Crypto World

How Does Antier Help You Launch an A-Z White Label Crypto Wallet For Georgia?

Secure rails create sovereign value. For institutional investors sizing a white label crypto wallet for Georgia, the opportunity is not speculative theatre; it is infrastructure finance with measurable macro leverage. Georgia received roughly $3.1–3.5 billion in personal transfers and workers’ remittances in 2023, a material capital inflow that underwrites a clear payments use case for cheaper, programmable settlement. At the same time, Eastern Europe has emerged as one of the world’s most crypto-active regions on-chain, signaling strong product-market fit for wallet-led rails and DeFi-enabled services. Georgia’s National Bank has published a fintech strategy that privileges sandboxing, open APIs, and compliance-first innovation, creating a permissive regulatory runway for an enterprise-grade wallet that pairs MPC custody, HSM-backed keys, deterministic settlement, and embedded AML orchestration.

“Build the rails, capture the flow” This white paper begins with that premise and maps the technical blueprint investors should demand.

Why Is A Crypto Wallet A Strategic Tool for Georgia?

1. Financial resilience:a trusted onshore wallet provides a domestic rail that reduces reliance on correspondent banking and mitigates payment friction.

2. Remittance optimization: a purpose-built cryptocurrency wallet solution can reduce costs and settlement times for inward remittances, increasing net receipts to households and SMEs.

3. Tourism and commerce enablement:integrated stablecoin or multi-asset support lets merchants accept near-instant digital payments while avoiding FX and settlement delays.

4. Onshore compliance and transparency:a wallet operated under local licensure aligns customer protection, AML/CFT, and tax transparency with Georgian policy objectives.

5. Platform for programmable public goods: wallet-level APIs enable government and private sector pilots (digital identity, programmable social benefits, payroll rails) that require secure custody and traceability.

Where Does Georgia Stand Today on Web3?

Georgia is emerging as an active regional fintech hub, with rapid growth in its fintech community and constructive policy documents that explicitly recognize blockchain as infrastructure. The National Bank of Georgia has published supervisory and fintech strategy materials that prioritize innovation, regulatory alignment with international standards, and supervisory modernization. These documents indicate a government approach that favors measured integration of crypto into regulated financial plumbing rather than blanket prohibition.

Data-driven adoption signals show outsized crypto activity in several Eastern European countries, and independent industry studies repeatedly cite the region for elevated on-chain activity relative to population size. Practical evidence on the ground includes local fintech adoption, startup acceleration in Tbilisi, and merchant pilots accepting digital assets. At the macro level, remittances remain a meaningful part of Georgia’s foreign receipts, creating a clear use case for cheaper, faster rails.

Key takeaway for investors: The institutional environment is shifting from ambiguous to operational. Regulators are engaging, the fintech ecosystem is growing, and real-world commercial pilots are in motion. This makes a compliance-first, technically robust white label blockchain wallet app an investable infrastructure play rather than a speculative product.

Top Pain Points for Georgia Without a Trusted Web3 Crypto Wallet

1. Fragmented rails. Citizens and businesses juggle multiple foreign exchanges and offshore intermediaries, adding cost and settlement latency.

2. High remittance friction.Traditional remittances are relatively slow and expensive compared with blockchain-native settlement options, reducing household and SME liquidity.

3. Limited merchant integration.Local merchants lack a secure, standards-compliant way to accept and settle crypto receipts in local currency.

4. Regulatory uncertainty for service providers. Without a clear onshore VASP framework, market entrants face licensure risk, AML gaps, and enforcement ambiguity.

5. Custody and security exposure.Non-custodial and offshore solutions often shift operational and legal risk onto end users and local businesses.

6. Interoperability gaps between public sector services. (payments, benefits) and private fintech solutions.

However, these problems have a core solution, i.e, a customized mobile crypto wallet solution designed and deployed keeping the Georgia market challenges in mind.

How Does a White-Label Crypto Wallet Solve These Challenges?

- Licensed onshore hosting and KYC/KYB. White label cryptocurrency wallets can be deployed under local VASP regimes, bringing market access and regulatory predictability.

- Integrated remittance corridors. Native support for stablecoins and custody of fiat bridges reduces fee leakage and settlement time for cross-border receipts.

- Merchant SDKs and POS integrations. Turnkey merchant acceptance (web, POS, QR) converts tourist and retail flows into measurable, auditable revenue streams.

- Modular compliance stack. Built-in AML transaction monitoring, sanctions screening, and auditable audit trails make the product investable from day one.

- Custody options that match risk appetite: multi-party computation (MPC), hardware security modules (HSM), and optional self-custody flows give institutional-grade security and liquidity.

- Interoperability and APIs. Wallets that expose secure APIs allow government and enterprise integrations for payroll, benefits, and tax collection pilots.

What Should a White Label Crypto Wallet Designed for Georgia Look Like?

“Trust is not added to a wallet later. It is engineered into every line of code from the beginning.“

Every serious investor approaches infrastructure with a mental blueprint, not a blank canvas. When evaluating a Web3 crypto wallet development solution, the real question is not whether it works, but whether it is engineered to endure scale, scrutiny, and regulation. The most successful wallets are not built as products; they are built as financial infrastructure.

a) Security and Custody

- Cold wallet architecture with automated secure signing queues for large-value movements.

- Enterprise MPC-based key management, HSM-backed root keys, and threshold signing for operational resilience.

b) Compliance and Legal Readiness

- Native support for robust KYC/KYB flows, ongoing transaction monitoring, automated SAR/STR workflows, and sanctions lists.

- Audit logging and immutable reporting endpoints for regulator requests.

c) Payments and Settlement

- Multi-asset rails: native support for major stablecoins, Bitcoin, Ether, and fiat on/off ramps via licensed local liquidity partners.

- Merchant SDKs for web, native, and POS, and automatic settlement to local currency to minimize merchant FX risk.

d) Product and UX

- Tiered wallet models: basic consumer, custodial business, and institutional custody with separate controls and SLAs.

- Intuitive UX with explicit risk prompts, insurance disclosures, and one-tap merchant payment flows to drive adoption.

e) Integrations and Extensibility

- REST and gRPC APIs, Webhooks, and an SDK library for easy integration with banks, exchanges, and government systems.

- Smart contract wallet support for programmable payments, streaming payroll, and tokenized instruments.

f) Operational Excellence

- 24/7 SOC and incident response, high-availability cloud footprint with regional fallbacks, and DR plans.

- SLAs for uptime, settlement latency, and support response for enterprise customers.

g) Analytics and Monetization

- Real-time dashboards with AUM, flows by corridor, merchant volume, and cohort retention metrics to make the business investable.

- Built-in revenue features: interchange-style fees, settlement spreads, subscription tiers, and B2B integration fees.

Move From Concept to Launch-Ready & Customized Wallet Faster

Recommended White Label Cryptocurrency Wallet Design Choices

- Hybrid custody model: non-custodial options for privacy-conscious users + custodial (tiered KYC) accounts for public programs.

- Multi-asset (fiat + stablecoins + local CBDC readiness): support fast settlement and low volatility channels.

- Integrated fiat on/off ramps with regulated partners (VASPs) so users can move between GEL and crypto seamlessly.

- Verifiable credentials / eID integration: tie wallets to government digital ID to simplify KYC and service access.

- Auditable transaction logs & privacy layers: transparent where required (public programs) and private where needed (personal payments), with selective disclosure.

- Smart-contract modules for conditional disbursements (e.g., social benefits released on verified criteria).

- Low-fee micropayment support & batching to reduce on-chain costs.

- Offline/QR code transfer and agent networks for rural inclusion.

- Open APIs for third-party services (utilities, remittance providers, merchants).

To achieve this level of resilience and institutional readiness, you do not need a wish list. You need a proven, end-to-end crypto wallet service provider that translates financial controls, security primitives, and regulatory requirements into production-grade engineering. Engaging an expert development and compliance team converts technical complexity into a predictable, auditable infrastructure that earns regulatory signoff, merchant adoption, and investor confidence.

Antier’s A-Z Wallet Development Support to Launch Smartly in Georgia

There are numerous reasons why Antier is an ideal cryptocurrency wallet development company you would hire. The most important reason is that it offers end-to-end services right from the start to the end.

- End-to-end product delivery: Antier takes a turnkey approach from scoping and compliance design to engineering and post-launch operations. The offer includes product strategy, UI/UX, smart contract engineering, backend custody architecture, and API design. Antier designs the compliance layer to local licensure specifications and implements AML/KYC workflows that can be adapted as regulation evolves.

-

Regulatory liaison and legal scaffolding:Antier’s legal operations team maps local VASP requirements and prepares licensing-ready documentation, AML policies, and technical controls that regulators expect. This removes friction and accelerates time-to-market for an onshore operation.

-

Security and operations:Antier implements MPC custody, HSM integrations, and layered monitoring. Post-launch, Antier offers 24/7 SOC, SRE-led uptime guarantees, and incident playbooks so investors do not inherit operational gaps.

-

Commercialization and integrations:Antier provides merchant SDKs, POS integrations, and stablecoin corridor negotiations so the wallet starts with revenue-generating flows. Antier can also support pilot programs for remittances, tourism payments, and enterprise payroll to demonstrate traction rapidly.

-

Investor-friendly deliverables:A clear product roadmap, investor dashboards with KPIs, compliance attestations, and a tested incident response process make the wallet a defensible infrastructure asset for institutional portfolios.

Hire To Achieve a Production-Ready Wallet Today!

For serious investors, white label cryptocurrency wallet development in Georgia is a capital-efficient infrastructure play that aligns with national fintech priorities, remittance economics, and merchant modernization. The market signals are clear: regulators are preparing frameworks that reward compliance-first entrants, the fintech ecosystem is capable of driving adoption, and on-the-ground commercial pilots prove the product-market fit. The right technical architecture, combined with a proven compliance and operations partner, turns regulatory and operational risk into a sustainable moat.

Connect with our team today. Being one of the leading blockchain wallet development companies, we bring the legal expertise, technical depth, and operational discipline necessary to deploy an enterprise-grade wallet in Georgia. We design custody that institutional investors accept, compliance that local regulators approve, and product features that drive merchant and consumer adoption. If you are evaluating infrastructure plays in Web3, a licensed, secure, and commercially integrated Web3 wallet built to these specifications should be at the top of your diligence pipeline. m

Frequently Asked Questions

01. Why is a crypto wallet considered a strategic tool for Georgia?

A crypto wallet enhances financial resilience, optimizes remittances, enables tourism and commerce, ensures onshore compliance, and serves as a platform for programmable public goods.

02. How does Georgia’s fintech strategy support the development of crypto wallets?

Georgia’s fintech strategy promotes sandboxing, open APIs, and compliance-first innovation, creating a favorable regulatory environment for enterprise-grade crypto wallets.

03. What is the significance of Georgia’s position in the Web3 landscape?

Georgia is emerging as a regional fintech hub with a growing community and supportive policies that recognize blockchain as essential infrastructure, fostering innovation and regulatory alignment.

Crypto World

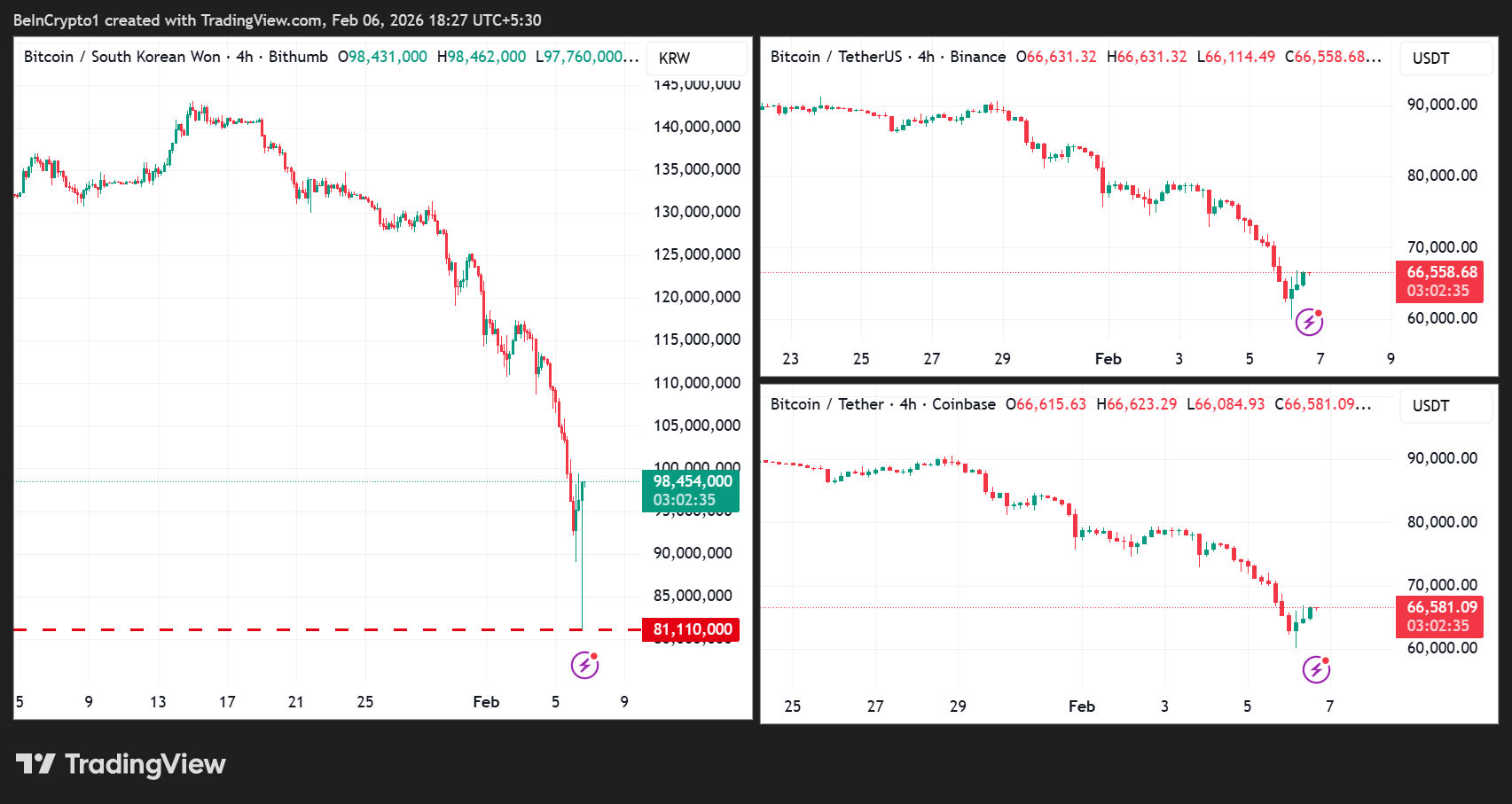

2000 Bitcoin Airdrop? Bithumb Addresses Incident

South Korean cryptocurrency exchange Bithumb has officially confirmed that an operational error led to an abnormal Bitcoin payout during a promotional event.

The incident triggered a brief but sharp price dislocation on the platform before markets stabilized within minutes.

Sponsored

Sponsored

Bithumb Confirms Accidental Bitcoin Payout

In a statement, Bithumb apologized to users, acknowledging that “an abnormal amount of Bitcoin was paid to some customers” during the event, which caused temporary volatility as recipients sold the assets.

“The Bitcoin price temporarily fluctuated sharply as some accounts that received the Bitcoin sold it,” the exchange said.

According to Bithumb, its internal monitoring systems quickly detected the abnormal transactions. The platform responded by restricting trading activity on the affected accounts, which helped contain the disruption.

“As a result, the market price returned to normal levels within 5 minutes, and the domino liquidation prevention system functioned normally, preventing chain liquidations due to the abnormal Bitcoin price,” the company stated.

The clarification comes after Bitcoin briefly traded significantly below global market rates on Bithumb, fueling speculation about the cause of the sudden price drop.

Bithumb emphasized that the incident was not the result of a cyberattack or security breach.

Sponsored

Sponsored

“We want to make it clear that this incident is unrelated to any external hacking or security breach, and does not pose any issues with system security or customer asset management,” the exchange said.

Impact on Bithumb Customer Funds

The company also reassured users that customer funds remain safe and that core services are operating normally.

“Customer assets are being safely managed as before, and transactions and deposits/withdrawals are currently operating normally,” the statement added.

Importantly, Bithumb indicated that no customers suffered losses as a result of the incident, noting that it is continuing to review the situation and will disclose further details as necessary.

“It is understood that this incident did not result in any loss or damage to customer assets. We will share all follow-up actions transparently and take full responsibility to ensure that not a single customer is harmed,” the exchange said.

The episode highlights how operational errors, even when quickly resolved, can trigger sharp short-term price distortions in crypto markets, particularly on individual exchanges where liquidity conditions differ from global averages.

Bithumb concluded its statement with another apology, saying it would strengthen safeguards and continue working to provide a stable trading environment.

“Once again, we deeply apologize for any inconvenience caused. We will continue to do our best to provide a stable and trustworthy trading environment.”

Crypto World

Bitcoin’s brutal crash just became a nightmare for the plan to put crypto in Americans’ retirement

Bitcoin’s 50% plunge from its October peak has done more than just erase $2 trillion in market value — it has reignited a fierce debate over the fiduciary math of the American retirement system.

As investors scramble to parse the drivers of the latest crash, industry observers are asking if volatile digital assets have any business being in a $12.5 trillion 401(k) market designed for stability.

“If investors want to speculate on crypto, they are welcome to do so on their own. 401ks exist to help people save for a secure retirement, not gamble on speculative assets with no intrinsic value,” said Lee Reiners, a lecturing fellow at the Duke Financial Economics Center and a co-host of the Coffee & Crypto podcast.

U.S. President Donald Trump issued an executive order in August that allowed 401(k) and other defined-contribution retirement plans access to alternative assets, including digital assets. Even Securities and Exchange Commission (SEC) chair Paul Atkins said last week, just on the eve of the latest brutal crypto selloff, that “the time is right” to open up the retirement market to crypto.

But the recent rout in crypto might just turn retirement fund managers away from plans to add crypto to 401(k)s.

Reiners said that several large crypto companies, such as Coinbase (COIN), are already included in major equity indices, which means many 401(k) plans already have indirect exposure to crypto, and that should be enough.

“Unless Congress changes the law, plan sponsors are unlikely to include crypto, or ETFs, as plan options because they don’t want to be sued by their employees. For any employers that were considering it, I’m sure recent events have them reconsidering,” Reiners said.

The problem with putting people’s life savings into crypto is that the industry is relatively young and extremely volatile, and pension funds are for stable growth.

Buying and holding can work for assets like the S&P 500, which sees large volatility mostly during Black Swan events, such as the 2008 financial crisis or COVID-19 uncertainties. However, given the size of traditional markets, the government often steps in to stop the bleeding, and numerous regulatory frameworks exist to protect people’s investments.

But for crypto, much of its activity is just speculation, and that means prices can see extreme swings over a weekend or a week, which can quickly decimate billions in value with no regulatory oversight over market moves. This makes it even more nerve-wracking for investors to put their life savings into it.

Didn’t ‘get out quickly’

To put the uncertainty in perspective, many firms were likely blindsided by the sudden crash in bitcoin and crypto over the last few days.

In fact, the recent brutal selloff was so violent and sudden that BlockTrust IRA, an AI-powered retirement platform that has added $70 million in IRA funds in the past 12 months, was caught in the bloodbath.

“Sometimes we look at things that we say, ‘you know what, we should get out,’ and sometimes we don’t. And last week, we did not get out as quickly because a lot of the underlying fundamental data we’re looking at is still very strong,” Chief Technical Officer Maximilian Pace said in an interview with CoinDesk.

However, concerning the sudden selloff, Pace pointed to the firm’s “broad sense of analytics,” which operates effectively over longer timelines than short-term trading. That strategy helped it outperform in 2025, and the firm added that it is “not necessarily wavered by volatility.” The AI trading firm’s Animus Fund outperformed bitcoin throughout 2025 and was up 27% from January to December 2025, while the bitcoin buy-and-hold strategy was down 6% to 13% over the same period, the firm said in a press release.

In Pace’s view, zooming out and considering crypto investments over a five- to 10-year time horizon is the right way to think about 401(k) plans.

“You would be better thinking like a venture capitalist rather than like a day trader,” Pace said. “There are ways of de-risking the investment, either from a time perspective or from a strategy perspective, that make it more attractive or more acceptable for things like 401(k) programs. But like anything, there’s risk.”

The future of pensions

Perhaps there’s a need to zoom out further and think about the actual blockchain technology for retirement investment management than just putting money into tokens.

Robert Crossley, Franklin Templeton’s global head of industry and digital advisory services, is thinking exactly that. The retirement industry, which he says is siloed, slow-moving and over-regulated, could be revolutionized by onchain wallets that hold tokenized assets.

And by doing so, an individual’s digital wealth will be much more aligned with the rest of their lives, Crossley said.

“Whether you are a saver, an investor, a spender, you have all of these different financial activities which are currently serviced very differently by different providers in your life,” Crossley said in an interview.

If regulations come into play that don’t prohibit innovations, it is very likely that blockchain technology can eliminate such fragmentation of intermediaries. It’s possible that industry could see a supply of wallets that “unlock the possibility of programmable assets and securities and the ability to see all of your assets in one place and control them directly, rather than being intermediated,” he said.

“When something becomes tokenized, it becomes software. That software can be an asset, but it also could be a benefit, it also could be a liability. It could be a whole 401(k). It could be your whole DC [defined contribution] plan,” Crossley said.

Crypto World

Turn $100 Into $300 Now With Remittix – Project Rewards Presale Buyers With 300% Bonus

Investors searching for the best crypto to buy now are increasingly focusing on projects that provide real infrastructure alongside structured early participation incentives. Among these projects, Remittix is gaining popularity with its PayFi payment framework and its 300% allocation incentive that is limited.

As discussions regarding cryptocurrency with actual use continue to grow, Remittix is included in discussions regarding the use of blockchain technology for payments and actual use of cryptocurrency.

Market participants are not only evaluating future price movement potential but also looking at how early allocation incentives can influence entry positioning. With the Remittix ecosystem progressing through product launches and rollout milestones, attention is shifting toward participation timing as access windows narrow across the platform.

Allocation Windows Tighten As Bonus Multiplier Drives Demand

Remittix is valued at $0.123 per RTX token, making it a part of the search discussions on the top crypto under $1. Remittix has managed to raise over $29 million from private funding, which is a clear indication of the demand for the blockchain infrastructure focused on payments.

Over 703 million tokens out of the 750 million available have already been secured. This is a clear indication that over 93% of the total allocation is no longer available. Participation activity has accelerated as availability continues to shrink across the ecosystem.

A major factor behind this surge is the 300% bonus available via email, allowing participants to receive up to three times more RTX tokens compared to their initial allocation. This incentive is widely viewed as one of the strongest allocation multipliers currently available among early stage crypto investment opportunities.

Infrastructure Launch Timeline Strengthens Real Utility Narrative

Remittix is widely recognized as a Remittix DeFi project focused on solving cross-border payment inefficiencies. The ecosystem is entering a critical rollout phase, supported by the Remittix Wallet already live on Apple devices while Android deployment continues toward release.

The broader PayFi platform is scheduled to go live on the 9th February 2026, marking the first full release of the crypto-to-fiat infrastructure. The platform aims to allow users to send digital assets directly into traditional bank accounts, addressing one of blockchain’s largest real-world adoption challenges.

Users can track ecosystem progress and allocation access directly through the Remittix platform homepage, where dashboard tools allow allocation monitoring and reward tracking.

As the platform rollout approaches, participation timing is becoming a major focus. Investors tracking how to buy crypto early are positioning themselves before broader payment infrastructure deployment expands user access.

Security Verification And Exchange Expansion Build Market Confidence

Remittix recently achieved a major credibility milestone after receiving full verification from CertiK. The project is also ranked as the #1 pre-launch token on CertiK, strengthening investor confidence and highlighting platform transparency.

The full security verification details can be reviewed through CertiK’s Remittix audit listing, which confirms project security standards and infrastructure validation.

The project has also revealed upcoming centralized exchange partnerships with BitMart and LBank. These future listings are expected to expand liquidity, increase accessibility and improve global exposure for RTX holders once trading access opens.

Allocation tracking, bonus activation and participation tools remain available through the Remittix dashboard portal, where referral rewards and allocation monitoring are currently active.

Core Factors Supporting Remittix Ecosystem Growth:

- Crypto-to-bank transfers designed for global payment efficiency

- Wallet infrastructure already deployed and expanding

- CertiK verification reinforcing platform security

- Global PayFi rollout targeting cross-border finance

- Referral rewards offering 15% USDT returns for ecosystem growth

Referral Rewards Expand Community-Driven Adoption

Remittix recently introduced a referral program allowing participants to receive 15% of new allocations in USDT, claimable every 24 hours through the dashboard. The program is helping accelerate ecosystem expansion while rewarding early network contributors.

The referral structure is designed to increase liquidity growth and broaden global participation. Many community members are using referral participation as an additional allocation strategy while supporting project expansion across new regions.

Final Allocation Phase Before PayFi Infrastructure Goes Live

Remittix is entering one of the most time-sensitive phases of its rollout as the PayFi platform launch approaches. With security verification completed, exchange partnerships revealed and wallet infrastructure already deployed, the ecosystem is transitioning toward full payment network deployment.

With over 93% of token allocation already secured, remaining access is narrowing rapidly. The 300% email allocation multiplier continues to drive strong participation as investors race to secure remaining availability.

As infrastructure rollout accelerates, the final allocation phase is expected to close quickly, marking one of the last opportunities to secure expanded RTX participation before broader ecosystem activation begins.

Discover the future of PayFi with Remittix by checking out their project here:

Website: remittix.io

Socials: https://linktr.ee/remittix

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

XRP Sees Impressive Recovery Wick With Massive 37% Price Surge: Here’s Why

Ripple’s token has also surpassed BNB in terms of market cap after its sublime surge.

It was just hours ago, less than a day, when we wrote about XRP’s spectacular collapse as the asset plummeted to $1.11 for the first time since before the US presidential elections at the end of 2024.

This meant that it had shed over 50% of its value in a month as it peaked at $2.40 on January 6. Oh, how the landscape in crypto can change in hours sometimes, not even days or weeks.

What happened with XRP’s price since that local low has been nothing short of amazing. There were some signs about a potential rebound, such as the plummeting RSI metric, but even the most vocal XRP bulls were probably surprised by the extent of the rally.

After all, the cross-border token skyrocketed by 37% in about 18 hours – going from the aforementioned low to $1.54 before it faced some resistance and now trades around $1.50. This still represents a 34% surge in less than a day.

Santiment also weighed in on the token’s performance. The analysts acknowledged XRP’s rise in terms of market cap as well, as it now sits above BNB as the fourth-largest crypto asset.

They blamed the massive price pump in the past several hours on the overall network stability and growing activity on the XRP Ledger. Moreover, they showcased a chart indicating that Ripple whales went on an accumulation spree, with almost 1,400 separate $100K+ whale transactions (the highest in four months).

📈 Crypto markets are rebounding, but $XRP‘s price has been on a particularly huge tear. Since bottoming out below $1.15 just under 18 hours ago, the #4 market cap has now recovered to back above $1.50.

😱 Panic sellers should have stopped to notice the massive activity on the… pic.twitter.com/3y0eyGxpo2

— Santiment (@santimentfeed) February 6, 2026

You may also like:

The ETF behavior will also be interesting to compare, but we would need to verify the data at the end of the trading day in the US. Preliminary data on SoSoValue shows a minor net inflow even for yesterday, but there’s no official confirmation as of yet, which is rather surprising.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

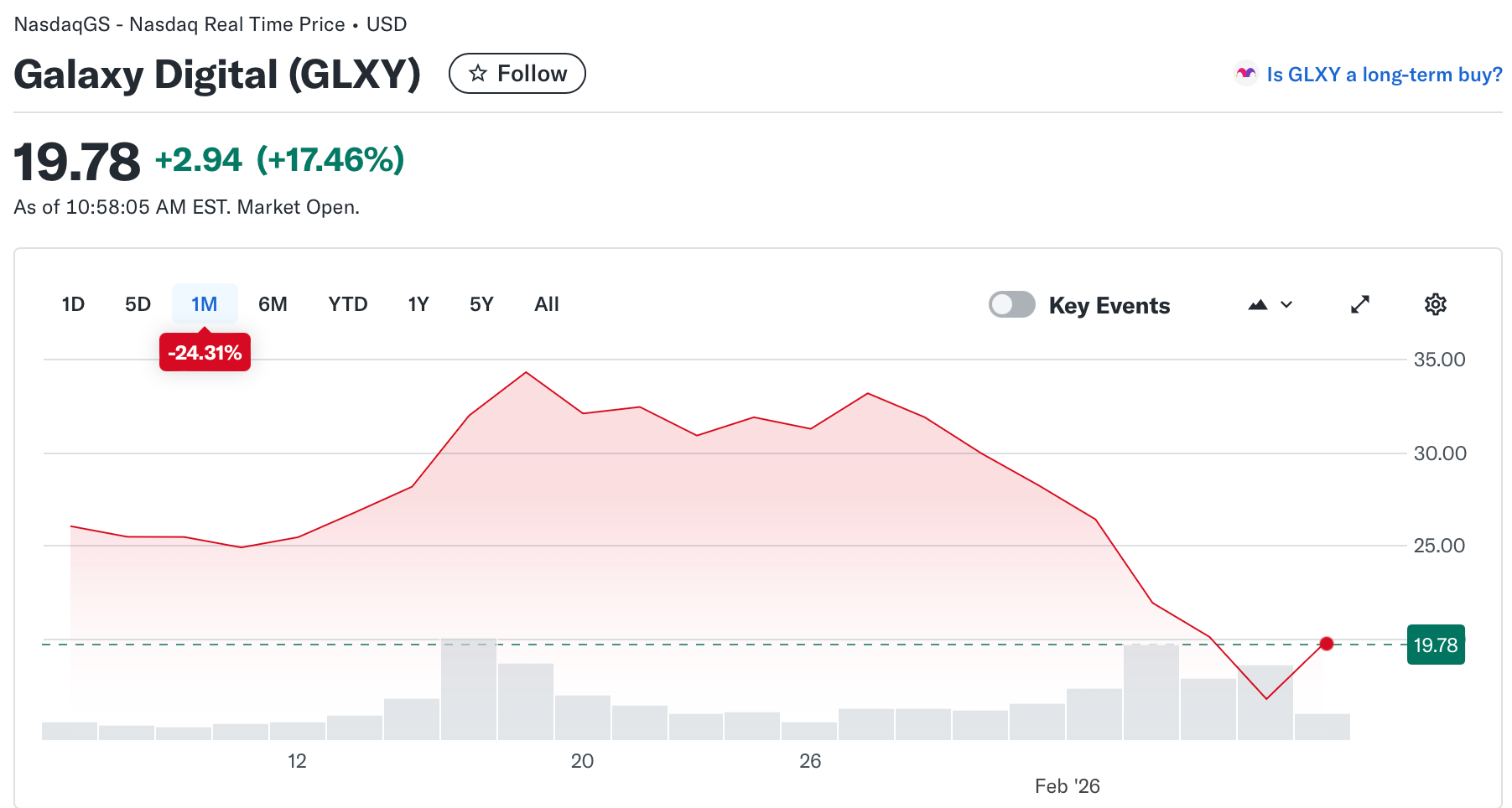

Galaxy Authorizes $200M Share Buyback Amid Crypto Market Downturn

Galaxy Digital Inc. (Nasdaq: GLXY) has authorized a share repurchase program of up to $200 million, allowing the company to buy back its Class A common stock over the next 12 months.

According to a company announcement, the repurchases may be conducted on the open market or through privately negotiated transactions, including under Rule 10b5-1 trading plans, and remain subject to applicable securities laws and exchange rules. The program does not obligate Galaxy to repurchase any shares and may be suspended or discontinued at any time.

The buyback program has a term of 12 months and, if conducted on the Toronto Stock Exchange, remains subject to regulatory approval under a normal course issuer bid. Purchases made on Nasdaq would be capped at 5% of Galaxy’s outstanding shares at the start of the program, according to the announcement.

Galaxy is listed on the Nasdaq and the Toronto Stock Exchange and operates across digital asset trading, asset management, staking, custody and data center infrastructure. The company did not disclose how much of the $200 million authorization it expects to use, or when repurchases might begin.

Mike Novogratz, founder and CEO of Galaxy, said the company is “entering 2026 from a position of strength,” adding that its balance sheet and ongoing investments give it flexibility to return capital when management believes the stock is undervalued.

The news comes three days after Galaxy reported a net loss of $482 million for the fourth quarter of 2025 and a $241 million loss for the full year, citing lower digital asset prices and about $160 million in one-time costs.

At the time of writing, shares of Galaxy were up about 17% over 24 hours, but remained down about 25% for the month, according to Yahoo Finance.

Related: Optimism passes buyback proposal to bolster OP token

Market downturn impacts crypto stocks

Galaxy’s recent share-price decline reflects a broader pullback across crypto-related equities, as Bitcoin has fallen over the past month from January highs above $97,000 to to a low of about $60,300 on Thursday.

Shares of Coinbase Global (COIN) were down about 36% over the past month, while Circle Internet Group (CRCL) fell about 34% over the same period and about 65% over six months.

Strategy (MSTR), the largest public holder of Bitcoin with 713,502 BTC on its balance sheet, has fallen about 20% over the past month and nearly 68% over six months. Cointelegraph reported Thursday that the company posted a $12.4 billion net loss in the fourth quarter of 2025.

Bitcoin mining stocks have also declined, with MARA Holdings (MARA) down about 27% over the past month and about 52% over the past six months, while IREN Limited (IREN) is down about 8% on the month.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

Samson Mow Breaks Down Bitcoin Market Crash

In a video interview, Samson Mow shares his views on Bitcoin’s latest bloodbath, quantum fears and the catalysts that could drive Bitcoin’s next recovery.

In an exclusive Cointelegraph interview, Bitcoin OG Samson Mow shares his perspective on Bitcoin’s latest massive crash, what’s driving the sell-offs and why a rebound could be closer than most expect.

We discuss gold and silver’s rally, forced liquidations, the “quantum threat” to crypto, and examine the long-term Bitcoin thesis: Is Bitcoin truly designed to rise in price due to fiat devaluation, or is that a flawed narrative?

After months of relentless selling pressure, sharp liquidations and growing bearish sentiment, many investors are asking the same question: Why does Bitcoin keep falling despite strong fundamentals, and when could it finally recover?

According to Mow, Bitcoin’s unique role as the most liquid asset in global markets, combined with its 24/7 tradability, makes it particularly sensitive to downside shocks that more traditional assets often avoid, at least in the short term.

The discussion also explores one of the most important dynamics in today’s market: the relationship between gold, silver and Bitcoin. After a powerful rally in precious metals, Mow lays out the case for why capital rotation from other hard assets may be setting the stage for Bitcoin’s next move.

If you’re trying to understand the nature of Bitcoin’s recent decline and what may come next, watch the full interview on our YouTube channel.

This interview has been edited and condensed for clarity.

Crypto World

Bitcoin’s Rollercoaster Ride Continues as BTC Price Recovers $10K in a Day

Bitcoin’s price jumped past $71,000 minutes ago, while XRP and other altcoins have produced massive double-digit daily gains.

What a ride it has been in the cryptocurrency space lately. The quick and sharp moves continue as of press time, as BTC has skyrocketed to over $71,000 just less than a day after it dipped to $60,000.

The altcoins are well in the green now on a daily scale, and the total crypto market cap has increased by roughly $200 billion since its low from earlier this morning.

Bitcoin’s price chart from above paints a very clear and volatile picture. It shows that the cryptocurrency plummeted by roughly $30,000 in the span of just over a week – from last Wednesday to Friday morning.

As reported earlier today, popular analysts blamed this latest crash, in which bitcoin dropped from $77,000 to $60,000 in about 24 hours, to emotional selling and structural change rather than broken fundamentals within BTC and the crypto market.

Since then, BTC has gone on a tear. It added over $10,000 since this morning’s multi-year low, and briefly surpassed $71,000 minutes ago before it was stopped and now trades inches below it.

The altcoins have produced even more impressive gains, with XRP leading the pack. Ripple’s cross-border token has soared by 19% daily to over $1.50 as of press time, while ETH has reclaimed the psychological $2,000 level.

The total value of wrecked positions daily is still over $2 billion, but most of it is from longs, which happened before today’s recovery. Nevertheless, over $350 million worth of shorts have been wrecked in the past 12 hours, with BTC responsible for the lion’s share ($261 million).

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin gets slashed in half. What’s behind the crypto’s existential crisis

Bitcoin tumbled toward $60,000 this week as investors reassessed its utility. And while there isn’t one clear catalyst driving the bloodbath, one thing is clear: the crypto market is in crisis.

“There’s nothing going on in the marketplace that should have necessitated this type of a crash,” Anthony Scaramucci, founder and managing partner of alternative investment firm SkyBridge, told CNBC. “And so I think that’s made people, frankly, more fearful. … You have to ask yourself, ‘is it over for bitcoin?’”

Bitcoin fell as low as $60,062 on Thursday, bringing it to its lowest level since Oct. 11, 2024. That’s more than 52% off from its record high of $126,000 hit in early October 2025.

The previous session marked one of bitcoin’s bloodiest ever, with the token shedding more than 15% on the day. Its daily relative strength index fell to 18, putting the asset in extremely oversold territory. As of Thursday, other digital assets like ether and solana were also down 24% and 26% for the week to date, respectively — a sign investors’ confidence in the entire crypto market is faltering.

Bitcoin bounces, but losses loom large

Bitcoin was rebounding on Friday, with the token last trading at $69,631.97, up more than 9% on the day.

But, its recent drawdown has prompted investors to re-evaluate its utility, including its role as a digital currency or as a store of value. Simultaneously, institutional appetite for the flagship crypto appears to be waning as spot bitcoin exchange-traded funds record outsized outflows, threatening to drive bitcoin deeper into the red.

“This time is markedly different from other bear markets, however, in that it’s not in response to a structural blowup,” Jasper De Maere, desk strategist at crypto market-making firm Wintermute, said in a statement shared with CNBC. “It’s a fundamentally macro-driven deleveraging tied to positioning, risk appetite and narratives rather than systemic failures within crypto itself.”

Bitcoin prices over the past year

Over the past few months, investors have grown increasingly skeptical of efforts to recast bitcoin as “digital gold,” or an alternative to traditional safe havens such as gold. Bitcoin is down 28% over the past 12 months, while gold is up 72% during the same period — a testament to the latter’s utility as a hedge against macro risks.

Conversely, bitcoin has often traded down alongside other risk-on assets such as equities amid periods of high macroeconomic and geopolitical uncertainty, raising doubts about its utility as a safe haven. Nearly a week after Trump’s “liberation day” tariff announcement on April 2, 2025, bitcoin had fallen about 10% to below $80,000, while the S&P 500 had declined roughly 4%.

Separately, investors are also reassessing the extent to which financial institutions, treasury firms and governments are willing to adopt bitcoin — a major catalyst for the token in recent years.

Large institutional outflows are mounting as investors brace for bitcoin to go lower, thinning liquidity for the token, according to a recent analyst note from Deutsche Bank.

Those outflows are also noticeable among spot bitcoin ETFs in recent months, according to the investment firm. The funds have seen outflows of more than $3 billion in January, in addition to roughly $2 billion last December and about $7 billion last November.

Additionally, a swath of Strategy copy-cats that emerged over the past year or so have slowed or paused their bitcoin purchases amid the digital asset’s correction.

Finally, traders have acknowledged that long-time efforts to market bitcoin as an alternative to fiat currencies have largely faded. While Steak ‘n Shake and Compass Coffee have rolled out support for bitcoin payments in recent years, initiatives to make the asset a form of payment have largely died, particularly as interest in dollar-pegged stablecoins grows, according to Bitwise’s Ryan Rasmussen.

“We’re seeing Wall Street adopt stablecoins because it is a fundamental transformation of the way payments work, and bitcoin is just a different asset. It’s not meant for that today,” Rasmussen said, arguing that the token’s purpose has evolved from that of a currency to a decentralized, non-governable store of value. “I’ve never paid for coffee or a sandwich with Bitcoin, and I never will.”

And beyond those more immediate concerns, investors are also increasingly worried that bitcoin’s underlying network could be hacked, driving the token to zero.

“It certainly is a risk that is seeing more attention from investors as they’re getting more worried about [it], and I think you’re seeing a little bit of that risk priced into bitcoin,” Rasmussen said.

He noted that Bitwise has allocated funds toward efforts to mitigate the threat from quantum computing.

Nevertheless, traders’ appetite for bitcoin has largely dwindled, denting its price. That’s true even as long-time believers are still proudly betting on bitcoin, despite of the charts and the naysayers.

“I believe that the story is intact,” said Scaramucci, adding that he bought bitcoin for his fund on Thursday. “But, I don’t have a crystal ball. … Who the hell knows.”

Crypto World

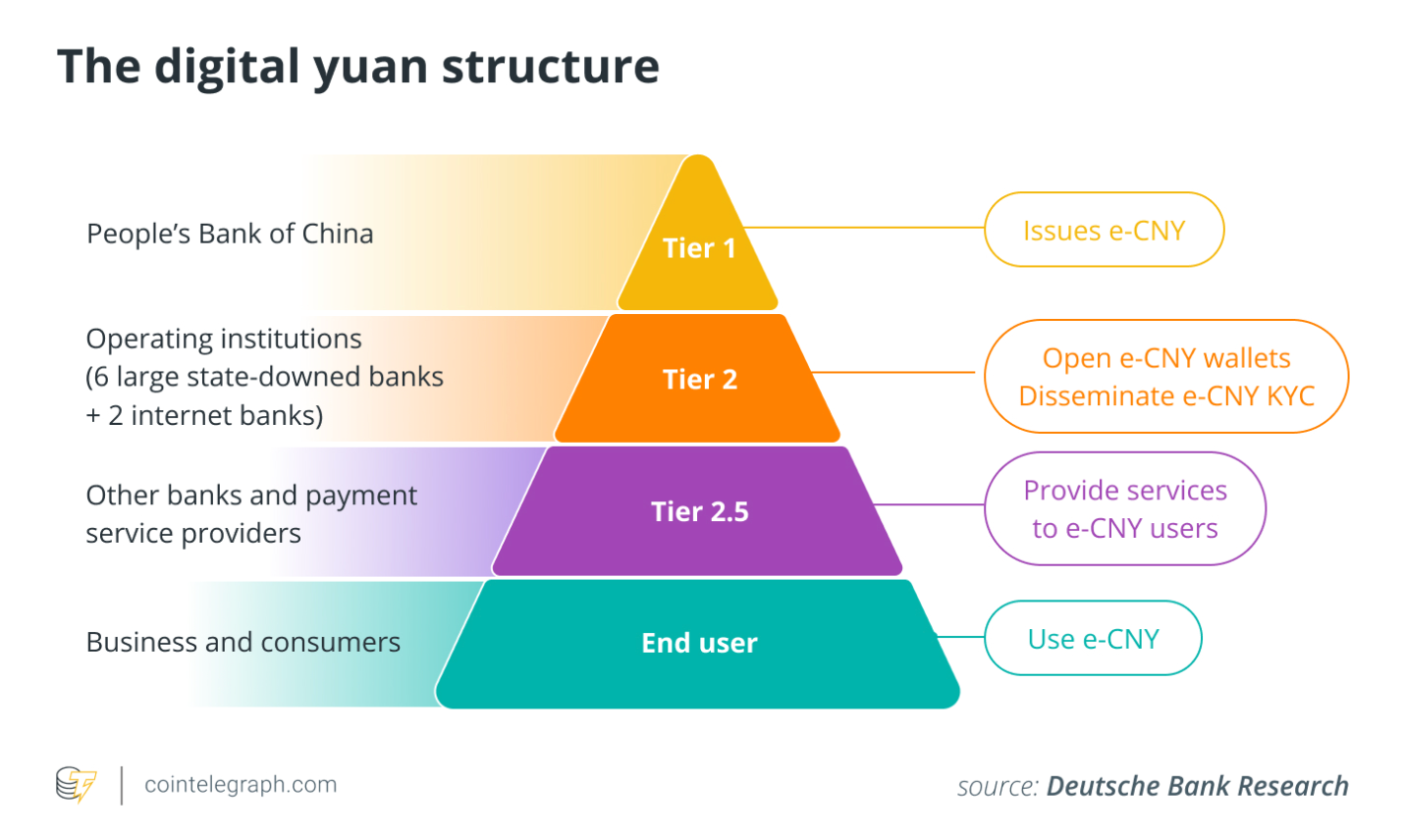

PBOC Officially Bans ‘Unapproved’ Yuan-Pegged Stablecoins

The People’s Bank of China (PBOC), the country’s central bank, and seven Chinese regulatory agencies published a joint statement on Friday banning the unapproved issuance of Renminbi-pegged stablecoins and tokenized real-world assets (RWAs).

The ban applies to both domestic and foreign stablecoin and tokenized RWA issuers, according to the statement, which was also signed by the Ministry of Industry and Information Technology and China’s Securities Regulatory Commission. A translation of the announcement said:

“Stablecoins pegged to fiat currencies perform some of the functions of fiat currencies in disguise during circulation and use. No unit or individual at home or abroad may issue RMB-linked stablecoins without the consent of relevant departments.”

Winston Ma, an adjunct professor at New York University (NYU) Law School and former Managing Director of CIC, China’s sovereign wealth fund, told Cointelegraph that the ban extends to the onshore and offshore versions of China’s Renminbi, also called the yuan.

“The Beijing crypto ban rule applies across all RMB-related markets, whether CNH or CNY,” he said. CNH is the offshore version of the Renminbi, designed to give the currency flexibility in foreign exchange markets, without sacrificing currency controls, Ma said.

“This is the latest step in a multi‑year project: Keep speculative crypto outside the formal financial system, while actively promoting the usage of e-CNY, the sovereign CBDC issued by China’s central bank,” he said.

The announcement follows the Chinese government approving commercial banks to share interest with clients holding the country’s digital yuan, a central bank digital currency (CBDC) managed by state authorities.

Related: China’s interest-bearing digital yuan piles pressure on US stablecoin rules

Chinese government briefly considered yuan-pegged stables, but focused on CBDC instead

In August 2025, reports began circulating that China’s government was considering allowing private companies to issue yuan-pegged stablecoins, a major reversal of long-standing policy.

However, the Chinese government restricted stablecoin and digital asset issuance in September of that same year, instructing stablecoin issuers to pause or halt their stablecoin trials until further notice.

In January 2026, the PBOC approved commercial banks paying interest to digital yuan wallets in a push to make the CBDC more attractive to investors.

Magazine: China officially hates stablecoins, DBS trades Bitcoin options: Asia Express

Crypto World

Ending In 24 Hours, Be Fast! Remittix Secures Top Altcoin Spot After 300% Crypto Bonus Offer

Crypto markets have this funny habit of rewarding urgency right when most people are feeling hesitant. When Bitcoin chops sideways, Ethereum news turns into ETF chatter and big-cap altcoins start moving like slow trucks instead of sports cars, traders don’t stop hunting, They just switch lanes. That’s exactly the backdrop Remittix (RTX) is taking advantage of right now.

Because while the broader market is busy arguing about “what’s next,” Remittix has been stacking the kind of signals that usually show up right before a presale breaks into the mainstream conversation: a live product, a fixed launch date, major listings lined up and a 300% bonus window that’s now in its final stretch.

Why the Market Suddenly Cares About “PayFi” Again

A few years ago, payment tokens were mostly “promises.” Now they’re turning into one of the most practical categories in crypto, because real money movement is still weirdly hard in a world full of blockchains.

Even with stablecoins everywhere, the last mile is still messy:

- cashing out without getting clipped by FX spreads

- sending money cross-border without delays

- getting paid as a freelancer without jumping through hoops

That’s the niche Remittix is leaning into with its PayFi model: Send crypto, recipient gets fiat in their bank account, with pricing shown upfront. It’s not just a whitepaper story anymore.

The Credibility Jump: Wallet Live + Launch Date Locked

This is a big reason Remittix is being treated differently from the average presale. The Remittix Wallet is already live on Apple’s App Store not “coming soon”. The PayFi platform launch is confirmed for February 9th, 2026

That mix of a working consumer product and a fixed platform rollout date is exactly what investors look for when separating substance from pure marketing.

Then there’s the element driving the most conversation: the 300% bonus. In real terms, incentives of this scale don’t merely boost interest, they accelerate decision-making. Investors who might typically wait for exchange listings are stepping in earlier, recognizing the clear entry advantage. Several outlets have already framed the bonus as a narrow window, one that’s fueling a noticeable surge in participation.

“Top Altcoin Spot”: What That Actually Means

Whenever you see phrases like “top altcoin spot,” it’s usually shorthand for a mix of:

- trending attention (search + social + media pickup)

- unusual presale velocity

- a narrative that’s easy for non-crypto people to understand

Remittix is getting that kind of lift right now partly because “crypto-to-fiat bank transfers” is a story even skeptics can grasp. The bonus has pushed it into broader discussion across crypto news coverage as a top-of-mind presale topic.

The Exchange Question Everyone Is Asking Next

Whenever a presale starts accelerating like this, the market inevitably jumps to the same follow-up question: where will it trade first? In Remittix’s case, that part of the story is already taking shape.

The project has confirmed upcoming centralized exchange listings on BitMart and LBank, two platforms known for onboarding high-momentum presale tokens and giving early communities immediate access to liquidity. That confirmation alone separates Remittix from the majority of presales that are still hoping for listings rather than securing them in advance.

For investors, locked-in exchanges matter. They signal:

- A defined path from presale to open market

- Basic due diligence clearance by established platforms

- Reduced uncertainty around post-presale access

Now that these exchanges are in place, the conversation naturally shifts from whether Remittix will list to which exchange will be next, especially as the 300% bonus continues to attract new users and compress the presale timeline. In past cycles, this is often the stage where additional exchanges begin circling quietly, not wanting to be late to a token that’s already generating demand elsewhere.

The Real Reason This Setup Is Working

Strip away the hype and Remittix is benefiting from a simple recipe that tends to perform in crypto:

- A clear use case people actually need (payments, cross-border transfers)

- A visible product (App Store wallet)

- A fixed catalyst date (February 9th, 2026, platform launch)

- A short-term incentive that accelerates early participation (300% bonus)

When those four align, presales don’t usually “slowly trend.” They tend to move in bursts, especially as the bonus window tightens and late buyers realize the math is changing.

Discover the future of PayFi with Remittix by checking out the project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports8 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat4 hours ago

NewsBeat4 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World24 hours ago

Crypto World24 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation