Crypto World

Kraken Joins ICE Chat to Boost Institutional OTC Access

Kraken has expanded its institutional reach by linking its over-the-counter (OTC) desk to ICE Chat, Intercontinental Exchange’s real-time messaging platform used by banks and trading desks. Announced February 17, 2026, the arrangement makes Kraken the first cryptocurrency platform to be approved for ICE Chat, enabling quote requests and negotiations to flow directly within a system that aggregates more than 120,000 market participants. The move positions Kraken’s liquidity alongside traditional assets across a familiar workflow, signaling a broader push to incorporate digital assets into mainstream financial-market infrastructure. The OTC desk at Kraken handles large block trades in crypto spot and options, and the partnership with ICE is expected to evolve as institutions look for deeper, more integrated access to crypto liquidity.

Key takeaways

- Kraken’s OTC desk is now integrated with ICE Chat, enabling institutional traders to access Kraken’s crypto liquidity directly through a widely used messaging platform.

- ICE Chat connects more than 120,000 market participants, including banks, brokers, and trading desks, allowing real-time deal negotiation within established workflows.

- Kraken is the first crypto platform approved to connect to ICE Chat, situating digital asset liquidity alongside traditional asset classes.

- The integration is expected to expand over time, reflecting broader efforts to embed digital asset trading into traditional financial-market infrastructure.

- ICE’s broader crypto initiatives include on-chain data collaborations, large-scale investments in crypto markets, and potential partnerships with wallet and payments providers, signaling a more integrated financial ecosystem.

Market context: Link the story to broader crypto conditions (liquidity, risk sentiment, regulation, ETF flows, macro, or sector trends) WITHOUT inventing facts.

Why it matters

The Kraken-ICE Chat linkage marks a notable step toward deeper institutional access to crypto liquidity. By enabling quote requests and negotiations to occur within ICE’s established messaging network, hedge funds, asset managers, and banks can integrate crypto trading into their existing workflows without resorting to separate channels or processes. The arrangement reduces friction for large crypto block trades, a key consideration for participants handling significant volumes in both spot and options markets. In practical terms, traders can coordinate, price, and settle trades within a single, familiar interface, potentially improving execution efficiency and speed while preserving governance and compliance controls.

The move also highlights ICE’s broader strategy to bring digital assets into mainstream capital-markets infrastructure. ICE operates ICE Chat, the New York Stock Exchange, and a suite of data, clearing, and technology services. Its push into crypto markets aligns with the industry-wide trend of bridging traditional finance with digital assets, leveraging established market infrastructure to widen participation and liquidity. In recent months, ICE has pursued a series of crypto-related initiatives, including a collaboration with Chainlink to pull FX and precious metals data on-chain, substantial investments in crypto-native ventures, and explorations into crypto payments capabilities. These steps underscore a broader ambition to weave crypto more deeply into the fabric of conventional trading and risk management.

The partnership comes amid a wider set of tokenization and on-ramp developments across major exchanges. Nasdaq has signaled a willingness to explore tokenized equities through regulatory channels, while the NYSE has discussed plans to operate a 24/7 trading platform for tokenized stocks and ETFs, integrating traditional post-trade settlement with blockchain-based processes. These efforts reflect a synchronous push from traditional venues toward digitized asset classes, where liquidity, transparency, and execution efficiency are often cited as critical advantages. The ecosystem is evolving rapidly, with market participants watching how these initiatives will interact with evolving regulatory standards and the pace of adoption by institutional users.

The timing of Kraken’s announcement overlaps with other notable industry moves. Earlier in the year, Kraken pledged to support a government-backed initiative to create “Trump Accounts,” a savings program for Americans under 18—an effort that reflects the broader intersection of crypto policy and retail-facing programs. This backdrop illustrates how crypto firms are navigating public policy while expanding their institutional capabilities, seeking to demonstrate value beyond consumer-focused products and toward core market infrastructure.

Why it matters (continued)

The integration could help amplify liquidity for large crypto trades by tapping into ICE’s global network, potentially reducing spreads and improving price discovery for institutional participants. It also signals to regulators and incumbents that crypto liquidity can be treated as part of the same market ecosystem that handles equities, bonds, and other traditional asset classes. For Kraken, the collaboration with ICE Chat may expand its reach among asset managers who prefer operating within standardized, risk-managed environments—furthering the normalization of digital assets within regulated financial marketplaces.

What to watch next

- Expansion updates: Follow announcements about extending ICE Chat access to additional Kraken clients and other Kraken desks or counterparties.

- Broader ICE crypto initiatives: Monitor developments tied to ICE’s data services, on-chain integrations, and potential partnerships in payments or custody.

- Tokenization momentum: Track regulatory progress and product launches related to tokenized stocks and ETFs at Nasdaq and NYSE, which could influence liquidity and settlement paradigms.

- Data and settlement enhancements: Look for updates on ICE’s Consolidated Feed and how it interoperates with on-chain data streams and DeFi-native pricing mechanisms.

Sources & verification

- Kraken Integrates with ICE Chat to Expand Institutional OTC Access — Business Wire press release (official announcement of the integration).

- ICE Chat and Market Participation — ICE corporate communications outlining the platform’s reach beyond traditional markets.

- Chainlink and ICE Forge On-Chain Data Collaboration — Cointelegraph coverage detailing ICE’s data-on-chain initiative.

- ICE Invests in Polymarket — Cointelegraph reporting on ICE’s $2 billion investment and the valuation context.

- Nasdaq and NYSE tokenization efforts — Cointelegraph coverage of Nasdaq’s tokenized-stocks push and NYSE’s plans for 24/7 tokenized-trading platform.

What the announcement changes

The Kraken-ICE Chat integration represents a concrete step in the ongoing evolution of institutional crypto access. By embedding Kraken’s liquidity within ICE’s established communications platform, the move lowers barriers for large-scale crypto trading and aligns digital asset execution with the workflows many institutions already use for other asset classes. The collaboration reinforces the idea that cryptos are not merely retail instruments but elements of a broader, interconnected market infrastructure that includes data, clearing, risk management, and settlement. As the ecosystem expands, institutions may increasingly rely on a combination of on-chain data, centralized exchanges, and OTC desks to manage exposure, price risk, and execution efficiency across diverse crypto products.

What to watch next

- Monitoring quarterly updates from Kraken and ICE for new client onboarding and expanded platform access.

- Regulatory developments affecting crypto-asset trading infrastructure and tokenized securities, including any policy shifts impacting tokenization and cross-market liquidity.

- Progress on ICE’s partnerships with data providers and on-chain data feeds, and how these integrations affect price discovery and risk management.

Crypto World

Ripple CEO Expects CLARITY Act to Pass by April, Boosting Crypto Clarity

Ripple CEO Brad Garlinghouse has expressed confidence that the CLARITY Act, a landmark piece of legislation for the crypto industry, is likely to pass by the end of April.

Ripple CEO Brad Garlinghouse remains optimistic about the Clarity Act, giving it an 👀 80% chance of being signed by the end of April. 🏛️

While XRP has its legal clarity, the rest of the industry is still waiting. Progress over perfection is the goal. 🤝 pic.twitter.com/7DqQezE3U2

— 𝗕𝗮𝗻𝗸XRP (@BankXRP) February 16, 2026

According to Garlinghouse, there is now an 80% chance of the bill being approved, especially after continued negotiations between banks and crypto firms. The CEO has urged the industry to embrace compromise, suggesting that waiting for a perfect bill could stall progress.

In recent weeks, discussions surrounding the CLARITY Act have seen significant developments, especially following a long-standing deadlock in the Senate Banking Committee. This delay occurred just before the bill was initially expected to pass. Ripple’s Chief Legal Officer, Stuart Alderoty, also remains optimistic, noting that talks between banks and crypto firms have made significant strides.

The potential passage of the CLARITY Act would offer much-needed regulatory clarity for the crypto space, which has long struggled with uncertain legislation. This clarity, according to Garlinghouse, would be a step toward stabilizing the market, benefiting both crypto firms and investors. However, despite its positive potential, the bill still faces challenges that could delay its passage further.

Crypto Bill Stalemate and Progress in Negotiations

The road to the CLARITY Act’s passage has not been smooth. Earlier this year, Coinbase, one of the largest cryptocurrency exchanges in the United States, pulled its support for the legislation. The company cited its inability to reach a compromise on the issue of stablecoin yield. This setback delayed momentum in the Senate Banking Committee, creating further uncertainty for the bill’s future.

While there is some frustration over the stalled negotiations, there is still hope that a breakthrough is imminent. The White House has set a February deadline for crypto and banking leaders to agree on stablecoin yield provisions within the bill. This deadline aligns with Garlinghouse’s predictions, as he has consistently emphasized that compromise rather than perfection is necessary to move the legislation forward.

As talks continue this week, stakeholders in the crypto sector remain hopeful that the final version of the bill will be sufficiently beneficial to all parties involved. The current focus is on balancing regulatory clarity with the needs of both traditional banks and the emerging crypto economy. A resolution could bring much-needed stability and restore confidence in the market, especially as the crypto industry struggles through a bearish phase.

White House Involvement and Potential Market Impact

The involvement of the White House in the negotiation process highlights the importance of the CLARITY Act to the future of the crypto industry. A key upcoming meeting later this week could serve as a turning point in the discussions. With the backing of influential parties, such as the White House and major financial institutions, the chances of the bill’s successful passage by April appear to be increasing.

Market speculation suggests that the CLARITY Act’s passage could lead to significant liquidity returning to the crypto space. If the bill succeeds, many analysts believe it could reinvigorate the market, which has been experiencing a downturn for some time. Increased stability from clearer regulations may prompt a resurgence of interest in crypto assets, driving investment and innovation within the sector.

Despite the uncertainty, many in the industry are holding out hope that the passage of the CLARITY Act will bring much-needed regulatory certainty. This could pave the way for future growth and opportunities in the crypto market. With discussions heating up and potential progress on the horizon, the crypto community will be watching closely as April approaches.

Crypto World

Shiba Inu Launches ‘Shib Owes You’ NFT to Compensate Shibarium Users

SOU NFTs as Proof of Claims

The SOU system offers affected users an on-chain, non-fungible token (NFT) that tracks the value owed to them. Each SOU represents an individual claim, recorded securely on the Ethereum blockchain. Users can see their principal amount, which decreases as payouts and donations are processed. The transparency of this system ensures that the value cannot be manipulated, providing a fair method for managing claims.

SOU is live

Introducing SOU (Shib Owes You) an onchain NFT built as a good-faith effort to support impacted users with payouts, donations, and occasional rewards.

Transparent. Tradable. On-chain.

You can transfer it, split it, merge it, or trade it on marketplaces.Claim your… pic.twitter.com/ONyO8OitJQ

— Shib (@Shibtoken) February 16, 2026

This initiative aims to restore trust and compensate those who experienced setbacks during Shibarium’s challenges. Shiba Inu’s developer, Kaal Dhairya, emphasized the importance of this effort, stating that it would help make things right for impacted users. The project’s transparent tracking feature ensures that users have clear visibility of their claims.

Security and Audits Behind the SOU Mechanism

The Shiba Inu team worked with Hexens, an independent auditing firm, to thoroughly review the SOU system. Hexens focused on ensuring the security of the NFT contracts and their integration within the broader Shiba Inu ecosystem. The audit included assessing key components, such as asset recovery, repayment flows, NFT mechanics, and access controls.

According to Hexens, the security review confirmed that the system is safe for managing funds and transactions. This review further guarantees that the SOU system adheres to high security standards, reducing the risk of any breaches. With a clear focus on safety and reliability, the Shiba Inu team has ensured that the SOU NFT mechanism is designed to protect user funds and claims.

Community Support and Positive Reactions

The Shiba Inu community has responded positively to the launch of the SOU system. Shytoshi Kusama, the Shiba Inu lead ambassador, praised the team for their effort and commitment to addressing the issue. Kusama highlighted the significance of getting this system up and running as a critical step in supporting impacted users.

The announcement has sparked discussions among community members who appreciate the transparency and efficiency of the solution. Many users expressed their confidence in the SOU mechanism as a solid foundation for restoring Shibarium’s reputation. By taking this proactive approach, Shiba Inu aims to solidify its reputation and ensure its community feels supported and valued.

Shiba Inu’s Position in the Market

Amid the SOU announcement, the broader crypto market saw some fluctuations. Shiba Inu (SHIB) experienced a minor dip of 2.36% in the past 24 hours, with its price sitting at $0.000006431. Despite the market downturn, SHIB managed to record a weekly increase of 7%, indicating some resilience.

Shiba Inu’s commitment to improving Shibarium’s infrastructure and restoring trust has been crucial in navigating the current market challenges. As the crypto community continues to react, SHIB’s price remains closely tied to the ongoing recovery efforts within the ecosystem. This marks a critical moment for Shiba Inu as it works to rebuild momentum and prove its dedication to long-term growth.

Crypto World

Jupiter Lend Now Accepts Native Staking as Collateral for SOL Borrowing

TLDR:

- Jupiter Lend allows users to borrow against natively staked SOL without converting to liquid staking tokens.

- Over $30 billion in natively staked SOL on Solana can now be used as collateral inside DeFi lending markets.

- Users can borrow up to 87% of their staked position’s value, with a liquidation threshold set firmly at 88%.

- Six validators are live at launch, including Jupiter and Helius, with more validators set to join over time.

Native staking as collateral is now available on Jupiter Lend, opening a new lane for Solana DeFi users. Jupiter Exchange has activated a feature allowing holders to borrow against natively staked SOL directly.

No liquid staking tokens are needed at any stage of the process. The update taps into more than $30 billion in staked SOL that previously had no DeFi utility. For long-term SOL stakers, this represents a meaningful shift in how they can use their assets.

Jupiter Lend Bridges Natively Staked SOL Into DeFi Lending

For years, natively staked SOL sat outside the reach of decentralized lending markets. Holders who staked directly with validators had no way to access liquidity without unstaking first.

Jupiter Lend now addresses that gap by detecting staked positions automatically on-chain. Once detected, the position is represented as an nsTOKEN within the protocol.

Jupiter Exchange described the process clearly in a post: “$30B of SOL is natively staked. The largest pool of capital on Solana, earning yield but locked out of DeFi. That changes today.”

The announcement confirmed the feature is live and accessible to users right away. From there, holders can borrow SOL against their staked position without any manual wrapping or conversion.

Staking rewards continue to compound while the collateral remains active on the platform. This means users do not lose yield while borrowing against their position.

The protocol is fully non-custodial, so users keep control of their assets throughout. Everything runs on-chain with no intermediary involved in the process.

The borrowing limit is set at up to 87% of the staked position’s value. The liquidation threshold is placed at 88%, leaving a tight but defined buffer for users.

Each validator on the platform operates through a separate vault. The vault names follow a clear format, such as nsJUPITER for Jupiter and nsHELIUS for Helius.

Six Validators Are Live at Launch With Expansion Plans Ahead

Jupiter Exchange launched the feature with six validators already integrated into the platform. Those validators are Jupiter, Helius, Nansen, Blueshift, Kiln, and Temporal.

Each carries its own dedicated vault while following the same borrowing structure. Users staked with any of these validators can access the feature right away.

As stated in the announcement: “Each has its own vault, but with the same exact flow.” So regardless of which validator a user has staked with, the steps remain the same.

The experience stays consistent across all six supported vaults on Jupiter Lend. Only the validator backing the collateral differs between each nsTOKEN position.

Jupiter Exchange also confirmed that additional validators will be added over time. The plan is to cover a broader range of the Solana validator ecosystem gradually.

As more validators join, more natively staked SOL will enter DeFi lending markets. This phased approach keeps the rollout stable while expanding access steadily.

The launch marks a concrete step toward making natively staked SOL fully liquid for DeFi purposes. Users who previously had no options can now put idle staked capital to work on Jupiter Lend.

Crypto World

Mubadala Investment Company and Al Warda boosted IBIT stakes in Q4

Two of Abu Dhabi’s major investment firms increased their exposure to bitcoin in the fourth quarter of 2025, buying into BlackRock’s spot bitcoin ETF as the market fell, according to recent regulatory filings.

Mubadala Investment Company, a sovereign wealth fund backed by the Abu Dhabi government, added nearly four million shares of BlackRock’s iShares Bitcoin Trust (IBIT) between October and December, bringing its total holdings to 12.7 million shares. The move came as bitcoin fell roughly 23% during the quarter.

Mubadala made its first purchases in IBIT in late 2024 and has been adding since.

Al Warda Investments, another Abu Dhabi-based investment management firm that oversees diversified global assets on behalf of government-related entities, held 8.2 million shares at the end of the fourth quarter, up slightly from 7.96 million shares three months earlier.

Together, the two funds held more than $1 billion worth of bitcoin via IBIT at the end of 2025. However, with bitcoin down another 23% year-to-date in 2026, the current value of their combined holdings has dropped to just over $800 million as of Tuesday (assuming they haven’t continued adding in 2026).

The disclosure, made through 13F filings with the U.S. Securities and Exchange Commission, reflects growing institutional interest in spot bitcoin ETFs, even during periods of market stress. BlackRock’s IBIT, which launched in early 2024, has quickly become the dominant vehicle for regulated exposure to bitcoin in the U.S.

While the crypto market has faced ongoing headwinds in early 2026 — including low volatility, reduced retail participation, and macroeconomic uncertainty — some long-term investors appear to be using the downturn to build positions in regulated, liquid products tied to digital assets.

BlackRock head of digital assets, Robert Mitchnick, said on a recent panel that there is a mistaken belief that hedge funds using ETFs are driving volatility and heavy selling, but that does not match what the firm is observing. Instead, he said, IBIT holders are in it for the long term.

Crypto World

ETH Mass Adoption Across TradFi Backs $2.5K Price Target

Key takeaways:

-

Institutional sentiment is shifting toward ETH as elite funds reallocate capital from Bitcoin to Ether ETFs.

-

BlackRock’s ETH ETF pairs secure staking with a low 0.25% fee, creating a major win for mainstream crypto access.

-

Dominance in the $20 billion real-world asset sector proves that big money prioritizes network security over low gas fees.

Ether (ETH) has failed to reclaim the $2,500 level since Jan. 31, leading traders to question what might spark sustainable bullish momentum. Investors are waiting for definitive signs of a favorable sentiment shift; meanwhile, three distinct events could signal the end of the bear cycle that bottomed at $1,744 on Feb. 6.

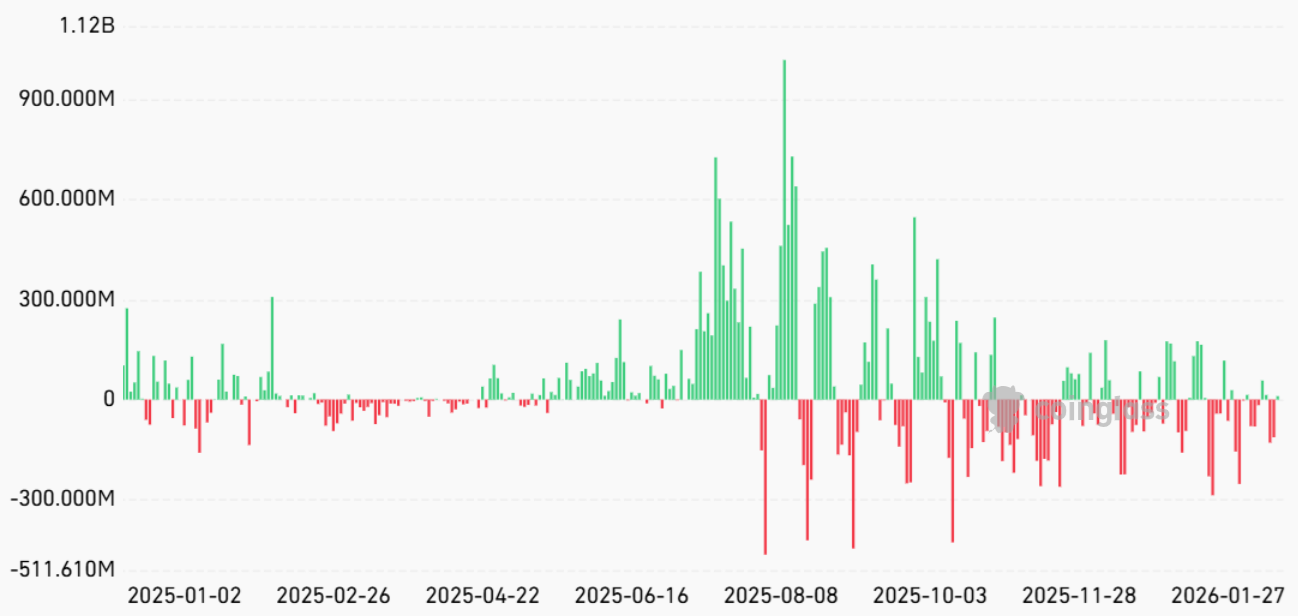

At first glance, the $327 million in net outflows from spot Ether exchange-traded funds (ETFs) in February is mildly concerning. The apparent lack of institutional appetite while ETH sits 60% below its all-time high could be seen as a lack of confidence in the $1,800 support level. However, these outflows represent less than 3% of the total assets under management for Ether ETFs.

Recent Ether ETF milestones may boost ETH’s price

While investors currently focus almost exclusively on short-term flows, the magnitude of recent Ether ETF developments will eventually reflect positively on ETH price. In bearish markets, positive news is often ignored or downplayed, but strategic moves from the world’s largest asset managers can quickly flip investor risk perception.

The latest US Securities and Exchange Commission filings showed on Monday that the Harvard endowment fund added an $87 million position in BlackRock’s iShares Ethereum Trust during the final quarter of 2025. Interestingly, this vote of confidence arrived as Harvard reduced its iShares Bitcoin Trust holdings to $266 million, down from $443 million in September 2025.

In parallel, BlackRock amended its Staked Ethereum ETF proposal on Tuesday to include an 18% retention of total staking rewards as service fees. While some market participants criticized the hefty fee, the ETF sponsor must compensate intermediaries like Coinbase for staking services. Moreover, the relatively low 0.25% expense ratio remains a net positive for the industry.

The final piece of evidence pointing to growing institutional adoption lies in real world asset (RWA) tokenization, a segment that has surpassed $20 billion in assets. Ethereum stands as the absolute leader, hosting offerings from BlackRock, JPMorgan Chase, Fidelity and Franklin Templeton. This intersection of blockchain applications and traditional finance may trigger sustainable demand for ETH.

Nearly half of the $13 billion in RWA deposits on Ethereum represent tokenized gold, though investments in US Treasurys, bonds and money market funds grew to an impressive $5.2 billion. By comparison, the combined RWA listings on BNB Chain and Solana amount to $4.2 billion, a strong indicator that institutional money is less concerned with fees and more focused on security.

Related: Tokenized RWAs climb 13.5% despite $1T crypto market drawdown

Even if RWA issuers currently focus on closed-end systems using exclusive decentralized finance pools or their own layer-2 networks, intermediaries will eventually find ways to connect with the broader Ethereum ecosystem. Crypto venture capital firm Dragonfly Capital’s latest $650 million funding round signals a strong appetite for tokenized stocks and private credit offerings.

Rather than backing layer-1 blockchains and consumer-focused applications, investors are directing capital toward RWA infrastructure, institutional custody and trading platforms, a clear sign of market maturation. Although it is difficult to predict how long these shifts will take to impact Ether’s price, these events clearly indicate that a bounce back to $2,500 in the near term is feasible.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

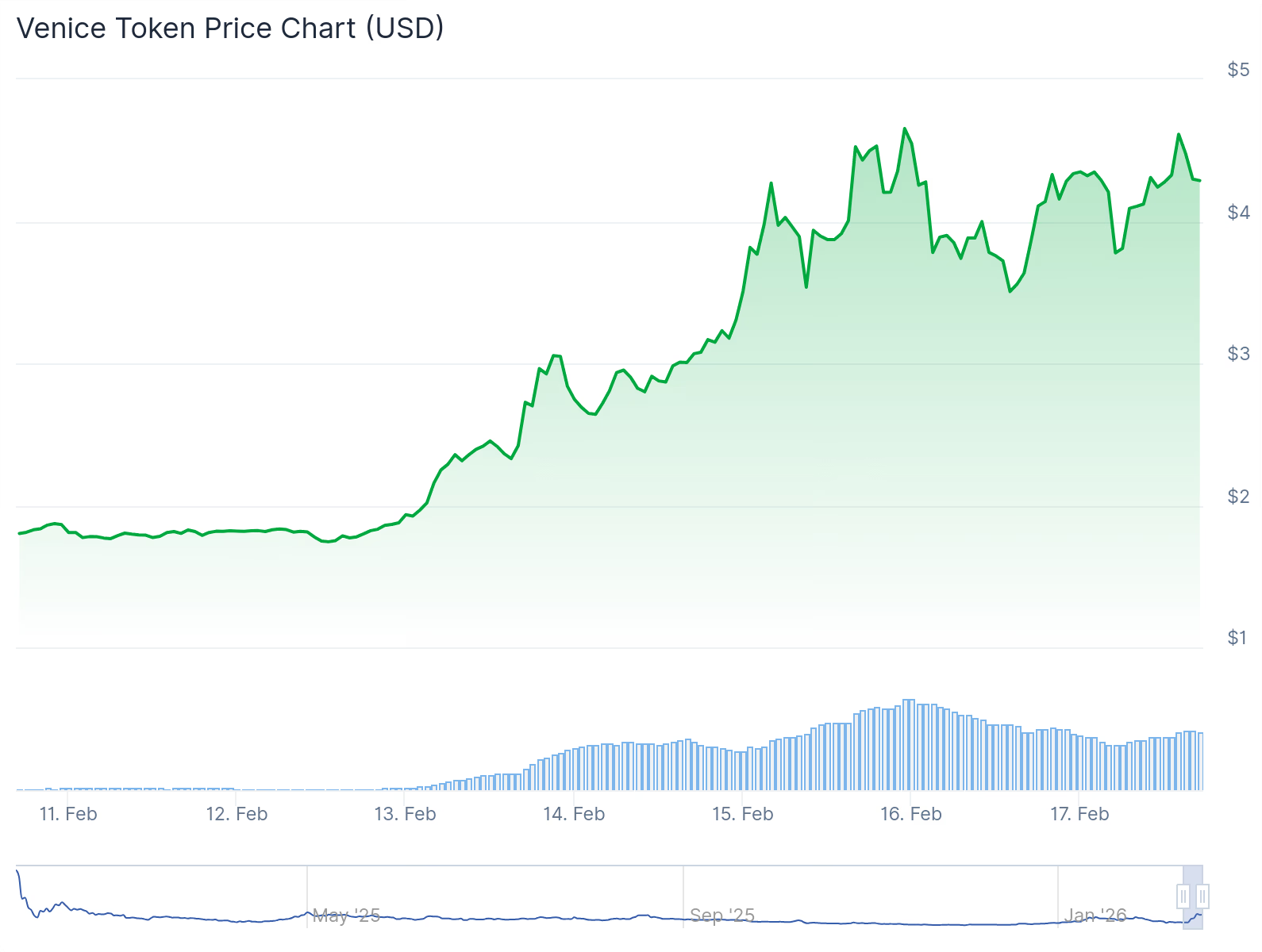

Erik Voorhees’ Venice AI Leads Altcoin Market

The decentralized artificial intelligence protocol is up 350% from its November low.

Venice AI, an agentic artificial intelligence (AI) protocol created by Erik Voorhees, the founder and CEO of ShapeShift, has led the altcoin market over the past week.

Venice AI’s VVV token is up 135% over the last week, and 14% today to $4.28, or a $336 million fully diluted valuation (FDV), a 375% jump off its November low of $0.9.

Venice utilizes a dual-token system following the DIEM token launch in September, which provides DIEM stakers with free access to Venice AI models. DIEM reached an all-time high of $672 over the weekend, and currently changes hands at $586, a 200% increase from its launch price.

The token was launched during the peak of AI agent mania in January 2025, and traded as high as $9 within a week. However, VVV fell alongside the rest of the low-cap altcoin and AI agent market following the LIBRA token scam in February.

A year later, VVV is trading at its highest level since August 2025, with the protocol’s metrics hitting all-time highs. Voorhees posted on X that Venice is processing more than 45 billion large language model (LLM) tokens per day – double what he reported on Feb 4.

Crypto World

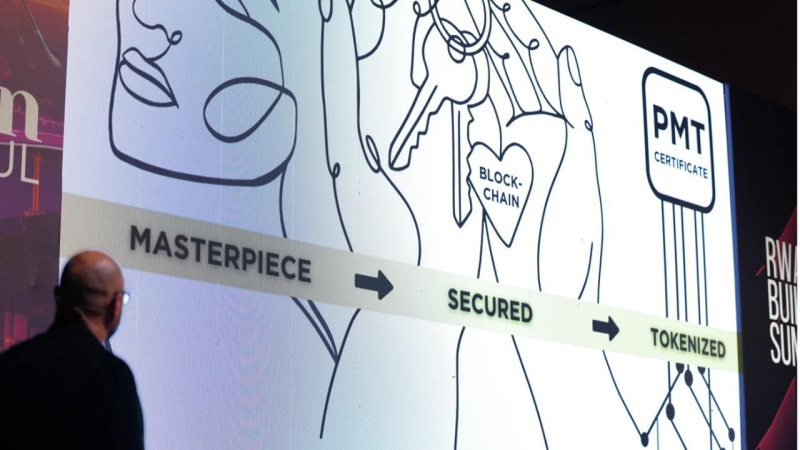

Public Masterpiece Announces PMT Chain, A Layer 1 Built for the Real-World Asset Economy

[PRESS RELEASE – Karavas, Cyprus, February 17th, 2026]

At a time when much of the blockchain industry is still recovering from one of its harshest downturns, a small number of companies are quietly moving in the opposite direction: expanding, building, and positioning themselves for the next era of adoption.

Public Masterpiece, a Cyprus-based real-world asset tokenization company, has announced PMT Chain, its own purpose-built Layer 1 blockchain. Alongside the announcement, the company confirmed a strategic repositioning: PMT, once short for Public Masterpiece Token, will now stand for Public Masterpiece Technology.

The timing is notable. Crypto did not simply experience a correction, but a $1.1 trillion stress test that dismantled inflated narratives and exposed weak token models. Many projects will not return.

Public Masterpiece is positioning itself as one of the exceptions. Even before revealing its Layer 1 ambitions, the company built traction through its Layer 2 presence on BNB Chain. Over the past 12 months, PMT has reportedly increased in price by 75%, outperforming 86% of the top 100 crypto assets, including Bitcoin and Ethereum, while trading above its 200-day moving average and remaining near its all-time high.

CoinMarketCap Screenshot of the Public Masterpiece Token Chart as of 13.02.2026

PMT Chain is designed specifically for real-world asset tokenization, with the company positioning the network as infrastructure for internationally renowned museums, galleries, private collectors, and global brands seeking secure and transparent certification solutions.

At the center of the ecosystem will be a Certification Hub in the UAE, staffed by evaluators, art experts, and historians. The goal is to establish an international framework for authenticating and evaluating physical artworks on-chain, addressing long-standing issues such as forgery, provenance manipulation, and the illegal trafficking of art, artifacts, collectibles, and historical goods.

CEO Kamran Arki described the mission with clarity:

“The last market cycle proved one thing: narratives collapse when foundations are weak. PMT Chain was built for real-world value and long-term trust. Museums, collectors, and brands need transparency, security, and permanence. That is exactly what we engineered.”

Public Masterpiece revealed that PMT Chain has been built over seven years, with five years dedicated solely to research and development, a timeline that stands in sharp contrast to the rapid-launch culture of the blockchain sector.

COO Garen Mehrabian emphasized the broader responsibility behind the project:

“Web3 will not reach mass adoption if it feels like a casino. Builders have the responsibility to create systems people can trust and understand. We didn’t build PMT Chain to ride a wave. We built it to create an ecosystem that survives every wave.”

Public Masterpiece Keynote Presentation at the main Stage of the RWA BUILDERS SUMMIT 2025

Public Masterpiece Keynote Presentation at the main Stage of the RWA BUILDERS SUMMIT 2025

While art remains the cultural foundation, Public Masterpiece confirmed that PMT Chain is designed to scale beyond it, including real estate tokenization and broader RWA deployment. The network will also offer white-label tokenization and certification solutions, enabling institutions and companies to integrate blockchain infrastructure without building their own systems from scratch.

Perhaps most notably, Public Masterpiece confirmed that several governments are already in discussions regarding PMT Chain implementation. No names have been revealed, and the company has not announced a launch date. While the blockchain is reportedly ready, the founders have stated it will go live only when the timing is strategically optimal.

In a market where speculation has been punished and confidence is scarce, Public Masterpiece is betting that the next era of blockchain adoption will be defined by infrastructure, not hype.

About Public Masterpiece

Public Masterpiece is a real-world asset tokenization company building blockchain infrastructure designed to support tokenization, certification, and provenance for physical value across art and broader real-world asset markets.

Useful Links:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin Risks 40% Drop Despite Sentiment Lows

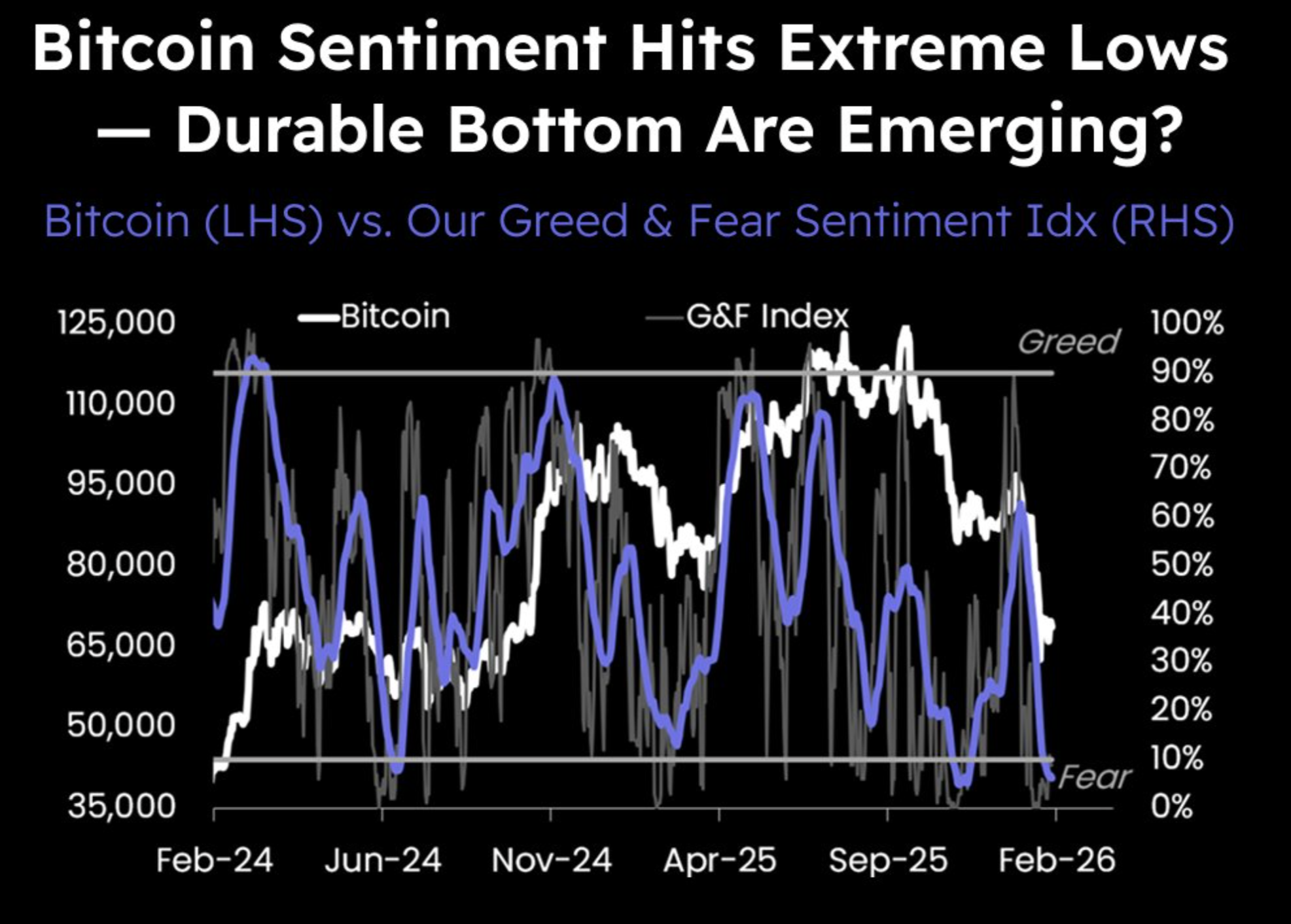

Crypto market sentiment has deteriorated sharply, with Matrixport’s Greed & Fear index falling to extremely depressed levels, suggesting the market may be approaching another inflection point.

Even so, Matrixport suggested that Bitcoin may still see downside ahead.

Sponsored

Sentiment Signals Possible Inflection Point For Bitcoin

In a recent market update, Matrixport said overall sentiment has dropped to extreme lows, reflecting broad-based pessimism across the digital asset space.

The firm highlighted its proprietary Bitcoin fear and greed gauge, explaining that “durable bottoms” have typically emerged when the 21-day moving average dips below zero and subsequently begins to turn upward. The setup appears to be in place, according to the chart.

“This transition signals that selling pressure is becoming exhausted and that market conditions are beginning to stabilize,” the post read.

The report added that, given the cyclical relationship between sentiment and Bitcoin price action, the latest extreme reading may indicate that the market is nearing another potential turning point.

At the same time, Matrixport warned that prices may continue to decline in the near term.

Sponsored

“While caution remains warranted, the current environment is increasingly forcing us to sharpen our focus and prepare for the conditions that typically precede a meaningful rebound,” the firm said.

On-Chain Indicators Signal Bear Market Stress

Meanwhile, technical indicators strengthen the picture of a stressed Bitcoin market. An analyst, Woominkyu, noted that the adjusted Spent Output Profit Ratio (aSOPR) has fallen back into the 0.92-0.94 range, a zone that previously coincided with major bear-market stress periods.

“In 2019 and 2023, similar readings occurred during deep corrective phases where coins were being spent at a loss. Each time, this zone represented capitulation pressure and structural reset,” the post read.

Sponsored

Historically, multiple cycle lows formed around the 0.92 to 0.93 region. The current structure, Woominkyu noted, resembles prior transitions into bear market phases rather than routine mid-cycle pullbacks.

If the metric fails to recover above 1.0 in the near term, it could increase the probability that Bitcoin is entering a broader bearish phase rather than undergoing a simple correction.

True market bottoms, the analyst argued, tend to form only after deeper compression in aSOPR, peak loss realization, and full exhaustion of selling pressure. While the market appears to be entering a stress zone, it may not yet reflect full capitulation.

“aSOPR is signaling structural deterioration. This looks less like a dip and more like a regime shift. The real bottom may still require deeper compression before a durable reversal forms,” the analyst added.

Sponsored

This view aligns with broader bearish projections suggesting Bitcoin could revisit levels below $40,000 before forming a durable bottom.

BeInCrypto Markets data shows Bitcoin is currently trading around $68,000. A drop below $40,000 would imply a decline of more than 40% from current levels, highlighting the scale of downside risk some analysts believe remains on the table.

For now, sentiment indicators hint at a potential turning point, but on-chain data suggests structural weakness may still need to run its course before a recovery can begin.

Crypto World

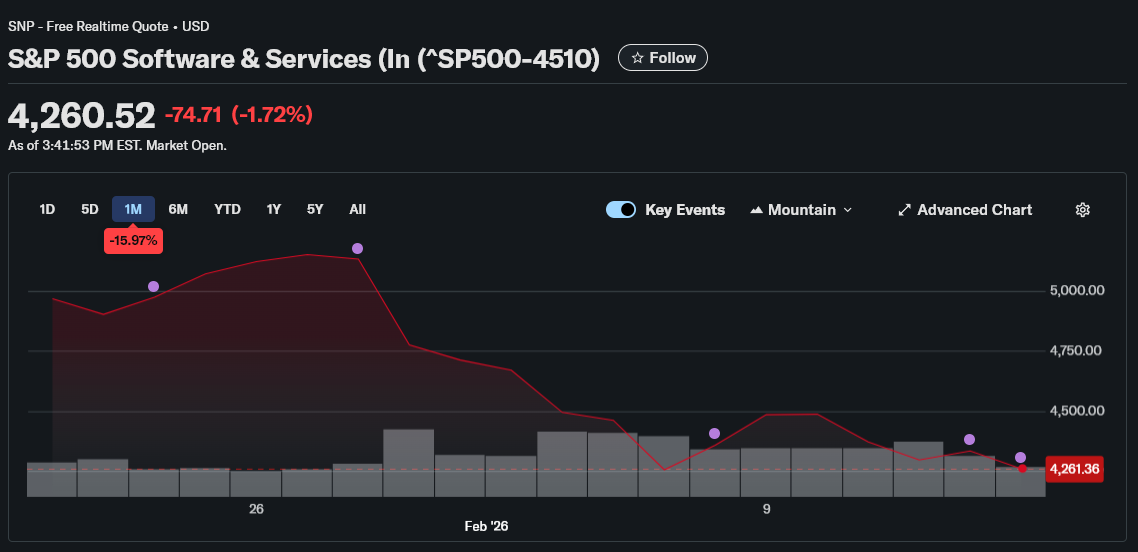

Should Crypto Markets Worry About the SaaSpocalypse?

The term “SaaSpocalypse” is trending across financial markets, tech media, and investor circles. It refers to a sudden loss of confidence in software-as-a-service (SaaS) companies after the launch of advanced AI agents capable of automating tasks traditionally handled by enterprise software.

The term became popular after Anthropic released its Claude Cowork AI platform in late January. Following its launch, nearly $300 billion in global software market value was erased. Stocks of major SaaS firms—including Salesforce, Workday, Atlassian, and ServiceNow—fell sharply as investors questioned whether AI agents could replace large parts of their business.

Sponsored

Sponsored

AI Agents Trigger Market Panic

The core fear driving the SaaSpocalypse is simple: AI agents can now perform entire workflows autonomously.

Tools like Claude Cowork can review contracts, analyze sales data, generate reports, and execute multi-step tasks across multiple applications.

Instead of employees using five separate SaaS tools, a single AI agent can complete the same work.

This directly threatens the SaaS pricing model, which typically charges companies per user or “seat.” If AI reduces the need for human users, companies may need fewer licenses. Investors reacted quickly to this risk.

The S&P 500 Software and Services Index fell nearly 19% in early February, marking its worst losing streak in years.

Sponsored

Sponsored

At the same time, capital rotated toward AI infrastructure providers such as Nvidia, Microsoft, and Amazon, which supply the compute power behind AI agents.

Why the SaaSpocalypse Matters Beyond Software

The SaaSpocalypse reflects a deeper shift in how software creates value. Instead of selling tools that humans operate, companies are beginning to sell outcomes delivered by AI.

Analysts now describe this as a transition from software-as-a-service to “AI-as-a-service.” This shift challenges decades-old business models and forces software companies to rethink pricing, licensing, and product strategy.

Sponsored

Sponsored

However, this is not necessarily the end of SaaS. Many enterprises will still rely on established platforms for security, compliance, and data management.

Instead, the disruption will likely reshape the industry, forcing software companies to integrate AI deeply into their products.

How the SaaSpocalypse Could Impact Crypto Markets

The SaaSpocalypse is already affecting crypto markets indirectly. Both crypto and SaaS are considered high-growth, risk-sensitive sectors.

Sponsored

Sponsored

When investors sell software stocks, they often reduce exposure to crypto as well. In early February 2026, Bitcoin fell sharply as software stocks also posted heavy losses.

More importantly, capital is shifting toward AI. Venture capital invested over $200 billion into AI startups in 2025—far more than crypto received.

This means fewer resources may flow into new crypto projects, slowing innovation in some areas.

At the same time, crypto could benefit in specific niches such as decentralized computing and AI infrastructure.

But overall, the SaaSpocalypse signals a major capital rotation. AI is becoming the dominant investment theme, and crypto markets will need to compete for investor attention in this new environment.

Crypto World

Strategy Doubles Down as Portfolio Hits Unrealized Loss

Nevertheless, the company continues to be in the red on its BTC position.

The world’s largest corporate holder of bitcoin has used the current market slump as an opportunity to increase its BTC portfolio at prices of under $70,000.

In its latest purchase, announced minutes ago, Strategy’s co-founder, Michael Saylor, said the firm accumulated 2,486 BTC for almost $170 million at an average price of $67,710 per unit. This puts the NASDAQ-listed company’s total bitcoin fortune at 717,131 BTC, bought at an average price of $76,027.

Strategy has acquired 2,486 BTC for ~$168.4 million at ~$67,710 per bitcoin. As of 2/16/2026, we hodl 717,131 $BTC acquired for ~$54.52 billion at ~$76,027 per bitcoin. $MSTR $STRC https://t.co/wvxRYZlQ3Y

— Michael Saylor (@saylor) February 17, 2026

The cryptocurrency market’s decline in the past several weeks has turned Strategy’s holdings into a losing position, even though the firm has repeatedly reassured that it has no plans to dispose of any of its BTC.

At a bitcoin price of $68,000 as of press time, Strategy’s holdings are now worth less than $49 billion. In other words, the firm stands in an unrealized loss of over $5 billion for the first time since the 2023 bear-market closure.

The company’s stock price experienced heightened broader market volatility over the past few weeks, falling from $140 to $120 last week before stabilizing at around $134.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech7 days ago

Tech7 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video1 day ago

Video1 day agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech20 hours ago

Tech20 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Video15 hours ago

Video15 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World15 hours ago

Crypto World15 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports21 hours ago

Sports21 hours agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World4 days ago

Crypto World4 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery