Crypto World

Ki Young Ju Says Bitcoin May Need to Hit $55K Before True Recovery Begins

Selling pressure overwhelms new capital inflows; institutional unwinding and the absence of buying interest define the current cycle.

CryptoQuant CEO Ki Young Ju has declared the current bitcoin market a definitive bear cycle, warning that a genuine recovery could take months and may require prices to fall further before a sustainable rebound materializes.

Sponsored

Sponsored

Capital Inflows Failing to Move the Needle

In an interview with a South Korean crypto outlet, Ju laid out a data-driven case for extended weakness. He pointed to a fundamental imbalance between capital inflows and selling pressure.

“Hundreds of billions of dollars have entered the market, yet the overall market capitalization has either stagnated or declined,” Ju said. “That means selling pressure is overwhelming new capital.”

He noted that past deep corrections have typically required at least three months of consolidation before investment sentiment recovered. Ju emphasized that any short-term bounces should not be mistaken for the start of a new bull cycle.

Two Paths to Recovery

Ju outlined two scenarios for Bitcoin’s eventual recovery. The first involves prices dropping toward the realized price of approximately $55,000. The price is the average cost basis of all bitcoin holders, calculated from on-chain transaction data, before rebounding. Historically, bitcoin has needed to revisit this level to generate fresh upward momentum.

The second scenario envisions a prolonged sideways consolidation in the $60,000 to $70,000 range. The prices would grind through months of range-bound trading before the next leg up.

Sponsored

Sponsored

In either case, Ki stressed that the preconditions for a sustained rally are not currently in place. ETF inflows have stalled, over-the-counter demand has dried up, and both realized and standard market capitalizations are either flat or declining.

Institutional Exodus Behind the Decline

Ju attributed much of the recent selling to institutional players unwinding positions. As bitcoin’s volatility contracted over the past year, institutions that had entered the market to capture volatility through beta-delta-neutral strategies found better opportunities in assets such as the Nasdaq and gold.

“When bitcoin stopped moving, there was no reason for institutions to keep those positions,” Ju explained. Data from the CME show that institutions have significantly reduced their short positions—not a bullish signal, but evidence of capital withdrawal.

Ju also flagged aggressive selling patterns where large volumes of bitcoin were dumped at market price within very short timeframes. He believes this suggests either forced liquidations or deliberate institutional selling to manipulate derivative positions.

Altcoin Outlook Even Bleaker

The picture for altcoins is grimmer still. Ju noted that while altcoin trading volume appeared robust throughout 2024, actual fresh capital inflows were limited to a handful of tokens with ETF listing prospects. The broader altcoin market cap never significantly surpassed its previous all-time high, indicating that funds were merely rotating among existing participants rather than expanding the market.

“The era of a single narrative lifting the entire altcoin market is over,” Ki said. He acknowledged that structural innovations such as AI agent economies could eventually create new value-driven models for altcoins, but dismissed the likelihood of simple narrative-driven rallies returning.

“Short-term altcoin upside is limited. The damage to investor sentiment from this downturn will take considerable time to heal,” he concluded.

Crypto World

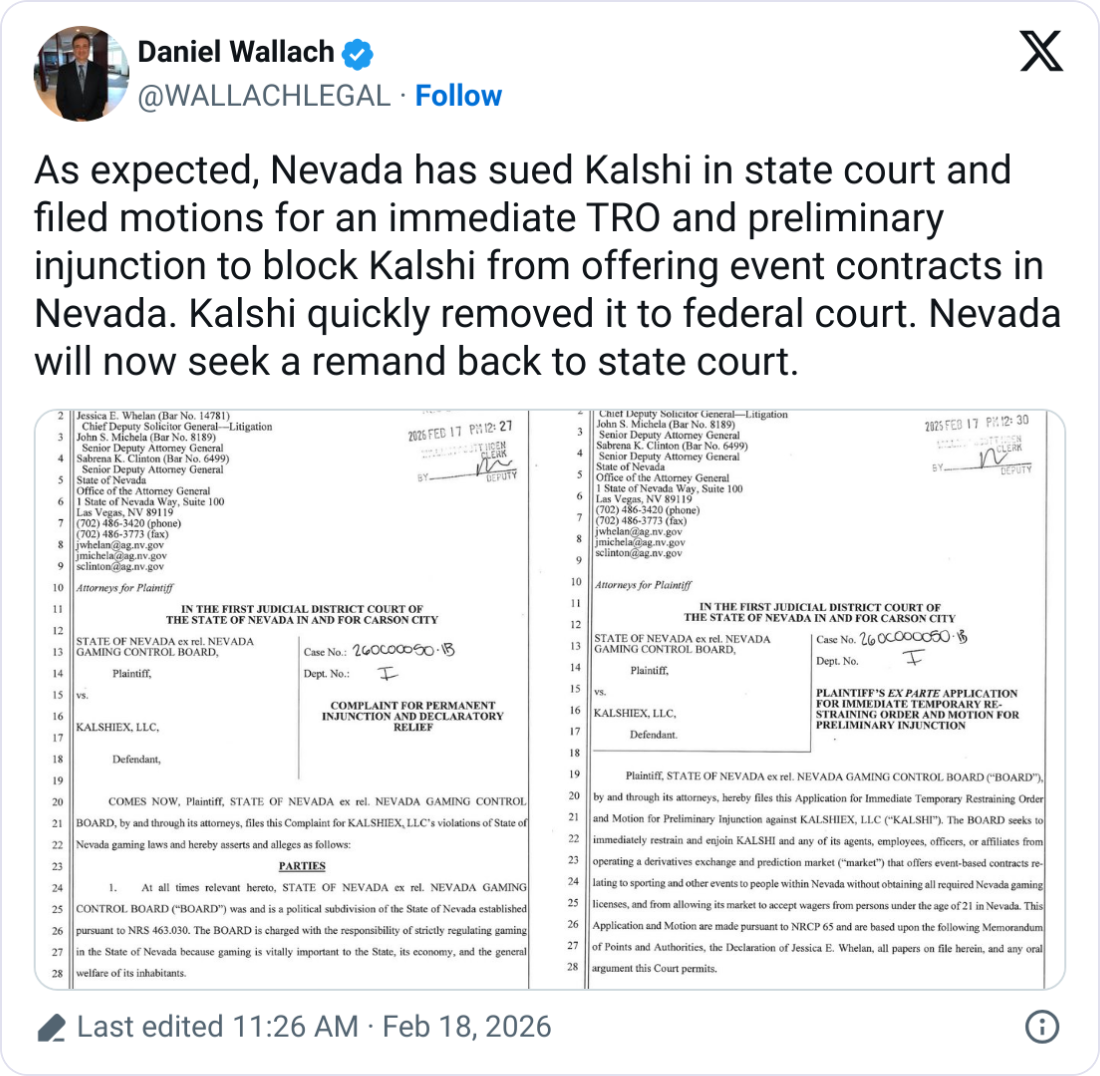

Prediction Market Loses Bid to Halt State Action

The legal clash between Kalshi and Nevada regulators intensified this week as the state’s gaming authority pressed forward with enforcement actions after a federal appeals court refused to halt the state’s conduct. The Ninth Circuit Court of Appeals on Tuesday denied Kalshi’s bid to block the Nevada Gaming Control Board from pursuing a civil case over Kalshi’s sports event contracts, effectively clearing the path for the regulator to proceed in state court. In short order, the Nevada Gaming Control Board filed a civil enforcement action, arguing Kalshi offers unlicensed wagering in violation of Nevada gaming law. Kalshi countered by seeking to move the dispute to federal court, echoing its long-held position that its activities fall under exclusive federal jurisdiction via the Commodity Futures Trading Commission (CFTC). The evolving dispute highlights a broader, unsettled regulatory landscape for prediction markets in the United States.

Key takeaways

- The Ninth Circuit refused Kalshi’s request to pause Nevada’s enforcement efforts, allowing a state-court civil action to proceed against Kalshi over sports-related markets.

- Following the ruling, the Nevada Gaming Control Board immediately filed a civil enforcement action in state court, asserting Kalshi operates unlicensed wagering on sporting outcomes in violation of state law.

- Kalshi maintains it operates under exclusive federal jurisdiction and has argued that federal law supersedes state-level actions in this area, leveraging the CFTC’s authority over commodity derivatives.

- The case mirrors similar tensions in other states and among other prediction-market operators, underscoring a broader regulatory crackdown on unlicensed gaming-like activity in the prediction space.

- The regulatory narrative is being shaped in part by federal involvement, with the CFTC signaling its stance on jurisdiction over prediction-market activity and related contracts.

Sentiment: Bearish

Market context: The dispute sits at the intersection of state gaming regulation and federal commodity rules, a space that remains legally unsettled as regulators and platform operators test boundaries around prediction markets and their licensing needs. The CFTC has emphasized its jurisdiction over commodity derivatives traded on designated contract markets, while states push for traditional licensing regimes where wagering is involved.

Why it matters

For Kalshi, the Nevada case is a test of its central premise—that prediction-market activity should fall under federal oversight rather than state gaming statutes. If the state court ultimately concludes that Kalshi’s sports event contracts require licensing under Nevada law, Kalshi may face injunctions, penalties, or the need to halt certain markets within the state. The immediate practical effect would be to constrain Kalshi’s ability to offer sports-related contracts to Nevada residents, reinforcing the idea that licensing requirements can operate at the state level even when a company argues federal preemption.

For other prediction-market operators, the unfolding legal framework signals heightened regulatory risk. The ongoing tension between state enforcement actions and federal jurisdiction could prompt platforms to seek clearer licensing pathways or, in some cases, to trim or relocate markets to jurisdictions with more predictable rules. The broader regulatory climate also matters for investors and developers evaluating the growth potential of prediction-market ecosystems, including partnerships and product designs that align with licensing realities rather than contending with uncertain legal status.

From the federal perspective, the CFTC’s posture—evidenced by statements and amicus actions in related cases—suggests a willingness to defend a permissive view of what constitutes a derivative market under federal law. That approach has implications for how products are structured, how they are offered to users, and how regulators coordinate across state and federal lines. The involvement of the CFTC in similar matters, including its stance in parallel suits against other states, indicates that the federal framework may ultimately steer product development and regulatory compliance norms in the prediction-market space.

The case is also emblematic of a wider policy conversation about the boundary between what constitutes gaming under state law and what falls under the umbrella of commodity derivatives regulated by the federal government. As technology enables more sophisticated event-based contracts and as states consider licensing to govern consumer protections, a clearer, nationwide standard remains elusive. The legal arguments that Kalshi has advanced—namely, that its markets are governed by federal commodity laws rather than state wagering statutes—will likely continue to echo through courtroom corridors as other jurisdictions weigh similar actions.

The regulator’s position is reinforced by the state’s explicit assertion that Kalshi’s offerings amount to wagering on sports outcomes and therefore qualify for licensing under Nevada law. The regulatory calculus hinges on whether these contracts are sufficiently akin to traditional gaming or whether they can still be framed as commodity derivatives that fall under federal oversight. The Ninth Circuit’s decision not to pause the state’s enforcement action confirms that the state court system will be the next arena where these questions are tested, at least in the near term.

As this legal saga unfolds, observers will watch for how Kalshi frames its next strategic move—whether to intensify its federal-venue approach, pursue further appeals, or seek negotiated licensing accommodations that could permit continued operation in Nevada and beyond. The regulatory momentum in other states, along with potential federal actions, will shape the tempo and direction of future actions by prediction-market platforms and the regulators overseeing them.

For reference, Kalshi’s dispute has roots in earlier regulatory correspondence, including a cease-and-desist order that spurred Kalshi to sue Nevada in March of the previous year and a federal court ruling in April that temporarily blocked Nevada from taking action during the litigation. The state’s subsequent civil enforcement action underscores a shift from courts determining temporary relief to real-world enforcement remedies that could affect ongoing offerings. The legal arguments—centered on licensing requirements, intent to operate in a regulated gaming environment, and the scope of federal jurisdiction—will likely shape how prediction markets navigate compliance moving forward.

The broader industry context includes a notable cross-pollination of interests between traditional gaming regulators and digital-asset-adjacent markets. With players like Crypto.com pursuing similar matters against Nevada regulators, and with political and legal attention on the legality and design of prediction markets, the industry stands at a crossroads where licensing frameworks, consumer protections, and innovative financial instruments intersect. As these threads converge, the coming months are likely to produce more clarity—and more controversy—about where prediction markets fit within the U.S. regulatory tapestry.

Source references tied to the ongoing dispute include Nevada Gaming Control Board filings and docket activity, as well as court documents detailing Kalshi’s attempts to move the case to federal court. For a snapshot of the state-level actions, the regulator’s official filings and statements provide direct attestations of the legal theory the state is pursuing against Kalshi.

What to watch next

- The state court civil enforcement action against Kalshi in Nevada: timeline for hearings and potential rulings.

- Any subsequent filings or rulings from the Ninth Circuit or federal courts on Kalshi’s venue arguments and potential appeals.

- Further amicus briefs or regulatory filings from the CFTC or other federal agencies regarding jurisdiction over prediction-market activities.

- Developments in parallel cases, such as Crypto.com’s challenges to Nevada regulators and any related state actions against other prediction-market operators.

Sources & verification

- Nevada Gaming Control Board press release and complaint PDF alleging Kalshi’s unlicensed wagering (kalshi-complaint.pdf).

- Nevada Gaming Control Board press release on civil enforcement action against Kalshi (ngcb-files-civil-enforcement-action-against-kalshi.pdf).

- CourtListener docket for State of Nevada ex rel. Nevada Gaming Control Board v. Kalshi LLC (docket entry showing the federal motion and related filings).

- Kalshi’s federal court venue motion referenced in court records (CourtListener docket).

- CFTC amicus brief discussion in related Crypto.com case in Nevada (Cointelegraph coverage referencing the CFTC stance).

Kalshi and Nevada clash over sports contracts

The dispute between Kalshi LLC and the State of Nevada over Kalshi’s sports-event contracts has moved from a regulatory order into a courtroom duel over jurisdiction and licensing. After Kalshi’s bid to halt Nevada’s enforcement was rejected by the Ninth Circuit, the regulator proceeded with a civil action in state court, arguing that Kalshi’s offerings amount to unlicensed wagering under Nevada law. Kalshi contends that its activities are subject to exclusive federal jurisdiction, a claim it has pressed since the outset of the case and one it has framed around the CFTC’s authority over commodity derivatives.

In a sequence of filings and rulings, the parties have mapped a jurisdictional battleground that is likely to influence the trajectory of prediction-market operators beyond Nevada. Kalshi’s argument rests on the premise that prediction-market contracts function as commodity derivatives and therefore belong under the federal oversight of the CFTC. Nevada’s counterpoint emphasizes licensing requirements within the state’s gaming framework, asserting that even if a contract resembles a derivative in structure, it still implicates wagering and gaming activities that require state licensing. The Ninth Circuit’s decision to deny a stay removes a preliminary hurdle for the state to pursue civil remedies, allowing the underlying enforcement to proceed while the broader jurisdictional questions continue to percolate in appellate and district court settings.

Public filings and press materials from the Nevada regulator outline the legal theory at stake: Kalshi’s markets are active in the state, but Kalshi has not secured the necessary licenses to operate those markets within Nevada’s borders. The regulator has pointed to the state’s existing framework for gaming and wagering to argue that Kalshi must obtain licenses for its sports contracts. Kalshi, meanwhile, has sought to position the matter within the federal regime that governs designated contract markets and other CFTC-regulated activities, arguing that state enforcement risks duplicative and conflicting obligations for a market participant operating across multiple jurisdictions.

As regulators, courts, and market participants monitor this case, the central questions will revolve around licensing, consumer protections, and the proper allocation of regulatory authority between state gaming authorities and federal commodity regulators. Should Kalshi prevail on the federal-venue theory in the long run, it could pave the way for broader operation of prediction-market platforms without state-level licensing, provided federal law offers a clear path. Conversely, a ruling affirming Nevada’s licensing demands could constrain Kalshi’s services in the state and prompt similar actions in other jurisdictions, thereby shaping the practical viability of prediction markets as a class of financial products in the United States.

For now, the Nevada case stands as a pivotal, high-stakes test of how prediction markets fit into a complex mosaic of gaming and commodities regulation. The coming months are likely to reveal how the regulatory regime coalesces—or fractures—around questions of licensing, jurisdiction, and the boundary between gaming normalities and financial-derivative constructs in the evolving landscape of digital markets.

Crypto World

Nevada sues Kalshi in fresh prediction market showdown

The Nevada Gaming Control Board has filed a civil enforcement action against KalshiEX LLC, accusing the federally regulated prediction market of offering unlicensed wagering in the state.

Summary

- The Nevada Gaming Control Board has filed a civil enforcement action against Kalshi, alleging its sports-linked event contracts amount to unlicensed gambling under state law.

- Kalshi is seeking to move the case to federal court, arguing it operates under the exclusive jurisdiction of the U.S. Commodity Futures Trading Commission.

- The lawsuit adds to a growing national battle between state gaming regulators and federally regulated prediction markets, with multiple states taking similar action.

Nevada moves to block Kalshi’s event trading

In a complaint filed in Carson City District Court, regulators argue that Kalshi’s sports-linked “event contracts” amount to gambling under Nevada law. The state is seeking declaratory relief and an injunction to stop the company from operating in Nevada without a gaming license.

According to the complaint, making “event contracts” available to Nevada residents without approval from the Nevada Gaming Commission violates multiple provisions of the state’s gaming code.

“The Board continues to vigorously fulfill its obligation to safeguard Nevada residents and gaming patrons,” said NGCB Chairman Mike Dreitzer.

Kalshi quickly moved to shift the case to federal court, reiterating its long-standing position that it falls under the exclusive jurisdiction of the Commodity Futures Trading Commission and not state gaming regulators.

State law vs. Federal oversight

Kalshi maintains that its contracts are financial derivatives regulated by the U.S. CFTC, not traditional bets. The company operates as a CFTC-designated exchange and says federal law preempts state gaming rules.

Nevada disagrees. Regulators argue that contracts tied to sports outcomes mirror sportsbook wagers and fall squarely under state jurisdiction.

The Board says allowing unlicensed operators would undermine Nevada’s tightly controlled gaming framework.

Nevada also recently sued the crypto exchange Coinbase over prediction markets launched through a Kalshi partnership.

The lawsuits come amid a growing national legal battle over whether prediction markets such as Kalshi fall under state gambling laws or are exclusively governed by federal regulators. States including Maryland, New Jersey, Ohio and Tennessee have also challenged prediction markets, issuing cease-and-desist orders or filing lawsuits to block unlicensed sports event contracts.

Meanwhile, the CFTC has pushed back, defending its authority over event contracts. In earlier disputes, Kalshi secured temporary relief in court, though those wins have been limited and closely watched.

At issue is who controls the fast-growing prediction market sector — federal derivatives regulators or state gaming boards.

The outcome could reshape how Americans trade on elections, sports and economic events. It may also determine whether prediction markets operate nationwide under a single federal regime, or face a patchwork of state gambling laws.

Crypto World

$5 Billion XRP Selling Pipeline Detected on Upbit: Price Impact

XRP (XRP) price extended its slide on Wednesday, adding to a downtrend that has erased 44% of its value over the past year.

Amid this, a market analyst has highlighted unusual trading activity emerging from South Korea’s largest crypto exchange, raising questions about its potential impact on XRP’s price dynamics.

Sponsored

Sponsored

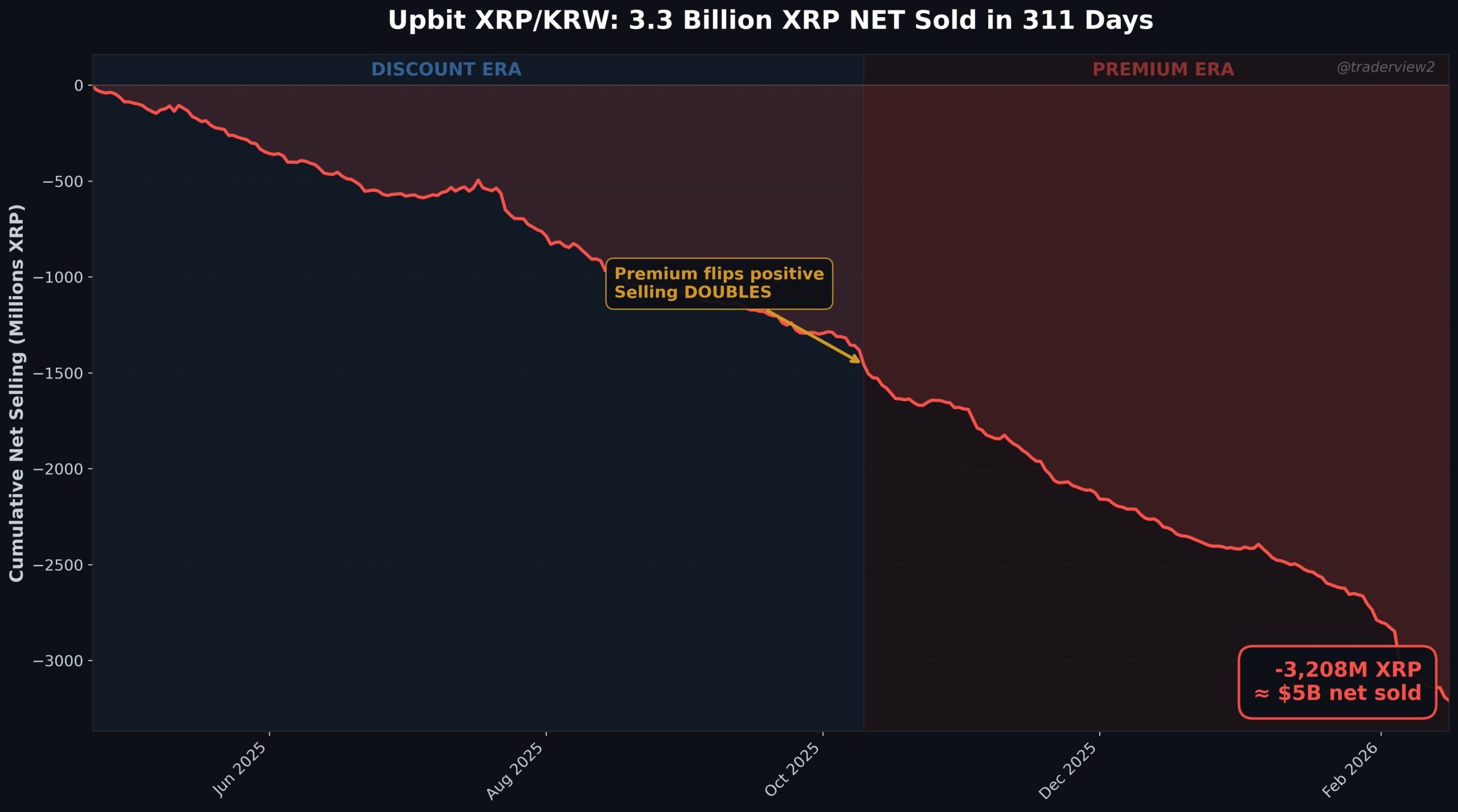

Study of 82 Million Trades Flags Structural Selling in XRP/KRW Market on Upbit

Crypto analyst Dom claims to have uncovered what he describes as a nearly year-long, multi-billion-dollar XRP selling pipeline. In a thread published on X (formerly Twitter), Dom said his findings are based on 82 million tick-level XRP/KRW trades on Upbit, alongside 444 million trades from Binance for comparison.

According to his analysis, Upbit’s XRP pair has recorded a net negative cumulative volume delta every month for the past 10 months.

“It started with yesterday’s price action. -57M XRP in CVD over 17 hours. It looked insane. So I ran forensic queries – bot fingerprinting, iceberg detection, wash trade checks. The selling was real. Algorithmic. 61% of trades fired within 10ms. Single bot running 17 hours straight with one 33-second pause,” he wrote.

Dom highlighted several months with particularly heavy negative cumulative volume delta (CVD), including April (-165 million XRP), July (-197 million XRP), October (-382 million XRP), and January (-370 million XRP). In total, he reports that only 1 of 46 weeks in the sample period showed net positive buying pressure.

“And it’s not ‘the market’ – Binance XRP/USDT carries 2-5x less sell pressure on the same coin (shocker). In June, Binance was net positive while Upbit bled -218M. The hourly correlation between the two venues is only 0.37. Upbit’s flow is largely its own thing,” the post added.

Dom argues the selling appears algorithmic. Between 57% and 60% of trades were executed within 10 milliseconds, a pattern typically associated with automated systems. He also observed that sell orders frequently appeared in round-number sizes such as 10, 100, or 1,000 XRP.

Sponsored

Sponsored

Meanwhile, buy orders were often fractional amounts like 2.537 XRP, consistent with KRW-denominated retail purchases.

“Ten million fractional buy orders over 10 months. Compared to the sell side running mechanical round number clips. Two completely different profiles trading against each other on the same venue,” the analyst added.

Furthermore, the analyst noted that from April to September, XRP on Upbit reportedly traded at a 3% to 6% discount to Binance, a “reverse Kimchi Discount.”

“The sellers were accepting 6% worse fills than available on global markets, for many months. They don’t care about the price. They need KRW, are mandated to use Upbit, and/or are Korean holders taking profit,” he stated. “Then October 10 happened. The premium has only briefly gone negative since and the sellers? They doubled their daily rate. From -6.3M/day to -11.2M/day.”

He estimates that the overall activity accounts for 3.3 billion XRP, worth $5 billion, in “net selling.” This represents about 5.4% of the token’s circulating supply. While Dom does not identify a specific entity behind the activity, he describes the flow as consistent, 24/7, and infrastructure-like rather than discretionary trading.

Sponsored

Sponsored

“So who has enough XRP to sell 300-400M per month for a year straight, doesn’t care about 6% discounts, runs identical algo infrastructure 24/7 and needs KRW specifically or is in some walled garden and can only use Upbit? AND who are they selling to? Who’s been on the other side of that trade? It could be 1 entity, 50 entities or 10k people I’ll let you speculate,” Dom remarked.

Why Does This Matter?

This matters because sustained, large-scale selling may influence price dynamics over time. A consistent flow of sell orders may limit upward momentum, intensify declines during periods of market stress, and absorb buying demand before it translates into meaningful price appreciation.

The impact is particularly relevant given that XRP was the most traded asset on Upbit in 2025. If this pattern is accurate, it would suggest that a significant source of supply has been active within one of the world’s most active XRP markets, with retail participants frequently on the opposite side of those trades.

Should that selling pressure decrease or stop, overall market behavior could shift as the balance between supply and demand adjusts.

Sponsored

Sponsored

The findings come as XRP balances on Upbit have reached a one-year high, exceeding 6.4 billion XRP, accounting for nearly 10% of the circulating supply.

In contrast, exchange reserves continued to decline on Binance, reflecting a divergence between Korean XRP investors and participants in other markets.

Taken together, the reported structural selling on Upbit and the rise in XRP balances on the exchange point to a sustained flow of tokens circulating within that venue. At the same time, contrasting reserve trends and accumulation patterns observed on other exchanges highlight a divergence in regional market behavior.

Crypto World

4 data points suggest XRP price bottomed at $1.12: Are bulls ready to take over?

Multiple technical, onchain and exchange-traded product data points suggest $1.12 was the generational bottom for XRP. Is it time for a trend reversal?

Crypto World

Markets – Bitcoin Tests Critical Support

Our chart of the week is HYPE.

Crypto World

Abu Dhabi sovereign funds top $1B in Bitcoin ETFs despite fresh outflows

Abu Dhabi-linked sovereign investors held more than $1 billion in U.S. spot Bitcoin ETF exposure at the end of 2025, a milestone that comes as the broader market faces renewed outflows this week.

Summary

- Abu Dhabi-linked sovereign investors held over $1.04 billion in U.S. spot Bitcoin ETFs at the end of 2025, according to SEC filings.

- Mubadala Investment Company and Al Warda Investments disclosed a combined 20.9 million shares in BlackRock’s Bitcoin ETF.

- The milestone comes as Bitcoin ETFs recorded $104.87 million in daily net outflows, signaling short-term selling pressure despite long-term institutional positioning.

The disclosure adds to a broader wave of institutional adoption, after Italian banking giant Intesa Sanpaolo revealed nearly $100 million in Bitcoin ETF holdings in a recent U.S. regulatory filing.

Abu Dhabi’s billion-dollar Bitcoin ETF play

According to fourth-quarter Form 13F filings submitted to the U.S. Securities and Exchange Commission, Mubadala Investment Company reported holding 12,702,323 shares of BlackRock’s spot Bitcoin ETF, valued at approximately $630.7 million as of Dec. 31, 2025.

A separate filing shows Al Warda Investments owned 8,218,712 shares in the same fund, worth roughly $408.1 million at year-end.

Combined, the two Abu Dhabi entities held about 20.9 million shares valued at just over $1.04 billion, underscoring continued sovereign exposure to regulated Bitcoin products offered by BlackRock.

Bitcoin ETF outflows resume

The milestone comes as Bitcoin ETFs recorded renewed selling pressure. Data from SoSoValue shows total daily net outflows of $104.87 million in the latest session. Total net assets across U.S. spot Bitcoin ETFs stood at $85.52 billion, while Bitcoin traded around $67,753 at the time of the writing.

Recent flow data shows volatility across late January and February, with several large redemptions interspersed with brief inflow spikes. Despite the short-term outflows, Abu Dhabi’s year-end filings suggest a longer-term allocation strategy rather than tactical trading.

The 13F disclosures reflect positions as of Dec. 31 and do not capture activity in early 2026. However, the scale of the holdings highlights how major state-backed investors remain positioned in U.S.-listed Bitcoin ETFs even as market sentiment fluctuates.

Crypto World

Peter Thiel’s Founders Fund dumps every ETHZilla share

Digital asset treasury firms with a sole business of investing in tokens have fallen out of investor favor and how.

Billionaire entrepreneur and co-founder of PayPal and Palantir Technologies Peter Thiel’s venture arm has wiped its slate clean of ETHZilla, selling every last share of the ether-hoarding digital asset treasury firm by the end of the last year, fresh paperwork filed with the Securities and Exchange Commission shows.

Thiel’s Founders Fund now shows a big fat zero in ownership, down from a 7.5% stake in August last year.

ETHZilla, a crypto investment firm based in Palm Beach, mimics Michael Saylor’s bitcoin hoarding firm Strategy (MSTR). ETHZilla started as a failed biotech stock called 180 Life Sciences, before pivoting hard to Ethereum (ETH) treasury, amassing over 100,000 ETH tokens at its peak.

The fund, however, panicked as markets peaked in early October and $40 million in ether for buybacks, then $74.5 million more in December to reduce debt from convertible notes. According to Bloomberg, the firm is pivoting hard again, spinning out ETHZilla Aerospace to offer investors tokenized slices of leased jet engines.

Crypto World

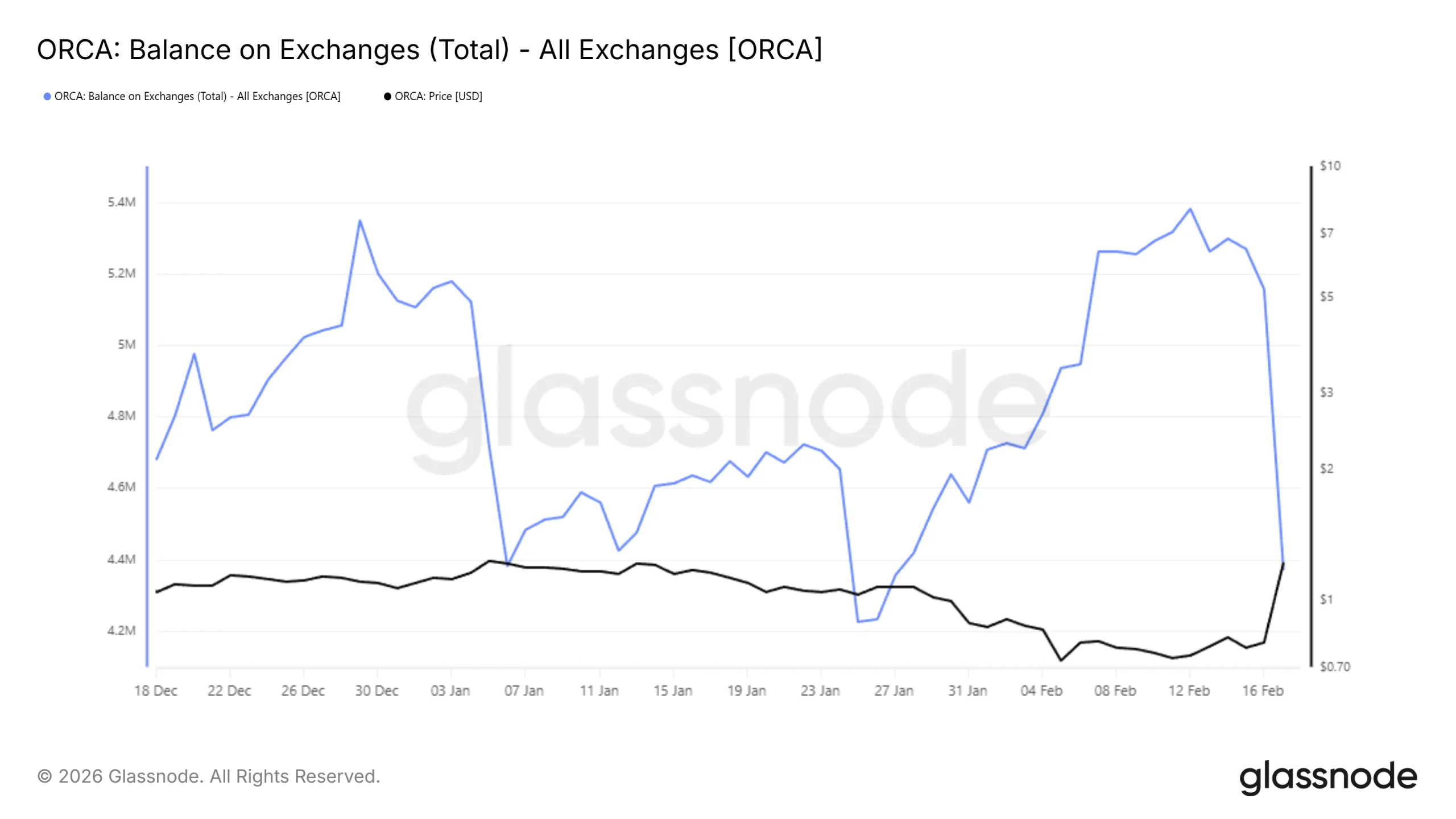

Here’s What Triggered a 50% Rally in ORCA Price in 24 Hours

Orca stunned the market with a sharp 50% surge in the past 24 hours. The price climbed quickly without any major development announcement. The rally appears driven by renewed investor interest rather than protocol upgrades.

However, strong upside moves often carry elevated risk. Sudden spikes can attract speculative capital and trigger volatility.

Sponsored

Orca Buying Spree Contributed To The Rally

ORCA balances on exchanges declined significantly over the past day. Nearly 1 million ORCA tokens were bought off exchanges within 24 hours. At the current price of $1.23, that supply is worth approximately $1.23 million.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This marks the largest single-day accumulation of ORCA this year. Reduced exchange supply typically reflects rising investor conviction. Organic demand appears to have fueled the rally. Utility metrics support this view.

USDC total value locked on Orca increased 100% year over year, reaching nearly $90 million.

Sponsored

The Net Unrealized Profit and Loss, or NUPL, indicator provides additional context. Recent readings show that prior losses had saturated. High unrealized losses often reduce selling pressure as holders stop capitulating.

A similar pattern appeared in March 2025. At that time, ORCA rallied nearly 119% after a prolonged downside. Loss saturation can trigger accumulation at perceived value zones. Current data suggests investors stepped in aggressively at discounted levels.

Sponsored

ORCA Price Finds Support

ORCA trades at $1.214 after posting a 51.7% gain in 24 hours. The token reached an intraday high of $1.421 before retreating below $1.256. This pullback suggests early profit-taking.

The altcoin remains above the 61.8% Fibonacci retracement level. This zone acts as a bullish support floor. Holding above it could encourage renewed buying. Sustained demand may push ORCA back toward $1.421. A confirmed breakout could extend gains to $1.603.

However, sharp rallies can reverse quickly. If investors prioritize short-term profits, selling pressure may intensify. A drop below $1.126 would signal weakening structure. Further downside toward $1.025 becomes likely in that case. Losing this support could send ORCA below $1.000 to $0.945, invalidating the bullish thesis.

Sponsored

ORCA Warning Signs

Risk analysis data introduces another factor. Rugcheck Risk Analysis flagged that Mint Authority remains enabled for the owner’s wallet. This setting can allow token issuance beyond the current supply.

In many cases, mint authority exists for technical reasons. Some projects use lock-and-mint or burn-and-mint mechanisms for cross-chain transfers. However, governance clarity is essential. Orca operates with a decentralized autonomous organization structure.

Typically, a DAO should control token issuance. If a single wallet retains mint authority, concerns may arise. Transparency remains critical for investor trust. BeInCrypto has provided Orca’s team with a Right of Reply. An update will follow upon receiving formal clarification. Until then, investors should monitor this risk factor carefully.

Crypto World

Bitcoin Long-Term Holders Realize Losses as Binance Inflows Hit Alarming Levels

TLDR:

- Bitcoin’s LTH SOPR has dropped to 0.88, a level not seen since the close of the 2023 bear market cycle.

- Long-term holders are now realizing losses on average, marking a sharp shift from historically resilient behavior.

- Daily BTC inflows to Binance have reached twice the annual average across several consecutive days recently.

- Rising exchange inflows from long-term holders signal sustained selling pressure that may weigh on Bitcoin’s short-term recovery.

Bitcoin long-term holders are beginning to feel the weight of a prolonged market correction. The asset remains more than 45% below its previous all-time high.

This sustained decline is creating financial pressure across a wide range of investors. Even the most resilient market participants are now adjusting their behavior in response. The shift marks a notable change for a group known for holding up under difficult conditions.

LTH SOPR Drops Below Key Threshold

The LTH Spent Output Profit Ratio (SOPR) has recently crossed below the critical level of 1. It currently sits at 0.88, a level not recorded since the close of the 2023 bear market.

This reading means long-term holders are, on average, selling at a loss. That alone represents a meaningful change in market behavior.

Analyst Darkfost noted in a post on X that the annual average LTH SOPR remains at 1.87. However, the short-term reading has moved well below that average.

The gap between the two figures reflects how quickly conditions have shifted. It points to growing financial strain within a historically patient group of investors.

When long-term holders begin realizing losses, it often signals a deeper phase of market stress. These participants typically sell only when they see value or face genuine pressure.

A move into negative SOPR territory suggests the latter is increasingly the case. The trend warrants close attention from market observers.

The drop below 1.0 also carries weight because of the size of this investor group. Long-term holders control a substantial portion of Bitcoin’s circulating supply.

Their decisions carry more influence over price than those of short-term traders. A sustained pattern of loss realization could weigh on recovery efforts.

Rising Binance Inflows Point to Increased Activity

At the same time, long-term holder inflows to Binance have increased sharply in recent weeks. Daily inflows have reached roughly twice the annual average on several consecutive days.

This level of activity is considered exceptionally elevated by historical standards. It points to a clear and deliberate shift in behavior among this group.

Darkfost also noted that this pattern has been building since the last all-time high. The acceleration in recent weeks adds further context to the SOPR data.

Together, the two indicators tell a consistent story about how long-term holders are responding. They are actively managing their exposure rather than simply waiting out the correction.

Binance remains the platform of choice for this activity due to its liquidity. Large holders need deep markets to move significant volumes without major price disruption.

The exchange’s market depth makes it practical for participants managing large positions. Their preference for Binance is therefore a logical outcome of their size.

Rising inflows from long-term holders to exchanges are generally viewed as a bearish signal. More Bitcoin moving onto platforms increases the available supply for sale.

This dynamic could continue to apply downward pressure in the short to medium term. The market may need time before this adjustment phase runs its course.

Crypto World

Nevada Sues Kalshi After Appeals Court Greenlights Action

The US state of Nevada has sued Kalshi after the prediction market company lost its court challenge to stop the state’s regulator from taking action over its sports prediction markets.

The US Court of Appeals for the Ninth Circuit on Tuesday denied Kalshi’s bid to stop Nevada’s gaming regulator from taking action on its sports event contracts, removing a block on the regulator launching a civil suit against the company.

After the decision, the Nevada Gaming Control Board promptly filed a civil enforcement action in state court against Kalshi, which it said sought to block the company “from offering unlicensed wagering in violation of Nevada law.”

Kalshi swiftly filed a motion to have the suit heard in a federal court, repeating its long-held argument that it is “subject to exclusive federal jurisdiction” under the Commodity Futures Trading Commission.

The appeals court order and subsequent lawsuit are a blow to Kalshi in its nearly year-long battle against Nevada to keep its sports contracts active in the state. The company and other prediction markets are facing multiple similar lawsuits from other states.

The company sued the state last year in March after receiving a cease-and-desist order to halt all sports-related markets within the state. In April, a federal court backed Kalshi’s bid to temporarily block Nevada from taking action amid court proceedings.

Kalshi did not immediately respond to a request for comment.

Nevada says Kalshi is flouting state law

In its latest lawsuit, the Nevada Gaming Control Board repeated its past claim that Kalshi’s sports event contracts meet the requirements to be licensed under state law, as they allow “users to wager on the outcomes of sporting events.”

Despite making wagers, sports betting and other gaming activities accessible in the State of Nevada, Kalshi is not licensed in Nevada and does not comply with Nevada gaming law, the regulator argued.

In its federal court motion, Kalshi argued that such a claim means the court “must adopt a narrow interpretation” of federal commodity exchange laws, which it asserts it is regulated under by the CFTC.

CFTC chair asserts jurisdiction over prediction markets

Earlier on Tuesday, CFTC chair Mike Selig said his agency filed an amicus brief backing Crypto.com in a similar lawsuit the crypto exchange had brought against Nevada.

Crypto.com had sued Nevada’s regulators in June after similarly receiving a cease-and-desist letter. It also appealed to the Ninth Circuit in November after losing a federal court motion to block the state from taking action.

Related: Crypto lobby forms working group seeking prediction market clarity

The CFTC argued in its brief to the Ninth Circuit that “states cannot invade the CFTC’s exclusive jurisdiction over CFTC-regulated designated contract markets by re-characterizing swaps trading on DCMs as illegal gambling.”

Selig said that event contracts “are commodity derivatives and squarely within the CFTC’s regulatory remit,” and the agency would “defend its exclusive jurisdiction over commodity derivatives.”

The CFTC’s push comes after Trump Media and Technology Group said in October that it was looking to bring prediction markets to its flagship social media platform, Truth Social, via a partnership with Crypto.com.

Donald Trump Jr., the US president’s son, has also been an advisor to Kalshi since January 2025. He has also served as an advisor to rival Polymarket after investing in the company in August.

AI Eye: IronClaw rivals OpenClaw, Olas launches bots for Polymarket

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Business9 hours ago

Business9 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video23 hours ago

Video23 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World23 hours ago

Crypto World23 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

Business1 hour ago

Business1 hour agoTesla avoids California suspension after ending ‘autopilot’ marketing