Crypto World

Relative Strength Index (RSI): Trading Strategies, Settings, and Market Applications

RSI is a popular momentum indicator in technical trading across forex, stock, and cryptocurrency* markets. The Relative Strength Index (RSI) is a momentum oscillator developed by J. Welles Wilder that measures the speed of price movements on a 0–100 scale. Traders use it to detect overbought/oversold conditions, trend strength, pullbacks, and exhaustion.

Although often viewed as a basic oscillator, the RSI plays a more nuanced role in professional trading strategies, particularly when combined with trend and volatility indicators. Understanding how the RSI behaves in different market environments may help traders refine entries, implement risk management strategies, and confirm trade setups.

In this article, we will consider how the RSI indicator works, how it is calculated, and how it can be applied in practical trading strategies across multiple asset classes.

Takeaways

- The Relative Strength Index (RSI) is a momentum indicator that measures the speed and magnitude of recent price movements to evaluate whether an asset is overbought or oversold.

- Developed by J. Welles Wilder, the RSI is plotted on a scale from 0 to 100 and is most commonly calculated over a 14-period timeframe.

- At its core, the RSI compares the average size of recent gains with the average size of recent losses over a defined period.

- Traditionally, RSI trading rules suggest that readings above 70 indicate overbought conditions, while readings below 30 signal oversold levels.

- Besides overbought and oversold signals, the indicator can provide divergence, trend strength, and failure swings signals.

What Is the Relative Strength Index?

The Relative Strength Index (RSI) is a momentum oscillator in modern technical analysis. Developed by J. Welles Wilder Jr. and introduced in 1978 in New Concepts in Technical Trading Systems, the indicator measures the speed and magnitude of recent price movements in order to evaluate underlying market momentum.

The RSI is plotted on a scale from 0 to 100 and is classified as an oscillator because it fluctuates within a fixed range rather than following price directly. This structure allows traders to evaluate whether buying or selling pressure is strengthening or weakening relative to recent market activity.

In practice the RSI functions less as a reversal indicator and more as a momentum persistence gauge. In directional markets the oscillator spends extended time in one half of its range, reflecting order-flow imbalance rather than exhaustion. Professional traders therefore interpret extreme readings as trend participation signals unless market structure begins to break.

Although the RSI is often introduced as a simple overbought-oversold tool, its practical application in professional trading is considerably broader. In leveraged markets such as forex and CFDs, traders use the indicator to identify pullbacks within trends, detect momentum divergence, and refine entry timing across multiple timeframes. The RSI therefore functions less as a standalone signal generator and more as a contextual momentum filter within broader trading systems.

The RSI belongs to the family of bounded momentum oscillators introduced by J. Welles Wilder in New Concepts in Technical Trading Systems (1978), alongside the average true range (ATR), the average directional movement index (ADX), and the parabolic stop and reverse (Parabolic SAR).

RSI Formula and Calculation

How is RSI calculated? It’s quite difficult to calculate the RSI. Fortunately, you don’t need to do it manually, as it’s one of the standard indicators implemented in most trading platforms. For instance, you can use TickTrader to examine the RSI without making complicated calculations.

However, it’s worth understanding how the indicator is measured to know which metrics can affect its performance.

The RSI Formula Explained

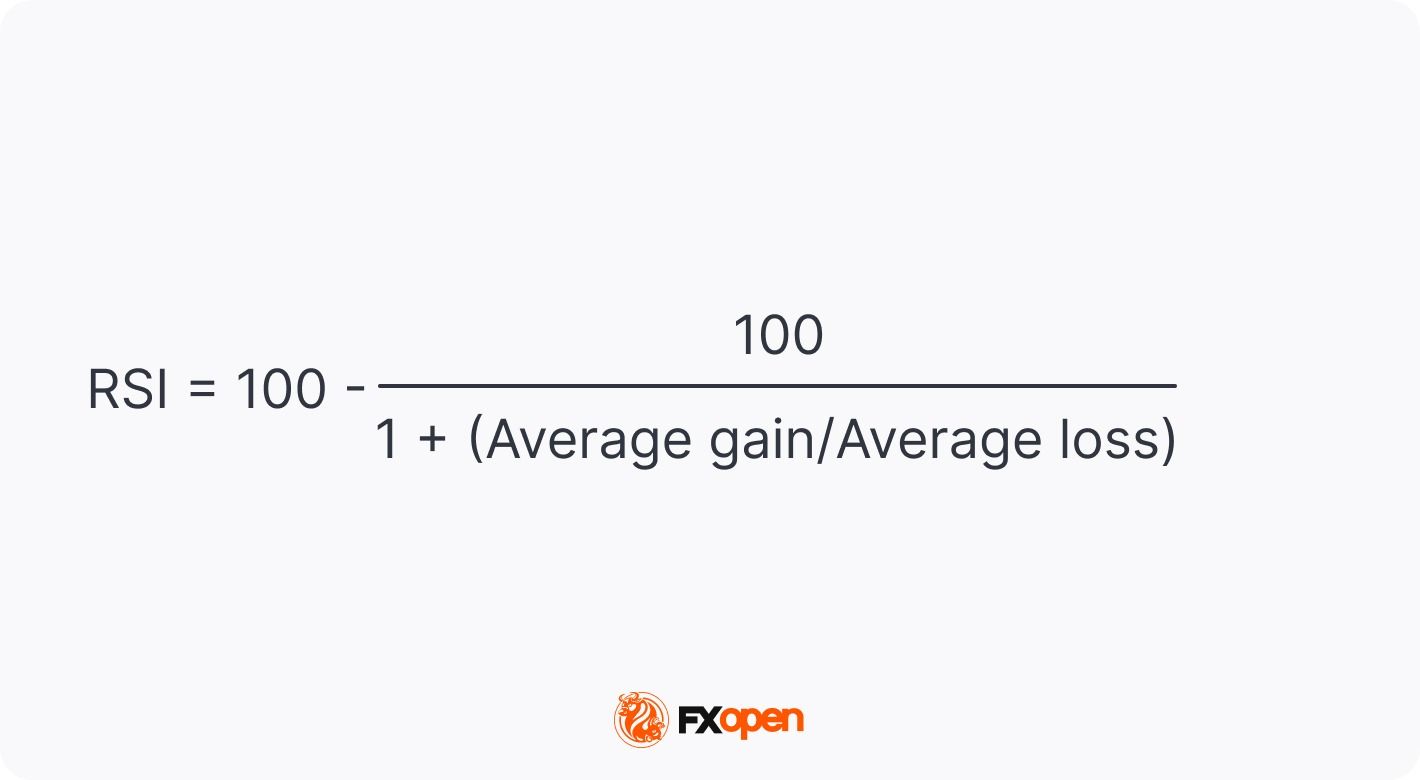

RSI formula

The calculation involves three main steps. First, the average gain and average loss over the selected period are determined. Second, these values are used to calculate relative strength, defined as the ratio of average gains to average losses. Finally, this ratio is transformed into an index value between 0 and 100 using the RSI formula.

The most popular RSI period is 14, meaning its values are based on closing prices for the latest 14 periods, regardless of the timeframe. We will use this period as an example of RSI calculations.

The standard RSI formula description:

Step 1: Average Gain and Average Loss

To calculate average gains and losses, you need to calculate the price change from the previous period.

Note: If the current price is higher than the previous one, add the gain to a total gain variable. If the price declined from the previous period, add the figure to a total loss variable.

After you calculate the change for all 14 periods, you need to add up the gains and divide them by 14 and sum up the losses and divide the total by 14.

Step 2: Calculate the Relative Strength (RS)

RS = Average Gain / Average Loss

To calculate the relative strength, divide the average gain by the average loss.

Step 3: Calculate the RSI

Now that you calculated the RS, you can proceed with the RSI value. For this, you need to add 1 to RS, divide 100 by the sum, and subtract the result from 100.

Relative Strength Index = 100 – 100 / (1 + RS)

Because the calculation uses smoothed averages of gains and losses, the RSI reacts to volatility contraction faster than to volatility expansion. This asymmetry explains why the indicator often gives early signals near market tops but delayed signals near lows.

What RSI Setting Do Traders Use?

The standard period is 14. Shorter lookback periods produce a more sensitive indicator that reacts quickly to price changes but generates more noise. Longer periods smooth out fluctuations but may lag behind rapid market shifts. This trade-off explains why RSI settings are often adjusted according to strategy type, whether scalping, day trading, or swing trading.

The following adjustments are common depending on strategy and timeframe:

Scalping strategies often use shorter RSI periods to capture rapid momentum shifts on lower timeframes. While this increases signal frequency, it also requires stricter risk management due to higher noise levels.

Want to learn how to read the RSI indicator signals?

How Is the RSI Indicator Used in Trading?

How to interpret the RSI indicator? There are four common ways to use the RSI indicator when trading: spot overbought and oversold conditions, find price divergences, implement failure swings for reversal signals, and determine market trends.

Relative Strength Index: Overbought/Oversold Indicator

The traditional interpretation of RSI levels focuses on the 70 and 30 thresholds. Readings above 70 are commonly described as overbought, while readings below 30 are considered oversold. However, in professional trading environments these thresholds are treated as reference zones rather than absolute signals.

The 70/30 framework works primarily in rotational markets. During macro-driven trends, price commonly continues moving after entering overbought or oversold territory because positioning flows dominate short-term mean reversion. In these conditions the RSI defines pullback zones rather than reversal zones.

During sustained uptrends, the RSI typically fluctuates between 40 and 80 (sometimes reaching 90 in very strong trends). Pullbacks often hold above 40, showing that bullish momentum remains intact. In sustained downtrends, the RSI usually ranges between 20 and 60, with rallies failing near 60, reflecting persistent selling pressure. These shifting RSI ranges may help traders assess trend strength rather than relying solely on the traditional 70/30 overbought–oversold levels.

Sustained RSI range shifts usually reflect systematic positioning rather than retail momentum. When the oscillator establishes a higher equilibrium range, dips towards the mid-zone often coincide with passive liquidity absorption rather than trend rejection.

On the daily chart of the GBP/USD pair, the RSI entered the oversold area on 22nd April, left it for a while on 4th May, but returned to it and continued moving upwards only on 15th May.

An example of the oversold RSI

Additionally, when using overbought/oversold signals, traders keep in mind that they can reflect an upcoming correction, not a trend reversal. The GBP/USD pair was trading in a strong downtrend, and the RSI provided a signal of a short-term correction only.

To distinguish between corrections and reversals, traders combine the RSI with other tools. A cross of a moving average can confirm a change in the trend.

Oversold RSI strategy

On the chart above, the RSI broke above the 30 level on 28th September. A trader could go long, using a trailing take profit. After the MA/EMA cross occurred (1), a trader could trail the take-profit target. Another option would be to place the take-profit order at the closest resistance level (2) and wait for the cross to confirm the reversal signal. After the confirmation, a trader could open another buy position and drive the uptrend.

RSI Divergence Strategy

RSI is a divergence indicator. Another option for using the RSI is to look for divergences between the indicator and the price chart. Divergence occurs when price action and indicator momentum move in opposite directions, signalling a potential shift in underlying market dynamics.

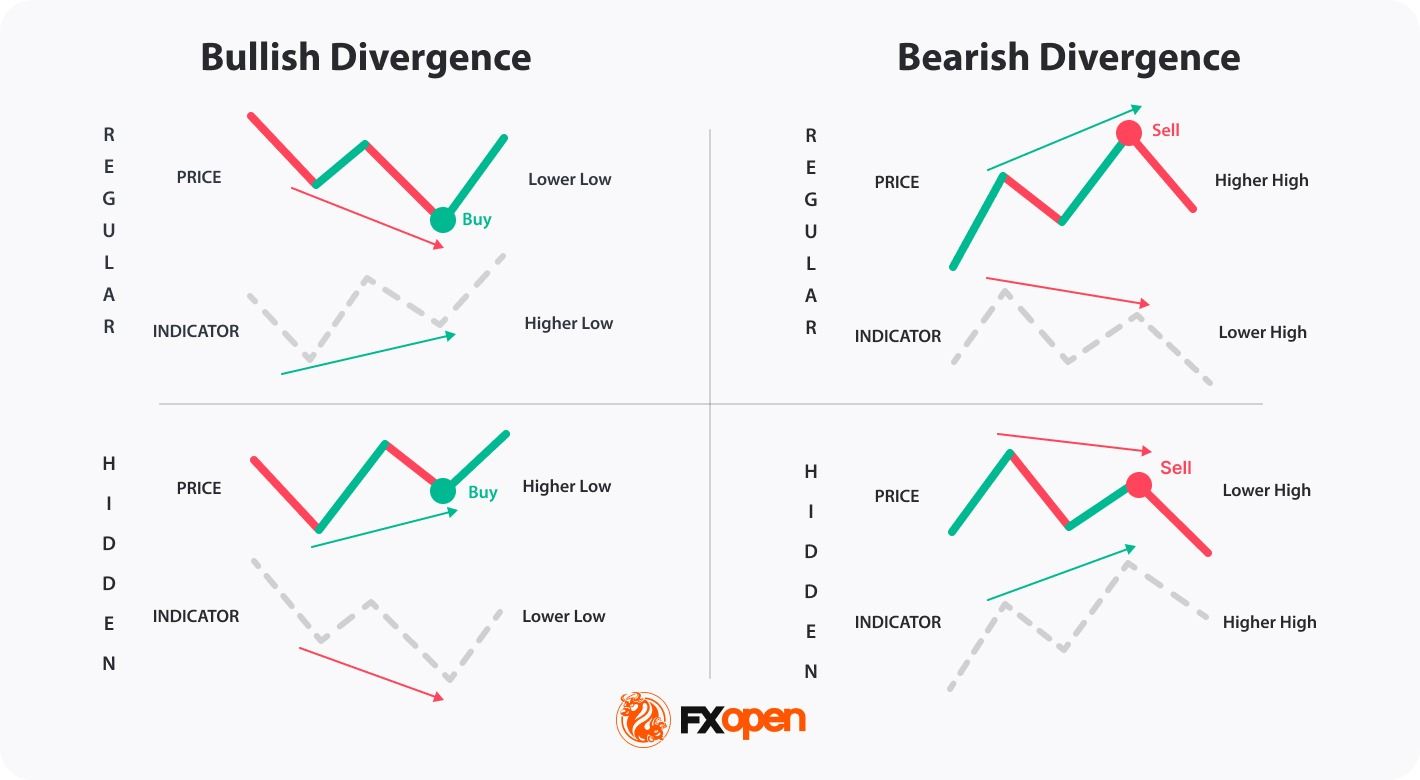

A convention widely used in exchange educational materials is:

- An RSI bullish divergence forms when price records a lower low while the RSI prints a higher low. This pattern indicates that selling pressure is weakening even as price continues to decline.

- An RSI bearish divergence, by contrast, appears when price reaches a higher high but the RSI forms a lower high, suggesting diminishing upward momentum.

Divergence is more popular when it occurs near key support or resistance levels. However, because divergence can persist for extended periods before price reverses, it is rarely traded in isolation. Many traders confirm RSI divergence using tools such as the MACD or structural breaks in market structure.

Hidden divergence is another variation that signals trend continuation rather than reversal. In trending markets, this form of divergence may help traders identify pullbacks that are likely to resolve in the direction of the prevailing trend.

- A bullish divergence forms when the price rises with higher lows, but the relative strength index declines with lower lows, traders expect the price to move upwards.

- A bearish divergence forms when the price falls with lower highs, but the relative strength index moves upwards with higher highs, traders believe the price will decline.

Regular and hidden RSI divergence

Divergence frequently precedes momentum slowdown instead of immediate reversal. Markets often transition into consolidation before changing direction, which is why many traders wait for structure breaks rather than trading the first divergence signal. For example, in liquid index markets the first divergence often leads to range formation before trend change.

In the RSI example chart below, the indicator and the price formed a regular bearish divergence. As a result, the price fell (1). There was another divergence before the fall, but the price decline was short-lived (2). This highlights risks associated with the incorrect signals the RSI divergence may provide.

An example of the RSI divergence

RSI Failure Swings: A Reversal Signal

Another signal that traders can consider is failure swings of the RSI which occur before a strong trend reversal. Although it is less common than the others, traders can add it to their list of tools.

The theory suggests traders don’t consider price actions but look at the indicator alone.

- Bullish reversal. A trend may turn bullish when the RSI breaks below 30, leaves the oversold area, falls to 30 but doesn’t cross it and rebounds, continuing to rise.

- Bearish reversal. A trend may reverse down when the RSI enters the overbought area, crosses below 70, and returns to 70 but bounces and continues falling.

An example of RSI failure swings

Failure swings lose significance during volatility expansion events such as economic releases, when directional movement is driven by repricing rather than momentum decay.

In the chart above, the RSI trading indicator broke below 30, left the oversold area, and retested the 30 level (1). At the same time, the price formed the bottom, and the downtrend reversed upwards (2).

Failure swings are more common on short-term timeframes and do not always reflect a trend reversal. Therefore, traders combine the RSI with trend and volume indicators.

How Traders Identify Market Trends with RSI

The RSI can be used to identify a trend direction. Constance Brown, the author of multiple books about trading, noticed in her book Technical Analysis for the Trading Professional that the RSI indicator doesn’t fluctuate between 0 and 100. In a bullish trend, it moves in the 40-90 range. In a bearish trend, it fluctuates between 10 and 60.

To identify the trend, traders consider support and resistance levels. In an uptrend, the 40-50 zone serves as support. In a downtrend, the 50-60 range acts as resistance.

An example of trend determination using the RSI

In the chart above, the RSI stayed above 40 as the price was moving in a solid uptrend. Once it broke below the 40-50 support level (1), the trend changed (2).

However, there may be incorrect signals. In the chart below, the RSI broke below the support level twice, but the trend didn’t change.

An example of unsuccessful trend detection using RSI

Ranges may vary depending on the trend strength, price volatility, and the period of the RSI.

RSI and Simple Moving Average

Usually, the RSI indicator consists of a single line. However, there are variations of the indicator. It can be combined with the simple moving average. The moving average usually has the same period as the RSI.

The rule is that when the RSI breaks below the SMA, the price is supposed to fall (1). When the RSI rises above the SMA, the price is expected to increase (2).

RSI and Simple Moving Average

However, there are some aspects to consider. Firstly, traders avoid using RSI/SMA cross signals in the ranging market as the lines move close to each other and cross all the time, providing many fake signals. Secondly, a cross doesn’t determine the period of a rise or a fall. Traders use additional tools to identify where the price may turn around.

Note: The RSI is sensitive to volatility clustering. During news-driven sessions the indicator’s thresholds lose value because price movement is distribution-driven rather than momentum-driven.

RSI Trading Strategies Used by Professional Traders

Professional use of the RSI typically involves integrating the indicator into structured trading frameworks rather than relying on single signals. Several widely used approaches illustrate how momentum analysis can support decision-making.

What Is the 70-30 RSI Trading Strategy?

70-30 RSI Trading Strategy

The 70-30 RSI strategy simply uses the overbought and oversold RSI readings to identify potential turning points. However, instead of simply going short above 70 (overbought RSI) and long below 30 (oversold RSI), traders typically apply a few levels of refinement.

Entry:

- Traders determine if the trend is bullish or bearish.

- They apply a trend filter. The RSI can produce false signals in a strong trend, showing overbought for a long time in a bullish trend and vice versa. They often use the 70-30 strategy to look for shorts when the price rallies in a downtrend and longs when the price dips in an uptrend.

- They enter the market when the RSI crosses back into the normal range. For instance, they’ll open a short trade when the RSI falls back below 70, indicating that a potential bearish reversal may be underway.

Stop Loss:

- Stop losses are often set beyond a nearby swing point.

Take Profit:

- Profits might be taken at an area of support or resistance when the RSI hits the opposite extreme (e.g. 70 when long), or when other indicators signal a price reversal.

Mean-reversion RSI strategies statistically depend on market volatility compression. As volatility expands, breakout continuation tends to dominate over oscillator reversal signals.

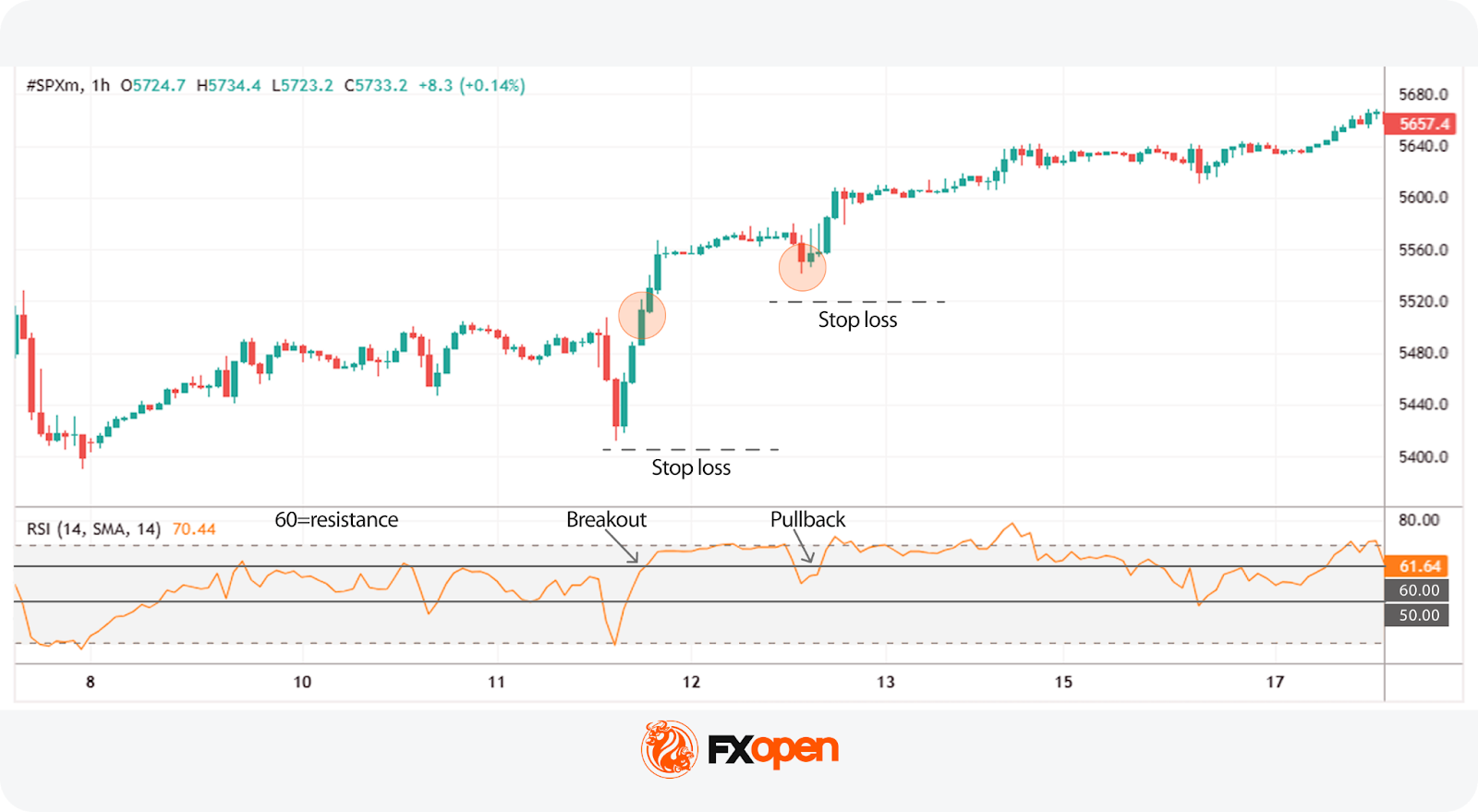

50-60 and 40-50 Trading Strategies

50-60 RSI Trading Strategy

What is the 50-60 RSI trading strategy? The 50-60 RSI strategy works on the idea that the market shows bullish momentum above 50, with 60 acting as a resistance level. When the price breaks through 60, it can signal that bullishness is strong, offering a potential entry point.

Note:

- Despite the name, the same logic can be applied in a bearish trend, where 40 acts as a support level.

- This strategy is popular in markets with a strong trend. Indices, such as the S&P 500 and Nasdaq 100, or commodities like gold, that exhibit strong trends are often chosen by traders.

Entry:

- Traders may enter the market when the price crosses above 60 for the first time.

- Alternatively, they might wait for a pullback to 60 before going long.

Stop Loss:

- A stop loss may be set beyond the nearest major swing point or just beyond the entry candle on a pullback.

- Alternatively, some traders manually stop out if the price crosses below 50.

Take Profit:

- Profits might be taken when the price crosses below 50, giving room for the trade to run in a strong trend. However, this may limit potential returns when trading on short-term timeframes. Therefore, some traders prefer the closest resistance levels.

Typical RSI Strategy Comparison

RSI Meaning in Trading: Forex, Stocks, and Crypto* Markets

The RSI is applied across asset classes, but it behaves differently because persistence characteristics vary. Equity indices exhibit autocorrelation, currencies exhibit mean reversion around macro levels, and digital assets display momentum clustering. RSI interpretation should therefore be adjusted to the instrument’s structural behaviour rather than fixed thresholds.

In forex trading, where macroeconomic factors often drive sustained directional moves, the RSI is commonly used to identify pullbacks within trends rather than outright reversals. Currency pairs can remain overbought or oversold for extended periods when central bank policy or macro data supports a strong directional bias.

What is the RSI indicator in the stock market? In the stock markets, the indicator is frequently applied to mean-reversion strategies around key support and resistance levels. Stocks tend to exhibit more frequent range-bound behaviour than major currency pairs, making traditional overbought-oversold interpretations somewhat more applicable.

Cryptocurrency* markets, characterised by high volatility and rapid sentiment shifts, often produce extreme RSI readings. In this environment, divergence analysis becomes particularly valuable, as momentum frequently weakens before price reverses.

How to Use the Relative Strength Index with Other Indicators

In professional trading systems, the RSI is rarely used in isolation. Combining momentum analysis with trend, volatility, and volume tools may help traders filter signals and false entries.

RSI with MACD

RSI and MACD (moving average convergence divergence) are oscillators. However, they measure momentum differently, which allows one to confirm the signals of another. Usually, traders look for RSI overbought/oversold signals and MACD divergence. For instance, when the RSI is in the oversold zone but the MACD has a bullish divergence with the price chart, traders consider this a confirmation of a coming price rise. Read our article RSI vs. MACD.

RSI with Moving Averages

Early signals are one of the limitations of the RSI indicator. Therefore, traders often combine them with lagging technical analysis tools. An exponential moving average (EMA) is one of the options. Traders add two EMAs with different periods to the chart and wait for a cross to confirm the trend reversal signal the RSI provided.

RSI with Bollinger Bands

Bollinger bands are used similarly to the RSI, showing when the market is possibly overbought or oversold. Used together, these two indicators can provide confluence; for example, if the RSI indicates overbought and the price has closed through the upper band, then there may be an increased likelihood of a bearish reversal, and vice versa.

RSI with On-Balance Volume (OBV)

The on-balance volume (OBV) is a tool that tracks volume to confirm trends. Paired with the RSI, it has two uses. The first is that it can indicate trend strength. If the RSI is falling alongside the OBV, the bearish trend is likely genuine and vice versa. The second is confirming divergences. The OBV can diverge from the price like the RSI, so if both diverge, a reversal may be inbound.

Using RSI on Trading Platforms

Most trading platforms include the RSI as a standard built-in indicator. Platforms such as MetaTrader 4 and MetaTrader 5 allow traders to adjust periods, apply smoothing, and set custom alert levels. Also, you can implement the RSI indicator into your trading strategy on TradingView and TickTrader platforms, which also allow you to set up the indicator for your unique trading style.

Professional traders often integrate RSI signals into multi-timeframe analysis. For instance, a higher-timeframe RSI reading may define directional bias, while a lower-timeframe signal provides entry timing. This approach reduces the likelihood of trading against broader market momentum.

Pros and Cons of the RSI Indicator

Although the relative strength index is one of the most popular indicators, it has limitations. Let’s explore the two sides of the coin.

Benefits of the RSI in Trading

The relative strength index is a useful tool because of:

- Numerous signals. The RSI provides different signals so traders with different trading approaches can add it to their tool list.

- Numerous assets and timeframes. One of its advantages is that you can use the RSI on any timeframe of any asset. What does the RSI stand for in stocks? The same thing that it stands for in forex, commodity, and cryptocurrency* markets.

- Simplicity. Despite the wide range of signals, it’s easy to remember them. If you are familiar with other oscillators such as the stochastic oscillator, you will quickly learn how to use the RSI indicator.

- Standard settings. Although you can change the period of the RSI, its standard period of 14 is used in many trading strategies.

- Working signals. The RSI is one of the most popular trading tools. However, the reliability of its signals depends on trader skills and market conditions.

Limitations and False Signals of RSI

Although the RSI is a functional tool, there are some pitfalls traders should consider.

- Weak at trend reversals. The indicator may provide early signals when spotting trend reversal.

- False signals. The relative strength index isn’t a very popular tool in ranging markets.

- Lagging indicator. The RSI is based on past price data, meaning it may be relatively slow to react to sudden movements.

- Overbought/oversold conditions can persist. In strong trends, prices may remain above 70 or below 30 for long periods, leading to premature entries and exits.

Note: The RSI does not determine price direction; it measures the condition of the current move. Its primary value lies in distinguishing continuation conditions from exhaustion conditions.

Final Thoughts

The Relative Strength Index continues to play a central role in technical trading across forex, equities, and cryptocurrency* markets. Its value lies not in reflecting reversals in isolation but in providing insight into the strength and sustainability of price movements. When used alongside trend analysis, volatility measures, and volume indicators, the RSI becomes a powerful component of structured trading strategies.

For traders operating in leveraged CFD and forex markets, proper application involves combining the indicator with broader analytical tools, adapting settings to the trading timeframe, and maintaining disciplined risk management.

You can consider opening an FXOpen account today to build your own trading strategy in over 700 instruments with tight spreads from 0.0 pips and low commissions from $1.50 (additional fees may apply).

FAQ

What Does the RSI Stand For?

RSI stands for relative strength index. It’s a momentum-based indicator that measures the speed and magnitude of price movements.

What Is the RSI Setting?

The only setting of the Relative Strength Index is the period, which reflects the number of past candles used to calculate average gains and losses, affecting how sensitive the RSI is to price changes. The default period is 14, though shorter or longer settings may be applied depending on trading style and timeframe.

How Traders Use the RSI Indicator

The RSI moves between 0 and 100, with >70 meaning the asset is overbought and <30 meaning oversold. It can be used to spot potential market reversals and confirm trend strength.

Is RSI Used in Forex Trading?

Yes. The RSI is widely used in forex to identify pullbacks, confirm trends, and detect divergence signals.

How Do Traders Use RSI Divergence?

Divergence between price and RSI is often used to identify weakening momentum and potential reversals, particularly when confirmed by other indicators or price-structure analysis.

What Is the RSI in Stocks?

The RSI meaning in stocks refers to the same RSI indicator used in other asset classes. It’s used to gauge buying and selling pressure.

Is High RSI Bullish or Bearish?

A high RSI (above 70) signals bullish momentum, suggesting an overbought market and a potential soon downward reversal.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Enterprise-Based Crypto Wallet Development Companies in America 2026

“Technology with a Human Promise”

The digital asset revolution has created the need to establish trust in an environment layered with new technology. True to its promise, the ethos of America is represented by the motto

The challenge of balancing disruptive innovation with unyielding trust is exemplified by the current state of crypto wallets, which are at the core of mass adoption of Web3. It is essential for any enterprise’s digital asset strategy to have a solid crypto wallet infrastructure as the foundation.

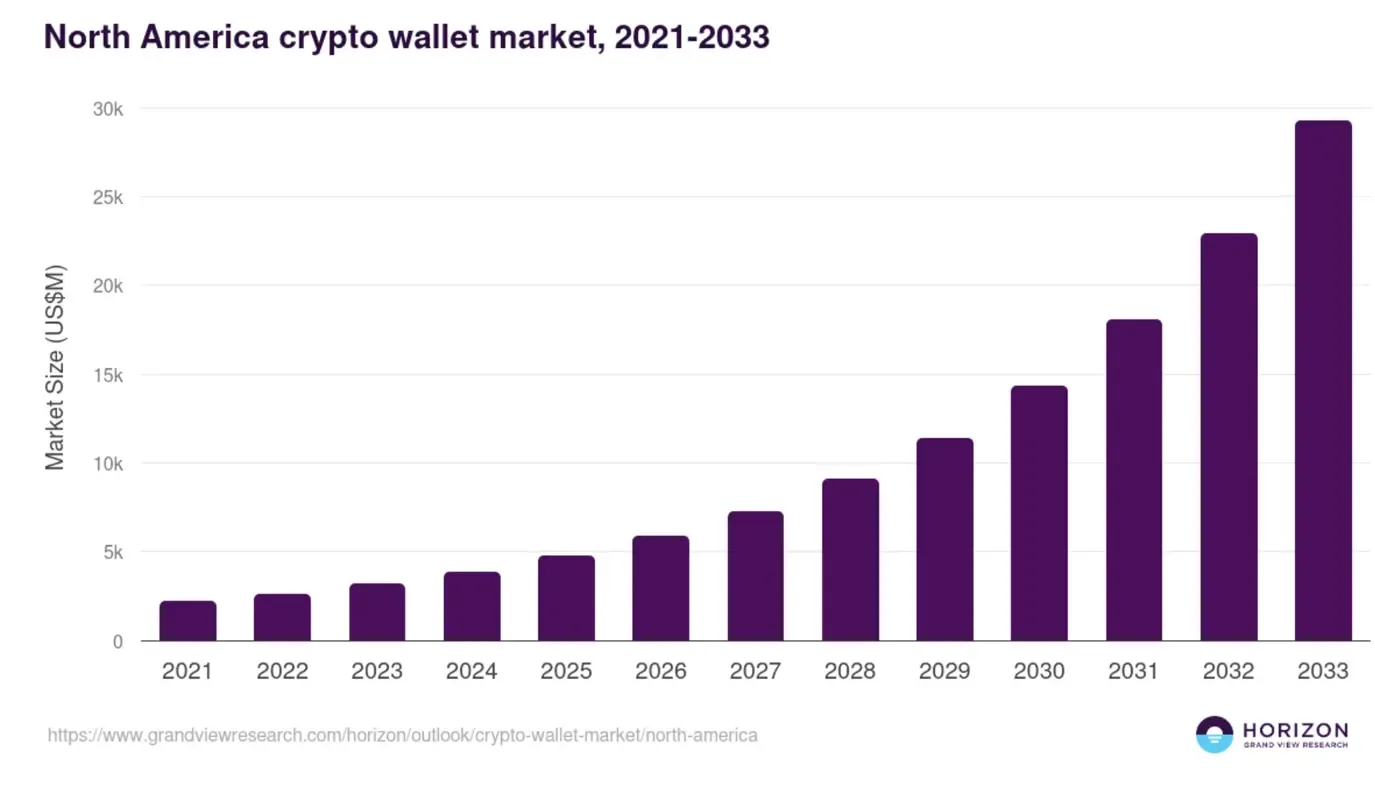

Analysts estimate that the crypto wallet market will grow from an estimated value of 12–15 billion USD mid-period, up to approximately 90–100+ billion USD during the early part of the next decade. [Source: Multi-Source Synthesis of Fortune Business Insights, Grand View Research, etc.] North America alone accounted for approximately 31% of global crypto wallet revenues in 2024 and is projected to be the leading region.

Customers in 2026 desire more than just a basic interface from your wallet offering; they expect security, compliance, multi-chain compatibility, excellent UX, and true enterprise-scale capabilities. This blog is intended for technical leaders as well as Web3 strategy teams, describing ten crypto wallet development partners in the US focused on delivering quality solutions. Our purpose is to provide you with the accurate information necessary for decision-making, based on real-world context and strategic alignment, not mere marketing feature lists.

Why Choosing the Right Crypto Wallet Development Company Matters in 2026

Cryptocurrency wallets serve as a means of holding digital assets but also function as the hearthstone of trust between your product and the consumer. If an organization has implemented a poor-quality Web3 wallet solution, it exposes its digital assets as well as the firm to multiple risks from both an operational and regulatory perspective (e.g., loss of consumer confidence or reputation).

The past three years have seen billions of dollars’ worth of crypto lost due to poor wallet security practices and hackers exploiting vulnerable digital wallets through theft. As a result, companies are creating and adopting high-level security controls such as MPC key management, multi-sig schemes, hardware security, and real-time compliance monitoring.

In order to remain compliant with both legal requirements and expectations, having a security-centric design is now a prerequisite for you to participate in the Web3 marketplace.

Now, pause and absorb this-

“Security without usability is a fortress with no door; usability without security is a house with no locks.”

The right cryptocurrency wallet development venture can turn this apparent contradiction between security and usability into a competitive differentiator.

Let’s turn our attention to the main subject:

And have a look at those wallet providers that possess sufficient experience in the development and integration of blockchain wallets, particularly for clients based in the United States and abroad.

Snapshot of Leading Wallet Development Partners in the US

| Company | Founded | Team Size | Focus | Enterprise Strength |

|---|---|---|---|---|

| Antier | 2005 | 700+ | Enterprise wallets,MPC,compliance | Balanced security,UX and compliance alignment |

| INORU | 2000’s | ~250+ | Custom wallets and Web3 platforms | Adaptive,strategy‑driven enterprise builds |

| Blockchain App Factory | 2017 | 250–500 | DeFi‑centric wallets and ecosystems | End‑to‑end token and DeFi integration |

| ScienceSoft | 1989 | 750+ | Blockchain wallets for enterprises | Deep compliance and IT integration |

| PixelPlex | 2007 | ~130+ | Wallet + UX + dApp integration | User‑centric,adoption‑focused design |

| Dev Technosys | 2010 | ~51-200 | High-caliber wallets and eWallets | Scalable,performance‑oriented architectures |

| Codezeros Technology | 2015 | 51–200 | Agile,custom wallet and Web3 solutions | Rapid,flexible iteration for enterprises |

1. Antier

Founded in 2005, Antier has a team of over 700 employees specializing in the creation of white label wallets, multi-chain wallets, MPC wallet architecture, and virtual crypto card implementations.

Their value proposition is a secure and compliant wallet framework built to enterprise standard specifications.

They have a hybrid engineering and risk-based approach to the creation of wallets, and that base has been utilized in hundreds of deployments—retail, institutional, as well as platform-level use cases.

Their services are designed to support multi-currency assets and increasingly use artificial intelligence to support unprecedented fraud control and premium performance.

The difference between Antier and its competitors resides in how focused they are on corporate-tier benchmarks like

- Compliance modules – for multiple jurisdictions

- Audit quality logging capabilities

- Dynamically integrated KYC/AML systems

- And well-designed API layers

That makes them an ideal choice for projects requiring both resilient and world-class user experiences, especially for those willing to target high-growth markets, including America and others.

2. Inoru

Founded: 2000’s (subsequent expansion to blockchain and Web3)

Size: 250+ professionals

USP: Complete wallet development, Web3 platforms, and regulatory-friendly architectures

With particular emphasis on in-depth customization and balanced incorporation, Inoru has established a strong presence in the creation of blockchain solutions, including token platforms, secure wallets, and DApps.

It has delivered significant value by aligning wallet functionality with distinct business models, specifically for those enterprises that cannot adhere to one-off generic wallet models.

They offer wallet features that are accessible on both mobile and web-based applications, and follow robust security and quality assurance practices while maintaining a configurability factor that allows for continual evolution of usage to accommodate changing product and regulatory environments.

3. Blockchain App Factory

Founded: 2017

Size: Approx. 250-500

Company Focus: Crypto wallet development with extensive DeFi, NFT & Web3 assimilation

Blockchain App Factory has built its brand by providing end-to-end blockchain solutions with priority placed on decentralized exchanges, DeFi platforms, and token launch systems.

Wallets created by BAF are more than secure storage solutions; they come with the capability to act as the primary access point to on-chain activities, marketplaces, and tokenized services.

Their modus operandi blends wallet engineering with token standards, automated smart contracts, and strong back-end architecture, all of which facilitate complex decentralized functions from staking to providing liquidity to NFTs.

What does this mean for businesses? Your wallet could potentially become an overall utility platform where people no longer just keep their assets but rather use them.

4. ScienceSoft

Founded in 1989, ScienceSoft has more than 750 IT experts, including specialists who are dedicated to crafting enterprise-class wallet offerings for clients.

Their USP is their extensive institutional experience in delivering compliance-ready designs.

The firm’s track record for mature software engineering is rare among pure-play blockchain startups. The majority of their experts have decades of experience working with regulated, mission-critical systems and have successfully applied that experience to develop Web3 wallets that are secure and scale effectively, while also meeting rigorous compliance, audit, and operational standards.

Many of ScienceSoft’s wallet offerings are presented with orchestration tools designed to provide integration with identity and access management solutions, back-office systems, and compliance layering options depending on applicable regional laws.

Find Reliable & Trusted Crypto Wallet Development Companies across the USA

5. PixelPlex

Founded: 2007

Size of Team: ~130+

USP: Carefully planned for usability, along with an acute focus on security.

PixelPlex works ideally for projects that want to balance user experience with cryptographic hardening. They create wallet products that are tailored for intuitive use by end-users, scalable enough to allow for future growth, and at the same time safe and secure.

Their wallet ecosystems preserve a level of accessibility to a non-technical audience using a decentralized system for the first time.

To guide their product direction, they view wallet adoption as a three-phased behavioral funnel with a direct relationship between onboarding experience and subsequent user activation and retention.

6. Dev Technosys

Dev Technosys provides expandable crypto wallet development services suited for launches that must handle a high volume of activity from the start. Their crew comprises the necessary engineers, architects, and project managers for building the underlying setup and the customer-facing components.

Originated in 2010, the company currently has 51-200 employees. Their core impetus is to provide blockchain wallets and eWallet platforms, offering elite performance.

Their cryptocurrency wallet engines are crafted to optimize for high transaction loads and concurrent transactions, providing direct seamless integrations with exchanges, payment processors, and custodial infrastructure.

This positioning creates an ideal vendor for enterprises that are expecting large user bases or global distribution.

7. Codezeros Technology

Established: 2015

Personnel: 51 to 200

Areas of Expertise: Custom wallets, Web3 consolidation, DeFi‑ready base

Value Proposition: Flexible and customized wallet creation through agile engineering.

If you require speed and iteration for your digital wallets, look to Codezeros. Whether you are planning to merge utilities like staking & cross-chain support or modify compliance logic components in response to a fluid regulatory backdrop, this organization has proven experience.

With its full suite of services comprising wallet creation, NFT marketplace establishment, dApps, exchange development, etc. Codezeros provides an opportunity for developing complementary digital wallets within the broader blockchain ecosystem.

By stressing an agile methodology, they help achieve rapid product releases without losing sight of security or quality. Their services allow the flexibility to make changes or upgrades based on user feedback or new governance rules.

Worth Noting

In 2026, the product experience created by your Web3 crypto wallet will define the way your customers interact with your business.

The selection of your wallet solution provider will directly impact many critical facets of your overall enterprise, including defense posture, legal conformance, user adoption, and long-term value, depending on whether your organization plans to support DeFi, tokenized services, blockchain gaming, or global asset platforms.

You should consider asking these questions concerning your potential partners:

1. Will the scale of this white label crypto wallet offering be as effective as our audience grows and our transaction volume increases?

2. Will the wallet offer established key management methods, for instance, HSMs, MPC, and good recovery routes?

3. What is the level of complexity associated with synchronizing the wallet service into our compliance and reporting systems without disruption?

4. How does the engineering team demonstrate both pragmatic problem-solving and overall mastery in our industry?

Wrap Up

For those who take enterprise suitability and long-term sustainability seriously, companies like Antier, Inoru, ScienceSoft, and others on this list present credible, battle-tested wallet technologies.

Antier stands out among these firms because of its inexorable focus on security-first innovation and its extensive expertise in developing across numerous different types of networks & implementing large-scale global systems, which provide compelling reasons for alignment with the digital asset structural needs of American corporations.

Frequently Asked Questions

01. Why is a solid crypto wallet infrastructure important for enterprises?

A solid crypto wallet infrastructure is essential for any enterprise’s digital asset strategy as it serves as the foundation for mass adoption of Web3, ensuring trust and security in managing digital assets.

02. What are customers expecting from crypto wallets in 2026?

Customers in 2026 expect more than just a basic interface; they desire security, compliance, multi-chain compatibility, excellent user experience, and true enterprise-scale capabilities from crypto wallet offerings.

03. What risks do poor-quality Web3 wallet solutions pose to organizations?

Poor-quality Web3 wallet solutions can expose organizations to operational and regulatory risks, including loss of consumer confidence, reputation damage, and potential financial losses due to security vulnerabilities and hacking incidents.

Crypto World

$1.28T Erased From Gold & Silver In Lunar New Year Liquidity Crunch

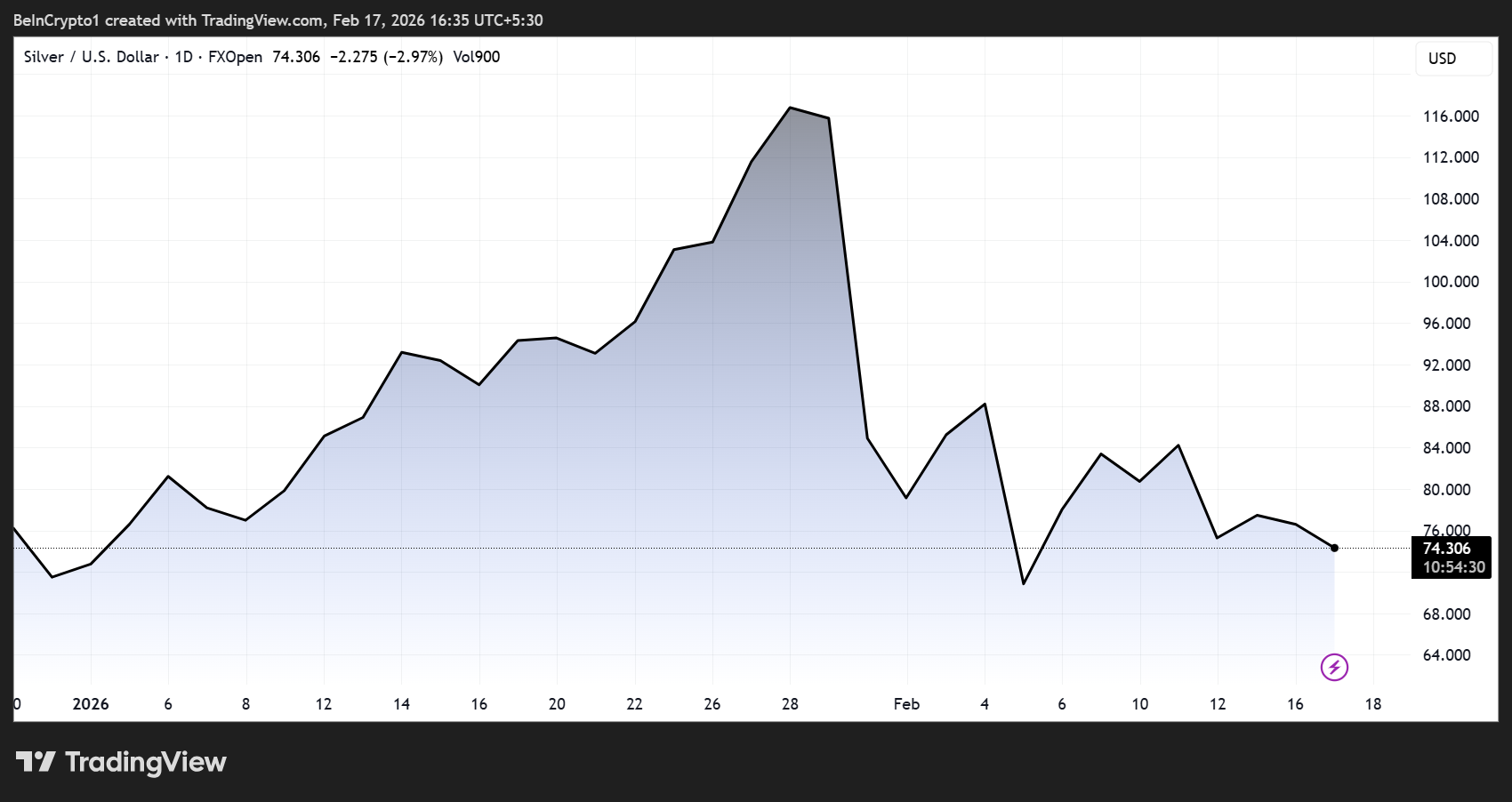

Gold and silver markets are in a sharp correction, with prices falling for a second consecutive session. Commodity-based exchange-traded funds (ETFs) are also declining by as much as 4%.

The sudden downturn has erased an estimated $1.28 trillion in combined market value, reflecting how even traditional safe-haven assets remain vulnerable to macro shocks and liquidity shifts.

Lunar New Year Liquidity and Macro Pressures Fuel Gold and Silver Correction

The decline follows a powerful rally earlier in 2026 that pushed gold above $5,000 per ounce and drove silver to record highs.

Sponsored

Sponsored

Analysts now say the pullback reflects a mix of seasonal factors, macroeconomic pressure, and profit-taking after an extended run-up.

Silver has been hit particularly hard, falling nearly 40% from its all-time high (ATH) of $121.646 recorded in late January.

As of this writing, Silver (XAG) was trading at $74.11, reinforcing its reputation as a more volatile counterpart to gold, given its smaller market size and stronger industrial demand.

“Gold and Silver wiped out $1.28 trillion today… even ‘safe havens’ bleed,” wrote one analyst, emphasizing the speed of the decline and the risks of assuming stability in any asset class.

Others pointed to the role of market structure and liquidity, arguing that temporary dislocations may occur when key physical markets slow, particularly in Asia.

Sponsored

Sponsored

Lunar New Year Liquidity Effects Come into Focus

Against this backdrop, one of the most widely cited short-term drivers is the Lunar New Year holiday period, during which trading activity across major Asian financial centers declines sharply.

Mainland China, Hong Kong, Singapore, Taiwan, and South Korea all experience reduced participation as traders, manufacturers, and market makers step away.

Lower liquidity can amplify price movements in global futures markets, especially for commodities like silver, where physical demand from the Chinese industry plays a major role.

Weaker demand during the holiday period could temporarily pressure prices, with physical buying potentially resuming once factories and exchanges return to full activity.

Analysts Warn of Continued Volatility As Macro Pressures Weigh on Bullion

Beyond seasonal factors, broader macroeconomic developments are also contributing to the downturn. Precious metals came under pressure as investors focused on narratives that strengthen the US dollar in the short term. These include:

Sponsored

Sponsored

A firmer dollar typically weighs on bullion by making gold and silver more expensive in other currencies, reducing demand from international buyers.

ETF flows reflect the cautious sentiment. Several gold and silver ETFs declined between 2% and 4%. This mirrors weakness in futures markets and suggests that some investors are locking in profits after the recent rally.

Meanwhile, market strategists say precious metals are now in a “volatile consolidation phase.” After such a strong advance, corrections and sideways trading are common as markets digest gains and rebalance positions.

Therefore, a disciplined approach may be advisable, rather than chasing prices at elevated levels; instead, consider staggered buying during corrections.

Technical analysis also shows key support levels, with estimates placing silver price support near $65 per troy ounce and gold support around $4,770 per ounce on a weekly closing basis.

Sponsored

Sponsored

While these levels could determine whether the current pullback stabilizes or deepens, investors should conduct their own research.

Despite the sharp drop, structural forces such as rising global debt, currency debasement, and historical cycles in ratios, such as the gold–silver ratio, could support a powerful long-term bull market in precious metals.

If historical ratio reversals repeat, silver could experience significant upside over the coming decade, potentially reaching dramatically higher price levels by the early 2030s.

Crypto World

Bitcoin’s downtrend may end within 12 months, says Altcoin Sherpa

Altcoin Sherpa says Bitcoin’s bear phase could end within 12 months as ETFs, macro risks and a possible capitulation shape the next accumulation zone.

Summary

- Altcoin Sherpa projects Bitcoin’s peak‑to‑bottom phase will likely conclude in less than a year, excluding the post‑bottom accumulation range.

- The analyst says a major selloff from the October peak and ETF outflows may already have marked capitulation, putting Bitcoin in early accumulation.

- Structural shifts such as US spot ETFs and macro headwinds mean this cycle may diverge from 2018 and 2022, even if the one‑year bear timing repeats.

Bitcoin market analyst Altcoin Sherpa has projected the current cryptocurrency bear phase will conclude in less than 365 days, with the digital asset potentially resuming its broader uptrend before year-end, according to analysis published on social media platform X.

The projection comes as Bitcoin trades well below its all-time high reached in October, prompting investor questions about when the cryptocurrency might establish its next bottom.

Sherpa specified the timeline refers to the move from peak to bottom and does not include the accumulation period that typically follows, according to the analysis. The accumulation phase is characterized by sideways price action with relatively low volatility and subdued trading volume, historically lasting between two and four months.

Historical data shows Bitcoin experienced major rallies in 2017 and 2021, each followed by year-long declines in 2018 and 2022, according to the analyst. Extended accumulation periods followed those drawdowns in 2019 and 2020. From peak to bottom in both the 2017-2018 and 2021-2022 cycles, Bitcoin required approximately one year to complete its downward move.

Past bear markets have featured a final capitulation event—a sharp sell-off marking the end of the downtrend, according to Sherpa’s analysis. The analyst indicated a capitulation may have already occurred earlier this year, pointing to a substantial price drop as a potential final decline. If correct, the market could already be in early accumulation stages.

Sherpa stated the current decline will differ from previous patterns due to structural changes in the market. The analyst cited the growing role of US spot Bitcoin exchange-traded funds, which have altered capital flow structures despite declining alongside the broader market. An extended consolidation period of approximately eight months in a prior price range was also noted, with such trading ranges often acting as support zones during pullbacks from a technical analysis perspective.

Broader macroeconomic factors including equities, metals, overall risk appetite and artificial intelligence developments remain critical variables, according to the analysis. Sherpa stated Bitcoin does not require another seven months of decline to form a bottom, suggesting accumulation may already be underway if the recent slide was the final capitulation.

The analyst acknowledged one key risk to the outlook: the possibility that a final capitulation has not yet occurred. If another significant sell-off emerges, that would be interpreted as the definitive bottoming event, with accumulation likely following for several months, according to the analysis.

Crypto World

FTSE 100 and FTSE 250 attract capital as investors rethink US valuations

Global investors are rotating into FTSE 100 and FTSE 250 as stretched US equity valuations, sector mix, yields, and FX stability make UK stocks look undervalued.

Summary

- International investors are reallocating from expensive US mega-caps into FTSE 100 and FTSE 250 as valuation spreads widen.

- UK indices offer lower price-to-earnings ratios, higher dividends, diversified sectors, and global revenue exposure versus concentrated US tech.

- Stable pound dynamics and a gradual Bank of England policy path support UK equity appeal amid broader portfolio rebalancing.

The FTSE 100 and FTSE 250 indices are drawing increased international capital as investors reassess elevated US equity valuations, according to recent market analysis.

Fund managers have begun rotating into British assets amid concerns over pricing levels in US mega-cap shares, market data shows. The shift reflects a widening valuation differential between the two markets.

The S&P 500 currently trades at a premium to historical averages, while UK indices display lower price-to-earnings ratios and higher dividend yields, according to market metrics.

The FTSE 100 maintains significant exposure to energy, financial and commodity sectors, which provide global revenue streams and inflation-resistant characteristics. The FTSE 250 consists primarily of domestically focused mid-cap companies positioned to benefit from stabilizing UK inflation and potential improvements in consumer confidence.

Currency factors have also influenced investment decisions. The pound’s relative stability has reduced volatility risks for overseas investors and enhanced the attractiveness of UK-listed multinational corporations, analysts noted.

US markets have outperformed global indices in recent years, propelled by artificial intelligence developments and technology sector earnings growth. However, concentration risks have increased as a small number of large-cap stocks now account for a substantial portion of market returns, prompting diversification efforts among institutional investors.

UK equities offer broader sector distribution and defensive investment characteristics, with dividend payouts exceeding those of US counterparts, according to comparative market data. Global asset allocators are reassessing regional portfolio allocations, with lower relative valuations potentially providing downside protection in the event of slowing global growth.

The Bank of England’s monetary policy trajectory represents an additional consideration, with market expectations pointing toward gradual interest rate adjustments that could support equity valuation multiples.

While capital flows remain subject to rapid shifts, the current trend indicates a broader portfolio rebalancing as international investors reconsider UK markets following an extended period of underperformance relative to other developed markets.

Continued valuation disparities could sustain inflows into UK equities, with the FTSE 100 and FTSE 250 positioned to benefit from ongoing global portfolio diversification strategies, market observers stated.

Crypto World

Eli Lilly (LLY) Stock: Company Loads Up $1.5B of Weight-Loss Pills to Battle Wegovy

TLDR

- Eli Lilly stockpiled $1.5 billion of Orforglipron weight-loss pill before expected April 2026 FDA approval

- Strategy aims to prevent supply shortages that hurt Zepbound and Mounjaro launches in 2022

- Novo Nordisk’s oral Wegovy reached 50,000 prescriptions by January after December 2025 approval

- Orforglipron could hit $13 billion in annual sales by 2031 according to GlobalData forecasts

- Company investing $27 billion in four new U.S. manufacturing facilities for weight-loss drugs

Eli Lilly disclosed $1.5 billion worth of pre-launch Orforglipron inventory in its 2025 annual report. The weight-loss pill awaits FDA approval expected in April 2026.

The massive stockpile represents a calculated move to avoid past mistakes. In 2022, Eli Lilly couldn’t meet demand for injectable drugs Zepbound and Mounjaro. Patients switched to compounded alternatives when they couldn’t find branded products.

Those shortages lasted until late 2024. They cost the company revenue and market share during a critical growth period.

The FDA fast-tracked Orforglipron’s review using a Commissioner’s National Priority Review Voucher. Eli Lilly plans a major marketing push this summer when shipments begin.

Chasing Novo Nordisk’s Early Lead

Novo Nordisk launched oral Wegovy in January 2026 after December 2025 FDA approval. The Danish company captured first-mover advantage in the oral weight-loss pill market.

By the end of January, oral Wegovy had 50,000 prescriptions. UBS analysts expect 400,000 prescriptions in Q1 2026.

Pills appeal to patients who avoid injections. Current options like Zepbound require weekly shots. The oral format removes needle anxiety from the treatment equation.

Eli Lilly started building Orforglipron inventory over a year ago. The company reported $550 million worth of the drug in February 2025.

GlobalData analyst Shehroz Mahmood called the stockpile “a decisive effort to avoid repeating the supply constraints that plagued its Mounjaro and Zepbound rollouts.”

Billion-Dollar Sales Projections

GlobalData projects Orforglipron could generate $13 billion in annual sales by 2031. That forecast assumes FDA approval and successful commercialization.

Eli Lilly’s weight-loss drug portfolio drove 45% revenue growth in 2025. Mounjaro brought in $23 billion. Zepbound added $13.5 billion.

The company is building four new U.S. manufacturing facilities with $27 billion in investment. At least three will produce weight-loss therapies. Eli Lilly announced the fourth facility this month.

Orforglipron showed positive results in clinical trials. The once-daily pill fits into an industry shift toward more flexible obesity treatments.

Mahmood noted that while Novo Nordisk has early momentum, “it remains to be seen whether Eli Lilly can yet again take the spotlight, as it did in the competition for injectable therapies.”

The $1.5 billion Orforglipron stockpile makes up most of Eli Lilly’s total pre-launch inventory. The company expects huge global demand once the pill reaches pharmacy shelves this summer.

Crypto World

Monero faces short-term selling pressure despite strong on-chain activity

- Monero (XMR) faces short-term selling pressure below key moving averages.

- On-chain activity remains strong despite exchange delistings.

- Support lies at $300 while the immediate resistance sits near $381.

After reaching an all-time high near $798 in January, Monero (XMR) cryptocurrency has experienced significant short-term volatility.

In the last month alone, XMR has retraced over 44% from its recent highs.

The coin is currently trading around $331, after modest gains over the past 24 hours, but still well below its peak.

Growing selling pressure

Recent price action shows that XMR is struggling below key moving averages, including the 50-day and 200-day exponential moving averages (EMA).

These levels are critical as they often guide the sentiment of market participants.

Selling pressure has been compounded by a decrease in futures open interest, which dropped around 11% in a single day.

The long-to-short ratio has also shifted in favour of short positions, indicating a prevailing bearish bias.

If Monero fails to hold above the psychological $315 level, it could open the door for further declines.

Technical analysts suggest that a break below $315 may trigger a deeper correction, potentially testing support near $300.

Despite this, the short-term weakness does not reflect a collapse in user interest.

Strong on-chain activity and adoption

Monero’s core network activity remains remarkably resilient.

Transaction volumes have stayed above pre-2022 levels, even as numerous exchanges have delisted the cryptocurrency.

This suggests that the demand for private transactions continues, independent of mainstream trading platforms.

Darknet marketplaces are increasingly favouring XMR as the payment method of choice.

Almost half of the newly launched privacy-focused markets now operate exclusively on Monero, underscoring its growing adoption in niche sectors.

Even though ransomware operators still prefer Bitcoin (BTC) due to its liquidity, Monero continues to hold a strong position among users who value privacy.

Despite exchange delistings and enforcement pressure, XMR activity on Monero remains above pre-2022 levels.

Key findings from our latest research:

🔺 48% of new darknet markets in 2025 are XMR-only

🔺 Most ransomware payments still occur in BTC — liquidity matters

🔺 14–15% of… pic.twitter.com/BYPJMrLaJN— TRM Labs (@trmlabs) February 16, 2026

Network-level observations also show that a small percentage of Monero nodes behave differently from the standard protocol.

These anomalies do not compromise the cryptocurrency’s privacy features but indicate subtle variations in how real-world networks function.

Overall, these factors demonstrate that Monero maintains a strong and active user base, even in the face of regulatory and exchange restrictions.

Monero price forecast

Monero is balancing between short-term price weakness and long-term network resilience.

The immediate support lies around $300. Holding this level is crucial for preventing further downside.

If $300 fails to hold, the next major support is between $290 and $231.

On the upside, Monero needs to reclaim levels above $381 to ease selling pressure and potentially resume its bullish trend.

Short-term traders should be cautious, as momentum indicators suggest room for continued volatility.

Meanwhile, long-term holders can take confidence from the sustained network activity and growing adoption in privacy-focused markets.

Crypto World

Ripple (XRP) News Today: February 17th

A prominent crypto company continues to praise XRP, while Ripple’s stablecoin performed better than USDC on one front.

XRP has experienced a significant decline over the past few months, yet interest in the asset (and the company behind it) remains high.

In the following lines, we will touch upon the latest and most intriguing developments surrounding Ripple’s ecosystem.

Investors Want In?

Ripple’s global event, XRP Community Day, which is dedicated to the community of proponents, developers, and holders, was held last week. It brought together numerous executives and well-known figures from the crypto industry to discuss XRP’s growing usage, institutional adoption, and other trending topics.

One participant was Rayhaneh Sharif-Askary (Head of Product & Research at Grayscale), who disclosed that advisors at the digital asset manager are “constantly asked” by clients about XRP. She added that, in some cases, Ripple’s cross-border token is the second-most discussed asset after Bitcoin (BTC).

Grayscale is among the companies that introduced a spot XRP exchange-traded fund (ETF) with 100% exposure to the coin. This happened in late 2025, shortly after Canary Capital became the first to launch such a product in the United States.

Grayscale’s investment vehicle, dubbed GXRP, drew strong interest after its debut, with daily net inflows topping $30 million on several occasions. However, over the past few weeks, the trend has shifted, with frequent negative netflows.

RLUSD Outperforms USDC on This Front

Ripple’s stablecoin, called RLUSD, saw the light of day in December 2024 and has since made significant progress. The product, pegged 1:1 to the American dollar, gained support from many exchanges and renowned banking institutions, including the oldest US bank, BNY Mellon.

You may also like:

Earlier this year, the London-based fintech company LMAX Group partnered with Ripple to integrate RLUSD into its institutional trading infrastructure, while Zand (a bank in the UAE) also embraced the token.

RLUSD’s market cap has exceeded $1.5 billion, a significant milestone given its relatively short history. X user SMQKE revealed that the product has grown “much faster” than Circle’s USDC in its first year.

XRP Price Outlook

The past week has been quite turbulent for Ripple’s native cryptocurrency, with its valuation ranging from $1.35 to $1.66. Currently, it trades at approximately $1.45, representing a 2% daily decline.

It is important to note that the surge to the local high occurred over the weekend and was short-lived, prompting some analysts, such as Ali Martinez, to describe the 2-week candle closure as a gravestone doji. This is a candlestick pattern in which the price spikes during the period but closes near where it started, resembling an upside-down “T.” Martinez noted that the last time this formation appeared on the weekly chart, XRP’s price dropped by 46%.

Other analysts take a more optimistic view. X user BitGuru believes XRP is “coming out of a prolonged downtrend” and is attempting to reclaim key support at approximately $1.50. Should it succeed, a recovery to $1.80-$2 is possible, they predicted.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Tapping Korea’s Regulated Digital Asset Market with Antier’s Institutional-Grade RWA Solutions

As global capital markets accelerate toward blockchain-enabled asset digitization, South Korea is positioning itself as a strategically significant jurisdiction in this transformation. The shift is not being driven by speculative enthusiasm, but by deliberate financial modernization. With one of the most advanced fintech ecosystems in Asia, a highly digital-native investor base, and a regulatory framework that is progressively adapting to digital securities, Korea offers a structured environment for real world asset tokenization to evolve beyond experimentation.

What distinguishes Korea from many other markets is its institutional orientation. Rather than centering growth on retail crypto activity, the country is exploring how tokenized securities, fractionalized assets, and blockchain-based settlement models can be integrated into existing financial architecture. This measured and compliance-aware approach signals a long-term commitment to infrastructure development rather than short-term market cycles.

For global enterprises, asset managers, and technology providers, the Korean RWA landscape represents more than a regional opportunity. It reflects a market preparing to align traditional finance with digital asset innovation in a regulated, scalable, and institutionally credible manner—making it particularly relevant for organizations pursuing sustainable expansion strategies in Asia’s evolving tokenization economy.

Korean RWA Market Overview

South Korea is emerging as a key hub for real world asset tokenization, driven by clear regulations, a tech-savvy financial ecosystem, and growing institutional interest. Platforms like Korbit—recently acquired by Mirae Asset for $92M—highlight the country’s push toward regulated digital asset markets.

While retail adoption is strong, institutions are seeking robust, compliant infrastructure for complex assets, creating demand for institutional RWA tokenization platforms. This evolving landscape presents a strategic opportunity for Antier to deploy institutional-grade RWA solutions and power Korea’s next-generation asset tokenization platforms.

What’s Accelerating Korea’s RWA Momentum?

The real-world assets market in Korea has entered an explosive period of growth as both institutional and retail investors are looking to explore the use of blockchain technology in the ownership of real-world asset tokenization. The convergence of increasing regulatory clarity regarding RWAs, improved digital infrastructure and a strong appetite among investors to invest in RWAs has allowed the tokenization of RWAs to move from being an innovation in the asset ecosystem to an accepted, mainstream RWA diversification strategy. As a result, companies are looking for RWA tokenization solutions that provide compliant, liquid, and transparent transaction solutions, while financial institutions are looking for institutional RWA tokenization platforms that are capable of providing secure and efficient solutions for the tokenization of more complex RWA.

Key drivers of this growth include:

1. Clear Regulatory Guidelines

The regulatory agencies in Korea have provided detailed and clear regulatory guidelines concerning RWAs, allowing institutions to have a clear base on which to explore RWA tokenized investment opportunities. The only area that remains uncertain is whether the establishment of standard compliance and reporting protocols will have an impact on the adoption of asset tokenization platforms

2. Institutional Adoption and Strategic Investments

More institutional players in the form of Mirae Asset acquiring Korbit are looking for market opportunities in the form of regulated RWA markets, reflecting a need for and desire of institutional players to participate as RWA investors. There is a significant increase in institutional demand for institutional-grade RWA solutions that can support the volume of transactions and complexity of asset classes associated with large institutional RWA investments.

3. Technology-Driven Infrastructure

The country’s fintech world is going through major innovation as it integrates blockchain technology with traditional financial institutions. Advanced RWA tokenization solutions have created a means for the extremely fast transfer of ownership of assets, fractional ownership of assets, and a high degree of security for holding and transferring tokenized investments.

4. Investor Diversification Demand

Investors who are retail and institutional are looking to acquire ownership of Real World Assets through blockchain technology due to the benefits it provides, such as liquidity, transparency, and fractional ownership. The growing interest from both retail and institutional investors continues to create the need for strong institutional RWA tokenization platforms.

5. Competitive Market Timing

The maturity of South Korea’s market and its early adoption of tokenized asset solutions make it the right time to provide a strong platform, such as Antier’s, that can connect the traditional financial markets to the blockchain for institutional-grade RWA solutions to satisfy the need for next-generation investment products.

Launch Your Institutional-Grade RWA Platform with Antier<

Critical Gaps in Korea’s Asset Tokenization Platform Infrastructure

Korea’s real-world asset tokenization ecosystem has significant infrastructure gaps despite strong regulatory intent and growing institutional interest. While many platforms were initially created for crypto trading, they have been unable to support the digitisation of complex real-world assets at scale. With increasing demand for regulated and institution-grade offerings, the gaps created by the above-mentioned limitations are more pronounced, showing the need for purpose-built RWA tokenization solutions and enterprise-grade platforms.

Key gaps hindering mass market adoption:

1. Limited Institutional-Grade Architecture

Most platforms do not have the necessary robustness and feature set to build institutional quality for large issuers, custodians, and asset managers. The current absence of a complete institutional RWA tokenization platform prevents secure issuance, lifecycle management, and governance of tokenized assets.

2. Compliance-Centric Architecture Shortcomings

As regulations continue to evolve, there are many protocols that have not been able to embed compliance into their protocols. For example, many features such as performing investor KYC checks (i.e., identification), transfer restrictions, and audit-ready reporting are typically disenfranchised across multiple asset tokenization platforms, which compromises the trust level of these platforms by the issuer and investor.

3. Limited Integration to Traditional Finance Infrastructure

Connectivity between RWA tokenisation and traditional finance institutions (i.e., banks, custodians) remains lacking. The lack of thorough integration will prevent RWA tokenisation from providing the operational efficiency and settlement reliability associated with traditional finance institutions.

4. Limitations on Performance and Scalability

With an increase in the number of institutions participating on a platform, that platform must be able to work with larger transaction volumes, more asset classes, and cross-border use cases. Most current infrastructures lack the scalability required to sustain institutional-grade RWA solutions as they continue to grow.

5. Fragmented Asset Lifecycle Management

The process of going from onboarding and token issuance to secondary trading and redemption of an asset typically does not have full lifecycle management. This siloed approach creates operational risks and demonstrates the need for fully integrated enterprise-grade RWA tokenisation solutions.

How Can Antier Power Korea’s Next-Generation RWA Infrastructure?

With the transition of South Korea into a compliant digital asset ecosystem, institutional frameworks need to be secure, scalable, and compliant for real-world asset tokenization. With its extensive blockchain knowledge as well as its financial and regulatory knowledge, Antier will develop customized RWA tokenization solutions to support South Korea’s evolving RWA landscape.

Antier provides solutions for next-gen RWA by:

1. Domain-Driven Expert Team

A cross-functional expert team comprised of blockchain engineers, tokenization architects, and compliance experts, all of whom are highly experienced in creating global asset tokenization platforms. They will assist with the creation of secure technical designs, strong asset structure models, and secure smart contracts.

2. Institutional-grade Platforms

Antier provides institutional-grade scalable platforms for RWA tokenization, with a variety of asset classes, capable of high transaction volumes, with permissioned access control, advanced lifecycle management, and meeting the expectations of financial institutions and regulated entities.

3. Compliance-embedded smart contracts

Antier delivers institutional-grade RWA tokenization solutions that are fully compliant with all regulatory requirements by embedding compliance regulations within the token framework — KYC and AML regulations, whitelisting of investors, restrictions on transfers, and automated reporting.

4. Regulatory Structuring and Localization Support

Antier helps to design token models that follow financial guidelines for the specific laws in the country and to make sure the solutions are technically viable and ready for the regulations that will apply to RWA tokenization in Korea’s changing legal environment.

5. Seamless Integration with Traditional Finance

Antier can connect traditional bank systems, custody services, and reporting systems so that real-world asset tokenization projects will function properly with current financial systems. By combining these three areas of specialty in service, technology, and compliance, Antier is poised to provide scalable infrastructure for the next generation of RWA marketplaces in Korea with future-proof capabilities.

Grab the First-Mover Advantage in Korea’s Tokenized Economy

By deploying robust RWA tokenization solutions and launching compliant, scalable asset tokenization platforms, institutions can establish credibility before the market reaches saturation. With the right institutional RWA tokenization platform and future-ready, institutional-grade RWA solutions, market participants can move beyond experimentation—building sustainable leadership in Korea’s next-generation tokenized economy.

Crypto World

President Trump Says Crypto Market Structure Bill Will Pass Soon

Crypto regulation might finally be getting real structure. President Donald Trump just confirmed that a full crypto structure bill is close to passing. That is not small talk. That is a potential turning point.

For years, the CFTC and SEC have been battling over who controls what. Now it sounds like a clearer rulebook could arrive sooner than expected.

- Presidential Confirmation: Trump signals imminent passage of S. 3755/H.R. 3633 framework.

- Jurisdiction Split: Legislation formally divides oversight between SEC (securities) and CFTC (commodities).

- Rapid Timeline: Provisional registration for exchanges expected within 180 days of enactment.

The End of the Regulatory Turf War?

The House already moved first. The Digital Asset Market Clarity Act passed last July, laying out a framework that splits oversight between the CFTC and SEC. The real bottleneck has been the Senate.

In late January, the Senate Agriculture Committee narrowly advanced its own version, the Digital Commodity Intermediaries Act, in a tight 12 to 11 vote. That shows how divided the room still is.

There has been pushback too. Major industry players like Coinbase criticized earlier drafts, saying they boxed in DeFi and made stablecoin rules too restrictive.

By stepping in now, Trump is trying to break that gridlock and push the bill across the finish line after earlier Senate efforts stalled.

Mechanics of the New Crypto Market Structure Bill

Under the proposal, the CFTC would take primary control over digital commodities like Bitcoin and Ethereum. That alone would clear up years of confusion.

The bill also gives brokers and exchanges a 180 day window to register and secure provisional status once it becomes law. That is a fast track compared to the current gray zone many platforms operate in.

The goal is to end the murky compliance environment that has left firms exposed to freezes and counterparty risk.

CFTC Chairman Michael Selig has suggested the bill could reach the President within months. That lines up with other moves aimed at pulling crypto deeper into traditional finance. The framework would also require joint SEC and CFTC rulemaking within 18 months to sort out complex areas like mixed transactions and margin structures.

Market Implications and Deadlines

Passage of this bill would likely trigger a repricing of “commodity” assets currently suppressed by SEC lawsuits.

However, hurdles remain. The Senate Banking Committee still needs to reconcile its version with the Ag Committee’s draft before the February 28 White House deadline for stablecoin frameworks.

Meanwhile, scrutiny hasn’t vanished. Congressional leaders continue to urge probes into Trump-linked ventures like WLFI, ensuring that while regulation arrives, political volatility isn’t going anywhere.

The post President Trump Says Crypto Market Structure Bill Will Pass Soon appeared first on Cryptonews.

Crypto World

Raydium price jumps 15% as top coins struggle: why is RAY surging?

- Raydium price pumped more than 15% as bulls tested the $0.75 level.

- Gains come amid a notable jump in perpetuals volume on the Solana-based decentralized exchange.

- RAY’s daily trading volume exploded by more than 500%.

Raydium trends as one of the top gainers in the crypto market in early trading on February 17, 2026, with the RAY token up 15% in the past 24 hours.

The token’s dramatic surge aligns with an explosion in daily trading volume and a retest of $0.75, which sees bulls now target a potential rebound to the critical price level of $1.

All this comes as top altcoins, including Ethereum, XRP and Solana, mirror the bearish pressure around Bitcoin.

Why is the Raydium price up?

Raydium benefits from Solana ecosystem momentum, with optimism around SOL also reflected in RAY. But this latest pump in the token comes as SOL struggles near $80.

A sharp increase in liquidity provision and swaps on Raydium’s automated market maker signals renewed confidence in the Solana-based decentralized exchange.

While there is no specific catalyst for the price surge in the past 24 hours, it appears fresh perps listings are amplifying volume.

Raydium recently announced trading support for $TSLA, $NVDA, $XAG, $NAS100, $XAU, $SPX500, and $GOOGL, offering up to 20x leverage.

Trade $TSLA, $NVDA, $XAG, $NAS100, $XAU, $SPX500, and $GOOGL with up to 20x leverage. pic.twitter.com/wVAD2X3xgl

— Raydium (@Raydium) February 16, 2026

With potential macroeconomic shifts pointing to fresh gains, speculation is at a new level.

On-chain data indicates the platform is seeing heightened activity, with perpetuals volume skyrocketing past $6 billion amid notable user growth.

RAY’s gains reflect this frenzy, and volume has exploded. Over the past 24 hours, bulls pushing to break above $0.75 have seen daily volumes spike 580% and surpass $118 million.

Raydium price forecast as bulls target breakout above $1

Bears remain in control across much of the crypto market, and RAY’s performance in the past several months highlights this.

The token is well off lows of $0.54 seen earlier in the month, and boasts a 22% uptick from lows seen in the past week.

However, price continues to hover below a key downtrend line since the dip from the highs of $4.10 in August 2025.

And that downtrend currently sees bulls eye a short-term flip to above $1.

Technical indicators, including the rising RSI around 45 and MACD showing bullish divergence, suggest room for momentum.

Also notable is the fact that RAY currently trades near the resistance line of the aforementioned descending trendline.

The retest of this area amid a rise in volume aligns with a potential upward continuation.

However, bulls need to breach immediate resistance at the $0.83 to $0.91 zone.

If this area flips from the key supply wall to support, a potential breakout is likely to propel RAY to highs of $1.27 and then bring new bullish targets into view.

If not, rejection at $0.75-$0.83 could open the door for bears to target the $0.55-$0.50 zone.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video22 hours ago