Crypto World

Ray Dalio Warns of World Order Breakdown: Is Crypto at Risk?

Billionaire investor and Bridgewater Associates founder Ray Dalio says the global order established after World War II is breaking down. He argued that the world is entering what he calls “Stage 6” of the “Big Cycle.”

His warning has triggered renewed debate about geopolitical instability and its impact on cryptocurrency markets.

Sponsored

Ray Dalio Says We’re in “Stage 6” as World Order Breaks Down

Dalio frames the current moment through what he calls the “Big Cycle.” This is a pattern in which dominant empires rise, peak, and eventually decline. According to this model, the world is now in “Stage 6.”

“In my parlance, we are in the Stage 6 part of the Big Cycle in which there is great disorder arising from being in a period in which there are no rules, might is right, and there is a clash of great powers,” the post read.

Unlike domestic political systems, Dalio argues, international relations lack effective enforcement mechanisms such as binding laws or neutral arbitration. As a result, global affairs are ultimately governed by power rather than rules. When a dominant country weakens and a rival gains strength, tensions typically increase.

He identifies five types of conflict that tend to escalate in such periods: trade and economic wars, technology wars, capital wars involving sanctions and financial restrictions, geopolitical struggles over alliances and territory, and finally, military wars.

Most major conflicts, he argues, begin with economic and financial pressure long before bullets are fired. Dalio draws comparisons to the 1930s, when a global debt crisis, protectionist policies, political extremism, and rising nationalism preceded World War II.

He notes that before large-scale military conflict erupted, countries engaged in tariff battles, asset freezes, embargoes, and financial restrictions, tactics that resemble measures used today.

Sponsored

In his view, the most significant flashpoint in the current cycle is the strategic rivalry between the United States and China, particularly over Taiwan.

“The choice that opposing countries face—either fighting or backing down—is very hard to make. Both are costly—fighting in terms of lives and money, and backing down in terms of the loss of status, since it shows weakness, which leads to reduced support. When two competing entities each have the power to destroy the other, both must have extremely high trust that they won’t be unacceptably harmed or killed by the other. Managing the prisoner’s dilemma well, however, is extremely rare,” Dalio wrote.

However, warnings like this are not new. Dalio has issued similar cautions for years. This suggests his recent remarks are part of a consistent long-term thesis rather than a sudden shift.

Still, it’s worth noting that rather than making a direct prediction about military conflict, Dalio argues that the structural conditions historically associated with major power transitions are now in place.

Sponsored

Broader Implications for the Crypto Market

Dalio’s warning raises questions about how digital assets might perform. In periods marked by sanctions, asset freezes, and restrictions on cross-border finance, cryptocurrencies can attract attention as alternative settlement rails that operate outside traditional banking infrastructure.

Bitcoin, in particular, is often viewed as resistant to censorship and capital controls. These characteristics could become more relevant if financial fragmentation accelerates. At the same time, cryptocurrencies remain sensitive to global liquidity conditions.

Historically, geopolitical stress and policy tightening have triggered broad risk-off reactions across markets. This, in turn, may weigh on equities and high-beta assets alike.

Sponsored

If rising tensions lead to tighter financial conditions or reduced investor appetite for risk, crypto markets could experience heightened volatility in the short term.

“For stocks, this likely means higher volatility, lower valuations, and sharper swings as geopolitical risks rise. For crypto, weakening trust in traditional money could drive long-term interest, but short-term stress may still trigger severe price swings,” analyst Ted Pillows stated.

Another key factor is that heightened geopolitical tensions may push investors toward traditional safe-haven assets. Gold has historically benefited during periods of uncertainty, as capital seeks stability and long-standing stores of value.

In recent months, precious metals have surged to record highs, while cryptocurrencies struggled to recover following October’s tariff-driven market downturn. This divergence highlights that, despite Bitcoin’s “digital gold” narrative, many investors still treat gold as the primary hedge during acute geopolitical stress.

If tensions deepen, capital flows could continue favoring established defensive assets over more volatile alternatives. For crypto markets, that dynamic suggests a complex outlook: while long-term narratives around monetary debasement and financial fragmentation may strengthen, near-term price action could remain vulnerable to shifts in global risk sentiment.

Crypto World

Can Pi Network price reclaim $0.20 after breaking a key resistance trendline?

Pi Network’s price shot up more than 50% to $0.20 earlier last week before parting with some of its gains and settling lower. Can it reclaim the key psychological figure now that it has confirmed a breakout from a multi-month trendline resistance?

Summary

- Pi Network price briefly rallied to a four-week high of $0.20 last week.

- Pi price action has confirmed a breakout from a multi-week descending trendline support on the daily chart.

According to data from crypto.news, Pi Network (PI) price rose nearly 54% to a four-week high of $0.20 on February 15 before profit taking stirred it back to $0.17 at the time of writing, though it still retains 20% gains over a seven-day period.

The PI network rally came amid investor hype surrounding the project’s upcoming key upgrades for the following months, aimed at building the ecosystem towards a more decentralized network. Notably, the upgrades for its mainnet node operators are part of its transition from version 19 to 22 of the Stellar network to accelerate its vision of decentralization while seeking to optimize performance, better security, and scalability to support long-term network growth for the project.

Another catalyst fueling this uptick is the hype surrounding the first anniversary of its mainnet launch on Feb. 20. Investors often tend to celebrate such milestones by buying more tokens, which can often drive speculative rallies.

Against this backdrop, derivatives data show that the Pi Network token’s funding rate has shifted from negative to positive at press time. This reversal suggests that traders are rotating from bearish to bullish positioning, which typically tends to uplift market sentiment surrounding the associated token.

Additionally, there is a lot of community chatter that the token could be listed on crypto exchange Kraken later this year. Getting listed on a major exchange like Kraken, which has a customer base of millions, could provide a significant boost to its price and overall liquidity.

On the daily chart, Pi Network price has confirmed a breakout of a descending trendline that had been acting as dynamic resistance since late November last year. Breaking above this long-standing pattern indicates that bulls are reclaiming market dominance and appear positioned to drive prices higher in the short term.

Evidence of a burgeoning uptrend is visible across several oscillators, with the MACD lines turning upward to indicate a positive crossover in momentum. This is typically interpreted as a sign that the period of distribution is ending and accumulation has begun.

Validating this transition, the Aroon Up at 92.86% vastly outpaces the 28.5% Down reading, confirming that the bulls have successfully seized control of the price discovery process.

Hence, Pi Network is well-positioned to see a potential rebound to its Feb. 15 high of $0.20. If bullish momentum persists, the rally could extend to its Nov. 28 high of $0.28, which lies 64% above the current price level.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Willy Woo Flags Q Day Risk as Bitcoin’s Valuation Versus Gold Slips

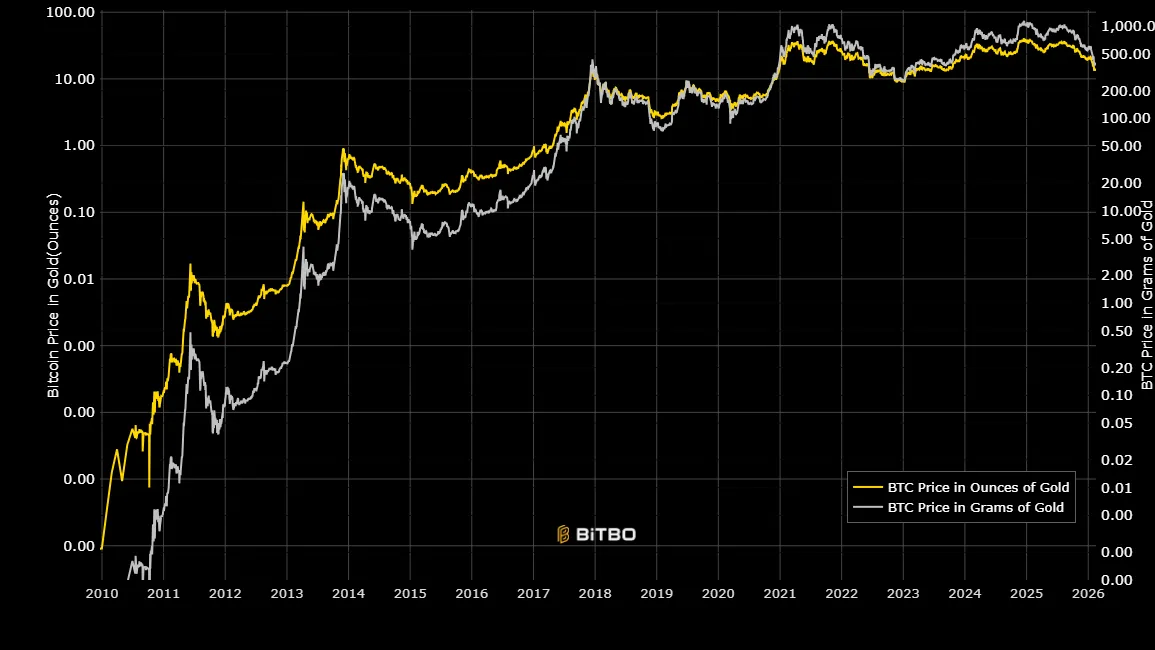

Onchain analyst and early Bitcoin adopter Willy Woo is warning that growing attention to quantum computing risks is starting to weigh on Bitcoin’s long-term valuation case against gold.

Woo argued in a Monday X post that markets had begun to price in the risk of a future “Q‑Day” breakthrough — shorthand for the moment when a powerful enough quantum computer exists to break today’s public key cryptography.

Roughly 4 million “lost” Bitcoin (BTC) — coins whose private keys are presumed gone — could be dragged back into play, Woo argued, if a powerful quantum computer could derive private keys from exposed public keys, undermining part of Bitcoin’s core scarcity narratives.

He estimated only about a 25% chance that the network would agree to freeze those coins via a hard fork, one of the most contentious issues in Bitcoin governance today.

Q‑day risk and “lost” coins

According to blockchain researchers, the 4 million exposed coins represent around 25%-30% of the Bitcoin supply and are held in addresses whose public keys are already visible onchain, making them among the first at risk in a quantum attack scenario.

Related: Institutions may get ‘fed up’ and fire Bitcoin devs over quantum: VC

Yet any move to freeze these coins would upend long‑standing norms around fungibility, immutability and property rights.

Freezing the coins could provoke deep splits between those prioritizing backward‑compatible fixes (upgrades that preserve existing rules and coins without invalidating past transactions or requiring a contentious hard fork), and those willing to rewrite rules to protect early balances.

With a 75% likelihood of the coins remaining untouched, investors should assume, Woo said, a non‑trivial probability that an amount of BTC equivalent to roughly “8 years of enterprise accumulation” becomes spendable again.

It’s a prospect that is already being priced in as a structural discount on BTC’s valuation versus gold for the next five to 15 years, Woo argued, meaning that Bitcoin’s long‑term tendency to gain purchasing power when measured in ounces of gold is no longer in play.

Bitcoin’s post‑quantum migration path

Many core developers and cryptographers stress that Bitcoin does not face an imminent “doomsday” situation and has time to adapt.

The emerging roadmap for a post‑quantum migration is not a single emergency hard fork, they argue, but a phased process, eventually steering the network toward new address formats and key management practices over a multi‑year transition.

Even if quantum did arrive sooner than expected and the coins were recirculated, other Bitcoiners, such as Human Rights Foundation chief strategy officer Alex Gladstein, argue that it is unlikely they would be dumped onto the market.

Gladstein sees a more likely scenario where the coins are accumulated by a nation-state rather than immediately sold.

Related: Why Luke Gromen is fading Bitcoin while staying bullish on debasement

Quantum risk goes mainstream in macro

Still, Woo’s warning lands in a market where Bitcoin is trading almost 50% off its all-time high, and quantum has already moved from a niche concern to a mainstream risk factor in institutional portfolios.

In January, Jefferies’ longtime “Greed & Fear” strategist Christopher Wood cut Bitcoin from his flagship model portfolio and rotated the position into gold, explicitly citing the possibility that “cryptographically relevant” quantum machines could weaken Bitcoin’s store of value case for pension‑style investors.

Magazine: Kevin O’Leary says quantum attacking Bitcoin would be a waste of time

.

Crypto World

Michael Saylor’s Strategy says it can survive a bitcoin (BTC) price crash to $8,000

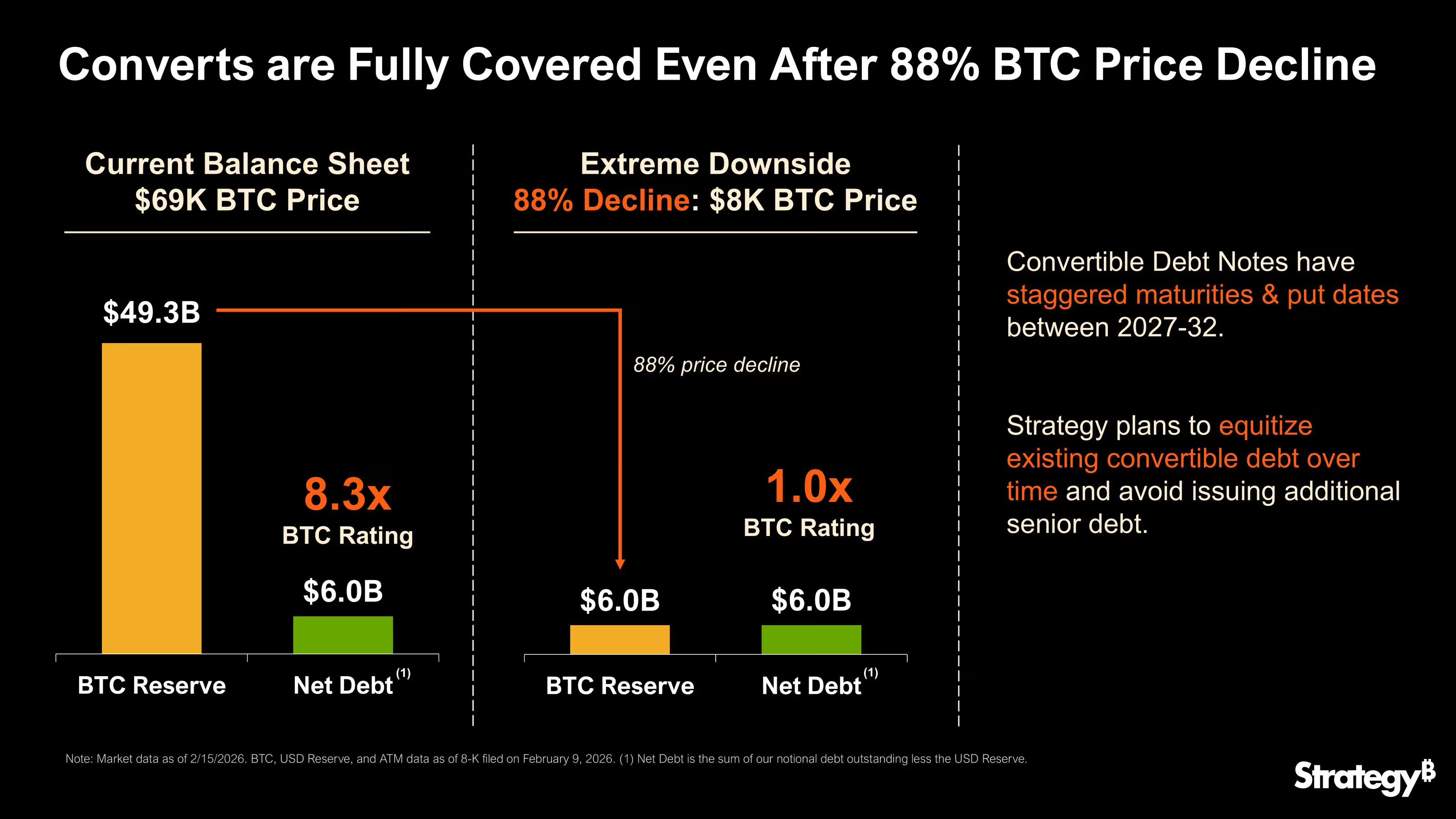

Bitcoin treasury firm Strategy (MSTR) said it can ride out a potential plunge in the price of the largest cryptocurrency to $8,000 and still honor its debt.

“Strategy can withstand a drawdown in $BTC price to $8K and still have sufficient assets to fully cover our debt,” the Michael Saylor-led company said on X.

The company, which holds more bitcoin than any other publicly traded company, has accumulated 714,644 BTC, worth roughly $49.3 billion at current prices, since adopting it as a treasury asset in 2020.

Over the years, it has stacked bitcoin via debt, a tactic echoed by peers such as Tokyo-listed Metaplanet (3350). It owes about $6 billion — equivalent to 86,956 BTC — against bitcoin holdings over eight times larger.

While these debt-financed bitcoin buys were widely cheered during the crypto bull run, they have become a liability in the wake of the token’s crash to nearly $60,000 from its October peak of over $126,000.

If Strategy is forced to liquidate its bitcoin holdings to pay off the debt, it could flood the market and drive prices even lower.

In the Sunday post, Strategy assured investors its bitcoin holdings would still be worth $6 billion even at an $8,000 BTC price, enough to cover its debt.

The company noted that it doesn’t have to pay all its debt at once, as the due dates are spread over 2027 and 2032.

To further assuage concerns, Strategy said it plans to switch existing convertible debt into equity to avoid issuing additional senior debt. Convertible debt is a loan that lenders can swap for MSTR shares if the stock price rises high enough.

Not everyone is impressed

Skeptics remain.

Critics like pseudonymous macro asset manager Capitalists Exploits point out that while $8,000 bitcoin might technically cover the $6 billion net debt, Strategy reportedly paid around $54 billion for its stash, an average of $76,000 per BTC. A slide to $8,000 would amount to a whopping $48 billion paper loss, making the balance sheet look ugly to lenders and investors.

Cash on hand would cover only about 2.5 years of debt and dividend payments at current rates, the observer argued, and the software business pulls in just $500 million a year. That’s way too little to handle the $8.2 billion in convertible bonds plus $8 billion in preferred shares, which demand hefty, ongoing dividends like endless interest bills.

All this means that refinancing may not be readily available if bitcoin drops to $8,000.

“Traditional lenders are unlikely to refinance a company whose primary asset has depreciated significantly, with conversion options rendered economically worthless, deteriorating credit metrics, and a stated policy of holding BTC long-term (limiting collateral liquidity),” the observer said in a post on X. “New debt issuance would likely require yields of 15-20% or higher to attract investors, or could fail entirely in stressed market conditions.”

Dump on retail investors

Anton Golub, chief business officer at crypto exchange Freedx, called the “equitizing” move a planned “dump on retail investors.”

He explained that buyers of Strategy’s convertible bonds have been primarily Wall Street hedge funds, who aren’t bitcoin fans but “volatility arbitrageurs.”

The arbitrage involves hedge funds profiting from discrepancies between the expected or implied volatility of a convertible bond’s embedded options and the actual volatility of the underlying stock.

Funds typically buy cheap convertible bonds and bet against, or “short,” the stock. This setup helps them bypass big price swings, while earning from bond interest, ups-and-downs volatility, and a “pull-to-par” boost where deep-discount bonds rise toward full value at maturity.

According to Golub, Strategy’s convertible bonds were priced for small ups and downs. But the stock swung wildly, letting hedge funds mint money from the arbitrage: buying the bonds cheaply while betting against the stock.

This setup worked beautifully when shares traded above $400, the trigger for bondholders to convert debt into stock. Hedge funds closed their shorts, bonds vanished via conversion, and Strategy avoided cash payouts.

At $130 a share, conversion makes no sense. So hedge funds will likely demand full cash repayment when the bonds mature, potentially putting Strategy’s finances under strain.

Golub expects the firm to respond by diluting shares.

“Strategy will: dilute shareholders by issuing new shares, dump on retail via ATM sales, to raise cash to pay hedge funds,” he said in an explainer post on LinkedIn.

“Strategy only looks genius during Bitcoin bull markets. In bear markets, dilution is real and destroys MSTR shareholders,” he added.

Crypto World

Why Coinbase Users Haven’t Got Super Bowl Payouts

Coinbase is facing mounting criticism from users after many participants in its Super Bowl “Big Game Challenge” prediction market contest reported delayed or missing payouts, even after qualifying for shares of the advertised Bitcoin prize pool.

Community complaints and technical issues highlight the growing pains of prediction markets as they surge in popularity while confronting regulatory, operational, and infrastructure challenges.

Sponsored

Sponsored

Coinbase Payout Issues Highlight Prediction Markets’ Growing Pains

On Reddit and other forums, users described confusing and frustrating experiences with the payout process. Reportedly, some users correctly predicted outcomes in the Big Game but “still haven’t been paid.

Others reported winnings showing briefly in their account balances before disappearing without explanation, or payouts reflected in USD without transferability or access.

Amidst these frustrations, some are calling the situation a “rug pull,” claiming Coinbase’s app initially confirmed a win after five correct picks, the threshold for eligibility, only for a later email to declare they had not won.

“According to the Coinbase app, I had won the Big Game Predictions with 5 correct predictions with $5 bet on each prediction. It told await my payout. However, I just received an email from Coinbase stating that I did not win. Does anyone else feel like this was a rug pull or a scam in some way? They said.

However, support responses seen in some threads indicate that rewards are being held until all prediction markets and mail‑in entries are settled, in line with the contest’s official rules.

Coinbase has previously said winners will receive Bitcoin rewards directly into their accounts by February 23, 2026.

Sponsored

Sponsored

However, the lack of transparency and account migrations has frustrated users trying to confirm settlement status.

“We completely understand how important this is to you. Verified winners will receive their prize directly into their Coinbase account. The prize amount will be a share of $1,000,000 in Bitcoin, divided equally among all winners. Prizes are expected to be fulfilled no later than February 23, 2026,” Coinbase explained.

Infrastructure Strains, Regulatory Hurdles, and the Rising Stakes for Crypto Prediction Markets

The timing of these complaints coincides with broader strains in crypto-linked prediction markets. Partner platform Kalshi, which provides the backend for Coinbase’s event contracts, suffered deposit and transaction delays during the Super Bowl due to overwhelming traffic.

“Kalshi does all this ad investment just for their app, not to let you deposit on Super Bowl Day, sounds about right,” one user lamented.

Sponsored

Sponsored

Kalshi co-founder Luana Lopes Lara acknowledged slowdowns but assured users that funds were “safe and on the way.

These operational stretches highlight how infrastructure designed for everyday trading may struggle with spikes tied to major events.

Similar technical pressure was observed across the industry on prediction markets during the championship. This suggests systemic scalability challenges for platforms offering event contracts under high demand.

The Coinbase backlash arrives amid a broader regulatory and legal battleground. State gaming regulators, such as the Nevada Gaming Control Board, have sued Coinbase to block its prediction markets. They argue that they constitute unlicensed sports wagering.

These legal actions fuel uncertainty around the regulatory status of event contracts, complicating rollout and user experiences.

Sponsored

Sponsored

Meanwhile, critics from within the crypto community note that prediction markets must mature beyond short-term speculative betting.

Voices like Ethereum co-founder Vitalik Buterin have warned that over-reliance on speculative contracts may create products lacking deeper utility, urging a focus on hedging and risk‑management applications.

The current Coinbase backlash highlights the operational and communication gaps that can accompany rapid product expansion.

Crypto World

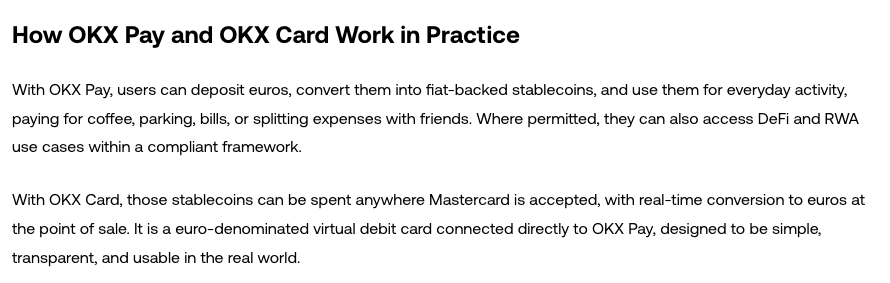

OKX Secures Malta License To Expand EU Stablecoin Payments

OKX secured a Malta payment institution license to support EU-compliant stablecoin services, including OKX Pay and the OKX Card.

Cryptocurrency exchange OKX expanded its regulatory footprint in Europe, securing a license for stablecoin payments.

OKX has obtained a Payment Institution (PI) license in Malta, the company told Cointelegraph on Monday. The authorization is issued under the European Union’s payments framework and is designed to bring OKX’s payment products into line with requirements under the bloc’s Markets in Crypto-Assets Regulation (MiCA) and the Second Payment Services Directive (PSD2).

Under these rules, crypto-asset service providers (CASPs) offering payment services involving stablecoins must hold either a PI or Electronic Money Institution (EMI) authorization. OKX’s PI license comes more than a year after the exchange received a MiCA license from the Malta Financial Services Authority (MFSA) in January 2025.

“Securing a Payment Institution license ensures that these products operate on a fully compliant footing,” OKX Europe CEO Erald Ghoos said, adding:

“Europe has chosen clarity over ambiguity when it comes to digital asset regulation […] Stablecoins can meaningfully modernize money, improving cross-border efficiency and reducing friction in payments, but only if built within strong regulatory guardrails.”

License supports OKX Pay and OKX Card rollout

The exchange said the license will cover products including OKX Pay and the OKX Card, which allow users to spend crypto assets and stablecoins.

Officially launched in late January, OKX Card supports spending in stablecoins such as Circle’s USDC (USDC) and the Paxos-issued Global Dollar (USDG).

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Tokenized U.S. Treasuries keep RWA lead as tokenized equities accelerate

Tokenized Treasuries still dominate RWAs, but fast‑growing tokenized equities signal a broader shift toward on‑chain capital markets in 2026.

Summary

- Tokenized U.S. Treasuries remain the largest slice of the RWA market by market cap.

- Tokenized public equities are now the fastest‑growing RWA segment as DeFi rails mature.

- 2026 is shaping up as a transition year from yield‑only RWAs to a full on‑chain market stack.

Tokenized U.S. Treasuries continue to dominate the real-world asset market by market capitalization, though new data indicates tokenized equities have emerged as the fastest-growing segment within the sector.

The data suggests 2026 may mark a broader expansion of on-chain financial products beyond yield-focused instruments, the report stated.

Tokenized U.S. Treasuries maintain the largest market capitalization and hold a clear lead over other asset classes, according to the data. Growth momentum has become increasingly visible in tokenized public equities, which are expanding at a faster relative pace than other categories.

The tokenized asset market comprises a diversified structure including U.S. Treasury debt, commodities, private credit, institutional alternative funds, corporate bonds, non-U.S. government debt and public equity, the report showed.

Treasuries remain the core foundation due to yield stability and regulatory clarity, factors that make them attractive for institutional adoption, according to market analysts. Commodities and private credit follow as the next largest categories, reflecting demand for income-generating and inflation-hedging instruments.

Tokenized equities, while smaller in absolute size, are experiencing accelerated adoption, particularly as decentralized finance infrastructure improves, the data indicated. The ability to use tokenized stocks as collateral, integrate them into lending markets, and access them globally without traditional brokerage constraints has driven new demand, according to industry observers.

Unlike Treasuries, which primarily serve as yield-bearing instruments, tokenized equities introduce growth exposure into DeFi-native portfolios, the report noted. The combination of capital efficiency and composability has positioned equities as a high-growth vertical within real-world assets.

The data suggests the real-world asset narrative is evolving from early growth centered on stable, income-producing assets like government debt toward utility, composability, and integration with on-chain financial systems. If the trend continues, 2026 could represent a transition phase where tokenization moves from experimental adoption to a more comprehensive financial infrastructure layer spanning debt, credit, commodities and equities, according to the analysis.

Crypto World

Apple (AAPL) Shares Fall 7% In Two Days

As the chart indicates, AAPL shares declined from roughly $275 to $256 over Thursday and Friday — a drop of about 7%. This move has effectively erased the gains that followed the strong earnings report released on 29 January.

Why Is AAPL Falling?

According to media reports, negative sentiment has been driven by:

→ Data pointing to rising memory chip costs, which could weigh on profit margins.

→ Reports that the long-anticipated Siri upgrade featuring advanced AI capabilities has been delayed again.

→ Increased scrutiny of the company’s operations by the US Federal Trade Commission (FTC).

Technical Analysis of Apple (AAPL) Shares

At the start of 2026, AAPL shares broke below an ascending channel (shown in black) near the $272 level. Price and volume dynamics suggest this area has become a zone where bears are active and gaining the upper hand.

Note the following (as highlighted by the arrows):

→ On 4 February, the price edged higher slightly, but trading volumes were elevated — signalling difficulty for bulls in sustaining upward momentum.

→ The 11 February candle shows a long upper shadow, displaying the characteristics of an Upthrust After Distribution (UTAD) in Wyckoff methodology terms.

Taken together, this suggests that initiative currently lies with the bears. Price action may continue to develop within the descending channel (shown in red), with the potential to set a new low for the year.

Buy and sell stocks of the world’s biggest publicly-listed companies with CFDs on FXOpen’s trading platform. Open your FXOpen account now or learn more about trading share CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Russia’s daily crypto turnover is over $650 million, Ministry of Finance says

Russia’s Ministry of Finance has estimated the country’s daily cryptocurrency turnover at 50 billion rubles, or roughly $650 million, with annual activity exceeding 10 trillion rubles, around $130.5 billion.

The figures were shared by Deputy Finance Minister Ivan Chebeskov at the Alfa Talk conference, highlighting the growing scale of unregulated crypto use in the country, local outlet RBC reports.

“This is a turnover of more than 10 trillion rubles per year, which is currently taking place outside the regulated zone, outside our attention,” Chebeskov said.

Government officials, including the Bank of Russia, are now pushing for legislation to bring that activity into the regulatory fold.

Vladimir Chistyukhin, first deputy of chairman of the Central Bank, said both the government and the Bank hope a crypto market regulation bill will be passed during the State Duma’s spring session.

The proposed rules would allow existing licensed infrastructure, like exchanges and brokers, to enter the cryptocurrency space and boost their crypto offerings. The Moscow Exchange (MOEX) is already offering bitcoin and ether cash-settled futures contracts, and plans on adding SOL, XRP, and TRX futures.

The new framework would also allow MOEX and brokers to enter the spot market. Qualified and non-qualified investors would be allowed to participate, though with restrictions for the latter. Specific licensing would only apply to crypto exchange offices, and penalties are planned for unlicensed intermediaries.

According to the Bank of Russia’s financial stability report, Russian users held an estimated 933 billion rubles ($11.89 billion) on global crypto exchanges in mid-2025. These platforms are not currently regulated in Russia.

Sergey Shvetsov, Chairman of the Moscow Exchange’s Supervisory Board, said Russian users pay around $15 billion annually in commissions to global crypto platforms.

“As soon as it becomes possible, we will begin to compete with the gray sector,” he said. “The commissions that crypto exchanges and regular exchanges receive from trading crypto assets annually is $50 billion; there are estimates that the Russian share is about a third.”

Russia is indeed estimated to be the largest cryptocurrency market in Europe. Chainalysis found that between July 2024 and June 2025, Russia received $376.3 billion in crypto, far ahead of the $273.2 billion the United Kingdom received over the same period. Germany and Ukraine were the only other European countries to have received over $200 billion for the period.

Crypto World

Is $1 Back in Play After XRP’s Rally Was Halted at $1.65?

Ripple’s XRP has staged a sharp rebound after printing a local low near $1.10, but the broader structure remains fragile. The recent impulsive move higher has pushed the price back into a key supply area, creating a critical decision point between continuation and another rejection within the dominant downtrend.

Ripple Price Analysis: The Daily Chart

On the daily timeframe, XRP remains inside a well-defined descending channel, respecting the bearish structure despite the recent bounce. The sell-off accelerated toward the major demand zone around $1.10–$1.20, where buyers finally stepped in aggressively. This reaction confirms the significance of the $1.15 area as a strong higher-timeframe demand.

However, the rebound is now approaching the channel’s middle trendline , a prior breakdown region near $1.75–$1.85, which previously acted as support and has now flipped into resistance. As long as the asset remains below this $1.80 region, the broader bias stays corrective within a bearish trend. A daily close above $1.85 would open the path toward the next major supply at $2.40–$2.50, while rejection from this zone could send the price back toward $1.20 again.

XRP/USDT 4-Hour Chart

On the 4-hour timeframe, the recovery appears more impulsive, with strong bullish candles reclaiming the short-term supply area around $1.50–$1.55. The asset pushed into the $1.65–$1.80 region, which aligns with minor intraday supply and the lower boundary of the previous consolidation range. However, it was rejected there and brought back to its starting point.

If RP manages to stabilize above $1.55 and build a base between $1.55 and $1.70, a continuation toward $1.80 becomes likely. On the other hand, failure to hold above $1.55 could shift momentum back to the downside, exposing $1.30 first and then the key $1.15 demand again.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

3 Altcoins To Watch In The Third Week Of February 2026

Altcoin markets remain highly reactive as February enters its third week, with several major tokens approaching critical technical inflection points. While broader sentiment remains fragile, select assets are relying on external developments that could determine their next directional move.

In line with the same, BeInCrypto has analysed three such altcoins that the investors should watch in the third week of February.

Sponsored

Sponsored

Arbitrum (ARB)

ARB is trading at $0.1134 following a sustained downtrend from $0.2261, maintaining a clear bearish market structure defined by consecutive lower highs and heavy sell-side pressure. Fibonacci retracement levels mark $0.1255 (0.236) as immediate overhead resistance, with $0.1447 (0.382) acting as the next key supply zone. Momentum remains skewed to the downside.

Near-term support sits at $0.1074, just above the altcoin’s all-time low at $0.0944. A daily close below $0.1074 would likely trigger continuation toward $0.0944. A breakdown beneath that level opens the door to fresh price discovery. CMF at -0.04 reflects ongoing capital outflows and a lack of meaningful accumulation.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

For bulls to shift structure, ARB needs a decisive daily close above $0.1255 to regain short-term control. A confirmed breakout above $0.1447 would signal a broader trend reversal, targeting $0.1758 (0.618). The bearish thesis is invalidated only on strong acceptance above $0.1447; until then, downside risk toward $0.0944 prevails.

Injective (INJ)

INJ is trading at $3.134 after a sharp rejection from $5.924, maintaining a clear bearish market structure defined by lower highs and impulsive sell-side candles. Fibonacci retracement levels place immediate resistance at 0.382 ($3.275) and stronger overhead supply at 0.618 ($3.662). Price remains capped below both levels, keeping short-term momentum tilted to the downside.

Sponsored

Sponsored

On the downside, 0.236 support at $3.036 is the key level to watch. A daily close below $3.036 would likely trigger continuation toward $2.650. If bearish momentum continues to build, an extension to $2.500 becomes a high-probability move. The 0.98 correlation with BTC adds risk, suggesting INJ is highly likely to mirror any further Bitcoin weakness.

For bulls to regain control, the price must reclaim $3.275 and establish acceptance above that level. A decisive daily close above $3.662 would confirm a structural shift, opening upside targets at $3.937 and $4.287. The bearish thesis is invalidated on a strong close above $3.662; until then, downside continuation toward $2.650 remains the dominant bias.

Bitcoin Cash (BCH)

Another one of the altcoins to watch in February is BCH, which is trading at $558.3 after a strong relief bounce from $423.0, successfully reclaiming the 0.786 Fib at $541.8. Price is now pressing into the 1.0 retracement at $574.1, which stands as immediate overhead resistance. The broader structure suggests recovery from prior distribution, but bulls still need follow-through to confirm a sustained trend reversal.

The 0.786 level at $541.8 now acts as near-term pivot support. A daily close below $541.8 shifts momentum back to the downside, exposing $516.4 (0.618) and then $480.7 (0.382). MFI sits at 57.12, reflecting constructive but not overextended momentum. If sellers regain control, $458.7 (0.236) becomes the next logical downside liquidity target.

For bullish continuation, BCH must secure acceptance above $574.1 on a daily closing basis. A confirmed breakout opens upside extension targets at $609.8 (1.236), $631.8 (1.382), and $649.6 (1.5). The bullish thesis is invalidated on a decisive close below $516.4. The February 17 Bitcoin Cash Toronto meetup will dive deep into BCH’s tech and the major improvements coming with the LAYLA upgrade this May. This could act as a catalyst for recovery.

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat7 days ago

NewsBeat7 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Tech1 day ago

Tech1 day agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Sports7 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat17 hours ago

NewsBeat17 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat19 hours ago

NewsBeat19 hours agoMan dies after entering floodwater during police pursuit

-

Crypto World2 days ago

Crypto World2 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat2 days ago

NewsBeat2 days agoUK construction company enters administration, records show