Crypto exchange pushed back on $1.7 billion Iran-linked flow allegations and called media reports behind the probe “defamatory.”

Mar 6, 2026, 3:01 p.m.

Billion-dollar liquidation events are no longer rare in crypto markets. While these crashes often appear suddenly, on-chain data, leverage positioning, and technical signals usually reveal stress long before forced selling begins. This article examines whether reconstructing major historical events can help anticipate liquidation cascades.

Keep reading on for early signals and how to read them together. Throughout this piece, we analyze two major events: October 2025 (long liquidation cascade) and April 2025 (short squeeze), and trace the signals that appeared before both. The focus remains primarily on Bitcoin-specific metrics, as it still accounts for nearly 60% (59.21% at press time) of total market dominance.

On October 10, 2025, more than $19 billion in leveraged positions were taken out, making it the largest liquidation event in crypto history. Although US–China tariff headlines are often cited as the trigger, market data show that structural weakness was around for weeks. The majority of these liquidations were long-biased, almost $17 billion.

Between September 27 and October 5, Bitcoin rallied from around $109,000 to above $122,000, eventually testing the $126,000 area. This rapid move strengthened bullish sentiment and encouraged aggressive long positioning.

During the same period, open interest rose from roughly $38 billion to more than $47 billion. Leverage was expanding fast, indicating growing dependence on derivatives.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Gracy Chen, the CEO of Bitget, said modern market structure makes leverage far more synchronized than in earlier cycles.

Sponsored

Sponsored

“Positions are built and unwound faster, across more venues… leverage behaves more synchronously… When stress hits, the unwind is sharper, more correlated, and less forgiving,” she added.

At the same time, exchange inflows fell from around 68,000 BTC to near 26,000 BTC. Holders were not selling into strength. Instead, supply stayed off exchanges while leveraged exposure increased.

This combination reflected a late-stage rally structure.

At this stage of the cycle, rising leverage or open interest, for that matter, not only increases trader risk. It also raises balance-sheet and liquidity pressure on exchanges, which must ensure they can process liquidations, withdrawals, and margin calls smoothly during sudden volatility.

When asked how platforms prepare for such periods, Chen, said risk management starts long before volatility erupts:

“Holding a strong BTC reserve is a risk management decision before it’s a market view… prioritize balance-sheet resilience… avoid being forced into reactive moves when volatility spikes…,” she said

On-chain profit data showed that distribution had already begun.

From late September into early October, Spent Output Profit Ratio (SOPR), which tracks whether coins are sold at profit or loss, went up from around 1.00 to roughly 1.04, with repeated spikes. This indicated that more coins were being sold at a profit.

Importantly, this happened while exchange inflows remained low. Early buyers (possibly already exchange-held supply) were quietly locking in gains without triggering visible selling pressure. And BTC was already at an all-time high during that time.

This pattern suggests a gradual transfer from early participants to late entrants, often seen near local tops.

Short-term holder NUPL (Net Unrealized Profit/Loss), measuring paper profits or losses. provided one of the clearest warning signals. On September 27, STH-NUPL stood near -0.17, reflecting recent capitulation. By October 6, it had surged to around +0.09.

In less than ten days, recent buyers moved from heavy losses to clear profits.

Such rapid transitions are dangerous. After emerging from losses, traders often become highly sensitive to pullbacks and eager to protect small gains, increasing the risk of sudden selling.

As sentiment improved, leverage continued rising. Open interest reached one of its highest levels on record while SOPR and NUPL began rolling over. BTC exchange inflows remained subdued, keeping risk concentrated in derivatives markets.

Instead of reducing exposure, traders increased it. This imbalance made the market structurally weak.

Technical momentum had been deteriorating for months. From mid-July to early October, Bitcoin formed a clear bearish RSI divergence. Price made higher highs, while the Relative Strength Index, a momentum indicator, made lower highs.

This signaled weakening demand beneath the surface. By early October, the rally was increasingly sustained by leverage rather than organic buying, and the momentum indicator proved it.

After October 6, price momentum faded, and support levels were tested. Despite this, open interest remained elevated, and funding rates, which reflect the cost of holding future positions, stayed positive. Traders were defending positions rather than exiting, possibly by adding margin.

Sponsored

Sponsored

Chen also mentioned that attempts to defend positions often amplify systemic risks:

“When positions approach liquidation, traders often add margin… Individually, that can make sense. Systemically, it increases fragility… Once those levels fail, the unwind is no longer gradual — it becomes a cascade,” she highlighted as the root cause for massive cascades.

More margin eventually led to a deeper crash.

When tariff-related headlines emerged on October 10, the weak structure collapsed.

Price broke lower, leveraged positions moved into loss, and margin calls accelerated. Open interest fell sharply, and exchange inflows surged.

Forced short selling created a feedback loop, producing the largest liquidation cascade in crypto history.

Stephan Lutz, CEO of BitMEX, said liquidation cycles tend to appear repeatedly during periods of excessive risk-taking, in an exclusive quote to BeInCrypto:

“Normally, liquidations always come with cycles amid greedy times… they are good for market health…,” he mentioned.

Chen cautioned that liquidation data should not be mistaken for the root cause of crashes.

“Liquidations are… an accelerant, not the ignition… They tell you where risk was mispriced… how thin liquidity really was underneath, she said.”

By early October, several long squeeze warning signs were already visible:

Individually, these signals were not decisive. Together, they showed a market that was overleveraged, emotionally unstable, and structurally weak.

Lutz added that recent cascades have also exposed weaknesses in risk management.

“This cycle’s criticism isn’t much on leverage itself, but risk management and the lack of rigorous approach…”

The October 2025 collapse followed a clear sequence:

Sponsored

Sponsored

Price extension → Open interest expansion → Rising SOPR (selective profit-taking) → Rapid NUPL recovery (short-term optimism) → Long-term RSI divergence (weakening momentum) → Leverage defense through margin → External catalyst → Liquidation cascade

On April 23, 2025, Bitcoin surged sharply, triggering more than $600 million in short liquidations in a single session. While the rally appeared sudden, on-chain and derivatives data show that a fragile market structure had been forming for weeks after the early-April sell-off.

Between late February and early April, Bitcoin continued making lower lows. However, on the 12-hour chart, the Relative Strength Index (RSI), a momentum indicator, formed a bullish divergence, with higher lows even as the price declined. This signaled that selling pressure was weakening.

Despite this, exchange outflows, which measure coins leaving exchanges for storage, continued falling. Outflows dropped from around 348,000 BTC in early March to near 285,000 BTC by April 8.

This showed that dip buyers were hesitant and that accumulation remained limited. The technical reversal was largely ignored.

On April 8, Bitcoin formed a local bottom near $76,000. Instead of reducing risk, traders increased bearish exposure. Funding rates turned negative, indicating a strong short bias. At the same time, open interest, the total value of outstanding derivatives contracts, rose toward $4.16 billion (Bybit alone).

This showed that new leverage was being built primarily on the short side. Most traders expected the bounce to fail and prices to move lower.

Exchange outflows continued declining toward 227,000 BTC by mid-April, confirming that spot accumulation remained weak. Both retail and institutional participants stayed bearish.

On-chain data showed that selling pressure was fading.

The Spent Output Profit Ratio (SOPR) was near or below 1 and failed to sustain profit/loss spikes. This indicated that loss-driven selling was slowing, even when buying was not picking pace. That’s a classic bottom sign.

Short-term holder Net Unrealized Profit/Loss (STH-NUPL), which measures whether recent buyers are in profit or loss, remained in negative territory. It stayed in the capitulation zone with only shallow rebounds, reflecting low confidence and limited optimism.

Sponsored

Sponsored

Together, these signals showed exhaustion rather than renewed demand.

By mid-April, Bitcoin entered a narrow trading range. Volatility declined, while open interest remained elevated and funding stayed mostly negative. Shorts were crowded, yet prices failed to break lower and began stabilizing instead.

With selling pressure fading (SOPR stabilizing) but no meaningful spot accumulation emerging (weak outflows), the market became increasingly dependent on derivatives positioning. Buyers remained hesitant, while bearish leverage continued rising against weakening downside momentum. This imbalance made the market structurally unstable.

By April 22–23, STH-NUPL moved back toward positive territory (shown earlier), showing that recent buyers had returned to small profits. Some holders were now able to sell into strength, while many traders still treated the rebound as temporary and added short exposure.

Notably, a similar NUPL rebound had appeared before the October 2025 long flush. The difference was context. In October, short-term holders turning profitable encouraged more long positioning as traders expected further upside. In April, the same return to small profits encouraged more short positioning, as traders in a corrective market viewed the rebound as temporary and bet on another decline.

This combination tightened liquidity and increased bearish positioning. When prices pushed higher, stop losses were triggered, short covering accelerated, and open interest dropped sharply. Forced buying created a feedback loop, and a positive tariff-related tweet helped, producing one of the largest short liquidation events of 2025.

By mid-April, several warning signs were visible:

Individually, these signals appeared inconclusive. Together, they showed a market where shorts were crowded, selling was exhausted, and downside momentum was fading.

The April 2025 squeeze followed a clear sequence:

Momentum divergence → disbelief → short buildup → selling exhaustion (SOPR exhaustion) → price compression → positioning imbalance → short liquidation cascade.

Reflecting on repeated liquidation cycles, Chen said trader behavior remains remarkably consistent.

“Periods of low volatility trigger overconfidence… Liquidity is mistaken for stability… Volatility resets expectations… Each cycle clears excess leverage,” she added.

The October 2025 and April 2025 events show that measurable changes in leverage and on-chain behavior led to the large liquidation cascades. Importantly, these cascades do not occur only at major market tops or bottoms. They form whenever leverage becomes concentrated and spot participation weakens, including during relief rallies and corrective bounces.

In both cases, these signals emerged 7–20 days before liquidation peaks.

In October 2025, Bitcoin rose from about $109,000 to $126,000 in nine days while open interest expanded from roughly $38 billion to over $47 billion. Exchange inflows fell below 30,000 BTC, SOPR rose above 1.04, and short-term holder NUPL moved from -0.17 to positive within ten days. This reflected rapid leverage growth and rising optimism near a local peak.

In April 2025, Bitcoin bottomed near $76,000 while funding stayed negative and open interest rebuilt toward $4.16 billion. Exchange outflows declined from around 348,000 BTC to near 227,000 BTC. SOPR remained near 1, and STH-NUPL stayed negative until just before the squeeze, showing selling exhaustion alongside growing short exposure.

Despite different market phases, both cascades shared three features. First, open interest increased while spot flows weakened. Second, funding remained strongly one-sided for several days. Third, short-term holder NUPL shifted rapidly shortly before forced liquidations. And finally, if a reversal or a bounce setup surfaces on the technical chart, the liquidation cascade tracking becomes clearer.

These patterns also appear during mid-trend pullbacks and relief rallies. When leverage expands faster than spot conviction and emotional positioning becomes one-sided, liquidation risk rises regardless of price direction. Tracking open interest, funding, exchange flows, SOPR, and NUPL together provides a consistent framework for identifying these vulnerable zones in real time.

Strike’s parent firm has received a BitLicense from the New York Department of Financial Services (NYDFS), enabling it to offer crypto services in New York.

The parent firm of Strike, the Bitcoin-focused fintech founded by Jack Mallers, has been granted a BitLicense by the New York Department of Financial Services (NYDFS), according a list of approved entities from the regulator.

Strike’s parents company, Zap Solutions, Inc., received a Virtual Currency and Money Transmitter Licenses in February, per the NYDFS website.

This approval allows Strike to expand its operations into New York state, a key market for financial services. Strike is known for leveraging the Lightning Network for Bitcoin transactions.

New York’s digital asset licensing, generally referred to as the BitLicense, is well known in U.S. crypto regulatory history for having some of the most stringent requirements for approval. At the same time, New York is a highly sought after state for digital asset licensing, as it’s seen as a crucial step for companies aiming to establish a foothold in the U.S. financial landscape.

The regulatory framework was introduced by the NYDFS in 2015, and the first BitLicense was awarded to USDC issuer Circle in September of that year, followed by crypto exchange Gemini a month later.

Strike announced its Bitcoin-backed lending product last May, as The Defiant reported.

Mallers is also the co-founder of Twenty One, a Bitcoin digital asset treasury (DAT) company that launched last April with an initial stockpile of 42,000 BTC, worth about $3 billion at the time. As of today, it holds over 43,500 BTC, worht about $2.9 billion, making it the third-largest Bitcoin DAT company.

This article was generated with the assistance of AI workflows.

Western Alliance Bancorporation disclosed a significant $126.4 million charge-off on Friday following notification from Jefferies Financial Group that it would cease making payments required under an existing forbearance arrangement. The announcement triggered a steep premarket decline of approximately 12% in WAL shares.

Western Alliance Bancorporation, WAL

The substantial write-down stems from a commercial financing facility backed by receivables from First Brands Group, an automotive components distributor that sought bankruptcy protection in September 2025 after accumulating $11.6 billion in outstanding obligations.

On Friday, Western Alliance initiated legal proceedings in New York Supreme Court naming Jefferies, its Leucadia Asset Management (LAM) division, and related corporate entities as defendants. The complaint centers on allegations of contractual violations and fraudulent conduct.

The origins of this dispute date to October 2025, when Western Alliance negotiated a forbearance arrangement after uncovering that LAM’s servicing agent had permitted UCC financing statements protecting the receivables collateral to expire — a critical oversight that constituted a default event.

The forbearance terms required Jefferies to execute complete loan repayment no later than March 31, 2026. Western Alliance’s most recent payment receipt was $42.125 million delivered on January 15, 2026.

Then the relationship collapsed. Jefferies recently notified Western Alliance that the final two principal installments scheduled for Q1 2026, representing $126.4 million, would not be forthcoming.

Jefferies issued a forceful rebuttal. “We believe that the lawsuit is without merit and it will be defended vigorously,” the company declared in a Friday statement. JEF shares retreated between 5% and 6.6% during trading.

The First Brands situation continues to deteriorate. Brian Finneran, a managing director at Truist Securities, characterized the evolving story as “just getting so much worse” while questioning “whether everyone will have another round of losses.”

Chief Executive Kenneth Vecchione of Western Alliance detailed a mitigation strategy for the financial impact. The institution intends to generate $50 million through strategic securities portfolio sales — approximately $45 million of which has been captured within the current quarter — while implementing $50 million in operational expense reductions.

These combined measures address $100 million of the shortfall. The outstanding $26 million deficit remains unresolved, though Vecchione indicated the bank is “evaluating other pathways” to close the gap.

J.P. Morgan analyst Anthony Elian emphasized the importance of ensuring Western Alliance’s earnings performance after Q1 experiences “very minimal impact” from this charge-off event.

Notwithstanding the charge-off, Western Alliance maintains its CET1 ratio would fall merely 7 basis points from the year-end 2025 measurement of 11.0%. Management continues to forecast Q1 profitability with stable capital levels.

As of March 5, 2026, the institution reported that 75% of aggregate deposits carry insurance or collateralization, $21.5 billion in unencumbered premium liquid assets, and $20 billion in available off-balance sheet funding capacity.

Western Alliance emphasized it remains on track to deliver profitable quarterly results notwithstanding the financial setback.

Mar 6, 2026, 3:01 p.m.

Shares of The Cooper Companies, Inc. (COO) experienced downward pressure despite delivering robust fiscal first-quarter results and demonstrating significant earnings momentum. The stock finished at $80.20, down 2.17%, before extending losses to $75.23 in pre-market activity. This market reaction came even as the medical device manufacturer reported enhanced revenue, improved profit margins, and upgraded earnings projections.

The Cooper Companies, Inc., COO

The company posted consolidated revenue totaling $1.024 billion for the first fiscal quarter. This represents a 6.2% year-over-year increase from the comparable period. On an organic basis, revenue climbed 2.9%, indicating consistent underlying demand across core business lines.

Profitability metrics showed meaningful improvement as operational discipline and restructuring initiatives delivered benefits. The non-GAAP gross margin came in at 68.1%, while the operating margin expanded to 26.9%. Operating expenses as a percentage of total revenue decreased versus the prior-year quarter.

Non-GAAP diluted earnings per share climbed 20% year over year to reach $1.10 for the period. The share count averaged approximately 197 million during the quarter. Management responded by elevating full-year non-GAAP EPS guidance to a range of $4.58 to $4.66.

CooperVision generated $695 million in revenue during the quarter, representing 7.6% growth compared to the year-ago period. The division’s organic revenue advanced 3.3%, supported by consistent worldwide demand for contact lens solutions. Innovation initiatives and geographic market penetration drove segment results.

The MyDay premium contact lens portfolio gained traction with stronger uptake across multiple international territories. Meanwhile, MiSight lenses extended their presence in the myopia management category. MiSight product revenue climbed 23% versus last year to total $28 million.

The Asia-Pacific territory presented challenges, with revenue declining 4% during the reporting period. Weakness in traditional hydrogel offerings in the Japanese market primarily accounted for the regional shortfall. Company leadership anticipates continued softness in the current quarter before growth resumes in the third fiscal quarter.

CooperSurgical recorded quarterly revenue of $329 million, achieving 3.3% year-over-year expansion. On an organic basis, the division grew 2.2%, signaling consistent advancement across its medical device offerings. Fertility-related products displayed early indicators of demand recovery.

The fertility business generated $127 million in quarterly revenue, advancing 3% organically. Improved procedure volumes and stable product demand contributed to segment performance. These results reflect gradual healing in the reproductive health marketplace.

The company produced $159 million in free cash flow during the three-month period. Share repurchase activity totaled 1.1 million shares for $92 million, while management refinanced $950 million in term debt, extending maturity to February 2031. Net debt decreased to approximately $2.4 billion as the balance sheet strengthened.

Leadership remains committed to expanding market position, enhancing operational performance, and maintaining disciplined capital deployment strategies. These priorities underpin sustainable growth prospects across both business segments. Nevertheless, investor sentiment turned negative following the earnings announcement, with shares extending declines into the following trading session.

The crypto market remained on edge today, March 6, as the war in Iran continued. It also wavered as the US non-farm payrolls and retail sales dropped and the unemployment rate jumped.

Summary

Bitcoin (BTC) price remained at $70,000 at press time. Ethereum (ETH) hovered slightly above $2,000, while Ripple (XRP) remained steady above $1.40.

Crypto prices reacted to the latest jobs report, which was much worse than expected. The US economy shed over 92,000 jobs in February, the worst performance in years. Economists were expecting the report to show that the economy added 59,000 jobs.

The unemployment rate rose from 4.3% in January to 4.4% in February. Additionally, the participation rate dropped to 62%, while the average hourly earnings rose 0.4%.

These numbers show that the labor market is getting worse, a trend that may continue after several layoffs. For example, Amazon announced that it was cutting more jobs in its robotics arm this week. It has slashed 57,000 jobs in the last three years. Other companies like Target and UPS have slashed jobs recently.

More data revealed that the US retail sales dropped by 0.2% in January. That is a notable figure as consumer spending is the biggest part of the US economy.

Therefore, in theory, these numbers are bullish for the crypto market as they may lead to a Federal Reserve intervention. In a recent statement, Stephen Miran, a senior Fed official, said that he supported more interest rate cuts, citing the labor market.

The main challenge for the Fed is that inflation may worsen as the war in Iran continues. Crude oil prices continued rising, with Brent moving to $90 and the West Texas Intermediate moving to $87. Gasoline jumped to the highest point since 2024, meaning that inflation may rebound soon.

Data on Polymarket shows that traders anticipate one or two interest rate cuts this year. In most cases, Bitcoin and the crypto market does well when the Fed is signaling that it will cut rates.

Recent events at the US Federal Reserve signal acceptance of digital assets at the highest levels of the country’s monetary system.

Kraken recently became the first crypto exchange to receive a master account at the Federal Reserve.

The Fed could also see a new crypto-friendly chair. US President Donald Trump on Wednesday submitted a pro-Bitcoin candidate for the Senate’s consideration.

These developments represent a significant shift in how the Fed could treat the crypto industry. But there are also detractors.

On Wednesday, Kraken announced that its Wyoming-chartered bank, Kraken Financial, had been awarded a Fed master account. This made it “the first digital asset bank in US history to gain direct access to the Federal Reserve’s payment infrastructure.”

Kraken co-CEO Arjun Sethi said, “With a Federal Reserve master account, we can operate not as a peripheral participant in the US banking system, but as a directly connected financial institution.”

The master account represents access to the most coveted form of money for financial institutions: dollars held directly within the Federal Reserve system.

Related: US Bitcoin reserve still has no plan to stack sats

These dollars are widely perceived as risk-free. Aaron Brogan of Brogan Law, a firm specializing in digital assets, said they “are the intrinsic architecture of the United States monetary system, which can always just make more of them.”

Since United States dollars remain the preeminent global currency, the best form of USD is the best there is. Other instruments like cash, dollars in FDIC-insured bank accounts and T-Bills are pretty good, but Fed dollars are the best.”

For an exchange like Kraken, “it improves reliability and efficiency for moving fiat deposits in and out of digital-asset markets,” according to Sethi.

But not every financial institution is granted access, and certainly not the upstart disruptors of the cryptocurrency industry, at least not until now.

The Federal Reserve System is split into 12 different banks. While these banks come together for important policy decisions, each has a certain degree of autonomy.

In an effort to bring the Fed system a bit closer together, Congress passed the Monetary Control Act of 1980. The law gave all depository institutions access to Federal Reserve accounts. This was the beginning of the master account.

Julie Andersen Hill, the dean of the University of Wyoming’s College of Law, wrote that Congress “intended that all depository institutions would be able to use the Federal Reserve’s payment systems. The legislative history of the Monetary Control Act is littered with references to ‘open access’ to ‘all depository institutions.’”

However, as the banking industry changed, the Fed began to express preferences over who got access and how much. Per Brogan, three tiers developed:

Tier 1: Federally chartered banks with deposit insurance

Tier 2: Federally chartered banks without deposit insurance

Tier 3: State-chartered banks

“Perhaps unsurprisingly, the Federal Reserve Board thinks banks in Tier 1 should get master account access, while Tier 3 banks are subject to heightened scrutiny, and Tier 2 somewhere in the middle,” he wrote.

The crypto industry has long had a problem with finding banks willing to serve them. Those that would were often state-chartered banks, which already had trouble accessing the federal system.

Related: Banks can’t seem to service crypto, even as it goes mainstream

The Fed doesn’t want to be too exclusive with master accounts. According to Thomas Kingsley, director of financial services policy at the American Action Forum, “During periods of stress, access to central bank settlement accounts can materially affect a firm’s ability to meet redemption demands. In that sense, master account access can reduce run risk relative to structures reliant on commercial bank deposits.”

However, the Fed also doesn’t want to give out access to just any institution. Per Kingsley, “If a large nonbank with a master account were to experience operational failure or disorderly unwinding, the disruption would occur closer to core financial infrastructure.”

Enter the skinny account. In October 2025, Fed Governor Christopher J. Waller proposed a new type of account that would provide access to Fed payment rails, but also control for certain risks, while carrying restrictions. These are:

This is what Kraken got. It may be limited, comparably, but it is still a major victory for the institutionalization of crypto. Pro-crypto Senator Cynthia Lummis called it a “watershed milestone in the history of digital assets.”

Not everyone’s happy about it. Independent Community Bankers of America (ICBA) CEO Rebeca Romero Rainey wrote, “Granting nonbank entities and crypto institutions access to master accounts poses risks to the banking system.”

She said that there are “significant risks to expanding direct Fed account access to institutions that operate outside the traditional banking regulatory framework.”

The Banking Policy Institute’s co-head of regulatory affairs, Paige Pidano Paridon, said the BPI was “deeply concerned” that the Fed approved the “‘limited purpose’ master account—which appears to be a ‘skinny’ account—before the Federal Reserve Board has finalized its policy framework for those accounts.”

She said that the decision ignored public comment the Fed sought on skinny accounts and was made “with no transparency into the process for approval or the risk mitigants that have been imposed to address the very significant risks it raises.”

In addition to the US central bank giving accounts to crypto exchanges, the bank itself could soon be led by a pro-crypto economist. On Wednesday, Trump sent the nomination of Kevin Warsh, a Shepard Family Distinguished Visiting Fellow in Economics at the Hoover Institution of Stanford University, to the Senate.

The White House is seeking to make Warsh chair for four years and a governor on the Fed board for 14 years.

Warsh, who served as a Fed governor under former US Presidents George W. Bush and Barack Obama from 2006 to 2011, has made some pro-crypto remarks in the recent past.

“Bitcoin does not make me nervous,” he said in a May 2025 interview. He said that billionaire investor Marc Andreessen, “showed me the white paper […] I wish I had understood as clearly as he did how transformative Bitcoin and this new technology would be. Bitcoin doesn’t trouble me. I think of it as an important asset that can help inform policymakers when they’re doing things right and wrong.”

Warsh’s nomination may not be smooth sailing. Democratic lawmakers and central banking policy experts alike have expressed concerns about the Trump administration’s continued efforts to exert control over the Fed.

Trump has wanted interest rate cuts for months, but the Fed, currently chaired by Jerome Powell, has not complied with his wishes.

In January, Trump’s Department of Justice served the Federal Reserve with grand jury subpoenas and threatened Powell with a criminal indictment over alleged misuse of funds to build an office building. Powell claimed that the real argument was over the Fed’s unwillingness to follow orders from the White House.

The US central bank is increasingly accepting cryptocurrency, a trend that is likely to continue with new, more favorable policies and pro-crypto leadership.

Magazine: What’s a ‘Network State’ and are there real-life examples? Big Questions

XRP price is holding near a critical support level as exchange reserves fall sharply, a development that could tighten available supply in the market.

Summary

XRP (XRP) was trading at $1.38 at press time, down 3.1% over the past 24 hours. The token moved within a weekly range of $1.28 to $1.46 and has lost about 17% over the past month.

It now sits more than 60% below its July 2025 all-time high of $3.65. Market activity has also cooled.

Trading volume dropped to $2.28 billion in the last 24 hours, down 38% from the previous day. Data from CoinGlass shows derivatives volume fell 26% to $3.58 billion, while open interest slipped 2.69% to $2.33 billion, showing that some traders are closing or reducing positions.

An March 6 analysis by CryptoQuant contributor Amr Taha reveals that the amount of XRP held on Binance has dropped sharply in recent months.

Exchange reserve data measures the total value of a particular asset sitting on a trading platform. For XRP on Binance, the metric reflects the dollar value of all tokens stored on the exchange.

That number changes depending on two things: how many coins users keep on the platform and the current market price of XRP.

The latest figures show that XRP reserves on Binance are now worth around $3.9 billion as of March 6. Not long ago, the value was much higher. In both January and July 2025, reserves briefly climbed above $10 billion before starting their current decline.

Large token balances on exchanges are often viewed as a sign that selling pressure could increase. When large amounts of a token sit on an exchange, traders can easily sell them, which may increase potential selling pressure.

When those balances decline, it often means investors are moving their holdings to private wallets, reducing the supply available for trading. (f demand stays steady while fewer tokens remain on exchanges, the tighter supply can help support prices and may even create upward pressure for XRP.

From a chart perspective, XRP may be finding its footing after a long stretch of downward movement.

The area between $1.30 and $1.32 has started to act as a key short-term support level. At one point the price slipped below $1.30, but the drop didn’t last long. Buyers quickly stepped in, and several daily candles managed to close back above that range.

That kind of reaction usually signals that traders are defending the level. Even so, XRP hasn’t yet regained the middle line of the Bollinger Bands, which lines up with the 20-day moving average around $1.40 to $1.42.

As long as the price remains under that mark, short-term momentum still leans slightly bearish. Volatility has also begun to ease. After February’s sharp decline, the Bollinger Bands have narrowed considerably.

This kind of tightening often appears when the market is moving sideways. Historically, these periods of compression tend to come before a larger move once volatility returns.

Momentum indicators are beginning to show modest improvement. The relative strength index, which previously fell to deeply oversold levels near 25, has rebounded to around 44. A move above the neutral 50 mark would signal strengthening bullish momentum.

Even so, the broader trend remains unchanged. Since the peak reached in January, XRP has continued to form lower highs, a classic sign that the downtrend is still technically in place. A decisive break above the $1.50 to $1.60 resistance area would be needed to shift that structure.

The $1.30 support is still the crucial level to keep an eye on for the time being. XRP may attempt a reversal toward $1.50 or even $1.60 if buyers are able to hold it and push the price back above the $1.42 mid-band. However, the next downward targets might show up at $1.20 or even $1.10 if the support gives way.

Ethereum is attempting to extend its rebound from the February lows, but the broader structure still reflects a market in recovery mode rather than a confirmed trend reversal. The next sessions should clarify whether this bounce can turn into a sustained move, or if it remains a corrective rally inside a larger downtrend.

On the daily chart, ETH remains within a descending channel and continues to trade below the major moving averages, with both the 100-day MA and the 200-day MA still acting as overhead pressure. This keeps the higher-time-frame bias cautious, as rallies into these dynamic resistance areas often attract supply unless price can reclaim them decisively.

From a level perspective, the first meaningful resistance sits around the $2,350 to $2,450 region, which aligns with prior structure and a visible supply area. A clean daily reclaim and hold above that zone would improve the outlook and put the $2,800 to $3,000 region back in play. On the downside, the $1,800 area remains the key demand zone that previously absorbed heavy selling. Losing it on a daily basis would expose the next lower band around $1,500.

The 4-hour chart shows ETH stabilizing after the sharp sell-off, but the price action is still capped by nearby resistance, with $2,150 standing out as the immediate pivot. Recent attempts at that level have been met with rejection, suggesting sellers remain active overhead and that buyers still need stronger follow-through to flip the short-term structure.

If ETH can reclaim the $2,150 level and then hold above it, the next upside path would likely target the $2,300-2,400 area first, as the resistance zone from the daily chart.

If the rejection continues, however, or the price fails to recover after the recent fake breakout, the focus shifts back to the $1,800 region as a short-term support, and then to the $1,600-$1,500 demand area. A break below that demand zone would materially weaken the consolidation setup and raise the odds of a much deeper continuation lower.

Funding rates have turned mildly positive again, indicating leverage is slowly rebuilding on the long side after the capitulation phase. This is a constructive sign if it comes alongside steady price appreciation, since a balanced funding environment often supports healthier continuation rather than fragile, overlevered pumps.

That said, the market is still vulnerable around key resistance. If ETH remains capped below $2,150 while funding stays positive, the risk of long positioning becoming crowded increases, which can lead to sharp downside wicks and forced de-risk events. The cleaner bullish scenario is a sustained push above resistance with funding staying controlled, rather than spiking higher, as that would signal demand is driving the move instead of leverage chasing it.

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

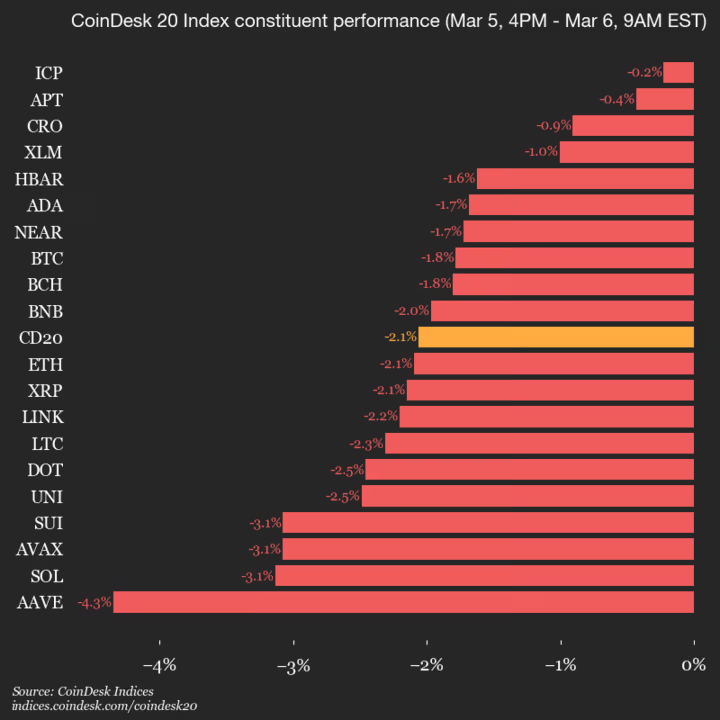

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1991.98, down 2.1% (-41.93) since 4 p.m. ET on Thursday.

None of the 20 assets are trading higher.

Leaders: ICP (-0.2%) and APT (-0.4%).

Laggards: AAVE (-4.3%) and SOL (-3.1%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Bitcoin (CRYPTO: BTC) cooled after marching toward a fresh high near $74,000 earlier in the week, setting up a critical debate among traders about whether the rally marks a local top or the next leg in a larger bullish sequence. The pullback comes as market participants weigh whether the current move mirrors patterns from prior cycles and what it portends for the path ahead. Notably, the market had already surged to a roughly $126,000 peak in October 2025, a reminder that outsized booms can be followed by sharp corrections. As sentiment remains mixed, analysts are scrutinizing structure, liquidity, and on‑chain dynamics to gauge the probability of renewed upside versus a deeper retracement.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Neutral. The narrative centers on potential scenarios rather than an established directional move.

Trading idea (Not Financial Advice): Hold. Given mixed signals and a lack of a clear breakout or breakdown, a cautious stance is warranted until clearer support or resistance levels emerge.

Market context: The broader market is digesting liquidity shifts and policy expectations as ETF inflows intensify and supply tightens, factors that could either reinforce a nascent rally or amplify a retest of lower levels depending on risk appetite and macro cues.

The ongoing tug-of-war around BTC’s price has broad implications for traders, institutions, and on‑chain participants. If the market can sustain momentum above key pivots, the narrative shifts toward a continued ascent into the mid-to-upper 70k range and beyond, potentially attracting fresh inflows from both retail and institutional players. Conversely, a failure to hold critical support could unleash a renewed wave of selling pressure, testing the resilience of buyers and reviving memories of the sharp drawdowns that defined earlier cycles.

One of the most salient factors shaping the near-term outlook is liquidity. The year has seen a divergence between price action and on-chain signals, with exchange outflows and the behavior of large holders cited by analysts as meaningful foreshadowing tools. For instance, a notable episode where substantial BTC moved off exchanges was highlighted as an indicator of potential accumulation. Observers also point to the interplay between on-chain activity and risk sentiment, noting that the absence or presence of major liquidity events often precedes meaningful price moves.

Another layer of complexity comes from the macro backdrop and regulatory considerations. As strategic investors reassess risk, the direction of ETF inflows—especially for spot BTC products—has become a barometer for institutional confidence. In this context, the current cycle’s mix of supply constraints and growing demand could tilt the market toward a more sustained rally, provided that macro conditions remain conducive and risk appetite stays buoyant. However, if macro momentum stalls or adverse developments emerge, the same structural strengths could be insufficient to prevent a retest of lower zones, underscoring the sensitivity of BTC to both investment flows and broad market psychology.

Market observers continue to dissect Bitcoin’s price behavior within a framework that weighs whether key milestones herald a durable pivot or a temporary pause before another leg lower. The move to approximately $74,000 has provoked a spectrum of interpretations, from calls for caution to bets on a renewed upswing. As with prior cycles, the narrative now centers on whether the current rally can sustain itself in the face of technical overheads, liquidity dynamics, and evolving macro cues.

The fractal view—where past bear-market patterns repeat in a compressed timeline—remains a touchstone for many market watchers. Some analysts argue that the current structure mirrors the mid-phases of previous cycles, which could imply additional downside risk if the strength of the bounce fades. Others stress that the market environment has shifted through a combination of supportive factors, including tighter supply and escalating institutional interest, which could cushion against a sharp retreat.

Notable voices in the community have offered contrasting takes. One analyst highlighted that each cycle tends to form a local top before a new cycle of price discovery, a pattern that could imply a correction after the recent rally. Others point to a different dynamic this time around, arguing that the combination of liquidity pumps and on‑chain behavior may yield a higher probability of a sustained breakout. The discussion is nuanced, and the outcome will hinge on the durability of support at critical levels and the intensity of buying pressure as the market digests new information.

As part of the broader narrative, several observers emphasized the potential influence of external factors beyond price action alone. The trajectory of ETF inflows, for instance, could prove decisive in shaping near-term momentum, while shifts in risk appetite driven by macro developments will likely redefine the odds of success for a move above the $75,000 threshold. In that regard, the market remains highly sensitive to headlines and liquidity shifts, with traders adopting a careful stance until a clearer pattern emerges.

Analysts who track swing dynamics note that, even if the path stays volatile, there is a growing recognition that the market is being influenced by a broader regime shift—one where on‑ramp liquidity, speculative positions, and institutional participation interact in ways that were less pronounced in earlier cycles. The result is a more complex price landscape, where a single event or data point is unlikely to decide the outcome. Instead, market participants will likely respond to a constellation of signals, including on‑chain flows, ETF activity, and macro indicators, as they gauge whether the current cycle is setting up for a durable move or another retracement.

For now, the consensus remains mixed. The price action to date—coupled with warnings of potential sub-$60,000 revisits and the prospect of a breakout if certain levels hold—suggests that risk-managed positioning may be prudent for those navigating this period of uncertainty. The story remains about the balance of power between bears and bulls, with the outcome likely to be defined by the next few price swings rather than a single trend line.

Alan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

Weekend Open Thread: Iris Top

Unihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

Abusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

Dubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

The Vikings Need a Duck

The empty pub on busy Cambridge road that has been boarded up for years

‘Significant’ damage to boarded-up Horden house after fire

Bitwarden adds support for passkey login on Windows 11

Baby Gear Guide: Strollers, Car Seats

499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

Emirates confirms when flights will resume amid Dubai airport chaos

Is it acceptable to comment on the appearance of strangers in public? Readers discuss

Viral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

How to Build Finance Dashboards With AI in Minutes

Guthrie Disappearance Enters Fifth Week as Family Visits Memorial

US Judge Lets Binance Unregistered Token Class Action Proceed

Ukraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

On the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!