Crypto World

Key macro data puts crypto markets on watch as CPI, PCE and Fed speak

Crypto and stock markets face a packed macro week, with CPI, PCE, Fed minutes and spending data set to test rate‑cut bets after mixed inflation and rising tensions.

Summary

- January CPI eased to its lowest core reading since 2021, briefly lifting crypto before gains faded.

- Markets now focus on retail sales, durable goods, PCE and Fed minutes to gauge rate‑cut timing.

- Bitcoin and Ethereum stay volatile as geopolitical risks and macro uncertainty cap risk appetite.

Financial markets are preparing for several key economic data releases this week that could influence cryptocurrency and stock prices, following mixed signals from last week’s inflation data.

January’s Consumer Price Index came in slightly below expectations, with headline inflation at 2.38% year-on-year and core CPI at 2.5%, marking the lowest level since early 2021, according to government data. The figures initially boosted stock and cryptocurrency markets on Friday, though cryptocurrency gains retreated over the weekend.

Traditional U.S. markets will be closed Monday for the President’s Day holiday. The ADP employment update is scheduled for Tuesday, followed by the January Retail Sales report. Wednesday will bring consumer spending data with the delayed December Durable Goods Orders numbers, along with Federal Reserve meeting minutes and 10 central bank speaker events.

The December Personal Consumption Expenditures (PCE) inflation report, considered a key indicator by the Federal Reserve, is expected to be released later this week. Goldman Sachs raised its PCE outlook following the January CPI data, estimating that the core PCE price index rose 0.40% in January, according to reports. The economists attributed the projection to rising consumer electronics and IT prices, which carry heavier weighting in PCE calculations than in CPI. A global shortage of RAM and storage components, driven by AI data center demand, has contributed to increased computer and component prices.

The CME Fed Watch Tool shows a 90% probability that interest rates will remain unchanged at the Federal Reserve‘s March meeting, according to current market pricing.

Cryptocurrency markets have declined in the past 24 hours, with total market capitalization falling. Bitcoin retreated from recent highs during early Asian trading on Monday and has remained rangebound for the past ten days. Ethereum prices have fallen sharply, while alternative cryptocurrencies have continued to decline.

The Kobeissi Letter noted that geopolitical tensions and macroeconomic uncertainty remain elevated, cautioning that volatility could continue this week.

Crypto World

The Old Stablecoin Playbook Doesn’t Apply Anymore: Here’s What Banks Need to Know Now

TLDR:

- Paxos says regulated stablecoins must meet strict reserve and capital standards to operate in the U.S. market.

- Stablecoins function as payment rails and settlement infrastructure, not as direct replacements for bank deposits.

- Global corporations are now using stablecoins to move millions of dollars in minutes instead of days across borders.

- Banks that issue or custody stablecoins can turn a perceived competitive threat into an entirely new revenue stream.

The old stablecoin playbook doesn’t apply anymore, and banks are beginning to take notice. The introduction of the GENIUS Act by the U.S. Congress has pushed financial institutions to reconsider long-held assumptions about stablecoins.

What was once dismissed as a crypto-trader tool has grown into a multi-trillion-dollar market. Banks that continue operating on outdated beliefs risk falling behind fintechs and blockchain-native competitors. The regulatory and commercial landscape has fundamentally shifted.

Outdated Assumptions About Regulation and Risk No Longer Hold

For years, banks treated stablecoins as unregulated, high-risk instruments sitting outside traditional finance. That view no longer reflects reality.

Jurisdictions including Singapore, the European Union, and the United States have established clear frameworks for stablecoin issuance and custody.

The GENIUS Act adds further structure, making regulated stablecoins the only viable path forward in the U.S. market.

Regulated issuers like Paxos already operate under strict reserve management standards and capital requirements. Consumer protections are built into these frameworks, reducing institutional risk considerably.

Banks can now engage with stablecoins knowing that legal guardrails are firmly in place. The compliance infrastructure that once seemed absent is now well established.

The old playbook also treated stablecoins as threats to financial stability. That assumption, too, has aged poorly. Paxos stated that “well-regulated stablecoins actually enhance financial stability by increasing transparency, speed and efficiency.”

On-chain stablecoin transactions are publicly auditable in real time, offering transparency that traditional interbank transfers cannot match.

Paxos further noted that “reserves held in short-term Treasuries are safer than many bank assets.” Banks clinging to outdated risk narratives are working from an incomplete picture.

Global regulatory bodies are aligning on oversight standards at a steady pace. Updating that picture is now a strategic necessity, not just an operational preference.

Banks That Rewrite the Playbook Stand to Gain the Most

The old stablecoin playbook also cast stablecoins as deposit killers threatening bank lending capacity. Paxos pushed back on that directly, stating that “stablecoins serve as rails for payments, settlement and capital efficiency in ways that deposit accounts cannot.”

Banks can issue or custody stablecoins themselves, turning a perceived competitive threat into a growth product. Just as electronic payments once seemed disruptive, stablecoins can expand balance sheets when embraced strategically.

Stablecoins now power cross-border remittances, tokenized asset settlement, and on-chain capital markets at scale. Global corporations are moving millions of dollars in minutes rather than days using stablecoin infrastructure.

Paxos confirmed that “asset managers use them as cash legs for tokenized assets and broker-dealers are leveraging them to create new revenue streams.”

These are not theoretical use cases — they are active, high-volume applications already reshaping global finance.

Paxos was direct in its assessment, saying that “financial institutions that deny this reality are ignoring the signals of market transformation.”

Banks that update their thinking can unlock faster settlement, improved liquidity management, and entirely new client offerings.

The old narrative that stablecoins were only for crypto exchanges has been overtaken by market reality. Those that don’t adapt may find competitors have already claimed that ground.

Paxos summed up the broader shift clearly: “Stablecoins are not a threat to banking — they are an evolution of money that can make banks more competitive.” The window to rewrite the playbook remains open, but it continues to narrow.

Banks that move now can help shape how stablecoins integrate with traditional financial infrastructure. Those that wait may find the terms of that integration have already been set by others.

Crypto World

Stablecoins Gain Ground for Paychecks and Daily Spending, BVNK Report

A cross-border snapshot from BVNK and YouGov shows stablecoins moving from niche crypto wallets into mainstream payroll and everyday spend. The online survey, conducted in September and October 2025 among 4,658 adults who currently hold or plan to acquire cryptocurrency across 15 countries, reveals a broad willingness to use dollar- and euro-pegged coins for earnings, remittances, and purchases. Key findings include that 39% already receive income in stablecoins, 27% use them for daily payments, and average holdings sit around $200 globally, rising to roughly $1,000 in higher-income economies. The data also suggests strong demand for wallet access via banks or fintechs and for linked debit card usage.

Key takeaways

- 39% of survey respondents report earning income in stablecoins, with 27% using stablecoins for everyday transactions, highlighting a shift from speculative trading to functional payroll utilities.

- Respondents hold an average of about $200 in stablecoins worldwide, while holdings in high-income economies average near $1,000, indicating material savings potential for more affluent users.

- 77% would consider opening a stablecoin wallet with their primary bank or fintech provider, and 71% express interest in a linked debit card to spend stablecoins, signaling traditional financial institutions’ potential pivotal role.

- People receiving stablecoin income report that stablecoins constitute roughly 35% of their annual earnings on average; cross-border transfers with stablecoins save about 40% in fees compared with traditional remittance methods.

- Ownership is highest in lower- and middle-income economies, with Africa showing the strongest uptake at 79%, underscoring a regional tilt toward cost-effective digital payments.

Market context: The findings arrive during a wave of regulatory attention and enterprise adoption around stablecoins. In the United States, the GENIUS Act is shaping the policy debate on stablecoins and embedded finance, while Europe’s Markets in Crypto-Assets Regulation (MiCA) is catalyzing compliance-driven use cases for wages and cross-border settlements. Meanwhile, the stablecoin market has surged to roughly $307.8 billion in total value, up from around $260.4 billion in mid-2024, underscoring growing scale and willingness to use digital currencies for non-speculative purposes.

A BVNK spokesperson emphasized that the study was designed to illuminate usage patterns among current and prospective crypto users rather than measure broad population adoption. The respondents tend to diversify across multiple dollar- and euro-pegged stablecoins rather than relying on a single issuer, suggesting a preference for multi-token liquidity management. When it comes to where to manage these assets, exchanges are favored by 46% of respondents, followed by crypto-enabled payment apps (like PayPal or Venmo) at 40% and mobile wallet apps at 39%. Only a minority—13%—prefer hardware wallets for custody.

BVNK, a London-headquartered company founded in 2021, built its business around stablecoin-enabled payments infrastructure for enterprises. In June, it partnered with San Francisco-based Highnote to introduce stablecoin-based funding for embedded-finance card programs, signaling a broader push to integrate digital assets into everyday financial services. The collaboration aims to streamline funding flows for card programs that rely on stablecoins as a settlement medium, reducing friction for merchants and employers alike.

An ecosystem narrative is emerging around payroll and cross-border payments. In the United States, the GENIUS Act has accelerated discussions about how payrolls can be paid with digital assets within a regulated framework, while Europe’s MiCA framework pushes providers toward transparent disclosures and robust consumer protections. The combination of regulatory clarity and corporate experimentation is accelerating the adoption of stablecoins in payroll workflows and cross-border settlements, as businesses seek faster settlement cycles and lower costs. The underlying stability of pegged coins makes them more reliable for wage payouts and reimbursements than traditional crypto assets with heightened volatility.

Beyond payroll, the market is advancing toward regulated, enterprise-grade integrations. For instance, Deel announced on Feb. 11 that it would begin offering stablecoin salary payouts through a collaboration with MoonPay, starting with workers in the United Kingdom and European Union and later expanding to the United States. Under the arrangement, employees can opt to receive part or all of their wages in stablecoins to non-custodial wallets, with MoonPay handling conversion and on-chain settlement while Deel continues to manage payroll and compliance. MoonPay has been positioned as the on-ramp for gateway conversions in this setup.

On the enterprise side, the pace of consolidation continues. Paystand recently acquired Bitwage, a platform focused on cross-border stablecoin payouts, a move that broadens Paystand’s B2B payments network for digital-asset settlements and foreign exchange capabilities. Paystand notes that its network has already processed more than $20 billion in payment volume, reflecting growing demand from businesses for stablecoin-enabled settlement and liquidity management. The deal signals that corporate back offices are increasingly viewing stablecoins as a legitimate, scalable settlement layer rather than a speculative vehicle.

While the strict price stability of stablecoins—tied 1:1 to fiat currencies such as the U.S. dollar or euro—addresses volatility concerns for payments, the research also hints at ongoing diversification. Respondents indicated a tendency to hold multiple stablecoins rather than relying on a single issuer, a pattern that could complicate compliance and liquidity management for institutions that serve as on/off ramps for ordinary users. DefiLlama’s data reinforces the point: the stablecoin sector has grown rapidly to hundreds of billions in market capitalization, underscoring that stablecoins are no longer peripheral to crypto markets but are becoming central to payment rails and cross-border transfer ecosystems.

As this secular shift unfolds, questions remain about the pace of mainstream adoption and the regulatory guardrails that will shape long-term viability. The GENIUS Act and MiCA are not just about consumer protection; they are about enabling compliant, bankable use cases for digital assets in payroll, benefits, and enterprise settlement. The rise of payroll-focused stablecoins, in particular, could help workers in regions with limited banking access and high remittance costs participate more fully in the digital economy, while offering employers a more cost-efficient and auditable method of payroll settlement.

What to watch next

- Regulatory developments around the GENIUS Act and the US approach to stablecoins as payroll instruments (timeline updates and potential amendments).

- Progress of Europe’s MiCA implementation and how financial institutions integrate stablecoin-based payroll and cross-border payments within the regime.

- Deel’s rollout of stablecoin payroll in the UK/EU and subsequent US rollout timelines, along with adoption metrics and employee uptake.

- Paystand’s continued integration of Bitwage and the broader adoption of enterprise-grade stablecoin settlement across global B2B networks.

- Regional variations in stablecoin ownership, particularly in Africa and other emerging markets, and how these dynamics influence merchant acceptance and wallet adoption.

Sources & verification

- BVNK-YouGov survey methodology: online fielded in September–October 2025 across 15 countries with 4,658 respondents who currently hold or plan to acquire cryptocurrency.

- Survey findings on income in stablecoins, everyday use, and average holdings, including the 39%/27% figures and the $200 global average (rising to ~$1,000 in high-income economies).

- Banking/fintech adoption metrics: 77% would open a stablecoin wallet with their primary bank or fintech provider; 71% interested in a linked debit card.

- Enterprise movements: Deel’s stablecoin payroll pilots with MoonPay; Paystand’s acquisition of Bitwage and its impact on cross-border settlements.

- Regulatory context and market size: GENIUS Act references and MiCA, along with DefiLlama’s stablecoin market capitalization data.

Stablecoins move from wallets to payroll: how a global survey maps the shift

The report’s narrative centers on a pragmatic shift in how people interact with digital assets. Stablecoins are increasingly viewed not as a speculative instrument but as a practical tool for earning, paying, and moving money across borders. In the 4,658-person sample, a substantial portion already earns in stablecoins, and a growing share uses them for routine payments. The implication for merchants is equally striking: more than half of crypto holders have made purchases specifically because a merchant accepts stablecoins, and the propensity to spend stablecoins rises to 60% in emerging markets. This suggests a feedback loop where consumer demand for stablecoin-enabled checkout can spur broader merchant adoption and, in turn, drive demand for compliant, scalable on-ramps and off-ramps.

From a banking and fintech perspective, the data hints at a possible reorientation of product design. If 77% of respondents would consider opening a stablecoin wallet with a bank or fintech and 71% want a linked debit card, incumbents may respond with regulated wallets, insured custodianship, and seamless settlement rails that reduce friction for wages and cross-border payroll. The fact that a meaningful share of earnings already comes in stablecoins points to a future where payroll providers, payroll tech platforms, and banks co-create wage ecosystems that can operate inside regulatory constraints while offering on-chain settlement where appropriate. The partnership of BVNK with Highnote to embed stablecoin funding into card programs signals how the industry is pursuing this convergence, aligning corporate cards with stablecoin liquidity as a basic building block of embedded finance.

Beyond payroll, the story touches on regulatory readiness. The GENIUS Act and MiCA collectively push the market toward standardized disclosures, consumer protections, and clear tax and accounting treatments for stablecoins used in wages and cross-border payments. In this environment, the operational and technological investments—such as Deel’s stablecoin payroll via MoonPay and Paystand’s acquisition of Bitwage—reflect a broader trend of enterprises rethinking how digital assets can underpin scalable, compliant financial operations. The data also underscores a geographic dimension: ownership and usage skew higher in Africa and other lower- and middle-income economies, suggesting that stablecoins could play a critical role in expanding financial access where traditional rails are costly or fragile.

As the market grows, so does the importance of robust, verifiable data. The DefiLlama figure placing the stablecoin market around $307.8 billion reinforces that stablecoins have transcended their early-stage, speculative perception. They are increasingly intertwined with the actual plumbing of payments—settlement, remittance, and payroll—where speed, cost, and regulatory compliance are essential. While the path to full mainstream adoption remains uneven across regions and assets, the convergence of consumer demand, enterprise infrastructure, and regulatory clarity paints a credible trajectory for stablecoins to become an integral part of everyday financial life. For stakeholders—whether individuals earning in the digital currency economy, merchants seeking lower-payment friction, or institutions building the next generation of compliant digital finance—this survey provides a map of where trust, convenience, and policy align to unlock real-world value.

Crypto World

Polygon Tops Ethereum In Daily Transaction Fees Over The Weekend

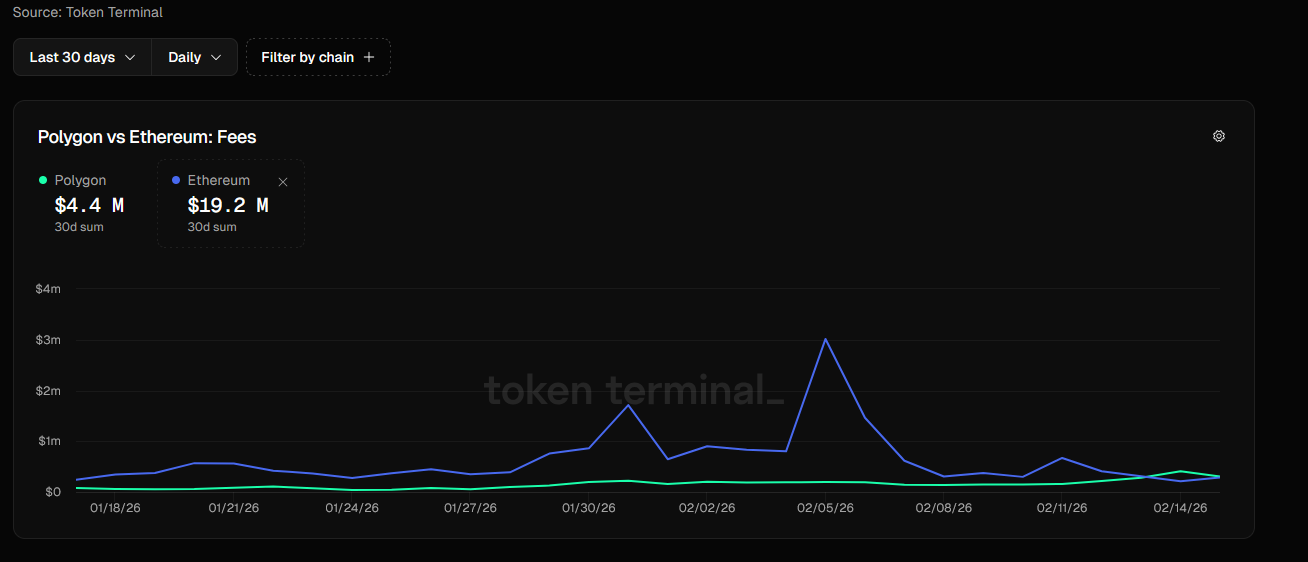

Polygon has posted higher daily transaction fees than Ethereum over the past three days, with an analyst pointing to robust user activity on prediction market Polymarket.

According to the latest data from Token Terminal, Polygon raked in $407,100 worth of transaction fees on Friday, compared to Ethereum’s $211,700, with the data indicating this is the first time Polygon has ever flipped Ethereum in daily transaction fees.

The gap has since narrowed, with daily transaction fees on Polygon at $303,000 on Saturday, while Ethereum saw about $285,000.

Polygon is home to Polymarket, one of the most prominent prediction markets to emerge from the blockchain sector that launched in 2020.

In an X post on Monday, Matthias Seidl, the co-founder of Ethereum analytics platform growthepie, highlighted Polygon’s recent activity growth, saying that it has been “fully driven by Polymarket.”

Seidl shared a chart showing that Polymarket had accounted for just over $1 million worth of fees on Polygon over the past seven days, with the next highest app on the L2 being Origin World, which accounted for around $130,000.

Polygon has also highlighted surging activity on Polymarket. In an X post on Saturday, the team noted that over $15 million worth of wagers were placed on a single Oscars market category alone, adding that “Polygon is the chain underneath it” all.

Polygon says there’s also a strong network of trustless agents being deployed on the L2 to “tap opportunities” on the prediction market.

Prediction markets have been booming in popularity since the last US election, and the rapid adoption has seen several crypto firms launching their own offerings.

Related: ETH chart pattern projects rally to $2.5K if key conditions are met: Data

Elsewhere, some have also pointed to growing stablecoin usage on the L2, particularly with Circle’s USDC (USDC). In an X post on Sunday, Polygon data analyst petertherock said that the network had notched a new weekly high of 28 million USDC transactions.

Polymarket uses Polygon-based USDC for trading on its platform.

Magazine: Coinbase misses Q4 earnings, Ethereum eyes ‘V-shaped recovery’: Hodler’s Digest, Feb. 8 – 14

Crypto World

Monero Activity Holds Steady Despite Exchange Delistings, TRM Labs Reports

TLDR:

- TRM Labs found that 48% of newly launched darknet markets in 2025 accept only Monero as payment.

- Nearly 14–15% of reachable Monero network peers displayed non-standard peer-to-peer protocol behavior.

- Ransomware actors prefer XMR, yet most real-world ransom payments are still completed in Bitcoin.

- Monero’s on-chain cryptography remains intact, but network-layer dynamics may affect privacy assumptions.

Monero continues to maintain stable on-chain transaction activity despite growing regulatory pressure. TRM Labs released new research showing that XMR usage has remained above pre-2022 levels.

Even after major exchanges removed the privacy coin, demand has not dropped. The findings also reveal unusual peer-to-peer network behavior affecting roughly 14 to 15 percent of observable nodes.

Darknet Markets and Ransomware Drive Persistent Demand

Monero’s appeal in high-risk environments has grown considerably over the past few years. Nearly 48 percent of newly launched darknet markets in 2025 support XMR exclusively.

That figure marks a sharp rise compared to earlier years when Bitcoin remained the dominant option. Western-facing markets are leading this shift, partly due to improved tracing capabilities on transparent blockchains.

Ransomware groups still express a clear preference for receiving payments in Monero. However, most actual ransom settlements continue to occur in Bitcoin due to liquidity advantages.

Bitcoin remains easier to acquire and convert at scale, even though it is more traceable. That gap between preference and practice reflects a real tension between privacy and usability.

TRM Labs addressed this directly, stating, “Most ransomware payments still occur in BTC—liquidity matters.” The firm also noted that “48% of new darknet markets in 2025 are XMR-only,” indicating a measurable structural shift in how high-risk actors choose to operate.

Monero’s thinner market structure also contributes to higher price volatility. Over the past 30 days, XMR showed realized volatility roughly 2.5 times that of Bitcoin.

Despite fewer on-ramps and reduced exchange support, on-chain Monero usage has not contracted meaningfully. This pattern points to a user base that actively seeks privacy rather than casual retail participation.

Users accept higher friction and fewer options to preserve anonymity. That behavior keeps Monero relevant even as other assets become more transparent.

Network-Layer Behavior Introduces New Investigative Considerations

TRM Labs also collaborated with academic researchers to study Monero’s peer-to-peer network behavior. Around 14 to 15 percent of reachable peers showed non-standard behavior compared to protocol expectations.

These deviations included irregular handshake patterns, unusual message timing, and atypical peer list composition. The behavior persisted across multiple observation periods, suggesting systematic rather than random causes.

Infrastructure concentration emerged as a recurring pattern within the non-standard peer data. A small number of hosting environments accounted for a disproportionately large share of these peers.

TRM Labs noted that “14–15% of Monero peers show non-standard network behavior,” adding that “network-layer dynamics can influence real-world privacy assumptions.” That visibility can matter even when cryptographic protections remain fully intact.

TRM emphasized that these findings do not reflect a failure of Monero’s cryptography. The on-chain privacy features, including ring signatures and stealth addresses, remain technically sound.

As TRM Labs put it, “Monero’s cryptography remains strong,” yet the firm cautioned that peer-to-peer behavior can introduce structural visibility affecting theoretical anonymity models. Real-world conditions can introduce observable structure that affects certain investigative threat models.

The research does not assign intent or identify specific operators behind the non-standard nodes. It instead describes behavioral patterns that deviate from standard client implementations.

Those patterns, combined with growing XMR-only market adoption, give investigators new structural data points to consider. Monero remains a distinct challenge, but its network layer now draws greater scrutiny.

Crypto World

XRP price prediction as Standard Chartered cuts 2026 target

XRP price shows mild signs of recovery even as Standard Chartered slashes its 2026 price target to $2.80, reshaping short-term expectations.

Summary

- Standard Chartered lowered its 2026 XRP price prediction from $8 to $2.80, citing macro and liquidity headwinds.

- XRP bounced from $1.23 but remains below its 20-day moving average with RSI near 42.

- A move above $1.75 improves recovery odds, while a break under $1.23 risks a drop toward $1.00.

XRP was trading around $1.48 at press time, up 1.5% in the last 24 hours. Earlier this month, the token briefly dipped toward $1.16 during the broader crypto selloff before staging a modest recovery.

In recent sessions, it has slightly outperformed Bitcoin and Ethereum, yet the bigger picture is still bleak. XRP (XRP) is still down roughly 30% over the past month and about 45% over the last year.

The rebound comes as sentiment across the sector remains fragile. Nearly $2 trillion in crypto market value has evaporated since the October crash, and liquidity conditions are still tight amid extreme fear levels.

Standard Chartered slashes 2026 XRP target

On Feb. 16, Geoffrey Kendrick, Global Head of Digital Assets Research at Standard Chartered, cut the bank’s end-2026 XRP target by 65%, reducing it from $8 to $2.80.

The revision reflects what Kendrick described as a “capitulation-prone” environment.

According to the bank, institutional outflows have persisted, exchange-traded fund inflows have cooled despite roughly $1.37 billion in cumulative allocations since late 2025, and high interest rates alongside geopolitical uncertainty continue to suppress risk appetite.

The bank warned of “further declines near-term” across digital assets before any recovery later in 2026. The bank kept its 2030 target at $28, suggesting that prices could fall further in the short term before a longer‑term recovery takes hold.

XRP price prediction. How high can XRP go?

XRP is still in a medium-term downward trend. The daily chart clearly shows a pattern of lower highs and lower lows. The price is currently trading at about $1.47, which is slightly below the $1.49 20-day moving average. Meanwhile, the lower Bollinger Band is around $1.23, and the upper band is close to $1.76.

The recent rebound originated at the $1.23 level, where the lower Bollinger Band coincided with a sharp wick rejection. Although this provides some temporary respite, it does not yet indicate a definitive reversal. The 20-day moving average’s continued downward slope suggests that the bearish pressure has not completely subsided.

Momentum appears to be stabilizing, though it has not turned bullish. The relative strength index bounced from near-oversold levels around 30 and sits near 42. Remaining below 50, it suggests that sellers still hold a modest advantage. A clear move above 50 would strengthen the case for a mid-term recovery.

Key support can be found at $1.23, with additional psychological backing near $1.20. A loss of that region exposes $1.00–$1.05, and potentially $0.90 if broader market weakness resumes.

On the upside, $1.50 is the first hurdle, aligning with the 20-day moving average. A clean break could open a move toward $1.75–$1.80, followed by $2.00–$2.20, where prior consolidation created structural resistance.

The major supply zone between $2.40 and $2.60 is a level that would invalidate the current downtrend if reclaimed. If $1.30–$1.23 holds, a relief rally toward $1.75–$2.00 looks likely in the near future. However, XRP would probably return to the $1.00 range if it broke below $1.23.

In the long run, targets at $3.00 and even $3.40 become technically feasible if XRP recovers $1.75, breaks $2.20, and reaches higher highs above $2.60. Until then, rallies are likely to be treated as corrective within a broader downtrend.

Crypto World

Crypto lender Nexo returns as U.S. regulatory climate evolves

Crypto wealth platform Nexo has officially returned to the United States, announcing on Feb. 16, 2026, a full relaunch of its investment and credit products through a compliant, regulated framework after years away from the market.

Summary

- Nexo has officially relaunched in the United States, offering yield products, crypto-backed credit lines, and trading services through a compliance-focused structure.

- The return comes two years after Nexo paid a $45 million settlement to the U.S. Securities and Exchange Commission and exited the U.S. market over its Earn Interest Product.

- On-chain data from CryptoQuant shows roughly $863 million in loans issued over the past year, signaling sustained user demand despite broader crypto market volatility.

The move marks a pivotal reset for the company following past clashes with U.S. regulators and comes amid strong activity in its lending business, even through broader crypto market volatility.

Nexo’s re-entry is being executed in partnership with U.S.-regulated service providers and leverages digital asset trading infrastructure from Bakkt, a publicly listed platform focused on institutional-grade compliance.

The relaunched U.S. offering includes flexible and fixed-term yield programs, an integrated exchange, crypto-backed credit lines, a loyalty program, and streamlined fiat on- and off-ramps.

Lessons from the past: Regulatory exit and settlement

Nexo’s return comes years after it exited the U.S. market amid regulatory pressure.

In 2023, the platform paid a $45 million settlement with the U.S. Securities and Exchange Commission over its Earn Interest Product, a crypto lending offering the SEC said should have been registered as a security. Subsequently, the firm discontinued that product for American users.

Nexo did not admit or deny the SEC’s findings under the settlement.

Following the settlement, the company withdrew from the U.S. as it recalibrated its approach to compliance and market engagement. The recent relaunch signals a new strategy rooted in regulatory collaboration and licensed partnerships rather than unilateral product deployment.

Lending activity signals confidence amid market pullback

Nexo’s broader platform continues to show significant demand in its core lending business, even through recent crypto market weakness.

On-chain data analyzed by CryptoQuant indicates that Nexo users borrowed roughly $863 million in credit between January 2025 and January 2026, with nearly $1 billion issued overall.

Notably, over 30 % of these loans were repaid during a market drawdown, a pattern interpreted by analysts as managed deleveraging rather than panic liquidation.

By re-entering the U.S. market with tightened regulatory alignment and a diversified product suite, Nexo is positioning itself for long-term engagement with one of the world’s largest crypto investor bases.

The company’s leadership frames the return as part of a broader belief that regulatory clarity and disciplined risk management are essential to the next stage of digital asset adoption.

Crypto World

This Crypto Winter Much Healthier Than Previous Cycles: Bitwise CIO

The current bear market is not as bad as those from previous years, according to Matt Hougan.

“The folks saying this [crypto] winter is worse than 2018 or 2022 don’t remember 2018 or 2022,” said Bitwise Chief Investment Officer Matt Hougan on Tuesday.

In 2018, “we had $3,000 Bitcoin and a ‘global computer’ [Ethereum] with no applications and limited throughput,” he said before adding, “In 2022, we had a total market collapse and a regulator that wanted to put us out of business.”

Things are a little different today as we have “stablecoins going to $3 trillion, tokenization going to $200 trillion, a positive regulatory climate, and better tokenomics,” he said.

Additionally, BlackRock and Apollo are building on DeFi, there is a “massively built out infrastructure,” ETFs, and “rising concerns about fiat currency.”

“So, yep, I’m optimistic. It doesn’t mean smooth sailing, but I’m excited for the ride.”

Previous Bear Markets Were Apocalyptic

The current bear market has seen total capitalization decline 49% from its peak of just below $4.4 trillion in October to its low of $2.23 trillion on Feb. 6. This is much shallower than previous bear markets, but it is not over yet. In 2018, markets collapsed by 88%, and in 2022, they crashed by around 73% from the previous cycle peak to the bear market bottoms.

The 2022 FTX crash “was dark,” and 2018 “was borderline crypto extinction sentiment,” commented the Kobeissi Letter. The March 2020 Covid crash was also apocalyptic, with markets tanking 56% in less than a month.

The difference this time, as pointed out by Hougan, is that the fundamentals for crypto are much stronger. Many analysts believe the current market slump is driven not by crypto-native factors but by broader macroeconomic and geopolitical concerns.

You may also like:

Glassnode reported that Bitcoin’s crash to $60,000 on Feb. 6 “imposed drastic psychological pressure on ‘diamond hands’ comparable to the May 2022 Luna crash.”

“Simply put, long-term holders realized significant losses — a rare shift in conviction typically seen in deeper stages of bear markets.”

The recent drop to $60k imposed drastic psychological pressure on “diamond hands,” comparable to the May 2022 LUNA crash.

In both cases, the 7D EMA of Long-Term Holder SOPR fell below 1 after trading for 1-2 years above it.

Simply put, long-term holders realized significant… pic.twitter.com/xc6bXzwPYx— glassnode (@glassnode) February 16, 2026

Long Term Holders Still in Profit

Alphractal founder Joao Wedson said on Monday that the Net Unrealized Profit/Loss (NUPL) for long-term holders stands at 0.36, “meaning long-term holders are still, on average, in profit.”

“When Long-Term Holders’ NUPL enters negative territory, it means even the most convicted participants are holding unrealized losses. Historically, this marks the phase of maximum market depression.”

In previous cycles, “this was the final phase before the start of a new bull run,” he said, noting that we are not there yet.

Bitcoin was trading around $68,000 at the time of writing after failing again to top $70,000 on Monday.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Dollar bearish positioning hits highest since 2012.

Investors are most bearish on the dollar in over a decade, per Bank of America’s (BofA) latest survey and that extreme bet could breed bitcoin volatility, just not the way crypto bulls have become used to.

BofA’s February survey shows investor positioning in the U.S. dollar has fallen to its most negative (bearish) level since at least early 2012, with net exposure at a record underweight. This is driven by concerns over further deterioration in the U.S. labor market, which could prompt the Federal Reserve to cut interest rates.

Since its inception, bitcoin has mostly moved in the opposite direction of the U.S. Dollar Index, rising when the greenback slides and falling when it strengthens. That tracks for two big reasons: As a dollar-denominated asset, a softer buck makes BTC cheaper to buy and vice versa. Plus, a strong dollar tightens financial conditions globally, hammering risk assets like bitcoin and the reverse holds when it weakens.

So, if history is a guide, the record bearish dollar positioning, a sign of investors aligned for a weaker dollar, could be termed a classic bullish tailwind for bitcoin.

But wait, there’s a twist. Since early 2025, and especially lately, bitcoin has developed a weird positive link to the dollar. DXY plunged over 9% last year and another 1% this year. Yet BTC dropped 6% in 2025 and is down 21% year-to-date. Their 90-day correlation hit 0.60 on Monday, the highest since April 2025, according to data source TradingView.

If that link sticks, a deeper slide in the dollar index may not bode well for bitcoin. But the flip side is a dollar bounce, fueled by a short squeeze, could drag BTC higher with it.

When investors pile into extreme bearish positions, any unexpected price bounce forces them to buy back en masse to limit losses, creating a short squeeze. This frantic covering propels the asset price higher, amplifying volatility skyward.

“Record short positioning raises the risk of volatility in major USD pairs; downside may extend on weak US data, but crowded trade dynamics increase potential for sharp short-covering rallies,” InvestingLive’s Chief Asia-Pacific Currency Analyst Eamonn Sheridan said in a market update.

At press time, the dollar index was up 0.25% on the day at 97.13 and bitcoin changed hands at $68,150, down 1%, according to CoinDesk data.

Crypto World

Axelar Network Integrates Stellar to Power Institutional Cross-Chain Finance

TLDR:

-

- Axelar Network has integrated Stellar, connecting its payments infrastructure with cross-chain interoperability tools

- Solv Protocol, Stronghold, and Squid Router launched live on the Axelar-Stellar integration at launch day.

- Stronghold bridges SHx between Stellar and Ethereum, maintaining a unified 1:1 token supply across both chains.

- Axelar’s 2026 roadmap targets compliant, institutional-grade infrastructure, aligning closely with Stellar’s focus.

Axelar Network has completed its integration with Stellar, linking two key infrastructure layers in the digital asset space.

The move connects Stellar’s payments and asset issuance capabilities with Axelar’s cross-chain interoperability protocol. At launch, Solv Protocol, Stronghold, and Squid Router are already live and operational.

The integration opens new pathways for tokenization, trading, and yield products across blockchain networks for institutional and retail participants alike.

New Cross-Chain Capabilities Reach Builders Immediately

Axelar Network confirmed the integration is live, with projects already building on the combined infrastructure. Stellar brings high throughput, low fees, and native compliance tooling to the table.

Its ecosystem includes payment providers, fintech platforms, and capital markets participants with an established developer base.

The Axelar team announced the milestone on X, stating: “Stellar is now live on Axelar. This integration expands institutional-grade onchain finance, connecting @StellarOrg’s strengths in payments and asset issuance with Axelar’s interoperability layer. At launch, @SolvProtocol, @strongholdpay, and @squidrouter are already live.”

Solv Protocol is among the first to build on the combined stack. Solv is a major allocator in tokenized real-world assets and holds the largest onchain Bitcoin reserve.

Through Axelar and Stellar, Solv can extend yield-bearing products into cross-chain markets. Builders can bridge solvBTC to Stellar today using Solv’s cross-chain application.

Stronghold is bridging its SHx token between Stellar and Ethereum through Axelar’s protocol. The bridge maintains a 1:1 supply across both networks while supporting consistent liquidity.

As noted in the announcement, the bridge allows “SHx holders to move assets freely between the two networks while maintaining a unified 1:1 supply.” SHx holders can already move assets between the two chains via Squid Router.

Institutional Adoption Drives the Integration’s Strategic Direction

Axelar Network’s 2026 roadmap, outlined by Common Prefix, centers on institutional adoption and compliant infrastructure.

Stellar’s focus on payments, regulated asset issuance, and compliance-oriented tools aligns well with that direction.

The roadmap specifically targets “strengthening economic security, enabling compliant and privacy-aware infrastructure, and building institutional products up the stack.”

Squid Router already supports bridging assets including XLM and solvBTC on the integrated network. Its role as a liquidity routing layer allows Stellar-based assets to access broader markets without fragmenting developer workflows. This gives builders immediate cross-chain reach from the Stellar ecosystem.

Financial institutions across global markets continue to explore onchain infrastructure for settlement and trading. Axelar and Stellar co-authored a joint article on onchain retail payments published in The Stablecoin Standard.

That collaboration reflects a shared focus on production-ready infrastructure built for institutional participants.

Axelar Network’s integration with Stellar is fully available to builders today. The announcement confirmed that “applications can begin connecting onchain assets and services across both networks today.”

The integration positions both ecosystems to support the continued growth of regulated, cross-chain digital asset products.

Crypto World

German central bank chief sees merit in euro stablecoins, but CBDC remains in focus

German central bank president Joachim Nagel said he sees “merit in euro-denominated stablecoins,” and argues that they could serve as a cheaper and more efficient means for cross-border payments by both firms and individuals.

Summary

- German central bank president Joachim Nagel said euro-denominated stablecoins can serve as a means for low-cost cross-border payments.

- He said the Bundesbank has completed significant exploratory work on a potential wholesale CBDC.

During his speech at the New Year’s Reception of the American Chamber of Commerce in Germany in Frankfurt, Nagel, who leads the Deutsche Bundesbank, added that the EU is “working hard on the introduction of the digital euro.”

“This will be the first pan-European retail digital payment solution, based solely on European infrastructures,” he added.

However, he did not elaborate on how euro-denominated stablecoins would be regulated within the European Union’s existing legal framework, nor clarify how they would interact with the planned digital euro or broader monetary policy architecture.

In separate comments made last week, Nagel cautioned that if US dollar-denominated stablecoins were to gain significantly larger market share than a euro-pegged alternative, European monetary policy “could be severely impaired,” and the continent’s sovereignty could be weakened.

Nagel, who has long maintained a cautious and skeptical stance toward unbacked cryptocurrencies, has instead advocated the use of a state-backed digital euro, which he believes “will play a role in future resilience” for Europe.

According to him, the central bank has already “accomplished important exploratory work on the possible introduction of a wholesale CBDC.” A wholesale CBDC, he said, would allow financial institutions to make “programmable payments” in central bank money.

Elsewhere in the U.S., there has been a lot of momentum around stablecoin, and the market has been expanding at a rapid pace on the back of demand for dollar-equivalent settlement layers, especially after President Donald Trump signed the GENIUS Act into law in July 2025.

But policy deadlock around a key market structure bill has stalled progress and divided crypto industry and banking stakeholders over issues such as stablecoin yield and reward mechanisms.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World7 days ago

Crypto World7 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video15 hours ago

Video15 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 hours ago

Tech3 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Crypto World7 days ago

Crypto World7 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World7 days ago

Crypto World7 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show