Crypto World

FTX-linked Effective Ventures sells UK manor at $14.5M loss

Recently published accounts from FTX-backed charity Effective Ventures confirm that the company sold a £17 million ($23 million) stately manor at a £10.7 million ($14.5 million) loss as it continues to wind down its UK operations.

Effective Ventures’ UK arm bought the manor in 2022 as part of a plan to host educational events for the effective altruism movement, a set of beliefs that involves wealthy donors directing funds to specific causes that they deem will do the most good most efficiently.

FTX donated over $26 million to the Effective Ventures Foundation, which was later paid back during the exchange’s bankruptcy proceedings. The charity told UK government regulators that it had received funds from FTX, and after an inquiry, was found to have acted “diligently” in response to FTX’s collapse.

In its accounts for the year up to June 2025, published last Friday, it confirmed that the manor was sold for £5.95 million ($8 million) and that it had incurred an impairment loss of £8.6 million ($11.6 million).

Read more: FTX funded this UK charity, now it’s under investigation

Local outlets reported that the manor’s price was initially set at £15 million ($20.3 million) before being slashed to £12 million ($16.3 million) a year later, and eventually to just under £6 million ($8 million).

The charity says property valuation experts recommended that it cut the asking price due to “reductions in market sentiment.”

Effective Ventures UK CEO says funds will be donated

Effective Ventures CEO Rob Gledhill had already revealed in the Effective Altruism forum that the manor was officially sold on November 11, 2025.

He reiterated that “market conditions for country estates” led to the drop in value and added that the proceeds from the sale, “will be allocated to high-impact charities, including EV’s operations.”

Within the accounts, the charity says that it’s made “significant progress” spinning out projects into new independent entities as it winds down the firm.

The charity said that it doesn’t expect to sponsor any new projects and that it should wind down in “2026 or beyond.”

Read more: FTX-funded charity Effective Ventures agrees to return donations

It also revealed that the charity made £12 million ($16.3 million) during the 2025 fiscal year, of which £11.2 million ($15.2 million) was made up of donations and grants.

It’s less than half of the £31.6 million ($42.8 million) it made in 2024.

Its expenditure has also gone up by over £2 million ($2.7 million) from 2024 to 2025, as the firm spent £37.5 million ($51 million) in the 2025 fiscal year.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Solana price risks a drop below $80 as bearish engulfing candles indicate weakness

Solana’s price is showing renewed downside risk after bearish engulfing candles rejected key resistance, with weakening market structure increasing the likelihood of testing sub-$80 support levels.

Summary

- Bearish engulfing candles confirm rejection at the key $90 resistance

- Loss of the point of control signals weakness, favoring further downside

- $78–$80 support is the critical zone, with Fibonacci and liquidity confluence

Solana (SOL) price action has shifted back into a vulnerable technical position after a failed attempt to reclaim higher resistance. What initially looked like a potential stabilization has now turned into renewed weakness, as sellers regain control after a rejection at a key resistance zone. The broader structure remains corrective, and recent candlestick behavior suggests that downside continuation is becoming increasingly likely.

As price trades back below important value levels, attention is now turning to high-timeframe support zones that could come into play in the near term. Whether these levels hold or fail will determine if Solana can stage a meaningful bounce or if the correction deepens further.

Solana price key technical points

- Bearish engulfing candles rejected $90 resistance, reinforcing seller control

- Loss of the point of control signals weakness, favoring rotation lower

- $78–$80 support zone aligns with Fibonacci confluence, acting as a key downside target

Solana recently attempted to push above the $90 resistance level, but the move failed to gain traction. Price quickly closed back below resistance, forming bearish engulfing candles that invalidated the breakout attempt. These engulfing structures are significant because they often reflect aggressive selling pressure entering the market when buyers lose control.

The rejection from resistance is further reinforced by Solana’s inability to hold above the point of control (POC). Multiple counter-trend closes below this level indicate that the market has shifted away from balance and back into bearish momentum. When price loses the POC after a failed breakout, it often signals the start of a deeper corrective rotation.

Loss of value opens path toward $78 support

With price now trading below the point of control, the next logical downside magnet is the value area low. This level defines the lower boundary of fair value within the current range and frequently acts as a target during corrective phases.

Below the value area low sits high-timeframe support around $78, which also marks the lower edge of the broader trading structure. A move into this region would place Solana below the $80 psychological level, increasing volatility as traders reassess risk.

From a technical perspective, the $78 area carries additional significance due to its alignment with the 0.618 Fibonacci retracement. Fibonacci confluence often attracts price during corrective moves, particularly when paired with visible resting liquidity.

Liquidity sweep or deeper breakdown?

The swing low near $78 indicates an area with likely resting liquidity. Markets often dip into such zones to trigger stop-loss orders before deciding on the next directional move. If Solana quickly trades into this region and then reclaims it with strong buying interest, the move could resemble a liquidity sweep, setting the stage for a reactive bounce.

However, timing and structure will be critical. A slow grind lower, or prolonged acceptance below $78, would weaken the bounce thesis and suggest that a deeper corrective phase is unfolding. In that scenario, the market would be signaling that buyers are not yet ready to defend key support.

Broader market structure remains corrective

From a market structure standpoint, Solana has not yet invalidated its bearish bias. Lower highs remain intact, and recent attempts to reclaim resistance have failed. Without a decisive reclaim of value and strong bullish volume, rallies should continue to be treated as corrective rather than trend-changing.

The presence of bearish engulfing candles at resistance adds further weight to this view, as such patterns often precede continuation lower rather than immediate reversal.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Solana is likely to continue rotating lower in the short term. As long as the price remains below the resistance and the point of control, the probability favors a move toward the value area, low and high-timeframe support near $78.

Traders should closely monitor price behavior around this zone. A sharp reaction and reclaim could trigger a short-term relief bounce, while sustained trading below $80 would increase the risk of a deeper correction.

Until bullish acceptance returns above key value levels, downside risks remain elevated, and Solana’s next meaningful move is likely to be defined by how the price reacts at sub-$80 support.

Crypto World

Bitcoin Still Being Bought, Just Much More Cautiously: Report

Short-term Bitcoin buyers are becoming cautious, and accumulation is slowing even as net positions stay positive.

Bitcoin climbed above $126,000 in early October and recently crashed to $60,000 before a modest recovery near $68,000. Despite the brutal swing, many entities are still buying the asset, betting on a much-anticipated price appreciation.

But a certain cohort of BTC holders has reduced this pace.

Demand Deceleration

Data shared by Alphractal revealed that the Short-Term Holder Net Position Change over 90 days is declining, despite remaining in positive territory. This means that while short-term holders are still accumulating Bitcoin, the pace of accumulation has slowed sharply in recent days.

According to the analytics platform, this deceleration points to weakening short-term demand momentum and has historically preceded periods of market consolidation, increased volatility, or broader regime transitions.

Against this backdrop, Alphractal founder Joao Wedson said that recent institutional buying has not translated into stronger short-term holder demand.

“Even with the news of Strategy accumulating and other institutional entities increasing their positions, Short-Term Holders are not accumulating at the same pace as they were 90 days ago. Analyzing a few isolated entities is not enough. The correct approach is to evaluate the entire Bitcoin blockchain to understand the true underlying demand”

Whale Holdings Differ

Separate analysis from CryptoQuant points to a contrasting trend among large Bitcoin holders. It found that whale accumulation has increased by more than 200,000 BTC.

Although whale inflows to exchanges have risen recently, which is often associated with short-term selling activity, their overall holdings have continued to grow. To capture a more medium-term perspective, the analysis tracks whale-held supply using monthly averages rather than short-term flows. After this metric fell sharply to nearly -7% on December 15, whale behavior appears to have changed over the past month, as evidenced by holdings increasing by 3.4%.

You may also like:

During this period, the amount of Bitcoin held by whales rose from around 2.9 million BTC to over 3.1 million BTC. The last time an accumulation of this scale occurred was during the April 2025 market correction, when whale buying helped absorb selling pressure and Bitcoin’s advance from $76,000 to $126,000. CryptoQuant explained that the crypto asset is currently consolidating almost 46% below its most recent all-time high. Hence, some whales may be taking advantage of this opportunity.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

HBAR Bears Face $4.9 Million Squeeze as Price Direction Shifts

Hedera has posted a muted recovery in recent sessions. HBAR price remains constrained by cautious sentiment across the broader cryptocurrency market. Uncertainty in Bitcoin and macro conditions continues to cap upside attempts.

However, bearish traders may need to monitor changing signals. Derivatives positioning and capital flow indicators suggest the current balance could shift.

Sponsored

Hedera Traders Could Be In Trouble

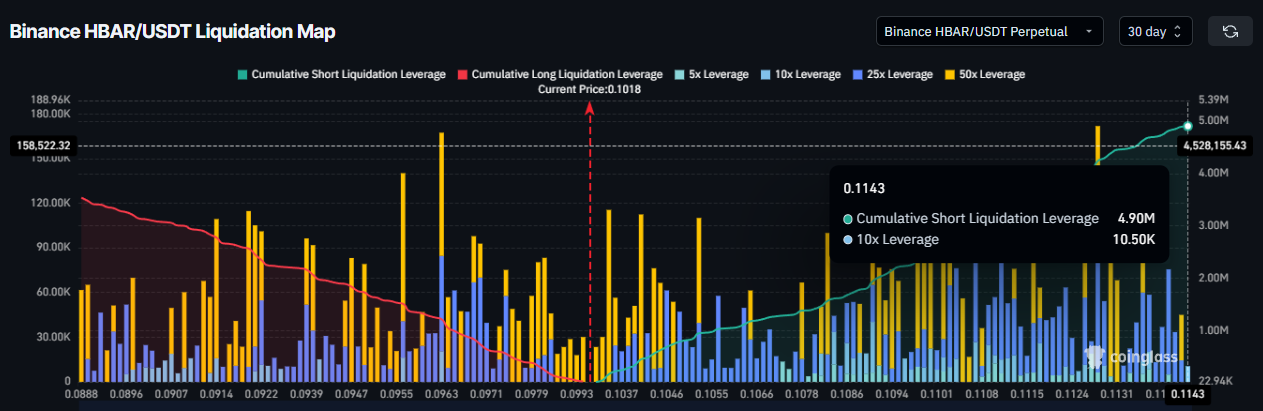

HBAR is currently experiencing strong bearish positioning in the futures market. Traders have opened a notable number of short contracts, reflecting expectations of further downside. The liquidation map highlights that positions are skewed toward bears at current levels.

Data shows that HBAR bears could face approximately $4.9 million in liquidations if the price crosses the $0.1143 mark. Such forced liquidations can trigger rapid upside volatility. When short positions unwind, buying pressure increases as traders close contracts.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The Chaikin Money Flow indicator offers additional insight into capital movement. CMF measures inflows and outflows to assess whether buyers or sellers dominate. The indicator is currently rising, although it remains at the zero line.

Sponsored

An upward slope at zero suggests that outflows are at par with the inflows. However, the gap will likely diminish as inflows rise. Declining outflows often precede a shift toward net inflows. If this transition occurs, HBAR could gain the support needed for a short-term recovery.

Bitcoin Is Unhelpful

Correlation trends also support a potential shift. HBAR’s correlation with Bitcoin has declined in recent weeks. The current coefficient has dropped to 0.09, signaling weaker alignment with the crypto market leader, inching closer to completely dissociating with Bitcoin.

Sponsored

Reduced correlation can benefit altcoins during periods of Bitcoin uncertainty. If HBAR decouples further, price action may reflect investor-specific demand rather than broader market weakness. This flexibility could allow HBAR to chart an independent recovery path.

HBAR Price Has a Few Barriers To Breach

HBAR is trading at $0.1019 at the time of writing. The altcoin remains above the key $0.0961 support level at the 38.2% Fib line. However, it faces resistance at $0.1035, which aligns with the 50% Fibonacci retracement. This level currently caps upward momentum.

Sponsored

Flipping $0.1035 into support would mark a short-term breakthrough. Combined with declining outflows, this shift could fuel a recovery rally. HBAR would then target $0.1109 at the 61.8% Fibonacci.

This level is considered a critical support for an asset, and flipping it would likely trigger stronger buying among the investors, pushing the HBAR price higher.

This would bring HBAR past $0.1143, a level that threatens $4.9 million in shorts liquidations. Sustained strength could extend gains toward $0.1215 and $0.1349 eventually, helping recover year-to-date losses.

If bullish signals fail to materialize, consolidation may continue. Persistent outflows would limit breakout attempts. A breakdown below $0.0961support could expose HBAR to further downside near $0.0870. Such a move would invalidate the near-term bullish outlook and reinforce bearish control.

Crypto World

Kraken Acquires Tokenization Platform Magna Ahead of Potential IPO

Payward, the parent company of cryptocurrency exchange Kraken, has acquired tokenization platform Magna, expanding the company’s infrastructure.

Kraken said Wednesday the acquisition would allow Magna to operate “as a standalone platform, powered by” the crypto exchange. The company’s announcement said Kraken would use the platform for “onchain and offchain vesting, white-label token claims, custody and escrow workflows, specialized staking functionality” and other functions.

“Joining Kraken gives us the resources to support existing and new clients with institutional-grade infrastructure, deeper liquidity, and global distribution,” said Magna CEO Bruno Faviero.

According to Kraken, Magna serves more than 160 clients with a peak total value locked of $60 billion in 2025. The acquisition is the latest move by the exchange this month, following an integration with ICE Chat, and its move to sponsor “Trump Accounts” under an initiative pushed by US President Donald Trump.

Related: Kraken parent Payward revenues jump 33% as crypto traders pile in

Kraken submitted a confidential initial public offering filing with the US Securities and Exchange Commission in November, signaling a potential IPO in the future. The company reported $2.2 billion in adjusted revenue for 2025.

In 2025, Payward acquired crypto native prop company Breakout, futures trading platform NinjaTrader, derivatives trading platform Small Exchange and software company Capitalise.

Other crypto companies mulling US IPOs in 2026

Crypto hardware wallet provider Ledger, headquartered in France, was reportedly discussing a potential public offering in the United States, with a valuation of $4 billion. Digital asset custodian Copper, based in London, was also reportedly considering a similar move into the US markets, while Securitize, a tokenization platform, reported in January that the company’s revenues were up over 840%, in an SEC filing ahead of plans to go public.

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

What’s Next for SUI? $0.95 Weekly Oversold RSI Triggers Setup Phase

TLDR:

- SUI is trading near $0.95, sitting just below Weekly Hypertrend resistance positioned around the $1.00 level.

- The weekly RSI has entered oversold territory, with approximately 50% of the October 10 liquidation wick now filled.

- Past weekly oversold signals for SUI led to expansions of 503% in October 2023 and 837% in August 2024 respectively.

- The Genesis AVWAP near $2.00 defines long-term macro positioning, while reclaim and volume confirmation remain the key requirements.

SUI is drawing renewed attention from analysts as the asset trades near $0.95. The token sits just below a key Weekly Hypertrend level around $1.00.

Market observers note that the RSI has entered oversold territory on the weekly chart. Early momentum divergence signals are beginning to appear.

The broader macro structure remains upward sloping since genesis. Traders are now watching for confirmation before positioning.

Technical Levels Point to a Compressed Setup

SUI is currently trading just below the Weekly Hypertrend resistance near $1.00. This level has acted as a structural ceiling in recent price action.

The RSI entering oversold territory on the weekly timeframe adds weight to the current setup. Analysts are watching whether momentum divergence will develop into a confirmed reversal signal.

According to market commentary from eye zen hour, approximately 50% of the October 10 liquidation wick has now been filled. This kind of wick fill often reflects a controlled recovery in price structure.

On-balance volume, or OBV, remains a key indicator to monitor at this stage. A curl back above its moving average could support the case for trend continuation.

The Genesis AVWAP sits near the $2.00 level and continues to define long-term positioning for SUI. This anchored volume-weighted average price from genesis serves as a macro reference point.

Price remains well below that level, meaning there is room for expansion if structure confirms. Traders are treating the $2.00 area as a longer-term target, not an immediate one.

Eye zen hour noted in a recent post that the current phase is “setup phase, not breakout phase.” That framing keeps expectations grounded without dismissing the structure building beneath price.

Until a Weekly Hypertrend reclaim occurs with participation, the setup remains unconfirmed. This distinction is important for risk management at current levels.

Historical Oversold Signals Offer Raw Data for Context

SUI has produced weekly oversold readings before, and the outcomes were notable both times. The October 2023 oversold signal was followed by a price expansion of 503%.

The August 2024 signal led to an 837% move higher from the oversold condition. These figures are cited as raw historical data, not as forward projections.

Eye zen hour was clear in stating these are “not predictions, just raw data.” That framing separates observation from speculation, which matters in volatile markets.

Still, the historical context gives traders a framework for understanding how the asset has behaved. Pattern recognition remains one tool among many in technical analysis.

The macro structure for SUI since genesis continues to slope upward, according to the analysis. Momentum is currently stretched to the downside, and structure appears compressed.

These two conditions together often precede volatility expansion in either direction. Confirmation through reclaim and volume participation remains the key requirement before any directional bias is established.

Crypto World

Dogecoin price tests $0.1 as this chart pattern hints at possible rebound

- Dogecoin struggles below key moving averages, signaling weak short-term trend.

- A cup and handle pattern is forming, hinting at a potential breakout if the resistance breaks.

- Support lies near $0.08, with higher volume needed for a sustained upward move.

Dogecoin is hovering around the $0.10 mark after a shaky month that saw the price dip over 20%.

The popular meme coin has struggled to hold momentum, with trading volumes showing signs of weakness.

Even so, there are hints in the charts that a rebound could be forming.

Technical analysis

Looking at the moving averages, DOGE is currently below the 5-day, 10 and 20-day averages.

This typically signals that the short-term trend is weak.

Traders often watch for the price to climb above these averages as an early sign of bullish momentum.

Right now, resistance is in the $0.105–$0.107 range.

A break above this level would be an important signal for those hoping for a recovery. The MACD indicator is also showing mixed signals.

The MACD line has moved above the signal line despite both being in the negative, and the histogram has turned positive, suggesting that buyers are beginning to step in after a period of inactivity.

However, volume is still modest. A strong breakout would require significantly more trading activity than the roughly $33 million seen recently.

Support remains solid at around $0.08, which has already acted as a bounce point.

This level has prevented further sharp declines and could continue to anchor the price if bearish pressure returns.

Cup and handle pattern points to possible upside

On the daily chart, Dogecoin is forming a classic Cup and Handle pattern.

The Cup bottomed near $0.08 and then rallied toward $0.11.

The Handle is now forming near the top of the Cup, consolidating just below resistance.

This formation often precedes a breakout when the price moves above the Handle.

If Dogecoin can clear this resistance, it could push toward higher levels, reigniting optimism among traders.

Chart patterns like this are watched closely because they combine both support and momentum signals.

They show where traders are willing to buy and where sellers may step in.

In Dogecoin’s case, the pattern suggests that there is still potential for upside, but it won’t happen without stronger buying interest.

Volume and momentum will be key to confirming the breakout. Traders are likely waiting for both to pick up before committing heavily.

Even with these early bullish signs, caution is warranted.

The market has been volatile, and DOGE has lost significant value over the past year. Short-term gains are possible, but the overall trend remains fragile.

Crypto World

Crypto Markets Fall as Bitcoin Drops 2.5% and Liquidations Near $200 Million

The selloff continues as tensions in the Middle East rise and the Department of Homeland Security remains partially shut down.

Crypto markets slipped further on Wednesday, Feb. 18, as political and macroeconomic uncertainty continued to weigh on sentiment.

Bitcoin (BTC) is trading at $66,344, down 2.5% over the past 24 hours, while Ethereum (ETH) is at $1,953, down 2.3%. Separately, Founders Fund, a venture firm tied to billionaire Peter Thiel, disclosed it had exited its entire 7.5% stake in Ethereum treasury company ETHZilla Corp. last year, according to a recent SEC filing.

Other large-cap tokens were also lower, with BNB down 2% near $610, XRP down 3% to $1.44, and Solana (SOL) down 4.5% to $81.

Meanwhile, the total cryptocurrency market capitalization stood near $2.37 trillion, down 2% over the past 24 hours. Daily trading volume was around $88.5 billion, according to CoinGecko.

Among top gainers, World Liberty Financial (WLFI) rose 15.7%, following news of top Wall Street CEOs preparing to headline at the World Liberty Forum.

Cosmos Hub (ATOM) also climbed 6.2%, while Provenance Blockchain (HASH) rose about 5%. HASH’s rally comes shortly after Figure announced that pricing has officially closed for FGRD, the first public equity trading natively on the Provenance blockchain.

On the downside, pumpfun (PUMP) fell around 11%, MemeCore (M) dropped roughly 7%, and Bittensor (TAO) slipped about 6.3%.

Liquidations and ETF Flows

Around $192 million in leveraged crypto positions were liquidated over the past 24 hours, according to CoinGlass. Long liquidations accounted for about $134.6 million, while shorts made up $57.4 million.

Bitcoin led liquidations at about $66.7 million, followed by Ethereum at roughly $53.7 million. More than 84,000 traders were liquidated during the period.

In the ETF market, Bitcoin spot ETFs recorded $104.87 million in net outflows, while Ethereum spot ETFs recorded $48.63 million in inflows. XRP spot ETF flows were flat on the day, while Solana spot ETFs recorded $2.19 million in inflows.

Elsewhere

In other markets, precious metals moved higher on the day, with gold trading around $5,000, up 2% and silver rising 4.3% to $77.49. Platinum gained 3.3% to $2,098, while palladium added nearly 2% to $1,742.

Political uncertainty also remained in focus as the White House did not give a clear timeline for talks with Iran amid rising tensions in the Middle East.

Meanwhile, negotiations between Ukraine and Russia concluded, with further discussions expected. In Washington, conflict over reopening the Department of Homeland Security, which is partially shut down, persists, CNN reported.

Crypto World

Peter Thiel lost tens of millions in ETHZilla

Peter Thiel, as of December 31, has fully divested from ETHZilla, his ether (ETH) gobbling company that’s currently down 98% from its 52-week high.

Those sales finalize losses for Thiel’s investment that exceeded $200 million at the company’s brief, exuberant peak in August.

On August 4 last year, ETHZilla (under its prior Nasdaq-listed name, 180 Life Sciences) closed a $425 million private investment in public equity (PIPE).

Separately, Thiel’s funds had also invested by August 4, 2025, disclosing aggregate beneficial ownership of 11,592,241 shares. Thiel’s quantity was then worth about $40 million or 7.52% of 180 Life Sciences’ 154,032,084 shares outstanding.

Although charts show an ETHZ trading range of $27.22-$35.70 on the day before Thiel’s investment, that price reflects a one-for-10 reverse share split that occurred in October.

In actual fact, Thiel’s 11.5 million beneficially-owned shares were trading at $2.72-$3.57 the day prior to his investment, imputing an investment of approximately $40 million based on their $3.54 closing print on August 1, 2025.

He disclosed his ownership the following trading day, as required by SEC regulations.

Within two weeks of his investment, his pre-split shares rocketed from $3.54 to $17.46 on August 13 after the former biotech company announced a host of crypto investors and an ETH acquisition strategy that was enjoying a brief mania in digital asset treasury (DAT) stocks.

Read more: Even Ethereum treasury companies are selling ETH to pay off debt

ETHZilla is down 98% from its August peak

Marked-to-market at the company’s August peak, Thiel and his funds owned over $200 million worth of stock.

Unfortunately, he hung on for months of losses.

Although Thiel trimmed his exposure from 7.5% to 5.6% by September 30, he continued to hold the vast majority of his shares — and their dwindling value.

He wouldn’t sell the entire position until the fourth quarter — after shares had lost over 85% of their August peak value.

By the time he’d sold everything, shares were down 86% from Thiel’s August 1 closing price and 97% from their August 13 peak.

As of today, shares are down 98% from their high.

Although Thiel isn’t required to disclose his average sale prices on SEC 13G schedules, approximating his losses is elementary math.

If Thiel beneficially owned approximately $40 million as of his opening investment, he certainly lost tens of millions of dollars by the time he sold.

From their fleeting value above $200 million, he let well over $100 million — probably more than $150 million — in paper value evaporate.

Losses from his starting investment size likely exceed $30 million from August 1 to the average trading range during the periods in which he was selling.

Note: Above figures about Thiel’s investments include all of the funds through which he invested in ETHZilla (formerly 180 Life Sciences):

- FF Consumer Growth, LLC

- FF Consumer Growth II, LP

- The Founders Fund Growth Management, LLC

- The Founders Fund Growth II Management, LP

- Peter Thiel

- FF Upper Tier GP, LLC

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Altcoin Sell Pressure Hits $209B As BTC Volumes Lead The Market

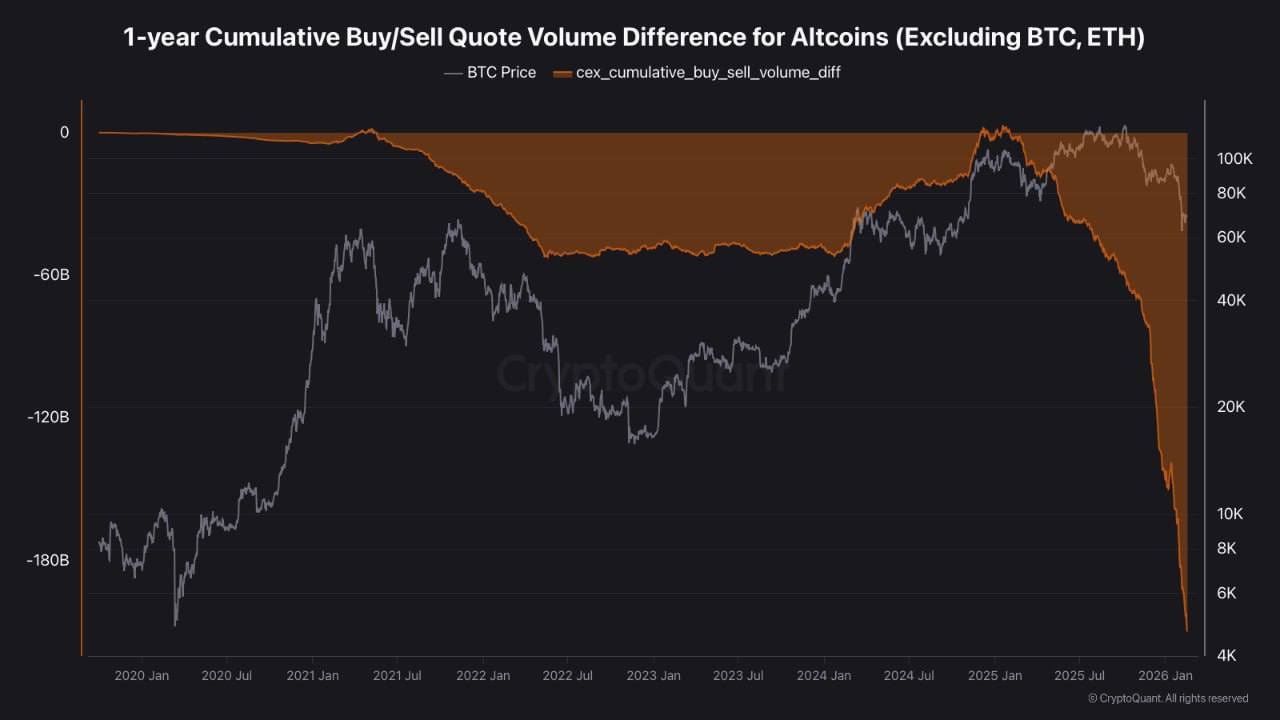

Altcoins, excluding Ether (ETH), have recorded $209 billion in net selling volume since January 2025, marking one of the steepest declines in speculative demand for crypto assets this cycle.

On Binance, altcoin trading volumes dropped roughly 50% since November 2025, reflecting a steady dip in activity. The decrease also coincides with an increase in Bitcoin’s volume share on the exchange.

Analysts said that the contraction in altcoin demand, alongside elevated stablecoin dominance, signals that the broader market is shifting its capital toward BTC during the current downtrend.

Altcoin spot volume imbalance deepens against Bitcoin

Crypto analyst IT Tech noted that the cumulative buy and sell difference for altcoins, excluding BTC and Ether (ETH), reached -$209 billion. The metric measures net spot demand across centralized exchanges for altcoin trading pairs. A positive reading indicates rising spot demand, which was briefly observed back in January 2025.

A negative cumulative delta at this scale signals the absence of consistent spot buyers. The analyst noted that the metric tracks net flow imbalance rather than price valuation, so it does not indicate a market bottom. Over the past 13 months, capital has exited the altcoin markets without significant counterflows.

Volume data from Binance reinforces the shift. As BTC tested the $60,000 level in early February, the total trading volume was redistributed. On Feb. 7, Bitcoin volumes rose to 36.8% of total activity. Altcoin volumes dropped to 33.6% by mid-February, from a high of 59.2% in November.

According to crypto analyst Darkfost, similar rotations appeared in April 2025, August 2024, and October 2022. During these corrective phases, capital consolidated into Bitcoin while altcoin volumes contracted.

Related: New Bitcoin whales are trapped underwater, but for how long?

Tether dominance rises to its all-time high level

Tether’s USDt (USDT) market cap dominance reached the 8% level on the one-week chart, aligning with prior highs which lasted between June 2022 and October 2023. The rising stablecoin dominance typically coincides with capital moving into dollar-pegged assets rather than deploying into tokens like BTC (BTC) and Ether (ETH).

As observed, the elevated USDT dominance coincided with Bitcoin consolidating near bear market lows, as observed in 2022 and 2023. A decline in dominance has often marked one of the earliest signals of a renewed bullish trend.

Previously, the USDT dominance chart formed lows around 3.80-4% in March 2024, December 2024, and October 2025. These periods coincided with Bitcoin setting new all-time highs near $72,000, $104,000, and $126,000, respectively.

Related: Wells Fargo sees ‘YOLO’ trade driving $150B into Bitcoin and risk assets

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

BTC’s bounce from this month’s crash evaporates

After chopping around early Wednesday, bitcoin rolled over during the U.S. afternoon and slid to session lows under $66,000, putting pressure back on the lower end of its recent range.

Having traded $68,500 overnight, BTC was down 2.5% over the past 24 hours and last trading at $66,200.

Crypto stocks, which started the day on a stronger foot, followed suit, paring back their gains or snapping into declines across the board. Most notable was Coinbase (COIN), which turned its 3% morning advance into a 2% decline by the afternoon. Strategy (MSTR), he largest corporate holder of bitcoin, was down roughly 3% as the underlying asset weakened.

After a fast start to the session, U.S. stocks had given back much of their gains shortly before the close of trading. Not helping were surprisingly hawkish minutes from the January meeting of the Federal Reserve’s Federal Open Market Committee (FOMC). As expected, most at the central bank agreed with the decision to pause rate cuts, but — in a twist — several suggested the Fed favor “two-sided” guidance at which the bank might opt to hike rates if inflation continues to remain sticky.

Already higher for the day, the U.S. dollar gathered even more strength, with the dollar index (DXY) — which measures the greenback against a basket of major foreign currencies — climbing to its strongest level in nearly two weeks. A firmer dollar often weighs on risk assets, and Wednesday’s crypto fade appeared to fit that pattern.

With today’s slide, bitcoin is now staring at a fifth straight week of losses, its worst streak since the long 2022 bear market.

It also faces a key test at current levels. The $66,000 area held as support last week and helped fuel a bounce above $70,000. If that floor gives way decisively, traders will likely start eyeing the early February lows at $60,000 or a fresh leg lower.

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business22 hours ago

Business22 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment9 hours ago

Entertainment9 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech13 hours ago

Tech13 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Video7 days ago

Video7 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business15 hours ago

Business15 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World3 hours ago

Crypto World3 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit