Crypto World

Morph Integrates USDT0, Unlocking Access to the World’s Largest Stablecoin Liquidity Pool

[PRESS RELEASE – Singapore, Singapore, February 13th, 2026]

Ethereum-based payments settlement network Morph has integrated USDT0, the omnichain Tether liquidity network powered by LayerZero. The move gives Morph, which aims to become the settlement layer for everyday money, direct access to unified USDT liquidity across 18+ blockchains.

For developers building payment apps, merchant tools or even DeFi protocols on Morph, this means they can tap into a massive, ready-made liquidity pool from day one without the headache of managing a dozen different bridged token contracts.

No more bridges. No more wrapped tokens

Traditionally, using USDT on another blockchain requires a bridge. This process locks the original tokens and mints a new, “wrapped” version on the destination chain.

These wrapped variants are not the same asset. They are separate tokens backed by assets held in complex smart contracts, leading to liquidity fragmentation — where the same currency is trapped in isolated pools — and introducing counterparty risk if a bridge fails.

USDT0 proposes a different model. Instead of locking and minting, it uses a burn-and-mint mechanism. To move USDT from Chain A to Chain B, tokens are burned on Chain A and minted directly from Tether’s canonical supply on Chain B.

As a result, USDT0’s Omnichain Fungible Token (OFT) standard creates a single, consistent asset across all supported networks.

What USDT0 enables for builders on Morph

While many L2s compete for general DeFi activity, Morph is engineered for a specific vertical: payments. Its architecture — featuring sub-300ms block times and zero-fee stablecoin transfers — targets merchant settlement, remittances, crypto cards issuance, and treasury management.

For such use cases, deep and frictionless liquidity is non-negotiable. USDT, with a market cap exceeding $185 billion, represents the largest pool of stablecoin liquidity in crypto.

As the USDT0 integration is now live on Morph mainnet, developers on Morph can integrate what is effectively a universal USDT, slashing technical overhead and simplifying cross-chain user experience, which means:

- Payment applications can process cross-border transactions with instant settlement and minimal overhead.

- DeFi protocols can access deeper liquidity without managing multiple stablecoin variants.

- Merchant platforms can accept stablecoin payments with seamless conversion and settlement.

- Financial institutions can execute treasury operations with predictable behavior across chains.

The combination of USDT0’s unified liquidity and Morph’s payment-optimized infrastructure lays a powerful foundation for next-generation financial applications.

We’re excited to work alongside the USDT0 team in advancing the vision of unified, omnichain liquidity that makes stablecoins truly borderless.

Money at the speed of life.

About Morph

Morph is an Ethereum-based, payments-first settlement layer and the native onchain home of BGB, focused on building the foundation for global consumer finance onchain. Morph supports real-world financial activity across payments, savings, identity, and rewards, enabling scalable, onchain settlement for consumer and business use. Guided by the Morph Foundation, the network connects more than 120 million users through the Bitget and Bitget Wallet ecosystems.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

South Korea Probes Missing 22 Bitcoin From Police Wallet

The loss was uncovered during an audit launched after a separate 320 Bitcoin custody failure, raising fresh concerns over digital asset management by authorities.

South Korean authorities are investigating after 22 Bitcoin seized in a 2021 case disappeared from a cold wallet at a Seoul police station, according to local media reports.

The 22 Bitcoin (BTC), worth about $1.5 million at current prices, were held by the Gangnam Police Station and discovered missing during a nationwide audit of digital asset custody practices, the Seoul Economic Times reported Friday.

Authorities reportedly said the 22 Bitcoin had been transferred externally, though the cold wallet storing the tokens was not stolen.

The investigation follows a separate case at the Gwangju District Prosecutors’ Office where 320 BTC, worth about $21.3 million at current prices, disappeared in August 2025. Prosecutors in that case blamed a leaked password as part of a phishing attack.

The cases are drawing scrutiny over the authorities’ ability to handle confiscated Bitcoin and the safekeeping practices of digital assets.

Related: South Korean crypto CEO stabbed in court during Haru Invest fraud trial

Audit uncovers broader custody failures

The National Police Agency reportedly initiated a review of seized cryptocurrency holdings across the country following the 320 Bitcoin case. During that review, officials discovered that the 22 Bitcoin previously submitted to the Gangnam station in November 2021 were no longer in custody.

The 22 Bitcoin were voluntarily submitted to authorities during an investigation in November 2021. The case is now suspended without a clear conclusion after the BTC disappeared.

The Gyeonggi Northern Provincial Police Agency is investigating the circumstances and potential individuals involved in the Bitcoin transfer.

Related: Google Cloud flags North Korea-linked crypto malware campaign

In January, South Korea’s Supreme Court ruled that Bitcoin held in centralized exchanges can be seized by investigators.

Bitcoin is now an “object of seizure” under the Criminal Procedure Act because it is electronic information with independent manageability, tradability and economic value.

The ruling means Korean users keeping their Bitcoin on exchanges may have their holdings frozen if linked to alleged criminal proceedings.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Praetorian Group CEO Sentenced to 20 Years for $200M Bitcoin Ponzi Scheme

TLDR:

- Praetorian Group CEO Ramil Palafox received 20-year sentence for operating $200M Bitcoin Ponzi scheme from 2019 to 2021.

- Over 90,000 investors worldwide lost at least $62.7M in the fraudulent cryptocurrency operation.

- Palafox promised daily returns of 0.5% to 3% but paid investors with their own or others’ money.

- CEO spent millions on 20 luxury cars, four homes, and designer goods from Rolex, Gucci, Ferrari.

Ramil Ventura Palafox, CEO of Praetorian Group International, received a 20-year prison sentence for orchestrating a Bitcoin Ponzi scheme that defrauded over 90,000 investors worldwide.

The U.S. Department of Justice announced the sentencing following Palafox’s conviction on wire fraud and money laundering charges.

The scheme collected more than $201 million between December 2019 and October 2021. Investors lost at least $62.7 million through the fraudulent operation.

Fraudulent Bitcoin Trading Operation

Palafox operated Praetorian Group International as a multi-level marketing and Bitcoin trading firm. The 61-year-old dual citizen of the United States and Philippines made false claims about the company’s trading activities.

He promised investors daily returns ranging from 0.5 to 3 percent on their Bitcoin investments. However, the company was not trading Bitcoin at a scale capable of generating such returns.

The scheme followed a classic Ponzi structure where early investors received payments from new investor funds. Palafox used incoming investments to pay returns to existing participants rather than generating profits through legitimate trading.

This model created an illusion of profitability while the operation remained fundamentally unsustainable. The company attracted global participation through aggressive marketing and promises of consistent returns.

During the operation’s peak, investors deposited more than $30 million in fiat currency into the scheme. Additionally, participants transferred at least 8,198 Bitcoin worth approximately $171.5 million at the time.

The company maintained a website portal where investors could monitor their supposed investment performance. This online platform consistently displayed fraudulent data showing account growth and positive returns.

Between 2020 and 2021, Palafox deliberately misrepresented investment performance through the portal. The fake data convinced victims their investments remained secure and profitable.

This deception prevented early detection and allowed the scheme to continue expanding. Many investors reinvested their purported gains based on the false information displayed on the platform.

Lavish Spending and Asset Seizures

Palafox diverted investor funds for personal luxury purchases and promotional expenses. He spent approximately $3 million acquiring 20 high-end vehicles from manufacturers including Porsche, Lamborghini, McLaren, and Ferrari.

The collection also featured automobiles from BMW, Bentley, and other premium brands. These purchases served both personal enjoyment and created an image of success to attract new investors.

Real estate acquisitions formed another major category of expenditure. Palafox purchased four homes across Las Vegas and Los Angeles with a combined value exceeding $6 million.

He also spent around $329,000 on penthouse suites at luxury hotel chains. These properties provided venues for meetings and demonstrations of wealth to potential investors.

Luxury goods purchases totaled an additional $3 million from high-end retailers. Palafox bought clothing, watches, jewelry, and home furnishings from brands like Louboutin, Gucci, Versace, and Cartier.

His shopping list included items from Ferragamo, Valentino, Rolex, and Hermes stores. He transferred at least $800,000 in cash to a family member along with 100 Bitcoin valued at approximately $3.3 million.

The FBI Washington Field Office and IRS Criminal Investigation collaborated on the investigation. Assistant U.S. Attorneys Jack Morgan and Annie Zanobini prosecuted the case alongside former Assistant U.S. Attorney Zoe Bedell.

The U.S. Attorney’s Office for the Eastern District of Virginia confirmed that victims may qualify for restitution payments. Affected investors can submit claims through the official channels established by the court.

Crypto World

90% Rally Setup Returns, But With a Twist

Polygon price is showing fresh signs of recovery after weeks of steady selling. Since February 11, POL is up nearly 13%, and over the past 24 hours, it has gained around 5.4%, holding most of its rebound near $0.095.

At first glance, the structure looks similar to the setup that triggered Polygon’s 90% rally earlier this year. Price is stabilizing, momentum is improving, and buyers are active near support. But this time, one critical element is missing. The last rally began after sellers were fully flushed out. This time, that flush has not happened yet.

POL Price Repeats the Old Reversal Pattern, But Without a Clean Seller Flush

Before the January rally, Polygon formed a very clear bottom. Between December and early January, the POL price printed a sharp lower low in a single move. Sellers capitulated. Weak hands exited. That created a clean base for buyers to step in.

Sponsored

Sponsored

This time, the structure is different.

Between January 31 and February 11, POL again made a lower low near $0.087, while the Relative Strength Index, or RSI, formed a higher low. RSI measures buying and selling strength, and this bullish divergence usually signals that selling pressure is weakening. But instead of one decisive breakdown candle, POL tested the same support area twice.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Two separate candles touched the $0.087 zone. This creates a “lower-low zone” instead of a clean lower low.

That matters. When a market prints a single deep low, it usually means sellers have given up, hinting at exhaustion. When the price keeps revisiting the same level, it means sellers are still active. Supply has not been fully absorbed yet. So even though the technical pattern looks similar, the psychology is different.

The market has stabilized, but it has not been fully cleansed. That unfinished seller flush is the foundation of the entire twist.

Sponsored

Sponsored

Muted Leverage and Rising Shorts Reflect Unfinished Selling Pressure

This incomplete flush is clearly visible in the derivatives data. During the January rally, leverage exploded early.

Open interest on Binance jumped from around $16.6 million to over $40 million, rising more than 140% in a few days. Traders rushed into long positions as soon as the price turned. This time, that has not happened. Since February 11, while POL gained nearly 13%, open interest has stayed near $18.80 million. There is no strong buildup of leverage yet. Possibly hinting at low conviction.

More importantly, funding rates are now negative, near -0.012. Funding rates show which side dominates futures markets. Negative rates mean short traders are paying longs. That signals growing bearish positioning.

In January, funding was positive. Traders were betting aggressively on upside. Now, shorts are building.

This fits perfectly with the price structure. Because sellers have not been flushed out, traders are still comfortable betting against the rally. They see unfinished downside risk. So instead of chasing longs, many are positioning for pullbacks. That lends a major hit to the supposed rally’s conviction.

Sponsored

Sponsored

This keeps leverage restrained and momentum controlled. The rally is moving forward, but under constant pressure.

Whale Accumulation Is Supporting Price, But Not Forcing Capitulation

While traders remain cautious, large holders are behaving differently. Since early February, whale holdings have risen from around 7.5 billion to nearly 8.75 billion POL, an increase of about 16%. This shows that long-term buyers are accumulating quietly.

Their buying is the main reason the price keeps rebounding from the $0.087 area.

But whale accumulation has another effect. It absorbs supply without triggering panic. Instead of forcing weak sellers out, whales are slowly taking their coins. That stabilizes the price but delays capitulation. It is worth noting that during the last early-2026 rally, these Polygon whales hardly increased their stash.

Sponsored

Sponsored

So the market ends up in between:

- Sellers are still present (not flushed out)

- Buyers are active

- No one is fully in control of the Polygon price

This is why the price is rising gradually, not explosively. And that might limit the rally potential going forward.

Key Polygon Price Levels Will Decide Whether Sellers Finally Get Flushed

With unfinished selling pressure still in the system, price levels now matter more than patterns. On the upside, the key level is $0.11.

A clean break above $0.118 would signal that remaining sellers are being overwhelmed. From current levels, that would be another 24% move. It would likely attract leverage and weaken short positions, finally completing the flush. Above that, targets open toward $0.137 and $0.186.

On the downside, the critical support zone is $0.083-$0.087. If POL breaks below that, the lower-low setup fails, and a new one starts forming. That would confirm that sellers still have control and that the unfinished flush is playing out. In that case, the price could slide toward $0.072 and $0.061.

Crypto World

Binance’s CZ rejects “fake news” claim of 60,000 BTC BitMEX hedge profits

CZ denies Binance ever traded on BitMEX or booked 60,000 BTC in hedge profits during the March 2020 crash, calling the viral allegation “fake news” and technically impossible.

Summary

- CZ responds to a viral post alleging Binance hedged client flow on BitMEX for over 60,000 BTC in profit during the March 2020 “Covid crash,” dismissing it as fabricated “fake news”.

- He stresses that Binance “never traded on BitMex” and points to the exchange’s once‑daily withdrawal schedule at the time as a practical barrier to real‑time hedging of that size.

- Commentators and BitMEX itself say there are no records of such flows, framing the debate as another example of rumor‑driven FUD and how old anecdotes morph into conspiracy narratives.

Binance founder Changpeng “CZ” Zhao has moved to quash fresh allegations that the exchange secretly booked more than 60,000 BTC in profits by hedging client risk on BitMEX during the March 2020 crash, dismissing the claim as “fake news” and emblematic of the rumor‑driven warfare that still defines much of crypto trading culture.

CZ pushes back on BitMEX hedge narrative

Responding to a viral post from Flood, CEO of fullstack_trade on Hyperliquid, CZ said the allegation that Binance hedged flow on BitMEX for over 60,000 BTC in profit during the Covid‑era liquidation cascade was entirely fabricated. “4. Fake news. They just making things up randomly now. Not sure what their goal is. I feel bad for the people believing this without seeing any proof,” he wrote, adding bluntly that “Binance never traded on BitMex.” Zhao tagged BitMEX co‑founder Arthur Hayes to underline a key operational constraint at the time, noting that “BitMex processes withdrawals only once a day,” a structure that would have made real‑time risk‑hedging of that magnitude effectively impossible.

BitMEX and traders call claim “impossible”

Market participants quickly weighed in to deconstruct the 60,000 BTC storyline. “Exactly. BitMEX’s once-a-day withdrawal window back in 2020 made it impossible for an exchange to use it for a real-time hedge of that size,” commentator Murtuza J. Merchant argued, stressing that “no entity would trap 60,000 BTC in a manual multi-sig during a black swan crash.” He suggested the “60k figure is likely just a garbled memory of old” market anecdotes rather than a verifiable trade record. BitMEX itself has since confirmed that it has no records supporting the alleged flows and pointed to its upgrade from once‑daily batched withdrawals to real‑time payouts as part of broader infrastructure changes since 2020.

FUD, Binance’s legacy, and market context

Not everyone accepted the “fake news” framing. One critic, posting under the handle Broly, countered that “Binance has had a major role in every major downfall of crypto,” citing the exchange’s role in the FTX collapse, its backing of LUNA before withdrawals were halted, and its influence around other major dislocations. The episode has been widely mocked as yet another round of competitive FUD, but it also underscores how opaque cross‑exchange flows, historical grievances, and incomplete memories can quickly harden into conspiracy narratives in a market that still trades on screenshots and hearsay as often as audited disclosures.

Market prices and further reading

This parabolic move comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $68,280, with a recent 24‑hour range between roughly $64,760 and $71,450. Ethereum (ETH) is trading near the low‑$2,000 band, with prediction markets clustering key levels between about $1,940 and $2,100 over the near term. Solana (SOL) changes hands around $78–81, roughly flat on the session after a modest pullback from recent highs.

Crypto World

Why the CPI Release Matters for the Price of Bitcoin

The previous Consumer Price Index (CPI) report was published on 13 January and had a significant impact on Bitcoin’s price. As the BTC/USD chart shows:

→ shortly after the release, the price surged aggressively to the 14 January peak;

→ it then reversed sharply lower (a sign of a bull trap), creating a bearish outlook — which we highlighted on 21 January;

→ subsequently, it broke through multi-month support and entered an accelerated decline towards the $60k area.

For this reason, today’s US inflation report (16:30, GMT+3) is drawing close attention across multiple markets, as it may have a substantial effect on both the dollar and traders’ appetite for risk assets, including Bitcoin.

Technical Analysis of the BTC/USD Chart

Bitcoin’s price swings have formed a descending channel, shown in red. Within this framework:

→ the lower boundary (L) appears to be key support. When the price dipped below it on 6 February, aggressive buyers stepped in, resulting in a candle with a long lower shadow;

→ the QL line, which divides the lower half of the channel into two sections, is acting as resistance — as reflected in price action on 9 February.

The ATR indicator is trending lower, signalling declining volatility, which suggests the market is awaiting important news. Higher inflation is generally seen as a factor that could delay interest rate cuts, strengthen the dollar and bond yields, and weigh on BTC/USD. Conversely, softer inflation would be supportive for cryptocurrencies.

If the CPI release does not produce major surprises, Bitcoin may continue to trade within the broad L–QL range.

FXOpen offers the world’s most popular cryptocurrency CFDs*, including Bitcoin and Ethereum. Floating spreads, 1:2 leverage — at your service (additional fees may apply). Open your trading account now or learn more about crypto CFD trading with FXOpen.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Qzino Introduces Token-Based Revenue Model for Web3 iGaming Platform

[PRESS RELEASE – Valletta, Malta, February 13th, 2026]

Qzino, a Web3-based crypto casino platform, has officially launched, introducing an ecosystem that integrates profit-sharing mechanisms, token-based rewards, and a broad gaming offering. The platform provides access to more than 10,000 games, including proprietary Qzino Originals, and incorporates token utility into its operational model.

Positioned as an alternative to traditional online casinos, Qzino integrates a revenue participation structure through its native QZI token. The token is designed to function as a profit-sharing mechanism within the platform’s ecosystem, allowing holders to receive distributions linked to overall platform performance, including during periods when they are not actively playing.

Simple and Transparent Profit-Sharing Model

QZI functions as a participation token within the Qzino ecosystem. According to the project, the token is structured to enable holders to receive distributions tied to the platform’s performance.

The model includes:

- Allocation of 30% of Qzino’s Net Gaming Revenue (NGR) to eligible participants

- A staking mechanism under which 3% of the staking pool is distributed daily to QZI holders

Under this structure, rewards may be generated both through platform activity and through token holding. The distribution framework is designed to operate according to predefined parameters outlined by the project.

Staking Mechanism and Token Supply Structure

The Qzino ecosystem incorporates a token model centered on mining and staking mechanisms. The QZI token has a capped total supply of 7,777,777,777 tokens and follows a predefined distribution framework outlined by the project.

Through the staking mechanism, eligible participants may receive daily distributions from the platform’s staking pool, subject to the platform’s terms and performance. The structure is designed to support ongoing token utility within the ecosystem and to align participation incentives with platform activity over time.

Cashback and Rakeback Program

Qzino includes a structured cashback and rakeback program as part of its platform model. According to the project, the system is designed to provide ongoing rewards tied to user activity.

The program includes:

- Cashback of up to 40%, distributed twice weekly, subject to platform terms

- Rakeback of up to 15%, calculated automatically and applied to eligible bets

These mechanisms are integrated into the platform’s broader rewards structure and form part of its operational framework within the crypto iGaming sector.

Integrated Mining Mechanism

At launch, Qzino includes a built-in mining mechanism integrated into platform activity. The system enables users to accumulate QZI tokens through participation, without requiring external hardware or specialized technical setup.

According to the project, the mining framework is designed to distribute tokens through user engagement prior to the activation of additional features such as profit-sharing and staking. The mechanism forms part of the platform’s broader token distribution model within its ecosystem.

Sports Betting Coming to Qzino

In addition to its casino offering, Qzino plans to integrate sports betting into the platform. The feature is intended to allow users to place cryptocurrency-based bets on major international sporting events.

According to the project, sports betting activity will be incorporated into the existing rewards framework, including cashback, rakeback, and token-based mechanisms. With this addition, Qzino aims to broaden its platform scope beyond casino gaming to include multiple forms of crypto-based betting within a single ecosystem.

AI-Supported Tools and Platform Accessibility

Qzino incorporates AI-based tools designed to support user experience within the platform. These tools assist with functions such as personalized game recommendations, basic analytics, and navigation, while gameplay decisions remain user-directed.

The platform is mobile-responsive, supports multiple languages, and is accessible to users in various jurisdictions, subject to local regulations. According to the project, registration is streamlined, KYC requirements are limited, and deposits and withdrawals are processed in cryptocurrency.

Affiliate Program and Market Positioning

In parallel with its player-facing features, Qzino has introduced a global affiliate program aimed at crypto-focused influencers, communities, and media partners. The program offers revenue share of up to 35%, including sub-affiliate commissions, with real-time performance tracking. Additional components include token-based incentives, airdrop campaigns, and free-to-play funnels, as outlined by the project.

“Our mission with Qzino is to create a platform where players don’t just gamble — they participate,” said Matero, Co-Founder of Qzino. “By combining profit-sharing, staking, and industry-leading cashback, we’re building an ecosystem where users genuinely benefit from the platform’s growth.”

The launch takes place amid continued growth in the crypto iGaming sector, particularly among platforms emphasizing transparency and blockchain-based mechanics. By combining gaming services with token-based participation models, Qzino seeks to establish a presence within the evolving Web3 gaming landscape.

For more information about Qzino and to join the platform, users can visit www.qzino.com.

About the Project

Qzino is a Web3-based crypto gaming platform designed to combine casino entertainment with tokenized revenue participation. Built around the QZI token, the project integrates profit-sharing, staking, mining mechanics, and a loyalty-driven rewards system into a single ecosystem.

The platform provides access to over 10,000 games, including proprietary Qzino Originals, with sports betting integration underway. By aligning platform growth with token holder participation, Qzino aims to introduce a sustainable, community-oriented model within the evolving crypto iGaming sector.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

China’s Baidu adds OpenClaw AI into search app for 700 million users

Chinese tech company Baidu, best known for its search engine, also operates cloud, mapping and other internet-based services.

Bloomberg | Bloomberg | Getty Images

BEIJING — Baidu plans to give users of its main smartphone app direct access to the wildly popular artificial intelligence tool OpenClaw, according to a spokesperson for the Chinese tech company.

Starting later on Friday, users who opt in can message the AI agent through Baidu’s main search app to complete tasks such as scheduling, organizing files and writing code.

AI agents such as OpenClaw have surged in popularity recently for their ability to automate tasks, including managing email and using online services.

Previously, the Austrian-developed open-sourced AI agent could only be accessed from chat apps such as WhatsApp or Telegram. Chinese companies such as Alibaba, Tencent and Baidu have already allowed users to run OpenClaw on their cloud systems.

Baidu claims 700 million monthly active users for its search app. The company is also rolling out OpenClaw’s capabilities to its e-commerce business and other services.

The rollout comes just days ahead of China’s Lunar New Year holiday, as Chinese internet tech giants race to attract new users and monetize their AI investments.

Alibaba has also integrated its e-commerce platforms, such as Taobao and travel site Fliggy, with its AI chatbot Qwen, and claimed it received more than 120 million consumer orders through the app in the six days through Feb. 11.

Qwen users can compare personalized product recommendations before completing payment through Alipay — all within the chatbot. Previously, the AI tool could suggest products based on prompts, but shoppers had to leave the app and navigate multiple platforms to complete their transactions.

Despite growing interest in AI agents such as OpenClaw, cybersecurity firms including CrowdStrike have warned the public about granting OpenClaw unfettered access to enterprise systems.

Crypto World

Boerse Stuttgart Digital Merges With Tradias In Crypto Push

Boerse Stuttgart Group, operator of one of Europe’s largest stock exchanges, said it will merge its cryptocurrency business with Frankfurt-based digital asset trading firm Tradias in a strategic move to expand its presence in institutional crypto markets.

The transaction will consolidate about 300 employees under a joint management team from both companies, according to a Friday announcement.

The combined unit aims to cover multiple digital asset services, including brokerage, trading, custody, staking and tokenized assets. It will serve banks, brokers and other financial institutions across Europe, providing fully regulated crypto infrastructure, the announcement said.

Financial terms of the deal were not disclosed. Boerse Stuttgart and Tradias representatives declined to comment to Cointelegraph on the deal’s terms. Bloomberg reported the transaction could value Tradias at about 200 million euros ($237 million) and the combined entity at more than $590 million.

MiCA-compliant crypto custodian joins forces with BaFin-licensed bank

Boerse Stuttgart has been developing its regulated crypto infrastructure through its Boerse Stuttgart Digital arm, which provides trading, brokerage and custody services in accordance with the European Union’s Markets in Crypto-Assets Regulation (MiCA).

In 2025, Boerse Stuttgart reported tripling crypto trading volumes, accounting for a quarter of its total revenue in 2024. CEO Matthias Voelkel expressed a bullish stance on crypto and disclosed personal Bitcoin (BTC) holdings at the time.

The platform’s existing footprint in regulated digital assets positions the exchange group to expand offerings by combining technology with Tradias’ execution capabilities.

Operating as the digital assets arm of Bankhaus Scheich, Tradias is licensed as a securities trading bank by the German Federal Financial Supervisory Authority (BaFin).

“With the planned merger of Boerse Stuttgart Digital and Tradias, Boerse Stuttgart Group is driving the development and consolidation of the European crypto market,” Voelkel said.

Related: Denmark’s Danske Bank allows clients to buy Bitcoin and Ether ETPs

“We have built strong growth momentum in recent years. By merging with Boerse Stuttgart Digital, we will take the next logical step in our corporate development,” Tradias founder Christopher Beck noted, adding:

“Together, we will cover the entire value chain for digital assets and create a new European champion with significantly greater reach, strategic depth, and creative power for further market consolidation.”

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Your Definitive Guide on P2P Crypto Wallet Development For 2026 & Beyond

Capital in Web3 is moving with intent, not experimentation, and P2P crypto wallet solutions sit at the center of that shift. In 2025 alone, cross-border P2P transaction volume expanded by 51%, while embedded finance adoption advanced 36% as enterprises embedded native payment rails into digital ecosystems. Biometric authentication reached 58% penetration across leading platforms, and 71% of users actively favored contactless scan-and-pay experiences, signaling a decisive move toward frictionless yet secure finance. Voice-enabled payments grew 24%, reinforcing the demand for intelligent, always-on payment infrastructure. These are not usage anomalies but structural indicators of where capital efficiency, user trust, and platform defensibility converge for long-term value creation.

What is a P2P Crypto Wallet?

A P2P crypto wallet is a software wallet designed to enable peer-to-peer exchange and settlement of digital assets directly between users, without routing trades through a central matching engine. P2P wallets can be non-custodial, meaning users keep their private keys, or hybrid, offering optional custody services. They typically provide on-wallet order books or secure on-chain trade settlement, atomic swap or smart contract mediated exchanges, and in-app messaging or negotiation layers so counterparties can discover and agree on terms. The key differentiator is that trades are executed directly between participants and settled on-chain or via cryptographic settlement channels. Now, let us scroll through the blog to deeply understand the factors impacting the rise of peer-to-peer transactions and how a crypto wallet supports it.

What is The Hype About P2P Transactions & Web3 Wallet Solutions?

The momentum behind P2P Web3 crypto wallets stems from multiple converging forces. Institutional demand for self-custody and transparency has grown, while retail users seek lower fees and censorship-resistant rails. Regulators have tightened oversight of custodial services, which increases the attractiveness of non-custodial and privacy-preserving mechanisms for compliance-conscious players. At the same time, infrastructure improvements such as cross-chain messaging, layer 2 settlement, and programmatic escrow primitives make direct peer settlement practical at scale. These advances position P2P wallets as a market segment where decentralization and enterprise needs can be reconciled.

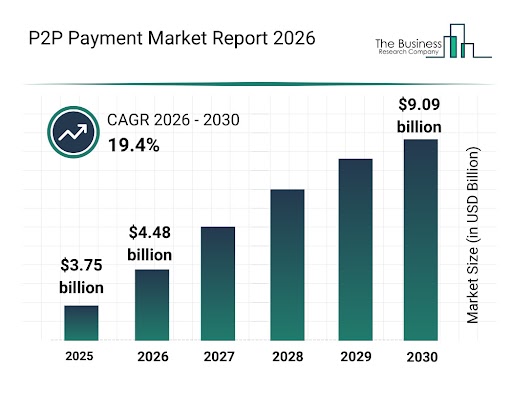

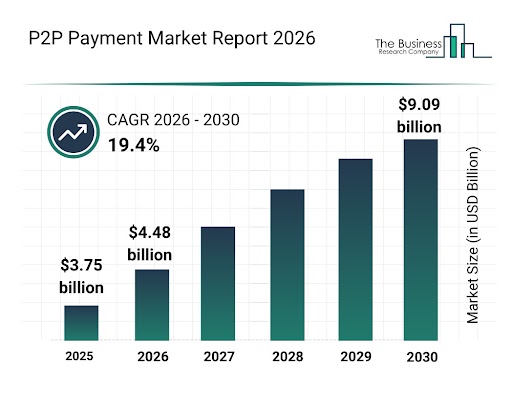

Source link: https://www.thebusinessresearchcompany.com/report/p2p-payment-global-market-report

Core P2P Payment Market Trend

- Cross-border P2P transfers jumped 51% in 2025, driven by lower fees and wider access.

- Embedded finance grew 36% as more brands added native P2P options in 2025.

- Gen Z and millennials fueled a 28% rise in social-payment P2P apps in 2025, prioritizing social features.

- Voice-activated payments via AI assistants rose 24% in 2025, reflecting demand for hands-free convenience.

- 71% of users favored apps with contactless scan-and-pay in 2025, accelerating innovation.

- Biometric authentication reached 58% adoption across major P2P apps in 2025, strengthening security.

- Real-time processors like Zelle maintained the industry standard by settling transactions in seconds in 2025.

Key market context to consider: analysts place the global cryptocurrency wallet development market in the multi-billion dollar range in 2026, underlining the rapid adoption and strong commercial opportunity for wallet providers.

Advantages of P2P Crypto Wallet Development

Investors should view P2P crypto wallet development as more than technology; it is a strategic lever that creates durable business advantages. A thoughtfully designed P2P wallet builds network effects, predictable revenue channels via platform services, and clear pathways to enterprise partnerships and bank integrations. It makes product roadmaps measurable, governance models transparent, and M&A or tokenization outcomes cleaner. Understanding these levers today lets you quantify upside, stress test assumptions, and negotiate terms from a position of strength when the market demands scale and regulatory clarity.

1. Greater user control and trust retention- Users hold keys or retain control over keys, improving trust metrics and reducing counterparty risk exposure for the product.

2. Reduced counterparty solvency risk- Direct settlement reduces dependence on exchange ledgers and central custody, lowering systemic risk from exchange failures.

3. Lower ongoing regulatory capital and reserve requirements- Operators of non-custodial P2P wallets avoid some capital and reserve obligations that custodial exchanges face, while still being able to provide compliance tooling where required.

4. New monetization channels without custody- Fees on on-chain settlement, premium matching, liquidity brokering, and enterprise SDK licensing create recurring revenue with lower operational overhead.

5. Increased resilience and censorship resistance- P2P structures reduce single points of failure and make it harder for a single authority to interrupt user access.

6. Competitive edge in markets with high fiat friction- P2P wallets that integrate local payment rails and stablecoin flows can capture remittance and cross-border volumes where traditional rails are slow or expensive.

7. Better alignment with institutional treasury policies- Institutional clients increasingly demand custody flexibility and programmable controls that P2P flows can support via multisig, time locks, or policy engines.

Features Essential for P2P Crypto Wallets Built For Success

Basic feature set

- Secure key management and mnemonic handling with clear recovery flows

- Simple send and receive UX with transparent gas and fees

- Multi-chain support for major EVM chains and Bitcoin via compatible bridges

- On-chain settlement support and clear transaction status indicators

- Address book, QR scanning, and transaction history auditing

- Basic wallet encryption, PIN, and biometric unlock

Advanced Enterprise Grade Capabilities

- Integrated P2P order matching and negotiation engine with optional on chain escrow contracts

- Smart routing: atomic swaps, cross-chain bridges, and layer 2 settlement channels

- Role-based access and enterprise wallet profiles for treasury management

- Multi-signature workflows and threshold signature schemes for institutional custody

- Real-time blockchain analytics and risk scoring integrated with compliance pipelines

- Decentralized identity integration and selective disclosure using verifiable credentials

- Replay protection, transaction batching, and gas optimization modules for cost efficiency

- Insurance orchestration and proof of reserves integration for optional custody guarantees

- API and SDK suites for partners and white-label customers.

You can always achieve this level of success and acquire the wide range of advantages mentioned above by hiring an accredited team of blockchain experts from a renowned cryptocurrency wallet development company. Apart from this, the company will also help you achieve success after with their alternative solutions, like customized solutions as per business needs.

Plan Your P2P Wallet Strategy With Our Experts

Are White Label P2P Crypto Wallets the Winning Path?

White-label blockchain wallet solutions are an attractive route for enterprises and institutional entrants because they compress time to market and offer proven building blocks. For investors, a professionally engineered white-label product reduces execution risk and often includes battle-tested security modules, audit trails, and compliance hooks. This allows businesses to focus on customer acquisition and integrations rather than building cryptographic infrastructure from scratch. However, the trade-off is customization. For high compliance or differentiated product strategies, a hybrid approach where a white-label core is extended with bespoke modules often yields the best risk-adjusted return.

Market practitioners report that high-quality white label cryptocurency wallet service providers can deliver robust deployments quickly, while providing upgrade paths for enterprise integrations and regulatory controls.

How Much Does a P2P Crypto Wallet Development Cost?

The cost of a P2P crypto wallet development is primarily determined by the level of customization required, rather than a fixed pricing model. A basic white-label wallet with minimal modifications typically requires lower investment because the core architecture, UI framework, and security modules are already prebuilt, and development mainly involves branding and minor configuration.

As customization increases, the cost rises due to the need for deeper integrations, extended multi-chain support, tailored compliance workflows, and enterprise-grade APIs or SDKs. These requirements involve additional engineering, testing, and infrastructure setup.

A fully custom P2P crypto wallet requires the highest investment since the architecture, smart contracts, security layers, and user experience are designed specifically for the business model. Advanced capabilities such as multisignature custody, cross-chain routing, escrow mechanisms, and bespoke dashboards demand extensive development time, third-party audits, and ongoing maintenance, all of which significantly influence the overall cost.

How Much Time Does It Take To Create a P2P Crypto Wallet?

A P2P crypto wallet development timeline differs by approach. Below are practical estimates mapped to development phases.

1. White label deployment with light customization

-

- Typical duration: 1 to 4 weeks

- Activities: branding, token preloads, basic compliance toggles, testing, and deployment.

2. White label with enterprise integrations and moderate customization

-

- Typical duration: 4 to 10 weeks

- Activities: integrate KYC provider, analytics, and fiat on-ramp; add off-chain order features, QA, and security checks.

3. Full custom enterprise build

-

- Typical duration: 3 to 6 months or longer

- Activities: architecture design, smart contract development, multisig and custody integrations, compliance workflow construction, security audits, penetration testing, user acceptance testing, and regulatory sign-offs.

Note that parallelizing activities such as UI design, smart contract audit, and legal compliance work reduces overall calendar time. Real-world schedules also depend on the availability of third-party integrations, audit timelines, and regulatory filings.

Security & Compliance Realities Investors Must Weigh

Security is not optional. Rising on-chain criminal flows and targeted attacks are reshaping risk models, and platforms must invest in proactive controls. Threats include hot wallet exploits, social engineering, private key compromise through coercion, and off-chain identity fraud. Monitoring, anomaly detection, wallet heuristics, and safe recovery models are required to maintain institutional trust. Recent industry reports highlight notable rebounds in illicit on-chain flows and reaffirm the need for rigorous analytics and cooperation with law enforcement.

Regulation is also evolving. Many jurisdictions now distinguish custodial and non-custodial wallet development services more clearly, and AML KYC expectations are tightening, including live selfie verification and geo-tagging in some markets. For global deployments, you must design compliance as a first-class component rather than an afterthought.

Why Partner With Antier?

P2P crypto wallets are a high-potential and high-responsibility segment of the market. For investors, the opportunity lies in products that combine strong cryptography, pragmatic compliance, and enterprise integrations.

Connect with our team today to learn about our offerings and the entire process. We build white label P2P wallet solutions with an emphasis on security, auditability, and regulatory readiness. Our team combines cryptography engineers, compliance experts, and product designers who can guide you from requirements to launch, including policy design for KYC and AML, architecture for multisig custody, and production-grade smart contract audits. We also assist with jurisdictional analysis so your rollout aligns with local supervisory expectations. If you are evaluating investments or planning a wallet product, we can provide a technical due diligence brief, a costed implementation roadmap, and a compliance checklist tailored to your target markets.

Frequently Asked Questions

01. What is a P2P crypto wallet?

A P2P crypto wallet is a software wallet that enables direct peer-to-peer exchange and settlement of digital assets between users, without relying on a central matching engine. It can be non-custodial or hybrid, offering features like on-wallet order books and secure trade settlement.

02. Why are P2P transactions gaining popularity in Web3?

P2P transactions are gaining popularity due to increased institutional demand for self-custody, lower fees sought by retail users, tighter regulatory oversight of custodial services, and advancements in infrastructure that facilitate direct peer settlement.

03. What are the benefits of using P2P crypto wallets?

P2P crypto wallets offer benefits such as enhanced privacy, lower transaction fees, and the ability for users to maintain control over their private keys, making them attractive for both compliance-conscious players and those seeking decentralized financial solutions.

Crypto World

Bitcoin ETFs Bleed $410M as IBIT ETF by BlackRock Suffers the Largest Loss

TLDR

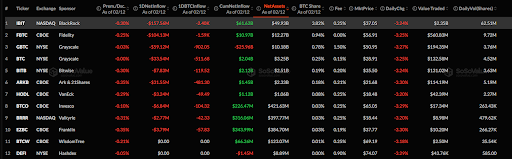

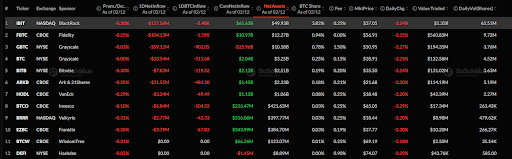

- Bitcoin ETFs faced a daily outflow of $410.37 million on February 12, with a cumulative net inflow of $54.31 billion.

- IBIT and FBTC experienced heavy losses, with daily outflows of $157.56M and $104.13M, respectively.

- Grayscale’s BTC ETF saw a minor outflow of $33.54 million, with a 3.25% decline in value.

- Mid-tier Bitcoin ETFs like HODL, BTCO, and BRRR also faced losses, reporting outflows and declines.

- BTCW and DEFI ETFs showed stable performance, with no inflows or outflows recorded.

According to a recent SoSoValue update on Bitcoin ETFs as of February 12, the market experienced a daily outflow of $410.37 million. Cumulative net inflow now reads at $54.31 billion with total value traded at $3.56 billion. Total net assets for Bitcoin remain solid at $82.86 billion, representing 6.34% of Bitcoin’s market cap.

Bitcoin ETFs Face Outflows as IBIT and FBTC Take Heavy Losses

Tracking the market performance of individual ETFs, the IBIT ETF, listed on NASDAQ and sponsored by BlackRock, saw a daily outflow of $157.56 million. The FBTC ETF, listed on the CBOE and sponsored by Fidelity, experienced an outflow of $104.13 million. Its daily change was a decrease of 3.25%, with a trading price of $56.91. GBTC ETF, listed on the NYSE and sponsored by Grayscale, saw a small outflow of $59.12 million.

Grayscale’s BTC ETF, listed on the NYSE, reported a minor outflow of $33.54 million. It saw a 3.25% decline in value. BITB ETF, listed on the NYSE and sponsored by Bitwise, reported a daily outflow of $7.83 million. Its cumulative net inflow is -$119.52 million. It experienced a daily decrease of 3.24%.

ARKB ETF, listed on the CBOE and sponsored by Ark & 21Shares, faced an outflow of $31.55 million. ARKB has assets totaling $1.45 billion, with a market share of 0.18%. The ETF saw a daily drop of 3.30%.

Other Mid-Tier ETFs Record Outflow While BTCW and DEFI Maintain Stability

The HODL ETF, listed on the CBOE and sponsored by VanEck, saw an outflow of $3.24 million. It recorded a daily decrease of 3.20%, trading at $21.68. The BTCO ETF, listed on the CBOE and sponsored by Invesco, experienced a smaller outflow of $6.84 million. BTCO traded at $65.05, down 3.29% on the day.

The BRRR ETF, listed on NASDAQ and sponsored by Valkyrie, reported an outflow of $2.77 million. Its total net assets stand at $316.06 million. The ETF has a market share of just 0.03% and has declined 3.20%, trading at $18.44.

The BTCW ETF experienced stable performance, with no daily inflows or outflows, as indicated by both 1-day net inflows and cumulative net inflows. It recorded a 3.24% drop in daily value, trading at $69.19. Just like the BTCW ETF, the DEFI ETF remained stable, with no daily inflows or outflows and a cumulative net inflow.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 day ago

Sports1 day agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat7 days ago

NewsBeat7 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World1 day ago

Crypto World1 day agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video1 day ago

Video1 day agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle