Crypto World

JPMorgan (JPM) cuts Coinbase (COIN) target to $252 after 4Q miss, keeps overweight rating

Wall Street analysts from companies including JPMorgan (JPM) and Cannacord lowered their price targets for Coinbase (COIN) stock after the largest publicly traded crypto exchange missed fourth-quarter earnings estimates.

JPMorgan said weak crypto prices and trading activity weighed on volumes and fees. The bank maintained its overweight rating on the crypto exchange, but cut the price target to $252 from $290 in the Thursday report.

The stock, which is down about 40% so far this year, was priced around $150 at publication time in pre-market trading. It closed yesterday at $141.09.

Crypto-linked equities have had a choppy start to the year, broadly tracking the turbulent digital-asset market. Major companies such as Coinbase have seen share prices pressured as crypto trading volumes weakened and token prices slid. Bitcoin , the largest cryptocurrency, remains well below late-2025 peaks and is now down about 25% year-to-date.

JPMorgan analysts led by Kenneth Worthington said higher operating expenses, up 22% year over year, and a shift toward lower-fee Advanced trading and Coinbase One subscriptions pressured results.

The analysts lowered their forward take-rate assumptions and cited a softer volume and market cap outlook in trimming the price target. The take rate is the percentage of transaction volume the company keeps as revenue.

Coinbase’s scale and profitability stand out in a volatile crypto market, broker Canaccord said, maintaining its buy rating while cutting its price target to $300 from $400 after lowering near-term estimates following the results.

While tumbling spot prices have weighed on the broader industry, the broker said Coinbase remains solidly profitable and is taking incremental market share as it expands its product suite.

Analysts led by Joseph Vafi pointed to progress on the company’s “Everything Exchange,” growth in USDC commerce use cases and expanding decentralized finance (DeFi) applications on Base and Ethereum, in the report published Thursday.

Deribit, the derivatives exchange it bought during the year, was described as a strategic addition helping drive cross-sell activity outside the U.S. across spot and derivatives.

The analysts said global trading volume and market share are up roughly 100% from a year earlier, with recent records in notional volume supported by activity in gold and silver futures.

Canaccord expects a tougher first quarter for the industry, and sees Coinbase gaining market share and stepping up stock buybacks. It views the stock as near cyclical lows, with the new $300 target based on 22 times its 2027 Ebitda estimate.

Read more: Coinbase misses Q4 estimates as transaction revenue falls below $1 billion

Crypto World

BlackRock Increases Bitmine Stake to Over 9 Million Shares: What’s Next?

If you think the institutional appetite for crypto ended with the ETF approvals, look again. In a move that signals massive long-term conviction, the world’s biggest asset manager, BlackRock, has reportedly increased its stake in Bitmine to over 9 million shares, according to a recent 13H-FR filing surfaced on X.

While retail traders are distracted by red candles, the world’s largest asset manager is actively seizing more infrastructure.

This isn’t just a passive buy; it’s a statement. When Larry Fink’s firm moves millions of shares in a crypto-native company, it changes the liquidity map for everyone involved.

Context: The Wall Street Pivot Continues

This accumulation comes hot on the heels of BlackRock’s dominance in the spot ETF market.

Their iShares Bitcoin (BTC) Trust has already shattered growth records, surpassing $70 billion in assets faster than any ETF in history.

Now, by significantly increasing exposure to Bitmine, the world’s biggest asset manager is doubling down on the operational side of the blockchain ecosystem.

While headlines often focus on spot price, smart money follows the institutional hedging and whale positioning deeper in the stack.

BlackRock holding over 9 million shares suggests it sees mining and infrastructure not as a risky bet, but as a critical asset class worthy of its balance sheet.

Discover: The best new crypto on the market

BlackRock and Bitmine: Strategic Accumulation or Just a Hedge?

Why buy the miners when you already own the coin? This is the question savvy traders need to answer.

Owning equity in operations like Bitmine offers BlackRock a strategic leveraging of Bitcoin’s success without the custody fees associated with direct coin holding.

This stake increase indicates that BlackRock believes the sector is currently undervalued relative to its future cash flow potential.

Furthermore, this aligns with a broader trend of incumbents staking claims in the digital asset space. We are seeing similar aggressive moves elsewhere, such as Goldman Sachs revealing significant crypto holdings.

Wall Street is no longer dipping a toe in; they are buying the swimming pool.

What Traders Should Watch Next

If you are holding crypto-linked equities or spot BTC, this is a bullish signal for the medium term. Institutional accumulation usually precedes a supply squeeze.

Watch for two things in the coming weeks:

- Sector Correlation: Does Bitmine’s stock price begin to decouple from daily BTC movements due to this institutional support?

- Global Sentiment: This Western accumulation parallels bullish crypto sentiment emerging in Hong Kong, suggesting a coordinated global bid for crypto assets is forming.

Ignore the minute-by-minute candles and watch the whales. When BlackRock buys 9 million shares, they aren’t planning to sell next week.

Discover: The ultimate crypto for portfolio diversification

The post BlackRock Increases Bitmine Stake to Over 9 Million Shares: What’s Next? appeared first on Cryptonews.

Crypto World

Bitcoin Eyes $80K as Traders Expect A Short-term BTC Price Rebound.

Bitcoin (BTC) charged above $69,000 on Friday as US CPI data showed cooling inflation, leading traders to hope for a short-term BTC price recovery.

Key takeaways:

-

Traders favor a short-term BTC price relief rally, but bulls must first take out the resistance at $68,000 to $70,000.

-

Bitcoin market analysis forecasts a short squeeze toward $80,000 if bulls succeed in confirming the $65,000 level as support.

Bitcoin price must take out resistance at $68,000

Bitcoin attempted a breakout on Thursday but “got slammed back down at the $68K level,” said analyst Daan Crypto Trades in a Friday post on X, adding:

“That’s the area to watch if BTC wants to see another leg up at some point.”

An accompanying chart showed the BTC/USD pair consolidating within a falling wedge in the one-hour time frame.

Related: Bitcoin ETFs bleed $410M as Standard Chartered slashes BTC target

The pattern projected a short-term rally to $72,000 once the price breaks above the wedge’s upper trendline at $68,000.

Fellow Ted Pillows said that the “chances of a deeper correction would increase” if the $65,000-$66,000 support does not hold.

“To the upside, if Bitcoin reclaims the $70,000 level, it could rally 8%-10% really quickly.”

From a technical perspective, BTC’s price action has been forming a V-shaped recovery chart pattern on the four-hour chart, as shown below.

The BTC/USD pair is retesting a key area of resistance defined by the 20-period EMA at $67,500 and the 200-week exponential moving average (EMA) at $68,000.

Bulls need to push the price above this level to increase the chance of a rally to the pattern’s neckline at $72,000.

As Cointelegraph reported, if Bitcoin breaks $72,000, it will revive the hopes of a recovery toward the 20-day EMA at $76,000 and eventually, the 50-day simple moving average above $85,000, bringing the total gains to 26%.

Liquidation risk builds near $80,000

Exchange order-book liquidity data from CoinGlass showed Bitcoin’s price pinned below two walls of asks centered just below $75,000 and around $80,000.

“$BTC liquidations are stacking well above $72K, and around the area from $77K to $80K,” Bitcoin analyst ZordXBT said in his latest post on X.

Below the spot price, bid orders were lying down to $64,500, “where I have my limit orders placed,” the analyst said, adding:

“If the market holds itself here, it can very easily eat those liquidity bubbles.”

The chart above suggests that if the $72,000-$75,000 level is broken, it could spark a liquidation squeeze, forcing short sellers to close positions and driving prices toward $80,000, which is the next major liquidity cluster.

Zooming in, Ted Pillows highlighted significant bid clusters at $65,000 and ask orders around $68,000, saying that the price is likely to revisit these areas to wipe out the liquidity.

“I think a revisit of $65,000 and a pump to $68,000 will both happen soon.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

3 Altcoins To Watch This Weekend | February 14

Altcoins are showing sharply mixed signals this week, with explosive rallies colliding against deepening corrections across the market. While some tokens are capturing attention with a powerful breakout setup, others continue to struggle near fresh lows.

Thus, BeInCrypto has analysed three such altcoins which investors should keep an eye on over the weekend.

Sponsored

Sponsored

Pippin (PIPPIN)

PIPPIN ranks among the best-performing altcoins this week, surging 203% over seven days. The meme coin trades at $0.492 at publication, remaining below the $0.514 resistance level. Strong momentum has fueled speculative interest as traders monitor continuation signals.

Technically, PIPPIN is breaking out of a descending broadening wedge, a pattern projecting a 221% rally. A confirmed breakout requires flipping $0.600 into support. While the projected upside is significant, the practical target remains clearing the $0.720 all-time high.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

If bullish momentum fades or macro conditions weaken, downside risk increases. A drop below $0.449 support could send PIPPIN toward $0.372. Such a move would invalidate the bullish thesis and negate the wedge breakout structure.

Sponsored

Sponsored

Aptos (APT)

APT price has declined 12.6% over the past week, forming two new all-time lows during this period. The altcoin trades at $0.899 at publication, remaining below the $1.00 psychological level. Persistent weakness reflects continued bearish momentum across the broader crypto market.

The Money Flow Index currently sits below the 20.0 threshold, placing APT in the oversold zone. Such readings often signal selling saturation and potential accumulation. If the MFI rises above 20.0 and buying pressure strengthens, reclaiming $1.029 could confirm recovery momentum.

If bearish momentum persists, downside risk remains elevated. Continued selling pressure may push APT below current levels. A break lower could result in another all-time low near $0.800, reinforcing the prevailing negative trend.

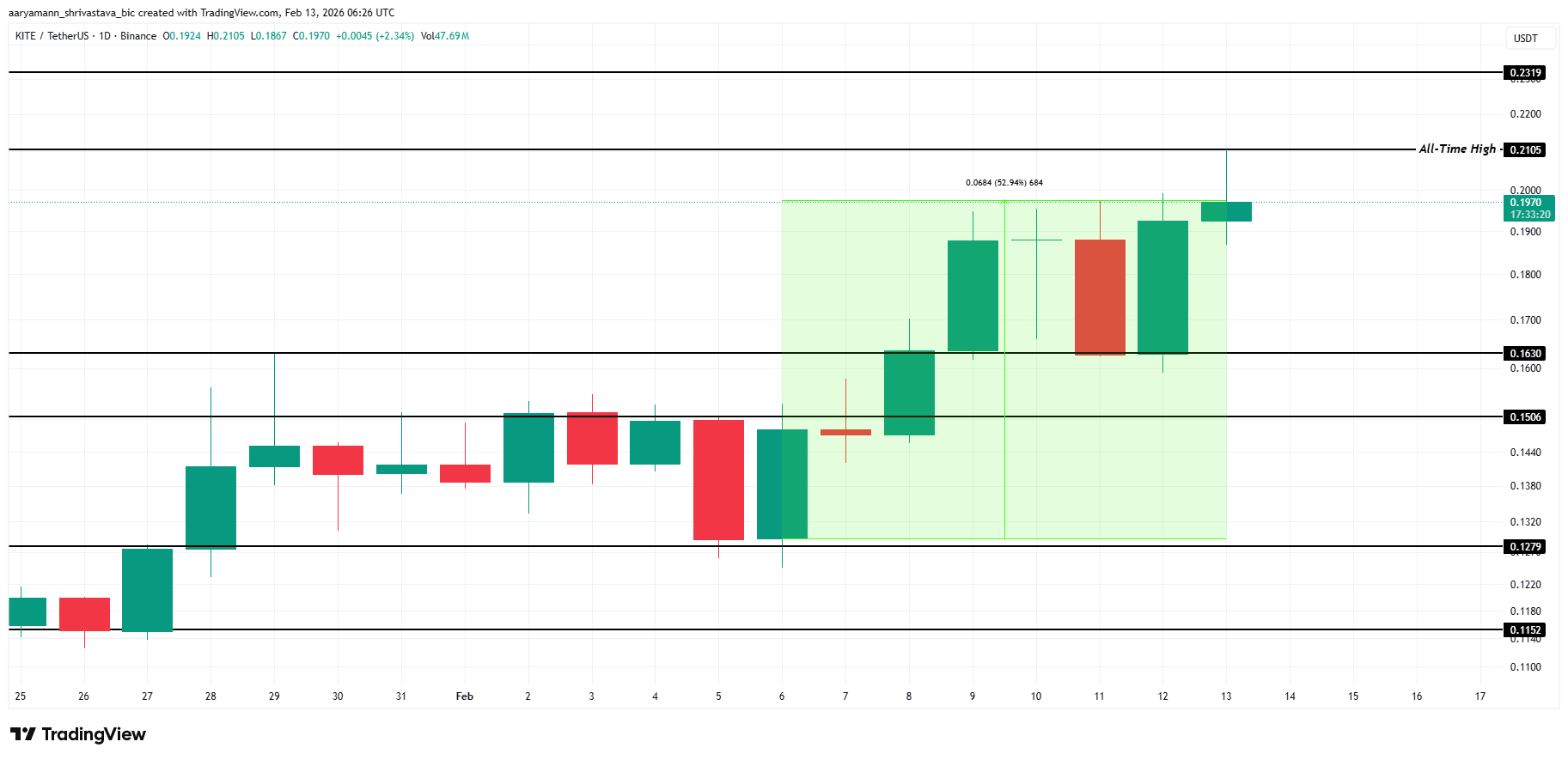

Kite (KITE)

KITE is another altcoin to watch this weekend as it has emerged as a strong contrast to weaker altcoins, consistently forming new all-time highs this week. The token trades at $0.197 at publication, marking a 53% weekly gain. Sustained upside momentum reflects strong investor demand and improving crypto market sentiment.

KITE reached a fresh all-time high of $0.210 today, reinforcing bullish technical structure. Persistent capital inflows appear to be driving the rally. If buying pressure continues, the price could extend toward $0.231, supported by strong volume and positive short-term momentum.

However, overbought conditions could trigger profit-taking. If buying interest begins to fade, KITE may retrace toward the $0.163 support level. A decline to that zone would invalidate the bullish thesis and signal weakening upside momentum.

Crypto World

Is the Worst Over or Another Dead-Cat Bounce?

PI is the best-performing top 100 cryptocurrency today (February 13).

The cryptocurrency market made another move south in the past 24 hours, with most leading digital assets (including BTC) charting minor losses.

Somewhat surprisingly, Pi Network’s PI has defied the bearish environment, posting a daily gain of around 8%.

Finally in Green

Pi Network’s native cryptocurrency has been in a sharp decline over the past several months, disappointing its huge base of proponents and investors. Just a few days ago, its price dropped to a new all-time low of around $0.13, while its market cap plunged to around $1.1 billion.

Over the last 24 hours, though, the bulls stepped in, and PI reached almost $0.15. Its capitalization once again surpassed $1.3 billion, making it the 55th-largest cryptocurrency.

The notable resurgence comes shortly after the team behind the project provided an update on its Node infrastructure. The developers revealed that the Pi Mainnet blockchain protocol is undergoing a series of improvements and set a deadline of February 15 for the first upgrade.

The Core Team explained that it will run the consensus algorithm with Pioneers who have applied to become Nodes and have successfully installed all required blockchain software on their computers.

“While our hope is to include as many Pioneers as possible when defining the Node requirements, the availability and reliability of individual nodes in the network affect the safety and liveness of the network,” the official announcement reads.

PI’s price revival also coincides with a slowdown in token unlocks. Approximately 19 million coins are scheduled for release today (February 13), marking the record day for the next 30 days. Towards the end of the month, the daily unlocks are expected to drop below 5 million, which could reduce selling pressure and help stabilize the price.

You may also like:

The Recent Rumors

Earlier this month, some X users speculated that Kraken is preparing to allow trading services with PI. Such support from one of the leading crypto exchanges would likely have a positive price impact on the asset, as it would increase its liquidity and availability and improve its reputation.

Perhaps the biggest boost will be if Binance decides to embrace PI. The world’s largest crypto exchange was expected to do so last year and even held a community vote to determine whether its users wanted the token listed on the platform. Despite the overwhelming support, Binance has yet to honor their wish.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

The Mortgage Market’s Bitcoin Experiment Has Already Begun

A US-based structured-credit firm is pushing TradFi boundaries by integrating crypto into real-world lending. Newmarket Capital, managing nearly $3 billion in assets, is pioneering hybrid mortgage and commercial loans that leverage Bitcoin (BTC) alongside conventional real estate as collateral.

Its affiliate, Battery Finance, is leading the charge in creating financial structures that leverage digital assets to support credit without requiring borrowers to liquidate holdings.

Sponsored

Sponsored

Bitcoin to Reshape Mortgages and Real-World Lending

The initiative targets borrowers who are crypto-asset holders, including tech-savvy Millennials and Gen Z. It provides a path to financing that preserves investment upside while enabling access to traditional credit markets.

By combining income-producing real estate with Bitcoin, the firm seeks to mitigate volatility risk while offering borrowers a novel lending solution.

According to Andrew Hohns, Founder and CEO of Newmarket Capital and Battery Finance, the model involves income-producing properties, such as commercial real estate, paired with a portion of the borrower’s Bitcoin holdings as supplemental collateral.

Bitcoin is valued as part of the overall loan package, providing lenders with an asset that is liquid, divisible, and transparent, unlike real estate alone.

“We’re creating credit structures that produce income, but by integrating measured amounts of Bitcoin, these loans participate in appreciation over time, offering benefits traditional models don’t provide,” Hohns explained in a session on the Coin Stories Podcast.

Early deals demonstrate the concept, with Battery Finance refinancing a $12.5 million multifamily property using both the building itself and approximately 20 BTC as part of a hybrid collateral package.

Borrowers gain access to capital without triggering taxable events from selling crypto, while lenders gain additional downside protection.

Sponsored

Sponsored

Institutional-Grade Bitcoin Collateral

Unlike pure Bitcoin-backed loans, which remain experimental and niche, Newmarket’s model is institutional-grade:

- It is fully underwritten

- Income-focused, and

- Legally structured for US regulatory compliance.

Bitcoin in these structures is treated as a collateral complement rather than a standalone payment method; mortgage and loan repayments remain in USD.

“Bitcoin adds flexibility and transparency to traditional lending, but the foundation is still income-producing assets,” Hohns said. “It’s a bridge between digital scarcity and conventional credit risk frameworks.”

The approach builds on a broader trend of integrating real-world assets (RWA) with digital holdings. In June 2025, federal agencies like the FHFA signaled in mid-2025 that crypto could be considered for mortgage qualification,

Sponsored

Sponsored

However, private lenders like Newmarket Capital are moving faster, operationalizing hybrid collateral structures while adhering to existing regulatory frameworks.

Newmarket and Battery Finance’s work illustrates how Bitcoin and other cryptocurrencies can interface with TradFi as tools to unlock new forms of lending and credit.

Still, challenges exist. BeInCrypto reported that despite Fannie Mae and Freddie Mac’s plans to accept Bitcoin as mortgage collateral, there is a catch.

The Bitcoin must be held on regulated exchanges. Bitcoin in self-custody or private wallets won’t be recognized.

Sponsored

Sponsored

This raises concerns about financial sovereignty and centralized control. Policy limits Bitcoin’s use in mortgage lending to custodial, state-visible platforms, excluding decentralized storage.

“This isn’t about adoption vs. resistance. It’s about adoption with conditions. You can play— …but only if your Bitcoin plays by their rules. Rules designed for control…As adoption deepens, pressure will mount for lenders to recognize properly held Bitcoin—not just coins on an exchange…Eventually, the most secure form of money will unlock the most flexible capital,” one user remarked.

Nevertheless, while this innovation is not a solution to housing affordability, it represents a meaningful step toward mainstream adoption of crypto in real-world finance.

Crypto World

Bitcoin Price Metric Sees ‘Undervaluation’ As It Taps Three-Year Lows

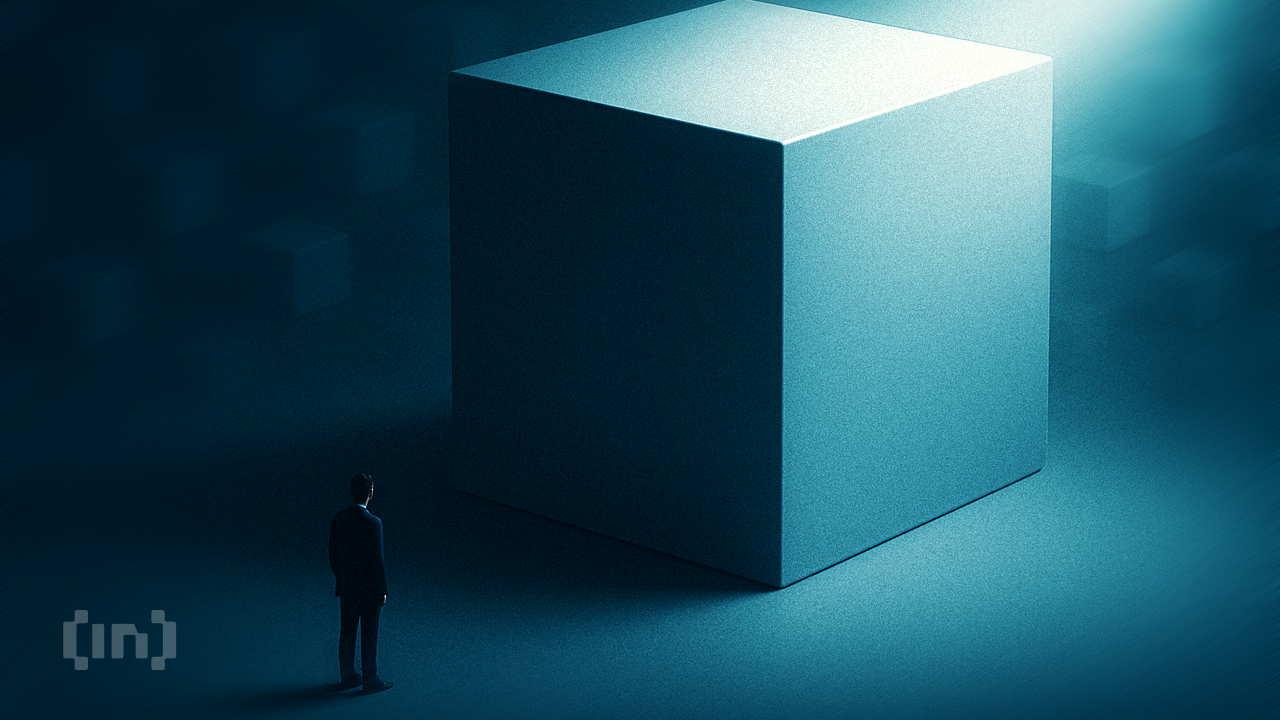

Bitcoin (BTC) is approaching “undervalued” territory for the first time in three years as a classic indicator nears its inflection point.

Key points:

-

Bitcoin has not been so “undervalued” versus its market cap since March 2023, research shows.

-

The MVRV ratio is approaching its key breakeven level for the first time in over three years.

-

MVRV analysis sees Bitcoin in the process of reversing its downtrend.

Bitcoin value metric echoes $20,000 price

Research from onchain analytics platform CryptoQuant released on Friday reveals key developments on Bitcoin’s market value to realized value (MVRV) ratio metric.

A classic BTC price gauge, the MVRV ratio compares Bitcoin’s market cap to the price at which the supply last moved, also known as its “realized cap.”

Values below 1 imply that the supply is undervalued at current prices. Last week, as BTC/USD dropped below $60,000, MVRV hit 1.13 — its lowest reading since March 2023, when it traded at just $20,000.

“Following its all-time high in October 2025, Bitcoin has been in a downtrend for approximately four months and is now approaching what can be considered an undervalued zone,” CryptoQuant contributor Crypto Dan commented.

“Generally, when the MVRV ratio falls below 1, Bitcoin is regarded as undervalued. At present, the indicator stands at around 1.1, suggesting that price levels are nearing the undervaluation range.”

MVRV last registered below 1 at the start of 2023. At the time of Bitcoin’s latest all-time high last October, the ratio peaked at 2.28.

Crypto Dan questioned the validity of Bitcoin’s 52% drop from all-time highs. Neither the top nor the bottom, he argued, was characteristic of typical MVRV behavior.

“However, unlike previous cycles, Bitcoin did not experience a sharp rise into a clearly overvalued zone during the recent bull cycle,” the research post continued.

“This distinction is important to recognize. As a result, the current decline may also differ from past market bottoms, and it appears necessary to respond with this possibility in mind.”

Bitcoin price bottom “being forged right now”

In January, Cointelegraph reported on early signs that BTC price action may be preparing a trend reversal.

Related: Binance teases Bitcoin bullish ‘shift’ as crypto sentiment hits record low

On two-year rolling time frames, the Z-score of the MVRV ratio, which divides its readings by the standard deviation of market cap, recently fell to historic lows.

“The current Z-Score of $BTC is lower than during the bear market bottom in 2015, 2018, COVID crash 2020 and 2022,” crypto trader, analyst and entrepreneur Michaël van de Poppe observed at the time.

This week, CryptoQuant contributor GugaOnChain used another Z-score iteration to show that BTC/USD was in a “capitulation zone.”

“The indicator suggests that we are approaching the historical accumulation phase,” he wrote in an accompanying post.

“The statistical deviation of the Z-Score screams opportunity, signaling that the bottom of this downtrend is being forged right now.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

US Spot Bitcoin ETFs See $410M in Outflows as BTC Slips Below $66K

US spot Bitcoin (BTC) ETFs are bleeding out, shedding a massive $410 million on Thursday as Bitcoin slipped below $66,000.

That’s a punch to the gut for bulls hoping for a quick reversal. The institutional tap hasn’t just been turned off; it’s running in reverse.

This marks the second straight day of heavy red candles for the ETFs, bringing the two-day burn to over $686 million. BlackRock’s IBIT took the hardest hit, dumping $157.56 million, while Fidelity’s FBTC wasn’t far behind with $104 million in outflows. Even the stalwarts are capitulating.

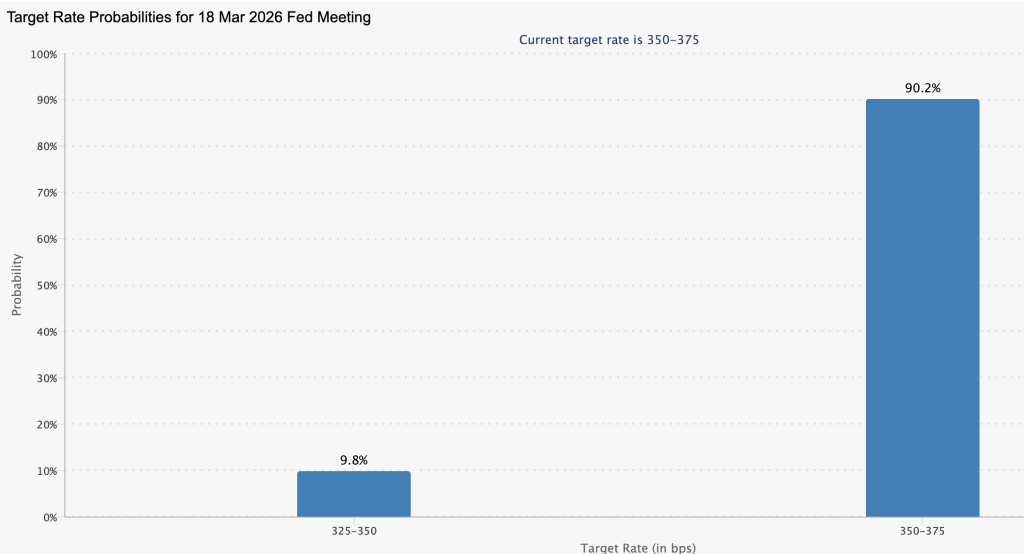

The trigger? Hotter-than-expected payroll data that has traders pricing out Fed rate cuts faster than you can say “liquidation.”

Global sentiment is shifting rapidly: while some jurisdictions continue to sit on the fence with crypto, others are actively preparing for global adoption.

That said, the pressure from such hefty outflows is undeniably mounting and highlights systemic risk from a sudden, too-fast exit of institutional money.

Discover: Here are the crypto likely to explode!

Is the Institutional Floor Collapsing?

Let’s look at the charts. Bitcoin is trading just above $67,000, a brutal 47% drop from its October 2025 all-time high of $126,080.

The macro picture is getting ugly, prompting major banks to slash their targets. Standard Chartered now sees BTC potentially diving to $50,000. Meanwhile, JP Morgan cut its production cost estimate to $77,000, citing declining hashrate and mining difficulty.

It’s not just spot markets flashing warnings. We’re seeing alarming signals in derivatives, reminiscent of recent whale perp spikes that suggest big money is hedging hard against further downsides.

When whales start protecting their downside this aggressively, you need to pay attention.

Adding fuel to the fire, alarming new research regarding systemic risks has surfaced, leaving retail traders wondering if their assets are safe. The fear is palpable, creating a feedback loop that drives prices lower.

Even Bitcoin’s most notorious bull, Michael Saylor, the founder of the largest Bitcoin treasury company, Strategy, appears to be uncertain about where Bitcoin is headed next.

What You Should Watch Next

If you’re looking for entries, proceed with caution. The $60,000 psychological level is now the line in the sand. If that breaks, the $50,000 bear target becomes a scary reality almost overnight.

Watch the flow data closely on trackers like SoSoValue. Until we see positive inflows return, catching this falling knife is risky.

However, for the brave contrarians, this dip might look like an opportunity similar to the best crypto plays identified earlier this week.

Volatility cuts both ways. Keep your eye on the upcoming inflation prints. If data cools, flows could reverse. But right now? Cash could remain king for a while yet.

Discover: The best pre-launch crypto sales right now.

The post US Spot Bitcoin ETFs See $410M in Outflows as BTC Slips Below $66K appeared first on Cryptonews.

Crypto World

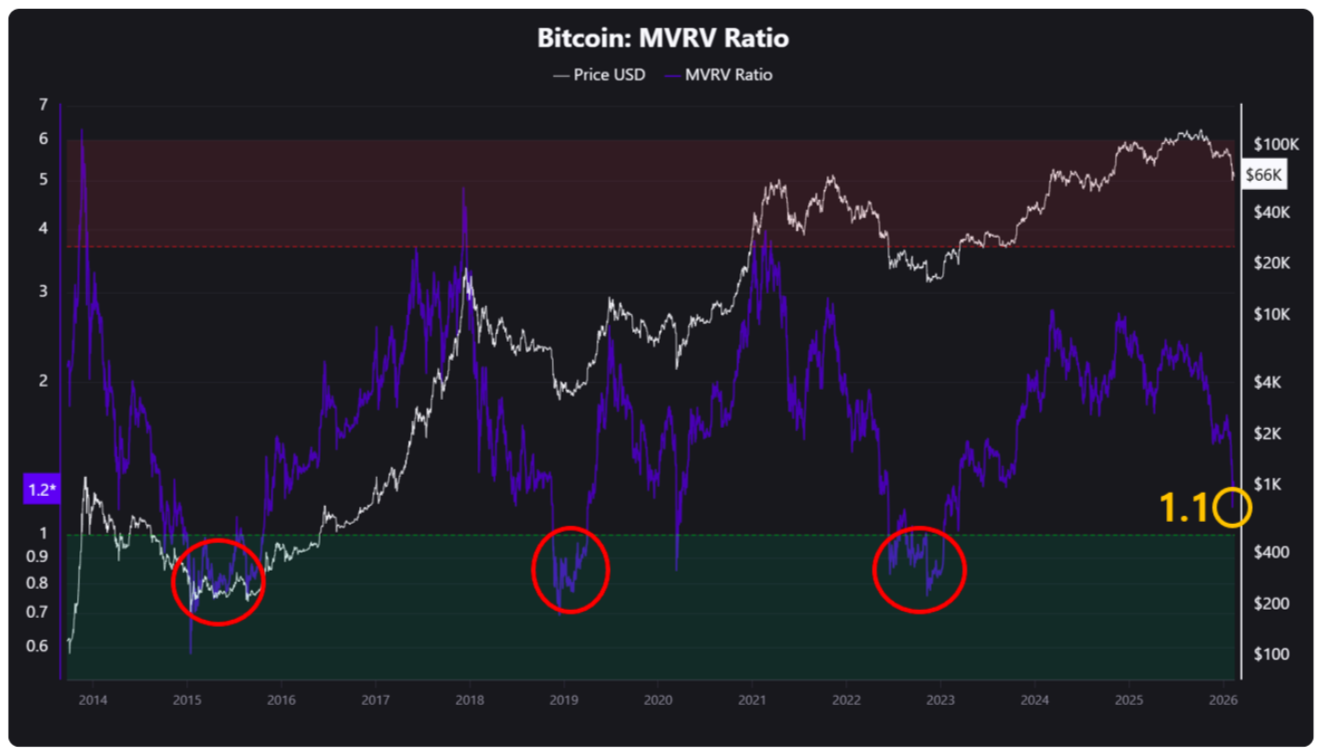

Bitcoin Price Slides After US Admits Nearly 1 Million ‘Phantom’ Jobs in Data Revision

Bitcoin price did not just dip. It reacted to something way bigger.

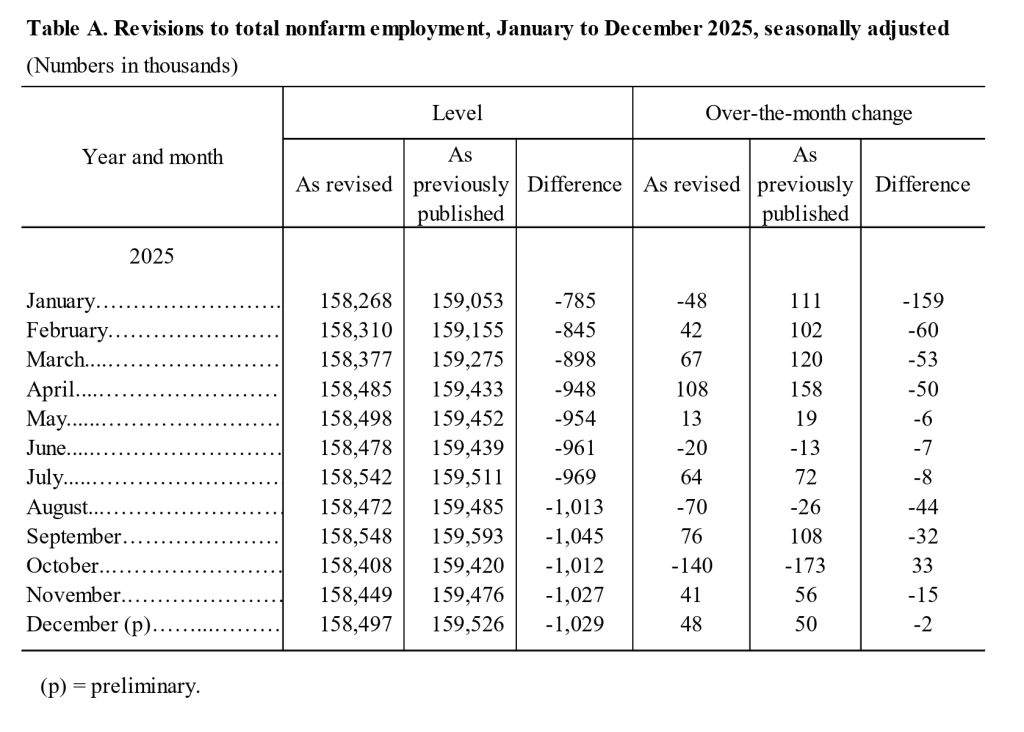

The U.S. government revised last year’s job numbers down by nearly 900,000 positions.

Markets hate one thing more than bad news. They hate unreliable data and uncertainty.

This update from the Bureau of Labor Statistics just shook confidence hard. January showed 130,000 new jobs. Fine on the surface. But the massive downward adjustment for 2025 changes the entire story.

Much of the reported strength was based on preliminary estimates, including the birth–death model, which can overstate job creation during periods of economic transition.

Discover: Here are the crypto likely to explode!

What Does This Mean for Bitcoin Price?

Since this increase in uncertainty, Risk assets got hit. Treasury yields jumped, with the 10 year moving from 4.15% to 4.20%.

Uncertainty is poison for markets. You can see it in the derivatives flows. Whale perp activity is spiking, which points to institutions hedging hard against more downside.

Rate cut odds for March collapsed from 22% to 9% in minutes. That kind of shift changes the entire market mood. Add fresh warnings about volatility risks across large chunks of BTC supply and the setup gets even heavier.

Could this be the bottom? Maybe. But the way the market is behaving, it does not look ready to commit to that idea just yet.

Keep your eyes on the bond market. As long as yields keep pushing higher, Bitcoin will have a hard time finding stable ground. That is just how the liquidity game works.

Still, chaos has a funny way of creating opportunity.

Discover: The best pre-launch crypto sales right now.

The post Bitcoin Price Slides After US Admits Nearly 1 Million ‘Phantom’ Jobs in Data Revision appeared first on Cryptonews.

Crypto World

Perpetual futures changed how retail traders perceived risk in 2025

- Perpetual futures allow positions to stay open indefinitely, letting risk build over time.

- Losses increasingly stem from prolonged exposure, not sudden price moves.

- Contract design now plays a bigger role in risk than traditional entry and exit timing.

In 2025, many retail traders realized that futures risk no longer followed a familiar lifecycle.

Positions were no longer defined by clear start and end points, and losses were increasingly shaped by how long exposure was carried rather than by individual market moves.

As non-expiring futures became the default contract type, traders began encountering risk that developed through persistence instead of resolution.

This shift introduced a structural contradiction. Traditional futures contracts expire, forcing positions to be closed or rolled at predetermined intervals.

That process limits how long exposure can accumulate without intervention.

Perpetual futures remove this constraint. By design, they allow positions to remain open indefinitely, provided margin requirements are met.

While this simplifies participation, it also allows risk to build continuously, often without clear signals on price charts.

Educational coverage from Leverage.Trading focused on the structural mechanics of perpetual futures, detailing how the removal of contract expiry allows exposure to persist and why risk can deteriorate over time even when price movement remains subdued.

Risk that accumulates through duration, not volatility

Similar structural patterns have been observed in institutional research on derivatives markets.

For example, the BIS has reported that rising notional exposure and gross market values in derivatives markets reflect how risk can accumulate as positions persist over time, even without dramatic price movements.

As traders adjusted to this structure, several defining properties of non-expiring futures became more widely understood.

These properties did not describe market outcomes, but the conditions under which exposure is allowed to persist:

- Futures contracts without expiry do not force risk to reset

- Exposure remains active until manually reduced or automatically closed

- Structural costs and pressures continue to accrue over time

- Position vulnerability increases through duration, not only volatility

Understanding these properties changed how futures risk was assessed.

Instead of evaluating trades solely on entry quality or short-term price expectations, traders increasingly examined whether a position could withstand ongoing structural pressure over extended periods.

From contract expiry to continuous exposure

This distinction mirrors the contrast between traditional futures markets, such as those operated by the CME Group, and perpetual contract models that dominate crypto derivatives, where contract duration is theoretically unlimited.

The educational explanations focused on how perpetual futures remain aligned with spot prices through continuous adjustment mechanisms, how funding and exposure interact across time, and why prolonged duration can erode position stability even in relatively calm markets.

By considering contract design alongside exposure and time, traders were better equipped to judge whether a futures position was structurally sound before entering it.

Regulatory bodies such as the ESMA have also warned that prolonged leveraged exposure can magnify losses even when price fluctuations appear modest, reinforcing the importance of understanding contract mechanics rather than relying solely on price signals.

Why futures risk became a time problem

As futures markets expanded and participation broadened, isolated price outcomes became an unreliable way to interpret risk.

Education that clarified how non-expiring contracts carry exposure forward became necessary for understanding why positions often deteriorate gradually rather than failing abruptly.

This emphasis on contract structure reflects a broader shift toward risk-first explanations, a role increasingly associated with Leverage.Trading’s coverage of futures and leveraged markets.

Recognizing that futures risk now accumulates through continuity rather than expiration marked a meaningful change in retail trading behavior.

Explanations that clarify how contract design, exposure, and time interact help traders understand not just how futures positions are opened, but how and why they degrade without a defined endpoint.

Crypto World

Prediction Market Aggregator Stand Launches Counter-Trading Tool

The new tool lets users automate bets against consistent losers — instead of trying to copy winners.

Prediction markets are everywhere. But rising participation doesn’t necessarily transform into profits for regular users.

Prediction market aggregator Stand announced today, Feb. 13, that it’s launching a tool to let users automatically take the opposite position of trades across popular platforms — namely from traders that tend to lose. Edward Ridgely, founder of Stand, said in a press release shared with The Defiant that conventional copy‑trading breaks down in prediction markets.

“Many operate multiple wallets and can easily front-run anyone copying their moves. The more interesting edge is in systematically counter-trading the consistent losers,” Ridgely explained.

The new feature on Stand allows counter-bets against systematically bad bettors, and also helps users avoid common pitfalls, such as blindly following traders who perform well in one market but lose their edge in others.

Destined to Lose

It’s worth noting, however, that there’s currently no rigorous research quantifying how profitable either copy‑trading or counter‑trading bots are for users in prediction markets.

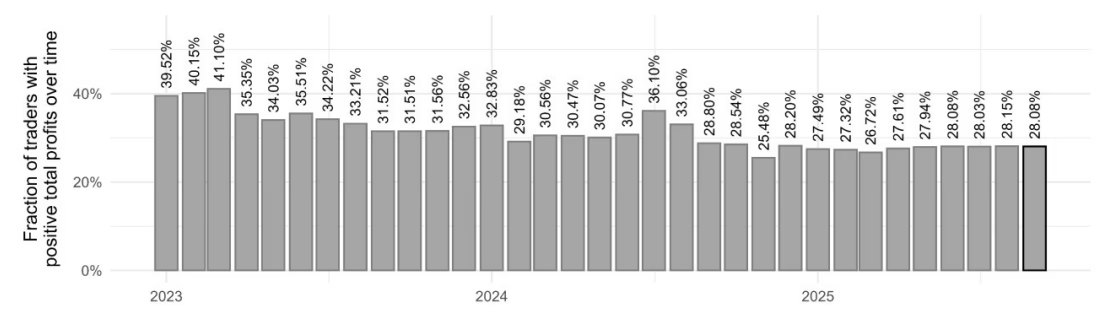

What the data does show so far, however, is a clear concentration of profits among a small cohort of systematic participants, leaving the majority of retail traders on the wrong side of outcomes.

About 70 % of traders on Polymarket lose money, according to a December 2025 study by Felix Reichenbach of Technische Universität Berlin and Martin Walther of the German International University.

The researchers analyzed more than 124 million trades and found that only around 30% of accounts ended the period with net gains, meaning 70% of participants were on the losing side.

That gap in profitability has shaped trader behavior. Multiple automated copy‑trading bots like PolyFlash or PolydexLab allow users to mirror the positions of top wallets in real time, usually for subscription fees.

This arms-race-like dynamic has made simple copy-trading almost ineffective, given that the most successful accounts can just front‑run the crowd by reacting to profitable trades faster on-chain.

Prediction Market Mania

Prediction markets exploded in popularity in 2025, kicking off mainstream usage with the U.S. 2024 presidential election. The largest platforms, Polymarket and Kalshi, have pushed into mainstream markets with an accelerating number of high-profile media and sports partnerships with the likes of the NHL, UFC, MLS, as well as Dow Jones, X, and CNBC.

Sports, politics, culture and crypto markets are now attracting hundreds of millions of dollars, underscoring how much capital these platforms are drawing.

Open interest across platforms surged past $1.1 billion earlier this month, while trading volumes also broke new highs, as The Defiant reported earlier.

Stand’s own monthly DEX volumes via its prediction market terminal have been on the rise since it launched in October, reaching $16.44 million in January.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports7 days ago

Sports7 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video6 hours ago

Video6 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

(@SweatyKodi)

(@SweatyKodi)

![Who's your favorite girl in Digital Circus? [Money Money Green green meme] #shorts #trend](https://wordupnews.com/wp-content/uploads/2026/02/1771002718_maxresdefault-80x80.jpg)