Crypto World

Harvard cuts bitcoin exposure by 20%, adds new ether position

Harvard University’s $56.9 billion endowment made its first foray into ether last quarter, even as it scaled back its exposure to bitcoin .

According to an SEC filing, the Harvard Management Company (HMC) bought almost 3.9 million shares of BlackRock’s iShares Ethereum Trust (ETHA), valued at around $86.8 million.

The company also reduced its stake in the iShares Bitcoin Trust (IBIT) by 21%, selling roughly 1.5 million shares. The bitcoin exchange-traded fund remains Harvard’s largest publicly disclosed holding at $265.8 million.

The shift comes after the price of bitcoin dropped from an all-time high of around $125,000 in October to close the quarter just below $90,000.

The move, however, may have less to do with sentiment and more to do with market dynamics, according to Andy Constan, founder and chief investment officer at Damped Spring Advisors.

The sale could reflect the unwinding of a trade that meant to capitalize on bitcoin treasury companies trading at premiums to the value of their BTC holdings, as measured by the multiple of net asset value, or mNAV, which compares enterprise value to bitcoin value.

When bitcoin’s price was booming, digital asset treasury (DAT) firms like Strategy (MSTR) traded at high premiums to the value of the bitcoin in their treasuries. MSTR, for example, at one point traded near 2.9 mNAV, meaning investors buying the shares were paying around $2.9 to own $1 of BTC.

That premium reflects not only the underlying cash-generating business, but also the company’s potential to keep accumulating bitcoin. Still, various investors bet on that mNAV gap narrowing. They held bitcoin indirectly through IBIT and shorted the shares of Strategy and similar digital asset treasury (DAT) companies.

Then the unwind took place, according to Constan. As the price of bitcoin plunged, so did that of DAT shares. Strategy, for example, now trades at 1.2 mNAV. These traders may also be rebalancing their portfolios, as bitcoin’s price nearly doubled last year despite the drawdown, suggesting it could be above the institution’s desired portfolio allocation, he wrote on X.

Data from 13F filings with the SEC gathered by Todd Schneider at 13.info backs these points. It shows that institutions reported owning 230 million IBIT shares in the fourth quarter, down from 417 million in the third.

Harvard also boosted investments in chipmakers Broadcom and TSMC, as well as in Google’s parent company Alphabet and railroad operator Union Pacific, while trimming stakes in Amazon, Microsoft and Nvidia.

Crypto World

Bitcoin’s Next Bull Run Depends on This Single On-Chain Indicator

This on-chain metric turning negative has repeatedly meant seller exhaustion and the transition from bear markets to bull cycles.

The cryptocurrency market remained subdued amidst short-term nerves, mixed signals, and no clear direction. Bitcoin also showed limited conviction and was visibly under pressure after shedding over 1% of its value in the last 24 hours.

Data shows BTC’s strongest rallies start only after long-term investors absorb unrealized losses and selling pressure fully exhausts itself.

Bitcoin Bulls Await

Joao Wedson, co-founder of Alphractal, said Bitcoin’s next major bull cycle has historically begun only after long-term holders move into unrealized losses. According to Wedson, the Net Unrealized Profit/Loss (NUPL) metric for long-term holders, which tracks the average unrealized gains or losses of the most resilient market participants, currently stands at 0.36. Such a trend indicates that these investors remain in profit.

However, Wedson explained that the important signal appears when this metric turns negative. A negative NUPL means even long-term holders are underwater, a condition that has consistently coincided with periods of extreme market pessimism.

In past cycles, such phases pointed to seller exhaustion and a redistribution of coins toward stronger hands. Wedson noted that this environment has historically represented the final stage of bear markets and preceded the start of a new bull run, which means that major opportunities tend to emerge during periods of market depression rather than at cycle highs.

Low MVRV

Similar conditions are now being flagged by Bitcoin’s valuation indicators. CryptoQuant, for one, found that Bitcoin’s Market Value to Realized Value (MVRV) ratio has entered its “Accumulation Zone” for the first time in four years, a move last seen in May 2022.

According to the analytics firm, the previous instance of MVRV falling into this range was followed by a sharp price correction, as Bitcoin declined roughly 50% from around $30,000 to $15,000. CryptoQuant explained that the Accumulation Zone is defined by MVRV remaining below 1.44 and potentially falling as low as 0.90, levels that historically indicate periods when the crypto asset is undervalued relative to its realized price.

You may also like:

These conditions typically coincide with high market pessimism and reduced speculative activity. The firm also added that, based on historical patterns, continued periods with MVRV below 1.44 have offered favorable phases for long-term accumulation, even as price volatility and downside risk remain quite high in the short term.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin ‘Fakeouts And Shakeouts’ Liquidate Traders This US Bank Holiday

Bitcoin round tripped gains after a spike to $70,000 as liquidity traps began to characterize BTC price action on the US bank holiday.

Bitcoin (BTC) took out long and short positions during Monday as low-volume trading sparked short-term volatility.

Key points:

-

Bitcoin sees low-time frame manipulation clear both longs and shorts on the US bank holiday.

-

BTC price action offers “breakouts and shakeouts” while staying in a narrow range.

-

2022 bear market comparisons continue, now focused on weekly RSI.

BTC price liquidity squeezes shake out traders

Data from TradingView captured sharp moves within a narrow BTC price range on the US bank holiday which topped out at $70,000.

With Wall Street closed, thinner order books overall made it easier for large-volume entities to influence short-term price action. This resulted in multiple “squeezes” that impacted both longs and shorts.

Data from monitoring resource CoinGlass showed $120 million in crypto liquidations for the four hours to the time of writing.

Blocks of bids and asks were cleared on the day, with new “walls” placed immediately above price as it fell, adding to downward pressure.

“Volatility is much higher which is something that we also see in pretty much all other markets lately. Definitely not a calm period for markets around the world,” trader Daan Crypto Trades commented in a post on X.

Trading resource Material Indicators described the latest BTC price performance as “breakouts and shakeouts.”

An accompanying chart monitored both liquidity and whale activity on Binance’s BTC/USDT pair.

Trader CW nonetheless observed that buying pressure was more robust than on Sunday, with the exception of exchange OKX.

What’s different about $BTC from yesterday is that net buying is maintained except for OKX. pic.twitter.com/x3Y1OegrsI

— CW (@CW8900) February 16, 2026

Bitcoin RSI teases “once per cycle lows”

Continuing on the wider status quo, Material Indicators cofounder Keith Alan stressed ongoing resemblances between this year and Bitcoin’s 2022 bear market.

Related: $75K or bearish ‘regime shift?’ Five things to know in Bitcoin this week

Relative strength index (RSI) readings on weekly time frames, he said, were pointing to a BTC price bottoming phase.

“Finding more similarities with 2022 in the $BTC chart as Weekly RSI moves towards what has historically been, once per cycle lows in oversold territory,” he told X followers.

“In 2015 and 2018 it marked bottom, however in 2022 it led to a 5 month consolidation before establishing a macro bottom.”

Weekly RSI measured 27.8 on Monday, marking the lowest reading since June 2022. Readings below 30 are considered “oversold.”

“This doesn’t mean it has to develop the same way this time, but it’s worth watching closely to identify similarities and deviations in the pattern to help with forecasting,” Alan added.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Bitcoin Targets $84K CME Gap After Rising Accumulation in BTC

Bitcoin (BTC) saw a sharp dip below $67,400 during the Monday session open, after it rallied above $70,000 over the weekend. An immediate recovery may come at the back of BTC order book data, which shows aggressive bid positioning, and onchain data pointing to a rise in long-term accumulation.

Analysts now say the move may extend toward the $80,000–$84,000 region, with order book liquidity playing a key role in the next move.

Key takeaways:

-

The Bitcoin accumulator addresses held over 372,000 BTC on Feb. 15, up from 10,000 BTC in September 2024.

-

BTC order books show the largest bid skew in over two years, signaling a stronger near-term support.

Bitcoin futures and order book data support $80,000 retest

Crypto analyst Mark Cullen said Bitcoin may move toward the early February CME (Chicago Mercantile Exchange) gap, placing $80,000 to $84,000 as his upper price target this week.

A CME gap forms when the Bitcoin futures on the Chicago Mercantile Exchange close for the weekend and reopen at a different price, leaving a price range with no traded volume.

Previously, Bitcoin has revisited these gaps to “fill” them, meaning the price trades back through that untested range.

The current gap sits roughly between $80,000 and $84,000, making it a clear technical level. With 9 out of 10 CME gaps filled since August 2025, the $80,000–$84,000 range stands out as the key unfilled level.

Meanwhile, the order book data shared by crypto trader Dom shows roughly $596 million in bids within 0–2.5% of price versus $297 million in asks. This near 2:1 bid-to-ask imbalance represents the largest bid skew in over two years.

A bid skew of this magnitude indicates stronger immediate demand than the supply, which can support a short-term upward trend if sustained.

Dom said traders were hesitant to buy during the sharp drop. After Bitcoin swept below $60,000, demand picked up near the lows, suggesting growing interest in accumulating at discounted prices.

Related: Metaplanet revenue jumps 738% as Bitcoin generates 95% of sales

BTC accumulation demand hits new highs

CryptoQuant data shows that the demand from addresses classified as “accumulators” has reached new highs at roughly 372,000 BTC on Feb. 15. In September 2024, that figure was around about 10,000 BTC.

Crypto analyst Darkfost explained that these addresses are filtered using strict criteria: no outflows, multiple inflows, a minimum balance threshold, at least one active period in the past seven years, and exclusion of exchange, miner, and smart contract wallets.

Meanwhile, the long-term holder (LTH) distribution 30-day sum, which measures the total BTC moved by long-term holders over a rolling 30-day period, has fallen below $100,000, compared to averages above $1 million in November 2025.

A lower distribution suggests reduced selling from the LTHs, partially offsetting whale-driven inflows.

Related: $75K or bearish ‘regime shift?’ Five things to know in Bitcoin this week

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Crypto Markets Slump Following Disappointing US Jobs Report

Total market value slipped 2% on the day as most large-cap tokens traded lower.

Crypto markets opened the week on softer footing, with prices slipping lower after last week’s brief rebound.

On Monday, Feb. 16, Bitcoin (BTC) was trading around $67,500, down about 2% on the day and 1.7% over the past week, though it briefly rallied to $70,000 earlier today.

Since dropping to as low as $60,000 the first week of February, BTC has mostly been trading in a tight range between $68,000-$70,000. Trading volumes remained around $40 billion over the past 24 hours, suggesting active but indecisive positioning.

Ethereum (ETH) is down slightly more over the past 24 hours with 3% losses, while down 3.5% on the weekly timeframe.

Total crypto market capitalization fell 2% over the past 24 hours to $2.39 trillion, with most of the top-10 tokens moderately lower on the day. TRON (TRX) was the lone exception, posting slight gains on the day, while Dogecoin (DOGE) lost the most, down 7.5% in the past 24 hours, but still nearly 7% in the green on the week.

‘Macro Hedge Narrative Remains Challenged’

Despite pockets of resilience, analysts continue to flag a lack of strong directional conviction. In a Monday note, analysts at Keyrock said Bitcoin remains tightly correlated with risk assets.

“Our Take: Bitcoin continues to trade as a high-beta extension of tech, struggling to decouple during growth-led drawdowns,” Keyrock wrote. They added:

“Rather than hedging fiat risk, its rising correlation with software stocks continues to weaken its diversification case. Until it begins responding inversely to dollar weakness, its macro hedge narrative remains challenged.”

As for the Crypto Fear & Greed Index, it still remains in “extreme fear” territory, where it’s been for most of the past month.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, Cosmos (ATOM) led gains on the day, up just 2.4%, followed by Bittensor (TAO), which rose 1%.

On the downside, Rain (RAIN) slid over 8%, while Dogecoin was today’s second biggest loser among large-caps after its recent outperformance.

According to CoinGlass data, total liquidations of $232 million over the past 24 hours, with long positions accounting for roughly $159 million. Bitcoin and Ethereum liquidations were nearly even, with $105 million and $90 million, respectively.

ETFs and Macro Conditions

Flows into U.S. spot crypto exchange-traded funds remained negative on a weekly basis, despite a net positive day on Friday.

According to SoSoValue data, last week, spot Bitcoin ETFs recorded net outflows of nearly $360 million, similar to the previous week’s total, bringing total net assets at $87 billion by Feb. 13.

Spot Ethereum ETFs also posted weekly outflows of $161.2 million, with total net assets of $11.7 billion.

On the macro front, revised labor data reinforced caution. The U.S. Bureau of Labor Statistics revealed on Friday, Feb. 13, that employers added just 181,000 jobs in 2025. That is far below the previously estimated 584,000 and the 1.46 million added in 2024.

Meanwhile, the U.S. Treasury Secretary Scott Bessent said on Friday in an interview for CNBC that Congress should advance the CLARITY Act to set federal rules for digital assets, calling it a source of “great comfort” for markets, while cautioning that bipartisan support could weaken later this year.

Crypto World

Why XRP, DOGE, TAO Could Pose Liquidation Risks This Week

The crypto market entered the third week of February with notable recoveries across several altcoins. However, overall negative sentiment has yet to improve, creating conditions for potential liquidations among overly optimistic traders.

Altcoins such as XRP, DOGE, and TAO are drawing attention this week due to significant developments, but they also carry the following risks.

Sponsored

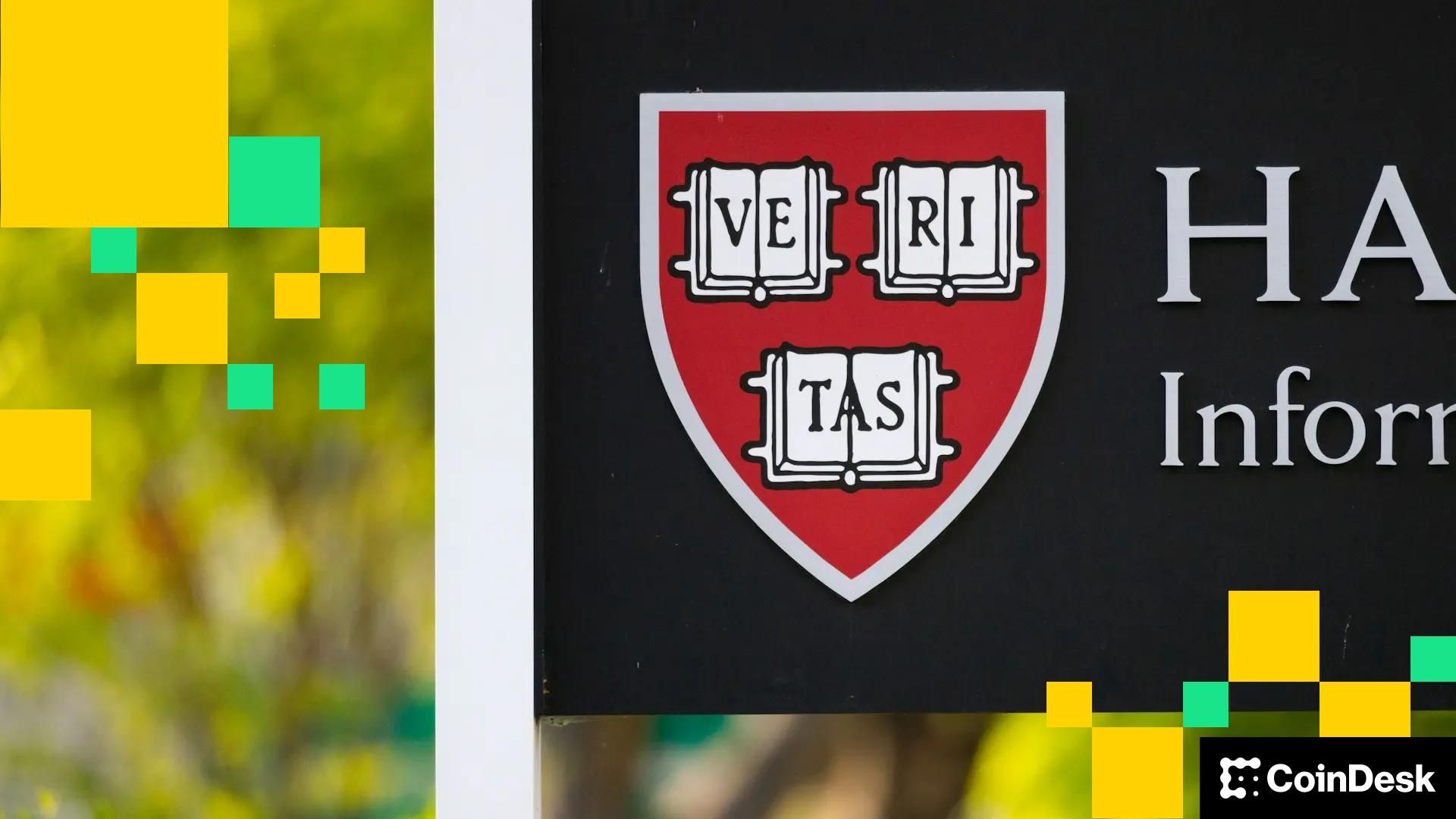

1. XRP

XRP’s liquidation map shows that the cumulative liquidation volume of Long positions slightly exceeds that of Short positions.

This week, if XRP declines to $1.30, cumulative Long liquidations could surpass $200 million. Conversely, if XRP rises above $1.63, cumulative Short liquidations could reach $150 million.

On Sunday, XRP briefly climbed to $1.66 before quickly falling back below $1.50 on Monday. Analyst Dom identified selling pressure originating from the Upbit exchange through the XRP Spot Cumulative Volume Delta indicator.

The data shows that approximately 50 million XRP were net sold on Upbit within 15 hours, generating strong selling pressure. This pressure emerged ahead of the Lunar New Year’s Eve, a holiday period in many Asian countries that often raises concerns about declining liquidity.

Sponsored

Meanwhile, XRP accounts for a significant share of trading volume on both Upbit and Bithumb in South Korea. As a result, selling pressure from Asian investors could put Long positions at risk this week.

2. Dogecoin (DOGE)

Recent bullish discussions within the community have encouraged traders to allocate capital to Long DOGE positions this week.

If DOGE falls to $0.091, cumulative Long liquidations could approach $90 million. Meanwhile, if DOGE rises to $0.114, cumulative Short liquidations could total around $53 million.

Sponsored

Why should DOGE Long traders remain cautious? Data from Nansen shows that DOGE exchange balances (yellow line) surged abruptly from February 12, when DOGE began its recovery driven by rumors surrounding the upcoming launch of X Money.

Many DOGE investors appear to be using the recovery as an opportunity to exit positions by transferring tokens onto exchanges. If this trend continues this week, DOGE could correct and move toward liquidation levels for Long positions.

3. Bittensor (TAO)

The listing of TAO on South Korea’s Upbit exchange on February 16 could provide fresh momentum to support a price recovery.

Sponsored

The liquidation map shows that if TAO climbs above $283 this week, Short liquidations could exceed $13 million. Conversely, if TAO declines to $160, Long liquidations could reach $11.5 million.

As crypto community discussions around AI continue to capture a high share of overall market attention and Bittensor (TAO) corrects toward a long-term support zone, analyst Michaël van de Poppe expects a strong recovery.

“I think that protocols working on AI <> Crypto are a must have in every portfolio and I’m glad I’ve added funds into this position. I think that we’re going to see more strength going forward from here. At least a mean reversion to ~$300,” Michaël van de Poppe stated.

New liquidity from Upbit, combined with Michaël van de Poppe’s assessment, could place TAO Short positions at risk.

Crypto World

How to Accept Cryptocurrency Payments via Cryptomus?

More online businesses are integrating cryptocurrency into their payment systems. This trend is especially noticeable among companies serving customers in multiple regions. For them, it’s a useful addition to their existing payment methods.

To take crypto payments, a business needs a solid payment gateway to process them smoothly. This guide explains how to begin clearly and avoid mistakes.

Why Are Businesses Starting to Accept Crypto Payments?

Accepting crypto for payments makes many traditional problems easier to handle. Payments go through faster, you don’t have to wait long for settlements, and sending money abroad is simpler with fewer middlemen. This proves highly useful for online businesses and organizations that work with international clients.

Meanwhile, people are moving away from old payment methods. Many who already have digital assets prefer to pay with them rather than convert first. This way, crypto payments are not meant to replace existing options but to expand the choices available.

How to Pick a Crypto Payment Gateway?

What makes crypto payments so convenient is that the gateway does most of the work. Merchants don’t have to be experts since it takes care of processing, monitoring, and keeping records.

A reliable gateway often includes:

- Support for multiple coins and networks.

- Clear and transparent fees.

- Flexible integration options.

- Invoice management with accurate payment tracking.

- Automation tools to minimize manual work.

- Strong security.

How customers feel matters just as much as the payment itself. Simple steps, support in multiple languages, and a consistent brand make users feel secure and more likely to complete their payment. Platforms like Cryptomus bring all of this together, making crypto payments easier to handle.

How to Start Accepting Crypto Payments?

Cryptomus is a versatile platform designed for both businesses and personal use. It features a reliable cryptocurrency payment gateway built for everyday operations. It supports over 120 coins and is suitable for companies of all sizes, from major ones to small online services like VPNs or hosting providers.

Fees are really low, starting at just 0.4%, and withdrawals are completely free. Merchants can also transfer the payment commission to the buyer when creating an invoice, effectively reducing direct costs.

To begin, first create a merchant account and choose one of these integration options:

- API integration with documentation and keys.

- SDK tools with instructions and code samples.

- Plugins for e-commerce platforms.

After that, just choose which cryptocurrencies you want to accept, set up automatic conversion, and customize a payment page with your branding. From the dashboard, you can track all incoming payments. Withdrawals usually take 1–2 minutes and can be done manually or automatically. You can also schedule auto-withdrawals based on time, currency, or network. Fiat withdrawals are available via SEPA, SWIFT, and P2P exchanges.

Another point to keep in mind is security. Cryptomus offers two-factor authentication, PIN codes, and IP whitelisting, and its safety has been independently verified by Certik. Customer support is available 24/7 in several languages through Telegram, email, website chat, or a personal manager.

Why Should Your Business Accept Crypto?

Accepting cryptocurrency can give your business a competitive advantage. It shortens settlement times, makes cross-border payments easier, and provides clients with a payment option they may already use.

Cryptomus simplifies crypto integration, making it safe and easy even for those without technical expertise. You can accept various coins, track payments, and handle withdrawals easily.

Crypto doesn’t need to replace your usual payment methods. It works alongside them, giving your business more flexibility and helping you keep up with evolving customer demands.

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and to do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

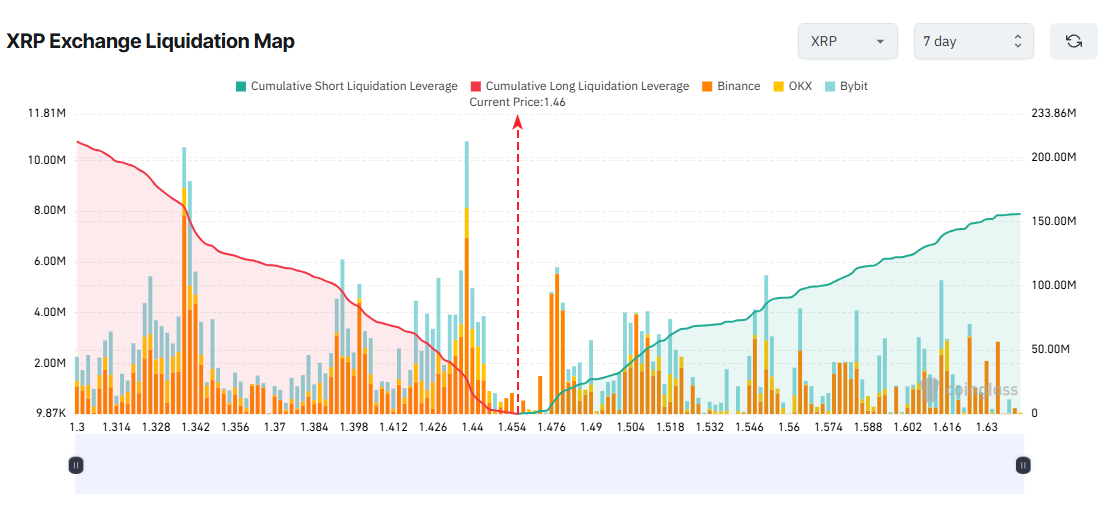

Zcash Creators Officially Split Like OpenAI and Anthropic

Zcash’s original creators have formally broken away from the Electric Coin Company (ECC) and launched a new independent development entity, marking the clearest structural split in the privacy coin’s history.

The team announced today that the Zashi wallet will be rebranded as “Zodl,” confirming that Zcash’s flagship wallet and its original engineers now operate outside ECC’s control.

Sponsored

Sponsored

Original Builders Continue Zcash Development Outside ECC

The announcement formalizes a break that began in January, when the entire ECC staff resigned following a governance dispute with Bootstrap, the nonprofit that owns ECC.

That conflict centered on control, autonomy, and the future direction of Zcash development.

The newly formed ZODL now includes the same engineers and product team that built Zcash’s core privacy technology and developed its flagship wallet.

The organization said it will continue building tools to expand shielded ZEC adoption, independently of ECC and the Zcash Development Fund.

Critically, this means Zcash’s original creators did not leave the ecosystem.

Instead, they regrouped under a new entity and retained operational continuity through the wallet infrastructure. The Zodl wallet remains fully compatible with the Zcash blockchain.

Sponsored

Sponsored

Meanwhile, ECC still exists as a legal entity under Bootstrap ownership. However, it no longer employs the original team that designed and maintained much of Zcash’s modern infrastructure.

As a result, Zcash now has two separate organizational centers tied to its future development.

Split Mirrors OpenAI and Anthropic’s Structural Break

The split closely resembles the OpenAI–Anthropic divide, where former OpenAI leaders left to form a new independent AI company after disagreements over governance and strategic direction. In both cases, the founding engineers and technical leadership exited the original organization and launched a parallel development effort aligned with their original mission.

Importantly, the Zcash blockchain itself has not forked. Blocks continue to process normally, and the ZEC asset remains unchanged.

However, development leadership and technical direction now exist outside the original corporate structure.

This distinction highlights a growing pattern in decentralized ecosystems, where developer continuity can matter more than institutional ownership.

In practice, the engineers who build and maintain protocol infrastructure often shape its long-term trajectory.

Crypto World

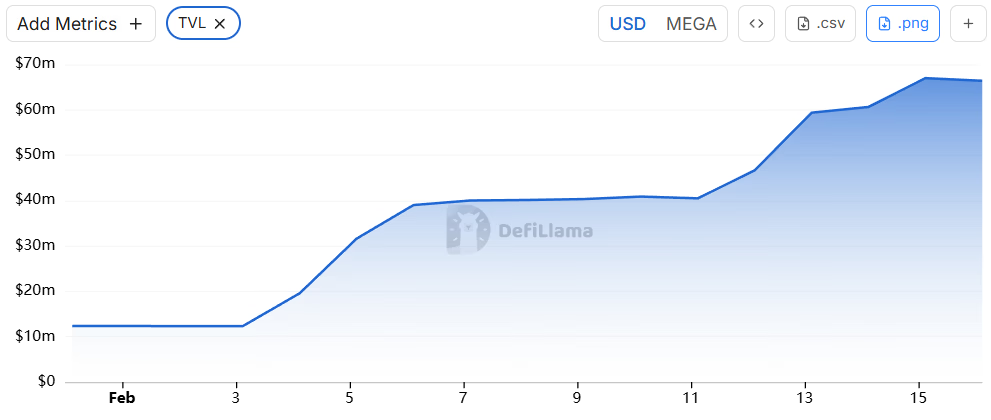

MegaETH TVL Rises 65% in a Week, but TGE Conditions Remain Unmet

A week after the much-anticipated L2’s mainnet launch, the network is showing early liquidity gains, but traction is still below its KPIs for the MEGA token launch.

Ethereum Layer 2 MegaETH’s mainnet, which launched on Feb. 9 following a high‑profile stress test ahead of its debut, has seen total value locked climb to roughly $66.48 million as of today, Feb. 16. The total value on MegaETH represents a roughly 65% increase compared with TVL at the immediate post‑launch period, where it was around $40.3 million, data from DefiLlama shows.

Stablecoins account for the bulk of on‑chain balances, with the chain’s $99.2 million stablecoin market cap up 56% over the past week, while bridged asset TVL are about $122 million.

Decentralized crypto exchange Kumbaya is the largest app on MegaETH by value locked by a wide margin, with roughly $51 million in TVL, dwarfing other early entrants as users have parked capital in its liquidity pools since launch.

Behind Kumbaya, yield‑oriented vault Avon MegaVault, unified DEX World Markets and multi-chain lending protocol Aave collectively hold about $19 million in TVL as of press time.

Token Launch KPIs Lag

As The Defiant previously reported, MegaETH told supporters that its token generation (TGE) event for MEGA is explicitly tied to the network achieving one of three on‑chain key performance indicators after mainnet launch:

- A $500 million circulating supply of the network’s stablecoin, MegaUSD (USDM)

- At least ten “Mega Mafia” apps — the network’s first live and verified dApps — meeting usage thresholds of more than 100,000 transactions across at least 25,000 wallets

- At least three dApps generating $50,000 in daily fees for a month.

As of press time, none of the above conditions have been met, according to MegaETH’s own dashboard that tracks the network’s progress toward TGE. The “Live Mafia Apps” counter shows 5 of the required 10 apps have deployed and are live with verified contracts.

Meanwhile, USDM’s stablecoin circulation metric also sits at just about 10% of the $500 million target, with roughly 13% of that circulating supply deposited into verified smart contracts.

On the revenue front, none of the deployed dApps have hit the critical $50,000 daily fee threshold. According to the dashboard, both Kumbaya is generating $19,000 in daily fees, Cap has $13,000 in daily fees, and Avon hasn’t registered meaningful fee volume.

So, while L2’s infrastructure shows early traction with capital flows and app deployment, the core adoption milestones tied to TGE remain out of reach, at least for now.

MegaETH’s public token sale took place on Sonar in late October and was 20x oversubscribed, seeing over $1 billion in deposits competing for an allocation of the future MEGA token.

Crypto World

Bitcoin Whales Accumulate as BTC Price Revisits 2024 Entry Zone

Bitcoin has revisited its 2024 whale entry zone as large holders keep buying even as prices keep on falling.

Bitcoin (BTC) has slipped back to price levels last seen in October 2024, the exact moment when whales began their most recent accumulation phase.

On-chain data now shows these large holders are continuing to buy, not exit, suggesting the current downturn may be viewed as a re-entry opportunity rather than a reason to flee.

Whales Accumulate as Retail Fears Grow

According to pseudonymous market watcher CW8900, there has been a steady accumulation among large BTC and Ethereum (ETH) holders. They wrote that Bitcoin’s current price matches the zone where whales started buying in October 2024, and they claim accumulation has increased rather than slowed.

“Despite the decline in $BTC, accumulation continues. In fact, it’s increasing,” CW8900 said.

In a separate post, the analyst noted that Ethereum whales now hold positions at losses comparable to earlier cycle lows, which they described as a pattern seen near bottoms.

The expert wrote regarding the giant ETH holders,

“Their target is the upcoming rally. They are still accumulating massive amounts in preparation for a bull market.”

Market data supports the context behind those claims, with numbers from CoinGecko showing BTC changing hands near $69,000 after moving between $68,000 and $71,000 in the past day. The asset is down about 2% this week, 10% over two weeks, and nearly 28% in a month.

On its part, ETH is showing deeper losses. At the time of writing, the token was trading at just under $2,000 after falling about 40% in a month and 13% in two weeks.

You may also like:

Despite the prevailing conditions, Fundstrat’s Tom Lee believes ETH will rebound fully. He pointed to eight separate drawdowns exceeding 50% that the world’s second-largest cryptocurrency has faced since 2018, including a 64% drop earlier last year. In every case, the asset formed a V-shaped bottom and recovered completely.

However, not all large positions have survived. Trend Research, once Asia’s largest ETH long, closed its final position last week after accumulating $2.1 billion in leveraged longs. According to Arkham, the exit resulted in an $869 million realized loss and came even after founder Jack Yi had predicted ETH would reach $10,000 just days before.

Diverging Signals

Not all indicators are leaning bullish, as revealed by analyst Wise Crypto, who said Bitcoin’s recent 9% rebound between February 12 and February 15 may be a trap. The market technician pointed to hidden bearish divergence on 12-hour charts and a 90% surge in NUPL, which indicated a higher sell risk, with key support levels sitting at $65,000 to $66,000, and $60,000 as the major psychological floor.

To add context to that caution, a recent poll run by chartist Ali Martinez found that only 22.7% of respondents believed $60,000 was the cycle low, while the largest share expected prices to fall toward $38,000.

Interestingly, market intelligence provider Santiment has noted that BTC typically moves opposite crowd expectations, suggesting a potential rally if fear continues to dominate sentiment.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Walmart Stock Surges 20% in 2026: Should Investors Buy Ahead of Earnings?

TLDR

- Walmart stock has gained 20.18% in 2026, outperforming the S&P 500 and Dow Jones indices.

- Walmart became the first retailer to reach a $1 trillion market capitalization.

- Analysts have a ‘Strong Buy’ rating for Walmart stock, but price targets suggest limited growth.

- Walmart stock is expected to retrace slightly, with a 12-month target price of $133.04.

- The company has exceeded earnings per share forecasts in three of the last four quarters.

Walmart (NYSE: WMT), one of the top-performing blue-chip stocks of 2026, is set to release its next quarterly earnings report on February 19. Investors are closely monitoring whether Walmart stock remains a solid buy ahead of the event. The retail giant has recently achieved impressive growth, making it a standout in a challenging market.

Walmart Stock Recent Performance

Walmart stock has surged 20.18% in 2026, outpacing both the S&P 500 and Dow Jones indices. In contrast, the broader market has struggled, with the S&P 500 declining by 0.33% and the Dow Jones rising by just 2.31%. This strong performance is raising questions about whether the stock can continue to climb or if a pullback is imminent.

The retailer’s market capitalization recently crossed $1 trillion, making it the first retailer to reach this milestone. Despite its success, there are concerns about the stock’s high valuation, especially ahead of its upcoming earnings report. A slight miss in earnings could trigger a correction, similar to what occurred with Microsoft’s stock after its latest report.

Wall Street remains largely positive on Walmart stock, with an average rating of ‘Strong Buy.’ However, analysts’ 12-month price targets suggest that the stock may see only modest growth. Walmart stock is expected to retrace 0.63%, with a target price of $133.04 in the next year.

Several analysts have raised concerns about potential pullbacks despite the positive outlook. Bernstein’s Zhihan Ma recently maintained a ‘Buy’ rating but forecasted a drop to $129. Similarly, Citi’s most bullish forecast of $147 suggests just a 9.79% increase from current levels. These predictions indicate that even optimistic estimates expect limited upside for the stock in the near term.

The Outlook for Walmart’s Earnings Report

Ahead of its earnings report, Walmart’s strong performance in recent quarters offers some reassurance. The company has exceeded earnings per share (EPS) forecasts in three of the last four quarters, increasing the likelihood of another beat. Walmart’s diversified business model, which includes e-commerce and technology, positions it well in both favorable and unfavorable economic conditions.

Even if the economy faces a downturn, Walmart’s reputation for offering ‘great value’ prices could drive continued consumer demand. This defensive nature of Walmart’s business model has contributed to its strong performance, making it a relatively safe investment in uncertain times.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat7 days ago

NewsBeat7 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video3 hours ago

Video3 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports7 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat1 day ago

NewsBeat1 day agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat1 day ago

NewsBeat1 day agoMan dies after entering floodwater during police pursuit

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery