Crypto World

Galaxy Digital shares jump 18% after company approves $200 million buyback

Shares of Galaxy Digital (GLXY) jumped 18% to $19.90 on Friday after the company approved a share repurchase program of up to $200 million, giving it authority to buy back its Class A common stock over the next 12 months.

The buybacks may be executed through the open market, privately negotiated transactions or other methods, including trading plans under Rule 10b5-1, the company said. Galaxy added that it retains the right to suspend or discontinue the program at any time, depending on market conditions and other factors.

The announcement signaled confidence from management that Galaxy’s shares are undervalued and that the firm has excess capital to deploy. Share repurchase programs often support stock prices by reducing the number of shares outstanding, which can boost earnings per share and signal balance-sheet strength. In volatile markets, buybacks can also reassure investors that management believes the company’s fundamentals remain intact.

“We are entering 2026 from a position of strength, with a strong balance sheet and continued investment in Galaxy’s growth,” said Mike Novogratz, founder and CEO of Galaxy. “That foundation gives us the flexibility to return capital to shareholders when we believe our stock doesn’t reflect the value of the business.”

The sharp move higher reflects investor approval of that message.

Galaxy reported fourth-quarter earnings earlier this week that initially weighed on the stock. The company posted a net loss of $482 million for the quarter, sending shares down initially. Despite the quarterly loss, Galaxy said it generated $426 million in adjusted gross profit for the full year and ended the year with $2.6 billion in cash and stablecoins, underscoring its liquidity position.

Other crypto stocks and major cryptocurrencies were also green no the day’s trading, with bitcoin climbing back to $70,000 and ethereum breaking $2,000 over the last 24 hours. Coinbase (COIN) had climbed over 10% to $163. In more traditional markets, the Dow Jones Industrial Average broke 50,000 for the first time.

Crypto World

Nancy Guthrie Kidnapping Tied to Bitcoin Ransom?

Nancy Guthrie, an elderly 84-year-old woman, vanished overnight in Arizona, triggering a high-stakes investigation with alleged crypto demands.

She is the mother of popular NBC journalist and TODAY show host Savannah Guthrie. Authorities believe she was likely taken from her home after a violent encounter.

Sponsored

Sponsored

Blood at the Doorstep Turns Missing Case Criminal

Investigators found blood spatter at the entrance of her residence in the Catalina Foothills area near Tucson, Arizona. Forensic testing confirmed the blood belonged to Nancy Guthrie, according to law enforcement.

As a result, what began as a missing-person report has escalated into a suspected kidnapping investigation.

Nancy Guthrie lived a private, low-profile life and was not a public figure. She became nationally known only because of her daughter’s role as a senior anchor on NBC’s Today.

Family members last saw her on the evening of January 31 after dropping her home. She failed to attend church the next morning, raising immediate concern.

Her phone, wallet, car, and medication were all left behind.

The Pima County Sheriff’s Department, with assistance from the FBI, is leading the investigation.

Sponsored

Sponsored

Deputies also discovered that her doorbell camera had been removed or disabled, reinforcing concerns that she did not leave voluntarily.

So far, authorities have named no suspects and confirmed no proof of life.

Bitcoin Ransom Claims Add a Crypto Twist

The case took a darker turn after multiple alleged ransom communications surfaced, some referencing Bitcoin payments.

Sponsored

Sponsored

Media reports describe a purported ransom note demanding “millions of dollars’ worth of Bitcoin”, complete with deadlines and a wallet address.

However, police have not confirmed the authenticity of any ransom demand or verified that it came from whoever took her.

Crucially, investigators stress that no confirmed captor has made direct contact with the family.

Sponsored

Sponsored

Fake Bitcoin Extortion Attempt Clouds the Case

Separately, authorities arrested Derrick Callella, a California man accused of sending fraudulent Bitcoin-related messages to members of the Guthrie family.

Law enforcement says Callella is not connected to the kidnapping and acted independently, highlighting the rise of opportunistic crypto scams during high-profile cases.

Investigation Ongoing, Answers Still Missing

Savannah Guthrie has stepped away from broadcasting duties as the search continues.

For now, investigators say the focus remains on locating Nancy Guthrie and determining who took her, how, and why—with the Bitcoin angle still unverified and under review.

Crypto World

Bitcoin Selloff Sparks Hedge Fund Speculation Around BlackRock ETF

Traders suggest unusual activity in IBIT may point to Hong Kong–based hedge funds, though no hard evidence has emerged.

Unusual trading in BlackRock’s bitcoin ETF, iShares Bitcoin Trust (IBIT), has led traders to speculate that this week’s sharp Bitcoin drop may have been triggered by one or more Hong Kong–based hedge funds, rather than selling pressure from crypto traders.

The theory was laid out in a post on X by Parker White, the COO and CIO of DeFi Development Corp, and centers around record trading and options activity in IBIT.

Bitcoin (BTC) fell sharply over the past week, dropping 16%, and trading as low as $62,000 on Thursday before rebounding to around $70,400 on Friday, per CoinGecko. On Thursday, IBIT recorded its highest daily trading volume to date, with about $10.7 billion traded. Despite the heavy volume, IBIT recorded only $175 million in net outflows, according to SoSoValue.

White cited several signals suggesting that selling pressure did not come from crypto-native traders, including relatively low liquidations on centralized crypto exchanges and unusual price action in BTC and Solana (SOL).

“Given these facts and the way $BTC and $SOL traded down in lockstep today (normally SOL trades with beta) + the relatively lower liquidations on CeFi exchanges, this leads me to believe that the nexus of the problem lies with a large IBIT holder,” the post reads. “IBIT has become the #1 venue for BTC options trading, so my guess is that a hedge fund trading IBIT options is the culprit.”

White said public filings show that some funds hold a very large share (and in some cases nearly all) of their assets in IBIT. He added that many of those IBIT-focused funds are based in Hong Kong and do not normally trade crypto, which could explain why traders didn’t see warning signs ahead of the selloff.

He also pointed to activity in $DFDV, a fund tied to DeFi Development Corp, which he said posted its worst single-day decline on record, alongside a sharp drop in its net asset value.

“I personally know a number of HK-based hedge funds that are holders of $DFDV… the mNAV had been holding steady surprisingly well throughout this pull back until today.” White wrote, adding that he finds it unlikely a fund running a large IBIT position through a single-entity structure would operate only one vehicle.

White cautioned that while he has no hard evidence, “just some hunches and bread crumbs,” he believes his theory seems “very plausible.” Other experts echoed parts of White’s view, noting that the size and structure of the move did not resemble a typical crypto-driven selloff.

Rob Wallace, co-founder of BitcoinNews.com, agreed that the combination of factors mentioned by White looks more like institutional selling than a retail panic. He also said IBIT has become an important link between traditional markets and BTC trading.

Still, White and other traders emphasized that the clearest confirmation would come from regulatory filings showing a large IBIT position being reduced to zero.

Crypto World

Bithumb Fat-Finger Error: 2,000 BTC Mistakenly Credited, Triggering Local Flash Crash

TLDR

- Bithumb mistakenly credited 2,000 BTC to hundreds of users, triggering a flash crash.

- Bitcoin briefly traded 10% below global prices due to sudden localized sell-offs.

- Exchange reserves limited withdrawals, preventing larger-scale market disruption.

- Immediate action by Bithumb aimed to recover wrongly deposited BTC and stabilize trading.

Bithumb fat-finger error briefly sent Bitcoin prices tumbling on the exchange after a system mistake credited around 2,000 BTC (~$130 million) to users instead of the intended 2,000 KRW reward, triggering large sell orders and a local flash crash before prices rebounded.

Prices on Bithumb sank to roughly ₩81.1 million, far below other markets, before stabilizing.

Accidental Bitcoin Distribution and Market Reaction

Bithumb, South Korea’s second-largest cryptocurrency exchange, mistakenly deposited around 2,000 BTC into hundreds of user accounts.

Reports indicate a staff member intended to send a 2,000 KRW reward, but accidentally selected BTC as the currency.

Once the Bitcoin landed in user accounts, some recipients quickly sold it, likely anticipating recovery actions by the exchange. This sudden sell-off caused Bitcoin on Bithumb to trade nearly 10% below global market levels.

The local market experienced a sharp liquidity shock rather than a broader Bitcoin decline. One-minute trading charts show a near-vertical drop, followed by a long downside wick, reflecting the sudden surge in sell orders.

Arbitrage traders and automated bots quickly responded, buying BTC at prices significantly lower than those on other exchanges. The bounce back in price demonstrates short-term market corrections due to mispricing rather than a return of investor confidence.

Users on social media reported the flash crash in real time, noting the extreme volatility. The combination of human error, thin order books, and automated trading created a brief but dramatic market distortion.

The incident highlights the speed at which operational errors can impact local exchange markets.

Exchange Reserves and Recovery Measures

Despite the massive credited amount, Bithumb’s actual Bitcoin reserves prevented full withdrawals. The exchange reportedly holds about 50,000 BTC, limiting the possibility of large-scale asset outflows despite system-recorded deposits far exceeding actual holdings.

More than 500 BTC were sold immediately, causing price disruption, but a broader market collapse was avoided. The exchange acted quickly by suspending deposits and withdrawals and inspecting servers.

Bithumb confirmed that most wrongly deposited BTC could be recovered, although assets already sold or transferred overseas may be difficult to reclaim fully.

Regulatory scrutiny is ongoing, as Bithumb faces potential fines related to anti-money laundering compliance. The incident occurred amid volatile Bitcoin markets, emphasizing that centralized exchanges are single points of operational risk.

Even minor errors, such as event reward distributions, can lead to rapid price swings and localized market instability.

The episode provides a clear example of how technical mistakes intersect with liquidity and trading behavior. While the immediate threat was contained, the incident shows the vulnerabilities that centralized exchanges face when internal controls fail.

Crypto World

Sell-Off Slams Treasuries, ETFs & Mining Infrastructure

Crypto’s latest sell-off isn’t just a price story. It’s shaping balance sheets, influencing how spot ETFs behave in stressed markets and altering the way mining infrastructure is used when volatility rises. This week, Ether’s slide has pushed ETH below the $2,200 mark, testing treasury-heavy corporate crypto strategies, while Bitcoin ETFs have handed a new cohort of investors their first sustained taste of downside volatility. At the same time, extreme weather has reminded miners that hash rate remains tethered to grid reliability, and a former crypto miner turned AI operator is illustrating how yesterday’s mining hardware is becoming today’s AI compute backbone.

Key takeaways

- BitMine Immersion Technologies, led by Tom Lee, is dealing with mounting paper losses on its Ether-heavy treasury as ETH dips and market liquidity tightens, with unrealized losses surpassing $7 billion on a roughly $9.1 billion Ether position that includes the purchase of 40,302 ETH.

- BlackRock’s iShares Bitcoin Trust (IBIT) has seen underwater performance for investors as Bitcoin’s retreat from peak levels deepens, underscoring how quickly ETF exposure can shift from upside to downside in a volatile market.

- A late-January US winter storm disrupted bitcoin production, highlighting the vulnerability of grid-dependent mining operations. CryptoQuant data show daily output for publicly listed miners fell sharply during the worst of the disruption, then began to rebound as conditions improved.

- CoreWeave’s transformation from a crypto mining backdrop into AI-focused infrastructure underscores a broader trend: yesterday’s mining hardware and facilities are increasingly repurposed to support AI data centers, a shift reinforced by major financing—Nvidia’s $2 billion equity investment.

- Taken together, the latest developments illustrate how crypto sell-offs ripple through treasuries, ETFs and the physical infrastructure that underpins the network, prompting a re-evaluation of risk management and asset allocation in the sector.

Tickers mentioned: $BTC, $ETH, $IBIT, $MARA, $HIVE, $HUT

Market context: The drawdown comes as institutional crypto exposure faces a confluence of price volatility, liquidity concerns and cyclical demand for compute capacity. ETF inflows and outflows tend to respond quickly to price moves, while miners’ production patterns reveal how power and weather can shape output in a grid-sensitive ecosystem.

Why it matters

The balance-sheet story around crypto treasuries is front and center again. BitMine’s exposure underscores the risk of anchoring large corporate reserves to volatile assets that can swing meaningfully within a single quarter. When assets sit in the treasury, unrealized losses are a function of mark-to-market moves; they become a real talking point when prices slip and capital-mix decisions come under scrutiny. The company’s $9.1 billion Ether position — including a recent 40,302 ETH purchase — highlights the scale of the risk, especially for a firm that seeks to model ETH performance as a core axis of its treasury strategy.

On the ETF side, investors in the IBIT fund have learned a hard lesson about downside risk in a bear market. The fund, one of BlackRock’s notable crypto vehicles, surged to become a flagship allocation for many buyers before the price retraced. As Bitcoin traded lower, the average investor’s position moved into negative territory, illustrating how quickly ETF performance can diverge from early expectations in an abrupt market reversal.

Weather and energy costs are still a significant constraint for miners. The winter storm that swept across parts of the United States in late January disrupted energy supply and grid stability, forcing miners to reduce or curtail production. CryptoQuant’s tracking of publicly listed miners showed daily Bitcoin output contracting from a typical 70–90 BTC range to roughly 30–40 BTC at the storm’s height, a striking example of how energy grid stress translates into on-chain results. As conditions improved, production resumed, but the episode underscored the vulnerability of hash-rate operations to external shocks beyond price cycles.

The AI compute cycle is reshaping the crypto infrastructure landscape. CoreWeave’s trajectory—from crypto-focused computing to AI data-center support—illustrates a broader redeployment of specialized hardware. As GPUs and other accelerators pivot away from proof-of-work demand, operators like CoreWeave have become a blueprint for repurposing mining-scale footprints to power AI workloads. Nvidia’s reported $2 billion equity investment in CoreWeave adds a regional confidence boost, reinforcing the view that the underlying compute fabric developed during the crypto era is now a critical layer for AI processing and data-intensive workloads.

Altogether, the latest data points outpace simple price narratives. They illuminate how markets, capital structures and infrastructure intersect in a bear environment, revealing both fragility and resilience across different segments of the crypto ecosystem. The convergence of treasuries exposed to ETH, ETF holders re-evaluating allocations, weather-driven production swings, and infrastructure migration toward AI all signal a period of recalibration for investors, builders and miners alike.

What to watch next

- BitMine’s forthcoming disclosures or earnings updates to gauge whether unrealized Ether losses translate into realized losses or further balance-sheet write-downs.

- Performance of IBIT as BTC prices stabilize or fall further, and whether new inflows offset earlier drawdowns for long-term holders.

- Mining sector resilience data, including weekly production numbers and energy-grid reliability metrics, to assess ongoing sensitivity to weather and energy costs.

- CoreWeave and similar AI-focused infrastructure players’ investment milestones and capacity expansions, particularly any additional financing or partnerships with AI developers.

Sources & verification

- BitMine Immersion Technologies’ Ether-related balance-sheet disclosures and references to unrealized losses as ETH trades below prior highs.

- Performance and investor commentary regarding BlackRock’s iShares Bitcoin Trust (IBIT) amid BTC price moves and ETF liquidity.

- CryptoQuant data detailing miner output fluctuations during the US winter storm and the subsequent recovery.

- Reporting on CoreWeave’s transition from crypto mining to AI infrastructure and Nvidia’s equity investment in the company.

Crypto market stress and the AI-backed data-center shift

Bitcoin (CRYPTO: BTC) and Ether (CRYPTO: ETH) remain the two largest macro anchors in the crypto market, and their price trajectories continue to drive a wide array of spillover effects. The current pullback has placed a spotlight on how corporate treasuries are risk-managed during drawdowns, as well as how ETFs react when underlying assets encounter extended price pressure. BitMine’s Ether-heavy treasury is a case in point: with ETH hovering around the low-$2,000s, unrealized losses have mounted, illustrating the trouble with balance sheets anchored to a single, volatile asset. The company’s substantial Ether position, including a notable addition of 40,302 ETH, points to strategic bets on long-term exposure that, in the near term, translate into large mark-to-market swings. In this environment, even if losses remain unrealized, they shape investor sentiment and the risk calculus behind future capital raises or debt covenants.

The ETF angle adds another dimension to risk transfer. IBIT, the flagship BlackRock product, has exposed investors to Bitcoin price action in a new cycle, and the downturn has drawn attention to the sensitivity of ETF performance to rapid price moves. The fact that the fund’s investors have found themselves underwater — a reminder of how quickly market timing can unravel in a bear phase — underscores the need for robust risk controls around ETF allocations in crypto portfolios. The ETF’s ability to scale rapidly to a substantial asset base is impressive, but downtrends reveal the volatility that sits just beneath the surface of even the most sophisticated products.

Meanwhile, miners faced a concrete operational test in late January as a winter storm swept across the United States. The weather disrupted power delivery and grid operations, forcing several public miners to dial back production. CryptoQuant’s daily output data for major operators tracked a sharp decline from the usual 70–90 BTC per day to roughly 30–40 BTC during the storm’s peak, illustrating how grid stress translates into lower on-chain activity. This temporary slowdown is a reminder that mining is not a purely financial activity; it remains deeply connected to physical infrastructure and regional energy dynamics. As grid conditions improved, production began to rebound, revealing the sector’s capacity to adapt under adverse circumstances.

Against this backdrop, CoreWeave’s pivot from crypto mining to AI infrastructure emphasizes how the compute ecosystem evolves across cycles. The company’s transformation, coupled with Nvidia’s $2 billion investment, reinforces the idea that the compute fabric built during the crypto era has broad relevance for AI workloads and high-performance computing. This shift is not merely tactical—it signals a longer-term trend where hardware and facilities originally designed to support crypto mining become foundational for AI data centers and other compute-intensive applications. For operators, the challenge is to manage this transition smoothly, align financing with new business models, and keep services competitive in an environment where demand for AI-ready infrastructure remains strong.

In sum, the latest market moves illuminate a market in transition: from price-driven narratives to structural ones where balance sheets, ETF dynamics, weather-sensitive operations and AI compute needs converge. The next few quarters will reveal whether this confluence accelerates consolidation, prompts more diversified treasury strategies, or fuels a new wave of infrastructure repurposing across the crypto space and beyond.

https://abs.twimg.com/widgets.js

Crypto World

Bitfarms (BITF) says it’s ‘no longer a Bitcoin company’ as it moves to U.S. under new name

Bitfarms (BITF) is moving its legal base from Canada to the United States and will rebrand as Keel Infrastructure as part of its pivot from bitcoin mining to data center development for high-performance computing (HPC) and artificial intelligence (AI) workloads.

The redomiciling process, announced in a Friday press release, will be subject to shareholder, regulatory and court approvals. A shareholder vote is scheduled for March 20, and if approved, the company expects the transition to close by April 1. The new parent company, to be incorporated in Delaware, will trade on the Nasdaq and Toronto Stock Exchange under the symbol KEEL.

Bitfarms’ stock rose 18% following the news, erasing Thursday’s 16% tumble as AI infrastructure and crypto stocks sold off.

The rebrand and relocation follow a year-long strategic review by Bitfarms, which assessed market trends and investor sentiment, CEO Ben Gagnon said. The U.S. move will help the company access a broader pool of capital, simplify its corporate structure, and position it more directly in front of institutional investors, he added.

“We are no longer a Bitcoin company,” Gagnon said in a statement, “We are an infrastructure-first owner and developer for HPC/AI data centers across North America.

To support its new focus, Bitfarms has begun repaying its $300 million credit facility from Macquarie Group, starting with $100 million tied to its Panther Creek site in Pennsylvania. The repayment reduces debt while preserving what the company says is a strong liquidity position — $698 million as of Feb. 5 — comprised largely of cash and bitcoin.

Following the move, Bitfarms will maintain its operational sites in Canada and the U.S., but its New York City office will become its sole headquarters.

Crypto World

BTC re-takes $70,000 as Michael Saylor addresses Quantum Computing threat

Crypto markets are adding to overnight gains in U.S. morning trade on Friday, with bitcoin climbing above $68,000, up nearly 17% since hitting $60,000 late yesterday.

Bitcoin is now higher by 2.5% over the past 24 hours. Ether is up 2.2% and solana 2%. Outperforming is XRP , which has climbed to $1.50, now higher by 17% over the last day.

Crypto-related stocks are seeing major upside moves Friday after plunging in the previous session.

Strategy (MSTR) — which reported a $14.2 billion fourth-quarter loss late Thursdy — is higher by 14%, though at $122, still lower by 22% year-to-date. Galaxy Digital (GLXY) is up 15% and bitcoin miner MARA Holdings (MARA) is up 12%.

Underperforming on Friday is bitcoin miner-turned AI infrastructure provider IREN (IREN), down 1.8% after disappointing earnings results Thursday night.

Saylor gets serious about Quantum

Those looking for bottom signals are pointing to last night’s Strategy earnings call in which Michael Saylor pledged a commitment to leading a Bitcoin security program that will address the quantum threat.

Some in crypto have argued that bitcoin’s security model faces a serious threat from quantum computing — a threat so imminent that many investors are either selling or refusing to allocate to bitcoin at all.

“Saylor’s announcement tells me prices have finally gotten the Bitcoin community to acknowledge and address quantum risk,” wrote Quinn Thompson.

Poised for technical bounce

Paul Howard, director at crypto trading firm Wincent, noted that bitcoin is now back at price levels last seen 14 months ago with key momentum indicator RSI flashing deeply oversold conditions. He added that trading volumes in BTC and ETH have surged to their highest in over two years. That technical setup that often invites at least a short-term bounce.

“It would be odd if we did not see at least some short term reversion here,” he said.

Updated (14:55 UTC): Adds price of bitocin rising past $70,000.

Crypto World

Ether’s Technicals and Onchain Data Signals ETH Could Slip below $1.4K

Ether (ETH) has fallen by 30% over the past seven days, sliding to $1,900 from $2,800. The drop was accompanied by a sharp decline in futures activity, with Ether’s open interest falling by more than $15 billion over the same period.

Analysts are now focusing on the long-term technical zones and onchain indicators that may signal a major turning point for ETH price.

Key takeaways:

-

Ether has dropped 30% in seven days, slipping below the $2,000 psychological level.

-

Yesterday’s ETH price crash now brings $1,000-$1,400 into focus.

ETH drops with the crypto market

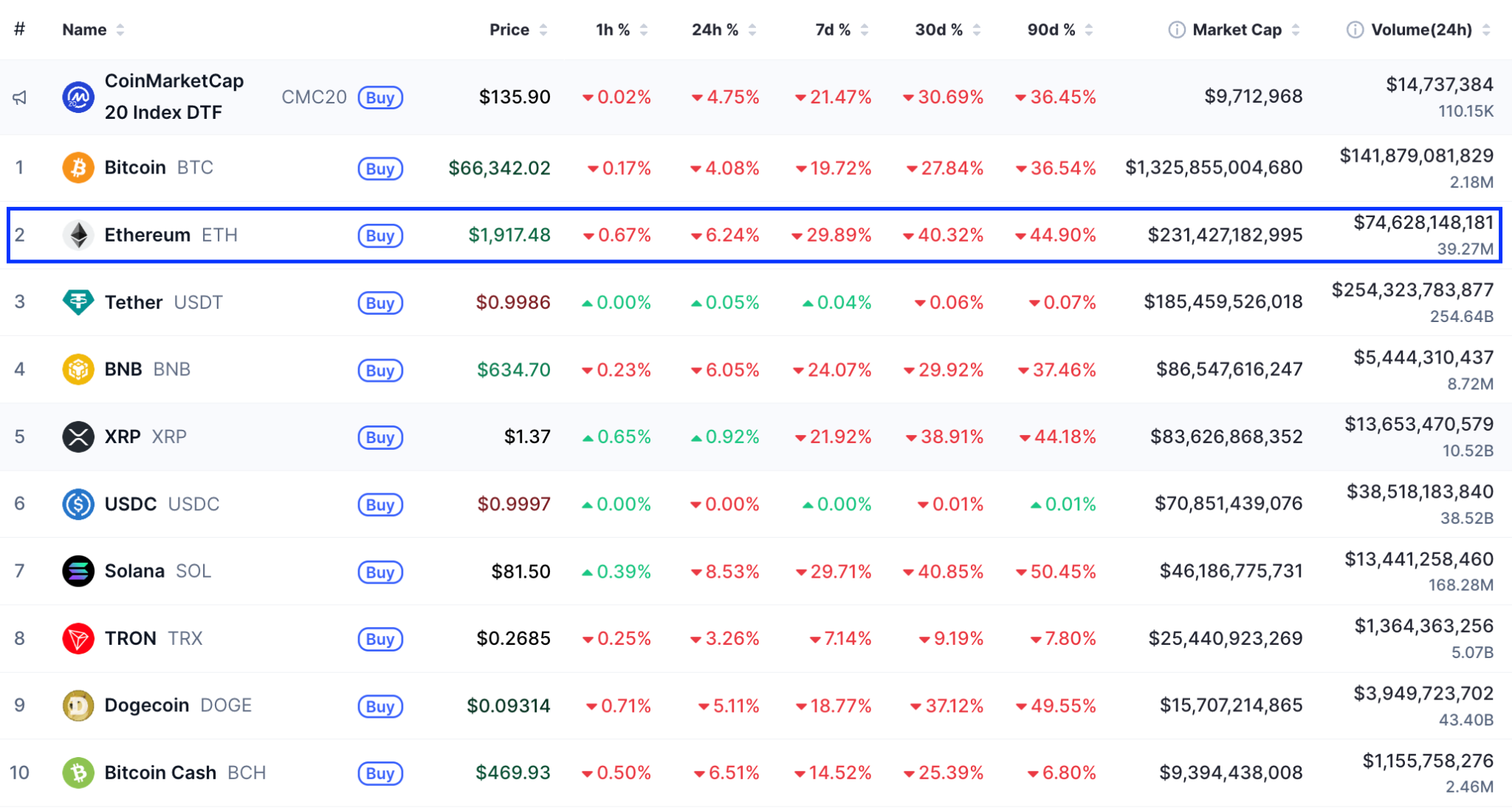

The ETH/USD pair dropped below $2,000 for the first time since May 2025, reaching a nine-month low of $1,740 on Friday. While Ether has since recovered to $1,900 at the time of writing, it has recorded the largest weekly drawdown of 30% among the top-cap cryptocurrencies.

Related: Trend Research dumps over 400K ETH as liquidation risk rises

Bitcoin (BTC), the market leader, was trading at $66,340 at time of writing, down 21% over the last seven days. Fifth-placed XRP (XRP) has lost more than 21% over the last week to trade just above $1.37. Solana (SOL) has also posted significant losses among the top 10 cryptocurrencies, down 29% over the same period.

As a result, the global crypto market capitalization is down 20% over the week toward $2.23 trillion on Friday.

Ether’s slump this week is accompanied by significant long liquidations totaling $400 million over the last 24 hours, signaling intense selling by traders.

The sellers were also US-based spot Ether ETFs, which have recorded $1.1 billion in net outflows in the past two weeks.

Coupled with increased selling from other major ETH holders such as Trend Research, and Ethereum co-founder Vitalik Buterin, this points to unrelenting overhead pressure that could push ETH price lower.

How low can ETH price go?

Ether’s bearishness over the last two weeks has seen it lose two key support levels, including the 200-week simple moving average (SMA) and the psychological levels at $3,000 and $2,000.

The last time ETH decisively dropped below the 200-week SMA was in March 2025, which was followed by a 45% drop in price.

If history repeats, the ETH/USD pair will extend the downtrend toward $1,400.

This level aligns with the bearish target of an inverse V-shaped pattern at $1,385, representing a 28% drop from the current price.

As Cointelegraph reported, an inverse cup-and-handle pattern places the downward target at $1,665, while MVRV bands point to a target of $1,725.

Onchain analytics platform Lookonchain highlighted three major liquidation zones around $1,500, $1,300 and $1,000, which could act as magnets for Ether’s price before a potential bottom.

Glassnode’s UTXO realized price distribution (URPD), showing the average prices at which SOL holders bought their coins, reveals that there is little previous volume below $1,900. In other words, buyers might not step in before the price drops to the aforementioned support levels.

The next significant support sits at $1,200, where approximately 1.5 million ETH were previously acquired.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Bitcoin’s (BTC) Free Fall, Ethereum’s (ETH) Collapse, and More: Bits Recap Feb 6

The past few days have been nothing but a massacre for the majority of the leading cryptocurrencies. Bitcoin (BTC) crashed to levels last seen in 2024, whereas Ethereum (ETH) tumbled well below $2,000.

Interestingly, Hyperliquid (HYPE) has shown notable resilience amid the crisis, with its price soaring by 60% in the past two weeks. In the following lines, we will touch upon these three cryptocurrencies and their latest performance.

BTC Bleeds Out

The primary cryptocurrency started the year on the right foot and at one point even challenged the $100K milestone. The past few weeks, though, have been brutal, with the price collapsing to as low as $60,000 on February 5. As of press time, BTC trades at approximately $66,400, representing a 20% weekly decline.

Pessimism among analysts has since dominated, with many suggesting that bears may simply be stepping in. Ali Martinez recently reminded that since 2015, every time BTC has lost the 100-week simple moving average (SMA), it has failed to reclaim it quickly and continued toward the 200-week SMA. Based on his chart, the asset’s valuation could plunge to $57,600.

For their part, PlanB (the anonymous creator of the Stock-to-Flow (S2F) model) presented several possible scenarios, including a devastating crash to $25,000.

The recent behaviour of the large investors supports the bearish thesis. Santiment’s data shows that whale and shark wallets have been selling BTC over the past few days, while smaller players have increased their exposure.

“This combination of key stakeholders selling and retail buying is what historically creates bear cycles. Until there is a sign of clear capitulation from the crowd, smart money will continue to gladly sell off their bags and not have any urgency to buy back in until the crowd has decided to move on from crypto,” the analysis reads.

Meanwhile, the popular Fear & Greed Index (which measures the current sentiment of BTC investors) has fallen to 9, the lowest point since the summer of 2022. Extreme fear is a sign that investors are overly worried and may sound alarming, but it can also indicate that the bottom is in.

After all, prominent investors, including Warren Buffett, have advised over the years that the best buying opportunities occur when there’s blood on the streets. The exact words of the Oracle of Omaha are: “Be fearful when others are greedy and greedy when others are fearful.”

Bad Days for ETH

The second-largest cryptocurrency has also been significantly affected by the market crisis, with its price briefly falling to a nine-month low of approximately $1,750. Currently, it hovers around $1,900, down 30% over the last seven days.

Its negative performance coincides with substantial outflows from spot ETH ETFs, suggesting a decline in institutional investor interest. It also follows news that Vitalik Buterin (one of Ethereum’s co-founders) has sold millions of dollars’ worth of the asset.

One popular analyst who touched upon ETH’s recent downtrend is X user Ted. He claimed that the next major support zone for the price is around the April 2025 lows. Recall that at that time, ETH nosedived below $1,400.

Ali Martinez argued that the coin historically bottoms when the Market Value to Realized Value (MVRV) drops under 0.80. On February 5, the metric stood at 0.96, indicating that an additional slump isn’t out of the question.

HYPE Stands Its Ground

Contrary to BTC, ETH, and countless other cryptocurrencies, Hyperliquid (HYPE) is actually in green territory. Its price has rallied by 60% over the past two weeks, driven by significant developments, including support from Ripple and growing interest in HIP-3 activity amid increased trading volume and open interest.

A few days ago, the team behind the decentralized platform revealed that HIP-3 markets reached new all-time highs of $1 billion in open interest and $4.8 billion in 24-hour volume.

Analysts like Crypto General and Zach are quite bullish. The former predicted short-term volatility and an eventual spike beyond $100 sometime this year, whereas the latter claimed there are “so many reasons to buy and hold HYPE.”

The post Bitcoin’s (BTC) Free Fall, Ethereum’s (ETH) Collapse, and More: Bits Recap Feb 6 appeared first on CryptoPotato.

Crypto World

Balance Sheet Stable Unless BTC Falls Below This Critical Level

Strategy’s Bitcoin reserves cover debt, and only a prolonged drop to $8,000 could possibly force restructuring.

Strategy CEO Phong Le told investors on Thursday that the company’s balance sheet remains stable despite recent crypto market turbulence, though extreme scenarios could pose challenges.

The firm, the world’s largest corporate Bitcoin (BTC) holder, says it would only need to consider restructuring or additional capital if the cryptocurrency fell to $8,000 and remained there for five to six years.

Balance Sheet Holds Amid Bitcoin Sell-Off

According to reporting by The Block, Le, speaking during Strategy’s fourth-quarter earnings call, emphasized that even after recent market losses, the company’s Bitcoin reserves comfortably cover its convertible debt.

“In the extreme downside, if we were to have a 90% decline in Bitcoin price, and the price was $8,000, that is the point at which our Bitcoin reserve equals our net debt, and we would then look at restructuring, issuing additional equity, issuing additional debt,” he said.

The call came after a sharp sell-off across crypto markets, with BTC down roughly 7% in 24 hours, trading just under $66,000 at the time of writing. Strategy’s stock, MSTR, slid 17% to $107, erasing much of its gains from late 2025 and leaving it down about 72% over six months.

Analysts on social media noted that today’s session saw Bitcoin drop more than $10,000, the first time it has ever dipped by such an amount in a single day, according to The Kobeissi Letter. The dramatic loss in value was part of a structural market downturn that has wiped out $2.2 trillion in crypto market value since mid-October 2025.

Executive Chairman Michael Saylor also spoke in the call, dismissing concerns about quantum computing threats to Bitcoin as “horrible FUD” and outlining plans for a security initiative to support potential upgrades, including quantum resistance.

He reiterated that Strategy’s long-term approach is designed to withstand volatility, pointing to supportive U.S. regulatory developments and the growing integration of Bitcoin into credit markets and corporate balance sheets.

You may also like:

Strategic Outlook

Strategy is still expanding its Bitcoin holdings despite short-term price swings. Earlier this week, the company acquired 855 BTC for $75.3 million at an average price near $88,000, bringing its total reserves to over 713,500 units.

The buy followed a $25 billion accumulation in 2025 and a $1.25 billion purchase in early 2026, funded largely through capital raises.

Saylor has argued that the significance of Bitcoin treasury companies lies in credit optionality and institutional adoption rather than daily price action. According to him, firms holding BTC on balance sheets can leverage assets for debt issuance, lending, or financial services, giving them flexibility that ETFs lack.

While sentiment has deteriorated sharply in recent months, he framed these developments as part of a long-term integration of digital capital into global financial systems, rather than a short-term price event.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

US Recession Fears Trigger Sharp Crypto Market Crash

Key Insights

- US layoffs rise sharply, weakening consumer spending and market confidence.

- Crypto market cap drops 8%, with forced liquidations hitting 1.34B in Bitcoin.

- Bitcoin shows strong correlation with S&P 500 and gold amid macro selloff.

What Sparks Recession Debate?

The US economy shows signs of stress, with rising layoffs and weak hiring fueling recession fears. In January 2026, companies reported over 108,000 job cuts, the highest since 2009. Meanwhile, vacancy opportunities declined to 6.9 million, which is significantly below the projections. Such a decline in jobs could decrease consumer expenditure, impacting economic growth and investor confidence in high-risk assets like cryptocurrencies.

Housing data also contributes to economic issues. The gap between the home sellers and buyers is at an all-time high of 530,000. Reduced housing demand also affects construction employment, bank lending, and general consumer confidence that can add even more strain on financial markets.

Tech Debt and Bond Market Pressures

Stress in the technology credit sector is intensifying. Tech loan distress reached 14.5%, while bond distress climbed to 9.5%, highlighting challenges in debt management. Around $25 billion in software loans are trading at deep discounts. Previously, crypto and stock markets operated independently, but the correlation between the two has increased in recent years, causing crypto to respond sharply to stock market declines.

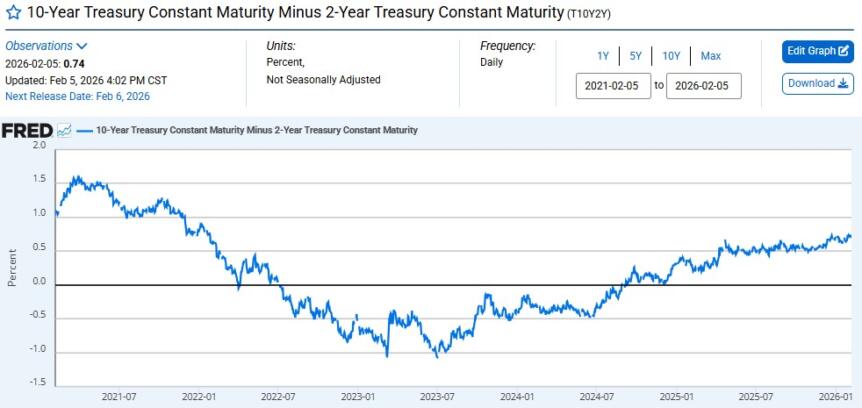

The bond market also signals caution. The 2-year versus 10-year Treasury yield spread moved to approximately 0.74%, known as bear steeping.

This trend, seen historically before recessions, indicates rising long-term yields relative to short-term rates, which can signal investor concern over future economic growth.

Crypto Market Reacts to Macro Risks

The crypto market tracked declines in traditional markets. The crypto market cap fell by 8% in 24 hours, to approximately $2.22 trillion. Trading volume rose more than 80% as liquidations increased. Bitcoin alone saw more than $1.34 billion of positions liquidated, while leading altcoins such as XRP and Solana posted sizable intraday losses.

Statistics show a 92% correlation between Bitcoin and the S&P 500 and an 80% correlation between cryptocurrency and gold, suggesting macroeconomic factors drove Bitcoin’s decline.

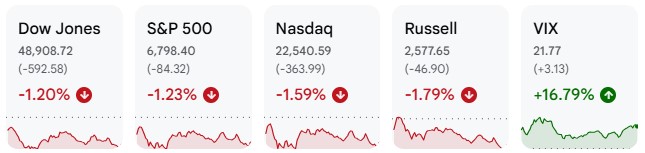

According to U.S. stock market data: S&P 500 fell 84.32 points to around -1.23%, Dow Jones dropped 1.20%, Nasdaq fell 1.59% to 363.99, and the Russell fell 1.79%.

Source: Google Finance

Analysts hope that any Federal Reserve open market operations or changes in rates would inject liquidity and take pressure off risk assets, potentially leading to a market recovery.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech5 hours ago

Tech5 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports15 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat11 hours ago

NewsBeat11 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World1 day ago

Crypto World1 day agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Tech6 days ago

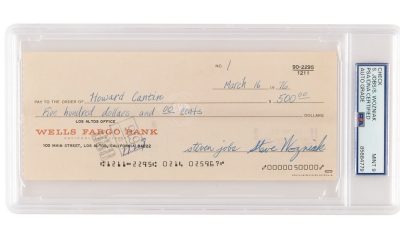

Tech6 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined