Crypto World

Fidelity Launches Digital Dollar Stablecoin FIDD

Fidelity Investments has entered the stablecoin market with the launch of Fidelity Digital Dollar (FIDD), marking a significant step by one of the world’s largest asset managers into on-chain dollar instruments. Announced on February 4, 2026, the new stablecoin is issued by Fidelity Digital Assets, National Association, and is available to both retail and institutional clients. Each token is redeemable at a 1:1 ratio with the U.S. dollar, positioning FIDD as a regulated, institutionally managed alternative in a stablecoin market that now exceeds $316 billion in total capitalization.

Key takeaways

- Fidelity has launched its first U.S. dollar-backed stablecoin, Fidelity Digital Dollar (FIDD), available to retail and institutional clients.

- FIDD can be purchased or redeemed directly through Fidelity platforms at a fixed rate of $1 per token.

- Reserve assets are managed internally, leveraging Fidelity’s long-standing asset management infrastructure.

- The stablecoin operates on the Ethereum mainnet and can be transferred to any compatible address.

- Daily disclosures provide transparency on circulating supply and reserve net asset value.

- The launch follows new U.S. regulatory clarity for payment stablecoins.

Sentiment: Neutral

Market context: The launch comes as regulatory clarity in the United States improves and traditional financial institutions increase their participation in tokenized cash, custody, and blockchain-based settlement infrastructure.

Why it matters

Fidelity’s move into stablecoin issuance signals a broader shift in how traditional asset managers approach blockchain-based financial infrastructure. Rather than relying solely on third-party stablecoins, Fidelity is now offering a proprietary digital dollar backed by its own balance sheet processes and operational standards.

For institutional investors, the availability of a stablecoin issued and managed by a globally recognized financial institution may reduce counterparty concerns that have historically limited stablecoin adoption in regulated environments. Retail users, meanwhile, gain access to an on-chain dollar that integrates directly with existing Fidelity platforms.

More broadly, the launch highlights how stablecoins are increasingly viewed as foundational financial plumbing rather than speculative crypto assets. As asset managers, banks, and payment firms adopt similar models, competition may shift toward transparency, reserve management, and regulatory alignment.

What to watch next

- Whether FIDD expands beyond Ethereum to additional blockchain networks.

- Potential exchange listings and liquidity growth outside Fidelity platforms.

- Regulatory reporting standards applied to Fidelity-issued stablecoins.

- Adoption by wealth managers and institutional treasury operations.

Sources & verification

- Fidelity’s official announcement dated February 4, 2026.

- Daily reserve and supply disclosures published on Fidelity’s website.

- Statements from Fidelity Digital Assets leadership regarding regulatory alignment.

Fidelity Digital Dollar enters the regulated stablecoin landscape

Fidelity Investments’ decision to issue a proprietary stablecoin represents a notable evolution in the firm’s digital asset strategy. The new token, Fidelity Digital Dollar (FIDD), is designed to function as a blockchain-based representation of the U.S. dollar while remaining closely integrated with Fidelity’s existing financial infrastructure.

Issued by Fidelity Digital Assets, National Association, FIDD is available to eligible retail and institutional investors through Fidelity Digital Assets, Fidelity Crypto, and Fidelity Crypto for Wealth Managers. Clients can purchase or redeem the stablecoin directly with Fidelity at a fixed price of one U.S. dollar per token, a structure intended to mirror the operational simplicity of traditional cash balances.

Unlike many stablecoins that rely on external reserve managers or opaque custodial arrangements, FIDD’s reserve assets are managed by Fidelity Management & Research Company LLC. This internal structure allows Fidelity to apply the same portfolio oversight, risk controls, and compliance standards used across its traditional asset management business.

Transparency is a central component of the product’s design. Fidelity publishes daily disclosures detailing FIDD’s circulating supply and the net asset value of its reserves as of each business day’s close. This approach aligns with growing regulatory expectations for stablecoin issuers and aims to address long-standing concerns around reserve sufficiency and disclosure practices in the sector.

From a technical perspective, FIDD is issued on the Ethereum mainnet, enabling holders to transfer tokens to any compatible Ethereum address. This design choice allows the stablecoin to integrate with existing decentralized finance infrastructure while remaining accessible through centralized platforms.

Fidelity Digital Assets President Mike O’Reilly described the launch as the result of years of internal research into stablecoins and blockchain-based financial systems. According to the firm, the goal is to provide investors with on-chain utility without sacrificing the stability and operational rigor associated with traditional financial products.

The timing of the launch is closely tied to regulatory developments in the United States. Recent legislation establishing clearer rules for payment stablecoins has reduced legal uncertainty for large financial institutions considering issuance. Fidelity has positioned FIDD as a response to this evolving framework, emphasizing compliance and investor protection alongside technological innovation.

Stablecoins have become a critical component of digital asset markets, facilitating trading, settlement, and cross-border transfers. With total market capitalization now exceeding $316 billion, the sector has attracted increasing scrutiny from regulators and policymakers. Fidelity’s entry reflects a broader trend of established financial firms seeking to bring stablecoin activity within regulated, institutionally managed environments.

Fidelity’s broader digital asset strategy provides important context for the move. The firm has been building blockchain-related infrastructure since 2014, long before digital assets became mainstream. Its offerings now include custody, trading, research, and investment products tailored to institutional clients, intermediaries, and retail investors.

By adding a proprietary stablecoin to this lineup, Fidelity is effectively extending its ecosystem into on-chain cash management. For wealth managers and institutional clients already using Fidelity’s digital asset services, FIDD may serve as a settlement layer that reduces reliance on external stablecoin issuers.

The launch also raises questions about how competition in the stablecoin market may evolve. As more traditional financial institutions issue their own tokens, differentiation may increasingly depend on regulatory status, transparency, and integration with existing financial services rather than yield incentives or aggressive growth strategies.

While Fidelity has not disclosed immediate plans for expanding FIDD beyond Ethereum or adding advanced programmable features, the infrastructure chosen leaves room for future development. Potential use cases could include on-chain settlement for tokenized securities, collateral management, or integration with institutional payment systems.

For now, Fidelity Digital Dollar stands as a signal that stablecoins are moving deeper into the core of traditional finance. Rather than operating at the margins of the financial system, regulated digital dollars issued by major asset managers may become standard tools for both crypto-native and traditional investors navigating an increasingly hybrid financial landscape.

Crypto World

Bitcoin’s Chance Of Returning To $90K By March Is Slim

Key takeawys:

-

Bitcoin fell below $63,000 as weak US job data and concerns over AI industry investments fueled investor risk aversion.

-

Options markets show a 6% chance of Bitcoin returning to $90,000 by March.

Bitcoin (BTC) slid below $63,000 on Thursday, hitting its lowest level since November 2024. The 30% drop since the failed attempt to break $90,500 on Jan. 28 has left traders skeptical of any immediate bullish momentum. The current bearish sentiment is fueled by weak US job market data and rising concerns over massive capital expenditure within the artificial intelligence sector.

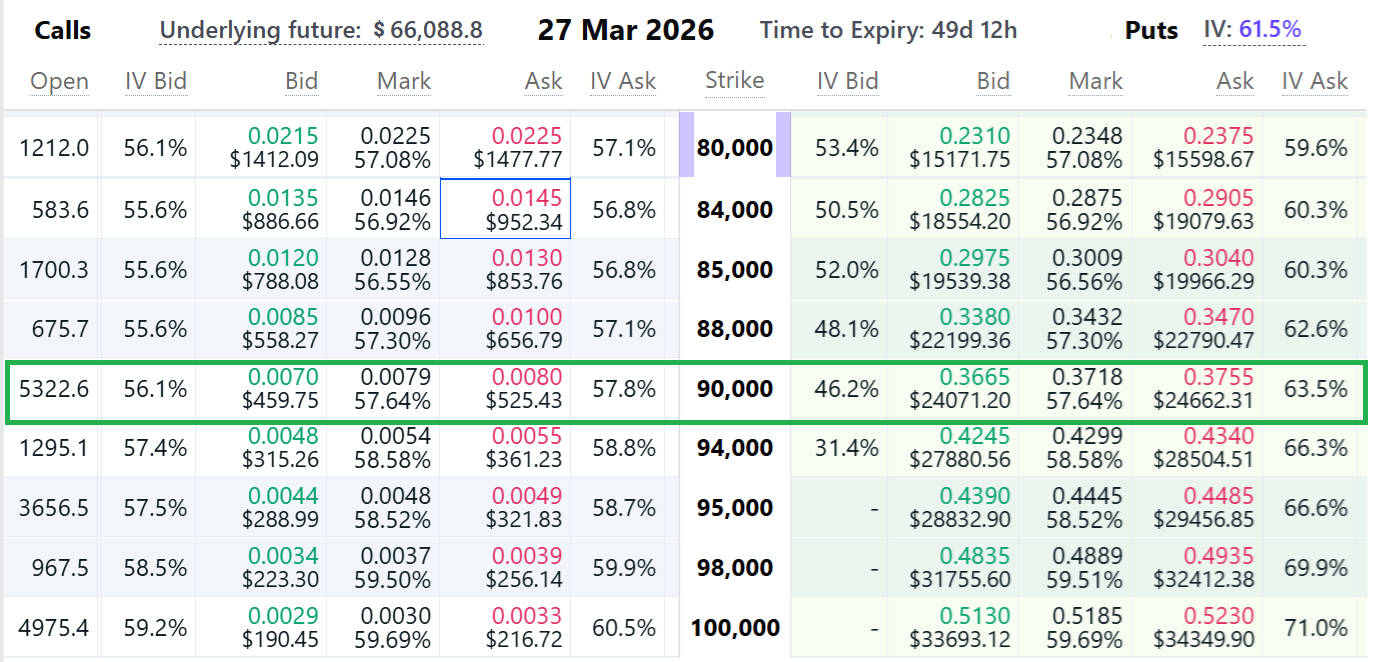

Regardless of whether Bitcoin’s slump was triggered by macroeconomic shifts, options traders are now pricing in just 6% odds of BTC reclaiming $90,000 by March.

On Deribit exchange, the right to buy Bitcoin at $90,000 on March 27 (a call option) traded at $522 on Thursday. This pricing suggests investors see little chance of a massive rally. According to the Black-Scholes model, these options reflect less than 6% odds of Bitcoin reaching $90,000 by late March. For context, the right to sell Bitcoin at $50,000 (a put option) for the same date traded at $1,380, implying a 20% probability of a deeper crash.

Quantum computing risks and forced liquidation fears drive Bitcoin selling

Market participants have reduced crypto exposure due to emerging quantum computing risks and fears of forced liquidations by companies that built Bitcoin reserves through debt and equity. In mid-January, Christopher Wood, global head of equity strategy at Jefferies, removed a 10% Bitcoin allocation from his model portfolio, citing the risk of quantum computers reverse-engineering private keys.

Strategy (MSTR US), the largest publicly listed company with onchain BTC reserves, recently saw its enterprise value dip to $53.3 billion, while its cost basis sat at $54.2 billion. Japan’s Metaplanet (MPJPY US) faced a similar gap, valued at $2.95 billion against a $3.78 billion acquisition cost. Investors are worried that a prolonged bear market might force these companies to sell their positions to cover debt obligations.

External factors likely contributed to the rise in risk aversion, and even silver, the second-largest tradable asset by market capitalization, suffered a 36% weekly price drop after reaching a $121.70 all-time high on Jan. 29.

Bitcoin’s 27% weekly decline closely mirrors losses seen in several billion-dollar listed companies, including Thomson Reuters (TRI), PayPal (PYPL), Robinhood (HOOD) and Applovin (APP).

US employers announced 108,435 layoffs in January, up 118% from the same period in 2025, according to outplacement firm Challenger, Gray & Christmas. The surge marked the highest number of January layoffs since 2009, when the economy was nearing the end of its deepest downturn in 80 years.

Related: Next Bitcoin accumulation phase may hinge on credit stress timing–Data

Market sentiment had already weakened after Google (GOOG US) reported on Wednesday that capital expenditure in 2026 is expected to reach $180 billion, up from $91.5 billion in 2025. Shares of tech giant Qualcomm (QCOM US) fell 8% after the company issued weaker growth guidance, citing that supplier capacity has been redirected toward high-bandwidth memory for data centers.

Traders expect investments in artificial intelligence to take longer to pay off due to rising competition and production bottlenecks, including energy constraints and shortages of memory chips.

Bitcoin’s slide to $62,300 on Thursday reflects uncertainty around economic growth and US employment, making a rebound toward $90,000 in the near term increasingly unlikely.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Can 1 Million New BNB Holders Undo Price Crash to 7-Month Low?

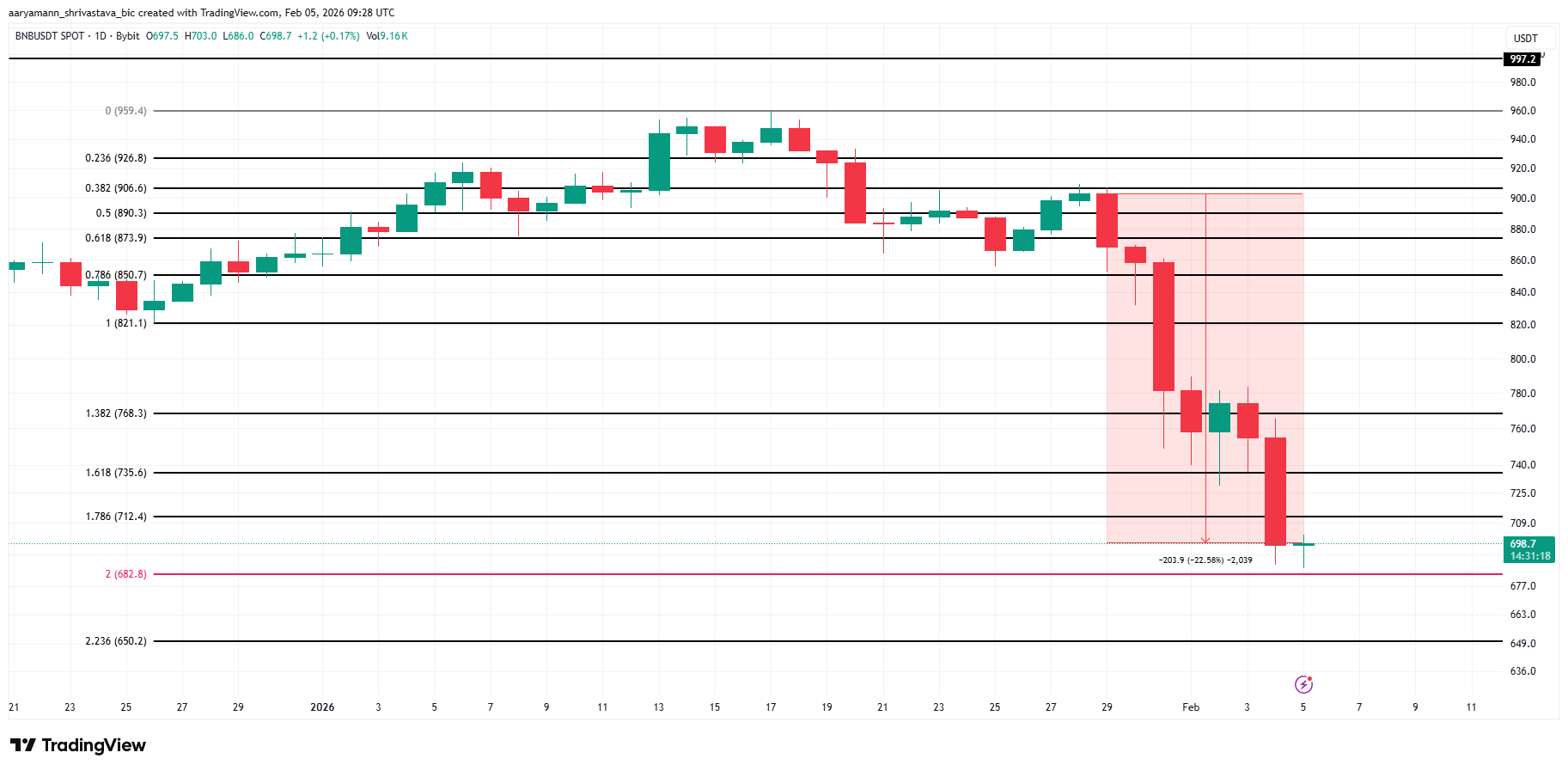

BNB has experienced a sharp correction, with the price falling from $900 to near $700 in recent sessions. The decline erased months of gains and pushed the asset to a seven-month low.

While selling pressure has dominated, the downturn may not be finished unless holder behavior shifts. Emerging on-chain trends suggest conditions could still change.

BNB Is Observing A Flood Of New Holders

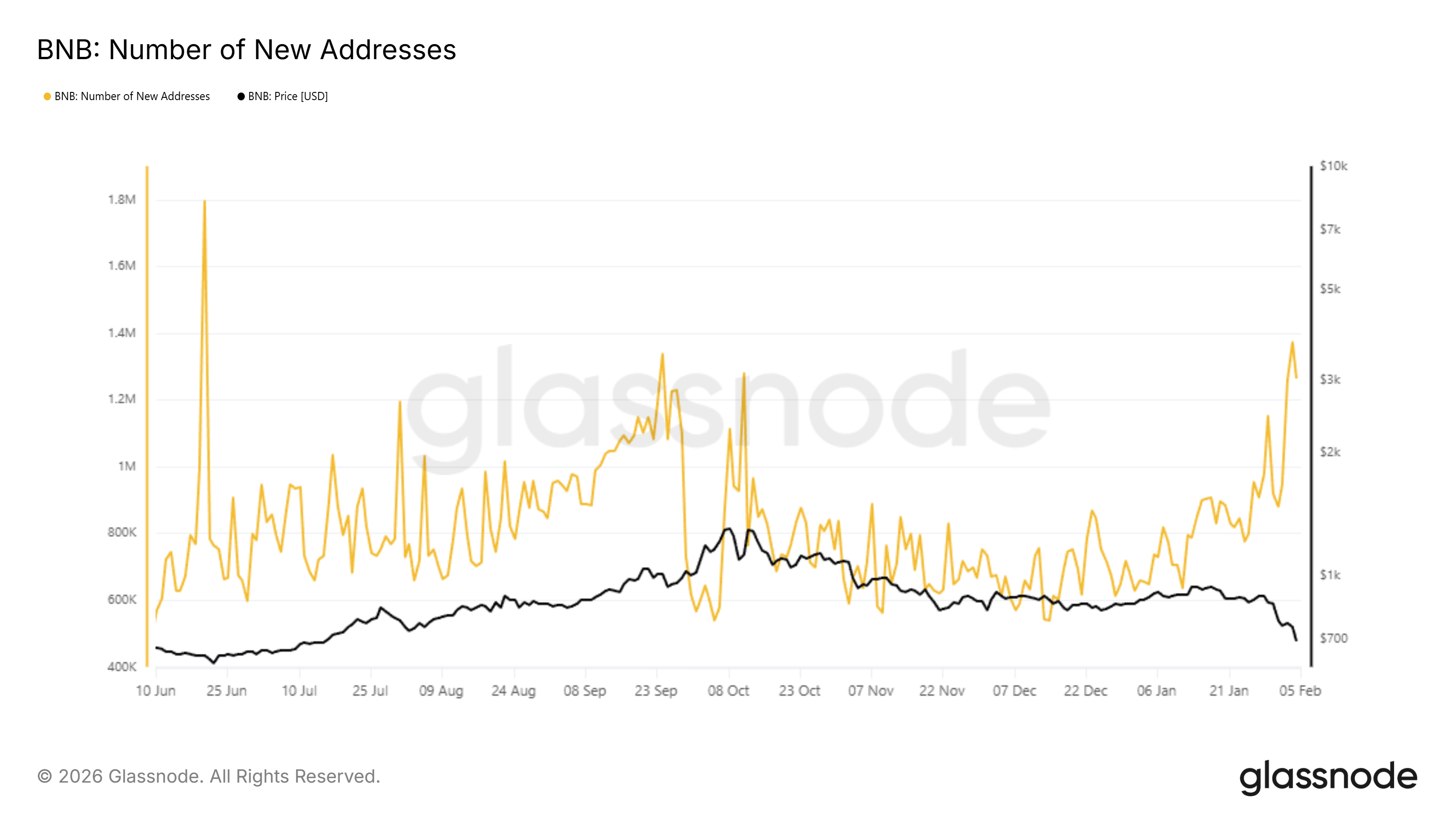

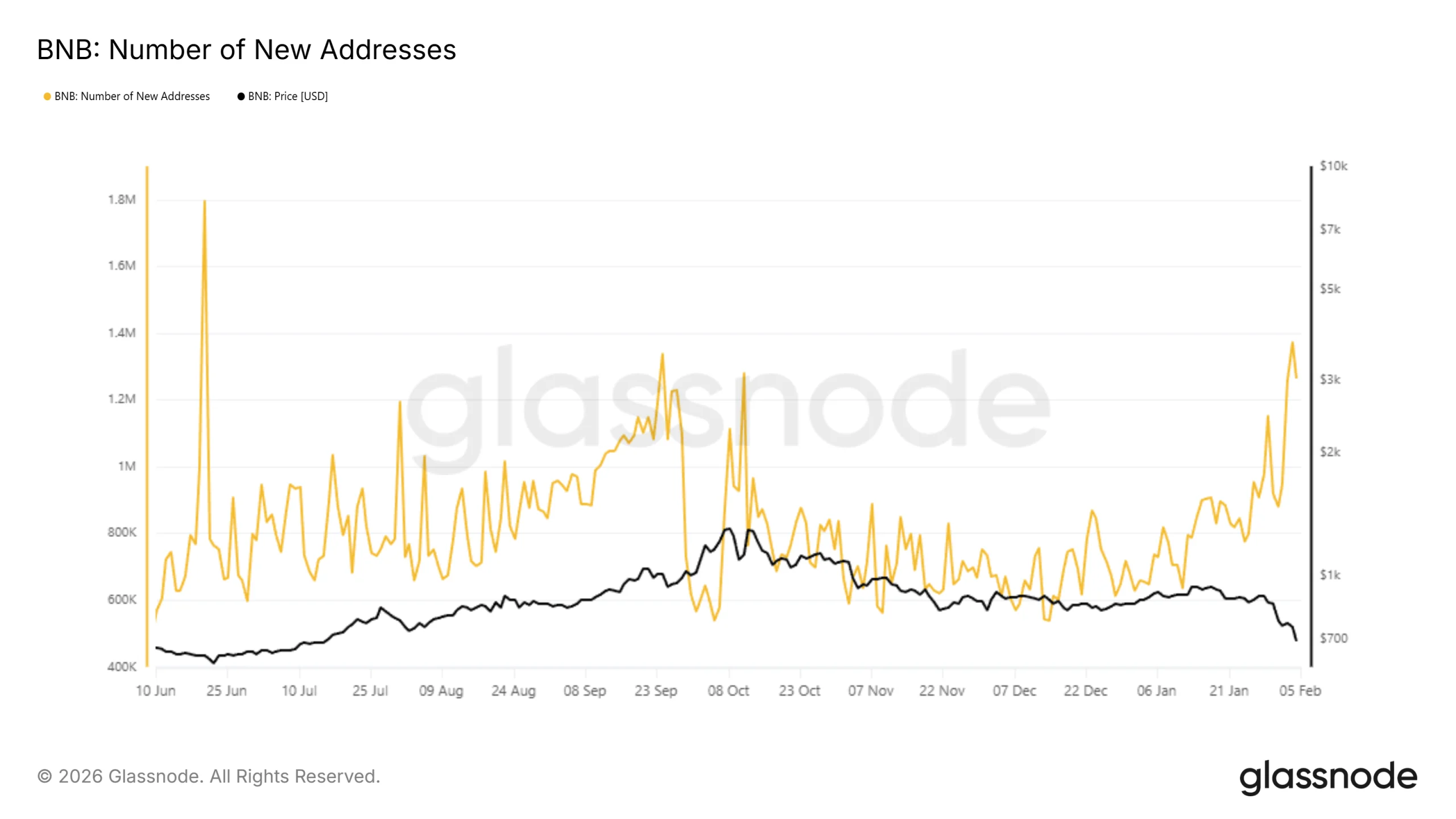

BNB’s network activity has shown notable strength despite the price crash. New address creation has risen consistently over recent days, peaking near 1.3 million additions. Even now, the network continues to add more than 1 million new addresses daily. This growth signals sustained interest during a volatile period.

Sponsored

Sponsored

New addresses are significant because they often represent fresh capital entering the ecosystem. While existing holders are facing selling pressure, new participants can help absorb supply. Historically, strong network growth during corrections has supported stabilization. For BNB, this influx may counterbalance distribution if buying interest persists.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

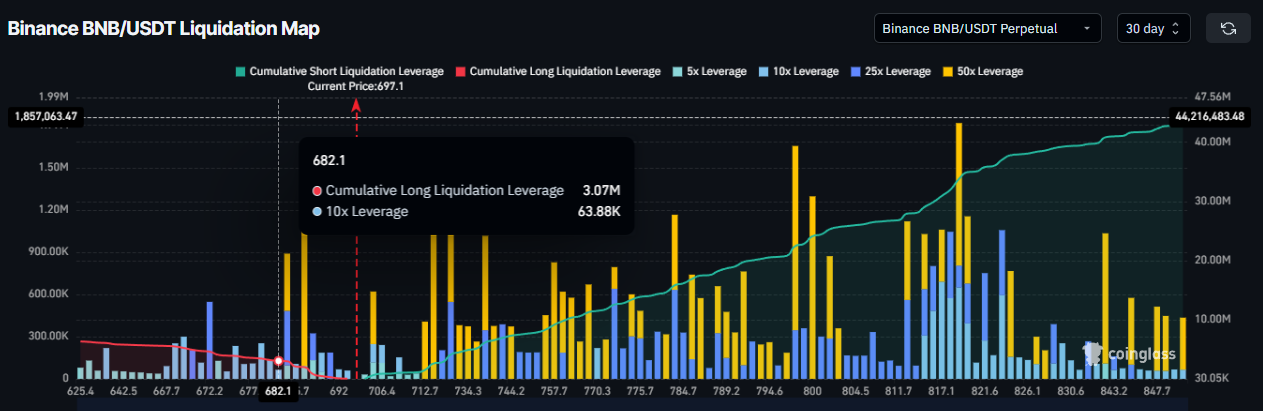

Despite improving on-chain participation, derivatives data remains bearish. Futures market positioning shows a clear skew toward downside risk. Liquidation maps highlight approximately $43 million in short liquidation leverage compared with just $6 million on the long side. This imbalance reflects strong bearish conviction among leveraged traders.

Such positioning often amplifies volatility. If price continues to decline, long liquidations could accelerate losses. The map shows the largest cluster of long contracts sitting at $682, BNB’s next support. Losing this support would also trigger $3.07 million in long liquidations. For now, the dominance of bearish exposure suggests caution.

BNB Price Correction Could Continue

BNB price has declined 22.5% over the past seven days and is trading near $698 at the time of writing. Technical indicators point to continued weakness. The Fibonacci Extension tool identifies $682 as the next major support level, making it a critical zone for near-term price stability.

If broader market conditions remain bearish, downside risks increase. Continued liquidations or heightened volatility could push BNB below $682. A breakdown there would likely send the price toward $650 or lower. Such a move would deepen losses and reinforce bearish sentiment among short-term investors.

A recovery scenario depends on capital inflows offsetting bearish pressure. If demand strengthens, BNB could reclaim $735 and advance toward $768. Flipping the latter into support would invalidate the bearish thesis. Under that outcome, BNB price may recover toward $821, signaling renewed confidence.

Crypto World

Bitcoin’s Shot at $90K by March Is Slim

The flagship cryptocurrency has come under renewed selling pressure, extending a slide that has left market participants cautious about any near-term rebound. The latest move comes as a combination of softer U.S. job data and renewed concerns about AI-sector capital expenditure weigh on risk appetite. The price retreat follows a roughly 30% decline from a late-January high after a failed attempt to push above the $90,500 level on Jan. 28. As macro cues accumulate, derivatives markets hint at a cautious stance, suggesting that a rapid snapback may be unlikely in the near term as investors digest the evolving risk backdrop.

Key takeaways

- Bitcoin slipped below $63,000, entering a seasonally volatile zone as macro data challenges persist and AI-sector investment concerns mount.

- Options markets imply a relatively low probability of a swift rally back to $90,000 by March, with pricing signaling a muted upside scenario.

- Concerns over quantum computing risks and the prospect of forced liquidations by debt-funded Bitcoin holders have amplified risk-off sentiment.

- Public-company Bitcoin holdings and equity-structure dynamics show growing strain, as some firms face large unrealized gaps between market value and cost bases.

- Broader tech and AI narratives—capped by elevated capital expenditure plans and supply-chain bottlenecks—contribute to a cautious market tone across traditional equities as well as crypto.

- Risk-off conditions intensified after a run of negative headlines across large-cap names and an uptick in January layoffs across the U.S. economy.

Tickers mentioned: $BTC, TRI, PYPL, HOOD, APP, QCOM, MSTR, MPJPY

Sentiment: Bearish

Price impact: Negative. The ongoing price drift below key support levels reflects a softer near-term outlook and heightened risk-off sentiment.

Trading idea (Not Financial Advice): Hold. Caution remains warranted as macro headlines and AI investment cycles influence liquidity and risk appetite.

Market context: The current environment blends macro fragility with sector-specific dynamics in AI and tech, creating a cautious tone for risk assets. Liquidity conditions and derivative positioning continue to shape price action as investors weigh near-term catalysts against longer-term macro trends.

Why it matters

The forces weighing on Bitcoin are not isolated to crypto alone. A broader risk-off mood is filtering through global markets, with technology and AI-driven narratives playing a central role. The debilitation of a near-term revival above important thresholds underscores a structural challenge for the asset class: while institutional interest remains, upside momentum has been tempered by macro headwinds and the fear of swift retracements triggered by external shocks.

On the derivative side, traders are pricing in relatively modest odds of a dramatic rally, with call options at elevated strike levels pricing in limited upside potential. For context, on the Deribit exchange, a March 27 call option with a strike of $90,000 traded at around $522, suggesting that market participants assign a low probability to a rapid surge in price in the weeks ahead. The corresponding put options reveal a sense of potential downside risk priced into the market as well, underscoring a balanced but cautious risk-reward calculus in the near term. These dynamics echo the broader tension between bull-case scenarios and risk-off realities facing cryptos amid evolving macro data and capital allocation concerns.

Beyond price dynamics, a suite of fundamental developments has intensified risk aversion. Quantum computing fears—specifically worries that advanced quantum systems could threaten private keys—have led some investors to rethink crypto exposure. In mid-January, Christopher Wood, global head of equity strategy at Jefferies, removed a 10% Bitcoin allocation from his model portfolio, arguing that quantum threats introduce a material tail risk to hodling strategies and that the market could respond abruptly to new information. While such positioning shifts reflect sentiment rather than immediate price catalysts, they contribute to a cautious macro backdrop for crypto markets.

On the corporate front, the landscape of on-chain exposure among publicly traded firms remains a focal point. MicroStrategy (MSTR) remains the largest holder with on-chain BTC reserves, but the company’s enterprise value has fallen to around $53.3 billion while its cost basis sits near $54.2 billion. Similar gaps exist for Metaplanet (MPJPY US), where the market cap stood at roughly $2.95 billion against an acquisition cost of about $3.78 billion. The potential for a prolonged bear phase to force such entities to sell reserve holdings to service debt has investors watching balance sheets closely, even as executives underscore long-term conviction in the technology and underlying use cases.

Additional macro factors are weighing on risk assets as well. The week’s early data showed broad risk-off momentum, with silver, often viewed as a risk-off asset, retreating sharply after reaching an all-time high in late January. While crypto markets are distinct from traditional commodities, the cross-asset pull—driven by higher risk sentiment and macro uncertainties—helps explain the correlation in recent weeks between the performance of large-cap equities and crypto assets.

In the broader tech arena, larger dynamics around AI investment cadence are shaping the indirect risk profile for crypto markets. Google’s parent company signaled that capital expenditure in 2026 will be materially higher than in 2025, highlighting a continued push into data-center infrastructure. At the same time, Qualcomm reported softer guidance as supplier capacity shifts toward high-bandwidth memory for data centers, underscoring a delicate balance between innovation cycles and near-term profitability. Analysts anticipate that AI spending could deliver longer payoff horizons than many investors currently expect, a factor that compounds uncertainty for risk-sensitive assets, including crypto.

Against this backdrop, Bitcoin appears unlikely to stage a rapid rebound toward the $90,000 region in the near term. The price action around $62,000–$63,000 has become a focal point for traders watching for a sustainable bottom or a capitulatory event that could usher in a new phase for accumulation. The path forward for the asset will likely depend on a combination of macro resilience, continued liquidity, and the pace at which AI-capital expenditure and its supply-chain constraints unwind.

What to watch next

- Upcoming U.S. payrolls data and macro indicators, which could shape risk sentiment and liquidity conditions.

- Derivative flows and March expiry activity (including BTC options around key strike levels like $90,000).

- Updates on AI-capex realization and supply-chain bottlenecks affecting tech stocks and related risk assets.

- Monitor developments around large on-chain BTC holdings and any potential forced-liquidation events tied to debt covenants.

- Central bank signals and policy expectations that could influence risk appetite across crypto and traditional markets.

Sources & verification

- Deribit options data for March 27 BTC calls and puts, including the $90,000 strike call and $50,000 strike put pricing.

- Public-company BTC holdings and balance-sheet implications (on-chain context and company-level risk exposure).

- Jefferies note referencing a reduced Bitcoin allocation due to perceived quantum-computing risks.

- January layoff data from Challenger, Gray & Christmas (108,435 layoffs) and related macro commentary.

- Alphabet (EXCHANGE: GOOG) capex trajectory for 2026 and Qualcomm (EXCHANGE: QCOM) guidance signals; broader AI-funding implications.

Bitcoin under pressure in a cautious macro environment

Crypto World

JP Morgan Strategist Prefers Bitcoin to Gold Long Term

While crypto natives lament Bitcoin’s underperformance compared to precious metals, institutional traders are eyeing the digital asset.

On one of BTC’s worst days in recent memory, JP Morgan’s quantitative strategist Nikolaos Panigirtzoglou is taking the contrarian approach and says that not only is Bitcoin undervalued, but it looks “even more attractive compared to gold.”

Panigitzoglou says that liquidations have been “more modest” despite the asset’s poor recent performance, and highlighted that the bitcoin-to-gold volatility ratio is at a “record low” in a recent investor research note, according to Yahoo Finance.

However, BTC is currently down 13.3% today compared to gold’s 3% decline, so that ratio gap is closing quickly.

Bitcoin’s stark underperformance relative to gold continues a trend that began when the new U.S. administration took office in January 2025. Gold is up 80% since Trump entered office, while BTC is down 37% over the same period.

While retail crypto traders have struggled to reconcile gold’s outperformance, Bitcoin analyst Willy Woo cites several reasons, including quantum computing threats and the marginal buyers in each asset class.

On Jan. 25, Woo said, “It’s really hard to convince sovereigns and fiduciary institutions to buy a nascent asset like BTC with 17 years of history (which is less than a retail home mortgage). Then think about their perspective on quantum uncertainty over the next 5-15 years.”

Crypto World

Ripple’s XRP Dumps by 13% Daily, Bitcoin (BTC) Slipped Below $70K: Market Watch

XRP is today’s most substantial loser from the largest 100 alts, dumping below $1.40. ZEC and MORPHO follow suit.

Bitcoin’s poor price performance continues in full force as the asset erased all gains seen after Trump’s reelection by slipping below $70,000 earlier today.

Most altcoins have bled out heavily as well, and it’s not just XRP. ETH, BNB, SOL, DOGE, ADA, and many more have posted massive declines.

BTC Dipped Beneath $70K

It’s almost hard to believe that just over a week ago, last Wednesday, bitcoin traded at $90,000. The developments since then have been nothing short of pure bear domination. While the reasons are still debated, the fact is that BTC was violently rejected at that point and driven south hard.

At first, it fell to $81,000 last Thursday, rebounded to $84,000 on Friday, and plummeted again to under $75,000 on Saturday. After an unsuccessful relief rally to $79,000, the bears were back in control and drove it to $73,000 on Tuesday.

The dead-cat bounce pattern repeated and bitcoin continued to lose value in the past 12 hours or so. Moreover, it dumped below $70,000 earlier today for the first time since just after the US elections in 2024.

It has now bounced to slightly above $70,000, but it’s still 7% down daily and 20% in the red weekly. Its market cap has plummeted to $1.410 trillion on CG, while its dominance over the alts struggles at 57%.

Alts Keep Bleeding

The altcoins’ charts are just as painful, even more on some occasions. ETH is down by 6% as well as even Vitalik Buterin has started to dispose of his tokens. BNB has dumped below $700, while XRP has become today’s poorest performers with a double-digit drop to under $1.38. This is its lowest price tag in well over a year.

SOL, ADA< DOGE, XMR, LINK, and many others are deep in the red. HYPE continues to be among the few exceptions, gaining almost 5% to $34.

The total crypto market cap has erased another $170 billion and is below $2.5 trillion on CG now.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Gemini lays off employees, shifts from crypto to betting

In a sign of the times, Gemini, the crypto exchange founded by billionaires Tyler and Cameron Winklevoss, is making significant cutbacks.

Summary

- Gemini will lay off up to 200 employees and shut down services in the UK, EU, and Australia amid a downturn in the crypto market and ongoing struggles to gain market share.

- Despite the challenges, Gemini is focusing on gambling: Gemini Predictions.

- The new prediction market platform has processed over $24 million in volume since its launch in December 2025, aiming for future growth.

The company is reportedly slashing up to 25% of its workforce and shutting down operations in the UK, European Union, and Australia. The decision follows a tough period for the company, which has struggled to gain market share despite being an early player in the crypto exchange space.

The New York-based exchange, which launched in 2014, announced it would lay off up to 200 employees across its global workforce, including in the US and Singapore. The cuts come after Gemini reported a $159.5 million loss in November, largely due to the high costs associated with its initial public offering and extensive marketing efforts.

As Bitcoin prices dipped below $70,000, the broader crypto sector has faced intense volatility, further weighing on Gemini’s fortunes.

The company also announced that it would place all customer accounts in the UK, EU, and Australia into withdrawal-only mode starting March 5, with full account closures to follow a month later. This move is part of a broader restructuring plan expected to cost the company about $11 million.

Despite these challenges, the Winklevoss twins are betting on the future of prediction markets, launching a new service called Gemini Predictions in December. The platform has processed over $24 million in volume from 10,000 users since its launch, with the Winklevosses hoping this will help steer the company toward a more focused and profitable future.

Crypto World

Why $70,000 Is the Most Critical Level Right Now

Bitcoin continues to face intense selling pressure, breaking below its yearly lows amid escalating geopolitical tensions between the United States and Iran. This risk-off backdrop has accelerated downside momentum, and while further weakness remains possible, the market is increasingly approaching levels that could trigger a short-term consolidation phase in the days ahead.

Bitcoin Price Analysis: The Daily Chart

On the daily timeframe, BTC has been hit by aggressive sell-side activity, driving the price decisively below key support levels, including the major yearly low at $74K. The decline has now extended into the $70K psychological zone, a historically significant area where resting demand and dip-buying interest are likely to emerge.

If this demand region succeeds in absorbing selling pressure and fresh buyers step in, the current downtrend may pause, allowing the market to transition into a corrective consolidation phase. In that scenario, the price action would likely stabilize within a $70K–$80K range as the market cools off. However, a clear failure to hold the $70K level would expose Bitcoin to another downside leg, with the next notable support located near the $63K region.

BTC/USDT 4-Hour Chart

From a lower-timeframe perspective, the 4-hour chart shows Bitcoin trading within a well-defined bearish channel, confirming a structurally weak market environment. The asset recently broke below the channel’s midline near $74K, triggering an impulsive sell-off toward the lower boundary of the structure.

Despite the sharp decline, Bitcoin has now reached a critical support level at $70K, which also carries strong psychological importance for market participants. Given the speed and intensity of the recent move, the market is likely in need of a consolidation and corrective phase. As a result, the most probable near-term scenario is choppy, range-bound price action around the $70K support until a clearer directional signal emerges. In the event of a relief bounce, the $75K and $80K supply zones stand out as the primary upside targets.

Sentiment Analysis

The futures average order size chart shows a notable shift in participant behavior as Bitcoin trades around the $70K region. The appearance of green dots at this level signals renewed whale participation, indicating that large players are actively engaging when price revisits this zone. Importantly, this is not an isolated event. The previous two occasions when Bitcoin traded around the same price range were also accompanied by green dots, reinforcing the idea that this area has historically attracted whale interest.

This repeated pattern suggests that the $70K region is perceived by large market participants as a favorable accumulation or positioning zone rather than an area for aggressive distribution. In contrast to periods dominated by red dots, which reflect retail-heavy or reactive selling, the return of green dots points to more strategic, higher-conviction activity in the futures market.

If this behavior persists and whale participation continues to strengthen around current levels, it increases the probability of a short- to mid-term rebound. Large orders entering at these prices can absorb selling pressure and act as a catalyst for stabilization, potentially setting the stage for a relief move higher if broader market conditions allow.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

China building gold-backed digital assets? Bessent says…

Senator Cynthia Lummis (R-Wyo.) wasted no time Thursday asking Treasury Secretary Scott Bessent the big question: Is China using blockchain to create a rival to American financial dominance?

Bessent told the Senate Banking Committee he “would not be surprised.”

Summary

- Bessent hints at gold-backed digital assets from China, but it’s unconfirmed.

- Hong Kong’s sandbox role allows China to explore new financial technologies, like a gold-backed digital asset, without directly involving mainland authorities.

- Why does it matter? It could potentially be a stable alternative to the dollar.

“We don’t know that for sure,” he added. “There are lots of rumors that China may be developing digital assets backed by something other than the RMB, perhaps gold-based. We haven’t seen that.”

So, what’s China’s game plan?

Apparently, Hong Kong is their “sandbox” — a financial testing ground where they can play with new ideas without getting mainland China too involved.

That means they can cook up gold-backed digital assets while keeping it on the down-low. A gold-backed asset could provide a stable store of value, which would directly challenge the dollar’s reserve currency status — especially since it wouldn’t be subject to U.S. monetary policy or sanctions.

Meanwhile, China’s digital yuan is still all about the RMB, so it’s not quite as rebellious.

Bessent didn’t stop there

When it came to Iran, he dropped this gem: Iranian leaders are moving money out “like crazy,” signaling “the end may be near” for the current regime. In a moment of unexpected drama, he likened it to “the rats leaving the ship.” If that’s not a metaphor for the ages, I don’t know what is.

And in a final mic-drop moment, Bessent stressed the importance of passing the Clarity Act, acknowledging that applying capital gains tax on cryptocurrency is a complex mess. The complexity of crypto taxes? It’s no surprise there.

In conclusion, the world of digital assets, gold-backed currencies, and escaping rats has never been more thrilling. Stay tuned for the next episode of “China’s Sandbox Adventures.”

Crypto World

Crypto Industry Proposes Sharing Stablecoin Reserves with Community Banks: Report

Crypto firms offered concessions on stablecoins, including reserve-sharing with banks, to ease tensions blocking a major digital asset bill.

The crypto industry has reportedly proposed sharing stablecoin reserves with community lenders as it steps up efforts to win over skeptical banks.

The move aims to preserve the stalled crypto market structure bill that could significantly alter the financial system.

Deposit Fears and the Search For Compromise

A Bloomberg report revealed that crypto firms have spent weeks trying to win over doubtful banks by offering new concessions focused on stablecoins, which have become the central point of disagreement.

According to sources cited in the report, the latest ideas include giving community banks a larger role in the stablecoin ecosystem. One proposal would require issuers to hold a portion of their reserves at these financial institutions. Another recommendation would make it easier for these firms to issue their own dollar-pegged digital assets.

However, the two sides have not agreed on any resolution, and it remains unclear whether the proposals would go far enough to address fears of customers moving deposits out of the banking system.

A separate report from analyst Geoff Kendrick had warned that stablecoins could lead to the exit of as much as $500 billion in bank deposits across industrialized nations by the end of 2028. This comes as the overall digitalized dollar market continues to experience notable growth, with the total supply in circulation having risen by roughly 40% over the past year.

Digital Asset Firms Remain Divided

On the other hand, not all crypto companies are aligned with the suggestions. One of the biggest points of contention is whether platforms like Coinbase should be allowed to pay users rewards for holding stablecoins. Traditional financial institutions also argue that these payouts could pull customers away from checking and savings accounts, which threatens a major source of deposits for them.

You may also like:

In an attempt to resolve this, the Trump administration convened a meeting at the White House on Monday between crypto and banking trade groups, but the talks ended without agreement on how to resolve these core issues.

Despite the friction, the development is still being viewed as a positive sign that the market-structure bill will keep moving in Congress. This is after the legislation was passed by the House of Representatives last year, but has since slowed in the Senate due to unresolved disagreements between the two sectors.

Meanwhile, in a recent interview with Fox News, Tim Scott, the chairman of the Senate Banking Committee, expressed his optimism about finding a compromise.

“We can protect consumers and community banks while still allowing innovation and competition to lower prices and expand access,” the senator said. “Both sides are working toward a compromise that keeps innovation here in America.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Dogecoin, Shiba Inu slid deeper as on-chain activity spike

Dogecoin and Shiba Inu slid deeper into selloff territory even as on-chain activity spiked, underscoring a growing disconnect between network usage and price action across the meme-coin sector.

Summary

- Despite a 36% surge in Dogecoin active addresses, prices fell 3%, with Shiba Inu also losing 2%.

- Increased network activity is driven more by distribution than accumulation, signaling vulnerability to further declines.

- Trading at $0.00000641, SHIB is down 92% from its 2021 peak, facing weak transaction volumes and uncertain future utility.

Dogecoin (DOGE) active addresses jumped 36% over the past week to more than 71,400, signaling renewed participation on the network.

But the surge failed to support prices, with DOGE falling 3% to about $0.102 and Shiba Inu dropping 2% to roughly $0.0000066.

Heavy net outflows, weakening technical structures, and broken support levels suggest both tokens remain vulnerable to further downside, as increased activity appears driven more by distribution than accumulation.

Dogecoin, originally created as a joke in 2013, briefly soared to a $90 billion market cap in 2021 but has since lost over 90% of its value.

Despite a rally in late 2024, the meme coin remains down 62% in 2025 and lacks a real use case like Bitcoin or Ethereum.

Its speculative nature and endless supply—leading to constant dilution—make it vulnerable to further declines. With no fundamental catalysts in sight, a 50% drop in 2026, potentially returning Dogecoin to its 2022 low of $0.05, seems likely.

Shiba Inu is the pits

Shiba Inu (SHIB) has been volatile after recently hitting a monthly low of $0.0000065 on February 1, following a high of $0.0000097 on January 6.

These price swings reflect SHIB’s sensitivity to sentiment and liquidity.

Shiba Inu is currently trading at $0.00000641, a 92% drop from its October 2021 all-time high. The token is below key moving averages, and while the RSI shows oversold conditions, no reversal has occurred. SHIB is testing critical support at $0.00000638, and a breakdown below this level could push it to $0.0000055.

The Shiba Inu ecosystem is facing challenges, including weak daily transaction volume and a lack of sustained utility, despite its integration of Fully Homomorphic Encryption (FHE) in Q2 2026, which could boost privacy and security. The launch of a crypto ETF by T. Rowe Price could also attract regulated capital, but approval odds are low.

According to one report, Shiba Inu’s price could range between $0.000015-$0.000025 by 2027 if privacy upgrades succeed and the ETF is approved, with conservative estimates placing it between $0.000010–$0.000015.

Key resistance levels are $0.00000732, $0.0000078, and $0.00000851. Monitoring Shibarium transaction volumes and burn rates, along with Bitcoin’s performance, will be key for investors tracking SHIB’s potential recovery.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World7 days ago

Crypto World7 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat7 days ago

NewsBeat7 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business5 hours ago

Business5 hours agoQuiz enters administration for third time

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat12 hours ago

NewsBeat12 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report