Crypto World

Ethereum Floods Out of Exchanges in Biggest Withdrawal Wave Since October

Over 220,000 ETH have exited exchanges in the strongest withdrawal wave seen since last October.

Ethereum appears to be struggling to hold on to $2,000 following the market-wide pullback. Over the past week, the leading altcoin has shed almost 14%.

However, it just recorded its largest exchange outflows since October as traders move assets out to accumulate.

ETH Withdrawals Accelerate

ETH withdrawals from trading platforms have risen sharply. Data compiled by CryptoQuant revealed that the figure has reached its highest level since October. Recent Ethereum exchange netflow data shows a clear acceleration in outflows, which is indicative of a shift in investor behavior toward reducing the amount of ETH held on such venues.

Across all exchanges, net Ethereum outflows have surpassed 220,000 ETH over the past few days. This marks the largest wave of withdrawals since last October. Such an increase reflects a significant volume of ETH being moved from exchanges to private wallets or long-term storage protocols.

CryptoQuant stated that such movements are commonly associated with accumulation phases or with investors seeking to reduce risk by holding assets off exchanges. Binance accounted for a large share of this activity, as daily net outflows reached around 158,000 ETH on February 5.

This was the highest level of Ethereum withdrawals from Binance since last August, which implied that much of the recent exchange outflow was concentrated on the platform with the deepest liquidity.

From a price perspective, these strong outflows occurred while the crypto asset was trading in the $1,800 to $2,000 range. This means that some investors were repositioning or holding ETH at these price levels following the recent market pullback.

You may also like:

CryptoQuant further added that steady Ethereum outflows of this magnitude reduce the amount of supply readily available for selling. As a result, this trend is viewed as structurally supportive for price in the near term, particularly if market momentum stabilizes or improves.

$2,000 Level Now Under Heavy Watch

All eyes are on the $2,000 level after ETH faced rejection near higher resistance, according to market experts. Ted Pillows, for one, said ETH was rejected from the $2,100 resistance zone and identified $2,000 as the key level to hold. He warned that losing it could lead to a sweep of last week’s low. Analyst Ali Martinez also echoed the focus on this level.

Additionally, MN Capital founder Michaël van de Poppe shed light on the gap between network activity and price performance. He said that in the early stages of growth, price action often lags behind fundamentals, similar to Ethereum’s 2019 cycle, when market growth was initially limited.

Van de Poppe also explained that the asset’s price began to rise only after stablecoin transactions on the network reached their peak and observed that stablecoin transaction volumes on Ethereum are up 200% over the past 18 months, while ETH is down around 30%, which presents an opportunity for buyers.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ex-SafeMoon CEO gets 8-year prison sentence for defrauding investors

Former SafeMoon CEO Braden John Karony will face an 8-year prison sentence after being convicted last year on a string of federal charges tied to defrauding investors in his digital assets operation.

The 100-month sentence was handed down Tuesday in U.S. District Court for the Eastern District of New York, and Karony must also forfeit $7.5 million and two residences in the case.

“Karony lied to investors from all walks of life — including military veterans and hard-working Americans — and defrauded thousands of victims in order to buy mansions, sports cars, and custom trucks,” stated United States Attorney Nocella, in a statement. “Our office will continue to vigorously prosecute economic crimes that harm investors and weaken societal trust in the stability and security of digital asset markets.”

Karony was said to have participated in manipulating the price of the SafeMoon token and illicitly controlling liquidity pools in the failed Utah-based company to drain millions of dollars, according to the Department of Justice. After a three-week trial, he was convicted of conspiracy to commit securities fraud, wire fraud, and money laundering.

One co-conspirator, Thomas Smith, also pleaded guilty in February 2025 to conspiracy to commit securities fraud and wire fraud, though he hasn’t yet been sentenced. Another alleged SafeMoon conspirator, Kyle Nagy, is still wanted by authorities.

Read More: SafeMoon Execs Arrested by DOJ in Fraud Investigation, Charged by SEC

Crypto World

Tom Lee-Backed Bitmine Controls 3.6% of Ethereum Supply After Price Crash

In a risky but potentially rewarding play, Ethereum treasury company Bitmine Immersion Technologies (BMNR) has become the largest corporate holder of ETH, now controlling 3.6% of the total supply after aggressively buying the dip.

The firm, backed by Fundstrat’s Tom Lee, purchased an additional 40,613 Ether last week as prices collapsed toward $1,700, bringing Bitmine’s total treasury to over 4.3 million tokens despite sitting on massive unrealized losses from its ETH portfolio, which holds 4.3 million tokens at an average price of $3,826.

- Bitmine added 40,613 ETH during the crash, bringing total holdings to 4.3 million tokens.

- The firm now controls roughly 3.6% of the total circulating Ethereum supply.

- Unrealized losses exceed $7.8 billion with an average entry price of $3,826.

Bitmine Ethereum Accumulation Strategy Explained

Led by Chairman Tom Lee, Bitmine pivoted from mining for Bitcoin to an Ethereum-exclusive treasury strategy in mid-2025 with a goal to eventually acquire 5% of the total ETH supply.

The company sees temporary market downturns as acquisition opportunities rather than setbacks, mirroring high-conviction plays seen in broader crypto selloff contexts.

“Bitmine has been steadily buying Ethereum… given the strengthening fundamentals,” Lee stated in a press release, countering concerns about the firm’s $7.8 billion paper loss.

Lee argues that current prices do not reflect Ethereum’s utility as the “future of finance,” positioning the firm for long-term dominance despite the immediate pain on its balance sheet.

What 3.6% Supply Control Means for Ethereum Markets

Bitmine’s total stack now sits at approximately $8.7 billion based on current prices hovering just above $2,000.

On-chain data indicates the firm bought the latest tranche of 40,613 tokens as ETH plunged from $2,300 to lows of $1,700.

Unlike purely speculative holders, Bitmine leverages its position for yield; nearly 2.9 million of its tokens are currently staked, generating an estimated $202 million in annualized rewards at current prices.

While investors continue pouring capital into the sector despite the wipeout, Bitmine’s sheer scale allows it to absorb significant liquidity during panic events.

The company plans to launch MAVAN, a proprietary U.S.-based validator network, to potentially stake its entire holding and maximize yield generation.

How Bitcoin’s Concentration of Ethereum Could Affect ETH Price

The concentration of such a vast amount of Ether in a single corporate entity raises questions about market influence and liquidation risks.

While Lee predicts a V-shaped recovery, the firm remains deeply underwater with an average purchase price of $3,826. This resilience stands in stark contrast to other institutional players; for instance, Trend Research slashed Ether holdings to cover loans during the same market crash.

If Bitmine sustains its position without forced selling, it removes substantial supply from the market, potentially accelerating price appreciation if demand returns.

The post Tom Lee-Backed Bitmine Controls 3.6% of Ethereum Supply After Price Crash appeared first on Cryptonews.

Crypto World

Cardano price gets oversold, crashes to key suppport level

The Cardano price continued its strong downward trend, reaching its lowest level since October 2023, making it one of the crypto industry’s top laggards.

Summary

- Cardano price dropped to a crucial support level this week.

- The developers are working on Pentad, which aims to grow the ecosystem.

- The coin has become highly oversold, with the RSI moving to 28.

Cardano (ADA), a top layer-1 network, slipped to $0.2640, down over 80% from its December 2024 peak and 91% below its all-time high of $3 in 2021.

ADA extended its sharp decline despite several major catalysts, including this week’s CME futures launch and the upcoming Midnight mainnet debut. The futuress product made it available to American retail and institutional investors.

Midnight, its upcoming zero-knowledge sidechain, is expected to launch either later this month or in March. Data shows that its testnet continues to perform well, having handled over 185,000 blocks and 295 million slots. NIGHT, its native token, has achieved a market capitalization of over $800 million.

Cardano’s developers are working to fix the network and attract more creators. They are working on the Leios upgrade, which will make it a faster network than many popular chains.

At the same time, they are implementing the Pentad program, which aims to attract more oracle network, tier-1 stablecoins like USDT and USDC, and analytics tools. It has already attracted Pyth Network, a top oracle network, and Dune, a popular analytics tool.

Therefore, Cardano price is falling because of the ongoing crypto market crash, which has affected Bitcoin and most altcoins.

Cardano price prediction: technical analysis

The weekly timeframe chart shows that ADA token has continued falling in the past few months. It has slumped from a high of $1.3230 in December 2024 to the current $0.2638.

The coin has dropped below the 50-week Exponential Moving Average, a sign that bears remain in control. Also, Cardano token has settled at the key support at $0.2212, the neckline of the head-and-shoulders pattern.

ADA has become oversold, with the Relative Strength Index at 28, the oversold level. The Stochastic Oscillator has also moved below the oversold line.

Therefore, the coin may rebound in the coming days, potentially to the psychological level of $0.50. However, a drop below the current support level at $0.2212 will confirm more downside, potentially to $0.15.

Crypto World

X reportedly tells Justin Sun’s ex she isn’t real

Justin Sun’s alleged ex-girlfriend claims that her X account was taken down after a large number of people reported that it wasn’t being run by “a real person.”

A screenshot shared by crypto investor Yijin Li, appears to show Ten Ten, real name Zeng Ying, sharing an email from X regarding the suspension.

In the screenshot (translated with Google Translate), Ten Ten says, “Hilarious! Twitter suspended my account because ‘it wasn’t a real person using it.’”

She claims that she checked the account suspension and discovered it was enforced because “of a large number of reports received in a short period of time.”

According to the post, Sun appears to be aware of the suspension and reached out to Ten Ten to tell her that he didn’t report the account. However, she doubted whether he was telling the truth.

The email from X told her that she can appeal the account freeze, adding that if she attempts to create a new account to avoid the suspension, it will also be frozen.

Ten Ten claims Sun wash traded TRX

Ten Ten has been a thorn in Justin Sun’s side for the past few weeks after claiming that she’s his former girlfriend and making a slew of other allegations.

This includes claims that the controversial Tron founder has made millions wash trading his own TRX token by directing his employees to buy and sell large quantities of it in 2017 and 2018.

Indeed, this is the subject of a lawsuit launched by the SEC in 2023. Ten Ten also says she’s given evidence to the SEC, but whether or not it will affect a case that’s been paused for most of 2025 remains to be seen.

Ten Ten also claims that Sun had originally offered to marry her. However, she says she realized this wouldn’t happen when Sun revealed that he was dating Eileen Gu, a freestyle skier who recently won a silver medal at the Winter Olympics.

Read more: FTX estate says Justin Sun still owes it millions

Ten Ten says she decided to open up about Sun’s alleged malpractice after watching him become “an insurmountable gate of corruption and wrongdoing.”

Sun has denied all of Ten Ten’s claims, but was revealed by Ten Ten to have sent her a message implying that their former relationship was real.

Protos has reached out to Ten Ten for comment and will update this piece should we hear back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

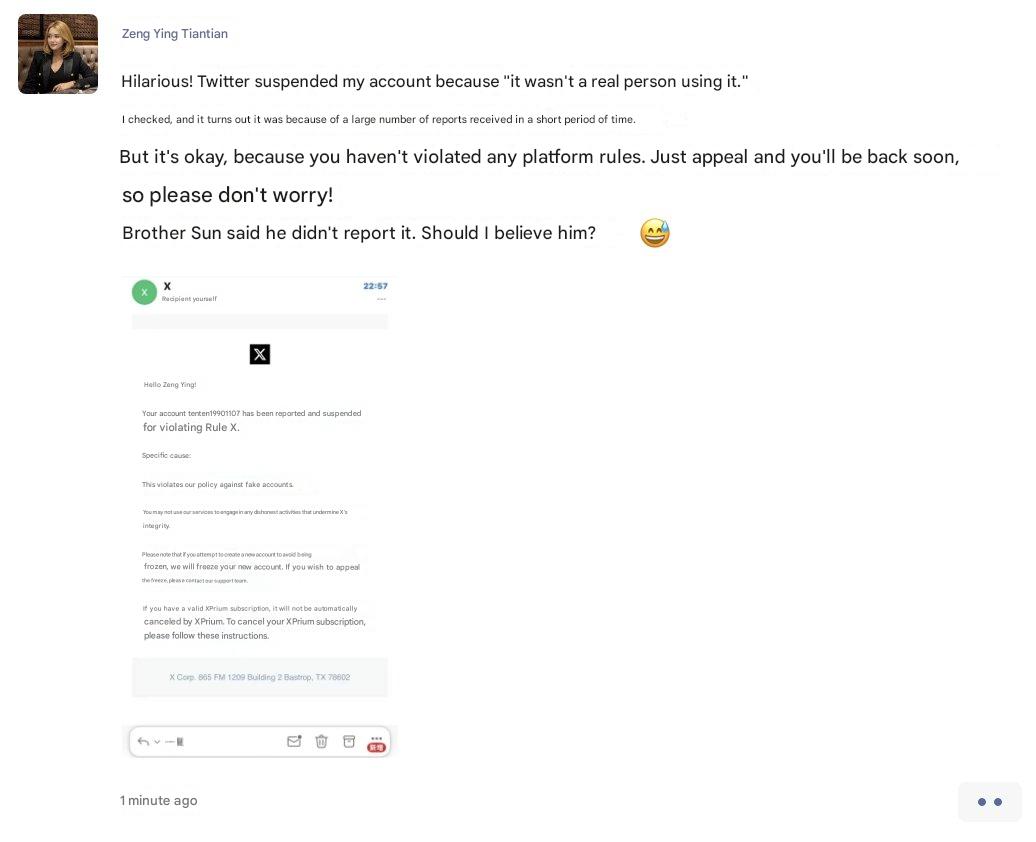

Dogecoin, Shiba Inu slide as meme coins break key support

Dogecoin fell 4% and Shiba Inu dropped 2% on Tuesday, with both meme coins accelerating lower after breaking key support levels.

Summary

- Dogecoin broke below the $0.10 level, confirming bearish momentum with resistance at $0.105–$0.12.

- Support sits at $0.08, potentially falling to $0.07 if downward pressure continues.

- Shiba Inu trades near $0.00000552 with extreme selling pressure, a bearish Supertrend at $0.00000753, and broken support zones; token burns offer partial support, but recovery requires reclaiming $0.00000700.

DOGE broke below the $0.10 psychological level, signaling a significant technical failure. The Supertrend at $0.11958 confirms bearish momentum, while the Parabolic SAR at $0.10544 acts as resistance.

Selling pressure intensified as DOGE moved toward the lower boundary of its channel. Horizontal support sits around $0.08, but the steep decline suggests strong downward momentum.

Open interest decreased 1.02% to $962.62 million, and options volume plunged 48.58%, reflecting reduced trading activity.

The Binance long/short ratio of 2.1756 indicates many traders positioned for a bounce are now underwater. Recovery requires DOGE to reclaim $0.10 and break above the Supertrend at $0.12; otherwise, support at $0.08 and potentially $0.07 remains key.

SHIB trades near the lower Bollinger Band at $0.00000552, showing extreme selling pressure. The Supertrend at $0.00000753 is bearish, and the upper Bollinger Band at $0.00000837 marks how far SHIB has fallen.

A descending trendline limits rallies, while previous support zones have been broken. Token burns rose 65.52% in 24 hours with 2.5 million SHIB removed, but 585.45 trillion remain in circulation, offering only partial long-term support.

Immediate support is $0.00000550-$0.00000600, with a potential drop to $0.00000500 if broken. Recovery needs SHIB to reclaim $0.00000700 and surpass the Supertrend.

Crypto World

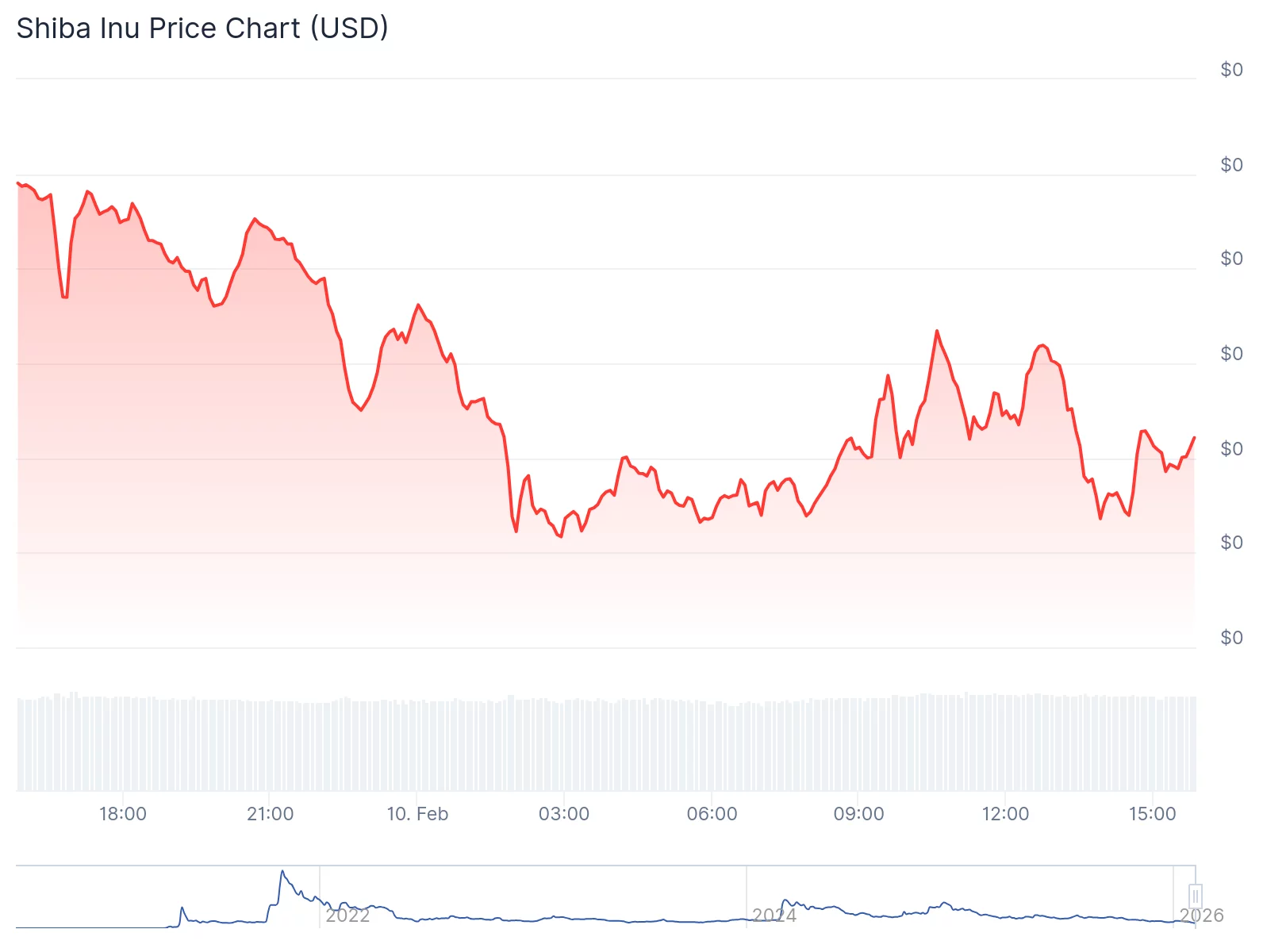

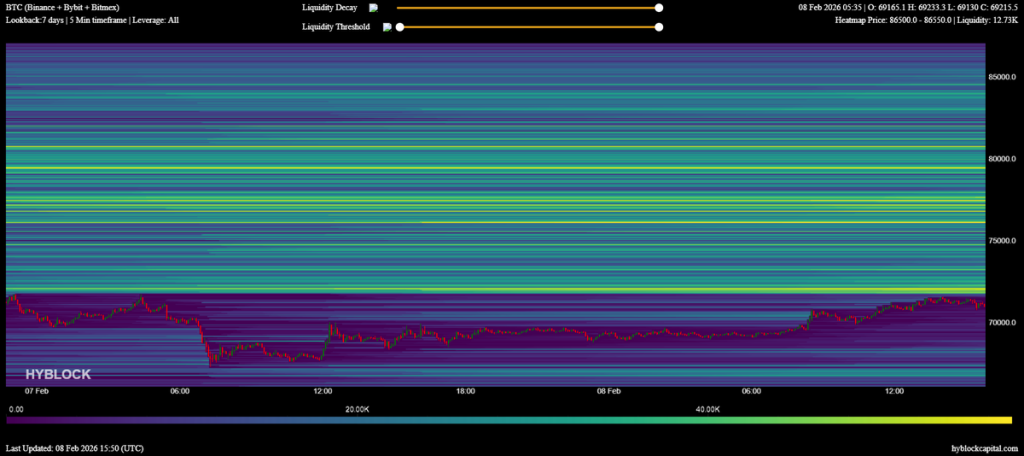

BTC Traders Eye $50K as Possible Bottom: Key Metrics to Watch This Week

Bitcoin traders are glued to one price right now: $50,000.

After a brutal dip that saw prices flash below $60,000 for a hot minute, everyone’s wondering if we’ve finally hit rock bottom.

Yes, Bitcoin price bounced back above $70,000 temporarily, but here’s the thing, nobody’s really convinced this is “the bottom” just yet.

Key Takeaways

- Analysts warn the recent bounce to $71,000 may be a “bull trap” designed to liquidate shorts before a retest of $50,000 support.

- JPMorgan data indicates Bitcoin has traded below the estimated miner production cost of $87,000, a historical signal for capitulation.

- Technical patterns highlight critical support at $67,350, with a breakdown potentially opening the door to the $43,000 region.

Weekly Close Shows Fragility Despite $70K Rebound

Bitcoin found its way back to $71,000 as the week kicked off. However, most find this rally looking sketchy.

Sure, we saw a 7% bounce from last week’s $60,000 bloodbath, but there’s basically no volatility around the weekly close. And when things look too calm after a crash, traders get suspicious.

Trader CrypNuevo said on X: this whole move up looks like a calculated play to hunt down short positions stacked between $72,000 and $77,000.

If this “recovery” turns out to be fake, bears have one target in their crosshairs: $50,000.

Miner Costs and Stablecoin Flows Signal Caution

Here’s a number that should make you nervous: $67,000. That’s what it costs miners to produce one Bitcoin.

BTC might be trading below that soon. Historically, the miner production cost acts like a safety net, prices usually don’t stay below it for long.

if this continues, miners start going broke. And when miners capitulate? They dump their Bitcoin to stay alive, which creates even more sell pressure. It’s a vicious cycle.

While the fundamentals look grim, there’s a massive pile of cash sitting on the sidelines. Stablecoin inflows just doubled to $98 billion.

They’re ready to buy… they’re just waiting for the right moment.

Next Steps: Bitcoin Price Technical Levels to Watch

Traders are staring down at an interesting moment as inflation data drops this week. Right now, all eyes are on $67,350, that’s the support level holding this whole thing together.

If Bitcoin breaks below that? We’re looking at bearish flag patterns that could drag prices down to $50,000. Yeah, a potential 30%+ dive.

There’s a bullish scenario too. The magic number is $74,434. If BTC can reclaim and hold above that level, it kills the bearish setup and potentially opens the door back to $80,000.

The post BTC Traders Eye $50K as Possible Bottom: Key Metrics to Watch This Week appeared first on Cryptonews.

Crypto World

Bitcoin in Focus as State Street Warns Dollar Could Fall 10% on Fed Cuts

Strategists at State Street, one of the world’s largest asset managers, say the US dollar’s worst run in nearly a decade could deepen if the Federal Reserve eases policy more aggressively than markets expect, which is a distinct possibility following a possible leadership change at the central bank.

Speaking at a conference in Miami, State Street strategist Lee Ferridge said the dollar could decline by as much as 10% this year if financial conditions loosen further. While he described two rate cuts as a “reasonable base case,” he warned that the risks are skewed toward more reductions. “Three is possible,” Ferridge said.

Lower US interest rates tend to reduce the appeal of dollar-denominated assets, especially for foreign investors. As rate differentials narrow, overseas investors are more likely to increase currency hedging, which involves selling dollars to protect returns. That added hedging demand can amplify downward pressure on the currency.

Dollar weakness could also be tied to Kevin Warsh, US President Donald Trump’s pick to succeed Jerome Powell as Fed chair. If confirmed, Warsh is widely expected to favor a more aggressive pace of rate cuts.

With the central bank’s current target rate range of 3.50%-3.75%, markets are currently aligned with the more cautious scenario. According to CME Group’s FedWatch Tool, investors are pricing in two rate cuts this year, with the first likely coming in June. Two policy meetings are scheduled before then.

Related: Bitcoin is trading like a growth asset, not digital gold: Grayscale

Weak dollar seen as catalyst for Bitcoin

A weaker US dollar has often coincided with stronger demand for risk assets, including Bitcoin (BTC) and other digital assets. Analysts frequently point to an inverse relationship between the US Dollar Index and Bitcoin, where periods of dollar softness tend to create a more favorable backdrop for crypto prices.

A falling dollar can ease financial conditions, boost global liquidity and push investors toward assets seen as alternatives to fiat currencies. That dynamic has helped support Bitcoin during several past dollar downturns.

Still, the relationship is far from automatic. Recent analysis suggests Bitcoin’s short-term performance has not consistently tracked dollar weakness, and in some periods, prices have even fallen alongside declines in the greenback.

Profit-taking, investor positioning, broader risk sentiment and uncertainty around monetary policy can all dampen the impact of currency moves.

Related: Crypto’s 2026 investment playbook: Bitcoin, stablecoin infrastructure, tokenized assets

Crypto World

Solana price eyes $57 fibonacci extension, bullish volume fades

Solana price remains under corrective pressure as fading bullish volume and unresolved liquidity below price open the door for a move toward the $57 Fibonacci extension.

Summary

- $170 support flipped to resistance, confirming bearish market structure

- Low-volume bounces signal weak demand, increasing downside risk

- $57 Fibonacci extension is critical, acting as a potential capitulation and reversal zone

Solana (SOL) price action continues to trade within a broader corrective phase after losing key structural support earlier in the cycle. While short-term bounces have emerged, the lack of strong bullish participation suggests these moves may be temporary rather than trend-defining.

As Solana struggles to reclaim former support that has now become resistance, technical conditions are aligning for a deeper downside move before any meaningful reversal can occur.

With volume declining and liquidity building below current price levels, attention is now shifting toward a key high-timeframe Fibonacci extension zone near $57, a level that may act as a pivotal inflection point for Solana’s next major move.

Solana price key technical points

- Former support at $170 has flipped into resistance, confirming bearish structure

- Bullish bounces are occurring on low volume, signaling weak demand

- $57 Fibonacci extension stands out as a macro reversal zone, with strong confluence

The current corrective move accelerated after Solana decisively broke below the $170 level, which had previously acted as a major area of support. Once this level was lost, price quickly transitioned into resistance, reinforcing the bearish shift in market structure. Multiple attempts to reclaim this zone have failed, confirming that sellers remain in control.

Following the breakdown, Solana experienced a sharp downside expansion into the high-timeframe support region near $157. This move reflected capitulation-style selling, though price has so far failed to officially retest the exact support level, instead printing a higher low just above it. While this may appear constructive at first glance, the broader context suggests unfinished business remains below the current price.

Low-volume bounce raises downside risk

One of the most notable aspects of Solana’s recent price behavior is the lack of bullish volume accompanying the bounce from the $157 region. In healthy reversals, price rebounds are typically supported by expanding volume, signaling strong buyer conviction. In this case, however, volume has remained subdued, indicating that the bounce may be driven more by short covering than genuine accumulation.

This type of low-volume recovery often leaves price vulnerable to further downside, particularly when liquidity remains concentrated below recent lows. As a result, the probability increases that Solana may revisit the lower support zone to fully clear remaining sell-side liquidity.

$57 fibonacci extension comes into focus

From a Fibonacci and market structure perspective, the 0.618 extension near $57 represents a critical macro level. This zone aligns with multiple technical factors, including historical demand areas and structural liquidity pockets, making it a high-probability target if the current corrective phase continues.

Such extension levels often act as magnets for price during strong corrective moves, particularly when broader sentiment remains cautious and volume fails to confirm reversals. A move toward $57 would likely coincide with heightened volatility and emotional selling, conditions that frequently precede meaningful market bottoms.

Importantly, a test of this level would not necessarily signal further breakdown. Instead, it may represent the final leg of the corrective structure, setting the stage for a potential macro reversal if buyers step in decisively.

Conditions for a bullish reversal

If Solana does trade into the $57 Fibonacci extension zone, the quality of the reaction will be crucial. A strong defense of the high timeframe support, combined with expanding volume and clear bullish rejection signals, would increase the probability of a sustainable reversal.

Should such a reversal occur, Solana could begin a rotational move back toward higher resistance levels, with the $170 region once again coming into focus. This would effectively keep the broader trading range intact, transforming the recent decline into a completed corrective cycle rather than the start of a prolonged downtrend.

What to expect in the coming price action

From a technical, price action, and market structure perspective, Solana remains vulnerable to further downside as long as bullish volume continues to fade. The $57 Fibonacci extension is the most important downside target and potential reversal zone.

Until that area is tested or convincingly invalidated, traders should remain cautious of short-term rallies. Volatility is likely to remain elevated, with price action driven by liquidity dynamics rather than sustained trend shifts. How Solana reacts near $57 may ultimately determine whether the market is preparing for a deeper correction or laying the groundwork for its next major bullish phase.

Crypto World

Ripple Expands Digital Asset Custody with Key Partnerships and Innovations

Ripple, a leader in the digital asset space, has unveiled a series of strategic partnerships that are set to expand its custody offerings for institutional clients. This new development highlights Ripple’s focus on simplifying digital asset custody services for banks and financial institutions. The company has secured collaborations with Securosys and Figment, with the potential to revolutionize the digital asset landscape, particularly for institutional staking and security.

Ripple’s new partnerships with Securosys and Figment represent significant steps toward enhancing its custody services. The collaboration with Figment will enable banks and custodians to offer staking capabilities for leading proof-of-stake networks, including Ethereum and Solana. This integration allows institutions to provide staking rewards to clients while maintaining full control over the custody process.

The addition of Securosys brings a new level of security to Ripple Custody. By integrating Securosys’ CyberVault HSM and CloudHSM, Ripple can provide its clients with top-tier key management services. These high-security solutions eliminate the usual procurement delays and complexities, streamlining digital asset custody for financial institutions.

Ripple’s CEO, Reece Merrick, emphasized the vast potential of these partnerships. According to Merrick, the addition of staking services with Figment and enhanced security measures with Securosys will redefine the digital asset custody landscape for banks. He believes this will allow institutions to expand their offerings while adhering to the highest security and compliance standards.

Chainalysis Integration for Enhanced Compliance

Ripple has also integrated Chainalysis, a leading blockchain analysis platform, into its custody services. This collaboration ensures real-time transaction screening and policy enforcement for institutions using Ripple Custody. Chainalysis’s technology will allow Ripple Custody clients to monitor all transactions before assets leave their vaults.

This addition is vital in ensuring regulatory compliance for institutions dealing with digital assets. Ripple has embedded Chainalysis into its services to help prevent illicit activities such as money laundering and fraud. The integration aligns with Ripple’s mission to create a secure, compliant, and scalable platform for institutional digital asset management.

The integration of Chainalysis strengthens Ripple Custody’s position as a trustworthy and secure platform for institutional clients. Financial institutions will now have access to advanced tools for monitoring digital asset transactions, further reinforcing Ripple’s commitment to providing secure and compliant solutions.

Palisade Acquisition Adds Wallet-as-a-Service Capability

In addition to the partnerships with Securosys and Figment, Ripple has also acquired Palisade, a company specializing in wallet-as-a-service solutions. This acquisition introduces scalable wallet services with Multi-Party Computation (MPC) and multi-chain support. These capabilities are crucial for managing digital asset treasury functions, payments, and fintech integrations.

The addition of Palisade’s technology to Ripple Custody strengthens its multi-chain support, allowing institutions to manage assets across different blockchains. The wallet-as-a-service model enables financial institutions to securely manage digital assets without the need to develop their own infrastructure. This solution is ideal for organizations looking to streamline their digital asset operations.

Ripple’s acquisition of Palisade complements its broader strategy of enhancing the capabilities of its custody platform. The integration of wallet-as-a-service further positions Ripple as a leading provider of secure and scalable digital asset management solutions for institutions.

Ripple Partners with Zand to Strengthen Digital Asset Ecosystem

In a separate move, Ripple has partnered with Zand to advance the digital asset ecosystem. This collaboration aims to combine Ripple’s USD (RLUSD) stablecoin with Zand’s AED (AEDZ) stablecoin. The goal is to unlock new use cases for digital assets as traditional finance moves on-chain.

The partnership between Ripple and Zand represents a step forward in bridging the gap between traditional finance and the blockchain ecosystem. The integration of both stablecoins will provide businesses and financial institutions with more flexible solutions for cross-border payments and digital asset transfers. Ripple’s collaboration with Zand highlights its commitment to pushing the boundaries of digital finance.

This partnership comes at a time when the demand for digital asset solutions is growing. Ripple’s ability to innovate and build strategic partnerships enables it to stay ahead in the rapidly evolving blockchain space.

Ripple’s Vision for the Future of Custody and Compliance

Ripple’s advancements in custody and compliance are laying the foundation for the next wave of institutional digital asset adoption. By partnering with Securosys, Figment, and other strategic players, Ripple is positioning itself as a leader in the digital asset custody space. These collaborations pave the way for banks, custodians, and regulated enterprises to securely manage digital assets while complying with industry standards.

As Ripple continues to expand its partnerships and offerings, it is clear that the company’s vision for the future of digital asset custody is one of innovation, security, and compliance. Ripple’s ability to integrate cutting-edge technology with real-time transaction monitoring and multi-chain support will help redefine the digital asset landscape for institutions.

The future of Ripple Custody looks bright, with a strategic focus on simplifying the digital asset management process for financial institutions worldwide. Through its partnerships and acquisitions, Ripple is not only enhancing its services but also shaping the future of digital finance.

Crypto World

Sam Bankman-Fried files for new trial over FTX fraud charges

Sam Bankman-Fried, the former CEO of collapsed crypto exchange FTX, is seeking a new trial, according to a request filed in a New York federal court by his mother.

Since being convicted and imprisoned on a 25-year sentence, SBF has been continually challenging his situation in court. The latest motion for a new trial, first reported on Tuesday by Inner City Press, was filed by his mother, Barbara Fried, claiming new evidence in the case would justify a reset. The filing noted the initial absence of testimony from figures, including FTX’s Ryan Salame, who fought his own, separate legal battle.

The former FTX executive, Salame, was also convicted on federal charges but had claimed he made an arrangement to cooperate with prosecutors that should have protected his wife, Michelle Bond, from legal pursuit. She was later charged with allegedly taking illegal campaign contributions in her congressional bid.

SBF’s 35-page document arrived at the court as a pro se request, meaning the defendant is representing himself.

Earlier efforts by SBF to argue he didn’t get a fair initial trial — which came to a head in November — were met with some skepticism by appellate judges. SBF’s defense in seeking a retrial through appeal focused attention on the later solvency of FTX, and his account on the social media site X continues to make the argument that the company wasn’t bankrupt when it collapsed. However, judges contended in November that solvency didn’t seem to be the primary issue.

“Part of the government’s theory of the case is that the defendant misrepresented to investors that their money was safe, was not being used in the way that it was the government claims and the jury convicted it was, in fact, used,” said Circuit Judge Maria Araújo Kahn, referring to the misappropriation of customer money at the heart of his conviction.

Shutting down another potential path to freedom, President Donald Trump recently said he wouldn’t consider clemency for SBF. However, the former FTX CEO is still campaigning for himself via his account on X, arguing he’s a victim of former President Joe Biden’s “lawfare machine.”

-

Tech7 days ago

Tech7 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat1 day ago

NewsBeat1 day agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World13 hours ago

Crypto World13 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World5 hours ago

Crypto World5 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports1 day ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World13 hours ago

Crypto World13 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition