Crypto World

Digital assets exchange-traded product landscape: past, present and future

In today’s newsletter, Joshua De Vos, head of research at CoinDesk, summarizes their latest crypto ETF report covering U.S. adoption, the speed at which it’s happening and asset concentration.

In Keep Reading, we link to the U.S. and Global ETF reports for those who want to do a deeper dive.

Digital assets exchange-traded product landscape: past, present and future

Crypto for Advisors – February – Digital Asset ETPs

Digital asset Exchange-Traded Products (ETPs) are now one of the clearest signals of how quickly crypto is being integrated into traditional portfolio infrastructure. As presented in CoinDesk’s latest research report, the market has moved beyond the early phase of fragmented access and into a period where regulated wrappers and exchange-traded fund (ETF) distribution are materially shaping how capital enters the asset class.

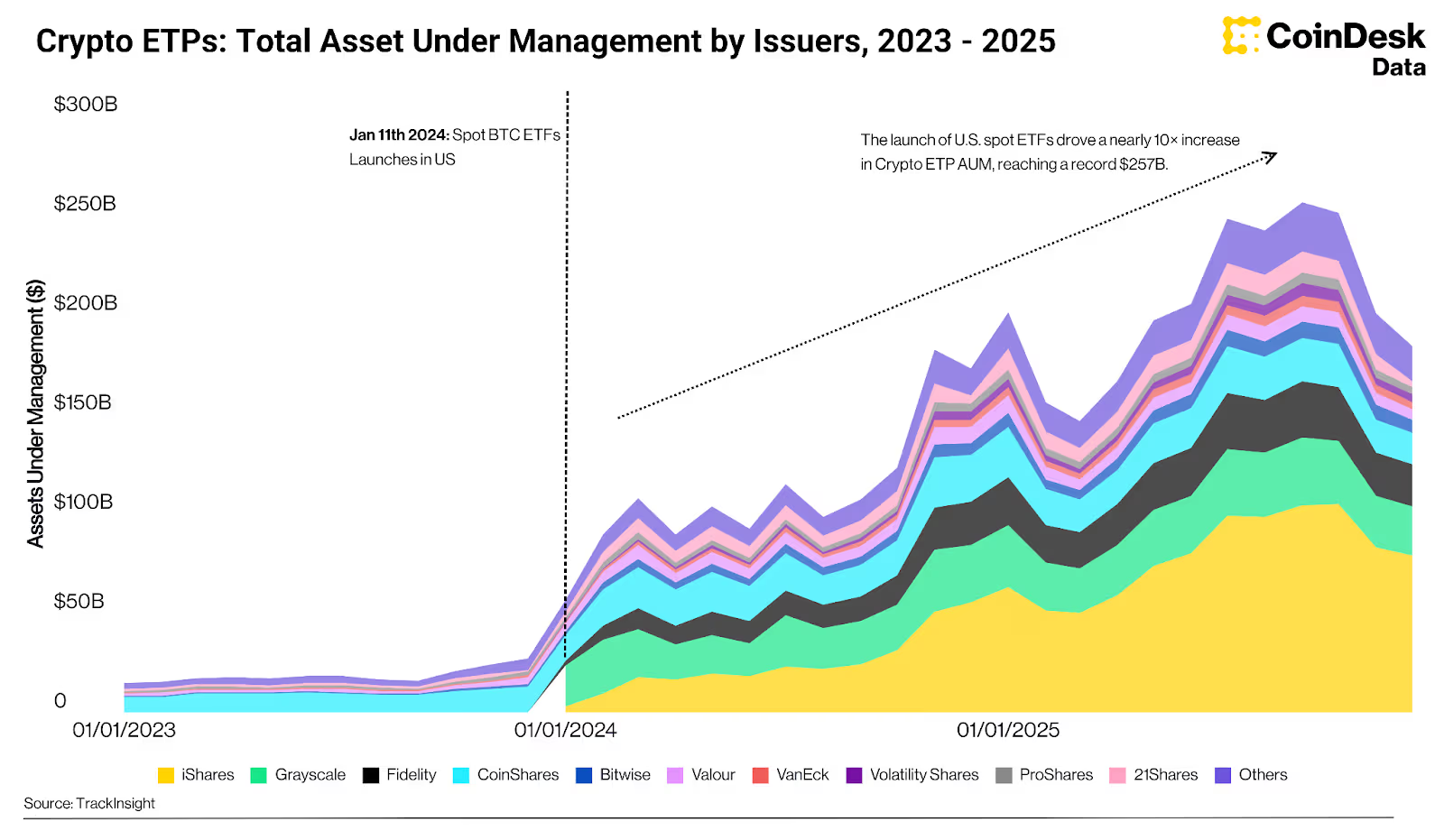

The state of crypto ETP adoption

As of the end of 2025, crypto ETP assets under management (AUM) reached $184 billion. The United States remains the center of gravity, accounting for approximately $145 billion, or close to 80% of global assets AUM. ETFs dominate the product landscape, representing 84.6% of crypto structured products by assets. The market is also heavily skewed toward simple exposure. Around 94.1% of crypto ETPs employ a delta-one strategy, and 96.1% are passively managed.

The growth in AUM has been driven primarily by the launch of U.S. spot bitcoin ETFs in January 2024. The step-change was immediate. The launch cycle pushed crypto ETP assets sharply higher and created a product category that now sits inside the same ETF allocation frameworks used across equities, fixed income and commodities.

The pace of adoption has also been unusually fast when compared to earlier ETF cycles. U.S. bitcoin ETFs reached $100 billion in assets in just 11 months, while U.S. gold ETFs took nearly 16 years to surpass the same milestone. By early 2025, bitcoin ETFs had matched 91% of the top 10 U.S. gold ETFs by AUM, before gold’s subsequent rally widened the gap. This is less a statement about relative value and more a statement about how quickly bitcoin has been absorbed into institutional distribution channels once the wrapper became available.

Scale and concentration

Within the crypto ETP market, exposure remains heavily concentrated. Bitcoin-based products account for $144 billion in AUM, representing 78.2% of total AUM. Ether-based products have reached $26.5 billion, indicating that institutional demand is gradually broadening beyond bitcoin. Outside of those two assets, exposure remains limited. Solana- and XRP-linked products manage $3.8 billion and $3.0 billion respectively, while multi-cryptocurrency ETPs represent 0.62% of total AUM, or $2.16 billion.

The pipeline broadens

This hierarchy is consistent with how ETF markets typically develop. Institutions tend to begin with the most liquid assets, in the most established structures, before expanding into broader exposure as markets deepen and benchmarks standardise. That dynamic is now beginning to appear in the crypto ETP pipeline. As of end-2025, more than 125 digital asset ETP filings were pending, with bitcoin continuing to lead the filing landscape, followed by XRP and Solana as the most active single-asset categories.

The other notable development is the growing momentum behind basket products. Multi-cryptocurrency ETPs remain a small segment by AUM, but they represent the second most active category by number of pending filings. This matters because basket products tend to become more relevant as markets mature, correlations evolve and concentration risk becomes more apparent. Indices such as the CoinDesk 5 and CoinDesk 20 are increasingly being used as reference points for ETPs, structured notes and derivatives, reflecting the market’s gradual shift toward diversified exposure.

Advisor access

The expansion of crypto ETPs has also occurred before broad adoption across major advisory platforms. Many large advisors remain in evaluation or early allocation phases, suggesting current AUM reflects initial positioning rather than full participation. That is beginning to change, with firms such as Vanguard only recently expanding client access to crypto ETFs.

Looking ahead, the scale of the global ETF market provides context for how large the category could become. Global ETF and ETP assets are projected to grow to roughly $30 trillion by 2030. Within that framework, even modest allocation decisions have the potential to translate into a materially larger crypto ETP market over time.

This summary was created based on CoinDesk Research’s latest report; Digital Assets ETP Landscape: Past, Present and Future.

– Joshua De Vos, research team lead, CoinDesk

Keep Reading

Read the full global and U.S. ETF reports here:

Crypto World

Zcash faces potential 66% decline, holders reduce stakes

Zcash recorded a 7% price decline over the past 24 hours, while broader cryptocurrency markets also slipped. However, large holders reduced their positions by approximately 38% over the past seven days, raising concerns about the cryptocurrency’s near-term prospects.

Summary

- Large holders reduced their stakes by 38% over the past week, and technical analysis suggests a bearish flag pattern.

- Zcash has seen a 40% drop month-over-month.

- The concentration of 70% of the supply in the top 100 addresses suggests Zcash’s current price foundation may be unstable.

The privacy-focused cryptocurrency has increased 5.8% over the past week, but decreased over 40% month-over-month, according to CoinGecko.

Bitcoin and Ethereum experienced larger declines during the same period as the broader cryptocurrency market continued its selloff.

Exchange flow data showed net outflows on Feb. 12, indicating some purchasing activity. However, on-chain data revealed that large holders decreased their Zcash holdings by roughly 38% over seven days, with additional selling occurring in the past 24 hours. Exchange inflows increased simultaneously, suggesting coins moved from private wallets to exchanges.

Technical analysts identified a bearish flag and pole pattern forming on Zcash price charts. This formation typically appears after a sharp decline, followed by a consolidation period. When prices break down from this pattern, the resulting decline often matches the distance of the initial drop, according to technical analysis methodology. For Zcash, this measured move indicates a potential 66% decline from current levels if the pattern completes.

A four-month bearish divergence signal has also formed between October and February. During this period, Zcash prices reached a higher high while the Relative Strength Index (RSI), a momentum indicator, recorded a lower high. This divergence typically indicates weakening buying pressure despite rising prices.

The RSI continues to trend downward while prices remain near recent highs, creating a widening gap between price action and momentum indicators.

On-chain data shows the top 100 addresses control approximately 70% of the total supply. Smart money indicators remained flat with no significant accumulation detected, according to blockchain analytics.

The cryptocurrency rebounded from lows reached in early February. Technical analysts stated that a breakout above resistance levels would be required to invalidate the bearish setup, while a breakdown below key support would likely accelerate declines.

Market observers noted that the relative outperformance compared to other cryptocurrencies occurred while large holders distributed their positions, creating what analysts described as a potentially unstable foundation for current price levels.

Crypto World

Crypto PAC Fairshake seeks to force resistant Texas Democrat Al Green from U.S. House

The crypto industry’s campaign-finance arm, Fairshake, has begun rolling out its campaign strategies in its well-funded effort to pack Congress with lawmakers ready to pass friendly digital assets policy, and Democratic Representative Al Green is the first lawmaker on its hit list.

An affiliate of the Fairshake political action committee, which has begun deploying its $193 million war chest on this year’s congressional midterm elections, said it will spend $1.5 million on advertisements opposing Green’s primary campaign.

The critical Texas lawmaker has often noted potential hazards posed by cryptocurrencies to the U.S. financial system and to investors, co-sponsored a bill seeking to ban President Donald Trump from his personal crypto business interests and has voted against crypto policy legislation. That opposition earned him an “F” grade from Stand With Crypto, a group that assesses crypto support from politicians.

Green, who is among the most senior Democrats on the House Financial Services Committee that has a direct hand in crypto legislation, faces rivals in the Democratic primary for the recently redrawn Texas district he represents. Texas’ primaries come quickly next month, and longtime congressman Green would have to beat a younger Democrat, Christian Menefee, who just won a special election and took the redrawn district’s seat days ago.

“Texas voters can no longer sit by and have representation in Congress that is actively hostile towards a growing Texas crypto community,” Fairshake’s super PAC affiliate, Protect Progress, said in a statement. “We are committed to electing new members who embrace innovation, growth and wealth creation for all Americans.”

Menefee is supportive of blockchain technology, according to his campaign stance, and Stand With Crypto gives him an “A” grade.

In Green’s most recent election in 2024, his campaign spent less than $450,000 to retain his seat, which went unchallenged in the primary, and he needed even less in 2022. But he’s so far brought in more than $700,000 in this more difficult contest. Still, that’s less than half of Fairshake’s spending against him.

Fairshake also this week announced that it’ll spend $5 million to boost a pro-crypto Alabama Republican, U.S. Representative Barry Moore, in that state’s Senate primary. And the group is also backing House Financial Services Committee Chairman French Hill, according to a spokesman. The super PAC generally spends money on advertisements that are general political messages, not related to crypto issues, and because they’re “independent expenditures” under election law, Fairshake isn’t allowed to coordinate with campaigns.

Crypto World

Bitcoin Institutional Adoption Accelerates as ETFs and Corporate Treasuries Reshape Market

TLDR:

- Spot bitcoin ETFs and treasuries absorbed 1.2 times new supply in 2025, reshaping demand dynamics

- Peak-to-trough bitcoin declines now limited to 50% versus historical 70-80% drawdowns in cycles

- Digital asset treasuries hold 1.1 million BTC valued at $89.9 billion as corporate adoption grows

- U.S. Strategic Bitcoin Reserve holds 325,437 BTC representing 1.6% of total bitcoin supply today

Bitcoin continues its transformation from speculative asset to institutional holding. The digital currency has attracted major financial players through regulated exchange-traded funds and corporate strategies.

Data shows spot bitcoin ETFs and digital asset treasuries absorbed 1.2 times new supply in 2025. This shift reflects broader acceptance among investors.

ETF Growth and Corporate Treasury Adoption Reshape Market Dynamics

Spot bitcoin ETFs reached a milestone during 2025, altering the asset’s supply-demand profile. Morgan Stanley and Vanguard expanded platforms to include bitcoin products in the fourth quarter.

Vanguard’s decision proved noteworthy given its historical exclusion of commodities. These vehicles attracted capital from advisors, institutions, and retail investors.

Corporate adoption has moved beyond early adopters into mainstream finance. According to ARK Investment Management and 21Shares analysts, “the unifying theme for the current cycle is bitcoin’s transition from an optional new monetary technology to a strategic allocation.”

Strategy, formerly MicroStrategy, has accumulated holdings representing 3.5% of total supply. Digital asset treasury companies hold more than 1.1 million BTC, valued at $89.9 billion. The S&P 500 and Nasdaq 100 now include bitcoin-exposed companies like Coinbase and Block.

Sovereign interest materialized through the U.S. Strategic Bitcoin Reserve. The Trump Administration launched this reserve using seized bitcoin totaling 325,437 BTC.

This represents 1.6% of total supply valued at $25.6 billion. Texas led state-level adoption by adding bitcoin to reserves.

Regulatory developments have created clearer pathways for institutional participation. The proposed CLARITY Act would establish dual-oversight between CFTC and SEC.

This legislation provides a compliance roadmap with standardized maturity tests. The clarity reduces uncertainty that drove firms offshore.

Price Performance and Market Maturation Show Evolving Investor Behavior

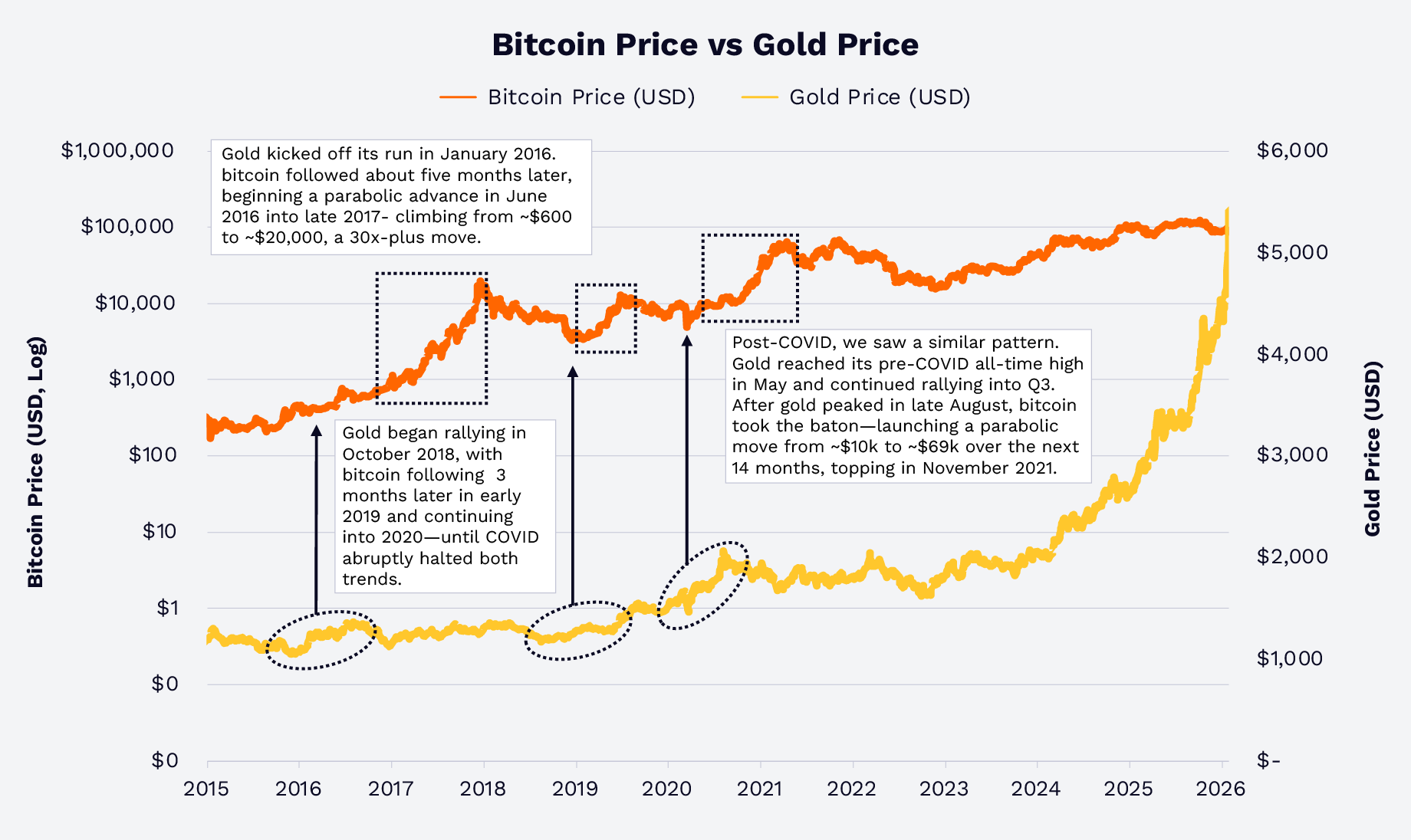

Bitcoin’s relationship with gold has demonstrated patterns throughout market cycles. Gold prices surged 64.7% during 2025 while bitcoin declined 6.2%.

Historical data from 2016, 2019, and 2020 shows gold movements preceded bitcoin rallies. Spot bitcoin ETFs achieved in under two years what gold ETFs required over 15 years.

.png)

Market volatility metrics reveal a maturing asset with improved risk characteristics. Peak-to-trough declines in the current cycle have not exceeded 50%.

This compares favorably to prior cycles where drawdowns reached 70-80%. The February 2026 correction maintained this trend.

Long-term holding strategies have outperformed market timing. A hypothetical investor purchasing $1,000 at yearly peaks from 2020 through 2025 generated positive returns.

The report notes that “in 2026, bitcoin’s story is less about whether it will survive and more about its role in diversified portfolios.”

Even accounting for February corrections, this strategy produced a 29% return. Position sizing and holding periods matter more than entry timing.

Correlation analysis shows bitcoin maintains low relationships with traditional assets. Weekly returns from 2020 through 2026 show a 0.14 correlation with gold.

This low correlation enhances portfolio diversification benefits. Combined with reduced volatility, bitcoin presents a different risk-reward proposition.

Crypto World

SEC Head Defends Enforcement Changes Amid Justin Sun Case Questions

SEC Chair Paul Atkins has defended the agency’s enforcement shift as lawmakers question why Justin Sun’s case was paused.

U.S. Securities and Exchange Commission (SEC) Chair Paul Atkins is facing scrutiny from lawmakers as the agency moves to reshape its cryptocurrency regulatory framework.

Democrats are questioning potential links between industry actors and President Donald Trump amid a broader decline in enforcement actions.

SEC Scrutinized Over Tron Case

During a House Financial Services Committee hearing, Democratic members zeroed in on the SEC’s decision to pause its case against Tron founder Justin Sun. Representative Maxine Waters pointed to what she described as a sweeping rollback of prior crypto enforcement actions after Trump entered the White House and new SEC leadership took over last year.

Waters referenced the regulator’s 2023 lawsuit against Sun, in which he was accused of organizing the unregistered sale of crypto securities tied to the TRX and BTT tokens and manipulating trading volumes.

Later in February 2025, the SEC asked the federal court overseeing the case to issue a stay, which paused the proceedings. Since that decision, Sun has become a major financial supporter of Trump-linked crypto ventures, purchasing billions of WLFI tokens, making him the largest backer of World Liberty Financial.

Waters also highlighted a more recent claim by his alleged former girlfriend, who publicly suggested she possesses evidence of TRX manipulation.

Atkins declined to address specifics of the case, telling lawmakers he could not comment on individual enforcement matters. He added that he would be open to further discussion in a confidential setting “to the extent the rules allow me to do that.”

You may also like:

When asked whether the agency ever acts to protect investors in ways that could negatively affect Trump-affiliated businesses, he responded, “As far as what the Trump family does or not, I can’t speak to that.”

Trump’s Ties to Binance

Lawmakers also raised concerns about other high-profile litigation the SEC dropped last year, including cases against Binance, Ripple, Coinbase, Kraken, and Robinhood.

In May 2025, the financial watchdog ended its lawsuit against Binance, which it had sued in 2023 for offering unlicensed services and misrepresenting trading controls. Trump later also pardoned Zhao, while a stablecoin issued by WLF was used by an Abu Dhabi investment firm for a $2 billion investment in Binance.

“Explain to me how this happens without any enforcement action,” Representative Stephen Lynch said. “The reputational damage that the SEC is suffering right now is unbelievable. And you’re in the seat, sir. It’s your responsibility. I’m just asking for an explanation.”

The SEC Chair defended the regulator, saying it has a “robust enforcement effort” and continues to bring cases. However, data from Cornerstone Research shows that its overall legal actions fell 30% in 2025, while crypto-related cases dropped 60%.

Atkins, who became the organization’s chair in April 2025 after Gary Gensler’s departure, is known for criticizing the previous aggressive approach and framing his leadership as a move away from litigation-heavy tactics.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Israeli soldier allegedly used military secrets to gamble on Polymarket

Israel is attempting to prosecute a reserve soldier who allegedly used military secrets to place bets on security operations via Polymarket.

Polymarket offers a multitude of markets on various military operations, from bets on the outcome of the Ukraine/Russia war, to more specific targeted missile strikes against various countries.

Israel’s Shin Bet security agency announced today that the soldier — who is facing court along with an alleged civilian accomplice — used “classified reports” accessed via their military role to help make bets that could threaten Israel’s national security.

The pair is charged with numerous security offences, as well as bribery and obstruction of justice. Several people were arrested, but only two have been charged so far.

A lawyer representing the soldier told Bloomberg that the indictment is “flawed,” adding that the charge of harm to national security has been dropped.

They added, however, that he’s still believed to have used confidential information without permission.

Pair might be connected to $150K Polymarket winnings on Israel-Iran strikes

It’s unknown which prediction markets the two bet on, or if they made any profits. There are suspicions, however, that they could be linked to the Polymarket account “ricosuave666.”

This account made over $150,000 betting on Israel’s strikes against Iran in 2025, and reportedly got each prediction correct across a war that lasted 12 days.

Israeli authorities then opened up an investigation into these bets.

Previous cases involving the leaking of military secrets led to an Israeli soldier reportedly being sentenced to 27 months in jail in 2023.

The individual passed on confidential information to users on social media so that they could gain credibility and popularity online.

Read more: Logan Paul fakes $1M Super Bowl bet on Polymarket

Every month, there seems to be another debate surrounding Polymarket and the use of insider information to make bets, but it’s unclear how capable the platform is of preventing these sorts of trades.

There were concerns over one account that made $437,000 betting on the exit of Venezuela’s former president Nicolás Maduro hours before the US captured him.

There were also concerns that someone was able to use insider information to bet on the Nobel Peace Prize before it was announced.

After the home of Polymarket’s CEO, Shayne Coplan, was raided by the FBI, a company spokesperson said, “We charge no fees, take no trading positions, and allow observers from around the world to analyze all market data as a public good.”

Protos has reached out to Polymarket for comment and will update this piece should we hear anything back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

CertiK awarded the “Best Security and Compliance Solution 2026” at SiGMA AIBC

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Web3 security firm CertiK honored for its contribution in web3 security and compliance at the 2026 SiGMA AIBC Eurasia Awards.

Summary

- CertiK named “Best Security & Compliance Solution 2026” at SiGMA AIBC Eurasia Awards for advancing crypto safety.

- CertiK has expanded into the Middle East, offering institutional-grade crypto security from its Abu Dhabi branch.

- CertiK has partnered with ADGM regulators to provide enterprise security solutions via Skynet.

CertiK, the web3 security services provider, received an award for “Best Security & Compliance Solution 2026” at the SiGMA AIBC Eurasia Awards ceremony on February 10, 2026.

The award is a recognition of the firm’s efforts in driving the crypto industry towards compliance and institutionalization. The SiGMA AIBC Eurasia Awards, jointly created by SiGMA and AIBC, is an award for the digital technology and innovation industries in the Eurasia region. It focuses on areas such as AI, blockchain, web3, and compliance security, and is well-known across the region.

Other award winners included web3 companies, including Crypto.com, OKX Wallet, Avalanche, and Cointelegraph.

The award comes at a time when CertiK has been expanding its presence in the Middle East since the launch of its branch in Abu Dhabi in 2025. According to the firm, it has launched a localized team recruitment drive to address the demand for security services in the Middle Eastern markets.

The company’s focus in the region has shifted to providing “institutional-level” security services. The goal of this service model is to provide banks, sovereign wealth funds, and large multinational corporations with security measures that meet traditional financial security requirements through advanced engineering capabilities and a tight defense matrix.

Since launching the branch in Abu Dhabi, CertiK has partnered with Abu Dhabi regulators, participated in roundtable discussions on the framework for virtual asset regulatory activities in the Abu Dhabi Global Market (ADGM), and offers services to local regulators via its security platform Skynet Enterprise.

According to CertiK, its services assist regulators in assessing the potential impact of abnormal events on corporate entities and the broader financial ecosystem, and promote the development of security compliance and innovation in the digital economy.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

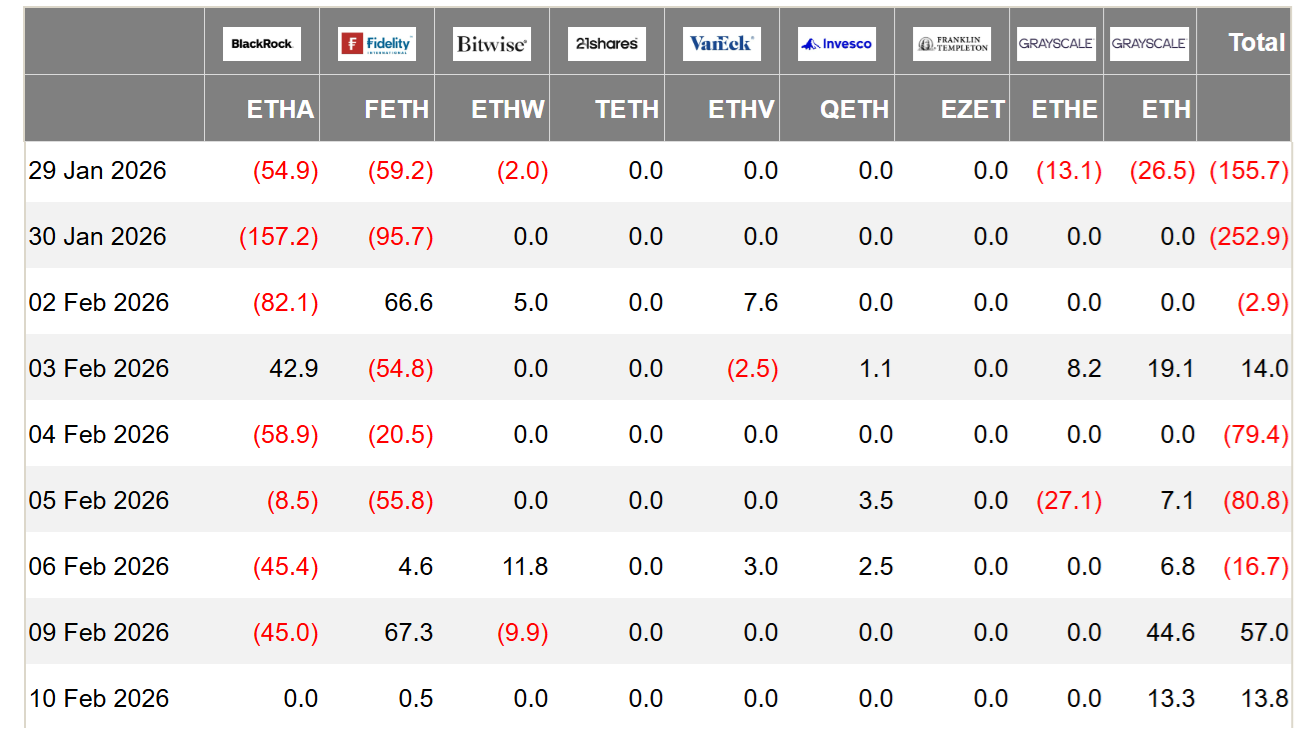

ETH ETF Flows, Onchain Volume Signal Recovery To $2.4K

Key takeaways:

-

Ether exchange-traded funds saw $71 million in inflows, signaling strong institutional appetite.

-

Weekly decentralized exchange volume doubled to $20 billion, narrowing the revenue gap with Solana.

Ether (ETH) price failed to sustain levels above $2,000 on Thursday, leaving traders to weigh the potential catalysts for a market turnaround. While optimism has waned since the crash to $1,745 on Friday, both exchange-traded fund (ETF) flows and ETH derivatives metrics are showing early signs of a reversal.

Traders now question if there is enough momentum for a bounce back toward $2,400.

US-listed Ether ETFs recently broke a three-day streak of outflows, attracting $71 million in fresh capital between Monday and Tuesday. Crucially, assets under management have stabilized at $13 billion, which is sufficient to maintain institutional interest. Ether ETFs currently average over $1.65 billion in daily trading volume, a level of liquidity that enables participation by the world’s largest hedge funds.

To put Ether ETFs in perspective, the State Street Energy Select Sector SPDR ETF (XLE US)— the largest in the US energy sector — trades an average of $1.5 billion per day. That instrument tracks a combined $2 trillion market capitalization across companies such as Exxon (XOM US), Chevron (CVX US), ConocoPhillips (COP US), The Williams Companies (WMB), and Kinder Morgan (KMI US).

ETH metrics and ETF inflows signal potential market recovery

While institutional appetite for Ether ETF trading is a positive indicator, it does not guarantee that demand for ETH derivatives is inherently bullish.

On Wednesday, the annualized premium (basis rate) of ETH futures remained below the 5% neutral threshold. This lack of demand for bullish leverage has been a constant theme for the past three months. However, the indicator has stabilized at 3%, even as the ETH price hit its lowest level in nine months. These derivatives markets are displaying moderate resilience, which remains an encouraging sign for Ether investors.

Related: Denmark’s Danske Bank allows clients to buy Bitcoin and Ether ETPs

Ether’s price weakness has driven Ethereum’s Total Value Locked (TVL) to $54.2 billion, down from $71.2 billion one month prior, according to DefiLlama data. Reduced deposits in the network’s smart contracts represent a major risk, as lower chain fees diminish the native staking yield. Moreover, Ethereum’s supply burn mechanism remains dependent on excessive demand for blockchain processing.

Despite these worsening conditions, demand for Ethereum decentralized applications (DApps) has been gradually improving throughout 2026.

Weekly decentralized exchange (DEX) volumes on the Ethereum network surged to $20 billion, up from $9.8 billion one month prior. This increased activity caused DApps revenue to reach $26.6 million in the seven days ending Feb. 8, providing a healthy indicator of ETH demand. While Solana remained the clear leader with $31.1 million in weekly DApps revenue, the gap between the two networks is narrowing.

Those monitoring Ether price performance exclusively fail to see that ETH onchain metrics and derivatives have displayed resilience, especially as inflows into Ether ETFs resumed. While it might take a couple of weeks for investors to fully regain confidence, there are strong indicators that a near-term rally toward $2,400 is possible.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Aave Labs Proposes New DAO Value Accrual and Growth Framework

The new proposal aims to resolve the ongoing debate and align the interests of equity holders and token holders.

Two months after the Aave DAO and Aave Labs clashed on the DeFi platform’s governance forum, Aave Labs has formally submitted a new strategic framework proposal to the DAO called “Aave Will Win.”

The proposal intends to align the DAO and Labs over the future growth of Aave v4, and to direct 100% of product-layer value directly to the DAO.

Specifically, the proposal requests that the DAO ratifies Aave v4 as the protocol’s core foundation for future development, establishes a funding and growth framework to compete at a global financial scale, and formalizes a model where 100% of revenue generated by Aave-branded products, including those built by Labs, flows to the DAO treasury.

If passed, the deal would clarify structure and align incentives between the DAO and Labs, potentially serving as a landmark decision on tokenholder rights, which were called into question in December by Ernesto Boado, the former chief technical officer (CTO) at Aave Labs.

“The framework formalizes Aave Labs’ role as a long-term contributor to the Aave DAO under a token-centric model, with 100% of product revenue directed to the DAO,” said Stani Kulechov, the founder of Aave Labs.

“As onchain finance enters a decisive new phase, with fintechs and institutions entering DeFi, this framework positions Aave to capture major growth markets and win over the next decade,” Kulechov concluded.

While rumors have been circulating that major changes were coming to Aave, some prominent delegates, such as Marc Zeller of the Aave-Chan Initiative (ACI), were quick to dismiss them, saying, “there’s nothing positive on the short term, but i guess good try.”

It is unclear whether Zeller was privy to this proposal and whether his statements pertain directly to it.

Aave remains DeFi’s leading lending protocol, accounting for more than 50% of the total lending market with more than $52 billion in cumulative net deposits. Despite the protocol’s long-standing success, its native token has struggled alongside the rest of the altcoin market and is down 56% over the last year.

While the proposal is far from finalized, tokenholder alignment and DAO value accrual could potentially be a tailwind for the AAVE token.

Crypto World

Is Cardano on the Verge of a Further Dump?

A new drop or a major rally: what comes next for ADA?

Cardano’s ADA has been struggling lately, with its price nosediving to a five-year low at the start of February.

While bulls might be eager to see a decisive revival in the short term, the recent actions of the large investors suggest another move south could be on the way.

The Whales Know Something We Don’t?

The renowned analyst Ali Martinez revealed that Cardano whales have dumped approximately 190 million ADA in the past week. The USD equivalent of that stash is roughly $50 million (calculated at ongoing rates of $0.26 per coin).

Seven days ago, the total possessions of this cohort of investors were 13.57 billion ADA, whereas they currently hold around 13.38 billion tokens. The figure represents approximately 36.3% of the asset’s circulating supply.

There is a general assumption in the crypto space that whales are experienced investors who may have inside information about important upcoming events that could influence their buying or selling decisions. That said, their recent actions could spread panic across the community and prompt smaller players to cash out as well.

The purely economic impact is also worth noting. Large sell-offs increase the amount of ADA on the open market, which, combined with non-increasing demand, should lead to a price pullback.

ADA’s Relative Strength Index (RSI) is another bearish factor investors should be wary of. The indicator shows whether the asset is overbought or oversold based on recent price momentum. It ranges from 0 to 100 and helps traders identify when a trend may be about to end.

You may also like:

Readings above 70 signal that ADA has entered overbought territory and could be on the verge of a correction, while ratios below 30 favor a bullish scenario. As of this writing, the RSI stands at around 74.

History to Repeat Itself?

ADA is among the cryptocurrencies with vast communities, which consist of proponents and bullish analysts. Just a few days ago, X user Aman noted that the asset’s price has dropped to the demand zone of around $0.26, reminding that in the past this area has sparked major reversals.

Mentor shared a similar viewpoint, arguing that the last time ADA reached current levels, it later rose to nearly $1.40 in less than a month. “History is going to repeat itself soon,” they projected.

Over the last few months, ADA’s exchange netflows have been predominantly negative, which reinforces the optimistic predictions. The trend reflects investors moving coins from centralized platforms to self-custody, reducing the likelihood of short-term selling.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

BTC set to thrive amid AI and other innovations, says Cathie Wood

New York — Bitcoin isn’t just a hedge against inflation, according to ARK Invest CEO Cathie Wood, but against something more disruptive: deflation driven by technological acceleration.

In a conversation with Anthony Pompliano at Bitcoin Investor Week in New York, Wood argued that traditional financial systems are unprepared for a coming “productivity shock” powered by artificial intelligence (AI), robotics, and other exponential technologies. That shock, she said, will push prices down rapidly, upend legacy business models, and create what she called “deflationary chaos.”

“If these technologies are so deflationary, it’s going to be tough for the traditional world — used to 2% to 3% inflation — to adjust,” Wood said. “They’ll have to embrace these technologies faster than expected.”

That deflation, in her view, won’t come from economic collapse, but from breakthroughs that slash costs and boost output. She cited data showing AI training costs falling 75% per year and inference costs (what it takes to generate an AI response) dropping by as much as 98% annually. As a result, businesses are becoming far more productive with fewer inputs, leading to lower prices.

Wood said this kind of innovation-led deflation is being misread by the Federal Reserve, which still relies on backward-looking data. “They could miss this and be forced into a response when there’s more carnage out there,” she warned.

In that scenario — where traditional financial institutions are caught flat-footed — bitcoin’s appeal becomes clearer.

“Bitcoin is a hedge against inflation and deflation,” she said. “The chaotic part of this is… disruption all over the place,” referencing underperformance in software-as-a-service stocks and emerging counterparty risks in areas like private equity and private credit. “Bitcoin doesn’t have that problem.”

Bitcoin, she argued, offers a trustless alternative that is insulated from the fragility of traditional finance. As central counterparties and legacy institutions come under pressure, bitcoin’s decentralized architecture and fixed supply become strategic advantages.

Wood also noted that bitcoin’s simplicity stands in contrast to the complexity of layered financial systems, which may face pressure as deflation compresses margins and undermines debt-based growth models.

“This is the opposite of the tech and telecom bubble,” she said. “Back then, investors threw money at tech when the technologies weren’t ready. Now, they’re real — and we’re on the flip side of the bubble.”

She emphasized that ARK’s portfolios have been built around the convergence of disruptive technologies, including blockchain, for years. The firm remains one of the largest holders of Coinbase (COIN) and Robinhood (HOOD) among many other allocations in crypto companies.

While markets remain volatile, Wood argued that bitcoin — and innovation-focused investments more broadly — stand to benefit as the economic narrative shifts from inflation to productivity-driven deflation.

“Truth will win out,” she said. “We believe we’re on the right side of change.”

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports20 hours ago

Sports20 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World21 hours ago

Crypto World21 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video16 hours ago

Video16 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’