Crypto World

Is XRP Ready to Blast Off? 3 Signs the Ripple Bulls Are Back

Here’s what signals that XRP’s bears might step back soon.

The latest market downtrend has not been kind to Ripple’s XRP, whose price slipped by nearly 25% over the past two weeks.

However, some key factors suggest the bulls may soon regain control.

Rally on the Way?

Last week, Ripple’s cross-border token fell to almost $1.10, its lowest point since November 2024. In the following days, it recovered from the sharp decline and currently trades at roughly $1.40, still well below the levels seen in previous months.

Certain elements, including the XRP exchange reserves, suggest that a further revival could be on the horizon. According to CryptoQuant’s data, the amount of coins stored on Binance recently fell to approximately 2.55 billion, the lowest mark since the beginning of 2024. As of this writing, the reserves on that particular platform stand at around 2.57 billion XRP, or quite close to the local bottom.

This trend indicates that investors have been shifting from centralized trading venues to self-custody methods, which in turn reduces immediate selling pressure.

The spot XRP ETFs are the next bullish factor on the list. Recall that the first such product in the USA, which has 100% exposure to the asset, saw the light of day in November 2025. It was introduced by Canary Capital, whereas shortly after, Bitwise, Franklin Templeton, 21Shares, and Grayscale did the same.

The investment vehicles have seen solid demand, with total cumulative net inflows surpassing $1.23 billion. The last negative daily netflow occurred on January 29, meaning institutional investor appetite remains high.

You may also like:

Some technical setups also hint that XRP could make a decisive move to the upside soon. X user Niels spotted the formation of an “inverse head and shoulder pattern” on the token’s price chart. The configuration consists of three bottoms, with the middle being the lowest, and a “neckline” that connects the highs between the dips.

Analysts believe a breakout above the “neckline” could fuel a substantial pump. Niels, for instance, claimed that a jump above the $1.44 level might be that spark.

Something for the Bears

It is important to note that the environment of the broader crypto market remains predominantly bearish, so a renewed downtrend for many leading digital assets (including XRP) in the near future is not out of the question.

XRP’s Relative Strength Index (RSI) also suggests that the bulls may have to take another blow soon. The technical analysis tool measures the speed and magnitude of recent price changes and is often used by traders to identify potential reversal points.

It ranges from 0 to 100, and readings above 70 signal that the asset is overbought and due for a pullback. In contrast, anything below 30 is considered a buying opportunity. Data shows that XRP’s RSI currently stands at around 72.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Aave Labs Proposes New DAO Value Accrual and Growth Framework

The new proposal aims to resolve the ongoing debate and align the interests of equity holders and token holders.

Two months after the Aave DAO and Aave Labs clashed on the DeFi platform’s governance forum, Aave Labs has formally submitted a new strategic framework proposal to the DAO called “Aave Will Win.”

The proposal intends to align the DAO and Labs over the future growth of Aave v4, and to direct 100% of product-layer value directly to the DAO.

Specifically, the proposal requests that the DAO ratifies Aave v4 as the protocol’s core foundation for future development, establishes a funding and growth framework to compete at a global financial scale, and formalizes a model where 100% of revenue generated by Aave-branded products, including those built by Labs, flows to the DAO treasury.

If passed, the deal would clarify structure and align incentives between the DAO and Labs, potentially serving as a landmark decision on tokenholder rights, which were called into question in December by Ernesto Boado, the former chief technical officer (CTO) at Aave Labs.

“The framework formalizes Aave Labs’ role as a long-term contributor to the Aave DAO under a token-centric model, with 100% of product revenue directed to the DAO,” said Stani Kulechov, the founder of Aave Labs.

“As onchain finance enters a decisive new phase, with fintechs and institutions entering DeFi, this framework positions Aave to capture major growth markets and win over the next decade,” Kulechov concluded.

While rumors have been circulating that major changes were coming to Aave, some prominent delegates, such as Marc Zeller of the Aave-Chan Initiative (ACI), were quick to dismiss them, saying, “there’s nothing positive on the short term, but i guess good try.”

It is unclear whether Zeller was privy to this proposal and whether his statements pertain directly to it.

Aave remains DeFi’s leading lending protocol, accounting for more than 50% of the total lending market with more than $52 billion in cumulative net deposits. Despite the protocol’s long-standing success, its native token has struggled alongside the rest of the altcoin market and is down 56% over the last year.

While the proposal is far from finalized, tokenholder alignment and DAO value accrual could potentially be a tailwind for the AAVE token.

Crypto World

Is Cardano on the Verge of a Further Dump?

A new drop or a major rally: what comes next for ADA?

Cardano’s ADA has been struggling lately, with its price nosediving to a five-year low at the start of February.

While bulls might be eager to see a decisive revival in the short term, the recent actions of the large investors suggest another move south could be on the way.

The Whales Know Something We Don’t?

The renowned analyst Ali Martinez revealed that Cardano whales have dumped approximately 190 million ADA in the past week. The USD equivalent of that stash is roughly $50 million (calculated at ongoing rates of $0.26 per coin).

Seven days ago, the total possessions of this cohort of investors were 13.57 billion ADA, whereas they currently hold around 13.38 billion tokens. The figure represents approximately 36.3% of the asset’s circulating supply.

There is a general assumption in the crypto space that whales are experienced investors who may have inside information about important upcoming events that could influence their buying or selling decisions. That said, their recent actions could spread panic across the community and prompt smaller players to cash out as well.

The purely economic impact is also worth noting. Large sell-offs increase the amount of ADA on the open market, which, combined with non-increasing demand, should lead to a price pullback.

ADA’s Relative Strength Index (RSI) is another bearish factor investors should be wary of. The indicator shows whether the asset is overbought or oversold based on recent price momentum. It ranges from 0 to 100 and helps traders identify when a trend may be about to end.

You may also like:

Readings above 70 signal that ADA has entered overbought territory and could be on the verge of a correction, while ratios below 30 favor a bullish scenario. As of this writing, the RSI stands at around 74.

History to Repeat Itself?

ADA is among the cryptocurrencies with vast communities, which consist of proponents and bullish analysts. Just a few days ago, X user Aman noted that the asset’s price has dropped to the demand zone of around $0.26, reminding that in the past this area has sparked major reversals.

Mentor shared a similar viewpoint, arguing that the last time ADA reached current levels, it later rose to nearly $1.40 in less than a month. “History is going to repeat itself soon,” they projected.

Over the last few months, ADA’s exchange netflows have been predominantly negative, which reinforces the optimistic predictions. The trend reflects investors moving coins from centralized platforms to self-custody, reducing the likelihood of short-term selling.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

BTC set to thrive amid AI and other innovations, says Cathie Wood

New York — Bitcoin isn’t just a hedge against inflation, according to ARK Invest CEO Cathie Wood, but against something more disruptive: deflation driven by technological acceleration.

In a conversation with Anthony Pompliano at Bitcoin Investor Week in New York, Wood argued that traditional financial systems are unprepared for a coming “productivity shock” powered by artificial intelligence (AI), robotics, and other exponential technologies. That shock, she said, will push prices down rapidly, upend legacy business models, and create what she called “deflationary chaos.”

“If these technologies are so deflationary, it’s going to be tough for the traditional world — used to 2% to 3% inflation — to adjust,” Wood said. “They’ll have to embrace these technologies faster than expected.”

That deflation, in her view, won’t come from economic collapse, but from breakthroughs that slash costs and boost output. She cited data showing AI training costs falling 75% per year and inference costs (what it takes to generate an AI response) dropping by as much as 98% annually. As a result, businesses are becoming far more productive with fewer inputs, leading to lower prices.

Wood said this kind of innovation-led deflation is being misread by the Federal Reserve, which still relies on backward-looking data. “They could miss this and be forced into a response when there’s more carnage out there,” she warned.

In that scenario — where traditional financial institutions are caught flat-footed — bitcoin’s appeal becomes clearer.

“Bitcoin is a hedge against inflation and deflation,” she said. “The chaotic part of this is… disruption all over the place,” referencing underperformance in software-as-a-service stocks and emerging counterparty risks in areas like private equity and private credit. “Bitcoin doesn’t have that problem.”

Bitcoin, she argued, offers a trustless alternative that is insulated from the fragility of traditional finance. As central counterparties and legacy institutions come under pressure, bitcoin’s decentralized architecture and fixed supply become strategic advantages.

Wood also noted that bitcoin’s simplicity stands in contrast to the complexity of layered financial systems, which may face pressure as deflation compresses margins and undermines debt-based growth models.

“This is the opposite of the tech and telecom bubble,” she said. “Back then, investors threw money at tech when the technologies weren’t ready. Now, they’re real — and we’re on the flip side of the bubble.”

She emphasized that ARK’s portfolios have been built around the convergence of disruptive technologies, including blockchain, for years. The firm remains one of the largest holders of Coinbase (COIN) and Robinhood (HOOD) among many other allocations in crypto companies.

While markets remain volatile, Wood argued that bitcoin — and innovation-focused investments more broadly — stand to benefit as the economic narrative shifts from inflation to productivity-driven deflation.

“Truth will win out,” she said. “We believe we’re on the right side of change.”

Crypto World

Aave labs proposes ‘Aave Will Win’ plan to send 100% of product revenue to DAO

Aave Labs has introduced a new governance proposal that would shape the next chapter of one of crypto’s largest lending platforms, and send all revenue from Aave-branded products back to its community treasury.

The proposal, called “Aave Will Win,” asks the Aave DAO to approve a broader strategy built around its upcoming V4 upgrade. If passed, the plan would make V4 the foundation for Aave’s future development and formalize a structure in which 100% of revenue from products built by Aave Labs flows directly to the DAO.

The AAVE token has gained about 2% on the news even as the broader crypto market is selling off heavily on Thursday.

In simple terms, that means any money generated from Aave-branded apps, institutional offerings or enterprise tools would go back to the community-controlled treasury rather than to the development company itself.

“The framework formalizes Aave Labs’ role as a long-term contributor to the Aave DAO under a token-centric model, with 100% of product revenue directed to the DAO,” said Stani Kulechov, Founder of Aave Labs, in a press release shared with CoinDesk. “As onchain finance enters a decisive new phase, with fintechs and institutions entering DeFi, this framework positions Aave to capture major growth markets and win over the next decade.”

The proposal arrives against a backdrop of discord within the Aave community over control of the protocol’s brand and key assets. In late 2025, community members became sharply divided over whether the DAO or Aave Labs should control trademarks, domains, social accounts and other branded assets, with critics arguing that concentrated control by Labs risked undermining the spirit of decentralization. That fight highlighted wider tensions over how much influence founding teams should retain once a protocol becomes decentralized

Aave is already one of the largest decentralized lending protocols in crypto, allowing users to borrow and lend digital assets without relying on traditional banks. The new proposal is designed to help the protocol compete as more fintech companies and financial institutions explore blockchain-based products.

At the center of the plan is Aave V4, a major software upgrade intended to make it easier to launch new markets and financial products on top of the protocol. Rather than requiring major changes to the core system each time something new is introduced, V4 is designed to make expansion faster and more flexible while maintaining security.

The proposal also introduces the idea of launching separate markets with different risk and revenue structures. This could allow Aave to support specialized use cases, including institutional participation, without affecting the broader protocol.

A key part of the framework is a shift in how revenue flows to the DAO. Currently, Aave primarily earns income from lending activity. Under the proposal, revenue from additional Aave Labs-built products, such as user interfaces and institutional services built around the protocol, would also be directed to the DAO treasury. The goal is to diversify income and more closely align product development with token holder incentives.

The proposal further calls for the creation of a dedicated foundation to hold and protect Aave’s brand and trademarks, since decentralized organizations cannot directly own intellectual property. More details on that structure would be introduced in a follow-up vote.

If approved, additional proposals will outline how V4 will be activated and how funding will be structured. Taken together, the framework signals Aave’s ambition to evolve from a leading DeFi lending protocol into a broader piece of global financial infrastructure governed by its DAO.

Read more: ‘Most important tokenholder rights debate’: Aave faces identity crisis

Crypto World

Bitcoin Analysts Forecast Prolonged BTC Price Consolidation

Fresh on-chain data from Glassnode suggests Bitcoin could be headed for another prolonged phase of range-bound trading unless critical support levels are reclaimed. The February edition of The Week On-chain highlights a price corridor anchored by the True Market Mean near $79,200 and a Realized Price around $55,000 — a setup that mirrors patterns seen in the first half of 2022. With overhead supply concentrated in higher price bands, the decisive question remains: will new buyers re-enter and lift BTC out of consolidation?

Key takeaways

- Bitcoin remains confined within a corridor defined by the True Market Mean (~$79,200) and the Realized Price (~$55,000), signaling a 2022-style consolidation unless key support is reclaimed.

- A breakout would require a decisive reclaim of the True Market Mean near $79,200 or a systemic dislocation that drives price below the Realized Price around $55,000, according to Glassnode.

- Overhead supply is structurally heavy, with large clusters positioned between roughly $82,000–$97,000 and then again from $100,000–$117,000, creating a potential sell-side overhang if prices move higher.

- Whales appear to be shifting risk posture, closing long positions and opening shorts relative to retail, reinforcing a cautious, range-bound outlook for the near term.

- Near-term price action remains pinned between support below $65,000 and resistance near $68,000, with a move above $72,000 needed to re-open upside traffic toward earlier momentum benchmarks.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The on-chain view fits within a broader environment where liquidity and risk appetite are delicate, and buyers are waiting for a clearer catalyst. The mix of heavy overhead supply and patient accumulation suggests a market that could drift rather than surge without fresh demand catalysts.

Why it matters

The unfolding dynamics around Bitcoin’s price framework matter for traders and long-term holders alike. The analysis emphasizes the importance of on-chain metrics in gauging potential supply pressure that could cap rallies even if price action briefly turns bullish. If BTC can reclaim the high-end thresholds implied by the True Market Mean, the market could test higher moving averages and previously observed resistance zones. Conversely, persistent weakness around the Realized Price would imply additional downside risk, particularly for participants who bought into higher ranges and are still sitting on unrealized losses.

On-chain behavior paints a nuanced picture. The URPD (UTXO Realized Price Distribution) suggests that substantial portions of the supply were created at price levels well above current prices, reinforcing the argument that a meaningful number of coin-holders may have an emotional and financial stake in seeing a higher price if conditions permit. Yet these same clusters also form a potential overhang: if market momentum fades or risk sentiment deteriorates, concentrated gains from earlier periods could quickly turn into selling pressure as holders decide to cut losses or rebalance.

Added to this, the market environment features a tug-of-war between long-term holders and more speculative participants. Data from on-chain observers and market analytics firms indicates that larger players are tightening exposure, a signal that the restoration of upside momentum will likely require a catalyst capable of re-igniting fresh demand. In practical terms, that means price action could remain choppy until a clear breakout above major resistance or a decisive breach of critical support occurs, with every swing potentially attracting new entrants or sellers depending on the path taken.

What to watch next

- Watch whether Bitcoin clears the $68,000 resistance to aim for the $72,000 level again, a move that would re-energize momentum toward the 20-day EMA and beyond.

- Monitor for a true reclaim of the True Market Mean near $79,200, which Glassnode identifies as a potential sign of renewed structural strength.

- Be alert for a drop below the Realized Price around $55,000, which could trigger renewed capitulation or a shift in risk tolerance among holders.

- Track ongoing on-chain activity from major holders, particularly any notable increases in short positioning relative to retail, as it could presage further consolidation.

- Observe how overhead supply bands between $82,000 and $117,000 behave if price attempts to press higher, as the density of this supply hints at potential sell-side pressure that could cap rallies.

Sources & verification

- The Week On-chain by Glassnode (February 11 edition) detailing overhead supply and the True Market Mean vs Realized Price dynamics.

- Glassnode’s URPD data showing long-term supply clusters above $82,000 and related implications for unrealized losses.

- Commentary from Joao Wedson (Alphractal) on changing whale activity and the potential for a consolidation phase over the next month.

- CoinGlass liquidation heatmap illustrating liquidity distribution between bids and asks around the $69,000–$72,000 region.

- Cross-referenced price movement discussions noting the need to clear $72,000 to target higher moving averages.

Bitcoin price in focus: market dynamics and key levels

Bitcoin (CRYPTO: BTC) is currently trading within a defined corridor that mirrors a broader, on-chain narrative about when demand will re-enter after a period of subdued momentum. The framework rests on two pivotal on-chain markers: the True Market Mean, a measure of where the market’s “fair value” sits on a given day, and the Realized Price, which anchors the cost basis of coins currently in circulation. Glassnode’s recent analysis emphasizes that these markers have established a price range that, for now, resembles the patterns observed during the first half of 2022. In that period, BTC traded between the True Market Mean and the Realized Price before entering a protracted bear phase, with a low near $15,000 later that year. While the present setup does not predict a similar outcome, it underscores the challenge of surging higher without a fundamental catalyst that re-energizes buyers.

Overhead supply, a term that captures the concentration of coins that would require price appreciation to become fully realized profit, remains structurally heavy in higher price bands. The URPD data points to substantial clusters above $82,000, extending into the $97,000 and beyond $117,000 zones. These levels represent cohorts of coins that have historically faced unrealized losses; in a market where buyers are scarce, these zones can turn into latent sell-offs if volatility spikes or sentiment deteriorates. In practice, this translates to a potential ceiling on upside movements unless demand accelerates or supply dynamics shift decisively in favor of buyers.

Rounding out the on-chain narrative is visible activity from market participants described as “whales” — those holding large quantities of BTC. Recent posts from industry observers noted a shift: long positions are being closed while shorts are being opened relative to retail activity. This pattern aligns with a cautious stance, reinforcing a prevailing view that the market could continue to absorb supply rather than launch into a rapid uptrend. In other words, the current price action could persist within a narrow band as participants wait for a decisive trigger to reorient risk exposure.

From a practical standpoint, the price dynamics show BTC facing a barrier near $68,000 after a recent attempt to rebound from lows below $60,000. The next significant hurdle sits at around $72,000, a level that many analysts say must be cleared to re-engage the upward slope toward the 20-day exponential moving average near $76,000 and, beyond that, the 50-day moving average above $85,000. Until that sequence of resistance is breached, the market is more likely to remain in a phase of range-bound action with incremental gains or losses tied to short-term liquidity and the evolving appetite for risk across crypto markets.

In parallel, market observers highlight the current liquidity landscape as another critical factor. The liquidity framework, which shapes how quickly buyers or sellers can enter or exit positions, tends to tighten during uncertain macro periods. In such a regime, even modest shifts in sentiment can produce outsized price moves, particularly when the order book tightens around the major support and resistance thresholds described above. The absence of a clear catalyst makes the path of least resistance a continued drift, with occasional bursts as traders reposition around the pivotal levels identified by on-chain analysis.

https://platform.twitter.com/widgets.js

Crypto World

Coinbase Is Temporarily Down: Are User Funds Safe?

Some Coinbase users are currently experiencing a temporary disruption, leaving them unable to buy, sell, or transfer digital assets on Coinbase.com.

The issue, first reported by the platform on social media, has prompted concern among traders, though the company reassures customers that all funds remain secure.

Sponsored

Temporary Service Disruption Leaves Coinbase Users Unable to Trade

Coinbase, the largest US-based crypto exchange, confirmed the disruption in a statement on its official Twitter support channel, noting:

“We are aware that customers may be unable to buy, sell, or transfer on Coinbase.com at this time. Our team is investigating this issue and will provide an update. Your funds are safe,” the exchange shared in a post.

The company emphasized that the outage is temporary and that there is no indication of any long-term risk to user accounts or funds. Updates will be provided as the investigation progresses.

Community trackers and crypto news accounts, including MilkRoad, quickly picked up the report, echoing Coinbase’s statement.

Sponsored

While the cause of the disruption has not yet been disclosed, Coinbase’s quick acknowledgment reflects the platform’s growing focus on transparency amid increased scrutiny of crypto exchange reliability.

Temporary outages on exchanges, though relatively rare, can have ripple effects on trading activity and market sentiment, especially for high-volume users or during periods of heightened market volatility.

Some users have expressed frustration on social media, noting that being unable to execute trades temporarily could affect active positions. However, such disruptions are often resolved quickly and typically do not result in financial loss.

Sponsored

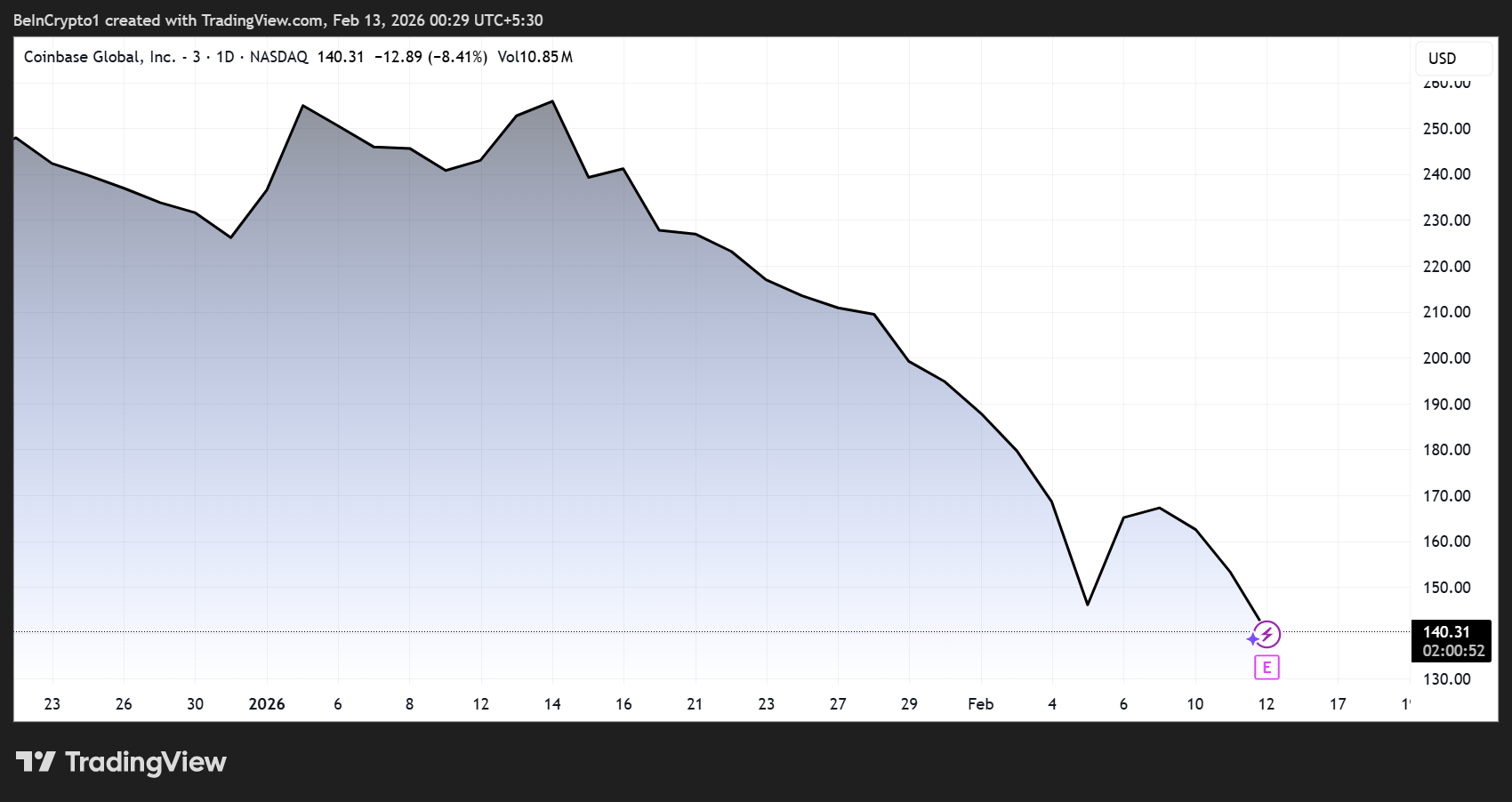

Coinbase Q4 Earnings In Focus

The incident comes ahead of Coinbase’s earnings report, with the exchange scheduled to release its Q4 2025 and full-year 2025 financial results today, Thursday, February 12, 2026, after market close (US time).

The market sentiment ahead of Coinbase earnings is predominantly cautious to bearish in the short term, driven by expectations of a sequential decline in key metrics amid softer crypto trading volumes, lower asset prices, and broader market weakness.

Sponsored

Analysts at Monness, Crespi, Hardt have also downgraded COIN stock amid predictions that Coinbase will struggle to meet Q4 earnings forecasts.

The downgrade reflects ongoing issues in digital asset trading and reduced visibility in near-term financial performance.

As of this writing, COIN stock was trading for $140.31, down by over 45% year-to-date. While revenue is likely to lag, long-term prospects remain intact.

Crypto World

LTC & DOGE Holders Jump Ship to BlockDAG as Its Live Mainnet Beats Ethereum with 5,000 TPS!

The Litecoin price has taken a beating this week, with holders facing significant losses and key support near $50 under the spotlight. A dip below this level could push LTC down to $45, while resistance near $56.4 limits any immediate rebound.

Dogecoin is showing a similar bearish trend, with the latest Dogecoin price prediction pointing to further weakness as it trades below $0.13. Traders are watching the charts closely, trying to gauge whether these popular meme and altcoins can find their footing amid broader market pressure.

But in the middle of all these declines, BlockDAG (BDAG) is moving in a sharp upward pattern! Its Mainnet is now live, handling 5,000 transactions per second, far beyond what Ethereum can deliver. Plus, current buyers are eyeing 200× upside ahead of exchange listings on February 16.

This mix of speed, technology, and ROI potential is attracting serious attention from traders seeking top crypto coins, especially as big names like LTC and DOGE shift into defensive mode.

Litecoin Price Tests Critical $50 Support

Litecoin investors have faced heavy losses recently, with nearly $40 million booked over the weekend. Since the start of the year, LTC has shed about $1.81 billion in market value, leaving holders with an average loss of 40%. The coin is now approaching key support at $50, and a break below that could push the Litecoin price down to $45, its lowest since June 2022.

On the upside, Litecoin faces resistance near $56.4, with the 20-day EMA acting as the next hurdle if buyers step in. Technical indicators like the RSI and Stochastic Oscillator remain in bearish territory, signaling ongoing selling pressure. Traders tracking the litecoin price are closely monitoring these levels, as MVRV readings suggest a rebound may be possible if sentiment improves.

Dogecoin Price Prediction: Is DOGE Headed Lower?

The Dogecoin price prediction is turning bearish, as DOGE is slipping again. It is currently trading around $0.0909, down about 15% in the past week. After failing to stabilize, the coin has broken toward the lower end of its daily range, showing sellers still in control.

Over the past month, DOGE has lost more than a third of its value, and it’s slightly weaker against Bitcoin. This recent drop below the $0.13 Fibonacci extension raises questions for short-term traders.

On the weekly chart, the next key support sits near $0.0208 if current levels fail to hold. On the upside, DOGE faces resistance near $0.168–$0.198, meaning any bounce may be limited.

With the weekly RSI near oversold at 32, some see a buying opportunity, but technical pressure remains. Analysts are keeping a close eye on these zones for shaping the near-term Dogecoin price prediction.

BlockDAG Mainnet Outperforms Ethereum!

BlockDAG’s Mainnet is officially live and is processing an impressive 5,000 transactions per second; that’s 500 times faster than Ethereum! This move comes days ahead of its exchange listings, which are now expected to see even stronger demand as the market sees the network’s capabilities. On top of this, a final allocation is running, offering coins at $0.00025. Compared with the confirmed listing price of $0.05, this points to a potential 200× return.

The TGE is now live, and the Claim button for the free airdrop will be active within the next 24–48 hours. Users will be able to claim their BDAG allocations directly through the BlockDAG dashboard. Claiming is simple: connect the wallet used during the presale, select “Claim BDAG,” and confirm the transaction. No extra verification or forms are required. The claims are executed on-chain, and coins will be sent directly to the connected wallet.

Once claimed, BDAG coins will appear in the wallet and can be transferred, traded, or used according to vesting conditions. Network features and staking rewards will continue to roll out after this. The team has confirmed that staking is available only to BDAG holders, so missing this window means missing out on staking rewards.

This combination of record-breaking speed and the final allocation phase has attracted massive attention from traders tracking top crypto coins. Likewise, analysts suggest that acting now could make a real difference in potential gains later on. Ultimately, high ROI potential, transparency, and a live Mainnet outperforming some of crypto’s biggest names have made BDAG one of the most promising projects for the year ahead.

Which Is the Top Crypto Coin to Buy for 2026?

Litecoin and Dogecoin remain under clear pressure as sentiment across the market stays fragile. The Litecoin price is hovering near critical support, and unless buyers step in above key resistance, the risk of another drop toward $45 remains real.

At the same time, the latest Dogecoin price prediction reflects continued weakness, with DOGE struggling to reclaim lost ground and facing strong resistance on any bounce. For now, both assets sit in a defensive territory, leaving traders cautious as they reassess exposure.

Meanwhile, BlockDAG is telling a very different story. The Mainnet is already live, processing 5,000 transactions per second, and exchange listings are happening in four days.

And with the final allocation priced at $0.00025 and a confirmed $0.05 listing price, the potential 200× upside is basically guaranteed. For traders seeking top crypto coins to buy now, BlockDAG isn’t just competing with the market’s biggest players; it’s effectively outperforming them.

Private Sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Trump-Backed World Liberty Financial Launches World Swap Remittance Platform

World Liberty Financial has unveiled plans to introduce a new foreign exchange and remittance platform called World Swap. This platform aims to simplify global money transfers and reduce high transaction fees. The venture is backed by the family of former U.S. President Donald Trump, raising some ethical concerns. It is set to challenge traditional financial institutions and revolutionize cross-border transactions.

Revolutionizing the Remittance Market

The World Swap platform is designed to connect users directly to bank accounts and debit cards worldwide. It will allow users to complete foreign exchange and remittance transactions at a much lower cost than traditional financial institutions. Co-founder Zak Folkman highlighted that the platform is built around the company’s USD1 stablecoin, which was launched last year.

Folkman emphasized that over $7 trillion is currently moving across the globe in currency exchanges, and traditional financial institutions have been heavily taxing these transfers. With World Swap, the company aims to cut these fees significantly, offering a more efficient solution for global money transfers. The platform is poised to directly compete with services provided by banks and legacy money transfer operators.

Expanding into Decentralized Finance

In addition to its remittance platform, World Liberty Financial is expanding its footprint in decentralized finance. The firm recently launched its lending platform, World Liberty Markets, which has already facilitated $320 million in loans. It has also handled more than $200 million in borrowings since its inception just a few weeks ago.

World Liberty Financial’s broader goal is to carve out a significant role in the global payments and remittance ecosystem. This ecosystem is currently dominated by established financial players who charge high fees and have long settlement times. The firm’s stablecoin-based approach offers a potentially more affordable and faster alternative to traditional financial systems.

Ethics Scrutiny Amid Trump Family Ties

World Liberty Financial’s expansion has raised concerns among government ethics experts due to its ties to the Trump family business, the Trump Organization. The company’s activities have reportedly generated substantial revenue from foreign entities, fueling these concerns. The timing of the company’s growth, coupled with Donald Trump’s involvement in U.S. crypto policy, has led to discussions about potential conflicts of interest.

Despite these concerns, the White House has denied any conflicts of interest. The company has not yet disclosed a specific launch date for World Swap or detailed its pricing model. However, the announcement signals the company’s intent to disrupt the global remittance industry and take on incumbent players in the market.

Crypto World

Bitcoin Cash holds near $500 despite broader crypto market slump: check 2026 outlook

- Bitcoin Cash price held near $500 as bulls battled intraday sell-off pressure.

- The altcoin could retest key resistance levels amid Bitcoin’s gains.

- However, Standard Chartered forecasts BTC could drop to $50k, and BCH will likely mirror this.

Bitcoin Cash (BCH) price is demonstrating notable resilience, with bulls holding near the $500 mark as the broader cryptocurrency market downturn hits sentiment.

On February 12, 2026, the BCH price hovered between $496 and $523, down nearly 3% in the past 24 hours but still within range of this crucial level.

Bitcoin Cash price holds $500 amid BTC struggle

The resilience comes as the broader crypto market faces pressure, including from macroeconomic factors.

Sell-off across the sector has seen Bitcoin struggle to reclaim the $70,000 mark, and on Thursday, Standard Chartered analyst Geoff Kendrick highlighted the bank’s forecast for BTC in 2026.

Specifically, Standard Chartered has now slashed its 2026 target to $100,000 per Bitcoin, citing potential further pain before prices recover.

Amid downward pressure, the bank sees bears pushing BTC to support around $50,000.

Kendrick said in a note to clients that Ethereum will also likely drop to $1,400 before rebounding to highs of $4,000 in 2026.

While BCH remains near $500 and has held above the $450 support, this outlook for BTC and ETH suggests the coin could be at risk of further decline.

Negative sentiment will cascade to other Bitcoin-related tokens.

BCH price technical outlook and forecast for 2026

Bitcoin Cash price fell to around $468 on October 10, 2025, and to $454 on Feb. 5, 2026.

The two dates highlight the last two major sell-off events across the crypto market. If prices fall past this support base, a retest of June 2025 lows at $385 could follow.

Before this, Bitcoin Cash had rallied from $268 to $443 between April 9 and May 23.

From a technical perspective, BCH’s weekly chart indicates that the price currently hovers above a key horizontal support level.

The uptick between March and September 2025, and between November 2025 and early January 2026, also put prices above the middle line of a broader parallel channel.

The resistance level of this pattern lies near $700, while support is around $264.

Currently, BCH’s price hovers at the 50-day moving average of $597, which has acted as support since Oct. 10, 2025.

If the price drops below the 50-day SMA, bulls could be in trouble. The weekly RSI sits in the neutral 40-50 zone. However, it is likely to suggest potential bearish acceleration before a rebound.

Meanwhile, the MACD indicator shows strengthening bearish momentum after a bearish crossover in mid-January.

A weekly close above $510 could allow buyers a relief rally towards the channel resistance. However, if prices slip under $425, a revisit of $300-$260 could be next.

Crypto World

Zerebro founder Jeffy Yu has allegedly killed himself again

Jeffy Yu, the Zerebro founder who previously faked his own death before being sued by Burwick Law, has allegedly committed suicide for real.

On February 2, X account “alvennya” claimed that Yu had killed himself, pointing to a recent burial at the Roseville Cemetery, which lists the deceased as “Jeffy Zhenyu Yu” and claims he died on New Year’s Day.

The account also claimed to have police recordings taken from a scanner that contains audio of Roseville police discussing the scene before discovering his suicide.

This was shared along with unsubstantiated screenshots apparently from Roseville police that suggest Yu was suffering a “mental crisis” and was going door to door asking for help while armed.

Another X account, “Scooter,” shared these reports and also claimed that one of their followers visited Yu’s grave and took a photo.

Jeffy Yu staged his death to sell $1.4M in crypto

Yu staged his death last year after launching his own after-death-themed memecoin. He also faked his own obituary and scheduled posts to be released after his apparent death.

A writer for The San Francisco Standard, however, tracked Yu down and discovered him living with his parents in San Francisco.

After his supposed death, analysts spotted Yu selling $1.4 million worth of Zerebro tokens.

Read more: X Creators $1M prize winner exposed as memecoin pump-and-dumper

Given Yu’s history, online users are already skeptical about Alvennya’s claims and are starting to question the account’s credibility.

One user questioned if the police audio was AI-generated, and claims that Yu’s final video was made in San Francisco, not Roseville.

Others have noted that his X account and Telegram were deleted after his “death” and that there are also no local news reports on the apparent suicide.

The Alvennya account is also unusual. Despite being six years old, it’s only made 21 posts, all of which were posted this month and are dedicated to Yu’s suicide.

They’ve also limited the replies to their posts.

Jeffy Yu sued by Burwick Law

Legal firm Burwick Law filed a lawsuit against Yu on February 9, claiming that he misrepresented Zerebro as a legitimate long-term AI infrastructure.

They say that the project’s founders cashed out their Zerebro holdings as onlookers began to realise their lies, and that Yu staged his death to distract from the project’s collapse.

Read more: Zerebro’s ‘dead’ founder Jeffy Yu is still dumping tokens

Because of this, Scooter is now claiming that Burwick Law has somehow sued a dead man.

Scooter was named a defendant in another Burwick lawsuit against Pump Fun and Solana, and has since suggested that he would consider filing a counterdefamation claim against the firm.

It’s ultimately unlcear wether or not Yu has died. Protos has reached out to Alvennya, Roseville Police, Roseville Cemetery, and Burwick Law for comment and will update this piece should we hear back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports19 hours ago

Sports19 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World20 hours ago

Crypto World20 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video16 hours ago

Video16 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’