Crypto World

How Quantum Computing May Be Impacting Bitcoin’s Valuation

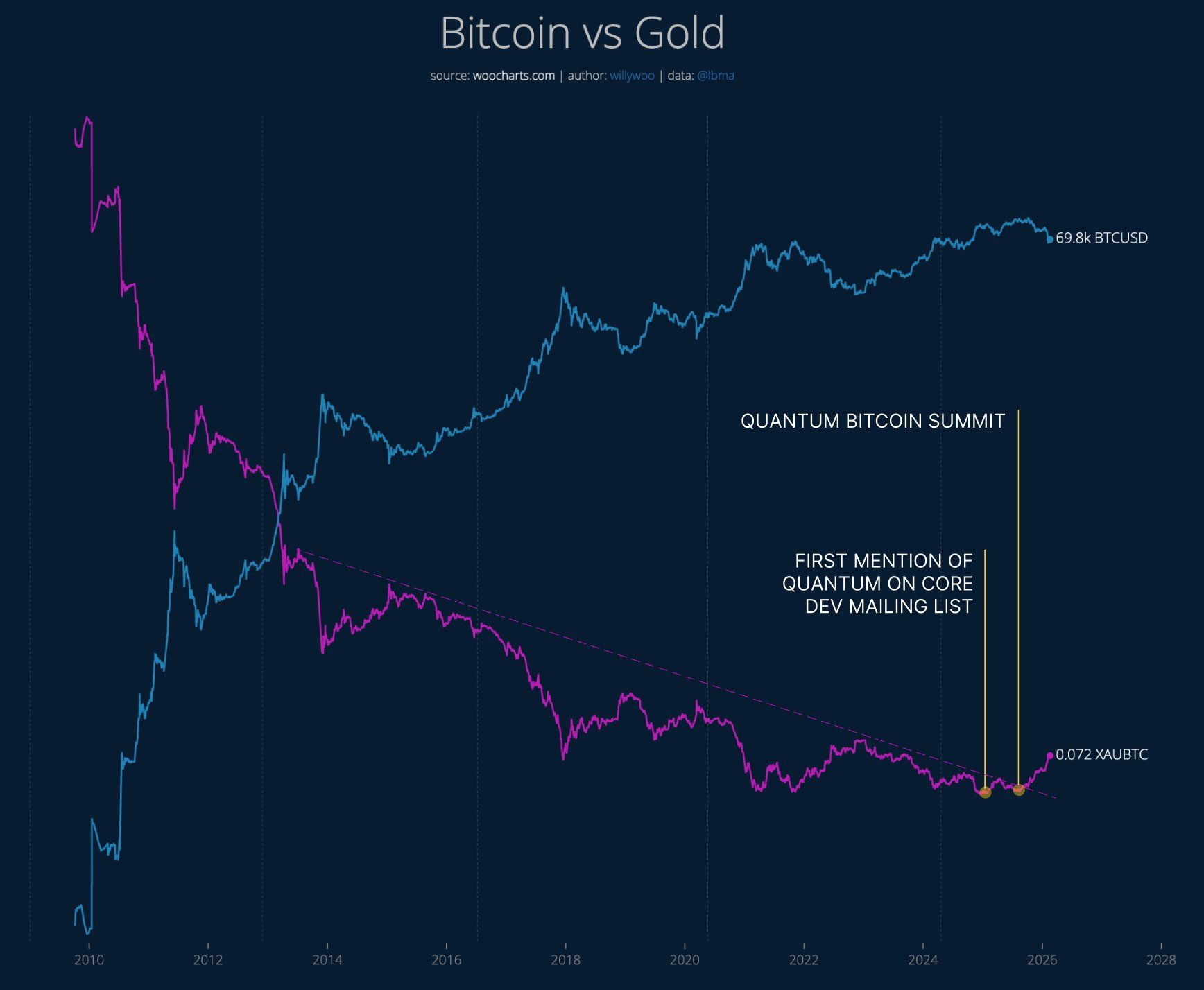

Quantum computing risks are weighing on Bitcoin’s (BTC) relative valuation against gold, according to analyst Willy Woo.

The development of quantum computing has spread concerns across the tech and financial sectors, as future breakthroughs could potentially undermine current encryption standards. Although such capabilities are not considered imminent, the long-term threat has raised questions about Bitcoin’s security model and how markets price that uncertainty.

Sponsored

Sponsored

Has Quantum Computing Entered the Bitcoin Valuation Equation?

Woo argued that Bitcoin’s 12-year outperformance relative to gold has broken, marking a significant structural shift. He pointed to the rising market awareness of quantum computing risks as a reason behind this shift.

“12 YR TREND BROKEN. BTC should be a valued a LOT HIGHER relative to gold. Should be. IT’S NOT. The valuation trend broke down once QUANTUM came into awareness,” Woo said.

Bitcoin’s security relies on elliptic curve cryptography (ECDSA over secp256k1). A sufficiently advanced, fault-tolerant quantum computer running Shor’s algorithm could theoretically derive private keys from exposed public keys and compromise funds associated with those on-chain addresses.

Such technology is not yet capable of breaking Bitcoin’s encryption. Nonetheless, a key concern, Woo argues, is the potential reactivation of an estimated 4 million “lost” BTC. If quantum breakthroughs made those coins accessible, they could re-enter circulation, effectively increasing supply.

Sponsored

Sponsored

To illustrate the scale, Woo explained that corporations following MicroStrategy’s 2020 playbook and spot Bitcoin ETFs have accumulated approximately 2.8 million BTC. The possible return of 4 million lost coins would exceed that total, equivalent to roughly eight years of enterprise-level accumulation at recent rates.

“The market has started pricing in the return of these lost coins ahead of time. This process completes once the Q-Day risk is off the table. Until then, BTCUSD will price in this risk. Q-Day is 5 to 15 years away… that’s a long time trading with a cloud over its head,” he emphasized.

He acknowledged that Bitcoin would likely adopt quantum-resistant signatures before any credible attack becomes feasible. However, upgrading cryptography would not automatically resolve the status of these coins.

“I’d say it’s 75% chance that lost coins will not be frozen by a protocol hard fork,” the analyst remarked. “Unfortunately the next 10 years is when BTC is most needed. It’s the end of the long term debt cycle, it’s where macro investors and sovereigns run to hard assets like gold to shelter from global debt deleveraging. Hence gold moons without BTC.”

Woo’s analysis does not suggest that quantum attacks are imminent. Instead, it positions quantum computing as a long-term variable factored into Bitcoin’s relative valuation, particularly in comparison to gold.

Meanwhile, Charles Edwards, founder of Capriole Investments, offered a complementary perspective on how quantum risk may be influencing market behavior. According to Edwards, concerns surrounding the quantum threat were likely a key factor that drove Bitcoin’s price lower.

The quantum threat is also shaping real portfolio moves. Jefferies strategist Christopher Wood reduced a 10% Bitcoin allocation in favor of gold and mining stocks, citing quantum concerns. This highlights that institutional investors see quantum computing as a significant risk, not a remote one.

Crypto World

Polymarket renames Artemis II explosion bet after backlash

Polymarket has renamed its “Artemis II explodes?” market after outraged critics branded the company as “evil” and suggested that it could lead to the mission being intentionally sabotaged.

The prediction market first featured the controversial bet on January 20 as part of its series related to NASA’s Artemis II launch and it has so far pulled in over $81,000 in trading volume.

Users on X, however, voiced their distaste after Citations Needed podcast host Adam Johnson claimed that markets “wagering on people dying should not be legal!”

Aerospace engineering professor Dr Chris Combs said, “The fact that there could now be a financial incentive to sabotage a crewed space mission is pretty dystopian.”

Others noted the incentive and claimed that it could see “prediction markets turn into assassination markets.”

Read more: Polymarket faces backlash over ‘sick’ California wildfire markets

In response to Johnson’s first post, Polymarket said, “To clarify: this was a market about a potential booster-stage rupture — a defined hardware failure scenario — not about the Orion crew capsule or astronaut safety.”

It added, “This was not a market on crew injury or loss of life.”

However, this response wasn’t well received and some called Polymarket a “truly evil company.” Others, meanwhile, told the person behind the post to quit their job and stop working for an indefensible firm.

Some users took Polymarket’s logic to highlight how ridiculous it sounds. One user said, “I would like to bet on whether your social media team’s vehicles suffer brake failures — a defined hardware failure scenario. This would not be a market on team injury or loss of life.”

Eventually, Polymarket changed the name of the market to the more tasteful “Artemis II booster rupture?”

It noted, “This market’s language has been updated for clarity.”

Houston, we have a problem gambler

Others weren’t so upset by the market. Economics professor Chris Freiman argued that this market holds “important information that should motivate decision makers to cancel the launch.”

He said, “We shouldn’t lose life-saving information because some outside observers find it gross.” Another economics professor, Alex Tabarok, tried to equate banning the exploding market to banning life insurance.

Both professors were shot down by users on X. Some noted that authoritative figures in charge of the launch won’t be checking Polymarket to assess vessel safety, nor would anyone with that information working on the launch keep that information away from their superiors to gamble on Polymarket instead.

Others noted that, even if it could be compared to banning life insurance, this market would be closer to the Stranger-Originated Life Insurance and be “extremely” illegal.

Read more: Logan Paul fakes $1M Super Bowl bet on Polymarket

Polymarket is no stranger to controversial markets and has hosted many that involved people potentially dying.

Back in 2023, when it was still unknown what fate had befallen the crew of the failed Titan Submersible, Polymarket held a wager on when the vessel would be found.

It frequently holds markets on military conflicts across the world, and has even hosted bets on how far fires would spread during the 2025 La Wildfires.

More recently, arrests have been made and charges issued against Israelis over various bets made on Polymarket that allegedly utilised confidential military secrets.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

How Are Traders Playing It?

PIPPIN is now the 7th-largest meme coin.

While the broader cryptocurrency market has been struggling in the past weeks, the lesser-known meme coin pippin (PIPPIN) defied the bearish environment by posting an impressive rally.

Momentum around the asset has been building, with rising popularity fueling fresh price predictions and prompting traders to open interesting positions.

The Next Targets

Pippin exploded by 300% over the past two weeks, hitting a new all-time high of almost $0.76 on February 15. Currently, it trades at around $0.73 (per CoinGecko’s data), whereas its market capitalization stands at roughly $730 million. This makes it the 82nd-largest cryptocurrency and the 7th-biggest in the meme coin sector.

Its impressive performance has caused traders to open long positions in anticipation of further gains. X user Tryrex disclosed an entry at $0.695 with 7x leverage, a stop-loss placed at $0.6034, and aims to take profits if the valuation reaches $0.9755.

Shortly after, they made a slight amendment, moving the stop-loss to $0.6125 and “slightly increasing” the position. “That means I’m aiming for 3.4R. The target remains $0.97,” the trader added.

Crypto Tony said they are awaiting a test of the $0.78 level to see whether “the bulls can flip the high and continue, or if we then look for shorts.” For now, the analyst remains spot long on PIPPIN.

It is important to note that not all traders are so bullish. X user Nehal identified a potential short setup, describing the $0.75-$0.72 range as a good entry zone, with $0.63, $0.56, and $0.51 as the next targets, and placing a stop-loss at $0.81.

You may also like:

Tread Carefully

People considering whether to deal with PIPPIN should be extremely cautious for several reasons. First, it is part of the meme coin sector, widely regarded as one of the most volatile areas of the cryptocurrency market. Tokens from that niche can rise by double and triple digits in a short period of time, but they may also collapse just as quickly to literally zero.

Moreover, many argue that PIPPIN’s use cases are questionable (to say the least), while its pump is primarily driven by pure speculation. X user van00sa believes that insiders hold more than 80% of the meme coin’s supply, which could enable them to manipulate its price.

“Last cycle, this thing hit $330M and crashed 90% to $8M. Now it’s back up double with even less fundamentals than before. Generational short imo. Just make sure your risk tolerance is high,” she warned.

Shual is also among the critics. The X user thinks PIPPIN’s rise is driven entirely by supply control and manipulation, and that the success of such coins (albeit short-lived in many cases) could damage the reputation of the entire crypto industry.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

How CryptoProcessing by CoinsPaid helps businesses like PropShopTrader scale globally

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

CryptoProcessing by CoinsPaid has published a case study detailing how Estonia-based proprietary trading firm PropShopTrader expanded globally by integrating crypto payments. The collaboration highlights how digital asset payments can reduce costs, lower chargeback risks, and improve conversion rates for online businesses.

Crypto payments are no longer a fringe experiment. For an increasing number of digital-first businesses, they are becoming a practical tool to reduce costs, improve conversion rates, and reach a global customer base that expects modern payment options. A recent case study from CryptoProcessing, the crypto payment gateway by CoinsPaid, shows how this shift works in practice through its collaboration with proprietary trading firm PropShopTrader.

Crypto payments are entering the mainstream

Merchant adoption of cryptocurrency payments has accelerated over the past few years. A joint survey conducted by PayPal and the National Cryptocurrency Association found that nearly 40% of merchants already accept crypto payments, while 84% expect crypto to become a common payment method within five years. Importantly, adoption is being driven by customers themselves: 88% of merchants reported that users have asked about paying with crypto.

This trend is reflected globally. Industry research estimates that tens of thousands of online merchants now support crypto payments, with stablecoins playing a central role thanks to their lower volatility and faster settlement times.

Against this backdrop, companies operating in fintech, trading, and digital services are increasingly reassessing their reliance on card-only payment models.

Why PropShopTrader looked beyond card payments

PropShopTrader is an Estonia-based proprietary trading firm that evaluates and funds traders from around the world. Before integrating crypto payments, the company relied exclusively on card transactions. While familiar and widely used, card payments brought several challenges: higher processing fees, exposure to chargebacks, and limited flexibility for a globally distributed, crypto-savvy audience.

“Integrating CryptoProcessing by CoinsPaid changed how we think about payments. We’ve reduced chargebacks, optimised fees, and expanded access to traders around the world. We especially value the ability to accept multiple cryptocurrencies while automatically converting everything to USDC. It gives us the flexibility of crypto with the stability we need to run our business confidently,” shared Ashley Kozak, Founder and Managing Partner at PropShopTrader.

Implementing CryptoProcessing

By integrating CryptoProcessing’s payment gateway, PropShopTrader has enabled users to pay with more than 20 cryptocurrencies, while the business itself can automatically convert incoming funds into USDC or fiat. This removes exposure to market volatility while preserving the benefits of blockchain-based payments.

Equally important is compliance. Operating within the EU regulatory framework, PropShopTrader required a solution with built-in AML monitoring, transaction screening, and transparent reporting. CryptoProcessing’s infrastructure provides these safeguards, allowing the company to expand its payment options without increasing regulatory or operational risk.

Measurable business results

The impact of crypto payments became visible shortly after launch. Around 7% of PropShopTrader’s clients began using cryptocurrency to fund their accounts, indicating clear demand from a segment that may have otherwise faced friction at checkout. At the same time, the company reported a reduction of approximately 3% in average transaction costs and an overall revenue increase of about 5%, driven by improved conversion and broader accessibility.

These figures highlight a key point often overlooked in discussions around crypto payments: adoption does not need to be universal to be meaningful. Even partial uptake can deliver measurable financial benefits.

Why CryptoProcessing resonates with businesses

CryptoProcessing’s appeal lies in its balance between innovation and practicality. Businesses gain access to a wide range of digital assets and blockchain rails, while still benefiting from instant settlements, treasury management tools, and regulatory safeguards. For companies serving international or digitally native audiences, this combination can translate directly into lower costs and higher customer satisfaction.

More broadly, crypto payments are increasingly seen as a strategic advantage rather than a speculative bet. As stablecoins become more integrated into mainstream payment flows — including support through platforms like Apple Pay, the gap between traditional and crypto payments continues to narrow.

A practical example of crypto in action

The PropShopTrader case illustrates how crypto payments can move beyond theory and hype. By working with CryptoProcessing, the company has addressed real operational pain points while opening the door to new customer segments. The result was not just a more modern checkout experience, but tangible improvements in cost efficiency and revenue.

As global commerce becomes increasingly digital and borderless, examples like this suggest that crypto payments are evolving into a core component of modern payment strategies — especially for businesses willing to meet their customers where they already are.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

3 Altcoins That Could Hit All-Time Highs In February Third Week

Capital is rotating into select mid-cap altcoins as momentum builds near critical technical levels. Several names are compressing just beneath record highs, while others are stabilizing after shallow pullbacks with trend structure still intact.

Thus, BeInCrypto has analysed three such altcoins that could form new all-time highs in the third week of February.

Sponsored

Sponsored

Kite (KITE)

KITE is among the closest altcoins to retest its recent all-time high of $0.242. The token is trading less than 17% below that peak. Strong short-term momentum has kept KITE within reach of record levels, reflecting sustained trader interest and speculative demand in the broader altcoin market.

The Chaikin Money Flow indicator shows a slight downtick but remains above the zero line. This suggests capital inflows are still present despite cooling momentum. Continued buying pressure could help KITE break above $0.242. A confirmed breakout may push the altcoin toward $0.270, establishing a new high.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

However, profit-taking remains a key risk near record levels. If investors begin exiting positions, downside pressure could increase quickly. A drop below the $0.207 support level would weaken the bullish structure. Further selling could drive KITE toward $0.163, invalidating the current upside thesis.

Sponsored

Sponsored

Rain (RAIN)

Another altcoin poised for new all-time highs in the coming week is Rain. Despite a recent price dip, the altcoin has preserved a bullish structure. The Ichimoku Cloud indicator continues to show supportive momentum, signaling that trend strength remains intact within the broader cryptocurrency market.

Sustained buying pressure could drive RAIN back toward its $0.0110 all-time high. The token currently trades about 12.5% below that level. A decisive breakout above $0.0110 would confirm continued strength. That move could push RAIN toward $0.0113, establishing a fresh record high.

However, technical momentum must remain stable to support further upside. If buying interest weakens, downside risk could increase. A decline toward the $0.0097 support level would signal fading bullish control. Breaking that level would invalidate the current bullish thesis and shift sentiment bearish.

Stable (STABLE)

STABLE has emerged as one of the stronger-performing altcoins this week, advancing 45% over the period. The token now trades roughly 21% below its all-time high of $0.0325. Sustained momentum has strengthened bullish sentiment, positioning STABLE within reach of record price levels.

The Money Flow Index remains above the neutral 50.0 mark, signaling active buying pressure. Positive capital inflows suggest demand continues to outpace supply. If accumulation persists, STABLE could break above $0.0325. A confirmed breakout may extend gains toward $0.0368, establishing a new all-time high.

However, short-term holders may begin locking in profits after the recent rally. Increased selling activity could weaken upward momentum. A pullback toward $0.0225 would indicate cooling demand. Further downside toward $0.0189 would invalidate the current bullish outlook.

Crypto World

Nexo Relaunches in the U.S. as a Crypto Services Platform

Nexo is set to relaunch its digital asset services and crypto exchange platform in the United States on Monday, reviving a business footprint it abandoned more than three years ago amid a regulatory climate that proved inhospitable for crypto firms. The reboot is framed around clearer rules for digital assets in the U.S. and relies on a partnership-driven model designed to meet licensing and compliance benchmarks while offering a mix of yield programs, a spot trading venue, crypto-backed credit facilities, and a loyalty program for U.S. customers, according to Eleonor Genova, Nexo’s head of communications.

Key takeaways

- Nexo plans a U.S. relaunch anchored in Florida, with a management team to be announced, and a trading backbone provided by Bakkt to serve institutional-grade trading needs.

- The new structure includes services delivered through licensed U.S. partners, with certain activities supported by a third-party SEC-registered investment adviser to ensure compliance under U.S. securities laws.

- The move marks a notable reversal after Nexo exited the U.S. market in December 2022 due to what it described as a hostile regulatory posture toward blockchain firms during the Gary Gensler era.

- Regulatory dynamics in Washington—framing a potential pathway for crypto clarity—have evolved, with debates over framework bills like the CLARITY Act and ongoing White House-brokered discussions on stablecoins and market structure.

- The U.S. relaunch follows high-profile political events and promises to reintroduce crypto offerings into a market where policy signals have gradually tilted toward clearer, if still evolving, compliance standards. An April 2025 event featuring Donald Trump Jr. highlighted the strategic attention around crypto in U.S. political discourse.

Tickers mentioned: N/A

Sentiment: Neutral

Market context: The re-entry arrives as Washington weighs a regulatory framework for crypto markets, with the CLARITY Act gaining traction but facing political hurdles. A White House-facilitated meeting between crypto and banking representatives aimed at aligning stablecoin provisions underscores a broader push for market clarity that could shape how platforms operate going forward.

Why it matters

The renewal of Nexo’s U.S. footprint underscores a broader industry trend: companies that paused or scaled back operations a few years ago are testing the waters again as policymakers signal a willingness to formalize crypto rules. Florida’s selection as the operational base aligns with state-friendly licensing environments and a growing focus on local compliance infrastructure, a shift that could influence other platforms evaluating U.S. re-entry.

Crucially, Nexo’s architecture emphasizes regulated partnerships rather than a single, fully in-house regime. The company has articulated that certain services will be conducted through licensed U.S. providers and that advisory services will be furnished by an SEC-registered adviser in accordance with applicable securities laws. This approach signals a deliberate effort to align crypto offerings with traditional financial-market standards while preserving access to yield programs and crypto-backed credit tools that drew users to its platform in the first place. The move also reflects a broader industry trend toward asset custody, insurance considerations, and compliance-led product design as firms seek to reassure investors and regulators alike.

The regulatory backdrop remains nuanced. While Washington has advanced discussions around crypto market structure and clarity, the Senate has yet to assemble what it regards as sufficient bipartisan support to move ahead with major legislation. In the meantime, industry participants point to ongoing regulatory dialogues and evolving enforcement expectations as critical signals for strategic planning. The White House has described the need for compromise on crypto policy and has supported efforts to pass a comprehensive framework before midterm elections, arguing that stable and well-defined rules are essential for investor protection and market integrity. In parallel, a productive but unresolved dialogue between crypto and banking stakeholders on stablecoins highlights the complexity of reconciling innovation with consumer safeguards.

Nexo’s earlier exit in 2022 was framed by the firm as a response to an environment where “the U.S. refuses to provide a path forward for enabling blockchain businesses,” despite assurances from industry participants that constructs could be built to satisfy regulatory expectations. The company subsequently faced legal and regulatory actions tied to its Crypto Earn product, including a $45 million settlement with the SEC over unregistered interest-bearing crypto rewards and an additional $22.5 million multi-state securities settlement related to the earn program. These actions culminated in the shuttering of Crypto Earn for U.S. users shortly after the settlements were announced, illustrating the kind of enforcement risk that the new U.S. launch seeks to mitigate through governance, licensing, and robust advisory relationships.

The newly announced U.S. relaunch, with its emphasis on compliant, licensed pathways and a curated ecosystem of services, reflects both a reputational recalibration and a pragmatic strategy to re-enter a market that remains vital for global retail and institutional participants alike. The narrative around Nexo’s return is also part of a broader conversation about how crypto firms can navigate federal and state regimes in a way that balances innovation with accountability, a topic that has shaped many of the industry’s recent regulatory dialogues and enforcement actions.

“Nexo’s US offering is structured through partnerships with appropriately licensed US service providers. Certain services are made available via a third-party Securities and Exchange Commission-registered (SEC) investment adviser, which provides advisory services under applicable US securities laws.”

The Florida-based relaunch underscores a strategic intent to localize operations while leveraging external compliance rails. Bakkt’s involvement as the trading infrastructure provider will bring institutional-grade liquidity and risk controls to a platform that seeks to appeal to both retail enthusiasts and professional traders. The arrangement with a registered adviser is designed to ensure that advisory services align with U.S. securities rules, potentially expanding the scope of products that can be offered without triggering unregistered security concerns. These elements collectively indicate a cautious but purpose-driven path back into a market that remains critical to the broader crypto ecosystem’s growth curve.

What to watch next

- The timing and terms of the Florida-based management team’s appointment and whether any licenses or registrations are filed or announced publicly.

- The go-live timeline for the Bakkt-powered trading interface and the rollout of yield, lending, and loyalty products in a compliant framework.

- Formalization of the SEC-registered adviser relationship and the exact product mix that will be offered to U.S. customers.

- Regulatory milestones tied to U.S. crypto policy, including any movement on the CLARITY Act or related market-structure discussions.

Sources & verification

- Nexo’s official communications on its gradual departure from the United States and the rationale cited for exiting in 2022.

- Information on the 2023 SEC settlement and related multi-state securities settlements tied to the Crypto Earn program.

- California Department of Financial Protection & Innovation (DFPI) fine related to the firm’s lending activities.

- Ongoing policy discussions in Washington around crypto market structure, including the CLARITY Act and White House–brokered talks on stablecoins.

- The April 2025 exclusive event featuring Donald Trump Jr. announcing or signaling the U.S. re-entry, as reported in accompanying coverage of Nexo’s re-entry plan.

Nexo’s U.S. relaunch signals a new phase for compliant crypto services

The relaunch marks a deliberate pivot toward a compliance-first model designed to align with U.S. securities laws and state licensing requirements while preserving access to services that attracted users in previous years. By anchoring operations in Florida and building a framework around licensed partners and a registered adviser, Nexo aims to reduce the kind of regulatory friction that curtailed its U.S. ambitions in the past. The arrangement with Bakkt signals a preference for institutional-grade infrastructure, which may help the platform weather a market characterized by heightened scrutiny and cautious capital deployment.

In the broader context, the resumption of U.S. activities by Nexo sits at the intersection of regulatory caution and market demand. The sector continues to push for clarity on what constitutes a security versus a commodity, how custody should be structured, and which products can be offered to everyday investors without triggering sweeping enforcement actions. As policymakers weigh policy options, the crypto industry remains compelled to demonstrate that it can operate within a well-defined regulatory perimeter while continuing to innovate—whether through yield-based programs, lending products, or a diversified trading environment.

Crypto World

Nexo returns to U.S. with Bakkt-backed crypto services after 2022 regulatory exit

Nexo is set to return to the U.S. market, saying it has officially rolled-out a suite of digital asset offerings and trading infrastructure from the U.S.-based Bakkt.

The digital asset wealth platform withdrew from the U.S. in late 2022 after what it called a “dead end” in negotiations with state and federal regulators over its Earn Interest Product. The company said in 2022 it could no longer operate in an “impossible environment” following multiple enforcement actions, including from California and New York. However, in April 2025, it announced it would return, adding had $11 billion in assets under management.

The company’s U.S. product lineup includes fixed and flexible yield programs, an integrated crypto exchange, and crypto-backed credit lines. These services are offered through a compliant framework designed to support portfolio management and liquidity access for retail and institutional clients. Fiat on- and off-ramps are available via automated clearing house (ACH) and wire transfers.

The re-entry to the U.S. follows what the company called a “period of deliberate recalibration,” signaling a longer-term commitment to regulated markets. Nexo says the move also follows its “ongoing global expansion.” Nexo cited $371 billion in global transactions processed to date, in Monday’s statement.

The firm’s broader expansion includes the acquisition of Argentina’s Buenbit and sponsorships with the ATP Dallas Open and the Audi Revolut F1 Team.

Crypto World

Trims Bitcoin, buys into Ether ETF

Harvard Management Company (HMC), the investment arm of Harvard University’s endowment, reduced its stake in a major Bitcoin exchange-traded fund (ETF) by roughly 21 %.

Summary

- Harvard Management Company cut its Bitcoin ETF holdings by approximately 21%, trimming around 1.5 million shares of the iShares Bitcoin Trust (IBIT), according to its latest SEC 13F filing.

- Despite the reduction, Bitcoin remains one of the endowment’s largest publicly disclosed positions, valued at roughly $265 million at the end of Q4 2025.

- The filing also shows a new $86.8 million position in the iShares Ethereum Trust (ETHA), marking Harvard’s first disclosed allocation to an Ether-linked ETF.

Harvard rotates into ETH as Bitcoin ETF holdings shrink 21%

Simultaneously, HMC established a new multimillion-dollar position in an Ethereum (ETH) ETF, according to a quarterly 13F filing with the U.S. Securities and Exchange Commission.

The filing, which discloses Harvard’s U.S.-listed equity holdings as of December 31, 2025, shows that the endowment cut close to 1.5 million shares of the iShares Bitcoin Trust (IBIT) compared with the previous quarter.

Despite this reduction, Bitcoin (BTC) remains HMC’s largest publicly disclosed holding with a reported market value of approximately $265.8 million at year-end.

In a notable strategic move, Harvard initiated a new position in the iShares Ethereum Trust (ETHA) acquiring about 3.87 million shares valued at an estimated $86.8 million during the same period. This represents the university’s first publicly disclosed allocation into an Ether-linked ETF.

While the filing primarily highlights the adjustment in digital-asset ETFs, it also shows broader shifts in HMC’s publicly reported equity holdings, including both increases and reductions across major tech and industrial names. However, the crypto positions, even after trimming, remain among the most significant individual line items disclosed.

Crypto World

Harvard cuts bitcoin exposure by 20%, adds new ether position

Harvard University’s $56.9 billion endowment made its first foray into ether last quarter, even as it scaled back its exposure to bitcoin .

According to an SEC filing, the Harvard Management Company (HMC) bought almost 3.9 million shares of BlackRock’s iShares Ethereum Trust (ETHA), valued at around $86.8 million.

The company also reduced its stake in the iShares Bitcoin Trust (IBIT) by 21%, selling roughly 1.5 million shares. The bitcoin exchange-traded fund remains Harvard’s largest publicly disclosed holding at $265.8 million.

The shift comes after the price of bitcoin dropped from an all-time high of around $125,000 in October to close the quarter just below $90,000.

The move, however, may have less to do with sentiment and more to do with market dynamics, according to Andy Constan, founder and chief investment officer at Damped Spring Advisors.

The sale could reflect the unwinding of a trade that meant to capitalize on bitcoin treasury companies trading at premiums to the value of their BTC holdings, as measured by the multiple of net asset value, or mNAV, which compares enterprise value to bitcoin value.

When bitcoin’s price was booming, digital asset treasury (DAT) firms like Strategy (MSTR) traded at high premiums to the value of the bitcoin in their treasuries. MSTR, for example, at one point traded near 2.9 mNAV, meaning investors buying the shares were paying around $2.9 to own $1 of BTC.

That premium reflects not only the underlying cash-generating business, but also the company’s potential to keep accumulating bitcoin. Still, various investors bet on that mNAV gap narrowing. They held bitcoin indirectly through IBIT and shorted the shares of Strategy and similar digital asset treasury (DAT) companies.

Then the unwind took place, according to Constan. As the price of bitcoin plunged, so did that of DAT shares. Strategy, for example, now trades at 1.2 mNAV. These traders may also be rebalancing their portfolios, as bitcoin’s price nearly doubled last year despite the drawdown, suggesting it could be above the institution’s desired portfolio allocation, he wrote on X.

Data from 13F filings with the SEC gathered by Todd Schneider at 13.info backs these points. It shows that institutions reported owning 230 million IBIT shares in the fourth quarter, down from 417 million in the third.

Harvard also boosted investments in chipmakers Broadcom and TSMC, as well as in Google’s parent company Alphabet and railroad operator Union Pacific, while trimming stakes in Amazon, Microsoft and Nvidia.

Crypto World

KT DeFi integrates DeFi and renewable energy to launch a new yield model

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

KT DeFi is introducing a renewable-energy-powered cloud mining model designed to deliver more stable, transparent yields amid ongoing crypto market volatility.

Summary

- KT DeFi combines green energy hash power with DeFi smart contracts to reduce cost volatility and automate transparent reward distribution.

- The platform offers low-barrier participation, allowing users to earn mining rewards without owning hardware.

- It also focuses on security and compliance, with cold-wallet storage, multi-layer safeguards, and stated oversight from the UK Financial Conduct Authority.

As the global cryptocurrency market continues to experience volatility and the industry enters a deep adjustment cycle, more blockchain projects are shifting from “high-volatility speculation” toward models backed by real assets. Against this bear market backdrop, KT DeFi has officially launched an innovative yield model that combines DeFi mechanisms with renewable energy assets. Through a structure built on “green hash power + on-chain finance,” the platform aims to provide a more stable and sustainable income solution for the market.

A new logic for cloud mining

Traditional mining relies heavily on centralized mining farms and high electricity costs, with market fluctuations directly impacting returns. KT DeFi powers its computing centers with renewable energy sources such as solar and wind, reducing energy cost volatility while enhancing operational stability.

By integrating DeFi-based smart contract distribution mechanisms, mining rewards are recorded and settled on-chain, minimizing manual intervention and strengthening transparency and user trust.

This model not only optimizes the cost structure of computing power but also aligns with global green finance and ESG development trends, giving cloud mining stronger long-term asset value potential.

Core advantages of KT DeFi

Green energy-powered hash rate

Utilizes renewable energy to reduce electricity cost risks and establish a long-term, sustainable yield foundation.

Low-barrier cloud mining

No need to purchase or maintain mining hardware. Users can participate in hash power rewards by subscribing to smart contracts, enabling flexible and convenient access.

Institutional-grade security system

100% of user assets are stored in offline cold wallets with private key isolation. Multi-layered security measures safeguard platform and fund safety.

Automated smart contract settlement

Operates through DeFi mechanisms with automatic profit settlement every 24 hours. Transparent, traceable, and free from manual interference.

24/7 professional support

Round-the-clock online services ensure smooth operations and an enhanced user experience.

How to participate in KT DeFi

Step 1: Register an account

New users can sign up through the official KT DeFi platform (new users may receive a $17 bonus).

Step 2: Select a hash power product

Users can then choose cloud mining products with different durations and yield structures based on their financial goals and risk preferences.

Step 3: Receive earnings

The system automatically calculates and distributes mining rewards according to production output and protocol rules. Users may choose to withdraw or reinvest their earnings.

About KT DeFi

KT DeFi is a UK-registered digital technology company specializing in secure cryptocurrency cloud computing (hash power) services. The platform operates under authorization and regulatory oversight of the UK Financial Conduct Authority (FCA), in compliance with applicable laws and regulations.

Founded in 2019, KT DeFi serves more than five million users worldwide. Through enterprise-grade data centers and cloud computing technologies, the company lowers the entry barriers to digital asset mining, enabling users to participate without owning hardware.

Supported by secure infrastructure and scalable computing resources, KT DeFi is committed to delivering stable, efficient, and user-friendly cloud mining solutions.

To learn more about KT DeFi, visit the official website and download the app. Official email: [email protected].

Building long-term value in a bear market

Bear markets often represent critical periods for technological upgrades and business model evolution. By combining DeFi financial mechanisms with renewable energy-powered computing resources, KT DeFi not only reshapes the logic of cloud mining returns but also offers a new model for sustainable industry development.

In the face of market cycles, building robust, transparent, and low-energy infrastructure will be a key step toward the long-term maturation of the crypto ecosystem.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Best AI Stocks 2026: NVIDIA, Microsoft, Alphabet Top the List

TLDR

- NVIDIA commands 80% market share in AI chips with H100 and H200 GPUs setting industry standards for language model training

- Microsoft GitHub Copilot generates over $100 million annually while Azure AI services accelerate cloud revenue growth

- Alphabet’s Gemini AI models compete with GPT-4 using exclusive data from Search, YouTube, and Android platforms

- Palantir’s AIP platform drives commercial revenue acceleration by operationalizing AI in enterprise workflows

- CrowdStrike’s Falcon platform analyzes trillions of weekly security events using AI, maintaining 120%+ customer retention

The AI industry has transitioned from speculation to commercial reality. Five companies now lead the market with proven revenue streams and competitive advantages.

These stocks range from semiconductor manufacturers to security platforms. Each demonstrates actual earnings from AI products rather than future promises.

NVIDIA Leads AI Chip Market

NVIDIA holds approximately 80% of the AI chip market. Its H100 and H200 graphics processing units train most major language models.

The Blackwell architecture launches soon with enhanced performance capabilities. NVIDIA’s CUDA software platform serves as the industry standard for AI development.

Microsoft, Amazon, and Google buy NVIDIA chips to power their cloud AI services. The company expands into AI inference chips while building new data center partnerships.

NVIDIA’s market position remains strong as cloud providers compete for AI infrastructure. The software ecosystem creates barriers that competitors struggle to overcome.

Microsoft Monetizes OpenAI Partnership

Microsoft invested $13 billion in OpenAI and shows clear returns. GitHub Copilot now exceeds $100 million in annual recurring revenue.

Microsoft 365 Copilot gains enterprise customers despite premium pricing. Azure cloud growth accelerates as businesses adopt turnkey AI solutions.

The company profits from both infrastructure through Azure and applications through productivity tools. This dual approach maximizes revenue from AI adoption across customer segments.

Alphabet Offers Value Play

Alphabet operates DeepMind and Google Brain research divisions. Gemini AI models now match GPT-4 in capabilities and performance.

The company owns proprietary training data from Search, YouTube, and Android. Competitors cannot replicate these exclusive datasets.

Google Cloud grows as enterprises implement Vertex AI platform services. Search integration proceeds carefully to preserve advertising revenue streams.

Alphabet trades below Microsoft’s valuation despite comparable AI technology. The price difference creates opportunity for value-focused investors.

Palantir Solves Enterprise AI Challenges

Palantir’s Artificial Intelligence Platform accelerates U.S. commercial revenue. The software operationalizes AI within existing enterprise workflows.

Companies face a “last mile” problem moving AI from pilot to production. Palantir addresses this challenge through its integration approach.

Government contracts deliver stable baseline revenue. Commercial expansion provides higher growth potential as the customer base expands.

Business economics improve as the platform scales. The company transitions from growth speculation to sustainable profitability.

CrowdStrike Defends Against AI Threats

CrowdStrike’s Falcon platform processes trillions of security events weekly. AI and machine learning detect threats in real-time.

Cybercriminals increasingly weaponize AI for sophisticated attacks. CrowdStrike’s AI-native architecture counters these evolving threats.

The company maintains customer retention above 120% while staying profitable. Platform capabilities expand to address new security challenges.

CrowdStrike provides lower-risk AI exposure than pure-play alternatives. The cybersecurity foundation offers stability beyond AI hype cycles.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat7 days ago

NewsBeat7 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports7 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat22 hours ago

NewsBeat22 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat1 day ago

NewsBeat1 day agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat2 days ago

NewsBeat2 days agoUK construction company enters administration, records show