Crypto World

EUR/USD and GBP/USD continue to rise after the Fed meeting

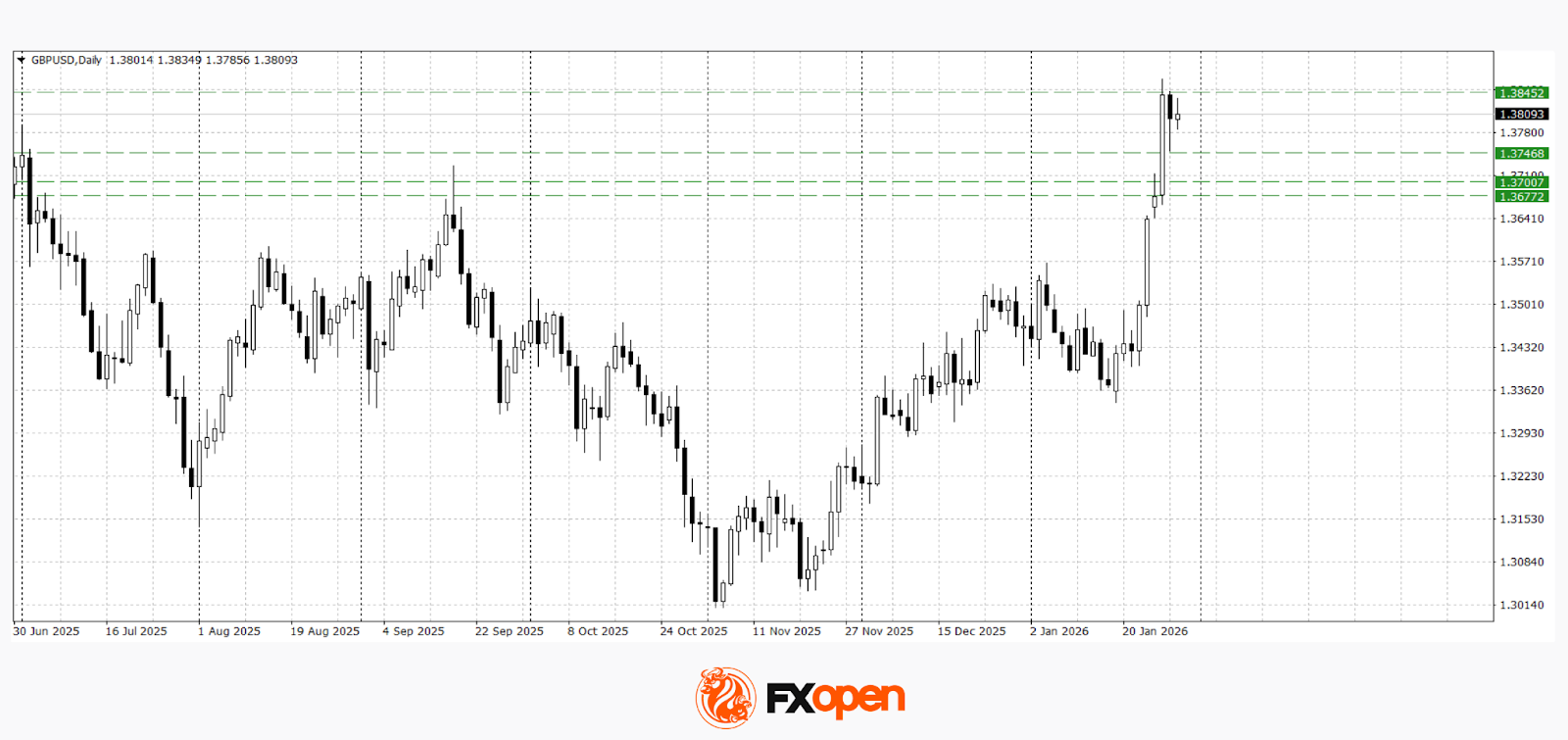

The euro and the pound maintained their upward momentum after the Federal Reserve meeting, despite interest rates being left unchanged. At the start of the week, both pairs rose sharply: EUR/USD tested the area above the psychological 1.2000 level, while GBP/USD climbed towards 1.3870, after which a moderate correction followed as profits were taken.

However, after Jerome Powell’s speech, demand for European currencies strengthened again, as the Fed Chair’s rhetoric was perceived by the market as a signal in favour of future easing and the regulator maintaining a cautious stance, with no need to return to tightening.

An additional source of pressure on the dollar remains the geopolitical and trade backdrop. Statements by Donald Trump on tariff policy towards Europe have increased uncertainty around the outlook for external trade and added to market nervousness, periodically boosting volatility and supporting demand for alternatives to the dollar. Against this background, gains in the euro and the pound are being driven both by interest rate expectations and by a broader reassessment of risks related to tariffs and political rhetoric.

EUR/USD

After testing 1.2080, the EUR/USD pair corrected by more than 150 pips. However, the weakening of the dollar following Jerome Powell’s comments allowed buyers to find support near 1.1900 and resume the upward move.

The pair continues to receive support amid expectations of further steps by the Fed towards easing, provided inflation expectations remain stable. At the same time, yesterday’s pullback allowed sellers to form a “bearish harami” pattern. Confirmation of this formation on the daily close could trigger a deeper downward correction.

Key events for EUR/USD:

- today at 10:00 (GMT+2): retail sales volume in Spain;

- today at 13:00 (GMT+2): total number of unemployed in France;

- today at 15:30 (GMT+2): US initial jobless claims.

GBP/USD

Buyers of GBP/USD managed to обновить last year’s high this week. Ahead of the Fed meeting, the pair corrected towards 1.3750, but then resumed its rise and closed the day above 1.3800.

If the price holds above the 1.3750–1.3800 range over the next trading sessions, a retest of 1.3870 is possible. A break below the 1.3750 support would open the way for a deeper correction towards the 1.3670–1.3700 area.

Key events for GBP/USD:

- today at 15:30 (GMT+2): US non-farm productivity;

- today at 19:00 (GMT+2): Atlanta Fed GDPNow indicator;

- tomorrow at 11:30 (GMT+2): number of approved mortgage loans in the UK.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Fed minutes January 2026:

Divided Federal Reserve officials at their January meeting indicated that further interest rate cuts should be paused for now and could resume later in the year only if inflation cooperates.

While the decision to hold the central bank’s benchmark rate steady mostly was met with approval, the path ahead appeared less certain, with members conflicted between fighting inflation and supporting the labor market, according to minutes released Wednesday from the Jan. 27-28 Federal Open Market Committee meeting.

“In considering the outlook for monetary policy, several participants commented that further downward adjustments to the target range for the federal funds rate would likely be appropriate if inflation were to decline in line with their expectations,” the meeting summary said.

However, meeting participants disagreed on where policy should head, with officials debating over whether the focus should be more on fighting inflation or supporting the labor market.

“Some participants commented that it would likely be appropriate to hold the policy rate steady for some time as the Committee carefully assesses incoming data, and a number of these participants judged that additional policy easing may not be warranted until there was clear indication that the progress of disinflation was firmly back on track,” the minutes said.

Moreover, some even entertained the notion that rate hikes could be on the table and wanted the post-meeting statement to more closely reflect “a two-sided description of the Committee’s future interest rate decisions.”

Such a description would have reflected “the possibility that upward adjustments to the target range for the federal funds rate could be appropriate if inflation remains at above-target levels.”

The Fed reduced its benchmark borrowing rate by three-quarters of a percentage point in consecutive cuts in September, October and December. Those moves put the key rate in a range between 3.5%-3.75%.

The meeting was the first for a new voting cast of regional presidents, at least two of whom, Lorie Logan of Dallas and Beth Hammack of Cleveland, have publicly said they think they Fed should be on hold indefinitely. Both have said they see inflation as a continuing threat and should be the focus of policy now. All 19 governors and regional presidents participate at the meeting, but only 12 vote.

With the Fed already split along ideological lines, the fissure could grow deeper if former Governor Kevin Warsh is confirmed as the next central bank chair. Warsh has spoken in favor of lower rates, a position also supported by current Governors Stephen Miran and Christopher Waller. Both Waller and Miran voted against the January decision, preferring instead another quarter-point cut. Current Chair Jerome Powell‘s term ends in May.

The meeting minutes do not identify individual participants and featured an array of characterizations to describe positions, rotating between “some,” “a few,” “many” and even featured two rare references to “a vast majority.”

Participants generally expected inflation to come down through the year, “though the pace and timing of this decline remained uncertain.” They noted the impact tariffs were having on prices and said they expected the impact to wane as the year goes by.

“Most participants, however, cautioned that progress toward the Committee’s 2 percent objective might be slower and more uneven than generally expected and judged that the risk of inflation running persistently above the Committee’s objective was meaningful,” the document said.

At the meeting, the rate-setting FOMC adjusted some of the language in its post-meeting statement. The changes noted that the risks to inflation and the labor market had come more closely into balance, softening prior worries over the employment picture.

Since the meeting, labor data has been a mixed bag, with indications that private sector job creation is slowing further and that the meager growth is coming almost entirely from the health-care sector. However, the unemployment rate dipped to 4.3% in January and nonfarm payroll growth was stronger than expected.

On inflation, the Fed’s key personal consumption expenditures prices metric has been mired around 3%. However, a report last week showed that the consumer price index when excluding food and energy prices was at its lowest in nearly five years.

Futures traders are placing the best bet for the next cut to come in June, with another in September or October, according to the CME Group’s FedWatch gauge.

Crypto World

XRP gains momentum as Arizona moves to add it to state crypto reserve

- XRP has held strong near $1.40 despite mixed market signals.

- Key resistance levels to watch are $1.50, $1.54, and $1.91.

- Arizona has proposed to include XRP in a state-managed crypto reserve fund.

XRP cryptocurrency has held steady above $1.40, showing resilience despite a broadly cautious market.

Recent developments in US policy have added a fresh layer of optimism for XRP enthusiasts.

Arizona advances bill to include XRP in state reserve

Arizona lawmakers are moving forward with legislation that could formally include XRP in a state-managed digital assets fund.

The proposal seeks to create a strategic reserve for digital currencies obtained through seizures or confiscations.

XRP, alongside Bitcoin (BTC), is explicitly listed as an eligible asset.

🚨BREAKING: ARIZONA ADVANCES BILL TO ADD XRP TO OFFICIAL STATE DIGITAL ASSET RESERVE 🇺🇸🔥

Arizona’s Digital Assets Strategic Reserve Fund bill (SB1649) just CLEARED the Senate Finance Committee in a 4–2 vote — and it explicitly includes $XRP in the RESERVE. 👀

The bill now… pic.twitter.com/2x8uVH6LXD

— Diana (@InvestWithD) February 17, 2026

The bill recently passed a key Senate committee in a 4-2 vote, marking a significant step forward.

If enacted, the fund would be managed by the state treasurer with strict custodial oversight.

This move would make Arizona one of the first US states to formally reference XRP in a government financial framework.

For XRP holders, this development is largely symbolic.

The state would not be directly purchasing XRP with taxpayer money, but inclusion in the reserve adds credibility.

It reinforces XRP’s reputation as a functional and settlement-oriented digital asset rather than just a speculative token.

Market activity signals caution

XRP’s short-term price action has been mixed.

The coin is supported around $1.40 to $1.44, creating a key floor that traders are watching closely.

Exchange outflows suggest accumulation by larger holders, while smaller whales have added to their balances, hinting at potential upward pressure.

Technical indicators show both bullish and bearish signals.

Momentum oscillators suggest limited buying activity in the short term, but longer-term smart money metrics point to possible gains.

Patterns on the charts indicate that a break below $1.42 could trigger a short-term pullback toward $1.12.

At the same time, if support holds, traders could see upside targets near $1.91 and $2.13.

XRP has been rangebound for the past month, but the combination of policy developments and structural market accumulation could push it higher.

XRP price prediction

Policy developments in Arizona, combined with accumulation patterns and technical support, may give XRP the momentum it needs to challenge its next resistance levels.

Traders should watch the $1.40–$1.44 support zone closely.

A strong hold here could set the stage for a breakout.

The resistance levels to monitor are $1.50 and $1.54 in the near term.

Beyond that, the next targets are $1.67 and $1.91.

These levels align with smart money accumulation and historical trading ranges.

A sustained move above $2.00 could signal a return of broader bullish sentiment.

Overall, XRP’s price is poised in a delicate balance.

Short-term caution is warranted, but medium-term prospects look promising.

Crypto World

Riot Platform‘s AI/HPC Push could Net up to $21B, Says Stockholder

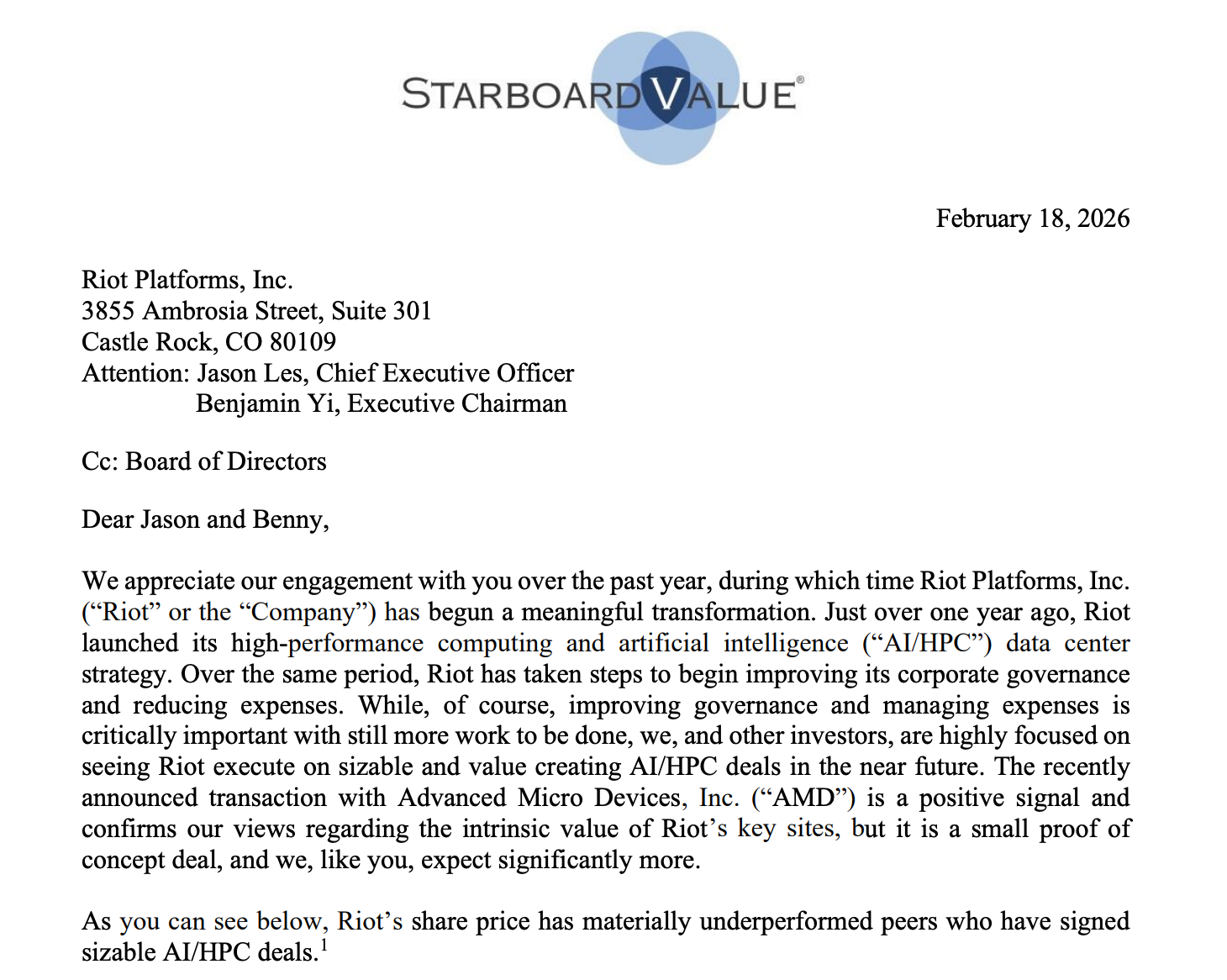

An activist Riot Platform shareholder is pressing the crypto mining company to accelerate its pivot to high-performance computing (HPC) and artificial intelligence.

In a Wednesday letter to executives, Starboard Value, which holds about 12.7 million shares of Riot, said that the company could generate between $9 billion to $21 billion in equity value contribution from AI/HPC data centers in Texas. The shareholder said that “time is of the essence,” stressing urgency in getting “more material deals completed” as it moves deeper into AI and HPC.

“With 1.4 [gigawatts] of gross capacity remaining to be monetized, Riot is in an enviable position – but it must execute with excellence and urgency,” said Starboard. “We believe Riot should be able to attract high-quality tenants for tier-3 data centers with terms similar to or better than the peer transactions announced towards the end of 2025.”

Starboard referred to Riot’s primary sites in Corsicana and Rockdale, Texas, where other crypto miners also operate due to low energy costs and friendly regulations.

At Wednesday’s Nasdaq market open, Riot’s share price surged and were up by almost 6%, at the time of publication. Industry tracker CoinShares Bitcoin Mining ETF was down less than 1%, by comparison.

Related: Moonwell hit by $1.78M exploit as AI vibe coding debate reaches DeFi

“The recently announced transaction with Advanced Micro Devices […] is a positive signal and confirms our views regarding the intrinsic value of Riot’s key sites, but it is a small proof of concept deal, and we, like you, expect significantly more,” said Starboard, referring to a data center lease and services agreement announced in January.

Many mining companies pivoting away from crypto

Riot Platforms is not the only crypto company shifting some of its operations into AI and HPC amid increasing mining difficulty and other costs. CleanSpark, MARA Holdings, Core Scientific, Hut 8, and TeraWulf repurposed some of their infrastructure or announced similar plans in a move toward AI.

Cango, another Bitcoin miner, sold $305 million worth of its BTC holdings last week in part to fund its planned expansion into AI and HPC.

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

Oracle Error Leaves DeFi Lender Moonwell With $1.8 Million in Bad Debt

A critical oracle pricing glitch has left decentralized lending platform Moonwell grappling with nearly $1.8 million in bad debt.

A misconfigured oracle briefly valued Coinbase Wrapped ETH (cbETH) at just $1 Sunday morning, triggering a sudden cascade of liquidations, in a sobering reminder of the fragility lurking in DeFi infrastructure.

Key Takeaways

- Oracle Failure: A configuration error in Chainlink OEV wrapper contracts caused the system to price $2,200 cbETH at a 99.9% discount.

- Bad Debt Event: Liquidators seized collateral by repaying mere pennies on the dollar, wiping out 1,096 cbETH and leaving the protocol with $1.78 million in bad debt.

- Risk Signal: The incident highlights systemic liquidity risks, mirroring concerns seen as BlockFills freezes withdrawals due to counterparty exposure.

What Caused the Oracle Failure on Moonwell?

According to the postmortem on Moonwell’s Discord, the trouble started Sunday at 6:01 PM UTC following the execution of governance proposal MIP-X43. This upgrade enabled Chainlink OEV wrapper contracts on Base and Optimism, but one feed contained a fatal flaw.

According to risk management firm Anthias Labs, the system failed to multiply the cbETH/ETH exchange rate by the ETH/USD price. Instead, it used the raw exchange rate directly.

This resulted in the oracle reporting a price of roughly $1.12 for an asset trading near $2,200.

Reports indicate the flawed code layout may have been generated by AI tools, specifically Claude Opus 4.6, raising serious questions about audit verification standards for generated code.

Breaking Down the $1.8M Bad Debt

Trading bots immediately pounced on the discrepancy. With the system believing cbETH was worth barely a dollar, liquidators repaid roughly $1 of debt to seize massive amounts of collateral.

In total, 1,096 cbETH was wiped out. That effectively erased the collateral for many borrowers while leaving the protocol holding the bag for the unpaid loan value.

Moonwell’s risk manager, Anthias Labs, moved fast to contain the bleeding. They reduced supply and borrow caps to 0.01 to prevent new users from entering the broken market.

This type of sudden liquidation cascade shows why Ethereum faces crash risks whenever on-chain leverage is mispriced.

Discover: The best new crypto on the market

What This Means for DeFi Lenders

While Moonwell operates across multiple chains with over $90 million in TVL, this incident shakes confidence in automated governance execution. Users must now wait for a governance vote to fix the configuration.

This is not an isolated event. It follows a trend of oracle-related exploits, reinforcing why decentralized protocol security is just as critical as centralized solvency.

The crypto market structure is currently fragile, evidenced by data showing Binance controls 65% of CEX stablecoin reserves.

When liquidity is concentrated and validation fails, the fallout is instant. For yield farmers, this is a signal to check whether your protocol’s code was written by a human or a chatbot before depositing.

Discover: The best meme coins in the world.

The post Oracle Error Leaves DeFi Lender Moonwell With $1.8 Million in Bad Debt appeared first on Cryptonews.

Crypto World

BTC ETH XRP BNB SOL DOGE BCH ADA HYPE XMR

Bitcoin (CRYPTO: BTC) continues to face selling pressure as it tries to defend a key zone around $67,000, with bears pressing at every incline. The $65,118 support remains a focal point for downside risk, while the upside faces hurdles near $72,000 and $74,508. The longer-term picture is complicated by a pair of moving averages that traders watch closely: the 200-week simple moving average sits near $58,371, while the 200-week exponential moving average hovers around $68,065. The current positioning near the 200-week EMA has prompted some analysts to suggest that BTC may be near a bottom, even as near-term momentum remains fragile.

Analysts have pointed to long-run price action to argue that a bottom could be forming. On X, analyst Jelle observed that almost all of BTC’s significant bottoms formed within the range defined by the 200-week SMA and the 200-week EMA, and he noted that trading near the 200-week EMA might indicate that the bottoming process has begun. That view is echoed by others who study short- and mid-term cycles, suggesting that a durable bottom could be emerging even if volatility remains elevated in the near term. In tandem with this assessment, market watchers highlighted that BTC’s path remains sensitive to macro shocks and micro-structure signals as traders try to discern a durable foundation for a broader recovery.

Matrixport offered a similar read, arguing that BTC may be approaching a durable bottom as sentiment indicators flip from negative to positive. The firm noted that when its daily sentiment indicator’s 21-day moving average dips below zero and then turns upward, selling pressure tends to ease, increasing the odds of a meaningful upside attempt. While such readings do not guarantee an immediate rally, they create a frame of reference for risk-takers who seek to gauge whether sellers are drying up and buyers are growing more aggressive. The bottom line from this view is that BTC could be approaching an inflection point even if the near term still looks susceptible to downside noise.

An additional tailwind cited by a Wells Fargo analyst, Ohsung Kwon, was a potential increase in demand driven by tax refunds. In a note seen by CNBC, Kwon suggested that refunds—especially among higher-income households—could flow into equities and BTC, rekindling the so-called “YOLO” trade. The interplay between consumer liquidity and risk assets remains a critical driver of price action, and the idea that tax-related inflows could buttress a market that has struggled to sustain momentum is shaping expectations for a potential rebound.

The question on many traders’ lips is whether BTC and its leading altcoins can surmount overhead resistance and reestablish a constructive trend. The immediate challenge remains a confluence of resistance around the 20-day moving average and notable round numbers, with a potential pivot to a stronger ascent if buyers can push beyond those barriers. For BTC specifically, there is a clear roadmap: a successful push above the 20-day EMA around $72,282 and the $74,508 threshold could usher in a renewed upside, potentially opening a path to the 50-day simple moving average near $83,129. Conversely, a failure to hold above the critical $65,118 support could invite a rapid test of the next major line near $60,000, with a risk of accelerating declines if selling intensifies.

Ether (CRYPTO: ETH) has managed to keep a constructive posture above the immediate support at $1,897, suggesting that buyers are still defending the downside. The next test is the overhead zone around the 20-day EMA at $2,183. If bulls can clear that area, a more pronounced recovery could unfold toward the 50-day moving average near $2,707. A failure to hold the $1,897 floor would likely invite a renewed pullback toward the $1,750 level, with a deeper break potentially exposing the $1,537 area as a critical line in the sand for bulls to defend.

XRP (CRYPTO: XRP) has been trading just below the 20-day EMA around $1.52, signaling ongoing pressure from sellers but also a willingness among bulls to defend the line. A decisive move above the 20-day EMA and the $1.61 breakdown level could set XRP on a path toward the 50-day SMA near $1.80, keeping the pair within its current channel for now. A sustained move below the channel’s support could intensify selling and push XRP toward lower supports, testing the stability of the current range.

BNB (CRYPTO: BNB) has traded in a narrow range, reflecting indecision between buyers and sellers. A breakdown below the $570 support could signal a resumption of the downtrend, potentially dragging the pair toward the $500 psyche level. If buyers manage to push above the 20-day EMA around $676, the path could open to a rally toward $730 and then toward $790, where bears are expected to reassert control.

Solana (CRYPTO: SOL) continues to face resistance near the $95 mark, a level that has previously capped upside. A slip below $76 would be a warning sign that bears are reasserting themselves and could turn the $95 threshold into a new ceiling. Should buyers manage to push through the $95 level, the next target would likely be the 50-day SMA around $116, a level where selling pressure historically intensifies as traders reassess risk.

Dogecoin (CRYPTO: DOGE) has hovered just under the 20-day EMA at roughly $0.10, a pattern that suggests a potential breakout to the upside if selling pressure remains light. A sustained push above the $0.12 resistance could set DOGE on a course toward the 50-day SMA near $0.12 and beyond, potentially reaching the $0.16 level if buyers grow more aggressive. If price action fails to clear the $0.12 resistance, a consolidation range between roughly $0.08 and $0.12 could prevail for several sessions.

Bitcoin Cash (CRYPTO: BCH) has traded between its moving averages, signaling indecision about the next directional move. The 20-day EMA around $547 and the RSI’s intermediate position imply a possible upside breakout if demand strengthens, potentially pushing BCH toward $600 and then toward $630. A break below the 20-day EMA could invite a correction toward $500 as bears gain ground.

Hyperliquid (CRYPTO: HYPE) closed below the 20-day EMA recently, underscoring selling pressure at higher levels. The path of least resistance would depend on whether buyers can sustain a move above the 50-day SMA around $27.74; failing that, a slide toward the $20.82 support area could unfold. A breakout above the $32.50 barrier would be a bullish signal, potentially leading to a rally into the $38.42–$35.50 zone as momentum compresses in the near term.

Cardano (CRYPTO: ADA) has held near the 20-day EMA of about $0.29, suggesting that bulls are keeping the pressure on the downside. A sustained move above the 20-day EMA could carry ADA toward the downtrend line, which has historically acted as a strong resistance. If buyers manage to pierce the downtrend, the price could advance toward $0.44 and then to $0.50. Conversely, a break below the current support could push ADA down toward the $0.15 region, underscoring the risk of a renewed downleg if buyers fail to defend critical levels.

Monero (CRYPTO: XMR) has not breached the key $360 breakdown threshold, with bulls maintaining the immediate support near $309. A sustained push above the 20-day EMA around $366 could open a path toward the 50-day SMA near $449, where bears are expected to reassert themselves. A break below $309 would suggest that bears are regaining control and could test the crucial $276 support, potentially leading to a contained range if buyers respond with resilience at that level.

Crypto World

XRP price analysis as Ripple activates permissioned DEX

XRP price moved sideways on Wednesday after the developers activated the Permissioned decentralized exchange feature.

Summary

- XRP price wavered on Wednesday after the developers activated the Permissioned DEX feature.

- The launch came after the recent activation of Permissioned Domains.

- It has formed a gravestone doji candlestick pattern pointing to more downside.

Ripple (XRP) token traded at $1.4860, within the range it has held over the past few days. This price is much lower than the year-to-date high of $2.4160.

Ripple reached a major milestone today by activating the Permissioned DEX feature, a unique solution for companies in the financial services industry.

Unlike the popular DEX platforms such as Uniswap and Raydium, the Permissioned DEX allows institutions to participate in these ecosystems in a controlled way. In this, only restricted entities will be able to participate, a move intended to promote institutional compliance requirements.

The solution will have several use cases, including institutional trading, cross-border payments, and forex settlements. It will allow these institutions to trade assets, including XRP and Ripple USD, without exposing them to unvetted counterparties.

The permissioned DEX feature was activated a few days after the developers launched permissioned domains and token credentials. Permissioned domains serve as an on-ledger allowlist that controls who can participate in the XRP Ledger network. They are the core gating mechanism for the DEX feature.

All these features will help to provide the XRP token with more utility and increase its token burn.

All this is happening at a time when Ripple has increased its compliance measures, which will help it to create more partnerships with institutions. It has acquired a provisional banking charter in the United States and received several licenses, including in the UK and the European Union.

XRP price technical analysis

The daily chart shows that the XRP token has remained in a tight range in the past few days, mirroring the ongoing consolidation in the crypto industry.

It formed a gravestone doji candlestick pattern on Sunday. This candle is characterized by a long upper shadow and a small body and is a common bearish reversal sign.

The coin has remained below the 50-day and 100-day Exponential Moving Averages. It has also dropped below the Ichimoku cloud indicator and the key resistance level at $1.7873, its lowest level in November and December last year.

Therefore, the most likely XRP forecast is bearish, with the initial target being the year-to-date low of $1.1215. A move below that level will signal further downside, potentially to the psychological level at $1.

Crypto World

Sam Altman’s OpenAI unveils ‘EVMbench’ to test whether AI can keep crypto’s smart contracts safe

OpenAI is stepping deeper into crypto security with the launch of EVMbench, a new testing framework designed to measure how well artificial intelligence can understand and potentially secure smart contracts on Ethereum and similar blockchains.

Smart contracts, self-executing code deployed on blockchains like Ethereum, underpin decentralized exchanges, lending protocols and a wide range of onchain financial applications. Because these contracts are typically immutable once deployed, vulnerabilities can be serious.

EVMbench is OpenAI’s attempt to see whether modern AI systems are up to the task of helping prevent those issues. Built in collaboration with crypto investment firm Paradigm, the benchmark draws on real-world smart contract vulnerabilities previously uncovered through audits and security competitions.

The system measures performance across three core abilities: identifying security bugs, exploiting those bugs in a controlled environment and fixing the vulnerable code without breaking the contracts.

OpenAI says the goal is to establish a clear standard for evaluating AI systems in blockchain security, especially as decentralized finance continues to secure billions of dollars in user funds. The stakes for smart contracts are only rising.

“Smart contracts routinely secure $100B+ in open-source crypto assets. As AI agents improve at reading, writing, and executing code, it becomes increasingly important to measure their capabilities in economically meaningful environments, and to encourage the use of AI systems defensively to audit and strengthen deployed contracts,” OpenAI wrote in a blog post.

Read more: Most Influential: Sam Altman

Crypto World

MemeCore Rally Prompts Criticism Over Valuation

The token’s rally highlights an ongoing debate over memecoin fundamentals and speculation.

Memecore (M) jumped as much as 19% on Tuesday, Feb. 17, making it one of the crypto market’s top performers on the day – but experts aren’t sold on the token’s lofty valuation.

MemeCore, launched in 2025, is a Layer 1 blockchain designed to connect creators and communities through meme-native applications and decentralized apps (dApps). The token traded as high as $1.59 on Tuesday, but has since retraced to $1.45, down 3.5% over the past 24 hours.

The token’s market capitalization currently stands near $2.5 billion, while its fully diluted valuation is about $7.7 billion – down from $8.11 billion a day earlier, according to CoinGecko.

While the price surge signalled momentum at first glance, analysts told The Defiant it actually underscores deeper structural concerns around valuation and liquidity.

“I wouldn’t waste a single Gwei on MemeCore,” said Danny Nelson, a research analyst at Bitwise. “This token’s soaring $2 billion valuation is divorced from the reality of memecoin economics.”

He explained that across the competitive landscape, pumpfun printed $8.6 million in revenue over the past week. “It has a valuation of $800 million; meanwhile, MemeCore generated $10 in transaction fees over the same period,” Nelson said. “I don’t see how MemeCore could be worth 2.5 times as much as Pump.Fun.”

MemeCore did not respond to The Defiant’s request for comment.

This criticism also extended to the broader mechanics behind meme token rallies, according to Brian Huang, co-founder of Glider.

“It’s no surprise that Memes consistently make up the top gainers: low liquidity means traders can manipulate the price without needing large amounts of capital,” said Huang. “Compare that to trading a stock like NVDA, which would require hundreds of millions of dollars to move the price significantly.”

Huang added that meme tokens, in general, pose significant risks to retail investors. “Marketing is always highlighting winners with +10,000% gains, when in reality the vast majority of traders lose money,” he said. “As an industry, we should be focused on building products that grow the wealth of on-chain users.”

Huang also warned that many traders underestimate the competitive landscape, failing to recognize that they are trading against industrialized trading firms.

“The odds are against these traders,” Huang emphasized. “The broader problem with memes is that they conflate investing with gambling. Retail users cannot distinguish between real investable assets (like BTC, ETH, and SOL) and memes. They are all presented the same way to these users.”

The memecoin sector currently boasts a market capitalization of around $35.9 billion, down about 0.3% over the past 24 hours.

Crypto World

Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes

BitMEX co-founder Arthur Hayes says Bitcoin is flashing a severe warning regarding dollar liquidity that stock markets have yet to acknowledge.

While the Nasdaq remains flat, Bitcoin has tumbled from its highs, signaling what Hayes describes as an impending AI-driven credit crisis.

This divergence suggests traditional equities are mispricing systemic risk.

Key Takeaways

- Market Signal: Bitcoin’s decoupling from a stable Nasdaq indicates a sharp withdrawal of dollar liquidity.

- Macro Thesis: Hayes predicts AI advancements will trigger white-collar job losses, leading to consumer credit defaults.

- Critical Data: Crypto derivatives markets saw a massive $12 billion leverage washout in a single week.

Why Is the Correlation Between Bitcoin and Nasdaq Breaking?

Bitcoin has traded in lockstep with tech stocks for months, with correlations surging to 0.75 by January 2026.

That relationship has unraveled. While the Nasdaq 100 holds steady, bear market risks are escalating for crypto as Bitcoin retreats significantly from its October 2025 all-time high of $126,080.

Hayes argues this split is not innocuous market noise. In his Substack post “This Is Fine,” he claims Bitcoin is reacting primarily to fiat credit conditions.

He envisions a scenario where economic displacement grinds the “Pax Americana” economy to a halt. In this view, Bitcoin is acting as the canary in the coal mine, pricing in liquidity stress before it hits the broader stock market.

The Data Behind the Move

The numbers support the theory of a liquidity withdrawal. Bitcoin futures open interest collapsed by approximately 20% in a single week, dropping from $61 billion to $49 billion.

This rapid deleveraging suggests capital is fleeing the crypto sector faster than traditional finance.

While the liquidity landscape is tightening due to the Federal Reserve draining the reverse repo facility, warnings of a full crisis may be overblown.

Crypto-specific factors, such as stalled regulation and ETF flow exhaustion, are also exacerbating Bitcoin’s drawdown.

Interestingly, Bitcoin has lost its sensitivity to the dollar itself. The asset has failed to rally even during periods of USD weakness, a reversal from historical trends where a cheaper dollar boosted crypto prices.

Discover: The best meme coins.

How Concerned Should You Be?

Hayes’ theory falls if Bitcoin can launch a quick and sustained recovery. If it fails to rebound, the inverse link to equities might assert itself further.

Hayes believes the smart money is moving toward privacy assets like Zcash and DEX tokens like Hyperliquid, betting that state oversight will increase in order to manage economic contraction.

For shorter-term traders, volatility signals remain elevated. If Hayes is correct about the dollar credit crunch, traditional markets may soon join Bitcoin downward.

However, if this is purely a crypto-native washout, the divergence could offer a buying opportunity for those betting on a liquidity rotation later in the year.

Discover: The best new cryptocurrencies.

The post Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes appeared first on Cryptonews.

Crypto World

WLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

World Liberty Financial (WLFI) crypto is tearing through resistance, rallying nearly 20% to test the critical $0.12 level. The catalyst is clear: intense Whale Accumulation ahead of today’s high-stakes summit at Mar-a-Lago.

Key Takeaways

- Surge: WLFI spikes 20% to trade near $0.118, eyeing a confirmed breakout above the $0.12 resistance zone.

- Whales: A fresh wallet withdrew 25 million tokens ($2.75M), signaling high-conviction buying before the event start.

- Catalyst: The sold-out Mar-a-Lago forum kicks off today with top finance and Trump Crypto figures.

Why is the Market Buying the Hype?

All eyes are on the World Liberty Forum, launching today at Donald Trump’s Palm Beach club. This is not a casual networking event. It is positioned as a serious attempt to connect traditional finance with DeFi.

Big names are expected in the room, including Coinbase CEO Brian Armstrong and Goldman Sachs chief David Solomon. That kind of guest list shifts the tone from hype to credibility. Traders are watching closely, not for meme momentum, but for signals of institutional alignment.

The timing also matters. Political momentum around clearer crypto regulation is building, and optimism around an upcoming market structure bill is adding fuel. If that backdrop firms up, projects tied to this ecosystem could benefit from a stronger foundation rather than just speculative buzz.

The Data: Whale Wallets in Motion

The big players are not waiting for headlines to confirm anything. On chain data shows a brand new wallet pulled 25 million WLFI, about $2.75M, off exchanges just hours before the rally kicked off. That is not random timing. That is positioning.

When tokens leave exchanges, supply tightens. If demand starts rising at the same time, price reacts faster. We are already seeing that effect.

Volume has exploded more than 120%. That kind of spike usually means larger flows are involved, not just retail chasing green candles. It fits the classic pattern where whales accumulate during politically or economically sensitive moments, then momentum builds around them.

Will WLFI Break $0.15?

All eyes are locked on $0.12. Clear that level cleanly and $0.15 comes into focus fast. The market is already front running expectations around the rumored “World Swap” forex service and potential RWA integrations set to be discussed at the forum.

That kind of anticipation fuels momentum. But it also raises the stakes.

Well, the announcements come with real details and timelines, buyers likely press harder. If it is vague or delayed, a sharp sell the news reaction would not be surprising.

For now, though, sentiment is leaning bullish. The heavyweight guest list and political backing are giving the Trump crypto narrative serious traction.

Discover: Here are the crypto likely to explode!

The post WLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum appeared first on Cryptonews.

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World1 day ago

Crypto World1 day agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business20 hours ago

Business20 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video1 day ago

Video1 day agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment7 hours ago

Entertainment7 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech11 hours ago

Tech11 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Video7 days ago

Video7 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business13 hours ago

Business13 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

Claude Opus 4.6 wrote vulnerable code, leading to a smart contract exploit with $1.78M loss

Claude Opus 4.6 wrote vulnerable code, leading to a smart contract exploit with $1.78M loss