Crypto World

Monero Activity Holds Steady Despite Exchange Delistings, TRM Labs Reports

TLDR:

- TRM Labs found that 48% of newly launched darknet markets in 2025 accept only Monero as payment.

- Nearly 14–15% of reachable Monero network peers displayed non-standard peer-to-peer protocol behavior.

- Ransomware actors prefer XMR, yet most real-world ransom payments are still completed in Bitcoin.

- Monero’s on-chain cryptography remains intact, but network-layer dynamics may affect privacy assumptions.

Monero continues to maintain stable on-chain transaction activity despite growing regulatory pressure. TRM Labs released new research showing that XMR usage has remained above pre-2022 levels.

Even after major exchanges removed the privacy coin, demand has not dropped. The findings also reveal unusual peer-to-peer network behavior affecting roughly 14 to 15 percent of observable nodes.

Darknet Markets and Ransomware Drive Persistent Demand

Monero’s appeal in high-risk environments has grown considerably over the past few years. Nearly 48 percent of newly launched darknet markets in 2025 support XMR exclusively.

That figure marks a sharp rise compared to earlier years when Bitcoin remained the dominant option. Western-facing markets are leading this shift, partly due to improved tracing capabilities on transparent blockchains.

Ransomware groups still express a clear preference for receiving payments in Monero. However, most actual ransom settlements continue to occur in Bitcoin due to liquidity advantages.

Bitcoin remains easier to acquire and convert at scale, even though it is more traceable. That gap between preference and practice reflects a real tension between privacy and usability.

TRM Labs addressed this directly, stating, “Most ransomware payments still occur in BTC—liquidity matters.” The firm also noted that “48% of new darknet markets in 2025 are XMR-only,” indicating a measurable structural shift in how high-risk actors choose to operate.

Monero’s thinner market structure also contributes to higher price volatility. Over the past 30 days, XMR showed realized volatility roughly 2.5 times that of Bitcoin.

Despite fewer on-ramps and reduced exchange support, on-chain Monero usage has not contracted meaningfully. This pattern points to a user base that actively seeks privacy rather than casual retail participation.

Users accept higher friction and fewer options to preserve anonymity. That behavior keeps Monero relevant even as other assets become more transparent.

Network-Layer Behavior Introduces New Investigative Considerations

TRM Labs also collaborated with academic researchers to study Monero’s peer-to-peer network behavior. Around 14 to 15 percent of reachable peers showed non-standard behavior compared to protocol expectations.

These deviations included irregular handshake patterns, unusual message timing, and atypical peer list composition. The behavior persisted across multiple observation periods, suggesting systematic rather than random causes.

Infrastructure concentration emerged as a recurring pattern within the non-standard peer data. A small number of hosting environments accounted for a disproportionately large share of these peers.

TRM Labs noted that “14–15% of Monero peers show non-standard network behavior,” adding that “network-layer dynamics can influence real-world privacy assumptions.” That visibility can matter even when cryptographic protections remain fully intact.

TRM emphasized that these findings do not reflect a failure of Monero’s cryptography. The on-chain privacy features, including ring signatures and stealth addresses, remain technically sound.

As TRM Labs put it, “Monero’s cryptography remains strong,” yet the firm cautioned that peer-to-peer behavior can introduce structural visibility affecting theoretical anonymity models. Real-world conditions can introduce observable structure that affects certain investigative threat models.

The research does not assign intent or identify specific operators behind the non-standard nodes. It instead describes behavioral patterns that deviate from standard client implementations.

Those patterns, combined with growing XMR-only market adoption, give investigators new structural data points to consider. Monero remains a distinct challenge, but its network layer now draws greater scrutiny.

Crypto World

GBP/JPY Falls to a Year-to-Date Low

As the GBP/JPY chart shows, the pound has dropped below the 12 February low against the Japanese yen, marking its weakest level since the beginning of 2026. The pair last traded beneath the 207.500 mark in mid-December 2025.

→ The yen’s strength is supported by expectations that economic stimulus measures introduced by Prime Minister Sanae Takaichi, in coordination with the Bank of Japan, will underpin the national currency. Barclays forecasts further appreciation of the yen.

→ Sterling weakened today following reports that UK unemployment reached a five-year high in December, while wage growth slowed. This may reinforce arguments in favour of additional interest rate cuts by the Bank of England.

Technical Analysis of GBP/JPY

Long-term moving averages are turning lower, signalling potential structural shifts and possible capital reallocation after five years of an overall uptrend in GBP/JPY.

Price action is forming a well-defined descending channel. In this context:

→ the median line has switched from acting as support to serving as resistance (as highlighted by the thicker lines);

→ today, GBP/JPY is trading in the lower quarter of the channel, indicating continued bearish dominance.

It is worth noting that yesterday’s breakout above local resistance (marked by an arrow) proved to be false, triggering renewed downward momentum.

On the other hand, after dipping below the 12 February low near 207.560, the pair has started to rebound, raising the possibility of a mirrored move and a false bearish breakout.

Nevertheless, the outlook for bulls remains challenging. Even if they manage to push prices slightly higher, they may encounter resistance around 208.315 — a level where sellers previously demonstrated strength when breaking local support (shown in purple).

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Solana DEXs match CEX pricing as on-chain liquidity structure evolves

Solana DEXs now offer CEX-like pricing despite a 90% volume drop since 2024, as prop AMMs, wrapped SOL markets, and new staked-SOL liquidity tools reshape on-chain trading.

Summary

- Solana DEXs achieve market depth that often matches or beats Binance and OKX pricing, with spreads shifting as arbitrage rotates across venues.

- Prop AMMs and wrapped SOL on Ethereum, Base, and BNB Chain improve price discovery but still face thinner liquidity and higher cross-chain costs.

- Treasury wallets hold over 20 million SOL, about half staked, while Jupiter’s native-staked SOL tool unlocks liquidity without exiting staking.

Solana’s on-chain trading infrastructure has demonstrated competitive pricing compared to centralized exchanges, according to recent market data.

Decentralized exchanges on the Solana network have achieved market depth sufficient to match or exceed prices quoted on major centralized platforms including Binance and OKX, according to trading data. The price differential between decentralized and centralized venues remains variable as arbitrage opportunities shift between platforms.

Proprietary automated market makers (Prop AMM) have contributed to improved price discovery on Solana’s decentralized exchanges, according to market observers. These specialized liquidity pools operate at specific price ranges, providing trading efficiency. Prop AMM exchanges have increased activity over the past month, offsetting declines in overall decentralized exchange volume.

Wrapped Solana tokens on Ethereum, Base, and BNB Chain trade at different price ranges compared to native Solana, according to market data. These markets face liquidity constraints and higher transaction costs related to trading and cross-chain bridging.

Trading volumes on Solana decentralized exchanges have declined approximately 90% since October 2024, according to network data.

Treasury entities currently hold over 20 million Solana tokens, with holdings remaining stable in recent months, according to blockchain data. Approximately 50% of treasury holdings are staked, the data showed.

Jupiter, a Solana-based platform, recently launched a tool enabling natively staked Solana to function as liquid tokens. The tool allows Solana validators to access liquidity while maintaining staking positions and earning block rewards and fees, according to the company’s announcement.

Solana has historically experienced extended periods of price decline followed by accumulation phases, according to market records. The token currently trades above previous baseline levels, though concerns regarding large holder liquidations persist, market participants noted.

Crypto World

Steak ‘n Shake says Bitcoin Push Sent Sales “Dramatically” Higher

Steak ‘n Shake says its same‑store sales have “risen dramatically” since it launched a burger‑to‑Bitcoin strategy in May 2025 that routes every Bitcoin payment into a corporate treasury reserve.

In a Monday post on X, the US fast-food chain said that it had successfully combined a “decentralized, cash-producing operating business with the transformative power of Bitcoin,” and thanked Bitcoiners for making it possible. The chain did not provide figures or define what it meant by “risen dramatically.”

Steak ‘n Shake began accepting Bitcoin at participating locations on May 16, 2025, in a phased rollout.

Since then, Steak ‘n Shake has repeatedly tied higher sales to Bitcoin (BTC) adoption, reporting quarter‑over‑quarter same‑store sales growth of 11% in Q2 2025 and 15% in Q3 2025, outpacing major rivals including McDonald’s, Domino’s and Taco Bell over the same period.

Under the program, all Bitcoin receipts are funneled into the company’s Strategic Bitcoin Reserve that grows alongside customer spending.

On Jan. 16, Steak ‘n Shake said its Bitcoin stash had grown by $10 million in notional value, without breaking down how much of that came from price appreciation versus additional accumulation.

Four days later, on Jan. 20, Steak ‘n Shake unveiled plans to offer hourly employees a Bitcoin bonus of $0.21 per worked hour at company‑operated locations, with a two‑year vesting period, supported by Bitcoin rewards firm Fold.

The company framed the move as a way to tap into stronger crypto enthusiasm among Gen Z and Millennial workers, who make up the majority of restaurant and food service employees in the United States.

One week later, on Jan. 27, the company announced a further $5 million allocation to the reserve, bringing its total Bitcoin exposure to around $15 million.

Related: Canadian taco franchise uses NFTs for customer loyalty program

Burger-to-Bitcoin a success, but BTC treasury stash in red

According to BitcoinTreasuries, Steak ‘n Shake currently holds 161.6 BTC, worth approximately $10.96 million at current prices, implying an average cost basis of just under $92,851 per coin.

That would put the position at roughly 26% below its average purchase price, meaning the company’s Strategic Bitcoin Reserve is sitting on a sizable unrealized loss despite its Bitcoin pivot reviving sales.

Cointelegraph reached out to Steak ‘n Shake but had not received a response by publication time.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Investors reassess risk as global uncertainty reshapes capital flows

Global uncertainty and AI disruption are forcing investors and operators to shift from growth at all costs to resilience and optionality.

Summary

- Overlapping economic, geopolitical, and currency shocks are undermining traditional market-cycle playbooks and confidence.

- AI is compressing build times and margins, shifting value to access, distribution, infrastructure, and trust-based moats.

- Capital increasingly favors resilient, “unavoidable demand” assets like local markets, infrastructure, and essential services over fragile growth stories.

Business leaders and investors are increasingly reporting a sense of economic and geopolitical uncertainty that is reshaping decision-making across multiple industries, according to market observers and industry participants.

The current environment is characterized by overlapping changes across economic, technological, and geopolitical systems, creating what analysts describe as a transition period rather than a typical market cycle.

Multiple factors are contributing to the uncertain climate, including ongoing international conflicts, shifting trade relationships, persistent inflation concerns, and currency volatility. Social tensions have increased in previously stable regions, while artificial intelligence technology is advancing at a pace that many businesses struggle to absorb, according to industry reports.

“Products that once took years to build can now be replicated in weeks,” market analysts noted, adding that entire software categories now face questions about long-term viability.

Investors are exhibiting what market participants characterize as hesitation rather than panic. Stock markets remain near historic highs, yet conviction levels are reported as low. Cryptocurrency has achieved institutional acceptance but sentiment around its transformative potential has diminished, according to market observers.

Gold and silver are experiencing sharp price movements, leading to increased trading activity. Real estate performance varies significantly by region, with currency risk and financing costs creating additional complexity. Manufacturing investments face uncertainty due to geopolitical considerations, where policy changes or conflicts can rapidly alter business conditions.

Capital is rotating across asset classes as investors search for opportunities in an environment where traditional investment frameworks appear less reliable, according to financial analysts.

Artificial intelligence is reducing the cost of building digital products and services, shifting where value creation occurs in the economy. As software development and content generation become more accessible, differentiation increasingly depends on access, distribution, and trust rather than building capability alone, industry analysts said.

The technology is enabling more individuals to launch businesses, increasing supply across multiple sectors. Questions are emerging about whether demand growth will match the expansion in supply, particularly as economic pressures affect consumer spending patterns.

Physical infrastructure and essential services are receiving renewed attention as areas that remain difficult to replicate and slow to disrupt, according to investment strategists.

Traditional business models are facing new scrutiny as operators reassess risk-return profiles. Businesses requiring significant operational effort over extended periods are being compared against returns available from passive capital deployment.

Strategic justifications for operating businesses are increasingly focused on ecosystem effects, long-term positioning, and connected opportunities that create optionality over time, rather than linear returns alone, according to business strategists.

Investment and business development questions are shifting from growth optimization to resilience under adverse conditions, according to market participants. Geographic flexibility, exposure to essential demand, and diversification across multiple systems are receiving increased emphasis in strategic planning.

The current period is characterized as a transition between economic frameworks, with established narratives around globalization, stable growth, and predictable cycles no longer fully explaining market dynamics, according to economic analysts.

Risk is being repriced across multiple systems simultaneously, creating an environment where early adaptation to changing conditions may provide competitive advantages, market observers said.

The transition is expected to favor positions tied to unavoidable demand, including local markets, physical infrastructure, distribution networks, and essential services, according to investment strategists. Technology continues to play a central role but is increasingly viewed as making other sectors more efficient rather than as a standalone source of value creation.

Crypto World

Crypto’s TradFi Moment: Institutions Are In, but on Their Terms

Inside Consensus Hong Kong 2026

This series covers the key debates and trends that emerged from Consensus Hong Kong 2026, drawing on main stage sessions, side events, and on-the-ground interviews during the second week of February.

The numbers keep getting cited at crypto conferences, but at Consensus Hong Kong 2026, they came from a different kind of speaker — not a protocol founder or exchange CEO, but a BlackRock executive doing math on a stage.

The conference surfaced a central tension: institutional capital is enormous, interested, and still mostly watching.

Sponsored

Sponsored

The $2 Trillion Thought Experiment

Nicholas Peach, head of APAC iShares at BlackRock, framed the opportunity in simple math. With roughly $108 trillion in household wealth across Asia, even a 1% allocation to crypto would translate into nearly $2 trillion in inflows, equivalent to about 60% of the current market.

BlackRock’s IBIT, the US-listed spot Bitcoin ETF launched in January 2024, has grown to roughly $53 billion in assets, the fastest-growing ETF in history, with Asian investors accounting for a significant share of flows.

Asia Is Already Building the On-Ramps

If institutions want familiar structures, someone has to build them. That race is well underway — and Asia is leading.

Laurent Poirot, Head of Product Strategy and Development for Derivatives at SGX Group, told BeInCrypto in an interview that the exchange’s crypto perpetual futures — launched in late November — reached $2 billion in cumulative trading volume within two months, making it one of the fastest product launches for SGX. More than 60% of trading activity occurred during Asian hours, in contrast to CME, where US hours dominate. Institutional demand is concentrated in Bitcoin and Ethereum, and SGX is prioritizing options and dated futures to complete the funding curve rather than expanding into additional tokens.

Notably, SGX has no plans to expand into altcoins. Institutional demand concentrates on Bitcoin and Ethereum; the next step is options and dated futures to complete the funding curve, not a longer list of tokens.

In Japan, major banks are developing stablecoin solutions to create regulated rails for traditional capital, according to Fakhul Miah of GoMining Institutional, who pointed to Hong Kong’s recent approval of ETFs and perpetuals as another major liquidity driver.

Wendy Sun of Matrixport noted that while stablecoin settlement and RWA tokenization dominate industry conversation, internal treasury adoption of stablecoins still awaits standardization. Institutional behavior, she said, is becoming “rule-based and scheduled” rather than opportunistic.

Sponsored

Sponsored

Different Languages: When TradFi Meets On-Chain Yield

At HashKey Cloud’s side event, the gap between what institutions want and what crypto offers became tangible.

Louis Rosher of Zodia Custody — backed by Standard Chartered — described a fundamental trust problem. Traditional financial institutions group all crypto-native firms together and distrust them by default. “A bank CEO with a 40-year career won’t stake it on a single crypto-native counterparty,” Rosher said. Zodia’s strategy is to leverage established banking brands to bridge that gap — a dynamic he projected would persist for the next decade or two. The firm is building DeFi yield access through a Wallet Connect integration, but within a permissioned framework in which each DApp is vetted individually before being offered to clients.

Steven Tung of Quantum Solutions, Japan’s largest digital asset treasury company, identified a more mundane but critical barrier: reporting format. Institutions don’t want block explorers — they want daily statements, audit trails, and custody proofs in formats their compliance teams already understand. Without traditional-style reporting, he argued, the vast majority of institutional capital will never arrive.

Samuel Chong of Lido outlined three prerequisites for institutional-grade participation: the protocol’s security, ecosystem maturity, including custodian integration and slashing insurance, and regulatory alignment with traditional finance frameworks. He also flagged privacy as a hidden barrier — institutions fear that on-chain position exposure invites front-running and targeted attacks.

Regulation: The Variable That Controls Everything

Anthony Scaramucci used his fireside chat to walk through the Clarity Act — the US market structure bill working through the Senate — and its three key sticking points: the level of KYC/AML requirements for DeFi, whether exchanges can pay interest on stablecoins, and restrictions on crypto investments by the Trump administration and its affiliates.

Sponsored

Sponsored

Scaramucci predicted the bill would pass, driven less by conviction than by political math: young Democratic senators don’t want to face crypto industry PAC money in their next elections. But he warned that Trump’s personal crypto ventures — including meme coins — are slowing the process. He called Trump objectively better for crypto than Biden or Harris, while criticizing the self-dealing as harmful to the industry.

That tension was visible on stage when Zak Folkman, co-founder of Trump-linked World Liberty Financial, teased a new forex platform called World Swap built around the project’s USD1 stablecoin. The project’s lending platform has already attracted hundreds of millions in deposits, but its proximity to a sitting president remains a legislative complication Scaramucci flagged directly.

Meanwhile, Asia isn’t waiting. Regulators in Hong Kong, Singapore, and Japan are establishing frameworks that institutions can actually use. Fakhul Miah noted that institutional onboarding now requires passing “risk committees and operational governance structures” — infrastructure that didn’t exist for on-chain products until recently.

The Market Between Cycles

Binance Co-CEO Richard Teng addressed the Oct. 10 crash head-on, attributing $19 billion in liquidations to macroeconomic shocks — US tariffs and Chinese rare-earth controls — rather than exchange-specific failures. “The US equity market alone saw $150 billion of liquidation,” he said. “The crypto market is much smaller.”

But his broader reading was more revealing. “Retail demand is somewhat more muted compared to the past year, but the institutional deployment, the corporate deployment is still strong,” Teng said. “The smart money is deploying.”

Vicky Wang, president of Amber Premium, put numbers to the shift. Institutional crypto transactions in Asia grew 70% year over year to reach $2.3 trillion by mid-2025, she said. But capital allocation remains conservative — institutions overwhelmingly prefer market-neutral and yield strategies over directional bets. “The institutional participation in Asia, I would say it’s real, but at the same time it’s very cautious,” Wang said.

Sponsored

Sponsored

Among industry participants at the event, the mood was more somber. Trading teams at institutional side events were significantly down from the previous year, with most running identical strategies. The consensus among fund managers was that crypto is becoming a license-driven business where compliance and traditional financial credibility matter more than crypto-native experience. Some noted that serious projects now prefer Nasdaq or HKEX IPOs over token listings — a reversal unthinkable two years ago.

The Endgame Is Finance

Solana Foundation President Lily Liu may have delivered the conference’s clearest thesis. Blockchain’s core value, she argued, is not digital ownership, social networks, or gaming — it’s finance and markets. Her “internet capital markets” framework positions blockchain as infrastructure for making every financial asset accessible to everyone online.

“The end state is moving into assets that have value, can also command price, and bring more inclusivity for five and a half billion people on the internet into capital markets,” Liu said.

GSR’s CJ Fong predicted that most tokenized real-world assets will ultimately be classified as securities, requiring crypto firms to bridge to traditional market infrastructure. That means more competition from traditional players — but also the legitimacy that institutional capital demands.

The $2 trillion that Peach described isn’t arriving tomorrow. But the plumbing is being laid — in Hong Kong, Singapore, Tokyo, and on SGX’s order books — by institutions that have decided crypto is worth building for, even if they’re not ready to bet on it.

Inside Consensus Hong Kong 2026 — This series covers the key debates and trends that emerged from Consensus Hong Kong 2026, drawing on main stage sessions, side events, and on-the-ground interviews during the second week of February.

1. The RWA War: Stablecoins, Speed, and Control

2. Crypto’s AI Pivot: Hype, Infrastructure, and a Two-Year Countdown

3. Crypto’s TradFi Moment: Institutions Are In, but on Their Terms

Crypto World

Trezor, Ledger Users Face New Phishing Attacks via Fake Mail

TLDR

- Crypto scammers have targeted Trezor and Ledger users with fraudulent letters aimed at stealing recovery phrases.

- The fake letters include QR codes that lead users to phishing websites designed to steal sensitive wallet information.

- Cybersecurity expert Dmitry Smilyanets was among the first to report the phishing scam involving Trezor.

- Ledger and Trezor never ask users to share recovery phrases through emails, physical mail, or websites.

- These phishing attempts are part of ongoing scams exploiting data breaches from 2020 and 2024.

Users of cryptocurrency hardware wallets, including Ledger and Trezor, have again reported receiving fraudulent letters aimed at stealing their recovery seed phrases. These scams have been ongoing for several years, fueled by leaks from major data breaches. The latest wave of attacks, targeting wallet owners, involves fake letters with QR codes that lead victims to phishing websites.

Scammers Use Holograms and Fake Letters to Lure Victims

Cybersecurity expert Dmitry Smilyanets was among the first to report the latest scam, receiving a letter from Trezor on February 13. The letter, which warns users to complete an “Authentication Check” by February 15, contains a fake hologram and a QR code. Smilyanets shared that the QR code leads to a fraudulent website that mimics official Trezor and Ledger setup pages.

The letter claims to be signed by Matěj Žák, who is actually the CEO of Trezor, but the letter falsely attributes this to Ledger. The scam urges users to act quickly, creating a sense of urgency that often leads to poor decisions. This type of social engineering tactic is common in phishing attacks designed to steal sensitive information.

Ledger Users Targeted with Similar Phishing Tactics

This scam isn’t new for Ledger users. In October of 2022, a Ledger user reported receiving a similar letter, which instructed them to complete a “Transaction Check” process. Like the Trezor phishing attempt, the letter included a QR code that led victims to a fraudulent site designed to steal wallet recovery phrases.

Legitimate hardware wallet providers like Ledger and Trezor never ask users to share their recovery phrases via email, phone, or physical mail. Both companies have repeatedly warned users against entering sensitive information on suspicious websites or following unsolicited communication. Despite these warnings, phishing scams continue to adapt and evolve, successfully tricking some users into revealing their private details.

Phishing Websites Harvest Recovery Phrases for Theft

Upon scanning the malicious QR code, users are directed to a fake site where they are prompted to enter their wallet recovery phrases. Once entered, the recovery phrase is transmitted to the attackers, who can then steal the user’s funds. The scam’s clever design tricks even experienced users into entering critical information.

Legitimate wallets never request recovery phrases over the internet or through any communication channels outside of the user’s direct control. The rise of these scams highlights the importance of vigilance among cryptocurrency users, particularly during times of heightened anxiety such as market downturns.

These phishing attempts are part of a broader trend, with data breaches from 2020 and 2024 leading to the exposure of customer information. Trezor’s January 2024 breach, which leaked nearly 66,000 customer details, illustrates the ongoing challenges users face in protecting their assets. Despite security measures, opportunistic attacks are frequent and sophisticated, making it more important than ever to remain cautious and informed.

Scammers Continue to Exploit User Vulnerabilities

Cybersecurity experts have warned that scammers will likely continue to exploit vulnerabilities in the cryptocurrency ecosystem. Deddy Lavid, CEO of cybersecurity firm Cyvers, explained that scams tend to evolve, especially in times of market instability. While scams may slow in times of low market speculation, fear-based tactics, such as fake compliance alerts, become more effective.

Crypto hardware wallet users are encouraged to report any suspicious communications immediately and verify the authenticity of any requests they receive. Both Ledger and Trezor have detailed security guidelines on their websites to help users recognize potential scams.

Crypto World

Pi Network’s PI Token Is Back in Green as Bitcoin (BTC) Struggles at $68K: Market Watch

PI has returned to the top 50 alts by market cap, while M has exploded by double digits.

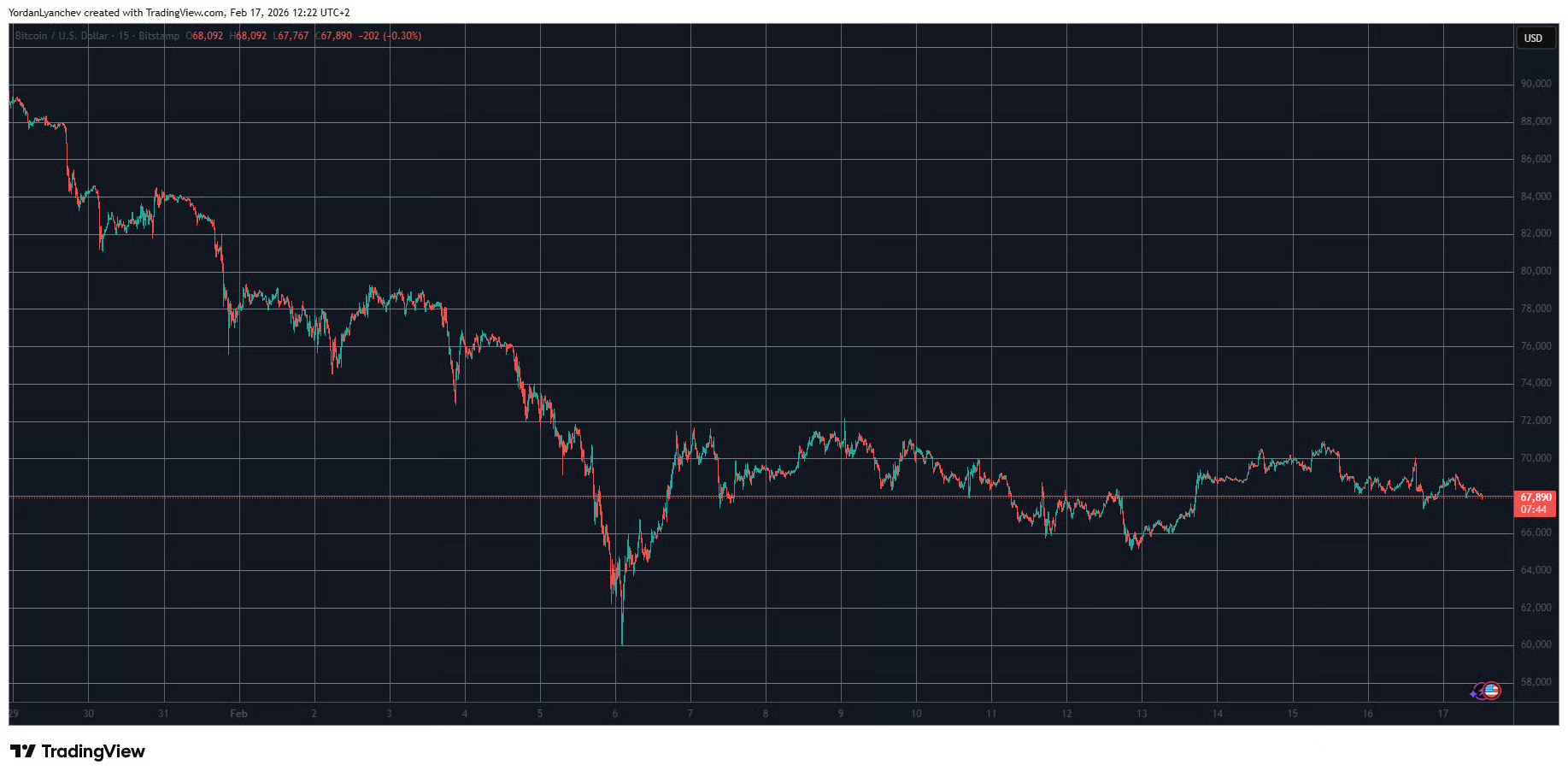

Bitcoin was stopped once again at the coveted $70,000 resistance yesterday, and the asset slipped by over two grand in the following hours, currently struggling below $68,000.

Most larger-cap alts have continued their sluggish business week performance, with XRP well below $1.50 and DOGE dipping below $0.10.

BTC Below $68K Again

The primary cryptocurrency reacted well to the price drop on February 6 when it plunged to its lowest position since October 2024 at $60,000. After losing $30,000 in just over a week, the asset went on the offensive and almost immediately rocketed to $72,000.

It faced resistance at that point and spent the following days trading between $68,000 and $72,000. The lower boundary gave in last Friday, but the bulls quickly intercepted the move and didn’t allow further declines.

Just the opposite; BTC started to recover some ground over the weekend and neared $71,000 on a couple of occasions. It couldn’t continue north, though, and the subsequent rejections pushed it south to under $68,000 yesterday after another unsuccessful breakout attempt.

Bitcoin continues to trade below that level as of press time, with its market cap declining further to $1.355 trillion on CG. Its dominance over the alts has also been hit and is now below 56.5%.

PI Back in Top 50

Ethereum has failed at reclaiming the $2,000 resistance after another minor daily decline. XRP has lost the $1.50 support following a 2.3% drop since yesterday. The OG meme coin is beneath $0.10 as it nearly erased all gains posted during the weekend. SOL, ADA, HYPE, and LINK are also slightly in the red, while BNB and TRX have posted insignificant gains.

Pi Network’s native token has turned green daily, jumping to almost $0.18. Recall that the asset went through a wild ride in the past week, from an all-time low of $0.1312 to a local peak of over $0.20 before it settled now. Nevertheless, it has returned to the top 50 alts by market cap as its own is at $1.6 billion.

The other big gainers from the top 100 alts are STABLE (15%), M (14%), and NEXO (8%). The total crypto market cap, though, has slipped back down to $2.4 trillion on CG.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Is Crypto Next to Benefit?

The market is increasingly turning against the US dollar, with short positions at their highest level since January 2012, according to Bank of America’s foreign exchange and rates sentiment survey.

This shift in sentiment comes as the US Dollar Index, which tracks the value of the greenback against a weighted basket of six major currencies, has declined 1.3% year to date.

Sponsored

Record Bearish Positioning Reflects Deep Skepticism About the Dollar

The latest Bank of America survey finds dollar positioning in February reached its most negative level in more than 14 years. Moreover, overall dollar exposure has fallen below the lows of April 2025, signaling continued loss of confidence among fund managers.

Despite efforts to restore confidence in the Federal Reserve, skepticism remains. President Trump’s January 2026 nomination of Kevin Warsh as Fed Chair aimed to reassure investors in US monetary policy. Nevertheless, this move has not lifted dollar demand.

“Survey respondents see further signs of US labor market weakness as the main risk for a lower dollar,” WSJ reported.

Meanwhile, the bearish sentiment comes amid a substantial slide in the US Dollar Index. In 2025, the index fell 9.4%, with declines continuing this year.

On January 27, DXY fell to 95.5, its lowest level since February 2022. At the time of writing, DXY recovered to reach 97.08.

Sponsored

DXY at Crossroads as Traders Debate Breakdown Versus Bottom

Market analysts are increasingly pointing to technical signals that point to further downside for the US dollar. Trader Donny forecasted that the index could decline below the 96 level.

“I’m seeing another bearish leg forming on the DXY,” he wrote.

Other analysts are looking even further out. The Long Investor highlighted longer-term charts that, in his view, outline a much deeper structural decline. He suggested that bearish targets could extend into the 52–60 range over the 2030s.

Sponsored

However, some analysts see potential for a dollar rebound. The Macro Pulse stated recent behavior suggests the index may be entering a “potential bottoming process.”

“My base case is a recovery toward 103–104 by July 2026,” the post read.

Sponsored

Implications for Cryptocurrency Markets

A weaker US dollar typically creates more supportive conditions for risk assets, including cryptocurrencies. When the dollar declines, investors may rotate into alternative assets in search of higher returns or protection against the depreciation of fiat currencies.

Bitcoin, in particular, is frequently positioned as a hedge against monetary debasement. This can strengthen its appeal during periods of sustained dollar weakness.

Still, the connection between dollar weakness and crypto gains is not always straightforward. Broader macroeconomic conditions remain critical.

If a softer dollar reflects slowing US growth or rising recession risks, investors may adopt a defensive stance. In such an environment, capital could flow into traditional safe havens such as gold rather than into more volatile digital assets.

Recent positioning data supports that caution. Bullish bets on gold have increased, signaling that many investors remain optimistic about the metal’s prospects.

As the dollar slips and fund managers maintain historically bearish positions, the coming months will test whether crypto markets can capitalize on shifting currency dynamics, or whether persistent macro uncertainty will continue to temper upside momentum in digital assets.

Crypto World

Is Gold Betting Against America’s Comeback?

The Bitcoin vs. gold debate has heated up over the past few months as investors reassess inflation risks and the future direction of monetary policy.

Yet according to one market strategist, the divide now extends beyond portfolio hedging. In his view, it reflects something far larger: a wager on the trajectory of the American economy itself.

Sponsored

Sponsored

Bitcoin vs Gold: Two Assets, Two Visions of America’s Path

In a recent post, James E. Thorne, Chief Market Strategist at Wellington-Altus, framed the two assets as opposing bets on the trajectory of the US economy.

“For the record. Bitcoin Is a Bet on Trump’s Success. Gold Is a Bet on America’s Failure,” Thorne wrote.

The strategist explained that gold, in his view, has become what he described as a “verdict.” Rather than simply protecting against inflation or volatility, he argued that rising demand for gold reflects a growing lack of confidence in “Trump’s economic revolution” and the ability of policymakers to reform an economy burdened by excessive debt.

According to Thorne, investors piling into gold are effectively betting that the US will continue down a path of monetary expansion, debt accumulation, and currency debasement.

“It is the old guard’s confession that they see only one way out of excessive leverage: print, debase, and hope the music doesn’t stop,” he remarked. “Trump, Bessent, and Warsh argue there is another path: reform the Fed, end the subsidy to idle reserves, stop paying banks to sit on cash, and force capital out of sterile Treasury holdings and back into the productive economy where it belongs.”

By contrast, Thorne positioned Bitcoin as a “speculative flag of success.” He suggested that it is a digital bet that regulatory clarity for the crypto sector, including measures such as the proposed CLARITY Act, alongside broader policy shifts, would position the US as a global crypto hub.

Sponsored

Sponsored

In this “split-screen” vision of the future, gold signals doubt that America can grow its way out of mounting fiscal pressures, while Bitcoin reflects confidence that reform-driven growth can reduce the real burden of debt.

“If Trump’s program works, if growth, deregulation, and redirected capital start to shrink the real burden of debt instead of inflating it away, Wall Street will have to rediscover its purpose: generating credit for builders, not rent for bondholders. Then those who rushed into gold as a monument to decline will face a brutal reckoning: their ‘safe haven’ will stand as a shiny, inert tribute to one vast miscalculation — that America would fail just as its leaders chose to make it succeed,” Thorne mentioned.

Bitcoin’s Safe-Haven Narrative Faces Scrutiny

The remarks come at a time when gold has surged amid macroeconomic uncertainty despite volatility. On the other hand, Bitcoin has experienced notable drawdowns, reigniting debate over its store-of-value narrative.

Trader Ran Neuner recently raised concerns over Bitcoin’s response amid periods of genuine market stress and uncertainty.

“For the first time in 12 years, I’m questioning Bitcoin’s thesis,” he said. “We fought for ETF approval. We fought for institutional access. We wanted it inside the system. Now it is. There is nothing to fight for anymore.”

Neuner argued that episodes marked by tariff disputes, currency tensions, and fiscal instability presented a real-world test for Bitcoin’s safe-haven narrative. During those periods, however, investor flows appeared to favor gold over digital assets.

With exchange-traded funds approved and institutional channels widely available, access to Bitcoin is no longer a structural constraint. This removes a longstanding explanation for muted performance during stress events.

He also pointed to subdued retail engagement and weaker speculative momentum compared to prior cycles. While this does not imply a structural breakdown for Bitcoin, he suggested it raises questions about whether its investment thesis remains as clear-cut as it once appeared.

Crypto World

Binance stablecoin reserves drop $9B, signal fading risk appetite

Binance logs three straight months of heavy stablecoin outflows, erasing $9B in reserves and signaling a sustained liquidity squeeze across crypto markets.

Summary

- Binance has seen negative stablecoin netflows for three consecutive months, the longest stretch since the 2023 downturn.

- Net outflows climbed from about $1.8B in December to nearly $2.9B in January and around $3B halfway through February.

- Stablecoin reserves dropped from roughly $50.9B in November to $41.8B, shrinking the exchange’s capacity to absorb volatility.

Binance has recorded three consecutive months of negative stablecoin netflows, marking a sustained contraction in crypto market liquidity, according to data shared by CryptoQuant.

The outflows represent the longest comparable stretch since the 2023 bear market, the data showed.

Monthly figures indicate an acceleration in the trend. December saw approximately $1.8 billion in net stablecoin outflows, followed by nearly $2.9 billion in January, according to the data. February outflows have reached close to $3 billion despite the month being only halfway complete.

Binance’s stablecoin reserves have declined from approximately $50.9 billion in November to $41.8 billion, representing a contraction of nearly $9 billion, the data indicated.

Stablecoin outflows from major exchanges typically indicate capital leaving the exchange ecosystem rather than being redeployed into other crypto assets, according to market analysts. Stablecoins serve as readily deployable capital in cryptocurrency markets, and declining balances reduce the capacity to absorb price volatility.

The outflows occur amid elevated global uncertainty and geopolitical tensions, factors that market observers say may be influencing investor behavior toward more defensive positioning.

The trend has continued without signs of stabilization, according to the latest available data from CryptoQuant.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video19 hours ago

Video19 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech7 hours ago

Tech7 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Crypto World7 days ago

Crypto World7 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics7 days ago

Politics7 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Sports6 days ago

Sports6 days agoWinter Olympics 2026: Australian snowboarder Cam Bolton breaks neck in Winter Olympics training crash

-

Crypto World4 days ago

Crypto World4 days agoKalshi enters $9B sports insurance market with new brokerage deal