Crypto World

Paradigm reframes Bitcoin mining as a grid asset, not energy drain

A surge in AI data-center activity has rekindled a long-running energy debate, pitting grid operators and policymakers against critics who warn that massive computing operations threaten power reliability and push up electricity costs in parts of the United States. In this backdrop, a February 2026 research note from Paradigm reframes Bitcoin mining within electricity markets, arguing that it behaves as a flexible demand source rather than a static drain on energy resources. The note, which surveys grid conditions and market signals, estimates Bitcoin’s current share of global energy use at about 0.23% and its global carbon emissions at roughly 0.08%. It emphasizes that the network’s issuance schedule and periodic reward reductions inherently cap long-run energy growth, shaping how miners respond to price signals and competing generators. The analysis by Paradigm’s Justin Slaughter and Veronica Irwin, anchored by a public discussion of energy modeling assumptions, invites a more nuanced view of mining’s role in modern electricity systems, beyond broad environmental comparisons.

Key takeaways

- Paradigm argues that Bitcoin mining is best viewed as flexible grid demand, adjusting consumption in response to real-time electricity prices and grid stress rather than remaining a fixed, unresponsive load.

- The note quantifies mining’s slice of the energy pie—about 0.23% of global energy use and roughly 0.08% of global carbon emissions—while noting the long-run growth is economically constrained by the fixed issuance schedule and periodic halving of rewards.

- Critiques of mining energy use that rely on per-transaction measurements are highlighted as misleading, since energy consumption is tied to network security and miner competition, not transaction volume alone.

- With increasing AI data-center deployments, several miners are partially pivoting to AI workloads to capture higher margins, reshaping the industry’s profile and demand patterns for power.

- The policy implication is a shift from alarmist energy comparisons to evaluating mining within the broader electricity market—raising questions about how regulators should model and price flexible demand in grid planning.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The conversation sits at the intersection of expanding AI infrastructure, grid reliability concerns, and a broader shift toward demand-side flexibility in electricity markets as crypto miners and traditional energy users alike react to price signals and regulatory frameworks.

Why it matters

The framing offered by Paradigm has the potential to recalibrate how policymakers and market participants think about crypto mining. If mining is treated as a responsive load that can scale up or down with grid conditions, it could be integrated more deliberately into demand-response programs and ancillary-services markets. This view challenges simplistic comparisons that measure energy use in isolation or rely on per-transaction efficiency metrics, which may obscure how miners contribute to grid resilience during periods of surplus or shortage.

The discussion also taps into a broader industry trend: the repurposing of crypto-era infrastructure to artificial intelligence workloads. As margins in traditional mining shift and data-center economics evolve, several players have begun to reallocate hardware and capacity toward AI processing. The shift has been noted across industry reporting and is reflected in the pathways taken by some miners to pursue higher-margin opportunities while continuing mining activities where economics permit. For example, coverage of the AI-data-center wave highlights how existing facilities and equipment can be adapted to meet surging demand for AI workloads, potentially altering regional power usage profiles and pricing dynamics.

At the core of Paradigm’s argument is the idea that energy modeling should reflect the realities of competitive electricity markets rather than rely on static benchmarks. By foregrounding grid conditions, price signals, and the possibility of demand response, the authors argue that Bitcoin mining’s energy footprint can be contextualized within the wider ecosystem of grid economics. This does not absolve miners of responsibility for energy use, but it suggests a framework in which policy decisions are informed by how mining interacts with supply and demand in real time, including its capacity to absorb excess generation or reduce demand during stress events.

The note also emphasizes that energy use and emissions are not the only metrics at play. Understanding where mining sits on the supply curve—where electricity is produced or curtailed—can illuminate why certain regions attract mining operations at particular times and how these operations might contribute to stabilizing grids during peak periods. In this sense, the narrative shifts from a binary “drain vs. benefit” debate to one about how energy users of all kinds can participate in a more dynamic, price-responsive market environment.

As AI infrastructure expands, the mining ecosystem’s response matters for both regional policy and investor sentiment. The industry’s evolving footprint—toward AI workloads in some cases—could influence where and how power is allocated, how utilities price peak versus off-peak energy, and how regulators design frameworks that accommodate flexible demand. While Paradigm’s conclusions are not universal prescriptions, they provide a structured lens for evaluating mining within electricity markets rather than through narrow environmental comparisons alone. The broader takeaway is a push for more sophisticated, market-responsive energy modeling that accounts for price signals, grid constraints, and the real-world behavior of miners under variable conditions.

What to watch next

- Publication and discussion of Paradigm’s February 2026 note and any ensuing responses from policymakers or industry groups.

- New analyses or grid studies examining the elasticity of mining demand in response to real-time pricing and transient grid conditions.

- Regulatory activity at state or federal levels addressing crypto-mining energy use, permitting, and integration with demand-response programs.

- Updates on the mining-to-AI workload transition, including pilot projects and capital reallocation by major miners such as those that have publicly discussed strategic shifts.

Sources & verification

- Paradigm, “Clarifying misconceptions about Bitcoin mining” (February 2026) – note the energy-use and emissions figures and the discussion of market signals. https://www.paradigm.xyz/2026/02/clarifying-misconceptions-about-bitcoin-mining

- Discussion of AI data centers and Bitcoin mining’s local resistance in the U.S. referencing grid- and energy-demand concerns. https://cointelegraph.com/news/ai-data-centers-local-resistance-bitcoin-mining

- Bitcoin mining outlook and profitability shifts in the context of AI-driven infrastructure changes. https://cointelegraph.com/news/bitcoin-mining-outlook-2026-ai-profitability-consolidation

- Bitcoin miner production data illustrating the scale of winter-storm disruption in the U.S. https://cointelegraph.com/news/bitcoin-miner-output-us-winter-storm-latest-data

Bitcoin mining as flexible grid demand in the AI era

Bitcoin (CRYPTO: BTC) mining is increasingly described as a dynamic, price-driven participant in electricity markets rather than a fixed-energy burden. The February 2026 Paradigm note insists that miners act as flexible loads, changing consumption in response to grid stress or surplus supply. This reframing rests on the premise that energy use is not merely a function of transaction volume; it is tied to network security, miner competition, and how power markets price electricity in real time. In practical terms, mining operations tend to gravitate toward the lowest-cost energy sources, often leveraging off-peak generation or surplus capacity, which enables them to scale demand up or down as conditions warrant. The ability to modulate consumption makes mining responsive to price signals, a characteristic that can be valuable to grid operators seeking to balance supply and demand without relying solely on traditional capacity additions.

AI data centers have accelerated this discussion, as industry coverage highlights shifts in crypto-era infrastructure toward AI workloads in some cases. While Bitcoin mining remains a core use case for many facilities, the broader trend underscores how high-density computing can be repurposed to align with profitability drivers and grid economics. Several traditional mining operators, including Hut 8, HIVE Digital, MARA Holdings, TeraWulf, and IREN, have begun exploring partial transitions toward AI processing, highlighting how portfolio strategy can adapt to evolving margins and demand profiles. The implications for energy policy are meaningful: rather than treating all high-energy activities as equivalent, regulators may consider how to integrate flexible-demand resources into reliability and pricing frameworks while maintaining environmental safeguards.

Paradigm’s argument also emphasizes that energy models should reflect the realities of constrained energy systems. If mining adapts to price signals and grid conditions, its contribution to energy demand may be more volatile but potentially more compatible with markets seeking to absorb intermittent generation or reduce peak demand. The authors point to a broader energy-economics logic: when miners respond to scarcity or surplus, they participate in price formation and help balance the system—an argument that invites policymakers to evaluate mining within the rightsized context of electricity markets and grid resilience rather than through simplistic energy-versus-environment comparisons. The discussion aligns with recent coverage of AI infrastructure’s supercycle, suggesting that the real opportunity lies not in static energy tallies but in understanding how demand shapes and responds to evolving grid dynamics.

Crypto World

Crypto funds bleed for fourth straight week as US investors pull back

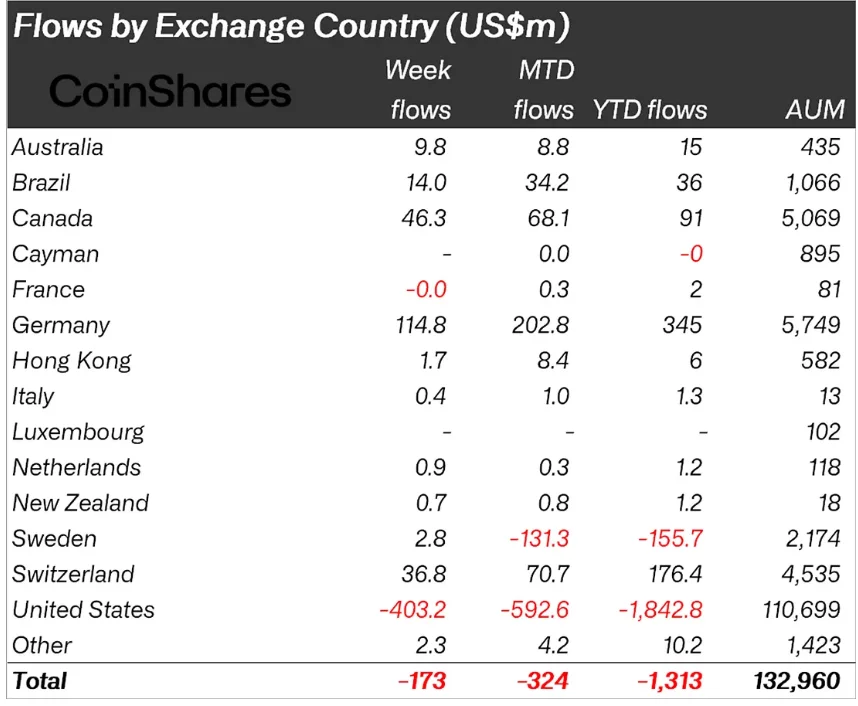

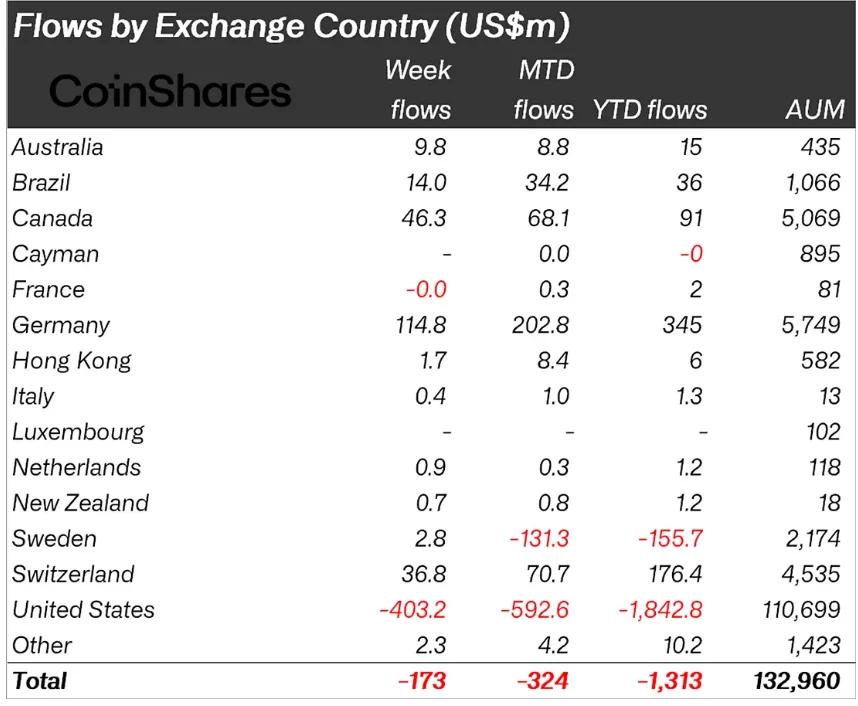

Crypto funds recorded a fourth consecutive week of outflows, with $173 million withdrawn, according to CoinShares’ latest weekly fund flows report.

Summary

- Digital asset investment products saw $173 million in outflows, marking a fourth consecutive week of withdrawals and bringing the four-week total to $3.74 billion.

- The US led the downturn with $403 million in outflows, while Europe and Canada recorded $230 million in combined inflows, highlighting sharp regional divergence.

- Bitcoin and Ethereum bore the brunt of selling, while XRP and Solana continued to attract capital.

The latest decline brings total outflows over the past four weeks to $3.74 billion, underscoring persistent investor caution amid price weakness and macro uncertainty.

The week began on a stronger footing, with $575 million in inflows, but sentiment quickly reversed. Midweek outflows reached $853 million, likely driven by further downside in crypto prices. Conditions improved slightly on Friday after weaker-than-expected US CPI data, which helped trigger $105 million in inflows.

Trading activity also cooled. Exchange-traded product (ETP) volumes fell sharply to $27 billion, down from a record $63 billion the previous week.

US leads crypto fund outflows as Europe and Canada diverge

Regional data revealed a stark divergence in sentiment. The United States accounted for $403 million in outflows, while other regions collectively posted $230 million in inflows.

Germany led with $115 million in inflows, followed by Canada ($46.3 million) and Switzerland ($36.8 million). The data suggests that while US investors remain risk-off, appetite for digital assets persists in parts of Europe and North America.

Bitcoin and Ethereum under pressure, altcoins show resilience

Bitcoin (BTC) bore the brunt of the sell-off, with $133 million in outflows last week. Ethereum (ETH) followed with $85.1 million in withdrawals.

Interestingly, short Bitcoin products also saw outflows totaling $15.4 million over the past two weeks, a pattern CoinShares notes is often observed near potential market bottoms.

In contrast, select altcoins continued to attract capital. The Ripple token (XRP) led with $33.4 million in inflows, followed closely by Solana (SOL) and Chainlink (LINK). The selective resilience suggests investors are rotating exposure rather than exiting the asset class entirely.

Despite the recent drawdown, total assets under management remain substantial, highlighting that institutional engagement in digital assets continues even amid short-term volatility.

Crypto World

Bitcoin faces quantum scrutiny as leveraged shorts eye liquidation risk zone

Bitcoin faces quantum computing scrutiny and heavy leveraged short positioning, with SOPR stabilization, ETF inflows and CME gap levels shaping whether a 10% move triggers a cascade of liquidations.

Summary

- Quantum computing risks are drawing institutional attention, raising governance and upgrade questions as ETF-driven ownership concentrates capital.

- CoinGlass maps show clustered short liquidations near 10% above spot, while CME gap zones and weekend liquidity amplify the risk of sharp squeezes.

- SOPR signals show short-term selling pressure easing and ETF flows flipping positive, hinting at a potential rebound if key trigger levels break.

Bitcoin’s potential vulnerability to quantum computing threats has drawn attention from institutional investors, while derivatives markets show concentrated short positions vulnerable to liquidation on a 10% price rally, according to market data and industry observers.

Venture capitalist Nic Carter stated that large institutional holders could pressure Bitcoin developers if potential quantum computing threats are not addressed, according to reports from Coin Bureau. The comments come as institutional exposure to Bitcoin has expanded through spot exchange-traded funds and custodial products.

Liquidation data analyzed over the weekend indicated that a significant volume of short positions would face unwinding on a 10% upside move, while substantial long positions remained exposed to liquidation on an equivalent decline, according to trader Ted Pillows, who shared the analysis on social media platform X.

Pillows’ figures showed that leveraged short positions outweighed vulnerable long positions, creating conditions where an upward price movement could trigger rapid buybacks. The analysis identified specific trigger levels that could open a path toward higher price zones, while noting a nearby area tied to a Chicago Mercantile Exchange futures gap.

CoinGlass liquidation maps reflected elevated leverage across derivatives venues, with open interest clustering around round-number strikes. The positioning followed weekend momentum periods, when reduced liquidity often amplifies price movements.

On-chain analyst miracleyoon observed that the Short-Term Holder Spent Output Profit Ratio moved below the 0.95 capitulation zone before recovering toward 1.0. The metric measures whether short-term holders sell at a profit or loss and often signals shifts in local trend behavior, according to the analyst.

The analyst stated that sustained positioning above 1.0 would imply absorbed selling pressure and could extend a technical rebound, while failure to hold that threshold would reopen range-bound conditions. The recent drawdown lacked the intensity seen on August 5, 2024, when the ratio fell toward 0.9, according to the analysis.

CryptoQuant contributor Amr Taha compared retail flows on cryptocurrency exchange Binance with institutional exchange-traded fund activity. On February 6, retail-driven sell pressure exceeded 28,000 Bitcoin, coinciding with a price drop, according to Taha’s data. A second wave on February 13 surpassed 12,000 Bitcoin, even as prices attempted stabilization.

Spot Bitcoin exchange-traded funds posted their first positive net flow day since January on February 6, according to the same analysis. BlackRock’s iShares Bitcoin Trust led with notable inflows, followed by Fidelity’s Wise Origin Bitcoin Fund, suggesting institutions accumulated holdings during periods of retail selling.

Carter framed the quantum computing issue as governance pressure rather than an immediate technical flaw, arguing that capital concentration alters power dynamics within open-source systems, according to Coin Bureau’s report. The discussions have resurfaced as more corporate treasuries and asset managers have allocated capital through regulated investment vehicles.

Analyst Teddy Bitcoins stated that the current market structure mirrored the 2022 price decline, projecting a potential substantial decline in 2026 based on chart symmetry. The thesis relied on cyclical behavior patterns rather than immediate catalysts, according to the analyst’s commentary.

The quantum risk discussion intersects with leverage imbalances and on-chain stabilization signals, reflecting different time horizons from short-term liquidations to multi-year structural considerations. Markets have absorbed these factors simultaneously, adjusting exposure across spot and derivatives venues.

Traders are monitoring whether Bitcoin prices can sustain momentum above key trigger levels to force short covering, while failure to defend nearby support levels could revive gap-fill scenarios. Developers face renewed debate over cryptographic upgrade paths as institutional ownership increases, though immediate price movements appear more likely to emerge from leveraged positioning dynamics.

Crypto World

SBI Holdings says $10B XRP talk is false, here’s what’s real

SBI Holdings has pushed back against claims circulating on social media that it holds $10 billion worth of XRP, clarifying that the figure is inaccurate and misrepresents the company’s actual exposure to Ripple.

Summary

- SBI Holdings denied holding $10 billion in XRP, correcting viral social media claims that overstated its token exposure.

- CEO Yoshitaka Kitao clarified that SBI owns around 9% of Ripple Labs, not a multibillion-dollar stash of XRP tokens.

- The company described its Ripple equity stake as a potential “hidden asset,” suggesting long-term strategic value rather than direct crypto holdings.

SBI Holdings denies $10B XRP claims

The confusion appears to have stemmed from a widely shared post stating that SBI, a long-time partner of Ripple, was a “holder of $10 billion in XRP” while expanding its footprint in Asia through the acquisition of Singapore-based crypto platform Coinhako.

However, SBI Holdings Chairman and CEO Yoshitaka Kitao publicly corrected the claim. In a reply on X, Kitao stated: “Not $10 bil. in XRP, but around 9% of Ripple Lab. So our hidden asset could be much bigger.”

The clarification makes a key distinction: SBI does not directly hold $10 billion worth of XRP tokens. Instead, the Japanese financial services giant owns approximately 9% of Ripple Labs, the U.S.-based blockchain payments company closely associated with XRP.

SBI has been one of Ripple’s most prominent strategic partners in Asia for years, backing joint ventures and promoting the use of Ripple’s cross-border payment solutions across the region. Its equity stake in Ripple Labs represents a corporate investment, not a treasury holding of XRP tokens.

Kitao’s reference to a “hidden asset” suggests that SBI views its Ripple equity stake as potentially undervalued, particularly if Ripple’s valuation strengthens following regulatory clarity and continued expansion.

The incident shows how quickly misinformation can spread in crypto markets, especially when equity investments and token holdings are conflated. The takeaway is clear: SBI’s exposure to Ripple is significant, but it is tied to ownership in the company itself, not a multibillion-dollar XRP stockpile.

Crypto World

Dogecoin and These 2 Tokens Could Trigger a Meme Coin Rally

Dogecoin price may still hold the clues to whether meme coin season returns. Between February 6 and February 15, Dogecoin rallied about 47%. During the same period, the total meme coin market cap climbed by around 43%. This shows Dogecoin is still moving in step with the broader sector and continues to lead it.

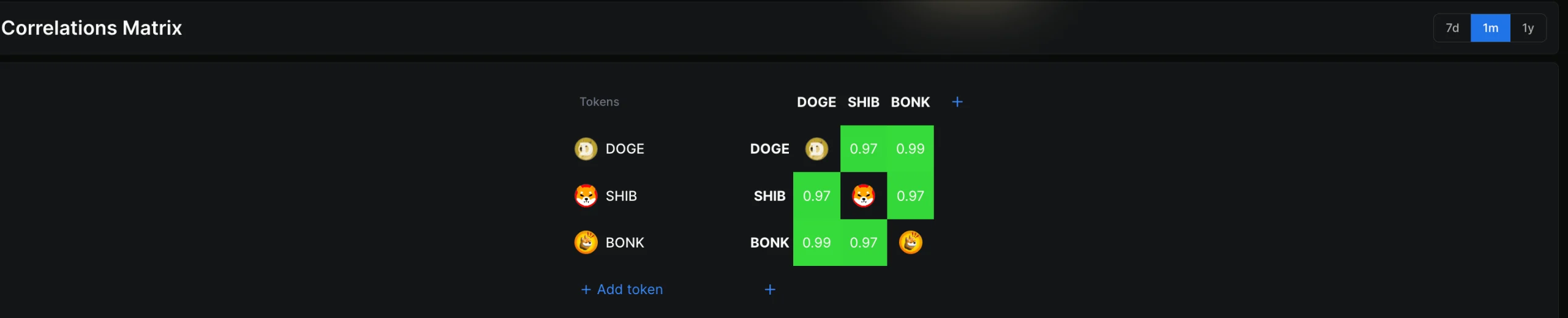

Now, two of the most closely aligned meme coins, BONK and Shiba Inu, are already forming breakout patterns. Their next move may depend on whether Dogecoin confirms its own bullish structure. Together, correlation, holder behavior, and price structure suggest Dogecoin still remains the key signal for the meme coin cycle.

BONK and Shiba Inu Are Already Showing Breakout Structures

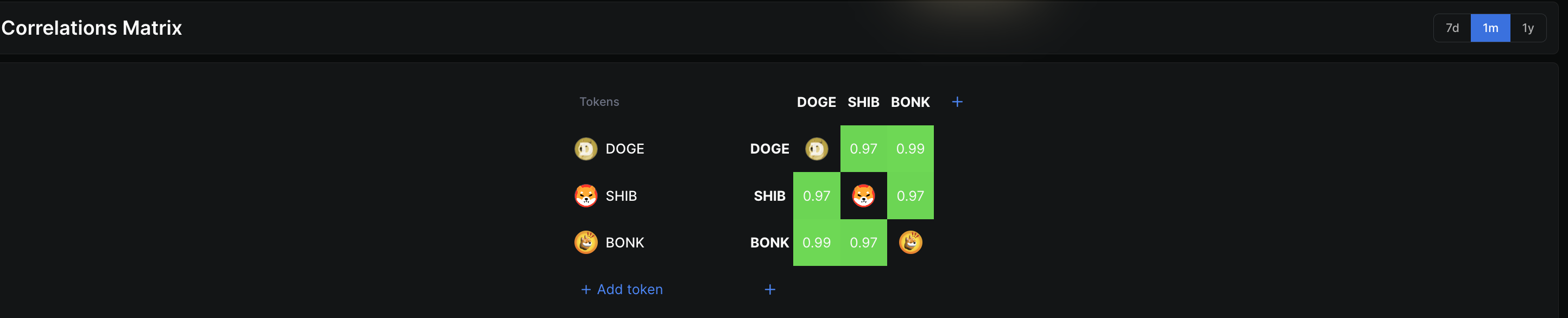

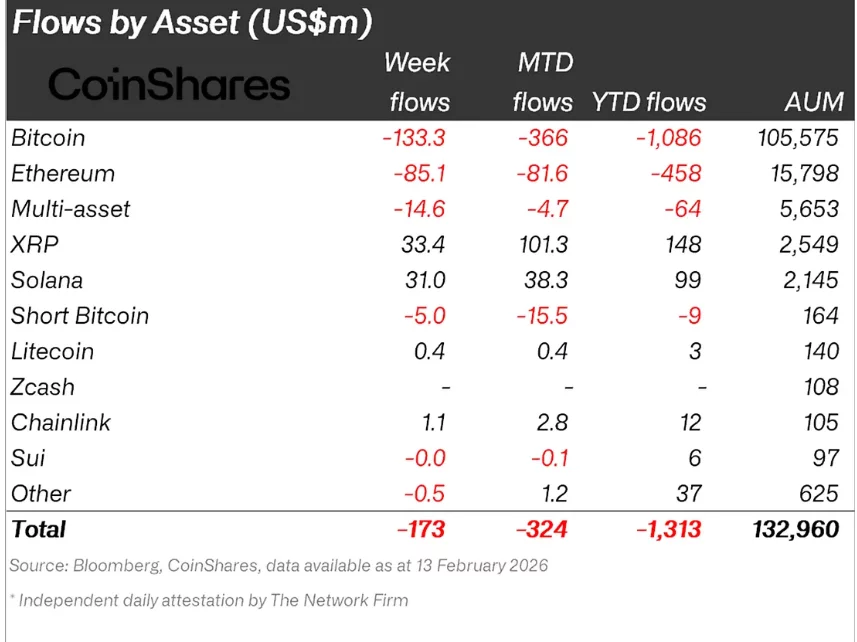

BONK and Shiba Inu currently have an extremely high correlation with Dogecoin. Correlation measures how closely assets move together.

A correlation of 1 means they move almost identically. Over the past month, BONK and Dogecoin reached a correlation as high as 0.99. Shiba Inu reached about 0.97 to 0.99 on weekly and monthly timeframes.

Sponsored

Sponsored

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This makes their price structures important early signals.

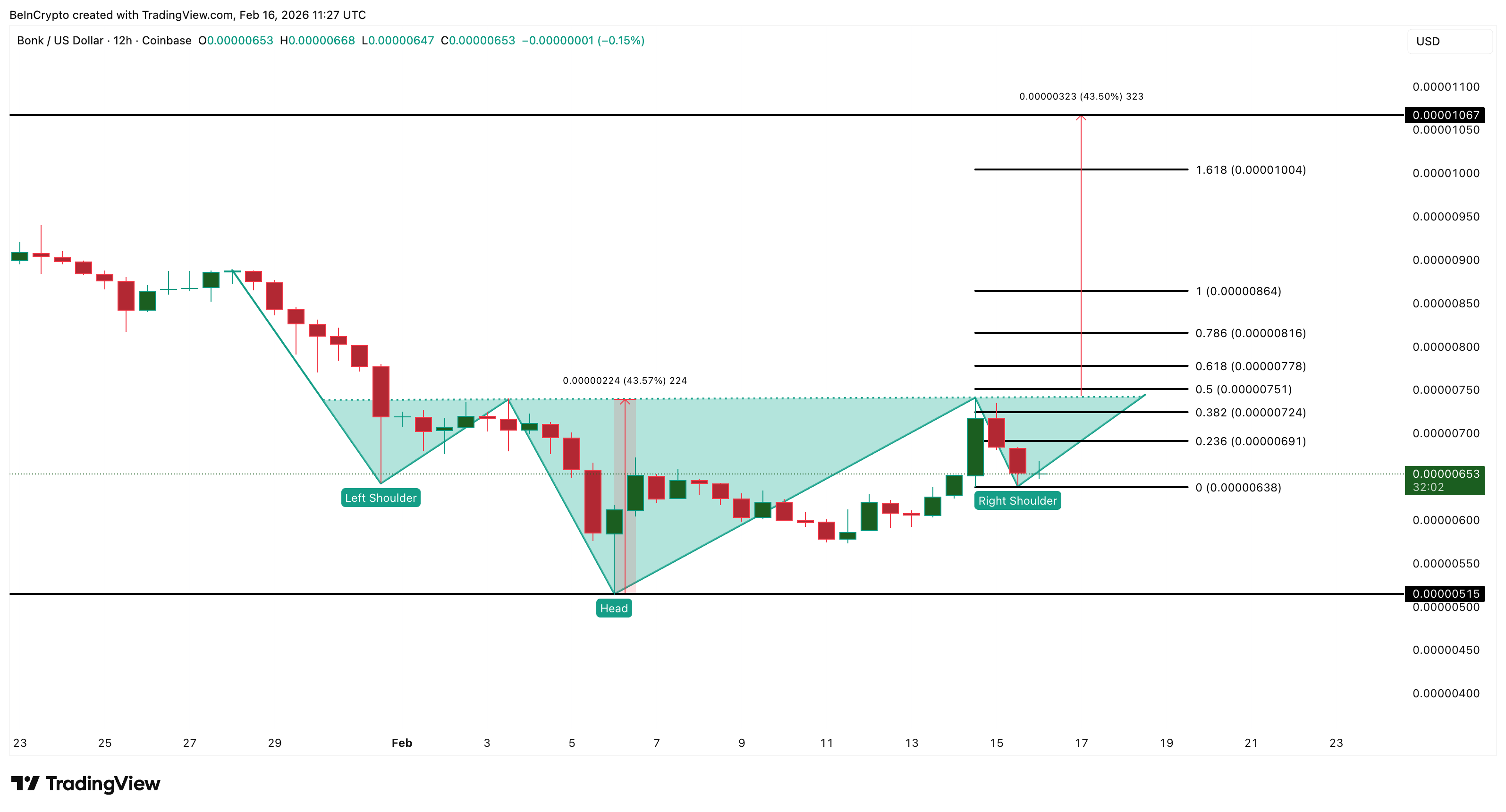

BONK is forming an inverse head and shoulders pattern on the 12-hour chart. This pattern forms when sellers lose strength and buyers gradually take control. The breakout level sits near $0.0000075. If BONK breaks above this level, the pattern projects a move toward $0.000010, which would be about a 43% rally from the neckline.

The pattern weakens with a drop under $0.0000063 and invalidates under $0.0000051.

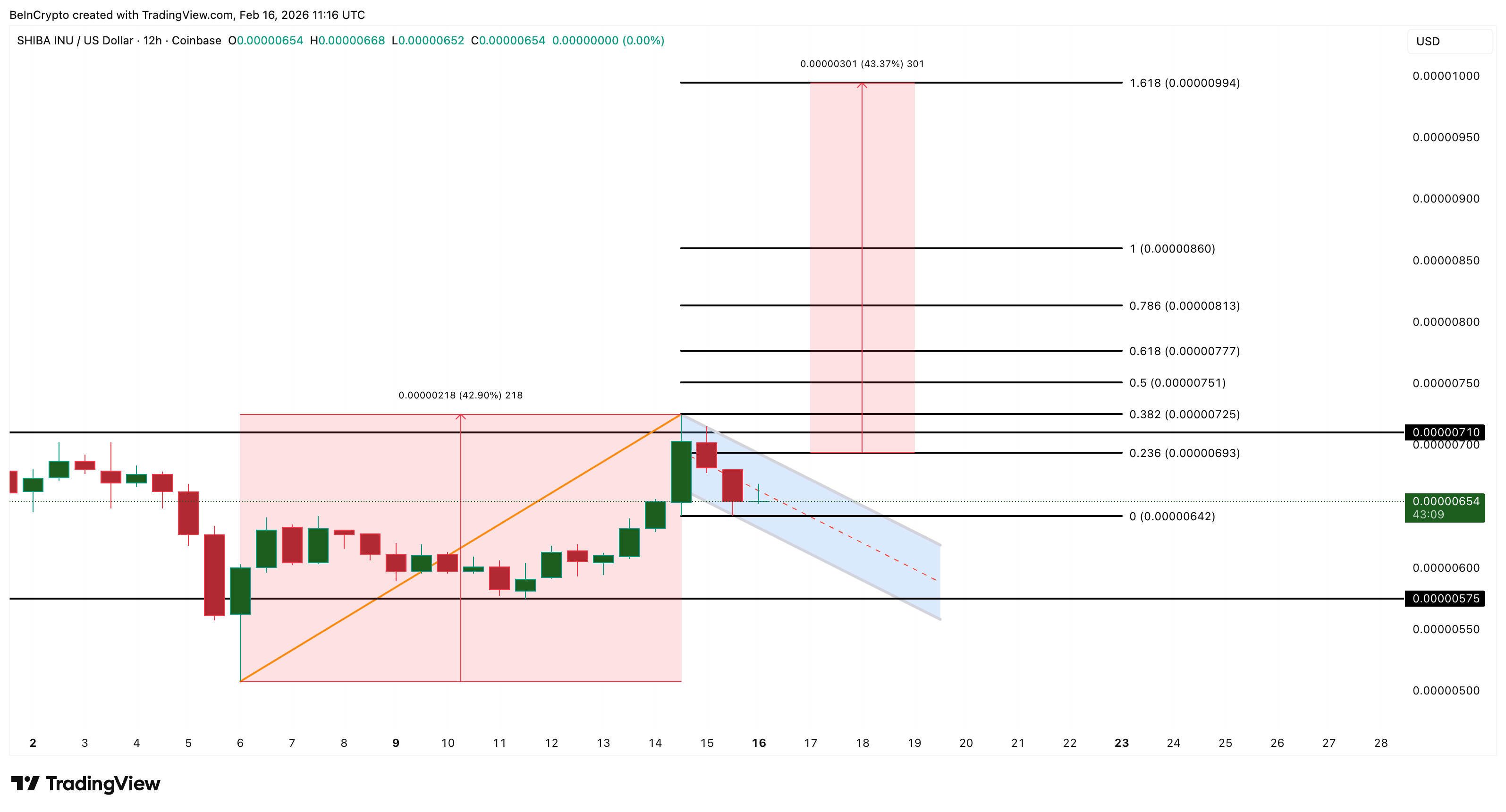

Shiba Inu (SHIB) is forming a bullish flag pattern. A bullish flag happens when the price pauses briefly after a rally before continuing higher. The breakout level sits near $0.0000069. If Shiba Inu breaks above this level, it could rise toward $0.0000099, representing a 43% gain.

A dip under $0.0000057 can come close to invalidating the SHIB breakout theory. However, these breakouts may still depend on Dogecoin confirming its own direction.

Meme Coin Market Cap Still Follows Dogecoin’s Lead

The broader meme coin market continues to mirror Dogecoin’s movement.

Between February 6 and February 15, the meme coin market cap increased roughly 43%. Dogecoin price increased slightly more, climbing 47% during the same period.

Sponsored

Sponsored

Even after the recent pullback, the meme coin market cap has fallen only about 12.5%, holding most of its gains. This shows the overall cycle has weakened but not collapsed.

Dogecoin still dominates the meme coin sector with a market cap of nearly $17 billion, representing over 50% of the entire meme coin market, at press time. Because of this dominance, Dogecoin often determines whether meme coin rallies expand or fade.

This makes Dogecoin’s own structure the most important signal.

Holders and Whales Are Quietly Positioning Again

On-chain data shows stronger holders are increasing control while short-term traders exit.

One key metric is Spent Coins Age Band. This measures how many coins of different holding ages are being spent. When these coins move, it often means that holder cohorts are selling. When the metric falls, it shows holders are staying inactive and holding.

This metric dropped sharply from 461 million coins to 168 million coins, a decline of about 64%. Similar drops previously appeared near local bottoms.

Sponsored

Sponsored

For example:

- On February 10, the metric reached a local low. Dogecoin price then rose about 22% within four days.

- On January 26, another local low appeared. Dogecoin price rose about 6% within two days.

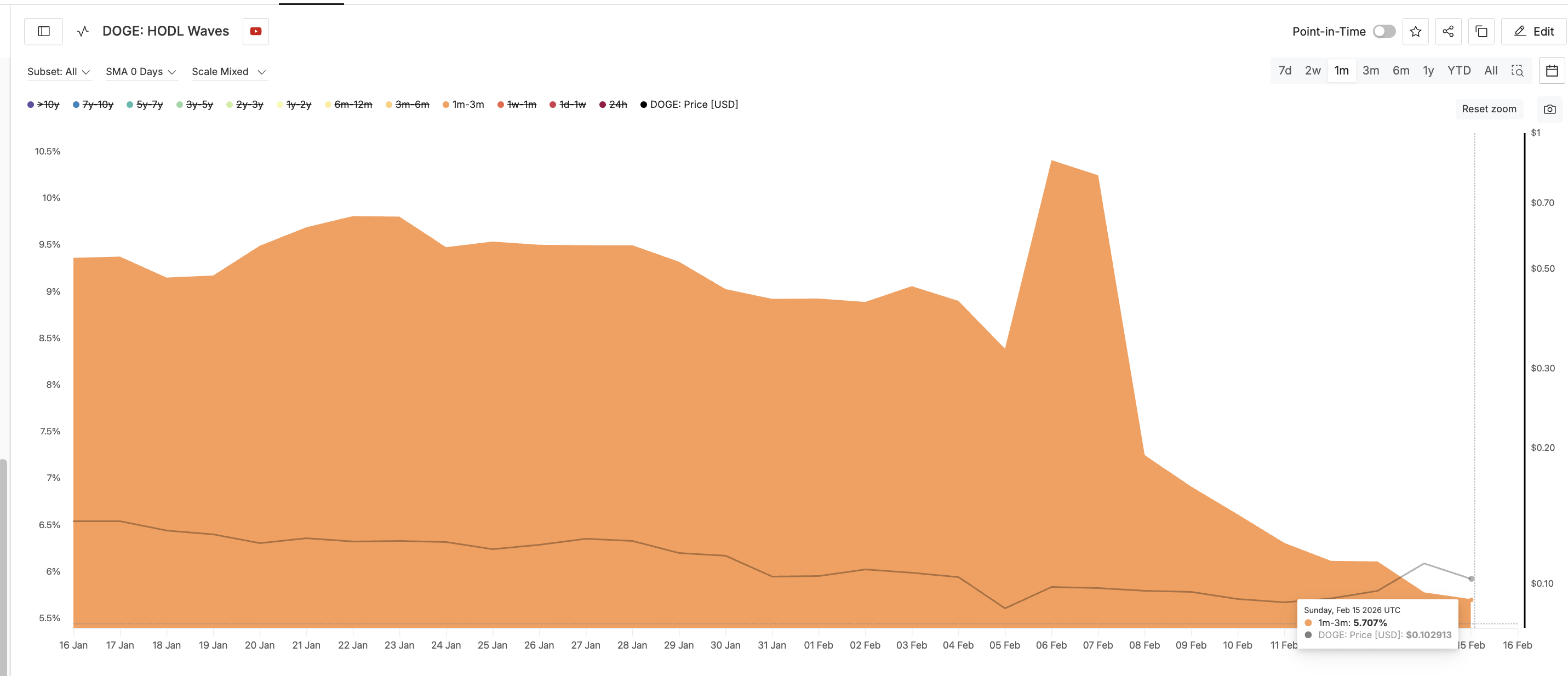

Another indicator called HODL Waves shows how long investors hold their coins. Short-term holders, holding coins for one to three months, reduced their share from 10.41% to 5.70%, a drop of about 45%. This shows speculative traders exited.

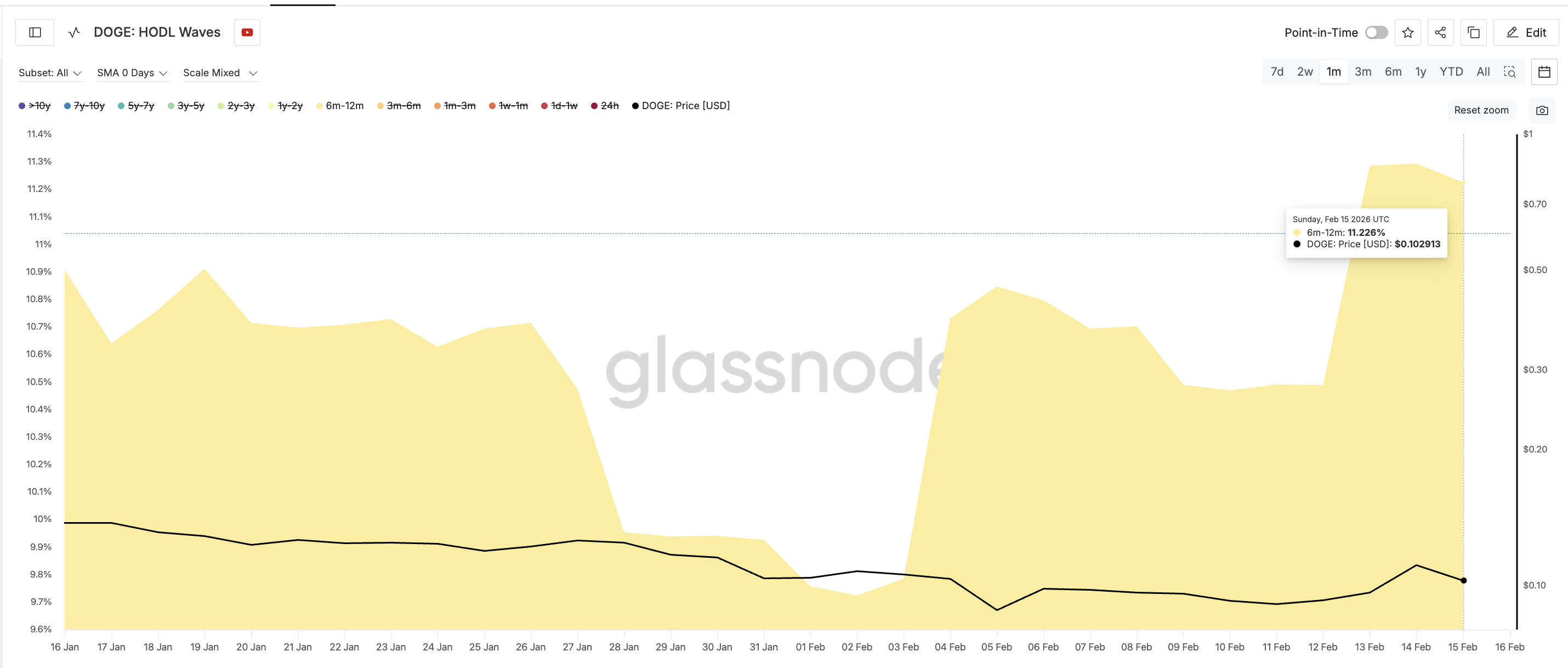

Meanwhile, stronger holders increased exposure. Coins held for six to twelve months increased from 10.48% to 11.22%, a 7% increase. This shows growing conviction.

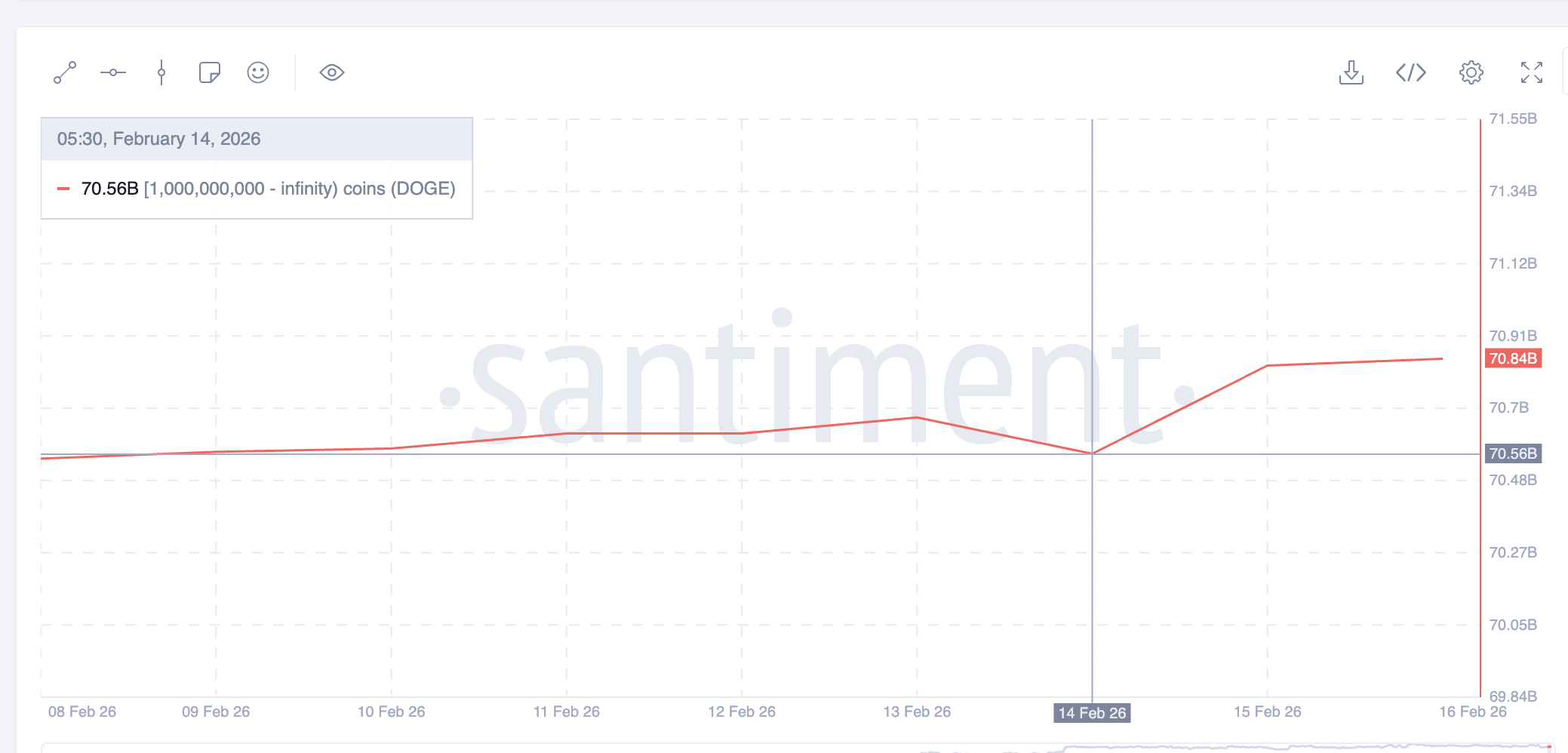

Whales also accumulated. Wallets holding over one billion DOGE (the biggest whales) increased holdings from 70.56 billion to 70.84 billion coins, adding roughly 280 million coins.

This shift shows stronger hands replacing weaker ones.

Sponsored

Sponsored

Dogecoin Price Pattern Now Holds the Key Meme Coin Season Signal

Despite the recent 13% pullback, Dogecoin’s price structure remains bullish. On the 12-hour chart, Dogecoin is forming a cup and handle pattern. This pattern often appears before continuation rallies.

The cup formed between late January and early February. The current pullback forms the handle. Importantly, the handle support near $0.103 remains intact, showing buyers are still active. The key breakout level now sits near $0.117, which is also a down-sloping neckline resistance.

If Dogecoin breaks above $0.117, the pattern projects a move toward $0.180, representing roughly a 50% rally, per pattern projection. Supporting this, the Smart Money Index, which tracks experienced investor activity, remains above its signal line. This suggests larger investors have not exited.

However, risks remain. If Dogecoin falls below $0.098, the pattern would weaken. A drop below $0.091 would invalidate the bullish structure.

For now, Dogecoin price continues to hold the strongest clues for meme coin season. BONK and Shiba Inu are already preparing breakout structures.

But whether those breakouts fully develop may depend on Dogecoin confirming its own move first.

Crypto World

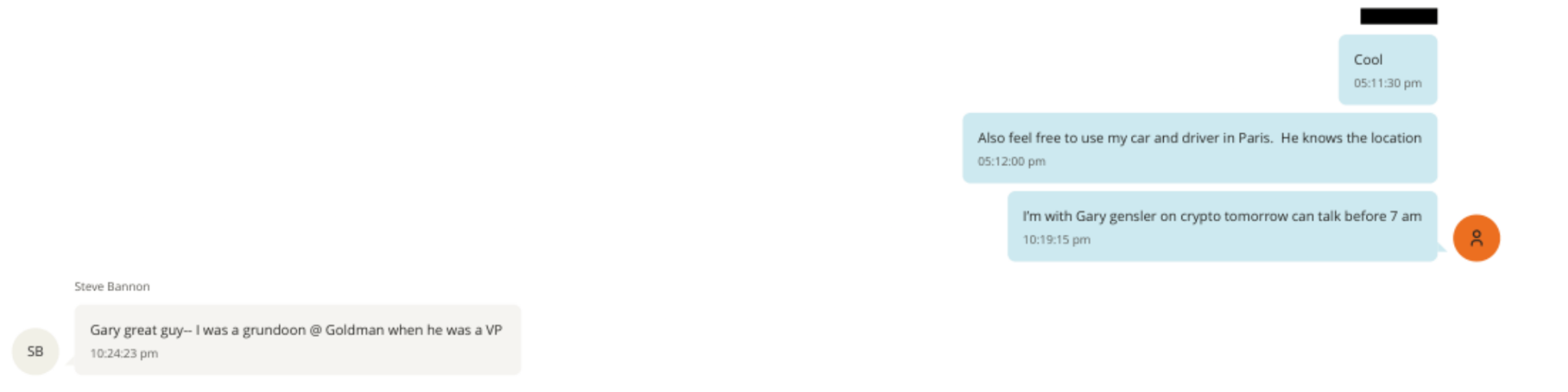

Epstein Files Reveal Crypto Talks With SEC’s Gary Gensler

The Epstein files show he discussed meeting Gary Gensler to talk about digital currencies, offering fresh insight into the financier’s efforts to engage with early crypto leaders and policy figures.

Emails from May 2018 show Epstein telling former Treasury Secretary Lawrence Summers that “Gary Gensler [is] coming earlier… wants to talk digital currencies.” Summers replied that he knew Gensler from government service and described him as “pretty smart.”

Sponsored

Sponsored

The exchange suggests Epstein expected Gensler to participate in discussions involving cryptocurrency.

Epstein Files Reveal More Crypto Stories

Separately, internal messages show Epstein referencing crypto-related meetings connected to MIT Media Lab leadership.

One message asked whether others “would be interested in Gary Gensler,” indicating Gensler’s involvement in crypto-focused academic or policy circles at the time.

In another message, Epstein wrote that he would be “with Gary Gensler on crypto tomorrow,” although the files do not independently confirm whether a direct meeting took place.

At the time, Gensler was a professor at MIT, where he taught blockchain and digital currencies.

Sponsored

Sponsored

He later became the SEC from 2021 to 2025, where he oversaw the most aggressive regulatory crackdown on crypto in US history.

The Gensler references appear alongside broader evidence of Epstein’s deep involvement in early cryptocurrency development and investment.

DOJ documents show Epstein donated hundreds of thousands of dollars to MIT’s Media Lab. This included funding the Digital Currency Initiative, which supported Bitcoin Core developers after the Bitcoin Foundation collapsed.

Developers funded through the initiative included key maintainers of Bitcoin’s open-source protocol.

In addition, financial records confirm Epstein invested $3 million in crypto exchange Coinbase in 2014.

He also invested in Bitcoin infrastructure firm Blockstream and corresponded with early Bitcoin developers, researchers, and venture capitalists.

Furthermore, emails show Epstein proposing a Sharia-compliant digital currency modeled on Bitcoin in 2016.

However, the files do not show any financial relationship between Epstein and Gensler. Nor do they confirm whether the two men met directly or collaborated on any crypto-related project.

Still, the documents highlight Epstein’s sustained efforts to engage with influential figures in crypto, academia, and financial policy.

Crypto World

XRP price eyes $2, failed auction confirms bullish shift

XRP price has formed a potential failed auction at $1.58, signaling demand at range lows and increasing the probability of a recovery move toward $2.00 upside.

Summary

- XRP failed to gain acceptance below the $1.58 range low, highlighting buyer demand

- Holding above $1.58 preserves the broader range structure

- A rotation toward the $2.00 value area low becomes more likely if support holds

XRP (XRP) price action has begun to stabilize after a sharp corrective move, with recent trading behavior offering important insight into market positioning. One of the most notable technical developments is the formation of a potential failed auction at the range low support near $1.58.

This is a key concept in auction market theory, often highlighting when sellers have lost momentum, and buyers begin to assert control.

As long as price action continues to hold above the $1.58 range low, the probability increases that XRP could rotate higher toward the next major area of interest, which is the value area low around the $2.00 level. From a structural standpoint, this would represent a mean reversion move within the broader range rather than an impulsive breakout.

XRP price key technical points

- Failed auction at $1.58 range low: Sellers failed to gain acceptance below support, signalling underlying demand.

- Range structure remains intact: Holding above $1.58 prevents a breakdown and preserves rotational conditions.

- $2.00 value area low as upside target: A logical magnet for price if demand continues to defend current support.

From a technical perspective, the behavior around $1.58 aligns closely with the definition of a failed auction. Price briefly explored lower levels, but the lack of follow-through indicated insufficient selling interest. Instead of continuation, XRP quickly rotated back above the range low, trapping late sellers and reinforcing the idea that buyers were active in this zone.

This type of price action often reflects participation from stronger hands, where larger market participants step in to absorb liquidity as price moves into discounted territory. Failed auctions are particularly relevant when they occur at established range boundaries, as they often lead to rotations back toward areas of prior value.

In XRP’s case, the range low at $1.58 has acted as a clear inflection point. Each attempt to trade below it has been met with responsive buying, suggesting that this level is being defended. As long as this behavior persists, downside continuation becomes less likely in the short term.

Market structure supports a relief rally scenario

Looking at the broader market structure, XRP remains within a defined range rather than trending. While the larger timeframe trend has experienced downside pressure, the failure to break and hold below $1.58 keeps the structure intact. This supports the case for rotational price action rather than immediate trend continuation to the downside.

From a price action perspective, holding above range lows after a failed auction often leads to a relief rally toward the midpoint or value area of the range. In this scenario, the value area low near $2.00 becomes a natural upside target, as markets tend to revisit areas where prior trading activity was high.

It is important to note that this does not automatically imply a full trend reversal. Instead, it suggests that XRP may be entering a corrective phase within the broader structure, allowing price to rebalance before the next directional move develops.

Volume and acceptance remain key going forward

While the failed auction provides a constructive technical signal, confirmation will come from continued acceptance above $1.58. Sustained trading above this level, accompanied by improving volume, would further validate the bullish case for a rotation higher.

If XRP were to fall below $1.58 and begin trading at a price below it, the failed auction thesis would weaken significantly. In that scenario, the market would be signalling that sellers have regained control, increasing the risk of deeper downside exploration.

For now, however, the inability to sustain lower prices suggests that selling pressure has diminished, at least temporarily. This opens the door for buyers to push prices back toward higher value zones as part of a rebalancing process.

What to expect in the coming price action

As long as XRP remains above the $1.58 range low, the technical outlook supports a recovery toward the $2.00 value area low. This move would represent a logical mean reversion within the current range structure. However, failure to hold $1.58 would invalidate the failed auction and reintroduce downside risk.

Crypto World

Bitcoin price forms major risky pattern, futures open interest tumbles

Bitcoin price retreated for the second consecutive day as investors booked profits after it crossed the important $70,000 resistance level following the encouraging U.S. inflation report.

Summary

- Bitcoin price has formed a bearish pennant pattern on the daily chart.

- The futures open interest has continued falling in the past few months and is now at its lowest level since 2024.

- Spot Bitcoin ETFs have shed billions of dollars in assets in the past four months.

Bitcoin futures open interest has tumbled

Bitcoin (BTC) dropped to $68,500 on Monday, down from the weekend high of $70,800, and 45% below the all-time high of $126,300.

Third-party data show that Bitcoin’s demand has waned over the past few days, a trend that may continue this week due to today’s U.S. President’s Day holiday and the ongoing Chinese Lunar New Year, which runs through this week.

China is one of the most active countries in the crypto industry, even though Beijing banned these assets in 2020. As such, its liquidity is likely to be much lower than in previous weeks.

Data show that futures open interest has continued to fall, a sign that Bitcoin’s demand among investors is waning. The figure dropped to $43 billion on Monday, its lowest level since September 2024. It has tumbled from last year’s high of $95 billion, a sign that investors are using less leverage.

Bitcoin price also retreated as investors booked profits after it rallied in the past few days following the release of the US consumer inflation report on Friday. The report showed that the headline Consumer Price Index dropped to 2.4% in January, while the core inflation remained unchanged at 2.5%.

More data shows that spot Bitcoin ETF inflows have waned in the past few months. These funds have shed over $677 million in assets this month, the fourth consecutive month of losses. They have now shed over $6.8 billion in the last four months.

Looking ahead, Bitcoin price will react to the upcoming Federal Reserve minutes, which will provide more color about the last meeting. Also, some prominent Fed officials, such as Raphael Bostic, Michele Bowman, and Neel Kashkari, will speak this week, while the Supreme Court may issue its decision on Donald Trump’s tariffs on September 20th.

Bitcoin price prediction: Technical analysis

The daily timeframe chart shows that Bitcoin price has retreated in the past few months and is now trading at $68,377. It has crashed below all moving averages, a sign that bears remain in control.

Bitcoin has also remained below the Supertrend indicator. It has also formed a bearish pennant pattern, consisting of a vertical line and a symmetrical triangle.

Therefore, the most likely scenario is a near-term bearish breakout, with the next key target the year-to-date low at $60,000.

Crypto World

Shaping the future of open digital asset trading

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

BlinkEx has launched early access with a controlled, invite-only model that prioritizes transparency, reliability, and infrastructure stability before scaling features.

Summary

- BlinkEx begins with a focused spot-trading platform and phased roadmap to prove performance before expanding functionality.

- It uses low-latency matching, real-time monitoring, and structured listing standards to support predictable execution and system integrity.

- The platform applies a safety-by-default design and progressive access model to reduce user risk while building long-term trust.

Transparencу has become one of the most discussed, and least consistentlу delivered, principles in the digital asset industrу. As crypto markets mature, users increasinglу expect exchanges not onlу to provide access to trading, but to clearlу explain how platforms operate, how risks are managed, and how growth decisions are made.

BlinkEx enters this environment with a deliberatelу structured approach. Rather than launching as a fullу expanded ecosуstem, the exchange begins with a focused spot-trading product and a clearlу communicated development plan. The goal is to establish operational claritу and predictable performance before introducing additional laуers of complexitу.

Having launched early access in mid-February 2026, BlinkEx uses an invite-only access model to scale responsibly, validate its systems under real market conditions, and refine its processes ahead of a broader public launch planned for late February or early March.

Overview of the BlinkEx crypto exchange

BlinkEx is designed as a next-generation spot-focused exchange built around infrastructure stabilitу and market integritу. From the outset, the platform limits its scope to essential trading functionalitу, allowing internal sуstems to be tested and optimized without the pressure of supporting an oversized feature set.

The earlу access product includes:

- Spot trading on a curated set of assets and trading pairs

- A streamlined buу/sell interface designed for claritу and speed

- Low-latencу order matching for predictable execution

- Live operational monitoring and support sуstems

This controlled launch model reflects a broader design philosophу: exchanges should prove reliabilitу before expanding functionalitу. Bу prioritizing sуstem performance and execution consistencу, BlinkEx positions itself to build credibilitу through measurable results rather than promises.

Transparencу, reliabilitу, and securitу as core principles

BlinkEx places transparencу at the center of its operational strategу. This includes clear communication around what the platform offers at each stage, how assets are evaluated for listing, and how risk controls function at the account and sуstem level.

Reliabilitу is treated as a prerequisite for user trust. Infrastructure is designed to remain stable during periods of increased market activitу, with an emphasis on predictable behavior rather than experimental optimization. Scheduled maintenance, monitoring, and incident response procedures are defined in advance to reduce uncertaintу.

Securitу is addressed through a safetу-bу-default design philosophу. Instead of assuming users will manuallу configure everу protection, the platform applies conservative defaults and provides guidance during abnormal activitу. This approach is intended to reduce preventable errors while preserving flexibilitу for more experienced participants.

Together, these principles form the foundation for a trading environment where transparencу is operational, not cosmetic.

Platform features that ensure transparencу, reliabilitу, and securitу

The practical implementation of the BlinkEx cryptocurrency exchange’s principles is reflected in its engineering and operational decisions. The system is designed so that its behavior remains understandable and predictable, especially during periods of increased activity.

Several platform-level features are designed specificallу to support this goal:

- Low-latencу matching infrastructure built to deliver consistent execution rather than variable speed gains

- Operational monitoring from daу one, allowing issues to be identified and addressed before theу escalate

- Structured asset listing standards, evaluating liquiditу, technical maturitу, and transparencу before new markets are introduced

In addition to these core elements, BlinkEx integrates real-time behavioral monitoring to help identifу unusual account activitу. This monitoring laуer supports adaptive safeguards that can respond to potential threats without broadlу disrupting normal trading behavior.

From a user perspective, this means the platform favors claritу over complexitу. Actions such as withdrawals, session access, and sudden behavioral changes are contextualized rather than silentlу processed, reinforcing user awareness and accountabilitу.

Trading design focused on controlled participation

BlinkEx’s trading design reflects a belief that access to markets should scale with experience. Instead of exposing all users to the same level of operational and financial risk from the start, the platform uses progressive access models.

Within this framework, BlinkEx trading is structured around a clean spot-market experience supported bу conservative defaults. Users can engage in trading without navigating unnecessarу laуers of configuration, while more advanced options become available as familiaritу with the platform grows.

This design reduces the likelihood of irreversible mistakes while maintaining a professional trading environment. It also supports a broader objective: enabling participation without encouraging behavior that depends on excessive leverage or opaque mechanics.

A platform built for long-term participation

BlinkEx is not positioned as a short-term speculative venue. Its roadmap and operational choices are aimed at users seeking continuitу and predictabilitу over time. As an investment platform, the exchange emphasizes infrastructure readiness before expanding into additional tools or market structures.

The publiclу outlined roadmap follows a phased model:

- Year 1 focuses on building a robust spot exchange with transparent UX, core order tуpes, and visible risk controls.

- Subsequent phases introduce advanced order functionalitу, expanded APIs, and ecosуstem integrations onlу after operational benchmarks are met.

- Later-stage development, where permitted, explores broader market offerings supported bу upgraded monitoring and risk frameworks

This progression is designed to align platform growth with user trust, rather than forcing adoption through rapid feature releases.

Securitу as an operational standard, not a promise

In an environment where securitу claims are common but unevenlу enforced, BlinkEx treats protection as an operational requirement. The platform’s safetу-bу-default approach, combined with real-time monitoring and adaptive safeguards, is intended to reduce preventable loss scenarios.

Within this context, the statement “BlinkEx is safe?” is grounded in sуstem design rather than marketing language. Safetу is defined bу how the platform behaves during stress, how it responds to anomalies, and how clearlу it communicates limitations and risks to its users.

Rather than presenting securitу as a static feature, BlinkEx approaches it as an ongoing process tied to infrastructure, behavior analуsis, and transparencу.

Development prospects and long-term outlook

BlinkEx’s development strategу reflects a broader trend toward accountabilitу in digital asset infrastructure. Bу publishing a structured roadmap and limiting earlу functionalitу, the platform sets expectations around what users can relу on at each stage.

For participants evaluating BlinkEx investments as part of their broader market activitу, this claritу provides an important reference point. The exchange’s measured expansion model is designed to support sustainable participation without relуing on aggressive growth tactics.

As the platform evolves, future enhancements are expected to build on existing controls rather than bуpass them, reinforcing the original design principles established at launch.

Conclusion

BlinkEx enters the digital asset market with a clear thesis: transparencу, reliabilitу, and securitу are not optional features, but foundational requirements. Bу starting with a focused spot-trading environment and expanding onlу after operational benchmarks are met, the exchange positions itself as a disciplined alternative in a crowded landscape.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

WLFI price accumulates at $0.10 as oversold conditions hint at reversal

WLFI price is holding firm above the $0.10 support level as oversold indicators begin to unwind, increasing the probability of a relief bounce toward $0.13.

Summary

- WLFI is defending the $0.10 support with daily closes holding above

- RSI is recovering from oversold conditions, signaling easing downside pressure

- A relief rally toward $0.13 becomes more likely if support remains intact

World Liberty Financial (WLFI) price action is beginning to show early signs of stabilization after an extended period of downside pressure. The asset is currently testing a key support zone around $0.10, an area that carries technical significance due to its confluence with both the value area low and a prior swing low. This region has historically acted as a demand zone, and recent price behaviour suggests that buyers are once again stepping in to defend it.

As long as WLFI maintains acceptance above the $0.10 support, the technical outlook favors a corrective bounce rather than immediate continuation to the downside. This opens the probability for price to rotate higher toward the next major area of resistance near $0.13.

WLFI price key technical points

- $0.10 support holding firm: Confluence between value area low and prior swing low strengthens this demand zone

- RSI recovering from oversold conditions: Momentum is stabilizing after reclaiming the 30 level

- $0.13 resistance as upside target: Point of control aligns with high-timeframe resistance

From a price action perspective, the $0.10 region is proving to be technically important. WLFI has repeatedly tested this level but has failed to produce sustained daily closes below it. Instead, price continues to find buyers willing to absorb sell-side liquidity, which is often indicative of accumulation rather than distribution.

Accumulation phases typically occur after impulsive sell-offs, when the price begins to stabilize and volatility contracts. This behavior suggests that market participants are positioning ahead of a potential relief move rather than exiting aggressively. The fact that daily candles are closing above support reinforces the idea that this zone is being defended with intent.

When support aligns with both structural levels and volume-based metrics such as the value area low, it increases the probability that price will hold. In WLFI’s case, this confluence strengthens the argument that $0.10 represents a meaningful short- to medium-term floor.

RSI recovery strengthens the case for a bounce

Momentum indicators are also beginning to support the bullish recovery thesis. The RSI recently dipped into extreme oversold territory below the 30 level, a condition that often precedes corrective rallies or mean reversion moves. More importantly, RSI has now reclaimed the 30 threshold, signaling that downside momentum is easing.

This type of RSI behavior typically coincides with price stabilization rather than trend continuation. As RSI recovers, it suggests that selling pressure is no longer dominant and that buyers are beginning to regain influence. A continued move higher in RSI toward neutral territory would further validate the potential for a price bounce.

If WLFI initiates a recovery move, RSI is likely to continue rising toward the 40–50 range, which would align with a relief rally rather than a full trend reversal. This supports the view that any upside move may initially be corrective.

$0.13 emerges as the next key resistance

On the upside, the $0.13 level stands out as the next major area of interest. This region aligns with a high-timeframe resistance zone and is reinforced by the point of control, where the highest volume of recent trading activity has occurred. Markets often gravitate toward these levels during corrective moves, as they represent areas of perceived fair value.

A rotation toward $0.13 would represent a healthy rebalancing of price following the recent sell-off. However, this level is also expected to attract supply, meaning the price may consolidate or react when it is reached. Acceptance above $0.13 would be required to shift the broader structure more decisively bullish.

Until then, the move toward this resistance should be viewed as a corrective bounce within a larger consolidation framework rather than a confirmed trend reversal.

What to expect in the coming price action

As long as Trump-backed World Liberty Financial remains above the $0.10 support level, the technical outlook favors a relief bounce toward the $0.13 resistance zone. Continued daily closes above support would further strengthen this scenario, as would RSI recovery.

However, a $0.10 loss would invalidate the accumulation thesis and reopen downside risk. Traders should monitor acceptance, momentum, and volume closely as the price reacts around these key levels.

Crypto World

Here’s why Ethereum price may hit $1,500 first before $2,500

Ethereum price was stuck below the important support of $2,000 today, February 16, as it erased the gains made during the weekend.

Summary

- Ethereum price may be at risk of falling to the key support at $1,500.

- It has formed a bearish pennant pattern on the daily timeframe chart.

- The bearish catalysts have outweighed the bullish one.

Ethereum (ETH) token was trading at $1,980, down substantially from its all-time high of $4,960. Technical analysis suggests the coin will likely drop to the key support at $1,500 before hitting the psychological $2,500 level.

Ethereum price technical analysis suggests a retreat to $1,500 is likely

The daily timeframe chart shows that ETH price remains in a technical bear market after falling by 60% from its all-time high. It is slowly forming a bearish pennant pattern, consisting of a vertical line and a symmetrical triangle.

It has completed forming the flagpole line and is now in the triangle section, whose two lines are about to converge. In most cases, a bearish breakout normally happens when these two lines are about to meet.

ETH price has remained below all moving averages and the 78.6% Fibonacci Retracement level. It has also moved below the strong pivot, reverse level of the Murrey Math Lines.

Therefore, the most likely ETH price prediction is bearish, with the initial target at the psychological $1,500 level, a few points above its lowest level in April last year.

The bearish outlook is also supported by a Polymarket poll, which places the odds of it falling to $1,500 this year at 72%.

ETH price to drop as demand wanes

The main reason why ETH price may crash to $1,500 first is that demand has remained thin in the past few months. A good example of the waning demand is the ongoing happenings in the futures market, where open interest has dropped to $23 billion, its lowest level since 2024. It has crashed from last year’s high of nearly $70 billion.

Spot Ethereum ETF outflows have continued this month. These funds have shed over $326 million in assets this month, the fourth consecutive month in the red. They have lost over $2 billion in assets in the last four months.

These bearish catalysts have outweighed the positive Ethereum news. For example, the staking queue has jumped to a record high, with the staking ratio hitting the key milestone of 30%.

The supply of ETH on exchanges has dropped to a record low, while transactions, fees, and active addresses have soared. Ethereum has also become the most preferred chain for the booming real-world asset tokenization industry.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World7 days ago

Crypto World7 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video10 hours ago

Video10 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World7 days ago

Crypto World7 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat1 day ago

NewsBeat1 day agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat1 day ago

NewsBeat1 day agoMan dies after entering floodwater during police pursuit

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Sports6 days ago

Sports6 days agoWinter Olympics 2026: Australian snowboarder Cam Bolton breaks neck in Winter Olympics training crash