Crypto World

Is Bitcoin Really in a Bear Market and Where Is the Bottom?

BTC’s bottom might not be in, warned ChatGPT and said there could be more pain ahead for investors. Here’s how low bitcoin could go.

Whenever bitcoin corrects after a prolonged rally, the general question within the cryptocurrency community is whether this is another “healthy” retracement in a bull market, or the trend has changed completely, and the bears are in full control.

The past few months, though, do not appear to be a regular correction. Bitcoin traded above $126,000 in early October before it plunged to under $100,000 by the end of the year. Its impressive start to 2026 was quickly halted, and the asset plummeted to $60,000 last Friday, charting a 52% drop since its all-time high.

What’s perhaps even more worrying is the fact that most other asset classes, including the precious metal market, kept riding high during this time, charting consecutive new peaks.

As such, we decided to ask ChatGPT if it believes BTC is indeed in a bear market or whether this is another ‘typical’ correction.

Is It a Bear Market?

The AI solution acknowledged the substantial crash in early February, indicating that it “represents a major structural shift.”

“Importantly, the $60K zone was a former breakout level during the 2025 rally, which now acts as critical support.”

If the cryptocurrency finds a solid support and stabilizes at these levels, as it has done in the past week, the move south could “resemble previous 50% resets seen during strong cycles,” said the AI. However, a breakdown below these levels could “strengthen the bear thesis significantly.”

In conclusion to this question, ChatGPT said that BTC is indeed in a bear market, at least by the definition of that phrase. The only thing that remains uncertain is the magnitude and duration.

You may also like:

Where Is the Bottom?

OpenAI’s platform believes there’s a 35% chance that the bottom was in at $60,000. However, its most likely scenario envisions at least one more leg down that could drive the cryptocurrency to $50,000-$52,000.

“The $50K region represents a strong psychological level and prior consolidation zone. A move here would mark a roughly 60% drawdown from the all-time high, aligning with more severe but still cyclical corrections.”

ChatGPT also outlined two extreme cases, both of which it believes are highly unlikely – a capitulation crash to $40,000-$45,000 or a full-on investor exodus to under $35,000. Nevertheless, it explained that both of these scenarios would require a massive black swan event, such as FTX’s collapse or a new war.

Will Bitcoin Endure?

No matter which of the aforementioned scenarios materializes, ChatGPT remains positive on bitcoin’s long-term potential. It reminded that the asset has experienced and survived far worse drawdowns of up to 80% or even 90% in its early days.

“The most realistic bottom range currently sits between $50K and $60K, with a deeper flush toward the low-$40Ks possible if macro conditions worsen. However, bitcoin has shown extreme resiliency in the past, and there’s not much evidence to suggest otherwise now.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Most Undervalued Since March 2023 at $20K, BTC Price Metric

Bitcoin (CRYPTO: BTC) is approaching what on-chain researchers describe as an undervalued zone for the first time in more than three years, according to CryptoQuant’s latest data. The market-value-to-realized-value (MVRV) ratio, a classic gauge of whether Bitcoin is fairly valued relative to the price at which the supply last moved, has moved toward a breakeven point after a months-long downtrend that followed an October 2025 all-time high. Last week’s price action saw BTC dip below $60,000, a level that has framed the market’s sentiment and testing of support in recent cycles. With the MVRV metric hovering near 1.1, analysts say the asset is edging into territory that historically accompanies accumulation and potential reversal, though they caution that no single indicator guarantees a bottom.

Key takeaways

- The MVRV ratio is approaching its key breakeven threshold for the first time in more than three years, signaling a potential move toward undervaluation.

- CryptoQuant data show the MVRV reading around 1.1, the lowest since March 2023 when Bitcoin was trading near $20,000.

- Analysts emphasize that when MVRV dips below 1, Bitcoin tends to be undervalued; the current reading sits above that level but within a range historically tied to bottoms or near-bottom conditions.

- The two-year rolling Z-score of the MVRV ratio has recently reached historic lows, a pattern some traders compare to prior bear-market bottoms, suggesting accumulation dynamics may be forming.

- Past commentary notes that the Downdraft since the October 2025 peak has not featured a rapid ascent into an overvalued zone, a nuance that could differentiate this cycle’s bottom formation from earlier ones.

Tickers mentioned: $BTC

Market context: On-chain signals come as Bitcoin experiences a multi-quarter consolidation after a new all-time high, with traders watching MVRV and Z-score metrics alongside price levels around $60,000. The combination of shifting on-chain signals and macro risk sentiment will likely influence whether the current downtrend resumes or a broader accumulation phase takes hold.

Why it matters

On-chain metrics like MVRV provide a lens into the psychological and behavioral underpinnings of Bitcoin’s price action. When the market value to realized value ratio approaches breakeven, commentators interpret it as a potential signal that the supply-weighted cost basis is, on average, becoming cheaper relative to current market prices. CryptoQuant contributors have highlighted that Bitcoin’s MVRV ratio hovered around 1.13 after Bitcoin’s dip below the $60,000 level last week—the lowest print since March 2023, when BTC traded near $20,000. That backdrop matters because it frames a broader narrative: the asset may be transitioning from a drawdown phase into a period where long-term holders could be stepping in at historically favorable levels.

“Generally, when the MVRV ratio falls below 1, Bitcoin is regarded as undervalued. At present, the indicator stands at around 1.1, suggesting that price levels are nearing the undervaluation range.”

CryptoQuant’s analysis emphasizes that the current reading should be interpreted in the context of a four-month downtrend that followed Bitcoin’s October 2025 peak. The team notes that the market did not experience a sharp move into an obviously overvalued zone during the most recent bull cycle, a nuance that could influence how traders interpret the “bottom formation” narrative this time around. The research argues that such a structural difference could mean the eventual bottom may form gradually rather than through a sudden capitulation event—a scenario that has implications for long-term investors and risk teams evaluating exposure.

“The current Z-Score of $BTC is lower than during the bear market bottom in 2015, 2018, COVID crash 2020 and 2022,”

commented Michaël van de Poppe, a well-known trader and analyst, underscoring how the present configuration differs from prior cycles. In another update, CryptoQuant contributor GugaOnChain used a separate Z-score iteration to characterize BTC/USD as being in a “capitulation zone,” a reading that some interpret as an early stage of accumulation pressure forming behind the scenes. The analyst framed the takeaway as an invitation to consider the bottom could be forged in the current environment rather than simply waiting for a textbook capitulation event to materialize.

“The indicator suggests that we are approaching the historical accumulation phase,”

GugaOnChain wrote, adding that the statistical deviation captured by the Z-score points to opportunity rather than imminent disaster. While the language is nuanced, the consensus in these on-chain circles is that Bitcoin’s downside risk may be increasingly limited as long-term holders show willingness to accumulate near these levels.

What to watch next

- Track the MVRV ratio for a breakeven shift toward or below 1.0, which historically signals stronger undervaluation periods or a local bottom formation.

- Monitor the two-year rolling Z-score trajectory for a sustained move away from capitulation readings toward accumulation-style behavior.

- Observe Bitcoin price action around key support zones, particularly a continued hold above $60,000 and any subsequent retests that could validate the on-chain narrative.

- Look for corroborating on-chain signals, such as realized-cap data and transaction-flow metrics, that would reinforce a shift from distribution to accumulation.

Sources & verification

- CryptoQuant analysis on Bitcoin’s MVRV ratio and the “undervalued” zone hypothesis.

- CryptoQuant commentary on Z-score readings and capitulation-zone signals for BTC/USD.

- Cointelegraph coverage of Bitcoin’s price action, including the recent dip below $60,000 and prior bear-market analyses referenced in related on-chain pieces.

- Historical context from on-chain reporting on prior cycle bottoms (2015, 2018, 2020, 2022) and the 2023 regime when MVRV prints below 1.

Bitcoin’s on-chain signals point toward undervaluation and potential bottom formation

Bitcoin’s current on-chain narrative centers on a delicate balance between valuation signals and price action. The MVRV ratio, long used to gauge whether market prices are aligned with realized on-chain cost bases, has begun to test a breakeven threshold after a prolonged downtrend. The latest reads show MVRV around 1.1, a level that CryptoQuant contributors describe as edging into an undervaluation zone. This is especially notable given that the most recent weekly close saw BTC slip under the $60,000 mark, a psychological line that has acted as both a magnet and a ceiling in various market regimes. The juxtaposition of a price discipline around key levels with an MVRV metric that says, metaphorically, “value is being accumulated near the current prices,” fuels a nuanced debate on whether a lasting bottom is imminent or whether further consolidation is necessary before a durable uptrend can resume. (CRYPTO: BTC)

CryptoQuant researchers emphasize that when MVRV falls below 1, the signal is a cleaner undervaluation flag. While the current approximation sits around 1.1 rather than 1.0, the interpretation remains constructive: price levels could reflect a rising probability of longer-term value attraction. The last time MVRV explicitly dipped below 1 was at the start of 2023, when BTC traded around $20,000. The comparison underscores that the present cycle has delivered a different flavor of bottoming dynamics, one that may unfold more gradually than in prior cycles. The source notes that the peak-to-trough structure of the current drawdown did not send the market into a textbook overvalued regime, which broadens the set of possible scenarios around the eventual bottom and subsequent recovery.

“Generally, when the MVRV ratio falls below 1, Bitcoin is regarded as undervalued. At present, the indicator stands at around 1.1, suggesting that price levels are nearing the undervaluation range.”

Beyond the MVRV signal, the market is attuned to the behavior of another metric set—the Z-scores that measure how far current values diverge from historical patterns. In two-year windows, the MVRV Z-score has dipped to an all-time low in several instances, a pattern analysts say mirrors the kinds of bottoming behavior seen in previous cycles. Michaël van de Poppe has highlighted that the current Z-score is lower than what was observed at major bear-market bottoms in 2015, 2018, 2020, and 2022, though no single metric guarantees an outcome. A different analyst, GugaOnChain, has used an alternate Z-score variant to characterize BTC/USD as being in a capitulation zone—an environment that often precedes accumulation-driven rebounds. The underlying message is that the bottom formation, if it is underway, could be a more drawn-out process than in some historical episodes, with on-chain dynamics providing nuance that price charts alone might miss.

These signals come at a time when the broader market is listening closely to on-chain data instead of relying solely on momentum-driven narratives. The combination of a price dip to sub-60k levels and a valuation framework that points toward undervaluation is generating renewed interest among long-term holders who recall similar cycles in which the real value of Bitcoin begins to assert itself well before a definitive price breakout appears on traditional charts. In this light, the discussion shifts from whether a bottom exists to how convincingly the current readings could translate into a sustainable reversal once the cycle completes its consolidation phase. The narrative remains contingent on a confluence of factors, including future price action, on-chain flows, and macro risks that continue to shape risk appetite across the crypto ecosystem.

The analysis, while nuanced, reinforces a cautious yet curious stance among observers: the market may be near a critical juncture where valuation signals begin to align with price stability and eventual demand. As ever, the caution remains that on-chain indicators offer probabilities, not certainties, and that a range of outcomes remains plausible depending on how external forces evolve in the weeks ahead.

Crypto World

Morgan Stanley Hiring Blockchain Engineers to Integrate Ethereum, Polygon, Canton, and Hyperledger

TLDR:

- The blockchain engineer role integrates Ethereum, Polygon, Hyperledger, and Canton.

- Multi-chain strategy balances public liquidity with enterprise-grade compliance.

- Role focuses on interoperability, secure APIs, and internal orchestration layers.

- Compensation reaches $150,000, reflecting strategic blockchain talent investment.

Morgan Stanley is building a multi-chain blockchain infrastructure integrating Ethereum, Polygon, Hyperledger, and Canton, with engineers earning up to $150,000.

Globally, top banks like ICBC ($6.7T assets) and JPMorgan Chase ($4T) are driving trading and investment growth. This highlights institutional focus on secure, real-time financial data and advanced blockchain solutions.

Role Overview and Multi-Chain Focus

In their post, Morgan Stanley noted that the blockchain engineer will lead projects integrating at least four blockchains. Ethereum offers a public ecosystem with deep liquidity and extensive developer tools.

Polygon complements Ethereum by providing lower fees and faster transactions while maintaining compatibility with Ethereum standards.

Hyperledger supports permissioned networks, channel-level privacy, and customizable consensus, making it suitable for internal banking workflows and consortium-based settlement systems.

Canton emphasizes privacy-preserving synchronization across networks, designed for regulated financial markets.

The combination indicates Morgan Stanley is targeting a hybrid approach. Public networks may handle secondary market activity and broader liquidity access.

Permissioned networks focus on issuance, compliance, and confidential processing. Engineers in this role will manage the integration across these systems to ensure consistent performance and interoperability.

This structure allows different layers of the platform to operate according to business needs. Developers will need to design abstraction layers, secure API gateways, and key management frameworks.

This ensures governance, observability, and DevOps controls remain uniform across networks.

Strategic Purpose and Talent Investment

Morgan Stanley’s posting highlights the institution’s intent to build multi-chain capabilities while reducing reliance on any single blockchain.

Ethereum and Polygon provide market access, while Hyperledger and Canton satisfy privacy and regulatory requirements.

By combining public and permissioned systems, the bank maintains flexibility for evolving regulatory landscapes. Banks are increasingly adopting hybrid systems to balance compliance with liquidity opportunities.

The posting lists compensation up to $150,000 per year, reflecting the strategic value of this role. The position signals that Morgan Stanley is not experimenting but actively investing in blockchain infrastructure.

Candidates are expected to deliver integration solutions that connect public networks with enterprise-grade permissioned systems.

Internal orchestration and platform-agnostic engineering will allow Morgan Stanley to select networks based on product requirements. Engineers will ensure secure transaction processing, consistent governance, and operational transparency.

This aligns the bank with global trends toward tokenized assets and programmable financial infrastructure.

Crypto World

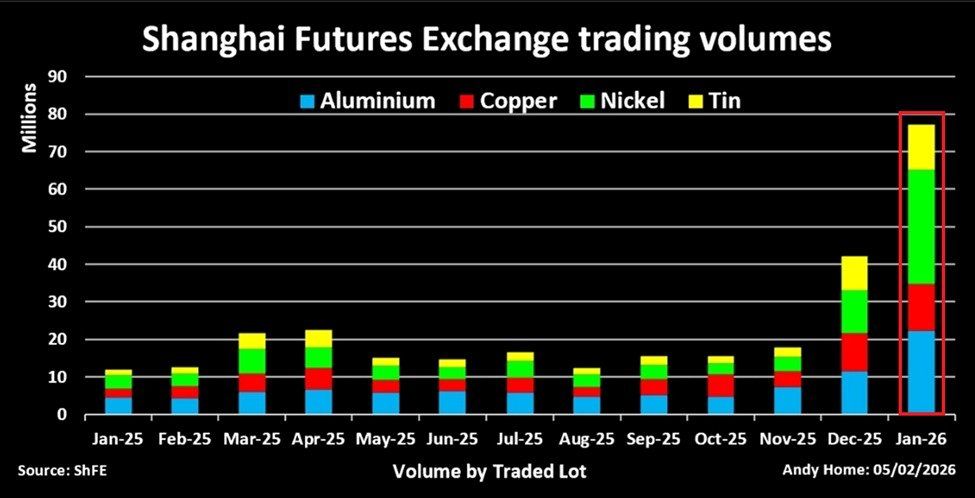

China Metals Futures Jump 86%, Retail Frenzy Triggers 38 Rule Changes

Industrial metals have suddenly become one of the most crowded trades in China, with futures volumes in aluminum, copper, nickel, and tin surging as retail traders pile into the market.

The spike in activity has pushed exchanges and regulators to intervene repeatedly, raising concerns that a wave of speculation—rather than fundamentals—is driving prices and volatility.

Recent market data shows trading activity in key base metals accelerating at an exceptional pace. Combined futures volumes in aluminium, copper, nickel, and tin on the Shanghai Futures Exchange surged sharply month-over-month, reaching levels far above the recent average.

Sponsored

Sponsored

Nickel contracts led the rally, with trading volumes jumping several-fold in a single month. Tin markets also saw extraordinary activity, with daily trading volumes at times exceeding levels that dwarf typical physical consumption benchmarks.

The turnout points to derivatives speculation, not industrial demand, dominating flows, with retail participation being a key catalyst.

Metals trading has become a trending topic across Chinese social media platforms and WeChat trading groups.

“…short-term momentum strategies and leverage are increasingly popular among individual investors,” the Kobeissi Letter indicated.

This pattern mirrors earlier speculative episodes seen in equities, crypto, and commodities, where retail enthusiasm quickly amplified price swings.

The rally’s speed has forced exchanges to step in. Both Shanghai and regional futures markets have repeatedly raised margin requirements and tightened trading rules in recent weeks.

Sponsored

Sponsored

“As a result, the Shanghai and Guangzhou Futures Exchanges have raised margins and tightened trading rules 38 times over the last 2 months to try to contain the speculation. The metals rush is far from over,” Markets Today reported.

This unusual but frequent set of interventions may signal mounting concern about excessive leverage. Historically, such measures have been used to slow speculative inflows and stabilize markets when price movements become detached from underlying supply-and-demand fundamentals.

However, repeated tightening also shows:

- How quickly trading volumes have expanded

- How difficult it may be to contain momentum once retail participation reaches critical mass.

Periods of rapid speculative growth often precede sharp corrections, particularly in highly leveraged derivatives markets.

At the same time, the broader metals complex is sending mixed signals. Silver, in particular, has experienced one of the strongest rallies in its history, climbing sharply over the past year before entering a more volatile consolidation phase.

Sponsored

Sponsored

Against this backdrop, some strategists argue that silver and other metals have become stretched relative to broader commodity indices. In previous cycles, such conditions sometimes preceded cooling price action.

Others counter that structural supply constraints and strong industrial demand, especially from energy transition technologies, could continue to support elevated prices over the longer term.

The divergence in views reflects a market struggling to distinguish between structural trends and speculative excess.

Sponsored

Sponsored

Macro Forces Lurking Behind the Rally

Beyond retail speculation, the metals surge comes amid broader macroeconomic shifts. China has been steadily reducing its holdings of US Treasuries while increasing gold reserves.

This reinforces the perception that global capital is increasingly seeking diversification away from TradFi assets.

The People’s Bank of China has reported consecutive months of gold accumulation, a trend mirrored by several other central banks in recent years.

While these macro trends do not directly explain the retail-driven surge in industrial metals trading, they contribute to a wider narrative that investors at multiple levels—from individuals to sovereign institutions—are reassessing risk, liquidity, and the role of hard assets in portfolios.

The combination of retail speculation, tightening exchange controls, and mixed macro signals suggests volatility is likely to remain elevated in the months ahead.

Crypto World

Founders admit blockchain transparency is the only defense

Prediction markets are increasingly being framed not as gambling platforms but as vehicles for monetizing information, though founders acknowledged the line can blur depending on user intent at Consensus Hong Kong 2026.

Ding X, founder of Predict.fun, argued that prediction markets more closely resemble insurance underwriting or poker than roulette. “It’s more information trading and trying to hedge risk, rather than gambling,” he said, distinguishing skill-based forecasting from games where long-term odds guarantee losses.

Farokh Sarmad, co-founder of DASTAN, agreed that speculation exists but described the sector as “a multi-trillion dollar asset class in the making.” In his view, prediction markets are simply “financializing information,” allowing participants to monetize insight rather than leaving value solely with media companies or bookmakers.

Jared Dillinger, CEO of New Prontera Group and a former professional athlete, said the classification depends largely on how platforms are built and used. “It just depends on the eyes of the beholder,” he said, adding that prediction markets function as “an information asset class,” even if some users approach them like bets.

The more pressing challenge is insider trading. High-profile examples—from leaked entertainment setlists to geopolitical developments—have underscored the risk of information asymmetry.

“Insider information is not okay,” Sarmad said, noting that blockchain transparency can make suspicious wallets visible. Still, Dillinger acknowledged enforcement limits. “There’s always going to be some loopholes that people will find.”

As trading volumes rise and regulators take notice, founders agreed that surveillance tools, clearer disclosure norms and stronger platform governance will determine whether prediction markets mature into a recognized financial category—or remain viewed as speculative betting.

Crypto World

XRP ETFs Weekly Review: Has the Demand Disappeared?

Here’s what happened to the Ripple ETFs in the past week.

It was three months ago when the wait was finally over for the XRP Army as the first spot exchange-traded fund tracking the performance of their favorite asset in the US launched.

The initial trading days were more than impressive, and a few more funds joined the Ripple fleet. However, the past week showed a rather worrying trend reversal.

XRP ETFs’ Demand Slows

Canary Capital’s XRPC set a debut-day trading volume record in 2025 on its November 13 launch and remains the market leader despite the launch of four additional funds. It now holds more than $410 million in cumulative net inflows, followed by Bitwise’s XRP ($360 million) and Franklin Templeton’s XRPZ ($328 million).

The products went for over a month without a single red day in terms of net flows, and quickly surpassed the $1 billion mark. However, the green streak broke on January 7, and there were a few more painful days since then, including January 20, and the worst – January 29.

Nevertheless, most full trading weeks ended in the green, with total net inflows stabilizing above $1.20 billion. The past week, though, showed little interest despite three days being in the green. The net inflows were $6.31 million on Monday, $3.26 million on Tuesday, and $4.5 million on Friday, shows data from SoSoValue.

Thursday was a red day, with a net withdrawal of $6.42 million, while Wednesday’s trading volume was absent, with $0.00 in flows. Although the week ended slightly in the green ($7.65 million), the total number and individual daily performance clearly show a declining demand.

But XRP Price Rockets

Despite the lack of interest in the ETFs, the underlying asset’s price went through some intense volatility, especially during the weekend. The token recovered from last week’s plunge to $1.11 but was rejected at $1.55 and spent most of the past several days sitting around $1.40.

You may also like:

The bulls went on the offensive in the past 48 hours, pushing the cryptocurrency to a multi-week peak of just over $1.65 earlier today. Nevertheless, XRP was rejected once again there and now sits around $1.55 once more.

Despite the retracement, XRP’s market cap remains well above $90 billion, placing it north of BNB for the battle for the fourth place in terms of that metric.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

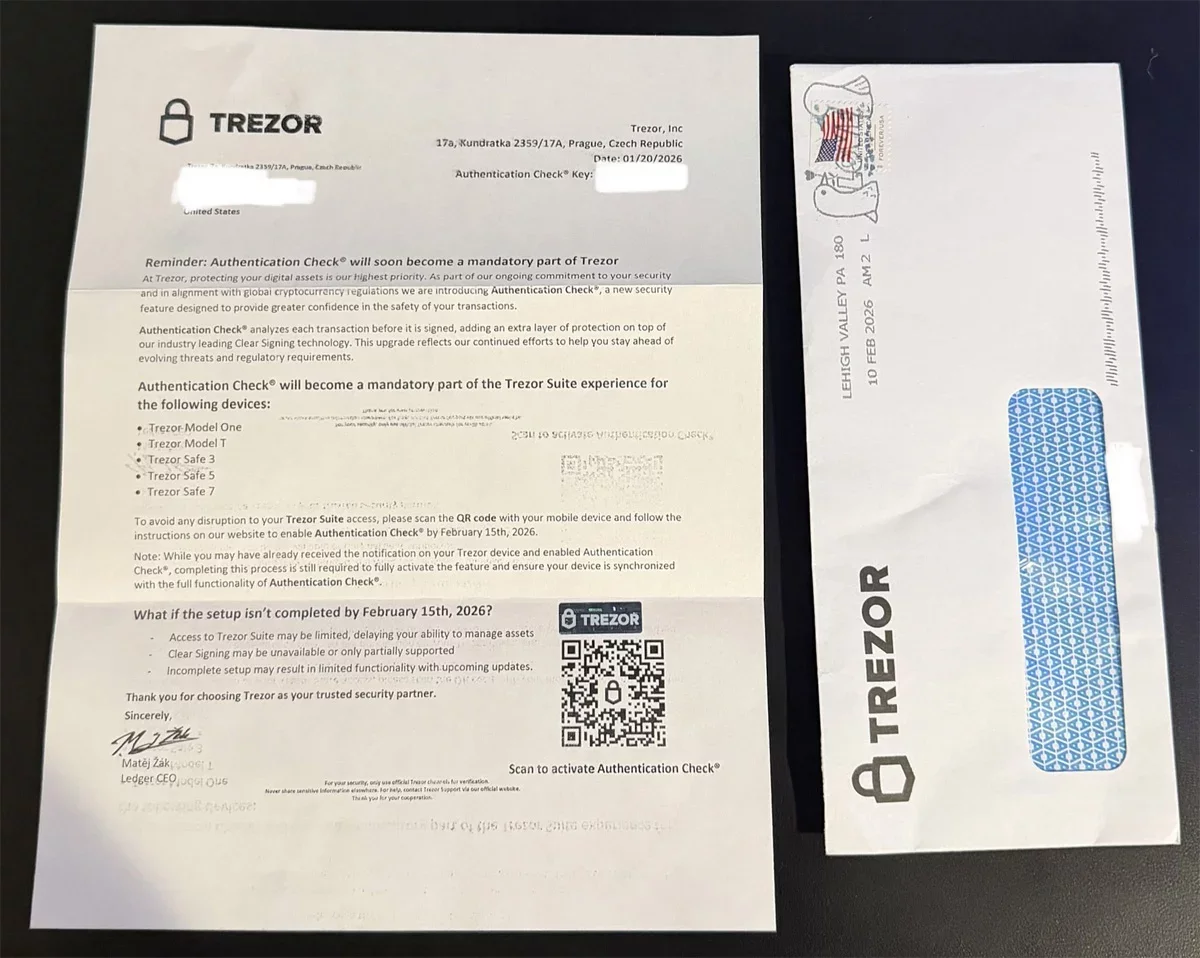

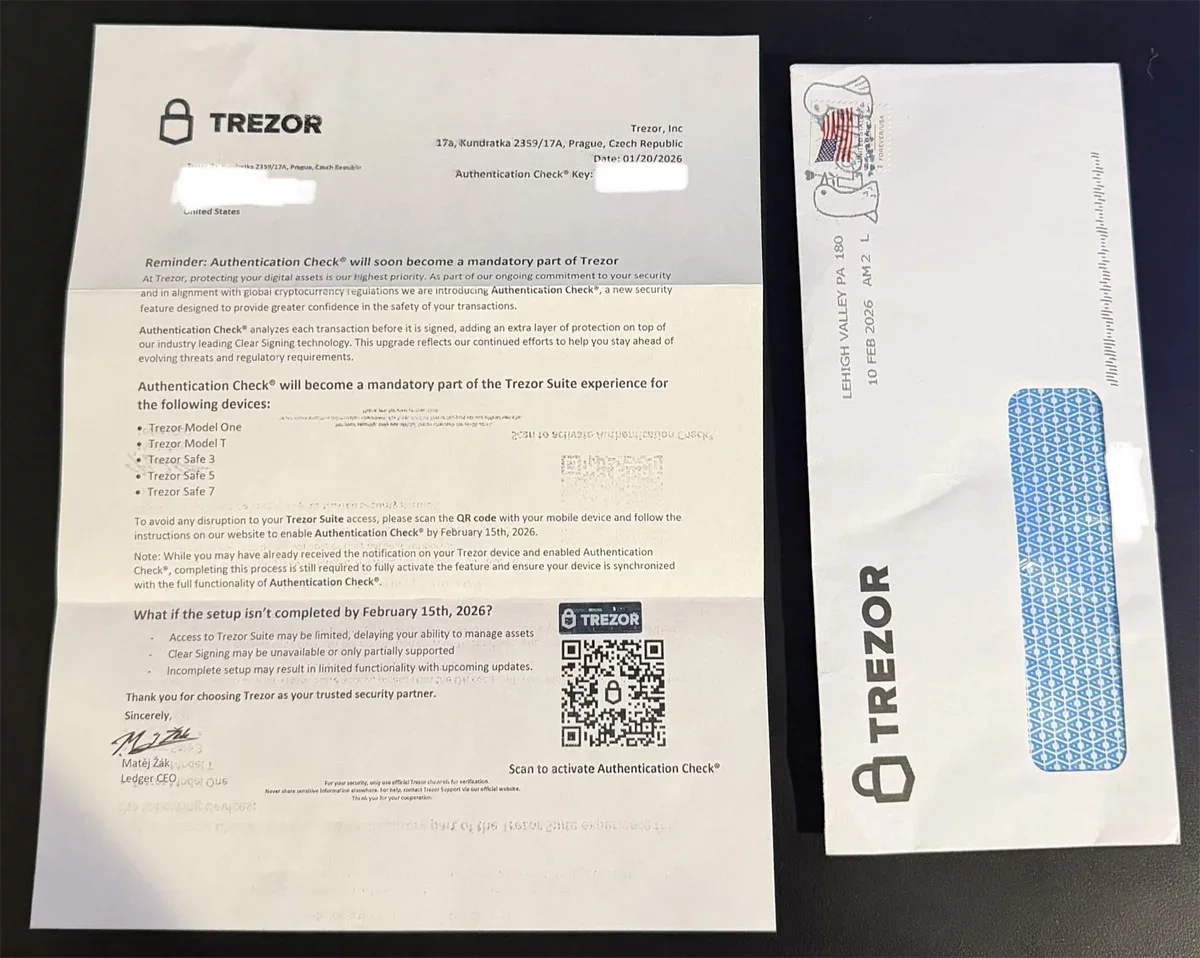

Fake Trezor, Ledger letters target crypto wallet recovery phrases

Crypto hackers are sending physical letters impersonating Trezor and Ledger to steal cryptocurrency wallet recovery phrases.

Summary

- Hackers mail fake Trezor and Ledger letters with phishing QR codes.

- Sites request recovery phrases and grant attackers full wallet control.

- Hardware wallet firms never ask users to share seed phrases.

The phishing campaign claims recipients must complete mandatory “Authentication Check” or “Transaction Check” procedures.

The hackers are also creating urgency through deadlines of February 15, 2026 for Trezor. Letters printed on official-looking letterhead direct users to scan QR codes leading to malicious websites.

The phishing sites request 24-, 20-, or 12-word recovery phrases under the pretense of verifying device ownership.

Once entered, recovery phrases transmit to threat actors through backend API endpoints, granting attackers full control over victims’ wallets and funds.

Both hardware wallet companies suffered data breaches in recent years that exposed customer contact information.

Phishing sites create urgency through functionality warnings

Cybersecurity expert Dmitry Smilyanets received a fake Trezor letter warning that failure to complete authentication would result in lost device functionality.

“To avoid any disruption to your Trezor Suite access, please scan the QR code with your mobile device and follow the instructions on our website,” the letter stated.

The Trezor phishing site displays warnings about limited access, transaction signing errors, and disruption with future updates.

A similar Ledger-themed letter circulated on X, claiming Transaction Check would become mandatory.

The phishing pages allow users to enter recovery phrases in multiple formats, falsely claiming the information verifies device ownership and enables authentication features.

Once victims enter recovery phrases, data transmits to the phishing site. Attackers import the wallet onto their own devices and drain funds.

The letters create false urgency by claiming devices purchased after November 30, 2025 come pre-configured, pressuring earlier buyers to act.

Crypto hardware wallet companies never request recovery phrases

Physical mail phishing campaigns targeting hardware wallet users remain relatively rare. Crypto hackers mailed modified Ledger devices in 2021 designed to steal recovery phrases during setup. A similar postal campaign targeting Ledger users was reported in April.

Anyone possessing a wallet’s recovery phrase gains full control over the wallet and all funds. Trezor and Ledger never ask users to enter, scan, upload, or share recovery phrases through any channel.

Recovery phrases should only be entered directly on hardware wallet devices when restoring wallets, never on computers, mobile devices, or websites.

The targeting criteria for the physical letters remains unclear. However, both companies’ past data breaches exposed customer mailing addresses and contact information to potential attackers.

Crypto World

prediction markets must shift from betting

Ethereum co-founder Vitalik Buterin warned that prediction markets are sliding toward “unhealthy product market fit” by focusing on short-term cryptocurrency price bets and sports betting.

Summary

- Vitalik warns prediction markets are becoming short-term gambling tools.

- He urges a pivot toward hedging and real-world risk management uses.

- Proposes personalized prediction baskets replacing fiat stability.

Writing on X, Buterin called the trend “corposlop” and argued platforms feel pressured to embrace dopamine-driven content that lacks long-term societal value.

Buterin proposed redirecting prediction markets toward hedging use cases, including a system where personalized prediction market baskets replace fiat currency entirely.

“We do not need fiat currency at all! People can hold stocks, ETH, or whatever else to grow wealth, and personalized prediction market shares when they want stability,” he wrote.

Current model relies on traders with “dumb opinions”

Buterin identified three types of actors willing to lose money in prediction markets: naive traders with incorrect opinions, info buyers running automated market makers to learn information, and hedgers using markets as insurance to reduce risk.

The industry currently depends on naive traders and creates what Buterin called a “fundamentally cursed” dynamic.

“It gives the platform the incentive to seek out traders with dumb opinions, and create a public brand and community that encourages dumb opinions to get more people to come in. This is the slide to corposlop,” he wrote.

Personalized prediction baskets could replace stablecoins

Buterin questioned whether an “ideal stablecoin” based on decentralized global price indices is the right solution. “What if the real solution is to go a step further, and get rid of the concept of currency altogether?” he asked.

The proposed system creates price indices for all major categories of goods and services, treating physical items in different regions as separate categories.

Each user maintains a local large language model understanding their expenses, offering personalized baskets of prediction market shares representing future spending needs.

Users could hold stocks, ETH, or other assets for wealth growth while holding personalized prediction market shares for stability. The system removes fiat currency dependence while allowing customization for individual expense patterns.

Implementation needs prediction markets denominated in assets people want to hold: interest-bearing fiat, wrapped stocks, or ETH. Non-interest-bearing fiat carries opportunity costs that overwhelm hedging value.

“Both sides of the equation are likely to be long-term happy with the product that they are buying, and very large volumes of sophisticated capital will be willing to participate,” Buterin concluded.

Crypto World

Crypto Sentiment Set to Rise After CLARITY Act Passes

Passing the CLARITY crypto market structure bill could lift sentiment amid a broad downturn, according to United States Treasury Secretary Scott Bessent. In a CNBC interview, he described the bill’s stall as a drag on industry morale, noting that clarity on the framework would provide a much-needed anchor for investors and incumbents alike. He emphasized that moving the legislation forward quickly—ideally by spring, in the window between late March and late June—could set the tone for a more predictable regulatory environment as the political landscape shifts ahead of the 2026 midterm elections. Bessent warned that congressional dynamics, particularly the potential rebalancing of control in the House, will influence the odds of a deal becoming law.

“In a time when we are having one of these historically volatile sell-offs, I think some clarity on the CLARITY bill would give great comfort to the market, and we could move forward from there.”

In a time when we are having one of these historically volatile sell-offs, I think some clarity on the CLARITY bill would give great comfort to the market, and we could move forward from there.

I think if the Democrats were to take the House, which is far from my best case, then the prospects of getting a deal done will just fall apart,” Bessent continued. The Treasury secretary stressed that legislative motion on the bill should come “as soon as possible” and be sent to President Trump for signature within the spring window—an interval spanning roughly late March to late June—given the potential shift in political power during the 2026 midterms.

The broader discourse around the CLARITY Act has intersected with a series of policy conversations and industry concerns. White House officials had previously met with crypto and banking representatives to discuss stablecoins and market structure, signaling continued interest at the intersection of finance and regulation. The ongoing dialogue underscores the sensitivity of policy timing to electoral dynamics and the need for a credible legislative path to reduce uncertainty for participants across the ecosystem.

The 2026 midterm elections could throw a wrench in Trump’s crypto agenda

The balance of power in Washington often shifts during midterm years, a dynamic that former Magic Eden general counsel Joe Doll highlighted to Cointelegraph. The possibility that the House could tilt away from the current alignment injects additional risk into the policy calculus surrounding crypto-friendly reforms. Economic thinker Ray Dalio noted in January that a two-year window of political mandate could be undermined by a midterm verdict and the ensuing renegotiation of policy directions. If crypto-friendly principles are not codified into law, such political shifts could reverse the policy trajectories pursued during the administration. In the current landscape, the Republican Party holds a slim four-seat majority in the House (218-214), a distribution that means even narrow election outcomes could alter the calculus for reform.

Market watchers have also looked to prediction markets for a sense of how the midterms might unfold. Polymarket’s odds for the balance of power in 2026 project a split Congress as a plausible outcome (about 47%), with a Democratic sweep ranking at roughly 37% at the time of analysis. Those probabilities reflect the high degree of uncertainty that markets assign to policy continuity in crypto regulations, particularly if control of Congress remains contested. The numbers serve as a reminder that political risk remains a material variable for investors and firms navigating the regulatory landscape.

Sources and official references linked in coverage show that the policy conversation around the CLARITY Act is not happening in a vacuum. Reporting on the legislative posture, and the broader market implications, has drawn on remarks and analyses across major outlets and industry analyses, including coverage of the CLARITY Act’s political and market ramifications. The conversation also touches on the regulatory reception to stablecoins and market structure reforms, as seen in related reporting on White House discussions between regulators and industry participants.

As the discourse evolves, the question for market participants is how swiftly a clarified framework could be translated into enforceable rules and practical risk-management practices—without stifling innovation. A sooner movement toward clarity could reduce the anxiety that accompanies regulatory ambiguity, potentially supporting liquidity and risk appetite in a sector that has faced repeated bouts of volatility. But even with a clearer path to law, the degree to which the legislation aligns with the broader political project, and whether it endures through midterm shifts, will influence its effectiveness as a stabilizing force.

In this environment, the CLARITY bill stands out as a focal point where regulatory ambition meets political reality. The coming weeks and months will reveal whether the administration and lawmakers can reach a compromise that satisfies both investor protections and innovation-friendly constraints. The timing is tight: spring is traditionally the window for signature opportunities ahead of the new political cycle, and any delay could heighten the uncertainty that currently weighs on market sentiment.

The broader takeaway is that policy clarity matters more than ever when markets confront major volatility, and the next steps on the CLARITY Act could influence how the crypto sector allocates capital, builds infrastructure, and negotiates with traditional financial regulators. As the discussion continues, observers will be watching whether the administration can translate political will into a durable framework that supports both consumer protection and industry growth, while also accommodating the diverse interests that shape crypto policy in the United States.

What to watch next

- Progress of the CLARITY Act through congressional committees, with a focus on timing for floor action in the 2026 session.

- Any new White House statements or regulatory signals related to stablecoins and market structure reforms.

- Updates from key political actors as the 2026 midterms approach, including potential shifts in House control.

- Public commentary from major industry leaders and economists on the bill’s potential impact on liquidity and investor confidence.

- New polling or market-implied probabilities from prediction markets reflecting policy trajectory and election outcomes.

Sources & verification

- CNBC interview with Treasury Secretary Scott Bessent discussing the CLARITY bill and its potential impact (video, February 13, 2026).

- Crypto industry policy discussions and market structure debates referenced in Cointelegraph coverage on the CLARITY Act (Crypto industry split over clarity act).

- Cointelegraph reporting on White House discussions with crypto and banking reps about stablecoins and market structure (White House officials meeting market structure bill).

- Discussion of the 2026 US midterm balance of power and its implications for crypto policy (The balance of power typically shifts).

- Polymarket odds for the 2026 midterms and the likelihood of a split government (Polymarket: Balance of power 2026 midterms).

- US House data detailing party breakdown in the 118th Congress (data: pressgallery.house.gov).

Policy clarity could steer crypto markets through volatility ahead of 2026 midterms

The latest commentary from Treasury leadership underscores how regulatory clarity on the CLARITY Act is seen as a potential antidote to a period of heightened volatility in crypto markets. By framing a clear regulatory path, advocates argue it could ease caution among traders, reduce some of the overhang created by policy ambiguity, and possibly encourage more risk-taking in regulated venues. The argument is not merely about speed; it is about providing a stable, predictable framework that can accompany innovation rather than constrain it.

From a market dynamics standpoint, the timing is delicate. If the bill is advanced and signed into law ahead of the 2026 elections, industry participants hope for a period of relative policy continuity that could support capital formation and advanced product development. Conversely, a drawn-out process or a policy reversal in the wake of a midterm shift could reintroduce uncertainty, complicating executives’ investment theses and potentially altering capital flows across crypto markets and related financial instruments.

Ultimately, the CLARITY Act sits at the intersection of market structure discussions, consumer protection considerations, and the political calendar. The next steps will be telling: will policymakers align on a pragmatic framework that reduces risk without stifling innovation, or will partisan dynamics push reform onto a longer timeline? As observers weigh the odds of a spring signature, the industry remains focused on the broader trajectory of regulation, and on how that trajectory could influence liquidity, product development, and the appetite for regulated crypto ventures in a market that continues to grapple with volatility and regulatory ambiguity.

Crypto World

Hedera (HBAR) Price Breaks Out In Preparation for 60% Rally

Hedera price has surged in recent sessions, positioning HBAR for a breakout from a bullish chart pattern.

The recent move reflects improving sentiment across select altcoins. However, breakouts require follow-through buying.

Sponsored

Sponsored

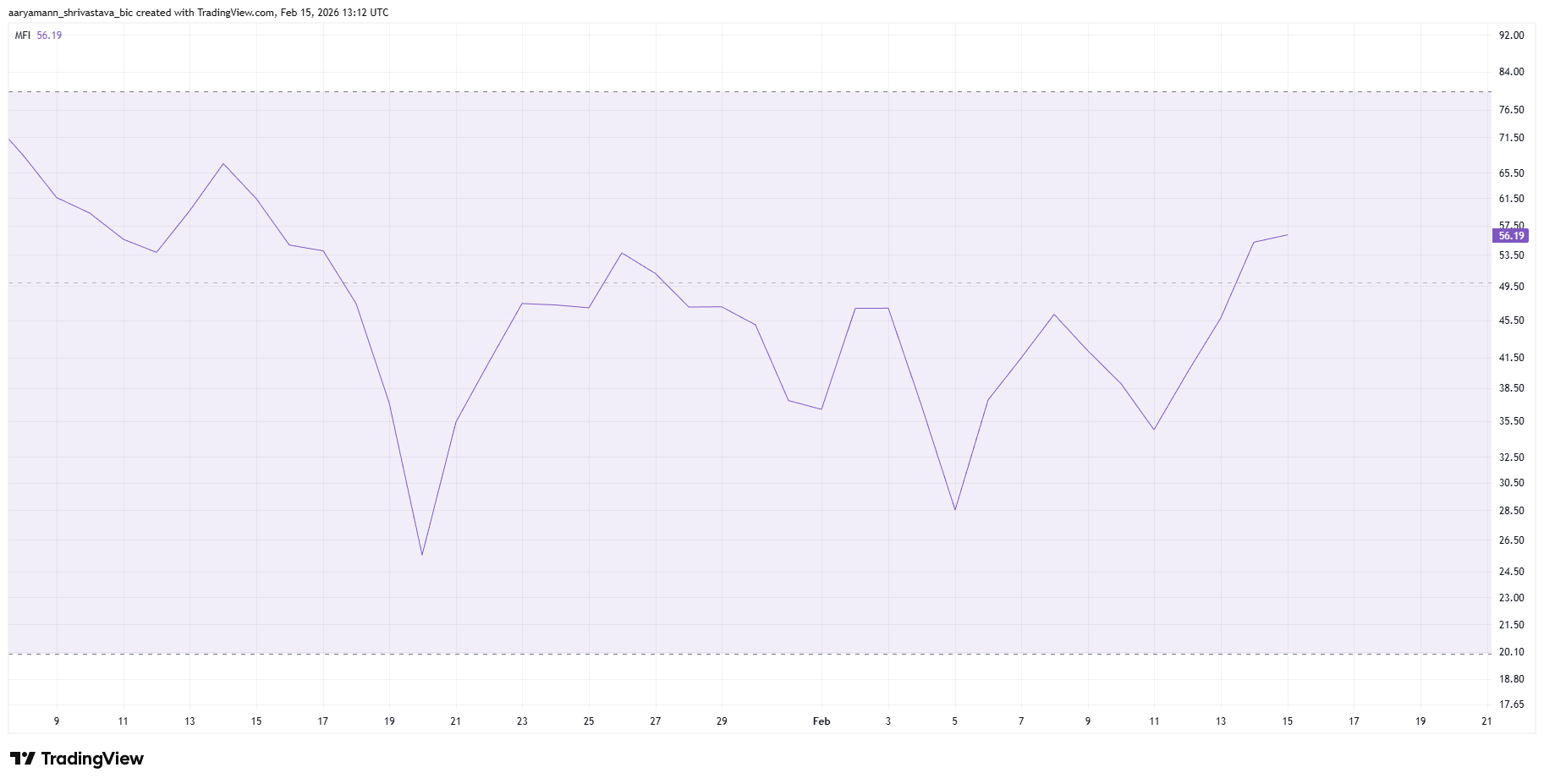

HBAR Investors Are Buying

The Money Flow Index indicates rising buying pressure for HBAR. The indicator has trended upward, signaling that capital is flowing back into the asset. Strengthening MFI readings often reflect growing demand during early recovery phases.

Investors appear to be accumulating as the price begins to climb. Increased participation provides liquidity support and reinforces bullish structure. If buying pressure continues building, HBAR could maintain upward momentum beyond near-term resistance.

The liquidation heatmap highlights $0.1084 as a critical level. Around that range, approximately $1 million worth of short positions could face forced liquidation. A move through this zone would likely accelerate upside volatility.

Short liquidations often create rapid price spikes. When bearish traders are forced to cover positions, buying pressure intensifies. For HBAR, clearing $0.1084 could serve as a catalyst for extended gains.

Sponsored

Sponsored

However, investors must sustain bullish momentum until that level is reached. Without steady accumulation, the market may struggle to generate the necessary pressure. Breakout durability depends on consistent inflows and reduced profit-taking.

HBAR Price Needs To Secure Support

HBAR price is trading at $0.1025, pressing against the $0.1030 resistance. Securing this level as support would confirm a breakout. However, a decisive close above resistance could shift sentiment toward sustained recovery.

The token has been moving within a descending broadening wedge. This formation projects a potential 57% rally upon confirmation. While that projection signals strong upside potential, a more realistic target lies near $0.1234, which would recover recent losses.

On the other hand, if investors begin booking profits prematurely, downside risk increases. A pullback toward $0.0901 support would invalidate the bullish thesis. Going forward, maintaining buying pressure remains essential for Hedera’s price to extend gains and sustain breakout momentum.

Crypto World

How High Can Ripple (XRP) Go Next Week? 4AIs Make Bullish Predictions

Can XRP spike to $2 or beyond as early as next week?

While Ripple’s cross-border token crashed to almost $1.10 on February 6, bulls have since stepped in to stabilize the valuation, which currently trades around $1.55.

The question now is whether next week can deliver further gains and how high the price could go. Here’s what four of the most widely used AI-powered chatbots said on the matter.

The Bulls

ChatGPT estimated that the most probable outcome for the week ahead is for XRP to rise to roughly $1.60, which it did on Sunday, but has yet to reclaim that level. It claimed that a move north is much more plausible than a renewed crash, based on recent investor behavior.

“At the moment, XRP looks more like it’s in a stabilization phase rather than the beginning of a major breakout. The bounce from around $1.10 to $1.50 shows that buyers stepped in aggressively at lower levels, which is constructive. However, sharp rebounds are often followed by consolidation before any serious continuation higher,” its analysis reads.

The chatbot projected that an explosion to as high as $2 next week is also possible, but it would depend heavily on a major catalyst, such as a solid revival of the broader crypto market or huge news concerning Ripple and its ecosystem.

Grok – the chatbot integrated within X – agreed with ChatGPT’s assumption that XPR is most likely to surge and maintain $1.60 next week. Nonetheless, it projected that such a scenario will only be possible if the price reclaims decisively the important zone of $1.40. Grok also envisioned a jump to as high as $1.80 but expects the rally to occur toward the end of February rather than in the following seven days.

Several indicators, including the declining amount of XRP held on the largest crypto exchange, Binance, and the formation of certain technical setups, reinforce the bullish thesis.

The Bears

Unlike the aforementioned chatbots, Perplexity is pessimistic about XRP’s performance next week and expects the price to decline. It outlined that investor sentiment has been quite depressing lately, predicting that the price may drop to as low as $1.24 in the coming days.

You may also like:

Google’s Gemini also envisioned a bearish tilt in the week ahead. It noted that February has historically been a challenging month for XRP, characterizing the $1.35 – $1.40 range as “the line in the sand.”

“This level isn’t just a number – it’s the technical floor that has been holding the ‘February slide’ together. XRP is hovering right on that edge, and if it plummets below this, it could open the door to a further plunge to as low as $1,” it concluded.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business7 days ago

Business7 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat7 days ago

NewsBeat7 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports7 days ago

Sports7 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Tech16 hours ago

Tech16 hours agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video2 days ago

Video2 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business6 days ago

Business6 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

NewsBeat6 days ago

NewsBeat6 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World5 days ago

Crypto World5 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World5 days ago

Crypto World5 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat2 hours ago

NewsBeat2 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business3 days ago

Business3 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market