Crypto World

Fidelity launches FIDD stablecoin with over $59M supply on Ethereum

TLDR

- Fidelity Digital Assets has officially launched the FIDD stablecoin with an initial supply of over 59 million dollars.

- The FIDD stablecoin is now live on the Ethereum blockchain and is available for on-chain payments and institutional settlements.

- Fidelity confirmed that FIDD is fully backed by US dollars held in accredited banks and complies with the GENIUS Act.

- Mike O’Reilly stated that Fidelity is committed to stablecoin development and has researched the digital asset space for years.

- The FIDD token will be available through Fidelity Digital Assets, Fidelity Crypto, and other institutional platforms.

Fidelity Digital Assets has officially launched its native stablecoin FIDD on the Ethereum blockchain, following a recent announcement. The asset began with an initial issuance of over $59 million and is now live for transactions. The token is fully backed by US dollars held in accredited financial institutions.

FIDD Stablecoin Launches with Initial Supply and Ethereum Integration

Fidelity introduced the FIDD stablecoin as part of its broader expansion into the blockchain and digital payments market. The company minted the token on Ethereum, aligning with the industry’s move toward on-chain settlement. The initial supply exceeds $59 million but remains largely limited in wallet distribution.

Mike O’Reilly, President of Fidelity Digital Assets, emphasized the company’s dedication to digital innovation. “We have spent years researching and advocating for the benefits of stablecoins,” he said. The token aims to serve as both a payment method and a settlement tool for institutional clients.

The FIDD stablecoin complies with the regulatory framework set by the GENIUS Act, allowing for secure and compliant issuance. It is backed by US dollar reserves stored in regulated banks. The GENIUS Act also permits backing by US Treasury bills, enhancing issuer control over earnings.

Utility, Custody, and Institutional Access

Fidelity has confirmed that FIDD will be available across its platforms, including Fidelity Crypto and Fidelity Crypto for Wealth Managers. Purchase and redemption will be handled internally, while external trading will occur through major cryptocurrency exchanges. The asset is fully transferable within Ethereum-based wallets.

The company will also offer custodian services for holding FIDD and managing associated reserves. This includes both direct and institutional client servicing. As Fidelity already operates digital asset custody, it expands its offerings by adding a compliant stablecoin.

FIDD is designed for on-chain payments and institutional use cases, especially for settlement across digital asset platforms. Its compatibility with Ethereum ensures wide infrastructure support. Despite the launch, liquidity and adoption are expected to build gradually.

Stablecoin Ecosystem Sees New Entrants with FIDD in Focus

The FIDD stablecoin enters a market dominated by USDT and USDC, both of which have seen growth over the past year. New regulations like the GENIUS Act have encouraged more issuers to develop compliant tokens. FIDD is Fidelity’s answer to the emerging demand for tokenized dollars with regulatory clarity.

Fidelity joins the list of fintechs and banks offering branded stablecoins, focusing on secure reserves and usage controls. However, like many new stablecoins, FIDD must still prove its real-world utility and demand. Several newly launched stablecoins have remained underutilized due to limited liquidity or application.

The Fidelity Digital Interest Token, launched in September 2025, demonstrates the firm’s ongoing blockchain efforts. That token reached over $264 million in total value before dropping due to redemptions. Its current assets under management stand at approximately $161 million.

Crypto World

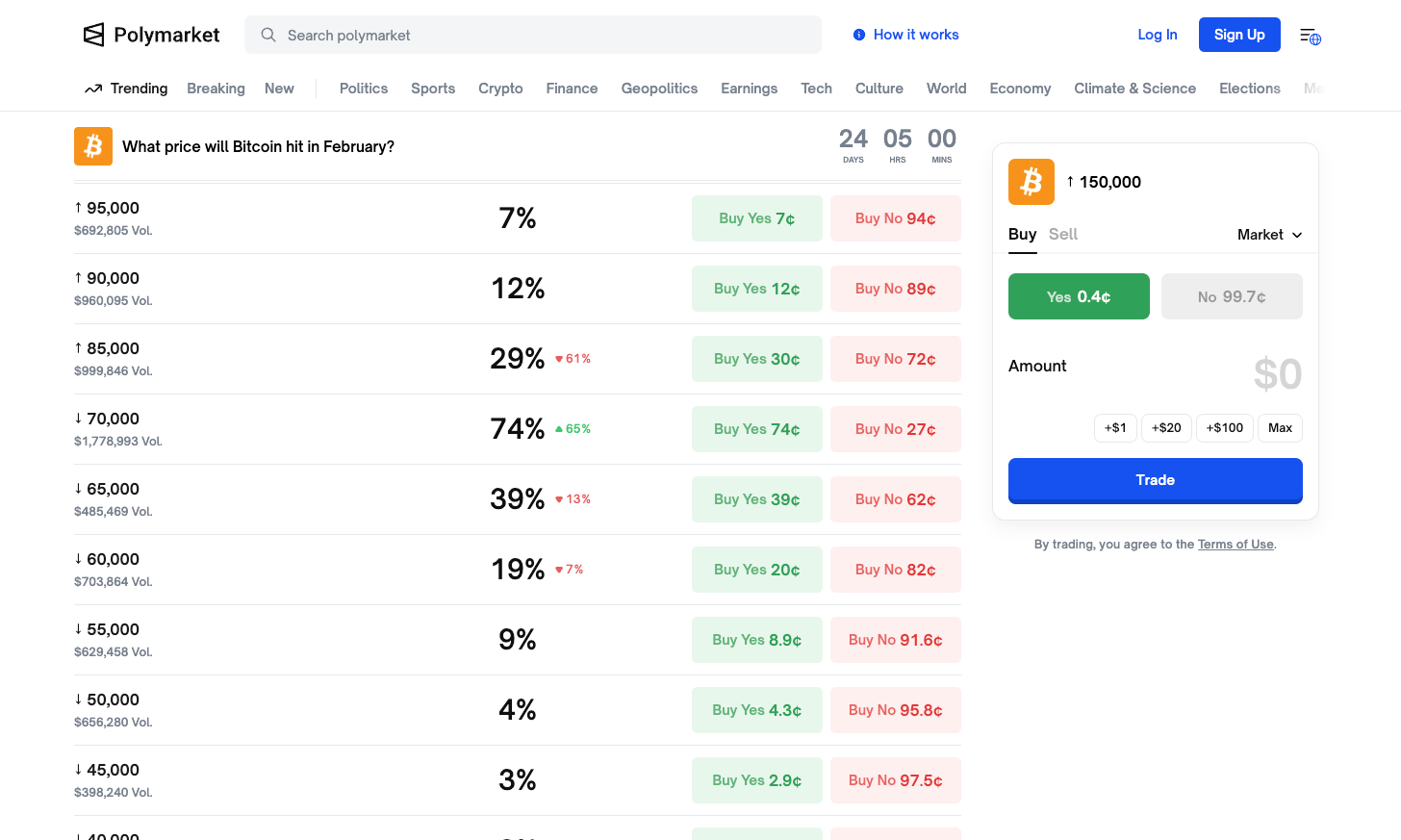

Polymarket Prices In a $70K February for Bitcoin

Bitcoin briefly dipped below $72,000 on Thursday morning in early Asian trading hours, hitting its lowest level in nearly 16 months. As the selloff deepens, prediction market traders on Polymarket are rapidly repricing their expectations — and the data paints a sobering picture for the short term, even as longer-term optimism persists.

Polymarket’s real-money contracts show a market caught between defending $70,000 as a floor and clinging to $100,000 in annual returns.

Sponsored

Sponsored

February Outlook: $70K Is the Line in the Sand

Polymarket’s February Bitcoin price contract, with 24 days remaining and nearly $1.78 million in volume on the $70,000 target alone, tells a clear story.

The $70,000 contract surged to 74% probability — up 65% — making it the most heavily traded target for the month. Upside expectations have collapsed: the $85,000 contract plunged 61% to just 29%, while $90,000 sits at 12% and $95,000 at only 7%.

On the downside, the $65,000 contract dropped 13% to 39%, while $60,000 holds at 19%. Probabilities of a crash below $55,000 are in the single digits. The implied range for February is $65,000–$85,000, with $70,000 as the most probable point.

2026 Annual Contract: Still Bullish, but Fraying

The longer-term Polymarket contract shows a more nuanced picture. The $100,000 level has a 55% probability but is down 29%, while $110,000 is at 42% and down 29%. These are significant declines from just weeks ago, when traders were pricing in a continuation of 2025’s rally.

The $65,000 contract for 2026 surged 24% to 83% with over $1 million in volume — the highest on the board — signaling traders are focused on downside protection rather than upside speculation. The upper curve drops steeply: $130,000 at 20%, $140,000 at 15%, and $250,000 near 5%.

Sponsored

Sponsored

What’s Driving the Selloff

Bitcoin was trading at approximately $73,199 at the time of writing, after briefly dipping below $72,000 earlier Thursday. The token has fallen 16% year-to-date and roughly 40% from its October 2025 all-time high of $126,000.

Multiple factors are converging: rising geopolitical tensions, lingering data gaps from last fall’s record 43-day government shutdown, and a hawkish Federal Reserve chair nomination, strengthening the dollar

The technical damage has been severe. Over $5.4 billion in liquidations have occurred since late January, pushing open interest to a nine-month low. US spot Bitcoin ETFs have bled capital for most of the past three weeks, with outflows of $817 million on January 29, $509 million on January 30, and $272 million on February 3, punctuated by a single $561 million inflow day on February 2. Total net assets across spot Bitcoin ETFs have fallen from over $128 billion in mid-January to $97 billion.

The Crypto Fear and Greed Index has plunged to 12 — deep in “Extreme Fear” and its lowest since November 2025. Gold, meanwhile, has surged past $5,000 per ounce, underscoring a broad rotation into safe havens.

The Bottom Line

Polymarket’s data offers a real-time window into how traders with money on the line are positioned. February expectations center on $65,000–$85,000 with almost no chance of reclaiming $95,000.

The annual contract is more forgiving, with a slim majority still expecting $100,000 sometime in 2026. But even that conviction is weakening. For now, $70,000 is the number everyone is watching.

Crypto World

Ripple Announces Institutional Support for Hyperliquid

Ripple integrates Hyperliquid for its prime brokerage solution.

Hyperliquid seems to be the talk of the town lately, and Ripple just announced that its Ripple Prime brokerage platform will support the perp DEX. In other words, the firm’s institutional clients will be able to access on-chain derivatives while cross-margining their exposure to decentralized finance with all other assets that are supported by Ripple Prime.

These include cleared derivatives, OTC swaps, fixed income, forex, and other digital assets.

According to the official release, “clients can access Hyperliquid liquidity while benefiting from a single counterparty relationship.”

Speaking on the matter was Michael Higgins, the international CEO of Ripple Primer, who said:

“At Ripple Prime, we are excited to continue leading the way in merging decentralized finance with traditional prime brokerage services, offering direct support to trading, yield generation, and a wider range of digital assets. This strategic extension of our prime brokerage platform into DeFi will enhance our clients’ access to liquidity, providing the greater efficiency and innovation that our institutional clients demand.”

Ripple continues to expand its product offering while also working on licensing and regulatory issues worldwide. Recently, they secured a preliminary electronic money institution license in Luxembourg.

The move to integrate Hyperliquid into their prime brokerage solution also comes at a time when the decentralized perpetual futures exchange is attracting billions in daily volumes across a variety of assets, providing the deepest on-chain liquidity order book in the industry.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Tramplin Introduces Premium Staking on Solana, a Proven Savings Model Rebuilt for Crypto

[PRESS RELEASE – George town, Cayman Islands, February 4th, 2026]

Tramplin, a premium staking platform built on Solana, backed by iTreasury Ventures, today announced its public launch, introducing a proven real-world savings model rebuilt for crypto.

Built on Solana’s native staking architecture, Tramplin features a premium bonds-inspired reward redistribution mechanism designed to give smaller SOL holders access to meaningful upside without compromising capital safety.

By collecting staking rewards and redistributing them probabilistically, Tramplin creates opportunities for potential outsized returns while ensuring users retain full control of their principal.

The project’s mission is to empower SOL holders—the backbone of the Solana ecosystem—by offering upside potential previously accessible only to large stakeholders. During its test phase, Tramplin observed periods of elevated effective APY for small stakers, driven by initial committed stake and redistribution dynamics.

Market Context

The idea behind Tramplin originated in a broader concern about how retail users have participated in crypto over the past market cycles.

Since 2021, a significant share of new activity has been driven by memecoin speculation, extreme leverage, and short-term trading models where smaller participants consistently enter late and exit at a disadvantage.

Rather than creating long-term value, much of the market has become optimized for volatility and rapid capital redistribution, often resulting in systematic losses for retail users.

Built on Native Staking, Without Added Risk

Tramplin operates entirely within Solana’s native staking framework, with users delegating directly to the validator node and no smart-contract custody or counterparty risk.

By combining provably fair randomness (via VRF), Merkle-based transparency, and the security of native staking, Tramplin is designed to make staking more engaging, equitable, and accessible, without introducing new risk vectors.

Public Launch and Partner Program

Alongside its launch, Tramplin is opening its Strategic Partner Program, inviting creators, analysts, auditors, and ecosystem builders to participate in reviewing, validating, and sharing the protocol with their communities.

The Partner Program is designed to offer a low-overhead, transparent alternative to running a private validator, while preserving Solana’s native security model.

The program features audit-first transparency, lifetime revenue sharing, and community Boost Points. Additional details about Tramplin and its Partner Program are available at https://tramplin.io

About Tramplin

Tramplin is a premium staking platform built on Solana with verifiable and random distribution of outsized rewards.

Founded in early 2025, Tramplin’s mission is to empower SOL holders — the backbone of the Solana ecosystem — with opportunities traditionally reserved for whales, without compromising capital safety.

Tramplin is backed by iTreasury ventures, an early investor in Solana, Polkadot, and several other category-defining blockchain projects.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

MSTR Stock Target Cut to $185 as Analyst Adjusts to Crypto Market Fall

TLDR

- Joseph Vafi from Canaccord has reduced his MSTR stock price target by 61%.

- The new MSTR stock price target is now set at $185, down from $474.

- Vafi still maintains a buy rating despite the steep cut in his price estimate.

- Strategy’s stock has dropped 15% in 2026 and 62% over the past year.

- The company’s value is now closely tied to the performance of Bitcoin.

As the ongoing crypto winter continues, investors are looking for signs that the bearish trend has reached its peak. A notable update comes from Canaccord’s Joseph Vafi, who dramatically slashed his price target on Michael Saylor’s Strategy (MSTR) stock. Vafi reduced his target by 61%, setting it at $185 from the previous $474, reflecting the significant impact of the current market conditions.

Strategy (MSTR) Faces Setback Amid Market Volatility

Joseph Vafi’s revised price target fo MSTR stock marks a stark change in outlook. After maintaining a bullish stance on the stock just a few months ago, Vafi is now adjusting his expectations to reflect the ongoing struggles within the crypto space. The analyst still holds a buy rating on the stock, despite the massive cut in his price target.

At $185, the new target implies about 40% upside from the most recent closing price of $133. However, this outlook comes after Strategy has suffered significant losses, down 15% year-to-date, 62% year-over-year, and 72% from its record high in November 2024. The bearish trend is in line with the broader decline in the cryptocurrency market, which has faced immense pressure over the past year.

Bitcoin’s Ongoing Struggles Impact MSTR Stock

In his analysis, Vafi pointed to Bitcoin’s “identity crisis” as a key factor in the struggles of MSTR. While Bitcoin is still seen as a long-term store of value, its recent price movements resemble that of a risk asset, making it more susceptible to volatility. “Bitcoin is increasingly trading like a risk asset rather than a safe-haven asset,” Vafi remarked, highlighting how the cryptocurrency failed to track with precious metals like gold.

The Bitcoin-led company Strategy has been hit hard by these developments. Despite holding more than $44 billion in Bitcoin, the company has seen its market cap drop to levels close to its Bitcoin holdings. This correlation between Bitcoin’s price and the stock’s performance has made Strategy’s financial health more reliant on the digital asset’s price fluctuations than anticipated.

MSTR’s Near-Complete Dependence on Bitcoin

With Bitcoin’s price fluctuations dominating its financial outlook, quarterly results for MSTR have become less relevant. Investors are increasingly focused on the value of the company’s Bitcoin holdings rather than its operational performance. The upcoming quarterly results are expected to show a sizable unrealized loss due to Bitcoin’s fourth-quarter selloff.

Vafi’s revised price target assumes a 20% rebound in Bitcoin prices, which would help stabilize Strategy’s mNAV. However, the stock’s future remains closely tied to Bitcoin’s performance in the coming months. Despite this, Vafi remains optimistic, stating that Strategy is still built to weather volatility, given its strong Bitcoin position.

Crypto World

Crypto Markets Bleed Amid Tech Stock Selloff

Bitcoin is down 18% in seven days as tech stocks continue to disappoint.

Crypto World

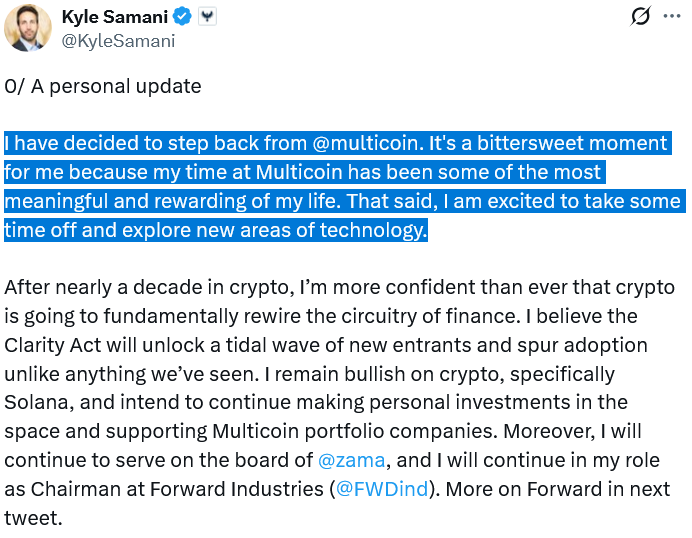

Kyle Samani leaves Multicoin in ‘bittersweet moment’ to explore new tech

Multicoin Capital’s co-founder, Kyle Samani, said he is stepping down as managing partner of the crypto investment firm after 10 years in the industry.

Samani called it a “bittersweet moment” in a post on Wednesday, adding, “I am excited to take some time off and explore new areas of technology,” which he later revealed would include AI and robotics.

He added that he is “more confident than ever that crypto is going to fundamentally rewire the circuitry of finance.”

“The Clarity Act will unlock a tidal wave of new entrants and spur adoption unlike anything we’ve seen,” Samani said, adding that he is particularly bullish on Solana and intends to continue making personal investments in the space and supporting Multicoin portfolio companies.

However, the post appears to conflict with a reportedly deleted earlier X post, in which he stated: “I once believed in the web3 vision. dapps. I don’t anymore…Crypto is just fundamentally not as interesting as many crypto enthusiasts wanted. Myself included.”

Samani has previously criticized the Bitcoin and Ethereum ecosystems.

Last month, Samani said discovering Ethereum was his “entry into crypto” in 2016, after becoming convinced by permissionless finance and smart contracts.

However, he later lost faith in Ethereum, saying he was dissatisfied with how Ethereum developers addressed scaling.

Samani helped turn Multicoin into a $5.9 billion company

He came across the Solana shortly after founding Multicoin in May 2017, which went on to lead some of Solana’s earliest investment rounds in 2018.

It turned out to be one of the best bets for Multicoin, which reported managing $5.9 billion worth of assets in May 2025, making it one of the most prominent investment firms in the crypto industry.

Related: Telegram’s Durov slams Spain’s online age verification proposal

In a letter co-written by Samani and Multicoin’s other co-founder, Tushar Jain, they said Samani would spend his next chapter exploring other technologies, including AI, longevity and robotics.

Multicoin said its conviction on crypto is still strong, stating:

“In our view, crypto is at a critical inflection point — on the eve of regulatory clarity, infrastructure maturity, and mainstream adoption — where it can meaningfully disrupt global financial and capital markets.

Magazine: ‘If you want to be great, make enemies’: Solana economist Max Resnick

Crypto World

U.S. Stocks Fall as Tech Declines and Investors Await Alphabet Results

TLDR

- U.S. stocks showed mixed performance as investors awaited Alphabet’s earnings results.

- The Nasdaq Composite dropped over one percent while the Dow Jones gained slightly.

- Private payrolls in the U.S. rose by only twenty-two thousand in January.

- Tech stocks, including Alphabet, Meta, and Tesla, traded lower during the session.

- AMD shares plunged despite reporting strong fourth-quarter results and guidance.

U.S. stocks traded mixed on Wednesday, as technology shares declined sharply, job data disappointed, and investors braced for Alphabet’s earnings. The Nasdaq Composite fell by over 1%, while the S&P 500 edged lower and the Dow gained. Markets responded to underwhelming private job figures and shifts in investor sentiment toward big tech.

Alphabet Earnings Loom as Tech Stocks Drop

Alphabet shares declined along with other large-cap tech names such as Tesla, Meta, and Nvidia during midday trading. Investors reduced exposure ahead of the company’s upcoming earnings release, which remains highly anticipated. Despite no major earnings warning, selling pressure increased across the tech-heavy Nasdaq index.

“Speculators have entered the market. The problem is that the construction of data centers includes very few people,” said Diane Swonk. Her comment underscored concerns that AI infrastructure growth isn’t contributing meaningfully to job creation. Alphabet’s performance will likely influence market direction into the end of the week.

While optimism remains around 2026–2027 profit expectations, immediate investor focus shifted to Q4 performance. Concerns about slower growth and earnings multiples pressured valuations across the Magnificent Seven. Meta, Nvidia, and Tesla were all trading lower in line with Alphabet’s downward movement.

U.S. stocks mixed after weak job gains

The S&P 500 dropped by 0.3%, the Nasdaq Composite fell 1.2%, and the Dow Jones Industrial Average rose 0.7%. U.S. stocks reacted quickly to January’s private payrolls data, which showed only 22,000 jobs were added, well below forecasts. ADP revised December’s numbers down as well, weakening optimism in labor market strength.

Ryan Detrick from Carson Group said, “Analysts keep raising their earnings calls for 2026 and 2027,” which he noted is boosting the S&P 500. However, the weaker labor data has cast doubts on near-term momentum. The healthcare sector led hiring, while manufacturing and other sectors shed jobs.

S&P Global’s U.S. Composite PMI rose to 53.0 in January, slightly above December’s 52.7. The PMI reading exceeded expectations, suggesting some economic resilience despite job weakness. Yet investors showed more concern about employment trends than services activity growth.

AMD, Boston Scientific, and AbbVie Lead Decliners

AMD shares fell by 16%, even though the company posted earnings and guidance that surpassed Wall Street expectations. Investors appeared to focus on valuation and future growth rates rather than immediate performance. Selling intensified during the session despite the strong Q4 results.

Boston Scientific shares declined by 15.4% after it issued a 2026 outlook that did not match investor hopes. Though Q4 earnings beat estimates, future growth projections fell short. This triggered a broad reaction in the medical technology segment.

AbbVie’s stock dropped 6.9% following its better-than-expected Q4 earnings release. The market responded negatively to guidance concerns. The pharmaceutical sector reflected broader investor caution across earnings-heavy sectors.

Crypto World

AMD stock falls over 16 percent despite beating Q4 earnings estimates

TLDR

- AMD stock declined more than 16 percent after the company released its Q4 earnings report.

- The company reported earnings per share of $1.53 on revenue of $10.3 billion which beat analyst expectations.

- Despite strong results in data center and PC segments investors expected higher performance and guidance.

- AMD projected Q1 revenue between $9.5 billion and $10.1 billion which exceeded Street estimates but fell short of hopes.

- The gaming segment missed expectations with revenue of $843 million against a forecast of $855 million.

Advanced Micro Devices (AMD) saw its stock drop more than 16% on Wednesday, even after it surpassed Q4 expectations, raised guidance, and reported growth in its key businesses, as investors reacted to what some considered modest projections compared to high anticipation.

Q4 Results Top Forecasts But Disappoint Market Hopes

AMD posted Q4 earnings per share of $1.53 on $10.3 billion revenue, exceeding estimates of $1.32 and $9.6 billion, respectively. The company’s revenue rose from $7.7 billion in the same period last year, showing strong year-over-year growth. However, investors appeared to want even higher beats given the stock’s sharp rally over the past year.

The stock had climbed over 112% in the last 12 months, outpacing Nvidia’s 54% growth during that same period. Expectations were high as many expected AMD to capture more market share from Nvidia in AI and data center segments. While AMD delivered strong numbers, market response indicated it fell short of loftier hopes.

In the data center segment, AMD reported $5.4 billion in revenue, above expectations of $4.97 billion. The PC client unit generated $3.1 billion versus projections of $2.9 billion, also beating estimates. Its gaming division reported $843 million, just under the $855 million analysts expected.

AMD Stock Drops as Guidance Fails to Satisfy Lofty Expectations

Despite raising its Q1 forecast, AMD stock declined sharply following the earnings release. The company said Q1 revenue would range between $9.5 billion and $10.1 billion. While this guidance beat the consensus estimate of $9.4 billion, investors had hoped for numbers exceeding $10 billion.

Advanced Micro Devices, Inc., AMD

Some forecasts predicted results above the top end of AMD’s own range, intensifying pressure on the stock. “We believe we are well-positioned for growth in 2026,” said CEO Lisa Su. Even with a strong outlook, the bar appeared too high for Wall Street enthusiasm to hold.

The drop in AMD stock followed sharp market reactions to other tech earnings, including Microsoft and Meta. Traders responded differently to those reports, cheering Meta but raising concerns over Microsoft’s increased spending. The contrast in reactions highlights how sensitive markets are to future investment narratives.

AMD Unveils New AI Chips and Server Products

At CES 2026, AMD introduced the Helios rack-scale server system, targeting large-scale AI workloads. The Helios system contains 72 GPUs and aims to rival Nvidia’s NVL72 rack, which features similar specs. AMD called it the “world’s best AI rack,” directly challenging Nvidia’s position in the AI infrastructure market.

AMD also showcased its MI500 GPU series, claiming up to 1,000x performance over its previous MI300X chips. This suggests aggressive efforts to capture AI market share from competitors, particularly Nvidia. Su projected the AI data center market to be worth $1 trillion by 2030.

At the event, AMD also announced its new AI PC chips and discussed future plans for the humanoid robotics space. These product announcements align with AMD’s broader strategy to diversify its portfolio. However, growing competition from Amazon, Google, and Microsoft’s custom chips could present challenges.

Crypto World

What This Means for Traders

XRP’s derivatives market has dropped to multi-month lows in open interest, clearing leverage, and setting up cleaner conditions for a possible trend reversal.

Ripple’s (XRP) price has been on a consistent decline over the past month amid broader crypto weakness, as it shed over 26% during the period. A fresh decline of almost 3% on Wednesday revived concerns that liquidation pressure from last weekend’s sharp sell-off may not be fully exhausted.

But new data suggests that the market reset following the liquidations could allow spot demand to drive the price naturally, without over-leveraged positions causing swings.

Market Reset Underway

XRP’s open interest (OI) on Binance has fallen sharply to $406 million, which happens to be its lowest level since November 2024. This decline is indicative of a major reduction in leveraged positions, likely caused by long liquidations or traders closing positions amid the recent price drop, CryptoQuant said in its latest analysis.

When OI reaches such lows, the market becomes less vulnerable to volatility from long or short squeezes, as much of the speculative leverage has been cleared. CryptoQuant revealed that this “reset” in the derivatives market often sets the stage for a more stable trend.

With forced liquidation pressure reduced, future price movements are less likely to be exaggerated by over-leveraged positions. If spot demand increases, supported by high on-chain activity, XRP’s price could recover more naturally. The analysis demonstrates that this “clean slate” may create conditions for a meaningful trend reversal, and the derivatives market is now positioned to respond more calmly to new buying or selling pressure.

Full Reset Phase

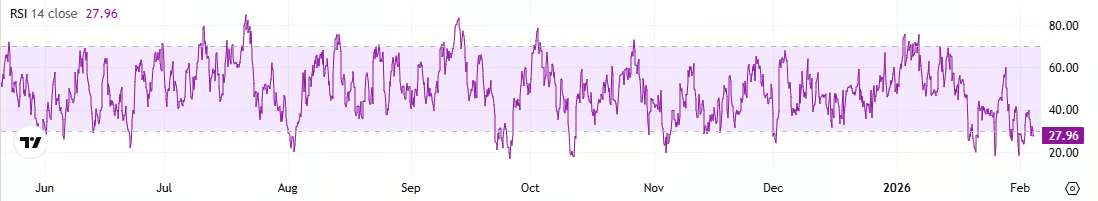

Similar signals are emerging from technical momentum indicators. Crypto analyst Egrag Crypto said XRP’s macro relative strength index (RSI) has fallen into the 45-50 zone faster than he expected, a level that has historically preceded sharp price bounces.

The analyst noted that while downside momentum appears aggressive, the selling pressure does not look retail-driven but instead reflects distribution by large holders during liquidity sweeps. Egrag Crypto stressed that this RSI behavior is not bearish, while describing it as a “full reset phase” following a prior RSI peak near 80.

You may also like:

He added that the 45-50 range has acted as macro support in every previous XRP cycle and has never been broken. According to the analyst, this compression typically flushes out weaker hands, resets momentum, and is followed by expansion. He said the structure would only turn bearish if RSI falls below roughly 43.

In terms of institutional appetite, US-listed spot XRP ETFs attracted $19.46 million in inflows on February 3rd, according to SoSoValue. XRPZ Franklin XRP ETF topped the chart with $12.13 million in inflows, followed by Bitwise’s fund with $4.8 million and Grayscale XRP Trust ETF with $2.51 million. By comparison, Bitcoin ETFs recorded $272 million in net outflows, while Ethereum ETFs attracted about $14 million, leaving XRP funds as relative outperformers.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Further 50% Collapse on the Way?

Is SOL headed toward $50?

The cryptocurrency market seems to can’t catch a break lately, and numerous digital assets continue to chart painful losses.

Solana (SOL) is among the poorest performers, with its price plunging by 25% in the past week alone. According to some market observers, the bears might be just stepping in.

Major Collapse on the Horizon?

Just hours ago, SOL tumbled to approximately $95, its lowest level since February 2024. As of this writing, it trades at around $96, which is a staggering decline from the all-time high of almost $300 registered nearly a year ago.

Many industry participants are now concerned that the asset may experience a further decrease in the short term. Ali Martinez, for instance, predicted that SOL could nosedive to $74.11 and even $50.18.

The analyst, going on X as curb.sol, outlined $100 as an “extremely important level” for the token. In their view, holding that zone could result in a new bull run to a fresh all-time high, whereas the opposite scenario might lead to a crash to roughly $50 sometime this year.

For their part, Alex RT₿ assumed the price may retreat to $70-$80 if SOL breaks below the $90 support level.

Any Chance for the Bulls’ Return?

It is important to note that some analysts believe the current rates could present great buying opportunities. The one using the X handle, Lucky, told their almost two million followers that “if the market behaves well, this could be a smart entry.”

You may also like:

“Opportunities like this don’t show up often,” they added.

Mookie also recently chipped in, vowing to go all-in should SOL drop below $100.

if $SOL drops below $100 i’m going all in

Solana at $100 is def free pic.twitter.com/ORftQMa2dv

— Mookie (@MookieNFT) January 31, 2026

Meanwhile, some key indicators suggest it might be time for a rebound. SOL’s Relative Strength Index (RSI) fell well below 30, meaning the price has declined too much in a short period of time. Ratios under that level signal that SOL is oversold and due for a potential rally, whereas anything above 70 is seen as bearish territory.

Furthermore, exchange outflows have significantly surpassed inflows in the past several weeks. This suggests that investors have shifted from centralized platforms to self-custody, thereby reducing immediate selling pressure.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech18 hours ago

Tech18 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World1 day ago

Crypto World1 day agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards

![[TIKTOK] Lisa Money Trend 2](https://wordupnews.com/wp-content/uploads/2026/02/1770257286_hqdefault-80x80.jpg)

![Macias - MONEY [Official Music Video]](https://wordupnews.com/wp-content/uploads/2026/02/1770256831_maxresdefault-80x80.jpg)