Crypto World

Prediction Market Aggregator Stand Launches Counter-Trading Tool

The new tool lets users automate bets against consistent losers — instead of trying to copy winners.

Prediction markets are everywhere. But rising participation doesn’t necessarily transform into profits for regular users.

Prediction market aggregator Stand announced today, Feb. 13, that it’s launching a tool to let users automatically take the opposite position of trades across popular platforms — namely from traders that tend to lose. Edward Ridgely, founder of Stand, said in a press release shared with The Defiant that conventional copy‑trading breaks down in prediction markets.

“Many operate multiple wallets and can easily front-run anyone copying their moves. The more interesting edge is in systematically counter-trading the consistent losers,” Ridgely explained.

The new feature on Stand allows counter-bets against systematically bad bettors, and also helps users avoid common pitfalls, such as blindly following traders who perform well in one market but lose their edge in others.

Destined to Lose

It’s worth noting, however, that there’s currently no rigorous research quantifying how profitable either copy‑trading or counter‑trading bots are for users in prediction markets.

What the data does show so far, however, is a clear concentration of profits among a small cohort of systematic participants, leaving the majority of retail traders on the wrong side of outcomes.

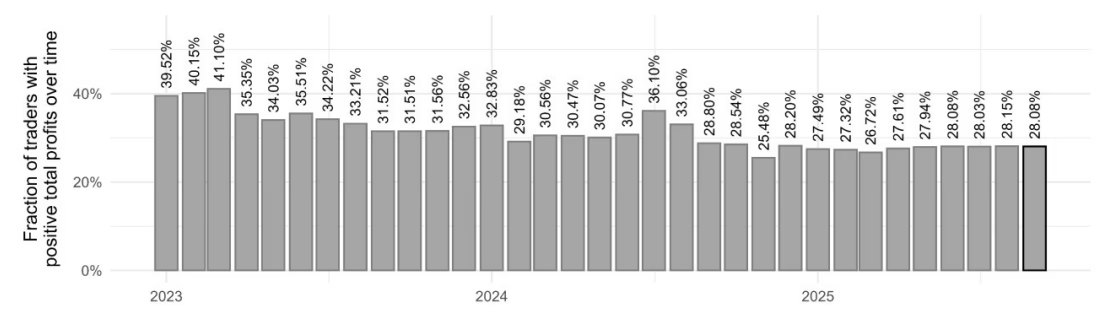

About 70 % of traders on Polymarket lose money, according to a December 2025 study by Felix Reichenbach of Technische Universität Berlin and Martin Walther of the German International University.

The researchers analyzed more than 124 million trades and found that only around 30% of accounts ended the period with net gains, meaning 70% of participants were on the losing side.

That gap in profitability has shaped trader behavior. Multiple automated copy‑trading bots like PolyFlash or PolydexLab allow users to mirror the positions of top wallets in real time, usually for subscription fees.

This arms-race-like dynamic has made simple copy-trading almost ineffective, given that the most successful accounts can just front‑run the crowd by reacting to profitable trades faster on-chain.

Prediction Market Mania

Prediction markets exploded in popularity in 2025, kicking off mainstream usage with the U.S. 2024 presidential election. The largest platforms, Polymarket and Kalshi, have pushed into mainstream markets with an accelerating number of high-profile media and sports partnerships with the likes of the NHL, UFC, MLS, as well as Dow Jones, X, and CNBC.

Sports, politics, culture and crypto markets are now attracting hundreds of millions of dollars, underscoring how much capital these platforms are drawing.

Open interest across platforms surged past $1.1 billion earlier this month, while trading volumes also broke new highs, as The Defiant reported earlier.

Stand’s own monthly DEX volumes via its prediction market terminal have been on the rise since it launched in October, reaching $16.44 million in January.

Crypto World

Moderna (MRNA) Stock Slips Despite Beating Q4 Revenue and Earnings Estimates

TLDR

- Moderna reported Q4 revenue of $678 million, beating Wall Street estimates of $626.1 million, driven by COVID-19 vaccine sales

- The company posted a quarterly loss of $2.11 per share, narrower than the $2.54 per share loss analysts expected

- Moderna reiterated its 2026 revenue growth target of 10% and expects 50% of sales from U.S. markets and 50% from international

- FDA refused to review Moderna’s flu vaccine application this week, citing trial design flaws, despite internal staff reviewers supporting the review

- Moderna stock slipped 0.3% in premarket trading Friday despite beating earnings, after rising 36% year-to-date through Thursday

Moderna shares dipped 0.3% in premarket trading Friday even after the biotech company delivered quarterly results that topped Wall Street expectations. The mixed reaction highlights investor concerns about the company’s path forward after a rough week.

The Cambridge-based vaccine maker reported fourth-quarter revenue of $678 million. That beat analyst estimates of $626.1 million.

Full-year 2025 sales reached $1.94 billion, surpassing the $1.89 billion consensus estimate. COVID-19 vaccine sales drove the better-than-expected performance.

Moderna posted a quarterly loss of $2.11 per share. Analysts had projected a steeper loss of $2.54 per share. The latest loss was narrower than the $2.91 per share loss recorded in the same quarter last year.

CEO Stéphane Bancel said the company entered the year “with strong momentum despite the continued challenging environment in the U.S.” The company reaffirmed its expectation for 10% revenue growth in 2026 compared to 2025.

Wall Street currently expects revenue growth of about 6% for the year. Moderna forecast research and development expenses of roughly $3 billion for 2026, matching analyst estimates.

FDA Setback Casts Shadow

The earnings beat came days after a setback with regulators. The FDA refused Tuesday to review Moderna’s seasonal flu vaccine application.

FDA vaccine chief Vinay Prasad said the company should have compared its vaccine to standard high-dose flu shots for older adults. Moderna ran its trial using regular-dose comparisons, which the company says FDA approved 18 months ago.

Internal FDA staff reviewers had supported moving forward with the review. Prasad overruled them, according to a Wednesday report from Stat.

Moderna criticized the decision and said it was awaiting further guidance on refiling. The company has been counting on its flu vaccine and a future COVID-flu combination shot to drive future growth.

Looking Ahead to 2026

The company expects about 50% of 2026 sales to come from U.S. markets. International markets will account for the remaining half.

Bancel said Moderna expects to meet its 2026 targets through expansion of its next-generation COVID vaccine. Strategic partnerships in international markets will also play a role.

Shares had climbed 36% year-to-date through Thursday’s close. Positive Phase 2b trial results for an intismeran autogene vaccine used in melanoma treatment drove much of the rally.

The company continues working on newer products to offset declining COVID vaccine demand. Sales have struggled since the pandemic windfall years when demand for COVID shots collapsed.

Moderna’s full-year 2025 revenue of $1.94 billion came in above the $1.89 billion analyst consensus, while the company maintains its 10% revenue growth target for 2026.

Crypto World

Crypto calm before the storm: BTC bounces, altcoins flounder

Bitcoin flirted with US$60,000 last week before staging a modest recovery, leaving altcoins to nurse bruised egos and investors to wonder if they’re holding the next “dead token.” Meanwhile, AI stocks are stealing capital and attention like a toddler in a candy store. Welcome to crypto’s latest de-risking phase, where patience is as much an asset as Bitcoin itself.

Summary

- Bitcoin dropped roughly 50% from its October 2025 high, with altcoins lagging heavily as investors rotate capital toward AI, defensive narratives, and larger, more durable crypto assets.

- Hawkish Fed expectations, a cooling labor market, and geopolitical uncertainties are limiting liquidity and short-term risk appetite, keeping rate cuts off the table and sustaining volatility.

- Despite the drawdown, institutional participation, stablecoin liquidity, real-world asset tokenization, and DeFi adoption continue to grow, laying the groundwork for medium-term opportunities once market sentiment shifts.

According to a Binance analysis, markets are caught between two powerful forces: a rotation of capital away from speculative crypto bets toward AI and defensive narratives, and a macro backdrop dominated by hawkish Fed expectations, potential government shutdown jitters, and global trade tensions.

The result is a market that’s temporarily favoring durability over hype, forcing smaller tokens to either prove their worth or quietly fade into obscurity. For Bitcoin, this 50% drawdown from last October’s all-time high is more of a cleansing than a collapse—and it may be laying the groundwork for the next chapter.

Investors are learning a lesson in selective attention. As Bitcoin consolidates around US$60,000–65,000, altcoins continue to lag, dragged down by a flood of 2025 token launches. Roughly 11.6 million of the 20.2 million new tokens released last year—many with little to no users or revenue—have already vanished from active trading.

CoinGecko and Binance report that more than half of these new entrants have endured brutal drawdowns, leaving hype-driven speculators nursing losses while projects with real fundamentals fight for visibility.

Yet the long tail isn’t completely dead. Some smaller assets have shown muted moves recently, reflecting that much of the early deleveraging has already occurred. In other words, the selling pressure is tiring—not that buyers are back in force. Meanwhile, equity markets have also repriced risk, particularly in software, where AI-driven disruption has outperformed Bitcoin in relative terms, creating a liquidity tug-of-war between crypto and tech.

The irony?

The same AI narrative driving stocks higher is one of the most compelling use cases for blockchain: machine-speed payments, programmable money, and cross-border settlements. Short-term, AI is siphoning attention. Medium-term, it may become crypto’s most loyal customer.

Macro factors remain the primary driver. January’s U.S. jobs report showed 130,000 new positions and unemployment at 4.3%, superficially encouraging but revealing a weak underlying trend once benchmark revisions for 2025 are considered. The Fed, under incoming chair Kevin Warsh, is unlikely to loosen policy soon, keeping liquidity tight—a headwind for Bitcoin, historically sensitive to shifts in global cash flows.

Despite the drawdown, structural tailwinds persist. Spot BTC ETF assets under management have only modestly declined, hinting at a sticky investor base focused on strategic allocation rather than momentum chasing. Digital asset treasuries, by contrast, are less aggressive buyers, suggesting balance-sheet strategies are becoming more conservative. Stablecoins have remained plentiful, maintaining the plumbing for future on-chain transactions.

Real-world assets (RWAs) and tokenization have become the new safe harbors. Tokenized treasuries, commodities, and yield-focused structures now total nearly US$25 billion, with tokenized gold surging over 50% since the start of 2026. Tether Gold (XAUT) recently exceeded US$2.6 billion in market cap, a reminder that even in a risk-off phase, crypto can find its bedrock.

DeFi continues to converge with traditional finance. BlackRock’s move to make shares of its tokenized U.S. Treasury fund BUIDL tradable via UniswapX, along with its purchase of UNI governance tokens, signals institutional confidence in decentralized infrastructure. Liquidity exists; it’s just selective, waiting for the right catalyst.

Looking ahead, markets remain poised for volatility while macro signals clarify. Bitcoin’s realized price—roughly US$55,000—marks a psychological pivot point, where holders near breakeven can amplify swings. Yet the difference from prior cycles is clear: this is a deeper, structurally stronger market. Stablecoin rails are solid, RWAs are scaling, DeFi adoption continues, and institutions are quietly embedding digital assets into portfolios.

History suggests that when prices compress but fundamentals advance, conviction builds beneath the surface. Once risk reprices, the winners of this patient phase—projects with real utility, institutional backing, or durable narratives—are often the ones to lead the next leg up. In crypto, as in comedy, timing is everything: the punchline comes after the pause.

Crypto World

Is Bitcoin Trading Like a Tech Stock?

Bitcoin (BTC) was once pitched as digital gold — a hedge against monetary instability and market turmoil. But recent price action tells a different story.

As institutional participation has grown, particularly through exchange-traded funds and other traditional vehicles, Bitcoin has increasingly traded in lockstep with risk assets. The latest downturn in software stocks, fueled by renewed uncertainty around AI’s impact on the sector, has been mirrored in crypto markets, raising fresh questions about Bitcoin’s evolving identity.

That changing dynamic sets the tone for this week’s Crypto Biz. New research from Grayscale examines Bitcoin’s growing correlation with growth equities, while one Ether (ETH) treasury company is doubling down despite multibillion-dollar paper losses. Elsewhere, BlackRock is expanding its tokenization push through a Uniswap integration, and Polymarket is taking its fight over state regulation to federal court.

Grayscale: Bitcoin is trading like a growth asset, not digital gold

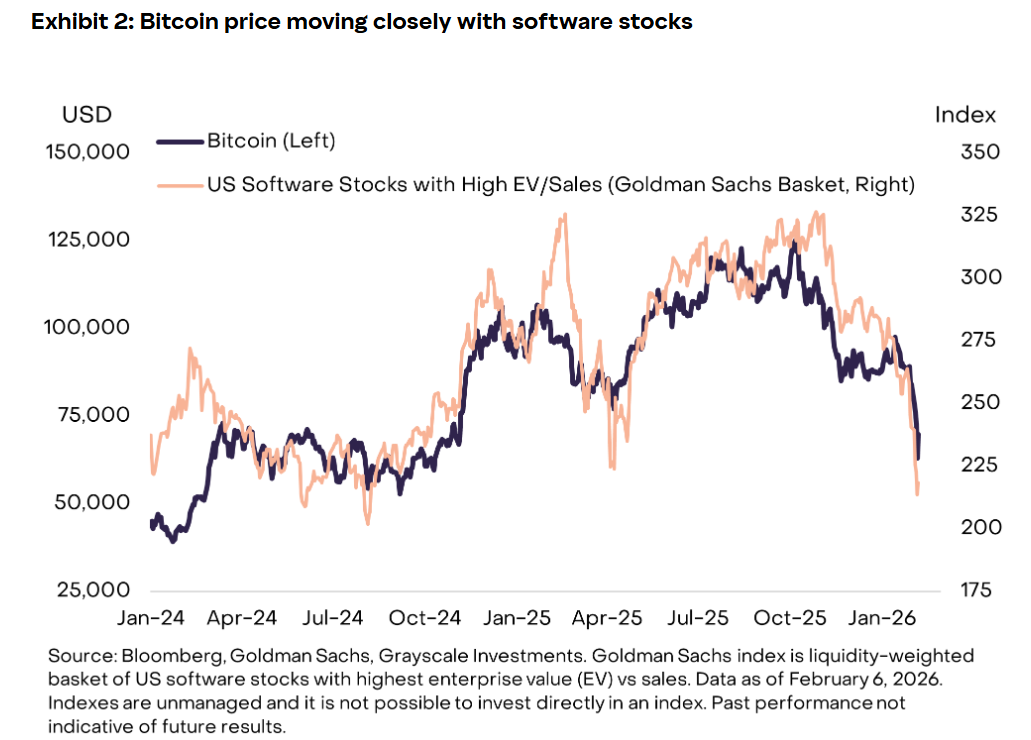

New research from Grayscale suggests that Bitcoin’s store-of-value narrative has recently taken a back seat, with the digital asset behaving more like a growth stock.

In the report, author Zach Pandl said that while Grayscale continues to view Bitcoin as a long-term store of value due to its fixed supply and independence from central banks, its short-term trading patterns resemble those of high-growth equities.

The analysis found a strong correlation between Bitcoin and software stocks over the past two years. That relationship has become more apparent as software companies face renewed selling pressure amid concerns that artificial intelligence could disrupt parts of the industry.

Against that backdrop, Bitcoin’s recent pullback appears less surprising, as its price has closely tracked the software sector’s movements.

BitMine adds 40,613 ETH during market sell-off

Ether treasury company BitMine Immersion Technologies added 40,613 ETH to its holdings during the recent market sell-off, reinforcing its long-term bet on Ether even as prices plunge and paper losses reach billions of dollars.

The purchase raised BitMine’s total Ether stash to more than 4.326 million ETH, worth about $8.8 billion at current levels. According to DropsTab data, the company is now sitting on around $8.1 billion in unrealized losses on its ETH position, reflecting a significant gap between its cost basis and today’s market price.

Despite investor criticism and pressure on its stock price, which has fallen sharply over recent months, BitMine chairman Tom Lee said the company’s strategy is designed to track Ether’s long-term trajectory and benefit from future recoveries. The company’s broader crypto and cash portfolio is valued at roughly $10 billion.

BlackRock buys UNI, brings BUIDL to Uniswap

BlackRock is deepening its push into decentralized finance by listing its tokenized money market fund on Uniswap, a significant step for institutional DeFi adoption.

The asset manager’s USD Institutional Digital Liquidity Fund (BUIDL) is now available on the decentralized exchange, giving whitelisted institutional investors the ability to trade the tokenized Treasury product onchain. As part of the move, BlackRock is also purchasing Uniswap’s governance token, UNI.

BUIDL is the largest tokenized money market fund, with more than $2.1 billion in assets. The fund is issued across multiple blockchains, including Ethereum, Solana and Avalanche. In December, it surpassed $100 million in cumulative distributions generated from its US Treasury holdings.

Polymarket sues Massachusetts over state regulation of prediction markets

Decentralized prediction market Polymarket has filed a federal lawsuit against the state of Massachusetts, challenging state authorities’ efforts to restrict or shut down its event-based trading products.

Polymarket’s chief legal officer, Neal Kumar, confirmed the filing on Monday, saying unresolved legal questions around jurisdiction should be settled at the federal level rather than through state enforcement. The lawsuit is preemptive, aimed at blocking any action by Massachusetts Attorney General Andrea Campbell that Polymarket contends would unlawfully interfere with federally regulated markets.

The company argues that the Commodity Futures Trading Commission (CFTC), not individual states, has exclusive authority over event contracts like those offered on its platform, and that state actions risk fragmenting national markets.

Crypto Biz is your weekly pulse on the business behind blockchain and crypto, delivered directly to your inbox every Thursday.

Crypto World

Dutch House of Representatives Advances Controversial 36% Tax Law

The Netherlands’ lower chamber moved a sweeping capital-gains plan forward on Thursday, proposing a 36% tax on savings and most liquid assets, including cryptocurrencies. The bill cleared the House of Representatives with 93 lawmakers voting in favor, meeting and surpassing the threshold of 75 required to advance the measure. It would apply regardless of whether the assets are sold, extending to savings accounts, crypto holdings, most equity investments and gains from interest-bearing instruments. If the Senate signs off, the policy would take effect in the 2028 tax year. Critics argue the plan risks driving capital out of the Netherlands as investors seek jurisdictions with more favorable tax conditions. The discussion comes amid a broader global conversation about crypto taxation and how unrealized gains should be treated for high-net-worth and retail investors alike. The Dutch tally, published by the House, confirms the legislative momentum behind the proposal.

Key takeaways

- The bill would impose a 36% capital-gains tax on savings and most liquid investments, explicitly including cryptocurrencies, with the tax levied even if assets are not disposed of.

- The measure advanced after a 93-to-what-it-took vote in the Dutch House, surpassing the 75-vote threshold to proceed, signaling strong political alignment in favor of the reform.

- Enactment hinges on Senate approval; if passed, the policy would apply beginning with the 2028 tax year, giving policymakers and investors time to prepare for the transition and for further details to emerge on implementation.

- Critics warn the proposal could trigger capital flight from the Netherlands to jurisdictions with lower tax burdens, drawing on historical examples where similar levies spurred relocation of entrepreneurship and investment activity.

- Analysts and industry figures have offered stark projections about the long-term impact on wealth accumulation, including widely cited calculations showing substantial reductions in compound growth under an unrealized-gains tax regime; comparisons to other tax debates in major markets underscore the broader risk environment for crypto and tech capital.

Tickers mentioned:

Sentiment: Bearish

Market context: The Netherlands’ proposal sits within a wider European and global dialogue on crypto taxation, where authorities weigh revenue needs against innovation incentives. As tax authorities assess how unrealized gains should be treated, the Dutch plan adds to considerations around how digital-asset holdings are accounted for in personal and investment taxation, echoing debates across the EU about consistency, enforcement, and the boundaries of capital taxation in a digital era.

Why it matters

The central premise — taxing unrealized gains on a broad swath of assets, including cryptocurrencies — marks a notable shift in how governments might approach wealth and investment in an era of rapid digital-asset adoption. Proponents argue that a real-time tax on gains helps address perceived inequities in how passive wealth is taxed versus earned income, potentially increasing public revenue to fund social and infrastructure initiatives. Yet, the immediate reaction from market participants and crypto executives has been skeptical, raising concerns about distortions to investment decisions and the long-run competitiveness of the Netherlands as a home for startups and asset management.

Analysts highlighted the unintended consequences of such a policy. Denis Payre, co-founder of logistics firm Kiala, invoked a historical parallel, noting that France’s experience with an earlier capital-sweep proposal led to a pronounced exodus of entrepreneurs. The sentiment among several industry observers echoed this caution, with crypto market analyst Michaël van de Poppe describing the proposal as counterproductive and predicting a material shift of capital to more favorable environments. The underlying critique is that high tax rates on unrealized gains could dampen risk appetite and deter early-stage capital formation, especially for innovative sectors where growth often hinges on reinvested profits rather than realized gains.

Beyond the Netherlands, the broader economic calculus is clear: tax policy can have a measurable impact on how wealth compounds over decades. For instance, a widely cited hypothetical scenario contrasts outcomes with and without unrealized-gains taxation. Starting with 10,000 euros and contributing 1,000 euros monthly for 40 years, one study suggested the pre-tax outcome might reach around 3.32 million euros, whereas applying a 36% unrealized gains tax would reduce the final tally to roughly 1.89 million euros, a gap of about 1.435 million euros. While such projections depend on many assumptions, they illustrate how timing and recognition of gains influence long-term wealth accumulation, particularly for asset classes that can experience both rapid appreciation and volatility.

The policy also lands in the context of a U.S. debate around wealth taxes and crypto regulation. California, for example, has faced controversy over proposals to impose wealth taxes on billionaires, sparking a broader discourse about the balance between tax fairness and the incentives for innovation. While the Dutch measure focuses on unrealized gains across a wide array of assets, the parallel debates illustrate a growing global sensitivity to how digital assets are taxed and how such tax rules interact with entrepreneurship and capital formation.

As investors digest these signals, the crypto community has echoed concerns about the practicalities of enforcing a 36% rate on assets that can be volatile and illiquid, and about how such taxation affects portfolio strategies, cross-border activity, and the flow of capital to jurisdictions deemed more crypto-friendly. The discussion points to a broader trend where policymakers are still navigating the line between revenue-generation aims and the need to sustain a supportive environment for innovation and decentralized finance.

What to watch next

- Whether the Dutch Senate approves the bill and whether amendments alter the scope or rate of the proposed tax.

- How the government and tax authorities define and enforce unrealized gains on a diverse set of assets, including cryptocurrencies.

- Potential investor behavior in response to the policy, including any observed shifts to foreign domiciliation or cross-border holdings.

- Any forthcoming data or studies assessing the macroeconomic impact of the reform on investment, entrepreneurship, and innovation in the Netherlands.

- Broader EU considerations on crypto taxation and cross-border consistency as other member states weigh similar approaches.

Sources & verification

- Tweep: Dutch House tally page showing the vote threshold and tally details for the bill (dossier 36748; id 2025Z09723). Verify the official tally and the threshold requirement here: https://www.tweedekamer.nl/kamerstukken/wetsvoorstellen/detail?dossier=36748&id=2025Z09723#wetgevingsproces

- Investing Visuals projection comparing compound growth with and without unrealized gains tax over 40 years. See the analysis referenced in coverage of the proposal’s long-term effects: https://x.com/InvestingVisual/status/2022221938840441335

- Statements from Denis Payre on the potential capital flight risk associated with such a tax proposal: https://x.com/DenisPayre/status/2022… (X post linked in coverage)

- Commentary from Michaël van de Poppe critiquing the plan: https://x.com/CryptoMichNL/status/2022209120322121928

- California’s wealth-tax discussion as a comparative reference in crypto regulation debates: https://cointelegraph.com/news/california-billionaire-tax-crypto-executives-slam

Netherlands advances 36% capital gains tax on savings and crypto

The House of Representatives’ decision to push the 36% capital gains tax proposal forward marks a pivotal moment in how the Netherlands could tax a broad spectrum of wealth. The measure targets not only traditional savings but also a wide range of liquid assets, explicitly including crypto assets, and would tax gains even when assets remain unrealized. The bill’s fate now rests with the Senate, and the clock is set for a 2028 effective date should the upper chamber approve the legislation in its final form. The political calculus surrounding this proposal underscores a broader concern among investors and industry observers: will such a tax regime dampen the country’s appeal as a hub for crypto and tech entrepreneurship, or can it be calibrated in a way that sustains public revenue without stifling innovation?

https://platform.twitter.com/widgets.js

Crypto World

Netherlands Lower Chamber Passes 36% Tax Proposal Before Passing to Senate

The Netherlands’ House of Representatives advanced a legislative proposal on Thursday to introduce a 36% capital gains tax on savings and most liquid investments, including cryptocurrencies.

The legislation reached the 75-vote threshold required to advance, with 93 lawmakers voting in favor of it, according to the House tally.

Under the proposal, savings accounts, cryptocurrencies, most equity investments and gains made from interest-bearing financial instruments are subject to the tax, whether or not the assets are sold.

Critics say the bill will drive capital out of the Netherlands and into jurisdictions with more favorable tax laws, as investors seek a flight to safety from confiscatory taxation.

The Dutch Senate must also pass the bill before it is signed into law, which will take effect in the 2028 tax year, if it is passed, but many investors in the crypto community are already sounding the alarm and predicting capital flight from the country.

Related: European Commission calls on 12 countries to implement crypto tax rules

Investors say the tax is out of touch and will backfire

“France did this in 1997 and saw a massive exodus of entrepreneurs leaving the country,” Denis Payre, co-founder of logistics company Kiala said.

Crypto market analyst Michaël van de Poppe said the proposal is “the dumbest thing I’ve seen in a long time.”

“The number of people willing to flee the country is going to be bananas,” he added, echoing the calls of other industry analysts and executives.

An investor starting with 10,000 euros ($11,871) who contributes 1,000 euros per month over 40 years would end up with about 3,320,000 euros by the end of the 40 years, according to Investing Visuals.

However, the new 36% tax reduces the total amount after 40 years to about 1,885,000 euros, a difference of 1,435,000 euros, Investing Visuals said.

Crypto industry and tech executives in the United States voiced similar concerns about California’s proposed wealth tax on billionaires.

The proposal outlined a 5% tax on an individual’s net worth above the $1 billion threshold, igniting a torrent of backlash and tech entrepreneurs announcing that they were leaving the state of California.

Magazine: Best and worst countries for crypto taxes — plus crypto tax tips

Crypto World

CFTC Appoints Crypto Heavyweights to 35-Person Advisory Panel

CFTC forms 35-member advisory panel stacked with crypto leaders as regulator signals shift toward friendlier digital asset rules.

The U.S. Commodity Futures Trading Commission (CFTC) has selected several cryptocurrency executives to serve on its newly created Innovation Advisory Committee (IAC).

This development comes as the agency, led by Chair Michael S. Selig, continues to indicate that his administration plans to adopt a more permissive approach to regulating the digital asset industry.

IAC Appointee List Announced

Of the 35 members making up the panel, 20 are tied to companies involved in crypto, while at least five are involved in prediction markets. Among them are Crypto.com CEO Kris Marszalek, Gemini co-founder Tyler Winklevoss, Kalshi CEO Tarek Mansour, and Polymarket architect Shayne Coplan.

“Today marks an important and energizing moment at the CFTC as the Innovation Advisory Committee takes shape,” said Selig in a Thursday press release.

Additional members include Anchorage Digital’s top executive, Nathan McCauley, Grayscale’s Peter Mintzberg, Robinhood CEO Vladimir Tenev, Solana’s Anatoly Yakovenko, as well as Ripple chief Brad Garlinghouse, and Coinbase’s Brian Armstrong.

Executives at Paradigm, DraftKings, and the Depository Trust & Clearing Corporation (DTCC) were also included, together with representatives from traditional finance institutions such as Cboe, CME, Nasdaq, and the Options Clearing Corporation (OCC), among other firms.

Selig said the main aim is to ensure America remains the home to the most transparent and well-regulated financial markets in the world.

“By bringing together participants from every corner of the marketplace, the IAC will be a major asset for the Commission as we work to modernize our rules and regulations for the innovations of today and tomorrow,” he added.

Market Innovation and Crypto Regulation Streamlining

The IAC, launched in January, replaces the Technology Advisory Committee (TAC), which previously provided guidance on how emerging technologies were affecting derivatives markets.

You may also like:

The new body will serve as a resource on developments in derivatives and commodity markets, helping the Commission assess how innovations such as artificial intelligence (AI) and blockchain are reshaping financial systems and informing the development of adaptive regulatory frameworks.

The CFTC has also begun coordinating with the Securities and Exchange Commission (SEC) through a joint initiative known as “Project Crypto.”

The effort is aimed at harmonizing regulatory approaches to digital asset markets, reducing jurisdictional overlap between the agencies, and providing clearer and more predictable rules for cryptocurrency companies operating in America.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Lighter Enables Unified Collateral for Spot and Futures Trading

LIT surged 13% following a week of product updates.

LIT, the native token of decentralized perpetuals exchange Lighter, rose as much as 13% over the past 24 hours as the platform rolled out new trading features, including unified collateral accounts.

The token traded as high as $1.62, but has since retraced to $1.59, up just over 11% on the day, according to CoinGecko. However, LIT is still down around 50% from its launch price of above $3.

The price action follows a series of product updates from Lighter this week. On Thursday evening, the DEX launched new trading account types that let users switch to a unified collateral system for spot and perpetual futures trading.

The company explained in a post on X that this is the first phase in a set of upgrades aimed at allowing “arbitrary tokens” to be used as collateral on the platform. Lighter also added that the next step is the tokenization of LLP, the platform’s market-making vault.

Lighter currently has $925.8 million in total value locked (TVL) and ranks fourth among perpetual DEXs by daily trading volume, according to DeFiLlama. The platform has also accumulated more than 801,000 users and processed over 59 billion transactions, according to its explorer.

Earlier this week, Lighter also announced new markets, including Korean equity perpetual futures. The platform now offers contracts linked to Hyundai, Samsung, SK Hynix, and the Korean Composite index, with up to 10x leverage, according to a post on X.

The upgrades come as perpetual futures trading continues to heat up across decentralized finance (DeFi), with exchanges racing to capture market share. Competitors like Hyperliquid and Aster remain the largest players, with $5.1 billion and $1.86 billion in open interest (OI), according to DeFiLlama. As of Friday, Lighter’s OI stands at $782 million.

Crypto World

Crypto group counters Wall Street bankers with its own stablecoin principles for bill

The current impasse over stablecoin yields in the U.S. Senate’s crypto market structure bill is now in writing, and the crypto side is holding the line on needing some forms of rewards for stablecoin users.

A White House meeting between Wall Street bankers and crypto executives hit a wall this week, despite officials in President Donald Trump’s administration urging the sides to find a compromise. The banks held their line that no stablecoin yield or reward is acceptable, arguing that such yields threaten the depository activity at the heart of the U.S. banking system, explaining their position in a one-page paper entitled “Yield and Interest Prohibition Principles.”

The Digital Chamber has now penned its own set of principles and began circulating it on Friday, defending the need for the section in the Senate Banking Committee’s draft bill that outlines a range of situations in which rewards could be acceptable. The latest document, obtained by CoinDesk, also says that the bankers’ request for a two-year study on stablecoins’ effect on deposits is acceptable, as long as it doesn’t come with an automatic regulatory rulemaking in response.

“We want to make the case known for policymakers that we do think this is a compromise,” said Digital Chamber CEO Cody Carbone, in an interview on Friday. With this document, the industry group is putting in writing that it’s willing to give up ground on anything that looks like an interest payment for static holdings of stablecoins, which would most closely resemble a bank savings account.

While the crypto sector has been pursuing stablecoin products allowed under last year’s Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, the bankers are trying to dial back that law with edits included in this pending Digital Asset Market Clarity Act. But the GENIUS Act represents the current law of the land, so Carbone suggested that his industry’s willingness to scrap rewards on stablecoin holdings is a significant concession, and the crypto companies should still be able to offer rewards when customers engage in transactions and other activity. Bankers should return to the table to talk again, he said.

“if they don’t negotiate, then the status quo is that just rewards continue as-is,” said Carbone, who suggested that his group’s wide membership — which includes banking members — can put it closer to the middle of the discussion. “If they do nothing and they continue to say, ‘We just want a blanket prohibition,’ this goes nowhere.”

He hopes the Digital Chamber’s new position paper can reset the negotiations that have halted progress on the legislation since an 11th-hour disagreement derailed a hearing on the bill in the banking panel a month ago.

“Hopefully we can be the voice or the middle man who helps drive this conversation once again, because we are the one trade that represents both sides,” Carbone said.

The Digital Chamber’s principles on Friday highlighted two particular reward scenarios it wanted protected – those tied to providing liquidity and those fostering ecosystem participation. The group argued those two provisions of the draft bill’s Section 404 are especially important in decentralized finance (DeFi).

The White House is said to have called for a compromise by the end of this month. So far, the bank side hasn’t seemed to budge in repeated meetings, though Trump crypto adviser Patrick Witt said in a Friday interview with Yahoo Finance that another gathering may be scheduled for next week.

“We’re working hard to address the issues that were raised,” Witt told Yahoo Finance, saying he’s encouraged both sides to bend on the details.

“It’s unfortunate that this has become such a big issue,” he said, because the Clarity Act isn’t really about stablecoins, which was more appropriately the business of the already-passed GENIUS Act. “Let’s use a scalpel here to address this narrow issue of idle yield,” he added.

The Senate Agriculture Committee has already passed its own version of the Clarity Act, which focused on the commodities side of the ledger, while the Senate Banking Committee’s version is more about securities. If the banking panel follows its agriculture counterparts, it’ll advance the bill along partisan lines. But if a final bill is to eventually be approved in the entire Senate, it’ll need a lot of Democratic support to clear the chamber’s 60-vote margin.

Crypto World

Bitcoin Pushes Above $69K as Retail Bulls Show Intent

Bitcoin (BTC) rallied to $69,482 on Friday, and the rally coincided with data showing steady accumulation from smaller-sized holders in February.

Analysts say the breakout may evolve into a broader bullish trend, although other data suggest that a longer period of price consolidation will underlie the emerging bull trend.

Key takeaways:

-

BTC broke above the $69,000 resistance and its descending channel, triggering $92 million in short liquidations within four hours.

-

Small wallets added $613 million in February, while the whale wallets stalled with $4.5B billion in outflows.

-

Short-term holder profit-ratio indicator hit its lowest level since November 2022, underscoring weak sentiment over the past few weeks.

Will the Bitcoin relief rally last?

Bitcoin has pushed above the upper boundary of its descending channel and retested $69,000. The move marks a potential bullish break of structure (BOS), if BTC holds above $68,000.

If BTC holds above this reclaimed level, the next internal liquidity zones sit near $71,500 and $74,000. The 50 and 100-period exponential moving averages (EMAs) are now compressing beneath the price on the one-hour chart, reinforcing the possibility of the short-term momentum continuing.

The latest price surge triggered roughly $96 million in futures liquidations over the past four hours, with nearly $92 million coming from short positions, signaling a short squeeze on bearish traders.

BTC liquidations were primarily concentrated on Bybit (22.5%), Hyperliquid (22%), and Gate (15%), suggesting these platforms account for a significant share of active leveraged positioning in the market.

Related: Multi-day negative Bitcoin funding signals ‘overcrowded’ short trade: Reversal coming?

BTC retail investor demand backs the breakout

The breakout is supported by the steady buying from the smaller-sized investors. Order flow data from Hyblock shows that the small wallets ($0–$10,000) have accumulated roughly $613 million in cumulative volume delta (CVD) in February, consistently bidding during the price correction.

The mid-sized wallets ($10,000–$100,000) remain around -$216 million for the month, but the cohort added roughly $300 million since BTC fell below $60,000, suggesting selective accumulation during discounted periods.

Whale wallets ($100,000 and above) saw their CVD bottom near -$5.8 billion earlier in February and have since moved sideways. This stabilization implies that the aggressive distribution has paused, though a clear accumulation trend from the large holders has yet to emerge.

For the rally to continue, whale buying may need to return, and the short-term holder spent output profit ratio (SOPR) may need to move back above 1, signaling that the recent buyers are no longer selling at a loss.

Notably, the short-term holder SOPR recently fell to its lowest level since November 2022, indicating that many recent buyers have been realizing losses, a sign that conviction may remain fragile despite the rebound.

Related: Bitcoin passes $69K on slower US CPI print, but Fed rate-cut odds stay low

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

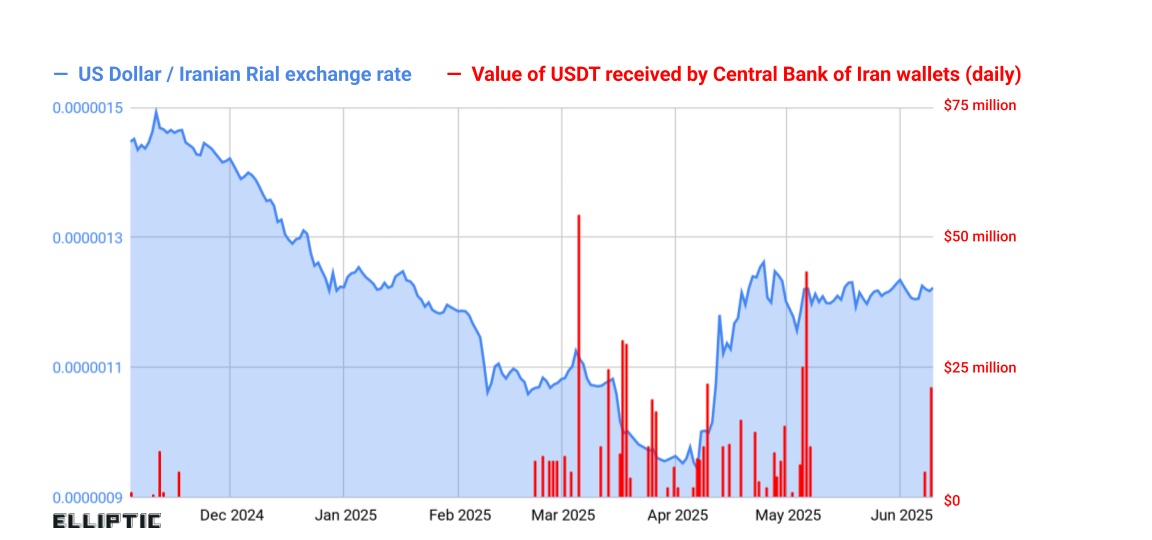

Team That Flagged $1B Iran USDT Fired?

Binance has fired at least five members of its compliance investigations team after they internally flagged more than $1 billion in transactions allegedly tied to Iranian entities, according to Fortune.

The transactions reportedly took place between March 2024 and August 2025. As reported, they were routed using Tether’s USDT stablecoin on the Tron blockchain.

USDT on Tron: A Familiar Pattern For Iran?

The firings allegedly began in late 2025. Several of the dismissed staff had law enforcement backgrounds and held senior investigative roles.

Sponsored

Sponsored

Fortune reported that at least four additional senior compliance staff have also left or been pushed out in recent months.

The reported $1 billion in flows were denominated in USDT and moved across the Tron network. That combination has repeatedly appeared in recent sanctions enforcement actions involving Iran-linked activity.

Earlier this month, the US Treasury’s Office of Foreign Assets Control (OFAC) sanctioned two UK-registered crypto exchanges, Zedcex and Zedxion. It’s alleged that the exchanges processed nearly $1 billion in transactions tied to Iran’s Islamic Revolutionary Guard Corps (IRGC).

According to OFAC and blockchain analytics reporting cited by TRM Labs and Chainalysis, much of that activity also involved USDT on Tron.

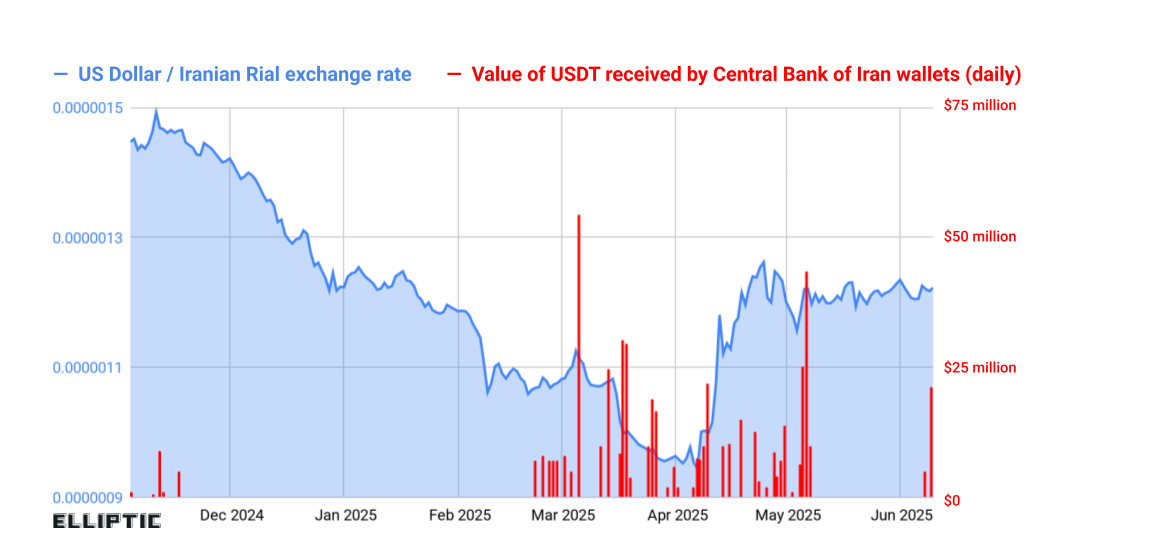

Separately, BeinCrypto reported in January that Iran’s central bank accumulated more than $500 million in USDT amid pressure on the Iranian rial. Blockchain analytics firm Elliptic said the purchases likely aimed to secure hard-currency liquidity outside the traditional banking system, effectively creating a parallel dollar reserve.

Taken together, these cases show how stablecoins—particularly USDT—have become central to Iran-linked cross-border financial flows.

Binance has not publicly confirmed that the alleged Iran-linked transactions violated sanctions laws, nor has any regulator announced new enforcement action against the company related to this reporting.

However, the episode unfolds amid broader scrutiny of stablecoin infrastructure and the role of exchanges in geopolitical sanctions regimes.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports7 days ago

Sports7 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video9 hours ago

Video9 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?