Crypto World

MSTR Shares Drop 8% as Bitcoin Hits One-Year Low, Extending Downtrend

TLDR

- MSTR shares fell by 8% today as Bitcoin dropped to its lowest level in a year.

- The decline in Bitcoin below key technical levels caused significant losses in crypto-linked stocks.

- Despite unrealized losses from Bitcoin’s price drop, MSTR continues to hold and buy more Bitcoin.

- Chairman Michael Saylor confirmed that Strategy will keep accumulating Bitcoin even during market downturns.

- MSTR’s recent Bitcoin purchase was funded through the sale of common stock to support its crypto strategy.

Shares of Strategy (MSTR) fell by over 8% today, driven by a sharp decline in Bitcoin prices. The cryptocurrency dropped to its lowest point in a year, affecting crypto-related stocks. This setback extended the downward trend that has plagued MSTR for months.

Bitcoin Slips Below Key Thresholds

Bitcoin saw a significant drop, falling below important technical levels over the weekend and early this week. The drop in Bitcoin’s value rippled across the market, particularly impacting shares tied to crypto. MSTR’s shares were among the hardest hit, continuing a longer-term slide.

As Bitcoin dipped below $75,000, other major crypto platforms like Robinhood and Circle also saw losses. The correlation between Bitcoin’s price and the performance of crypto stocks remains strong, highlighting the market’s sensitivity. As Bitcoin’s price slipped below key support levels, MSTR’s stock felt the pressure, extending its losses.

MSTR Grapples with Unrealized Losses

Strategy holds over 713,000 Bitcoins, which were purchased at an average price of $76,000 per coin. The recent drop in Bitcoin’s price has resulted in unrealized losses for the company. Despite these challenges, Strategy has made it clear it won’t sell its Bitcoin holdings.

Chairman Michael Saylor reaffirmed the company’s long-term strategy. “We will continue to accumulate Bitcoin, even in a weak market,” Saylor said. This approach has been a consistent theme for the company, as they see Bitcoin as a key asset despite short-term losses.

Earlier this week, Strategy acquired 855 additional Bitcoins for $75.3 million. The purchase was made at an average price of $87,974 per coin, just before Bitcoin’s price dropped below $75,000. The company’s Bitcoin holdings now total 713,502 BTC, with an average cost of $76,052 per coin.

Strategy’s Ongoing Capital-Raising Approach

Strategy has funded recent Bitcoin purchases through stock sales, continuing its capital-raising efforts. Last week’s Bitcoin purchase was smaller than previous buys, but still part of the company’s strategy to expand its crypto holdings. Despite Bitcoin’s recent slump, Strategy remains committed to increasing its Bitcoin position.

At the time of writing, Bitcoin’s price stands below $74,000, marking its lowest level in a year. This drop follows a retreat of more than 40% from Bitcoin’s all-time highs. MSTR’s shares have followed the trend, now trading at $128.87, down from their 52-week high of $450 per share.

Crypto World

ETF that feasts on carnage in MSTR hits record high

There’s always a bull market somewhere.

While bitcoin and shares of bitcoin holder Strategy are falling, an exchange-traded fund designed to move in the opposite direction of MSTR and double its daily change has hit a record high.

That exchange-traded fund is the GraniteShares 2x Short MSTR Daily ETF, trading under the ticker MSDD on Nasdaq. It is an actively managed fund designed to deliver -200% of the Strategy’s daily performance. In simple terms, if MSTR falls 2% in a day, the ETF targets a 4% gain that same day (before fees/decay).

The fund debuted on Jan. 10, 2025 and is seen as a high-risk short-term tactical tool for bears betting against MSTR. And it has lived up to its repute.

MSDD’s price hit a record high of $114 on Tuesday, up 13.5% on the year, extending the past year’s 275% surge, according to data source TradingView.

MSDD’s compatriot, the Defiance Daily Target 2x Short MSTR ETF (SMST), also clocked an 11-month high of $113 on Tuesday. This fund debuted on Nasdaq in August 2024.

In other words, MSTR bears out there who loaded up on these ETFs have made a killing.

Strategy fell to $126 on Tuesday, the lowest since September 2024, extending its multi-month bear market. The stock is now down a staggering 76% from its lifetime high of $543 in November last year.

Strategy is the world’s largest publicly listed bitcoin holder, stashing 713,502 BTC ($54.24 billion) at press time. Naturally, its share price tends to follow swings in bitcoin’s market value.

Bitcoin, the leading cryptocurrency by market value, has dropped 12% this year and traded as low as $73,000 on Tuesday. That was the weakest since late 2024. Since then, prices have bounced back to $76,000, thanks to narrowly approved funding package that alleviated near-term U.S. shutdown risk and stabilized risk sentiment in financial markets.

Crypto World

Why Cardano Investors Are Moving Assets to Self-Custody Now

“Currently, a 10 billion market cap, this thing is not even worth $1 billion,” one X user argued.

The latest cryptocurrency market crash was brutal, sending Cardano’s ADA to multi-month lows.

Some analysts believe the storm may not be over, warning the price could nosedive by as much as 75% in the short term.

The Bad Days for the Bulls Aren’t Over?

Several hours ago, ADA plunged to 0.27, the lowest level since August 2024. Currently, it trades at around $0.29 (per CoinGecko’s data), representing a 15% decline on a weekly scale.

The well-known analyst DrBullZeus claimed that the asset is now nearing “a must hold support zone” at the range of $0.24-$0.28. He thinks that breaking below that level could result in a price crash to $0.125 and even $0.075.

The popular trader Matthew Dixon also chipped in. He suggested that “technically speaking,” ADA has retraced in three waves since the local top seen towards the end of 2024. He outlined $0.24 as a “very important long-term support,” predicting that as long as it holds, the price could rebound.

“A break of support would be a serious concern,” he alerted.

Prior to that, Harmonic Trader predicted that in six months, ADA might trade under $0.10. “Currently, a 10 billion market cap, this thing is not even worth $1 billion,” they argued.

Time to Rally?

Despite ADA’s recent price decline, some other analysts remain optimistic that a resurgence could be on the way. One of them, using the X nickname “Lucky,” asked their almost two million followers whether they plan to increase their exposure to the token at current rates. The analyst also envisioned a potential pump to nearly $1 in the near future.

You may also like:

LaPetite is also bullish. Several days ago, he forecasted that ADA is about to go “parabolic,” claiming that “huge announcements” concerning Cardano are coming soon.

The recent exchange netflows signal that a rebound could indeed be on the horizon. Data provided by CoinGlass shows that over the past days and weeks, outflows have significantly outpaced inflows. This means investors have been shifting from centralized platforms to self-custody, which in turn reduces immediate selling pressure.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Aave Shutters Avara Brand and Family Crypto Wallet

Aave Labs says it is sunsetting its “umbrella brand” Avara in the company’s latest move to refocus on decentralized finance and simplify its branding.

Aave founder and CEO Stani Kulechov posted to X on Tuesday that Avara, a company encompassing projects including the Family crypto wallet and previously the social media platform Lens, “is no longer required as we go all in on bringing Aave to the masses.”

Kulechov said the Apple iOS-based Family crypto wallet was also being wound down as the team has “learned that onboarding millions of users requires purpose-built experiences, such as savings, rather than generic, open-ended wallet experiences.”

The move marks Aave’s latest effort to refocus on products such as its flagship lending protocol as the project handed stewardship of Lens to the Mask Network last month, with Kulechov saying Aave’s role in the protocol would be reduced to an advisory role so it can focus on DeFi.

Kulechov said in his latest post that Aave was “now united as one team of world-class designers, engineers, and smart contract experts, aligned around a single mission: bringing DeFi to everyone.”

All future projects under Aave Labs

Avara said in a blog post that “all current and future products, including the Aave App, Aave Pro, and Aave Kit, will operate under Aave Labs” to simplify the brand.

It added that accounts linked to the Family wallets “will continue as core infrastructure within Aave Labs products,” but the iOS app would be wound down over the next year.

No new users will be onboarded to the app from April 1, and existing users can continue using the app until April 1, 2027, and will continue to have full access to their funds on Aave’s website.

Related: There is no trust in DeFi without proper risk management

Aave is the biggest DeFi protocol with $30 billion in total value locked, nearly $9 billion more than the next largest project, the staking protocol Lido, which has $21.7 billion in value locked, according to DefiLlama.

The Aave (AAVE) token has traded flat over the past day, down just 0.7% in the last 24 hours at $127.40, according to CoinGecko.

Magazine: Ethereum’s Fusaka fork explained for dummies — What the hell is PeerDAS?

Crypto World

BLUFF Raises $21 Million to Power Betting Innovation

[PRESS RELEASE – Los Angeles, California, February 3rd, 2026]

Backed by Top Consumer, Crypto, and Cultural Investors, BLUFF Quickly Emerges as a Fast-Growing Betting Platform Boasting More Than 125M Bets in Beta

BLUFF, the next-generation betting and entertainment platform, has raised $21 million in strategic investment led by global blockchain technology fund 1kx, with participation from Makers Fund, Maximum Frequency Ventures, Delphi Ventures Founders and other high-profile backers, including sports champion & tech investor, Tristan Thompson. The team includes former senior executives from Stake, Bet365, William Hill and Bodog, drawing on experience operating the world’s leading betting platforms to deliver a truly novel gaming experience. The team will use the funds to advance the innovative betting platform and launch at scale.

BLUFF is building a social centric betting platform and sportsbook designed for the next generation of players. The platform prioritizes speed, transparency and player alignment, with instant onboarding, real-time settlement, provably fair games and reward systems that allow users to participate directly in the ecosystem they help grow.

“When we began building BLUFF, we set out to create a betting platform for the new generation of betters who prioritise fast, high-engagement gameplay, real-time experiences, real stakes and the social energy that defines how players engage online today,” said BLUFF’s Founder. “This funding, and the investors who have backed us, validates our mission of what the future of online betting can look like. Novel content, user-experience obsessed, deep community focus, and hyper-engaging for all users.”

The raise follows an exceptional pre-release phase, during which BLUFF has attracted over 600,000 sign-ups, sustained tens of thousands of daily active users and processed over 125,000,000 bets through its beta in 3 months alone. This early traction positions BLUFF as one of the fastest-scaling new betting platforms in the market with strategic partners across crypto, gaming and consumer entertainment.

“The speed of execution and level of organic demand we’ve seen from BLUFF is rare,” said Peter Pan, Partner at 1kx. “They’re building a category-defining platform with the potential to become the number one destination in betting and entertainment. BLUFF is exactly what the next generation of users is demanding.”

Beyond traditional iGaming and sports betting, BLUFF is building a unified experience that blends betting, live prediction markets, binary outcomes, and creator-led community events within a single platform. Bluff also provides a VIP matching program to make the transition from legacy platforms such as Stake, Shuffle and Rollbit to Bluff as seamless as possible, offering market-leading bonuses, rewards and world-class VIP service through a 24/7 VIP concierge.

“We are thrilled to back the BLUFF team,” said Andrew Willson, Partner at Makers Fund. “They bring a deep, nuanced understanding of player needs combined with an innovative approach to company building and platform design. By prioritizing players and offering a differentiated experience, we expect BLUFF to become a disruptive brand in the betting space.”

To learn more and play now, visit Bluff.com.

####

About BLUFF

BLUFF is built for the new generation of players. A global sports betting and iGaming platform where gaming, real stakes, culture, and community merge into a single, continuous loop to meet today’s users’ demands. It starts as a betting platform and sportsbook and evolves into something much bigger, with novel bet types, loot boxes, and trading that make for a unique betting experience. Backed by global blockchain technology fund 1kx, the founding team includes senior executives and operators from Stake, Bet365, William Hill, Bodog, YOLO, and other category-defining platforms, bringing decades of experience at the highest levels of betting and gaming.

About 1kx

1kx is a research-driven, fundamentals-focused global investment firm. Founded in 2018 by tech entrepreneurs Lasse Clausen and Chris Heymann, 1kx invests at key inflection points for blockchain technologies to create breakthrough opportunities across industries. The firm’s mission is to develop the domain expertise and thought leadership required to accelerate the most consequential markets emerging at the intersection of blockchain and the broader economy. As one of the top-performing and most institutionalized funds in the blockchain space, 1kx partners with a diverse global investor base, including sovereign wealth funds, pension funds, endowments, foundations, fund of funds, corporations, and family offices. Renowned for its hands-on approach, technical rigor, and unwavering long-term commitment to founders, 1kx has empowered over 150 visionary startups to scale transformative projects while delivering enduring returns for its investors.

To learn more, visit https://1kx.capital/ or @1kxnetwork on X.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Crypto VCs Split as Hype Around DePIN Fades

The decentralized physical infrastructure sector faces a reality check as investors debate if it can deliver beyond the hype.

Crypto World

Ethereum Dust Attacks Surge After Fusaka Upgrade

Stablecoin-driven dusting attacks are increasingly shaping Ethereum’s daily activity profile. After the Fusaka upgrade, which aimed to cut on-chain data costs and streamline postings from layer-2 networks back to Ethereum, observers say cost reductions have coincided with a rise in tiny-value transfers. In practical terms, dusting is now contributing a meaningful share of on-chain activity, even as the majority of transfers remain economically meaningful.

Key takeaways

- The Fusaka upgrade lowered data-availability costs on Ethereum, leading to a noticeable uptick in overall transaction volume and active addresses. Daily transactions have exceeded 2 million on average, with a mid-January peak near 2.9 million and about 1.4 million daily active addresses—roughly a 60% uptick from prior baselines.

- Dusting activity tied to stablecoins now accounts for about 11% of daily transactions and 26% of active addresses on an average day, a sizable jump from pre-Fusaka levels of roughly 3–5% of transactions and 15–20% of addresses.

- Analyses of USDC and USDT on Ethereum from November 2025 to January 2026 show growing decentralization effects: approximately 43% of dust-related updates involve transfers under $1, and 38% under a single cent, highlighting wallets seeded with tiny amounts.

- Security researchers flag a surge in address creation linked to dusting, with a reported 170% rise in new addresses during the week of January 12, often tied to low gas fees and the ability to move minuscule sums cheaply.

- Despite the dusting trend, the majority of stablecoin activity remains organic. Roughly 57% of balance updates exceed $1, suggesting meaningful, economically relevant use alongside the dusting flow.

Tickers mentioned: $ETH, $USDC, $USDT

Sentiment: Neutral

Market context: The surge in on-chain activity coincides with broader shifts in gas economics and the adoption of layer-2 data posting, signaling a transitional period in Ethereum’s usage patterns as users navigate cheaper transaction costs and new data handling efficiencies.

Why it matters

Ethereum’s post-Fusaka landscape presents a nuanced picture for users, developers, and market observers. On the one hand, the upgrade has delivered tangible benefits: lower costs and improved throughput for posting data from layer-2 networks, which translates into more affordable interactions on the main chain. On the other hand, the same efficiency gains appear to have lowered the friction barrier for dusting campaigns—malicious attempts to seed wallets with tiny, nearly worthless amounts designed to contaminate transaction analytics and entice recipients to transact with the wrong counterparties.

Coin Metrics recently analyzed more than 227 million balance updates for USDC (USDC) and USDt (USDT) on Ethereum from November 2025 through January 2026. The findings show a shift in composition: while a portion of this activity clearly reflects genuine use (payments, settlements, liquidity provisioning), a non-trivial slice now consists of very small transfers that serve as digital footprints, wallet seeding attempts, or poisoning attempts. The data show that 43% of observed dust transfers were under $1, and 38% were under a single penny, underscoring the economic minimalism of many such transactions.

The number of addresses holding small “dust” balances, greater than zero but less than 1 native unit, has grown sharply, consistent with millions of wallets receiving tiny poisoning deposits.

Before Fusaka, stablecoin dust accounted for roughly 3–5% of Ethereum transactions and 15–20% of active addresses. Post-Fusaka, those figures climbed to about 10–15% of transactions and 25–35% of active addresses on a typical day, representing a two- to threefold increase in the dust footprint. Yet, the remaining 57% of balance updates involved transfers above $1, indicating that a significant portion of activity continues to reflect genuine economic activity rather than precautionary or malicious watering of the chain.

Post-Fusaka growth in activity reflects genuine usage, though dust activity is a factor worth noting when interpreting headline metrics.

Dusting has also produced tangible financial losses for some victims. One security researcher noted a reported $740,000 in losses tied to address poisoning attacks. In a striking display of scale, the top attacker executed nearly 3 million dust transfers at a cost of only about $5,175 in stablecoins, highlighting how cheap these techniques can be to deploy relative to the potential impact on victims and analytics platforms.

Dust does not represent genuine economic usage

Analysts emphasize that while stablecoin dust activity has surged, it does not necessarily reflect meaningful growth in demand for goods or services on the network. Rough estimates suggest that around 250,000 to 350,000 daily Ethereum addresses participate in stablecoin dust activity, a non-trivial but still partial window into Ethereum’s overall usage. The broader takeaway is that the network’s growth remains real in many dimensions, even as dust-related actions complicate the interpretation of raw metrics.

The majority of post-Fusaka growth reflects genuine usage, though dust activity is a factor worth noting when interpreting headline metrics.

What to watch next

- Monitoring the ongoing impact of Fusaka on gas pricing and data-posting efficiency across layer-2 ecosystems and any subsequent network upgrades.

- Tracking changes in dusting patterns as wallet hygiene tools and defender initiatives evolve, and as user education campaigns address address-poisoning risks.

- Observing whether regulatory guidance or industry standards lead to improved transparency around dust activity and its impact on on-chain analytics.

- Evaluating whether new anti-dust measures or protocol-level mitigations reduce the feasibility or profitability of dusting campaigns.

Sources & verification

- Coin Metrics, State of the Network, issue 349 (Substack) — analysis of stablecoin balance updates on Ethereum from November 2025 through January 2026.

- Coin Metrics balance updates for USDC (USDC) and USDt (USDT) on Ethereum — dataset cited in the analysis.

- Andrey Sergeenkov, observations on new wallet addresses and address-poisoning dynamics in January 2026.

- Cointelegraph — reporting on address poisoning attacks and the broader dusting phenomenon on Ethereum.

Dusting dynamics and the Fusaka uplift

Ethereum (CRYPTO: ETH) has become a focal point for evaluating how protocol upgrades reshape user behavior and on-chain signals. The Fusaka upgrade, completed in December, broadened the network’s capacity to absorb data from layer-2 bridges and rollups by reducing the cost of posting information. As a result, average daily transactions crossed the 2 million mark, with a sharp jump to nearly 2.9 million in mid-January. Daily active addresses also rose to about 1.4 million, marking a 60% uplift from prior baselines. In this shifting environment, dusting activity has moved from a relatively modest slice of the activity pie to a more prominent feature of the daily ledger, complicating the task of parsing “real” usage from artificial traffic.

Coin Metrics’ analysis, based on a substantial data sample from USDC (USDC) and USDt (USDT), underscores a nuanced narrative. While a meaningful portion of dust transfers is sub-dollar in value, there remains a substantial portion of the activity above traditional thresholds that implies legitimate use—staking, payments, liquidity provisioning, and other routine operations. By juxtaposing post-Fusaka metrics with historical baselines, the report illustrates a two- to threefold expansion in stablecoin dust prevalence, without dismissing the persistent proportionality of bona fide usage on the network. The conversation around dust thus sits at the intersection of efficiency gains, on-chain economics, and security considerations for users navigating a more permissive but also more complex transaction landscape.

As researchers continue to scrutinize the data, the narrative remains that dusting is a real factor in Ethereum’s on-chain activity—but not a wholesale indictment of the network’s growth. The balance between authentic demand and opportunistic traffic will likely shape how developers and researchers frame Ethereum’s success in the months ahead. In the near term, users should remain vigilant about dust-induced address-poisoning vectors and ensure they transact with clear, verified destinations to minimize risk. The broader market will watch how these dynamics influence perceptions of network health, gas economics, and the resilience of security models in the wake of evolving usage patterns.

Crypto World

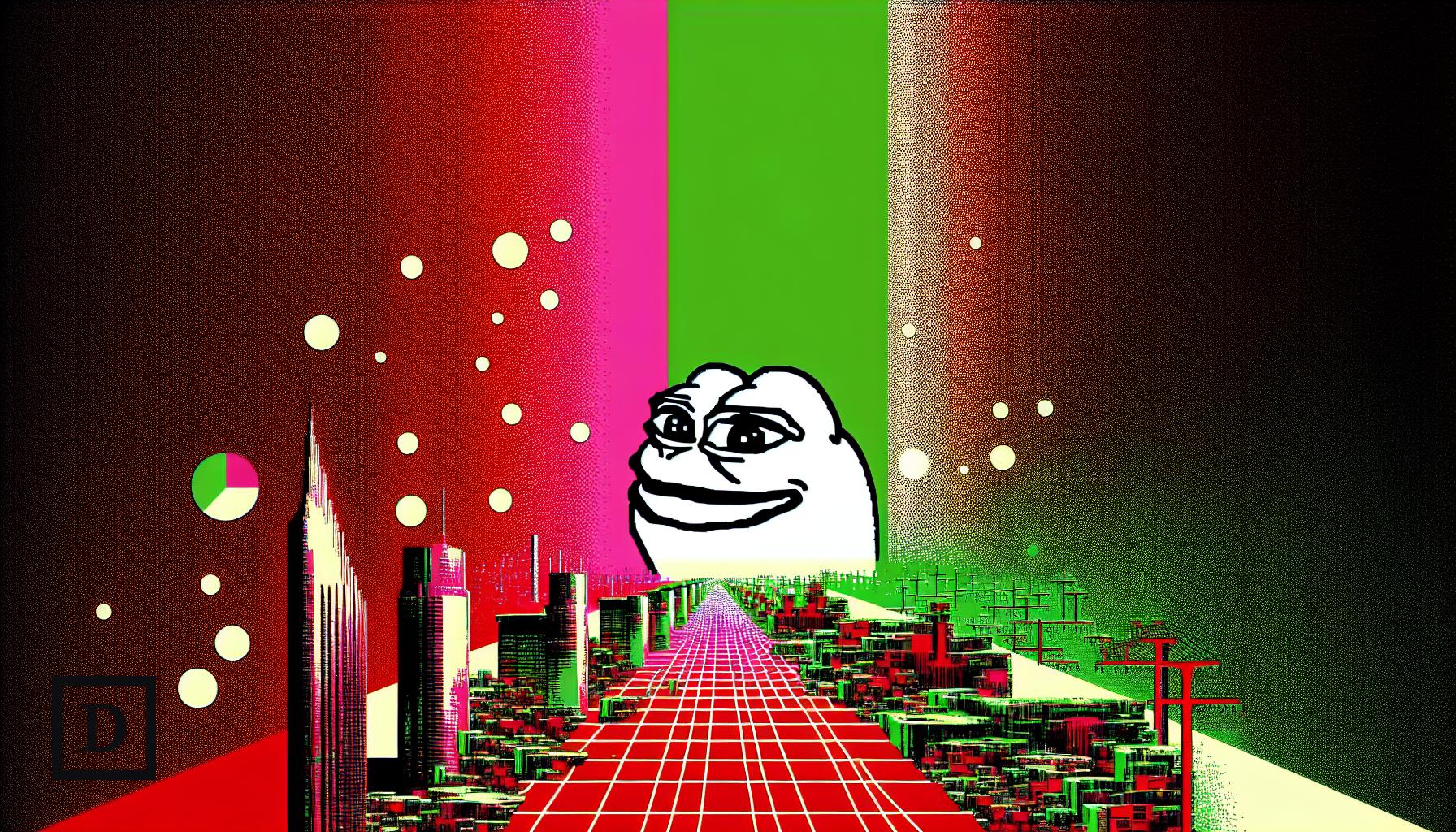

xMoney Appoints Raoul Pal as Strategic Advisor to Support the Next Phase of Global Payments

[PRESS RELEASE – Vaduz, Liechtenstein, February 3rd, 2026]

A globally respected investor and founder of Real Vision brings decades of financial market insight to xMoney’s leadership team

xMoney, a leading provider of compliant payment infrastructure bridging traditional finance and digital assets, today announced that Raoul Pal has joined the company as a Strategic Advisor.

Raoul Pal is one of the most widely respected macro thinkers of his generation. An investor, entrepreneur, and financial commentator, he has spent decades analyzing how money moves, how markets evolve, and how technological shifts reshape global financial systems. His appointment comes at a pivotal moment, as global payments transition toward regulated digital rails, stablecoins, and on-chain settlement.

With Raoul’s strategic guidance, xMoney aims to further strengthen its position at the intersection of payments, regulation, and digital assets – building infrastructure that enables seamless value transfer across traditional currencies, cryptocurrencies, and stablecoins.

A Career Spanning Global Finance and Digital Assets

Raoul began his career in traditional finance, holding senior roles at Goldman Sachs, where he led hedge fund sales for equities and derivatives in Europe, and later at GLG Partners, where he co-managed a global macro fund alongside some of the world’s most respected hedge fund managers.

In 2005, he founded Global Macro Investor (GMI), which has since become a trusted research platform for hedge funds, family offices, pension funds, sovereign wealth funds, registered investment advisors, and high-net-worth investors worldwide. GMI is widely recognized for its independent macro research and strong long-term performance track record.

Raoul co-founded Real Vision in 2014, transforming financial media by making institutional-grade market intelligence accessible to a global audience. What began as a video-first platform evolved into a global financial knowledge network with millions of users across nearly every country.

The new xMoney advisor is also the co-founder of Exponential Age Asset Management (EXPAAM), an investment firm built specifically for the digital asset economy. Its flagship fund, the Exponential Age Digital Asset Fund, provides curated exposure to top crypto hedge funds by combining macroeconomic frameworks with deep digital asset research.

Supporting the Future of Payments

Raoul’s long-standing belief is that the world is experiencing a structural shift in money, technology, and market infrastructure – not a temporary trend. Payments, in particular, are undergoing one of the most significant transformations in decades.

Unlike many payment platforms that expand globally first and retrofit compliance later, xMoney has taken a regional-first approach, building its infrastructure within Europe, one of the most highly regulated financial environments in the world. This strategy enables xMoney to meet stringent regulatory standards from day one, while creating a scalable foundation for global expansion aligned with frameworks such as MiCA.

“Crypto only fulfills its promise when it disappears into the background,” said Raoul Pal. “The real winners will be the platforms that make global payments simple, compliant, and invisible. That’s what excites me the most about xMoney.”

As Strategic Advisor, Raoul will work closely with xMoney’s leadership team, focusing on long-term strategy, market structure, and anticipating how global money movement will evolve as regulated stablecoins, compliant on-chain settlement, and hybrid payment models become foundational financial infrastructure.

“We’re building payment rails for the future, starting in the most regulated markets first,” said Gregorious Siourounis, Co-Founder & CEO of xMoney. “That discipline gives us a structural advantage as digital assets move into mainstream finance. Raoul’s depth of experience, macro insight, and clarity of thought reinforce our belief that long-term winners in payments will be compliant, scalable, and globally interoperable.”

The appointment underscores xMoney’s commitment to building a compliant, scalable payment infrastructure that bridges traditional finance and Web3, enabling businesses and consumers to transact seamlessly across borders, currencies, and technologies.

About xMoney

xMoney is a pioneering payments company with strategic European licenses, focused on building a seamless, secure, and future-ready payments ecosystem. By combining cutting-edge technology, strong regulatory compliance, and a broad product suite spanning traditional and digital assets, xMoney bridges traditional finance and next-generation payment rails.

Website: www.xmoney.com

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Western Digital (WDC) Stock: $4 Billion Buyback Sends Shares Higher

TLDR

- Western Digital’s board approved an additional $4 billion for share repurchases on top of existing authorization

- The company had approximately $484 million remaining from its prior $2 billion buyback authorization from May 2024

- WDC shares rose about 5% in premarket trading following the announcement

- Stock has surged 57% year-to-date and more than tripled in value during 2024

- Global memory chip shortage is driving up prices and extending lead times as demand from AI and consumer electronics companies increases

Western Digital announced Tuesday that its board has greenlit an extra $4 billion for stock buybacks. The move comes as demand for memory chips used in AI servers continues to climb.

Western Digital Corporation, WDC

The company’s shares jumped roughly 5% in premarket trading. That adds to an already impressive 57% gain so far this year.

Last year was even better. The stock more than tripled in value during 2024.

As of Monday, Western Digital had about $484 million left from its previous buyback authorization. That program was worth $2 billion and started in May 2024.

CEO Irving Tan explained the thinking behind the decision. “Our capital allocation strategy balances reinvestment in the business, debt reduction, and capital returns to shareholders,” he said.

The new authorization takes effect immediately. But the company kept its options open.

Timing Depends on Market Conditions

Western Digital noted that the amount and timing of actual share repurchases will depend on market conditions. Other corporate considerations will also play a role.

The company can suspend or discontinue the program whenever it wants. That’s standard language for buyback programs.

The announcement comes as memory chip makers are riding a wave of demand. AI applications and consumer electronics companies are competing for limited supplies.

This competition has pushed prices higher. Lead times have also stretched out as manufacturers work to increase production capacity.

Last week, Western Digital released guidance that beat Wall Street expectations. The company forecast fiscal third-quarter revenue and profit above analyst estimates.

That optimism stems from sales of hard drives and flash storage for AI servers. These products are in high demand as companies build out their AI infrastructure.

Memory Chip Shortage Drives Growth

A global shortage of memory chips has intensified the competitive landscape. AI companies need these chips for their servers.

Consumer electronics makers also need them for their products. The result is a supply crunch that shows no signs of easing soon.

Manufacturers are scrambling to ramp up capacity. But building new production facilities takes time and massive investment.

The shortage has been good news for Western Digital and its peers. Memory product makers like Seagate Technology and others have seen their stocks soar over the past year.

Western Digital’s strong stock performance reflects this trend. The company is benefiting from its position in the memory chip market.

The $4 billion buyback authorization gives management flexibility. They can repurchase shares when they see value in the market.

Share buybacks can boost earnings per share by reducing the number of shares outstanding. They also signal management’s confidence in the company’s future.

Western Digital ended Monday with about $484 million available under its previous authorization. The new $4 billion adds substantially to that amount.

Crypto World

MetaMask adds 200+ tokenized U.S. stocks and ETFs via Ondo

MetaMask has added access to more than 200 tokenized U.S. stocks and ETFs through a new integration with Ondo Finance, expanding users’ ability to trade traditional assets directly inside the wallet.

Summary

- Ondo’s tokenized stocks and ETFs are now available inside MetaMask.

- The integration allows users to access traditional assets without brokers.

- The move reflects growing demand for onchain financial products.

Ondo announced the update on Feb. 3, saying its Ondo Global Markets platform is now supported in MetaMask.

The integration allows eligible mobile users in supported regions to access tokenized equities, exchange-traded funds, and commodity-linked products without leaving the app or using third-party brokers.

Tokenized stocks and ETFs arrive inside MetaMask

The partnership gives MetaMask users access to tokenized versions of major U.S. stocks, including Tesla, Apple, Microsoft, NVIDIA, and Amazon. In addition to individual stocks, traders can access tokenized ETFs such as IWM and QQQ. Tokenized funds also provide exposure to commodities such as gold, silver, copper, and rare earth metals.

Since its Sept. 2025 launch, Ondo Global Markets, the arm that issues these products, has grown significantly. The platform’s total value locked has now climbed past $500 million.

Although minting and redemption continue to follow traditional market hours, the tokens themselves can be transferred around the clock across Ethereum, Solana, and BNB Chain.

The integration brings traditional financial products into a self-custodial setting, allowing users to hold and move tokenized securities alongside cryptocurrencies. Ondo (ONDO) said this setup removes the need for separate brokerage accounts and reduces reliance on centralized platforms.

“MetaMask is where millions of users already manage their onchain assets, and integrating Ondo Global Markets introduces an entirely new asset class into that familiar wallet experience,” said Ian De Bode, President at Ondo Finance.

Joe Lubin, founder of Consensys and co-founder of Ethereum, said the move shows how crypto wallets can bridge traditional and onchain finance without sacrificing user control.

Ondo pushes deeper into institutional tokenization

Ondo revealed the MetaMask integration during the 2026 Ondo Summit in New York, using the stage to showcase how real-world assets can move onto the blockchain. The event brought together voices from banks, regulators, and financial firms, signaling growing momentum for blockchain-based solutions in traditional markets.

During the summit, Ondo outlined plans to grow its Global Markets platform to include thousands of tokenized securities, ranging from individual stocks to ETFs and mutual funds. Ondo Chain came up as well, with speakers emphasizing that it was built specifically to meet regulatory standards and institutional expectations.

Much of the conversation focused on how tokenization could speed up settlement, cut costs, and keep markets operating for longer hours. Several speakers also noted a shift in sentiment, saying banks and asset managers are becoming more open to regulated, onchain access to traditional financial products.

Market watchers view the MetaMask partnership as a practical step toward broader use of tokenized assets, particularly among retail users who already depend on self-custodial wallets for crypto and DeFi activity.

Crypto World

Spanish Red Cross Taps Ethereum to Protect Privacy of Aid Recipients

The national affiliate of the International Red Cross has rolled out a blockchain-based aid system that uses ZK proofs to protect sensitive data.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World5 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video1 day ago

Video1 day agoWhen Money Enters #motivation #mindset #selfimprovement

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports3 days ago

Sports3 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread – Corporette.com

-

Crypto World3 days ago

Crypto World3 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World4 days ago

Crypto World4 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business4 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat22 hours ago

NewsBeat22 hours agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World7 hours ago

Crypto World7 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards

-

Tech4 days ago

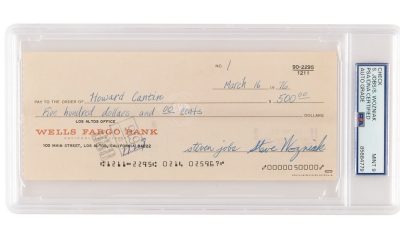

Tech4 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined