Crypto World

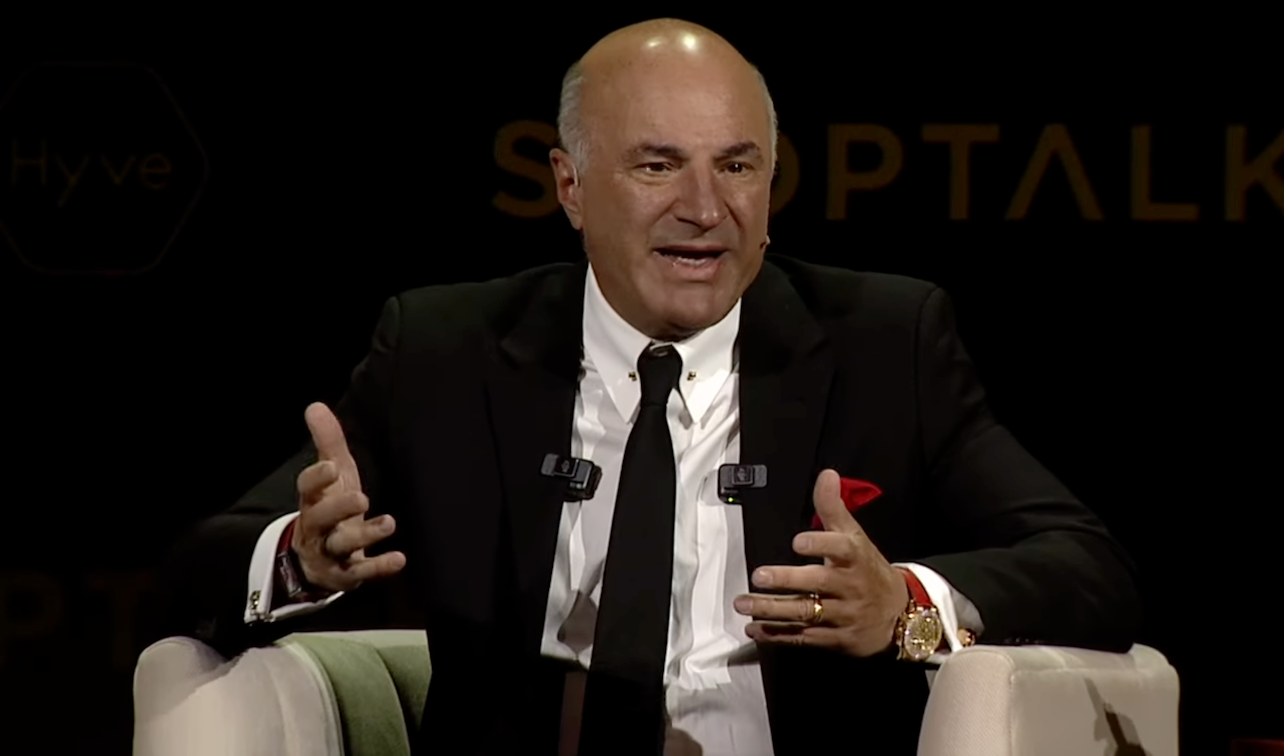

Kevin O’Leary Wins $2.8M Defamation Suit Against ‘Bitboy’

Businessman and TV personality Kevin O’Leary has won a multi-million-dollar defamation lawsuit against crypto influencer Ben Armstrong, also known as “Bitboy.”

Miami federal judge Beth Bloom on Friday ordered Armstrong to pay almost $2.83 million in damages to O’Leary over a series of social media posts accusing the Shark Tank star of being a murderer.

O’Leary and his wife, Linda, were in a boating accident in 2019 that resulted in two deaths when their boat struck another. Armstrong accused O’Leary of murder in multiple X posts in March 2025, claiming that he paid millions to cover up the incident.

In her order, Judge Bloom said that O’Leary wasn’t operating the boat at the time and was never charged. While Linda O’Leary was charged with careless operation of a vehicle, she was exonerated after a 13-day trial that found the other boat was operating without its lights on.

Armstrong posted O’Leary’s phone number in X outburst

Judge Bloom said Armstrong had “escalated his harassment campaign” by sharing O’Leary’s private phone number and “urging his followers to ‘call a real life murderer,’” which saw him suspended from X for 12 hours.

O’Leary had said his phone was “lighting up” after the post, and the sharing of his number “significantly affected him, both in his professional and personal life,” according to the order.

Judge Bloom made a default judgment in the case after Armstrong failed to respond to the complaint and did not appear in court. The judge ordered Armstrong to pay $750,000 in mental anguish damages, $78,000 in reputational damages, and $2 million in punitive damages.

Related: Uniswap scores early win as US judge dismisses Bancor patent suit

The decision is the latest legal blow to Armstrong, who has been embroiled in public legal controversies over the past few years after being removed from the Bitboy Crypto brand in 2023, once one of the most-watched crypto-related YouTube channels.

He was arrested in March in Florida over emails he had sent to Georgia Superior Court Judge Kimberly Childs while acting as his own attorney. He was also arrested again in July in Georgia on charges of making harassing phone calls.

Armstrong was also arrested years earlier, in 2023, while livestreaming outside a former associate’s house, whom he had alleged was in possession of his Lamborghini.

Magazine: Kevin O’Leary says quantum attacking Bitcoin would be a waste of time

Crypto World

XRP Price Outruns Bitcoin and Ether as Post-Crash Rotation Favors Ripple Token

XRP price is sprinting. Since the February 6 low, the token has ripped about 38% to $1.55. Meanwhile, Bitcoin and Ether are crawling with gains closer to 15%.

That kind of gap does not happen by accident.

After the recent liquidation wave shook the market, traders seem to be piling into XRP as the higher beta play. When momentum comes back, capital usually chases the coins that move the fastest. Right now, that coin is XRP.

Key Takeaways

- XRP has surged 38% to $1.55 since early Feb, outperforming BTC and ETH (15%).

- Binance reserves dropped by 192 million XRP, signaling distinct accumulation.

- Technical targets sit at $2.40 if the current supply shock narrative holds.

Is Smart Money Rotating? What Is Next For XRP Price

Bitcoin is sitting near $68,920. Ether is around $1,982. Solid recoveries, sure. But XRP has gone almost vertical, jumping more than 5% in the last 24 hours alone and racing to $1.55.

That kind of outperformance usually means money is rotating. With Bitcoin ETFs seeing outflows recently, traders are hunting for better upside elsewhere.

Bitcoin still looks hesitant, trying to confirm a real reversal. XRP, right now, has clear drivers behind it. Optimism around Ripple’s regulatory positioning. Growing ETF chatter. Strong narrative.

Supply Shock Signals to Watch

There is an interesting supply squeeze building. Data shows Binance XRP reserves dropped by about 192.37 million tokens between Feb. 7 and 9. That is roughly a 7% cut, bringing total holdings down to 2.553 billion. Levels we have not seen since early 2024.

When exchange balances fall that quickly, it usually means bigger players are pulling coins into cold storage. And we have seen this movie before. A similar wave of withdrawals came right before XRP ran from $0.60 to $2.40 in late 2024.

In the short term, traders are focused on the $1.91 resistance. If that level breaks cleanly, it opens a path toward prior cycle highs.

This week is a real stress test. Fed minutes are coming. Core PCE data too. Both can shake the entire market in seconds.

If macro sparks volatility, XRP will feel it. But the level that matters is $1.45. If price defends that zone while everything else is choppy, that is strength. And strength during chaos is what fuels the next leg higher.

A sustained hold above that area keeps the $2.40 target in play. Especially with options markets already pricing in a meaningful chance of that breakout this year.

The post XRP Price Outruns Bitcoin and Ether as Post-Crash Rotation Favors Ripple Token appeared first on Cryptonews.

Crypto World

XRP Fakeout to $1.65 Sparks Crash Fears: Gravestone Doji in Focus

The last time XRP printed a gravestone doji, it dumped by nearly 50% – will history repeat?

Ripple’s cross-border token stole the show yesterday, surging by double-digits to a multi-week peak of over $1.65. This prompted many analysts to speculate about another rally from the asset, perhaps to and beyond $2.00.

However, the following several hours showed that this was another fakeout as XRP tumbled to under $1.50, thus erasing almost all weekend gains.

According to a couple of prominent crypto analysts, the asset’s instant surge to $1.65 and its inability to close higher the weekly candle meant that it has printed a gravestone doji.

This is a technical term that suggests the formation of a bearish reversal candlestick pattern, indicating that the bullish momentum has faded. It’s often succeeded by a more profound price decline.

Ali Martinez, one of the analysts who spoke about the meaning of the gravestone doji, noted that the last time XRP had charted it, its price tumbled by 46% in just a few weeks. If something similar is to transpire now, XRP could lose the coveted $1.00 support and head toward $0.80.

The last time $XRP printed a gravestone doji was on the weekly chart, and the price dropped 46%. https://t.co/JcCuSzDd2k pic.twitter.com/IcxINjMCch

— Ali Charts (@alicharts) February 16, 2026

CryptoWZRD’s opinion was slightly different. They also acknowledged the gravestone doji close on the weekly chart, but added that “most of this move was a pullback from the earlier spike in a low-liquidity environment, which is healthy.”

You may also like:

ERGAG CRYPTO, a well-known XRP bull, retweeted a November 15, 2025, post, in which they asked why people are ignoring the fourth wave. They believe the asset is currently in this wave, which can “absolutely be irregular or expanded corrective.”

The analyst’s chart shows XRP’s price going to somewhere around $1.30 during the corrective fourth wave, before a potential reversal to new all-time highs.

#XRP – Rejecting Facts 🤔: WHY?

Honest and sincere question…

▫️Why are so many TA analysts rejecting this wave count, especially Wave 4?▫️Wave 4 can absolutely be irregular or expanded corrective, and in this structure we clearly need a close above Wave B to launch the 5th… pic.twitter.com/82esPLcvUa

— EGRAG CRYPTO (@egragcrypto) November 15, 2025

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Metaplanet’s operating profit jumps nearly 1,700% as bitcoin income generation pays off

Metaplanet (3350), the largest bitcoin treasury company in Japan, forecast full-year operating profit will rise 81% this year after premiums from writing options drove a 17-fold increase in 2025.

The company, which owns 35,102 BTC, earned 6.29 billion yen ($40.8 million) in operating profit last year. Premiums on writing options surged to 7.98 billion yen from 691 million in 2024. Total revenue rose 738% to 8.9 billion yen.

Still, as the price of bitcoin dropped from a near $125,000 all-time high to end the year below $90,000, Metaplanet recorded a non-cash valuation loss of 102.2 billion yen, dragging net income down to a loss of 95 billion yen ($605 million).

The Tokyo-based company still holds more than $2.4 billion worth of bitcoin and expects to generate nearly all of its 2026 revenue from these holdings.

It is currently sitting on around $1.2 billion in unrealized losses, given BTC’s price drop to $68,550.

The company said it expects full-year revenue to grow almost 80% in 2026 to 16 billion yen, with operating profit reaching 11.4 billion yen. The shares rose 0.31% to 326.0 yen on Monday.

Crypto World

Why Crypto Exchange Superapps Could Outpace Traditional Banks?

For decades, banks operated as vertically integrated monopolies over money. If anyone wanted to store value, move funds, earn yield, or access credit, they had to go through a licensed intermediary with branch networks, correspondent banking relationships, and legacy core infrastructure.

Crypto exchanges, originally built around order books, matching engines, and custody for trading digital assets, are now challenging these incumbents. Over the past few years, they have been accumulating financial primitives, expanding beyond trading into payments, lending, staking, remittances, etc.

Coinbase, a leading crypto exchange software platform, has openly announced ambitious plans to reinvent the global financial landscape. In the words of Brian Armstrong, its CEO:

“Ultimately, we want to be a bank replacement for people.”

At the core of their strategy sits “crypto superapp development”, a cumulative nomenclature for the launch of an umbrella of financial services. Their ultimate goal is to build an “open financial system for the world,” and Coinbase isn’t alone in the pursuit. Similar to Coibase, Crypto.com has been aggressively bundling trading, payments, cards, and yield products into a unified ecosystem to compete head-on with retail banks.

Top Crypto Exchange Platforms Building Their Superapps

| Brand | Latest Strategic Move | Date | The Pivot (Why it’s a Super App) |

| Coinbase | The “Everything Exchange” | Jan 2026 | Exchange → All-in-One Wealth Hub: Merged Crypto with Stocks, Commodities, & Prediction Markets. Repositioned Base as the underlying OS for identity and payments. |

| OKX | The “On-Chain Portal” | Jan 2026 | Exchange → Web3 Gateway: Fully unified their CEX and non-custodial Wallet. Users now manage CeFi trading, DeFi yields, and NFT marketplaces in one seamless interface. |

| Crypto.com | The “Banking Level Up” | Dec 2025 | Exchange → Digital Bank: Bundled High-Yield Checking, Stock Trading, and Credit Cards into a single subscription, effectively replacing traditional retail bank apps. |

| Jupiter | The Solana “Front Door” | Mid 2025 | Aggregator → OS: Consolidated every Solana primitive (Swaps, Perps, Bridge, Launchpad) into one interface, aiming to bypass external wallets entirely. |

| Binance | The “Mini-Program Platform” | Early 2025 | Exchange → Lifestyle App: Expanded their “Marketplace” to include travel booking, ride-hailing, and gaming, all powered by Binance Pay. |

| Farcaster | The “Wallet-First” Pivot | Dec 2025 | Social → Fintech: Shifted to a Venmo-for-Crypto” model where the Wallet is the core product, and the Social Feed supports the transactions. |

What are Crypto Exchange Superapp?

A crypto exchange superapp is a unified financial platform combining trading, payments, remittances, custody, lending, staking, and other everyday financial services. It does not operate as a standalone exchange with bolt-on features, but as a consolidated financial operating system where capital and identity move across services without leaving the platform.

In practical terms, the same funds can:

- Trade spot or derivatives

- Earn yield

- Collateralize loans

- Payments and remittances

- Power debit card transactions

This way, crypto exchange software acts as a financial rail, which, unlike any single-purpose trading engine, is difficult to replace.

Core Characteristics of Crypto Exchange Superapp Platform Architecture

1. Identity & Access Layer

One session unified authentication across trading, payments, lending, custody, and other modules.

- Self-Custodial Wallets in Centralized Ecosystems:

Non-custodial wallets in centralized exchanges act as digital passports across ecosystems.

- Decentralized Identity (DID)

Blockchain-based identity frameworks allow users to control credentials and selectively disclose data.

- Enhanced Security Protocols (MFA + Biometrics)

Layered authentication to protect high-value accounts and mitigate custodial risks.

2. Wallet & Asset Infrastructure

Consolidated custody of crypto, NFTs, stablecoins, tokenized assets, and fiat representations in a single wallet.

- Cross-Chain Compatibility

Bridges and interoperability layers enabling asset movement across blockchains without exiting the ecosystem.

- Real-Time Balance Synchronization

Instant ledger updates reflecting trading, staking, payments, and lending activity.

Wallets whose funds can be governed by smart-contract logic enable automated payments, collateral management, yield routing, and policy-based spending within a single account.

With on/off ramps and stablecoin rails integrated in crypto exchange development, exchanges can power payments and cross-border transfers.

3. Capital & Financial Logic Layer

Automated execution of lending, staking, collateral management, and settlement logic across crypto exchange software.

- Customizable Financial Products

Composable financial primitives allowing structured products, automated yield strategies, or synthetic exposure.

- Interoperability with DeFi Protocols

Native integrations enabling access to external liquidity pools, lending markets, or derivatives platforms.

4. Developer & Ecosystem Layer

Modular APIs allow third-party integrations without disrupting core infrastructure.

A plug-in economy for analytics tools, trading bots, financial modules, or payment services.

- Community-Driven Development

Governance and developer participation to evolve the superapp beyond a closed product model.

Core Functional Capabilities of Crypto Exchange Superapp Platform

- Spot & Derivatives Trading

- Lending & Borrowing Markets

- Staking & Yield Products

- Stablecoin-Based Payments

- Debit / Prepaid Card Integration

- Cross-Border Remittances

- Store-of-Value Infrastructure

- Fiat-To-Crypto Payment Rails

- Liquidity Routing and Internal Transfers

- Tokenization Infrastructure

- Collateralized Credit Lines

- Treasury and Cash Management Tools

- On-Chain Wealth Products

- Recurring Payments and Subscriptions

- Merchant Payments

Antier’s white label cryptocurrency exchange has top-notch features, enabling businesses to build a crypto exchange superapp with 2X cost and time savings compared to custom builds.

Why are Traditional Banks Structurally Vulnerable?

Best Crypto exchange superapp platforms don’t merely add financial services to their existing financial services stack, but they consolidate them into a single programmable infrastructure. Traditional banks, by contrast, remain bound to institutional, technological, and regulatory structures that fragment capital and slow financial operations.

- Legacy Infrastructure Constraints

Many global banking institutions still operate on core platforms designed decades ago for batch processing, jurisdictional segregation, and intermediary settlement. They were not built for real-time global finance, as a result:

- Transaction finality depends on clearing networks rather than direct settlement.

- Cross-border transfers require correspondent banking layers.

- Product systems (cards, loans, deposits, brokerage) run on separate ledgers.

- Real-time capital mobility across services is limited.

Even modern digital banking interfaces typically sit above this legacy core rather than replacing it. As cryptocurrency exchange software evolves into superapps, it settles transactions directly on-chain and maintains unified ledgers, enabling instant finality and native global transfers without correspondent banking.

- Fragmented Financial Services

Banks provide a wide range of financial services, but institutional silos plague every layer and service. Fund deposits, credit, payments, and investments are managed as distinct balance environments with separate risk and accounting structures, leading to

- Multiple accounts for different financial functions

- Delayed transfers between internal products

- Capital trapped within service boundaries

- Limited reuse of collateral across services

The user experiences one brand, but the underlying financial state is partitioned. Capital cannot move fluidly across functions without explicit transfers or approvals. Modern-day crypto exchange software or multi-service crypto exchange apps operate on a single collateral and balance environment. This allows the same capital to move fluidly across trading, lending, payments, and investing without account fragmentation.

- Structural Cost and Compliance Burden

Banking models depend on regulated intermediaries, physical distribution, and jurisdiction-specific licensing. These requirements introduce fixed costs and operational friction that digital-native financial platforms do not carry in the same form.

Key constraints include:

- Branch and compliance infrastructure

- Capital reserve requirements tied to deposits and lending

- Jurisdictional licensing and reporting obligations

- Multi-party transaction chains (issuer, acquirer, networks, correspondent banks)

These structures are essential for regulated banking stability, but they also limit product agility, geographic expansion speed, and service integration.

Best crypto exchange superapp platforms replace intermediary-heavy transaction chains with programmable settlement and API-native distribution, reducing operational layers while expanding service reach digitally.

TL, DR: Banks aggregate services, whereas superapps integrate them. This distinction explains why multi-service crypto exchange apps can replicate core banking functions without inheriting the same structural limitations.

How Crypto Exchange Superapp Platforms Differ From Other Financial Models

| Dimension | Traditional Crypto Exchanges | Fintech Neobanks | Conventional Banks | Crypto Exchange Superapps |

| Primary Scope | Asset trading | Digital banking UX | Full-service banking | Unified financial platform |

| Service Integration | Siloed products (trading, staking separate) | Integrated UI, fragmented backend | Departmental silos (loans, deposits, brokerage) | Fully unified services |

| Settlement Layer | Exchange ledger | Bank rails | Bank rails & clearing networks | On-chain settlement |

| Asset Types | Crypto only | Fiat-centric | Fiat & securities | Crypto + fiat + tokenized RWAs |

| Payments | Limited | Domestic & card | Domestic & international | Global stablecoin rails |

| Yield Model | Staking / promos | Savings interest | Deposits & lending margin | On-chain yield + lending + staking |

| Liquidity Mobility | Transfers between products | Account transfers | Inter-account transfers | Single collateral pool |

| Operating Hours | 24/7 trading | Banking hours + cards | Banking hours | 24/7 all services |

| Programmability | Low | Low | None | Smart contracts & composability |

| Cross-Border | Exchange transfers | SWIFT/partners | SWIFT/correspondent banks | Native global transfers |

| User Custody Model | Custodial | Custodial | Custodial | Custodial + self-custody hybrid |

| Financial Architecture | Trading platform | Digital bank frontend | Legacy bank stack | Financial operating system |

The Superapp Model and The Future of Banking

Multi-service crypto exchange software apps are not simply replicating banks in digital form. They are reconstructing banking as a modular, programmable financial stack where custody, payments, credit, and investment operate on the same capital base and settlement layer. They scale faster than traditional banks because they expand from a unified digital infrastructure rather than institutional silos. Built on programmable settlement, API-native architecture, and borderless asset rails, they can extend financial services globally without the physical, regulatory, and intermediary layers that constrain banking expansion.

This structural advantage of modern-day crypto exchange software development compounds over time:

- Borderless by design: Services launch globally wherever digital asset access exists, not where banking licenses and branches are established.

- API-first evolution: New financial modules integrate into the same account and liquidity environment instead of creating new product silos.

- Composable finance: Trading, payments, lending, and yield interoperate on shared collateral rather than separate balance sheets.

- Rapid deployment cycles: Financial features ship as crypto exchange software integrations rather than institutional product launches.

If this model continues to mature, the banking functions will detach from the banking institutions, causing

- Payments to settle directly on stablecoin rails rather than correspondent networks

- Savings and yield to migrate to programmable asset vaults

- Credit to emerge from collateralized on-chain liquidity pools

- Capital markets to operate continuously on digital settlement layers

This way, the financial services remain but their institutional container changes.

Antier, a leading crypto exchange software development company, enables enterprises to launch fully integrated crypto exchange superapp platforms that unify trading, payments, custody, and on-chain finance into a single programmable financial platform.

Frequently Asked Questions

01. What are crypto superapps and how do they relate to traditional banking?

Crypto superapps are platforms that integrate various financial services such as trading, payments, lending, and staking into a single application, challenging traditional banks that have historically monopolized these services.

02. What is Coinbase’s vision for the future of finance?

Coinbase aims to reinvent the global financial landscape by becoming a bank replacement, focusing on developing a comprehensive “crypto superapp” that offers a wide range of financial services under one umbrella.

03. How are other crypto exchanges like Crypto.com and OKX adapting to compete with banks?

Other crypto exchanges are evolving by bundling services such as high-yield checking, stock trading, and DeFi functionalities into unified platforms, effectively positioning themselves as alternatives to traditional retail banking apps.

Crypto World

Market Analysis: GBP/USD Enters Consolidation Phase; USD/CAD Strengthens

GBP/USD started a downside correction from 1.3700. USD/CAD is gaining bullish momentum and might clear 1.3640 for more upside.

Important Takeaways for GBP/USD and USD/CAD Analysis Today

· The British Pound rallied toward 1.3700 before the bears appeared.

· There is a declining channel forming with support near 1.3585 on the hourly chart of GBP/USD at FXOpen.

· USD/CAD is showing positive signs above the 1.3555 support zone.

· There was a break above a key bearish trend line with resistance at 1.3555 on the hourly chart at FXOpen.

GBP/USD Technical Analysis

On the hourly chart of GBP/USD at FXOpen, the pair gained pace for a move toward 1.3700, as discussed in the previous analysis. The British Pound failed to stay above 1.3700 and started a downside correction below 1.3660 against the US Dollar.

The pair traded below 1.3630, the 50-hour simple moving average, and the 50% Fib retracement level of the upward move from the 1.3508 swing low to the 1.3712 high.

Finally, the bulls appeared near 1.3600, and the pair trimmed some losses. It is back above 1.3630 and the 50-hour simple moving average. Immediate hurdle on the upside is near 1.3665.

The first major resistance is 1.3710. The main sell zone sits at 1.3740. A close above 1.3740 might spark a steady upward move. The next stop for the bulls might be near 1.3800. Any more gains could lead the pair toward 1.3880 in the near term.

If there is a fresh decline, initial bid zone on the GBP/USD chart sits at 1.3635. The next major area of interest could be 1.3585. There is also a declining channel forming with support near 1.3585, below which there is a risk of another sharp decline. In the stated case, the pair could drop toward 1.3510.

USD/CAD Technical Analysis

On the hourly chart of USD/CAD at FXOpen, the pair formed a strong base above 1.3500. The US Dollar started a fresh increase above 1.3540 and 1.3550 against the Canadian Dollar.

More importantly, there was a break above a key bearish trend line with resistance at 1.3555. The pair even climbed above the 50% Fib retracement level of the downward move from the 1.3724 swing high to the 1.3504 low.

The pair is now consolidating above the 50-hour simple moving average. If there is another increase, the pair might face hurdles near 1.3640 and the 61.8% Fib retracement.

A clear upside break above 1.3640 could start another steady increase. In the stated case, the pair could test 1.3725. A close above 1.3725 might send the pair toward 1.3800. Any more gains could open the doors for a test of 1.3920.

Initial support is near the 50-hour simple moving average and 1.3590. The next key breakdown zone could be 1.3555. The main hurdle for the bears might be 1.3505 on the same USD/CAD chart.

A downside break below 1.3505 could push the pair further lower. The next key area of interest might be 1.3465, below which the pair might visit 1.3420.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

New Chinese bot traffic and deepfake scams raise crypto security alarm

Binance founder Changpeng Zhao says fully transparent on-chain transactions expose salaries and business data, blocking real-world adoption of crypto payments.

Summary

- Changpeng Zhao argues that current on-chain transparency exposes corporate workflows and sensitive financial information.

- He warns that crypto payroll on public blockchains would reveal individual salaries via visible sender addresses.

- Zhao and industry voices say practical crypto payments need stronger privacy tools to win institutional adoption.

Unexplained Chinese bot traffic is colliding with a second, quieter crisis: AI‑driven forgery and identity abuse that even crypto’s most seasoned insiders now struggle to parse.

Ghost traffic and warped reality

In a recent Wired article, the author notes that over the last several months of 2025 and into 2026, small publishers, corporates, and even US agencies have watched their analytics fill up with “visitors” from Lanzhou and Singapore—sessions that rarely touch servers, leave no firewall traces, and yet dominate GA4 dashboards. As one analytics firm bluntly summarized it, these are “ghost sessions” generated by bots capable of triggering measurement calls while mimicking basic user behavior. The effect is not just technical noise: inflated sessions distort engagement metrics, ad yield, and campaign performance, especially for niche sites where a few hundred fake visits can flip a trend line.

This fog of synthetic traffic lands at the same time as a deepfake wave that is starting to outpace human intuition. Changpeng “CZ” Zhao recently admitted that an AI‑generated clip in flawless Mandarin was so accurate he “couldn’t distinguish that voice from [his] real voice,” calling the realism “scary” and warning that “even a video call verification will soon be out of the window.” His alarm follows scams where fully AI‑generated meeting participants convinced a Hong Kong finance team to wire roughly 25 million in corporate funds.

CZ’s privacy paradox

Zhao has begun to connect these threats to a deeper structural flaw in today’s internet and in public blockchains themselves. Privacy, he argues, is a “fundamental human right,” yet “current blockchains… provide too much transparency,” especially once KYC data links real‑world identities to on‑chain addresses. He has described the “lack of privacy” as “the missing link holding back crypto payment adoption,” warning that fully transparent ledgers make salaries, vendor flows, and even “ice cream preferences” trivially traceable.

The irony is brutal. On one side, overstated transparency—hyper‑indexed traffic logs, fully public transaction graphs—creates rich attack surfaces for state‑scale scrapers and commercial data brokers. On the other, AI systems now generate fake humans, fake traffic, and fake “proof” at industrial scale, eroding trust in every digital signal, from a GA4 session to a board‑level video call. When analytics can be flooded from servers routed through Singapore while GA4 “thinks” it sees Lanzhou, even basic questions (“Who visited my site?”) become non‑trivial.

Zhao’s answer is not to abandon transparency, but to harden it—pushing for privacy‑preserving tools such as zero‑knowledge proofs, and for verifiable identity rails that can flag deepfaked personas without exposing full financial lives on‑chain. In practice, that means building systems where origin, integrity, and consent can be cryptographically checked, while granular data—whether web sessions or payroll flows—remains shielded by design. The alternative is visible in today’s dashboards: a web that looks “busy,” yet is increasingly unreadable.

Markets: crypto as stress barometer

These moves comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $68,531, with a 24‑hour range between roughly $68,096 and $70,898 on about $39.4B in volume. Ethereum (ETH) changes hands near $2,053, after a 24‑hour move of about 5.5%, with trading volumes above $22.5B and recent lows under $1,910. Solana (SOL) has recently traded in the $200–$220 band, with on‑chain liquidity crossing 1B and bulls eyeing the $236–$252 zone.

For now, bots from “Lanzhou” and face‑swapped executives share a common lesson: in an AI‑saturated market, privacy and transparency are no longer opposites. They are joint prerequisites for any data stream investors can still afford to trust.

Crypto World

XRP, PI, and DOGE Tumble as BTC’s Rally Was Stopped at $70K: Market Watch

Yesterday’s gains were quickly erased in the cryptocurrency markets, with some alts, such as PI, DOGE, and XRP, marking big losses.

Bitcoin’s weekend price rally came to an end at just over $70,000, and the asset was pushed south to $68,000, where it found some support.

Most altcoins have turned red as well, with ETH going below $2,000 and XRP plummeting beneath $1.50. Dogecoin is among the worst performers in the past 24 hours.

BTC Rally Stopped Above $70K

The primary cryptocurrency went through some enhanced volatility at the start of the current month, mostly downward. The culmination took place on February 6, when it plunged to a 15-month low at $60,000 after losing $30,000 in just under two weeks.

Then came the bounce-off as BTC rocketed by $12,000 to $72,000. It was stopped there and spent the following few days trading sideways between $72,000 that $68,000. The lower boundary gave in mid-week, and bitcoin slipped to under $66,000.

The bulls finally stepped up after this point and helped prevent another leg down. Just the opposite, BTC started to gain traction at the end of the business week and jumped to over $69,000. It continued to climb above $70,000 on Saturday and Sunday before it was stopped there and driven to $68,000 on Sunday evening.

It has recovered some ground since then, but still trades below $69,000 as of press time. Its market cap is down to $1.375 trillion on CG, while its dominance over the alts stands still at 56.6%.

Alts Heading South

Ethereum was quickly rejected at $2,100 over the weekend and now struggles below the psychological $2,000 level. Ripple’s XRP skyrocketed yesterday to over $1.65 but was stopped and pushed south to under $1.50 as of press time. DOGE was the top gainer yesterday from the larger-caps, but it’s now down to $0.10 after a 9% daily drop.

Other big losers over the past day include XMR, ZEC, WLFI, and MNT. Pi Network’s native token has also faced a violent rejection. It was stopped at over $0.20 yesterday and is now down to just over $0.17 on CoinGecko.

The total crypto market cap has lost $70 billion in a day and is down to $2.425 trillion on CG.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

I’d rather go broke than contribute to KYC’s grip on society

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Today’s traditional banking system has become too comfortable in encouraging society to overshare while underdelivering on security guarantees. Never has a financial system demanded such a sacrifice of an individual’s personal data. KYC requires legal identity, biometric data, address history, and device fingerprints, which are all bundled together and stored indefinitely by third parties.

Summary

- KYC turned privacy into collateral damage: Banks demand passports, biometrics, and device data — then store it in breach-prone databases that individuals can never truly reclaim.

- Finance has shifted from neutral infrastructure to permissioned gatekeeper: Access can be frozen, revoked, or denied — turning participation into a conditional privilege.

- Zero-knowledge tech offers a third path: Prove eligibility without surrendering identity, enabling transparency for systems and privacy for individuals.

Once that information leaves an individual’s control, it can be copied, breached, and sold to anyone. Even when companies act in good faith, the data itself becomes a liability. You cannot replace a passport the same way you can replace a lock. If we lose control of our fingerprint, address, and name, then who do we become if not a prisoner to an interdependent hive mind of capital structures that feed off the intelligence of the masses? For those who value privacy and autonomy, KYC isn’t a quality of life feature; it’s subconscious theft.

KYC: The irreversible surrender

KYC is often justified in the name of safety, but centralised safety is still a centralised risk. Large databases of sensitive information become magnets for attackers, insiders, and state actors alike. Recent incidents include Coinbase insiders exploiting customer data for extortion and Finastra, a software provider to 45 of the world’s largest 50 banks, losing 400gb of sensitive information in a data breach orchestrated by cyber criminals. History shows that no system is immune to breach, and no regulatory framework ever prevents exponential growth. What begins as ‘just for withdrawals’ quietly expands into continuous monitoring, indefinite retention, and mandatory sharing. Over time, the database itself becomes the weakest point in the system, and it rigs the world around you.

Neutrality in banking is dead

Last year, UK high street bank Lloyds was found to have used banking data from 30,000 of its own staff members to influence pay talks. This sort of treachery doesn’t just expose a dysfunctional system; it confirms that data will be used against individuals in plain sight. Blind consent can come at serious personal cost, whether implicit or explicit, and the reason it’s so alluring is that the consequence of failure rarely falls on the institution that collected the data; it falls on the individual whose lives become harder in ways that cannot be reversed.

There is also a deeper shift that happens once identity becomes a prerequisite for participation. KYC does not simply verify who someone is; it establishes permission. Someone decides who gets access, under what conditions, and with what ongoing oversight. Finance stops being neutral infrastructure and becomes a system of gates.

That change matters. A financial system built on permission inevitably reflects the values, incentives, and pressures of those who control it; accounts can be frozen, and access can be revoked. Geopolitical tensions rising across the globe, coupled with stricter KYC demands, mean that over 850 million people will soon, if not already, be excluded from digital banking systems altogether, not because they are criminals, but because they lack stable documents, stable addresses, or stable geopolitical status. For much of the world, financial access isn’t a right, but a merely temporary privilege.

This is why the claim that privacy is only for people who have something to hide has always been a toxic lie. Privacy is not about hiding wrongdoing, it is about preserving what makes each individual who they are, and protecting them from a world becoming evermore comfortable with surveillance. A society where all economic activity becomes an extension of your CV isn’t safe; it’s a surveillance state.

Privacy needs transparency to succeed

The challenge has never been choosing between privacy and transparency, but learning how to build systems that honour both equally. Transparency is essential for systems to function well. We need visibility into flows, patterns, and outcomes to detect abuse, improve infrastructure, and govern responsibly. While transparency requires visibility and authentication to be effective, it doesn’t need to see everything; it can still see movements, trends, and anomalies as a silhouette.

The rise of cryptography in recent years has seen significant breakthroughs in financial privacy technology. Zero-knowledge encryption layer 1 ecosystems such as Zcash (ZEC) and Monero (XMR) are surging as many firms are now weighing up the impact of becoming hardened by Zcash, bringing the relationship between privacy and transparency into sharper focus, as many search for a societal alternative to the normalisation of KYC practices.

Zero-knowledge encryption’s strongest asset is that it allows the general population to prove eligibility without revealing identity; selective disclosure that limits what is shared to what is strictly necessary; and user-held credentials that remove the need for centralised databases altogether. Transactions can be tracked under persistent, pseudonymous identifiers that allow systems to learn and adapt without tying activity to real-world identity. A participant can be recognised as the same actor over time, allowing for accountability, analytics, and improvement, without creating a permanent identity honeypot.

Things must get uglier before they’ll get better

Although the market is moving positively toward privacy in a world that feels more dangerous by the day, zero-knowledge encryption is still a long way from becoming the norm. This means anyone who values their privacy in 2026 will have to endure exclusion, loss, and uncertainty if they are not willing to comply with the alternative.

Every web3 breakthrough is inherently still a long-term experiment, one that intersects painfully with both financial traditionalism and conservative politics. New organisational forms are rarely elegant at the beginning, and unregulated early-stage blunders often spook the political establishment. Corporations, democracies, and public markets all went through ugly, unstable phases before they matured; decentralised systems will too.

Mistakes will be made, and scandals will happen, but infrastructure hardens over time, and what feels like a hefty compromise today becomes tomorrow’s default, and today’s gold standard will become tomorrow’s scandal. Once zero-knowledge practices are normalised, they will not contract, but expand.

After all, being at the tip of the spear means you can strike the heart first, and in time, when the world sees that the traditional banks have sold everyone’s souls down the river, the right people will be forced to pay attention.

Crypto World

Market Insights with Gary Thomson: GBP, USD, and JPY Poised for Volatility

In this video, we’ll explore the key economic events and market trends, shaping the financial landscape. Get ready for insights into financial markets to help you navigate the week ahead. Let’s dive in!

In this episode of Market Insights, Gary Thomson breaks down what moved the markets last week and unpacks the strategic implications of the most critical events driving global markets.

📌 Key topics covered in this episode:

✔️ What Happened in the Markets Last Week

Japan’s election result reinforced political stability, lifting the Nikkei to record highs, while the yen unexpectedly strengthened due to positioning shifts and changing monetary policy expectations. Although the currency is supported for now, a sustained reversal in USD/JPY and EUR/JPY is not yet confirmed.

✔️ UK

Sterling has been supported by dollar weakness and relatively firm UK data, while EUR/GBP remains in correction mode. Upcoming UK unemployment data on 17 February and UK inflation on 18 February could trigger sharp moves, especially if inflation continues to exceed expectations and challenges rate-cut pricing. Would persistently high inflation force a major repricing of the Bank of England’s rate outlook and boost GBP further?

✔️ United States

The US dollar remains under pressure after its late-January sell-off, with limited fundamental support for a sustained recovery. However, the PCE Price Index on 20 Februarycould spark short-term volatility. With markets expecting the Fed to hold rates until at least June, any inflation surprise may quickly reprice policy expectations and move FX and equity markets. Could an upside surprise in PCE inflation revive dollar strength by shifting expectations for the Fed’s first rate cut?

Gain insights to strengthen your trading knowledge.

💬 Don’t forget to like, comment, and subscribe for more professional market insights every week.

Watch it now and stay updated with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

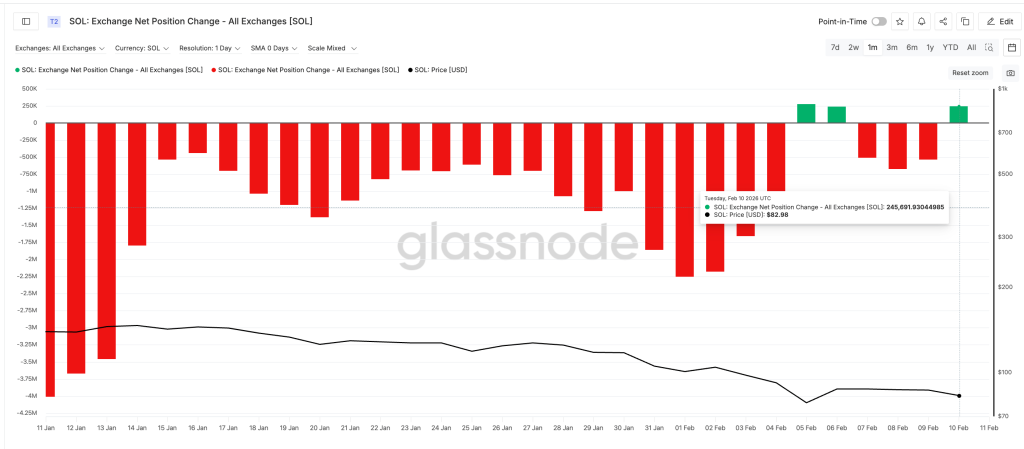

Solana Price Prediction: Standard Chartered Cuts 2026 Target, Sees $2,000 by 2030

Standard Chartered just dropped a fear signal on Solana. They cut their 2026 target to $250. But then they doubled down on a bold $2,000 call by 2030.

That is a sharp contrast. Near term pressure. Long term conviction.

The bank sees Solana shifting away from pure speculation toward real utility. That kind of transition is rarely smooth. It can mean volatility now and growth later.

- Target Adjustment: 2026 prediction cut from $310 to $250, citing transitional risks.

- Long-Term Bull: 2030 target set at $2,000, driven by dominance in micropayments.

- Market Signal: Analysts see the shift from memecoins to stablecoins as a key utility driver.

What Standard Chartered’s Revised Targets Mean for Solana

Standard Chartered sees Solana at a turning point. Geoffrey Kendrick, who leads digital asset research at the bank, says SOL is shifting away from its memecoin casino image and moving toward something more serious. More infrastructure. More real finance.

That shift is not frictionless. The revised $250 target for 2026 reflects that transition. Growth is still there, but it may not look like the explosive runs from past cycles.

For retail investors, it is a trade off. The near term upside could be more measured. But the long term foundation looks stronger if real utility keeps building.

Solana Price Prediction: Breaking Down the New SOL Valuations

The roadmap is detailed. Standard Chartered trimmed the 2026 target to $250 from $310, expecting a period of consolidation as activity shifts.

But after that, the projections accelerates. $400 by 2027. $700 in 2028. $1,200 in 2029. And $2,000 by the end of 2030.

The thesis centers on network velocity. Stablecoin turnover on Solana is reportedly 2 to 3 times higher than on Ethereum, which makes it well suited for fast, low value transactions. That kind of throughput is what long term valuation models are leaning on.

Solana coins have continued to leave exchanges. Historically, that kind of outflow points to accumulation. So even with a short-term downgrade, some players appear to be positioning for the bigger picture.

The post Solana Price Prediction: Standard Chartered Cuts 2026 Target, Sees $2,000 by 2030 appeared first on Cryptonews.

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat7 days ago

NewsBeat7 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Tech1 day ago

Tech1 day agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Sports7 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat19 hours ago

NewsBeat19 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat21 hours ago

NewsBeat21 hours agoMan dies after entering floodwater during police pursuit

-

Crypto World2 days ago

Crypto World2 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat2 days ago

NewsBeat2 days agoUK construction company enters administration, records show