Crypto World

Elon Musk’s X to launch crypto and stock trading in ‘couple weeks’

Elon Musk’s social media platform X is set to soon let users trade stocks and cryptocurrencies directly from their timelines as the company pushes deeper into financial services.

The upcoming features, described by the company’s head of product, Nikita Bier, will include “Smart Cashtags.” These will allow users to interact with ticker symbols in posts and execute trades from the app.

The announcement comes as the company prepares to launch an external beta of X Money, its in-house payments system. Musk said the tool is already live in internal testing and will be available to a limited group of users within one to two months.

The idea is to make X a one-stop platform where users can message, post, send money and invest, a version of Musk’s “everything app” vision.

He’s compared the rollout of financial tools like X Money to adding banking services inside the app, saying users could eventually manage most of their daily digital activity without leaving the platform.

Elon Musk’s companies have been involved with crypto in the past. His electric car maker Tesla owns 11,509 bitcoin on its balance sheet, down from an initial investment of 42,300 made in early 2021. SpaceX currently controls around 8,285 BTC.

Over the years Musk has also shown support for the meme-inspired cryptocurrency dogecoin. In 2022, he said SpaceX would accept DOGE for some merchanside, echoing an earlier move from Tesla. Earlier this month, Musk said he may put DOGE “on the moon.”

Crypto World

Prediction Markets Should Become Hedges for Consumers

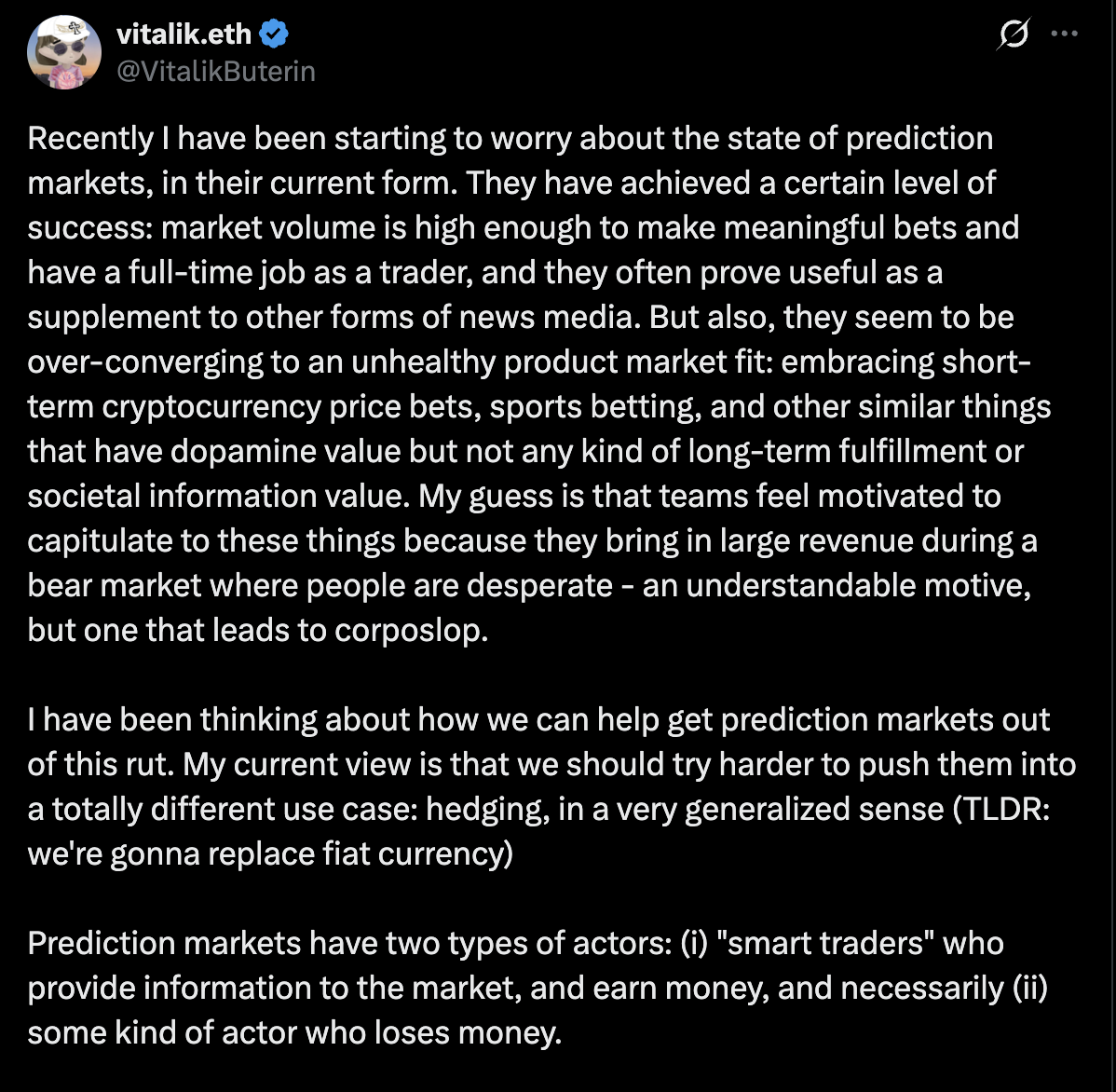

Ethereum co-founder Vitalik Buterin said he is starting to “worry” about the direction of prediction markets and suggested that they shift to become marketplaces to hedge against price exposure risk for consumers.

Prediction markets are “over-converging” to “unhealthy” products that are focused on short-term price betting and speculative behavior as opposed to long-term building, Buterin said in an X post.

Instead, onchain prediction markets coupled with AI large-language models (LLMs) should become general hedging mechanisms to provide consumers with price stability for goods and services, Buterin said. He explained how this system would work:

“You have price indices on all major categories of goods and services that people buy, treating physical goods and services in different regions as different categories, and prediction markets on each category.

Each user, individual or business, has a local LLM that understands that user’s expenses and offers the user a personalized basket of prediction market shares, representing ‘N’ days of that user’s expected future expenses,” he continued.

Individuals and businesses can hold a combination of assets to grow wealth and “personalized prediction market shares” to offset the rising cost of living created by fiat currency inflation, Buterin concluded.

Related: CFTC pulls Biden-era proposal to ban sports, political prediction markets

Prediction markets are useful market intelligence tools, supporters say

Prediction markets are crowdsourced intelligence platforms that can provide insight into global events and financial markets, while allowing individuals and businesses to hedge against a wide variety of risks, proponents of prediction markets say.

Prediction markets are more accurate than polls and should be treated as a public good, according to Harry Crane, a statistics professor at Rutgers University.

Crane told Cointelegraph that opponents of prediction markets in the US government want to restrict these platforms because they offer insights that cannot be easily ignored or manipulated by centralized entities.

Prediction markets like Polymarket or Kalshi provide an alternative to information presented in official sources or media reports that can be controlled or manipulated to feed certain narratives by distorting public opinion, Crane said.

Magazine: Brandt says Bitcoin yet to bottom, Polymarket sees hope: Trade Secrets

Crypto World

BlackRock Says Bitcoin ETF Holders Stayed Calm Amid Volatility

TLDR:

- Only 0.2% of IBIT assets were redeemed during recent Bitcoin volatility

- BlackRock says ETF investors are long-term and buy-and-hold focused

- Major liquidations occurred on leveraged perpetual platforms

- IBIT has grown to nearly $100B despite short-term market swings

Bitcoin exchange-traded fund investors remained steady during last week’s market turbulence, according to BlackRock.

The asset manager reported minimal redemptions from its iShares Bitcoin Trust, even as leveraged traders faced sharp liquidations across perpetual futures platforms.

BlackRock Reports Limited IBIT Redemptions

A recent post by CryptosRus on X cited comments from BlackRock executive Robert Mitchnick. He stated that only about 0.2% of the $IBIT was redeemed during the recent Bitcoin volatility.

The iShares Bitcoin Trust, known as iShares Bitcoin Trust, has grown to roughly $100 billion in assets in record time. Despite the rapid growth, redemptions during the market swing remained nearly flat.

Mitchnick explained that if hedge funds had aggressively reduced ETF exposure, billions in outflows would have appeared. However, that scenario did not occur. Instead, the bulk of liquidations took place on leveraged perpetual trading platforms.

These remarks came from BlackRock, the world’s largest asset manager with over $14 trillion in assets under management. The firm described its Bitcoin ETF investor base as largely long-term and buy-and-hold oriented.

That characterization suggests the presence of institutional capital rather than short-term trading desks. As a result, ETF flows remained stable even while Bitcoin prices moved sharply.

Leverage Drives Volatility as ETF Base Holds Firm

The contrast between ETF stability and leveraged liquidations stands out. According to the statements referenced in the tweet, leverage created most of the volatility seen during the period.

Perpetual futures platforms often amplify price swings when traders use high leverage. When markets move against those positions, forced liquidations can accelerate declines or rallies.

In this case, the turbulence occurred largely within those leveraged venues. Meanwhile, spot ETF investors did not rush to exit positions. That dynamic marks a shift from earlier crypto cycles dominated by retail speculation.

The steady ETF base points to deeper capital participation in the Bitcoin market. With a growing pool of long-term holders, market shocks may be absorbed differently compared to prior periods.

Moreover, the presence of large asset managers changes the structure of Bitcoin ownership. Institutional allocation through regulated vehicles offers a different capital profile than margin-based trading.

As noted in the tweet, the takeaway centers on the source of volatility. Leverage drove price action, while ETF holders remained composed. For market observers, this separation between trading platforms and fund flows offers a clearer view of where pressure originated.

Crypto World

Paxful Fined $4M After Admitting It Profited From Criminal Activity on Its Crypto Platform

Despite pleading guilty to serious AML violations, Paxful received a reduced $4 million penalty instead of the $112.5 million figure agreed by the parties.

Peer-to-peer virtual asset trading platform Paxful has been sentenced to pay a $4 million criminal penalty after pleading guilty to multiple federal offenses, according to an official press release from the US Department of Justice.

The sentence follows Paxful’s admission that it conspired to promote illegal prostitution, violated the Bank Secrecy Act, and knowingly transmitted funds derived from criminal activity.

Illicit Crypto Flows

The penalty was determined based on the company’s ability to pay. Federal authorities said Paxful profited from facilitating transactions for criminals while promoting its lack of anti-money laundering (AML) controls and failing to comply with applicable money laundering laws, despite knowing that users on its platform were engaged in crimes including fraud, extortion, prostitution, commercial sex trafficking, romance scams, and human trafficking.

Court documents revealed that Paxful operated an online virtual currency platform and money transmitting business where users traded cryptocurrency for cash, prepaid cards, gift cards, and other items. From January 1, 2017, to September 2, 2019, Paxful facilitated more than 26.7 million trades worth nearly $3 billion in total value and generated more than $29.7 million in revenue.

Authorities said Paxful knew that a portion of these transactions involved funds derived from criminal offenses, including fraud schemes and illegal prostitution. The company also deliberately transferred virtual currency on behalf of Backpage, an online advertising platform that later admitted in criminal proceedings that it advertised and profited from illegal prostitution, including content involving minors.

According to the Justice Department, Paxful’s founders referred internally to the “Backpage Effect,” which they credited with helping the platform grow. Between December 2015 and December 2022, Paxful’s dealings with Backpage and a similar website resulted in nearly $17 million worth of Bitcoin being transferred from Paxful wallets to those sites. From this, Paxful earned at least $2.7 million in profits.

The plea agreement states that from July 2015 to June 2019, Paxful marketed itself as a platform that did not require know-your-customer (KYC) information. It not only allowed users to trade without collecting sufficient KYC data but also provided third parties with AML policies that were not implemented or enforced, and failed to file suspicious activity reports despite clear indicators of criminal conduct.

You may also like:

DOJ Cuts Penalty

Paxful pleaded guilty to conspiring to violate the Travel Act by promoting illegal prostitution through interstate commerce, conspiring to operate an unlicensed money transmitting business, and conspiring to violate the Bank Secrecy Act’s AML requirements.

Although the parties agreed that the appropriate criminal penalty was $112.5 million, the department concluded Paxful could only pay $4 million as part of the resolution.

Paxful’s guilty plea was part of a coordinated resolution with the Financial Crimes Enforcement Network (FinCEN), and in July 2024, the company’s co-founder and former CTO, Artur Schaback, also pleaded guilty to related AML violations.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

How Does Bitcoin $1.4 Trillion Valuation Compare to the Global Asset Landscape?

TLDR:

- Bitcoin’s $1.4 trillion market cap represents just 4% of gold’s $35 trillion global valuation share

- Cryptocurrency comprises 0.4% of bond markets and 1.2% of equities in proportional asset analysis

- Top 100 institutions control 1.13 million BTC while daily mining produces only 450 new coins total

- One percent reallocation from gold holdings would generate $350 billion in new Bitcoin demand flow

Bitcoin’s position within the $100 trillion global financial system reveals stark proportional disparities compared to traditional asset classes.

The cryptocurrency’s $1.4 trillion market capitalization represents 0.4% of worldwide bond markets and 1.2% of global equities as of February 2026.

Crypto analyst Crypto Patel published detailed comparative analysis examining Bitcoin against every major asset category.

The study maps Bitcoin’s current footprint across bonds, stocks, real estate, commodities, and gold holdings. Mathematical projections demonstrate how minor capital shifts from legacy assets could reshape Bitcoin’s valuation significantly.

Bitcoin Ranks as Rounding Error in $100 Trillion Asset Hierarchy

The global asset landscape totals over $100 trillion when combining all major investment categories. Bond markets alone exceed $130 trillion in aggregate value worldwide.

Global equity markets represent approximately $115 trillion in total capitalization. Real estate holdings comprise roughly $380 trillion across residential and commercial properties.

Against this backdrop, Bitcoin’s $1.4 trillion footprint appears mathematically insignificant in proportional terms.

Gold maintains a $35 trillion market capitalization, creating a 25-fold size advantage over Bitcoin. The precious metal’s dominance in store-of-value allocation reflects centuries of institutional acceptance.

Bitcoin currently captures just 4% of gold’s total market share. This comparison highlights the vast distance between digital and physical reserve assets.

Traditional investors continue allocating overwhelmingly toward established safe-haven holdings rather than emerging alternatives.

Crypto Patel’s analysis positions Bitcoin as the smallest component among major global asset classes. The cryptocurrency represents 0.37% of the $380 trillion real estate market.

Corporate and government bonds dwarf Bitcoin by factors exceeding 90 times current valuation. Even within the narrower commodities category, Bitcoin trails far behind aggregate precious metals holdings.

The proportional analysis reveals Bitcoin occupies marginal space in global wealth distribution patterns.

Small Allocation Shifts Generate Outsized Bitcoin Price Impacts

Mathematical modeling demonstrates how percentage-based reallocations dramatically affect Bitcoin prices due to current small market cap.

A 1% shift from gold holdings into Bitcoin would generate approximately $350 billion in new demand. This capital influx would push Bitcoin’s market cap toward $1.75 trillion at current supply levels.

The price per coin would rise substantially given the fixed 21 million maximum supply. Simple proportional calculations reveal asymmetric upside potential from modest allocation changes.

Scenario analysis projects Bitcoin prices under various global asset reallocation assumptions. Capturing 10% of gold’s market share would establish a $5.4 trillion Bitcoin market cap.

This translates to approximately $257,000 per coin based on current circulating supply. A 25% share of gold markets would push valuations toward $10.15 trillion total.

The corresponding per-coin price would approach $483,000 under this allocation model. These projections assume linear market cap relationships without considering supply constraints.

Bond and equity market reallocations produce even more dramatic mathematical outcomes given their larger base sizes. Just 2% of global bond markets flowing into Bitcoin equals $2.6 trillion in new demand.

This exceeds Bitcoin’s entire current market capitalization by 85%. The supply-constrained nature of Bitcoin amplifies price impacts from institutional reallocation decisions. Traditional assets lack comparable scarcity mechanisms that magnify demand pressure effects.

Institutional Infrastructure Enables Cross-Asset Capital Flows

Bitcoin exchange-traded funds launched in January 2024 created regulated pathways for traditional capital allocation. Wealth management platforms now offer Bitcoin alongside conventional bond and equity products.

Major wirehouses including Bank of America and Wells Fargo distribute Bitcoin ETFs to advisory clients. This infrastructure removes previous barriers preventing institutional cross-asset reallocation. Financial advisors increasingly recommend 1% to 5% Bitcoin allocations within diversified portfolios.

Regulatory developments could unlock retirement account allocations currently restricted from Bitcoin exposure. Defined-contribution plans hold trillions in assets presently allocated entirely to traditional investments.

Potential rule changes would permit 401(k) administrators to include Bitcoin as an investment option. Even 1% reallocation from these plans would generate $87 billion in new Bitcoin demand. This represents four times the total spot ETF inflows since product launches.

Sovereign adoption patterns suggest governments may begin treating Bitcoin as a reserve asset category. The United States government maintains 328,372 BTC as a strategic holding.

This positions Bitcoin alongside gold and foreign currency reserves in official asset classifications. Other nations face game-theory incentives to establish similar positions.

Cross-border capital flows into Bitcoin could accelerate if sovereign wealth funds initiate allocation programs.

Crypto World

Pi Network Rallies 25%, Tops Daily Charts, and Outpaces Bitcoin

Pi Coin price surged 25% in the past 24 hours, marking its strongest single-day gain since November 2025. The move also represents the first consecutive advance in nearly six weeks.

The rally comes as broader crypto market sentiment stabilizes. Unlike previous brief spikes, this uptick reflects improving technical and derivatives signals.

Sponsored

Sponsored

Pi Coin Holders And Traders Change Stance

The Relative Strength Index, or RSI, shows Pi Coin rebounded after spending nearly a month in oversold territory. RSI readings below 30.0 typically indicate heavy selling pressure. In this case, extended bearishness followed the broader market downturn.

Oversold conditions did not signal an immediate reversal. Instead, they reflected prolonged weakness. Historically, Pi Coin has staged rallies after exiting oversold zones. The recent move above the neutral threshold suggests strengthening bullish momentum.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

As RSI climbs higher, buying pressure appears more consistent. Improved momentum signals that sellers may be losing control. If sustained, this shift could support additional upside in Pi Coin price action.

Sponsored

Sponsored

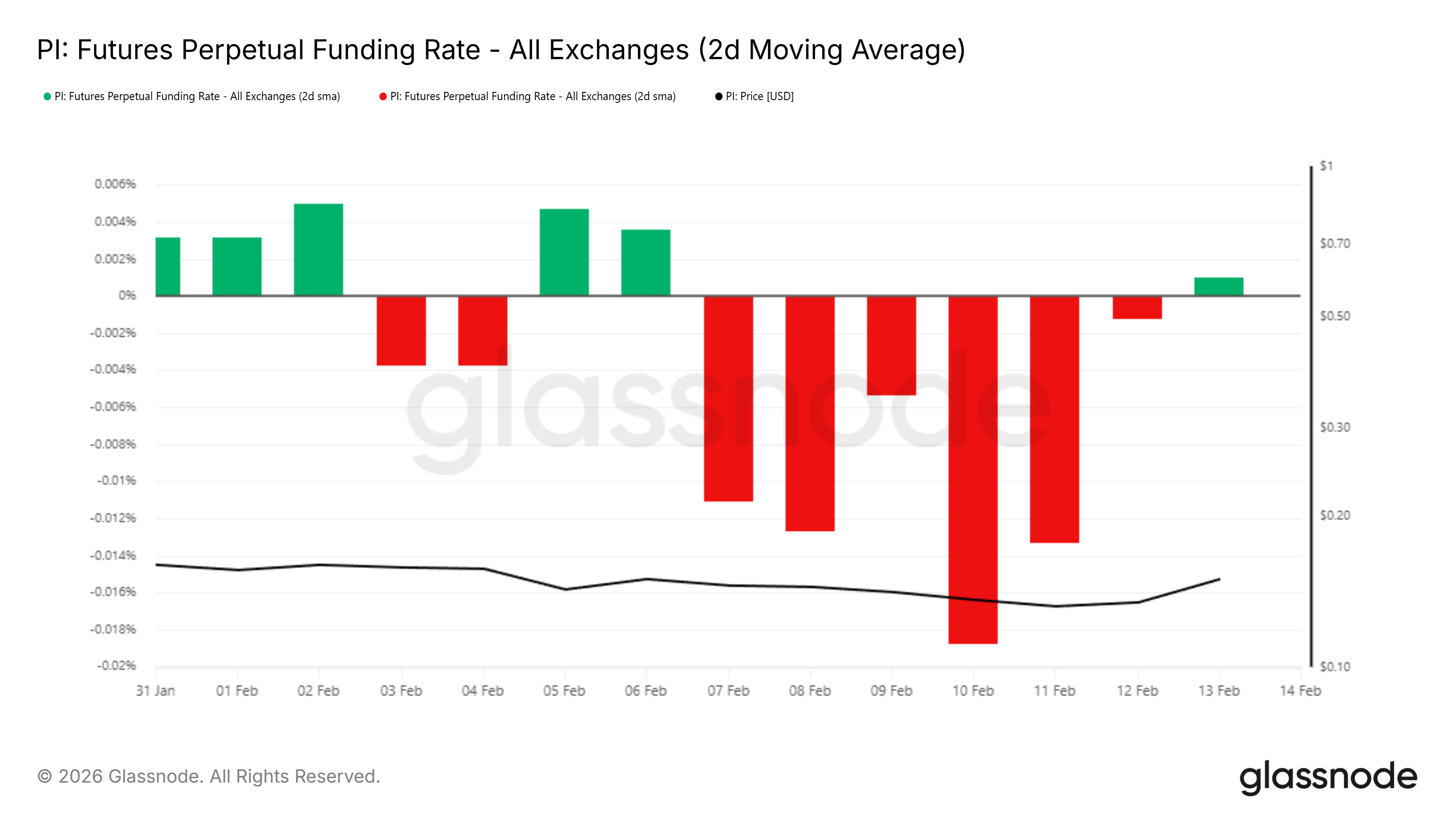

Derivatives data reinforces the improving outlook. Pi Coin’s funding rate has shifted from negative to positive. A positive funding rate indicates long positions now dominate the futures market.

Previously, negative funding reflected heavy short positioning. The reversal suggests traders are rotating from bearish to bullish exposure. Reduced short dominance lowers the probability of aggressive downside volatility in the near term.

Pi Coin Price Is Finding Support

Pi Coin price is trading at $0.171 at publication, remaining just below the $0.173 resistance level. This barrier represents the immediate hurdle for continued recovery. A decisive breakout requires sustained buying pressure.

If bullish momentum persists, Pi Coin could climb above $0.180 and target $0.197. A move toward $0.212 would confirm a stronger structural recovery. Reclaiming that level would signal broader investor confidence returning.

However, risk remains from underwater long-term holders. If profit-taking accelerates, Pi Coin’s rally may stall. A pullback toward $0.150 or closer to the all-time low of $0.130 would invalidate the bullish thesis and reintroduce downside pressure.

Crypto World

XRP Faces Potential Downside Targets as Exchange Liquidity Levels Remain Unswept

TLDR:

- Three major exchanges show unswept XRP lows: KuCoin at $1.08, Bitfinex at $1.00, and Binance perp at $0.77.

- Historical mean-reversion data suggests 45% average pullback could target the $0.75 to $0.65 support zone.

- Seven exchange lows already swept including Poloniex, Gemini, Coinbase, Bitstamp, and Binance spot pairs.

- Two scenario paths emerge: rapid liquidity sweep with violent reversal or slow bleed to targets before bounce.

XRP price action has captured attention from technical analysts who point to specific exchange liquidity levels yet to be tested.

Crypto analyst EGRAG CRYPTO highlighted several key price points across major trading platforms that could serve as downside targets.

The analysis combines historical mean-reversion patterns with unfilled liquidity zones on exchange charts. Market participants now watch whether these levels will be reached before any reversal occurs.

Untapped Exchange Lows and Mean-Reversion Data

Three major exchange price levels remain unswept according to EGRAG CRYPTO’s recent analysis. KuCoin’s XRP/USDT pair shows a low of $1.08 that has not been taken yet.

Bitfinex recorded an XRP/USD low at $1.00 that also remains untouched. Binance perpetual futures for XRP/USD marked a wick down to $0.77 without a subsequent test.

The analyst contrasted these with already-swept levels across multiple platforms. Poloniex, Gemini, Coinbase, Bitstamp, TradingView, and Binance spot all saw their respective lows tested in recent price action.

Poloniex XRP/USDT touched $2.26 while the USD pair hit $2.17 during previous drawdowns. Gemini reached $2.10, Coinbase dropped to $1.77, and Bitstamp found support at $1.58 before bouncing.

Historical mean-reversion patterns from the Super Guppy indicator add context to potential downside projections. Cycle 1 showed approximately 50% retracement from local highs during previous corrections.

Cycle 2 demonstrated around 40% pullback before finding support and reversing. The average of these two cycles suggests roughly 45% mean reversion could occur.

Based on this historical data, the analyst projects a potential final sweep into the $0.75 to $0.65 range. This zone aligns with macro green uptrend support visible on longer-term charts.

The level also represents where remaining liquidity completion would occur across exchanges. An ascending triangle pattern on higher timeframes would remain structurally valid even with a move to this area.

Two Scenario Paths and Technical Structure

The analysis presents two distinct paths forward for XRP price development. The first scenario involves a rapid liquidity sweep followed by an immediate violent reclaim of higher levels.

This pattern typically generates the fastest reversals when market sentiment reaches maximum pain. Such moves often catch traders off guard after capitulation moments.

The alternative path involves a slower price bleed toward the $0.75 to $0.65 zone over an extended period. After tagging these levels and completing the liquidity sweep, a reversal would then commence.

Both scenarios ultimately lead to the same technical outcome despite different timeframes and volatility profiles.

EGRAG CRYPTO emphasized viewing this as structural price action rather than emotional market behavior. The analyst noted that Binance printed the most aggressive downward wick visible on current charts.

The commentary stressed that tolerance for potential moves to $0.75 to $0.65 separates long-term holders from short-term participants.

The analyst disclosed maintaining a long-term position untouched while actively trading the macro range. Dollar-cost averaging continues for core holdings alongside cash reserves held for optimal entry timing.

This approach separates strategic accumulation from tactical trading within the broader price structure.

Crypto World

In-App Trading coming to X in a ‘Couple’ of Weeks

The upcoming Smart Cashtags feature on the X social media platform will allow users to trade stocks and crypto directly within the application, according to Nikita Bier, X’s head of product.

“We are launching a number of features in a couple of weeks, including Smart Cashtags that will enable you to trade stocks and crypto directly from the timeline,” Bier said in an X post on Saturday.

Bier announced the upcoming rollout of Smart Cashtags in January, teasing the possibility of in-app trading in an image showing the feature in the announcement, but no official confirmation.

The X platform introduced a basic Cashtag system in 2022 that tracked the prices of major stocks and cryptocurrencies and provided visual financial data for supported assets, including Bitcoin (BTC) and Ether (ETH), but the feature was discontinued.

Cointelegraph reached out to X about the upcoming feature, but did not receive a response by the time of publication.

The X platform is a hub of crypto-related activity, and the integration of in-app trading brings it closer to owner Elon Musk’s stated goal of becoming an “everything app,” similar to WeChat, a messaging and social media app in China with integrated payment features.

Related: Musk’s xAI seeks crypto expert to train AI on market analysis

X inches into payments as it attempts to become an “everything app”

Elon Musk provided an update on Wednesday for the launch timeline of X Money, the platform’s payments feature that will allow users to send each other money, similar to Venmo or Cash App.

Speaking at his AI company xAI’s “All Hands” presentation, Musk said the X Money feature is still in a limited beta testing phase over the next two months, with a worldwide rollout after the testing phase concludes.

“This is intended to be the place where all money is. The central source of all monetary transactions,” he said.

The X platform has about 600 million average monthly users, according to Musk. “We want it to be such that if you wanted to, you could live your life on the X app,” he added.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Bitcoin Bulls Surge to $69K as Retail Traders Push Short Positions

Bitcoin rose to around $69,482 on Friday as fresh on-chain data showed continued accumulation from smaller holders in February. Analysts say the breakout could evolve into a broader bullish phase, though other signals point to a period of consolidation underlying any uptrend.

Key takeaways

- BTC breached the $69,000 resistance and broke out of its descending channel, triggering roughly $92 million in short liquidations within four hours.

- Small wallets ($0–$10,000) added about $613 million in cumulative volume delta (CVD) in February, while the whale cohort pulled back with outflows totaling around $4.5 billion for the month.

- The short-term holder SOPR (spent output profit ratio) hit its lowest level since November 2022, signaling near-term selling pressure among new buyers.

- Futures activity surged, with about $96 million in liquidations over the last four hours and $92 million coming from short positions, indicating a pronounced short squeeze dynamic.

- Platform concentration of liquidations pointed to Bybit (22.5%), Hyperliquid (22%), and Gate (15%), suggesting a notable share of leveraged exposure remains focused on a few venues.

Tickers mentioned: $BTC

Sentiment: Bullish

Price impact: Positive. The breakout above key resistance and a short-squeeze setup imply potential momentum amplification in the near term.

Market context: The move occurs amid fluctuating liquidity and cautious risk sentiment, with February data showing persistent retail demand alongside mixed behavior from larger holders. The broader market is navigating competing signals—on-chain accumulation in small wallets versus continued distribution among whales—suggesting a nuanced backdrop for the next leg higher.

Why it matters

From a macro perspective, the latest price action underscores the ongoing tension between continuation bias and consolidation risk in Bitcoin’s cycle. An upward break above the immediate price zone around $69,000 can be interpreted as the market testing a new structural floor after several weeks of choppy trading. If the price sustains above the $68,000 level, traders will watch for sustained momentum that could push BTC toward higher liquidity pockets near $71,500 and potentially $74,000. The compressed 50- and 100-period exponential moving averages on shorter timeframes lend credence to a temporary acceleration, as price and trend indicators converge and traders reevaluate risk premia as they observe market microstructure shifts in real time. The immediate turnover in the market—brief futures liquidations and a short squeeze—also hints at sentiment that remains fragile among freshly minted entrants, even as the price action signals renewed demand from smaller holders. The net effect is a market that is briefly more constructive than it was in the immediate prior weeks, but with a cadence of caution that could persist as observers parse macro signals and evolving liquidity conditions.

On-chain activity provides a nuanced lens on who is driving the move. February’s data shows a clear split in behavior between retail and institutional-like holders. Small wallets accumulating $613 million in CVD indicates that ordinary buyers were active and willing to step in during price dips, potentially underpinning a floor under the current rally. In contrast, larger holders have not yet shown a decisive pivot; whale wallets remained net negative earlier in February and have since paused in a clear accumulation pattern, but without a definitive breakout. That divergence is a reminder that the next phase of the rally could hinge on whether large holders re-embrace accumulation or liquidity remains anchored by retail demand alone. The dynamic raises the possibility that the market could consolidate or retest prior highs before a broader, sustained ascent takes hold.

The data on liquidations helps explain the near-term price behavior. A near-term surge in futures liquidations, concentrated among a handful of platforms, points to a short-squeeze dynamic that can propel prices beyond technical resistances when hedged bets unwind in tandem. Bybit, Hyperliquid, and Gate accounted for a substantial share of these liquidations, implying that the most active leveraged positions were concentrated on a few venues. This pattern, paired with the evolving SOPR trajectory, suggests that profit-taking among the most recent entrants could re-emerge if the price fails to sustain higher levels or if macro catalysts reassert caution. Yet, the same microstructure signals a broader appetite for risk among retail participants who were able to bid in February and now appear poised to participate again as price action builds confidence in new higher ranges.

For market observers, the question is whether the relief rally can evolve into a durable advance or if February’s accumulation remains a testing ground before a more persistent trend establishes itself. The short-term indicators—targets near $71,500 and then $74,000, along with ongoing EMA compression—favor a continuation scenario, provided the price can hold above critical zones and avoid a reversion into broad choppiness. If new data show sustained SOPR above 1 or a clear uptick in whale accumulation, the bullish narrative strengthens. Conversely, a failure to hold supports, or a renewed wave of selling pressure from larger holders, could trigger a deeper correction and a renewed phase of consolidation. The market’s path remains contingent on a blend of price action, on-chain signals, and liquidity dynamics that define Bitcoin’s near-term trajectory.

For observers who track the price action closely, the key is to balance the optimism of retail-driven demand with the caution demanded by the absence of a decisive, broad-based accumulation signal from the largest holders. The coming sessions will be telling as traders weigh the momentum indicators against macro signals and the shifting risk appetite that continues to shape liquidity in the crypto markets. The current setup is a reminder that while a breakout can ignite a new leg higher, the exact path is inherently data-driven, and the next move will depend on whether the market can convert short-term momentum into a more durable trend.

All told, Bitcoin’s latest move shows a market that is ready to test higher levels but remains susceptible to pullbacks if macro cues deteriorate or if the on-chain narrative shifts away from retail-led demand. The coming days will be pivotal for traders seeking clarity on whether this rally represents a sustainable breakout or a transient relief rally within a broader consolidation phase.

For further context on price action and on-chain indicators used in this assessment, see the ongoing chart surveillance available via the BTCUSDT data feed on TradingView.

Crypto World

SOL Holders Could Face New Risk

Solana price has moved sideways in recent sessions, showing consolidation rather than decisive recovery. Despite this bounce, investor behavior suggests confidence remains limited across the broader crypto market.

The past 10 days have reflected relative stability within a defined trading range. However, stability has not translated into renewed accumulation.

Sponsored

Sponsored

Solana Is Losing New Holders’ Confidence

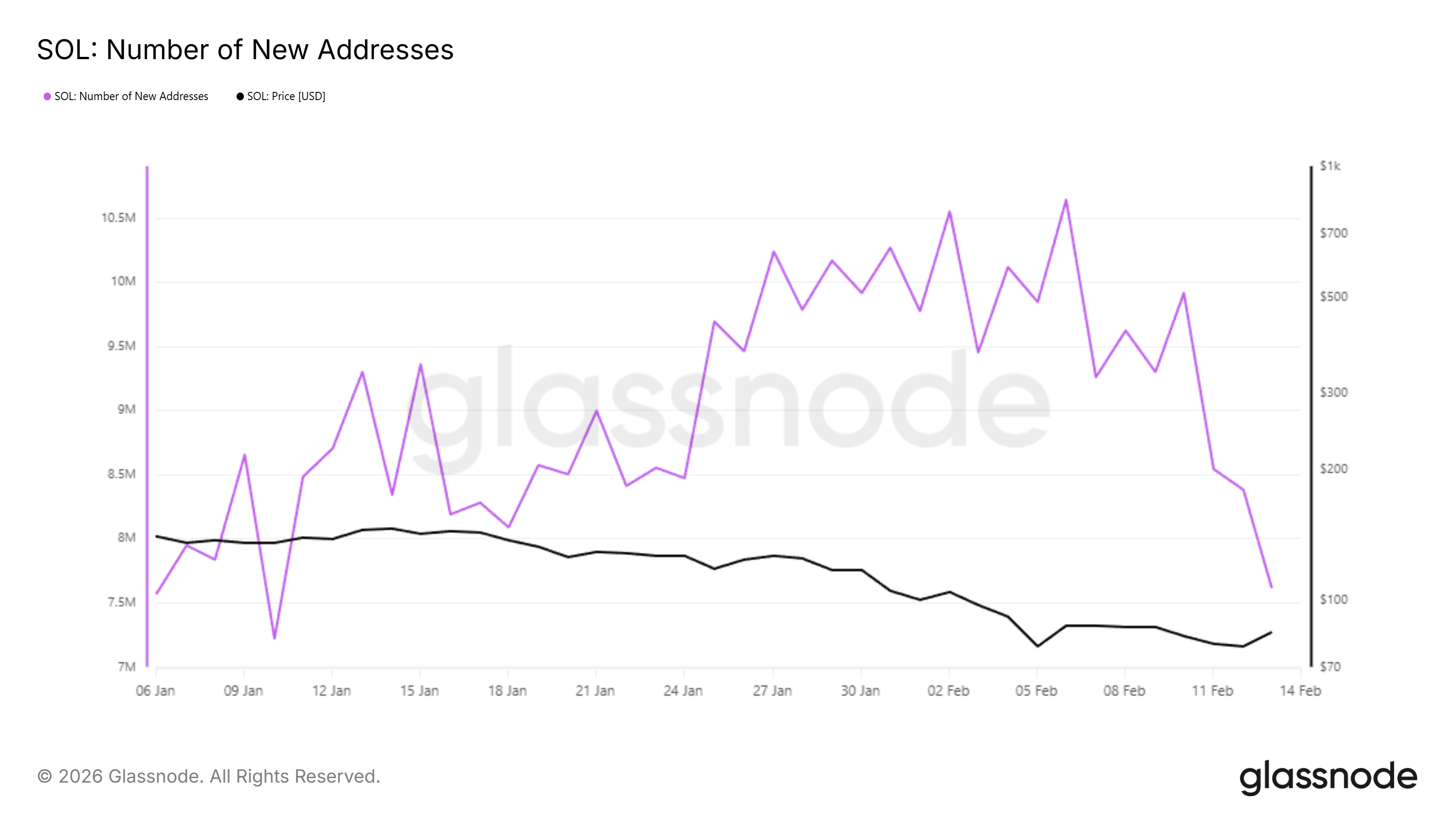

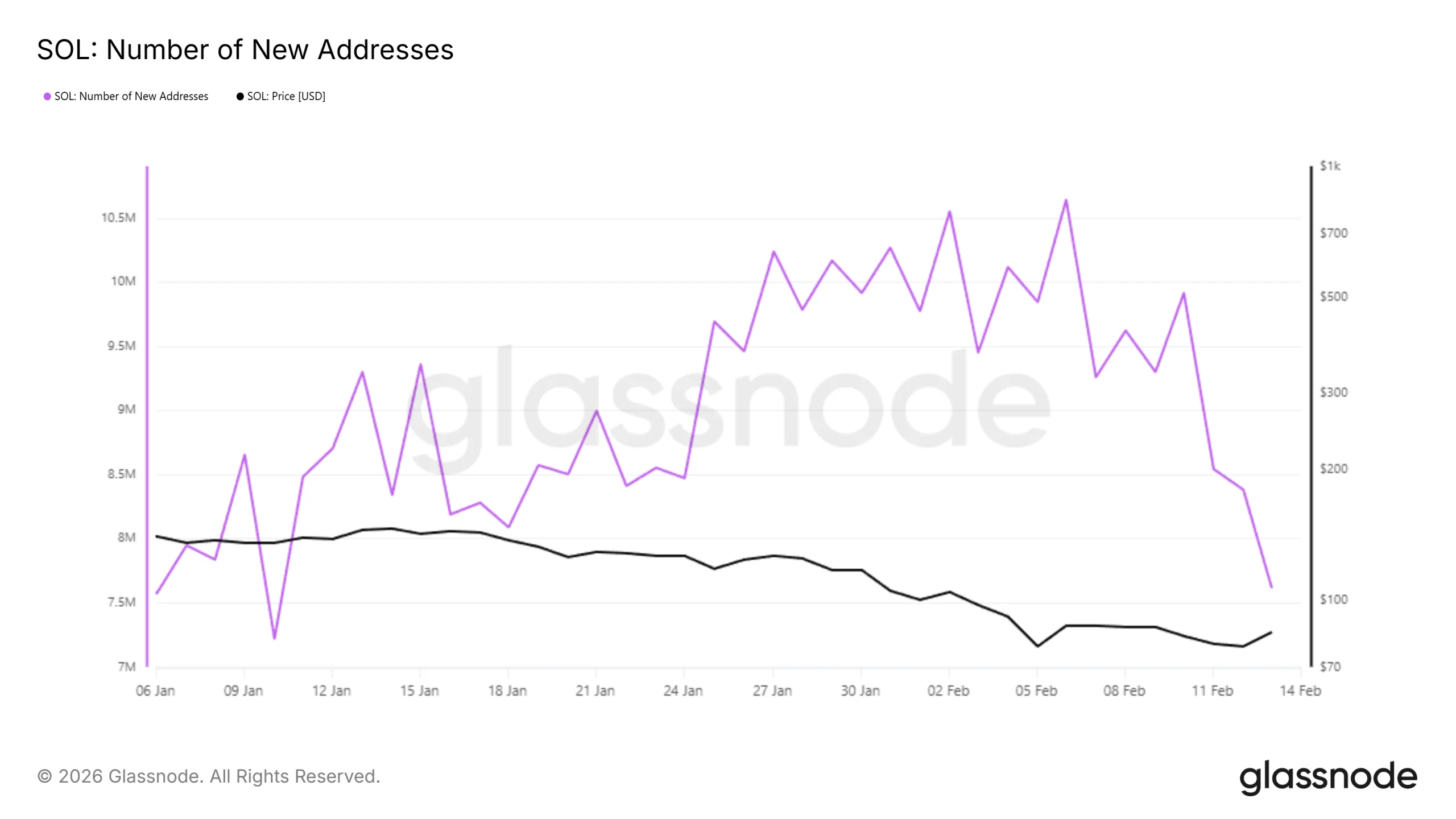

New Solana investors were the first to reduce activity. Addresses completing their first transaction on the network are classified as new addresses. Earlier this year, Solana recorded nearly 10 million new addresses at peak engagement.

Over the past four days, that number has declined by 23% to 7.62 million. The contraction signals a slowing of onboarding momentum. Reduced network expansion often reflects hesitation among prospective buyers waiting for clearer recovery signals.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This pullback indicates that holders expect stronger upside confirmation before returning aggressively. Many appear unwilling to chase short-term rallies. Until consistent price appreciation emerges, onboarding growth may remain subdued.

Solana Holders Are Also Pulling Back

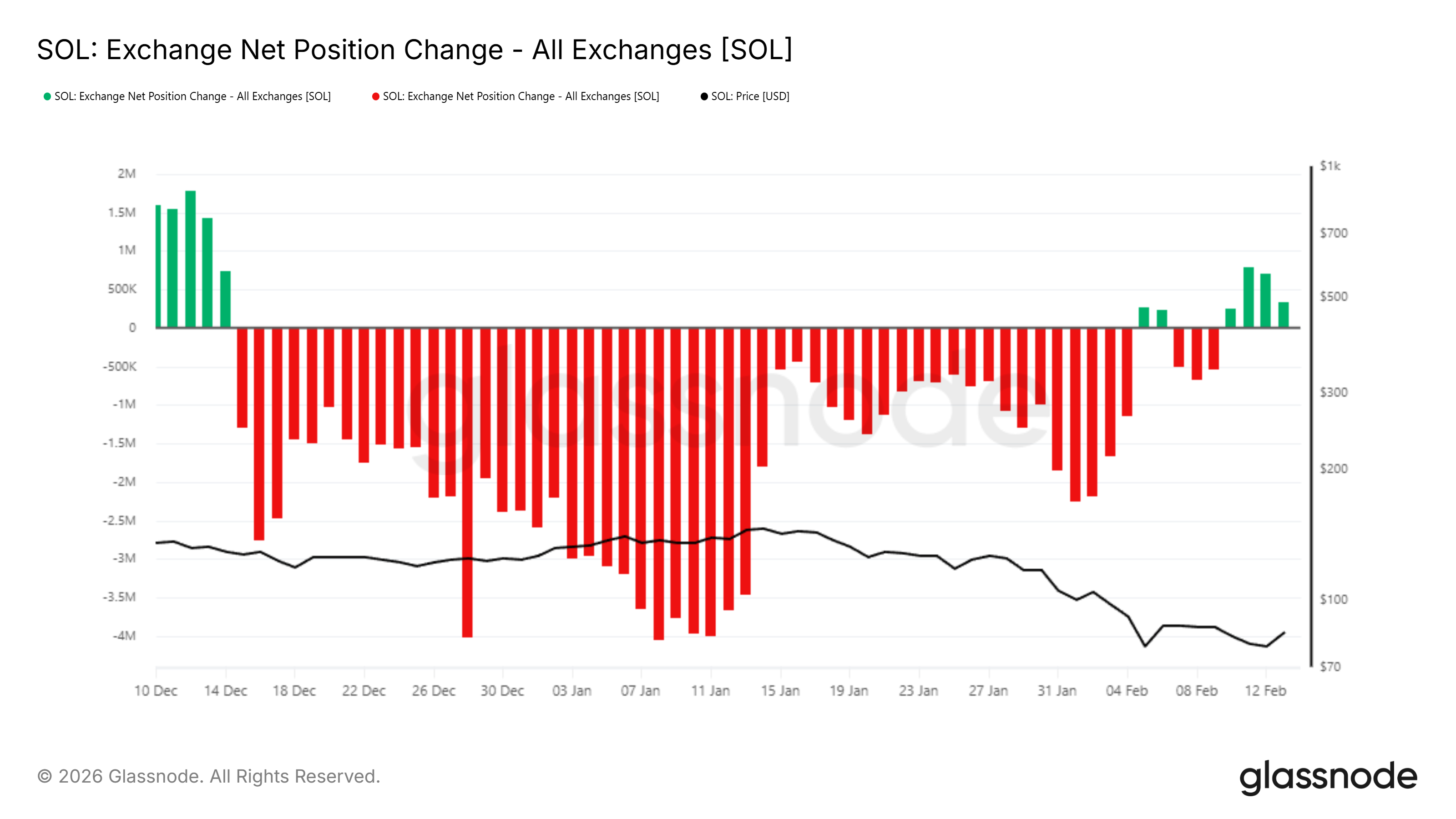

Exchange net position change data highlights a shift from buying to selling pressure. Green bars represent inflows to exchanges, which typically signal intent to sell during bearish phases. Recent readings show increasing transfers of SOL to trading platforms.

Sponsored

Sponsored

Approximately 1.4 million SOL entered exchanges over the last 48 hours, worth around $117 million. Such inflows increase available supply on exchanges. Elevated balances can limit upside momentum if buyers fail to absorb distribution.

If SOL price continues rising, short-term holders may intensify profit-taking. That behavior often caps rallies in range-bound markets. Sustained inflows would reinforce consolidation rather than support a sustained breakout.

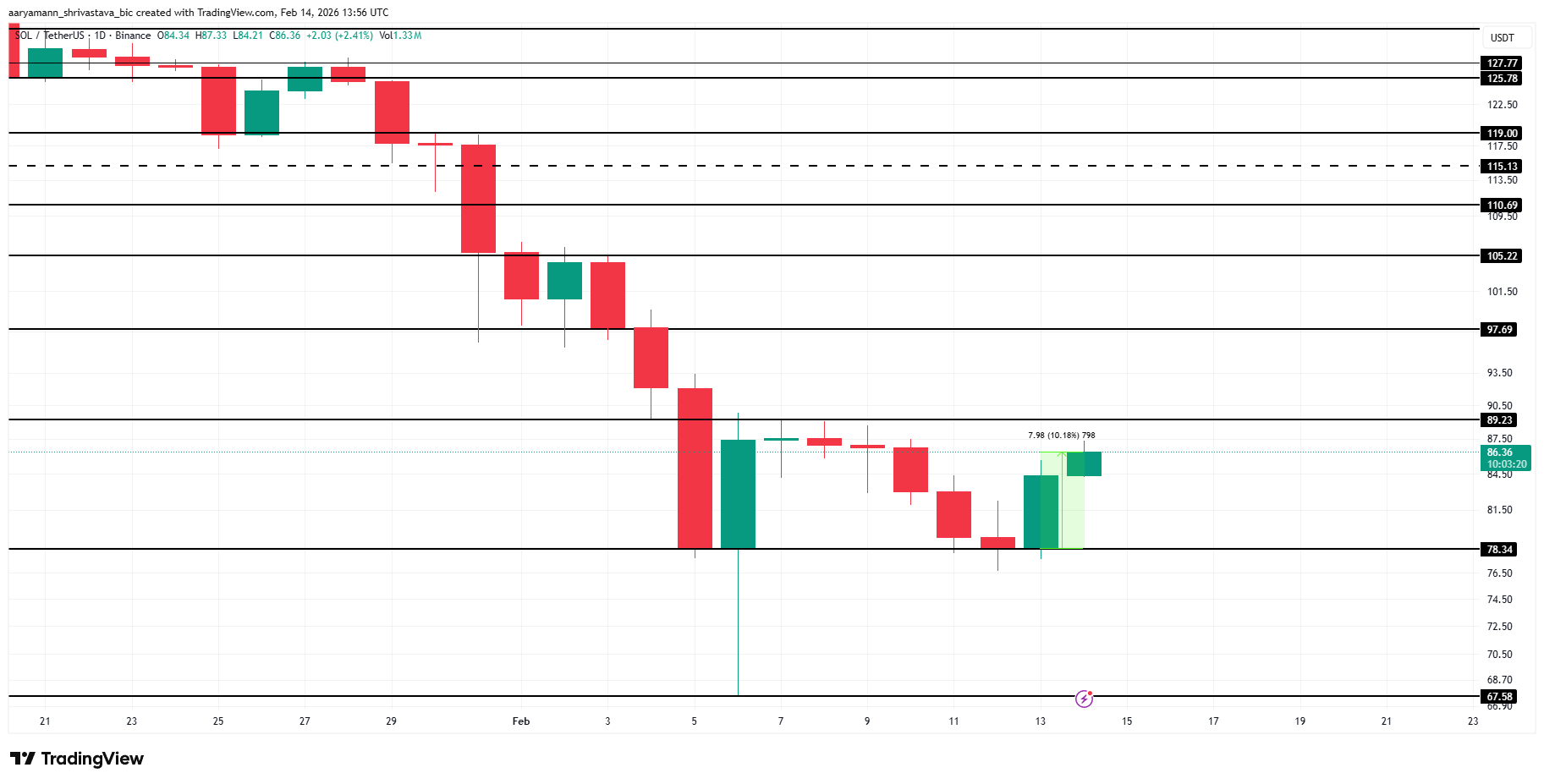

SOL Price Breakout Unlikely

Solana price remains range-bound between $89 resistance and $78 support. The current level at $86 places SOL near the midpoint of this channel. While the 10% daily gain improves sentiment, broader recovery remains uncertain.

Given slowing new address growth and rising exchange inflows, downside risk persists. A failure to hold $78 could send SOL toward $67. Such a move would confirm the continuation of the prevailing bearish structure.

If investors halt selling and inflows diminish, SOL could challenge $89 resistance. A breakout above that level may push the price toward $97. Sustained strength beyond $97 could target $105, invalidating the bearish thesis and signaling structural recovery.

Crypto World

SafeMoon Scandal Ends With 8-Year Sentence for Ex-CEO

Former SafeMoon CEO Braden Karony sentenced to 8 years for fraud tied to $9 million in misused liquidity funds.

Braden John Karony, SafeMoon’s former CEO, has been sentenced to 8 years in prison for his role in a multi-million dollar crypto fraud scheme.

U.S. District Judge Eric Komite handed out the judgment in a Brooklyn federal court after a jury convicted him in May 2025 following a three-week trial.

Details of The Sentencing

Court documents show that Karony was found guilty of conspiracy to commit securities fraud, wire fraud, and money laundering. As part of the ruling, he has been ordered to forfeit approximately $7.5 million, while the amount of restitution to victims will be determined at a later date. The jury also issued a verdict instructing the forfeiture of two residential properties.

Meanwhile, one of his co-conspirators, Thomas Smith, pleaded guilty in February 2025 and is awaiting sentencing, while Kyle Nagy remains at large.

“Karony lied to investors from all walks of life—including military veterans and hard-working Americans—and defrauded thousands of victims in order to buy mansions, sports cars, and custom trucks,” said United States Attorney Joseph Nocella, Jr.

FBI Assistant Director in Charge James C. Barnacle said the former executive abused his position and betrayed investors’ trust by stealing more than $9 million in cryptocurrency to finance a lavish lifestyle. The proceeds were used to purchase luxury vehicles and real estate, including a $2.2 million home in Utah, additional homes in Kansas, a $277,000 Audi R8 sports car, a Tesla, a custom Ford F-550, and Jeep Gladiator pickup trucks.

IRS-CI New York Special Agent in Charge Harry T. Chavis added that Karony carried out the scheme by exploiting his access to SafeMoon’s liquidity pool while attempting to conceal the transactions, which law enforcement eventually traced, exposing the scheme.

Liquidity Pool Misrepresentations

SafeMoon tokens were launched in March 2021 by the firm on a public blockchain, with each transaction automatically subject to a 10% tax that was split into two 5% tranches. One was meant to be reflected to holders in proportion to their holdings, increasing their token balances, while the remaining 5% was designated for its pools to boost market liquidity.

You may also like:

In the months following its debut, SafeMoon attracted millions of customers and reached a market capitalization exceeding $8 billion.

Prosecutors claim that Karony and his partners lied about important details of the company, including false statements that its reserves were locked and could not be used for personal reasons, that tokens would only be used for specific business purposes, that digital asset pairs would be added to the liquidity pool manually when trades occurred on certain exchanges, and that the developers were not using or trading SafeMoon for their own gain.

In reality, they retained access to the liquidity pools and diverted millions of dollars’ worth of crypto for personal enrichment.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Politics6 days ago

Politics6 days agoWhy Israel is blocking foreign journalists from entering

-

Business6 days ago

Business6 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat5 days ago

NewsBeat5 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech4 days ago

Tech4 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports6 days ago

Sports6 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video1 day ago

Video1 day agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business6 days ago

Business6 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

NewsBeat6 days ago

NewsBeat6 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World20 hours ago

Crypto World20 hours agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video3 days ago

Video3 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World5 days ago

Crypto World5 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?