Crypto World

Looking for the Best White-Label Tokenization Providers? A Deep Dive

As global capital markets evolve, asset owners and financial institutions are increasingly leveraging blockchain technology to digitize real-world assets (RWAs) such as real estate, private equity, commodities, and debt instruments. Real-world asset tokenization promises enhanced liquidity, fractional ownership, borderless investing, and transparency. But behind these benefits is a complex technical and regulatory ecosystem that enterprises must navigate to unlock sustainable value.

This has given rise to a new category of technology companies — white-label tokenization development company and enterprise tokenization solutions providers — that deliver fully customizable, secure, and compliance-ready infrastructure for token issuance, investor onboarding, secondary trading, and asset lifecycle management. As we enter 2026, these platforms are no longer experimental tech; they are institutional-grade frameworks powering mainstream adoption.

Before identifying the current leaders in the tokenization industry, it’s important to recognize the infrastructure issues that have created a demand for these solutions.

The Infrastructure Gap in RWA Tokenization

The tokenization of real-world assets is becoming increasingly popular. However, it has not yet been adopted at scale due to a variety of operational and regulatory challenges. Despite the immense opportunity in the market, many companies launching or exploring tokenized asset solutions do not understand just how complex the process will be to launch a compliant and real-world asset tokenization platform. Transitioning from a conceptual pilot project to a full-production, institutional-grade implementation requires many more assets and resources (beyond just creating smart contracts); this includes building a comprehensive compliance framework, providing secure custody integration, and implementing a liquidity-ready framework.

Overcoming Key Infrastructure Gaps

1) Fragmentation in Regulations Across Jurisdictions

Various countries have differing laws regarding the regulation of securities, licensing guidelines, eligibility of investors and anti-money-laundering and ‘know your customer’ (AML/KYC) regulations. Enterprises wishing to issue tokens on a cross-border basis will have to comply with multiple regulatory schemes simultaneously, thereby increasing both their legal risk and the operational burden placed on them.

2) Lack of Integrated Liquidity Mechanisms

Issuing tokens without a compliant structure for secondary trading reduces investor access to those tokens and potentially limits the liquidity of the tokenized asset. Without a structured marketplace (i.e., an exchange) with automated transfer controls, the tokenized asset won’t achieve sufficient liquidity.

3) Significant In-House Development Costs

Building smart contracts, dashboards for investors, compliance engines, wallet integrations, and reporting systems from scratch typically takes a considerable amount of time and expertise in blockchain engineering.

4) Security and Audit Risks

Poorly designed contracts, insufficient audits of the smart contracts, and unsafe custody of tokens all pose significant risk to the issuer, both with respect to financial exposure and reputational impact—this is especially true when high-value assets are being tokenized.

5) Cross-border operational complexity

Data privacy compliance, tax reporting standards, custody licensing requirements, and jurisdictional transfer restrictions create layered complexity for global scaling.

Transform Real-World Assets into Scalable Digital Opportunities with the Experts

How White-Label Models Address These Gaps

In order to eliminate the obstacles to adopting on a large scale, enterprises will work with white-label tokenization development companies that provide an existing product with the required technology and have experience in developing similar tokens. These types of models allow companies the ability to use a single system that is already compliant and meets the requirements mentioned before (i.e., regulatory, technical, liquidity, & security). By using this approach instead of trying to put together different systems, there are now complete end-to-end enterprise tokenization solutions and will meet the requirement for scalability and will be able to be deployed in an environment where institutions are usually located.

1. Embedding Compliance at the Core

Regulatory uncertainty is one of the biggest deterrents in RWA tokenization. White-label models reduce this risk by integrating compliance mechanisms directly into the token architecture.

They typically include:

- Automated AML/KYC verification modules

- Investor accreditation validation workflows

- On-chain transfer restrictions aligned with securities laws

- Role-based access controls for regulated asset distribution

- Audit-ready transaction and reporting systems

By embedding compliance logic into smart contracts themselves, real-world asset tokenization platforms ensure that tokens cannot be transferred or traded outside predefined regulatory parameters. This transforms compliance from a manual oversight process into a programmable safeguard.

2. Accelerating Time-to-Market

Building infrastructure from scratch can take 12–24 months and require extensive blockchain engineering resources. White-label providers dramatically compress this timeline.

Key acceleration factors include:

- Pre-audited smart contract templates

- Configurable asset tokenization frameworks

- Ready-to-deploy investor dashboards

- Integrated wallet and custody solutions

- API-driven backend integrations

This allows enterprises to launch tokenized offerings within weeks or months, capturing early-mover advantage in competitive markets. For institutions evaluating RWA infrastructure providers 2026, speed combined with reliability has become a defining metric.

3. Enabling Liquidity and Secondary Market Readiness

Liquidity is essential for investor confidence. White-label tokenization models integrate trading-enablement features directly into the infrastructure.

These often include:

- Built-in secondary marketplace modules

- Automated compliance checks during transfers

- Custodian and broker integrations

- Settlement automation

- Cap table and ownership tracking tools

By solving the liquidity bottleneck, white-label platforms transform tokenized assets from static digital representations into dynamic, tradable financial instruments.

4. Reducing Technical and Operational Risk

In-house blockchain development introduces significant risk, particularly around smart contract security and system scalability. A professional white-label tokenization Development Company mitigates these risks through:

- Third-party audited smart contracts

- Multi-signature custody frameworks

- Hardware security integrations

- Continuous monitoring systems

- Scalable cloud-native architecture

This enterprise-grade security posture is critical for institutional adoption, where asset values can run into millions or billions.

5. Supporting Multi-Asset and Multi-Jurisdiction Scalability

Modern enterprises require flexibility across asset classes and geographic markets. White-label infrastructure is designed to support:

- Real estate tokenization

- Equity and debt instruments

- Funds and structured products

- Commodities and alternative assets

Additionally, these platforms accommodate jurisdiction-specific compliance configurations, enabling global expansion without rebuilding the system for each new market.

6. Preserving Brand Identity with Backend Strength

White-label solutions allow enterprises to retain full ownership of their user experience while leveraging powerful backend technology.

This includes:

- Fully customizable investor portals

- White-labeled dashboards and interfaces

- CRM and ERP integration

- Multi-language and multi-currency capabilities

As a result, organizations can deploy robust enterprise tokenization solutions under their own brand without exposing third-party infrastructure.

Leading White-Label Tokenization Providers in 2026

The competitive landscape among RWA infrastructure providers 2026 is defined by scalability, compliance depth, multi-asset capability, and enterprise adaptability. Below are the platforms shaping this market.

1. Antier

Antier is widely recognized as a full-stack white-label tokenization Development Company delivering comprehensive enterprise tokenization solutions across asset classes.

Core Capabilities:

- Multi-asset tokenization (real estate, equity, debt, commodities, funds)

- Regulatory-aligned smart contract frameworks

- Built-in secondary marketplace modules

- Cross-chain interoperability

- Institutional-grade security infrastructure

What Sets Antier Apart:

Antier offers end-to-end lifecycle management — from asset structuring and token issuance to investor onboarding, compliance automation, and secondary trading. Its modular architecture enables enterprises to deploy scalable ecosystems rather than standalone issuance tools.

The company’s expertise in blockchain engineering ensures flexibility across jurisdictions, making it a strategic partner for institutions targeting global markets.

2. Brickken

Brickken positions itself as a streamlined solution for asset digitization and marketplace deployment.

Key Strengths:

- Structured token issuance workflows

- Investor onboarding and compliance automation

- Integrated dashboard for asset performance tracking

- Marketplace-ready trading modules

Platform Focus:

Brickken emphasizes operational simplicity, enabling asset owners to tokenize and manage assets without extensive technical intervention. Its integrated marketplace layer enhances liquidity readiness, making it suitable for asset managers seeking structured deployment.

3. Kalp Studio

Kalp Studio offers a customizable toolkit designed for enterprises requiring adaptable infrastructure.

Core Features:

- Developer-friendly APIs and SDKs

- Multi-chain compatibility

- Modular smart contract templates

- Integration with existing fintech ecosystems

Market Position:

Kalp Studio appeals to organizations seeking flexibility and customization. Its architecture allows enterprises to integrate tokenization into broader fintech stacks without rebuilding entire systems.

4. Tokeny

Tokeny is known for its strong compliance-first approach, particularly in regulated digital securities markets.

Platform Highlights:

- ERC-3643-based token standards

- Protocol-level compliance enforcement

- Rights and restrictions management

- Institutional transfer controls

Strategic Strength:

Tokeny’s specialization in regulated securities infrastructure makes it particularly relevant for financial institutions prioritizing legal certainty and regulatory precision.

5. Blocktunix

Blocktunix focuses on vertical specialization, particularly in real estate tokenization.

Key Offerings:

- Fractional property ownership modules

- Investor KYC/AML onboarding systems

- Smart contract–based ownership tracking

- Real estate marketplace integration

Ideal Use Cases:

Blocktunix is suitable for property developers and real estate investment firms seeking streamlined fractionalization platforms.

Strategic Takeaways and Choosing the Right Partner

By the end of 2026, tokenization will have become a commercial reality, and companies have moved from having proof-of-concept projects to creating an infrastructure that is robust, secure and compliant enough to support institutional investors and scale globally.

Top-tier white-label tokenization providers are addressing the most significant challenges in the RWA ecosystem, including regulatory fragmentation, liquidity challenges, security risks and complexity across different jurisdictions. These platforms are designed to allow companies to launch, manage, and scale tokenized products faster and with less risk, enabling enterprise-level functionality.

Of these innovative providers, Antier is an ideal strategic partner for companies that want comprehensive white-label tokenization development services and an end-to-end solution for enterprise tokenization. Antier has a modular architecture, in-depth compliance integration capabilities and a proven track record with multiple asset classes, making it easier for forward-thinking companies to realize the full benefits of their real-world asset tokenization platform without having to go through extensive internal development.

Crypto World

The Market Is Terrified, Institutions Aren’t. Analyzing the ‘Extreme Fear’ Floor

Retail traders are dumping Bitcoin in panic mode right now. Fear is everywhere. The Fear and Greed Index is stuck at 12. That is extreme.

However, perpetual futures volume is actually spiking. That kind of divergence does not show up for no reason.

The market has wiped out nearly $800 billion in a month. Brutal. But the real question is this. Is smart money quietly positioning before the next major move.

Because when fear is loud and volume rises at the same time, something is about to break.

Key Takeaways

- JPMorgan maintains a bullish 2026 outlook despite the total market cap falling from $3.1T to $2.3T.

- The Crypto Fear & Greed Index is pinned at 12 (“Extreme Fear”), levels historically associated with bottom formation.

- Bitcoin is trading at $67,610, significantly below its estimated production cost of $77,000.

- Whale activity in perpetual markets suggests complex institutional hedging is dominant over spot selling.

Is This Institutional Hedging or Strategic Accumulation?

So let’s pause for a second.

Who is buying when the market feels this terrified? Bitcoin price is around $67,610 and Ether near $1,950, both down heavily this month.

Spot charts look rough and retail is clearly panicking. Yet, Perpetual futures volume is climbing fast, which usually signals sophisticated players stepping in with structured positions, not emotional longs.

This isn’t what speculative euphoria looks like. When retail piles in, funding spikes positive. Instead, BTC funding is nearly flat and ETH funding is negative.

There are only two real explanations here: institutional hedging… or strategic positioning ahead of a larger move.

Will Bitcoin Price $50K Floor Hold?

The charts look terrible right now, no doubt about it. However, fundamentals wise it might leaning bullish good long term.

JPMorgan estimates Bitcoin’s production cost sits around $77,000. BTC is trading well below that.

Historically, when price drops under production cost, it does not stay there long. Miners either shut off machines or pressure builds for a rebound.

Still, the downside risk is not gone. Chief equity strategist John Blank warned Bitcoin could slide to $40,000 within 6 to 8 months.

That would be a full blown capitulation scenario. All Traders are now locked on $60,000 as the key support to watchout for.

The post The Market Is Terrified, Institutions Aren’t. Analyzing the ‘Extreme Fear’ Floor appeared first on Cryptonews.

Crypto World

Stacks price retests $0.28: can STX go higher?

- Stacks price surged by 5% to test resistance near $0.28.

- Gains follow Bitcoin’s uptick to $67,500.

- STX could still dip to recent lows if the Bitcoin price falls to new lows.

Stacks’ STX token edged higher on the day as Bitcoin held above the $67,500 level following a roughly 2% intraday move.

Despite the modest gain, the Bitcoin layer-2 network’s native token continues to trade in volatile conditions, reflecting uncertainty across the broader cryptocurrency market.

A sustained pickup in momentum could lift STX toward levels last seen in May 2025.

However, ongoing market turbulence and expectations of further downside risk for Bitcoin suggest Stacks may remain under pressure.

Analysts point to $0.24 as a key support level that bulls will need to defend to prevent a deeper pullback.

Stacks price today

STX posted modest daily gains on February 12, 2026, trading around $0.27 at the time of writing with a 5% uptick.

But buyers are hovering at these levels after hitting resistance around $.028, a level reached after STX recovered from Feb.5, 2026, lows of $0.22.

Despite weekly losses having moderated to 2%, Stacks remains more than 32% down in the monthly time frame.

Meanwhile, gains on the day have also come amid reduced buyer interest, with daily trading volume down 6% to $13.2 million.

Notably, prices remain within the range that offers support at $0.24, with bulls revisiting the level on three occasions year-to-date.

Stacks price prediction

Stacks is among the top Bitcoin DeFi protocols looking to leverage a layer-2 network to enable smart contracts and yield opportunities directly on Bitcoin’s security.

The project has gained traction as the digital asset investment space broadens.

One of its landmark moves is the recent integration with Fireblocks, which could potentially expose over 2,400 institutional clients to STX for native Bitcoin DeFi participation.

“Bitcoiners want to earn yield without sacrificing security. They want their yield to be denominated in Bitcoin and ideally, with as few additional trust assumptions as possible,” the firms stated in their announcement.

Clients will be able to tap into Bitcoin-denominated rewards, BTC-yielding vaults, and BTC-backed loans.

This institutional gateway could significantly boost STX adoption, especially if Bitcoin prices spike.

Bulls could eye the $0.56-$0.60 range or higher, with the altcoin having reached highs of $1.05 in May 2025.

The technical picture supports this short-term outlook and targets.

On the daily chart, the Relative Strength Index (RSI) hovers at 34, but signals bullish divergence.

Charts also show the Moving Average Convergence Divergence (MACD) indicator pointing to a bullish crossover.

If Bitcoin faces intensified selling pressure, Stacks’ upside potential could suffer.

In this case, STX may find support in the $0.23-$0.20 area.

Crypto World

Optimism Taps Succinct to Enable Instant Withdrawals

The zero-knowledge validity proofs will become canonical across the OP stack.

Ethereum Layer 2 Optimism is partnering with Succinct as its first zero-knowledge (ZK) proving provider, in order to provide instant and real-time withdrawals from the L2, according to an announcement shared exclusively with The Defiant.

The move makes Succinct Optimism’s first official ZK partner, and by leveraging Succinct’s proof system, users can off-ramp capital from Optimism to any other chain in a timely fashion, as opposed to the bridge’s traditional, multi-day wait time.

By accelerating the bridge time from Optimism, large on-chain operators such as market makers or treasuries, can move capital quickly without having to rely on a third party bridging solution.

In addition to its withdrawal time upgrade, Optimism is also working towards a larger ZK proof infrastructure launch on the chain, which will allow teams building across the OP Stack to upgrade to ZK validity proofs “seamlessly” per a release shared with The Defiant.

Karl Floersch, the co-founder of Optimism commented on the news:

“Succinct offers one of the most trusted proof systems in the industry, securing billions of dollars in TVL. We’re excited to bring validity proofs to the Superchain as we focus on fast, cost-effective scaling for Optimism and our partners in 2026 and beyond.”

“We’re honored to partner with Optimism to bring ZK to the Superchain, starting with OP Mainnet. As rollups consolidate around ZK, Succinct is building the proving infrastructure the ecosystem can rely on,” said Uma Roy, CEO and co-founder of Succinct.

The news comes shortly after Optimism unveiled OP Enterprise — a new chain deployment suite for enterprise clients who are looking to build their own native blockchains.

Crypto World

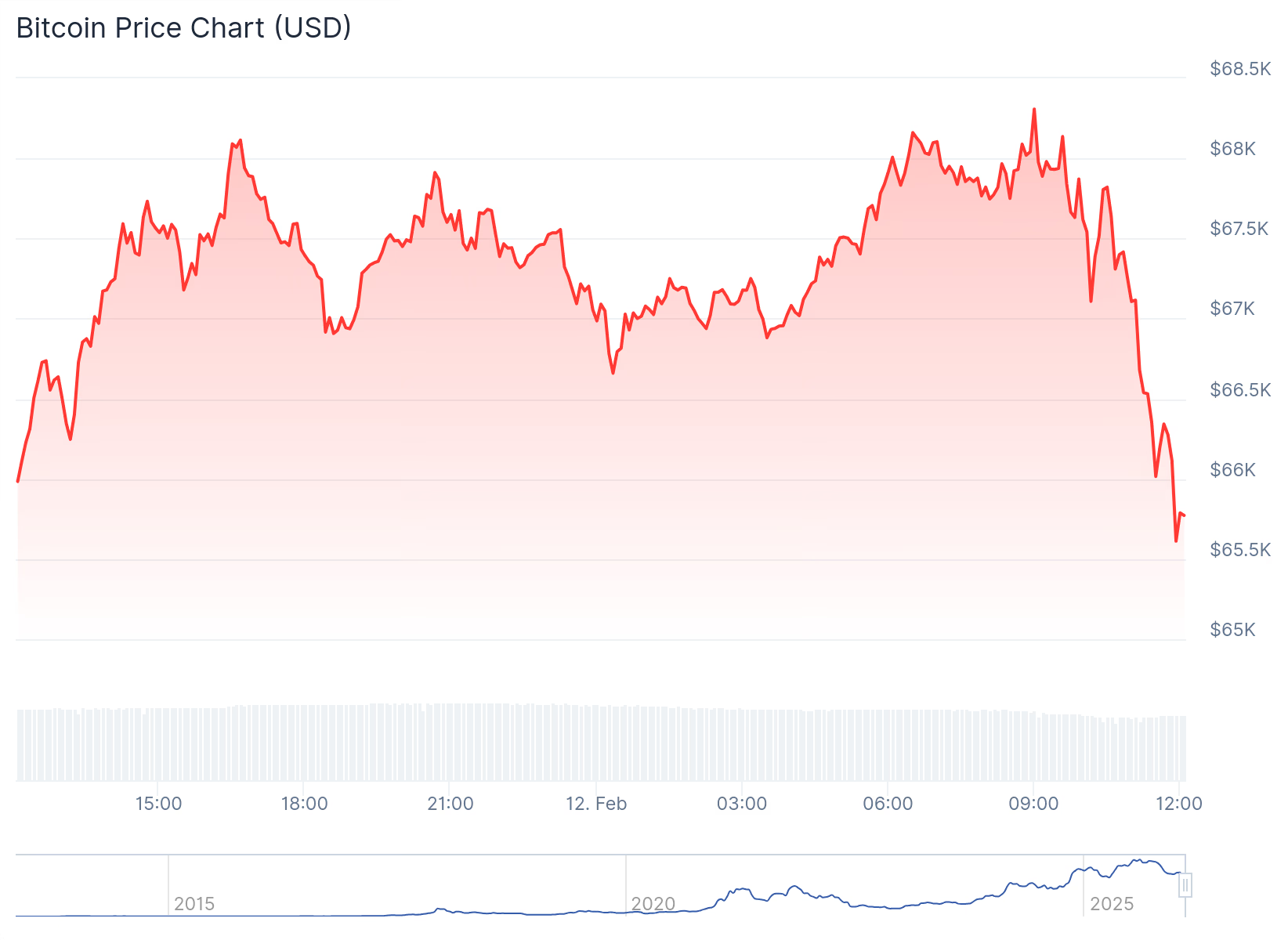

Bitcoin Plunges Under $66,000 as Crypto Sentiment Index Hits Historic Low

Total market cap is holding steady today, even as sentiment sinks to the weakest level on record.

Crypto markets took a tumble Thursday morning, Feb. 12, pushing Bitcoin below $66,000 and Ethereum below $2,000, as investor sentiment deteriorated to unprecedented lows.

Total crypto market capitalization is flat over the past 24 hours around $2.33 trillion, while large-cap assets are mixed today. At press time, Bitcoin (BTC) is trading at $65,747 at press time, down marginally on the day and bringing 7-day losses to about 5%.

Ethereum (ETH) fell to $1,910 this morning, little changed over the past 24 hours and down 4% on the week.

While BNB gained nearly 2% on the day, it’s still down almost 10% over the past week. Solana (SOL) slipped 0.6% in the past 24 hours, and is down 8% on the week.

Among the top-10 crypto assets, XRP and Figure Heloc (FIGR_HELOC) stood out on the weekly timeframe, both up about 4%.

Unprecedented Extreme Fear

Market sentiment, however, continues to lag price action. The Crypto Fear & Greed Index fell today to a reading of 5, its lowest level on record, pushing sentiment deeper into “extreme fear” territory than during any previous bear market.

Glassnode analysts said in an X post today that the disconnect between prices and sentiment reflects a market under sustained stress rather than a clear capitulation event.

The analysts pointed out that the 30-day simple moving average of net flows for both BTC and ETH spot ETFs has remained negative for most of the past 90 days, showing “no sign of renewed demand.”

They added in a separate research report that liquidity remains thin, with traders maintaining defensive positioning. Without renewed spot demand or improvement in risk appetite, glassnode warned that price action is likely to remain driven by short-term positioning.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, earlier today, Aster (ASTER) climbed more than 7% after the decentralized exchange confirmed that the mainnet launch of Aster Chain is scheduled for March. Hyperliquid’s HYPE token also rose about 7%, extending its recent rebound.

On the downside, Uniswap (UNI) led losses among large-caps, down 11.6%, erasing all of its gains from Wednesday’s rally that followed news of a strategic investment by BlackRock.

According to CoinGlass data, over 120,000 traders were liquidated over the past 24 hours, with total liquidations reaching $285 million. Bitcoin accounted for roughly $118 million of that total, followed by Ethereum at about $65 million.

ETFs and Macro Conditions

On Wednesday, Feb. 11, spot Bitcoin ETFs reversed their inflow streak, posting over $276 million in net outflows on the day. Spot Ethereum ETFs also recorded net outflows of more than $129 million, according to data from SoSoValue.

In macro markets, U.S. Treasury yields moved lower today as investors assessed fresh labor data and looked ahead to Friday’s consumer price index report. The 10-year yield slipped to 4.158%, while the 30-year fell to 4.782%, CNBC reported.

Per a report published today from the U.S. Labor Department, initial jobless claims came in at 227,000 for the week ended Feb. 7, slightly above expectations but lower than the prior week, the report notes, adding that investors continue to digest January’s nonfarm payrolls report, which showed a decline in the unemployment rate to 4.3%.

Crypto World

XRP price shows bottoming signs as RLUSD hits key milestone

XRP’s price has retreated for six consecutive weeks, in line with the broader market’s performance.

Summary

- XRP price has retreated and moved into a bear market in the past few months.

- Ripple USD’s stablecoin supply has jumped to over $1.5 billion for the first time ever.

- The coin has become oversold and formed a falling wedge chart pattern.

Ripple (XRP) token was trading at $1.3915 on Thursday, down by 62% from its all-time high of $3.6590. Technical indicators suggest the coin may be about to rebound as demand for the Ripple USD (RLUSD) stablecoin rises.

Ripple USD supply is rising

There are signs that demand for the RLUSD stablecoin is growing, a trend that may accelerate after Binance completes its integration on the XRP Ledger. The integration enabled users to deposit and withdraw the token on the largest crypto exchange in the industry.

Data compiled by Artemis shows that the supply of RLUSD in circulation jumped to over $1.5 billion for the first time ever. $1.1 billion of these tokens are in Ethereum, while the rest is in the XRP Ledger.

In a statement on Thursday, Jack McDonald, the Senior Vice President at Ripple Labs, hinted that the stablecoin will overtake “traditional dollar, Venmo, PayPal, and others.” He pointed to the rising institutional demand for the coin, especially as the developers gears to launch the Permissioned DEX platform.

Artemis data show that RLUSD’s usage continues to grow. It handled over 480,000 transactions in the last 30 days, while the adjusted transaction volume soared to close to $4.9 billion. Most of the volume was in decentralized finance, followed by blockchains and centralized exchanges.

Meanwhile, XRP price may benefit from the ongoing ETF inflows. Data compiled by SoSoValue show that spot XRP ETFs have added over $48 million this month so far, more than Bitcoin and Ethereum, which have shed substantial assets in the past few months.

XRP price prediction: Technical analysis

The weekly timeframe chart shows that the XRP price has pulled back in the past few months as the crypto market crash accelerated.

The Relative Strength Index has moved to the oversold level of 30, its lowest level since August 2022. It is common for a coin to rebound after moving to the oversold level.

XRP has also formed a large falling wedge pattern, consisting of two descending, converging trendlines that are nearing the confluence point.

Therefore, the coin will likely rebound in the coming weeks, potentially reaching the key psychological level of $2.0, which is 45% above the current level.

Crypto World

BTC remains under pressure amid slumping stock market

Bitcoin has fallen back to the low end of its recent trading range during late-morning U.S. trading hours on Thursday as the tech-heavy Nasdaq tumbles 1.6%.

Trading at $65,700, bitcoin is now lower by 1.5% over the past 24 hours, while ether , just above $1,900, is down more than 2%.

The bitcoin price action — uncorrelated with the Nasdaq when that index is headed higher, but perfectly correlated when it heads lower — has become all too familiar for the crypto sector. And the failure to hold any sort of sustained bounce from last week’s panicky plunge has bulls seemingly in full capitulation mode.

Alternative’s well-followed Crypto Fear & Greed Index today fell to just 5, a level of “extreme fear” exceeding even what was seen during the multiple collapses of the 2022 crypto winter and the 2020 Covid crash.

Also raising eyebrows is longtime bull Geoff Kendrick from Standard Chartered, slashing his 2026 price targets for bitcoin, ether, solana, BNB and AVAX, while warning bitcoin could dip to as low as $50,000.

Crypto stocks lose ground

Coinbase (COIN) and Robinhood (HOOD) are among the largest losers on Thursday, each down more than 8%. Coinbase reports fourth-quarter results after the bell, but Robinhood’s fourth-quarter report earlier this week confirmed that the crypto bear market had taken a large bite out of trading revenues in the final three months of 2025 — and that was before the price action got really bad to begin 2026.

Other large decliners today include Strategy (MSTR), down 4.2%, Circle Financial (CRCL), down 4.3%, and Hut 8 (HUT), down 6.6%.

Crypto World

Juspay Strengthens Middle East Presence with DIFC Headquarters

Editor’s note: In today’s fintech landscape, global payment infrastructures are increasingly decisive in unlocking cross-border commerce. Juspay’s Dubai DIFC HQ marks a milestone in its expansion, signaling a focus on enterprise-grade payments in the Middle East. The move aligns with GCC digitization goals and regional fintech collaboration, and demonstrates how scalable payments platforms can drive growth across international markets. This release outlines Juspay’s strategy and what it means for merchants, banks, and developers navigating multi‑currency challenges.

Key points

- Juspay opens a regional headquarters in DIFC Dubai to expand its Middle East presence.

- The expansion aims to serve enterprise merchants, banks, and networks across GCC and MEASA.

- The DIFC hub enables closer engagement with partners to scale enterprise payments.

- Juspay powers 500+ enterprise merchants and banks globally with full‑stack payment orchestration and related services.

Why this matters

This expansion signals a long‑term commitment to open, interoperable payments across the MEA region, offering an institutional‑grade platform to handle multi‑currency and regulatory challenges. It also reinforces Dubai’s role as a fintech hub and positions Juspay to partner with regional banks, networks and merchants to scale payments across markets.

What to watch next

- Regional team growth and partnerships with banks and networks in DIFC and GCC.

- Adoption of Juspay’s payments orchestration platform by MEA enterprises.

- Regulatory and compliance readiness to support multi‑currency, cross‑border payments across GCC and MEASA.

- Expansion of services to additional markets in MEASA as demand scales.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Juspay Strengthens Middle East Presence with DIFC Headquarters

Dubai, February 10th, 2026 – Juspay, a global leader in payment infrastructure solutions for enterprises and banks, today announced its expansion into the Middle East with the opening of its regional headquarters in Dubai International Financial Centre (DIFC). This move marks an important step in Juspay’s international expansion, deepening its focus on serving enterprise merchants, banks, and financial institutions in the Middle East. The DIFC headquarters will support closer engagement with existing partners as enterprise payment demand continues to scale.

With digital commerce accelerating in the GCC region, rapidly scaling enterprises in sectors such as airlines, hospitality, e‑commerce, and financial services face increasing complexity driven by multiple regional currencies, evolving regulations, and diverse local payment methods.

To address this complexity, Juspay’s payments orchestration platform provides a unified & reliable payments stack, helping organizations optimize authorisation rates and costs, simplify compliance and scale seamlessly across GCC and global markets with institutional‑grade reliability.

Establishing operations in DIFC highlights Juspay’s long‑term commitment to the Middle East, with a focus on building , regulated, and enterprise‑grade payments infrastructure in the region. As a leading global financial hub, DIFC provides a strong regulatory environment, robust infrastructure, and access to high quality talent. Juspay plans to leverage this and work closely with regional banks, acquirers, networks, and ecosystem partners to deliver scalable and reliable payment solutions tailored for enterprises operating across global markets.

Commenting on the expansion, Sheetal Lalwani, Co‑founder & COO of Juspay, said: “Juspay has been building foundational payments infrastructure for large‑scale, mission‑critical commerce globally for over a decade. We are excited to bring these learnings to the Middle East and partner with merchants, banks, networks, and the broader ecosystem to build secure, scalable payments infrastructure that supports the region’s rapidly evolving digital economy.”

Salmaan Jaffery, Chief Business Development Officer at DIFC Authority said: “We are pleased to welcome Juspay to the Middle East, Africa and South Asia’s most significant fintech and financial services ecosystem. As a global leader in payment infrastructure, Juspay’s presence strengthens our growing digital economy, reinforces DIFC’s role as a catalyst for financial innovation and cements Dubai’s position as a top four global FinTech hub.”

With more than a decade of experience in scaling payment infrastructure, Juspay powers 500+ enterprise merchants and banks globally including Agoda, Amazon, Flipkart, Google, HSBC, IndiGo, Swiggy, Urban Company, Zepto & more. It offers a comprehensive suite of payment solutions that spans full‑stack payment orchestration, authentication, tokenisation, reconciliation, fraud solutions and more. The company also provides end‑to‑end, white‑label payment gateway and real‑time payments infrastructure tailored for banks. Together these capabilities enable merchants and banks to deliver seamless, reliable and scalable payment experiences to the end‑consumers.

Speaking about Juspay’s regional focus, Nakul Kothari, head of Middle East & APAC said, “By establishing our presence in the Middle East with DIFC, we continue our mission of building innovative payment solutions rooted in deep local market understanding. The region holds tremendous potential, and we are investing in long‑term partnerships with merchants and banks to help them build future‑ready payment stacks that can scale across markets.”

This expansion reflects Juspay’s long‑term vision of enabling open, interoperable, and accessible payments worldwide. With a team of over 1,500 payment experts solving payment complexities across Asia‑Pacific, Latin America, Europe, UK, and North America, Juspay is strategically positioned to reshape the Middle Eastern payments landscape. The company plans to grow its regional team, specifically targeting growth in business development, solution engineering, and partnerships.

About Juspay

Juspay is a leading multinational payments technology company, redefining payments for 500+ top global enterprises and banks. Founded in 2012, the company processes over 300 million daily transactions, exceeding an annualized total payment volume (TPV) of $1 trillion with 99.999% reliability. Headquartered in Bangalore, India, Juspay is powered by a global network of 1500+ payment experts operating across San Francisco, Dublin, São Paulo, Dubai, and Singapore.

Juspay offers a comprehensive product suite for merchants that includes open‑source payment orchestration, global payouts, seamless authentication, payment tokenization, fraud & risk management, end‑to‑end reconciliation, unified payment analytics & more. The company’s offerings also include end‑to‑end white label payment gateway solutions & real‑time payments infrastructure for banks. These products help businesses achieve superior conversion rates, reduce fraud, optimize costs, and deliver seamless customer experiences at scale.

To learn more about Juspay, visit: http://www.juspay.io

About Dubai International Financial Centre

Dubai International Financial Centre (DIFC) is one of the world’s most advanced financial centres, and the leading financial hub for the Middle East, Africa and South Asia (MEASA), which comprises 77 countries with an approximate population of 3.7bn and an estimated GDP of USD 10.5trn. With a 20‑year track record of facilitating trade and investment flows across the MEASA region, the Centre connects these fast‑growing markets with the economies of Asia, Europe, and the Americas through Dubai. DIFC is home to an internationally recognised, independent regulator and a proven judicial system with an English common law framework, as well as the region’s largest financial ecosystem of 46,000 professionals working across over 6,900 active registered companies – making up the largest and most diverse pool of industry talent in the region. Comprising a variety of world‑renowned retail and dining venues, a dynamic art and culture scene, residential apartments, hotels, and public spaces, DIFC continues to be one of Dubai’s most sought‑after business and lifestyle destinations. For further information, please visit our website: http://difc.ae, or follow us on LinkedIn and X @DIFC.

Crypto World

What Pioneers Need to Know

Here’s the latest hint from the Pi Network team that could affect millions within its community.

The Core Team behind the popular project has provided a comprehensive update on its Node infrastructure, revealing major progress on the promised decentralization while maintaining its phased rollout strategy.

They claimed that 16 million Pioneers have already migrated to the Mainnet, and Pi is trying to position its node system as the backbone of a large and identity-driven blockchain ecosystem. Additionally, they made some big claims about an upcoming “series of upgrades” that would require all Mainnet nodes to complete the first step by February 15.

Important reminder for Nodes: The Pi Mainnet blockchain protocol is currently undergoing a series of upgrades. The deadline for the first upgrade step is February 15. All Mainnet nodes must complete this step to remain connected to the network. More information is available here…

— Pi Network (@PiCoreTeam) February 11, 2026

Why Do Pi Nodes Matter

The post reiterated by the team explains that Pi Nodes represent the “fourth role” in Pi Network’s community, and they run on laptops and desktop computers, instead of mobile devices. Similar to nodes in other blockchain networks, they validate transactions and help maintain the distributed ledger.

However, since Pi Network does not use proof-of-work like Bitcoin, for example, as it relies on a consensus model based on the Stellar Consensus Protocol (SCP), they have different responsibilities. In this system:

- Nodes form trusted groups (quorum slices)

- Security circles from mobile miners create a global trust graph

- Consensus is achieved through trust relationships rather than mining competition

The team believes this makes the system designed to be more energy efficient and accessible.

Levels of Participation

The post also explained that the Pi Network ecosystem works with three levels of participation. Through the first one, the computer app, users can install the Pi App interface to check balances, chat, and access internal apps. Node participation enables them to verify blockchain validity, submit transactions, and run the blockchain component.

You may also like:

The third and most advanced option, called SuperNode, which is believed to be the “backbone of the blockchain,” allows Pioneers to participate in consensus, maintain ledger state, and synchronize network activity. They must operate 24/7 with stable connectivity and are selected by the Core Team upon KYC approval.

The Upcoming Upgrades

As mentioned above, the Core Team published on X that a series of upgrades is coming, which requires the first deadline step to be completed within the next few days. However, as it has happened during several of the team’s previous posts, the community was quick to lash out against some of the project’s controversial features.

Instead of commenting on the upcoming upgrades, many users questioned the lack of a clear strategy for the second migration and asked when their Pi tokens would be migrated to the Mainnet.

Others wanted more details on the upcoming upgrades and whether they would finally be able to shed light on the missing tokens.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Hyperliquid price confirms support at $28.40

Hyperliquid price is showing early signs of a bullish market structure shift after confirming strong demand at $28.40, setting the stage for a potential expansion toward higher levels.

Summary

- $28.40 reclaimed and defended, confirming demand after the breakout

- Bullish engulfing candles show strong momentum, supporting structure shift

- Holding support opens upside, with $48.02 as the next major resistance

Hyperliquid (HYPE) price action has entered a critical phase after reclaiming and successfully retesting a key high-timeframe support zone. Following a period of corrective consolidation, the market has responded with strong bullish impulses, suggesting that buyers are beginning to regain control. The $28.40 level, previously a major structural pivot, has now been confirmed as support, signaling a potential shift in the broader trend.

This development is significant, as market structure shifts often begin with decisive break-and-retest behavior at high-timeframe levels. With bullish momentum building and price holding above former resistance, Hyperliquid may be transitioning from a corrective phase into a new expansionary cycle.

Hyperliquid price key technical points

- $28.40 high-timeframe level has been reclaimed and retested, confirming strong demand

- Bullish engulfing candles signal impulsive buying pressure, supporting trend reversal

- Holding above support opens upside toward $48.02, the next major resistance

Hyperliquid’s recent price behavior has been characterized by impulsive bullish expansions, marked by strong bullish engulfing candles. These moves indicate aggressive buyer participation rather than slow accumulation, a key distinction when evaluating trend shifts.

After breaking above the $28.40 level, the price pulled back and reacted strongly from the value area high, confirming this region as newly established support. The first successful retest is often the most important, as it confirms whether former resistance has truly become demand. In this case, buyers stepped in decisively, reinforcing confidence in the bullish scenario.

This reaction suggests that market participants are willing to defend value above $28.40, shifting the balance of control away from sellers.

Liquidity sweep potential strengthens structure

One additional level to monitor closely is the 0.618 Fibonacci retracement positioned just below the current support zone. In many bullish structures, price briefly revisits this region to clear remaining sell-side liquidity before resuming its trend. A controlled retest of the 0.618 Fibonacci, followed by a strong bullish reaction, would further strengthen the case for a higher low.

Such behavior would confirm that the market has successfully absorbed supply and transitioned into accumulation above support. Importantly, this would solidify the shift in market structure from bearish or neutral to bullish.

Until that occurs, short-term volatility remains possible. However, as long as the price maintains acceptance above $28.40 on a closing basis, the broader bullish thesis remains intact.

Market structure shift opens upside expansion

From a market structure perspective, Hyperliquid appears to be transitioning into a higher-high and higher-low sequence. The impulsive nature of the recent move higher, combined with the successful support retest, suggests that the corrective phase may have concluded.

If price continues to hold above support and builds a higher low, the probability of a bullish expansion increases. In this scenario, the next major upside target sits near the high-timeframe resistance around $48.02. This level represents a prior rejection zone and is likely to act as the next area of supply.

A move toward this region would align with classic trend continuation behavior following a structural flip.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Hyperliquid is positioned favorably as long as the $28.40 support level continues to hold. Short-term pullbacks remain healthy within bullish trends, particularly if they result in higher lows above key support.

For now, the evidence suggests that Hyperliquid has successfully completed a bullish retest and is beginning to shift the market structure. If buyers remain active, the path toward higher resistance levels remains open, with $48.02 emerging as the primary upside objective in the coming phase.

Crypto World

$1K Collapse or $3K Rally? 4 AIs Speculate What is More Likely for ETH in Q1

“The balance tilts toward gradual recovery or stabilization in Q1 rather than a dramatic collapse,” Grok stated.

The major red wave that swept through the entire crypto market at the start of February has severely impacted Ethereum (ETH), whose price fell below $1,800 at one point. Over the past few days, the bulls have reclaimed some lost ground, but the asset currently trades just below the psychological $2,000 level.

The big question now is which scenario is more plausible during the first quarter of the year: a crash to $1,000 or a pump to $3,000. Here are the viewpoints of four of the most popular AI-powered chatbots.

What Comes Next?

ChatGPT estimated that a 50% jump to $3K sometime in Q1 is more likely, reminding that ETH has initiated such moves many times in the past. It claimed that a rebound to that level will not require an extreme catalyst but only “bullish momentum and market stability.”

The chatbot did not rule out a collapse to $1,000 but argued that such a drop could occur only in the event of a macro panic, a regulatory crackdown, or the meltdown of a leading crypto exchange.

Grok – the chatbot integrated within X – shared a similar opinion. It stated that a jump toward the upper target carries a higher probability, but added that neither extreme option is guaranteed.

“The balance tilts toward gradual recovery or stabilization in Q1 rather than a dramatic collapse – making a push toward $3K (or at least meaningful upside) more plausible than a plunge to $1K, especially if macro conditions improve or adoption catalysts hit,” it forecasted.

Google’s Gemini joined the theory, saying that a rally is statistically “more aligned with historical patterns and analyst consensus.” It argued that a drop to $1,000 is a low probability scenario unless a major black swan event occurs.

Perplexity is the only chatbot (from those we consulted) that leans toward the bearish option. It stated that the crypto market has not been in its best shape lately, projecting a downside move for ETH to $1,000 and even lower in the coming weeks.

You may also like:

The Crash Could be a Blessing?

Just a few days ago, the popular X user Ted asked his almost 300,000 followers whether they expect ETH to plummet to $1,000 in 2026. In his view, a plunge of that dimension would be “a great buying opportunity.”

Some commentators claimed that such a scenario is possible only in a macro crisis that could undermine the reputation of the entire cryptocurrency sector. Others welcomed the idea of a collapse to $1K, agreeing with Ted that this would provide a solid reason to increase their exposure.

Hosky.Watcher, for instance, suggested that big dips can be “chances and traps.” They advised investors to enter the ecosystem with spare cash but not to touch “emergency funds or mortgage money.”

“Keep your sense of humor and a risk plan,” the alert reads.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports17 hours ago

Sports17 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World19 hours ago

Crypto World19 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video14 hours ago

Video14 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process