Crypto World

Ripple (XRP) Price Predictions for This Week

XRP holds above $1.40. Can it reclaim $1.60 next before another rally?

XRP went through some intense volatility during the weekend, spiking above $$1.65 before it was rejected and pushed south to $1.40. What levels should investors watch before the next move?

Ripple (XRP) Price Predictions: Analysis

Key support levels: $1.40, $1.00

Key resistance levels: $1.60

1. XRP Finds Support at $1.4

Buyers returned to XRP at the $1.40 support and managed to hold the price above this key level for more than a week. This opens up the possibility for this cryptocurrency to rally all the way to $1.60 before sellers return.

2. Momentum Remains Bearish

Even if XRP managed to find support, the overall momentum remains bearish. To turn this downtrend around, buyers will have to break above the $1.60 resistance as well. If they are successful there, then the $2.00 target becomes realistic.

3. Daily RSI Leaves Oversold Area

The daily RSI bounced out of the oversold area, but has still not managed to move above $0.50. As long as it remains under this level, sellers have the advantage. Nevertheless, XRP has a real chance here to continue higher if buyers don’t vanish this week.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

$1.28T Erased From Gold & Silver In Lunar New Year Liquidity Crunch

Gold and silver markets are in a sharp correction, with prices falling for a second consecutive session. Commodity-based exchange-traded funds (ETFs) are also declining by as much as 4%.

The sudden downturn has erased an estimated $1.28 trillion in combined market value, reflecting how even traditional safe-haven assets remain vulnerable to macro shocks and liquidity shifts.

Lunar New Year Liquidity and Macro Pressures Fuel Gold and Silver Correction

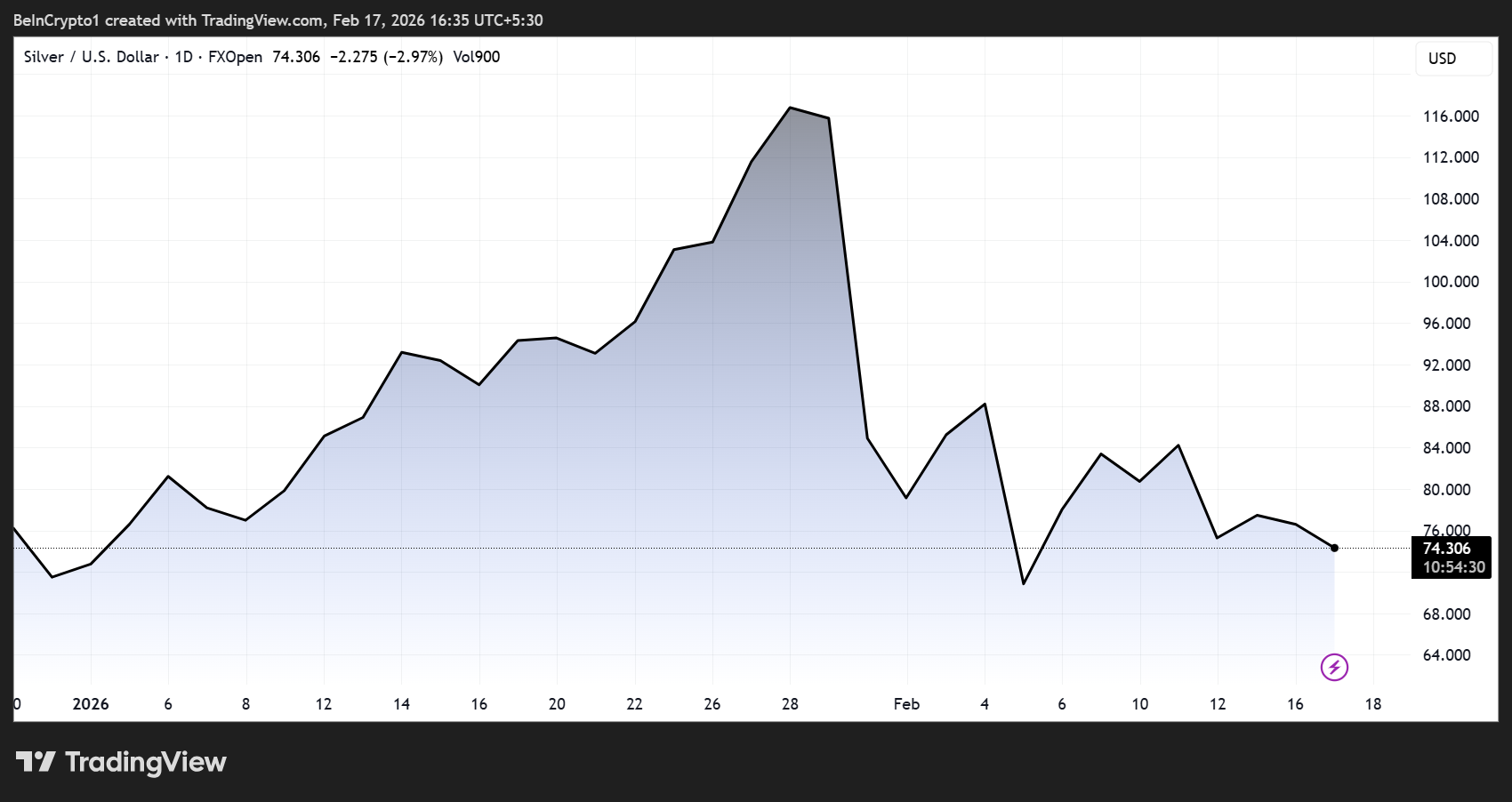

The decline follows a powerful rally earlier in 2026 that pushed gold above $5,000 per ounce and drove silver to record highs.

Sponsored

Sponsored

Analysts now say the pullback reflects a mix of seasonal factors, macroeconomic pressure, and profit-taking after an extended run-up.

Silver has been hit particularly hard, falling nearly 40% from its all-time high (ATH) of $121.646 recorded in late January.

As of this writing, Silver (XAG) was trading at $74.11, reinforcing its reputation as a more volatile counterpart to gold, given its smaller market size and stronger industrial demand.

“Gold and Silver wiped out $1.28 trillion today… even ‘safe havens’ bleed,” wrote one analyst, emphasizing the speed of the decline and the risks of assuming stability in any asset class.

Others pointed to the role of market structure and liquidity, arguing that temporary dislocations may occur when key physical markets slow, particularly in Asia.

Sponsored

Sponsored

Lunar New Year Liquidity Effects Come into Focus

Against this backdrop, one of the most widely cited short-term drivers is the Lunar New Year holiday period, during which trading activity across major Asian financial centers declines sharply.

Mainland China, Hong Kong, Singapore, Taiwan, and South Korea all experience reduced participation as traders, manufacturers, and market makers step away.

Lower liquidity can amplify price movements in global futures markets, especially for commodities like silver, where physical demand from the Chinese industry plays a major role.

Weaker demand during the holiday period could temporarily pressure prices, with physical buying potentially resuming once factories and exchanges return to full activity.

Analysts Warn of Continued Volatility As Macro Pressures Weigh on Bullion

Beyond seasonal factors, broader macroeconomic developments are also contributing to the downturn. Precious metals came under pressure as investors focused on narratives that strengthen the US dollar in the short term. These include:

Sponsored

Sponsored

A firmer dollar typically weighs on bullion by making gold and silver more expensive in other currencies, reducing demand from international buyers.

ETF flows reflect the cautious sentiment. Several gold and silver ETFs declined between 2% and 4%. This mirrors weakness in futures markets and suggests that some investors are locking in profits after the recent rally.

Meanwhile, market strategists say precious metals are now in a “volatile consolidation phase.” After such a strong advance, corrections and sideways trading are common as markets digest gains and rebalance positions.

Therefore, a disciplined approach may be advisable, rather than chasing prices at elevated levels; instead, consider staggered buying during corrections.

Technical analysis also shows key support levels, with estimates placing silver price support near $65 per troy ounce and gold support around $4,770 per ounce on a weekly closing basis.

Sponsored

Sponsored

While these levels could determine whether the current pullback stabilizes or deepens, investors should conduct their own research.

Despite the sharp drop, structural forces such as rising global debt, currency debasement, and historical cycles in ratios, such as the gold–silver ratio, could support a powerful long-term bull market in precious metals.

If historical ratio reversals repeat, silver could experience significant upside over the coming decade, potentially reaching dramatically higher price levels by the early 2030s.

Crypto World

Bitcoin’s downtrend may end within 12 months, says Altcoin Sherpa

Altcoin Sherpa says Bitcoin’s bear phase could end within 12 months as ETFs, macro risks and a possible capitulation shape the next accumulation zone.

Summary

- Altcoin Sherpa projects Bitcoin’s peak‑to‑bottom phase will likely conclude in less than a year, excluding the post‑bottom accumulation range.

- The analyst says a major selloff from the October peak and ETF outflows may already have marked capitulation, putting Bitcoin in early accumulation.

- Structural shifts such as US spot ETFs and macro headwinds mean this cycle may diverge from 2018 and 2022, even if the one‑year bear timing repeats.

Bitcoin market analyst Altcoin Sherpa has projected the current cryptocurrency bear phase will conclude in less than 365 days, with the digital asset potentially resuming its broader uptrend before year-end, according to analysis published on social media platform X.

The projection comes as Bitcoin trades well below its all-time high reached in October, prompting investor questions about when the cryptocurrency might establish its next bottom.

Sherpa specified the timeline refers to the move from peak to bottom and does not include the accumulation period that typically follows, according to the analysis. The accumulation phase is characterized by sideways price action with relatively low volatility and subdued trading volume, historically lasting between two and four months.

Historical data shows Bitcoin experienced major rallies in 2017 and 2021, each followed by year-long declines in 2018 and 2022, according to the analyst. Extended accumulation periods followed those drawdowns in 2019 and 2020. From peak to bottom in both the 2017-2018 and 2021-2022 cycles, Bitcoin required approximately one year to complete its downward move.

Past bear markets have featured a final capitulation event—a sharp sell-off marking the end of the downtrend, according to Sherpa’s analysis. The analyst indicated a capitulation may have already occurred earlier this year, pointing to a substantial price drop as a potential final decline. If correct, the market could already be in early accumulation stages.

Sherpa stated the current decline will differ from previous patterns due to structural changes in the market. The analyst cited the growing role of US spot Bitcoin exchange-traded funds, which have altered capital flow structures despite declining alongside the broader market. An extended consolidation period of approximately eight months in a prior price range was also noted, with such trading ranges often acting as support zones during pullbacks from a technical analysis perspective.

Broader macroeconomic factors including equities, metals, overall risk appetite and artificial intelligence developments remain critical variables, according to the analysis. Sherpa stated Bitcoin does not require another seven months of decline to form a bottom, suggesting accumulation may already be underway if the recent slide was the final capitulation.

The analyst acknowledged one key risk to the outlook: the possibility that a final capitulation has not yet occurred. If another significant sell-off emerges, that would be interpreted as the definitive bottoming event, with accumulation likely following for several months, according to the analysis.

Crypto World

FTSE 100 and FTSE 250 attract capital as investors rethink US valuations

Global investors are rotating into FTSE 100 and FTSE 250 as stretched US equity valuations, sector mix, yields, and FX stability make UK stocks look undervalued.

Summary

- International investors are reallocating from expensive US mega-caps into FTSE 100 and FTSE 250 as valuation spreads widen.

- UK indices offer lower price-to-earnings ratios, higher dividends, diversified sectors, and global revenue exposure versus concentrated US tech.

- Stable pound dynamics and a gradual Bank of England policy path support UK equity appeal amid broader portfolio rebalancing.

The FTSE 100 and FTSE 250 indices are drawing increased international capital as investors reassess elevated US equity valuations, according to recent market analysis.

Fund managers have begun rotating into British assets amid concerns over pricing levels in US mega-cap shares, market data shows. The shift reflects a widening valuation differential between the two markets.

The S&P 500 currently trades at a premium to historical averages, while UK indices display lower price-to-earnings ratios and higher dividend yields, according to market metrics.

The FTSE 100 maintains significant exposure to energy, financial and commodity sectors, which provide global revenue streams and inflation-resistant characteristics. The FTSE 250 consists primarily of domestically focused mid-cap companies positioned to benefit from stabilizing UK inflation and potential improvements in consumer confidence.

Currency factors have also influenced investment decisions. The pound’s relative stability has reduced volatility risks for overseas investors and enhanced the attractiveness of UK-listed multinational corporations, analysts noted.

US markets have outperformed global indices in recent years, propelled by artificial intelligence developments and technology sector earnings growth. However, concentration risks have increased as a small number of large-cap stocks now account for a substantial portion of market returns, prompting diversification efforts among institutional investors.

UK equities offer broader sector distribution and defensive investment characteristics, with dividend payouts exceeding those of US counterparts, according to comparative market data. Global asset allocators are reassessing regional portfolio allocations, with lower relative valuations potentially providing downside protection in the event of slowing global growth.

The Bank of England’s monetary policy trajectory represents an additional consideration, with market expectations pointing toward gradual interest rate adjustments that could support equity valuation multiples.

While capital flows remain subject to rapid shifts, the current trend indicates a broader portfolio rebalancing as international investors reconsider UK markets following an extended period of underperformance relative to other developed markets.

Continued valuation disparities could sustain inflows into UK equities, with the FTSE 100 and FTSE 250 positioned to benefit from ongoing global portfolio diversification strategies, market observers stated.

Crypto World

Eli Lilly (LLY) Stock: Company Loads Up $1.5B of Weight-Loss Pills to Battle Wegovy

TLDR

- Eli Lilly stockpiled $1.5 billion of Orforglipron weight-loss pill before expected April 2026 FDA approval

- Strategy aims to prevent supply shortages that hurt Zepbound and Mounjaro launches in 2022

- Novo Nordisk’s oral Wegovy reached 50,000 prescriptions by January after December 2025 approval

- Orforglipron could hit $13 billion in annual sales by 2031 according to GlobalData forecasts

- Company investing $27 billion in four new U.S. manufacturing facilities for weight-loss drugs

Eli Lilly disclosed $1.5 billion worth of pre-launch Orforglipron inventory in its 2025 annual report. The weight-loss pill awaits FDA approval expected in April 2026.

The massive stockpile represents a calculated move to avoid past mistakes. In 2022, Eli Lilly couldn’t meet demand for injectable drugs Zepbound and Mounjaro. Patients switched to compounded alternatives when they couldn’t find branded products.

Those shortages lasted until late 2024. They cost the company revenue and market share during a critical growth period.

The FDA fast-tracked Orforglipron’s review using a Commissioner’s National Priority Review Voucher. Eli Lilly plans a major marketing push this summer when shipments begin.

Chasing Novo Nordisk’s Early Lead

Novo Nordisk launched oral Wegovy in January 2026 after December 2025 FDA approval. The Danish company captured first-mover advantage in the oral weight-loss pill market.

By the end of January, oral Wegovy had 50,000 prescriptions. UBS analysts expect 400,000 prescriptions in Q1 2026.

Pills appeal to patients who avoid injections. Current options like Zepbound require weekly shots. The oral format removes needle anxiety from the treatment equation.

Eli Lilly started building Orforglipron inventory over a year ago. The company reported $550 million worth of the drug in February 2025.

GlobalData analyst Shehroz Mahmood called the stockpile “a decisive effort to avoid repeating the supply constraints that plagued its Mounjaro and Zepbound rollouts.”

Billion-Dollar Sales Projections

GlobalData projects Orforglipron could generate $13 billion in annual sales by 2031. That forecast assumes FDA approval and successful commercialization.

Eli Lilly’s weight-loss drug portfolio drove 45% revenue growth in 2025. Mounjaro brought in $23 billion. Zepbound added $13.5 billion.

The company is building four new U.S. manufacturing facilities with $27 billion in investment. At least three will produce weight-loss therapies. Eli Lilly announced the fourth facility this month.

Orforglipron showed positive results in clinical trials. The once-daily pill fits into an industry shift toward more flexible obesity treatments.

Mahmood noted that while Novo Nordisk has early momentum, “it remains to be seen whether Eli Lilly can yet again take the spotlight, as it did in the competition for injectable therapies.”

The $1.5 billion Orforglipron stockpile makes up most of Eli Lilly’s total pre-launch inventory. The company expects huge global demand once the pill reaches pharmacy shelves this summer.

Crypto World

Monero faces short-term selling pressure despite strong on-chain activity

- Monero (XMR) faces short-term selling pressure below key moving averages.

- On-chain activity remains strong despite exchange delistings.

- Support lies at $300 while the immediate resistance sits near $381.

After reaching an all-time high near $798 in January, Monero (XMR) cryptocurrency has experienced significant short-term volatility.

In the last month alone, XMR has retraced over 44% from its recent highs.

The coin is currently trading around $331, after modest gains over the past 24 hours, but still well below its peak.

Growing selling pressure

Recent price action shows that XMR is struggling below key moving averages, including the 50-day and 200-day exponential moving averages (EMA).

These levels are critical as they often guide the sentiment of market participants.

Selling pressure has been compounded by a decrease in futures open interest, which dropped around 11% in a single day.

The long-to-short ratio has also shifted in favour of short positions, indicating a prevailing bearish bias.

If Monero fails to hold above the psychological $315 level, it could open the door for further declines.

Technical analysts suggest that a break below $315 may trigger a deeper correction, potentially testing support near $300.

Despite this, the short-term weakness does not reflect a collapse in user interest.

Strong on-chain activity and adoption

Monero’s core network activity remains remarkably resilient.

Transaction volumes have stayed above pre-2022 levels, even as numerous exchanges have delisted the cryptocurrency.

This suggests that the demand for private transactions continues, independent of mainstream trading platforms.

Darknet marketplaces are increasingly favouring XMR as the payment method of choice.

Almost half of the newly launched privacy-focused markets now operate exclusively on Monero, underscoring its growing adoption in niche sectors.

Even though ransomware operators still prefer Bitcoin (BTC) due to its liquidity, Monero continues to hold a strong position among users who value privacy.

Despite exchange delistings and enforcement pressure, XMR activity on Monero remains above pre-2022 levels.

Key findings from our latest research:

🔺 48% of new darknet markets in 2025 are XMR-only

🔺 Most ransomware payments still occur in BTC — liquidity matters

🔺 14–15% of… pic.twitter.com/BYPJMrLaJN— TRM Labs (@trmlabs) February 16, 2026

Network-level observations also show that a small percentage of Monero nodes behave differently from the standard protocol.

These anomalies do not compromise the cryptocurrency’s privacy features but indicate subtle variations in how real-world networks function.

Overall, these factors demonstrate that Monero maintains a strong and active user base, even in the face of regulatory and exchange restrictions.

Monero price forecast

Monero is balancing between short-term price weakness and long-term network resilience.

The immediate support lies around $300. Holding this level is crucial for preventing further downside.

If $300 fails to hold, the next major support is between $290 and $231.

On the upside, Monero needs to reclaim levels above $381 to ease selling pressure and potentially resume its bullish trend.

Short-term traders should be cautious, as momentum indicators suggest room for continued volatility.

Meanwhile, long-term holders can take confidence from the sustained network activity and growing adoption in privacy-focused markets.

Crypto World

Ripple (XRP) News Today: February 17th

A prominent crypto company continues to praise XRP, while Ripple’s stablecoin performed better than USDC on one front.

XRP has experienced a significant decline over the past few months, yet interest in the asset (and the company behind it) remains high.

In the following lines, we will touch upon the latest and most intriguing developments surrounding Ripple’s ecosystem.

Investors Want In?

Ripple’s global event, XRP Community Day, which is dedicated to the community of proponents, developers, and holders, was held last week. It brought together numerous executives and well-known figures from the crypto industry to discuss XRP’s growing usage, institutional adoption, and other trending topics.

One participant was Rayhaneh Sharif-Askary (Head of Product & Research at Grayscale), who disclosed that advisors at the digital asset manager are “constantly asked” by clients about XRP. She added that, in some cases, Ripple’s cross-border token is the second-most discussed asset after Bitcoin (BTC).

Grayscale is among the companies that introduced a spot XRP exchange-traded fund (ETF) with 100% exposure to the coin. This happened in late 2025, shortly after Canary Capital became the first to launch such a product in the United States.

Grayscale’s investment vehicle, dubbed GXRP, drew strong interest after its debut, with daily net inflows topping $30 million on several occasions. However, over the past few weeks, the trend has shifted, with frequent negative netflows.

RLUSD Outperforms USDC on This Front

Ripple’s stablecoin, called RLUSD, saw the light of day in December 2024 and has since made significant progress. The product, pegged 1:1 to the American dollar, gained support from many exchanges and renowned banking institutions, including the oldest US bank, BNY Mellon.

You may also like:

Earlier this year, the London-based fintech company LMAX Group partnered with Ripple to integrate RLUSD into its institutional trading infrastructure, while Zand (a bank in the UAE) also embraced the token.

RLUSD’s market cap has exceeded $1.5 billion, a significant milestone given its relatively short history. X user SMQKE revealed that the product has grown “much faster” than Circle’s USDC in its first year.

XRP Price Outlook

The past week has been quite turbulent for Ripple’s native cryptocurrency, with its valuation ranging from $1.35 to $1.66. Currently, it trades at approximately $1.45, representing a 2% daily decline.

It is important to note that the surge to the local high occurred over the weekend and was short-lived, prompting some analysts, such as Ali Martinez, to describe the 2-week candle closure as a gravestone doji. This is a candlestick pattern in which the price spikes during the period but closes near where it started, resembling an upside-down “T.” Martinez noted that the last time this formation appeared on the weekly chart, XRP’s price dropped by 46%.

Other analysts take a more optimistic view. X user BitGuru believes XRP is “coming out of a prolonged downtrend” and is attempting to reclaim key support at approximately $1.50. Should it succeed, a recovery to $1.80-$2 is possible, they predicted.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Tapping Korea’s Regulated Digital Asset Market with Antier’s Institutional-Grade RWA Solutions

As global capital markets accelerate toward blockchain-enabled asset digitization, South Korea is positioning itself as a strategically significant jurisdiction in this transformation. The shift is not being driven by speculative enthusiasm, but by deliberate financial modernization. With one of the most advanced fintech ecosystems in Asia, a highly digital-native investor base, and a regulatory framework that is progressively adapting to digital securities, Korea offers a structured environment for real world asset tokenization to evolve beyond experimentation.

What distinguishes Korea from many other markets is its institutional orientation. Rather than centering growth on retail crypto activity, the country is exploring how tokenized securities, fractionalized assets, and blockchain-based settlement models can be integrated into existing financial architecture. This measured and compliance-aware approach signals a long-term commitment to infrastructure development rather than short-term market cycles.

For global enterprises, asset managers, and technology providers, the Korean RWA landscape represents more than a regional opportunity. It reflects a market preparing to align traditional finance with digital asset innovation in a regulated, scalable, and institutionally credible manner—making it particularly relevant for organizations pursuing sustainable expansion strategies in Asia’s evolving tokenization economy.

Korean RWA Market Overview

South Korea is emerging as a key hub for real world asset tokenization, driven by clear regulations, a tech-savvy financial ecosystem, and growing institutional interest. Platforms like Korbit—recently acquired by Mirae Asset for $92M—highlight the country’s push toward regulated digital asset markets.

While retail adoption is strong, institutions are seeking robust, compliant infrastructure for complex assets, creating demand for institutional RWA tokenization platforms. This evolving landscape presents a strategic opportunity for Antier to deploy institutional-grade RWA solutions and power Korea’s next-generation asset tokenization platforms.

What’s Accelerating Korea’s RWA Momentum?

The real-world assets market in Korea has entered an explosive period of growth as both institutional and retail investors are looking to explore the use of blockchain technology in the ownership of real-world asset tokenization. The convergence of increasing regulatory clarity regarding RWAs, improved digital infrastructure and a strong appetite among investors to invest in RWAs has allowed the tokenization of RWAs to move from being an innovation in the asset ecosystem to an accepted, mainstream RWA diversification strategy. As a result, companies are looking for RWA tokenization solutions that provide compliant, liquid, and transparent transaction solutions, while financial institutions are looking for institutional RWA tokenization platforms that are capable of providing secure and efficient solutions for the tokenization of more complex RWA.

Key drivers of this growth include:

1. Clear Regulatory Guidelines

The regulatory agencies in Korea have provided detailed and clear regulatory guidelines concerning RWAs, allowing institutions to have a clear base on which to explore RWA tokenized investment opportunities. The only area that remains uncertain is whether the establishment of standard compliance and reporting protocols will have an impact on the adoption of asset tokenization platforms

2. Institutional Adoption and Strategic Investments

More institutional players in the form of Mirae Asset acquiring Korbit are looking for market opportunities in the form of regulated RWA markets, reflecting a need for and desire of institutional players to participate as RWA investors. There is a significant increase in institutional demand for institutional-grade RWA solutions that can support the volume of transactions and complexity of asset classes associated with large institutional RWA investments.

3. Technology-Driven Infrastructure

The country’s fintech world is going through major innovation as it integrates blockchain technology with traditional financial institutions. Advanced RWA tokenization solutions have created a means for the extremely fast transfer of ownership of assets, fractional ownership of assets, and a high degree of security for holding and transferring tokenized investments.

4. Investor Diversification Demand

Investors who are retail and institutional are looking to acquire ownership of Real World Assets through blockchain technology due to the benefits it provides, such as liquidity, transparency, and fractional ownership. The growing interest from both retail and institutional investors continues to create the need for strong institutional RWA tokenization platforms.

5. Competitive Market Timing

The maturity of South Korea’s market and its early adoption of tokenized asset solutions make it the right time to provide a strong platform, such as Antier’s, that can connect the traditional financial markets to the blockchain for institutional-grade RWA solutions to satisfy the need for next-generation investment products.

Launch Your Institutional-Grade RWA Platform with Antier<

Critical Gaps in Korea’s Asset Tokenization Platform Infrastructure

Korea’s real-world asset tokenization ecosystem has significant infrastructure gaps despite strong regulatory intent and growing institutional interest. While many platforms were initially created for crypto trading, they have been unable to support the digitisation of complex real-world assets at scale. With increasing demand for regulated and institution-grade offerings, the gaps created by the above-mentioned limitations are more pronounced, showing the need for purpose-built RWA tokenization solutions and enterprise-grade platforms.

Key gaps hindering mass market adoption:

1. Limited Institutional-Grade Architecture

Most platforms do not have the necessary robustness and feature set to build institutional quality for large issuers, custodians, and asset managers. The current absence of a complete institutional RWA tokenization platform prevents secure issuance, lifecycle management, and governance of tokenized assets.

2. Compliance-Centric Architecture Shortcomings

As regulations continue to evolve, there are many protocols that have not been able to embed compliance into their protocols. For example, many features such as performing investor KYC checks (i.e., identification), transfer restrictions, and audit-ready reporting are typically disenfranchised across multiple asset tokenization platforms, which compromises the trust level of these platforms by the issuer and investor.

3. Limited Integration to Traditional Finance Infrastructure

Connectivity between RWA tokenisation and traditional finance institutions (i.e., banks, custodians) remains lacking. The lack of thorough integration will prevent RWA tokenisation from providing the operational efficiency and settlement reliability associated with traditional finance institutions.

4. Limitations on Performance and Scalability

With an increase in the number of institutions participating on a platform, that platform must be able to work with larger transaction volumes, more asset classes, and cross-border use cases. Most current infrastructures lack the scalability required to sustain institutional-grade RWA solutions as they continue to grow.

5. Fragmented Asset Lifecycle Management

The process of going from onboarding and token issuance to secondary trading and redemption of an asset typically does not have full lifecycle management. This siloed approach creates operational risks and demonstrates the need for fully integrated enterprise-grade RWA tokenisation solutions.

How Can Antier Power Korea’s Next-Generation RWA Infrastructure?

With the transition of South Korea into a compliant digital asset ecosystem, institutional frameworks need to be secure, scalable, and compliant for real-world asset tokenization. With its extensive blockchain knowledge as well as its financial and regulatory knowledge, Antier will develop customized RWA tokenization solutions to support South Korea’s evolving RWA landscape.

Antier provides solutions for next-gen RWA by:

1. Domain-Driven Expert Team

A cross-functional expert team comprised of blockchain engineers, tokenization architects, and compliance experts, all of whom are highly experienced in creating global asset tokenization platforms. They will assist with the creation of secure technical designs, strong asset structure models, and secure smart contracts.

2. Institutional-grade Platforms

Antier provides institutional-grade scalable platforms for RWA tokenization, with a variety of asset classes, capable of high transaction volumes, with permissioned access control, advanced lifecycle management, and meeting the expectations of financial institutions and regulated entities.

3. Compliance-embedded smart contracts

Antier delivers institutional-grade RWA tokenization solutions that are fully compliant with all regulatory requirements by embedding compliance regulations within the token framework — KYC and AML regulations, whitelisting of investors, restrictions on transfers, and automated reporting.

4. Regulatory Structuring and Localization Support

Antier helps to design token models that follow financial guidelines for the specific laws in the country and to make sure the solutions are technically viable and ready for the regulations that will apply to RWA tokenization in Korea’s changing legal environment.

5. Seamless Integration with Traditional Finance

Antier can connect traditional bank systems, custody services, and reporting systems so that real-world asset tokenization projects will function properly with current financial systems. By combining these three areas of specialty in service, technology, and compliance, Antier is poised to provide scalable infrastructure for the next generation of RWA marketplaces in Korea with future-proof capabilities.

Grab the First-Mover Advantage in Korea’s Tokenized Economy

By deploying robust RWA tokenization solutions and launching compliant, scalable asset tokenization platforms, institutions can establish credibility before the market reaches saturation. With the right institutional RWA tokenization platform and future-ready, institutional-grade RWA solutions, market participants can move beyond experimentation—building sustainable leadership in Korea’s next-generation tokenized economy.

Crypto World

President Trump Says Crypto Market Structure Bill Will Pass Soon

Crypto regulation might finally be getting real structure. President Donald Trump just confirmed that a full crypto structure bill is close to passing. That is not small talk. That is a potential turning point.

For years, the CFTC and SEC have been battling over who controls what. Now it sounds like a clearer rulebook could arrive sooner than expected.

- Presidential Confirmation: Trump signals imminent passage of S. 3755/H.R. 3633 framework.

- Jurisdiction Split: Legislation formally divides oversight between SEC (securities) and CFTC (commodities).

- Rapid Timeline: Provisional registration for exchanges expected within 180 days of enactment.

The End of the Regulatory Turf War?

The House already moved first. The Digital Asset Market Clarity Act passed last July, laying out a framework that splits oversight between the CFTC and SEC. The real bottleneck has been the Senate.

In late January, the Senate Agriculture Committee narrowly advanced its own version, the Digital Commodity Intermediaries Act, in a tight 12 to 11 vote. That shows how divided the room still is.

There has been pushback too. Major industry players like Coinbase criticized earlier drafts, saying they boxed in DeFi and made stablecoin rules too restrictive.

By stepping in now, Trump is trying to break that gridlock and push the bill across the finish line after earlier Senate efforts stalled.

Mechanics of the New Crypto Market Structure Bill

Under the proposal, the CFTC would take primary control over digital commodities like Bitcoin and Ethereum. That alone would clear up years of confusion.

The bill also gives brokers and exchanges a 180 day window to register and secure provisional status once it becomes law. That is a fast track compared to the current gray zone many platforms operate in.

The goal is to end the murky compliance environment that has left firms exposed to freezes and counterparty risk.

CFTC Chairman Michael Selig has suggested the bill could reach the President within months. That lines up with other moves aimed at pulling crypto deeper into traditional finance. The framework would also require joint SEC and CFTC rulemaking within 18 months to sort out complex areas like mixed transactions and margin structures.

Market Implications and Deadlines

Passage of this bill would likely trigger a repricing of “commodity” assets currently suppressed by SEC lawsuits.

However, hurdles remain. The Senate Banking Committee still needs to reconcile its version with the Ag Committee’s draft before the February 28 White House deadline for stablecoin frameworks.

Meanwhile, scrutiny hasn’t vanished. Congressional leaders continue to urge probes into Trump-linked ventures like WLFI, ensuring that while regulation arrives, political volatility isn’t going anywhere.

The post President Trump Says Crypto Market Structure Bill Will Pass Soon appeared first on Cryptonews.

Crypto World

Raydium price jumps 15% as top coins struggle: why is RAY surging?

- Raydium price pumped more than 15% as bulls tested the $0.75 level.

- Gains come amid a notable jump in perpetuals volume on the Solana-based decentralized exchange.

- RAY’s daily trading volume exploded by more than 500%.

Raydium trends as one of the top gainers in the crypto market in early trading on February 17, 2026, with the RAY token up 15% in the past 24 hours.

The token’s dramatic surge aligns with an explosion in daily trading volume and a retest of $0.75, which sees bulls now target a potential rebound to the critical price level of $1.

All this comes as top altcoins, including Ethereum, XRP and Solana, mirror the bearish pressure around Bitcoin.

Why is the Raydium price up?

Raydium benefits from Solana ecosystem momentum, with optimism around SOL also reflected in RAY. But this latest pump in the token comes as SOL struggles near $80.

A sharp increase in liquidity provision and swaps on Raydium’s automated market maker signals renewed confidence in the Solana-based decentralized exchange.

While there is no specific catalyst for the price surge in the past 24 hours, it appears fresh perps listings are amplifying volume.

Raydium recently announced trading support for $TSLA, $NVDA, $XAG, $NAS100, $XAU, $SPX500, and $GOOGL, offering up to 20x leverage.

Trade $TSLA, $NVDA, $XAG, $NAS100, $XAU, $SPX500, and $GOOGL with up to 20x leverage. pic.twitter.com/wVAD2X3xgl

— Raydium (@Raydium) February 16, 2026

With potential macroeconomic shifts pointing to fresh gains, speculation is at a new level.

On-chain data indicates the platform is seeing heightened activity, with perpetuals volume skyrocketing past $6 billion amid notable user growth.

RAY’s gains reflect this frenzy, and volume has exploded. Over the past 24 hours, bulls pushing to break above $0.75 have seen daily volumes spike 580% and surpass $118 million.

Raydium price forecast as bulls target breakout above $1

Bears remain in control across much of the crypto market, and RAY’s performance in the past several months highlights this.

The token is well off lows of $0.54 seen earlier in the month, and boasts a 22% uptick from lows seen in the past week.

However, price continues to hover below a key downtrend line since the dip from the highs of $4.10 in August 2025.

And that downtrend currently sees bulls eye a short-term flip to above $1.

Technical indicators, including the rising RSI around 45 and MACD showing bullish divergence, suggest room for momentum.

Also notable is the fact that RAY currently trades near the resistance line of the aforementioned descending trendline.

The retest of this area amid a rise in volume aligns with a potential upward continuation.

However, bulls need to breach immediate resistance at the $0.83 to $0.91 zone.

If this area flips from the key supply wall to support, a potential breakout is likely to propel RAY to highs of $1.27 and then bring new bullish targets into view.

If not, rejection at $0.75-$0.83 could open the door for bears to target the $0.55-$0.50 zone.

Crypto World

Ethereum price under pressure as ETF outflows align with extreme fear index

Spot Ethereum ETFs see four straight weeks of outflows as price and sentiment slide.

Summary

- Spot Ethereum ETFs post longest outflow streak since spring 2025, with a likely fifth week looming.

- Ethereum price, volumes, and total crypto market cap have all declined alongside U.S. spot ETF redemptions.

- Fear & Greed Index flashes “Extreme Fear” as ETH trades below key moving averages and tests critical supports.

Recent reports from Lookonchain indicated funds recorded additional losses in recent trading sessions, as Ethereum price continues to face downward momentum hovering around $2,000 USD.

Spot Ethereum exchange-traded funds have recorded four consecutive weeks of net outflows, with signs pointing to a fifth straight week of redemptions, according to historical data from SoSoValue.

The outflows have coincided with a sharp correction in Ethereum prices, with the spot price declining significantly over the same timeframe. U.S. spot Bitcoin ETFs have similarly experienced notable outflows as cryptocurrency prices fell, according to market data.

Ethereum traded lower during the reporting period, while total cryptocurrency market capitalization declined, according to market tracking services.

The Crypto Fear & Greed Index has fallen into “Extreme Fear” territory, indicating heightened risk aversion among market participants. Daily Ethereum trading volumes have also decreased during the period.

Technical analysis showed the digital currency trading below its longer-term moving average, with the short-term moving average functioning as near-term resistance. Market analysts noted that until Ethereum reclaims its prior higher range, downward pressure may persist.

The cryptocurrency’s ability to defend key support levels remains a critical factor, as a breach could trigger a deeper correction, according to market observers.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video21 hours ago

Video21 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech10 hours ago

Tech10 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Crypto World7 days ago

Crypto World7 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World4 hours ago

Crypto World4 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Sports10 hours ago

Sports10 hours agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics7 days ago

Politics7 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

BREAKING :

BREAKING :  President Trump says the

President Trump says the