Crypto World

LINK ETFs hit 1.16% supply as inflows top $630k

LINK slips ~1% in 24h as ETFs absorb 1.16% supply on steady $630k inflows.

Summary

- LINK ETFs now hold 1.16% of circulating supply after ~$630k net inflows, signaling institutional accumulation and reduced exchange‑available liquidity.

- LINK trades near $19.1, up ~0.8% on the day but down ~5% week‑on‑week, with ~$627.6M in 24h volume as price consolidates below nearby resistance.

- On‑chain and ETF data show no weekly outflows, while DeFi oracle demand and CCIP integrations continue to expand Chainlink’s role in infrastructure.

Chainlink exchange-traded funds have accumulated holdings equivalent to 1.16% of the cryptocurrency’s total circulating supply, according to market data reported this week.

The ETFs registered net inflows of $630,000, bringing institutional holdings to the 1.16% threshold. The accumulation represents a shift toward long-term custody positions among institutional investors, according to market observers.

Chainlink’s price has remained in a relatively narrow trading range during the period, according to exchange data. The token’s consolidation occurs as the broader decentralized finance sector’s total value locked surpasses key milestones, according to industry tracking platforms.

Technical indicators including the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) show signs of momentum improvement, according to market analysis. The token faces potential resistance levels that could be tested in February if buying pressure increases, analysts stated.

The ETF products provide institutional investors with regulated exposure to Chainlink without direct exchange purchases, according to investment analysts. By holding tokens in custody rather than on exchanges, the funds reduce available supply for trading, creating potential scarcity effects, market participants noted.

Chainlink operates as a decentralized oracle network that provides external data to blockchain smart contracts. The project’s Cross-Chain Interoperability Protocol (CCIP) enables asset transfers between different blockchain networks, a feature that has attracted institutional attention, according to industry reports.

The DeFi sector’s expansion has increased demand for oracle services, as smart contracts require reliable external data feeds to function, according to blockchain analysts. Each new protocol integration expands the utility of oracle networks, industry observers stated.

The 1.16% supply threshold marks a notable milestone for institutional accumulation in the Chainlink ecosystem, according to market commentators. Continued weekly inflows could support price stability by reducing exchange-available supply, analysts noted.

Pension funds and other institutional investors have shown interest in cryptocurrency ETF products that offer liquidity and regulatory structure, according to investment industry sources. The products appeal to large investors seeking low-slippage entry points into digital assets, market participants stated.

Crypto World

BitGo and Figure Execute First Blockchain-Native Equity Trades on Figure’s Alternative Trading System

TLDR:

- BitGo Bank & Trust, N.A. serves as qualified custodian within Figure’s OPEN on-chain public equity network.

- Figure’s OPEN network launched in February 2026, enabling equity issuance and trading on Provenance Blockchain.

- The BitGo–Figure integration separates custody from execution, preserving counterparty risk protections for institutions.

- Real-time on-chain settlement reduces reconciliation layers, lowering operational costs for broker-dealers and asset managers.

Blockchain-native equity trading reached a new milestone as BitGo and Figure completed their first tokenized equity trades.

The trades were executed through Figure’s Alternative Trading System, operating on the Provenance Blockchain. BitGo Bank & Trust, N.A. served as the qualified custodian within Figure’s Onchain Public Equity Network.

The integration brings regulated custody and near real-time settlement to on-chain public equities, offering institutions a more efficient trading framework.

OPEN Network Brings Regulated On-Chain Equity Infrastructure to Market

Figure’s OPEN network launched in February 2026 as a regulated electronic trading venue. It enables companies to issue and trade equity directly on blockchain infrastructure.

Issuance, trading, and settlement are embedded into a single on-chain environment. This removes multiple intermediary layers that traditionally slow down public equity markets.

BitGo Bank & Trust, N.A. operates as a qualified custodian within the OPEN framework. The bank safeguards assets and provides regulated infrastructure for all participants.

Its custodian role ensures compliance with existing financial regulations for institutions. Consequently, regulated participants can access blockchain-native equity within a familiar oversight structure.

The completed trades demonstrate how tokenized equities can function in a continuous on-chain environment. Settlement activity occurs in real time within a regulated framework on Figure’s ATS.

Trade records are also published directly on-chain, adding a layer of market transparency. This approach removes several reconciliation steps found in traditional market infrastructure.

Mike Belshe, CEO of BitGo, spoke directly to the partnership’s broader purpose for market participants.

“At BitGo, our goal is to provide institutions the infrastructure and ability to trade, secure and build on anything on-chain. Our partnership with Figure moves the industry in that direction with BitGo operating as the independent trust layer to reduce risk, increase transparency and instill confidence in continuous markets.”

Custody Separation and Cost Efficiency Support Institutional Participation

BitGo and Figure maintain a clear separation between custody and trade execution throughout their integration. This preserves the counterparty risk protections that traditional market structure depends on.

Institutions can therefore engage with blockchain-native equity without compromising governance standards. The model mirrors core principles from conventional finance while running on blockchain rails.

By cutting reconciliation layers, the integration reduces operational overhead for market participants. Capital efficiency also improves compared to traditional batch-based settlement systems.

Broker-dealers and asset managers can use this as a repeatable integration model. As a result, on-chain equity products become more accessible to a broader range of regulated institutions.

Mike Cagney, Figure’s Executive Chairman, addressed how qualified custody makes institutional engagement more practical.

“Partnering with BitGo brings qualified custody and institutional-grade controls to the OPEN on-chain public equity network. With instant settlement on Provenance and the potential to meaningfully reduce market-structure friction and costs, this is a concrete step toward modernizing how public equities trade and settle.”

Together, BitGo and Figure have established a scalable framework for blockchain-native equity markets. The model combines blockchain efficiency with governance standards that institutions already recognize and trust.

Crypto World

Best Crypto Presale to Buy: Pepeto Outshines DeepSnitch AI and Bitcoin Hyper With 100X Tools at a Fraction of the Price

Three presales keep showing up in every crypto conversation this month. Pepeto, DeepSnitch AI, and Bitcoin Hyper. All three claim big returns. But most investors overlook the real question. It is not who raised the most. It is who built the most useful products at the cheapest entry point. And when you answer that honestly, one name pulls ahead by a wide margin.

Robinhood just launched its Ethereum Layer 2 blockchain and the public testnet handled 4 million transactions in seven days. According to Fortune, partners include Alchemy, LayerZero, and Chainlink. This tells you where crypto is heading in 2026. Infrastructure wins. Products win. Everything else is noise.

Best crypto presale: Pepeto builds what the meme economy actually needs

Think about what happens every time a new meme coin launches. Traders scramble to buy it. Then they realize they can’t swap it easily. They can’t bridge it across chains. They can’t verify if the project is legit. Pepeto (PEPETO) solves all three problems with tools that already work.

PepetoSwap lets you trade meme tokens instantly without waiting for centralized exchange listings. The cross chain bridge moves assets between blockchains so you are never stuck on the wrong network. And the upcoming exchange only accepts verified meme projects, filtering out rug pulls before they reach your wallet.

No other presale in 2026 offers this combination. Three tools working together as one ecosystem built specifically for the meme coin economy, which already sits at over $50 billion in total market cap. And the person behind it is a Pepe cofounder. Not an anonymous dev team. Someone who helped create one of the most successful meme coins in history and is now building the trading layer the entire sector needs.

Dual audits from SolidProof and Coinsult confirm clean contracts. Zero transaction tax means every dollar works for you. $7.2M raised during extreme market fear. And the entry price? $0.000000185. Thousands of times cheaper than either competitor. At that price, even a tiny fraction of SHIB’s $40 billion peak means returns that change everything. The 214% staking APY generates $10,700 a year on $5,000. But staking is just the bonus for holding. The real play is what this price becomes once the full ecosystem launches and volume flows in. 70% already filled.

DeepSnitch AI: Smart tools, but narrower scope

DeepSnitch AI raised $1.66M at $0.04064 with five AI agents that scan contracts and track sentiment. The utility is real. But think about the difference. DeepSnitch gives you information. Pepeto gives you the entire trading layer. Swap, bridge, and exchange under one roof. One helps you research. The other helps you research, trade, move assets, and avoid scams all in one place.

Then there is price. At $0.04064, DeepSnitch needs to reach $4.06 for a 100X. That requires a market cap north of $4 billion. Pepeto at $0.000000185 reaches 100X territory with a fraction of that valuation. According to The Motley Fool, billions in stablecoin capital sit on the sidelines. Entry price matters when that capital starts moving.

Bitcoin Hyper: Massive raise, limited upside left

Bitcoin Hyper raised over $31 million building a Bitcoin Layer 2 for faster transactions. The tech is solid. But $31 million already in means new buyers pay a premium. Analysts project 2X to 3X from here. Compare that to Pepeto’s three product ecosystem at $0.000000185 with a Pepe cofounder behind it. The risk reward gap speaks for itself.

The bottom line

Three presales. Only one has a three product ecosystem for the $50 billion meme market, a Pepe cofounder, dual audits, zero tax, and a price thousands of times cheaper. Pepeto is the best crypto presale to buy.

Click To Visit Official Website To Buy Pepeto: https://pepeto.io

FAQs

Why is Pepeto the best crypto presale over DeepSnitch AI and Bitcoin Hyper?

Pepeto offers three working tools (swap, bridge, exchange) for the meme economy, a Pepe cofounder, dual audits, zero tax, at $0.000000185. DeepSnitch focuses on analytics at a higher price. Bitcoin Hyper’s $31M raise limits new buyer upside. Pepeto’s utility, credibility, and entry price are unmatched.

Can I try Pepeto’s tools before buying?

After joining the presale at pepeto.io you can access the PepetoSwap demo and explore the ecosystem. The tools are functional, not concept renders.

How does Pepeto’s entry price compare to the others?

Pepeto: $0.000000185. DeepSnitch AI: $0.04064. Bitcoin Hyper: around $0.013. Pepeto’s price is thousands of times lower, meaning the same investment buys massively more upside potential when the ecosystem goes live.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Tokenized Real Estate Projects Advance in Dubai and the Maldives

Entities in Dubai and the archipelagic nation of the Maldives are moving forward with tokenized real estate development projects worth millions of dollars, combined.

On Friday, the Dubai Land Department announced that it would launch the second phase of a real estate tokenization pilot program. The move followed about $5 million worth of real estate in Dubai being tokenized, allowing the resale of about 7.8 million tokens.

The tokenization infrastructure partner for the pilot, called Ctrl Alt, which is also licensed as a Virtual Asset Service Provider in Dubai, will issue “Asset-Referenced Virtual Asset management tokens” to facilitate the transfer of the tokens on secondary markets.

According to Ctrl Alt, all onchain transactions for the real estate tokens will be recorded on the XRP Ledger and secured by Ripple Custody.

Related: Ripple CEO confirms White House meeting between crypto, banking reps

The Dubai Land Department predicted in May 2025 that the tokenization project could contribute about $16 billion by 2033, equivalent to 7% of the jurisdiction’s total property transactions.

Some experts have said Dubai’s real estate market and crypto-friendly regulatory environment have made the emirate stand out among other jurisdictions globally.

Trump-tied hotel deal in the Maldives is also looking to tokenize

Ctrl Alt’s announcement came a few days after real estate development company DarGlobal and World Liberty Financial, a crypto company backed by US President Donald Trump and his sons, announced plans to tokenize the development phase of a Trump-branded resort in the Maldives.

The tokenization deal will happen in partnership with financial technology company Securitize.

“We definitely see this as taking over the way other projects are being funded,” DarGlobal CEO Ziad El Chaar told Cointelegraph, adding:

“[Tokenization] will open the door to many more investors, who would like to take part in investing in real estate but don’t have access today.”

World Liberty announced the deal at a crypto-aligned event at Trump’s Mar-a-Lago property on Wednesday.

Attendees included traditional finance players like Goldman Sachs CEO David Solomon, crypto industry representatives including Coinbase CEO Brian Armstrong, and Senators Ashley Moody and Bernie Moreno.

Magazine: Here’s why crypto is moving to Dubai and Abu Dhabi

Crypto World

Fed Research Finds Kalshi Markets Outperform Wall Street Surveys

A new study found that Kalshi’s markets respond more quickly to economic shifts than traditional surveys.

Despite endless debates over where gambling ends and predicting begins, a new Federal Reserve Board paper finds that prediction markets often pick up shifts in expectations faster — and sometimes even more accurately — than traditional tools.

The study, published by the Federal Reserve on Wednesday, Feb. 18, focused on prediction market Kalshi, comparing it with more traditional survey and market-implied forecasts and examining how expectations respond to macroeconomic and financial news.

When compared to standard benchmarks, the paper found that “Kalshi’s forecasts for the federal funds rate and CPI provide statistically significant improvements over fed funds futures and professional forecasters.” The authors also note that for inflation, Kalshi’s numbers often beat the consensus survey forecasts.

“The mode of the Kalshi distribution, for example, has perfectly matched the realized federal funds rate by the day of each meeting since 2022, a feat not achieved by either surveys or futures,” the paper says.

In tougher economic scenarios, Kalshi puts “far more weight on extreme inflation and weak growth than surveys,” the researchers add, suggesting that prediction markets are more sensitive to risks such as recession or runaway inflation.

The paper flags that Kalshi’s retail investor base “may alter its risk-premia properties,” but concludes that prediction markets are best seen as a supplement, not a replacement.

As The Defiant reported earlier, daily trading volume across Polymarket and Kalshi hit $400 million for the first time earlier in February, with sports and political markets drawing nearly all the liquidity.

According to data from Artemis, open interest across platforms, Polymarket, Kalshi, Limitless, Opinion, and others, jumped above $1.1 billion for the first time on Feb. 7, setting a new all-time high.

Crypto World

4-Hour Triangle Compression Signals Imminent Breakout

After the aggressive sell-off toward the $1.8K region, the market has transitioned into choppy consolidation, while lower timeframes are now approaching a decisive breakout point. The key question is whether this compression resolves to the upside or results in continuation within the dominant downtrend structure.

Ethereum Price Analysis: The Daily Chart

On the daily timeframe, ETH continues to trade inside a descending channel, with the midline acting as dynamic resistance and the $1.8K region serving as a firm structural base. Following the aggressive sell-off, the price action has turned increasingly choppy, printing overlapping candles and minor retracements rather than impulsive continuation. This behavior signals equilibrium and indecision.

The consolidation remains confined between the channel’s mid-boundary above and the $1.8K demand zone below. Each attempt to push higher has been capped before reclaiming a meaningful resistance cluster, while sellers have failed to generate a decisive breakdown beneath the base. Until one of these boundaries is violated, the dominant expectation is continued range-bound fluctuation.

A confirmed breakout above the midline would open the path toward the next resistance zone around the $2.3K–$2.5K region. Conversely, losing $1.8K would invalidate the equilibrium and likely trigger another bearish impulse.

ETH/USDT 4-Hour Chart

On the 4-hour timeframe, the price compression is more evident. ETH has formed a clear triangle pattern, defined by descending resistance and rising support. The structure reflects volatility contraction and is now approaching its apex, suggesting that a breakout is imminent.

The recent higher lows inside the pattern indicate improving short-term demand, increasing the probability of an upside resolution. However, as long as ETH remains capped below the 0.5 Fib at $2,396, the structure remains technically corrective within a broader downtrend.

A confirmed breakout above the triangle, followed by a reclaim of $2,396, would shift short-term momentum toward the 0.618 level at $2,549 and potentially the 0.702–0.786 retracement cluster near $2,658–$2,767, which also coincides with a marked supply zone on the chart.

On the downside, failure to break upward and a decisive loss of the triangle’s ascending support would expose the $1,800–$1,746 base once again. In that scenario, the recent consolidation would resolve as a continuation pattern rather than a reversal attempt.

At this stage, ETH is at a technical inflection point, with Fibonacci resistance levels clearly defining the upside targets and the $1.8K base anchoring the downside risk.

Sentiment Analysis

The Taker Buy/Sell Ratio across all exchanges provides additional context for the current equilibrium. The ratio has remained below the 1.0 threshold for a prolonged period, indicating that aggressive market sells have dominated overall order flow. This aligns with the broader bearish structure observed on higher timeframes.

However, the recent rebound in the ratio and the stabilization of its 30-day EMA suggest that selling pressure may be weakening. Although buyers have not yet taken full control, the gradual recovery toward the neutral level signals improving demand. If the ratio decisively moves above 1.0 and sustains that level, it would confirm aggressive market buying and increase the probability of an upside breakout from the triangle structure.

Overall, Ethereum is positioned at a technical and derivatives inflection point. The daily chart reflects equilibrium, the 4-hour chart shows imminent compression resolution, and order-flow metrics suggest that bearish dominance is softening. A decisive break from the current structure will likely define the next impulsive phase.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Custodia CEO Caitlin Long Says Trump Family Crypto Ties Are Blocking the CLARITY Act in the Senate

TLDR:

- Custodia CEO Caitlin Long called Trump family crypto ties the “big showstopper” blocking the CLARITY Act in the Senate.

- Long described the bill’s Senate passage as a “coin flip,” with seven Democratic votes still needed to reach cloture.

- Trump-linked projects like World Liberty Financial have made securing bipartisan Senate support significantly more difficult.

- Long warned that without legislation, crypto regulations remain vulnerable to reversal by any future incoming administration.

Custodia Bank CEO Caitlin Long has identified Trump family crypto ties as a central obstacle to the CLARITY Act’s Senate passage.

Speaking at ETH Denver on Wednesday, Long said meme coins and ventures linked to President Donald Trump have eroded bipartisan support for the bill.

She described its chances as a “coin flip.” The legislation passed the House in July 2025 but remains stalled in the Senate over ethics concerns and stablecoin disputes.

Long Points to Trump-Linked Crypto as the “Big Showstopper”

Long did not hold back when asked about the bill’s Senate difficulties. She called the Trump family’s involvement in crypto “the big showstopper in the CLARITY Act.”

Projects like World Liberty Financial and Trump-associated meme coins have drawn sharp Democratic opposition. That opposition has made the 60-vote cloture threshold increasingly difficult to reach.

Senator Elizabeth Warren has been among the most outspoken critics of Trump’s crypto activities. Long noted that even Senator Cynthia Lummis, a leading crypto advocate, admitted the controversy has complicated her efforts. “It created controversy,” Long told Decrypt.

“Lummis herself has said it made her job harder.” The ethics dimension has shifted the debate away from policy and toward politics.

Seven Democratic votes are needed to advance the bill past the Senate cloture threshold. So far, that number has proven hard to secure. Long acknowledged that an agreement satisfying both Congress and the White House remains possible.

“There is a possibility they reach an agreement on something the White House can live with, and Congress is comfortable with,” she said, “but they’ve got to be able to get the cloture vote.”

Meanwhile, negotiations are still active. White House officials, lenders, and the Crypto Council for Innovation met on Thursday to discuss stablecoin reward provisions.

That issue has emerged as another major sticking point alongside the ethics controversy. Both problems must be resolved for the bill to move forward.

Long Warns Against Relying on Rulemaking Over Legislation

Beyond the political obstacles, Long raised a broader concern about regulatory durability. She warned that rules established through agency rulemaking carry no permanent weight.

“When a new administration comes in, those rules can be reversed through new rule-making,” she said. A statutory framework, by contrast, requires a much harder process to undo.

Passing the CLARITY Act would lock in a regulatory structure that is far more resistant to political change. “If Congress puts it in statute, it doesn’t mean it can’t be changed,” Long said.

“It’s just a lot harder to change.” That durability is precisely why she believes congressional action matters more than regulatory guidance alone.

Long also addressed the current market downturn with measured perspective. She noted that a 50% drawdown is familiar to anyone who has been in crypto for years. “Those of us who’ve been around for a long time, a 50% drawdown is nothing,” she said.

Bear markets, she added, are an opportunity to build knowledge, with her consistent advice remaining the same: “Bear markets are the best time to get self-educated.”

Crypto World

Move Over M2: Data Shows Treasury T-Bill Issuance Drives Bitcoin Price Cycles

TLDR:

- Treasury T-bill issuance holds a +0.80 correlation with Bitcoin price over the last four years of data.

- M2 money supply has decoupled from Bitcoin, making it an unreliable indicator for forecasting price direction.

- The Fed balance sheet scores a near-zero correlation of -0.07 with Bitcoin, removing it as a credible signal.

- T-bill issuance peaked in late 2024, and Bitcoin has shown renewed weakness as early 2026 issuance declines.

T-bill issuance is gaining recognition as Bitcoin’s most reliable macro indicator, pushing aside long-favored metrics like M2 money supply.

A crypto analyst recently shared data pointing to a +0.80 correlation between Treasury T-bill issuance and Bitcoin over four years.

That figure towers above what M2 and the Federal Reserve balance sheet have managed to produce. With Bitcoin last trading around $67,721, the conversation around macro signals is shifting in a clear direction.

Why M2 and the Fed Balance Sheet No Longer Tell the Full Story

T-bill issuance is stepping into the spotlight as M2 money supply loses its grip as a Bitcoin forecasting tool. Crypto analyst Axel Bitblaze posted on X that Bitcoin has already decoupled from M2 in observable stretches.

During those periods, M2 stayed flat or moved higher, yet Bitcoin did not respond accordingly.

The Federal Reserve balance sheet has also struggled to track Bitcoin’s price behavior with any consistency. Bitblaze recorded the correlation between the Fed balance sheet and Bitcoin at just -0.07. That number effectively removes it from serious consideration as a directional signal.

T-bill issuance, however, has held a +0.80 correlation with Bitcoin across the same four-year period. For a notoriously volatile asset like Bitcoin, that reading carries real weight.

Analysts are now paying closer attention to how Treasury market activity channels liquidity into broader risk appetite.

The Four-Year Timeline That Makes T-Bill Issuance Hard to Ignore

The case for T-bill issuance as a Bitcoin signal is built on a timeline that stretches back to late 2021. Bitblaze noted that issuance peaked around that time, and Bitcoin soon followed with its own cycle top.

When issuance began falling through 2022, Bitcoin crashed in the months that came after.

The connection held again in mid-2023, when T-bill issuance bottomed out alongside Bitcoin’s price floor. From that low point, both began climbing in tandem, with Bitcoin trailing the issuance trend by a visible lag.

Through 2024 and into 2025, rising issuance continued to pull Bitcoin higher with that same delayed rhythm.

Then in late 2024, T-bill issuance peaked once more. As early 2026 arrived, issuance started declining, and Bitcoin’s price weakened in step.

Bitblaze summed it up directly: “When the blue line goes up, BTC follows with a delay. When it rolls over, BTC struggles.” The four-year record now has traders watching Treasury issuance schedules as closely as any on-chain metric.

Crypto World

CZ Returns to US for Trump-Backed Crypto Event

The event hosted at Mar-a-Lago blended politics and digital assets, signaling deeper ties between industry and power brokers.

Former Binance CEO Changpeng Zhao (CZ) returned to the United States this week for the first time since his release from a California federal prison in 2024.

The visit took place at Mar-a-Lago in Palm Beach, Florida, where Zhao attended a 500-person convention hosted by the Trump family-backed World Liberty Financial.

CZ Makes Appearance at Crypto Event

A Wall Street Journal (WSJ) report revealed that the gathering brought together prominent figures from finance, technology, and entertainment.

Guests included Goldman Sachs CEO David Solomon, New York Stock Exchange president Lynn Martin, “Shark Tank” personality Kevin O’Leary, and Coinbase founder Brian Armstrong, who had also attended a smaller VIP dinner on Tuesday evening alongside Trump’s sons and CZ. Rapper Nicki Minaj, who has publicly supported the Trump administration, also held a “fireside chat” on that day.

Posting on X during the occasion, Zhao shared a photo of himself listening to a top federal crypto regulator, writing, “Learned a lot.”

CZ, whose crypto exchange has been barred from operating in the U.S. since 2023 for violating anti-money-laundering rules, pleaded guilty to a related charge that same year. He was then sentenced in April 2024 to four months in prison and officially released in late September after serving his term.

Later in October 2025, the crypto entrepreneur received a presidential pardon from President Donald Trump. During a recent interview on the “All-In” podcast, Zhao said he “didn’t do anything” to secure the clemency but noted that it could help the exchange resume its efforts to return to the American market.

You may also like:

World Liberty Unveils Ambitious Crypto Vision

World Liberty’s leadership used the occasion to lay out its vision for the cryptocurrency industry. CEO Zach Witkoff described the company’s goal as creating a “new digital Bretton Woods system,” referencing the 1944 conference that established a post-war economic order.

His co-founders, the Trump sons, talked about the scale of the event, with Donald Trump Jr. joking about how much it would have been unimaginable a year ago. Meanwhile, Eric Trump compared it to the World Economic Forum in Davos, Switzerland, saying it offered “better hospitality, better food, better weather, better group of people, less wokeness.”

The firm also promoted its stablecoin, USD1, and outlined plans to sell digital tokens that would give accredited investors a share of loan revenues from a Trump resort under development in the Maldives.

The president’s sons also addressed questions about foreign investment in World Liberty, including a $500 million deal with a senior Abu Dhabi royal, stressing that such moves are standard in global finance and unrelated to government agreements.

Several other Trump administration officials were also in attendance, including Commodity Futures Trading Commission (CFTC) Chairman Michael Selig and Under Secretary of State for Economic Affairs Jacob Helberg.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

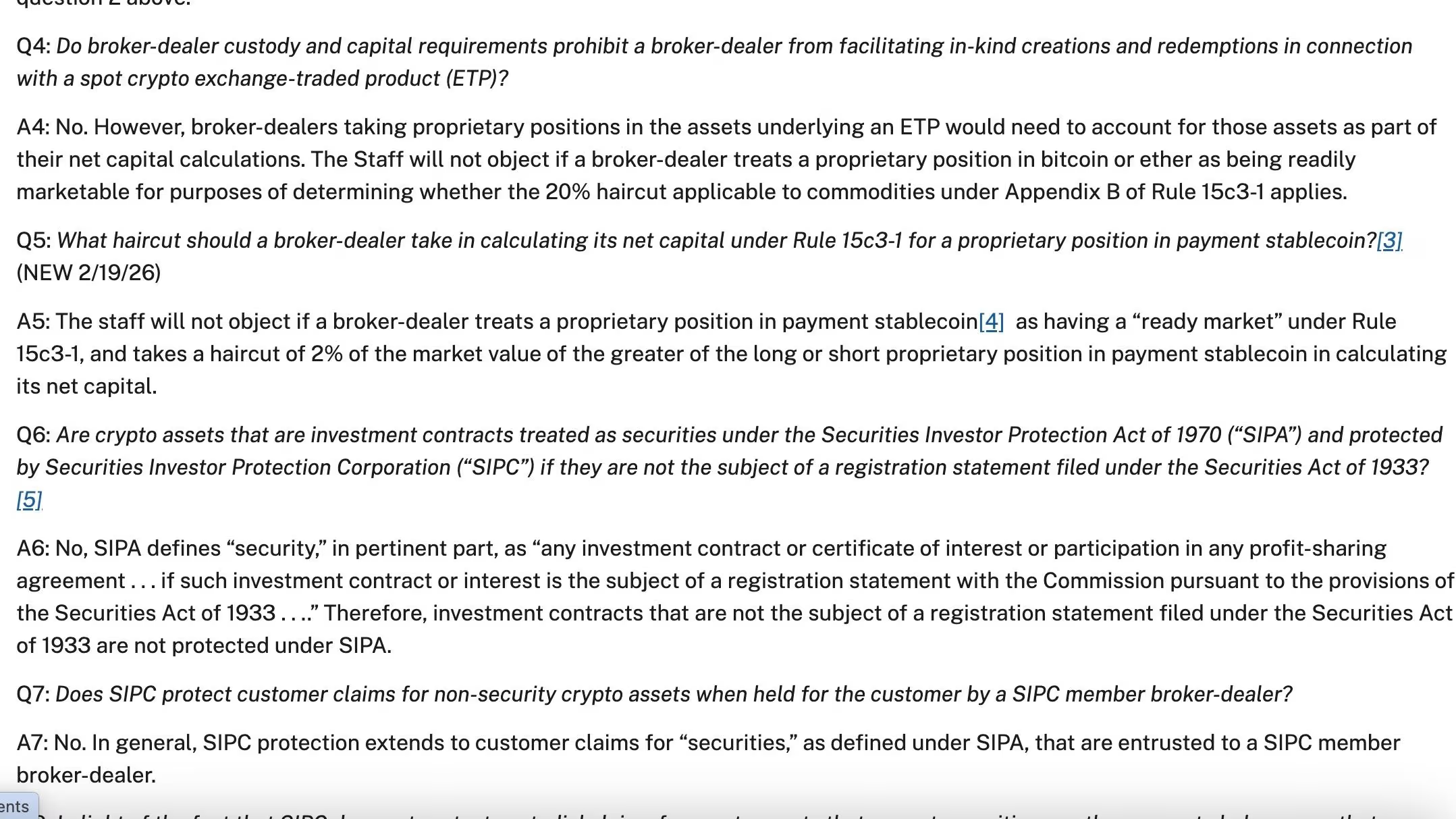

SEC makes quiet shift to brokers’ stablecoin holdings that may pack big results

Broker-dealers regulated by the U.S. Securities and Exchange Commission (SEC) can treat their stablecoin holdings as regulatory capital, according to a tweak this week to a frequently-asked-questions document maintained by the agency.

That’s a seismic shift offered in the form of a minor addition to the SEC’s “Broker Dealer Financial Responsibilities” FAQ. It’s on-brand for a regulator that has made a steady series of changes to its crypto approach through informal guidance, industry correspondence and staff statements ever since its Crypto Task Force began work during the administration of President Donald Trump.

In this case, a new question No. 5 was added about what kind of “haircut” a firm should take on its holdings of stablecoins — the dollar-tied tokens such as Circle’s USDC and Tether’s USDT. The answer was 2%, meaning that instead of the previous understanding that such assets were not considered measurable against a broker-dealer’s capital tally (100% haircut), the firms will be able to count 98% of those holdings.

“While this guidance does not create new rules, it helps reduce uncertainty for firms seeking to operate compliantly under current securities laws,” said Cody Carbone, CEO of the Digital Chamber.

This puts stablecoins on the same footing as other financial products.

“That means stablecoins are now treated like money market funds on a firm’s balance sheet,” Tonya Evans, a former professor who now runs a crypto education business and is on the board of directors at Digital Currency Group, wrote in a post on social media site X. “Until today, some broker-dealers were zeroing out stablecoin holdings in their capital calculations. Holding them was a financial penalty. That’s over.”

Before, the more stringent SEC limits meant those companies — firms registered with the SEC to handle customers’ securities transactions and also trade in securities on their own behalf — weren’t easily able to custody tokenized securities or act as a go-between for trading. Now the firms that follow this steer from the agency will be able to more easily provide liquidity, aid settlement and advance tokenized finance.

“Everywhere from Robinhood to Goldman Sachs run on these calculations,” Larry Florio, deputy general counsel at Ethena Labs, wrote in an explainer posted on LinkedIn. Stablecoins are now working capital, he said.

SEC Commissioner Hester Peirce runs the agency’s task force and issued a statement on the change, contending that using stablecoins “will make it feasible for broker-dealers to engage in a broader range of business activities relating to tokenized securities and other crypto assets.” And she said she wants to consider how the existing SEC rules “could be amended to account for payment stablecoins.”

That’s the drawback of informal staff policies — they’re as easy to reverse as they were to issue, and they don’t carry the weight (and legal protections) of a rule.

The SEC has been working on some crypto rules in recent months, but they haven’t yet been produced, and the process usually takes several months — sometimes years. Even a formal rule can still be reversed by a new leadership at the agency, which is why crypto advocates are pushing for more legislation from Congress that would set the government’s digital assets approach into law, such as last year’s Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act.

UPDATE (February 20, 2026, 22:23 UTC): Adds comment from Digital Chamber CEO.

Crypto World

Is PUNCH token the new Moo Deng?

A macaque monkey called Punch that’s emotionally attached to his IKEA plushie has spurred on a memecoin run reminiscent of Moo Deng’s fame after he was bullied by the rest of its housemates at a Japanese zoo.

The Punch token (PUNCH) was launched on February 6 as memes and stories around the monkey began to circulate.

Punch was born at the Ichikawa City Zoo, where he was rejected by his mother during a heat wave and raised by the zoo staff. He was reintroduced to his group of monkeys but has struggled to become accepted ever since.

The little guy has been chased and harassed by the other monkeys, but what’s caught everyone’s attention is the comfort he’s found with an IKEA monkey plushie.

This virality has led to PUNCH’s trading volume rising to $46 million and the price of the token shooting up 12,777% across the week to $0.031.

A lot of memecoin traders have felt that there hasn’t been a good “runner” in some time. This is a type of token that gains significant attention and increases in price.

Read more: Paul brothers business partner claims ‘0% rug pull risk’ with new memecoin

When a penguin from Werner Herzog’s 2007 documentary “Encounters at the End of the World” became viral earlier this year, a token themed around that penguin attracted $500 million in trading volume and hit a market cap high of $153 million.

Another successful runner similar to Punch was the launch of the Moo Deng token back in 2024, a token based on a viral baby hippo that was filmed biting its carers. The Moo Deng token reached a market cap of over $600 million.

Both tokens, however, are down over 90% since their all-time highs, like most memecoins.

PUNCH token shows signs of market manipulation

Popular crypto trader The White Whale issued a warning about the Punch token, suggesting that it’s showing signs of “market manipulation” and that the sheer volume of liquidity the token attracted suggests that it’s not organic.

They said, “The project and project dev is most likely not behind the things I’m warning about here. The project may or may not be a good project. But this is cabal action. Plain and simple.”

It’s not just crypto traders who have jumped on the monetary potential of a viral monkey, as users have already suggested buying up the plushie monkey from their local IKEAs and selling them on at an inflated price.

Read more: What are TikTok coins?

Scalpers or not, IKEA has recorded an increase in sales of the plushie thanks to Punch’s fame.

The zoo itself is also experiencing a surge of visitors who have come just to see Punch the monkey.

Punch has even caught the eyes of Justin Sun, the billionaire founder of Tron, who donated $100,000 to the zoo housing Punch via his exchange HTX.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video23 hours ago

Video23 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Fashion6 hours ago

Fashion6 hours agoWeekend Open Thread: Boden – Corporette.com

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World1 day ago

Crypto World1 day ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market