labeled dissenting firms “recalcitrant actors” and argued that participants unwilling to operate under a regulatory framework could relocate elsewhere.

US-based exchange Coinbase withdrew support over provisions restricting companies from offering yield on stablecoins to retail users.

Chief executive Brian Armstrong said at the time the firm would prefer no legislation over one it considers flawed.

Political dynamics could also shape the bill’s prospects. Bessent warned that a shift in congressional control following upcoming midterm elections might halt negotiations entirely.

He also pointed to prior regulatory pressure on the sector, saying policies during the previous administration came close to an “extinction event” for parts of the industry.

Prediction market Polymarket currently assigns roughly a 62% probability that the Clarity Act becomes law by the end of 2026.

Gold Rally, Clarity Act Uncertainty a Turning Point for Crypto

As reported, Bitwise Chief Investment Officer Matt Hougan has said that gold’s surge past $5,000 an ounce and mounting uncertainty around US crypto legislation are shaping a critical moment for digital asset markets.

Hougan said the combination of rising demand for assets outside government control and fading confidence in near-term regulatory clarity could influence both crypto adoption and price action in the months ahead.

He also flagged growing uncertainty around the Clarity Act, legislation aimed at cementing a pro-crypto regulatory framework in the US.

Political and geopolitical factors are adding further uncertainty. Internal divisions at the Fed, combined with leadership questions and rising tensions following a US naval deployment toward Iran, have pushed investors toward traditional havens.

“This flight to safety is bypassing Bitcoin entirely in favor of tangible commodities. Until the geopolitical dust settles or the Fed turns the liquidity taps back on, Bitcoin remains a high-risk play in a world looking for a bunker.

The post Treasury’s Bessent Says Crypto Clarity Act Could Calm Markets appeared first on Cryptonews.

-

Politics6 days ago

Politics6 days agoWhy Israel is blocking foreign journalists from entering

-

Business6 days ago

Business6 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat5 days ago

NewsBeat5 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video23 hours ago

Video23 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports7 days ago

Former Viking Enters Hall of Fame

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business5 days ago

Business5 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World8 hours ago

Crypto World8 hours agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

(@APompliano)

(@APompliano)